northerntrust.com / © 2025 Northern Trust NORTHERN TRUST CORPORATION Strategy Update & Second Quarter 2025 Earnings Review

northerntrust.com / © 2025 Northern Trust Delivering One Northern Trust for Clients $1.7 Trillion AUM1 ASSET MANAGEMENT ASSET SERVICING $16.9 Trillion AUC/A1 WEALTH MANAGEMENT $1.2 Trillion AUC/A1 INTEGRATED GLOBAL OPERATING PLATFORM Individuals Families Family Offices Foundations Pensions Asset Managers Sovereign Entities Endowments ¹ As of June 30, 2025. Client assets for the current quarter are considered preliminary until the Form 10-Q is fi led with the Securities and Exchange Commission. 2

northerntrust.com / © 2025 Northern Trust Executing on One Northern Trust Strategy PILLARS Dr i ve Organic Growth Ma na ging Enterprise Risk Ac hi eve Operational Excellence OPTIMIZE GROWTH DRIVE PRODUCTIVITY STRENGTHEN RESILIENCY & MANAGE RISK • Improving organic growth • Advancing growth initiatives • Enhancing control environment • Modernizing capabilities • Bending the cost curve • Deploying AI and increasing automation 3

northerntrust.com / © 2025 Northern Trust • Fundraising exceeding targets • Pipeline up 3x vs. historical levels • Assets under advisement up 66% • Large custom mandates awarded • Continued market leadership • Supporting 6 LTAFs and 5 ELTIFs ALTERNATIVES SOLUTIONS 1H 2025 PROGRESS Proprietary fund-of-funds investing across private equity, private credit, venture and hedge funds Third Party Managers Externally managed alternative investments for Wealth Management clients Alternatives Advisory Consulting, managing and constructing customized alternatives portfolios Fund Services Custody, fund administration and banking for alternative managers Alternatives Solutions Driving Growth • Record fundraising • Closed largest secondary fund 4

2025 PRIORITIES 1H 2025 PROGRESS • Deliver complete set of family office services to upper tier wealth clients • Strong organic growth in Global Family Office • International market acceleration – revenue up 20%+, comprising ~15% of total GFO revenue • Launched Family Office Solutions for ultra-high- net-worth clients • >75% win rate; strong pipeline 5northerntrust.com / © 2025 Northern Trust MARKET POSITION $468.5B Assets under Management1 $1.2T Assets under Custody / Administration1 Serve 30% of the Forbes 400 Best Private Bank in the U.S. 13 out of 16 years2 in N.A. for Ultra- High Net Worth Clients2 Best Digital Innovator of the Year in the U.S.3 ¹ As of June 30, 2025. Client assets for the current quarter are considered preliminary until the Form 10-Q is fi led with the Securities and Exchange Commission. Sources: 2 Financial Times Group, 2024. 3 Wealth Tech Awards, Financial Times and PWM, 2024. • Deepen penetration of priority markets • Expand alternative investments suite • Completed four new funds • Expect to launch eight more funds in 2H 2025 • Refreshed regional leadership • Investing in additional key talent to drive organic growth Wealth Management Update

Asset Management Update • Fundraising up 60% vs. FY 2024 • Strong demand from Wealth Management, Global Family Office and other institutional investors MARKET POSITION $1.7T Assets under Management1 Top 20 Global Asset Manager $17B Alternatives Solutions Platform $327B Liquidity AUM (11th largest, U.S.) Top 3 Largest Direct Index Manager2 Top 5 Largest U.S. Bond & Equities Index Manager2 Top 10 Manager of Retirement Solutions across DB & DC3 6northerntrust.com / © 2025 Northern Trust • Boost growth within 50 S. Capital and suite of alternative investment product offerings • Expand in key growth areas, particularly custom SMAs • Enhance ETF platform • $2B in net flows into Tax-Advantaged Equity strategies • Liquidity flows of $19B • On track to launch 11 new ETFs in 2H 2025 2025 PRIORITIES 1H 2025 PROGRESS ¹ As of June 30, 2025. Client assets for the current quarter are considered preliminary until the Form 10-Q is fi led with the Securities and Exchange Commission. Sources: 2 Pensions & Investments. 3 Pensions & Investments Rankings, as of June 2024

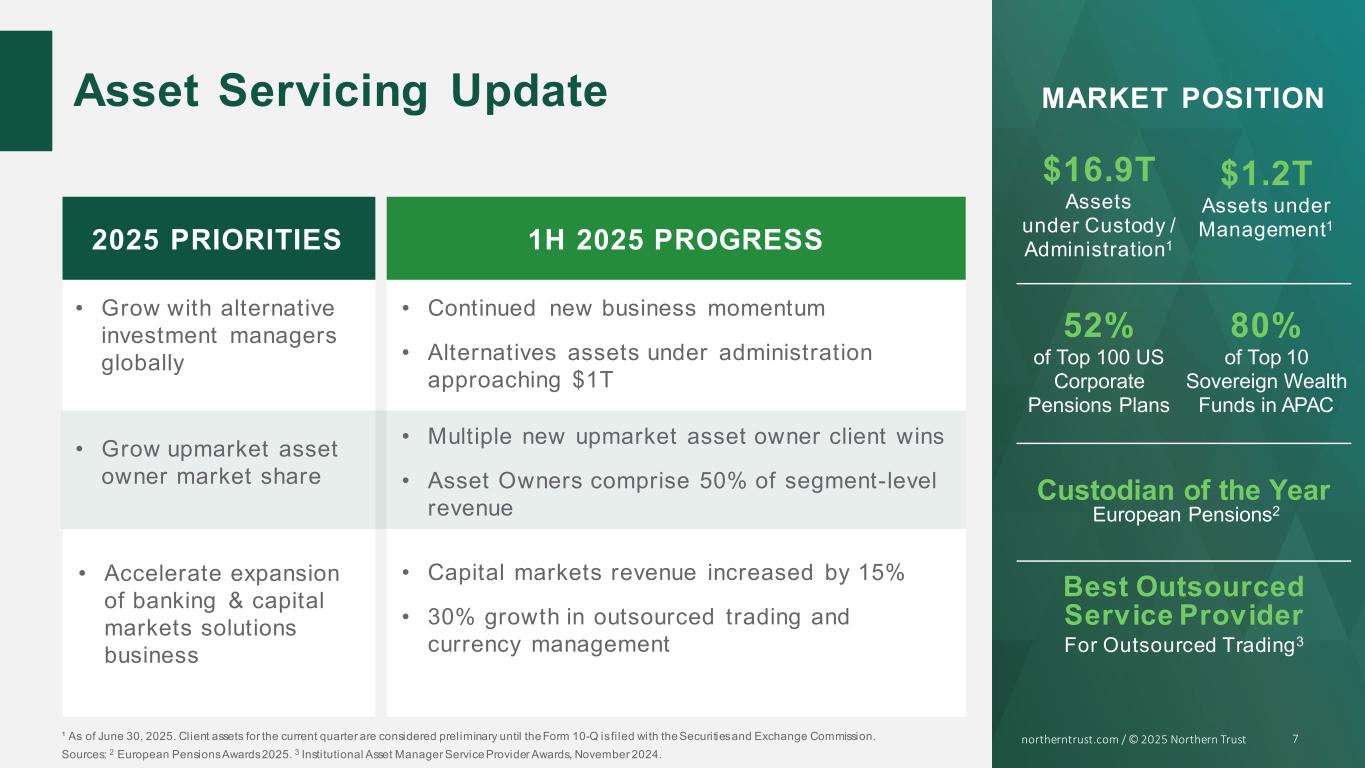

2025 PRIORITIES 1H 2025 PROGRESS • Continued new business momentum • Alternatives assets under administration approaching $1T 7northerntrust.com / © 2025 Northern Trust MARKET POSITION $16.9T Assets under Custody / Administration1 $1.2T Assets under Management1 52% of Top 100 US Corporate Pensions Plans 80% of Top 10 Sovereign Wealth Funds in APAC Custodian of the Year European Pensions2 Best Outsourced Service Provider For Outsourced Trading3 • Grow with alternative investment managers globally • Accelerate expansion of banking & capital markets solutions business • Grow upmarket asset owner market share • Capital markets revenue increased by 15% • 30% growth in outsourced trading and currency management • Multiple new upmarket asset owner client wins • Asset Owners comprise 50% of segment-level revenue Asset Servicing Update ¹ As of June 30, 2025. Client assets for the current quarter are considered preliminary until the Form 10-Q is fi led with the Securities and Exchange Commission. Sources: 2 European Pensions Awards 2025. 3 Institutional Asset Manager Service Provider Awards, November 2024.

northerntrust.com / © 2025 Northern Trust Annual Expense Growth1 2021-24A H1 2025A1 Productivity Drivers ¹ Excluding notable items 6.5% 4.8% 2025 Target: <5% Growth Drivers Revenue Generating Talent Product Expertise Technology Client Centric Capability Operating Model Operational Scale and Standards Unified Technology Global Resiliency Third Party Vendors Suppliers Utilization Management Process Automation AI Business Process Re-Engineering Digitization Workforce Management Optimization Spans & Layers Contractor Inversion Footprint Bending the Cost Curve 8

northerntrust.com / © 2025 Northern Trust 9 Expenses to Trust Fees 105-110% Pre-Tax Margin >30% Return on Equity 13-15% MEDIUM-TERM Total Payout Ratio >100% Positive Operating Leverage 2025 Total Expense Growth1 <5% ¹ Excluding notable items Financial Targets

northerntrust.com / © 2025 Northern Trust 10 135-year trusted steward of multi-generational wealth Unwavering fiduciary commitment Ingrained culture of integrity Northern Trust… Long-term perspective

northerntrust.com / © 2023 Northern Trust 115 11 FINANCIAL HIGHLIGHTS

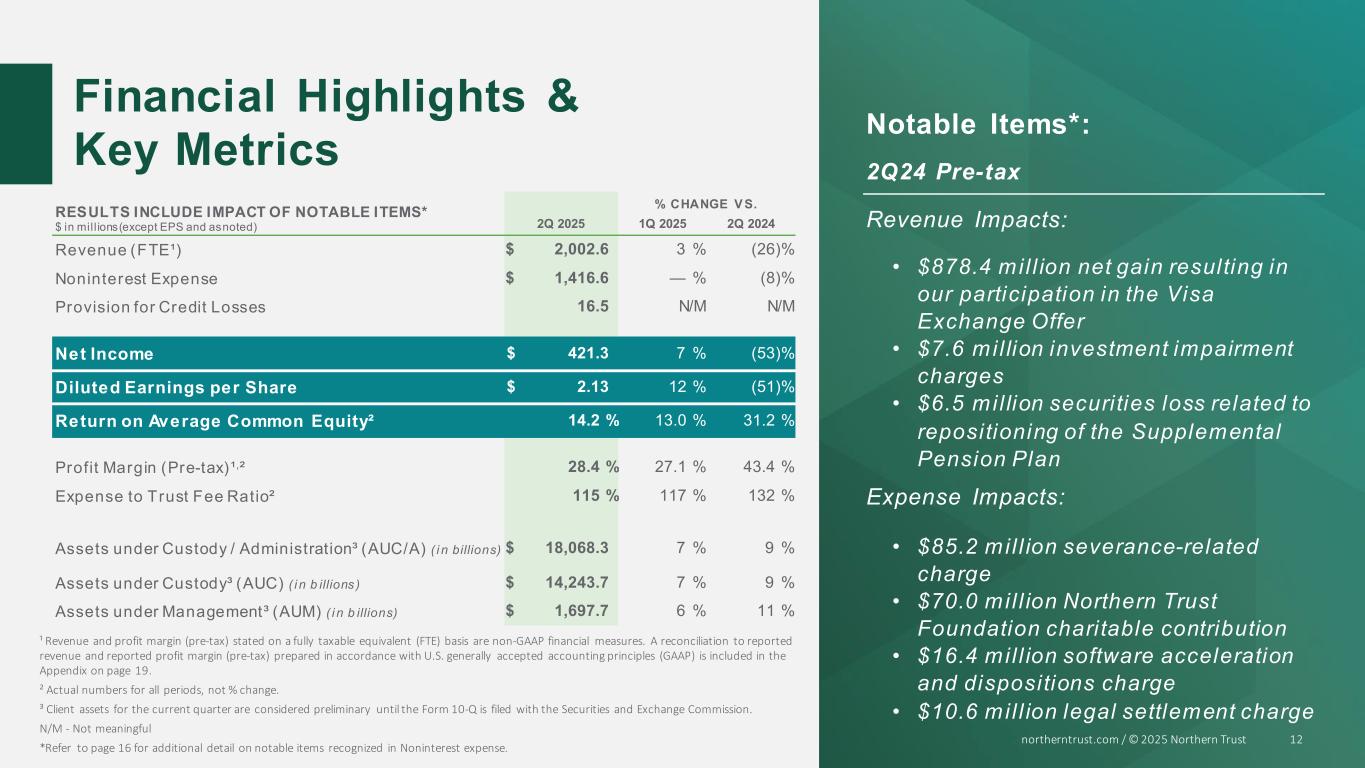

Notable Items*: 2Q24 Pre-tax Revenue Impacts: • $878.4 mil l ion net gain resulting in our participation in the Visa Exchange Offer • $7.6 mil lion investment impairment charges • $6.5 mil lion securi ties loss related to repositioning of the Supplemental Pension Plan Expense Impacts: • $85.2 mil l ion severance-related charge • $70.0 mil l ion Northern Trust Foundation chari table contribution • $16.4 mil l ion software acceleration and dispositions charge • $10.6 mil l ion legal settlement charge ¹ Revenue and profit margin (pre-tax) stated on a fully taxable equivalent (FTE) basis are non-GAAP financial measures. A reconciliation to reported revenue and reported profit margin (pre-tax) prepared in accordance with U.S. generally accepted accounting principles (GAAP) is included in the Appendix on page 19. ² Actual numbers for all periods, not % change. ³ Client assets for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission. N/M - Not meaningful *Refer to page 16 for additional detail on notable items recognized in Noninterest expense. Financial Highlights & Key Metrics 12northerntrust.com / © 2025 Northern Trust RESULTS INCLUDE IMPACT OF NOTABLE ITEMS* $ in mill ions (except EPS and as noted) % CHANGE V S. 2Q 2025 1Q 2025 2Q 2024 Revenue (FTE¹) $ 2,002.6 3 % (26)% Noninterest Expense $ 1,416.6 — % (8)% Provision for Credit Losses 16.5 N/M N/M Net Income $ 421.3 7 % (53)% Diluted Earnings per Share $ 2.13 12 % (51)% Return on Average Common Equity² 14.2 % 13.0 % 31.2 % Profit Margin (Pre-tax)¹,² 28.4 % 27.1 % 43.4 % Expense to Trust Fee Ratio² 115 % 117 % 132 % Assets under Custody / Administration³ (AUC/A) ( i n billions) $ 18,068.3 7 % 9 % Assets under Custody³ (AUC) ( i n b illions ) $ 14,243.7 7 % 9 % Assets under Management³ (AUM) ( i n b illions) $ 1,697.7 6 % 11 %

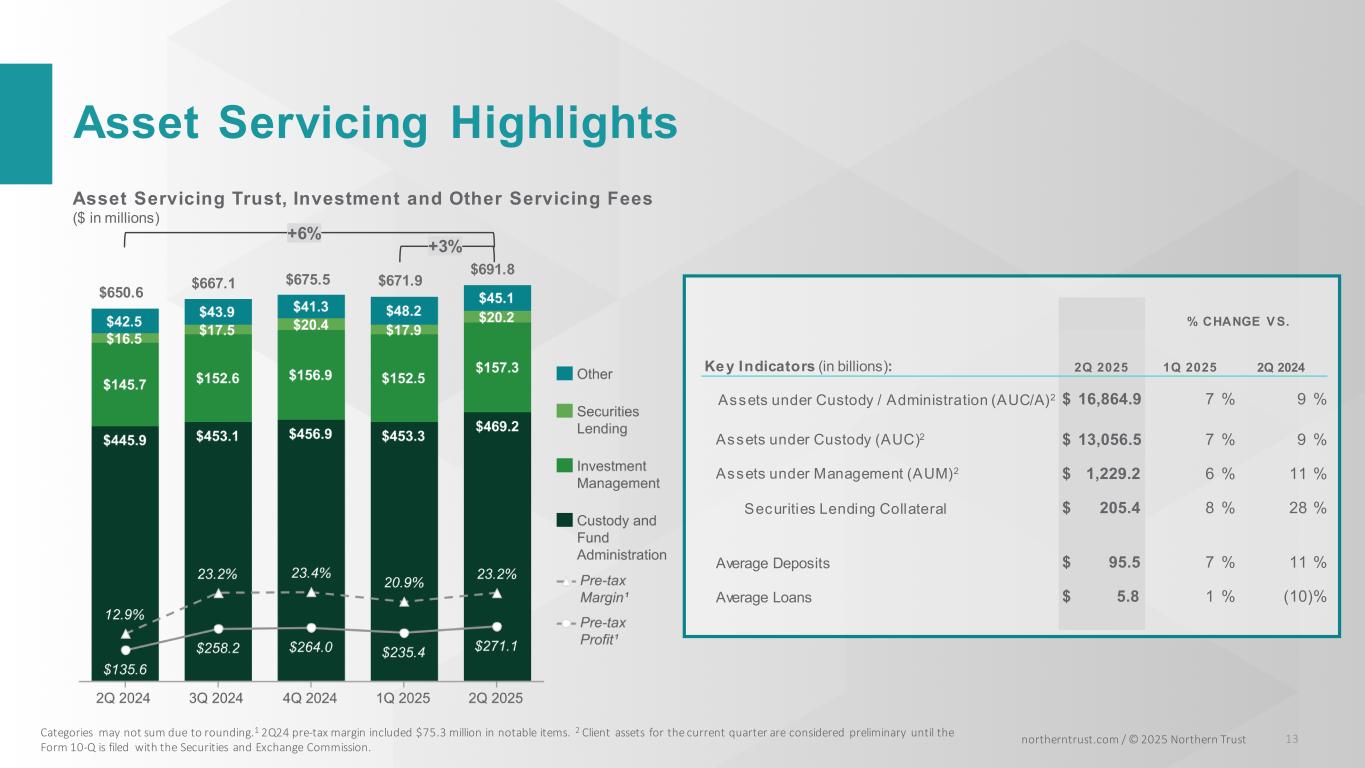

northerntrust.com / © 2025 Northern Trust +3% Asset Servicing Highlights 13Categories may not sum due to rounding.1 2Q24 pre-tax margin included $75.3 million in notable items. 2 Client assets for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission. % CHANGE V S. Key Indicators (in billions): 2Q 2025 1Q 2025 2Q 2024 Assets under Custody / Administration (AUC/A)2 $ 16,864.9 7 % 9 % Assets under Custody (AUC)2 $ 13,056.5 7 % 9 % Assets under Management (AUM)2 $ 1,229.2 6 % 11 % Securities Lending Collateral $ 205.4 8 % 28 % Average Deposits $ 95.5 7 % 11 % Average Loans $ 5.8 1 % (10)% Asset Servicing Trust, Investment and Other Servicing Fees ($ in millions) +6% $691.8 $671.9$675.5$667.1$650.6

northerntrust.com / © 2025 Northern Trust Wealth Management Highlights 14Categories may not sum due to rounding.1 2Q24 pre-tax margin included $32.9 million in notable items. 2 Client assets for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission. % CHANGE V S. Key Indicators (in billions): 2Q 2025 1Q 2025 2Q 2024 Assets under Custody / Administration (AUC/A)2 $ 1,203.4 8 % 10 % Assets under Custody (AUC)2 $ 1,187.2 7 % 9 % Assets under Management (AUM)2 $ 468.5 5 % 12 % Average Deposits $ 25.3 — % (4)% Average Loans $ 35.3 — % 2 % Wealth Management Trust, Investment and Other Servicing Fees ($ in millions) +5% —% $539.3$546.7 $529.5$515.5 $541.9

northerntrust.com / © 2025 Northern Trust Net Interest Income and Balance Sheet Trends 15 Categories may not sum due to rounding. 1 Net interest income and net interest margin stated on an FTE basis are non-GAAP financial measures. A reconciliation of these measures to reported results prepared in accordance with U.S. GAAP is included in the Appendix on page 19. ² Other Earning Assets includes Interest-Bearing Due from and Deposits with Banks, Federal Funds Sold and Securities Purchased under Agreements to Resell, and Other Interest-Earning Assets. Average Earning Assets ($ in billions) Net Interest Income (FTE¹) ($ in millions) +8% +6% +16% +7% $133.7 $138.0$134.8$135.4 $145.8

Noninterest Expense 16northerntrust.com / © 2025 Northern TrustCategories may not sum due to rounding. Total Noninterest Expense ($ in millions) (8)% —% Expense Highlights Noninterest expense included the fol lowing notable i tems: 2Q24 Pre-tax • $85.2 mill ion severance-related charge • $70.0 mill ion Northern Trust Foundation charitable contribution • $16.4 mill ion software acceleration and dispositions charge • $10.6 mill ion legal settlement charge

Capital Update 17 Standardized Tier 1 Leverage northerntrust.com / © 2025 Northern Trust Capital Highlights • Robust capital and liquidity • $12.0 bi l l ion in Tier 1 capi tal • 66% of average deposi ts covered by highly l iquid assets including 32% by cash and central bank deposi ts • Declared $146.2 million in common stock dividends and $4.7 million in preferred stock dividends in 2Q25 • Repurchased $339.4 million of common stock in 2Q25 • Net unrealized after-tax losses on available-for-sale securities of $481.2 million as of June 30, 2025 Northern Trust Corporation Capital Ratios 2Q 2025 CAPITAL RATIOS STANDARDIZED APPROACH ADVANCED APPROACH Common Equity Tier 1 Capital 12.2% 15.0% Tier 1 Capital 13.1% 16.1% Total Capital 14.8% 17.9% Tier 1 Leverage 7.6% 7.6% Supplementary Leverage N/A 9.1% Standardized Common Equity Tier 1 Capital ratios for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission.

Appendix northerntrust.com / © 2025 Northern Trust

northerntrust.com / © 2025 Northern Trust Reconciliation of Non-GAAP Financial Measures 19 The following table presents a reconciliation of interest income, net interest income, net interest margin, total revenue, pre-tax income, and profit margin (pre-tax) prepared in accordance with GAAP to such measures on a fully taxable equivalent (FTE) basis, which are non-GAAP financial measures. Management believes this presentation provides a clearer indication of these financial measures for comparative purposes. The adjustment to an FTE basis has no impact on net income. QUARTERS 2025 2024 ($ in Millions) SECOND FIRST FOURTH THIRD SECOND Net Interest Income Interest Income - GAAP $ 2,212.8 $ 2,140.9 $ 2,280.0 $ 2,530.2 $ 2,506.5 Add: FTE Adjustment 4.7 5.6 10.5 7.1 6.9 Interest Income (FTE) - Non-GAAP $ 2,217.5 $ 2,146.5 $ 2,290.5 $ 2,537.3 $ 2,513.4 Net Interest Income - GAAP $ 610.5 $ 568.1 $ 563.8 $ 562.3 $ 522.9 Add: FTE Adjustment 4.7 5.6 10.5 7.1 6.9 Net Interest Income (FTE) - Non-GAAP $ 615.2 $ 573.7 $ 574.3 $ 569.4 $ 529.8 Net Interest Margin - GAAP 1.68 % 1.67 % 1.68 % 1.66 % 1.55 % Net Interest Margin (FTE) - Non-GAAP 1.69 % 1.69 % 1.71 % 1.68 % 1.57 % Total Rev enue Total Revenue - GAAP $ 1,997.9 $ 1,940.0 $ 1,959.6 $ 1,968.5 $ 2,715.5 Add: FTE Adjustment 4.7 5.6 10.5 7.1 6.9 Total Revenue (FTE) - Non-GAAP $ 2,002.6 $ 1,945.6 $ 1,970.1 $ 1,975.6 $ 2,722.4 Pre-Tax Income Pre-Tax Income - GAAP $ 564.8 $ 521.4 $ 594.2 $ 601.1 $ 1,173.6 Add: FTE Adjustment 4.7 5.6 10.5 7.1 6.9 Pre-Tax Income (FTE) - Non-GAAP $ 569.5 $ 527.0 $ 604.7 $ 608.2 $ 1,180.5 Profit Margin (Pre-Tax) Profit Margin (Pre-Tax) - GAAP 28.3 % 26.9 % 30.3 % 30.5 % 43.2 % Profit Margin (Pre-Tax) (FTE) - Non-GAAP 28.4 % 27.1 % 30.7 % 30.8 % 43.4 %

northerntrust.com / © 2025 Northern Trust Forward-looking Statements 20 This presentation may include statements which constitute “forward-looking statements” within the meaning of the safe harbor provis ions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified typically by words or phrases such as “believe,” “expect,” “antic ipate,” “intend,” “estimate,” “project,” “likely,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements include statements, other than those related to historical facts, that relate to Northern Trust’s financial results and outlook, capital adequacy, dividend policy and share repurchase program, accounting estimates and assumptions, credit quality including allowance levels, future pension plan contributions, effective tax rate, antic ipated expense levels, contingent liabilities, acquis itions, strategies, market and industry trends, and expectations regarding the impact of accounting pronouncements and legis lation. These statements are based on Northern Trust’s current beliefs and expectations of future events or future results, and involve risks and uncertainties that are difficult to predict and subject to change. These statements are also based on assumptions about many important factors, including the factors discussed in Northern Trust’s most recent annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission, all of which are available on Northern Trust’s website. We caution you not to place undue reliance on any forward-looking statement as actual results may differ materially from those expressed or implied by forward-looking statements. Northern Trust assumes no obligation to update its forward-looking statements. This presentation should be reviewed together with Northern Trust Corporation’s Second Quarter 2025 earnings press release.