Third Quarter 2025 Earnings November 5, 2025 .2

2 Forward-Looking Statements and Non-GAAP Results These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," “model”, "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to: Fourth Quarter 2025 outlook, including revenue, adjusted EBITDA, adjusted EBITDA margin, and earnings per share and the drivers thereof; Full-Year 2025 guidance framework, including organic revenue growth, digital retail solutions (“DRS”) and ATM managed services (“AMS”) organic revenue growth, adjusted EBITDA margin expansion, free cash flow conversion and shareholder returns and the drivers thereof; capital allocation priorities; the impact of U.S. and global macroeconomic conditions; the impact of tariffs and foreign inflation; expected impact from deployment of technology-enabled solutions, including AMS and DRS; the effect of pending legal matters, including the Chile antitrust matter; the impacts of the operating environment in Argentina; and strategic priorities and initiatives, including the Brink’s Business System and technology and systems investments. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; general economic issues, including supply chain disruptions, fuel price increases, new or increased international tariffs and/or trade barriers, inflation, recessionary conditions and changes in interest rates; seasonality, pricing and other competitive industry factors; investment in information technology (“IT”) and its impact on revenue and profit growth; risks associated with the usage of artificial intelligence (“AI”) technologies; our ability to maintain an effective IT infrastructure and safeguard confidential information and risks related to a failure of our IT systems and networks, including cloud-based applications, and risks associated with current and emerging technology threats, and damage from computer viruses, unauthorized access and cyber attacks, including increasingly sophisticated cyber attacks incorporating the use of AI and other similar disruptions; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions (including political conflict or unrest), regulatory issues (including the imposition of international sanctions, including by the U.S. government), military conflicts (including but not limited to the conflict in Israel and surrounding areas, as well as the possible expansion of such conflicts and potential geopolitical consequences), currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions' higher-than-expected inflation and those determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including labor shortages, negotiations with organized labor and work stoppages; pandemics, acts of terrorism, strikes or other extraordinary events that negatively affect global or regional cash commerce; anticipated cash needs in light of our current liquidity position; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and product or market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee, environmental and other liabilities in connection with former coal operations, including black lung claims; the impact of the American Rescue Plan Act and Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the impact of foreign tax credit regulations; the impact of the One Big Beautiful Bill Act; the outcome of pending and future claims, litigation, and administrative proceedings; our ability to comply with regulatory compliance obligations; public perception of our business, reputation and brand; our ability to identify, recruit and retain key employees; changes in estimates and assumptions underlying our critical accounting policies; and the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations. This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2024, and in related disclosures in our other public filings with the Securities and Exchange Commission. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking statements, and all of the forward-looking statements in this document are expressly qualified by the cautionary statements contained or referred to herein and therein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on the Company or our business or operations. Readers are cautioned not to rely too heavily on the forward-looking statements contained in this document. The forward-looking information included in this document is representative only as of the date of this document and The Brink's Company undertakes no obligation to update, revise or clarify any information contained in this document or forward-looking statements that may be made from time to time on our behalf, whether as a result of new information, future events or otherwise, except as required by law. These materials are copyrighted and may not be used without written permission from Brink’s. Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix.

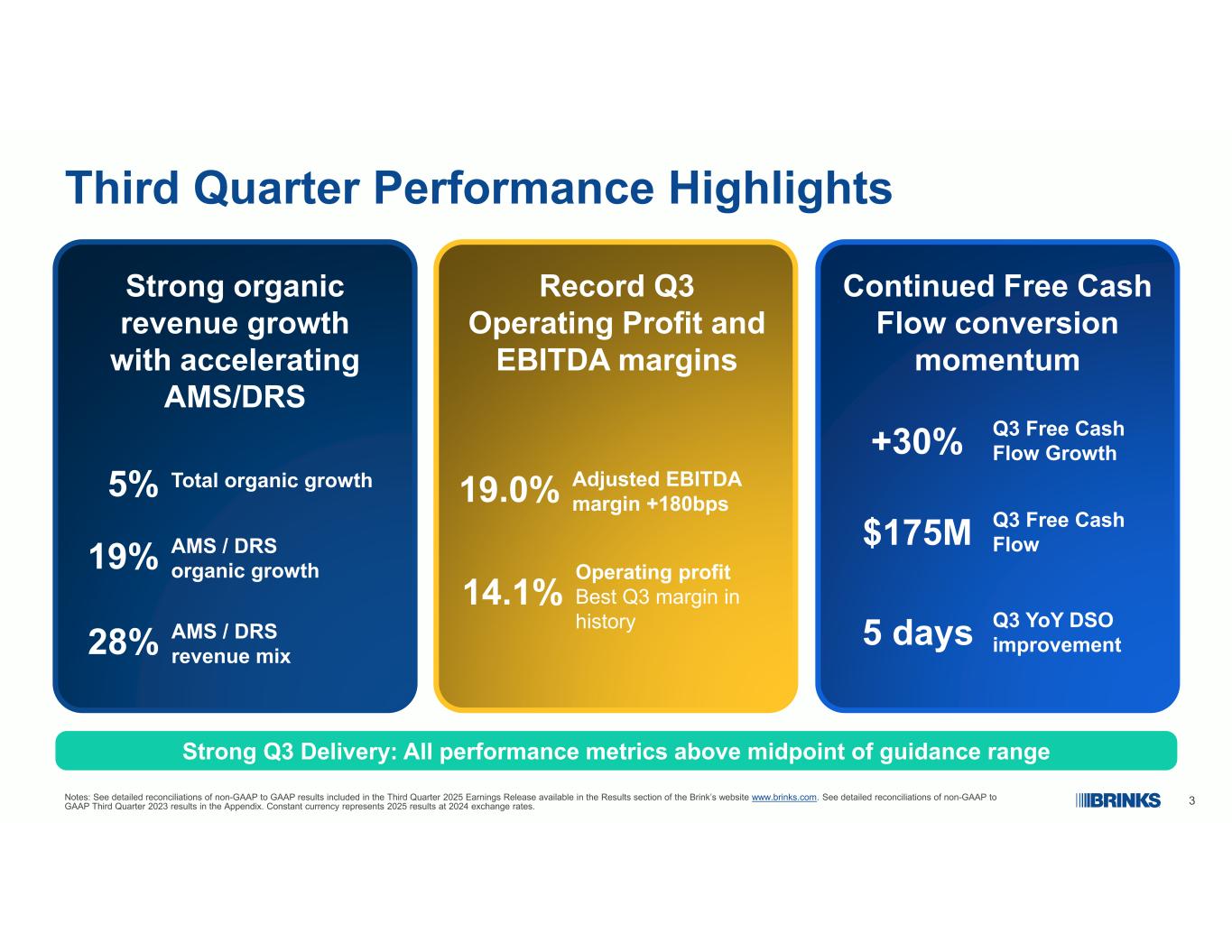

3 Third Quarter Performance Highlights Strong organic revenue growth with accelerating AMS/DRS 5% Total organic growth 19% AMS / DRS organic growth Record Q3 Operating Profit and EBITDA margins 19.0% Adjusted EBITDA margin +180bps 14.1% Operating profit Best Q3 margin in history Continued Free Cash Flow conversion momentum 5 days Q3 YoY DSO improvement $175M Q3 Free Cash Flow Strong Q3 Delivery: All performance metrics above midpoint of guidance range Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP Third Quarter 2023 results in the Appendix. Constant currency represents 2025 results at 2024 exchange rates. +30% Q3 Free Cash Flow Growth 28% AMS / DRS revenue mix

4 Executing Against Our Value Creation Strategy Grow Organically 01 Expand Profit Margins 02 Improve FCF Conversion 03 Maximize Shareholder Value 04 5% YTD Organic Growth 18% YTD AMS/DRS Organic Growth Record EBITDA Margins in North America / Europe Margin Expansion Accelerating in H2 +78% Increase to Free Cash Flow YTD Working Capital Improvements and Capex Efficiency Utilized $154M YTD to Repurchase 1.7M shares at $89.05 per share On Track for 50%+ FCF Returned to Shareholders 4Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP Third Quarter 2023 results in the Appendix. Constant currency represents 2025 results at 2024 exchange rates.

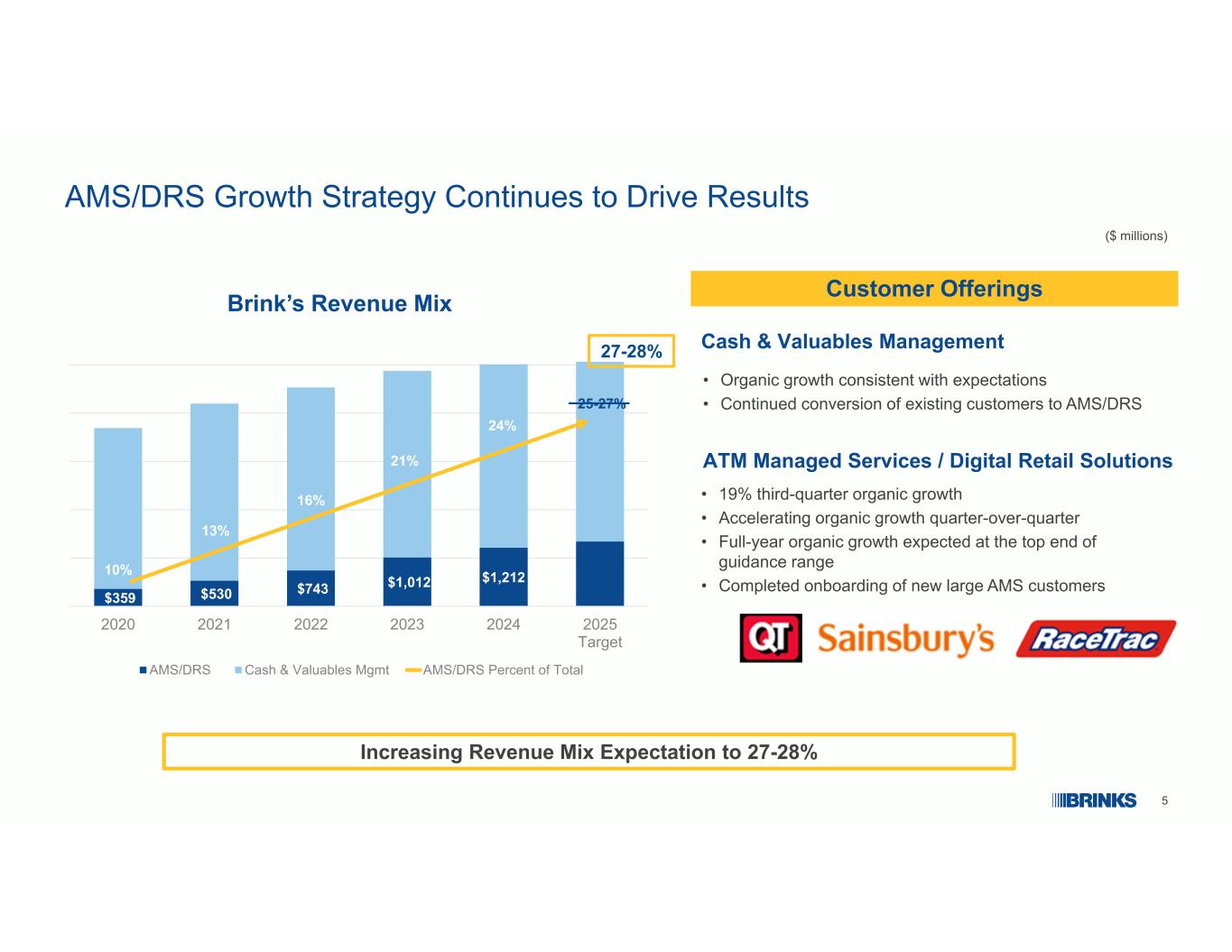

5 $359 $530 $743 $1,012 $1,212 10% 13% 16% 21% 24% 2020 2021 2022 2023 2024 2025 Target AMS/DRS Cash & Valuables Mgmt AMS/DRS Percent of Total AMS/DRS Growth Strategy Continues to Drive Results • Organic growth consistent with expectations • Continued conversion of existing customers to AMS/DRS Cash & Valuables Management • 19% third-quarter organic growth • Accelerating organic growth quarter-over-quarter • Full-year organic growth expected at the top end of guidance range • Completed onboarding of new large AMS customers ATM Managed Services / Digital Retail Solutions Customer OfferingsBrink’s Revenue Mix Increasing Revenue Mix Expectation to 27-28% ($ millions) 25-27% 27-28%

6 ATM Managed Service Growth Accelerating Globally ATM Outsourcing Remains in Early Stages with 2-3x Addressable Market Expansion Potential Brink’s presence Brink’s active AMS agreement

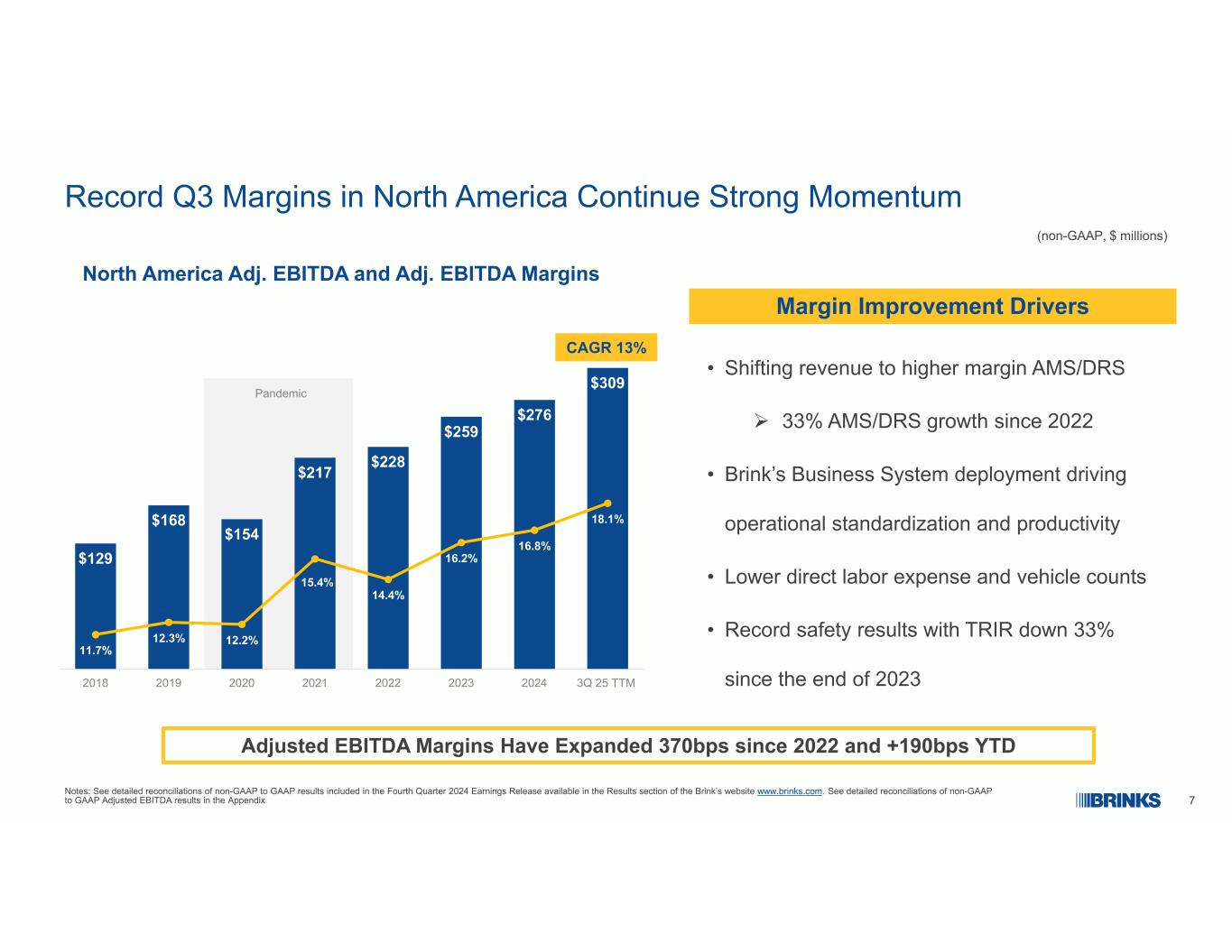

7 Pandemic $129 $168 $154 $217 $228 $259 $276 $309 11.7% 12.3% 12.2% 15.4% 14.4% 16.2% 16.8% 18.1% 2018 2019 2020 2021 2022 2023 2024 3Q 25 TTM Record Q3 Margins in North America Continue Strong Momentum North America Adj. EBITDA and Adj. EBITDA Margins Adjusted EBITDA Margins Have Expanded 370bps since 2022 and +190bps YTD CAGR 13% • Shifting revenue to higher margin AMS/DRS 33% AMS/DRS growth since 2022 • Brink’s Business System deployment driving operational standardization and productivity • Lower direct labor expense and vehicle counts • Record safety results with TRIR down 33% since the end of 2023 (non-GAAP, $ millions) Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Fourth Quarter 2024 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP Adjusted EBITDA results in the Appendix Margin Improvement Drivers

Q3 Financial Results

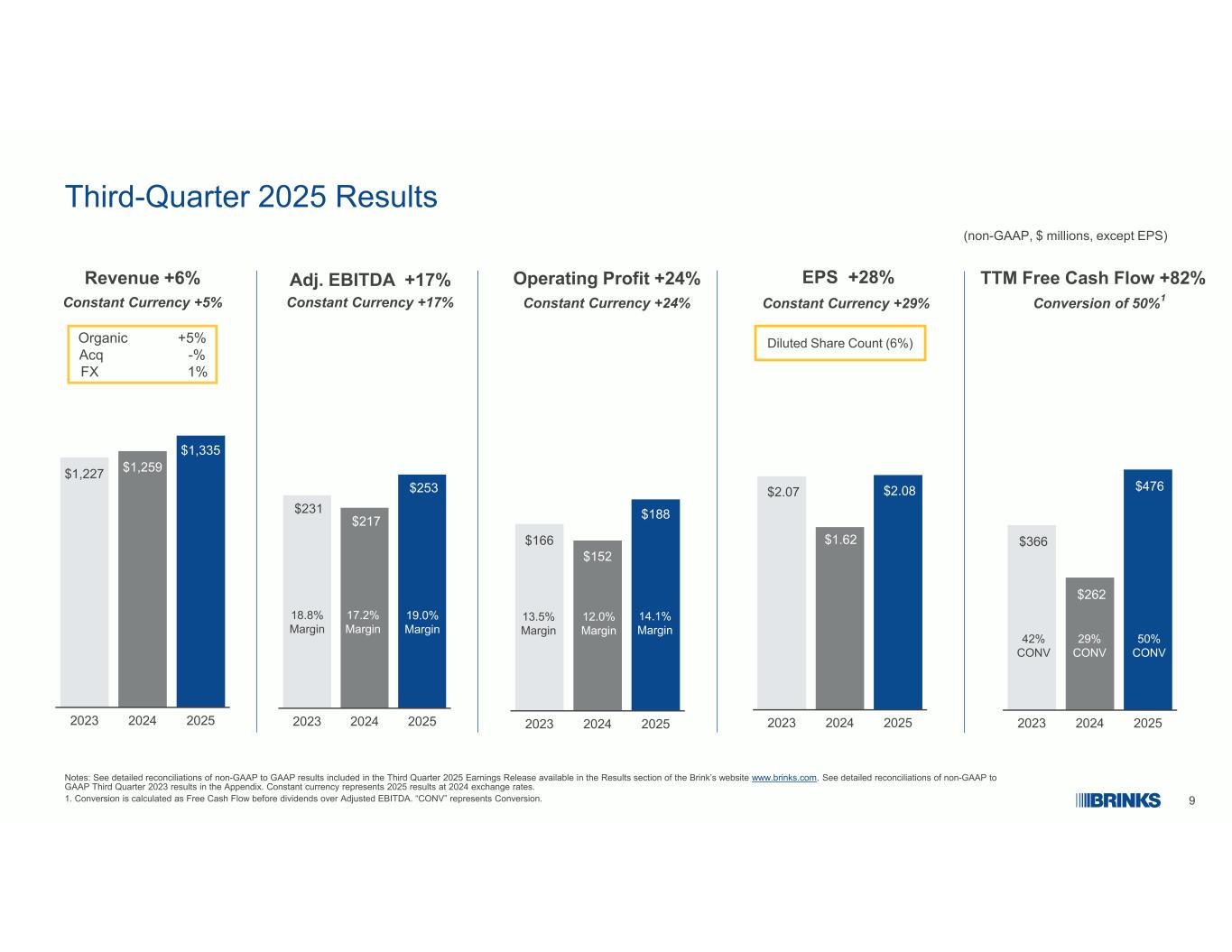

9 Third-Quarter 2025 Results (non-GAAP, $ millions, except EPS) Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP Third Quarter 2023 results in the Appendix. Constant currency represents 2025 results at 2024 exchange rates. 1. Conversion is calculated as Free Cash Flow before dividends over Adjusted EBITDA. “CONV” represents Conversion. Revenue +6% Organic +5% Acq -% FX 1% Adj. EBITDA +17% $1,227 $1,259 $1,335 2023 2024 2025 Constant Currency +5% Constant Currency +17% EPS +28% Constant Currency +29% $2.07 $1.62 $2.08 2023 2024 2025 $231 $217 $253 2023 2024 2025 19.0% Margin 17.2% Margin 18.8% Margin TTM Free Cash Flow +82% Conversion of 50%1 $366 $262 $476 2023 2024 2025 50% CONV 29% CONV 42% CONV $166 $152 $188 2023 2024 2025 Operating Profit +24% Constant Currency +24% 13.5% Margin 12.0% Margin 14.1% Margin Diluted Share Count (6%)

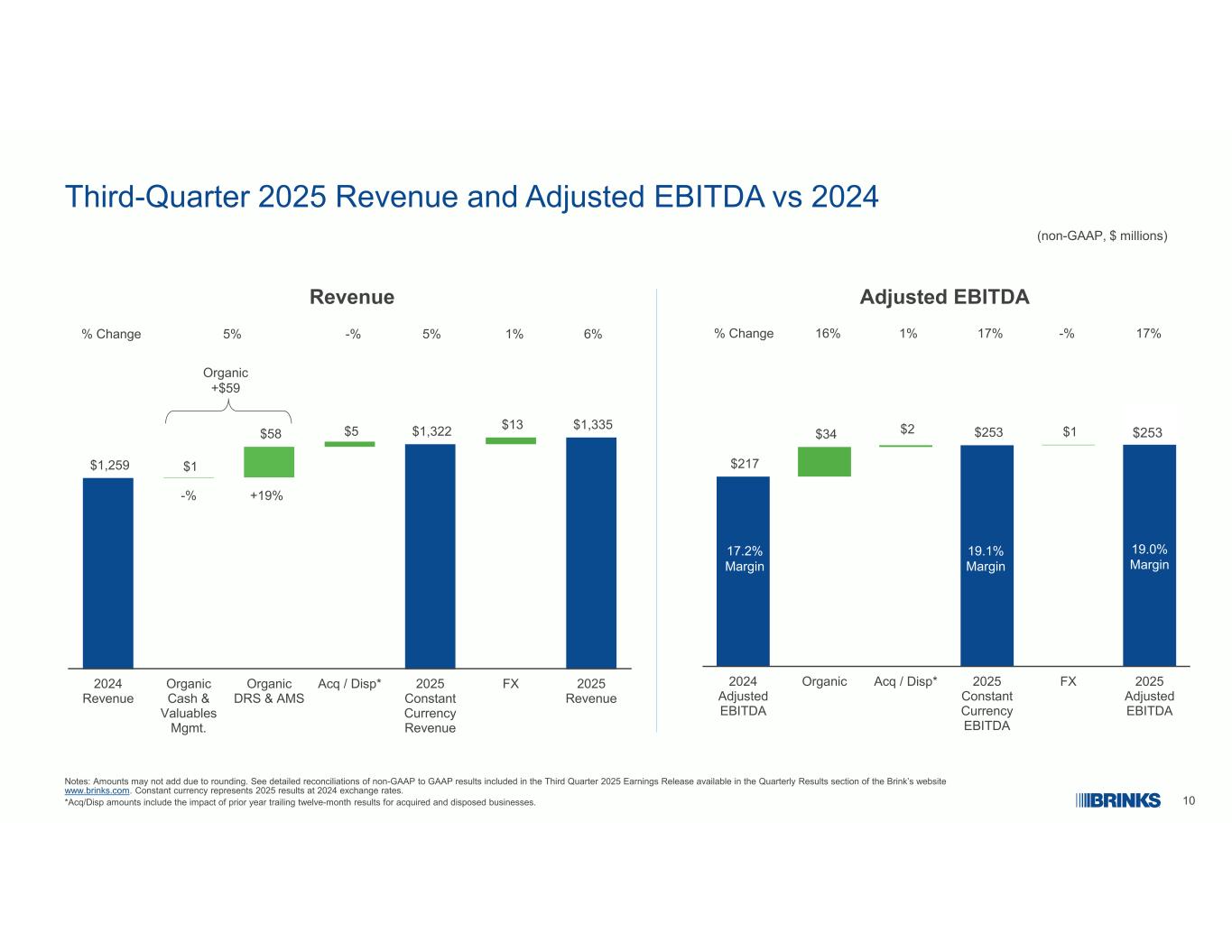

10 Third-Quarter 2025 Revenue and Adjusted EBITDA vs 2024 (non-GAAP, $ millions) Revenue $1,259 $1 $58 $5 $1,322 $13 $1,335 2024 Revenue Organic Cash & Valuables Mgmt. Organic DRS & AMS Acq / Disp* 2025 Constant Currency Revenue FX 2025 Revenue Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Constant currency represents 2025 results at 2024 exchange rates. *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses. % Change 1%5% -% 6%5% Organic +$59 -% +19% $253 $217 $34 $2 $253 $1 2024 Adjusted EBITDA Organic Acq / Disp* 2025 Constant Currency EBITDA FX 2025 Adjusted EBITDA Adjusted EBITDA 17.2% Margin 19.0% Margin % Change 16% 17% -% 17% 19.1% Margin 1%

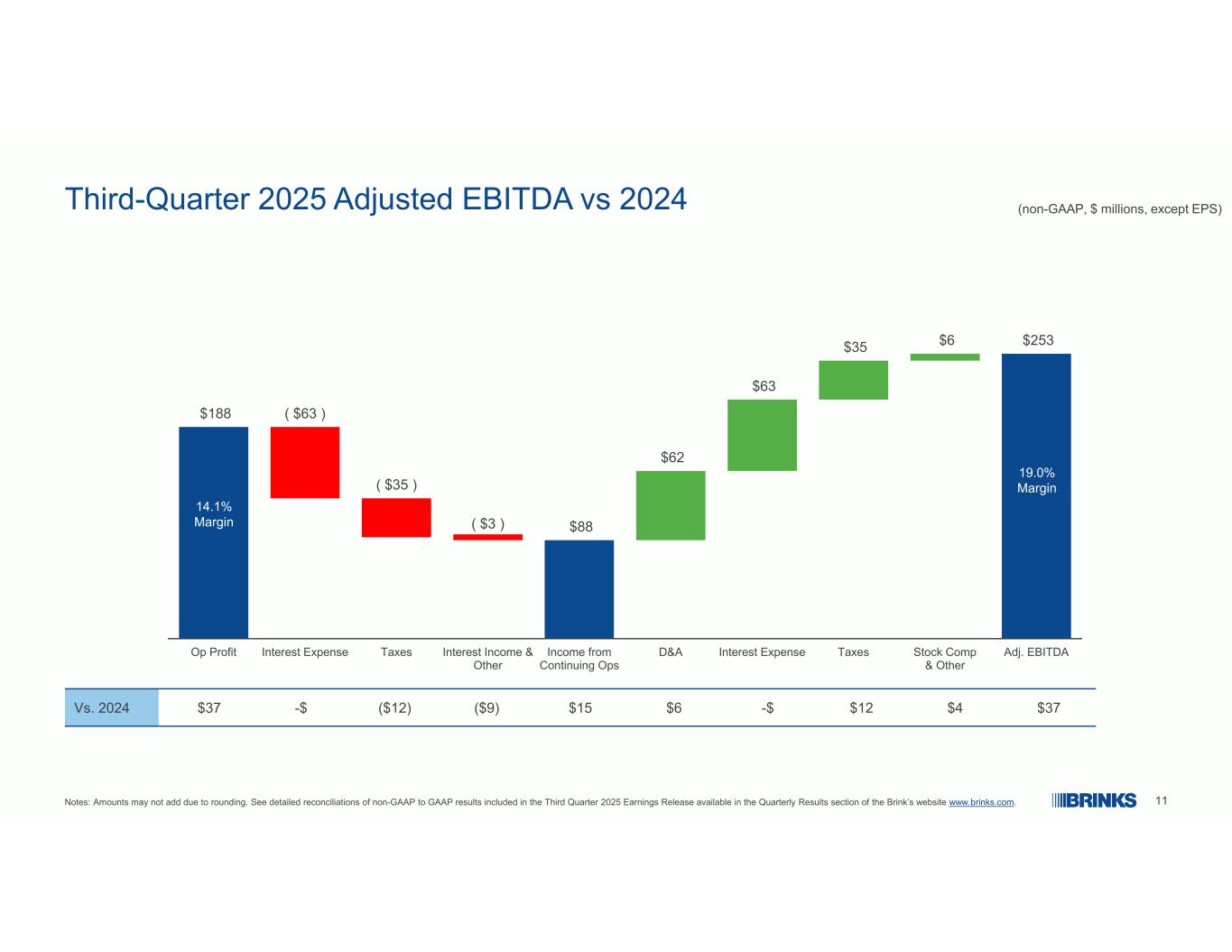

11 $188 ( $63 ) ( $35 ) ( $3 ) $88 $62 $63 $35 $6 $253 Op Profit Interest Expense Taxes Interest Income & Other Income from Continuing Ops D&A Interest Expense Taxes Stock Comp & Other Adj. EBITDA Third-Quarter 2025 Adjusted EBITDA vs 2024 (non-GAAP, $ millions, except EPS) 19.0% Margin 14.1% Margin Notes: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. $37$4$12-$$6$15($9)($12)-$$37Vs. 2024

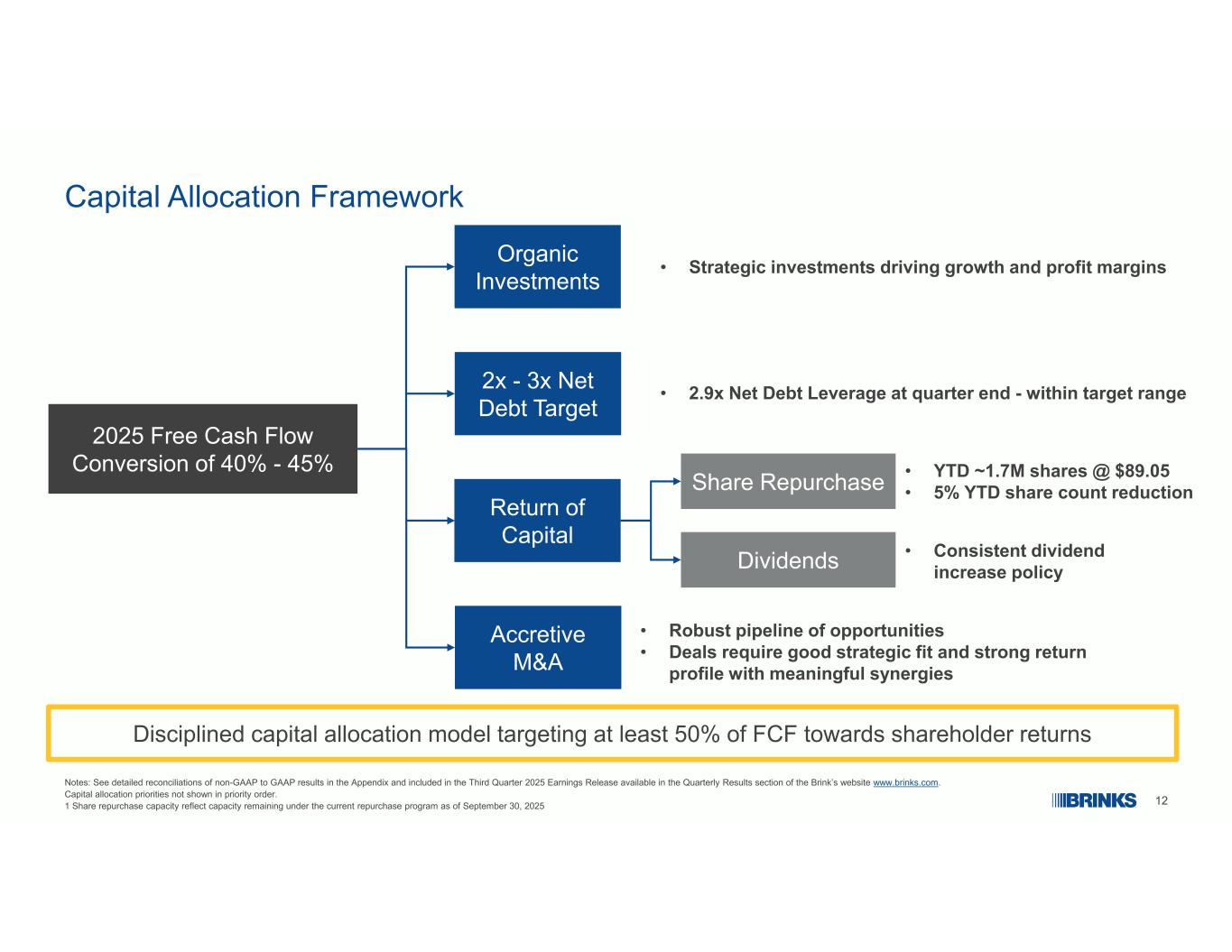

12 Capital Allocation Framework Notes: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Third Quarter 2025 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. Capital allocation priorities not shown in priority order. 1 Share repurchase capacity reflect capacity remaining under the current repurchase program as of September 30, 2025 Disciplined capital allocation model targeting at least 50% of FCF towards shareholder returns 2025 Free Cash Flow Conversion of 40% - 45% • Robust pipeline of opportunities • Deals require good strategic fit and strong return profile with meaningful synergies 2x - 3x Net Debt Target Accretive M&A Share Repurchase Return of Capital Organic Investments Dividends • YTD ~1.7M shares @ $89.05 • 5% YTD share count reduction • Consistent dividend increase policy • 2.9x Net Debt Leverage at quarter end - within target range • Strategic investments driving growth and profit margins

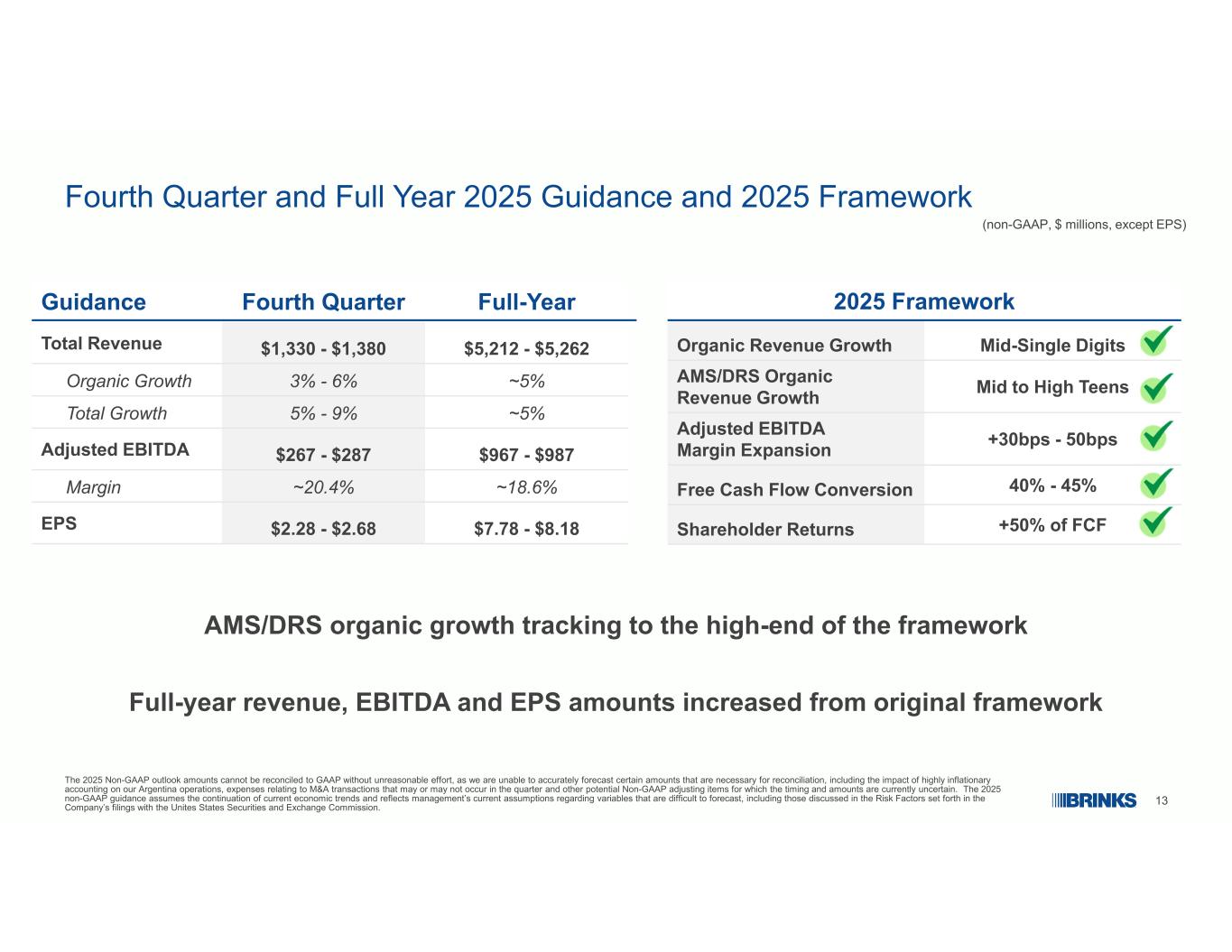

13 Fourth Quarter and Full Year 2025 Guidance and 2025 Framework (non-GAAP, $ millions, except EPS) The 2025 Non-GAAP outlook amounts cannot be reconciled to GAAP without unreasonable effort, as we are unable to accurately forecast certain amounts that are necessary for reconciliation, including the impact of highly inflationary accounting on our Argentina operations, expenses relating to M&A transactions that may or may not occur in the quarter and other potential Non-GAAP adjusting items for which the timing and amounts are currently uncertain. The 2025 non-GAAP guidance assumes the continuation of current economic trends and reflects management’s current assumptions regarding variables that are difficult to forecast, including those discussed in the Risk Factors set forth in the Company’s filings with the Unites States Securities and Exchange Commission. 2025 Framework Mid-Single DigitsOrganic Revenue Growth Mid to High TeensAMS/DRS Organic Revenue Growth +30bps - 50bpsAdjusted EBITDA Margin Expansion 40% - 45%Free Cash Flow Conversion +50% of FCFShareholder Returns Full-YearFourth Quarter Guidance $5,212 - $5,262$1,330 - $1,380Total Revenue ~5%3% - 6%Organic Growth ~5%5% - 9%Total Growth $967 - $987$267 - $287Adjusted EBITDA ~18.6%~20.4%Margin $7.78 - $8.18$2.28 - $2.68EPS AMS/DRS organic growth tracking to the high-end of the framework Full-year revenue, EBITDA and EPS amounts increased from original framework

Appendix

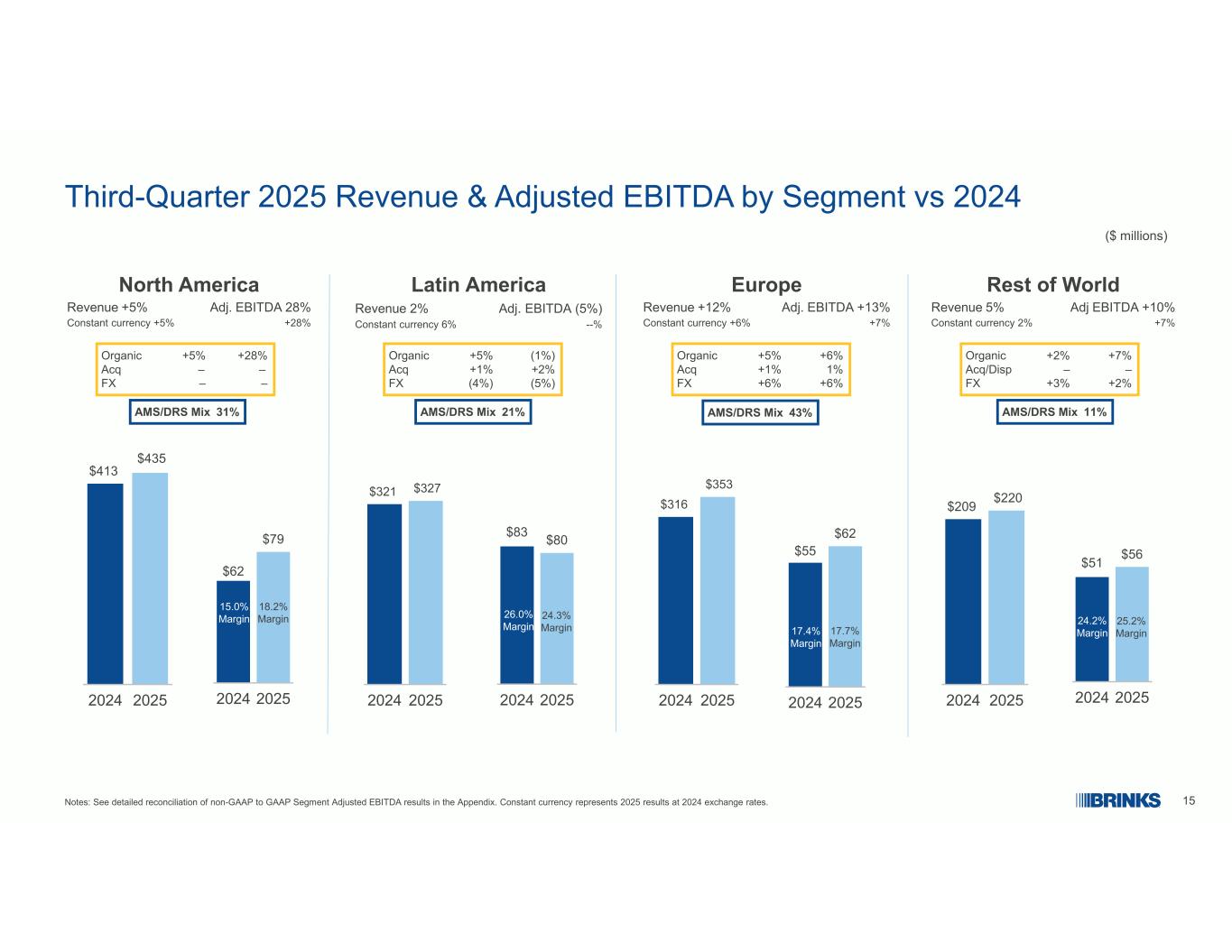

15 Third-Quarter 2025 Revenue & Adjusted EBITDA by Segment vs 2024 ($ millions) Notes: See detailed reconciliation of non-GAAP to GAAP Segment Adjusted EBITDA results in the Appendix. Constant currency represents 2025 results at 2024 exchange rates. $413 $435 2024 2025 $62 $79 2024 2025 15.0% Margin 18.2% Margin $321 $327 2024 2025 $83 $80 2024 2025 26.0% Margin 24.3% Margin $209 $220 2024 2025 $51 $56 2024 2025 24.2% Margin 25.2% Margin Latin America Adj. EBITDA (5%)Revenue 2% --%Constant currency 6% North America Adj. EBITDA 28%Revenue +5% +28%Constant currency +5% Europe Adj. EBITDA +13%Revenue +12% +7%Constant currency +6% Rest of World Adj EBITDA +10%Revenue 5% +7%Constant currency 2% Organic +5% +28% Acq – – FX – – Organic +5% (1%) Acq +1% +2% FX (4%) (5%) Organic +5% +6% Acq +1% 1% FX +6% +6% Organic +2% +7% Acq/Disp – – FX +3% +2% $316 $353 2024 2025 $55 $62 2024 2025 17.7% Margin 17.4% Margin AMS/DRS Mix 31% AMS/DRS Mix 21% AMS/DRS Mix 43% AMS/DRS Mix 11%

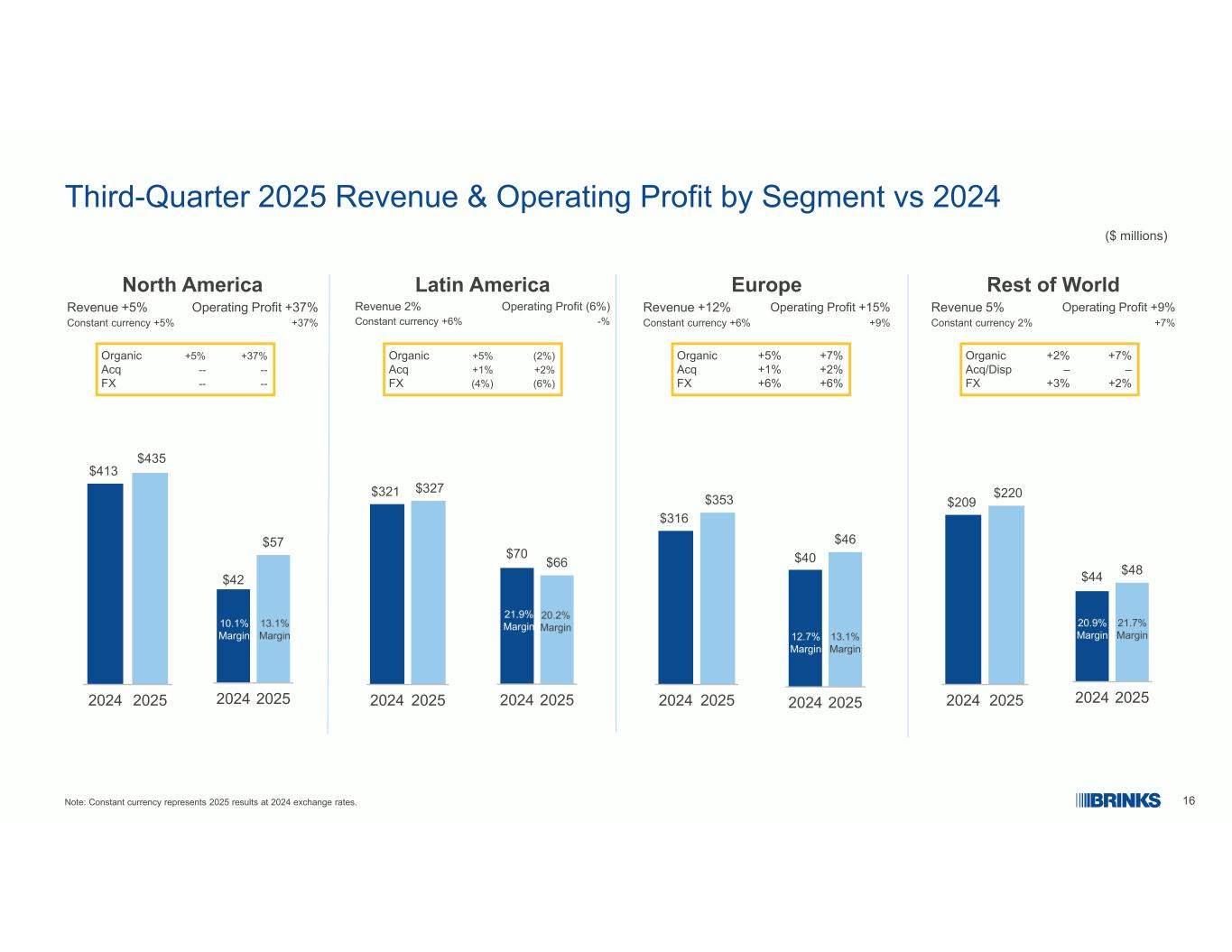

16 Third-Quarter 2025 Revenue & Operating Profit by Segment vs 2024 ($ millions) Note: Constant currency represents 2025 results at 2024 exchange rates. $413 $435 2024 2025 $42 $57 2024 2025 10.1% Margin 13.1% Margin $321 $327 2024 2025 $70 $66 2024 2025 21.9% Margin 20.2% Margin $209 $220 2024 2025 $44 $48 2024 2025 20.9% Margin 21.7% Margin Latin America Operating Profit (6%)Revenue 2% -%Constant currency +6% North America Operating Profit +37%Revenue +5% +37%Constant currency +5% Europe Operating Profit +15%Revenue +12% +9% Constant currency +6% Rest of World Operating Profit +9%Revenue 5% +7%Constant currency 2% Organic +5% +37% Acq -- -- FX -- -- Organic +5% (2%) Acq +1% +2% FX (4%) (6%) Organic +5% +7% Acq +1% +2% FX +6% +6% Organic +2% +7% Acq/Disp – – FX +3% +2% $316 $353 2024 2025 $40 $46 2024 2025 13.1% Margin 12.7% Margin

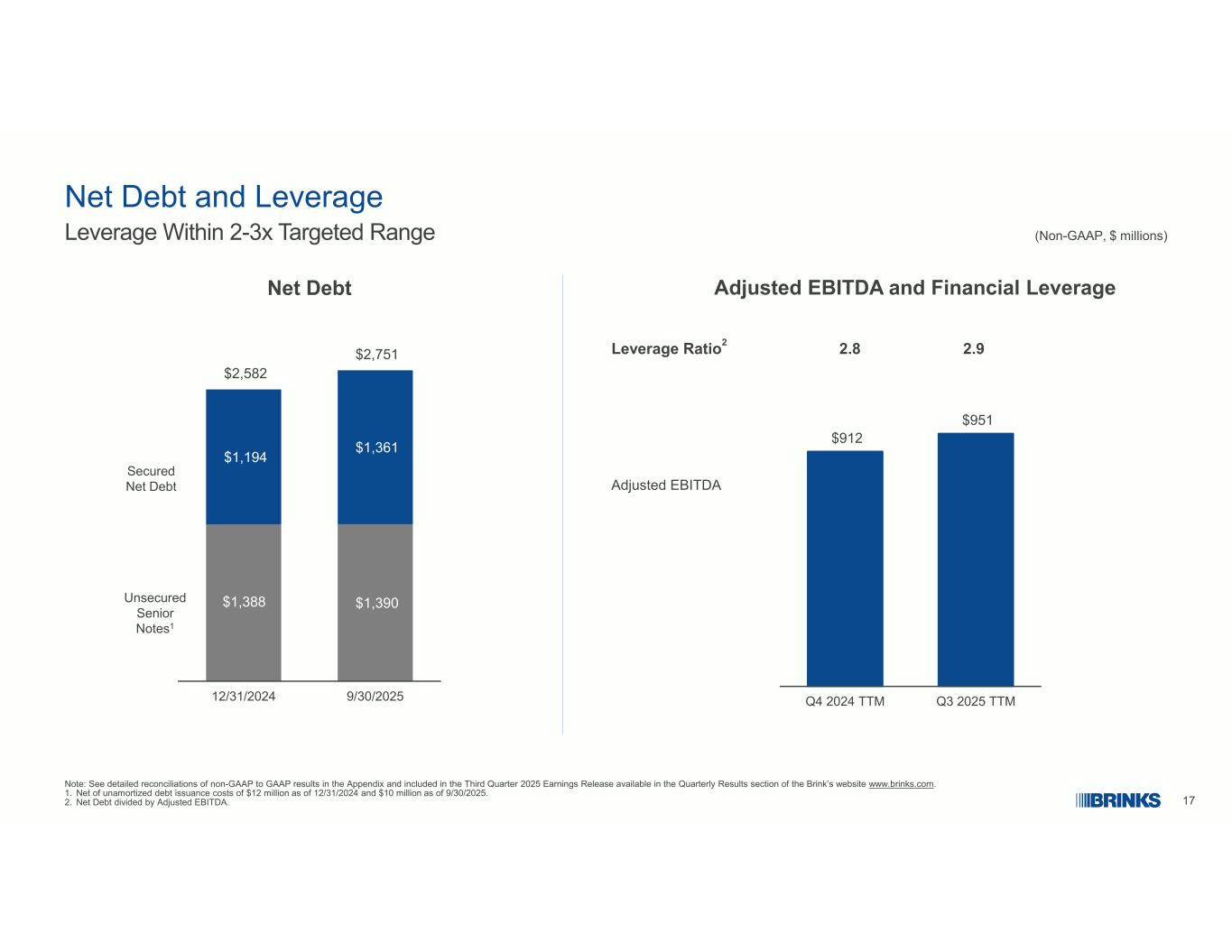

17 Net Debt and Leverage Note: See detailed reconciliations of non-GAAP to GAAP results in the Appendix and included in the Third Quarter 2025 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 1. Net of unamortized debt issuance costs of $12 million as of 12/31/2024 and $10 million as of 9/30/2025. 2. Net Debt divided by Adjusted EBITDA. (Non-GAAP, $ millions)Leverage Within 2-3x Targeted Range $912 $951 Q4 2024 TTM Q3 2025 TTM Net Debt Adjusted EBITDA and Financial Leverage Adjusted EBITDA $1,388 $1,390 $1,194 $1,361 $2,582 $2,751 12/31/2024 9/30/2025 Unsecured Senior Notes1 Secured Net Debt 2.9 2.8Leverage Ratio2

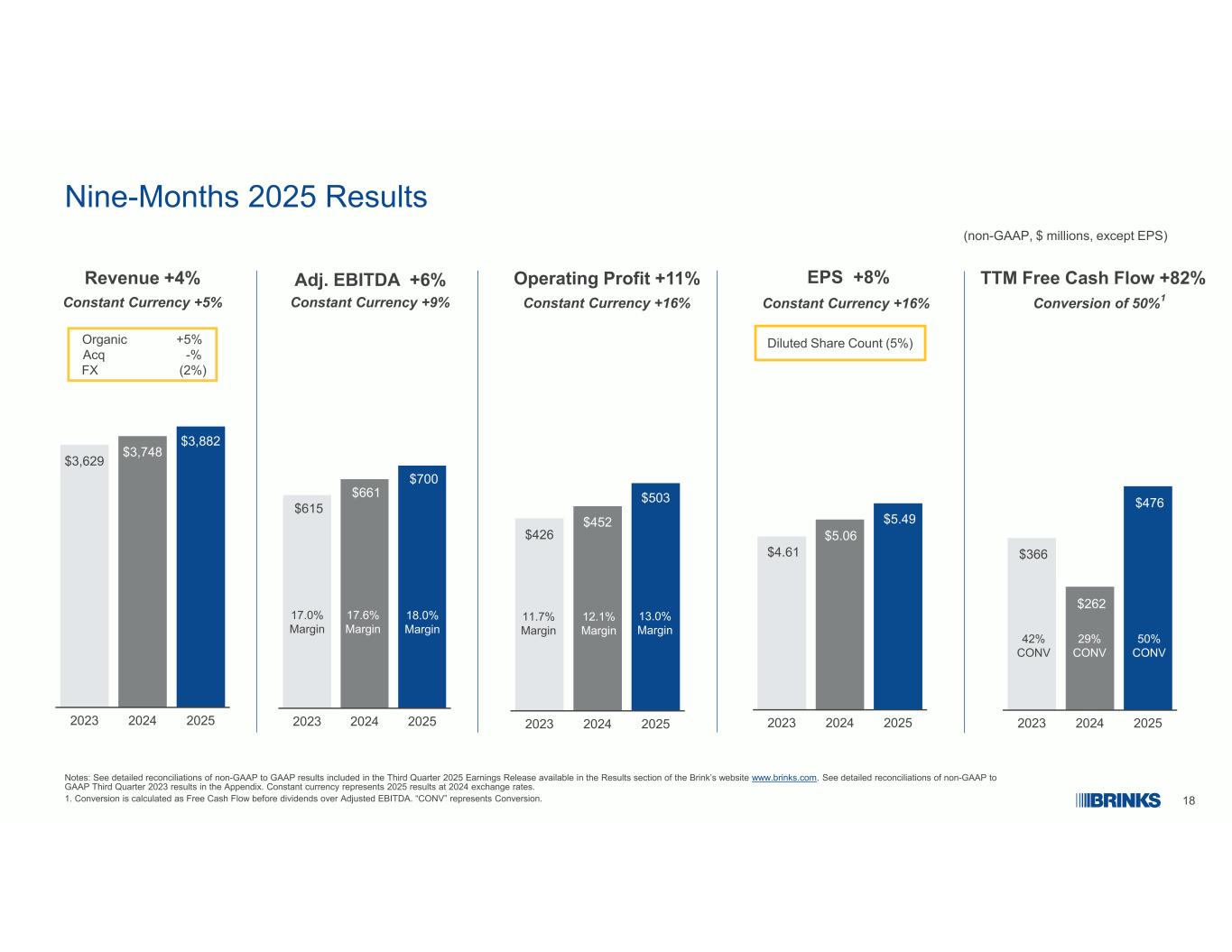

18 Nine-Months 2025 Results (non-GAAP, $ millions, except EPS) Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Third Quarter 2025 Earnings Release available in the Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP Third Quarter 2023 results in the Appendix. Constant currency represents 2025 results at 2024 exchange rates. 1. Conversion is calculated as Free Cash Flow before dividends over Adjusted EBITDA. “CONV” represents Conversion. Revenue +4% Organic +5% Acq -% FX (2%) Adj. EBITDA +6% $3,629 $3,748 $3,882 2023 2024 2025 Constant Currency +5% Constant Currency +9% EPS +8% Constant Currency +16% $4.61 $5.06 $5.49 2023 2024 2025 $615 $661 $700 2023 2024 2025 18.0% Margin 17.6% Margin 17.0% Margin $426 $452 $503 2023 2024 2025 Operating Profit +11% Constant Currency +16% 11.7% Margin 12.1% Margin 13.0% Margin Diluted Share Count (5%) TTM Free Cash Flow +82% Conversion of 50%1 $366 $262 $476 2023 2024 2025 50% CONV 29% CONV 42% CONV

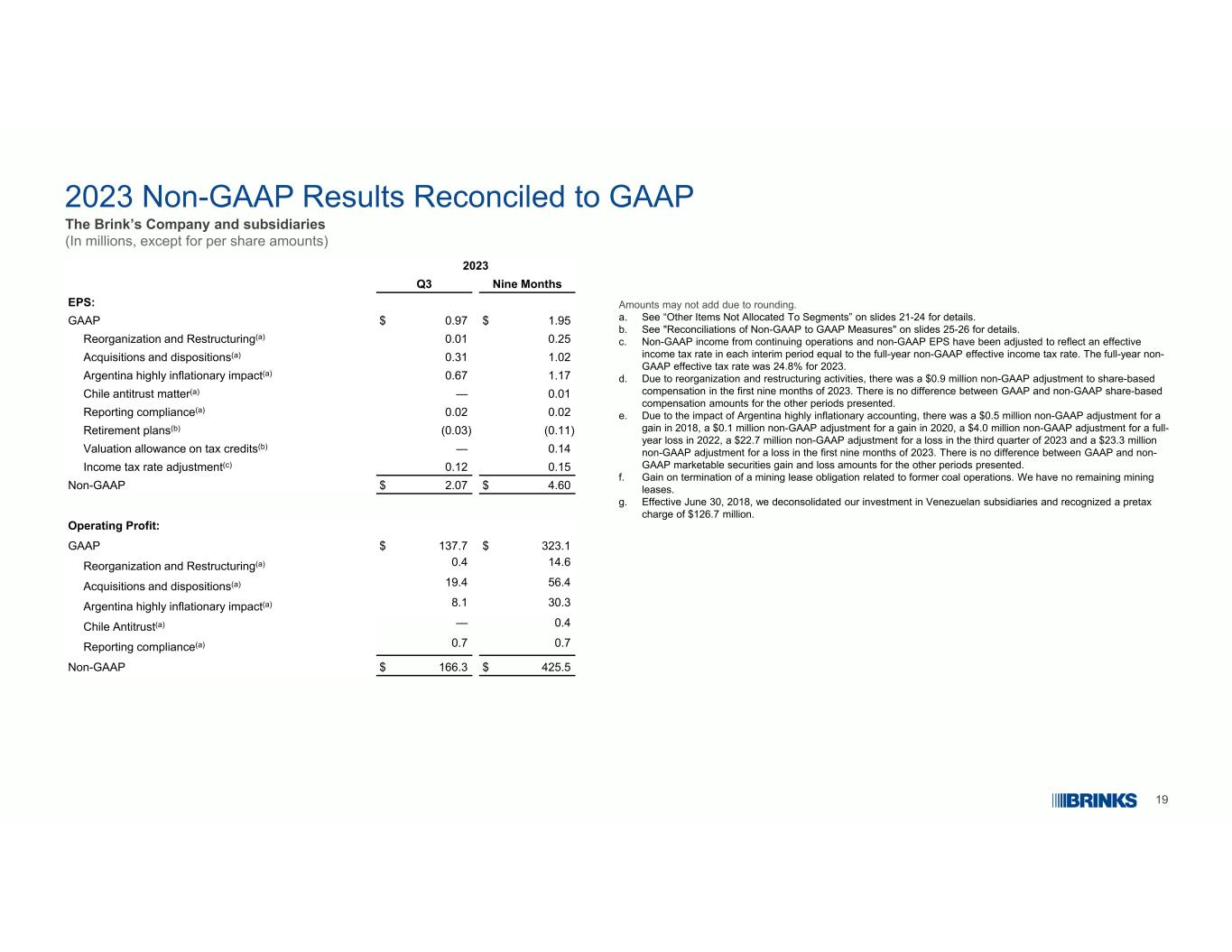

19 2023 Non-GAAP Results Reconciled to GAAP The Brink’s Company and subsidiaries (In millions, except for per share amounts) Amounts may not add due to rounding. a. See “Other Items Not Allocated To Segments” on slides 21-24 for details. b. See "Reconciliations of Non-GAAP to GAAP Measures" on slides 25-26 for details. c. Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non- GAAP effective tax rate was 24.8% for 2023. d. Due to reorganization and restructuring activities, there was a $0.9 million non-GAAP adjustment to share-based compensation in the first nine months of 2023. There is no difference between GAAP and non-GAAP share-based compensation amounts for the other periods presented. e. Due to the impact of Argentina highly inflationary accounting, there was a $0.5 million non-GAAP adjustment for a gain in 2018, a $0.1 million non-GAAP adjustment for a gain in 2020, a $4.0 million non-GAAP adjustment for a full- year loss in 2022, a $22.7 million non-GAAP adjustment for a loss in the third quarter of 2023 and a $23.3 million non-GAAP adjustment for a loss in the first nine months of 2023. There is no difference between GAAP and non- GAAP marketable securities gain and loss amounts for the other periods presented. f. Gain on termination of a mining lease obligation related to former coal operations. We have no remaining mining leases. g. Effective June 30, 2018, we deconsolidated our investment in Venezuelan subsidiaries and recognized a pretax charge of $126.7 million. 2023 Nine MonthsQ3 EPS: $ 1.95$ 0.97GAAP 0.250.01Reorganization and Restructuring(a) 1.020.31Acquisitions and dispositions(a) 1.170.67Argentina highly inflationary impact(a) 0.01—Chile antitrust matter(a) 0.020.02Reporting compliance(a) (0.11)(0.03)Retirement plans(b) 0.14—Valuation allowance on tax credits(b) 0.150.12Income tax rate adjustment(c) $ 4.60$ 2.07Non-GAAP Operating Profit: $ 323.1$ 137.7GAAP 14.60.4Reorganization and Restructuring(a) 56.419.4Acquisitions and dispositions(a) 30.38.1Argentina highly inflationary impact(a) 0.4—Chile Antitrust(a) 0.70.7Reporting compliance(a) $ 425.5$ 166.3Non-GAAP

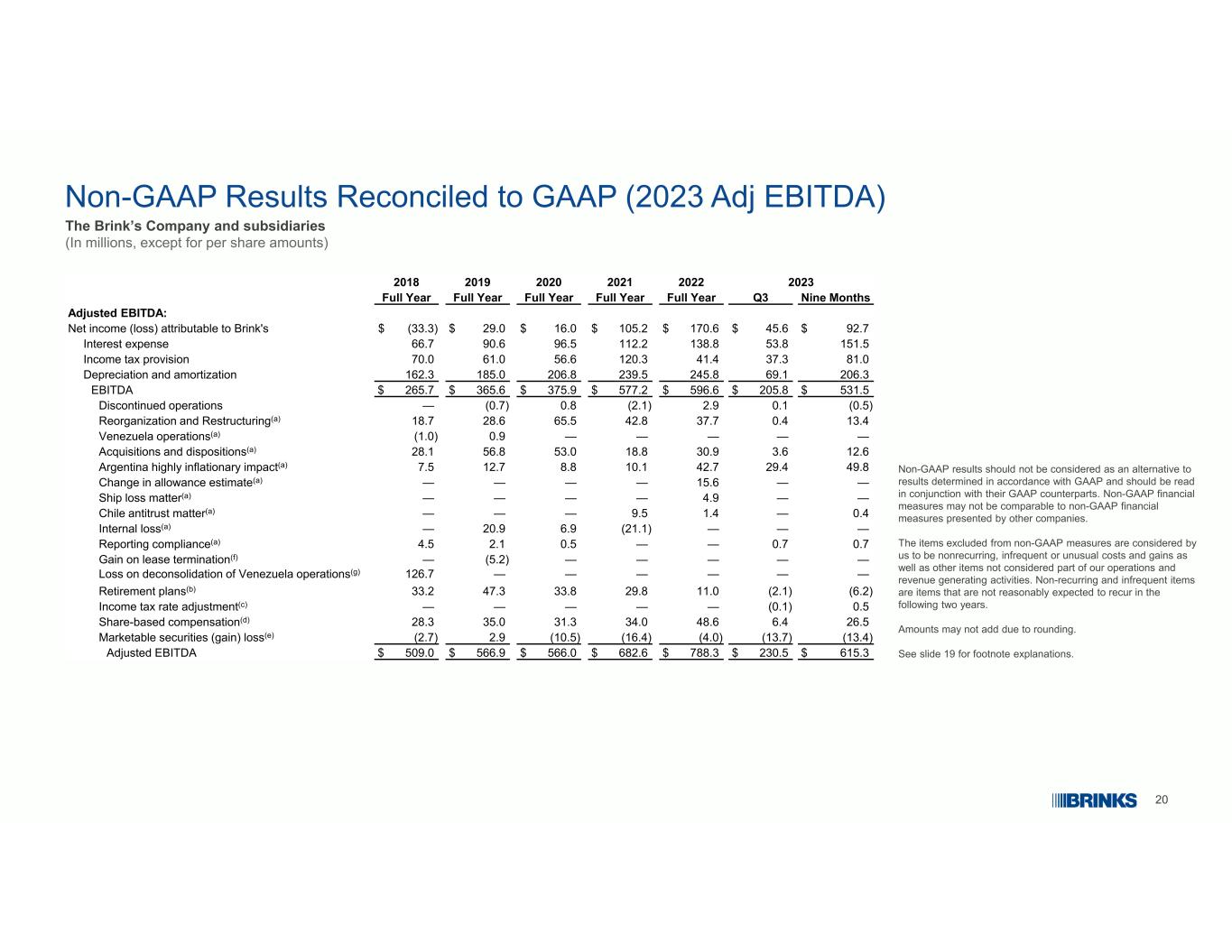

20 Non-GAAP Results Reconciled to GAAP (2023 Adj EBITDA) The Brink’s Company and subsidiaries (In millions, except for per share amounts) Non-GAAP results should not be considered as an alternative to results determined in accordance with GAAP and should be read in conjunction with their GAAP counterparts. Non-GAAP financial measures may not be comparable to non-GAAP financial measures presented by other companies. The items excluded from non-GAAP measures are considered by us to be nonrecurring, infrequent or unusual costs and gains as well as other items not considered part of our operations and revenue generating activities. Non-recurring and infrequent items are items that are not reasonably expected to recur in the following two years. Amounts may not add due to rounding. See slide 19 for footnote explanations. 202320222021202020192018 Nine MonthsQ3Full YearFull YearFull YearFull YearFull Year Adjusted EBITDA: $ 92.7$ 45.6$ 170.6$ 105.2$ 16.0$ 29.0$ (33.3)Net income (loss) attributable to Brink's 151.553.8138.8112.296.590.666.7Interest expense 81.037.341.4120.356.661.070.0Income tax provision 206.369.1245.8239.5206.8185.0162.3Depreciation and amortization $ 531.5$ 205.8$ 596.6$ 577.2$ 375.9$ 365.6$ 265.7EBITDA (0.5)0.12.9(2.1)0.8(0.7)—Discontinued operations 13.40.437.742.865.528.618.7Reorganization and Restructuring(a) —————0.9(1.0)Venezuela operations(a) 12.63.630.918.853.056.828.1Acquisitions and dispositions(a) 49.829.442.710.18.812.77.5Argentina highly inflationary impact(a) ——15.6————Change in allowance estimate(a) ——4.9————Ship loss matter(a) 0.4—1.49.5———Chile antitrust matter(a) ———(21.1)6.920.9—Internal loss(a) 0.70.7——0.52.14.5Reporting compliance(a) —————(5.2)—Gain on lease termination(f) ——————126.7Loss on deconsolidation of Venezuela operations(g) (6.2)(2.1)11.029.833.847.333.2Retirement plans(b) 0.5(0.1)—————Income tax rate adjustment(c) 26.56.448.634.031.335.028.3Share-based compensation(d) (13.4)(13.7)(4.0)(16.4)(10.5)2.9(2.7)Marketable securities (gain) loss(e) $ 615.3$ 230.5$ 788.3$ 682.6$ 566.0$ 566.9$ 509.0Adjusted EBITDA

21 Other Items Not Allocated to Segments (Unaudited) The Brink’s Company and subsidiaries (In millions) Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. See below for a summary of the other items not allocated to segments. Reorganization and Restructuring Costs associated with certain reorganization and restructuring actions are excluded from reported non-GAAP results. These items include primarily severance charges and asset impairment losses. The 2022 Global Restructuring Plan was designed to, among other things, enable growth, reduce costs and related infrastructure, and to mitigate the potential impact of external economic conditions in light of the COVID-19 pandemic. Other restructuring actions were primarily in response to the COVID-19 pandemic and a decision to exit a line of business in our Canada operating unit. Due to the unusual nature of the underlying events that led to these actions, the charges are not considered part of the Company's operations and revenue generating activities. Management has excluded these amounts when evaluating internal performance. As such, they have not been allocated to segment or Corporate results and are excluded from non-GAAP results. 2022 Global Restructuring Plan In the first quarter of 2023, management completed the review and approval of the previously announced restructuring plan across our global business operations. The actions were taken to enable growth, reduce costs and related infrastructure, and to mitigate the potential impact of external economic conditions. In total, we have recognized $34.2 million in charges under this program, including $22.2 million in 2022 and $10.0 million in the first nine months of 2023. The actions under this program were substantially completed in 2024. Severance actions from this restructuring plan reduced our global workforce by approximately 3,200 positions. 2016 Restructuring In the fourth quarter of 2016, management implemented restructuring actions across our global business operations and our corporate functions. As a result of these actions, we recognized charges of $13.0 million in 2018. The actions under this program were substantially completed in 2018, with cumulative pretax charges of approximately $48 million. Other Restructurings Management periodically implements restructuring actions in targeted sections of our business. As a result of these actions, we recognized charges of $7.6 million in 2018, primarily severance costs. We recognized charges of $28.8 million in 2019, primarily severance costs and charges related to the modification of share-based compensation awards. We recognized $66.6 million net costs in operating profit and $0.6 million costs in interest and other nonoperating income (expense) in 2020, primarily severance costs. As a result of these actions, we recognized $43.6 million net costs in 2021, primarily severance costs. We recognized $16.6 million in net costs in 2022, primarily severance costs. The majority of the costs from 2022 restructuring plans result from the exit of a line of business in a specific geography with most of the remaining costs due to management initiatives to address the COVID-19 pandemic. We recognized $4.6 million net costs in the first nine months of 2023, primarily severance costs. The majority of the costs in 2023 result from the exit of a line of business in a specific geography with most of the remaining costs due to management initiatives to address the COVID-19 pandemic. The actions were substantially completed in 2024. Acquisitions and dispositions Certain acquisition and disposition items are not part of the Company's operations and revenue generating activities. These items include non-cash amortization expense for acquisition-related intangible assets, as well as integration, transaction, restructuring and certain compensation costs. All of the items are significantly impacted by the timing and nature of our acquisitions and dispositions, and many are inconsistent in amount and frequency. Management has excluded these amounts when evaluating internal performance. Therefore, we have not allocated these amounts to segment or Corporate results and have excluded these amounts from non-GAAP results. These items are described below:

22 Other Items Not Allocated to Segments (Unaudited) The Brink’s Company and subsidiaries (In millions) 2023 Acquisitions and Dispositions • Amortization expense for acquisition-related intangible assets was $43.2 million in the first nine months of 2023. • We derecognized a contingent consideration liability related to the NoteMachine business acquisition and recognized a gain of $4.8 million. • We recognized $4.7 million in charges in Argentina in the first nine months of 2023 for an inflation-adjusted labor increase to expected payments to union workers of the Maco Transportadora and Maco Litoral businesses (together, "Maco"). • Net charges of $3.4 million were incurred for post-acquisition adjustments to indemnification assets related to previous business acquisitions. • We incurred $2.0 million in integration costs, primarily related to PAI, in the first nine months of 2023. • Transaction costs related to business acquisitions were $3.6 million in the first nine months of 2023. • We recognized a $2.0 million loss on the disposition of Russia-based operations in the first nine months of 2023. • Compensation expense related to the retention of key PAI employees was $1.3 million in the first nine months of 2023. 2022 Acquisitions and Dispositions • Amortization expense for acquisition-related intangible assets was $52.0 million in 2022. • We recognized $12.5 million in charges in Argentina in 2022 for expected payments to union workers of the Maco Transportadora and Maco Litoral businesses (together "Maco"). Although the Maco operations were acquired in 2017, formal antitrust approval was obtained in 2021, which triggered negotiation and approval of the expected payments in 2022. • Net charges of $7.8 million were incurred for post-acquisition adjustments to indemnification assets related to previous business acquisitions. • We incurred $4.8 million in integration costs, primarily related to PAI and G4S, in 2022. • Transaction costs related to business acquisitions were $5.6 million in 2022. • Restructuring costs related to acquisitions were $0.2 million in 2022. • Compensation expense related to the retention of key PAI employees was $3.5 million in 2022. 2021 Acquisitions and Dispositions • Amortization expense for acquisition-related intangible assets was $47.7 million in 2021. • We incurred $10.5 million in integration costs, primarily related to G4S, in 2021. • Transaction costs related to business acquisitions were $6.5 million in 2021. • Restructuring costs related to acquisitions were $5.3 million in 2021. • Compensation expense related to the retention of key PAI employees was $1.8 million in 2021.

23 Other Items Not Allocated to Segments (Unaudited) The Brink’s Company and subsidiaries (In millions) 2020 Acquisitions and Dispositions • Amortization expense for acquisition-related intangible assets was $35.1 million in 2020. • We incurred $23.5 million in integration costs related to Dunbar and G4S in 2020. • Transaction costs related to business acquisitions were $19.3 million in 2020. • Restructuring costs related to acquisitions were $4.7 million in 2020. 2019 Acquisitions and Dispositions • We incurred $43.1 million in integration costs related to Dunbar, Rodoban, COMEF and TVS in 2019. • Amortization expense for acquisition-related intangible assets was $27.8 million in 2019. • Restructuring costs related to acquisitions, primarily Rodoban and Dunbar, were $5.6 million in 2019. • Transaction costs related to business acquisitions were $7.9 million in 2019. • Compensation expense related to the retention of key Dunbar employees was $1.5 million in 2019. • In 2019, we recognized $2.2 million in net charges, primarily asset impairment and severance costs, related to the exit from our top-up prepaid mobile phone business in Brazil. 2018 Acquisitions and Dispositions • Amortization expense for acquisition-related intangible assets was $17.7 million in 2018. • Integration costs in 2018 related to acquisitions in France and the U.S. were $8.1 million. • 2018 transaction costs related to business acquisitions were $6.7 million. • We incurred 2018 severance charges related to our acquisitions in Argentina, France, U.S. and Brazil of $5.0 million. • Compensation expense related to the retention of key Dunbar employees was $4.1 million in 2018. • We recognized a net gain in 2018 ($2.6 million, net of statutory employee benefit) on the sale of real estate in Mexico.

24 Other Items Not Allocated to Segments (Unaudited) The Brink’s Company and subsidiaries (In millions) Argentina highly inflationary impact Beginning in the third quarter of 2018, we designated Argentina's economy as highly inflationary for accounting purposes. As a result, Argentine peso-denominated monetary assets and liabilities are now remeasured at each balance sheet date to the currency exchange rate then in effect, with currency remeasurement gains and losses recognized in earnings. In addition, nonmonetary assets retain a higher historical basis when the currency is devalued. The higher historical basis results in incremental expense being recognized when the nonmonetary assets are consumed. In the second half of 2018, we recognized $8.0 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $6.2 million. In 2019, we recognized $14.5 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $11.3 million. In 2020, we recognized $10.7 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $7.7 million. In 2021, we recognized $11.9 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $9.0 million. In 2022, we recognized $41.7 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $37.6 million. In the first nine months of 2023, we recognized $30.3 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $18.2 million. Highly inflationary adjustments also impact gains and losses on marketable securities due to the change in exchange rates. These non-cash charges are not part of the Company's operations and revenue generating activities. Management has excluded these amounts when evaluating internal performance. As such, they have not been allocated to segment or Corporate results and are excluded from non-GAAP results. Chile antitrust matter We recognized an estimated loss of $9.5 million in the third quarter of 2021 and recognized additional amounts in subsequent years (which were primarily related to changes in currency rates). Overall, these charges related to a potential fine associated with an investigation by the Chilean Fiscalía Nacional Económica or "FNE" (the Chilean antitrust agency). The investigation is related to potential anti- competitive practices among competitors in the cash logistics industry in Chile. These costs are not considered part of the Company's operations and revenue generating activities. Additionally, the nature of these amounts, including the estimated loss and associated third-party costs, is such that they are not reasonably likely to recur within two years, nor were there similar charges within the prior two years of the underlying event. Management has excluded these amounts when evaluating internal performance. Therefore, these amounts have not been allocated to segment or Corporate results and are excluded from non-GAAP results. Ship loss matter In 2015, Brink’s placed cargo containing customer valuables on a ship which suffered extensive damages and losses of cargo. Our cargo did not suffer any damage. However, the ship owner declared a "general average claim," an ancient maritime law principle, to recover losses from customers with undamaged cargo based on the pro rata value of ship cargo. In the fourth quarter of 2022, we recognized a $4.9 million charge for our estimate of the probable loss. Due to the unusual nature of the events that led to the charge, a similar charge is not reasonably likely to recur within two years, nor were similar costs incurred within the prior two years. Management has excluded this amount when evaluating internal performance. Therefore, it has not been allocated to segment or Corporate results and is excluded from non-GAAP results. Internal loss We recorded charges and gains associated with the impact of actions by a former non-management employee in our U.S. global services operations. The former employee embezzled funds from Brink's and, in an effort to cover up the embezzlement, intentionally misstated the underlying accounts receivable subledger data. We incurred costs to reconstruct the accounts receivable subledger, to reserve for uncollectible receivables and for legal expenses to recover insurance claims. Subsequently, we recognized gains as we collected previously reserved receivables and the insurance claims. Prior to 2021, we recorded charges to reconstruct the ledger and to reserve for uncollectible receivables. In 2021, we recognized a decrease in bad debt expense of $3.7 million and $1.3 million of legal charges. In the fourth quarter of 2021, we successfully collected $18.8 million of insurance recoveries. Both the expenses and the gains related to this matter are not part of the Company's operations and revenue generating activities. Additionally, the nature of these amounts is such that they are not reasonably likely to recur within two years, nor were there similar charges or gains within the prior two years of the underlying event. Management has excluded these amounts when evaluating internal performance. Therefore, these amounts have not been allocated to segment or Corporate results and are excluded from non-GAAP results. Reporting compliance We incurred certain compliance costs in 2023 to remediate a material weakness in internal controls over financial reporting. These third-party costs are not part of the Company's operations and revenue generating activities. Additionally, the nature of these amounts is such that they are not reasonably likely to recur within two years, nor were similar costs incurred within the prior two years of the underlying event. Management has excluded these amounts when evaluating internal performance. Therefore, they have not been allocated to segment or Corporate results and are excluded from non-GAAP results.

25 Non-GAAP Measures and Reconciliations to GAAP Measures Non-GAAP measures described below and included in this filing are financial measures that are not required by or presented in accordance with GAAP. The purpose of the disclosure of these non-GAAP measures is to report financial information from the primary operations of our business by excluding the effects of certain income and expenses that do not reflect the ordinary earnings of our operations. These non-GAAP financial measures are intended to provide investors with a supplemental comparison of our operating results and trends for the periods presented. Our management believes these measures are also useful to investors as such measures allow investors to evaluate our performance using the same metrics that our management uses to evaluate past performance and prospects for future performance. The reconciliations in the tables below include adjustments that we do not consider reflective of our operating performance as they result from events and circumstances that are not a part of our core business. Additionally, certain non-GAAP results, including non-GAAP operating profit, are utilized as performance measures in certain management incentive compensation plans. Non-GAAP results should not be considered as an alternative to results determined in accordance with GAAP and should be read in conjunction with their GAAP counterparts. Non-GAAP financial measures may not be comparable to non-GAAP financial measures presented by other companies. The items excluded from non-GAAP measures are considered by us to be nonrecurring, infrequent or unusual costs and gains as well as other items not considered part of our operations and revenue generating activities. Non-recurring and infrequent items are items that are not reasonably expected to recur in the following two years. In addition to the rationale described above, we believe the following non-GAAP metrics are helpful to investors in assessing results of operations consistent with how our management evaluates performance: Non-GAAP operating profit and Non-GAAP operating profit margin: Non-GAAP operating profit equals GAAP operating profit excluding Other Items not Allocated to Segments. Non-GAAP operating margin equals non-GAAP operating profit divided by revenues. • Non-GAAP income from continuing operations attributable to Brink's: This measure equals GAAP income from continuing operations attributable to Brink's excluding Other Items not Allocated to Segments as well as certain retirement plan expenses/gains and unusual adjustments to deferred tax asset valuation allowances. • Earnings Before Interest Expense, Income Taxes, Depreciation and Amortization ("EBITDA") and Adjusted EBITDA: EBITDA is calculated by starting with net income attributable to Brink's and adding back the amounts for interest expense, income taxes, depreciation and amortization. Adjusted EBITDA equals EBITDA excluding the applicable impacts of Other Items not Allocated to Segments as well as certain retirement plan expenses/gains, unusual adjustments to deferred tax asset valuation allowances, income tax rate adjustment, share-based compensation and marketable securities (gain) loss. • Non-GAAP diluted earnings per share ("EPS") from continuing operations attributable to Brink's common shareholders: This measure equals non-GAAP income from continuing operations attributable to Brink's divided by diluted shares. • Impact of Acquisitions/ Dispositions: This measure represents the impact of acquisitions or dispositions without a full year of reported results in either comparable period. • Currency Effect: This measure consists of the effects of Argentina devaluations under highly inflationary accounting and the sum of monthly currency changes. Monthly currency changes represent the accumulation throughout the year of the impact on current period results of changes in foreign currency rates from the prior year period. • Non-GAAP pre-tax income, Non-GAAP income tax and Non-GAAP effective income tax rate: Non-GAAP pre-tax income and non-GAAP income tax equal their GAAP counterparts excluding the applicable impacts of Other Items not Allocated to Segments as well as certain retirement plan expenses/gains and unusual adjustments to deferred tax asset valuation allowances. Non-GAAP effective income tax rate equals non-GAAP income tax divided by non-GAAP pre-tax income. •

26 Non-GAAP Measures and Reconciliations to GAAP Measures In addition to the rationale described above, we believe the following non-GAAP metrics are helpful in assessing cash flow and financial leverage consistent with how our management evaluates performance: Free Cash Flow before Dividends: This non-GAAP measure reflects Management’s calculation of cash flows that are available for capital or investing activities such as paying dividends, share repurchases, debt, acquisitions and other investments. The measure is calculated as net cash flows from operating activities, adjusted to exclude certain operating activities related to cash that is not available for corporate purposes, including the impact of cash flows from restricted cash held for customers, as well as cash received and processed in certain of our secure cash management services operations. The resulting amount is further adjusted to include the impact of cash flows related to equipment used to operate our business, including capital expenditures, cash proceeds from sale of property and equipment, as well as proceeds from lessor debt financing. The latter item, which is part of cash flows from financing activities and relates to the subsequent financings of certain capital expenditures, was added to our calculation in the second quarter of 2024 as we believe such cash flows are similar in nature to transactions reported in Investing Activities, which have historically been included in our calculation. Prior amounts were recast to reflect this change. • Net Debt: Net Debt equals total debt less cash and cash equivalents available for general corporate purposes. We exclude from cash and cash equivalents amounts held by our cash management services operations, as such amounts are not considered available for general corporate purposes. • Reconciliations of Non-GAAP to GAAP Measures Non-GAAP measures are reconciled to comparable GAAP measures in the tables below. Amounts reported for prior periods have been updated in this report to present information consistently for all periods presented. Most of the reconciling adjustments are described in Other Items Not Allocated to Segments on Slides 25-26. Additional reconciling items include the following: Retirement plans We incur costs, such as interest expense and amortization of actuarial gains and losses, associated with certain retirement plans that have been frozen to new entrants. Furthermore, we also incur non-cash settlement charges and curtailment gains related to all of our retirement plans. These costs and gains are not considered to be part of the Company's operations and revenue generating activities. Management has excluded these amounts when evaluating internal performance. Therefore, they are excluded from non-GAAP results. Valuation allowance on tax credits As a result of new foreign tax credit regulations, we released a valuation allowance on deferred tax assets and recorded a significant income tax credit in 2022. We then re- established some of the valuation allowance in 2023 primarily related to adjustments to the previous foreign tax credit changes, resulting in a significant incremental income tax expense. In 2024, we released an incremental valuation allowance on deferred tax assets that was otherwise expected to expire and recorded a tax credit. The gains and charges related to major tax law changes that impacted U.S. foreign tax credits. These gains and charges are not considered to be part of the Company's operations and revenue generating activities. Management has excluded these amounts when evaluating internal performance. Therefore, they are excluded from non-GAAP results. Change in restricted cash held for customers Restricted cash held for customers is not available for general corporate purposes such as payroll, vendor invoice payments, debt repayment, or capital expenditures. Because the cash is not available to support the Company's operations and revenue generating activities, management excludes the changes in the restricted cash held for customers balance when assessing cash flows from operations. We believe that the exclusion of the change in restricted cash held for customers from non-GAAP operating cash flows is helpful to users of the financial statements as it presents this financial measure consistent with how management assesses this liquidity measure. Change in certain customer obligations The title to cash received and processed in certain of our secure cash management services operations transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and is thus not available for general corporate purposes. Because the cash is not available to support our operations and revenue generating activities, management excludes the changes in this specific cash balance when assessing cash flows from operations. We believe that the exclusion of the change in this cash balance from our non-GAAP operating cash flows measure is helpful to the users of our financial statements as it presents this financial measure consistent with how our management assesses this liquidity measure. Amounts held by cash management services operations As described above, cash held in certain of our secure cash management services operations is not available to support our operations and revenue generating activities. Therefore, management excludes this specific cash balance when assessing our liquidity and capital resources, and in our computation of Net Debt. We believe that the exclusion of this cash balance from our non-GAAP Net Debt measure is helpful to the users of our financial statements as it presents this financial measure consistent with how our management assesses this liquidity measure.

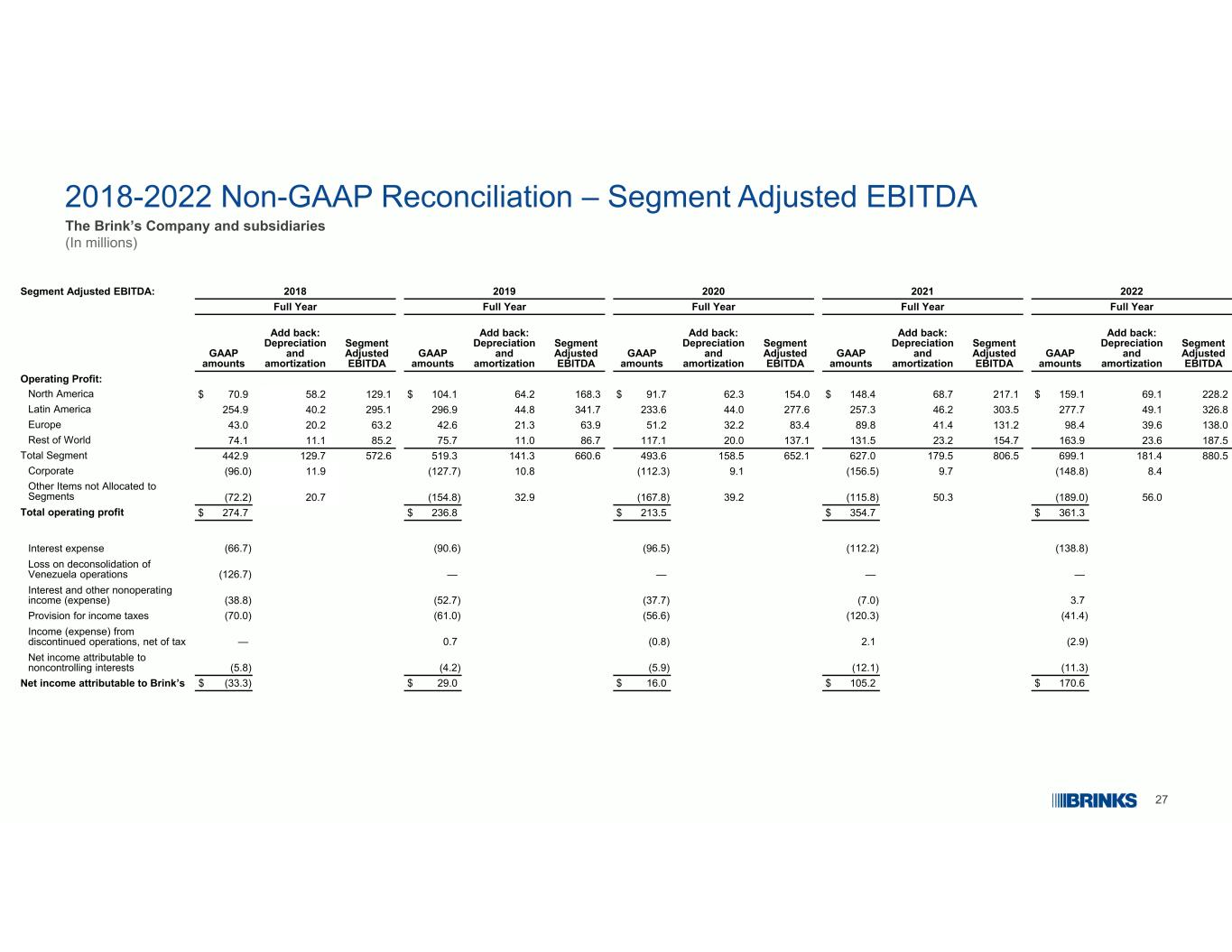

27 2018-2022 Non-GAAP Reconciliation – Segment Adjusted EBITDA The Brink’s Company and subsidiaries (In millions) 20222021202020192018Segment Adjusted EBITDA: Full YearFull YearFull YearFull YearFull Year Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Operating Profit: 228.269.1$ 159.1217.168.7$ 148.4154.062.3$ 91.7168.364.2$ 104.1129.158.2$ 70.9North America 326.849.1277.7303.546.2257.3277.644.0233.6341.744.8296.9295.140.2254.9Latin America 138.039.698.4131.241.489.883.432.251.263.921.342.663.220.243.0Europe 187.523.6163.9154.723.2131.5137.120.0117.186.711.075.785.211.174.1Rest of World 880.5181.4699.1806.5179.5627.0652.1158.5493.6660.6141.3519.3572.6129.7442.9Total Segment 8.4(148.8)9.7(156.5)9.1(112.3)10.8(127.7)11.9(96.0)Corporate 56.0(189.0)50.3(115.8)39.2(167.8)32.9(154.8)20.7(72.2) Other Items not Allocated to Segments $ 361.3$ 354.7$ 213.5$ 236.8$ 274.7Total operating profit (138.8)(112.2)(96.5)(90.6)(66.7)Interest expense ————(126.7) Loss on deconsolidation of Venezuela operations 3.7(7.0)(37.7)(52.7)(38.8) Interest and other nonoperating income (expense) (41.4)(120.3)(56.6)(61.0)(70.0)Provision for income taxes (2.9)2.1(0.8)0.7— Income (expense) from discontinued operations, net of tax (11.3)(12.1)(5.9)(4.2)(5.8) Net income attributable to noncontrolling interests $ 170.6$ 105.2$ 16.0$ 29.0$ (33.3)Net income attributable to Brink’s

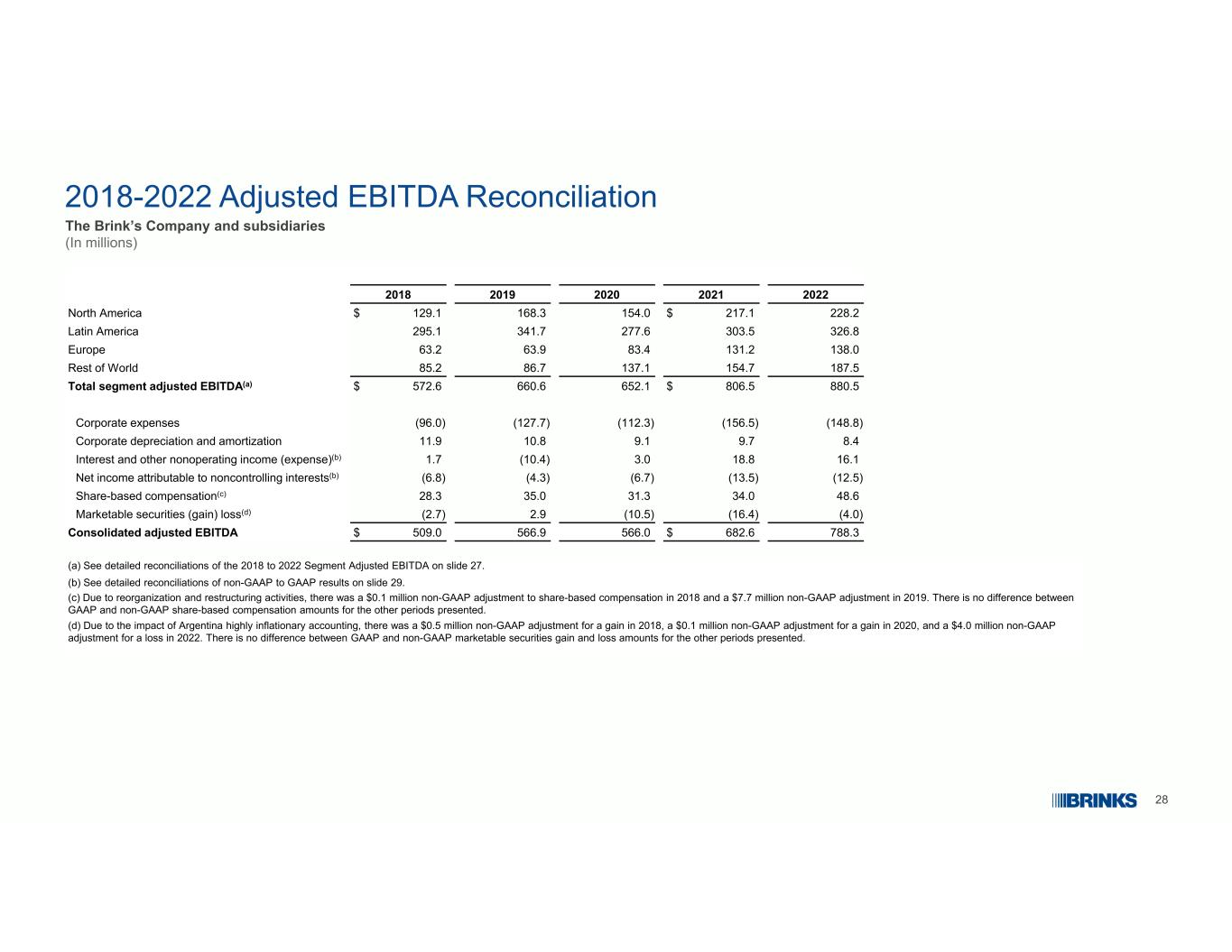

28 2018-2022 Adjusted EBITDA Reconciliation The Brink’s Company and subsidiaries (In millions) (a) See detailed reconciliations of the 2018 to 2022 Segment Adjusted EBITDA on slide 27. (b) See detailed reconciliations of non-GAAP to GAAP results on slide 29. (c) Due to reorganization and restructuring activities, there was a $0.1 million non-GAAP adjustment to share-based compensation in 2018 and a $7.7 million non-GAAP adjustment in 2019. There is no difference between GAAP and non-GAAP share-based compensation amounts for the other periods presented. (d) Due to the impact of Argentina highly inflationary accounting, there was a $0.5 million non-GAAP adjustment for a gain in 2018, a $0.1 million non-GAAP adjustment for a gain in 2020, and a $4.0 million non-GAAP adjustment for a loss in 2022. There is no difference between GAAP and non-GAAP marketable securities gain and loss amounts for the other periods presented. 20222021202020192018 228.2$ 217.1154.0168.3$ 129.1North America 326.8303.5277.6341.7295.1Latin America 138.0131.283.463.963.2Europe 187.5154.7137.186.785.2Rest of World 880.5$ 806.5652.1660.6$ 572.6Total segment adjusted EBITDA(a) (148.8)(156.5)(112.3)(127.7)(96.0)Corporate expenses 8.49.79.110.811.9Corporate depreciation and amortization 16.118.83.0(10.4)1.7Interest and other nonoperating income (expense)(b) (12.5)(13.5)(6.7)(4.3)(6.8)Net income attributable to noncontrolling interests(b) 48.634.031.335.028.3Share-based compensation(c) (4.0)(16.4)(10.5)2.9(2.7)Marketable securities (gain) loss(d) 788.3$ 682.6566.0566.9$ 509.0Consolidated adjusted EBITDA

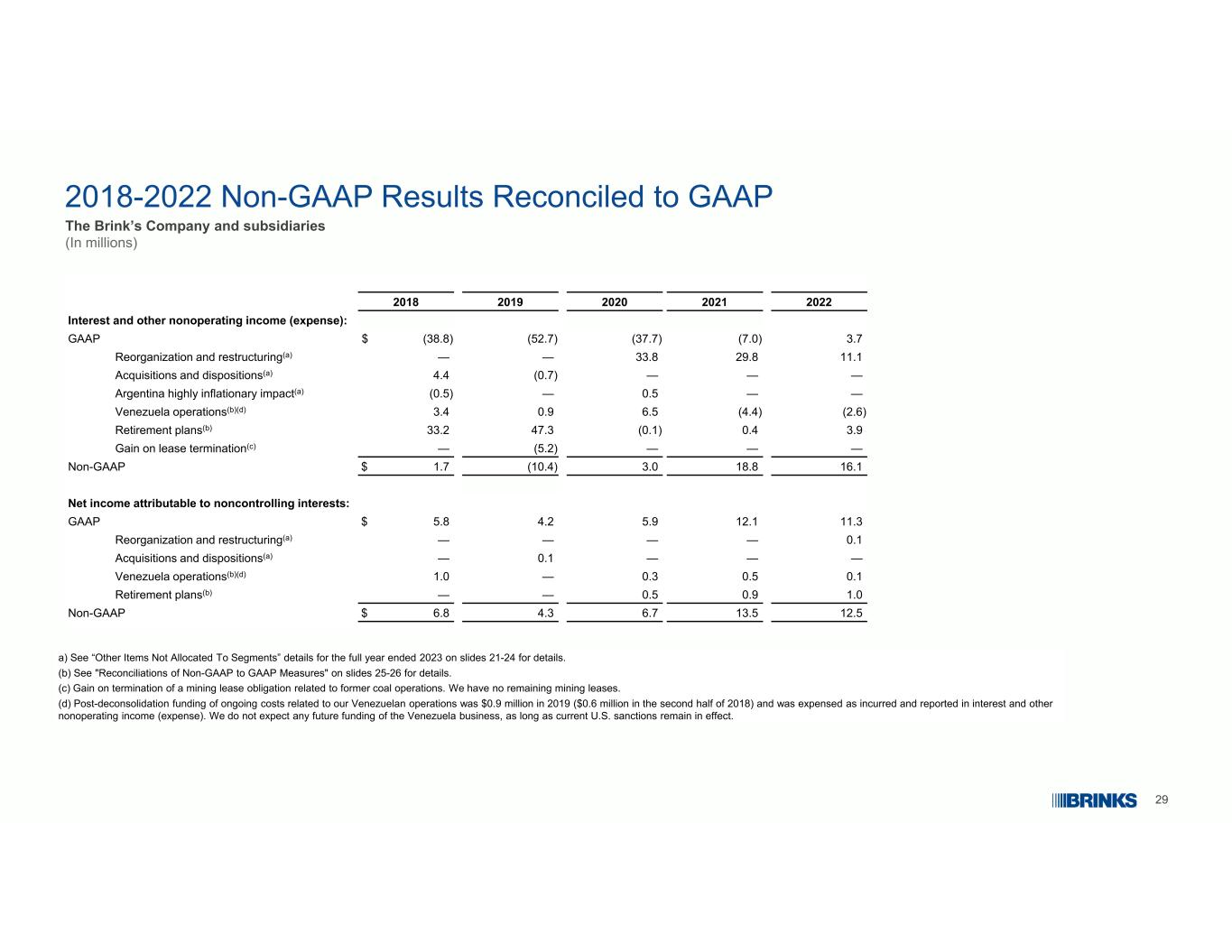

29 2018-2022 Non-GAAP Results Reconciled to GAAP The Brink’s Company and subsidiaries (In millions) a) See “Other Items Not Allocated To Segments” details for the full year ended 2023 on slides 21-24 for details. (b) See "Reconciliations of Non-GAAP to GAAP Measures" on slides 25-26 for details. (c) Gain on termination of a mining lease obligation related to former coal operations. We have no remaining mining leases. (d) Post-deconsolidation funding of ongoing costs related to our Venezuelan operations was $0.9 million in 2019 ($0.6 million in the second half of 2018) and was expensed as incurred and reported in interest and other nonoperating income (expense). We do not expect any future funding of the Venezuela business, as long as current U.S. sanctions remain in effect. 20222021202020192018 Interest and other nonoperating income (expense): 3.7(7.0)(37.7)(52.7)$ (38.8)GAAP 11.129.833.8——Reorganization and restructuring(a) ———(0.7)4.4Acquisitions and dispositions(a) ——0.5—(0.5)Argentina highly inflationary impact(a) (2.6)(4.4)6.50.93.4Venezuela operations(b)(d) 3.90.4(0.1)47.333.2Retirement plans(b) ———(5.2)—Gain on lease termination(c) 16.118.83.0(10.4)$ 1.7Non-GAAP Net income attributable to noncontrolling interests: 11.312.15.94.2$ 5.8GAAP 0.1————Reorganization and restructuring(a) ———0.1—Acquisitions and dispositions(a) 0.10.50.3—1.0Venezuela operations(b)(d) 1.00.90.5——Retirement plans(b) 12.513.56.74.3$ 6.8Non-GAAP

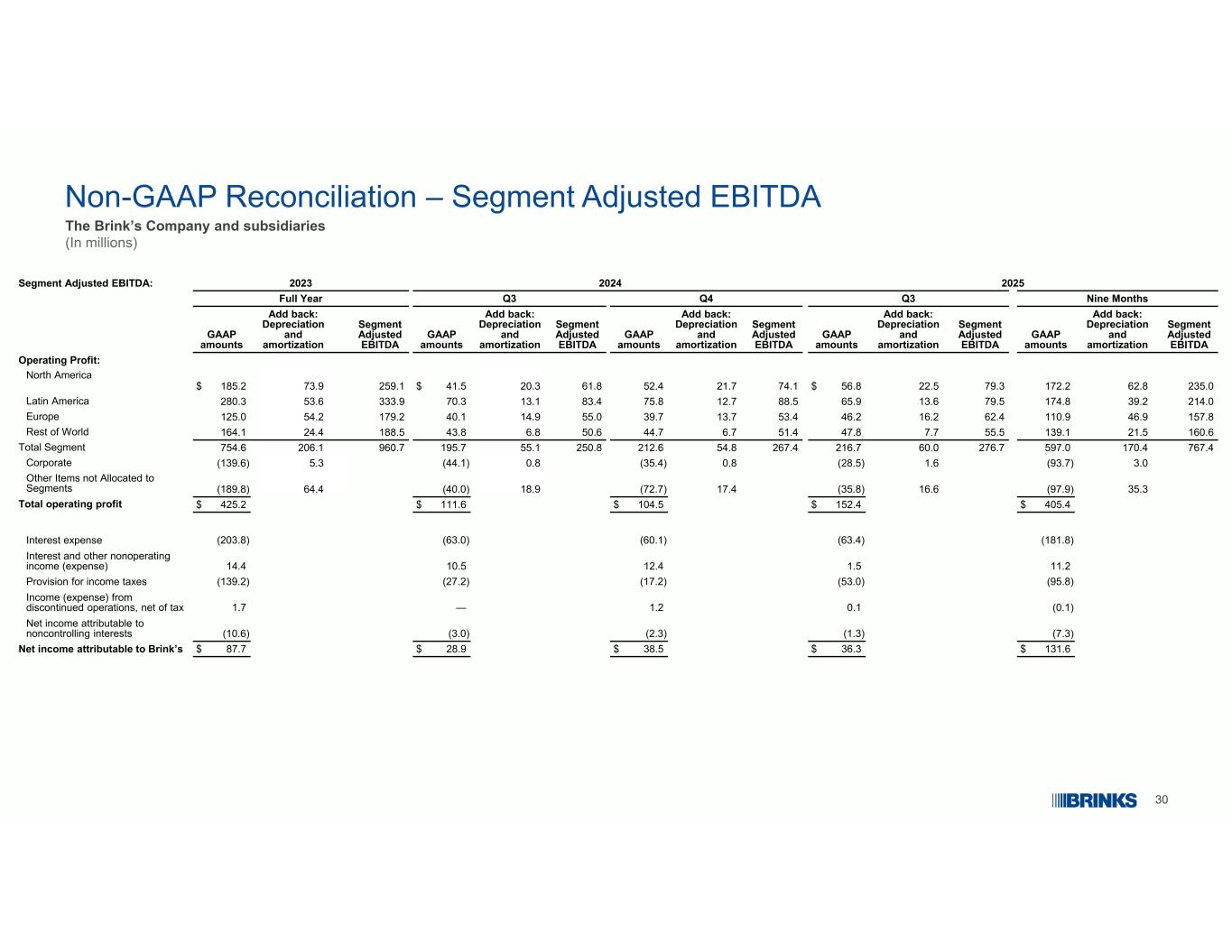

30 Non-GAAP Reconciliation – Segment Adjusted EBITDA The Brink’s Company and subsidiaries (In millions) 202520242023Segment Adjusted EBITDA: Nine MonthsQ3Q4Q3Full Year Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Segment Adjusted EBITDA Add back: Depreciation and amortization GAAP amounts Operating Profit: 235.062.8172.279.322.5$ 56.874.121.752.461.820.3$ 41.5259.173.9$ 185.2 North America 214.039.2174.879.513.665.988.512.775.883.413.170.3333.953.6280.3Latin America 157.846.9110.962.416.246.253.413.739.755.014.940.1179.254.2125.0Europe 160.621.5139.155.57.747.851.46.744.750.66.843.8188.524.4164.1Rest of World 767.4170.4597.0276.760.0216.7267.454.8212.6250.855.1195.7960.7206.1754.6Total Segment 3.0(93.7)1.6(28.5)0.8(35.4)0.8(44.1)5.3(139.6)Corporate 35.3(97.9)16.6(35.8)17.4(72.7)18.9(40.0)64.4(189.8) Other Items not Allocated to Segments $ 405.4$ 152.4$ 104.5$ 111.6$ 425.2Total operating profit (181.8)(63.4)(60.1)(63.0)(203.8)Interest expense 11.21.512.410.514.4 Interest and other nonoperating income (expense) (95.8)(53.0)(17.2)(27.2)(139.2)Provision for income taxes (0.1)0.11.2—1.7 Income (expense) from discontinued operations, net of tax (7.3)(1.3)(2.3)(3.0)(10.6) Net income attributable to noncontrolling interests $ 131.6$ 36.3$ 38.5$ 28.9$ 87.7Net income attributable to Brink’s

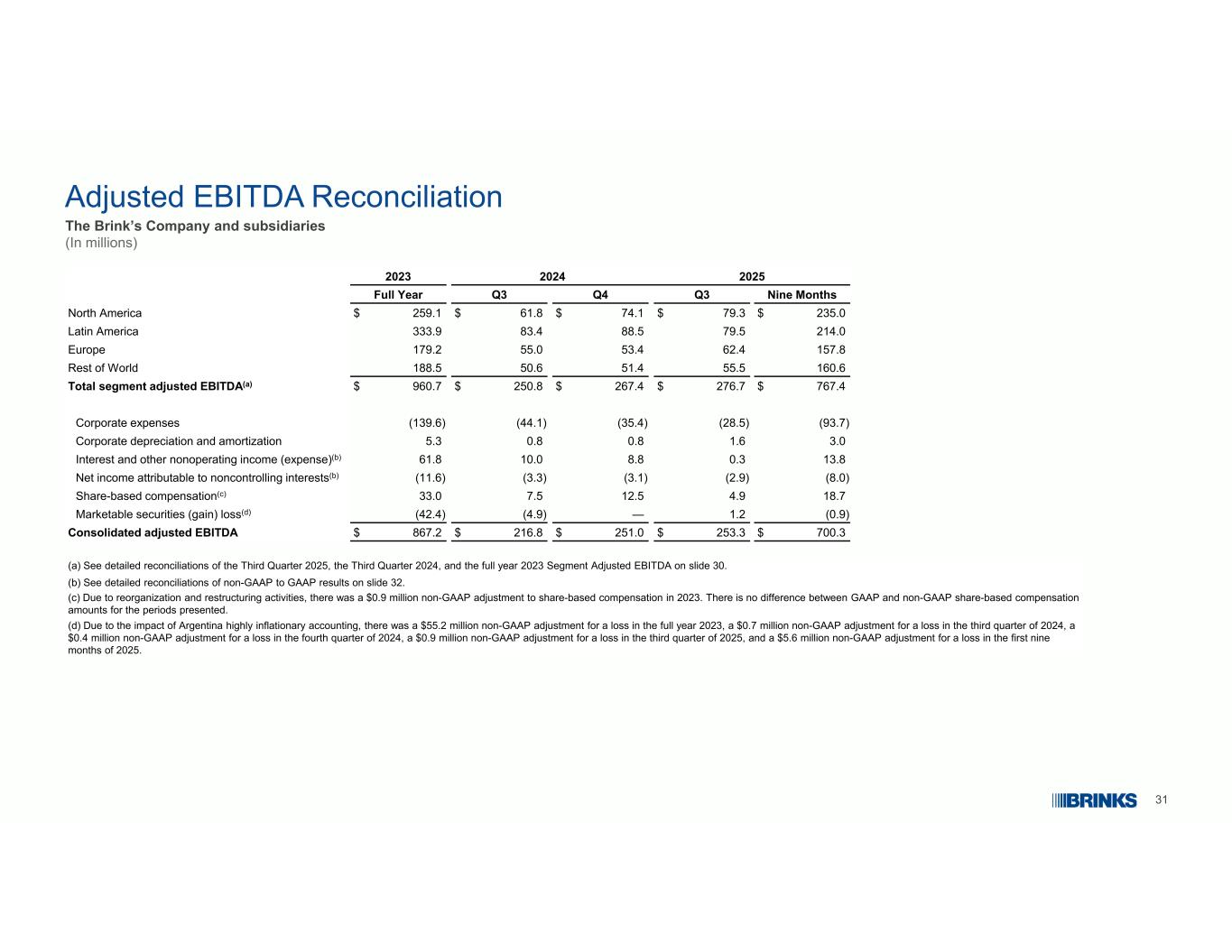

31 Adjusted EBITDA Reconciliation The Brink’s Company and subsidiaries (In millions) (a) See detailed reconciliations of the Third Quarter 2025, the Third Quarter 2024, and the full year 2023 Segment Adjusted EBITDA on slide 30. (b) See detailed reconciliations of non-GAAP to GAAP results on slide 32. (c) Due to reorganization and restructuring activities, there was a $0.9 million non-GAAP adjustment to share-based compensation in 2023. There is no difference between GAAP and non-GAAP share-based compensation amounts for the periods presented. (d) Due to the impact of Argentina highly inflationary accounting, there was a $55.2 million non-GAAP adjustment for a loss in the full year 2023, a $0.7 million non-GAAP adjustment for a loss in the third quarter of 2024, a $0.4 million non-GAAP adjustment for a loss in the fourth quarter of 2024, a $0.9 million non-GAAP adjustment for a loss in the third quarter of 2025, and a $5.6 million non-GAAP adjustment for a loss in the first nine months of 2025. 202520242023 Nine MonthsQ3Q4Q3Full Year $ 235.0$ 79.3$ 74.1$ 61.8$ 259.1North America 214.079.588.583.4333.9Latin America 157.862.453.455.0179.2Europe 160.655.551.450.6188.5Rest of World $ 767.4$ 276.7$ 267.4$ 250.8$ 960.7Total segment adjusted EBITDA(a) (93.7)(28.5)(35.4)(44.1)(139.6)Corporate expenses 3.01.60.80.85.3Corporate depreciation and amortization 13.80.38.810.061.8Interest and other nonoperating income (expense)(b) (8.0)(2.9)(3.1)(3.3)(11.6)Net income attributable to noncontrolling interests(b) 18.74.912.57.533.0Share-based compensation(c) (0.9)1.2—(4.9)(42.4)Marketable securities (gain) loss(d) $ 700.3$ 253.3$ 251.0$ 216.8$ 867.2Consolidated adjusted EBITDA

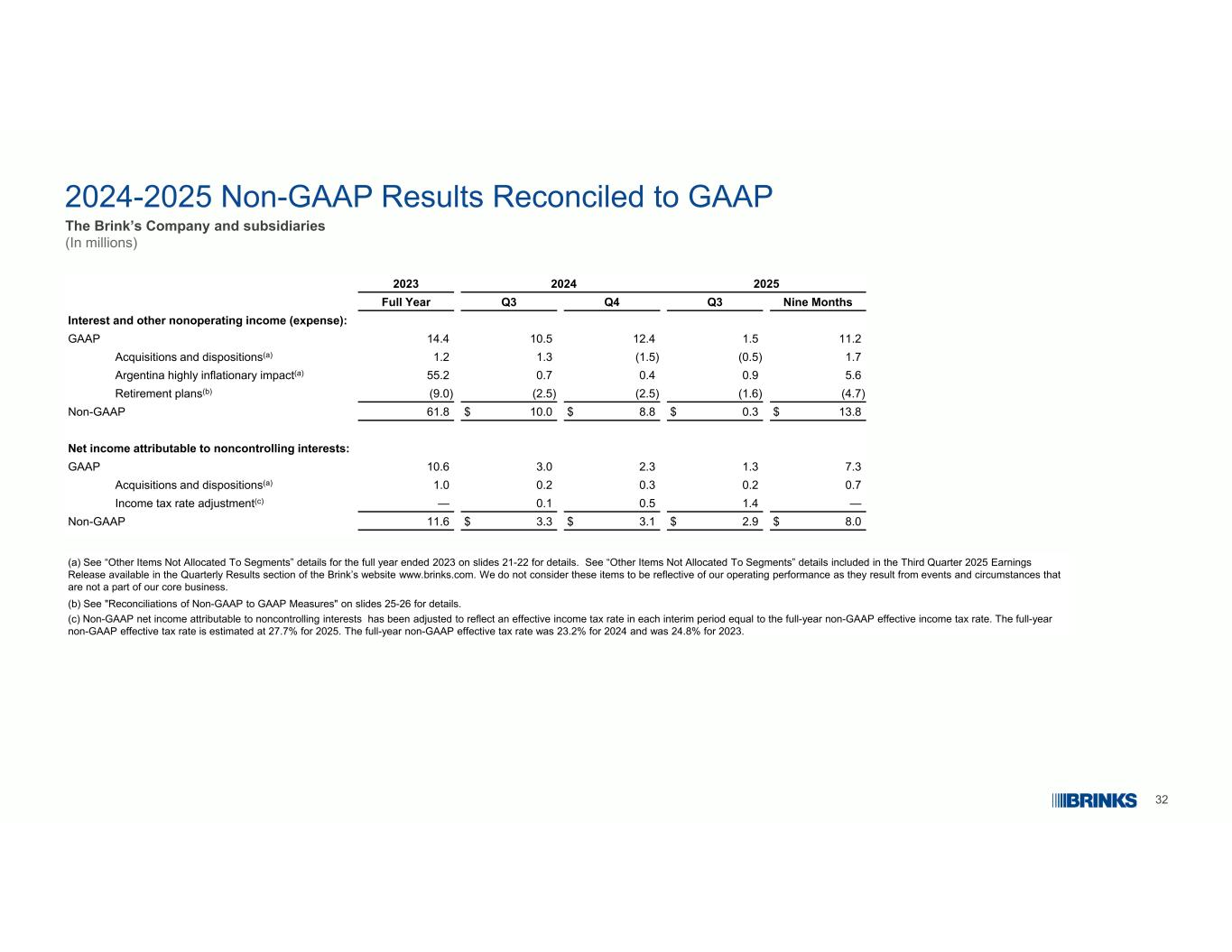

32 2024-2025 Non-GAAP Results Reconciled to GAAP The Brink’s Company and subsidiaries (In millions) (a) See “Other Items Not Allocated To Segments” details for the full year ended 2023 on slides 21-22 for details. See “Other Items Not Allocated To Segments” details included in the Third Quarter 2025 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. We do not consider these items to be reflective of our operating performance as they result from events and circumstances that are not a part of our core business. (b) See "Reconciliations of Non-GAAP to GAAP Measures" on slides 25-26 for details. (c) Non-GAAP net income attributable to noncontrolling interests has been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate is estimated at 27.7% for 2025. The full-year non-GAAP effective tax rate was 23.2% for 2024 and was 24.8% for 2023. 202520242023 Nine MonthsQ3Q4Q3Full Year Interest and other nonoperating income (expense): 11.21.512.410.514.4GAAP 1.7(0.5)(1.5)1.31.2Acquisitions and dispositions(a) 5.60.90.40.755.2Argentina highly inflationary impact(a) (4.7)(1.6)(2.5)(2.5)(9.0)Retirement plans(b) $ 13.8$ 0.3$ 8.8$ 10.061.8Non-GAAP Net income attributable to noncontrolling interests: 7.31.32.33.010.6GAAP 0.70.20.30.21.0Acquisitions and dispositions(a) —1.40.50.1—Income tax rate adjustment(c) $ 8.0$ 2.9$ 3.1$ 3.311.6Non-GAAP

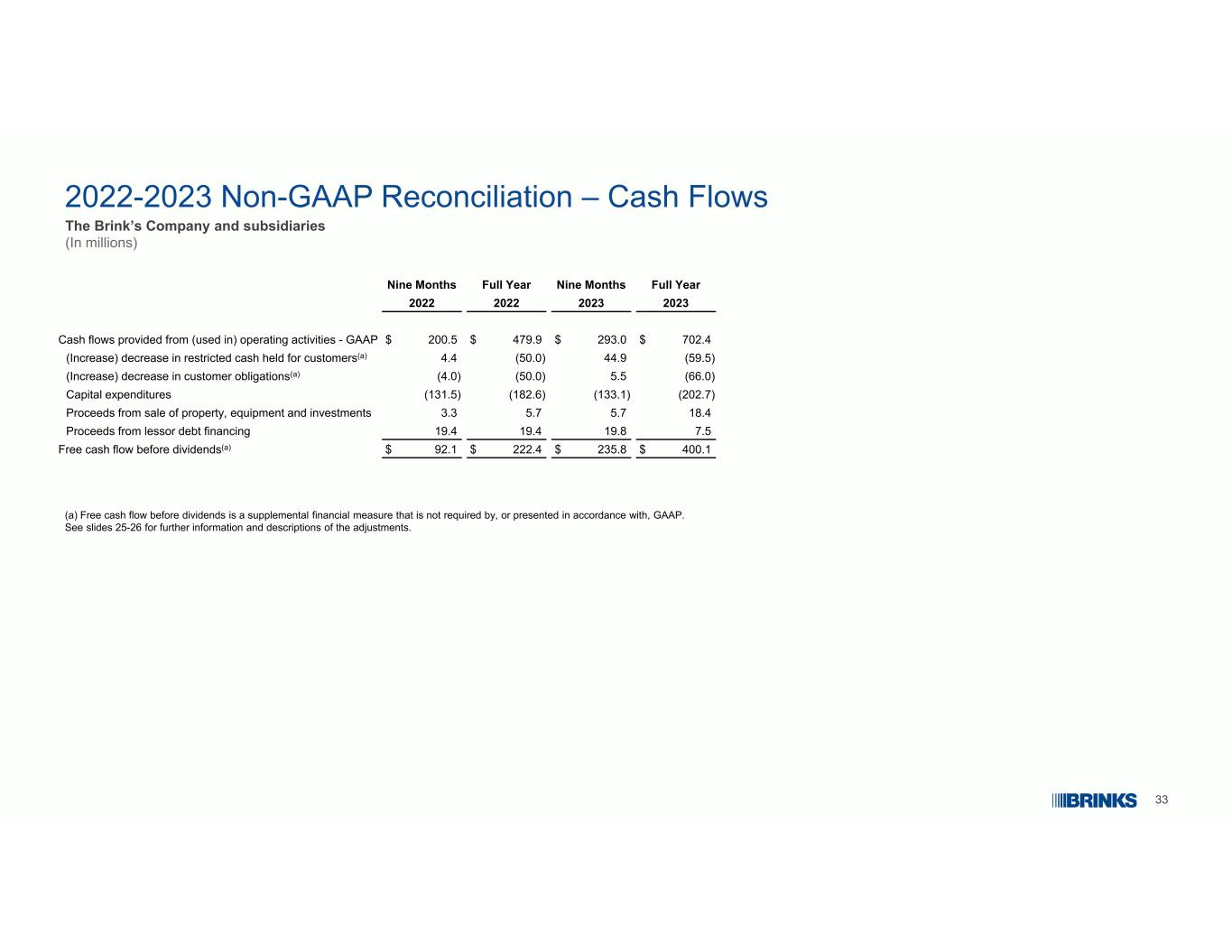

33 2022-2023 Non-GAAP Reconciliation – Cash Flows The Brink’s Company and subsidiaries (In millions) (a) Free cash flow before dividends is a supplemental financial measure that is not required by, or presented in accordance with, GAAP. See slides 25-26 for further information and descriptions of the adjustments. Full YearNine MonthsFull YearNine Months 2023202320222022 $ 702.4$ 293.0$ 479.9$ 200.5Cash flows provided from (used in) operating activities - GAAP (59.5)44.9(50.0)4.4(Increase) decrease in restricted cash held for customers(a) (66.0)5.5(50.0)(4.0)(Increase) decrease in customer obligations(a) (202.7)(133.1)(182.6)(131.5)Capital expenditures 18.45.75.73.3Proceeds from sale of property, equipment and investments 7.519.819.419.4Proceeds from lessor debt financing $ 400.1$ 235.8$ 222.4$ 92.1Free cash flow before dividends(a)

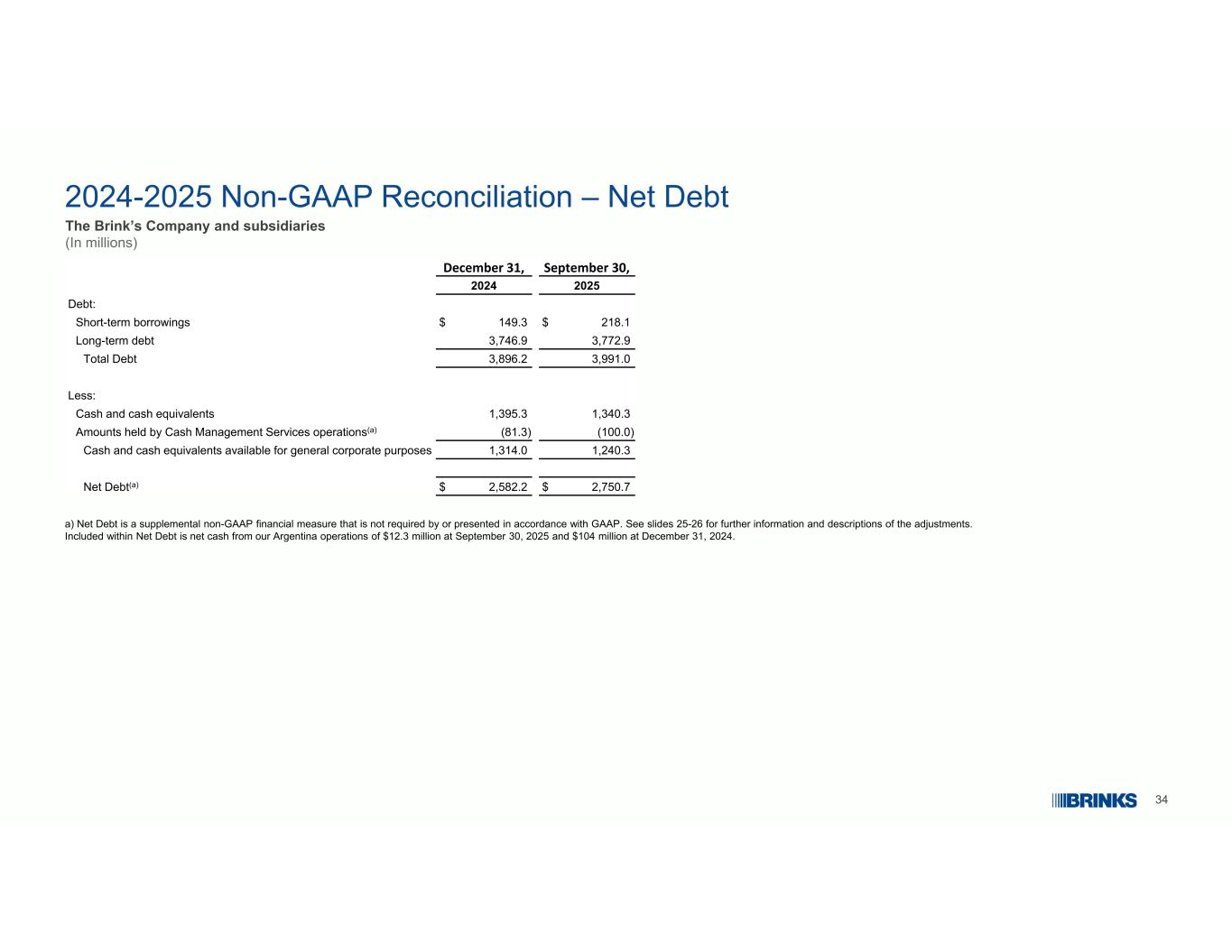

34 2024-2025 Non-GAAP Reconciliation – Net Debt The Brink’s Company and subsidiaries (In millions) a) Net Debt is a supplemental non-GAAP financial measure that is not required by or presented in accordance with GAAP. See slides 25-26 for further information and descriptions of the adjustments. Included within Net Debt is net cash from our Argentina operations of $12.3 million at September 30, 2025 and $104 million at December 31, 2024. September 30,December 31, 20252024 Debt: $ 218.1$ 149.3Short-term borrowings 3,772.93,746.9Long-term debt 3,991.03,896.2Total Debt Less: 1,340.31,395.3Cash and cash equivalents (100.0)(81.3)Amounts held by Cash Management Services operations(a) 1,240.31,314.0Cash and cash equivalents available for general corporate purposes $ 2,750.7$ 2,582.2Net Debt(a)