2024 ANNUAL REPORT UNLEASHING OUR POTENTIAL

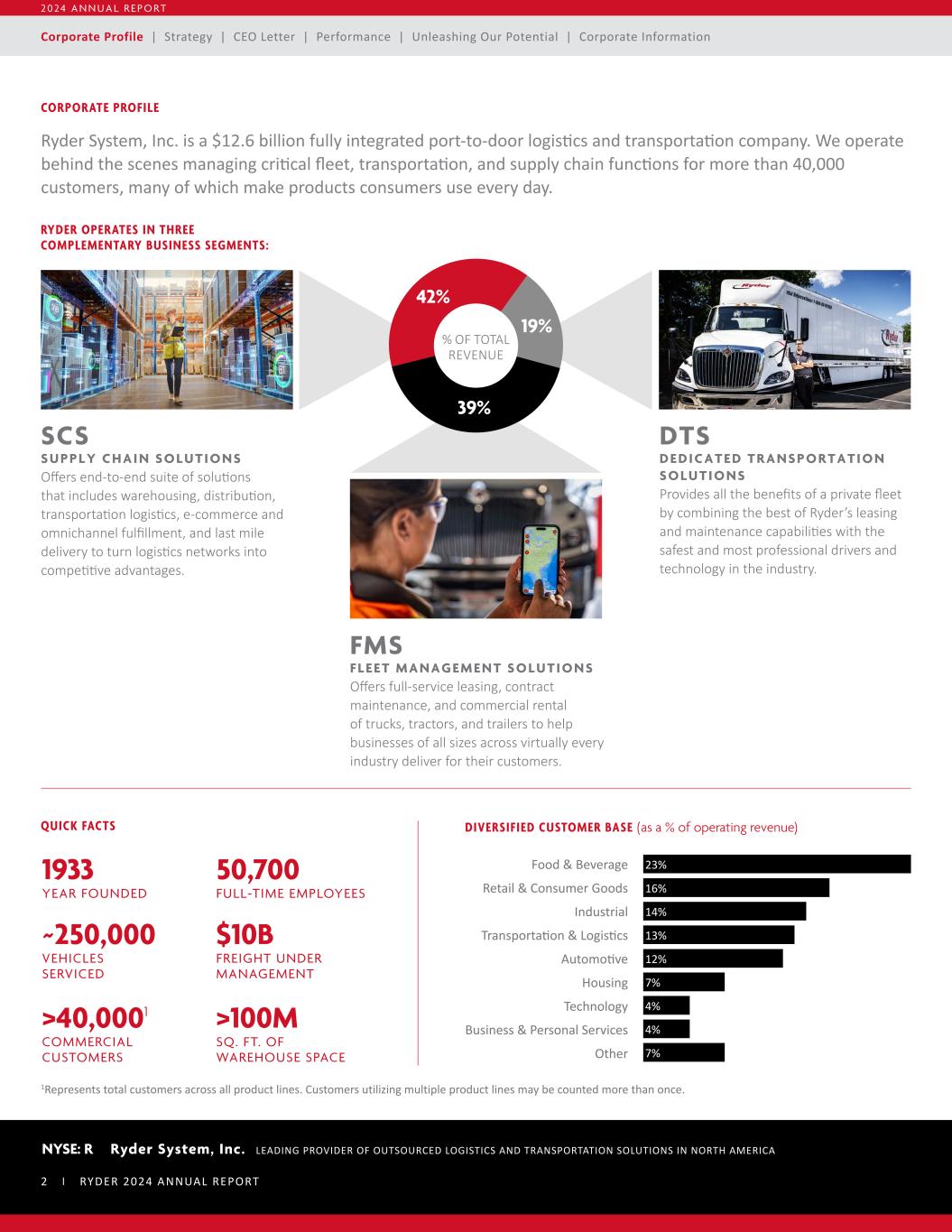

CORPORATE PROFILE Ryder System, Inc. is a $12.6 billion fully integrated port-to-door logistics and transportation company. We operate behind the scenes managing critical fleet, transportation, and supply chain functions for more than 40,000 customers, many of which make products consumers use every day. 1Represents total customers across all product lines. Customers utilizing multiple product lines may be counted more than once. LEADING PROVIDER OF OUTSOURCED LOGISTICS AND TRANSPORTATION SOLUTIONS IN NORTH AMERICANYSE: R Ryder System, Inc. 2 0 2 4 A N N U A L R E P O R T SCS S U P P L Y C H A I N S O L U T I O N S Offers end-to-end suite of solutions that includes warehousing, distribution, transportation logistics, e-commerce and omnichannel fulfillment, and last mile delivery to turn logistics networks into competitive advantages. DTS D E D I C A T E D T R A N S P O R T A T I O N S O L U T I O N S Provides all the benefits of a private fleet by combining the best of Ryder’s leasing and maintenance capabilities with the safest and most professional drivers and technology in the industry. FMS F L E E T M A N A G E M E N T S O L U T I O N S Offers full-service leasing, contract maintenance, and commercial rental of trucks, tractors, and trailers to help businesses of all sizes across virtually every industry deliver for their customers. QUICK FACTS RYDER OPERATES IN THREE COMPLEMENTARY BUSINESS SEGMENTS: ~250,000 VEHICLES SERVICED $10B FREIGHT UNDER MANAGEMENT >40,0001 COMMERCIAL CUSTOMERS >100M SQ. FT. OF WAREHOUSE SPACE 50,700 FULL-TIME EMPLOYEES 1933 YEAR FOUNDED Food & Beverage 23% Retail & Consumer Goods 16% Transportation & Logistics 14% Automotive 13% Industrial 12% Housing 7% Other 7% Technology 4% Business & Personal Services 4% DIVERSIFIED CUSTOMER BASE (as a % of operating revenue) % OF TOTAL REVENUE 42% 19% 39% Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information 2 | RYDER 2024 ANNUAL REPORT

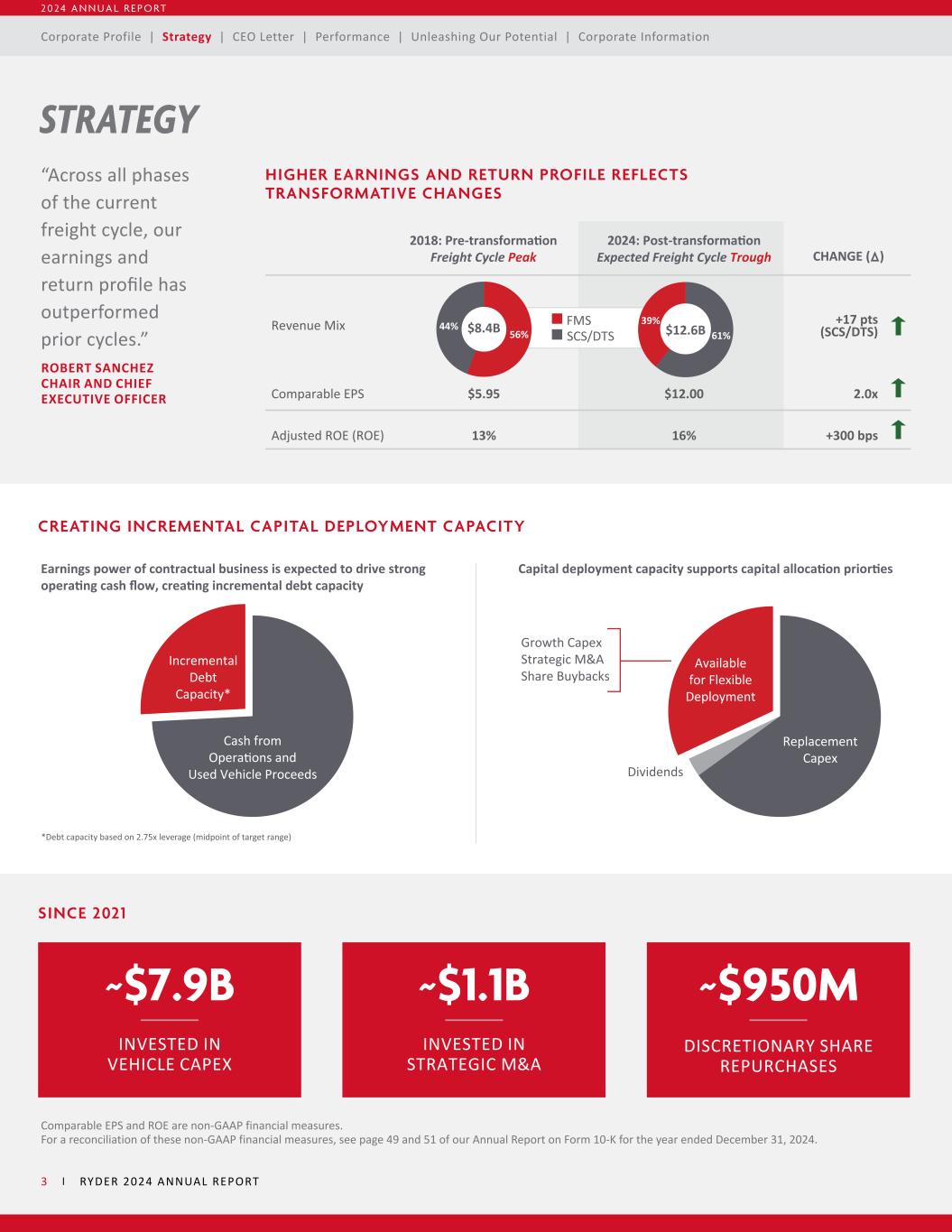

STRATEGY “Across all phases of the current freight cycle, our earnings and return profile has outperformed prior cycles.” ROBERT SANCHEZ CHAIR AND CHIEF EXECUTIVE OFFICER HIGHER EARNINGS AND RETURN PROFILE REFLECTS TRANSFORMATIVE CHANGES CREATING INCREMENTAL CAPITAL DEPLOYMENT CAPACITY SINCE 2021 INVESTED IN STRATEGIC M&A ~$1.1B INVESTED IN VEHICLE CAPEX ~$7.9B DISCRETIONARY SHARE REPURCHASES ~$950M Comparable EPS and ROE are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures, see page 49 and 51 of our Annual Report on Form 10-K for the year ended December 31, 2024. FMS SCS/DTS 2018: Pre-transformaon Freight Cycle Peak 2024: Post-transformaon Expected Freight Cycle Trough CHANGE ( ) Revenue Mix Comparable EPS $5.95 13% $12.00 16% 2.0x +17 pts (SCS/DTS) +300 bpsAdjusted ROE (ROE) $8.4B44% 56% $12.6B 39% 61% Earnings power of contractual business is expected to drive strong opera ng cash flow, crea ng incremental debt capacity Capital deployment capacity supports capital alloca on prior es Dividends Growth Capex Strategic M&A Share Buybacks Available for Flexible Deployment Replacement Capex Cash from Operaons and Used Vehicle Proceeds Incremental Debt Capacity* *Debt capacity based on 2.75x leverage (midpoint of target range) 2 0 2 4 A N N U A L R E P O R T 3 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

Continuous improvement process to drive maintenance and operations efficiencies – $50M multi-year maintenance cost savings initiative Leverage multi-client network; well-positioned to benefit from long-term growth trends Continue to deploy Ryder Flex operating structure – improve efficiencies while driving increased customer service levels Proprietary technologies differentiate services and provide customer value: • RYDERSHARE TM • RYDERGYDE TM • RYDERVIEW TM • RYDERSHIP TM Baton, a Ryder Technology Lab – creating a first-of-its-kind AI-powered digital platform and optimization engine Differentiate lease pricing with focus on higher return segments – full annual benefit of $125M (compared to FY18) expected to be realized in 2025 Expand share of wallet within vertical subsegments–cross sell co-packaging and co-manufacturing within CPG and expand to other verticals Integrate Cardinal acquisition to realize synergies and benefit from top-grade talent; $40-60M synergies expected by 2026 CREATE COMPELLING VALUE THROUGH OPERATIONAL EXCELLENCE INVEST IN CUSTOMER-CENTRIC INNOVATION FURTHER IMPROVE FULL-CYCLE RETURNS AND GENERATE PROFITABLE GROWTH STRATEGY INCREASED ROE TARGET TO LOW 20S OVER THE CYCLE ROE is a non-GAAP financial measure. For a reconciliation of this non-GAAP financial measure, see page 51 of our Annual Report on Form 10-K for the year ended December 31, 2024. ONGOING EXECUTION OF STRATEGY EXPECTED TO FURTHER LIFT RETURNS PROFILE CURRENT PHASE OF BALANCED GROWTH STRATEGY BUILDS ON TRANSFORMED BUSINESS MODEL 2 0 2 4 A N N U A L R E P O R T 4 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

D E A R S H A R E H O L D E R S : I’m extremely proud of the Ryder team for delivering solid results throughout 2024 despite an extended freight cycle downturn. We continue to outperform prior cycles, driven by our high-quality contractual portfolio and reflecting the actions we’ve taken under our balanced growth strategy to de-risk the business, increase the return profile, and accelerate growth in our asset-light Supply Chain Solutions (SCS) and Dedicated Transportation Solutions (DTS) businesses. We continue to see long-term growth opportunities in all three of our business segments, supported by secular trends that favor outsourcing decisions, large addressable markets, and the value of our solutions. 2024 R E S U LT S During 2024, the business generated comparable earnings per share (EPS) of $12.00, which is significantly above the $5.95 of comparable earnings per share generated in 2018, prior to our business transformation and representing prior freight cycle peak. The business also delivered adjusted return on equity (ROE) of 16%, which is in line with our expectations for an extended freight cycle downturn and reflects the benefits of our initiatives focused on enhancing returns. The strength of our contractual businesses continues to demonstrate the enhanced quality of the portfolio and increased resilience of our business model. Operating revenue grew by 8%, reflecting the Cardinal and IFS acquisitions. Through organic growth, strategic acquisitions, and innovative technology, we have shifted our revenue mix towards SCS and DTS, with 61% of 2024 revenue coming from these asset- light businesses, compared to 44% in 2018. For several years, you have heard me speak of my optimism toward Ryder’s transformation journey. During 2024, we continued to outperform key metrics relative to prior cycles, demonstrating the effectiveness of the strategy. The next phase of our balanced growth strategy focuses on creating compelling value through operational excellence, investing in customer-centric innovation, and further improving full-cycle returns and generating profitable growth. At the Investor Day we hosted in June 2024, we increased our ROE target over the cycle from high teens to low 20s. We are confident in our ability to achieve this new target over time as we continue to execute on our initiatives. CEO LETTER “During 2024, the business generated comparable earnings per share of $12.00, which is significantly above the $5.95 of comparable earnings per share generated in 2018, prior to our business transformation and representing prior freight cycle peak.” R O B E R T S A N C H E Z C H A I R A N D C H I E F E X E C U T I V E O F F I C E R $456M R E T U R N E D I N C A S H TO S H A R E H O L D E RS 14% I N C R EA S E D D I V I D E N D Comparable EPS, ROE and operating revenue are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures, see page 49-51 of our Annual Report on Form 10-K for the year ended December 31, 2024. 2 0 2 4 A N N U A L R E P O R T 5 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

C A PA C I T Y TO S U P P O R T C A P I TA L A L L O C AT I O N P R I O R I T I E S The earnings power of our contractual portfolio provides us with increased capital deployment capacity, which we expect to use to support profitable growth and return capital to shareholders. During 2024, we returned $456 million in cash to shareholders through share repurchases and dividends. We repurchased 2.5 million shares and increased our dividend by 14%. Since 2021, we have repurchased approximately 19% of our shares outstanding and increased the average dividend growth rate to 12%. C U S TO M E R - C E N T R I C I N N O VAT I O N A N D T H O U G H T L E A D E R S H I P Ryder is at the forefront of identifying new technology for operational advancements. This has led Ryder to develop a suite of customer-centric technology solutions for enhanced supply chain visibility (RyderShare™), control of last mile orders (RyderView™), fleet management (RyderGyde™), and e-commerce fulfillment (RyderShip™), and even new services like our retail mobile maintenance solution (Torque by Ryder™). Ryder also acts as an extended research and development arm for our suppliers and customers. We are at the table with vehicle manufacturers, technology innovators, and industry peers to develop solutions our customers can implement to reach their goals. In 2024, one area fleet operators frequently asked us about centered on the cost, benefit, and complexities of converting to electric. As a result, Ryder published “Charged Logistics: The Cost of Electric Vehicle Conversion for U.S. Commercial Fleets.” Using extensive Ryder historical data and current market prices for both electric and internal combustion engine (ICE) vehicles as well as charging infrastructure, Ryder examined the potential economic impacts of implementing an all- EV fleet in California and Georgia, states where electricity, fuel, and labor costs range from highest in the country to more modest. The results of the study delivered data-driven insights that fleet operators, regulators, vehicle manufacturers, and technology innovators will find valuable as they evaluate the opportunities and costs of fleet electrification. C O R P O R AT E R E S P O N S I B I L I T Y We strive daily to uphold our corporate values of being Responsible, Determined, and Trustworthy, as well as live up to our tagline of “Ever better!” and its message of continuous improvement. With 50,000 plus employees living those values every day, instilling them as a natural part of Ryder’s workplace culture, I’m proud to say that their efforts did not go unnoticed. For the 13th year in a row, FORTUNE named Ryder one of the “World’s Most Admired Companies” for 2025. Of course, one of our most important distinctions is cultivating a positive, inclusive, and innovative work environment for our employees, and I was proud to see Ryder named among Newsweek’s “America’s Greatest Workplaces” as well as being named a 2024 “Top Company for Women to Work in Transportation” by Women in Trucking. Finally, to be the best, you must employ the best. Ryder has long seen the Lease or Buy? Evaluating the Rising Costs of Truck Fleet Ownership Data-driven analysis for fleet owners and managers to understand the total cost of ownership (TCO) and make informed decisions about fleet management strategy. LEARN MORE ABOUT THE VALUE PROPOSITION OF RYDER CHOICELEASE HERE. 2 0 2 4 A N N U A L R E P O R T 6 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

value in recruiting military veterans, which is why we were proud to be honored as a 2024 VETS Indexes Recognized Employer for our commitment to recruiting, hiring, retaining, developing, and supporting veterans and the military-connected community. Ryder employees live and work in communities across North America. And it’s not only the business we conduct, but how we conduct our business that has a direct impact on those communities. In October, we hosted our annual United Way workplace campaign. Between employee contributions and Ryder’s corporate gift, we raised a record $1.15 million. Ryder is focused on optimizing supply chains by improving efficiencies, conserving resources, and minimizing waste. Doing business responsibly, efficiently, and safely is ingrained in our culture and supports creating value for all Ryder stakeholders. The U.S. EPA named Ryder a 2024 SmartWay® Excellence Award winner and SmartWay® High Performer for outstanding environmental performance and freight sustainability leadership in our dedicated transportation business. Ryder has earned the SmartWay Excellence Award—the EPA’s highest accolade in this program—six times since 2013. L O O K I N G A H E A D On behalf of Ryder’s leadership team and all our employees, thank you for your investment and confidence in Ryder. We remain focused on executing our balanced growth strategy, which is delivering profitable growth and we expect will continue increasing shareholder value with more opportunity ahead. Sincerely, Robert Sanchez Chair and Chief Executive Officer March 2025 Ryder sustainability reporting includes an annual Corporate Sustainability Report (CSR) and CDP Corporate Response. LEARN MORE ABOUT SUSTAINABILITY AT RYDER HERE. 2 0 2 4 A N N U A L R E P O R T 7 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

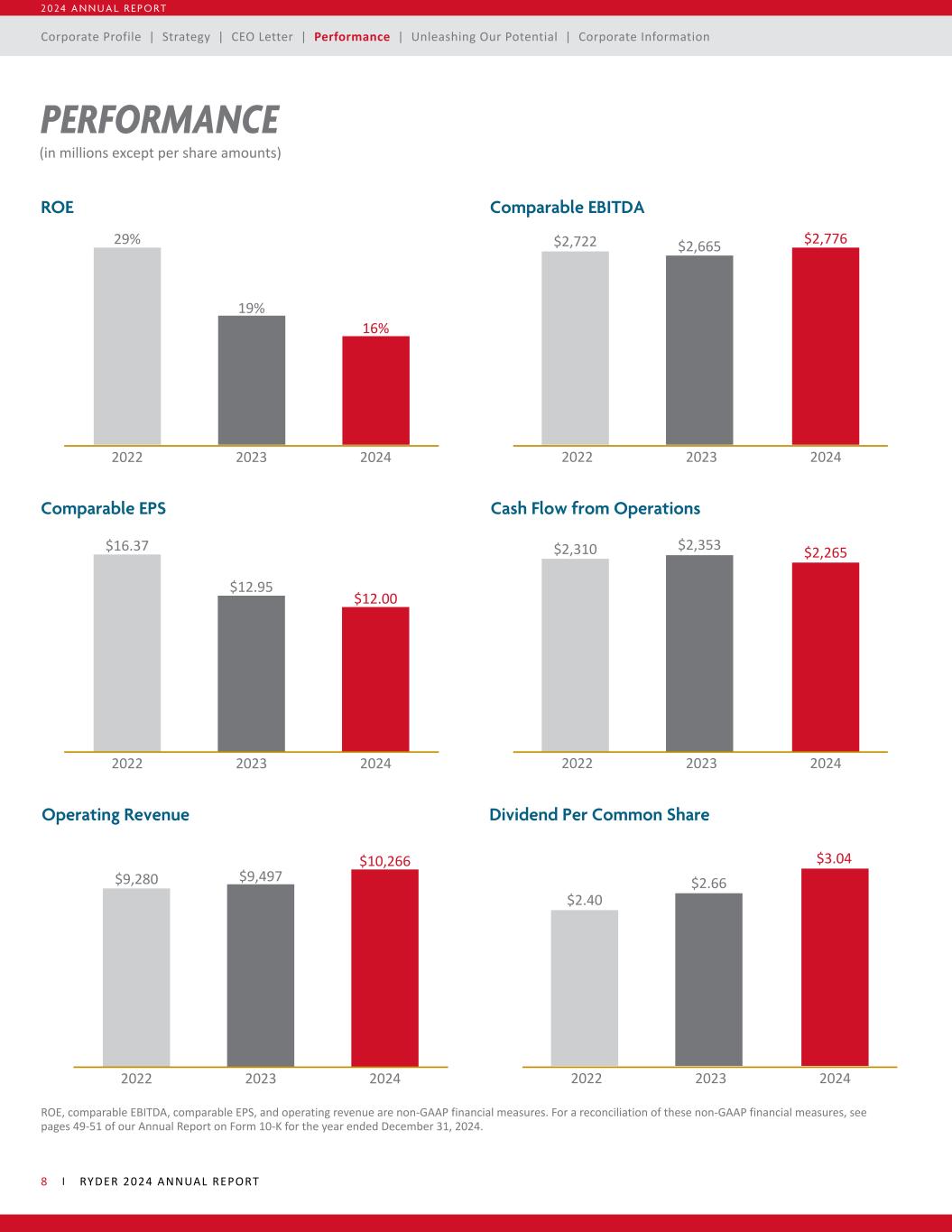

PERFORMANCE ROE Comparable EBITDA $2,665 $2,776 2022 2023 2024 $2,722 2022 2023 2024 29% (in millions except per share amounts) 19% 16% Comparable EPS Cash Flow from Operations $2,353 $2,265 2022 2023 2024 $2,310 2022 2023 2024 $16.37 $12.95 $12.00 Dividend Per Common ShareOperating Revenue $2.66 $3.04 2022 2023 2024 $2.40 2022 2023 2024 $9,280 $9,497 $10,266 ROE, comparable EBITDA, comparable EPS, and operating revenue are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures, see pages 49-51 of our Annual Report on Form 10-K for the year ended December 31, 2024. 2 0 2 4 A N N U A L R E P O R T 8 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

STRENGTHENING OUR MARKET LEADERSHIP ADDING SCALE AND DENSITY WITH CARDINAL ACQUISITION The 2024 acquisition of Cardinal Logistics advances Ryder’s strategy to accelerate profitable growth in its dedicated business by adding scale and density, driving operating efficiencies, and delivering better value. Primarily serving the consumer packaged goods, omnichannel, grocery, building products, automotive, and industrial verticals, Cardinal brings to Ryder a highly diversified portfolio serving long-tenured blue-chip customers. In 2024, Ryder integrated Cardinal operations, facilities, and equipment into its dedicated transportation, fleet management, and supply chain businesses. The transaction is expected to be accretive in 2025. The acquisition of Cardinal complements and strengthens Ryder’s position as a leading specialized dedicated transportation provider in North America and establishes Ryder as the second largest Dedicated provider in our industry. EXPANDING RYDER’S CPG WALLET SHARE Through the 2023 acquisition of Impact Fulfillment Services (IFS), Ryder is now a one-stop-shop for customers with added co-packing and co-manufacturing capabilities. Their proven model in both food and non-food products, as well as 15 multi-client and dedicated operations, enables Ryder to address an identified need of top customers for co-packing and co-manufacturing services. While Ryder already serves the top 10 U.S. food and beverage companies, this acquisition has expanded and strengthened our relationships with existing customers while also attracting new customers in additional verticals. OMNICHANNEL EXCELLENCE: THE KEY TO CUSTOMER SATISFACTION Ryder released its 10th annual e-commerce consumer study, “The Influence of Omnichannel Excellence on Consumer Behavior.” The survey of more than 1,300 U.S. shoppers explored preferences, expectations, sentiment, and behavior pertaining to purchasing, omnichannel experiences, packaging, shipping, returns, and sustainability. This latest study demonstrates that, while consumers maintain a robust appetite for e-commerce, they are simultaneously embracing in-person shopping, presenting an impetus for merchants to refine their omnichannel strategies. “We continue to be a market leader in third-party logistics, providing port-to-door services across North America. By bringing in and leveraging new capabilities across industry verticals, Ryder is leveraging the complementary services we’ve achieved through strategic investments and acquisitions and increasing the value we offer to our customers.” S T E V E S E N S I N G P R E S I D E N T, S U P P LY C H A I N S O L U T I O N S A N D D E D I C AT E D T R A N S P O R TAT I O N S O L U T I O N S UNLEASHING OUR POTENTIAL 2 0 2 4 A N N U A L R E P O R T 9 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

INNOVATION DRIVEN BY CUSTOMER- CENTRIC MINDSET RYDERSHARE TM Ryder’s one-of-a-kind visibility and collaborative logistics technology RyderShare™ enables everyone involved in moving goods through supply chains – shippers, receivers, carriers, and service providers – to work together in real-time to prevent costly delays and find efficiency gains. The platform gives Ryder customers unprecedented visibility into their supply chains, and in fact is the only digital platform from a 3PL that provides end-to- end visibility, collaboration, and exception management across the supply chain. It is clear customers are seeing the value in the platform as 35% of new business revenue in SCS and DTS can be attributed to RyderShare™. RYDERVIEW TM RyderView™ is the industry’s leading comprehensive last mile digital application that gives customers real-time visibility and control of orders—and their brand— while enhancing the delivery experience for their consumers. The platform allows companies and consumers to schedule deliveries, track orders, receive notifications, and access actionable data. In 2024, Ryder Last Mile completed more than 700,000 orders that utilized the RyderView™ application. RYDERGYDE TM Designed to enhance the way customers manage their fleets, RyderGyde™ offers a full suite of fleet management tools so they can easily schedule and see the status of maintenance service, access complete vehicle history, view real-time contracted fuel rates, and access roadside assistance. This allows businesses to manage their fleets more efficiently. As of 2024, RyderGyde™ is utilized by 9,000 customers and has more than 65,000 users. RYDERSHIP TM In 2022, Ryder acquired nationwide e-commerce and omnichannel fulfillment services provider Whiplash. This acquisition amplified Ryder’s e-commerce network, bringing with it a best-in-class technology and operating platform. RyderShip™ is the only digital platform purpose-built for e-commerce fulfillment that is customizable to customers’ needs and easily integrates with their entire ecosystem. UNLEASHING OUR POTENTIAL Real-time visibility of your goods on trucks and inside warehouses Productivity Increased productivity up to 50% Labor Efficiency Labor efficiency savings up to 50% On-Time Performance On-time performance of 99% Organizational Reaction Improved organizational reaction time by 90% RYDERSHARE TM CUSTOMER BENEFITS 2 0 2 4 A N N U A L R E P O R T 10 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

ENABLING ELECTRICFICATION OF FLEETS RYDERELECTRIC+TM RyderElectric+,™ is a turnkey electric vehicle (EV) fleet solution, which helps our customers navigate the EV landscape and provides electrification advisory services, vehicles, charging and infrastructure support, telematics, and maintenance. By combining Ryder’s 90-plus-year industry expertise, our network of roughly 800 facilities, and the best-in-class relationships with vehicle, charging, and telematic providers, RyderElectric+ helps companies adopt an electric fleet that fits their needs. We currently have approximately 200 EVs in our managed fleet, 20 locations with charging to support our rental fleet, and have tested more than 30 different advanced vehicle technologies from various OEMs. The introduction of EVs into Ryder’s lease and rental fleet, and the simplicity of RyderElectric+, allows us to identify and provide EV solutions that fit the operational needs for our customers. TOTAL COST OF TRANSPORT To assist our customers in better understanding the costs, benefits, and complexities of converting their fleets to electric vehicles, including the evolving state and federal legal requirements and regulations, Ryder published a ground- breaking study in 2024 titled “Charged Logistics: The Cost of Electric Vehicle Conversion for U.S. Commercial Fleets.” Based on representative network loads and routes from Ryder’s dedicated fleet operations in today’s market and other factors, the data shows the annual total cost to transport (TCT) by EV versus diesel in the light-, medium-, and heavy-duty vehicle classes. The data revealed the annual TCT by EV versus diesel is estimated to increase across the board – ranging from up to 5% for a light-duty transit van to as much as 114% for a heavy-duty tractor (depending on the geographic area). And, for a mixed fleet of 25 light-, medium- and heavy-duty vehicles, the analysis shows an increased TCT of up to 67% for an all-electric fleet. Our analysis also considered the potential inflationary impact if companies were required to convert to electric vehicles at the time of the study. Based on the TCT for a mixed EV fleet, and assuming companies pass the increased TCT on to consumers, Ryder estimated those increases could cumulatively add 0.5% to 1% to overall inflation. In May 2024, Ryder Chair and CEO Robert Sanchez delivered a keynote address to the Advanced Clean Transportation (ACT) Expo where he presented these findings and explored the transport costs and infrastructure challenges associated with converting commercial diesel vehicles to EVs in today’s market. “One of the top competitive advantages Ryder can offer our customers is to serve as an extended R&D partner for their transportation network, while advising them when emerging technologies can provide their business a tangible benefit, or when a technology may not be ready to roll out. Through close collaboration with both customers and OEMs, we often serve as beta testers for the businesses we support, ensuring that they can stay on the cutting-edge of vehicle technology while meeting and exceeding their operational objectives.” T O M H A V E N S P R E S I D E N T, F L E E T M A N A G E M E N T S O L U T I O N S UNLEASHING OUR POTENTIAL CHARGED LOGISTICS: THE COST OF ELECTRIC VEHICLE CONVERSION FOR U.S. COMMERCIAL FLEETS Ryder’s data-driven analysis of the potential economic impacts of state and federal legal requirements aimed at converting commercial diesel vehicles to zero- emission vehicles. LEARN MORE ABOUT ELECTRIC VEHICLE TCT ANALYSIS AT RYDER HERE. 2 0 2 4 A N N U A L R E P O R T 11 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

ON THE FOREFRONT OF DISCOVERY RYDERVENTURES Through RyderVentures, our corporate venture capital fund, we’re committed to investing in and collaborating with start-up companies that are tackling disruptions in our industry, driven by accelerating demand for e-commerce fulfillment commercial asset sharing, next generation vehicles, and digital technologies. With RyderVentures, we gain early access to emerging technologies that address our customers’ pain points and help speed them up to market. To date, RyderVentures has made investments in start-ups that range from warehouse automation to autonomous vehicles, computer vision to mobile carbon capture, among others. BATON, A RYDER TECHNOLOGY LAB Ryder first invested in Baton in 2021 through RyderVentures. Seeing the value in their efforts to disrupt and optimize transportation networks through technology- driven solutions early on, Ryder acquired Baton in August 2022, establishing Baton, A Ryder Technology Lab, a Silicon Valley-based innovation lab. The mission of Baton, A Ryder Technology Lab is to pioneer a suite of groundbreaking customer-facing technologies designed to revolutionize how Ryder’s customers interact with their transportation and supply chain networks. These technologies will digitize and optimize networks at a level not currently available in the industry and will prepare Ryder for future advancements. THE DIGITAL YARD Ryder conducted a pilot program in 2024 along with Terminal Industries, which develops artificial intelligence (AI) platforms to digitize yard operations, to automatically index and analyze trucks and trailers flowing in and out of the warehouse yard. Terminal estimates that more than 90% of yards lack the technology to operate efficiently, costing the industry up to $146 billion each year. Since January 2024, the ongoing pilot at a Ryder e-commerce fulfillment center in City of Industry, California, has processed more than 10,000 truck detections, achieving 99% accuracy in capturing license plates and Department of Transportation (DOT) numbers. “Find the best and most qualified people, put them in a room together, and give them the resources and freedom to create. Innovation and disruption don’t just happen. They are a choice Ryder has been making and investing in, so we are the ones bringing to market the tools, products, technologies, and services that our customers recognize will improve their logistics networks and drive their businesses.” K A R E N J O N E S E X E C U T I V E V I C E P R E S I D E N T A N D C H I E F M A R K E T I N G O F F I C E R UNLEASHING OUR POTENTIAL 2 0 2 4 A N N U A L R E P O R T 12 | RYDER 2024 ANNUAL REPORT Corporate Profile | trategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information

EXECUTIVE LEADERSHIP ROBERT E. SANCHEZ Chair and Chief Executive Officer JOHN J. DIEZ* President and Chief Operating Officer CRISTINA GALLO-AQUINO** Executive Vice President, Chief Financial Officer THOMAS M. HAVENS President, Fleet Management Solutions J. STEVEN SENSING President, Supply Chain Solutions and Dedicated Transportation Solutions STEVE W. MARTIN Executive Vice President, Dedicated Transportation Solutions ROBERT D. FATOVIC Executive Vice President, Chief Legal Officer and Corporate Secretary KAREN M. JONES Executive Vice President and Chief Marketing Officer FRANCISCO LOPEZ Executive Vice President and Chief Human Resources Officer SANFORD J. HODES Senior Vice President and Chief Procurement and Corporate Development Officer RAJEEV RAVINDRAN Executive Vice President and Chief Information Officer BOARD OF DIRECTORS ROBERT E. SANCHEZ Chair and Chief Executive Officer ROBERT J. ECK2,3,5 Retired Chief Executive Officer of Anixter International Inc. ROBERT A. HAGEMANN1,4 Retired Senior Vice President and Chief Financial Officer of Quest Diagnostics Incorporated MICHAEL F. HILTON2,3 Retired President and Chief Executive Officer of Nordson Corporation TAMARA L. LUNDGREN1,3 Chairman, President and Chief Executive Officer of Radius Recycling LUIS P. NIETO, JR.2,4 Retired President of the Consumer Foods Group for ConAgra Foods Inc. DAVID G. NORD1,4 Retired Chairman, President and Chief Executive Officer of Hubbell Incorporated ABBIE J. SMITH1,4 Professor of Accounting at the University of Chicago Booth School of Business E. FOLLIN SMITH2,3 Retired Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Constellation Energy Group, Inc. DMITRI L. STOCKTON2,4 Retired Chairman, President and CEO of GE Asset Management CHARLES M. SWOBODA1,3 Retired Chairman, President and Chief Executive Officer of Cree, Inc. NEW YORK STOCK EXCHANGE NYSE: R ANNUAL MEETING Ryder System, Inc. will be hosting its Annual Meeting of Shareholders on Friday, May 2, 2025, at 10 a.m. The Annual Meeting will be held in person at the Hotel Colonnade Coral Gables, 180 Aragon Avenue, Coral Gables, Florida 33134. INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM PRICEWATERHOUSECOOPERS LLP TRANSFER AGENT AND REGISTRAR EQ SHAREHOLDER SERVICES Post Office Box 64854 St. Paul, MN 55164-0854 (866) 927-3884 (651) 450-4085 (fax) www.shareowneronline.com OUTSIDE THE U.S. (651) 450-4064 D I V I D E N D R E I N V E S T M E N T P L A N Shareholders may automatically reinvest their dividends and cash in additional shares of Ryder System, Inc. stock by enrolling in the Company’s Dividend Reinvestment Plan. Information about the Dividend Reinvestment Plan may be obtained by contacting: EQ SHAREHOLDER SERVICES Post Office Box 64854 St. Paul, MN 55164-0854 (866) 927-3884 (651) 450-4085 (fax) www.shareowneronline.com OUTSIDE THE U.S. (651) 450-4064 For Dividend Reinvestment Plan Optional Cash Investments: EQ SHAREOWNER SERVICES Post Office Box 64856 St. Paul, MN 55164-0856 RYDER CORPORATE HEADQUARTERS 2333 Ponce De Leon Blvd., Suite 700 Coral Gables, FL 33134 INVESTOR RELATIONS https://investors.ryder.com (305) 500-4053 RyderForInvestors@ryder.com CALENE CANDELA Vice President, Investor Relations ccandela@ryder.com NICOLE DOMINGUEZ Group Director, Investor Relations nicole_dominguez@ryder.com 1-Audit Committee 2-Compensation Committee 3-Corporate Governance and Nominating Committee 4-Finance Committee 5-Lead Independent Director * John J. Diez was appointed President and Chief Operating Officer, effective January 1, 2025. ** Cristina Gallo-Aquino was appointed Executive Vice President, Chief Financial Officer and Principal Accounting Officer, effective January 1, 2025. 2 0 2 4 A N N U A L R E P O R T 13 | RYDER 2024 ANNUAL REPORT Corporate Profile | Strategy | CEO Letter | Performance | Unleashing Our Potential | Corporate Information