U.S. Securities and Exchange Commission

Washington, DC 20549

Notice of Exempt Solicitation

Submitted Pursuant to Rule 14a-6(g)

1. Name of the Registrant: Wells Fargo & Company

2. Name of person relying on exemption: The Comptroller of the City of New York, on behalf of the New York City Employees’ Retirement System, the New York City Teachers’ Retirement Systems, and the New York City Police Pension Fund,

3. Address of person relying on exemption: 1 Centre Street, 8th Floor, New York, New York 10007

4. Written materials required to be submitted pursuant to Rule 14a-6(g)(1):

| · | Attachment 1: Letter and PowerPoint Presentation to shareholders in support of NYCRS' Clean Energy Financing Ratio Shareholder Proposal |

April 11, 2025

Dear Fellow Wells Fargo Shareholders,

Re: Vote FOR Item 6 on Energy Supply Ratio (ESR) disclosure

I urge you to vote FOR Item 6 on Energy Supply Ratio (ESR) disclosure at Wells Fargo’s annual meeting on April 29, 2025. As Comptroller of the City of New York, I serve as custodian, investment advisor, and a trustee for the five New York City Retirement Systems. The two Systems that submitted Item 6 are long-term institutional investors of Bank of America.

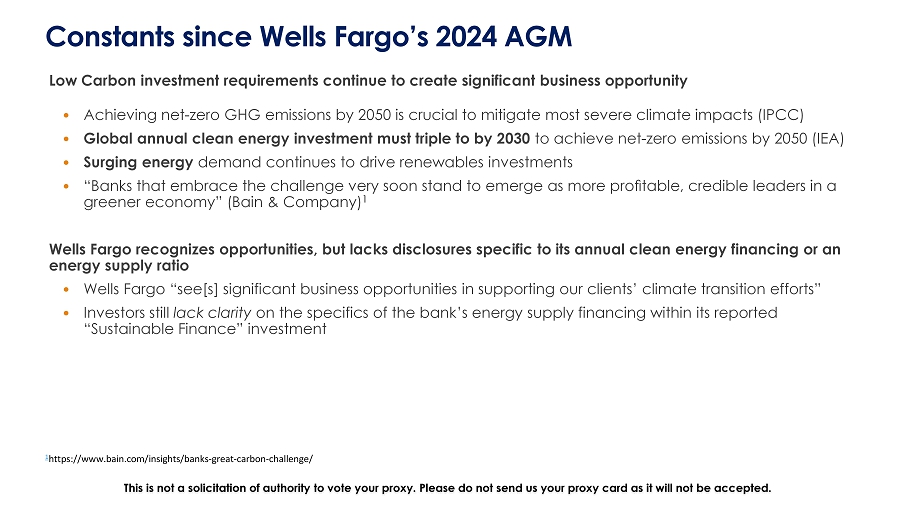

The bank is one of the largest energy underwriters and lenders, ranking among the top financiers of fossil fuel. The International Energy Agency (IEA) has emphasized that global investment in low-carbon energy supply must triple by 2030 to meet Paris Agreement’s climate targets. While Wells Fargo no longer maintains a net zero goal, it continues to recognize the material risks and opportunities associated with climate change. In its 2024 10-K, the bank acknowledges that “our operations, businesses, and clients could be adversely affected by the impacts related to climate change.” At the same time, the bank states in its 2024 Climate Report, “[w]e understand the role financial institutions can play to address climate change, and we see significant business opportunities in supporting our clients’ climate transition efforts.” The bank re-affirmed its commitment to “Sustainable Finance” in February 2025.

ESR, a dollar-based metric, complements GHG disclosures by showing how financing is allocated between low-carbon and fossil fuel projects. This data will provide investors with insight into the bank's energy transition priorities, risk management, and impact on energy supply— essential for assessing the bank’s progress on its climate commitments and its role in reducing global emissions.

Recent Company, Industry and Policy Developments Strengthen the Investor Case for ESR

Since receiving 26% support at Bank of America’s 2024 annual meeting, key industry developments have reinforced the feasibility, growing adoption, and investor relevance of ESR disclosure, and provided expert guidance for banks considering ESR disclosure:

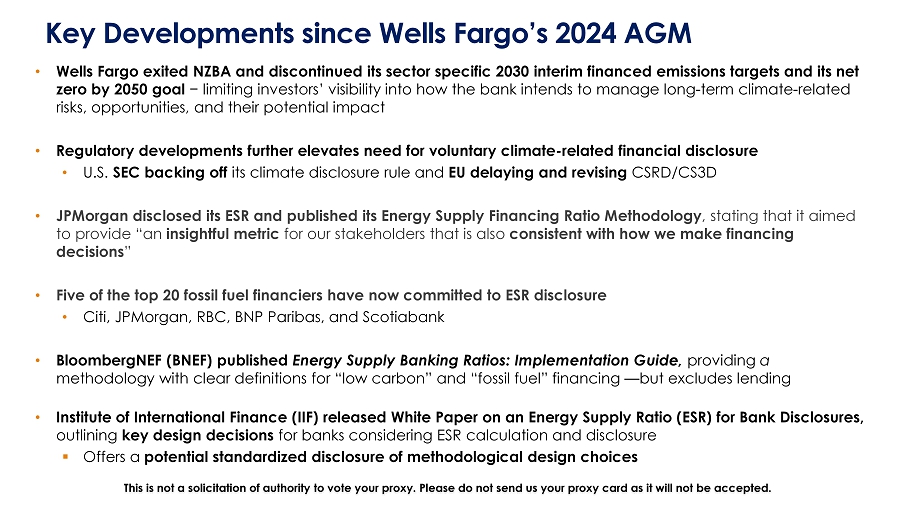

| · | Wells Fargo exited NZBA and discontinued its sector-specific 2030 interim financed emissions targets and its goal to achieve net zero by 2050 for financed emissions. Investors are concerned it will also discontinue essential and decision-useful financed emissions disclosures, thereby limiting investors’ visibility into how the bank intends to manage long-term climate-related risks, opportunities, and their potential impact. This development makes ESR disclosure essential. |

| · | JPMorgan has now disclosed its ESR, confirming that it is feasible and provides "an insightful metric for our stakeholders that is also consistent with how we make financing decisions."1 |

| · | Five of the top 20 fossil fuel financiers—including Citi, JPMorgan, RBC, BNP Paribas, and Scotiabank—have committed to ESR disclosure. |

| · | BloombergNEF (BNEF) published an ESR Implementation Guide, providing a methodology and clear definitions for “low carbon” and “fossil fuel” financing. |

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

| · | The Institute of International Finance (IIF) released a White Paper outlining key considerations for banks evaluating ESR disclosure and offering a potential standardized disclosure of methodological design choices. |

| · | The U.S. SEC's retreated from mandatory climate disclosure, the E.U. delayed CSRD/CS3D, further underscoring the urgent need for voluntary and timely climate-related financial disclosures on the bank’s energy transition risks and opportunities. |

Investor Benefits of ESR Disclosure

| · | Reflects financial flows in to the energy transition and real-world impact: The ESR—a dollar-based ESR metric, based on internal bank data, provides an essential perspective on the institution’s positioning within the energy transition. In light of Wells Fargo’s abandonment of its GHG emissions targets—investors are appropriately concerned that Wells Fargo intends to discontinue its financed emissions and other disclosures making the ESR even more important. |

| · | Not Prescriptive: The proposal leaves the ESR’s methodology entirely at Bank of America’s discretion while ensuring critical transparency for investors. The proposal does not request targets nor constrain any of the bank’s financing activities. |

| · | More Reliable Than Third-Party Estimates: A bank-calculated ESR using internal data rather than third-party estimates like BNEF—which rely solely on public information and may be costly or inaccessible to many investors—enhances reliability, transparency and accountability. Notably, BNEF estimates do not include lending. |

| · | Management of Climate Risks and Opportunities: A bank-calculated ESR will enable investors to better assess the extent to which the bank is addressing risks associated with continued fossil fuel financing and capitalizing on the opportunities created by surging clean energy demand. |

| · | Bank’s Real-World Impact: Directly addresses the bank’s role in the energy supply, offering a clearer picture of its role in the energy transition. |

| · | Early Adoption Benefits Investors: ESR disclosure by Wells Fargo would enable year-over-year trend analysis of Wells Fargo and inform future industry-led standardization (e.g. PCAF); delaying such disclosures until standardization is achieved deprives investors of urgently needed insights into capital allocation decisions. |

Conclusion

I strongly encourage you to vote FOR Item 6 to ensure investors have the transparency needed to assess the bank’s progress towards its climate goals and its commitment to the energy transition.

For a more detailed analysis of why investors should support Proposal 8, please refer to the presentation available at https://comptroller.nyc.gov/wp-content/uploads/2025/04/Wells-Fargo-ESR-Proposal-2025.pdf or see the attached copy included with this letter.

Please contact CorporateGovernanceTeam@comptroller.nyc.gov for any questions or to discuss the proposal.

Sincerely,

Brad Lander

Comptroller, City of New York

1 https://www.jpmorgan.com/content/dam/jpm/cib/complex/content/investment-banking/carbon-compass/JPMC_ESFR_Methodology.pdf

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card as it will not be accepted.

NYCRS Energy Supply Ratio (ESR) Shareholder Proposal Support Item 6 at Wells Fargo’s April 29, 2025 Annual Meeting This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. Corporate Governance & Responsible Investment

| 1 |

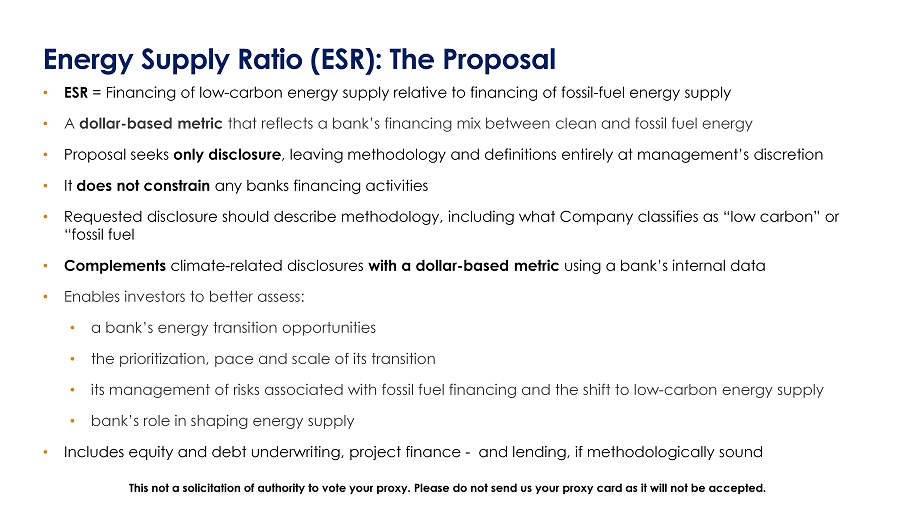

• ESR = Financing of low - carbon energy supply relative to financing of fossil - fuel energy supply • A dollar - based metric that reflects a bank’s financing mix between clean and fossil fuel energy • Proposal seeks only disclosure , leaving methodology and definitions entirely at management’s discretion • It does not constrain any banks financing activities • Requested disclosure should describe methodology, including what Company classifies as “low carbon” or “fossil fuel • Complements climate - related disclosures with a dollar - based metric using a bank’s internal data • Enables investors to better assess: • a bank’s energy transition opportunities • the prioritization, pace and scale of its transition • its management of risks associated with fossil fuel financing and the shift to low - carbon energy supply • bank’s role in shaping energy supply • Includes equity and debt underwriting, project finance - and lending, if methodologically sound Energy Supply Ratio (ESR): The Proposal This not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 2 |

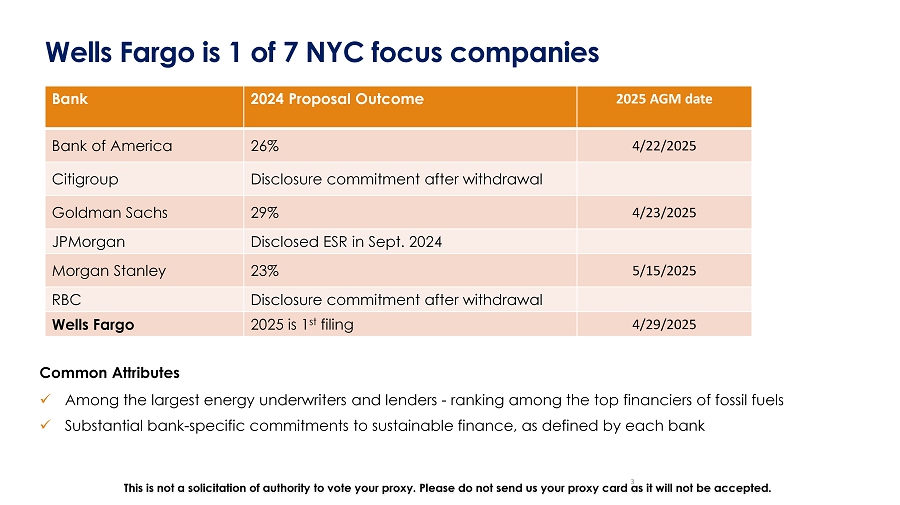

Wells Fargo is 1 of 7 NYC focus companies Common Attributes x Among the largest energy underwriters and lenders - ranking among the top financiers of fossil fuels x Substantial bank - specific commitments to sustainable finance, as defined by each bank 3 This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. 2025 AGM date 2024 Proposal Outcome Bank 4/22/2025 26% Bank of America Disclosure commitment after withdrawal Citigroup 4/23/2025 29% Goldman Sachs Disclosed ESR in Sept. 2024 JPMorgan 5/15/2025 23% Morgan Stanley Disclosure commitment after withdrawal RBC 4/29/2025 2025 is 1 st filing Wells Fargo

| 3 |

Key Developments since Wells Fargo’s 2024 AGM • Wells Fargo exited NZBA and discontinued its sector specific 2030 interim financed emissions targets and its net zero by 2050 goal − limiting investors’ visibility into how the bank intends to manage long - term climate - related risks, opportunities, and their potential impact • Regulatory developments further elevates need for voluntary climate - related financial disclosure • U.S. SEC backing off its climate disclosure rule and EU delaying and revising CSRD/CS3D • JPMorgan disclosed its ESR and published its Energy Supply Financing Ratio Methodology , stating that it aimed to provide “an insightful metric for our stakeholders that is also consistent with how we make financing decisions ” • Five of the top 20 fossil fuel financiers have now committed to ESR disclosure • Citi, JPMorgan, RBC, BNP Paribas, and Scotiabank • BloombergNEF (BNEF) published Energy Supply Banking Ratios: Implementation Guide, providing a methodology with clear definitions for “low carbon” and “fossil fuel” financing — but excludes lending • Institute of International Finance (IIF) released White Paper on an Energy Supply Ratio (ESR) for Bank Disclosures, outlining key design decisions for banks considering ESR calculation and disclosure ▪ Offers a potential standardized disclosure of methodological design choices This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 4 |

Constants since Wells Fargo’s 2024 AGM Low Carbon investment requirements continue to create significant business opportunity • Achieving net - zero GHG emissions by 2050 is crucial to mitigate most severe climate impacts (IPCC) • Global annual clean energy investment must triple to by 2030 to achieve net - zero emissions by 2050 (IEA) • Surging energy demand continues to drive renewables investments • “Banks that embrace the challenge very soon stand to emerge as more profitable, credible leaders in a greener economy” (Bain & Company) 1 Wells Fargo recognizes opportunities, but lacks disclosures specific to its annual clean energy financing or an energy supply ratio • Wells Fargo “see[s] significant business opportunities in supporting our clients’ climate transition efforts” • Investors still lack clarity on the specifics of the bank’s energy supply financing within its reported “Sustainable Finance” investment This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted. 1 https://www.bain.com/insights/banks - great - carbon - challenge/

| 5 |

Lessons from JPMorgan’s ESR Disclosure • Demonstrates feasibility and investor value: JPMorgan called it "An excellent example of what ongoing engagements and pragmatic requests can accomplish“ • JPMorgan weighed “the relevance of the subject matter of the [2024 NYC shareholder] proposal in the context of our business and its value to long - term shareholders” in making its disclosure decision • Improves upon BNEF approach by incorporating lending and other internal data , offering a more comprehensive and forward - looking picture • Transparent methodology can inform future standardization efforts This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 6 |

Reasons to vote FOR “ESR” Proposal 8 Climate - Related Disclosures at Risk • A dollar - based ESR complements financed emissions disclosure to provide a clearer, more comprehensive view of the bank’s role in the energy transition • Given its retreat from its public climate commitments, investors are concerned that the bank will also discontinue essential and decision - useful financed emissions disclosures • Financed emissions disclosure remains essential, however, such concern underscores the need for ESR Captures Pace and Scale of Bank’s Energy Transition • ESR provides an integrated financial metric that uniquely captures both the scaling up of low - carbon energy and the phasing down of fossil fuels — essential for mitigating systemic financial and physical climate risks • Pace at which low - carbon energy supply is scaled up will dictate rate at which fossil fuels are phased down (IEA) Not Prescriptive • Proposal seeks only disclosure, leaving methodology and definitions entirely at management’s discretion • It does not request targets nor constrain any of the banks’ financing activities Feasible with expert guidance available This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

| 7 |

Reasons to vote FOR the “ESR” Proposal 8 More Reliable Than Third - Party Estimates • A bank - calculated ESR based on internal data rather than third - party estimates like BNEF — which rely solely on public information and may be costly or inaccessible to many investors — enhances reliability, transparency, and accountability • Notably, BNEF estimates do not include lending Clarifies Real Economy Impact • ESR reflects the bank’s financial flows — enabling investors to better assess the bank’s role in financing the energy transition Early Adoption Benefits Investors • Demonstrate bank’s continuing commitment to financing the energy transition – critical given NZBA exit and regulatory developments • Voluntary disclosure offers year - over - year insights at each bank and can inform industry - driven standardization (e.g., PCAF) • Delaying bank - specific disclosures until standardization is achieved deprives investors of urgently needed insights into capital allocation decisions This is not a solicitation of authority to vote your proxy. Please do not send us your proxy card as it will not be accepted.

8