¨ | Preliminary Proxy Statement | |||

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

þ | Definitive Proxy Statement | |||

¨ | Definitive Additional Materials | |||

¨ | Soliciting Material Pursuant to § 240.14a-12 | |||

OCEANEERING INTERNATIONAL, INC. | ||||

(Name of Registrant as Specified in its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

þ | No fee required. | |||

¨ | Fee paid previously with preliminary materials. | |||

¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|  |  |

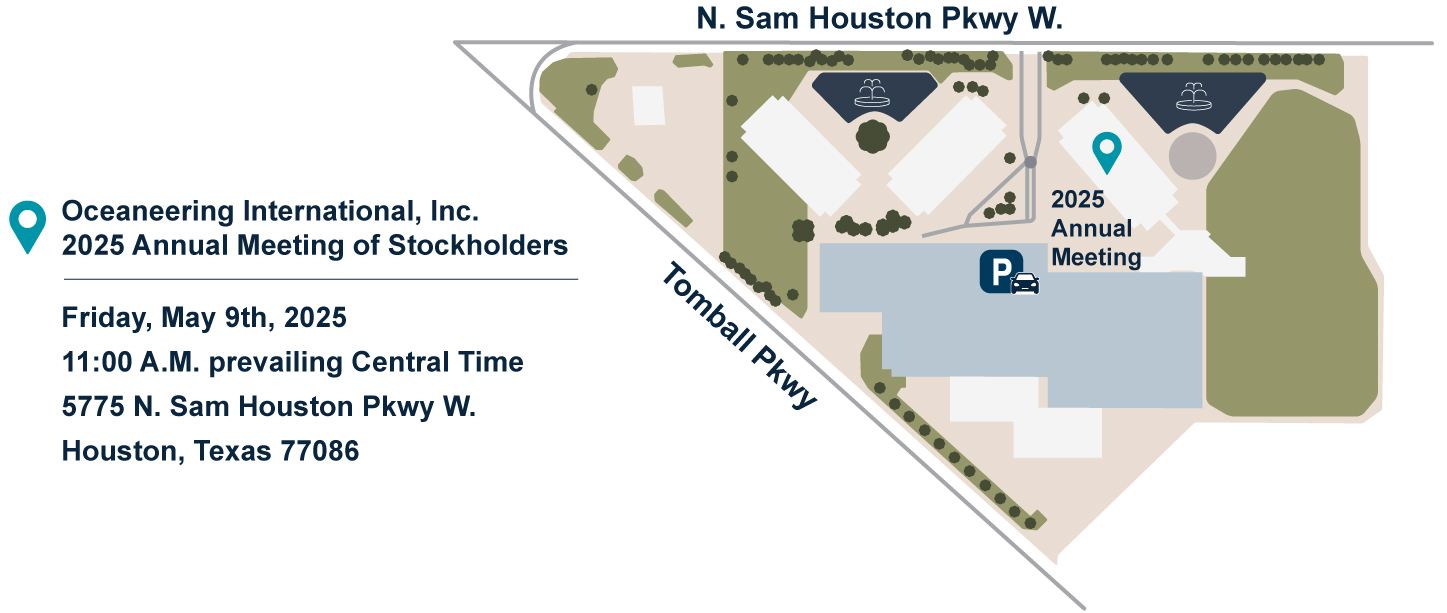

Date and Time: Friday, May 9, 2025 11:00 A.M. prevailing Central Time | Location: 5775 N. Sam Houston Pkwy. W. Houston, Texas 77086 | Who Can Vote: Stockholders of record at the close of business on March 17, 2025 |

1 | Election of Class III Directors: Roderick A. Larson, M. Kevin McEvoy, and Paul B. Murphy, Jr. | FOR each of the nominees |

2 | Advisory Vote to Approve Executive Compensation | FOR |

3 | Ratification of Appointment of Ernst & Young LLP as independent auditors of Oceaneering for the year ending December 31, 2025 | FOR |

4 | Approval of Amended and Restated 2020 Incentive Plan | FOR |

Sincerely, |

|

Jennifer F. Simons Senior Vice President, Chief Legal Officer and Secretary |

March 28, 2025 |

| Subsea Robotics (SSR) merges our underwater robotics and automation capabilities by combining our Remotely Operated Vehicles (ROV), Survey, and ROV Tooling businesses. |

| Manufactured Products (MP) brings together our competencies and expertise in manufacturing, project management, and advanced technology product development, including in robotics and automation, to deliver subsea and surface products to energy and non-energy customers. |

| Offshore Projects Group (OPG) provides a broad portfolio of integrated subsea solutions for completions, construction, well intervention, inspection, maintenance, and repair activities that enhance the efficiency and capability of our customers’ assets. |

| Integrity Management & Digital Solutions (IMDS) leverages software, analytics, and services to establish optimized inspection and maintenance programs that promote the safety, efficiency, and cost effectiveness of our customers’ programs and assets. |

| Aerospace and Defense Technologies (ADTech) provides engineering services and related manufacturing, principally for the U.S. Department of Defense and for government and commercial space customers. |

About the cover art: Our stakeholders often ask us what the “crystal ball” is telling us about the future of our markets, offerings, and performance. With this in mind, our talented graphic designers imagined an Oceaneer gazing into an aquatic sphere where future offerings are springing forth to join our core current business lines. The Oceaneer is demonstrating our mission to “Solve the Unsolvable” as a new day dawns. | |

|

Roderick A. Larson President and Chief Executive Officer |

| Do Things Right We work safely and act with integrity in the best interest of our industry partners, employees, and the environment. |

| Solve Complex Problems We provide products and services that work through listening, experience, and curiosity. |

| Grow Together We collaborate, respect, and support each other so we can reach our full potential. |

| Outperform Expectations We perform with excellence to serve our customers and each other. |

| Own the Challenge We hold ourselves accountable for the promises we make and work we do. |

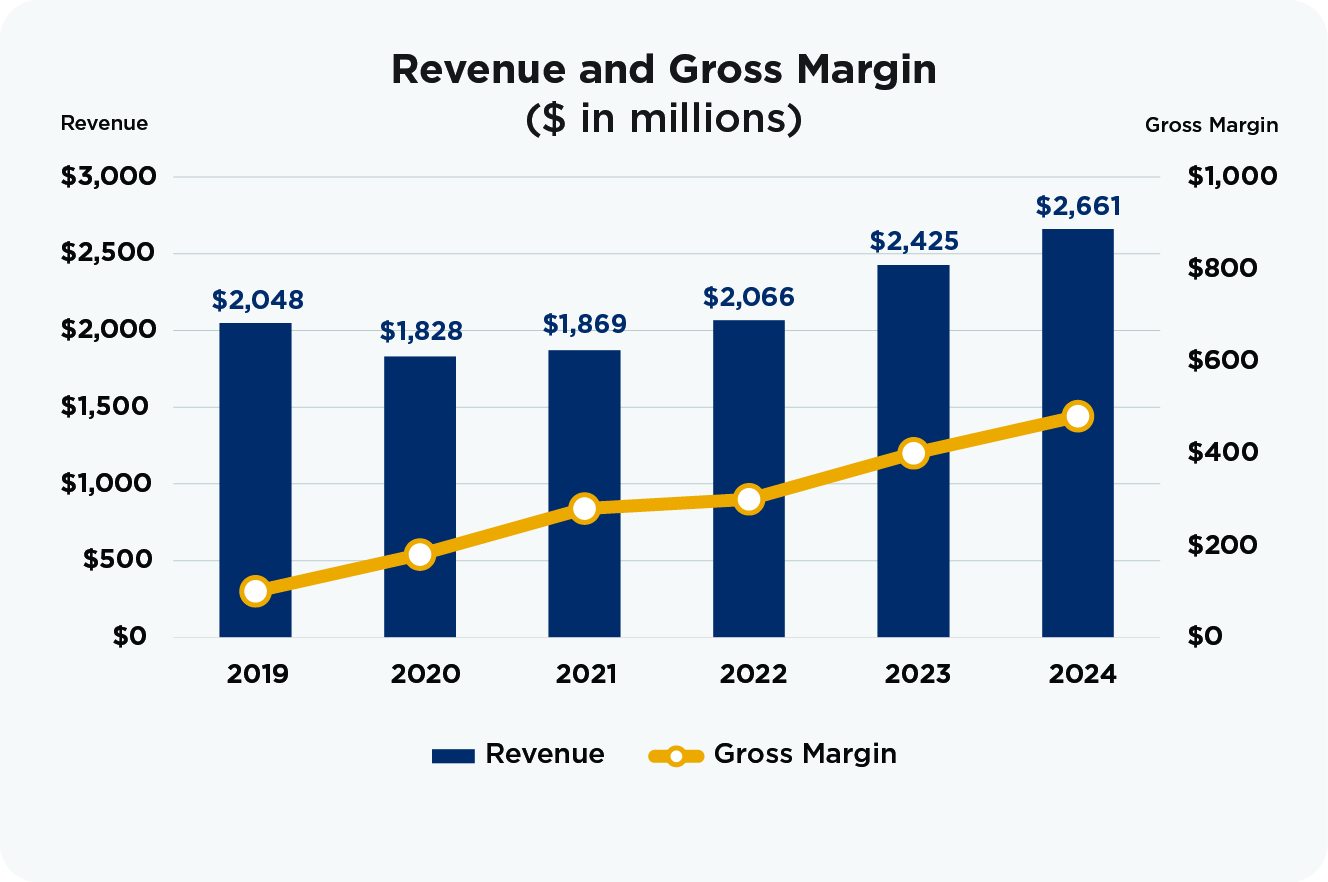

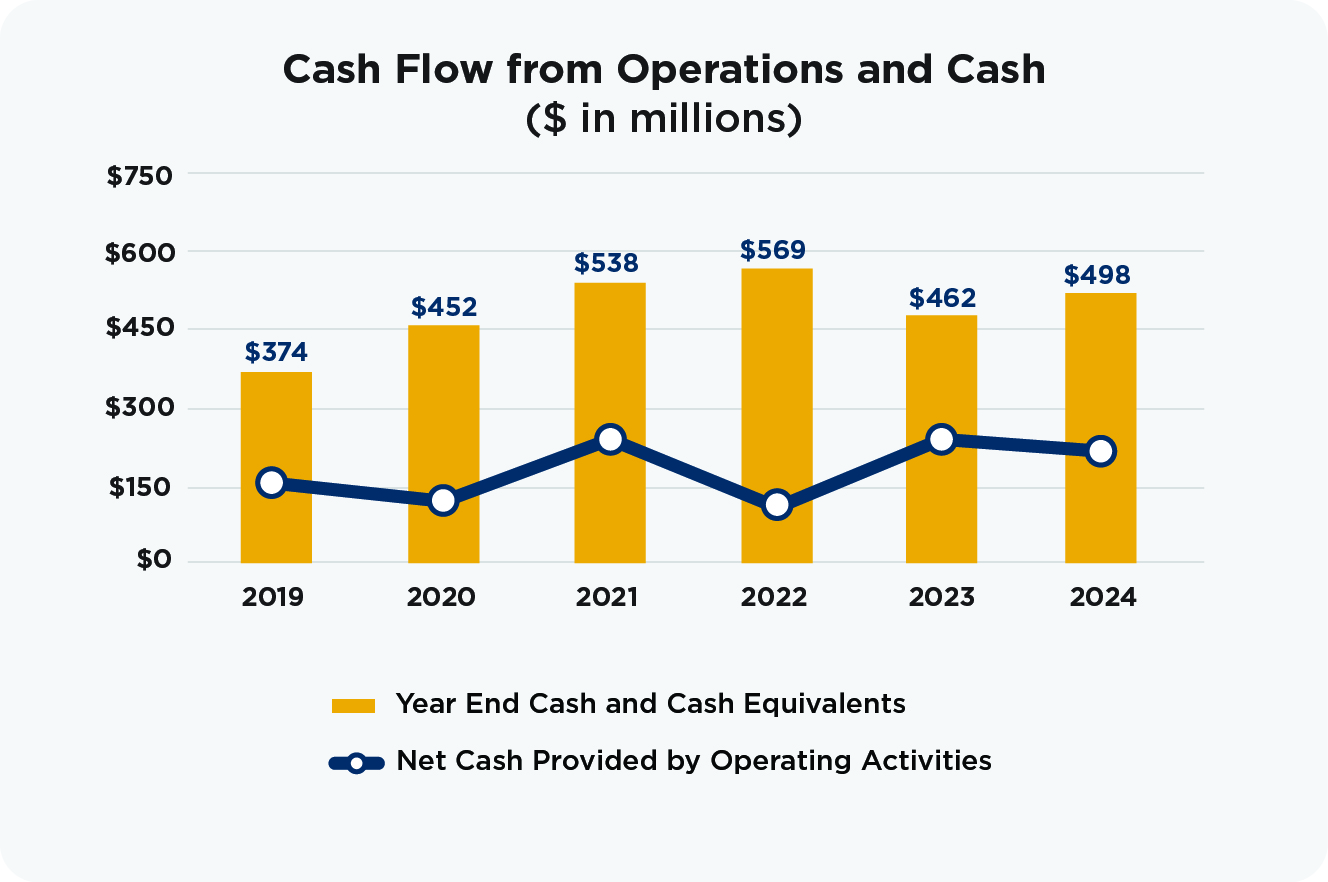

Financial Highlights | ||||||

|  |  |  | |||

Revenue | Operating Income | Net Income | Adjusted EBITDA (non-GAAP) | |||

$2.7 billion consolidated | $246 million | $147 million | $347 million | |||

10% year-over-year increase | 36% year-over-year increase | 51% year-over-year increase | 20% year-over-year increase | |||

Growth in all five operating segments | 6th consecutive year of growth | |||||

|  | |

Stockholder Value | ||||

Organizational Highlights | ||||

|  |  | ||

New Markets and Technology | Talent | ROV Uptime | ||

U.S. DoD contract award for Freedom ROV/AUV vehicle | 10% improvement on employee engagement and enablement | 99% ROV uptime | ||

Acquisition of Global Design Innovation Ltd. | 20% reduction in voluntary attrition | 10th consecutive year of 99% uptime in rig support | ||

Segment Highlights | ||

| Subsea Robotics (SSR) | |

SSR achieved a 99% Remotely Operated Vehicle (ROV) uptime rate, underscoring our commitment to deliver value to our customers. We saw a 12% improvement in average ROV revenue per day utilized. | ||

| Manufactured Products (MP) | |

MP secured contracts for umbilicals with delivery dates extending into 2027. Our year- end backlog of $604 million provides visibility into expected future activity levels and profitability. | ||

| Offshore Projects Group (OPG) | |

OPG reported 14% year-over-year operating income improvement. We were awarded multiple contracts for committed vessel service days in the Gulf of Mexico and saw increased demand for intervention services that will continue into 2025. | ||

| Integrity Management and Digital Solutions (IMDS) | |

We acquired Global Design Innovation Ltd. (GDi), a digital twin and software services provider. GDi’s software enhances our integrity management capabilities, improving safety, data quality and integrity, and cost efficiency for our customers. | ||

| Aerospace & Defense Technologies (ADTech) | |

ADTech collaborated with SSR to win a contract award from the U.S. Department of Defense to build a Freedom hybrid ROV/autonomous underwater vehicle (AUV) and to establish an Onshore Remote Operations Center for the U.S. Navy. | ||

Name | Age | Independent | Class | Director Since | Membership (C denotes Chair) |

M. Kevin McEvoy | 74 | Y | III | 2011 | Board (C) |

Roderick A. Larson | 58 | III | 2017 | Board | |

Paul B. Murphy, Jr. | 65 | Y | III | 2012 | Board, Audit (C), NCGS |

William B. Berry | 72 | Y | I | 2016 | Board, Comp |

Reema Poddar | 57 | Y | I | 2024 | Board, Audit(1), NCGS |

Jon Erik Reinhardsen | 68 | Y | I | 2016 | Board, Comp, NCGS |

Karen H. Beachy | 54 | Y | II | 2021 | Board, Audit, Comp |

Deanna L. Goodwin | 60 | Y | II | 2018 | Board, Audit, Comp (C) |

Steven A. Webster | 73 | Y | II | 2015 | Board, NCGS (C) |

Approval of Say-On-Pay Vote | ||||

2024 | 2023 | 2022 | ||

|  |  | ||

What we do | What we do not do | |||

Align pay with performance | Gross-up for excise taxes | |||

Conduct annual say-on-pay vote | Enter into executive employment agreements | |||

Cap incentive award payouts | Utilize single-trigger severance arrangements | |||

Utilize short- and long-term incentives/measures | Pay above Target for Relative TSR if TSR is negative | |||

Maintain a clawback policy aligned with SEC requirements and NYSE listing standards | ||||

Utilize an independent compensation consultant | ||||

Employ stock ownership guidelines for directors and officers | ||||

Engage with stockholders and implement feedback | ||||

Prohibit hedging, pledging, and short sales | ||||

1 | Election of Class III Directors: Roderick A. Larson, M. Kevin McEvoy, and Paul B. Murphy, Jr. | FOR each of the nominees |

2 | Advisory Vote to Approve Executive Compensation | FOR |

3 | Ratification of Appointment of Ernst & Young LLP as independent auditors of Oceaneering for the year ending December 31, 2025 | FOR |

4 | Approval of the Amended and Restated 2020 Incentive Plan | FOR |

Strategy Oversight | Risk Oversight | |

With an enterprise-level perspective, encouraging investment and strategic divestment to maximize stockholder returns | Ensuring compensation programs do not encourage excessive risk-taking | |

Ensuring compensation philosophy and programs are aligned to strategic objectives | Encouraging sufficient investment in cybersecurity and business enablement | |

Assessing potential impact of evolving regulatory geopolitical landscape on business strategy | Monitoring management’s awareness and mitigation strategies for risks associated with generative AI and other emerging technologies | |

Preparing for potential business model disruption by rapid technological advancement | Verifying sufficient controls to promote accurate and timely financial reporting, regulatory compliance, and prevention of conflicts of interest and other lapses in ethical business practices | |

Challenging existing and future markets and market penetration | Promoting a culture that appreciates and prioritizes protection of health, safety, security, and environment | |

Ensuring sufficient focus on workforce of the future | Monitoring geopolitical changes for potential financial impact and encouraging robust regulatory compliance programs |

Access to management | Board members have access to management routinely and by outreach. |

Annual self- evaluations | The Board engages in annual self-, peer-, and Board assessments to identify areas that can be developed through training, education, and board succession planning. |

Committee Members are Independent | Committee members are independent and were never employed by the Company. |

Committee Chairs | Our Chairs may only serve as Chair for one committee. |

Continuing education and training | The full Board receives annual education on governance and risk oversight and has access to individual formal board member education and certifications. |

Executive sessions | Non-employee directors meet in executive sessions at Board and committee meetings outside the presence of management. |

Financial expertise | Each Audit Committee member is financially literate, and Mr. Murphy (Chair) and Ms. Goodwin each qualify as an “audit committee financial expert” as that term is defined under SEC and NYSE rules. |

Single Class of Shares | We have a single class of shares with equal voting rights. |

Prohibition of hedging, pledging and other transactions | We prohibit short sales, transactions in derivatives, and hedging of Company securities by directors, executive officers, and employees, and prohibit pledging of Company securities by directors and officers. |

Separation of Chair and CEO Roles | Our Chair and CEO currently serve the Company in separate and distinct roles, and the Board retains the flexibility to combine those two positions in the future. |

Stockholder engagement | We have a comprehensive year-round stockholder engagement program. |

Stock ownership guidelines | We have robust stock ownership guidelines for our directors and executive officers. |

Succession planning | Our Board regularly reviews Board and executive succession planning. |

•All members of standing committees are independent in accordance with NYSE standards; and |

•Standing committees perform audit, compensation, and nominating/corporate governance functions in accordance with NYSE standards. |

Audit Committee | ||

Paul B. Murphy, Jr. (Chair) | Primary Responsibilities: | |

Karen H. Beachy | •Oversee the integrity of our financial statements; •Monitor compliance with applicable legal and regulatory requirements; •Verify independence, qualifications and performance of our independent auditors; •Validate the performance of our internal audit function; •Evaluate the adequacy of our internal control over financial reporting; •Oversee cybersecurity and other emerging technology risks; and •Annually evaluate its own performance and its charter. | |

Deanna L. Goodwin | ||

Reema Poddar (1) | ||

7 meetings during 2024 | ||

Other Important Items: | ||

Our Board has determined that all Audit Committee members are independent as required by the U.S. Securities and Exchange Commission (the “SEC”). In addition, it has determined that Ms. Goodwin and Mr. Murphy are audit committee financial experts and that all members of the Audit Committee are financially literate, as defined in the applicable rules of the SEC and the NYSE. For information relating to the background of each member of the Audit Committee, see the biographical information under “Biographical Information for Nominees and Continuing Directors” below. The Audit Committee is responsible for oversight of our management team with respect to their responsibility for our internal controls and the preparation of our consolidated financial statements, as well as our independent auditors, who perform an independent audit of the consolidated financial statements and internal controls over financial reporting. The Audit Committee regularly meets in executive session with the Company’s internal audit director and independent auditors. A copy of the Audit Committee charter is available under the Governance tab in the Investors section of our website (www.oceaneering.com). Any stockholder may obtain a written copy of the charter from us upon request. For the report of the Audit Committee for the fiscal year ended December 31, 2024, please see “Report of the Audit Committee” below. | ||

Compensation Committee | ||

Deanna L. Goodwin (Chair) | Primary Responsibilities: | |

Karen H. Beachy | •Oversee compensation of our executives, nonemployee directors and other key employees, including short-term and long-term incentive plans, benefit plans, and our supplemental executive retirement plan; •Consider adequacy and appropriateness of employee benefit plans and practices; •Administer, review and make recommendations to the Board regarding severance, termination, and change-of-control arrangements; •Review and make recommendations to the Board regarding the directors’ and officers’ indemnification and insurance matters; •Evaluate performance of executive officers, including our Chief Executive Officer; •Recommend to the Board the compensation of nonemployee directors, Board committee chairpersons, and Board committee members; •Administer the Company’s clawback policy; •Produce or assist management with the preparation of any disclosure or reports with respect to compensation, plans or practices that may be required from time to time by the rules of the NYSE or the SEC to be included in our proxy statements for our annual meetings of stockholders, annual reports on Form 10-K or any other filings to be made with the SEC; and •Annually evaluate its own performance and its charter. | |

W. Bill Berry | ||

Jon Erik Reinhardsen | ||

4 meetings during 2024 | ||

Other Important Items: | ||

On an annual basis, the Compensation Committee engages a recognized independent executive compensation consulting firm (the “Compensation Consultant”) to assist the Compensation Committee in its administration of compensation for our directors and executive officers (see “Compensation Discussion & Analysis – The Role of the Compensation Consultant” in this Proxy Statement). The Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) to serve as the Compensation Consultant in 2024. Meridian has served in this capacity since 2015. A copy of the Compensation Committee charter is available under the Governance tab in the Investors section of our website (www.oceaneering.com). Any stockholder may obtain a written copy of the charter from us upon request. For the report of the Compensation Committee for the fiscal year ended December 31, 2024, please see “Report of the Compensation Committee” below. | ||

Nominating, Corporate Governance & Sustainability Committee | ||

Steven A. Webster (Chair) | Primary Responsibilities: | |

Paul B. Murphy, Jr. | •Recommend qualifications that should be represented on the Board; •Identify prospective directors and recommend candidates to stand for election; •Recommend individuals to serve in chair and committee roles; •Assess the performance of our Board and its committees; •Review succession planning with respect to our Chief Executive Officer, other executive officers, and Board; •Advise the Board regarding corporate responsibility; •Monitor emerging issues potentially affecting company reputation; •Monitor and advise the Board regarding public policy issues; •Evaluate related-person transactions; •Annually review and assess the adequacy of our corporate governance policies, practices, and procedures; and •Annually evaluate its own performance and charter. | |

Reema Poddar | ||

Jon Erik Reinhardsen | ||

4 meetings during 2024 | ||

Other Important Items: | ||

The Nominating, Corporate Governance & Sustainability Committee solicits ideas for potential Board candidates from a number of sources, including members of our Board and our executive officers. The Committee also uses and compensates third-party search firms to identify qualified potential Board candidates who might not be in the networks of members of our Board and our executive officers. The Nominating, Corporate Governance & Sustainability Committee operates under a written charter adopted by our Board. A copy of this charter and a copy of our Corporate Governance Guidelines are available under the Governance tab in the Investors section of our website (www.oceaneering.com). Any stockholder may obtain a written copy of each of these documents from us upon request. | ||

Skills and Qualifications | McEvoy | Beachy | Berry | Goodwin | Larson | Murphy | Poddar | Reinhardsen | Webster | |

Corporate Development & Strategy: Public company executive level experience leading growth, developing a strategic plan, driving value, and overseeing growth and expansion; experience with M&A |  | • | • | • | • | • | • | • | • | • |

Energy Industry: Executive level experience at an energy company or at a company providing products or services to the energy industry; other experience with energy transition |  | • | • | • | • | • | • | • | • | |

Financial Management: Executive level experience in corporate finance, accounting, capital deployment, capital markets, debt, and relevant financial legal and regulatory issues |  | • | • | • | ||||||

Global Business: Executive level experience leading international business strategy and operations; perspective and experience evaluating an international entity’s operating and strategic performance and growth; experience with global regulatory matters |  | • | • | • | • | • | • | |||

Governance: Experience as chair of corporate governance committee, compensation committee, or audit committee, or as lead independent director of public company board |  | • | • | • | • | • | • | • | ||

Government Contracting: Experience with defense or government contracting; holds a security clearance |  | • | • | • | ||||||

Health, Safety, Security & Environment (HSSE): Executive level experience leading HSSE operations at a large or multinational company; depth of experience and familiarity with factors specific to energy, aerospace, defense, and industrial settings |  | • | • | • | • | • | • | |||

Human Capital Management: Executive level experience at a company with a large or global workforce, including strategic workforce planning and development. |  | • | • | • | • | • | • | • | ||

Logistics, Industrial & Manufacturing: Executive level experience providing oversight of extensive or complex operations spanning industrial, manufacturing, or supply chain |  | • | • | • | • | • | ||||

Maritime, Offshore & Admiralty: Experience with seafaring commercial operations, offshore operations including exploration and subsea activities, and maritime law |  | • | • | • | • | |||||

Risk Management: Executive level experience identifying and evaluating business-related risk, deep knowledge of industry-related risks; strong familiarity with management controls |  | • | • | • | • | • | • | • | • | • |

Technology, Al, Robotics & Cybersecurity: Executive level experience leading technology programs; advanced knowledge of cybersecurity controls; experience providing oversight of extensive or complex operations spanning engineering, robotics or Saas |  | • | • | • |

Roderick A. Larson President, Chief Executive Officer, and Director, Class III | ||

Key Qualifications Mr. Larson has in-depth knowledge of our business and the energy industry, gained from nearly three decades of experience in the oilfield services sector, including leading the strategic evolution of energy companies in response to changing market conditions, driving business expansion into new geographies and markets, and spearheading advanced technological innovation. Select Skills •Energy Industry – Mr. Larson contributes to the Board his deep understanding of Oceaneering’s strategy, operational priorities, and valuable insights into market dynamics and growth opportunities. Prior to joining Oceaneering, he held several leadership positions at Baker Hughes, where he developed a strong track record of successfully managing large-scale operations and delivering exceptional results across global markets. His early career roles as operations manager and field engineer for an oilfield services company in the U.S. and Venezuela provided him with foundational technical and operational skills. •Corporate Development and Strategy – Throughout his tenure at Oceaneering, he has been instrumental in guiding the Company through periods of significant growth and transformation. His efforts, including the acquisition of Ecosse Subsea Systems, have expanded the Company’s offshore renewable energy capabilities, and have consistently positioned Oceaneering at the forefront of technological advancement in engineered services to provide comprehensive service to the offshore energy industry. •Government Contracting – Developed through his extensive experience managing contracts and delivering services to government agencies, Mr. Larson possesses in-depth knowledge of government stakeholders and procurement regulations, including budgeting, cost accounting and financial reporting specific for government contracts. His expertise in compliance with regulations governing sensitive projects enhance Board’s oversight of Oceaneering’s Aerospace and Defense business. Professional Highlights Oceaneering International, Inc. (NYSE: OII) •President & CEO (since 2017) •President & COO (2015 – 2016) •SVP (2012 – 2015) Baker Hughes Company (NASDAQ: BKR) – a leading global oilfield services company •President, Latin America (2011 – 2012) •VP, Operations, Gulf of Mexico Region (2009 – 2011) •Gulf Coast Area Manager (2007 – 2009) •Special Projects Leader Technical Training (2006 – 2007) | ||

Committee Membership: N/A Director Since: May 2017 Age: 58 | ||

Education: •BS in Electrical Engineering, North Dakota State University •MBA, Jones Graduate School of Business, Rice University Current Public Company Boards: •Newpark International, Inc. (NYSE: NPKI) (since 2014) Other Notable Boards / Affiliations: •National Ocean Industries Association, Director (since 2018) •American Petroleum Institute, Director (since 2017) •Energy Workforce and Technology Council, Chair (2021) | ||

M. Kevin McEvoy Board Chair, Class III | ||

Key Qualifications Mr. McEvoy brings to our Board a comprehensive understanding of Oceaneering and its businesses gained through his decades of service with the Company, including as our former CEO and in leadership roles in each of our business segments (including three international assignments). His role as lead independent director for a publicly traded company in the construction industry has also equipped him with deep expertise in corporate governance and strategy oversight, including matters related to public policy, energy transition, risk management, and stakeholder engagement. Select Skills •Government Contracting – Acquired deep expertise in Oceaneering’s government contracting activities, including contract management, regulatory compliance, and stakeholder engagement through his nearly four decades with the Company, including six years as CEO. Mr. McEvoy’s significant knowledge of the government procurement process as well as the priorities of government stakeholders provide the Board with useful insights related to oversight of programs in our ADTech business. •Maritime, Offshore and Admiralty – Developed a deep expertise in offshore and maritime operations through his more than 45 years of experience in offshore, diving, and other subsea and marine-related activities, primarily in oilfield-related areas, with significant international exposure. Mr. McEvoy developed a solid foundation in maritime operations from his early career service with the Navy, where he was engaged in diving, salvage, and submarine rescue activities. •Health, Safety, Security, and Environment – Mr. McEvoy’s history of operational leadership and business development with Oceaneering, including as COO and as an instrumental leader in developing three of our five business segments, has provided him with significant experience in health, safety, security and environmental management in complex environments. Throughout his tenure, he maintained a strong focus on safety and environmental performance, with Oceaneering recognized for its safety practices in 2016 with an award from the National Ocean Industries Association. Professional Highlights Oceaneering International, Inc. (NYSE: OII) •CEO (2011 – 2017) •President (2011 – 2015) •COO (2010 – 2011) •EVP (2006 – 2010) •SVP, Western Region (2000 – 2006) U.S. Navy •Diving & Salvage Officer (1972 – 1976) | ||

Committee Membership: N/A Director Since: May 2011 Age: 74 | ||

Education: •MBA, Texas A&M University •CERT Certificate in Cybersecurity Oversight, Carnegie Mellon University Software Engineering Institute, and the National Association of Corporate Directors Current Public Company Boards: •EMCOR Group, Inc. (NYSE: EME), Lead Independent Director (since 2016) Other Notable Boards / Affiliations: •National Ocean Industries Association, Chairman (2016 – 2017) |

Paul B. Murphy, Jr. Independent Director, Class III | ||

Key Qualifications Mr. Murphy brings considerable experience and perspective through his executive officer roles with financial institutions that forged strong partnerships with energy companies. With over 43 years of business and entrepreneurial experience in the financial services industry including 23 years as a CEO, and with over 25 years of experience as a public company director, Mr. Murphy provides valuable perspectives on financial strategy, corporate development, core growth, risk control and many other aspects of running a business. Select Skills •Corporate Development and Strategy – Mr. Murphy played a key role in forming Cadence Bank raising $1 billion capital and assembling an experienced management team. He oversaw the bank’s NYSE 2017 IPO and its merger with BancorpSouth Bank in 2021. During Mr. Murphy's tenure at Cadence, the company grew to over $18 billion in assets. During his tenure as CEO of Amegy Bank, the company grew from less than $100 million in assets to more than $10 billion. During his 20 years there, the company went public on NASDAQ, successfully executing integration of multiple strategic acquisitions and sold to Zions Bancorp in 2005. •Financial Management – Through his senior executive leadership roles with several commercial banks, Mr. Murphy developed significant expertise in financial reporting, investment analysis, capital financing strategies and regulatory compliance. As CEO of Amegy Bank, a regional bank in Texas with strong partnerships with energy companies and a robust energy banking business, Mr. Murphy gained particular expertise in the energy sector, focusing on specialized lending products for the energy companies. •Risk Management – Mr. Murphy demonstrated strong risk management skills throughout his career, including navigating complex financial landscapes, optimizing asset growth strategies, and assessing strategic acquisitions, which delivered substantial returns to investors. Through his financial industry career, Mr. Murphy gained significant expertise in risk management, helping energy companies successfully navigate the cyclical and changing nature of the energy markets. Professional Highlights Cadence Bank (NYSE: CADE) and its predecessors Cadence Bancorporation and Cadence Bank, N.A. – an American commercial bank •CEO (2021 – 2023) •Chairman & CEO (2009 – 2021) Amegy Bank of Texas (acquired by Zions Bank in 2005) – a leading regional bank •CEO (2000 – 2009) •President (1996 – 2000) •EVP (1990 – 1996) Allied Bank of Texas (acquired by First Interstate in 1987) – a Houston- based regional bank •VP (1981 – 1989) | ||

Committee Membership: •Audit (Chair) •Nominating, Corporate Governance & Sustainability Director Since: August 2012 Age: 65 | ||

Education: •BS, Banking and Finance, Mississippi State University •MBA, University of Texas at Austin Current Public Company Boards: •Natural Resource Partners L.P. (NYSE: NRP) (since 2018) Other Notable Boards / Affiliations: •Murphy Interests, founder (2023) •Cadence Bank, Director (NYSE: CADE) (2011 – 2023) •Amegy Bank of Texas, Director (1994 – 2009) •Hines REIT, Director (2008 – 2017) •Houston Branch of the Federal Bank Reserve of Dallas, Director (2009 – 2016) |

William B. Berry Independent Director, Class I | ||

Key Qualifications Mr. Berry contributes over five decades of leadership experience in the domestic and international oil and gas industry, with deep expertise in both onshore and offshore exploration and production, which significantly contributes to Board discussions on strategy and oversight of safe and productive operations across numerous global markets. His extensive knowledge of energy-focused customer needs provides valuable insights into Oceaneering’s key growth drivers, evolving capabilities, global footprint, and application of advanced technologies and high-performance standards within challenging environments. Select Skills •Energy Industry – Mr. Berry developed expertise in the energy industry over his extensive industry tenure as a corporate advisor and member of executive leadership teams, with a successful track record of aligning strategic priorities with the variable oilfield lifecycle and introducing innovative petroleum technologies to enhance efficiency. In his most recent role as CEO of an oil and natural gas company, Mr. Berry was responsible for securing the company’s entrance into new regions and overseeing its carbon capture investment efforts, which aligns with Oceaneering’s growth priorities. •Human Capital Management – Mr. Berry is well-known as an operational leader who prioritizes people development and workforce planning within a broad international talent pool for achievement of financial, safety, and operational goals. Professional Highlights Continental Resources, Inc. (formerly NYSE: CLR) – American oil and natural gas company •CEO (2020 – 2023), President (2022 – 2023) ConocoPhillips (NYSE: COP) and its predecessor, Phillips Petroleum Company – global energy exploration and production company •EVP, Exploration & Production (2003 – 2008) •President, Asia Pacific (2002) •SVP, Exploration & Production, Eurasia-Middle East (2001 – 2002) •VP, Exploration & Production, Eurasia (1998 – 2001) •VP, International Exploration & Production, New Ventures (1997) •China Country Manager, Worldwide Drilling and Production (1995 – 1997) •Various other positions of increasing leadership (1976 – 1995) | ||

Committee Membership: •Compensation Director Since: June 2016 Age: 72 | ||

Education: •BS and MA, Petroleum Engineering, Mississippi State University Current Public Company Boards: •None Other Notable Boards / Affiliations: •Continental Resources, Inc. (formerly NYSE: CLR) (2014 – 2023) •Frank’s International N.V. (NYSE: FI) (2015 – 2020) •Teekay Corporation (NYSE: TK) (2012 – 2015) •Wilbros Group, Inc. (NYSE: WG) (2008 – 2014) •Access Midstream Partners, L.P. (formerly NYSE: ACMP) (2013 – 2014) •Woods Hole Oceanographic Institute (since 2024) •Hamm Institute of American Energy at Oklahoma State University (since 2022) •Mississippi State University Foundation, Board of Directors (since 2024) |

Reema Poddar Independent Director, Class I | ||

Key Qualifications Ms. Poddar brings extensive global experience in product and technology strategy, development, and delivery, accelerating digital transformation, cybersecurity, artificial intelligence, and other emerging technologies. Her 30- year career includes executive and board roles for public, private, and start-up companies where she exhibited deep expertise in enterprise risk management and held oversight responsibility for the full product innovation lifecycle from concept development to delivery. Select Skills •Technology, AI, Robotics, & Cybersecurity – Ms. Poddar has extensive experience driving innovation in technology-focused companies. She successfully launched AI-powered diagnostic and pathway informatics solutions to improve quality, promote efficiency, and enhance patient experience. She also led the product roadmap at an AI-integrated cybersecurity company, optimizing data privacy and compliance. At Teradata, she launched an AI-powered data and analytics SaaS platform on multiple cloud providers and oversaw the company’s corporate security, product strategy, go-to-market approach, and digital transformation. Ms. Poddar held a leadership role at GE in developing an AI/ML-driven Asset Performance Management cloud SaaS product with over $1 billion in sales. •Corporate Development and Strategy – At Koninklijke Philips, Ms. Poddar led strategic initiatives for its multi-billion dollar digital healthcare informatics business, including transitioning operating models, developing portfolio roadmaps, and ensuring strategic alignment across divisions. She also orchestrated a $12 billion transformation in GE Healthcare P&L from on- premises to cloud-based services, delivering substantial value creation. •Human Capital Management – Ms. Poddar has fostered creativity, collaboration, and success with a variety of teams throughout her career. She has demonstrated a strong track record of recruiting and developing high-performance talent, particularly at Philips and Teradata, where she led large, multidisciplinary teams responsible for driving enterprise-wide technological innovation initiatives. Professional Highlights Koninklijke Philips N.V. (NYSE: PHG) – a multinational health technology company •EVP & General Manager, Diagnostic and Pathway Informatics Business (2022 – 2023) OptimEyes.AI – an AI-integrated cybersecurity software firm •Executive Head of Product Development (2020 – 2022) Teradata Corporation (NYSE: TDC) – a software company that specializes in data warehousing and data analytics solutions, and data management solutions •EVP & Chief Development Officer (2019 – 2020) •EVP & Chief Product & Technology Officer (2018 – 2019) •SVP, Product Development (2017 – 2018) AdFender, Inc. – an advanced software privacy solutions company •Executive Head of Engineering & Operations (2016 – 2017) and Co- Founder (since 2010) General Electric Company (NYSE: GE) – a multinational conglomerate with aerospace, energy, healthcare, and finance divisions | ||

Committee Membership: •Audit •Nominating, Corporate Governance & Sustainability Director Since: February 2024 Age: 57 | ||

Education: •BS in Physics, Mahatma Gandhi University •MCA in Computer Science, Bangalore University •CERT Certificate in Cybersecurity Oversight, Carnegie Mellon University Software Engineering Institute, and the National Association of Corporate Directors Current Public Company Boards: •MeridianLink Inc. (NYSE: MLNK) (since 2021) Other Notable Boards / Affiliations: •Accion Labs Group Holdings, Inc., Director (since 2021) •OptimEyes.AI, Board of Advisors (since 2020) •Corporate Council Board of Advisors to the Dean of UC San Diego Jacobs School of Engineering, Director (2018 – 2020) | ||

Jon Erik Reinhardsen Independent Director, Class I | ||

Key Qualifications Mr. Reinhardsen brings an extensive international perspective and knowledge of the global energy industry, with a focus on the subsea oilfield services industry and ensuring safe operations, as well as an understanding of customer perspectives from his roles with two of Oceaneering’s international clients. His significant financial and operational expertise, gained during a career spanning over 35 years in engineering, construction, and energy-related businesses, provides crucial insights to Board oversight of operational strategy. Select Skills •Maritime, Offshore and Admiralty – Developed through his significant leadership experience with offshore oil and gas services, including nine years as CEO of a subsurface marine technology company focused on evolving energy sector needs. He led the company through the financial crisis to become one of the preeminent firms in its industry, leveraging strategic marine fleet acquisitions and driving the integration of cutting- edge technology. •Global Business – Mr. Reinhardsen brings significant perspective on international operations given his long tenure in executive roles at global energy companies. As CEO of Petroleum Geo-Services ASA, headquartered in Norway, he was responsible for operations and assets on multiple continents. He also served as Executive Vice President and Deputy CEO of Aker Kvaerner’s oil and gas businesses, with operations in North and South America, Australia, and Asia Pacific. •Health, Safety, Security, and Environment – Mr. Reinhardsen has deep expertise overseeing health, safety, and environment programs in the oil and gas services industry. While CEO of PGS, he achieved improvements in safety incident rates pursuing an ambitious goal to have industry-leading health, safety, environmental and quality performance. Mr. Reinhardsen also brings experience in environmental impact management and sustainability through his leadership roles with Aker Kvaerner, which was at the forefront in developing CO2 capture and storage technology. Professional Highlights Petroleum Geo-Services ASA (“PGS”) (formerly OSL: PGS, merged with TGS ASA in 2024) – an international company providing geophysical and geological services •CEO (2008 – 2017) Alcoa, Inc. (formerly NYSE: AA, split into Alcoa Corp. and Arconic Inc., now Howmet Aerospace, in 2016) – an American multinational industrial corporation •President, Global Primary Products Growth (2005 – 2008) Aker Solutions (formerly Aker Kvaerner and predecessor and affiliated companies) – an engineering and construction services company •EVP, Maritime (2003 – 2005) •Deputy CEO, Oil & Gas (operated from Houston) (2002 – 2003) •Group EVP (operated from Houston) (1997 – 2002) •Various positions of increasing leadership (1983 – 1997) | ||

Committee Membership: •Compensation •Nominating, Corporate Governance & Sustainability Director Since: October 2016 Age: 68 | ||

Education: •MSc in Applied Mathematics and Geophysics, University of Bergen Current Public Company Boards: •Equinor ASA (NYSE: EQNR), Chair (Since 2017) Other Notable Boards / Affiliations: •Baring Group, Chair (since 2023) •Telenor ASA (OSL: TEL.OS), Director (2014-2023) •Borregaard ASA (OSL: BRG), Director (2016 – 2018) •Cameron International Corporation (formerly NYSE: CAM), Director (2009 – 2016) |

Karen H. Beachy Independent Director, Class II | ||

Key Qualifications Ms. Beachy brings over 30 years’ experience in strategy implementation, corporate and business development, supply chain management, public policy, energy transition, risk management, and stakeholder engagement. Select Skills •Energy Industry – Ms. Beachy has demonstrated a strong track record of innovation and strategic transformation to reduce the carbon intensity of various energy supply sources, including Renewable Natural Gas (RNG) and Liquefied Natural Gas (LNG), carbon capture and sequestration, hydrogen and electrification of operations. More recently, she has served as an advisor to corporate clients on the transition to clean energy and smart grid technology. •Logistics, Industrial & Manufacturing – Gained during her executive leadership roles in supply chain logistics and energy procurement, most notably at Black Hills Corp, where she led the supply chain function, overseeing strategic planning, merger integrations, cost and third-party risk management, including cybersecurity, to enhance operational efficiencies and strategic sourcing capabilities. Additionally, Ms. Beachy brings international procurement experience developed through her experience working with a German electric utility, where she oversaw LNG procurement. •Government Contracting – Ms. Beachy’s leadership roles in the highly regulated energy and utility industries have equipped her with a comprehensive understanding of federal and state regulatory frameworks, and insights into the priorities of public agencies and stakeholders. Further, she brings a valuable perspective developed through her successful track record of developing strategic partnerships with government agencies. Professional Highlights Think B3 Consulting, LLC – a consulting firm providing strategic and business planning advisory services •Principal Consultant & Founder (since 2021) The Alliance Risk Group, LLC – a consulting firm providing risk management and capital efficiency advisory services to the energy sector •Associate (2022 – 2024) Black Hills Corp. (NYSE: BKH) – an electric and gas utility company •SVP, Growth & Strategy (2019 – 2020) •VP, Growth & Strategy (2018 – 2019) •VP (2016 – 2018) •Director, Supply Chain (2014 – 2016) Vectren Corp. (formerly NYSE: VVC, merged with CenterPoint Energy, Inc. in 2019) – a natural gas and electricity holding company •Leadership roles in operations and sourcing (2010 – 2014) J. J. Y. Legner Associates •Business Development Consultant (2009 – 2010) Ignite Business Solutions – Owner •Consultant (2008 – 2010) LG&E Energy Corporation (acquired by PPL Corp. in 2010) and predecessors LG&E and KU Energy LLC – an electric and natural gas utility company •LNG Project Manager: Expat Assignment, Germany (2007 – 2008) •Change Management Architect: Special Assignment (2006 – 2006) •Manager, Supplier Diversity (2003 – 2006) •Operations Manager, Elizabethtown & Shelbyville (2000 – 2003) •Supervisory Underground Construction & Maintenance (1998 – 2000) •Product Manager, Telecommunications Products (1997 – 1998) | ||

Committee Membership: •Audit •Compensation Director Since: January 2021 Age: 54 | ||

Education: •BS in Political Science and MS in Marketing, Purdue University Current Public Company Boards: •Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) (since 2022) |

Deanna L. Goodwin Independent Director, Class II | ||

Key Qualifications Ms. Goodwin brings to the Board almost 40 years of executive and board experience in the oil and gas products and services industry and for international public companies. Her expertise in operations and risk management in offshore engineering, manufacturing, and construction as well as significant public accounting and auditing background, strengthens the Board’s oversight of Oceaneering’s financial strategy and reporting. Select Skills •Financial Management – Developed throughout her divisional CFO roles at public companies, leadership positions at a leading global accounting and consulting firm, and as a chartered professional accountant, Ms. Goodwin has critical industry-specific experience in capital markets, capital deployment in asset intensive industries, financial strategy, P&L, budgeting, financial reporting and accounting, and audit and related assurances. •Risk Management – In her role as a regional President at Veritas DGC, Ms. Goodwin was responsible for developing and implementing strategies to mitigate cyclical energy-specific financial and operational risks. She also has experience managing risks associated with major international transactions, leading Technip’s $1.3 billion acquisition of Global Industries, which substantially expanded the company’s subsea market, and leading the global integration team in driving strategic organizational design, change management, and operational control. Professional Highlights Technip SA (formerly XPAR: TEC, merged with FMC Technologies in 2017) – a leading global provider of engineering and construction services for the offshore and onshore energy sector •President, North America (2013-2017) •COO, Offshore (2012-2013) •SVP, Operations Integration of Global Industries (2011-2012) •SVP & CFO, Technip USA (2008-2011) Veritas DGC, Inc. (formerly NYSE: VTS) – a leading provider of geophysical information and services to the petroleum industry •President, Western Hemisphere (2007 – 2008) •President, Land (2004 – 2006) •SVP, Operations (2003 – 2004) •VP, US Land Library (2001 – 2002) •CFO & VP, Land Division (1996 – 2001) •Manager, Financial Reporting (1993 – 1995) Price Waterhouse (now Price WaterhouseCoopers LLP), an audit, assurance, consulting and tax accounting firm •Various positions of increasing leadership (1987 – 1993) | ||

Committee Membership: •Compensation (Chair) •Audit Director Since: February 2018 Age: 60 | ||

Education: •B. Comm, Accounting, University of Calgary Current Public Company Boards: •Kosmos Energy Ltd. (NYSE: KOS) (since 2018) •Arcadis NV (OTCMKTS: ARCAY) (since 2016) Other Notable Boards / Affiliations: •Chartered Professional Accountants of Canada, Member |

Steven A. Webster Independent Director, Class II | ||

Key Qualifications Mr. Webster possesses extensive knowledge of the energy industry gained from decades of experience in onshore and offshore oil and gas exploration and production, and oilfield services. He provides the Board with deep expertise in financial management and strategy, drawing on over 30 years in private equity and investment, as well as significant business leadership skills developed through his roles as a CEO and as director of various public and private companies. Select Skills •Corporate Development and Strategy – Mr. Webster successfully drove corporate strategy at oil and gas companies, most notably as Co- Founder and CEO of R&B Falcon Corp., which he grew from a single- rig drilling contractor to one of the world’s largest offshore drilling companies through consolidation and strategic growth initiatives. As a Managing Partner at Avista and AEC Partners, he has advised on a range of successful mergers, acquisitions, and IPOs, positioning his clients for growth. Over his career, he has co-founded or been a lead investor in numerous successful energy ventures, including Carrizo Oil and Gas, R&B Falcon, Grey Wolf, Hercules Offshore, Laredo Energy, Peregrine Oil & Gas, and Union Drilling. •Financial Management – Developed significant expertise in capital allocation and financing strategies, financial reporting, and strategic financial planning during his extensive experience in venture capital and private equity investing, including co-founding a private equity firm in 2005. Mr. Webster also possesses unique perspectives on maximizing shareholder value in a cyclical energy sector with deep understanding of the global energy sector environment. •Risk Management – Acquired through his experiences serving as CEO of two leading companies in the offshore oil and gas exploration sector, Mr. Webster has a strong track record overseeing and developing effective mitigation strategies for operational and financial risks in dynamic energy markets. He also provides insights into best practices for managing environmental impact risks and building a strong safety culture across the enterprise, contributing to the Board his deep knowledge of regulatory compliance matters specific to our industry. Professional Highlights AEC Partners, L.P. – a private equity firm investing in the energy sector •Managing Partner (since 2018) Avista Capital Partners, L.P. – a private equity firm investing in the healthcare sector •Co-Founder (since 2005), Managing Partner (2005 – 2018) Global Energy Partners, Ltd. – an affiliate of DLJ Merchant Banking and CSFB Private Equity focused on investing in the energy sector •Managing Partner (2000 – 2005) Carrizo Oil & Gas (NASDAQ: CRZO) – an energy exploration, development and oil and gas production company •Chair & Co-Founder (1993 – 2019) R&B Falcon Corp. (formerly NYSE: FLC, acquired by Transocean Sedco Forex Inc. in 2000) and its predecessor, Falcon Drilling Company – an offshore drilling company •Chair, CEO, & Founder (1988 –1999) | ||

Committee Membership: •Nominating, Corporate Governance & Sustainability (Chair) Director Since: March 2015 Age: 73 | ||

Education: •BS in Industrial Management, Purdue University •MBA, Harvard University Current Public Company Boards: •Camden Property Trust (NYSE: CPT) (since 1993) Other Notable Boards / Affiliations: •Enterprise Offshore Drilling, Director (since 2017) •Callon Petroleum Company (formerly NYSE: CPE, acquired by APA Corporation in 2024) and its predecessor Carrizo Oil & Gas, Director (1993 – 2024) •ERA Group Inc. (formerly NYSE: ERA, acquired by Bristow Group, Inc. in 2020), Director (2013 – 2020) •Basic Energy Services, Inc., (formerly NYSE: BAS) Chair (2000 – 2016) |

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($)(3) | Total ($) | |||||

M. Kevin McEvoy | 105,000 | 301,961 | — | 30,022 | 436,983 | |||||

Karen H. Beachy | 90,000 | 203,362 | — | 10,668 | 304,030 | |||||

William B. Berry | 80,000 | 203,362 | — | 17,796 | 301,158 | |||||

Deanna L. Goodwin | 100,000 | 203,362 | — | 29,987 | 333,349 | |||||

Paul B. Murphy, Jr. | 105,000 | 203,362 | — | 15,339 | 323,701 | |||||

Reema Poddar | 64,167 | 203,362 | — | 31,231 | 298,760 | |||||

Jon Erik Reinhardsen | 85,000 | 203,362 | — | 43,046 | 331,408 | |||||

Steven A. Webster | 80,000 | 203,362 | — | 13,020 | 296,382 |

Compensation Committee | |

Deanna L. Goodwin, Chair | |

Karen H. Beachy | |

William B. Berry | |

Jon Erik Reinhardsen |

Named Executive Officers | ||

Name | Title as of January 1, 2024 | |

Roderick A. Larson | President and Chief Executive Officer | |

Alan R. Curtis | Senior Vice President and Chief Financial Officer | |

Martin J. McDonald | Senior Vice President, Subsea Robotics | |

Earl F. Childress | Senior Vice President and Chief Commercial Officer | |

Benjamin M. Laura | Senior Vice President and Chief Innovation Officer (1) | |

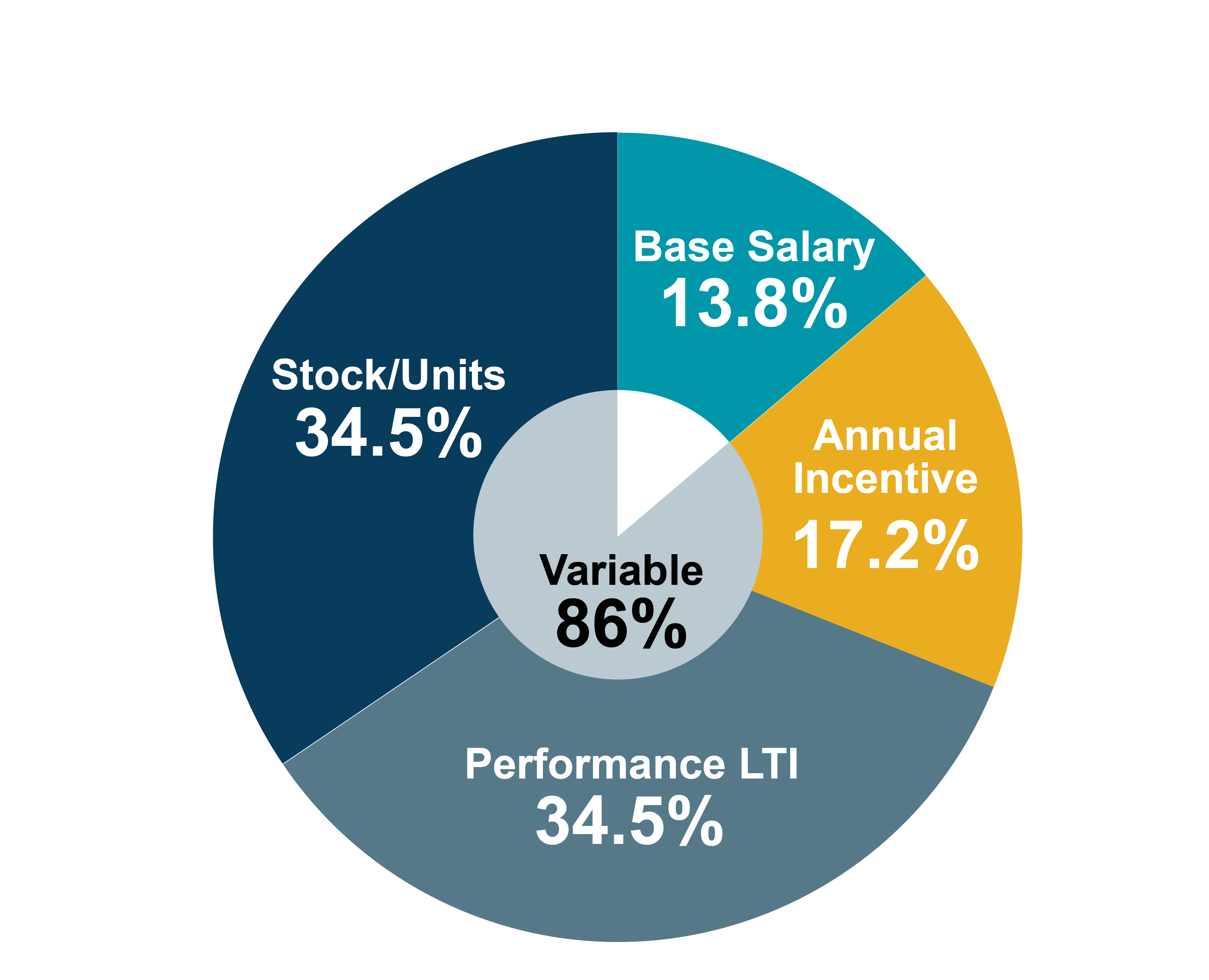

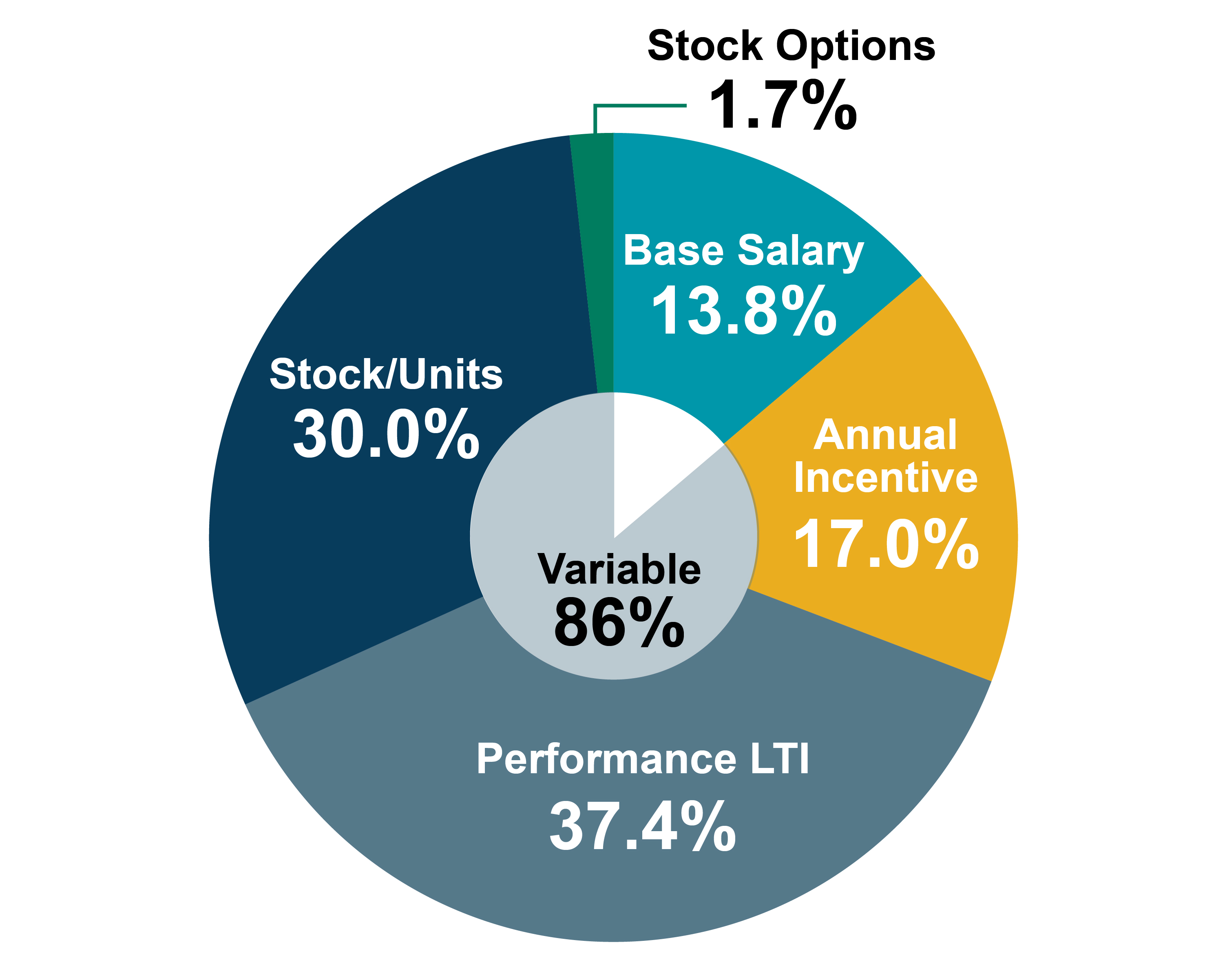

Our compensation programs are tied to performance and motivate our key executives | •Performance measured against financial and other key performance objectives. •Balances long-term and short-term performance to promote stockholder value. •Incentive compensation forms a significant part of key executives’ total direct compensation, with more than 50% of CEO’s total direct compensation at risk. |

Our compensation programs encourage our leaders to make decisions aligned with stockholder value. | •86% of CEO’s total direct compensation is at risk and tied to our delivery of short- and long-term stockholder value. •Our executives are subject to stock ownership guidelines, requiring them to own shares of our common stock having a market value or cost basis not less than a multiple of their base salary. The minimum holding requirement for our CEO is five times his base salary. |

Our compensation programs are designed to attract and retain the best leaders. | •Our compensation programs are competitive and benchmarked against industry market data and information from our compensation peer group. •Long-term incentives help us retain key executives, who have a keen understanding of our services and products in the markets we serve, and who maintain strong customer relationships over time. •Our compensation programs fairly reward performance and service across volatile market cycles. |

ChampionX Corporation | Flowserve Corporation | DNOW, Inc. | ||

Chart Industries, Inc. | Helix Energy Solutions Group, Inc. | Oil States International, Inc. | ||

Dril-Quip, Inc. | Helmerich & Payne, Inc. | Transocean Ltd. | ||

Expro Group Holdings N.V. | Noble Corporation | Weatherford International plc |

For 2024, the primary components of our compensation program for Named Executive Officers were: | ||

|  |  |

Annual base salary | Annual incentive awards paid in cash | Long-term incentive awards (comprised of restricted stock units and performance units) |

Our Named Executive Officers also receive certain retirement benefits, which comprised a relatively small percentage of compensation, as further described under “— Post-Employment Compensation Programs — Retirement Plans” below. | ||

Oceaneering CEO | Peer Company CEOs | |

|  |

Name | 2023 Base Salary | 2024 Base Salary | Percentage Increase | |||

Roderick A. Larson | $800,000 | $840,000 | 5% | |||

Alan R. Curtis | $452,620 | $466,199 | 3% | |||

Martin J. McDonald | $371,315 | $386,168 | 4% | |||

Earl F. Childress | $378,525 | $389,881 | 3% | |||

Benjamin M. Laura | $375,950 | $394,748 | 5% |

Performance Measures | Weight | Definition | ||

Adjusted EBITDA | 60% | Consolidated net income (loss) before interest, taxes, depreciation and amortization for the year, adjusted to remove the net impact of the following for such year: foreign currency gains and losses; sales of fixed assets and investments resulting in gains or losses; impairments of long-lived assets; write- downs or write-offs of assets; corporate restructuring expenses; and other unusual items; in each case, as may be approved by the Committee (“2024 Adjusted EBITDA”). In 2024, we took an adjustment for foreign exchange gains and loss on the sale of an asset. | ||

Free Cash Flow | 25% | Net cash provided by Oceaneering’s operating activities less purchases of property and equipment for such year (e.g., organic capital expenditures, which exclude those incurred in business acquisitions) (“2024 Free Cash Flow”). | ||

Safety | 10% | Verification of safety-critical controls, the elimination of hazards through engineered improvements and the implementation of safety-related corrective actions and process improvements. | ||

Environmental | 5% | Activities focused on ensuring environmental resiliency of our operations. |

Name | Target Bonus Award (as a Percentage of Base Salary) | |

Roderick A. Larson | 125% | |

Alan R. Curtis | 80% | |

Martin J. McDonald | 70% | |

Earl F. Childress | 70% | |

Benjamin M. Laura | 75% |

Performance Level | 2024 Adjusted EBITDA ($) | 2024 Free Cash Flow ($) | % of 2024 Adjusted EBITDA Target | % of 2024 Free Cash Flow Target | % of Target Payout | |||||

Gate | $231,000,000 | — | 65% | —% | —% | |||||

Threshold | $248,000,000 | $70,000,000 | 70% | 54% | 25% | |||||

Target (Plan) | $355,000,000 | $130,000,000 | 100% | 100% | 100% | |||||

Maximum | $411,000,000 | $200,000,000 | 116% | 154% | 200% |

2024 Annual Cash Bonus Program | % of 2024 Adjusted EBITDA Target | % of 2024 Free Cash Flow Target | % of 2024 Safety Target | % of 2024 Environmental Target | % of 2024 Overall Target | ||||||

Performance | 98% | 74% | 108% | 90% | — | ||||||

Payout | 95% | 58% | 108% | 90% | 87% |

Name | Target LTI Award (as a Percentage of Base Salary) | Dollar Value of Target Total Long- Term Incentive Award | Dollar Value of Target RSU Award | Number of Shares Underlying Target RSU Award (1) | Dollar Value of Target Performance Unit Awards | |||||

Roderick A. Larson | 500% | $4,200,000 | $2,100,000 | 100,962 | $2,100,000 | |||||

Alan R. Curtis | 300% | $1,398,597 | $699,299 | 33,620 | $699,298 | |||||

Martin J. McDonald | 145% | $559,944 | $279,972 | 13,460 | $279,972 | |||||

Earl F. Childress | 130% | $506,845 | $253,423 | 12,184 | $253,422 | |||||

Benjamin M. Laura | 150% | $592,122 | $296,061 | 14,234 | $296,061 |

Performance Measures | Weight | Threshold | Target | Maximum | ||||

Cumulative Adjusted EBITDA | 70% | $852 million | $1,065 million | $1,598 million | ||||

Relative TSR | 30% | 30th Percentile | 50th Percentile | Above 90th Percentile | ||||

Payout as a % of Target (1) | — | 50% | 100% | 200% |

Cumulative Adjusted EBITDA | Relative TSR | ||||||||||

Weight | 80% | 20% | |||||||||

Goal | Payout | Contribution Value | Goal | Payout | Contribution Value | ||||||

Threshold | $589 million | 50% | $40 | 30th Percentile | 50% | $10 | |||||

Target | $737 million | 100% | $80 | 50th Percentile | 100% | $20 | |||||

Maximum | $1,105 million | 200% | $160 | Above 90th Percentile | 200% | $40 | |||||

Performance Measures | Weight | Attainment | Attainment and Payout as % of Target |

Cumulative Adjusted EBITDA | 80% | $867 million (1) | 135% |

Relative TSR | 20% | 67th Percentile (6th out of 16 peers) | 142% |

Overall Weighted Payout | — | — | 137% |

Name | SERP Participation (as a Percentage of Base Salary) | |

Roderick A. Larson | 50% | |

Alan R. Curtis | 25% | |

Martin J. McDonald | 20% | |

Earl F. Childress | 20% | |

Benjamin M. Laura | 20% |

Level | Multiple of Retainer or Base Salary | |

Nonemployee Directors | 5 | |

Chief Executive Officer | 5 | |

President, Chief Operating Officer, and Corporate Senior Vice Presidents | 3 | |

Other Senior Vice Presidents | 2 |

Name and Principal Position as of December 31, 2024 | Year | Salary ($) | Bonus ($)(2) | Stock Awards ($)(3) | Non-Equity Incentive Plan Compensation ($)(4) | All Other Compensation ($)(5)(6) | Total ($) | |||||||

Roderick A. Larson | 2024 | 840,000 | — | 2,218,135 | 3,869,106 | 474,753 | 7,401,994 | |||||||

President and Chief | 2023 | 800,000 | — | 1,917,631 | 4,579,303 | 456,103 | 7,753,037 | |||||||

Executive Officer | 2022 | 760,000 | — | 1,473,176 | 3,094,211 | 427,421 | 5,754,808 | |||||||

Alan R. Curtis | 2024 | 466,199 | — | 738,631 | 1,285,840 | 162,963 | 2,653,633 | |||||||

Senior Vice President and | 2023 | 452,620 | — | 650,972 | 1,528,946 | 157,333 | 2,789,871 | |||||||

Chief Financial Officer | 2022 | 427,000 | — | 479,190 | 1,013,892 | 149,121 | 2,069,203 | |||||||

Martin J. McDonald | 2024 | 386,168 | — | 295,716 | 662,743 | 128,067 | 1,472,694 | |||||||

Senior Vice President, | 2023 | 371,315 | — | 258,121 | 785,972 | 120,616 | 1,536,024 | |||||||

Subsea Robotics | 2022 | 360,500 | — | 213,316 | 523,176 | 115,559 | 1,212,551 | |||||||

Earl F. Childress | 2024 | 389,881 | — | 267,682 | 598,063 | 135,200 | 1,390,826 | |||||||

Senior Vice President and | 2023 | 378,525 | — | 226,833 | 671,289 | 129,402 | 1,406,049 | |||||||

Chief Commercial Officer | 2022 | 367,500 | — | 179,960 | 444,047 | 122,381 | 1,113,888 | |||||||

Benjamin M. Laura | 2024 | 394,748 | — | 312,721 | 506,253 | 122,440 | 1,336,162 | |||||||

Senior Vice President and | ||||||||||||||

Chief Innovation Officer (1) |

Name | Award Type | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stock or Units (3) | Grant Date Fair Value of Stock Awards (4) | |||||||||

Threshold ($) | Target ($) | Maximum ($) | ||||||||||||

Roderick A. Larson | STI | 2/23/2024 | (1) | 254,625 | 1,050,000 | 1,974,000 | ||||||||

PU | 2/23/2024 | (2) | 1,050,000 | 2,100,000 | 4,200,000 | |||||||||

RSU | 2/23/2024 | 100,962 | $2,218,135 | |||||||||||

Alan R. Curtis | STI | 2/23/2024 | (1) | 90,443 | 372,959 | 701,163 | ||||||||

PU | 2/23/2024 | (2) | 349,650 | 699,300 | 1,398,600 | |||||||||

RSU | 2/23/2024 | 33,620 | $738,631 | |||||||||||

Martin J. McDonald | STI | 2/23/2024 | (1) | 65,552 | 270,318 | 508,197 | ||||||||

PU | 2/23/2024 | (2) | 140,000 | 280,000 | 560,000 | |||||||||

RSU | 2/23/2024 | 13,460 | $295,716 | |||||||||||

Earl F. Childress | STI | 2/23/2024 | (1) | 66,182 | 272,917 | 513,083 | ||||||||

PU | 2/23/2024 | (2) | 126,700 | 253,400 | 506,800 | |||||||||

RSU | 2/23/2024 | 12,184 | $267,682 | |||||||||||

Benjamin M. Laura | STI | 2/23/2024 | (1) | 71,795 | 296,061 | 556,595 | ||||||||

PU | 2/23/2024 | (2) | 148,050 | 296,100 | 592,200 | |||||||||

RSU | 2/23/2024 | 14,234 | $312,721 | |||||||||||

Name | Stock Awards | |||

Number of Shares or Units of Stock That Have Not Vested (1) | Market Value of Shares or Units of Stock That Have Not Vested (2) | |||

Roderick A. Larson | 302,046 | $7,877,360 | ||

Alan R. Curtis | 100,403 | $2,618,510 | ||

Martin J. McDonald | 41,589 | $1,084,641 | ||

Earl F. Childress | 36,373 | $948,608 | ||

Benjamin M. Laura | 36,683 | $956,693 | ||

Name | 2022 Agreement(s) (# of Units) | 2023 Agreement(s) (# of Units) | 2024 Agreement(s) (# of Units) | Total | ||||

2/25/2025 | 2/24/2026 | 2/23/2027 | (# of Units) | |||||

Roderick A. Larson | 104,185 | 96,899 | 100,962 | 302,046 | ||||

Alan R. Curtis | 33,889 | 32,894 | 33,620 | 100,403 | ||||

Martin J. McDonald | 15,086 | 13,043 | 13,460 | 41,589 | ||||

Earl F. Childress | 12,727 | 11,462 | 12,184 | 36,373 | ||||

Benjamin M. Laura | 8,788 | 13,661 | 14,234 | 36,683 |

Name | Stock Awards | |||

Number of Shares Acquired on Vesting | Value Realized on Vesting (1) | |||

Roderick A. Larson | 152,160 | $3,342,955 | ||

Alan R. Curtis | 49,494 | $1,087,383 | ||

Martin J. McDonald | 22,033 | $484,065 | ||

Earl F. Childress | 30,602 | $672,971 | ||

Benjamin M. Laura | 21,436 | $471,410 | ||

Name | Executive Contributions in 2024 | Company Contributions in 2024 (1) | Aggregate Earnings (Losses) in 2024 (2) | Aggregate Withdrawals/ Distributions | Aggregate Balance at 12/31/2024 (3) | |||||

Roderick A. Larson | $— | $420,000 | $1,501,941 | $— | $9,326,599 | |||||

Alan R. Curtis | $— | $116,550 | $471,924 | $— | $3,293,827 | |||||

Martin J. McDonald | $132,753 | $77,234 | $540,359 | $— | $3,640,311 | |||||

Earl F. Childress | $48,000 | $77,976 | $42,194 | $— | $525,206 | |||||

Benjamin M. Laura | $— | $78,950 | $69,096 | $— | $632,234 |

Aggregate Earnings (Losses) for the Year | ||||||

Name | Executive Contributions | Company Contributions | Total | |||

Roderick A. Larson | $462,832 | $1,039,109 | $1,501,941 | |||

Alan R. Curtis | $200,545 | $271,379 | $471,924 | |||

Martin J. McDonald | $307,510 | $232,849 | $540,359 | |||

Earl F. Childress | $7,035 | $35,159 | $42,194 | |||

Benjamin M. Laura | $— | $69,096 | $69,096 | |||

Aggregate Balance | ||||||

Name | Executive Contributions | Company Contributions | Total | |||

Roderick A. Larson | $2,777,071 | $6,549,528 | $9,326,599 | |||

Alan R. Curtis | $1,357,481 | $1,936,346 | $3,293,827 | |||

Martin J. McDonald | $2,119,110 | $1,521,201 | $3,640,311 | |||

Earl F. Childress | $107,040 | $418,166 | $525,206 | |||

Benjamin M. Laura | $— | $632,234 | $632,234 | |||

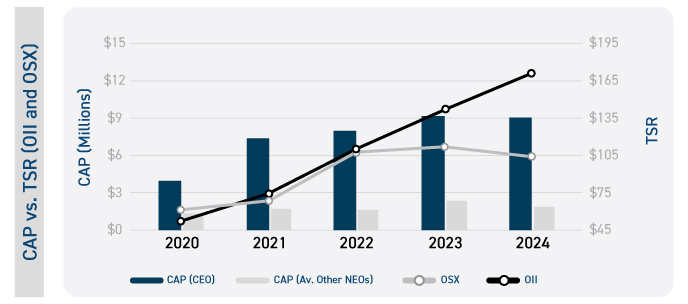

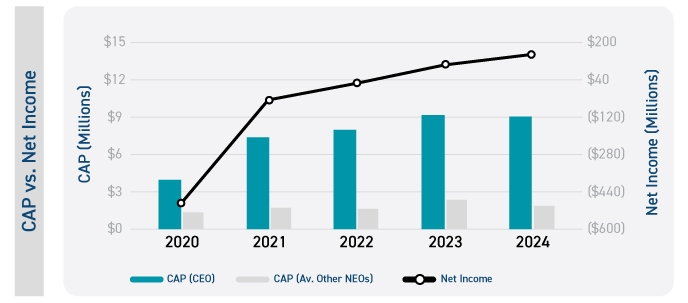

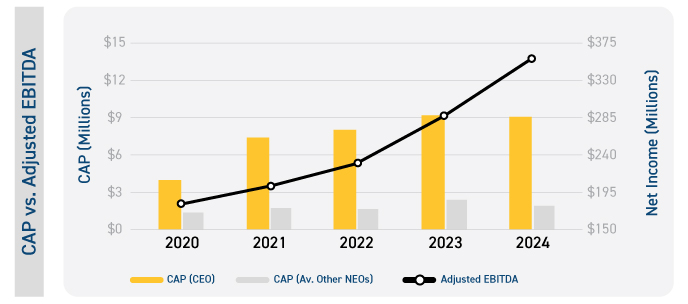

CEO Pay (1) | Other NEO Pay (1) | Value of Initial Fixed $100 Investment Based On: (4) | Other Performance Measures (5) | |||||||||||||

Year | Summary Compensation Table Total Compensation (2) | Compensation “Actually Paid” (3) | Average Summary Compensation Table Total Compensation (2) | Average Compensation “Actually Paid” (3) | Total Shareholder Return | Peer Group Total Shareholder Return | Net Income (thousands) | Adjusted EBITDA (thousands) | ||||||||

2024 | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||

2023 | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||

2022 | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||

2021 | $ | $ | $ | $ | $ | $ | $( | $ | ||||||||

2020 | $ | $ | $ | $ | $ | $ | $( | $ | ||||||||

Amounts Deducted from and Added to Total Compensation for the CEO to Determine Compensation “Actually Paid” | |||||||

Year | Summary Compensation Table Total | Stock Awards as Reported in Summary Compensation Table (A) | Other Adjustments | Total Compensation “Actually Paid” (F) | |||

Fair Value as of Year End of Awards Granted During Year that Remain Outstanding as of Year End (B) | Year-over-Year Change in Fair Value of Awards Granted in Prior Year that Remain Outstanding as of Year End (C) | Fair Value as of Vesting Date of Awards Granted During Year that Vest During Year (D) | Year-over-Year Change in Fair Value of Awards Granted in Prior Year that Vest During Year (E) | ||||

2024 | $ | $( | $ | $ | $ | $ | $ |

2023 | $ | $( | $ | $ | $ | $ | $ |

2022 | $ | $( | $ | $ | $ | $ | $ |

2021 | $ | $( | $ | $ | $ | $ | $ |

2020 | $ | $( | $ | $( | $ | $( | $ |

Amounts Deducted from and Added to Total Compensation for the Other NEOs to Determine Compensation “Actually Paid” | |||||||

Year | Summary Compensation Table Total | Stock Awards as Reported in Summary Compensation Table (A) | Other Adjustments | Total Compensation “Actually Paid” (F) | |||

Fair Value as of Year End of Awards Granted During Year that Remain Outstanding as of Year End (B) | Year-over-Year Change in Fair Value of Awards Granted in Prior Year that Remain Outstanding as of Year End (C) | Fair Value as of Vesting Date of Awards Granted During Year that Vest During Year (D) | Year-over-Year Change in Fair Value of Awards Granted in Prior Year that Vest During Year (E) | ||||

2024 | $ | $( | $ | $ | $ | $ | $ |

2023 | $ | $( | $ | $ | $ | $ | $ |

2022 | $ | $( | $ | $ | $ | $ | $ |

2021 | $ | $( | $ | $ | $ | $ | $ |

2020 | $ | $( | $ | $( | $ | $( | $ |

Key Performance Measures |

Roderick A. Larson | |||||||||

Payments upon Termination | Voluntary Termination | Involuntary Termination | Death and Disability | Change of Control with Termination | |||||

Severance Payments | $— | $420,000 | (1) | $— | $6,930,000 | (2) | |||

Benefit Plan Participation | — | 2,387 | (1) | — | 316,910 | (3) | |||

Restricted Stock Units (unvested) | — | — | 7,877,360 | (4) | 7,877,360 | (5) | |||

Performance Units (unvested) | — | — | 6,266,000 | (6) | 12,532,000 | (7) | |||

Accrued Vacation/Base Salary | 85,090 | 85,090 | 85,090 | 85,090 | |||||

SERP (vested) | 9,326,599 | (8) | 9,326,599 | (8) | 9,326,599 | (8) | 9,326,599 | (8) | |

TOTAL | $9,411,689 | $9,834,076 | $23,555,049 | $37,067,959 | |||||

Alan R. Curtis | |||||||||

Payments upon Termination | Voluntary Termination | Involuntary Termination | Death and Disability | Change of Control with Termination | |||||

Severance Payments | $— | $466,199 | (1) | $— | $1,678,316 | (2) | |||

Benefit Plan Participation | — | 2,387 | (1) | — | 168,913 | (3) | |||

Restricted Stock Units (unvested) | — | — | 2,618,510 | (4) | 2,618,510 | (5) | |||

Performance Units (unvested) | — | — | 2,082,800 | (6) | 4,165,600 | (7) | |||

Accrued Vacation/Base Salary | 66,344 | 66,344 | 66,344 | 66,344 | |||||

SERP (vested) | 3,293,827 | (8) | 3,293,827 | (8) | 3,293,827 | (8) | 3,293,827 | (8) | |

TOTAL | $3,360,171 | $3,828,757 | $8,061,481 | $11,991,510 | |||||

Martin J. McDonald | |||||||||

Payments upon Termination | Voluntary Termination | Involuntary Termination | Death and Disability | Change of Control with Termination | |||||

Severance Payments | $— | $386,168 | (1) | $— | $1,312,972 | (2) | |||

Benefit Plan Participation | — | 2,387 | (1) | — | 158,809 | (3) | |||

Restricted Stock Units (unvested) | — | — | 347,412 | 347,412 | (5) | ||||

Performance Units (unvested) | — | — | 276,400 | 552,800 | (7) | ||||

Restricted Stock Units (vested) | 737,229 | (9) | 737,229 | (9) | 737,229 | (9) | 737,229 | (9) | |

Performance Units (vested) | 428,378 | (10) | 428,378 | (10) | 586,400 | (10) | 1,172,800 | (10) | |

Accrued Vacation/Base Salary | 11,555 | 11,555 | 11,555 | 11,555 | |||||

SERP (vested) | 3,640,311 | (8) | 3,640,311 | (8) | 3,640,311 | (8) | 3,640,311 | (8) | |

TOTAL | $4,817,473 | $5,206,028 | $5,599,307 | $7,933,888 | |||||

Earl F. Childress | |||||||||

Payments upon Termination | Voluntary Termination | Involuntary Termination | Death and Disability | Change of Control with Termination | |||||

Severance Payments | $— | $194,941 | (1) | $— | $1,345,854 | (2) | |||

Benefit Plan Participation | — | 1,688 | (1) | — | 13,407 | (3) | |||

Restricted Stock Units (unvested) | — | — | 948,608 | (4) | 948,608 | (5) | |||

Performance Units (unvested) | — | — | 754,600 | (6) | 754,600 | (7) | |||

Accrued Vacation/Base Salary | 14,943 | 14,943 | 14,943 | 14,943 | |||||

SERP (vested) | 396,682 | (8) | 396,682 | (8) | 396,682 | (8) | 396,682 | (8) | |

SERP (unvested) | — | (8) | — | (8) | 128,524 | (8) | 128,524 | (8) | |

TOTAL | $411,625 | $608,254 | $2,243,357 | $3,602,618 | |||||

Benjamin M. Laura | |||||||||

Payments upon Termination | Voluntary Termination | Involuntary Termination | Death and Disability | Change of Control with Termination | |||||

Severance Payments | $— | $197,374 | (1) | $— | $1,410,262 | (2) | |||

Benefit Plan Participation | — | 2,387 | (1) | — | 18,600 | (3) | |||

Restricted Stock Units (unvested) | — | — | 956,693 | (4) | 956,693 | (5) | |||

Performance Units (unvested) | — | — | 760,800 | (6) | 760,800 | (7) | |||

Accrued Vacation/Base Salary | 60,730 | 60,730 | 60,730 | 60,730 | |||||

SERP (vested) | 501,845 | (8) | 501,845 | (8) | 501,845 | (8) | 501,845 | (8) | |

SERP (unvested) | — | (8) | — | (8) | 130,389 | (8) | 130,389 | (8) | |

TOTAL | $562,575 | $762,336 | $2,410,457 | $3,839,319 | |||||

Annual Total Compensation | Amount | |

Chief Executive Officer (A) | $7,401,994 | |

Median of all employees (excluding our Chief Executive Officer) (B) | $73,444 | |

Ratio of (A) to (B) | 101 |

| Our Board unanimously recommends a vote FOR election of the nominees for Class III directors, Roderick A. Larson, M. Kevin McEvoy, and Paul B. Murphy, Jr. |

| Our Board unanimously recommends a vote FOR the approval of the compensation of our Named Executive Officers as disclosed in this Proxy Statement |

| Our Board unanimously recommends a vote FOR this proposal. |

Fees Incurred for Audit and Other Services Provided by Ernst & Young LLP | 2024 | 2023 | ||

Audit Fees (1) | $2,774,000 | $2,610,000 | ||

Audit-Related Fees (2) | 15,000 | 77,800 | ||

Tax Fees (3) | 148,000 | 150,000 | ||

Total | $2,937,000 | $2,837,800 |

Audit Committee | ||

Paul B. Murphy, Jr., Chair | ||

Karen H. Beachy | ||

Deanna L. Goodwin |

| The Board unanimously recommends a vote FOR approval of the Amended and Restated 2020 Incentive Plan of Oceaneering International, Inc. |

Compensation Committee Oversight | ||||

No Discounted Options or Repricing of Options or SARs | ||||

No Dividends on Options or SARs | ||||

One-Year Minimum Vesting, Subject to Limited Exceptions | ||||

Accrued Dividends and Dividend Equivalents, if any, on Stock Awards Paid Only if Award Vests | ||||

Awards Subject to Clawback or Recoupment | ||||

No “Evergreen” Share Reserve | ||||

No Liberal Share Recycling | ||||

No Tax Gross-ups | ||||

EBITDA (non-GAAP) and Adjusted EBITDA (non-GAAP) | |||||||

For the Year Ended | |||||||

Dec 31, 2024 | Dec 31, 2023 | ||||||

Net income (loss) | $147,468 | $97,403 | |||||

Depreciation and amortization | 103,443 | 104,960 | |||||

Subtotal | 250,911 | 202,363 | |||||

Interest expense, net of interest income | 25,793 | 21,098 | |||||

Amortization included in interest expense | (6,075) | 574 | |||||

Provision (benefit) for income taxes | 77,448 | 63,652 | |||||

EBITDA (non-GAAP) | 348,077 | 287,687 | |||||

Adjustments for the effects of: | |||||||

Foreign currency (gains) losses | (866) | 1,359 | |||||

Total of adjustments | (866) | 1,359 | |||||

Adjusted EBITDA (non-GAAP) | $347,211 | $289,046 | |||||

Name | Number of Shares (1) | Number of Shares Underlying Restricted Stock Units (2) | Total (3) | |||

Karen H. Beachy | 28,229 | — | 28,229 | |||

William B. Berry | 86,945 | — | 86,945 | |||

Earl F. Childress | 28,452 | 34,338 | 62,790 | |||

Alan R. Curtis | 88,507 | 96,016 | 184,523 | |||

Deanna L. Goodwin | 28,642 | — | 28,642 | |||

Roderick A. Larson | 402,279 | 289,658 | 691,937 | |||

Benjamin M. Laura | 46,977 | 46,356 | 93,333 | |||

Martin J. McDonald | 86,068 | 37,987 | 124,055 | |||

M. Kevin McEvoy | 141,837 | — | 141,837 | |||

Paul B. Murphy, Jr. | 74,653 | — | 74,653 | |||

Reema Poddar | 8,743 | — | 8,743 | |||

Jon Erik Reinhardsen | 86,945 | — | 86,945 | |||

Steven A. Webster | 151,676 | — | 151,676 | |||

All directors and executive officers as a group (21 persons) | 1,440,195 | 685,166 | 2,125,361 |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (1) | |||

BlackRock, Inc. 50 Hudson Yards New York, NY 10001 | 16,015,288 | (2) | 15.8% | ||

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 12,461,454 | (3) | 12.3% | ||

EARNEST Partners, LLC 1180 Peachtree Street NE, Suite 2300 Atlanta, GA 30309 | 5,166,012 | (4) | 5.1% | ||

State Street Corporation State Street Financial Center 1 Congress Street, Suite 1 Boston, MA 02114-2016 | 4,989,187 | (5) | 4.9% |

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted- average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column) | |||

Equity compensation plans approved by security holders | 1,931,419 | N/A | 1,159,889 | |||

Equity compensation plans not approved by security holders | — | N/A | — | |||

Total | 1,931,419 | N/A | 1,159,889 |

Proposal | Recommendation of the Board | Vote Required | |

1 | Election of Class III Directors: Roderick A. Larson, M. Kevin McEvoy, and Paul B. Murphy, Jr. | FOR each of the nominees | Per our Bylaws, each director nominee who receives a plurality of the votes cast (i.e., nominees receiving the highest number of “for” votes) will be elected. However, our Corporate Governance Guidelines require a director nominee to tender their resignation in an uncontested election if such nominee does not receive a “for” vote by a majority of the shares present in person or by proxy and entitled to vote and actually voting on the proposal. |

2 | Advisory Vote to Approve Executive Compensation | FOR | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote thereon. |

3 | Ratification of Appointment of Ernst & Young LLP as independent auditors of Oceaneering for the year ending December 31, 2025 | FOR | Affirmative vote of a majority of the shares of Common Stock voted on this proposal at the meeting. |

4 | Approval of the Amended and Restated 2020 Incentive Plan | FOR | Affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote thereon. |

|  |  |  | |||

Voting by Mail You may sign, date, and return your proxy card in the pre-addressed, postage-paid envelope provided. If you return your proxy card without indicating how you want to vote, the designated proxies will vote as set forth above. | Voting by Telephone If you are a stockholder of record, you may vote by proxy by using the toll- free number listed on your proxy card. | Voting via the Internet If you are a stockholder of record, you may vote by proxy by using the following Internet address: proxyvote.com. | Voting at the Meeting Stockholders of record may also vote at the Annual Meeting. However, even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy as described in this Proxy Statement, so that your votes will be counted if you do not participate in the meeting. | |||

OCEANEERING INTERNATIONAL, INC. ATTN: CORPORATE SECRETARY 5875 N. SAM HOUSTON PKWY. W., SUITE 400 HOUSTON, TEXAS 77086 |  VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M., Eastern Daylight Time, the day before the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. You will need to provide the 16-digit identification number that is printed in the box below, marked by the arrow. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M., Eastern Daylight Time, the day before the meeting date. Have your proxy card in hand when you call and then follow the instructions. You will need to provide the 16-digit identification number that is printed in the box below, marked by the arrow. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | |

V65468-Z89676 | KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY |

OCEANEERING INTERNATIONAL, INC. | |||||||||||||||

The Board of Directors recommends a vote FOR each of the nominees listed: | |||||||||||||||

1. | Election of Directors | For | Withhold | ||||||||||||

1a. | Roderick A. Larson | 0 | 0 | ||||||||||||

1b. | M. Kevin McEvoy | 0 | 0 | ||||||||||||

1c. | Paul B. Murphy, Jr. | 0 | 0 | ||||||||||||

The Board of Directors recommends a vote FOR the following proposals 2, 3 and 4: | For | Against | Abstain | ||||||||||||