Please wait

0000085961false2025FYShares Issued, Not DisclosedP3YP3YP3Yhttp://fasb.org/us-gaap/2025#AccountsPayableAndOtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndOtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#DebtCurrenthttp://fasb.org/us-gaap/2025#DebtCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligations333333iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesr:segmentr:optionxbrli:purer:institutionr:programr:site00000859612025-01-012025-12-3100000859612025-06-3000000859612026-01-310000085961us-gaap:ServiceMember2025-01-012025-12-310000085961us-gaap:ServiceMember2024-01-012024-12-310000085961us-gaap:ServiceMember2023-01-012023-12-3100000859612024-01-012024-12-3100000859612023-01-012023-12-310000085961r:FuelServicesMember2025-01-012025-12-310000085961r:FuelServicesMember2024-01-012024-12-310000085961r:FuelServicesMember2023-01-012023-12-310000085961r:LeaseandRentalMember2025-01-012025-12-310000085961r:LeaseandRentalMember2024-01-012024-12-310000085961r:LeaseandRentalMember2023-01-012023-12-3100000859612025-12-3100000859612024-12-3100000859612023-12-3100000859612022-12-310000085961us-gaap:PreferredStockMember2022-12-310000085961us-gaap:CommonStockMember2022-12-310000085961us-gaap:AdditionalPaidInCapitalMember2022-12-310000085961us-gaap:RetainedEarningsMember2022-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000085961us-gaap:RetainedEarningsMember2023-01-012023-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000085961us-gaap:CommonStockMember2023-01-012023-12-310000085961us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000085961us-gaap:PreferredStockMember2023-12-310000085961us-gaap:CommonStockMember2023-12-310000085961us-gaap:AdditionalPaidInCapitalMember2023-12-310000085961us-gaap:RetainedEarningsMember2023-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000085961us-gaap:RetainedEarningsMember2024-01-012024-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000085961us-gaap:CommonStockMember2024-01-012024-12-310000085961us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000085961us-gaap:PreferredStockMember2024-12-310000085961us-gaap:CommonStockMember2024-12-310000085961us-gaap:AdditionalPaidInCapitalMember2024-12-310000085961us-gaap:RetainedEarningsMember2024-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000085961us-gaap:RetainedEarningsMember2025-01-012025-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-12-310000085961us-gaap:CommonStockMember2025-01-012025-12-310000085961us-gaap:AdditionalPaidInCapitalMember2025-01-012025-12-310000085961us-gaap:PreferredStockMember2025-12-310000085961us-gaap:CommonStockMember2025-12-310000085961us-gaap:AdditionalPaidInCapitalMember2025-12-310000085961us-gaap:RetainedEarningsMember2025-12-310000085961us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-12-310000085961srt:MinimumMember2025-01-012025-12-310000085961srt:MaximumMember2025-01-012025-12-310000085961srt:MinimumMemberr:TrucksAndTractorsMember2025-12-310000085961srt:MaximumMemberr:TrucksAndTractorsMember2025-12-310000085961r:TrailersMember2025-12-310000085961srt:MinimumMemberr:RevenueEarningEquipmentMember2025-12-310000085961srt:MaximumMemberr:RevenueEarningEquipmentMember2025-12-310000085961srt:MinimumMemberr:FacilitiesMember2025-12-310000085961srt:MaximumMemberr:FacilitiesMember2025-12-310000085961srt:MinimumMemberr:FacilitiesMember2025-01-012025-12-310000085961r:FacilitiesMember2025-12-310000085961srt:MinimumMemberr:RevenueEarningEquipmentMaterialHandlingEquipmentAutomatedWashingMachinesandVehiclesMember2025-12-310000085961srt:MaximumMemberr:RevenueEarningEquipmentMaterialHandlingEquipmentAutomatedWashingMachinesandVehiclesMember2025-12-310000085961r:RevenueEarningEquipmentMaterialHandlingEquipmentAutomatedWashingMachinesandVehiclesMember2025-01-012025-12-3100000859612025-09-302025-09-3000000859612025-10-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:SupplyChainSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:DedicatedTransportationSolutionsMember2025-01-012025-12-310000085961us-gaap:IntersegmentEliminationMember2025-01-012025-12-310000085961us-gaap:MaterialReconcilingItemsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:SupplyChainSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:DedicatedTransportationSolutionsMember2024-01-012024-12-310000085961us-gaap:IntersegmentEliminationMember2024-01-012024-12-310000085961us-gaap:MaterialReconcilingItemsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:SupplyChainSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:DedicatedTransportationSolutionsMember2023-01-012023-12-310000085961us-gaap:IntersegmentEliminationMember2023-01-012023-12-310000085961us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310000085961country:US2025-12-310000085961country:US2024-12-310000085961country:CA2025-12-310000085961country:CA2024-12-310000085961country:MX2025-12-310000085961country:MX2024-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:SupplyChainSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:DedicatedTransportationSolutionsMember2025-01-012025-12-310000085961us-gaap:IntersegmentEliminationMembercountry:US2025-01-012025-12-310000085961country:US2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:SupplyChainSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:DedicatedTransportationSolutionsMember2025-01-012025-12-310000085961us-gaap:IntersegmentEliminationMembercountry:CA2025-01-012025-12-310000085961country:CA2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:SupplyChainSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:DedicatedTransportationSolutionsMember2025-01-012025-12-310000085961us-gaap:IntersegmentEliminationMembercountry:MX2025-01-012025-12-310000085961country:MX2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:SupplyChainSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:DedicatedTransportationSolutionsMember2024-01-012024-12-310000085961us-gaap:IntersegmentEliminationMembercountry:US2024-01-012024-12-310000085961country:US2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:SupplyChainSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:DedicatedTransportationSolutionsMember2024-01-012024-12-310000085961us-gaap:IntersegmentEliminationMembercountry:CA2024-01-012024-12-310000085961country:CA2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:SupplyChainSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:DedicatedTransportationSolutionsMember2024-01-012024-12-310000085961us-gaap:IntersegmentEliminationMembercountry:MX2024-01-012024-12-310000085961country:MX2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:SupplyChainSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:USr:DedicatedTransportationSolutionsMember2023-01-012023-12-310000085961us-gaap:IntersegmentEliminationMembercountry:US2023-01-012023-12-310000085961country:US2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:SupplyChainSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:CAr:DedicatedTransportationSolutionsMember2023-01-012023-12-310000085961us-gaap:IntersegmentEliminationMembercountry:CA2023-01-012023-12-310000085961country:CA2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:SupplyChainSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMembercountry:MXr:DedicatedTransportationSolutionsMember2023-01-012023-12-310000085961us-gaap:IntersegmentEliminationMembercountry:MX2023-01-012023-12-310000085961country:MX2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:ChoiceLeaseMemberr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:ChoiceLeaseMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:ChoiceLeaseMemberr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:CommercialRentalMemberr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:CommercialRentalMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:CommercialRentalMemberr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:SelectCareAndOtherMemberr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:SelectCareAndOtherMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:SelectCareAndOtherMemberr:FleetManagementSolutionsMember2023-01-012023-12-310000085961us-gaap:OperatingSegmentsMemberr:FuelServicesAndChoiceLeaseLiabilityInsuranceRevenueMemberr:FleetManagementSolutionsMember2025-01-012025-12-310000085961us-gaap:OperatingSegmentsMemberr:FuelServicesAndChoiceLeaseLiabilityInsuranceRevenueMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961us-gaap:OperatingSegmentsMemberr:FuelServicesAndChoiceLeaseLiabilityInsuranceRevenueMemberr:FleetManagementSolutionsMember2023-01-012023-12-310000085961r:SupplyChainSolutionsMemberr:OmnichannelRetailMember2025-01-012025-12-310000085961r:SupplyChainSolutionsMemberr:OmnichannelRetailMember2024-01-012024-12-310000085961r:SupplyChainSolutionsMemberr:OmnichannelRetailMember2023-01-012023-12-310000085961r:SupplyChainSolutionsMemberr:AutomotiveIndustryMember2025-01-012025-12-310000085961r:SupplyChainSolutionsMemberr:AutomotiveIndustryMember2024-01-012024-12-310000085961r:SupplyChainSolutionsMemberr:AutomotiveIndustryMember2023-01-012023-12-310000085961r:SupplyChainSolutionsMemberr:ConsumerPackedGoodsMember2025-01-012025-12-310000085961r:SupplyChainSolutionsMemberr:ConsumerPackedGoodsMember2024-01-012024-12-310000085961r:SupplyChainSolutionsMemberr:ConsumerPackedGoodsMember2023-01-012023-12-310000085961r:SupplyChainSolutionsMemberr:IndustrialandOtherMember2025-01-012025-12-310000085961r:SupplyChainSolutionsMemberr:IndustrialandOtherMember2024-01-012024-12-310000085961r:SupplyChainSolutionsMemberr:IndustrialandOtherMember2023-01-012023-12-310000085961r:SupplyChainSolutionsMember2025-01-012025-12-310000085961r:SupplyChainSolutionsMember2024-01-012024-12-310000085961r:SupplyChainSolutionsMember2023-01-012023-12-310000085961r:MaintenanceServicesMember2025-01-012025-12-310000085961r:MaintenanceServicesMember2024-01-012024-12-310000085961r:MaintenanceServicesMember2023-01-012023-12-310000085961r:HeldForUseFullServiceLeaseMember2025-01-012025-12-310000085961r:HeldForUseFullServiceLeaseMember2025-12-310000085961r:HeldForUseFullServiceLeaseMember2024-12-310000085961r:HeldForUseCommercialRentalMember2025-01-012025-12-310000085961r:HeldForUseCommercialRentalMember2025-12-310000085961r:HeldForUseCommercialRentalMember2024-12-310000085961r:TrailersMember2025-01-012025-12-310000085961r:TrailersMember2025-12-310000085961r:TrailersMember2024-12-310000085961r:HeldForSaleMember2025-12-310000085961r:HeldForSaleMember2024-12-310000085961us-gaap:TrucksMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-12-310000085961us-gaap:TrucksMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310000085961us-gaap:TrucksMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-01-012025-12-310000085961us-gaap:TrucksMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000085961us-gaap:TrucksMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000085961r:TractorsMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-12-310000085961r:TractorsMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310000085961r:TractorsMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-01-012025-12-310000085961r:TractorsMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000085961r:TractorsMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000085961r:TrailersAndOthersMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-12-310000085961r:TrailersAndOthersMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310000085961r:TrailersAndOthersMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-01-012025-12-310000085961r:TrailersAndOthersMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000085961r:TrailersAndOthersMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000085961us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-12-310000085961us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310000085961us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2025-01-012025-12-310000085961us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000085961us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000085961us-gaap:LandMember2025-12-310000085961us-gaap:LandMember2024-12-310000085961srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2025-12-310000085961srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2025-12-310000085961us-gaap:BuildingAndBuildingImprovementsMember2025-12-310000085961us-gaap:BuildingAndBuildingImprovementsMember2024-12-310000085961srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2025-12-310000085961srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2025-12-310000085961us-gaap:MachineryAndEquipmentMember2025-12-310000085961us-gaap:MachineryAndEquipmentMember2024-12-310000085961srt:MinimumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2025-12-310000085961srt:MaximumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2025-12-310000085961us-gaap:PropertyPlantAndEquipmentOtherTypesMember2025-12-310000085961us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310000085961r:FleetManagementSolutionsMember2023-12-310000085961r:SupplyChainSolutionsMember2023-12-310000085961r:DedicatedTransportationSolutionsMember2023-12-310000085961r:FleetManagementSolutionsMember2024-01-012024-12-310000085961r:DedicatedTransportationSolutionsMember2024-01-012024-12-310000085961r:FleetManagementSolutionsMember2024-12-310000085961r:SupplyChainSolutionsMember2024-12-310000085961r:DedicatedTransportationSolutionsMember2024-12-310000085961r:FleetManagementSolutionsMember2025-01-012025-12-310000085961r:DedicatedTransportationSolutionsMember2025-01-012025-12-310000085961r:FleetManagementSolutionsMember2025-12-310000085961r:SupplyChainSolutionsMember2025-12-310000085961r:DedicatedTransportationSolutionsMember2025-12-310000085961us-gaap:TradeNamesMemberr:FleetManagementSolutionsMember2025-12-310000085961us-gaap:TradeNamesMemberr:SupplyChainSolutionsMember2025-12-310000085961us-gaap:TradeNamesMemberr:DedicatedTransportationSolutionsMember2025-12-310000085961us-gaap:TradeNamesMemberr:CentralSupportServicesMember2025-12-310000085961us-gaap:TradeNamesMember2025-12-310000085961us-gaap:CustomerRelationshipsMemberr:FleetManagementSolutionsMember2025-12-310000085961us-gaap:CustomerRelationshipsMemberr:SupplyChainSolutionsMember2025-12-310000085961us-gaap:CustomerRelationshipsMemberr:DedicatedTransportationSolutionsMember2025-12-310000085961us-gaap:CustomerRelationshipsMemberr:CentralSupportServicesMember2025-12-310000085961us-gaap:CustomerRelationshipsMember2025-12-310000085961r:CentralSupportServicesMember2025-12-310000085961us-gaap:TradeNamesMemberr:FleetManagementSolutionsMember2024-12-310000085961us-gaap:TradeNamesMemberr:SupplyChainSolutionsMember2024-12-310000085961us-gaap:TradeNamesMemberr:DedicatedTransportationSolutionsMember2024-12-310000085961us-gaap:TradeNamesMemberr:CentralSupportServicesMember2024-12-310000085961us-gaap:TradeNamesMember2024-12-310000085961us-gaap:CustomerRelationshipsMemberr:FleetManagementSolutionsMember2024-12-310000085961us-gaap:CustomerRelationshipsMemberr:SupplyChainSolutionsMember2024-12-310000085961us-gaap:CustomerRelationshipsMemberr:DedicatedTransportationSolutionsMember2024-12-310000085961us-gaap:CustomerRelationshipsMemberr:CentralSupportServicesMember2024-12-310000085961us-gaap:CustomerRelationshipsMember2024-12-310000085961r:CentralSupportServicesMember2024-12-310000085961r:CardinalLogisticsMember2024-02-012024-02-010000085961us-gaap:FiniteLivedIntangibleAssetsMember2025-01-012025-12-310000085961r:UnfavorableLeaseAssetsMember2025-01-012025-12-310000085961us-gaap:FiniteLivedIntangibleAssetsMember2024-01-012024-12-310000085961r:FavorableLeaseAssetsMember2024-01-012024-12-310000085961srt:MinimumMember2025-12-310000085961srt:MaximumMember2025-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2024-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2023-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2022-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2025-01-012025-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2024-01-012024-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2023-01-012023-12-310000085961r:ReserveForSelfInsuranceAccrualsMember2025-12-310000085961country:GB2025-01-012025-12-310000085961country:GB2024-01-012024-12-310000085961country:GB2023-01-012023-12-310000085961country:CA2025-01-012025-12-310000085961country:CA2024-01-012024-12-310000085961country:CA2023-01-012023-12-310000085961us-gaap:ForeignTaxJurisdictionOtherMember2025-01-012025-12-310000085961us-gaap:ForeignTaxJurisdictionOtherMember2024-01-012024-12-310000085961us-gaap:ForeignTaxJurisdictionOtherMember2023-01-012023-12-310000085961stpr:TX2025-01-012025-12-310000085961stpr:TX2024-01-012024-12-310000085961stpr:TX2023-01-012023-12-310000085961stpr:CA2025-01-012025-12-310000085961stpr:CA2024-01-012024-12-310000085961stpr:CA2023-01-012023-12-310000085961stpr:IL2025-01-012025-12-310000085961stpr:IL2024-01-012024-12-310000085961stpr:IL2023-01-012023-12-310000085961stpr:NJ2025-01-012025-12-310000085961stpr:NJ2024-01-012024-12-310000085961stpr:NJ2023-01-012023-12-310000085961us-gaap:StateAndLocalTaxJurisdictionOtherMember2025-01-012025-12-310000085961us-gaap:StateAndLocalTaxJurisdictionOtherMember2024-01-012024-12-310000085961us-gaap:StateAndLocalTaxJurisdictionOtherMember2023-01-012023-12-310000085961country:MX2025-01-012025-12-310000085961country:MX2024-01-012024-12-310000085961country:MX2023-01-012023-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2025-01-012025-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310000085961us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2025-12-310000085961us-gaap:DomesticCountryMember2025-12-310000085961us-gaap:DomesticCountryMember2024-12-310000085961r:NoExpirationMemberus-gaap:DomesticCountryMember2025-12-310000085961r:NoExpirationMemberus-gaap:DomesticCountryMember2024-12-310000085961us-gaap:StateAndLocalJurisdictionMember2025-12-310000085961us-gaap:StateAndLocalJurisdictionMember2024-12-310000085961r:NoExpirationMemberus-gaap:StateAndLocalJurisdictionMember2025-12-310000085961r:NoExpirationMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310000085961us-gaap:ForeignCountryMember2025-12-310000085961us-gaap:ForeignCountryMember2024-12-310000085961r:NoExpirationMemberus-gaap:ForeignCountryMember2025-12-310000085961r:NoExpirationMemberus-gaap:ForeignCountryMember2024-12-310000085961r:DomesticAndForeignTaxJurisdictionMember2025-12-310000085961r:DomesticAndForeignTaxJurisdictionMember2024-12-3100000859612024-10-012024-12-310000085961us-gaap:OperatingLeaseLeaseNotYetCommencedMember2025-12-310000085961r:TradeReceivablesFinancingProgramMember2025-12-310000085961r:TradeReceivablesFinancingProgramMember2024-12-310000085961r:USCommercialPaperLongTermMember2025-12-310000085961r:USCommercialPaperLongTermMember2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm463Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm463Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm335Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm335Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm695Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm695Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.81And5.53Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.81And5.53Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm290Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm290Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm3.94And4.27Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm3.94And4.27Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm430Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm430Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.30Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.30Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm565Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm565Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm525Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm525Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm6.30Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm6.30Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.38Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.38Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.50Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm5.50Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.95Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.95Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.90Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm4.90Member2024-12-310000085961r:UnsecuredMediumTermNoteIssuedFebruary2025Member2025-12-310000085961r:UnsecuredMediumTermNoteIssuedFebruary2025Member2024-12-310000085961r:UnsecuredMediumTermNoteIssuedMay2025Member2025-12-310000085961r:UnsecuredMediumTermNoteIssuedMay2025Member2024-12-310000085961r:UnsecuredMediumTermNoteIssuedNovember2025Member2025-12-310000085961r:UnsecuredMediumTermNoteIssuedNovember2025Member2024-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm6.60Member2025-12-310000085961r:UnsecuredUSNotesMediumTermNotesLongTerm6.60Member2024-12-310000085961r:UnsecuredUSObligationsPrincipallyBankTermLoansLongTermMember2025-12-310000085961r:UnsecuredUSObligationsPrincipallyBankTermLoansLongTermMember2024-12-310000085961r:AssetBackedUSObligationsMember2025-12-310000085961r:AssetBackedUSObligationsMember2024-12-310000085961r:FinanceLeaseObligationAndOtherMember2025-12-310000085961r:FinanceLeaseObligationAndOtherMember2024-12-310000085961us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2024-12-310000085961us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2025-12-310000085961us-gaap:MediumTermNotesMember2025-01-012025-12-310000085961r:USAndForeignTermLoanMember2025-01-012025-12-310000085961us-gaap:RevolvingCreditFacilityMember2025-12-310000085961r:TradeReceivablesFinancingProgramMember2025-12-310000085961us-gaap:LetterOfCreditMemberr:TradeReceivablesProgramMember2025-12-310000085961us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2025-01-012025-12-310000085961us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2025-01-012025-12-310000085961us-gaap:RevolvingCreditFacilityMember2025-01-012025-12-310000085961us-gaap:LetterOfCreditMember2025-12-310000085961r:TradeReceivablesFinancingProgramMembersrt:MinimumMember2025-01-012025-12-310000085961r:TradeReceivablesFinancingProgramMembersrt:MaximumMember2025-01-012025-12-310000085961r:TradeReceivablesFinancingProgramMemberus-gaap:SecuredOvernightFinancingRateSofrMember2025-01-012025-12-310000085961r:TradeReceivablesFinancingProgramMemberr:CommercialPaperYieldRateMember2025-01-012025-12-310000085961r:TradeReceivablesFinancingProgramMember2025-09-300000085961r:A2025AntiDilutiveProgramMemberus-gaap:CommonStockMember2025-12-310000085961r:October2025DiscretionaryProgramMemberus-gaap:CommonStockMember2025-12-310000085961r:October2025DiscretionaryProgramMemberus-gaap:CommonStockMember2025-01-012025-12-310000085961r:A2025AntiDilutiveProgramMember2025-01-012025-12-310000085961r:A2025AntiDilutiveProgramMember2024-01-012024-12-310000085961r:A2025AntiDilutiveProgramMember2023-01-012023-12-310000085961r:A2023AntiDilutiveProgramMember2025-01-012025-12-310000085961r:A2023AntiDilutiveProgramMember2024-01-012024-12-310000085961r:A2023AntiDilutiveProgramMember2023-01-012023-12-310000085961r:A2021AntiDilutiveProgramMember2025-01-012025-12-310000085961r:A2021AntiDilutiveProgramMember2024-01-012024-12-310000085961r:A2021AntiDilutiveProgramMember2023-01-012023-12-310000085961r:AntiDilutiveProgramsMember2025-01-012025-12-310000085961r:AntiDilutiveProgramsMember2024-01-012024-12-310000085961r:AntiDilutiveProgramsMember2023-01-012023-12-310000085961r:October2025DiscretionaryProgramMember2025-01-012025-12-310000085961r:October2025DiscretionaryProgramMember2024-01-012024-12-310000085961r:October2025DiscretionaryProgramMember2023-01-012023-12-310000085961r:October2024DiscretionaryProgramMember2025-01-012025-12-310000085961r:October2024DiscretionaryProgramMember2024-01-012024-12-310000085961r:October2024DiscretionaryProgramMember2023-01-012023-12-310000085961r:October2023DiscretionaryProgramMemberMember2025-01-012025-12-310000085961r:October2023DiscretionaryProgramMemberMember2024-01-012024-12-310000085961r:October2023DiscretionaryProgramMemberMember2023-01-012023-12-310000085961r:February2023DiscretionaryProgramMember2025-01-012025-12-310000085961r:February2023DiscretionaryProgramMember2024-01-012024-12-310000085961r:February2023DiscretionaryProgramMember2023-01-012023-12-310000085961r:DiscretionaryProgramsMember2025-01-012025-12-310000085961r:DiscretionaryProgramsMember2024-01-012024-12-310000085961r:DiscretionaryProgramsMember2023-01-012023-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-01-012025-12-310000085961us-gaap:AccumulatedTranslationAdjustmentMember2025-12-310000085961us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-12-310000085961us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-12-310000085961r:NonvestedStockMember2025-01-012025-12-310000085961r:NonvestedStockMember2024-01-012024-12-310000085961r:NonvestedStockMember2023-01-012023-12-310000085961r:StockOptionAndStockPurchasePlanMember2025-01-012025-12-310000085961r:StockOptionAndStockPurchasePlanMember2024-01-012024-12-310000085961r:StockOptionAndStockPurchasePlanMember2023-01-012023-12-310000085961us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-12-310000085961us-gaap:RestrictedStockUnitsRSUMember2025-12-310000085961srt:DirectorMember2025-01-012025-12-310000085961r:TimeVestedMemberus-gaap:RestrictedStockMember2024-12-310000085961r:PerformanceBasedVestedMemberDomainus-gaap:RestrictedStockMember2024-12-310000085961r:TimeVestedMemberus-gaap:RestrictedStockMember2025-01-012025-12-310000085961r:PerformanceBasedVestedMemberDomainus-gaap:RestrictedStockMember2025-01-012025-12-310000085961r:TimeVestedMemberus-gaap:RestrictedStockMember2025-12-310000085961r:PerformanceBasedVestedMemberDomainus-gaap:RestrictedStockMember2025-12-310000085961us-gaap:StockOptionMember2025-01-012025-12-310000085961r:EmployeeStockPurchasePlanMember2025-12-310000085961srt:MinimumMemberr:EmployeeStockPurchasePlanMember2025-01-012025-12-310000085961srt:MaximumMemberr:EmployeeStockPurchasePlanMember2025-01-012025-12-310000085961r:EmployeeStockPurchasePlanMember2024-12-310000085961r:EmployeeStockPurchasePlanMember2023-12-310000085961r:CompanyAdministeredPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-09-300000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-04-012025-04-300000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-04-300000085961us-gaap:ForeignPlanMember2025-12-310000085961us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2024-12-310000085961us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2025-12-310000085961r:CompanyAdministeredPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000085961r:CompanyAdministeredPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000085961r:CompanyAdministeredPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2025-01-012025-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2024-01-012024-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2023-01-012023-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2025-01-012025-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2024-01-012024-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberr:CompanyAdministeredPlanMember2023-01-012023-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000085961country:USus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000085961us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000085961us-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:PensionPlansDefinedBenefitMember2023-12-310000085961us-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000085961us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000085961us-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961country:US2025-12-310000085961country:US2024-12-310000085961us-gaap:ForeignPlanMember2024-12-310000085961r:DefinedBenefitPlanEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2025-12-310000085961r:DefinedBenefitPlanFixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2025-12-310000085961r:DefinedBenefitPlanFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2025-12-310000085961us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2025-12-310000085961r:DefinedBenefitPlanHedgeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2025-12-310000085961r:BulkAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2025-12-310000085961us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000085961r:DefinedBenefitPlanEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanEquityFundsMember2024-12-310000085961r:DefinedBenefitPlanFixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeFundsMember2024-12-310000085961r:DefinedBenefitPlanFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanFixedIncomeSecuritiesMember2024-12-310000085961us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2024-12-310000085961r:DefinedBenefitPlanHedgeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:DefinedBenefitPlanHedgeFundsMember2024-12-310000085961r:BulkAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberr:BulkAnnuityContractMember2024-12-310000085961us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000085961us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000085961us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000085961us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2025-12-310000085961us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2024-12-310000085961r:CardinalLogisticsMember2024-02-010000085961r:CardinalLogisticsMemberus-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-02-010000085961r:CardinalLogisticsMemberus-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-02-010000085961r:RetailMobileCommercialFleetMaintenanceBusinessMemberr:FleetManagementSolutionsMember2024-01-012024-12-310000085961r:IFSInvestmentsILLCMember2023-11-012023-11-010000085961r:IFSInvestmentsILLCMember2023-11-010000085961r:IFSInvestmentsILLCMemberus-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-11-010000085961r:IFSInvestmentsILLCMemberus-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K | | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2025

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-4364

RYDER SYSTEM, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Florida | | 59-0739250 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2333 Ponce de Leon Blvd., Suite 700 | | (305) | 500-3726 |

Coral Gables, Florida 33134 | |

| (Address of principal executive offices, including zip code) | | (Telephone number, including area code) |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol(s) | Name of exchange on which registered |

| Ryder System, Inc. Common Stock ($0.50 par value) | R | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the common equity was sold at June 30, 2025 was $6.3 billion. The number of shares of Ryder System, Inc. Common Stock outstanding at January 31, 2026 was 39,427,204.

| | | | | | | | |

| Documents Incorporated by Reference into this Report | | Part of Form 10-K into which Document is Incorporated |

Ryder System, Inc. 2025 Proxy Statement | | Part III |

RYDER SYSTEM, INC.

FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

OVERVIEW

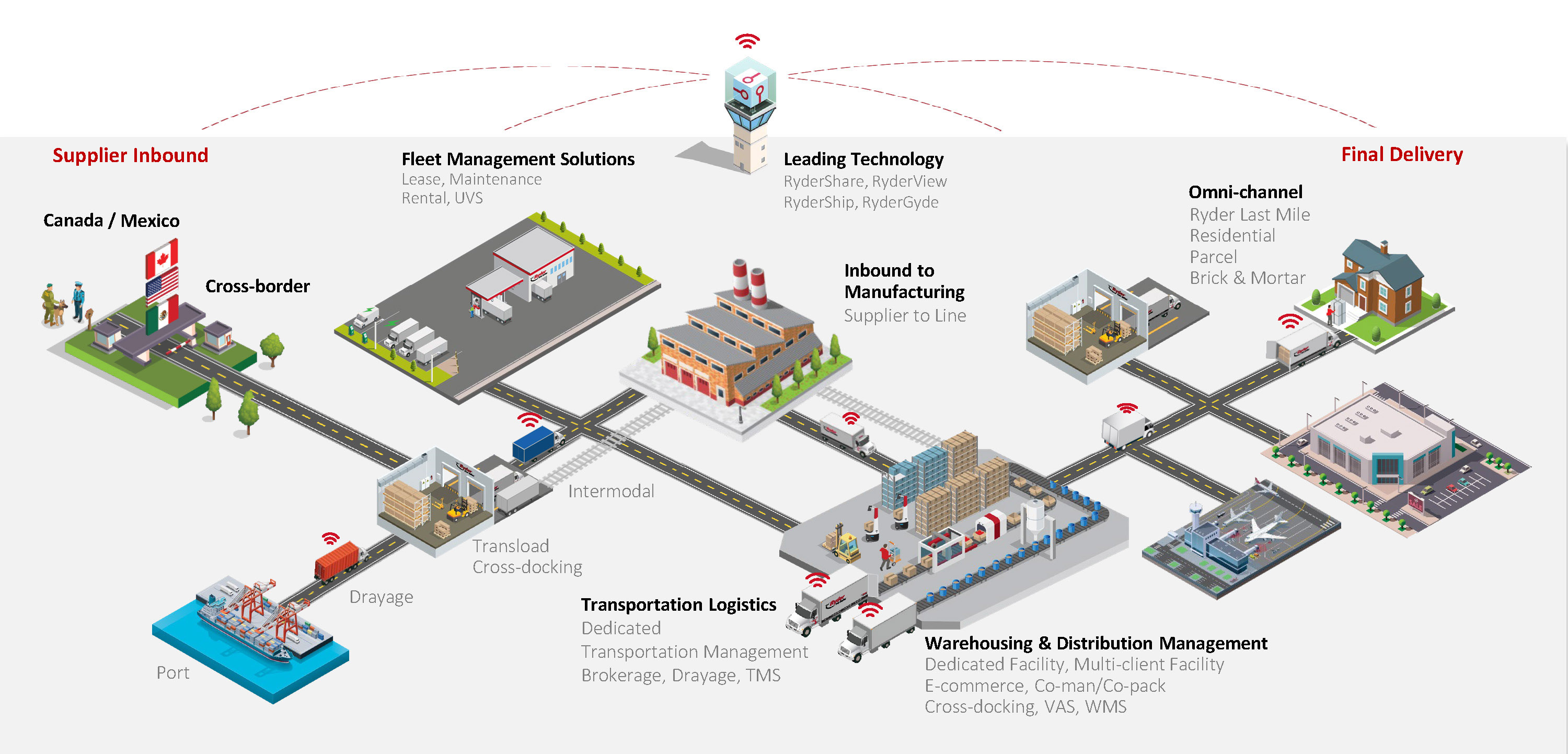

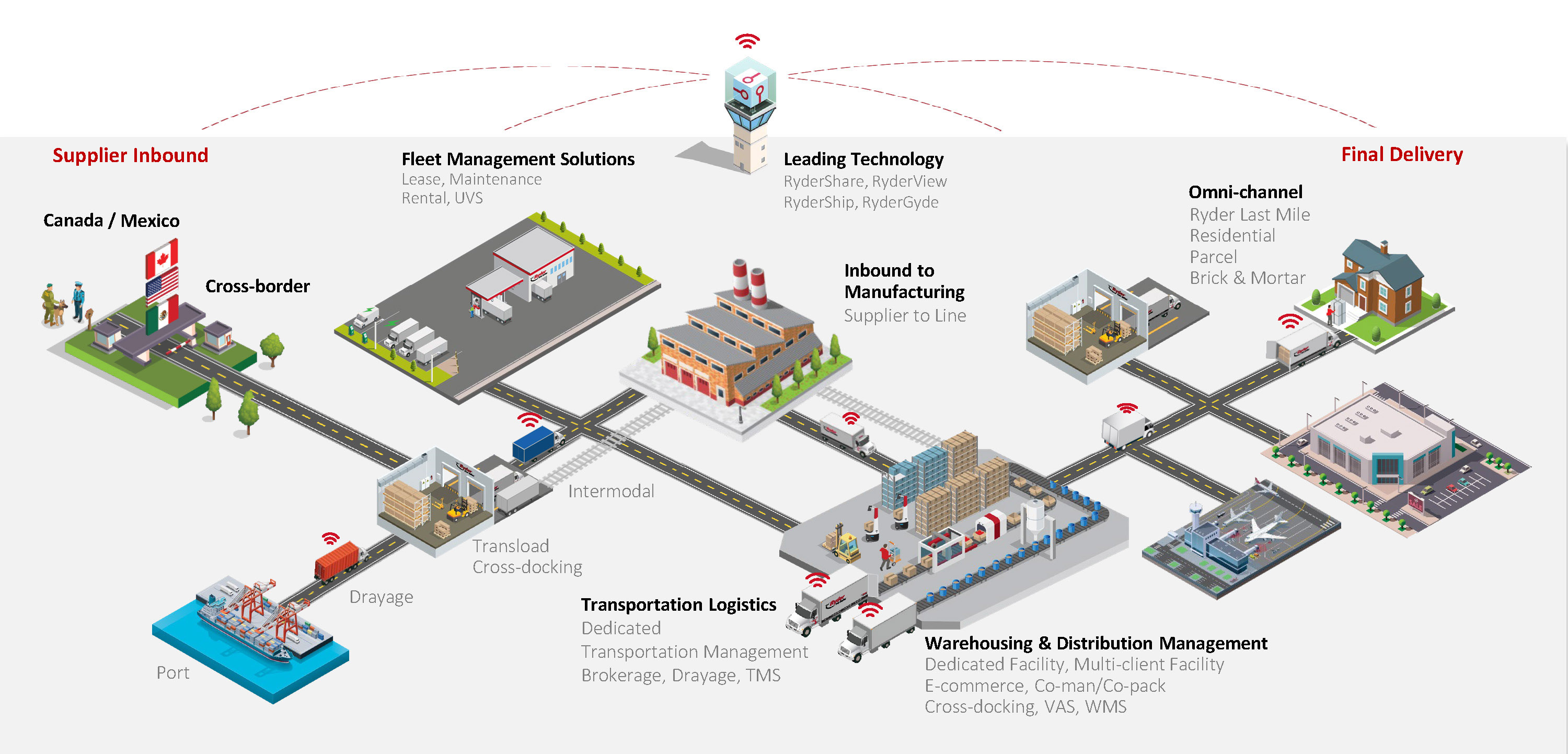

Ryder System, Inc. (Ryder) is a leading provider of outsourced logistics and transportation services throughout North America. We offer port‑to‑door solutions that integrate every step of the supply chain, including international inbound flows and cross‑border logistics, fleet and transportation management, warehousing, manufacturing support and multi-channel final delivery. Our complementary business segments provide a broad range of value-added solutions, which provides our customers with a seamless, end‑to‑end logistics network designed to reduce complexity and improve speed, reliability and efficiency across the entire flow of goods. Ryder connects every link in the supply chain, moving products smoothly from ports and suppliers all the way to customers’ doorsteps as illustrated below.

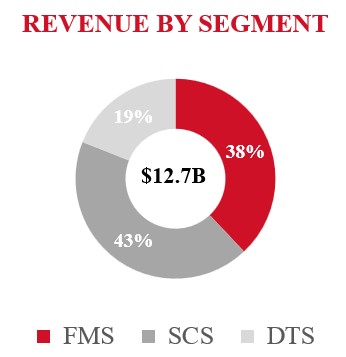

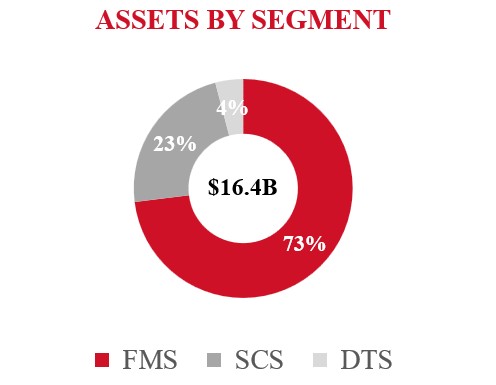

We report our financial performance based on three business segments: (1) Fleet Management Solutions (FMS), which provides full service leasing, commercial rental and vehicle maintenance services; (2) Supply Chain Solutions (SCS), which provides fully integrated logistics solutions; and (3) Dedicated Transportation Solutions (DTS), which provides turnkey transportation solutions, including dedicated vehicles, professional drivers, management and administrative support. Dedicated transportation services provided as part of an operationally integrated, multi-service supply chain solution to SCS customers are primarily reported in the SCS business segment.

___________________

As of and for the year ended December 31, 2025. FMS total revenue includes eliminations

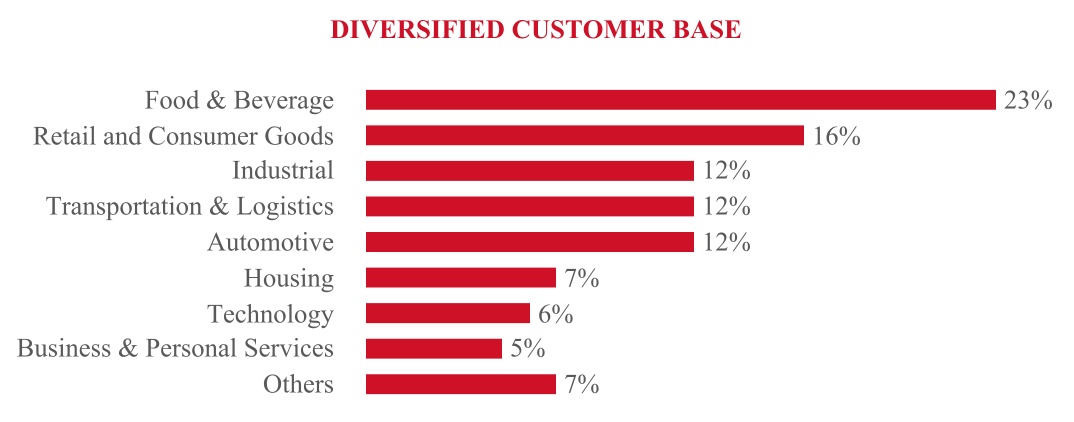

We operate in highly competitive markets. Our customers select us based on numerous factors including service quality, price, technology and service offerings. As an alternative to using our services, customers may choose to provide these services themselves or obtain similar services from other third parties. Our customer base reflects a variety of industries as shown below (as a percentage of operating revenue - a non-GAAP measure):

Further information on our business and business segments is presented in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations", and in Note 3, "Segment Reporting" of the Notes to Consolidated Financial Statements included in Part II, Item 8, "Financial Statements and Supplementary Data" in this Annual Report.

MISSION AND STRATEGY

Ryder's mission is to responsibly deliver innovative supply chain and transportation solutions that are reliable, safe and efficient, enabling our customers to deliver on their promises. Companies performing their own logistics and transportation services face increasing challenges related to dynamic supply chains, disruptive technologies, labor shortages, government regulation and increased vehicle cost and complexity. We offer the most comprehensive port-to-door solutions and transportation services in North America to help solve many of the challenges facing companies today. We have a balanced growth strategy focused on de-risking and optimizing the business model, enhancing returns and free cash flow, and driving long-term profitable growth. We aim to achieve this by growing with existing customers and new prospects who internally manage their supply chain services. The current phase of our balanced growth strategy is driven by three priorities: (i) create value through operational excellence, (ii) invest in customer-centric innovation, and (iii) further improve full-cycle returns and generate profitable growth. We seek to execute our strategy by:

•leveraging secular trends that favor outsourcing logistics and transportation services;

•offering market leading end-to-end supply chain solutions in North America;

•growing earnings from our contractual lease, dedicated and supply chain businesses;

•continuously improving productivity and processes;

•investing in customer-centric innovations that differentiate and enhance our solutions;

•attracting, developing and retaining the best talent; and

•executing our disciplined capital allocation priorities, including organic growth, targeted acquisitions and strategic investments, and returning capital to shareholders.

INDUSTRY AND OPERATIONS | | | | | | | | | | | | | | |

| Fleet Management Solutions |

Value Proposition

Our FMS business provides a variety of fleet solutions that are designed to improve our customers' competitive positions. By outsourcing their needs to us, our customers can focus on their core business, improve their efficiency and productivity and lower their costs. Our FMS product offerings include contract terms with full service leasing, as well as leasing with flexible maintenance options; commercial vehicle rental; maintenance services; digital and technology support services that optimize asset performance, compliance, and safety; and comprehensive fuel services. In addition, our customers are able to purchase used trucks, tractors and trailers through our used vehicle sales facilities or our digital channel. FMS also provides vehicles, as well as maintenance, fuel and other services, to our SCS and DTS businesses. FMS operates one of the leading full service leasing, commercial rental and contract maintenance businesses in North America.

Market Trends

The U.S. commercial fleet market is estimated to include approximately 11 million vehicles, of which 5 million are privately owned by companies, 2 million are for-hire carriers, 1 million are leased from banks or other financial institutions, 1 million are part of utilities and government fleets, and 1 million are being leased or rented from third parties like Ryder.1

Companies that privately own their fleets are generally providing fleet management services themselves rather than outsourcing those services to third parties like Ryder. Over the last few years, several trends have emerged that we believe increase the value of our product offerings and will increasingly lead companies with privately held fleets to outsource. These trends include:

•Demand for efficient and reliable vehicles have caused companies to place greater emphasis on the quality of their preventive maintenance and safety programs;

•Maintaining and operating commercial vehicles has become more complex and expensive, as truck technology must comply with increasing state and federal emissions regulations;

•Companies must also manage global supply chain and labor challenges, as well as volatile used vehicle markets; and

•The cost and total capital required for owning vehicles continues to rise with every technological change requiring increasing cash outlays.

Operations

In 2025, our global FMS business accounted for 38% of our consolidated revenue.

Our FMS customers range from small businesses to large enterprises operating in a variety of industries. As of December 31, 2025, we had 789 operating locations, excluding ancillary storage locations, in 49 states, the District of Columbia, Puerto Rico and seven Canadian provinces. Our operating locations serve multiple customers, and typically include maintenance facilities; service islands for fueling; sales and administrative offices; and commercial rental vehicle counters. As of December 31, 2025, 20% of our operating locations are at customer sites where we provide vehicle maintenance solely for that customer's fleet.

FMS Product Offerings

ChoiceLease. Our lease offering provides customers with bundled vehicle and maintenance services while our customers furnish and supervise their own drivers and exercise control over the vehicles. Customers are able to select the terms of their lease and their preferred level of maintenance services, from full service to on-demand maintenance.

Our ChoiceLease customers receive the following benefits:

•Competitive Prices as we leverage our vehicle buying power to benefit our customers. Once we have an executed customer agreement, we acquire vehicles and components that are custom engineered to our customer's requirements

(1) U.S. Fleet as of December 2024, Class 3-8, Polk/S&P Registration Data.

and lease such vehicles to them for periods generally ranging three to seven years for trucks and tractors and ten years for trailers;

•Extensive Network of Maintenance Facilities and Trained Technicians for vehicle maintenance and repairs, temporary substitute vehicles and 24-hour emergency roadside service;

•Preventive and Flexible Maintenance Programs that are cost-effective and designed to reduce vehicle downtime;

•Access to Lease Vehicles as we leverage our original equipment manufacturer (OEM) relationships to secure access to vehicles. Once we have a signed agreement with the customer, we acquire vehicles that are engineered to the customer's requirements;

•No Vehicle Residual Risk Exposure as we typically retain vehicle residual risk exposure;

•Fleet Support Services, including services related to fuel, safety, fuel tax reporting, permitting and licensing, certain regulatory compliance and physical damage coverage; and

•Digital Fleet Management Platform, RyderGyde™ available in a mobile application or at ryder.com®, that enables our customers to manage their fleets.

During 2025, ChoiceLease revenue accounted for 60% of our FMS total revenue.

Commercial Rental. We offer rental vehicles to customers that need to supplement their fleets on a short-term basis to handle seasonal increases or discrete projects. ChoiceLease customers also utilize our commercial rental fleet as substitute vehicles while their lease vehicles undergo maintenance and while they await delivery of new lease vehicles. Although our commercial rental business is transactional in nature, we focus on building long-term relationships with customers to become their preferred source for commercial vehicle rentals. In addition, we also provide other benefits, including extending auto-liability insurance coverage and competitive fuel pricing. During 2025, commercial rental revenue accounted for 16% of our FMS total revenue.

SelectCare. Through SelectCare, customers have access to our extensive network of maintenance facilities and trained technicians to maintain the vehicles they own or lease from third parties. We offer several bundles of services, including full service contract maintenance, as well as preventive and on-demand maintenance. We also offer on-demand retail mobile maintenance in select U.S. markets that enables our customers to order on-site maintenance services with no long-term contractual commitment through our Torque by Ryder™ service offering. While we typically service these vehicles at our own facilities, we also operate on-site maintenance facilities or provide mobile maintenance services at customer locations.

We also provide additional maintenance and repair services that are not included in our contractual maintenance programs and generally charge for those services on an hourly basis. By servicing all of our customers' maintenance needs, we create stronger, long-term relationships and can provide a wide range of outsourcing solutions.

During 2025, SelectCare revenue accounted for 12% of our FMS total revenue.

The following table provides information regarding the number of vehicles and customers by FMS product offering: | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | December 31, 2025 |

| | | | | | | | | | | Vehicles | | Customers |

| ChoiceLease | | | | | | | | | | 141,700 | | 11,700 |

Commercial rental (1) | | | | | | | | | | 31,600 | | 27,200 |

SelectCare (2) | | | | | | | | | | 44,100 | | 1,700 |

___________________

(1)Commercial rental customers represent those who rented a vehicle for more than three days during the year and include 5,000 ChoiceLease customers.

(2)Our SelectCare customers include approximately 1,000 ChoiceLease customers.

Fuel Services. Our FMS customers have access to competitively priced diesel fuel at 401 of our maintenance facilities across the U.S. and Canada. We also provide services such as fuel planning, fuel tax reporting, centralized billing, fuel cards and fuel monitoring. Although fuel sales do not significantly impact our FMS earnings, as the costs are largely a pass-through to our customers, we believe that leveraging our fuel buying power provides a valuable benefit to our customers. During 2025, fuel services revenue accounted for 12% of our FMS total revenue.

Used Vehicles. We offer used vehicles from our 61 retail sales centers throughout the U.S. and Canada (23 of which are co-located at an FMS shop), at our branch locations and through our website at www.ryder.com/used-trucks. We primarily sell our used vehicles through our retail channel, which allows us to leverage our maintenance expertise and strong brand reputation, and to realize higher sales proceeds than in the wholesale market. The realized sales proceeds of used vehicles are dependent upon various factors, including the used vehicle market, supply and demand in wholesale and retail markets, and

changes in vehicle technology. In recent years, the used vehicle sales market has been particularly weak. At December 31, 2025, we have used vehicle inventory of 9,500 vehicles, slightly above our long-term target range of 7,000 to 9,000.

FMS Business Strategy

Our strategy is to be the leading provider of fleet management services for light-, medium- and heavy-duty commercial vehicles. Our strategy is driven by the following priorities:

•drive fleet growth that maximizes our return on investment by (1) implementing sales and marketing initiatives to encourage private fleets to outsource their fleet management needs to us, (2) reducing costs through operational efficiencies, and (3) offering innovative products, solutions and support services that strengthen customer relationships;

•deliver a consistent, industry-leading and cost-effective lease and maintenance program through continued process improvement, productivity initiatives and technology improvements, which also help us attract new customers; and

•optimize asset utilization and management, particularly with respect to our rental fleet, used vehicle operations and maintenance facility infrastructure.

Competition

As an alternative to using our fleet management services, companies may choose to provide these services themselves or to obtain them from other third parties. We compete with finance lessors, truck and trailer manufacturers and independent dealers. We also compete with other companies on factors such as price, geographic coverage, equipment, maintenance options, and service reliability and quality. We also face competition from managed maintenance providers who are hired to coordinate and manage the maintenance of large fleets through a network of independent maintenance providers.

Value Proposition

Our SCS business provides a broad range of innovative logistics management services that optimize our customers' supply chains and key business requirements. Our business is organized by the following industry verticals: omnichannel retail (which includes retail, technology, last mile and e-commerce); automotive; consumer packaged goods (CPG); and industrial and other (which includes healthcare). Our SCS product offerings provide port-to-door solutions, giving our customers end-to-end control from pickup at any North American port to final delivery, including both dedicated distribution and multi-client distribution, transportation management, dedicated transportation, brokerage, e-commerce, last mile, contract manufacturing and contract packing, and other value-added services. These services are available individually, in various combinations, or as part of a comprehensive integrated solution. Key aspects of our value proposition are our operational execution, leveraged assets and infrastructure, technical and industry expertise and customer-facing visibility platforms.

Market Trends

Logistics spending in the U.S. in the key target markets in which we operate was approximately $1.5 trillion, of which $234 billion was outsourced.2 As supply chains continue to expand and become more complex, the demand for outsourced logistics is expected to continue increasing as companies will require more sophisticated, cost-effective and reliable supply chain practices. For example, we believe secular trends continue to accelerate demand for supply chain resiliency, e-commerce fulfillment, final mile delivery of big and bulky goods, and onshoring and nearshoring of manufacturing and supply chain operations.

(2) Armstrong & Associates – Working Through the Uncertainty, Latest Third-Party Logistics Market Results and Outlook, June 2025.

Operations

During 2025, our SCS business accounted for 43% of our consolidated revenue, and our customer accounts and warehousing square footage were as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2025 | | |

(Square footage in millions) | | Customer Accounts (1) | | Number of Warehouses | | Square Footage (2) | | |

| | | | | | | | |

| United States | | 552 | | | 254 | | | 93 | | | |

Mexico and Canada (3) | | 170 | | | 65 | | | 12 | | | |

| Total | | 722 | | | 319 | | | 105 | | | |

___________________

(1)Customer accounts excludes 285 brokerage customers.

(2)Includes Ryder leased and owned and Ryder managed.

(3)Includes 17 managed warehouses in Mexico.

In the U.S., SCS customer accounts are mostly large enterprises with complex supply chains. Most of our core SCS business operations are strategically located to maximize efficiencies and reduce costs. For example, we centralize certain administrative support services, including our carrier procurement and contract management, in our logistics centers in Novi, Michigan and Fort Worth, Texas. In Mexico, we offer a full range of logistics services and manage approximately 23,600 border crossings each month between the U.S. and Mexico. Our Canadian operations are also highly coordinated with their U.S. and Mexico counterparts and manage approximately 5,000 border crossings each month.

SCS Product Offerings

Distribution Management. We offer a variety of logistics services for warehousing and transportation, including network design; warehouse design and automation; coordinating inbound and outbound material flow; managing import and export of international shipments; coordinating just-in-time replenishment of component parts and final assembly; shipment delivery to distribution centers or end delivery points; and e-commerce fulfillment. During 2025, distribution management and value-added services accounted for approximately 36% of our SCS total revenue.

Dedicated Transportation. We offer specialized dedicated transportation services as part of an integrated supply chain solution with our equipment and professional drivers or with outside carriers. We also offer additional services related to routing and scheduling, fleet design, safety, regulatory compliance, risk management, technology and communication systems support. We operate at our customers' facilities, and our customers benefit from our extensive network of FMS facilities that provide maintenance for all Ryder vehicles used in SCS solutions. During 2025, approximately 28% of our SCS total revenue was related to dedicated transportation services.

Transportation Management and Brokerage. We offer transportation management and brokerage services, including shipment optimization, load scheduling and delivery confirmation through a series of technology and web-based solutions. Our transportation consultants focus on carrier procurement for all modes of transportation, with an emphasis on truck-based transportation, and also provide additional services like rate negotiation, freight bill audits and payment services. During 2025, we purchased or executed $9.8 billion in freight moves on our customers' behalf, including $334 million in brokerage services. During 2025, transportation management solutions accounted for 12% of our SCS total revenue.

E-commerce and Last Mile. We offer omnichannel delivery services through a network of over 165 sites strategically located throughout the U.S. that we own or that are leased by us, our customers or our agents. For our e-commerce customers, we receive, pick, pack and ship smaller items via parcel carriers to the end consumer's home or to our customer's warehouse or retail stores. For our last mile customers, we receive, assemble and coordinate final delivery of big and bulky items to the end consumer. We also offer minor installation and disposal services. Customers also benefit from our proprietary software, RyderView 2.0™, that optimizes routes and allows customers to schedule their appointments. During 2025, our e-commerce and last mile services accounted for 18% of our SCS total revenue.

Contract Manufacturing and Contract Packaging. We offer contract manufacturing and contract packaging and warehousing, for some of the largest and best-known consumer brands in the U.S., primarily in the consumer packaged goods, retail, and healthcare industries. During 2025, our contract manufacturing and contract packaging services and other services accounted for 6% of our SCS total revenue.

SCS Business Strategy

Our strategy is to offer differentiated and proactive solutions utilizing expertise in our key industry verticals. Our strategy is driven by the following key priorities:

•provide best in class execution and quality through reliable and flexible supply chain solutions;

•develop innovative solutions, automation capabilities, and customer-centric technology such as RyderShare™, RyderView 2.0™ and RyderShip™;

•focus consistently on network optimization and continuous improvement;

•execute on targeted sales and marketing growth strategies; and

•expand product offerings to complement port-to-door solutions.

Competition

As an alternative to using our services, companies may choose to internally manage their own supply chains and logistics operations, or obtain alternative services from other third parties. We compete with a few large, multi-service companies across all of our product offerings and industries, as well as with other companies on specific service offerings like transportation or distribution management. We compete based on factors such as price, service offerings, market knowledge, expertise in logistics-related technology and overall performance (e.g., timeliness, accuracy and flexibility).

| | | | | | | | | | | | | | |

| Dedicated Transportation Solutions |

Value Proposition

Our DTS business provides specialized dedicated transportation services. We provide our customers with vehicles and professional drivers, and offer a variety of engineering and other services related to routing and scheduling, fleet design, safety, regulatory compliance, risk management and technology and communication systems support. Our customers benefit from a dedicated transportation solution that mitigates the labor and regulatory challenges associated with maintaining a private fleet, such as driver recruitment and retention, hours of service requirements, Department of Transportation (DOT) audits and workers' compensation.

Market Trends

The outsourced U.S. dedicated market was estimated to be $31 billion3 from an addressable market of approximately $500 billion.4 Many of the same trends that impact our FMS business affect our DTS business. As operating and maintaining a private fleet becomes more complex, especially as companies must comply with increasing DOT regulations, we expect the demand for outsourced dedicated services to increase. In addition, there is still significant demand for qualified truck drivers, dedicated capacity from quality transportation and logistics providers, and industry expertise related to asset utilization analysis and fleet rationalization studies offered as part of our DTS services.

Operations/Product Offerings

During 2025, our DTS business accounted for 18% of our consolidated revenue. As of December 31, 2025, we had 210 DTS customer accounts in the U.S. Although a significant portion of our DTS operations are located at customer facilities, our DTS business also utilizes and benefits from our FMS services, including our extensive network of FMS maintenance facilities. Our DTS accounts typically operate in a limited geographic area for short-haul drives.

We provide custom transportation analysis using advanced logistics planning and operating tools. Based on this analysis, our logistics specialists create a distribution system that optimizes freight flow while meeting customer service goals. If a distribution system includes multiple modes of transportation (air, rail, sea and highway), we select appropriate transportation modes and carriers, and monitor and audit carrier performance. In addition, customers from our SCS business that utilize our dedicated transportation services benefit from our cost-effective solutions that help aggregate loads, consolidate shipments or optimize backhaul opportunities.

(3) Armstrong & Associates – Working Through the Uncertainty, Latest Third-Party Logistics Market Results and Outlook, June 2025.

(4) Addressable market as of December 2024, Class 3-8, IHS Markit Ltd. (formerly RL Polk) & Ryder Internal Estimates.

DTS Business Strategy

Our strategy is to offer custom solutions to customers who need specific vehicles, specialized handling, dedicated capacity or integrated transportation services. Our strategy is driven by the following key priorities:

•increase market share to provide more specialized services across industries, including retail, metals, agriculture and grocery, energy and utility, consumer product goods, construction and food and beverage;

•develop innovative solutions, capabilities, and customer-centric technology such as RyderShare™;

•leverage our FMS sales team to convince private fleet operators to outsource their transportation needs to us;

•focus consistently on network optimization and continuous improvement; and

•recruit and retain professional drivers.

Competition

We compete with other dedicated providers to provide highly engineered solutions, involving specialized handling or service requirements. To a lesser extent, we also compete with truckload carriers providing dedicated solutions for standard freight. We compete based on a number of factors, including price, equipment options and features, maintenance, service and geographic coverage, driver availability and operational expertise. As an alternative to using our services, companies may choose to manage their own private fleets or obtain alternative services from other third-party vendors. We differentiate our product offering by leveraging our FMS vehicles and maintenance services and integrating our services with those of our SCS business to create a more comprehensive transportation solution. Our strong safety record and focus on customer service also enables us to uniquely satisfy our customers' needs with high-value products that require specialized handling in a manner that differentiates us from truckload carriers.

CYCLICALITY

Our business is impacted by economic and market conditions. In a strong economic environment, there is generally more demand for our services. In a weak or volatile economy, demand for our services decreases and becomes more unpredictable. To mitigate this volatility, we have taken significant steps over recent years and continue to focus on diversifying our contractual business mix and strengthening our long-term customer relationships. Although we believe these efforts help lessen the immediate impact of an economic downturn, companies are often unwilling to commit to a full service lease or long-term supply chain and dedicated contracts. Our commercial rental and used vehicle sales businesses are transactional and more susceptible to economic and market conditions, which can significantly impact their results in both the short- and long-term. We mitigate some of the potential impact of an economic downturn through a disciplined and centralized approach to asset management. We strive to manage the size, mix and location of our operating fleet and used vehicle inventories to maximize asset utilization and used vehicle proceeds in both strong and weak market conditions.

SEASONALITY

Historically, our lease and related maintenance revenues, DTS service revenues and most of our SCS service revenues have not been impacted by seasonality because of the long-term nature of the underlying customer contracts and the associated fixed charges. However, our rental revenue and certain SCS service revenues are seasonal in nature.

Commercial rental operations are seasonal and generate the lowest revenue of the year typically in the first quarter due to lower market demand and the highest revenue typically in the third and fourth quarters. We generally decrease or increase the size of our rental fleet throughout the year to mitigate the seasonal effect of demand as well as changing economic conditions. As demand changes because of seasonal factors, we also move our rental vehicles among our locations.

Some of our SCS customers tend to operate in seasonal industries. Because of the concentration of customers in our SCS business, we experience reduction in freight volume shipped by those customers or a reduction in their need for our services from time to time. We actively monitor and shift resources to mitigate these seasonal effects.

REGULATION

Our business is subject to laws and regulations in the jurisdictions in which we operate and is regulated by various agencies, including the U.S. Department of Transportation (DOT), Department of Agriculture (USDA), Department of Health and Human Services (HHS), Department of Homeland Security (DHS), Department of Labor (DOL), Occupational Safety and Health Administration (OSHA), and Environmental Protection Agency (EPA), amongst others. The Federal Motor Carrier

Safety Administration (FMCSA), an agency within the DOT, manages the Compliance, Safety, Accountability program (CSA), designed to monitor and improve commercial vehicle motor safety. The FMCSA also has regulations mandating electronic logging devices in commercial motor vehicles that impact various aspects of our dedicated, supply chain and rental businesses.

We must comply with licensing and other requirements imposed by the DHS, and our supply chain security program is certified by the U.S. Customs and Border Protection Customs-Trade Partnership Against Terrorism certification, Canada’s Partners in Protection program, and Mexico’s Authorized Economic Operator program. We may also become subject to new or more restrictive laws and regulations related to emissions or vehicle specifications, drivers' hours of service, wage and hour requirements, employee and independent contractor classification, security, including data privacy and cybersecurity, and ergonomics.

Additional information about the laws and regulations that we are subject to can be found in Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

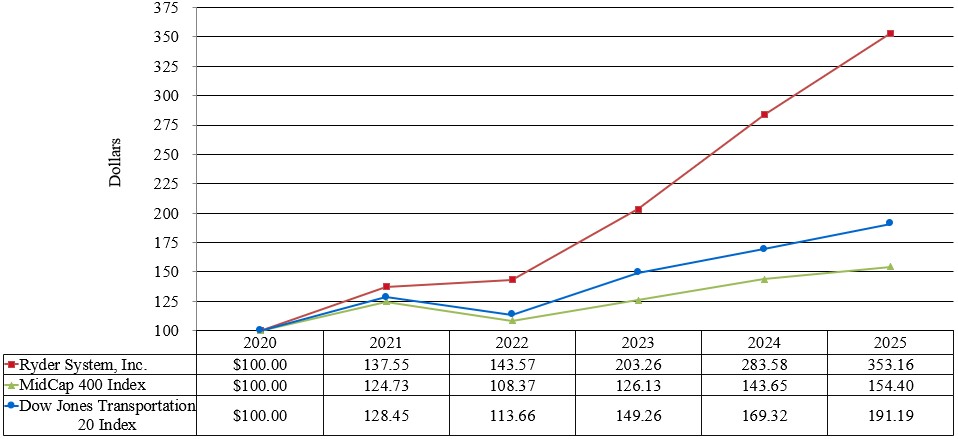

HUMAN CAPITAL