SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Wells Fargo & Company

NAME OF PERSON RELYING ON EXEMPTION: SOC Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1707 L Street, N.W., Suite 350, Washington, D.C. 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

April 1, 2025

Please vote AGAINST the Advisory Vote to Approve Named Executive Officer Compensation (Item 2) at the Wells Fargo & Company (NYSE: WFC) annual meeting on April 29, 2025.

Dear Wells Fargo Shareholder:

We urge you to Vote No on Item 2 (“Say on Pay”) at this year’s Annual Meeting of Shareholders on April 29, 2025. As we detail below, while Wells Fargo’s share price performed well during 2024, all other indicators – including both the adjusted and unadjusted financial metrics on which the Human Resources Committee relies to assess company and executive performance – show stagnation and decline. Nevertheless, executives received substantial raises above their 2024 pay, with CEO Charles W. Scharf receiving total reported pay of $30 million, an increase of $4.3 million or 17% year-over-year. Moreover, Wells Fargo’s long-term growth depends critically on both transforming, and being seen by the public and regulators to have transformed, the long-ingrained human capital management practices that led to the false account scandal revealed in the fall of 2016. While some of these limitations have been removed, others were imposed in 2024, and the most significant of these limitations – the Federal Reserve’s cap on the bank’s total assets – remains in place. We believe the excessive rewards for short-term share price performance warrant a “no” vote on the proposed compensation package this year.

The SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center, a coalition of unions representing millions of members, to enhance long term shareholder value through active ownership. These funds have over $250 billion in assets under management and are Wells Fargo shareholders. We previously engaged with the Company during the false account scandal in 2016 and subsequently with other investors in 2021 regarding the Company’s Human Rights Impact Assessment.

Sizeable Raises for Stagnant Performance

In 2024, Wells Fargo’s Board of Directors and Human Resources Committee (“HRC”) paid the Company’s named executive officers a total of $107.8 million, up 46% from the 2023 total of $73.6 million. While this figure, based in part on the grant-date fair value of equity compensation, includes “one-time” bonus payments and equity grants to newly hired executives Fernando Rivas and Bridget Engle, these executives joined the Company in May and August 2024, implying that Wells Fargo was paying other executives to fill their roles over the balance of the year.1 Moreover, when considering average compensation actually paid to the top 5 executive officers other than the CEO, the year-over-year increase is 63.7%, from an average of $17.6 million to $28.8 million. At the same time, CEO Charles Scharf’s “compensation actually paid” increased by 93%, from $36.4 million to $70.4 million.2

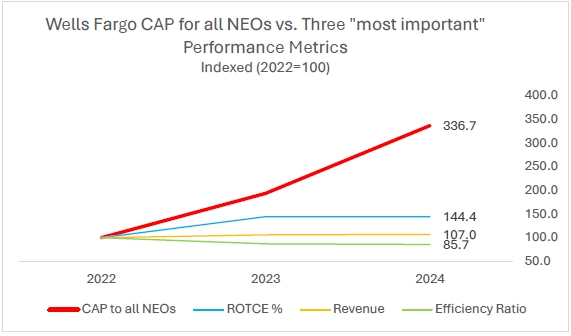

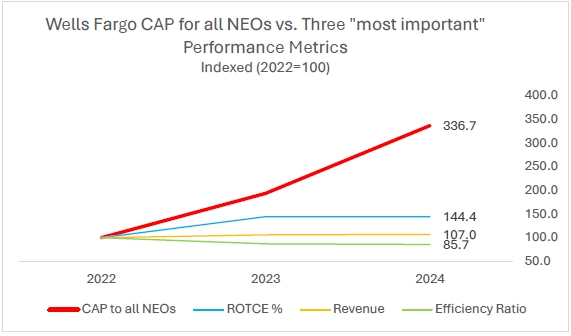

These substantial raises were paid despite Wells Fargo experiencing stagnant performance in terms of Return on Tangible Common Equity (ROTCE), total revenue, and the Efficiency Ratio, which the HRC describes as “the most important financial performance measures used by the Company to link executive compensation actually paid to the Company’s NEOs.”3 Figure 1 below illustrates the disconnect between substantial pay increases and flatlining performance, especially for 2024.

Figure 1

How did the HRC conclude that Wells Fargo’s executives earned such substantial pay increases despite mediocre performance? First, in calculating “Variable Compensation,”4 the HRC determined that the Company as a whole achieved 113% of its target level of performance. However, even a brief visual inspection of the metrics the HRC relied on to make this determination raises serious questions: on the 16 metrics shown (9 unadjusted and 7 adjusted), Wells Fargo’s performance declined on exactly half. Additionally, on the 8 metrics where Wells Performance improved, that improvement was very modest. For instance, unadjusted ROTCE increased, but only from 13.1% to 13.4% (while adjusted ROTCE declined from 14.2% to 13.6%). We further note that on the other two key metrics cited above, both revenue and the efficiency ratio declined (no adjusted figures reported). We are at a loss to determine how these reported measures amount to a Company achievement level of 113%.

But the HRC further gilds the lily by attributing above-target “personal achievement” scores to executives. Beyond being inherently subjective, these scores seem hard to square with events: CEO Charles Scharf received the highest personal achievement score at 125%, with the HRC explaining its decision by making vague references to “[leading] significant progress for the Company across multiple areas,” “[making] progress on key business initiatives,” and “[continuing] to advance our reputation through engagement with elected officials and community leaders.”5 Given that Wells Fargo was once again subject to an enforcement action by the Office of the Comptroller of the Currency (“OCC”) for deficiencies in its anti-money laundering controls in 2024,6 we are unsure that such engagement justifies the HRC’s assessment.

_____________________________

1 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 74.

2 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 85.

3 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 86.

4 The HRC’s report uses the term “Variable Compensation” to explain payments that appear on the Summary Compensation Table under the heading “Non-Equity Incentive Plan Compensation.”

5 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 58.

6 Office of the Comptroller of the Currency, Press Release, September 12, 2024, https://www.occ.treas.gov/news-issuances/news-releases/2024/nr-occ-2024-99.html,

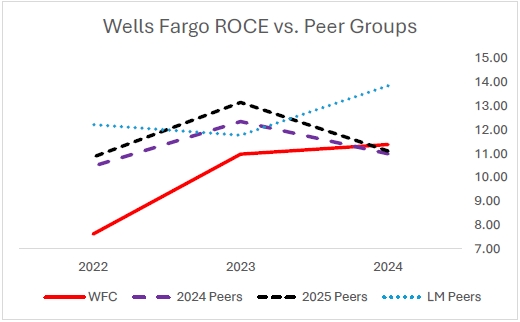

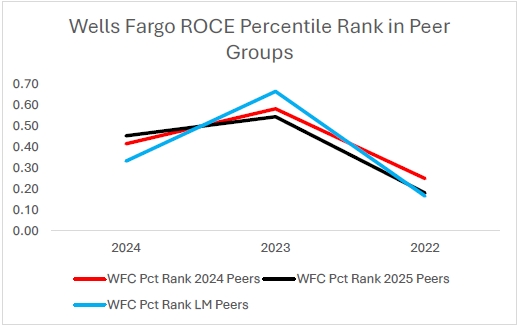

Similarly, the HRC provided executives with an overall payout for the Long-Term Equity Compensation Plan at 140% for a three year time period from 2022-2024 (the same years shown on the Figure 1), with 75% of that award tied to absolute ROTCE performance, and 25% to relative ROTCE performance, both taking into account adjustments. 7 First, we again observe that on an as-adjusted basis, ROTCE fell from 14.2% to 13.6% over the past two years, albeit rising from 9% in 2022.8 Nevertheless, because the HRC set the highest target level for average absolute ROTCE at 13%, despite Wells Fargo having reported ROTCE over 14% in 2021, the Company’s rather flat absolute performance generated the maximum payout of 150%. Additionally, the HRC determined that Wells Fargo’s ROTCE performance relative to 2024 Financial Peers achieved the 55th percentile, yielding a 109% for the second leg of the plan.9

However, as the HRC acknowledges, ROTCE is a non-GAAP measure that may be calculated in different ways by different companies, even prior to considering the adjustments Wells Fargo makes.10 As the HRC does not provide its own calculations of its peers ROTCE, we have instead relied on the more accessible measure Return on Common Equity (ROCE). Additionally, because Wells Fargo lists three peer groups in this year’s proxy, we have included the results for the Labor Market Peers and 2025 Financial Performance Peers in Figure 2 & 3 below:

Figure 2

_____________________________

7 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 68.

8 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 87 (numbers read off graphic).

9 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 68.

10 Wells Fargo 2024 proxy statement on DEF14A, March 19, 2025, pg. 126, first paragraph, second to last sentence.

Figure 3

Wells Fargo’s 2024 ROCE did slightly exceed that of the average of its 2024 and 2025 peers, but, as Figure 3 shows, Well Fargo’s percentile rank across these three years seems clearly to be well below the 55th percentile of its 2024 Peers. We calculate the overall average percentile ranks for each peer group, finding Wells Fargo to be at the 42nd percentile of 2024 Financial Performance Peers, and the 39th percentile of both the 2025 Financial Performance Peers and the Labor Market Peers. We are concerned that the particular measures and adjustments that the HRC has relied on may unduly flatter Wells Fargo’s performance relative to its peers, and that this has contributed to the significant misalignment of pay and performance for 2024.

Conclusion

As Wells Fargo seeks to fully emerge from the regulatory limitations imposed by regulators as a result of the false accounts scandal and related compliance deficiencies, we believe that a credible approach to human capital management is key. Unfortunately, this year the Board of Directors and the Human Resources Committee rewarded executives with a level of pay unjustified by the objective performance measures cited in the HRC’s report. Consequently, we urge shareholders to VOTE NO on Item 2, the Advisory Resolution to Approve Executive Pay.

THIS IS NOT A PROXY SOLICITATION AND NO PROXY CARDS WILL BE ACCEPTED

Please execute and return your proxy card according to Wells Fargo’s instructions.