1northerntrust.com | © 2026 Northern Trust Corporationnortherntrust.com | © 2026 Northern Trust Corporation Executive Sponsor: Presenting: STRATEGY UPDATE & FOURTH QUARTER 2025 EARNINGS REVIEW January 22, 2026

2northerntrust.com | © 2026 Northern Trust Corporation 2northerntrust.com / © 2026 Northern T ust 1 Strategic Update Page 3 2 Financial Highlights Page 11 3 Appendix Page 20Agenda

3northerntrust.com | © 2026 Northern Trust Corporation 3northerntrust.com / © 2026 Northern T ust Strategic Update

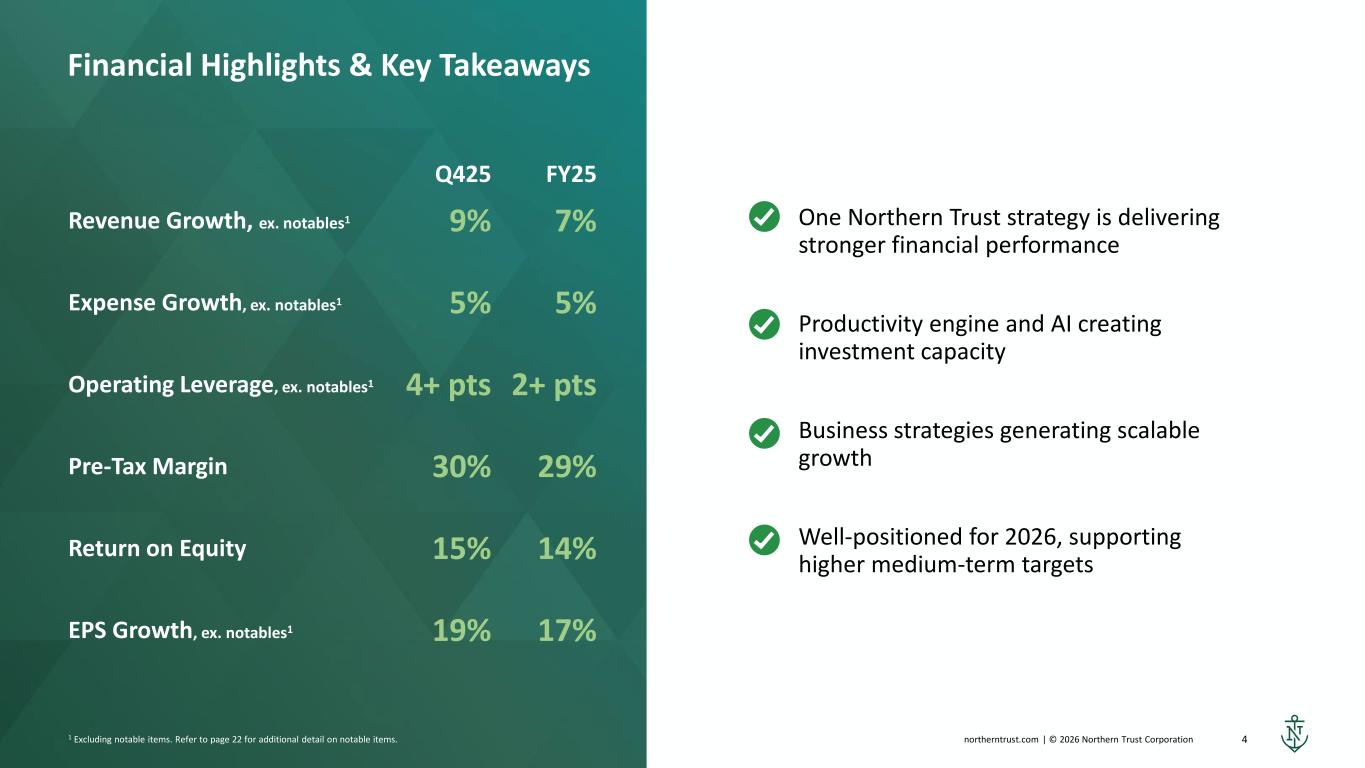

4northerntrust.com | © 2026 Northern Trust Corporation Q425 FY25 Revenue Growth, ex. notables1 9% 7% Expense Growth, ex. notables1 5% 5% Operating Leverage, ex. notables1 4+ pts 2+ pts Pre-Tax Margin 30% 29% Return on Equity 15% 14% EPS Growth, ex. notables1 19% 17% Financial Highlights & Key Takeaways 1 Excluding notable items. Refer to page 22 for additional detail on notable items. One Northern Trust strategy is delivering stronger financial performance Productivity engine and AI creating investment capacity Business strategies generating scalable growth Well-positioned for 2026, supporting higher medium-term targets

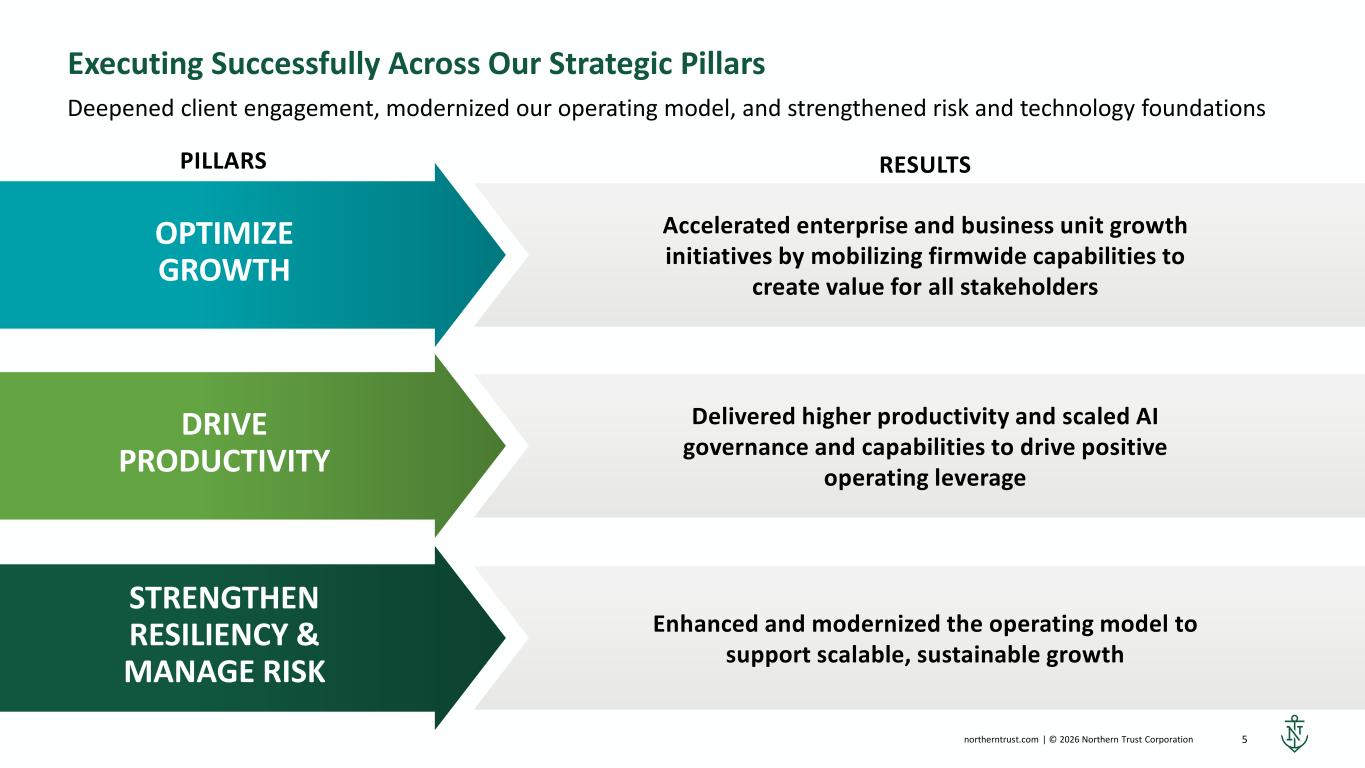

5northerntrust.com | © 2026 Northern Trust Corporation STRENGTHEN RESILIENCY & MANAGE RISK Executing Successfully Across Our Strategic Pillars RESULTSPILLARS Deepened client engagement, modernized our operating model, and strengthened risk and technology foundations Enhanced and modernized the operating model to support scalable, sustainable growth DRIVE PRODUCTIVITY OPTIMIZE GROWTH Delivered higher productivity and scaled AI governance and capabilities to drive positive operating leverage Accelerated enterprise and business unit growth initiatives by mobilizing firmwide capabilities to create value for all stakeholders

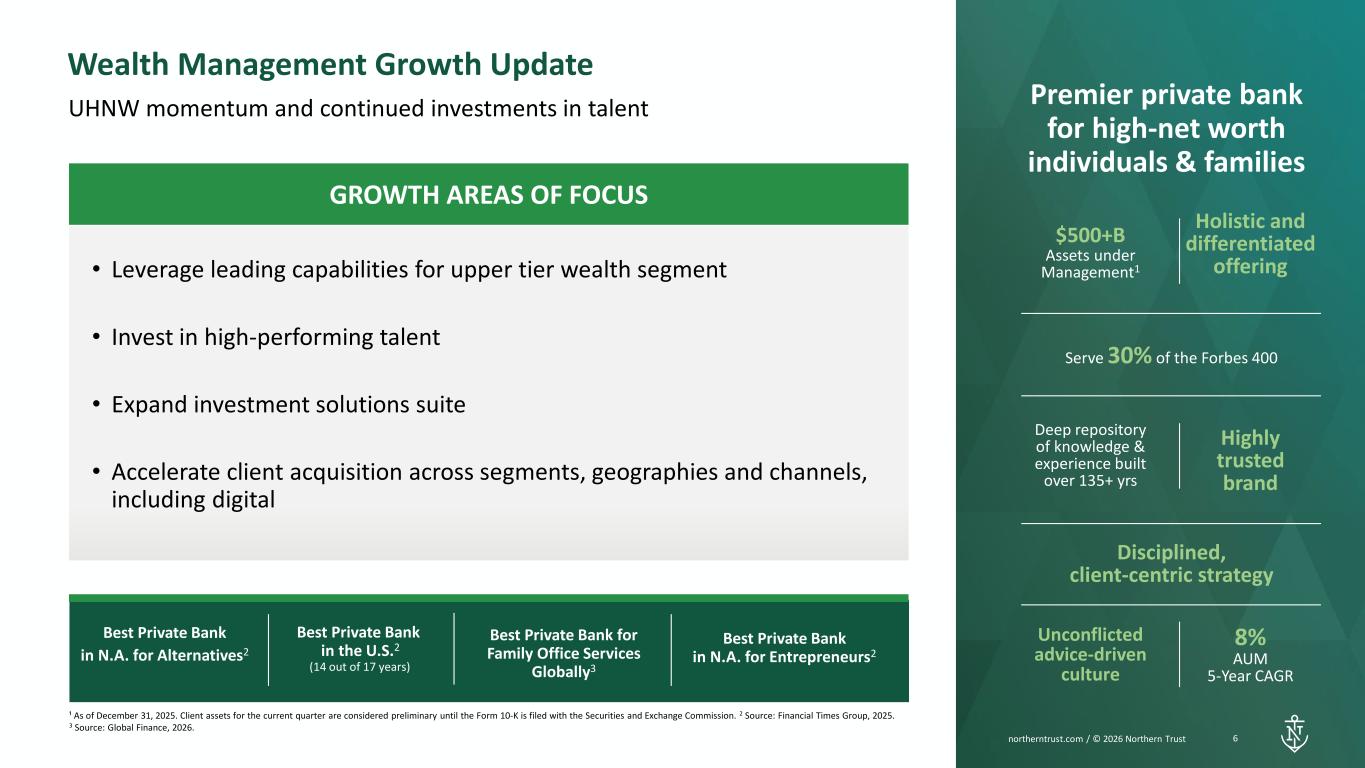

6northerntrust.com | © 2026 Northern Trust Corporation $500+B Assets under Management1 Holistic and differentiated offering Serve 30% of the Forbes 400 Deep repository of knowledge & experience built over 135+ yrs Highly trusted brand Disciplined, client-centric strategy Unconflicted advice-driven culture 8% AUM 5-Year CAGR Premier private bank for high-net worth individuals & families Wealth Management Growth Update GROWTH AREAS OF FOCUS • Leverage leading capabilities for upper tier wealth segment • Invest in high-performing talent • Expand investment solutions suite • Accelerate client acquisition across segments, geographies and channels, including digital UHNW momentum and continued investments in talent Best Private Bank in N.A. for Alternatives2 Best Private Bank in the U.S.2 (14 out of 17 years) Best Private Bank for Family Office Services Globally3 6northerntrust.com / © 2026 Northern T ust Best Private Bank in N.A. for Entrepreneurs2 ¹ As of December 31, 2025. Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. 2 Source: Financial Times Group, 2025. 3 Source: Global Finance, 2026.

7northerntrust.com | © 2026 Northern Trust Corporation 70% of Top 50 U.S. Healthcare Plans1 53% of Top 100 U.S. Corporate PensionPlans1 Market leading technology solutions Scaled and integrated operating platform 80% of Top 10 Sovereign Wealth Funds in APAC1 36% of Top 200 Asset Managers Worldwide1 Deep segment expertise Leading specialized asset servicer for institutional investors Asset Servicing Growth Update GROWTH AREAS OF FOCUS • Scale global Capital Markets and Banking • Maintain momentum with Private Markets • Expand share with up-market Asset Owners • Enhance select capabilities and products Scalable growth and improving margins Best Outsourcing Provider2 Best Global Custodian3 For Asset Owners 7northerntrust.com / © 2026 Northern T ust Institutional Digital Asset Infrastructure Provider of the Year4 International Innovation Awards 20255 (Green Bond Report Tokenization Pilot) ¹ Pensions & Investments, S&P's Money Market Directory. 2 WatersTechnology Asia Awards 2025. 3 AsianInvestor Asset Management Awards 2024. 4 Funds Europe Awards. 5 Enterprise Asia

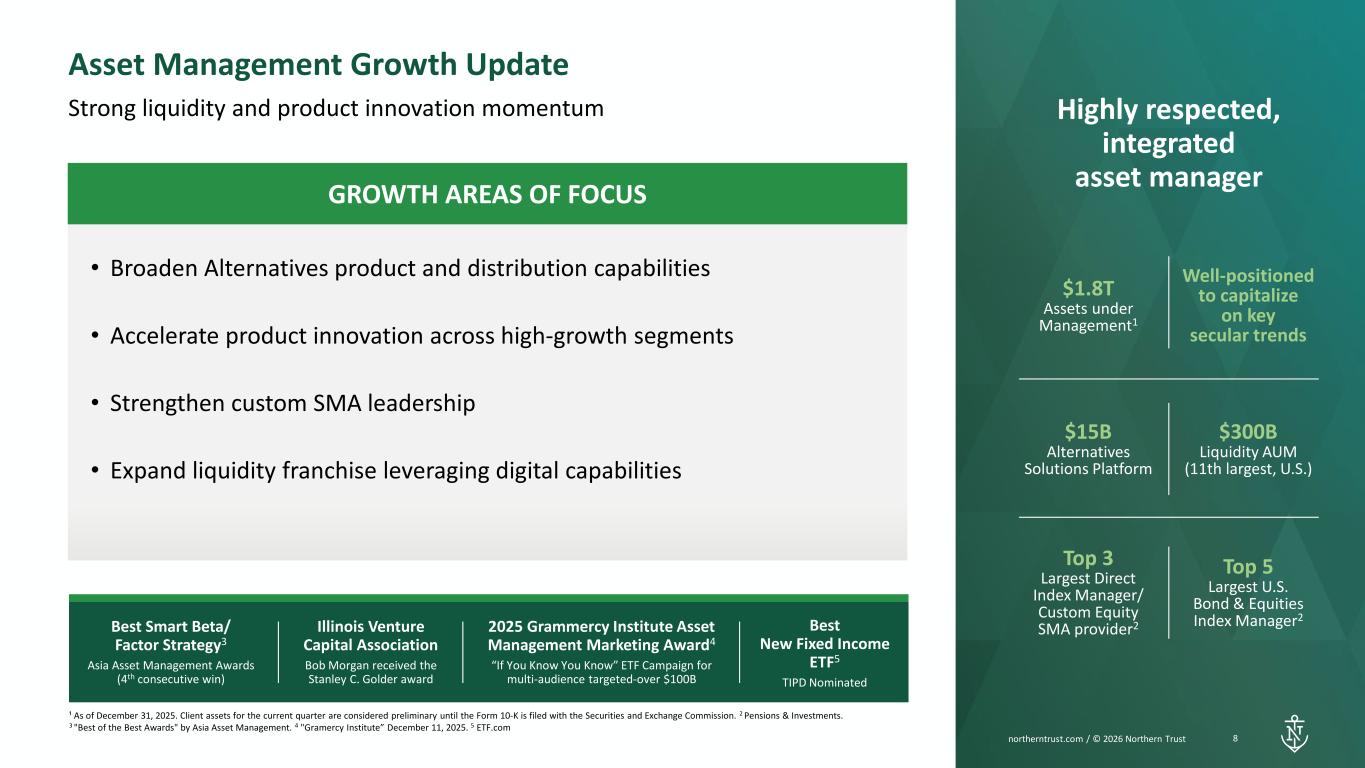

8northerntrust.com | © 2026 Northern Trust Corporation GROWTH AREAS OF FOCUS • Broaden Alternatives product and distribution capabilities • Accelerate product innovation across high-growth segments • Strengthen custom SMA leadership • Expand liquidity franchise leveraging digital capabilities $1.8T Assets under Management1 Well-positioned to capitalize on key secular trends $15B Alternatives Solutions Platform $300B Liquidity AUM (11th largest, U.S.) Top 3 Largest Direct Index Manager/ Custom Equity SMA provider2 Top 5 Largest U.S. Bond & Equities Index Manager2 8northerntrust.com / © 2026 Northern T ust Highly respected, integrated asset manager Asset Management Growth Update ¹ As of December 31, 2025. Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. 2 Pensions & Investments. 3 "Best of the Best Awards" by Asia Asset Management. 4 "Gramercy Institute” December 11, 2025. 5 ETF.com Strong liquidity and product innovation momentum Best Smart Beta/ Factor Strategy3 Asia Asset Management Awards (4th consecutive win) Illinois Venture Capital Association Bob Morgan received the Stanley C. Golder award 2025 Grammercy Institute Asset Management Marketing Award4 “If You Know You Know” ETF Campaign for multi-audience targeted-over $100B Best New Fixed Income ETF5 TIPD Nominated

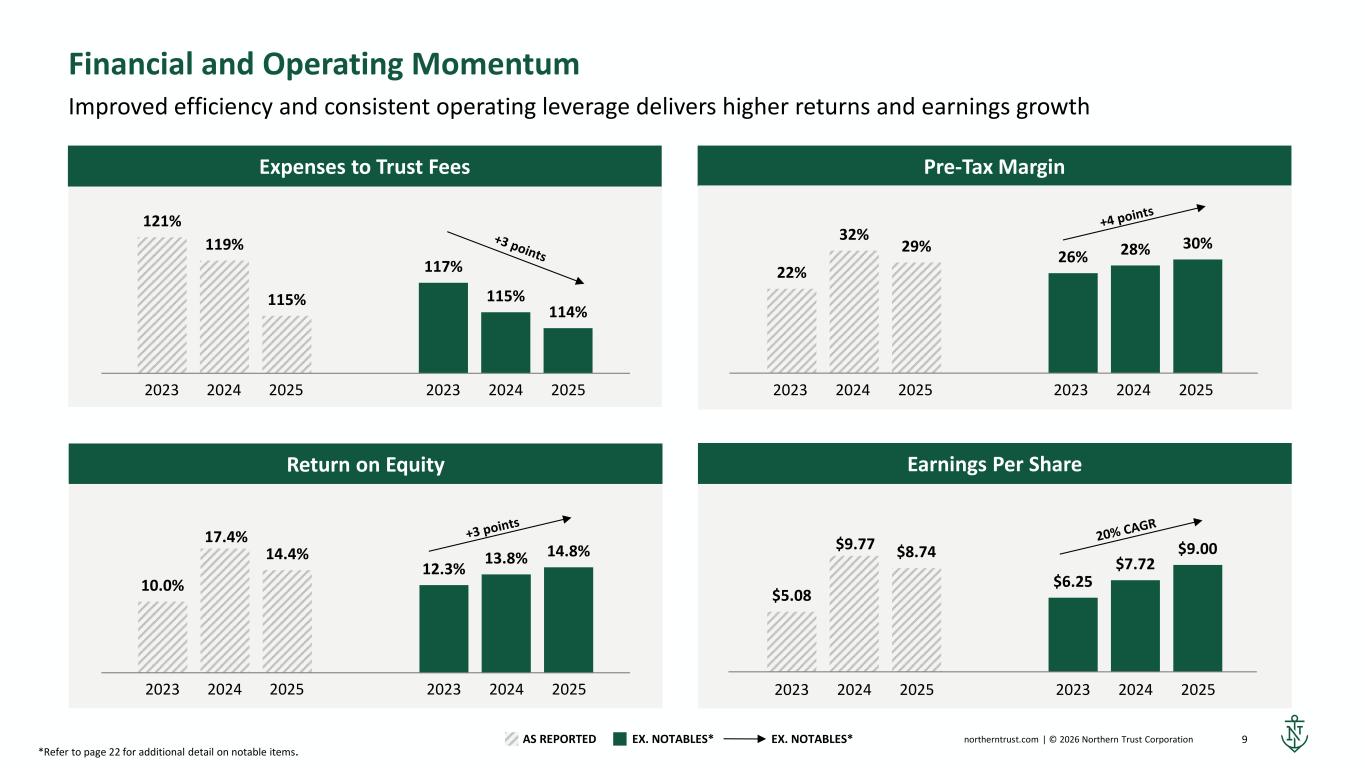

9northerntrust.com | © 2026 Northern Trust Corporation 121% 117% 119% 115%115% 114% Financial and Operating Momentum Improved efficiency and consistent operating leverage delivers higher returns and earnings growth Earnings Per ShareReturn on Equity Pre-Tax MarginExpenses to Trust Fees 2023 2024 2025 2023 2024 2025 22% 26% 32% 28%29% 30% 10.0% 12.3% 17.4% 13.8%14.4% 14.8% $5.08 $6.25 $9.77 $7.72 $8.74 $9.00 2023 2024 2025 2023 2024 2025 2023 2024 2025 2023 2024 2025 2023 2024 2025 2023 2024 2025 EX. NOTABLES*AS REPORTED EX. NOTABLES* *Refer to page 22 for additional detail on notable items.

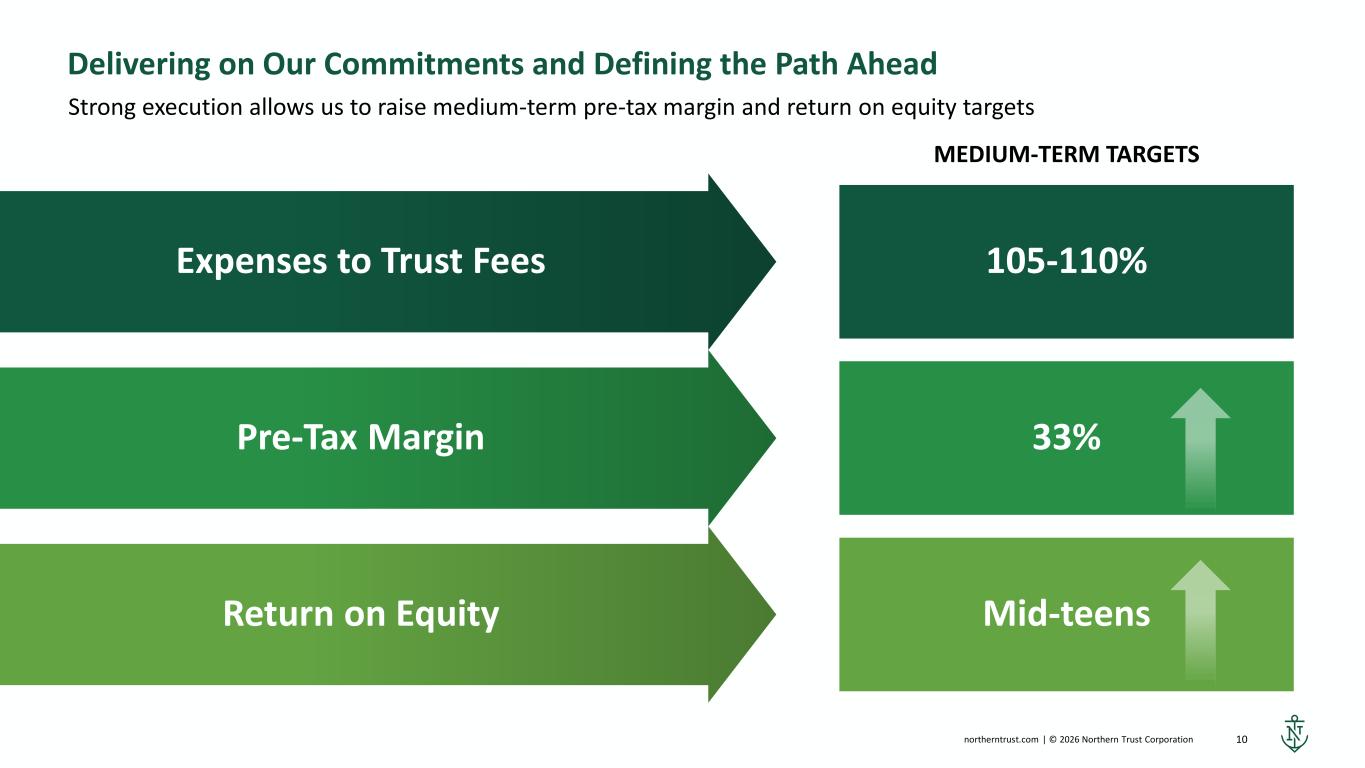

10northerntrust.com | © 2026 Northern Trust Corporation Pre-Tax Margin Expenses to Trust Fees Return on Equity Delivering on Our Commitments and Defining the Path Ahead MEDIUM-TERM TARGETS Strong execution allows us to raise medium-term pre-tax margin and return on equity targets 33% 105-110% Mid-teens

11northerntrust.com | © 2026 Northern Trust Corporation 11northerntrust.com / © 2026 Northern T ust Financial Highlights

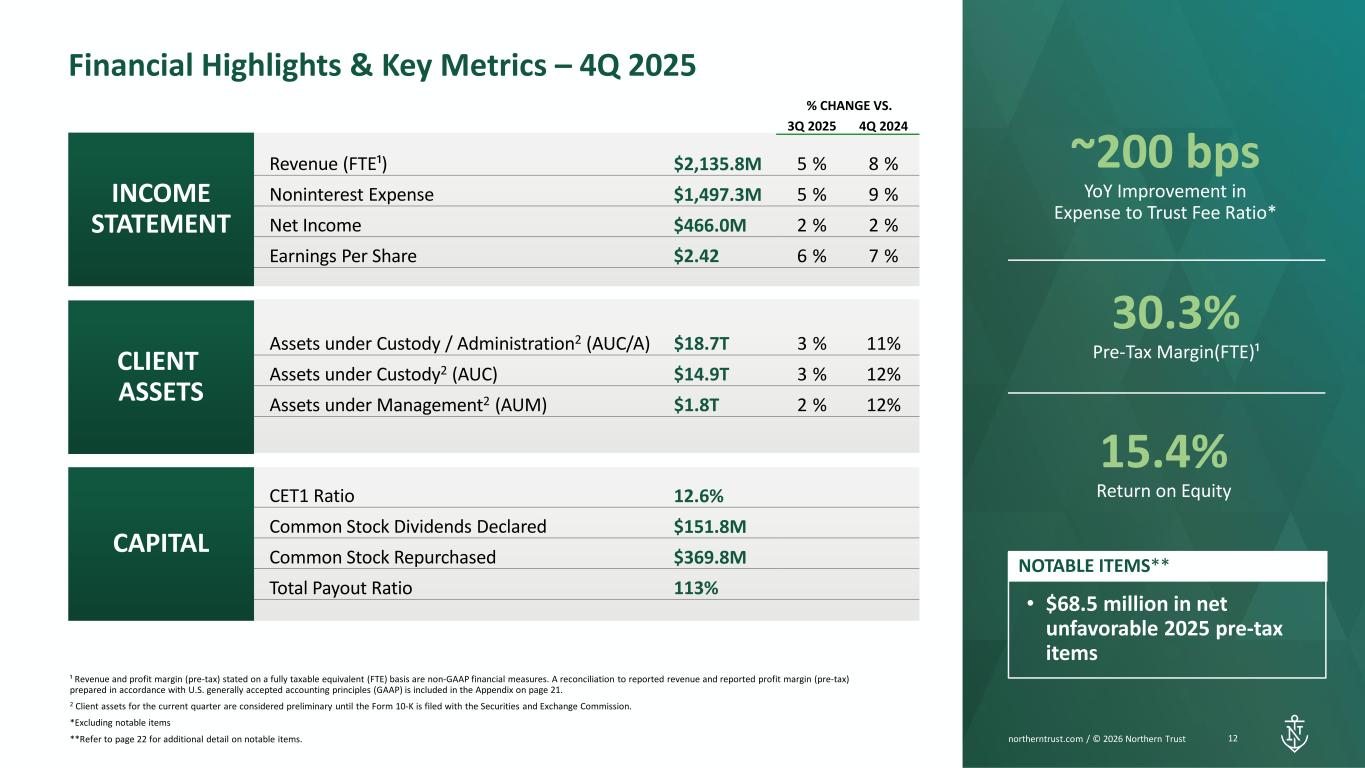

12northerntrust.com | © 2026 Northern Trust Corporation Financial Highlights & Key Metrics – 4Q 2025 ¹ Revenue and profit margin (pre-tax) stated on a fully taxable equivalent (FTE) basis are non-GAAP financial measures. A reconciliation to reported revenue and reported profit margin (pre-tax) prepared in accordance with U.S. generally accepted accounting principles (GAAP) is included in the Appendix on page 21. 2 Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. *Excluding notable items **Refer to page 22 for additional detail on notable items. % CHANGE VS. 3Q 2025 4Q 2024 Revenue (FTE¹) $2,135.8M 5 % 8 % Noninterest Expense $1,497.3M 5 % 9 % Net Income $466.0M 2 % 2 % Earnings Per Share $2.42 6 % 7 % Assets under Custody / Administration2 (AUC/A) $18.7T 3 % 11% Assets under Custody2 (AUC) $14.9T 3 % 12% Assets under Management2 (AUM) $1.8T 2 % 12% 30.3% Pre-Tax Margin(FTE)¹ ~200 bps YoY Improvement in Expense to Trust Fee Ratio* 15.4% Return on Equity 12northerntrust.com / © 2026 Northern T ust • $68.5 million in net unfavorable 2025 pre-tax items CET1 Ratio 12.6% Common Stock Dividends Declared $151.8M Common Stock Repurchased $369.8M Total Payout Ratio 113% NOTABLE ITEMS** INCOME STATEMENT CLIENT ASSETS CAPITAL

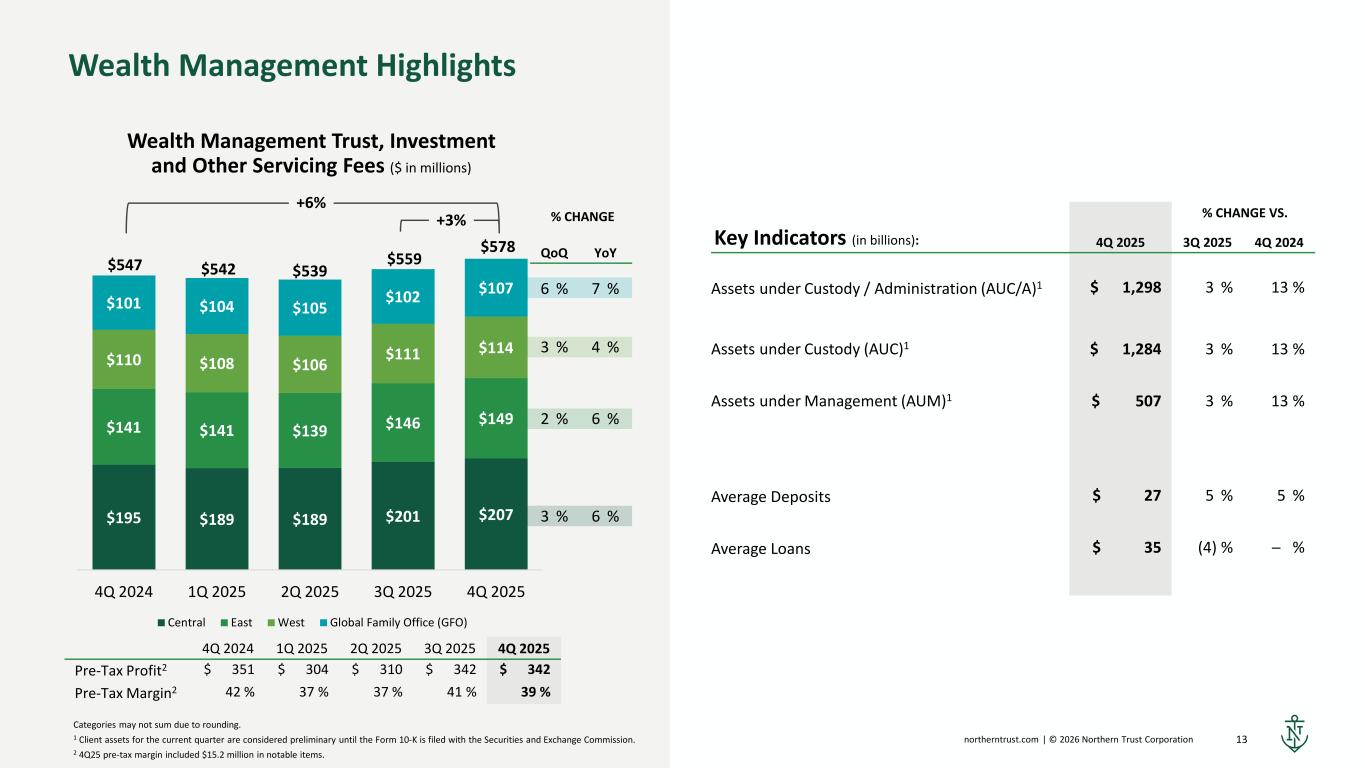

13northerntrust.com | © 2026 Northern Trust Corporation $195 $189 $189 $201 $207 $141 $141 $139 $146 $149 $110 $108 $106 $111 $114 $101 $104 $105 $102 $107 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Central East West Global Family Office (GFO) Wealth Management Trust, Investment and Other Servicing Fees ($ in millions) +6% +3% $539$547 $542 $559 $578 Wealth Management Highlights Categories may not sum due to rounding. 1 Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. 2 4Q25 pre-tax margin included $15.2 million in notable items. % CHANGE VS. Key Indicators (in billions): 4Q 2025 3Q 2025 4Q 2024 Assets under Custody / Administration (AUC/A)1 $ 1,298 3 % 13 % Assets under Custody (AUC)1 $ 1,284 3 % 13 % Assets under Management (AUM)1 $ 507 3 % 13 % Average Deposits $ 27 5 % 5 % Average Loans $ 35 (4) % ─ % 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Pre-Tax Profit2 $ 351 $ 304 $ 310 $ 342 $ 342 Pre-Tax Margin2 42 % 37 % 37 % 41 % 39 % % CHANGE QoQ YoY 6 % 7 % 3 % 4 % 2 % 6 % 3 % 6 %

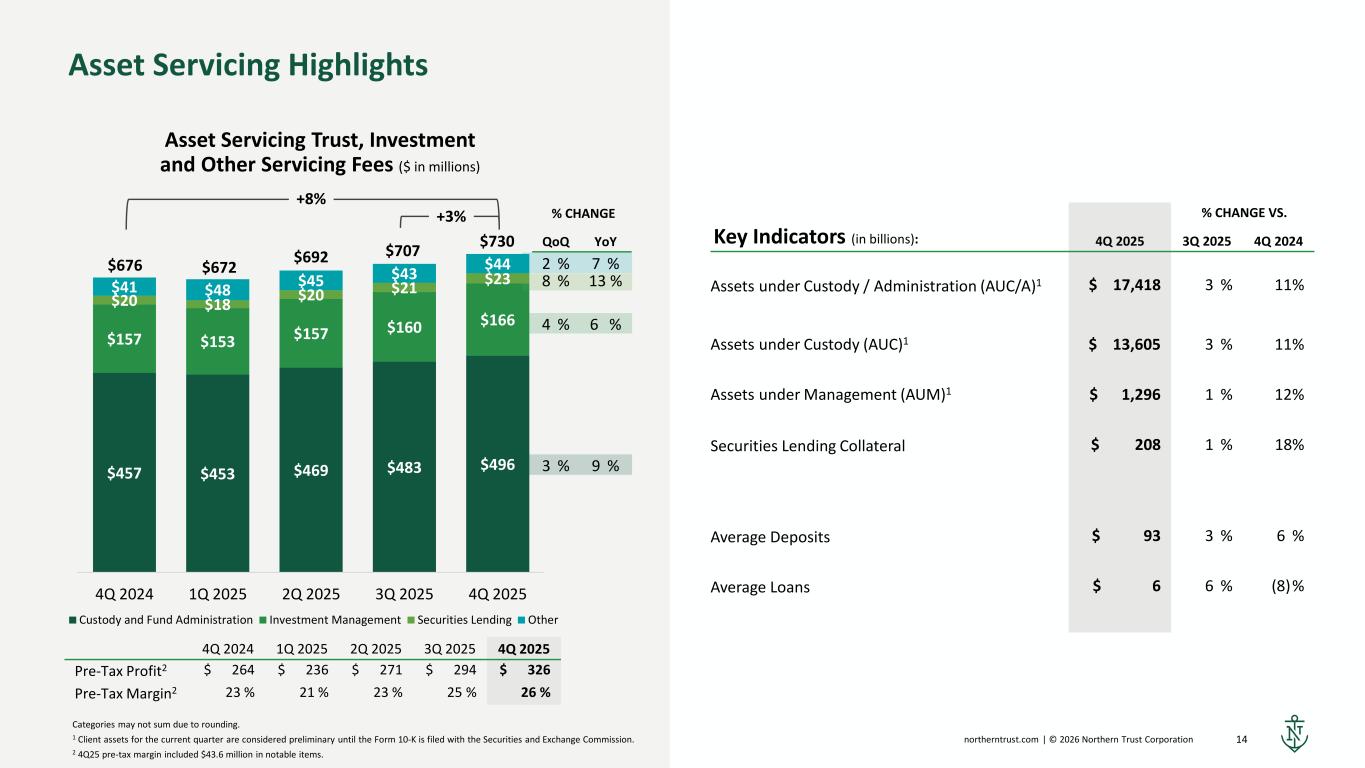

14northerntrust.com | © 2026 Northern Trust Corporation $457 $453 $469 $483 $496 $157 $153 $157 $160 $166 $20 $18 $20 $21 $23$41 $48 $45 $43 $44 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Custody and Fund Administration Investment Management Securities Lending Other % CHANGE VS. Key Indicators (in billions): 4Q 2025 3Q 2025 4Q 2024 Assets under Custody / Administration (AUC/A)1 $ 17,418 3 % 11 % Assets under Custody (AUC)1 $ 13,605 3 % 11 % Assets under Management (AUM)1 $ 1,296 1 % 12 % Securities Lending Collateral $ 208 1 % 18% Average Deposits $ 93 3 % 6 % Average Loans $ 6 6 % (8) % Asset Servicing Trust, Investment and Other Servicing Fees ($ in millions) $692$672$676 $707 $730 Asset Servicing Highlights +8% +3% Categories may not sum due to rounding. 1 Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. 2 4Q25 pre-tax margin included $43.6 million in notable items. 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Pre-Tax Profit2 $ 264 $ 236 $ 271 $ 294 $ 326 Pre-Tax Margin2 23 % 21 % 23 % 25 % 26 % % CHANGE QoQ YoY 2 % 7 % 8 % 13 % 4 % 6 % 3 % 9 %

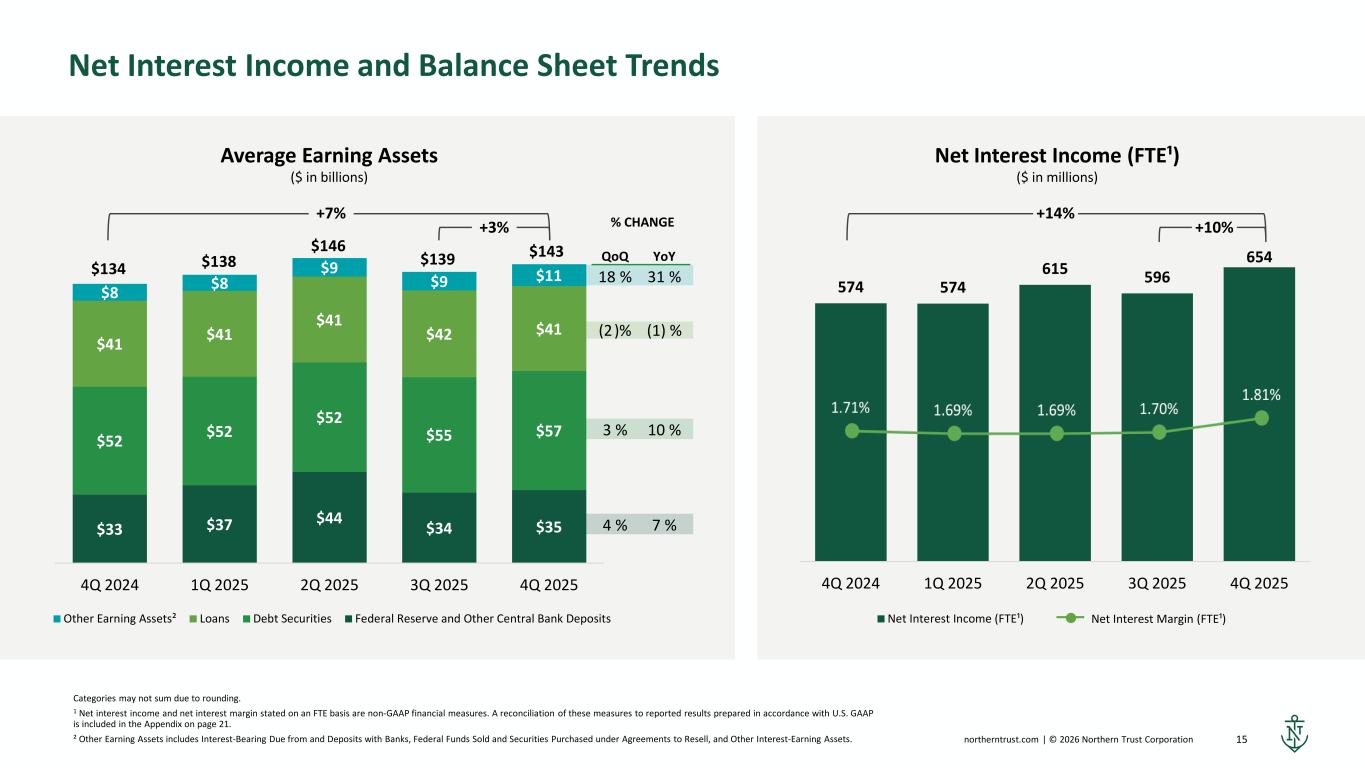

15northerntrust.com | © 2026 Northern Trust Corporation 574 574 615 596 654 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Net Interest Income (FTE¹) $33 $37 $44 $34 $35 $52 $52 $52 $55 $57 $41 $41 $41 $42 $41 $8 $8 $9 $9 $11 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Other Earning Assets² Loans Debt Securities Federal Reserve and Other Central Bank Deposits $139 Average Earning Assets ($ in billions) Net Interest Income (FTE¹) ($ in millions) $134 $138 $146 $143 Net Interest Income and Balance Sheet Trends Categories may not sum due to rounding. 1 Net interest income and net interest margin stated on an FTE basis are non-GAAP financial measures. A reconciliation of these measures to reported results prepared in accordance with U.S. GAAP is included in the Appendix on page 21. ² Other Earning Assets includes Interest-Bearing Due from and Deposits with Banks, Federal Funds Sold and Securities Purchased under Agreements to Resell, and Other Interest-Earning Assets. +7% +3% Net Interest Margin (FTE¹) +14% +10%% CHANGE QoQ YoY 18 % 31 % (2)% (1) % 3 % 10 % 4 % 7 %

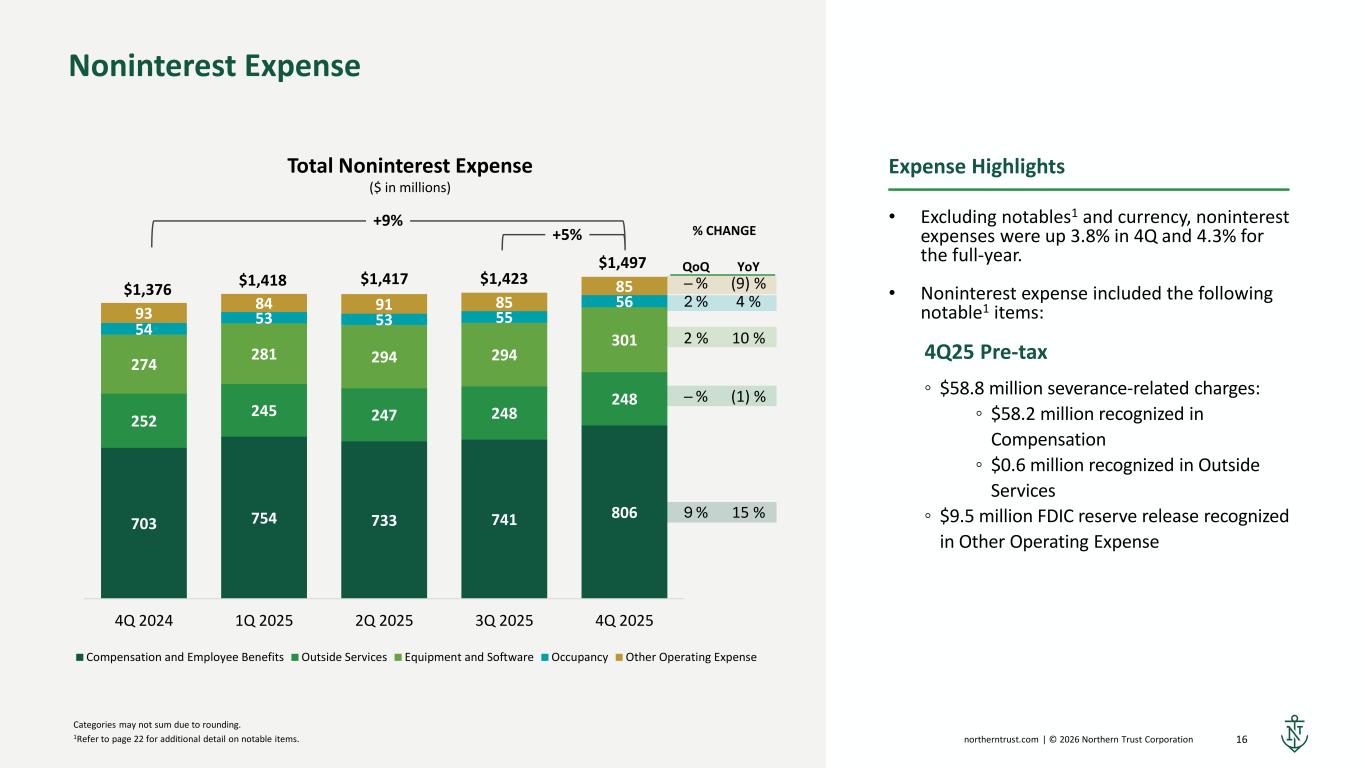

16northerntrust.com | © 2026 Northern Trust Corporation Total Noninterest Expense ($ in millions) Noninterest Expense Categories may not sum due to rounding. 1Refer to page 22 for additional detail on notable items. Expense Highlights • Excluding notables1 and currency, noninterest expenses were up 3.8% in 4Q and 4.3% for the full-year. • Noninterest expense included the following notable1 items: 4Q25 Pre-tax ◦ $58.8 million severance-related charges: ◦ $58.2 million recognized in Compensation ◦ $0.6 million recognized in Outside Services ◦ $9.5 million FDIC reserve release recognized in Other Operating Expense 703 754 733 741 806 252 245 247 248 248 274 281 294 294 301 54 53 53 55 56 93 84 91 85 85 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Compensation and Employee Benefits Outside Services Equipment and Software Occupancy Other Operating Expense +9% +5% $1,417$1,418$1,376 $1,423 $1,497 % CHANGE QoQ YoY ─ % (9) % 2 % 4 % 2 % 10 % ─ % (1) % 9 % 15 %

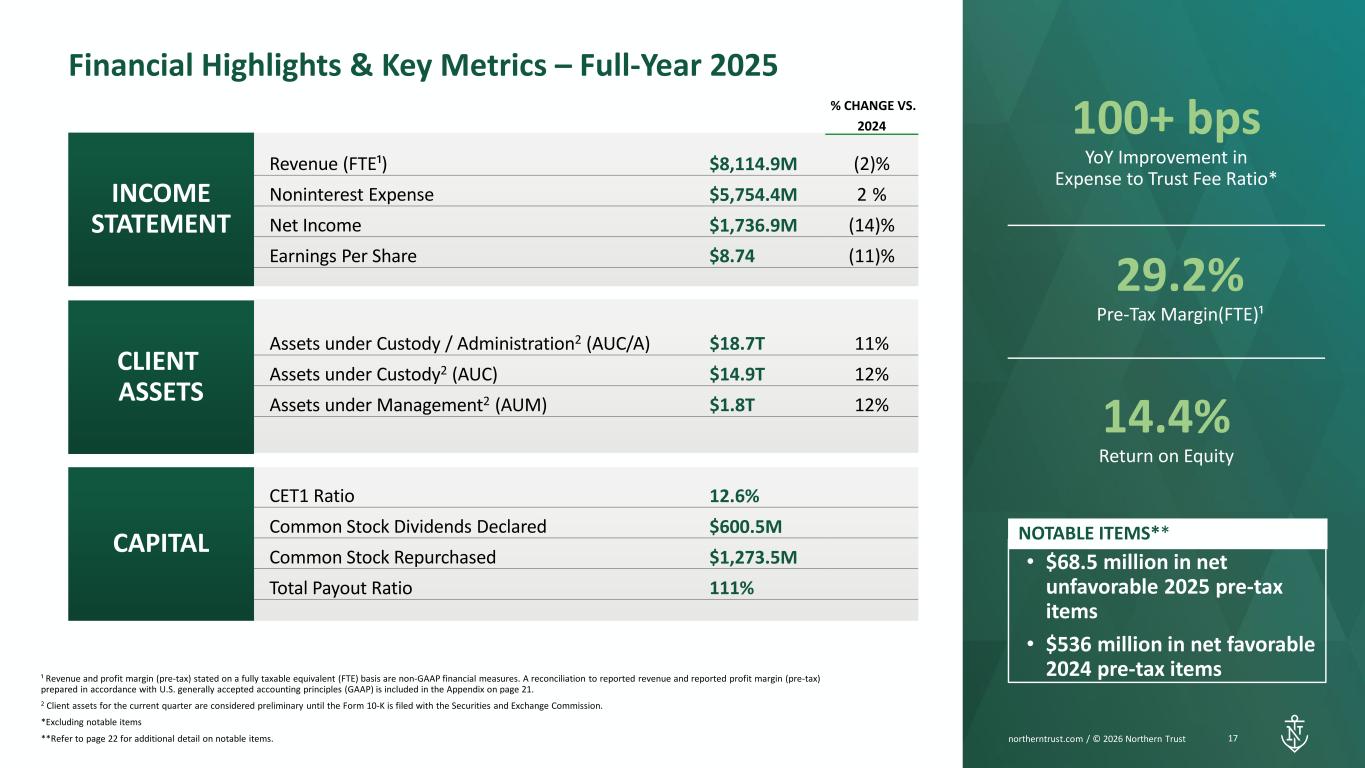

17northerntrust.com | © 2026 Northern Trust Corporation Financial Highlights & Key Metrics – Full-Year 2025 29.2% Pre-Tax Margin(FTE)¹ 100+ bps YoY Improvement in Expense to Trust Fee Ratio* 14.4% Return on Equity 17northerntrust.com / © 2026 Northern T ust ¹ Revenue and profit margin (pre-tax) stated on a fully taxable equivalent (FTE) basis are non-GAAP financial measures. A reconciliation to reported revenue and reported profit margin (pre-tax) prepared in accordance with U.S. generally accepted accounting principles (GAAP) is included in the Appendix on page 21. 2 Client assets for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. *Excluding notable items **Refer to page 22 for additional detail on notable items. INCOME STATEMENT CLIENT ASSETS CAPITAL % CHANGE VS. 2024 Revenue (FTE¹) $8,114.9M (2)% Noninterest Expense $5,754.4M 2 % Net Income $1,736.9M (14)% Earnings Per Share $8.74 (11)% Assets under Custody / Administration2 (AUC/A) $18.7T 11% Assets under Custody2 (AUC) $14.9T 12% Assets under Management2 (AUM) $1.8T 12% CET1 Ratio 12.6% Common Stock Dividends Declared $600.5M Common Stock Repurchased $1,273.5M Total Payout Ratio 111% • $68.5 million in net unfavorable 2025 pre-tax items • $536 million in net favorable 2024 pre-tax items NOTABLE ITEMS**

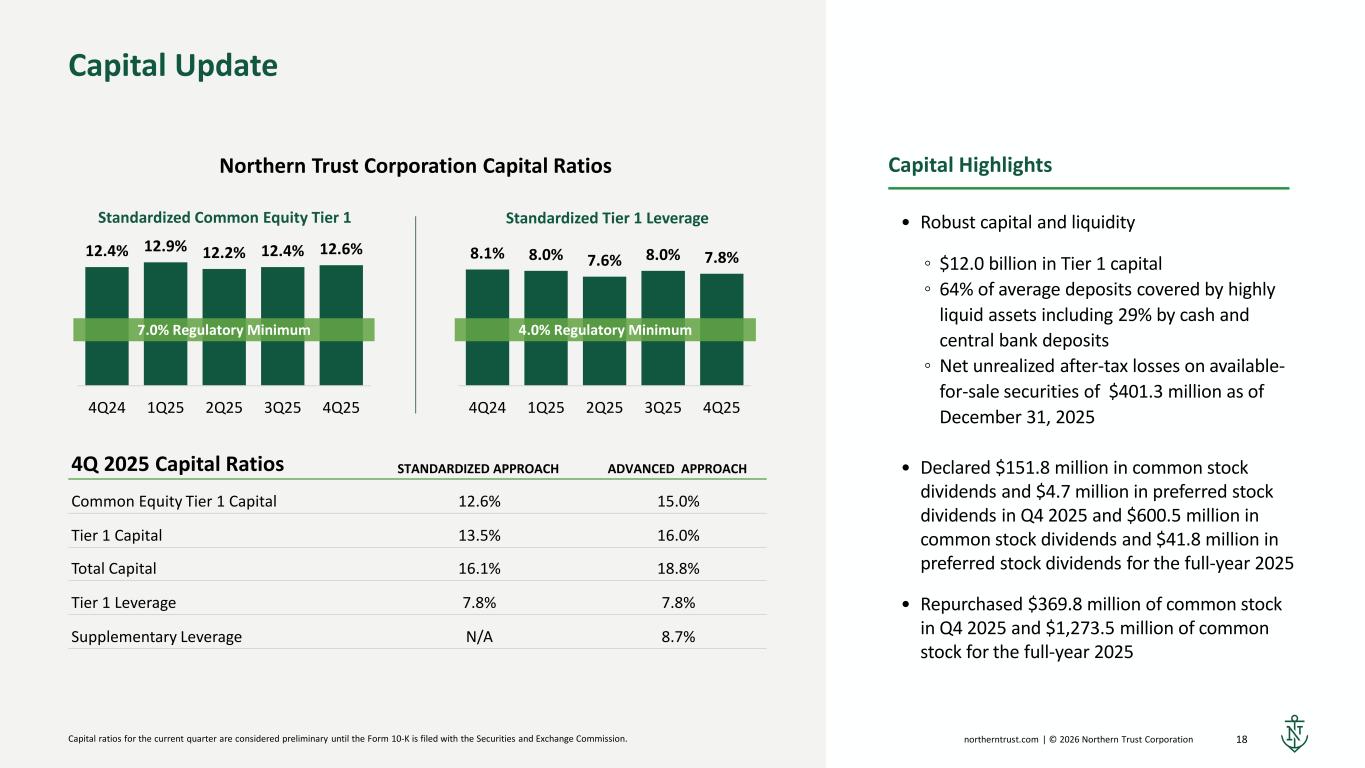

18northerntrust.com | © 2026 Northern Trust Corporation Standardized Tier 1 Leverage Capital Highlights • Robust capital and liquidity ◦ $12.0 billion in Tier 1 capital ◦ 64% of average deposits covered by highly liquid assets including 29% by cash and central bank deposits ◦ Net unrealized after-tax losses on available- for-sale securities of $401.3 million as of December 31, 2025 • Declared $151.8 million in common stock dividends and $4.7 million in preferred stock dividends in Q4 2025 and $600.5 million in common stock dividends and $41.8 million in preferred stock dividends for the full-year 2025 • Repurchased $369.8 million of common stock in Q4 2025 and $1,273.5 million of common stock for the full-year 2025 Northern Trust Corporation Capital Ratios 4Q 2025 Capital Ratios STANDARDIZED APPROACH ADVANCED APPROACH Common Equity Tier 1 Capital 12.6% 15.0% Tier 1 Capital 13.5% 16.0% Total Capital 16.1% 18.8% Tier 1 Leverage 7.8% 7.8% Supplementary Leverage N/A 8.7% Standardized Common Equity Tier 1 Capital Update Capital ratios for the current quarter are considered preliminary until the Form 10-K is filed with the Securities and Exchange Commission. 12.4% 12.9% 12.2% 12.4% 12.6% 4Q24 1Q25 2Q25 3Q25 4Q25 7.0% Regulatory Minimum 8.1% 8.0% 7.6% 8.0% 7.8% 4Q24 1Q25 2Q25 3Q25 4Q25 4.0% Regulatory Minimum

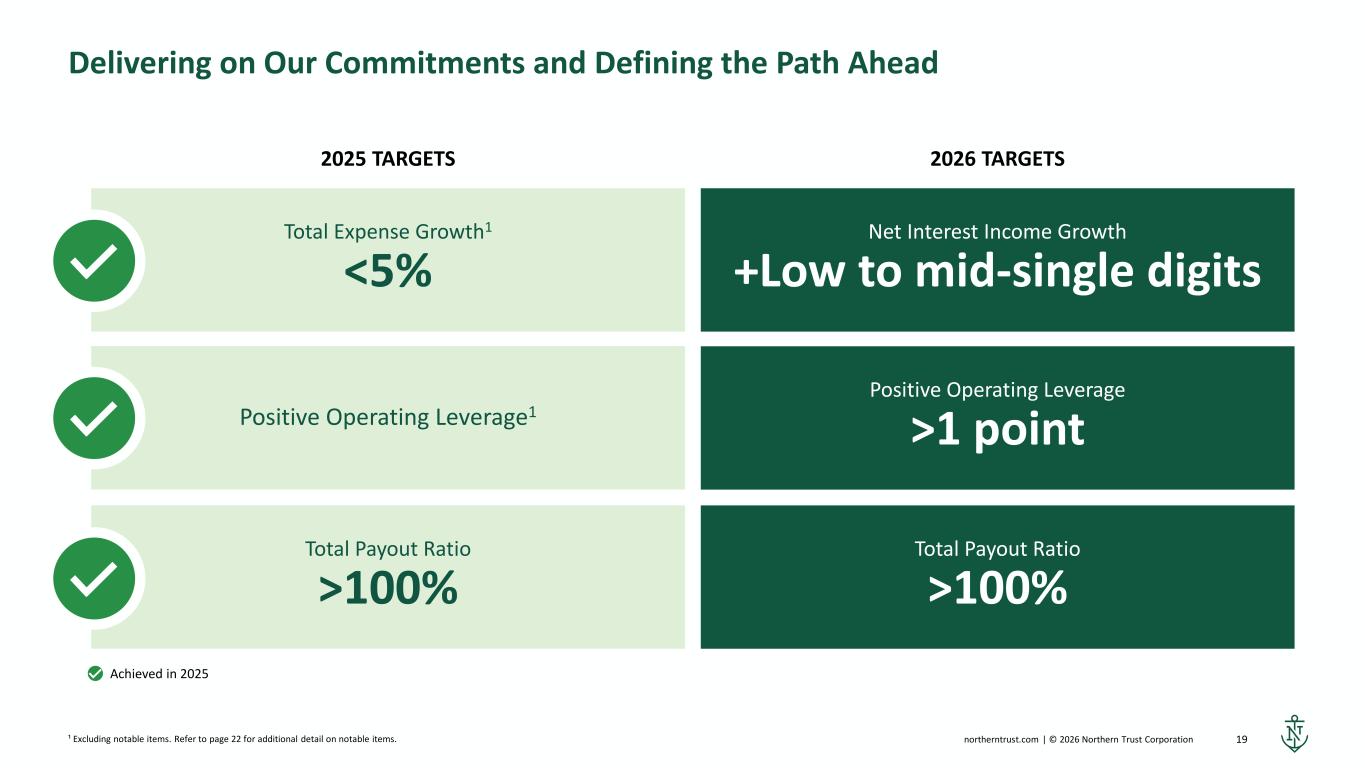

19northerntrust.com | © 2026 Northern Trust Corporation Delivering on Our Commitments and Defining the Path Ahead ¹ Excluding notable items. Refer to page 22 for additional detail on notable items. Positive Operating Leverage >1 point 2026 TARGETS2025 TARGETS Total Expense Growth1 <5% Positive Operating Leverage1 Total Payout Ratio >100% Net Interest Income Growth +Low to mid-single digits Total Payout Ratio >100% Achieved in 2025

Appendix northerntrust.com / © 2026 Northern Trust

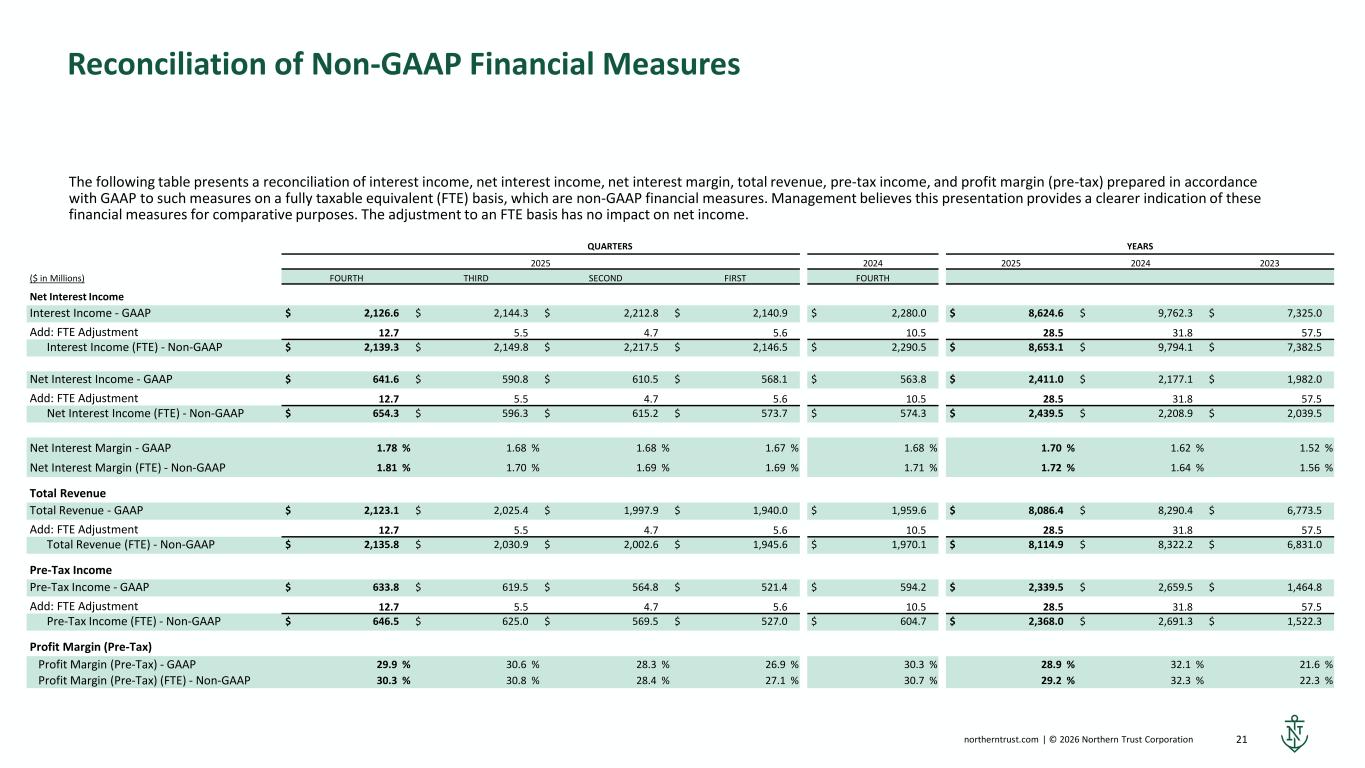

21northerntrust.com | © 2026 Northern Trust Corporation Reconciliation of Non-GAAP Financial Measures The following table presents a reconciliation of interest income, net interest income, net interest margin, total revenue, pre-tax income, and profit margin (pre-tax) prepared in accordance with GAAP to such measures on a fully taxable equivalent (FTE) basis, which are non-GAAP financial measures. Management believes this presentation provides a clearer indication of these financial measures for comparative purposes. The adjustment to an FTE basis has no impact on net income. QUARTERS YEARS 2025 2024 2025 2024 2023 ($ in Millions) FOURTH THIRD SECOND FIRST FOURTH Net Interest Income Interest Income - GAAP $ 2,126.6 $ 2,144.3 $ 2,212.8 $ 2,140.9 $ 2,280.0 $ 8,624.6 $ 9,762.3 $ 7,325.0 Add: FTE Adjustment 12.7 5.5 4.7 5.6 10.5 28.5 31.8 57.5 Interest Income (FTE) - Non-GAAP $ 2,139.3 $ 2,149.8 $ 2,217.5 $ 2,146.5 $ 2,290.5 $ 8,653.1 $ 9,794.1 $ 7,382.5 Net Interest Income - GAAP $ 641.6 $ 590.8 $ 610.5 $ 568.1 $ 563.8 $ 2,411.0 $ 2,177.1 $ 1,982.0 Add: FTE Adjustment 12.7 5.5 4.7 5.6 10.5 28.5 31.8 57.5 Net Interest Income (FTE) - Non-GAAP $ 654.3 $ 596.3 $ 615.2 $ 573.7 $ 574.3 $ 2,439.5 $ 2,208.9 $ 2,039.5 Net Interest Margin - GAAP 1.78 % 1.68 % 1.68 % 1.67 % 1.68 % 1.70 % 1.62 % 1.52 % Net Interest Margin (FTE) - Non-GAAP 1.81 % 1.70 % 1.69 % 1.69 % 1.71 % 1.72 % 1.64 % 1.56 % Total Revenue Total Revenue - GAAP $ 2,123.1 $ 2,025.4 $ 1,997.9 $ 1,940.0 $ 1,959.6 $ 8,086.4 $ 8,290.4 $ 6,773.5 Add: FTE Adjustment 12.7 5.5 4.7 5.6 10.5 28.5 31.8 57.5 Total Revenue (FTE) - Non-GAAP $ 2,135.8 $ 2,030.9 $ 2,002.6 $ 1,945.6 $ 1,970.1 $ 8,114.9 $ 8,322.2 $ 6,831.0 Pre-Tax Income Pre-Tax Income - GAAP $ 633.8 $ 619.5 $ 564.8 $ 521.4 $ 594.2 $ 2,339.5 $ 2,659.5 $ 1,464.8 Add: FTE Adjustment 12.7 5.5 4.7 5.6 10.5 28.5 31.8 57.5 Pre-Tax Income (FTE) - Non-GAAP $ 646.5 $ 625.0 $ 569.5 $ 527.0 $ 604.7 $ 2,368.0 $ 2,691.3 $ 1,522.3 Profit Margin (Pre-Tax) Profit Margin (Pre-Tax) - GAAP 29.9 % 30.6 % 28.3 % 26.9 % 30.3 % 28.9 % 32.1 % 21.6 % Profit Margin (Pre-Tax) (FTE) - Non-GAAP 30.3 % 30.8 % 28.4 % 27.1 % 30.7 % 29.2 % 32.3 % 22.3 %

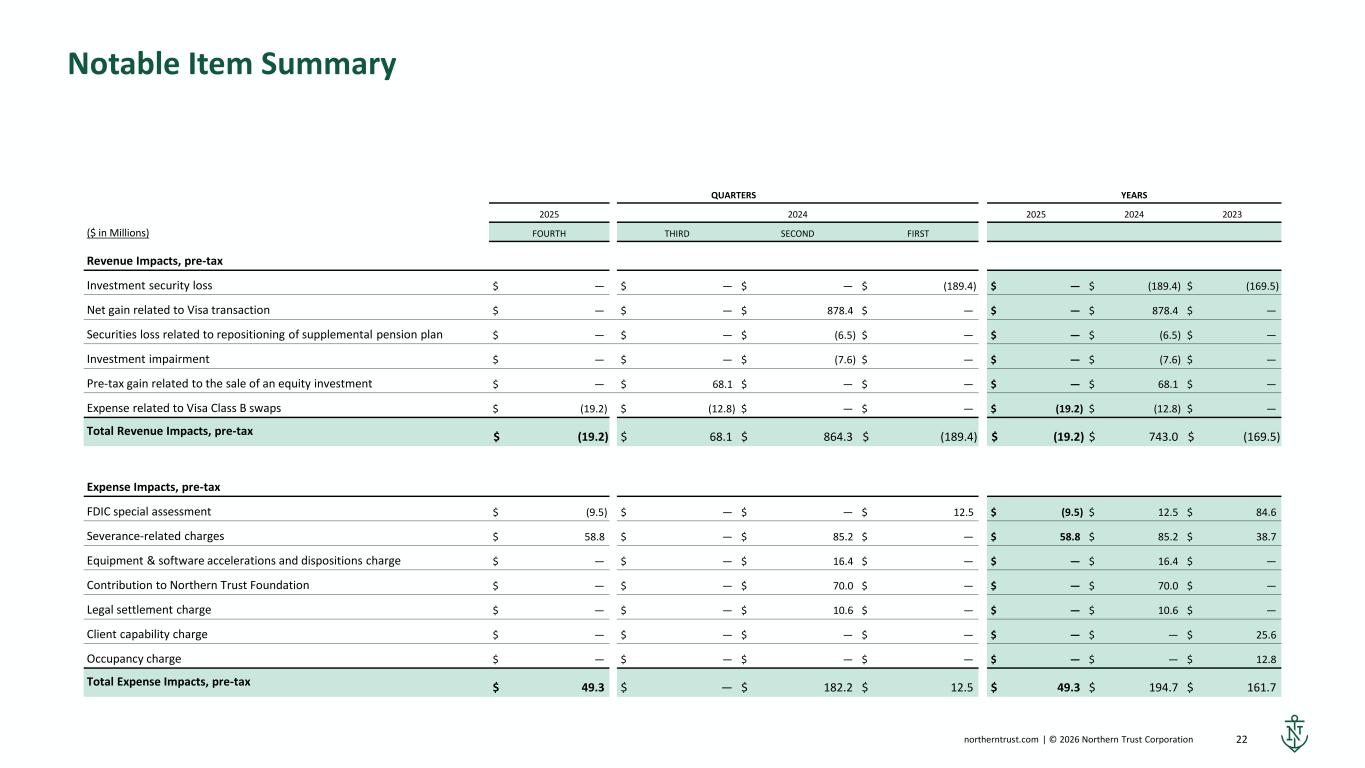

22northerntrust.com | © 2026 Northern Trust Corporation Notable Item Summary QUARTERS YEARS 2025 2024 2025 2024 2023 ($ in Millions) FOURTH THIRD SECOND FIRST Revenue Impacts, pre-tax Investment security loss $ — $ — $ — $ (189.4) $ — $ (189.4) $ (169.5) Net gain related to Visa transaction $ — $ — $ 878.4 $ — $ — $ 878.4 $ — Securities loss related to repositioning of supplemental pension plan $ — $ — $ (6.5) $ — $ — $ (6.5) $ — Investment impairment $ — $ — $ (7.6) $ — $ — $ (7.6) $ — Pre-tax gain related to the sale of an equity investment $ — $ 68.1 $ — $ — $ — $ 68.1 $ — Expense related to Visa Class B swaps $ (19.2) $ (12.8) $ — $ — $ (19.2) $ (12.8) $ — Total Revenue Impacts, pre-tax $ (19.2) $ 68.1 $ 864.3 $ (189.4) $ (19.2) $ 743.0 $ (169.5) Expense Impacts, pre-tax FDIC special assessment $ (9.5) $ — $ — $ 12.5 $ (9.5) $ 12.5 $ 84.6 Severance-related charges $ 58.8 $ — $ 85.2 $ — $ 58.8 $ 85.2 $ 38.7 Equipment & software accelerations and dispositions charge $ — $ — $ 16.4 $ — $ — $ 16.4 $ — Contribution to Northern Trust Foundation $ — $ — $ 70.0 $ — $ — $ 70.0 $ — Legal settlement charge $ — $ — $ 10.6 $ — $ — $ 10.6 $ — Client capability charge $ — $ — $ — $ — $ — $ — $ 25.6 Occupancy charge $ — $ — $ — $ — $ — $ — $ 12.8 Total Expense Impacts, pre-tax $ 49.3 $ — $ 182.2 $ 12.5 $ 49.3 $ 194.7 $ 161.7

23northerntrust.com | © 2026 Northern Trust Corporation Forward-Looking Statements This presentation may include statements which constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified typically by words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “likely,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements include statements, other than those related to historical facts, that relate to Northern Trust’s financial results and outlook, capital adequacy, dividend policy and share repurchase program, accounting estimates and assumptions, credit quality including allowance levels, future pension plan contributions, effective tax rate, anticipated expense levels, contingent liabilities, acquisitions, strategies, market and industry trends, and expectations regarding the impact of accounting pronouncements and legislation. These statements are based on Northern Trust’s current beliefs and expectations of future events or future results, and involve risks and uncertainties that are difficult to predict and subject to change. These statements are also based on assumptions about many important factors, including the factors discussed in Northern Trust’s most recent annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission, all of which are available on Northern Trust’s website. We caution you not to place undue reliance on any forward-looking statement as actual results may differ materially from those expressed or implied by forward-looking statements. Northern Trust assumes no obligation to update its forward-looking statements. This presentation should be reviewed together with Northern Trust Corporation’s Fourth Quarter 2025 earnings press release.