Packaging Corporation of America Investor Presentations December 10-11, 2025 Kent A. Pflederer Executive V. P. & CFO Mark W. Kowlzan Chairman & CEO

Some of the statements contained in this presentation that are not historical in nature may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are often identified by the words “will,” “should,” “anticipate,” “believe,” “expect,” “intend,” “estimate,” “hope” or similar expressions. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties. There are important factors that could cause actual results to differ materially from those in forward-looking statements, many of which are beyond PCA’s control. PCA’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements, and accordingly, PCA can give no assurances that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do occur, what impact they will have on our results of operations or financial condition. Given these uncertainties, investors are cautioned not to place undue reliance on these forward-looking statements. PCA expressly disclaims any obligation to publicly revise any forward-looking statements that have been made to reflect the occurrence of events after the date on which those statements are made. For additional information concerning some of the factors, risks and uncertainties that may affect our business, please refer to the “Risk Factors” in PCA’s Annual Report on Form 10-K for the year ended December 31, 2024, PCA’s Quarterly Report on Form 10-Q for the period ended September 30, 2025 and other documents filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov.” Certain information may be provided in this presentation that includes financial measurements that are not required by, or presented in accordance with, generally accepted accounting principles (GAAP), including, but not limited to EBITDA, (excluding special items), segment EBITDA (excluding special items), net debt, and free cash flow. Management excludes special items from such non-GAAP financial measures, as it believes that these items are not necessarily reflective of the ongoing operations of PCA’s business. These measures are presented because they provide a means to evaluate the performance of PCA’s segments and PCA on an ongoing basis using the same measures that are used by our management, because these measures assist in providing a meaningful comparison between periods and because these measures are frequently used by investors and other interested parties in the evaluation of companies and the performance of their segments. Any analysis of non-GAAP financial measures should be done in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. Reconciliations of the non-GAAP measures to the most comparable measure reported in accordance with GAAP are detailed the appendices to this presentation or included in the schedules to our earnings press releases. Packaging Corporation of America (“PCA”)

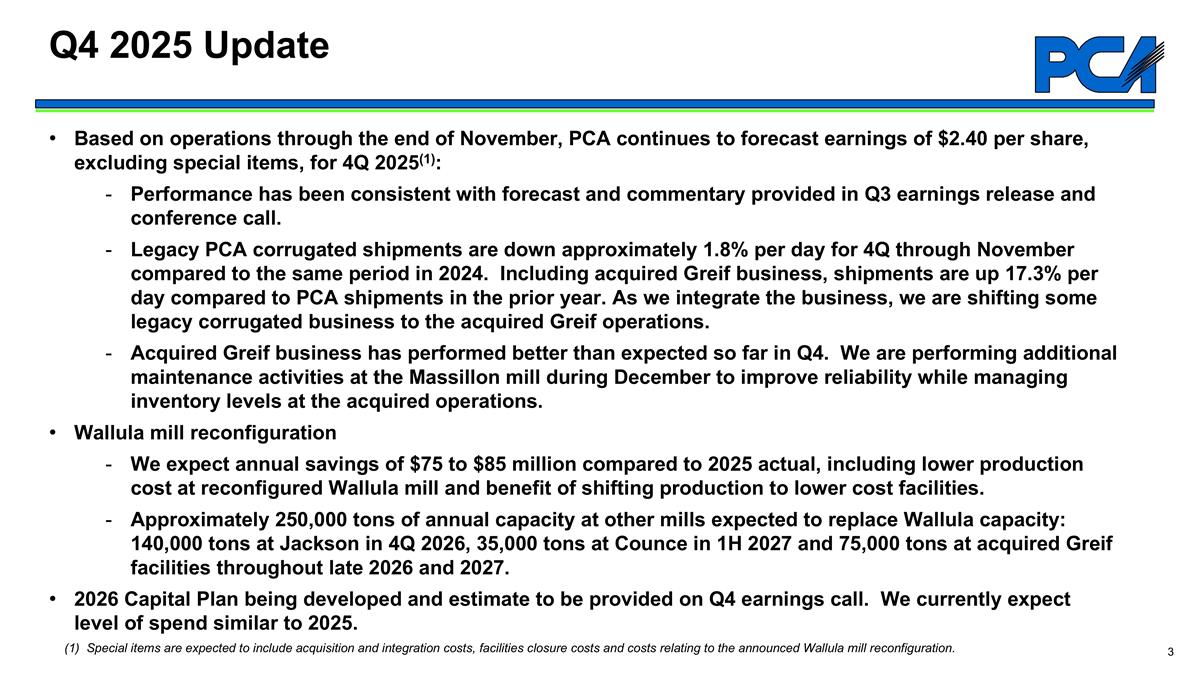

Based on operations through the end of November, PCA continues to forecast earnings of $2.40 per share, excluding special items, for 4Q 2025(1): Performance has been consistent with forecast and commentary provided in Q3 earnings release and conference call. Legacy PCA corrugated shipments are down approximately 1.8% per day for 4Q through November compared to the same period in 2024. Including acquired Greif business, shipments are up 17.3% per day compared to PCA shipments in the prior year. As we integrate the business, we are shifting some legacy corrugated business to the acquired Greif operations. Acquired Greif business has performed better than expected so far in Q4. We are performing additional maintenance activities at the Massillon mill during December to improve reliability while managing inventory levels at the acquired operations. Wallula mill reconfiguration We expect annual savings of $75 to $85 million compared to 2025 actual, including lower production cost at reconfigured Wallula mill and benefit of shifting production to lower cost facilities. Approximately 250,000 tons of annual capacity at other mills expected to replace Wallula capacity: 140,000 tons at Jackson in 4Q 2026, 35,000 tons at Counce in 1H 2027 and 75,000 tons at acquired Greif facilities throughout late 2026 and 2027. 2026 Capital Plan being developed and estimate to be provided on Q4 earnings call. We currently expect level of spend similar to 2025. Q4 2025 Update (1) Special items are expected to include acquisition and integration costs, facilities closure costs and costs relating to the announced Wallula mill reconfiguration.

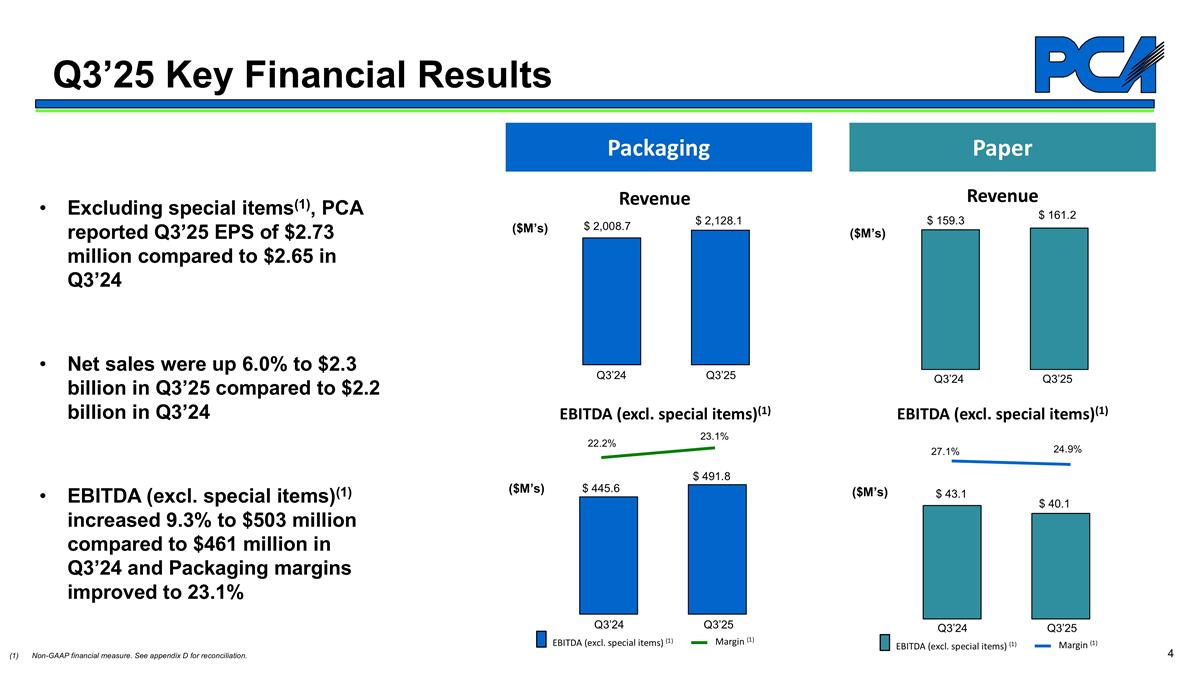

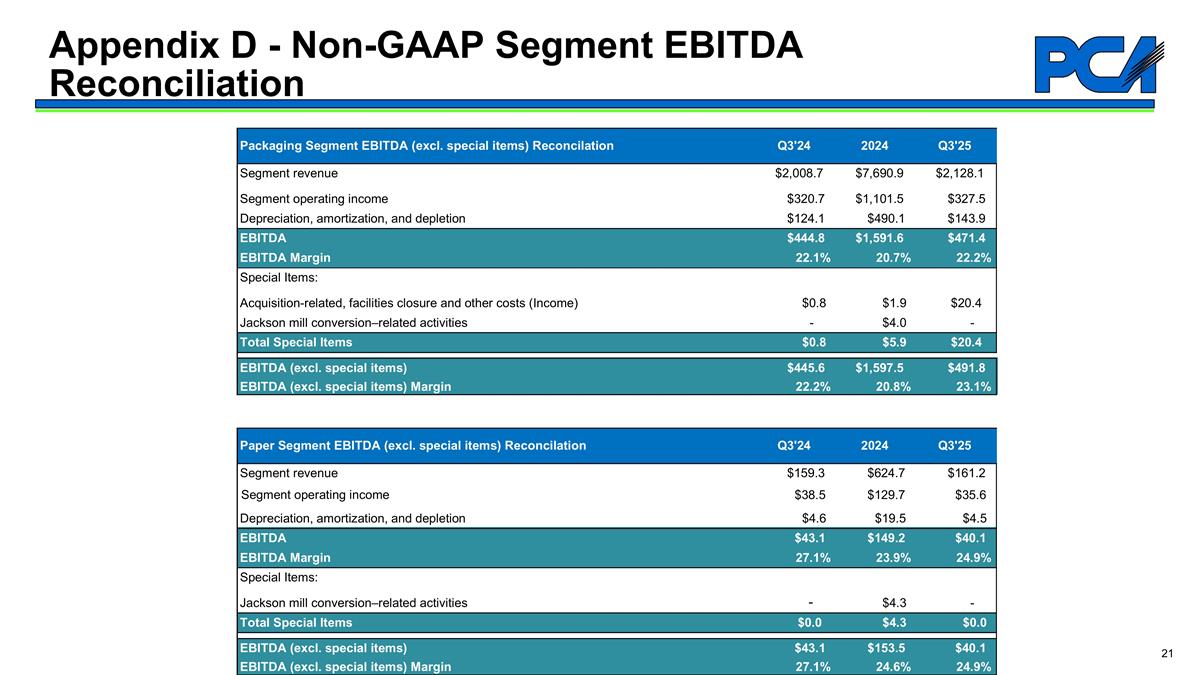

Revenue Q3’25 Key Financial Results Excluding special items(1), PCA reported Q3’25 EPS of $2.73 million compared to $2.65 in Q3’24 Net sales were up 6.0% to $2.3 billion in Q3’25 compared to $2.2 billion in Q3’24 EBITDA (excl. special items)(1) increased 9.3% to $503 million compared to $461 million in Q3’24 and Packaging margins improved to 23.1% Packaging Paper EBITDA (excl. special items)(1) Revenue EBITDA (excl. special items)(1) ($M’s) Non-GAAP financial measure. See appendix D for reconciliation. $ 2,008.7 $ 2,128.1 Q3’24 Q3’25 23.1% EBITDA (excl. special items) (1) ($M’s) Q3’24 Q3’25 $ 445.6 $ 491.8 22.2% Margin (1) EBITDA (excl. special items) (1) ($M’s) Q3’24 Q3’25 $ 43.1 $ 40.1 27.1% Margin (1) Q3’24 Q3’25 24.9% ($M’s) $ 159.3 $ 161.2

1.Top 3 producer of containerboard and corrugated packaging products and leading producer of uncoated freesheet paper in North America with track record of consistently executing profitable growth strategy World-class customer experience with proven local expertise and robust national footprint supported by best-in-class corrugated operations and low-cost integrated containerboard supply Strong, experienced hands-on management team with proven success achieving growth and maintaining industry-leading margins through all economic cycles Prudent and meaningful high ROI capital deployment supported by strong free cash flow generation further enhanced by recent Greif acquisition 5.Integration of acquired mills and converting facilities strengthened by management’s proven expertise with assets and complementary nature of business 6.Strong balance sheet and disciplined capital structure management allowing for reinvestment in business, return of capital to stockholders and opportunistic strategic growth investment Highlights

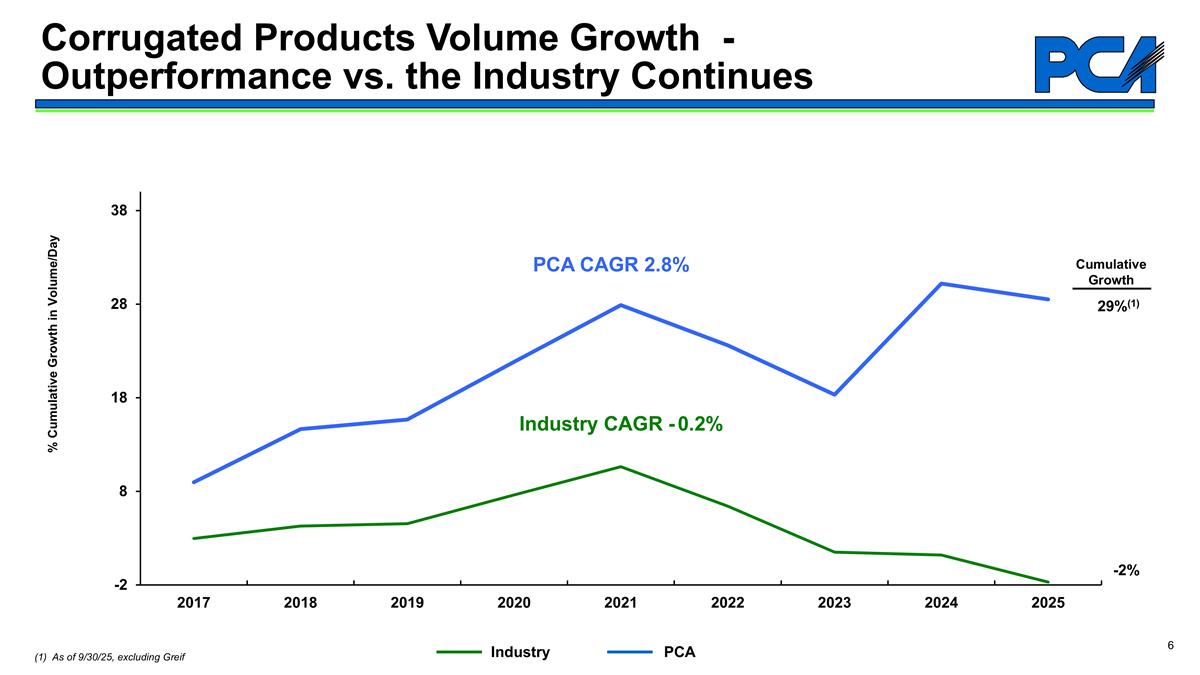

Industry PCA Corrugated Products Volume Growth - Outperformance vs. the Industry Continues % Cumulative Growth in Volume/Day 29%(1) -2% PCA CAGR 2.8% Industry CAGR - 0.2% Cumulative Growth (1) As of 9/30/25, excluding Greif

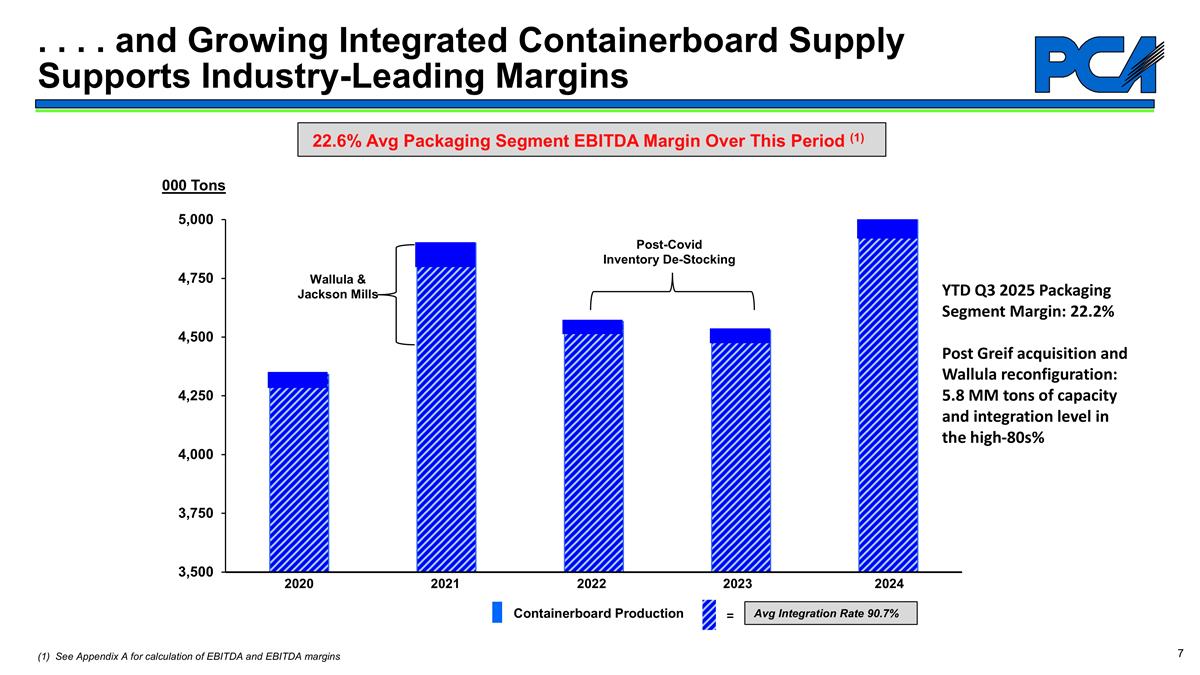

Containerboard Production . . . . and Growing Integrated Containerboard Supply Supports Industry-Leading Margins 2020 2021 2022 20232024 000 Tons Wallula & Jackson Mills (1) See Appendix A for calculation of EBITDA and EBITDA margins = Avg Integration Rate 90.7% 22.6% Avg Packaging Segment EBITDA Margin Over This Period (1) Post-Covid Inventory De-Stocking YTD Q3 2025 Packaging Segment Margin: 22.2% Post Greif acquisition and Wallula reconfiguration: 5.8 MM tons of capacity and integration level in the high-80s%

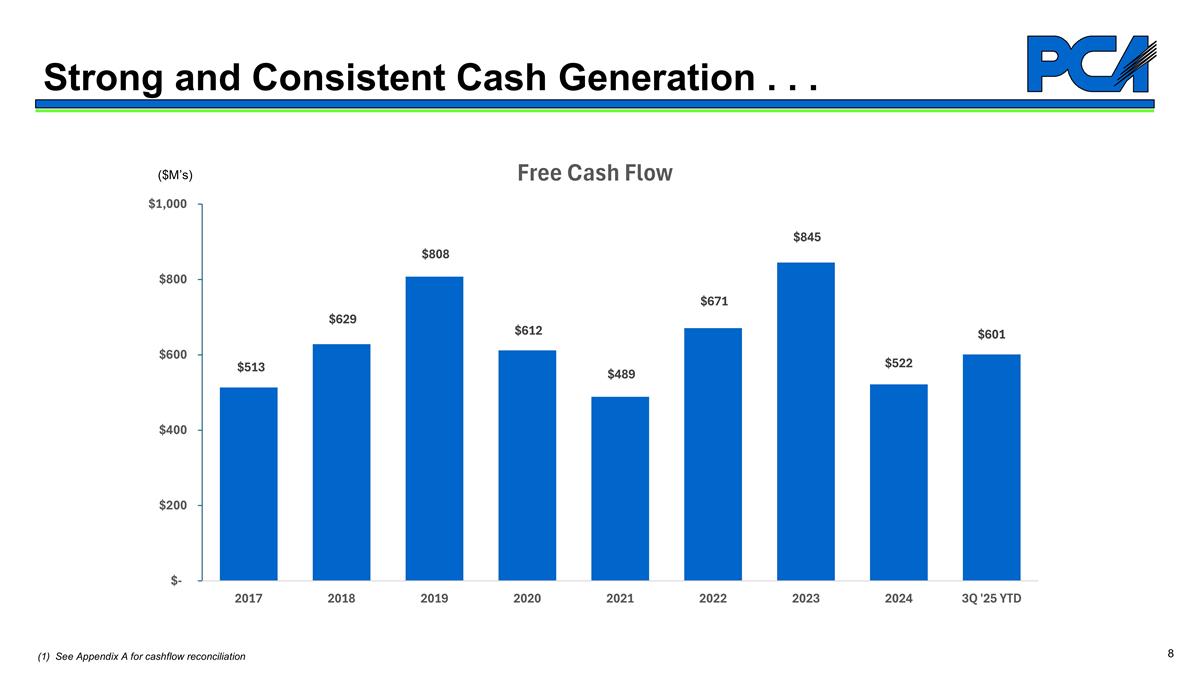

Strong and Consistent Cash Generation . . . ($M’s) (1) See Appendix A for cashflow reconciliation

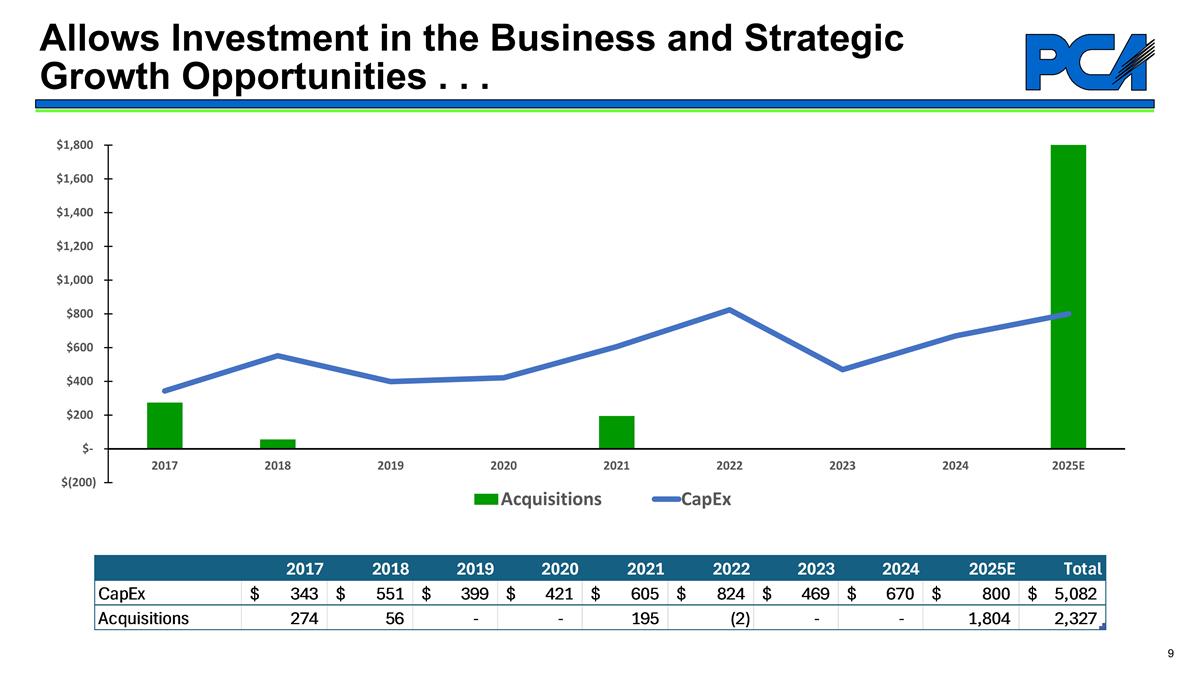

Allows Investment in the Business and Strategic Growth Opportunities . . . 2017 2018 2019 2020 2021 2022 2023 2024 2025E Total CapEx $343 $551 $399 $421 $605 $824 $469 $670 $800 $5,082 Acquisitions 274 56 - - 195 -2 - - 1,804 2,327 2017 2018 2019 2020 2021 2022 2023 2024 2025E Dividend $238 $268 $299 $300 $380 $420 $449 $449 $449 Share Repurchase - - - - $193 $523 $42 - - 2017 2018 2019 2020 2021 2022 2023 2024 2025E Total CapEx $343 $551 $399 $421 $605 $824 $469 $670 $800 $5,082 Acquisitions 274 56 - - 195 -2 - - 1,804 2,327 2017 2018 2019 2020 2021 2022 2023 2024 2025E Dividend $238 $268 $299 $300 $380 $420 $449 $449 $449 Share Repurchase - - - - $193 $523 $42 - -

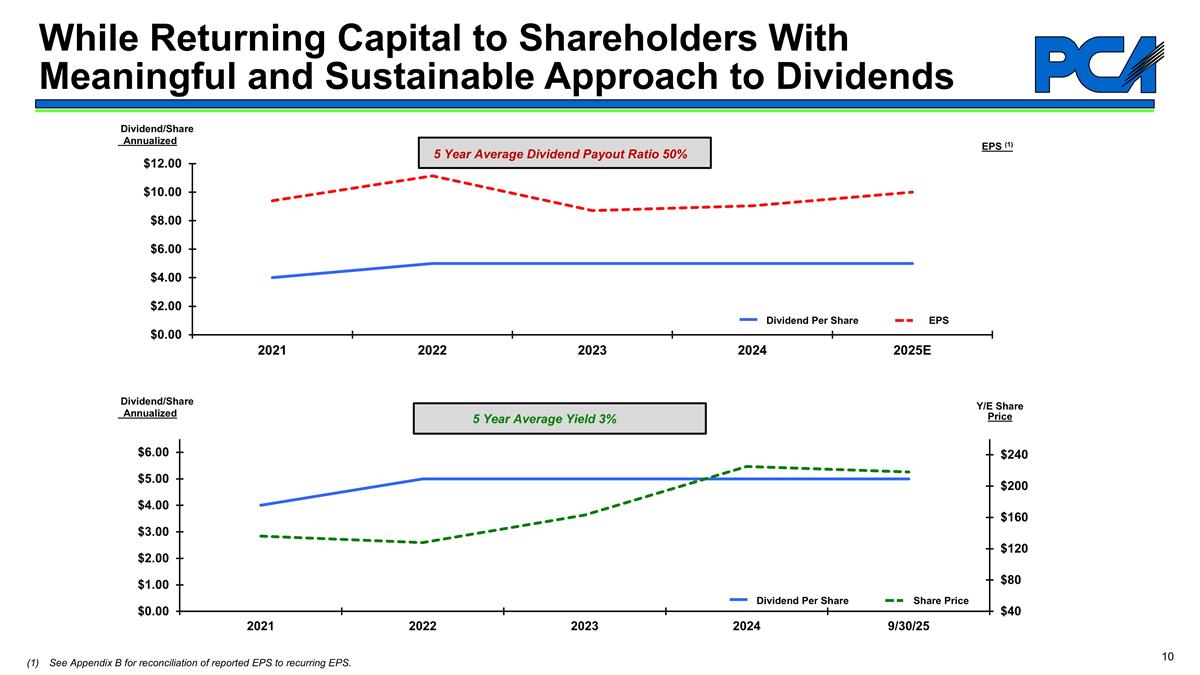

While Returning Capital to Shareholders With Meaningful and Sustainable Approach to Dividends EPS (1) Dividend Per Share EPS Dividend/Share Annualized 5 Year Average Dividend Payout Ratio 50% 5 Year Average Yield 3% Y/E Share Price Dividend/Share Annualized Dividend Per Share Share Price See Appendix B for reconciliation of reported EPS to recurring EPS.

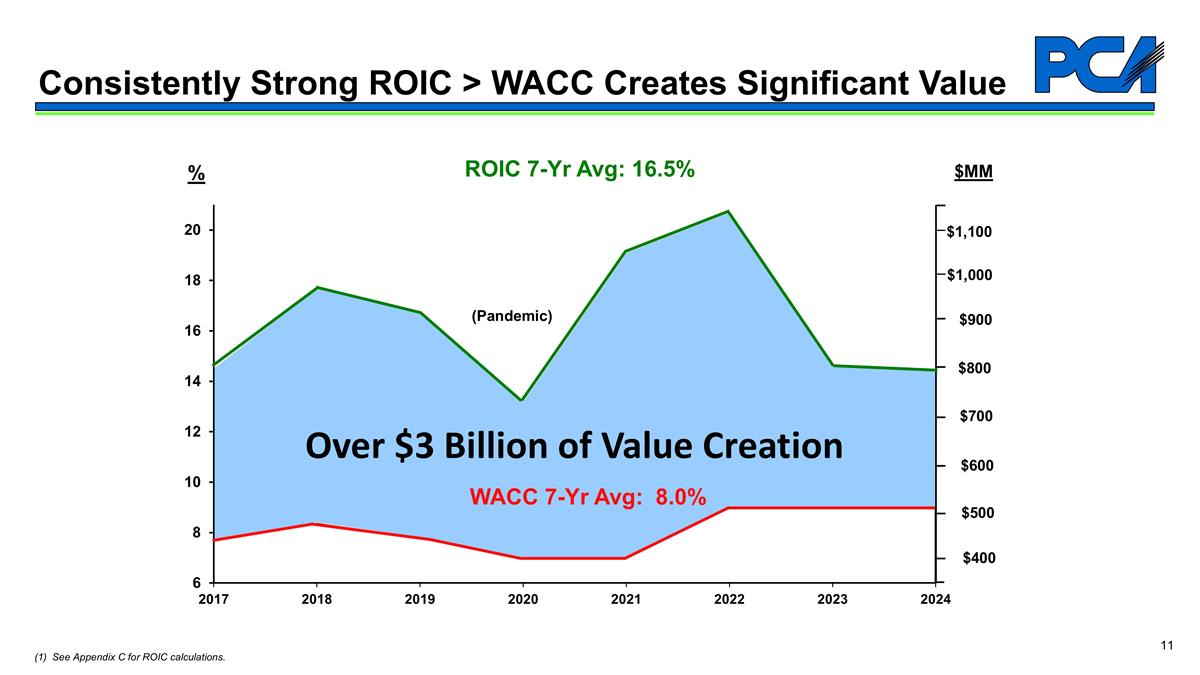

% Consistently Strong ROIC > WACC Creates Significant Value ROIC 7-Yr Avg: 16.5% $MM (1) See Appendix C for ROIC calculations. $1,000 $500 $600 $700 WACC 7-Yr Avg: 8.0% Over $3 Billion of Value Creation (Pandemic) $400 $900 $800 $1,100

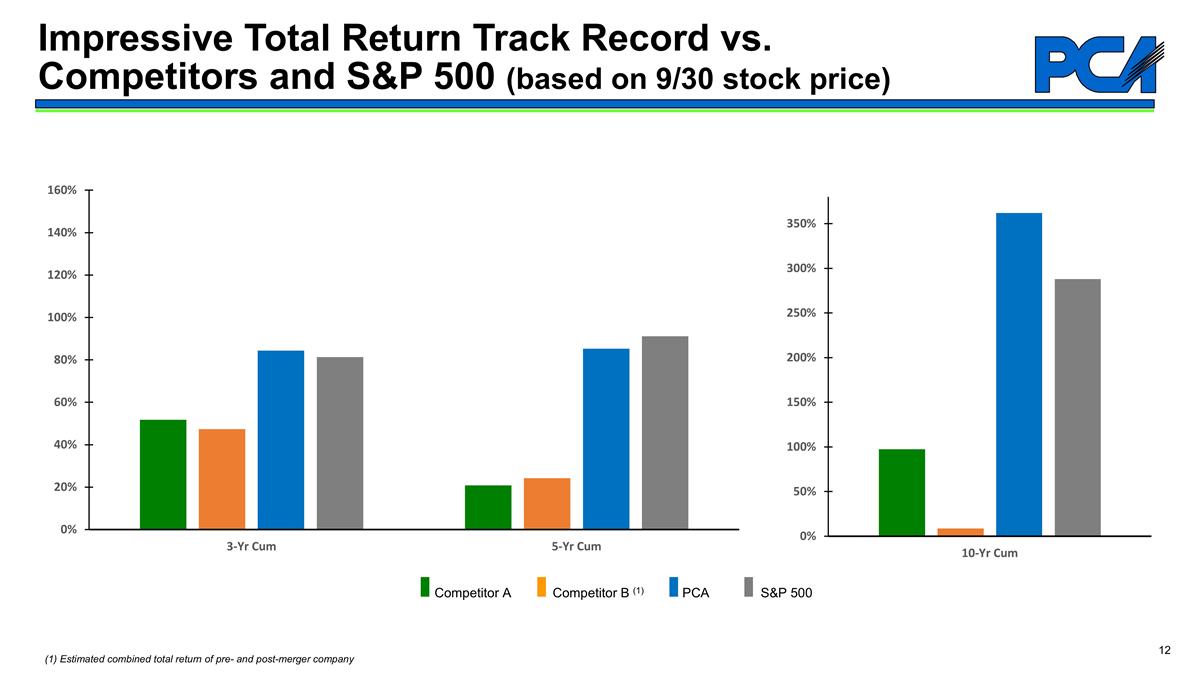

Impressive Total Return Track Record vs. Competitors and S&P 500 (based on 9/30 stock price) (1) Estimated combined total return of pre- and post-merger company Competitor ACompetitor B (1)PCAS&P 500

Greif Containerboard Acquisition

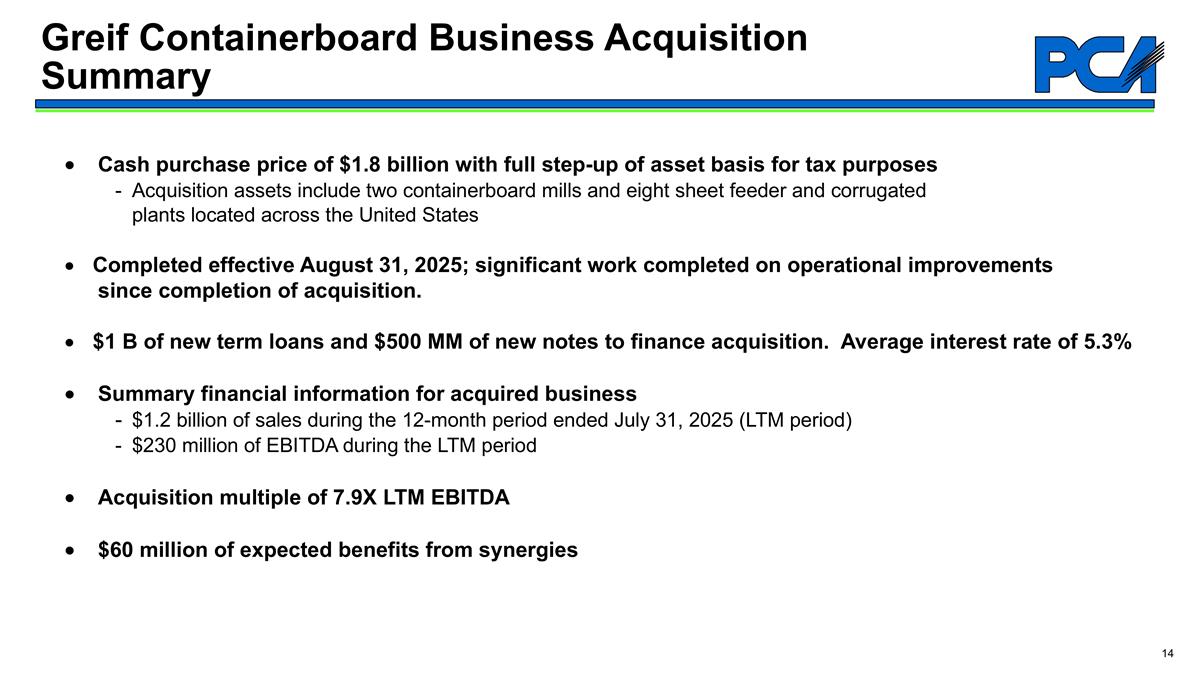

Greif Containerboard Business Acquisition Summary · Cash purchase price of $1.8 billion with full step-up of asset basis for tax purposes -Acquisition assets include two containerboard mills and eight sheet feeder and corrugated plants located across the United States Completed effective August 31, 2025; significant work completed on operational improvements since completion of acquisition. $1 B of new term loans and $500 MM of new notes to finance acquisition. Average interest rate of 5.3% · Summary financial information for acquired business - $1.2 billion of sales during the 12-month period ended July 31, 2025 (LTM period) -$230 million of EBITDA during the LTM period · Acquisition multiple of 7.9X LTM EBITDA · $60 million of expected benefits from synergies

Acquisition Rationale Similar End Market and Customer Mix: Adds a strong customer base of US companies providing a stable revenue stream as these relationships tend to be long-lasting and consistent throughout economic cycles P Significant Cost Synergy Opportunity: Combination provides a potential for significant cost synergies through additional integration opportunities, mill optimization initiatives, procurement, freight and organizational right-sizing P Greif Assets Attractive Margin and High Return Investment: Provides access to production assets with compelling integrated economics at a more efficient cost (and time) vs. new greenfield investments P Enhanced Scale and Capacity: Expands low-cost containerboard production capacity and provides opportunities for further improvement, positioning PCA to meet customers’ growing demand. Capabilities allow PCA to shed some higher cost capacity in corrugated plant and mill systems. P PCA

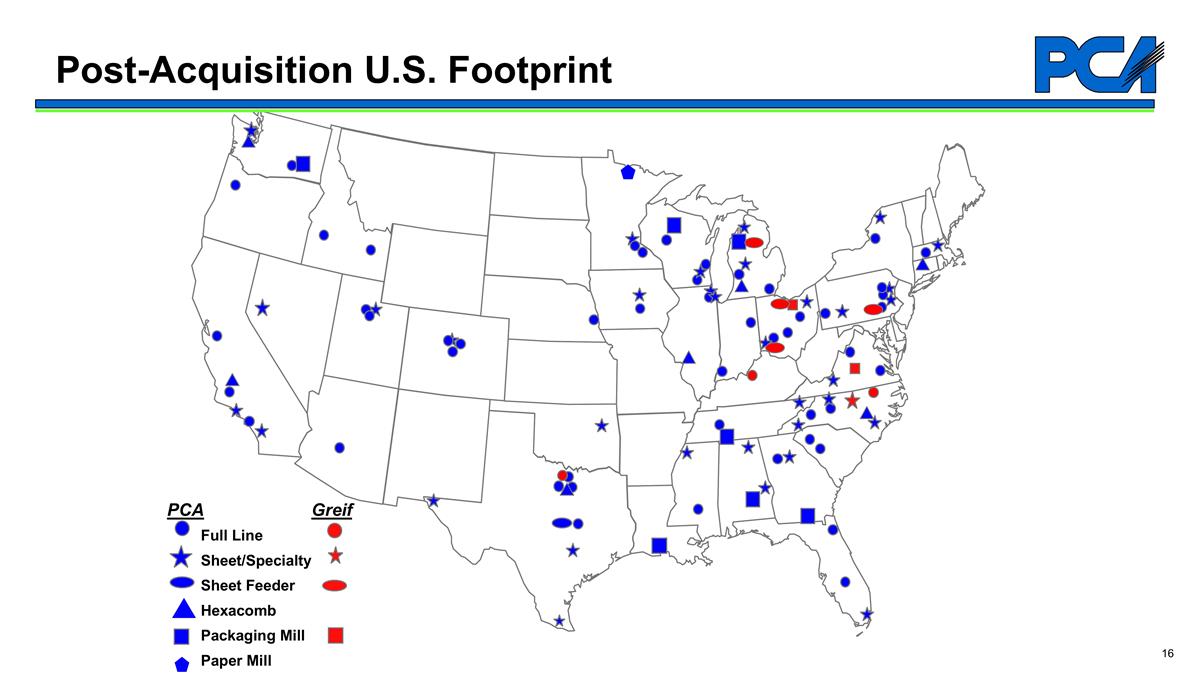

Pearl Post-Acquisition U.S. Footprint PCA Greif Full Line Sheet/Specialty Sheet Feeder Hexacomb Packaging Mill Paper Mill

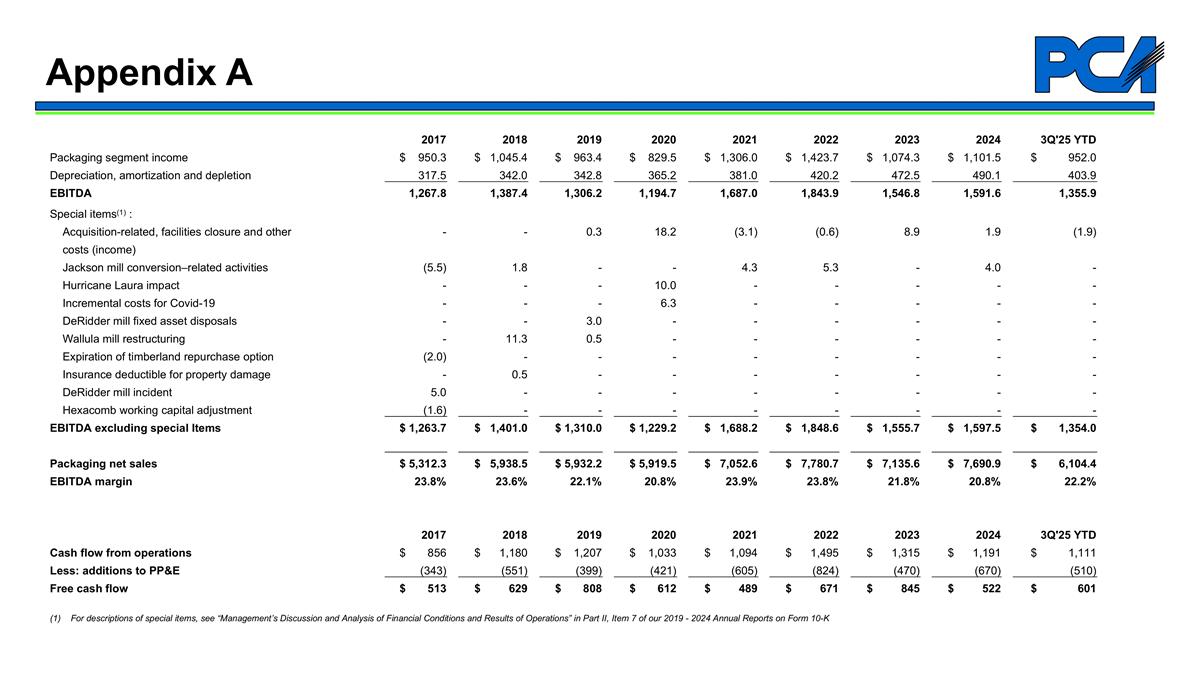

Appendix A 2017 2018 2019 2020 2021 2022 2023 2024 3Q'25 YTD Packaging segment income $ 950.3 $ 1,045.4 $ 963.4 $ 829.5 $ 1,306.0 $ 1,423.7 $ 1,074.3 $ 1,101.5 $ 952.0 Depreciation, amortization and depletion 317.5 342.0 342.8 365.2 381.0 420.2 472.5 490.1 403.9 EBITDA 1,267.8 1,387.4 1,306.2 1,194.7 1,687.0 1,843.9 1,546.8 1,591.6 1,355.9 Special items(1) : Acquisition-related, facilities closure and other - - 0.3 18.2 (3.1) (0.6) 8.9 1.9 (1.9) costs (income) Jackson mill conversion–related activities (5.5) 1.8 - - 4.3 5.3 - 4.0 - Hurricane Laura impact - - - 10.0 - - - - - Incremental costs for Covid-19 - - - 6.3 - - - - - DeRidder mill fixed asset disposals - - 3.0 - - - - - - Wallula mill restructuring - 11.3 0.5 - - - - - - Expiration of timberland repurchase option (2.0) - - - - - - - - Insurance deductible for property damage - 0.5 - - - - - - - DeRidder mill incident 5.0 - - - - - - - - Hexacomb working capital adjustment (1.6) - - - - - - - - EBITDA excluding special Items $ 1,263.7 $ 1,401.0 $ 1,310.0 $ 1,229.2 $ 1,688.2 $ 1,848.6 $ 1,555.7 $ 1,597.5 $ 1,354.0 Packaging net sales $ 5,312.3 $ 5,938.5 $ 5,932.2 $ 5,919.5 $ 7,052.6 $ 7,780.7 $ 7,135.6 $ 7,690.9 $ 6,104.4 EBITDA margin 23.8% 23.6% 22.1% 20.8% 23.9% 23.8% 21.8% 20.8% 22.2% 2017 2018 2019 2020 2021 2022 2023 2024 3Q'25 YTD Cash flow from operations $ 856 $ 1,180 $ 1,207 $ 1,033 $ 1,094 $ 1,495 $ 1,315 $ 1,191 $ 1,111 Less: additions to PP&E (343) (551) (399) (421) (605) (824) (470) (670) (510) Free cash flow $ 513 $ 629 $ 808 $ 612 $ 489 $ 671 $ 845 $ 522 $ 601 (1) For descriptions of special items, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in Part II, Item 7 of our 2019 - 2024 Annual Reports on Form 10-K

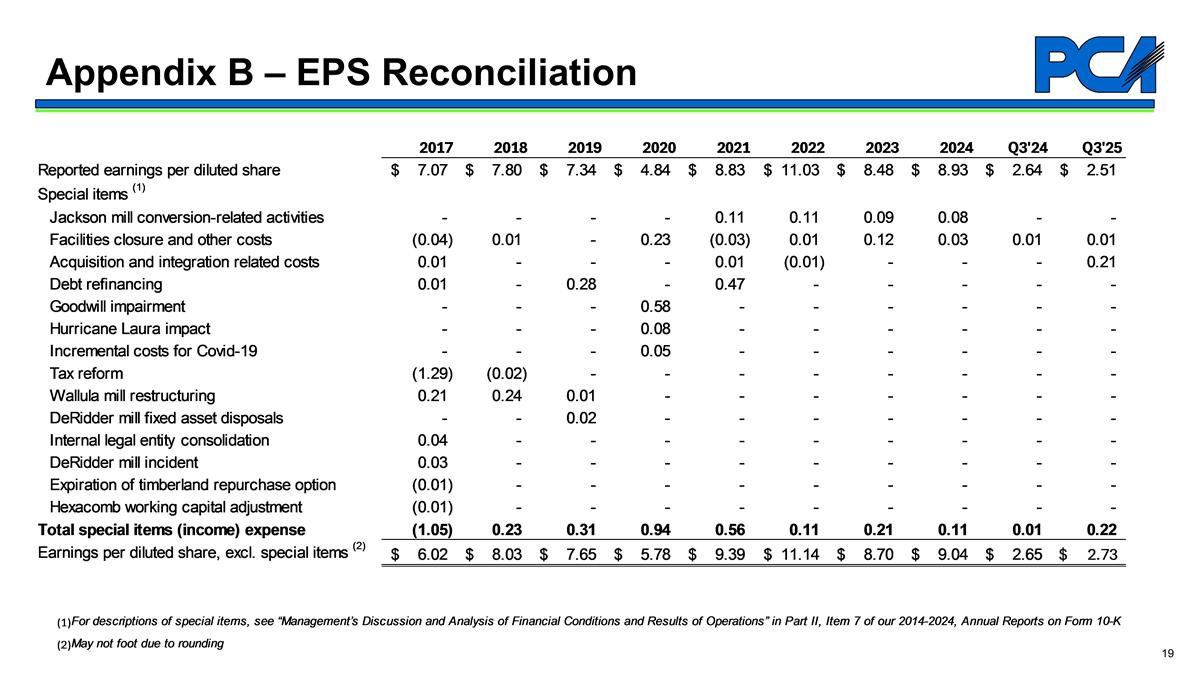

Appendix B – EPS Reconciliation 2017 2018 2019 2020 2021 2022 2023 2024 Q3'24 Q3'25 Reported earnings per diluted share $7.07 $7.8 $7.34 $4.84 $8.83 $11.03 $8.48 $8.93 $2.64 $2.5099999999999998 Special items (1) Jackson mill conversion-related activities - - - - 0.11 0.11 0.09 0.08 - - Facilities closure and other costs -0.04 0.01 - 0.23 -0.03 0.01 0.12 0.03 0.01 0.01 Acquisition and integration related costs 0.01 - - - 0.01 -0.01 - - - 0.21 Debt refinancing 0.01 - 0.28000000000000003 - 0.47 - - - - - Goodwill impairment - - - 0.57999999999999996 - - - - - - Hurricane Laura impact - - - 0.08 - - - - - - Incremental costs for Covid-19 - - - 0.05 - - - - - - Tax reform -1.29 -0.02 - - - - - - - - Wallula mill restructuring 0.21 0.24 0.01 - - - - - - - DeRidder mill fixed asset disposals - - 0.02 - - - - - - - Internal legal entity consolidation 0.04 - - - - - - - - - DeRidder mill incident 0.03 - - - - - - - - - Expiration of timberland repurchase option -0.01 - - - - - - - - - Hexacomb working capital adjustment -0.01 - - - - - - - - - Total special items (income) expense -1.05 0.22999999999999998 0.31000000000000005 0.94 0.55999999999999994 0.11 0.21 0.11 0.01 0.22 Earnings per diluted share, excl. special items (2) $6.02 $8.0299999999999994 $7.65 $5.78 $9.39 $11.14 $8.6999999999999993 $9.0399999999999991 $2.65 $2.73 (1)For descriptions of special items, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in Part II, Item 7 of our 2014-2024, Annual Reports on Form 10-K (2)May not foot due to rounding 2017 2018 2019 2020 2021 2022 2023 2024 Q3'24 Q3'25 Reported earnings per diluted share $7.07 $7.8 $7.34 $4.84 $8.83 $11.03 $8.48 $8.93 $2.64 $2.5099999999999998 Special items (1) Jackson mill conversion-related activities - - - - 0.11 0.11 0.09 0.08 - - Facilities closure and other costs -0.04 0.01 - 0.23 -0.03 0.01 0.12 0.03 0.01 0.01 Acquisition and integration related costs 0.01 - - - 0.01 -0.01 - - - 0.21 Debt refinancing 0.01 - 0.28000000000000003 - 0.47 - - - - - Goodwill impairment - - - 0.57999999999999996 - - - - - - Hurricane Laura impact - - - 0.08 - - - - - - Incremental costs for Covid-19 - - - 0.05 - - - - - - Tax reform -1.29 -0.02 - - - - - - - - Wallula mill restructuring 0.21 0.24 0.01 - - - - - - - DeRidder mill fixed asset disposals - - 0.02 - - - - - - - Internal legal entity consolidation 0.04 - - - - - - - - - DeRidder mill incident 0.03 - - - - - - - - - Expiration of timberland repurchase option -0.01 - - - - - - - - - Hexacomb working capital adjustment -0.01 - - - - - - - - - Total special items (income) expense -1.05 0.22999999999999998 0.31000000000000005 0.94 0.55999999999999994 0.11 0.21 0.11 0.01 0.22 Earnings per diluted share, excl. special items (2) $6.02 $8.0299999999999994 $7.65 $5.78 $9.39 $11.14 $8.6999999999999993 $9.0399999999999991 $2.65 $2.73 (1)For descriptions of special items, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in Part II, Item 7 of our 2014-2024, Annual Reports on Form 10-K (2)May not foot due to rounding

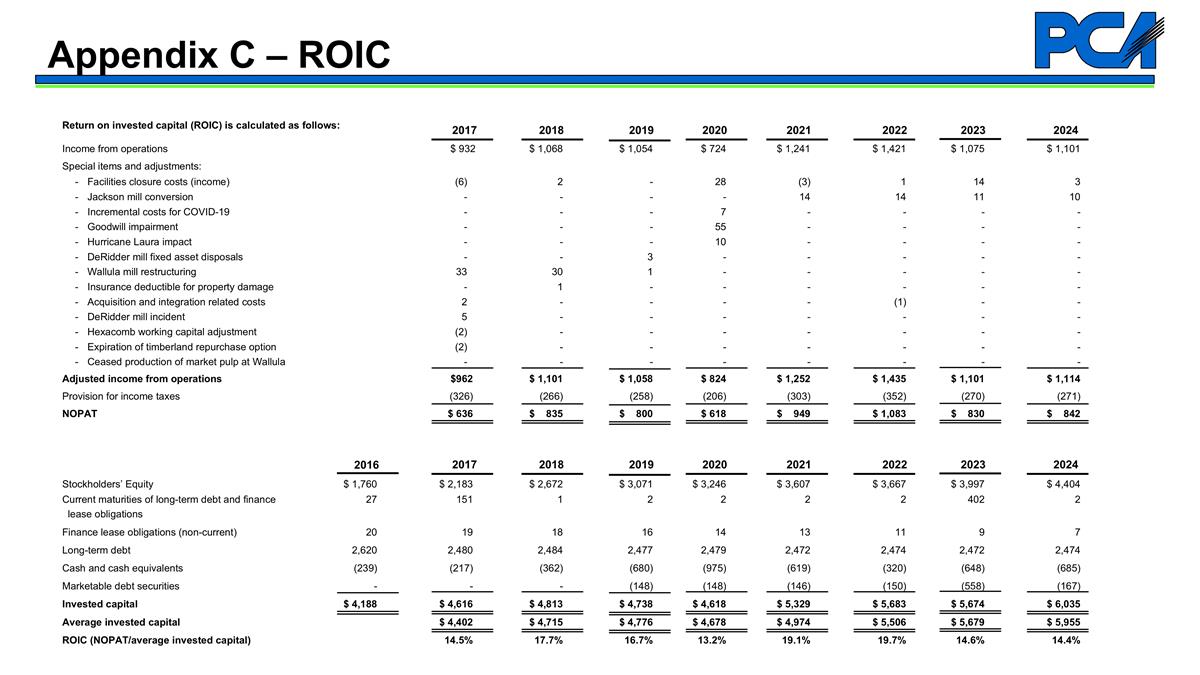

Return on invested capital (ROIC) is calculated as follows: Income from operations$ 932$ 1,068$ 1,054$ 724$ 1,241$ 1,421$ 1,075$ 1,101 Special items and adjustments: -Facilities closure costs (income)(6)2-28(3)1143 -Jackson mill conversion----14141110 -Incremental costs for COVID-19---7---- -Goodwill impairment---55---- -Hurricane Laura impact---10---- -DeRidder mill fixed asset disposals--3-- --- -Wallula mill restructuring 33301-- --- -Insurance deductible for property damage-1------ -Acquisition and integration related costs 2----(1)-- - DeRidder mill incident5------- -Hexacomb working capital adjustment (2)------- -Expiration of timberland repurchase option (2)------- -Ceased production of market pulp at Wallula -------- Adjusted income from operations$962$ 1,101$ 1,058$ 824$ 1,252$ 1,435$ 1,101$ 1,114 Provision for income taxes(326)(266)(258)(206)(303)(352)(270)(271) NOPAT$ 636$ 835$ 800$ 618$ 949$ 1,083$ 830$ 842 Stockholders’ Equity $ 1,760$ 2,183$ 2,672$ 3,071$ 3,246$ 3,607$ 3,667$ 3,997$ 4,404 Current maturities of long-term debt and finance27151122224022 lease obligations Finance lease obligations (non-current)2019181614131197 Long-term debt2,6202,4802,4842,4772,4792,4722,4742,4722,474 Cash and cash equivalents(239)(217)(362)(680)(975)(619)(320)(648)(685) Marketable debt securities---(148)(148)(146)(150)(558)(167) Invested capital$ 4,188$ 4,616$ 4,813$ 4,738$ 4,618$ 5,329$ 5,683$ 5,674$ 6,035 Average invested capital$ 4,402$ 4,715$ 4,776$ 4,678$ 4,974$ 5,506$ 5,679$ 5,955 ROIC (NOPAT/average invested capital)14.5%17.7%16.7%13.2%19.1%19.7%14.6%14.4% Appendix C – ROIC 2016 2017 2018 2019 2020 2021 2022 20232024 2017 2018 2019 2020 2021 2022 20232024

Appendix D - Non-GAAP Segment EBITDA Reconciliation Packaging Segment EBITDA (excl. special items) Reconcilation Q3'24 2024 Q3'25 Segment revenue $2,008.7 $7,690.9 $2,128.1 Segment operating income $320.7 $1,101.5 $327.5 Depreciation, amortization, and depletion $124.1 $490.1 $143.9 EBITDA $444.8 $1,591.6 $471.4 EBITDA Margin 22.1% 20.7% 22.2% Special Items: Acquisition-related, facilities closure and other costs (Income) $0.8 $1.9 $20.4 Jackson mill conversion–related activities - $4.0 - Total Special Items $0.8 $5.9 $20.4 EBITDA (excl. special items) $445.6 $1,597.5 $491.8 EBITDA (excl. special items) Margin 22.2% 20.8% 23.1% Paper Segment EBITDA (excl. special items) Reconcilation Q3'24 2024 Q3'25 Segment revenue $159.3 $624.7 $161.2 Segment operating income $38.5 $129.7 $35.6 Depreciation, amortization, and depletion $4.6 $19.5 $4.5 EBITDA $43.1 $149.2 $40.1 EBITDA Margin 27.1% 23.9% 24.9% Special Items: Jackson mill conversion–related activities $4.3 - Total Special Items $0.0 $4.3 $0.0 EBITDA (excl. special items) $43.1 $153.5 $40.1 EBITDA (excl. special items) Margin 27.1% 24.6% 24.9% -