Packaging Corporation of America Acquisition of Greif Containerboard Business July 1, 2025 .2

Certain statements in this presentation are forward-looking statements. Forward-looking statements include statements about our future financial condition, expected benefits from the acquisition, the timing of completion of the acquisition, our expectations regarding financing and our leverage, our industry and our business strategy. Statements that contain words such as “will,” “should,” “anticipate”, “believe”, “expect”, “intend”, “estimate”, “hope” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations are those identified under the caption “Risk Factors” in PCA’s Annual Report on Form 10-K for the year ended December 31, 2024 filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov”.

Greif Containerboard Business Acquisition Cash purchase price of $1.8 billion with full step-up of asset basis for tax purposes Subject to customary conditions, including regulatory approval under HSR Act Expected to close in the third quarter of 2025 Summary financial information for acquired business $1.2 billion of sales during the 12-month period ended April 30, 2025 (LTM period) $212 million of earnings before interest, tax, depreciation and amortization (EBITDA) during the LTM period Acquisition multiple of 8.5X LTM EBITDA; 6.6X with $60 million of synergy benefits

Two containerboard mills Gladstone, VA: approximately 575,000 tons of capacity of semi-chemical medium and recycled linerboard on two machines Massillon, OH: approximately 225,000 tons of recycled medium capacity on two machines Well located for the combined system in proximity to CorrChoice facilities and multiple high-volume PCA corrugated facilities Provides PCA with increased capability to produce products with higher recycled content Provides additional containerboard that can be integrated within PCA system CorrChoice sheet feeder and corrugated products business Sheet feeders located in Cincinnati, OH; Mason, MI; Massillon, OH and Palmyra, PA Full-line facilities located in Concord, NC; Dallas, TX; and Louisville, KY; Dallas commenced operations recently High quality, well-capitalized asset base Well-developed relationships with long-term customers that the combined organization is well-positioned to serve Corrugated facilities have complimentary product offerings to PCA Sheet plant located in Greensboro, NC Facilities to be Acquired

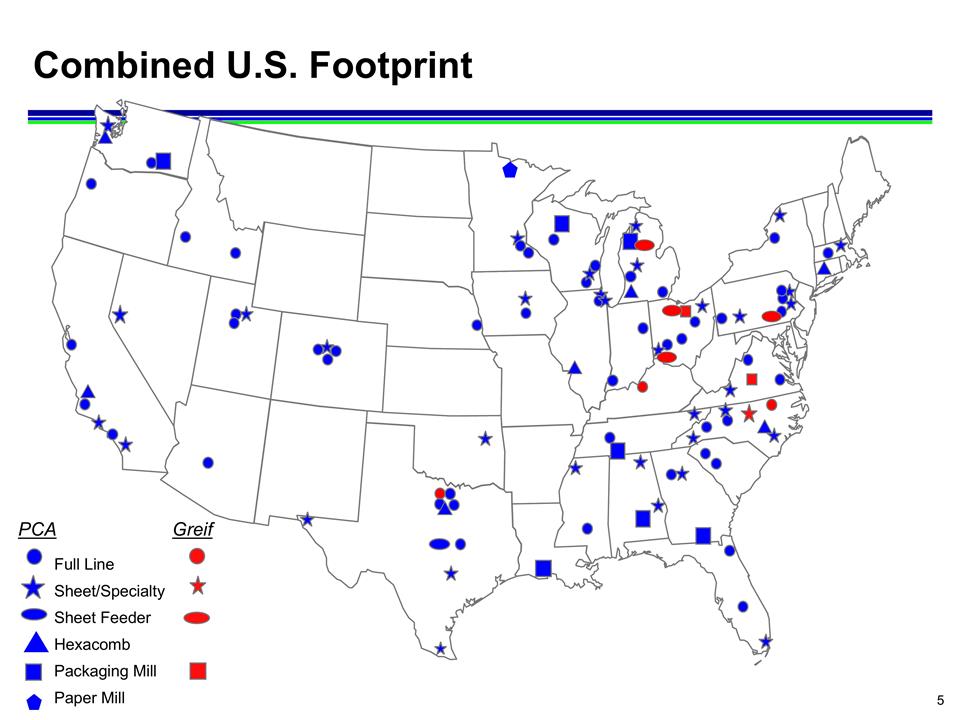

Pearl Combined U.S. Footprint PCA Greif Full Line Sheet/Specialty Sheet Feeder Hexacomb Packaging Mill Paper Mill

Expected Benefits $60 million of benefits from synergies: Expect to achieve on a run rate basis within two years after closing Approximately half by end of first year, remainder by end of second year Categories: Higher containerboard integration within combined system Operational and production efficiencies at acquired mills Mill grade optimization within combined system Lower transportation costs Operational and production efficiencies can be achieved with incremental maintenance capital Ongoing maintenance capital for entire acquired Greif business expected to be $40 to $50 million per year Additional opportunities for high return investments within combined mill and corrugated system

Expect new debt of $1.5 billion under new bank term loans ($1.0 billion) and notes ($500 million); remainder of purchase price and transaction expenses (approximately $20 million) to be funded from cash on hand Based on current interest rates and expected credit ratings, expect incremental net interest expense of ~$100 million per year PCA proforma leverage ratio will be 1.7X (net debt to EBITDA); compared to 0.9X currently With expected strong cash flow, PCA will have flexibility to pay down debt and return cash to shareholders, while continuing to invest in the business Financing