UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

April 29, 2025

Dear Stockholder:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders of Horizon Kinetics Holding Corporation, which will be held both virtually via the Internet at http://www.virtualshareholdermeeting.com/HKHC2025 and in person at the offices of Vinson & Elkins L.L.P., located at 1114 Avenue of the Americas, 32nd Floor, New York, New York 10036, on Tuesday, June 17, 2025, at 2:00 p.m., Eastern Time. The official Notice of Annual Meeting together with a proxy statement and proxy card are enclosed. Please give this information your careful attention.

We invite all stockholders to attend the meeting. Whether or not you expect to attend the Annual Meeting, we urge you to complete, sign, date and promptly return the accompanying proxy card in the enclosed postage-paid envelope or vote by Internet by following the instructions in the Notice of Annual Meeting to ensure your representation at the meeting. You can revoke your proxy at any time before it is voted by delivering written notice to our General Counsel and Secretary at our principal executive office, by signing and mailing to us a proxy card bearing a later date, by changing your vote by Internet (if you voted by Internet), or by attending the meeting and voting then.

Sincerely,

/s/Murray Stahl

Murray Stahl

Chairman of the Board, Chief Executive Officer and Chief Investment Officer

HORIZON KINETICS HOLDING CORPORATION

470 PARK AVENUE S. • NEW YORK, NEW YORK 10016 • T. (646) 291-2300 • https://hkholdingco.com/

TABLE OF CONTENTS

i

ii

HORIZON KINETICS HOLDING CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2025

To the Stockholders of Horizon Kinetics Holding Corporation:

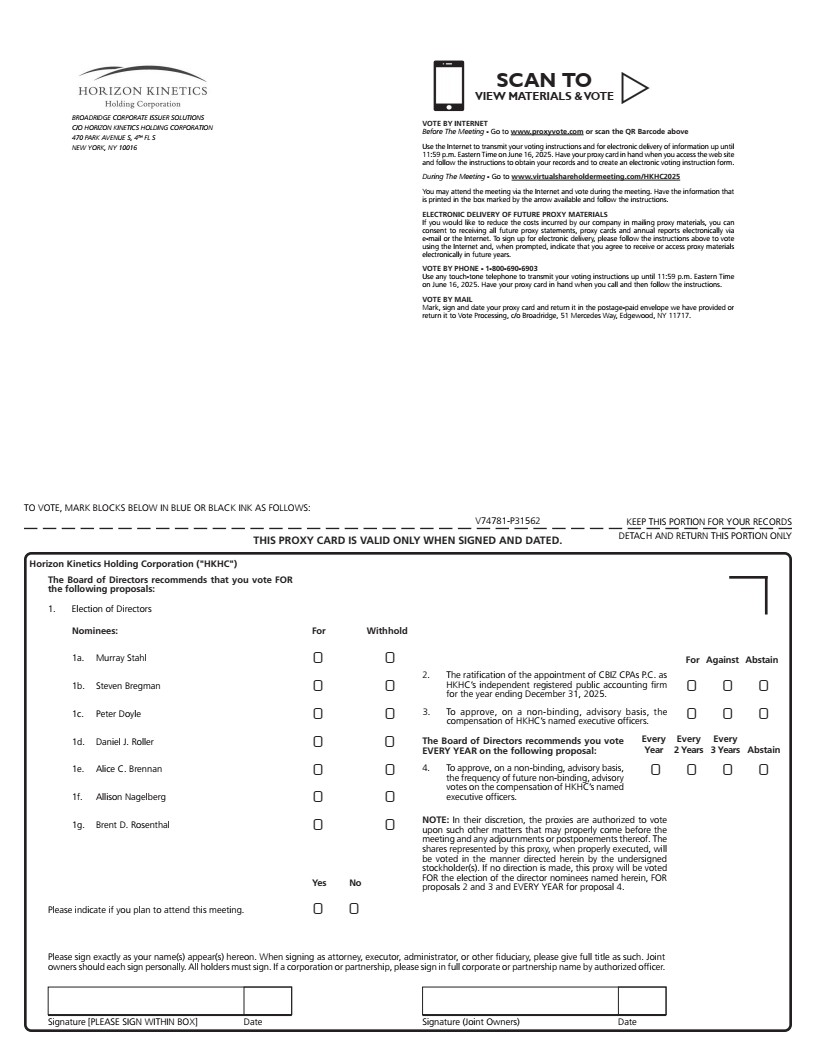

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Horizon Kinetics Holding Corporation ("HKHC," the "Company," "we," "us" or "our") will be held both virtually via the Internet at http://www.virtualshareholdermeeting.com/HKHC2025 and in person at the offices of Vinson & Elkins L.L.P., located at 1114 Avenue of the Americas, 32nd Floor, New York, New York 10036, on Tuesday, June 17, 2025, at 2:00 p.m., Eastern Time, to consider and vote on the following proposals:

|

|

Proposal |

Board Recommendation |

|

Proposal 1. |

The election of seven directors to hold office until the next annual meeting of HKHC's stockholders and until their successors have been duly elected and qualified or until their earlier death, resignation or removal; |

FOR ALL NOMINEES |

|

Proposal 2. |

The ratification of the appointment of CBIZ CPAs P.C. as HKHC's independent registered public accounting firm for the year ending December 31, 2025; |

FOR |

|

Proposal 3. |

To approve, on a non-binding, advisory basis, the compensation of HKHC's named executive officers; and |

FOR |

|

Proposal 4. |

To approve, on a non-binding, advisory basis, the frequency of future non-binding, advisory votes on the compensation of HKHC's named executive officers. |

EVERY YEAR |

In addition, we will consider the transaction of such other business as may properly come before the meeting or at any adjournments or postponements.

The foregoing items of business are more fully described in the attached proxy statement.

Only stockholders of record at the close of business on May 1, 2025, are entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof. A holder of shares of our common stock as of the record date is entitled to one vote at the meeting or by proxy for each share of common stock owned by such holder on all matters properly brought before the annual meeting or at any adjournments or postponements.

All of our stockholders are invited to attend the annual meeting. Whether or not you expect to attend the annual meeting, we urge you to complete, sign, date and promptly return the accompanying proxy card in the enclosed postage-paid envelope to assure your representation at the meeting. You may also vote by Internet at http://www.virtualshareholdermeeting.com/HKHC2025 using the control number shown on your proxy card or voting instruction card. You can revoke your proxy at any time before it is voted by delivering written notice to our General Counsel and Secretary at our principal executive office located at 470 Park Ave S., New York, New York 10016, by signing and mailing to us a proxy bearing a later date, by changing your vote by Internet (if you voted by Internet), or by attending the annual meeting and voting then.

iii

If you are the beneficial owner of shares of our common stock held in street name, you will receive voting instructions from your broker, bank or other nominee (who must be the stockholder of record). The voting instructions will provide details regarding how to vote these shares. Additionally, you may vote these shares at the annual meeting if you have requested and received a legal proxy from your broker, bank, or other nominee giving you the right to vote the shares at the annual meeting and you complete the legal proxy and present it to us electronically at the annual meeting. If you hold your shares in street name, nominees will not have discretion to vote these shares on the election of directors, the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, or the approval, on a non-binding, advisory basis, of the frequency of future non-binding, advisory votes on the compensation of our named executive officers. Accordingly, if your shares are held in street name and you do not submit voting instructions to your broker, bank, or other nominee, these shares will not be counted in determining the outcome on Proposals 1, 3, and 4 set forth in this proxy statement at the annual meeting. If you hold your shares in street name, we encourage you to provide voting instructions to your broker, bank, or other nominee so that your voice is heard on these proposals.

We expect to mail this proxy statement and the accompanying proxy card to our stockholders on or about May 7, 2025.

iv

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding Internet Availability of Proxy Materials for the

Stockholder Meeting to be Held on June 17, 2025

The proxy materials for the Company's Annual Meeting of Stockholders, including the 2024 Annual Report to Stockholders, the Proxy Statement and any other additional soliciting materials, are available over the Internet by accessing our website at www.hkholdingco.com. Other information on our website does not constitute part of the Company's proxy materials.

By Order of the Board of Directors

Horizon Kinetics Holding Corporation

/s/Murray Stahl

Murray Stahl

Chairman of the Board, Chief Executive Officer and Chief Investment Officer

v

HORIZON KINETICS HOLDING CORPORATION

PROXY STATEMENT FOR

2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2025

GENERAL QUESTIONS AND ANSWERS

The following questions and answers are intended to provide brief answers to frequently asked questions concerning the proposals described in this proxy statement and the proxy solicitation process. These questions and answers do not, and are not intended to, address all the questions that may be important to you. You should carefully read the remainder of this proxy statement. We expect to mail this proxy statement and the accompanying proxy card to the stockholders of Horizon Kinetics Holding Corporation ("HKHC," the "Company," "we," "us" or "our") on or about May 7, 2025.

THE ANNUAL MEETING

Q: When and where is the annual meeting?

A: The annual meeting will be held both virtually via the Internet at http://www.virtualshareholdermeeting.com/HKHC2025 and in person at the offices of Vinson & Elkins L.L.P., located at 1114 Avenue of the Americas, 32nd Floor, New York, New York 10036, on Tuesday, June 17, 2025, at 2:00 p.m., Eastern Time.

Q: What am I being asked to vote on?

A: Our stockholders are being asked to vote on the following proposals at the annual meeting:

• Proposal 1 - The election of seven directors to hold office until the next annual meeting of HKHC's stockholders and until their successors have been duly elected and qualified or until their earlier death, resignation or removal;

• Proposal 2 - The ratification of the appointment of CBIZ CPAs P.C.as HKHC's independent registered public accounting firm for the year ending December 31, 2025;

• Proposal 3 - To approve, on a non-binding, advisory basis, the compensation of HKHC's named executive officers; and

• Proposal 4 - To approve, on a non-binding, advisory basis, the frequency of future non-binding, advisory votes on the compensation of HKHC's named executive officers.

Q: How does the Board of Directors recommend that I vote?

A: The Board of Directors recommends that you vote your shares (i) "FOR" each of seven director nominees for election to the Board of Directors, (ii) "FOR" the ratification of the appointment of CBIZ CPAs P.C. as HKHC's independent registered public accounting firm for the year ending December 31, 2025, (iii) "FOR" the approval, on a non-binding, advisory basis, of the compensation of HKHC's named executive officers, and (iv) for a frequency of "EVERY YEAR" on the proposal to approve, on a non-binding, advisory basis, the frequency of future non-binding, advisory votes on the compensation of HKHC's named executive officers.

If you submit your properly executed proxy without voting instructions, your shares represented by that proxy will be voted as recommended by the Board of Directors.

Q: Who is entitled to vote at the annual meeting?

A: Stockholders of record at the close of business on May 1, 2025 (the "record date") are entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof. A holder of shares of our common stock as of the record date is entitled to one vote at the meeting or by proxy for each share of common stock owned by such holder on all matters properly brought before the annual meeting or at any adjournments or postponements thereof. As of April 21, 2025, there were 18,635,321 shares of common stock outstanding and entitled to vote on each of the proposals.

1

Q: What constitutes a quorum?

A: We must have a quorum in order to carry out the business of the annual meeting. This means at least a majority of the shares of common stock issued and outstanding as of the record date must be represented at the annual meeting, either by proxy or in person. Abstentions and broker non-votes, which are described in more detail below, are counted as shares present at the annual meeting for purposes of determining whether a quorum exists.

Q: What is the difference between holding shares as a "stockholder of record" and as a "beneficial owner"?

A: Stockholder of Record: A stockholder of record holds shares registered directly in the stockholder's name with our transfer agent. As a stockholder of record, you have the right to grant your voting proxy directly to us in accordance with the procedures described below or to vote at the annual meeting.

Beneficial Owner: If your shares are held through a bank, broker, or other nominee, you are the "beneficial owner" of shares held in "street name," and these proxy materials are being forwarded to you by your bank, broker or other nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares by completing the instructions provided to you by your bank, broker, or other nominee. However, since you are not a stockholder of record, you may not vote these shares at the annual meeting unless you obtain a valid proxy from your bank, broker, or other nominee (who must be the stockholder of record).

Q: What is a broker non-vote?

A: Generally, a broker non-vote occurs when a bank, broker, or other nominee that holds shares in "street name" for customers is precluded from exercising voting discretion on a particular proposal because (i) the beneficial owner has not instructed the bank, broker, or other nominee how to vote, and (ii) the bank, broker, or other nominee lacks discretionary voting power to vote such shares. A bank, broker, or other nominee does not have discretionary voting power with respect to the approval of "non-routine" matters, absent specific voting instructions from the beneficial owners of such shares.

Proposals 1, 3 and 4 are considered "non-routine" matters, on which banks, brokers, and other nominees are not allowed to vote unless they have received voting instructions from the beneficial owners of such shares. The proposal to ratify the appointment of CBIZ CPAs P.C. as HKHC's independent registered public accounting firm for the year ending December 31, 2025 (Proposal 2), is considered a routine matter on which banks, brokers, and other nominees may vote in their discretion on behalf of beneficial owners who have not provided voting instructions. If you are a beneficial owner, your bank, broker or other nominee will send you instructions on how you can instruct them to vote on Proposal 2. If you are a beneficial owner and you do not provide voting instructions, your bank, broker, or other nominee will have discretionary authority to vote your shares with respect to Proposal 2.

Q: What vote is required to approve each proposal?

A: Proposal 1: Directors must be elected by a plurality of the voting power of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. Plurality voting simply means that the number of candidates getting the highest number of votes cast "FOR" their election at the annual meeting will be elected. With respect to the election of directors, you may vote "FOR" or "WITHHOLD" authority to vote for each of the nominees for election to the Board of Directors. If you "WITHHOLD" authority to vote with respect to one or more director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will have no effect on the election of the nominees.

Proposal 2: The ratification of the appointment of CBIZ CPAs P.C. as HKHC's independent registered public accounting firm for the year ending December 31, 2025 requires the affirmative "FOR" vote of a majority of the shares present in person or represented by proxy at the annual meeting (meaning that of the shares represented at the annual meeting and entitled to vote, a majority of them must be voted "FOR" the proposal for it to be approved). You may vote "FOR," "AGAINST," or "ABSTAIN" with respect to this proposal. This proposal is considered a "routine" matter for which banks, brokers, and other nominees may vote in their discretion on behalf of beneficial owners who have not provided voting instructions. Abstentions will have the same effect as a vote "AGAINST" this proposal.

2

Proposal 3: The proposal to approve, on a non-binding, advisory basis, the compensation of HKHC's named executive officers requires the affirmative "FOR" vote of a majority of the shares present in person or represented by proxy at the annual meeting. You may vote "FOR," "AGAINST," or "ABSTAIN" with respect to this proposal. Abstentions will have the same effect as a vote "AGAINST" this proposal, and broker non-votes will have no effect on the vote for this proposal.

Proposal 4: The option of "EVERY YEAR," "EVERY TWO YEARS," or "EVERY THREE YEARS" that receives the affirmative vote of a majority of the shares present in person or represented by proxy at the annual meeting will be the frequency for future non-binding, advisory votes on the compensation of HKHC's named executive officers that has been recommended by our stockholders. Stockholders may "ABSTAIN" from voting their shares on this proposal. Abstentions will have the same effect as a vote "AGAINST" this proposal, and broker non-votes will have no effect on the vote for this proposal. In the event that no option receives a majority of the shares present in person or represented by proxy at the annual meeting, we will consider the option that receives the most votes by stockholders at the annual meeting to be the option selected by our stockholders.

PROCEDURES FOR VOTING

Q: Who is entitled to vote?

A: Only stockholders of record as of the close of business on May 1, 2025, the record date, will be entitled to vote on the proposals at the annual meeting. Each share of common stock is entitled to one vote.

Q: How do I vote?

A: If you are the record holder of your shares, you can vote by attending the annual meeting, or by completing, signing and returning your proxy card in the enclosed postage-paid envelope. You can also vote by Internet at http://www.virtualshareholdermeeting.com/HKHC2025 using the control number shown on your proxy card or voting instruction card.

If your shares are held by your broker as your nominee (in "street name"), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If your shares are held in street name, your voting instruction card may contain instructions from your broker that allow you to vote your shares using the Internet or telephone. Please consult with your broker if you have any questions regarding the electronic voting of your shares held in street name.

Q: Is my proxy revocable, and can I change my vote?

A: If you are a stockholder of record you may revoke your proxy at any time before it is officially voted by doing one of the following:

• Sending a written notice revoking your proxy to our General Counsel and Secretary at Horizon Kinetics Holding Corporation, 470 Park Ave S., New York, New York 10016;

• Signing and mailing to us a proxy bearing a later date;

• Changing your vote by Internet (if you voted by Internet); or

• Attending our annual meeting and voting then.

If you are not a stockholder of record, but instead hold your shares in "street name" through a bank, broker, or other nominee, the above-described options for revoking your proxy do not apply. Instead, you will need to follow the instructions provided to you by your bank, broker, or other nominee in order to revoke your proxy and submit new voting instructions.

3

Q: Is my vote confidential?

A: Yes. Only the inspector of votes and certain of our employees will have access to your proxy card.

OTHER INFORMATION

Q: Who is soliciting my proxy and who will pay the solicitation expenses?

A: The Company is soliciting your proxy by and on behalf of our Board of Directors, and we will pay the cost of preparing and distributing this proxy statement and the cost of soliciting votes. We will reimburse stockbrokers and other custodians, nominees, and fiduciaries for forwarding proxy and solicitation material to the owners of our common stock.

Q: Who can help answer my additional questions?

A: Stockholders who would like additional copies, without charge, of this proxy statement or have additional questions about this proxy statement, including the procedures for voting their shares, should contact:

Jay Kesslen, General Counsel and Secretary

Horizon Kinetics Holding Corporation

470 Park Ave S.

New York, New York 10016

Telephone: (646) 291-2300

This question and answer section is qualified in its entirety by the more detailed information contained in this proxy statement.

This proxy statement contains important information that should be read before you vote on the proposals herein. You are strongly urged to read this proxy statement in its entirety. You are also strongly urged to read our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Securities and Exchange Commission ("SEC") on March 31, 2025 (the "2024 Form 10-K"), which is being sent to you with this proxy statement.

4

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Bylaws provide that the Board of Directors of the Company (the "Board" or the "Board of Directors") will consist of one or more members, each of whom must be a natural person. Our Bylaws further provide that the number of directors shall be as determined from time to time by resolution of the Board. In accordance with our Bylaws, the Board has determined the number of directors to be seven. Each director elected at the 2025 Annual Meeting will serve until the 2026 Annual Meeting and until his or her successor has been duly elected and qualified or until his or her earlier death, resignation or removal. The Board of Directors has nominated the nominees listed below. Each nominee has consented to being named in this proxy statement and to serve if elected.

We have no reason to believe that any of the nominees will not serve if elected. If any of them should become unavailable to serve as a director, and if the Board of Directors designates a substitute nominee, the persons named in the accompanying proxy will vote for the substitute nominee designated by the Board of Directors, unless a contrary instruction is given in the proxy.

Each stockholder is entitled to cast one vote for each director nominee per share of common stock held by them at the close of business on May 1, 2025. Directors must be elected by a plurality of the voting power of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. Plurality voting simply means that the number of candidates getting the highest number of votes cast "FOR" their election at the annual meeting will be elected. With respect to the election of directors, you may vote "FOR" or "WITHHOLD" authority to vote for each of the nominees for election to the Board of Directors. If you "WITHHOLD" authority to vote with respect to one or more director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will have no effect on the election of the nominees.

Nominees

The persons nominated to be directors are listed below. The following information is submitted concerning the nominees for election as directors:

|

Name |

Age |

Position(s) With HKHC |

|

Murray Stahl |

71 |

Chairman of the Board, Chief Executive Officer and Chief Investment Officer |

|

Steven Bregman |

66 |

President and Director |

|

Peter Doyle |

62 |

Vice President and Director |

|

Daniel J. Roller |

44 |

Director |

|

Alice C. Brennan |

72 |

Director |

|

Allison Nagelberg |

60 |

Director |

|

Brent D. Rosenthal |

53 |

Director |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

FOR THE APPROVAL OF EACH OF THE DIRECTOR NOMINEES.

The biographical information for each director nominee is set forth below.

Murray Stahl is the Chairman of the Board, Chief Executive Officer and Chief Investment Officer of HKHC. He previously served in such roles for Horizon Kinetics, LLC, a Delaware limited liability company and wholly-owned subsidiary of HKHC ("Horizon Kinetics"), and is one of its co-founders. He has more than thirty years of investing experience and is responsible for overseeing Horizon Kinetics' proprietary research. Mr. Stahl chairs Horizon Kinetics' Investment Committee, which is responsible for portfolio management decisions. He is also the Co-Portfolio Manager for a number of registered investment companies, private funds, and institutional separate accounts. He serves as director and Chief Investment Officer of Kinetics Mutual Funds, Inc., a series of seven mutual funds with combined assets under management of approximately $2.45 billion as of December 31, 2024. Additionally, Mr. Stahl is the Chairman and Chief Executive Officer of FRMO Corp. (OTC Pink: FRMO) and serves as director and Portfolio Manager of RENN Fund, Inc. (NYSE: RCG), a closed-end fund with assets under management of approximately $19 million as of December 31, 2024. He is also a member of the Board of Directors of Texas Pacific Land Corporation (NYSE: TPL), the Minneapolis Grain Exchange, the Bermuda Stock Exchange and MSRH, LLC, an investment advisory company. Prior to co-founding Horizon Kinetics, Mr. Stahl spent 16 years at Bankers Trust Company (1978-1994) as a senior portfolio manager and research analyst. He received a Bachelor of Arts in 1976 and a Master of Arts in 1980 from Brooklyn College, and an MBA from Pace University in 1985.

5

Steven Bregman is the President of HKHC and a member of the Board. He previously served in such roles for Horizon Kinetics and is one of its co-founders. He is a senior member of Horizon Kinetics' research team and a member of the Investment Committee and supervises all research reports produced by Horizon Kinetics. Since 2021, Mr. Bregman has also served as Co-Portfolio Manager for RENN Fund, Inc. (NYSE: RCG), the President and CFO of FRMO Corp. (OTC Pink: FRMO), and is a member of the Board of Directors of Winland Electronics, Inc. He received a BA from Hunter College, and his CFA® Charter in 1989.

Peter Doyle is the Vice President of HKHC and a member of the Board. He previously served as Managing Director and member of the Board of Horizon Kinetics and is one of its co-founders. He is a senior member of the research team, and a member of the Investment Committee. He is also president of Kinetics Mutual Funds, Inc. Since 2021, Mr. Doyle has also served as a Co-Portfolio Manager for RENN Fund, Inc. (NYSE: RCG), and for several registered investment companies, private funds, and institutional separate accounts. He is also responsible for oversight of Horizon Kinetics' marketing and sales activities and is the Vice President of FRMO Corp. (OTC Pink: FRMO). Previously, Mr. Doyle was with Bankers Trust Company (1985-1994) as a Senior Investment Officer, where he also served on the Finance, Utility and REIT Research sub-group teams. Mr. Doyle received a BS from St. John's University and an MBA from Fordham University.

Daniel J. Roller is a member of the Board. He previously served as the Chairman of the Board of Scott's Liquid Gold-Inc., a Colorado corporation ("Scott's"). He is the founder, President, and Chief Investment Officer of Maran Capital Management, LLC, a Denver-based investment firm he founded in 2015. Maran Capital is focused on making concentrated, fundamentally driven, long-term oriented investments in publicly-traded small capitalization companies. Mr. Roller has over 20 years of investment research and management experience and has advised numerous public and private companies on topics such as M&A, capital allocation, corporate governance, and strategy. Mr. Roller holds a B.S.E. in Electrical Engineering and Computer Science from Duke University.

Alice C. Brennan is a member of the Board. She serves as a director of RENN Fund, Inc. (NYSE: RCG) and FRMO Corp. (OTC Pink: FRMO), including as a member of their audit committees and nominating and governance committees. She is also a director of independent power producer and climate-focused investment manager Greenbacker Renewable Energy Company II, serving on the audit committee and chairing the nominating and governance committee. Previously, she served as chief compliance officer at Verizon Wireless (2000-2014) and Bristol-Myers Squibb Company (1994-1999), where she led risk management, M&A, governance, and corporate and intellectual property law initiatives. Ms. Brennan holds a BA in Chemistry and Biology from Skidmore College, an MA in Microbiology and Immunology from Columbia University and a JD from Hofstra University.

Allison Nagelberg is a member of the Board. From 2000 until 2019, Ms. Nagelberg was the General Counsel of Monmouth Real Estate Investment Corporation (NYSE: MNR), a public REIT investing in net-leased industrial properties, where she was responsible for legal oversight of financial, capital markets and property transactions, ESG, SEC and NYSE compliance, legislative and regulatory policy analysis, human resources, investor relations and risk management. She also served as General Counsel of UMH Properties, Inc. (NYSE: UMH), an affiliated public REIT investing in residential real estate, from 2000 until 2013, and as General Counsel of Monmouth Capital Corporation (NASDAQ: MONM), an affiliated public REIT investing in net-leased industrial properties, from 2000 until 2007. She serves as an independent director of GoodHaven Funds Trust. Ms. Nagelberg holds a BA in Economics and Philosophy from Tufts University, an MBA in Finance from Rutgers University and a JD from New York University.

Brent D. Rosenthal is a member of the Board. Mr. Rosenthal is the founder of Mountain Hawk Capital Partners, LLC, an investment fund focused on small and microcap equities. Currently, Mr. Rosenthal serves on the board of directors of Syntec Optics Holdings, Inc. (NASDAQ: OPTX). Previously he has served as a director of Comscore, Inc. (NASDAQ: SCOR), Rentrak Corporation (NASDAQ: RENT), FLYHT Aerospace Solutions Ltd (OTCQX: FLYLF), RiceBran Technologies (OTCPK: RIBT), and SITO Mobile (NASDAQ: SITO), as well as Advisor to the board of Park City Group, Inc. (NASDAQ: PCYG), the parent company of ReposiTrak Inc. Earlier in his career, Mr. Rosenthal was a Partner in affiliates of W.R. Huff Asset Management, an employee-owned investment manager, where he worked from 2002 to 2016, during which time he was an Advisor to the boards of directors of Virgin Media (NASDAQ: VMED) and Time Warner Cable (NYSE:TWC). Earlier in his career, Mr. Rosenthal was director of mergers and acquisitions for RSL Communications Ltd. and served emerging media companies for Deloitte & Touche LLP. Mr. Rosenthal is an inactive Certified Public Accountant. Mr. Rosenthal earned his B.S. from Lehigh University and M.B.A. from the S.C. Johnson Graduate School of Management at Cornell University.

6

Corporate Governance Information

The Board of Directors held 2 meetings during 2024. All director nominees who served in the capacity of director during the 2024 year attended all the meetings that were held. The standing committees of the Board of Directors currently consist of the Audit Committee, the Compensation Committee, and the Nominating & Corporate Governance Committee. The membership and duties of these committees are described below.

|

Non-Management Directors(1) (2) |

Audit Committee |

Compensation |

Nominating & |

|

Daniel J. Roller |

M |

M |

M |

|

Alice C. Brennan |

M |

C |

M |

|

Allison Nagelberg |

M |

M |

C |

|

Brent D. Rosenthal |

C |

M |

M |

___________

M Committee member

C Committee chair

(1) The Board of Directors has determined that all members of the Audit, Compensation, and Nominating & Corporate Governance Committees are "independent directors" under applicable independence standards.

(2) The Board of Directors has determined that Brent Rosenthal, Allison Nagelberg, Alice Brennan and Daniel Roller are qualified as Audit Committee financial experts within the meaning of the regulations of the Securities and Exchange Commission ("SEC").

Board Committees

Audit Committee. The Audit Committee operates pursuant to a charter approved by our Board of Directors, which the Audit Committee reviews periodically to determine if revisions are necessary or appropriate. A copy of the charter is posted on our website at https://hkholdingco.com/corporate-documents/. In addition, a copy of the charter is available upon written request to our General Counsel and Secretary at our principal executive office (470 Park Ave S., New York, New York 10016). The Audit Committee monitors (1) the integrity of our financial statements, (2) the qualifications and independence of our independent registered public accounting firm, (3) the performance of our independent registered public accounting firm, and (4) our compliance with legal and regulatory requirements. The Audit Committee has the sole authority to appoint or replace our independent registered public accounting firm, and pre-approves all audit engagement fees and terms and all non-audit services. The Audit Committee, to the extent it deems necessary or appropriate, shall:

-

Review and discuss with our management and independent registered public accounting firm our annual audited financial statements, including disclosures made in management's discussion and analysis, and recommend to the Board whether the audited financial statements should be included in our Form 10-K;

-

Review and discuss with our management and independent registered public accounting firm our quarterly financial statements, including disclosures made in management's discussion and analysis for inclusion in our Form 10-Q;

-

Discuss with our management and independent registered public accounting firm significant financial reporting issues and judgments made in connection with the preparation of our financial statements;

-

Discuss with our management and independent registered public accounting firm any earnings press releases;

7

-

Discuss with our management and independent registered public accounting firm the effect of regulatory and accounting initiatives as well as any off-balance sheet structures on our financial statements;

-

Discuss with our management our major financial risk exposures, if any, and the steps our management has taken to monitor and control such exposures;

-

Review the experience and qualifications of the senior members of our independent registered public accounting firm's team;

-

Obtain and review a report from our independent registered public accounting firm at least annually regarding (a) the firm's internal quality-control procedures, (b) any material issues raised by the most recent quality-control review of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the firm and the Company.

-

Review reports and disclosures of insider and affiliated party transactions;

-

Advise the Board with respect to the Company's policies and procedures regarding compliance with applicable laws and regulations and with any code of business conduct;

-

Discuss with our management and independent registered public accounting firm any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding our financial statements or accounting policies;

-

Discuss with our counsel legal matters that may have a material impact on the financial statements or our compliance policies;

-

Approve or reject all related party transactions; and

-

Establish and oversee any anonymous complaint policy, which may be contained within any code of business conduct of the Company, regarding: (a) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and (b) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee met 2 times during 2024 and all board members were in attendance.

Compensation Committee. The Compensation Committee operates pursuant to a charter approved by our Board of Directors, which the Compensation Committee reviews periodically to determine if revisions are necessary or appropriate. A copy of the charter is posted on our website at https://hkholdingco.com/corporate-documents/. In addition, a copy of the charter is available upon written request to our General Counsel and Secretary at our principal executive office (470 Park Ave S., New York, New York 10016). The Compensation Committee has oversight responsibility with respect to the structure, operation and effectiveness of our compensation plans, policies and programs for officers and directors, including:

-

To review and approve corporate goals and objectives relevant to compensation for executive officers;

-

To evaluate the effectiveness of our compensation practices in achieving our strategic objectives to encourage behaviors consistent with our values, and to align performance objectives consistent with our goals and vision;

-

To evaluate the performance of our Chief Executive Officer based upon stated goals and objectives and determine and approve the compensation of our Chief Executive Officer;

-

To evaluate and approve the compensation of other executive officers, utilizing input and non-binding recommendations from our Chief Executive Officer;

8

-

To review and oversee the preparation of any disclosure relative to our compensation practices provided in our annual report and proxy statement or other materials distributed to shareholders or filed with the SEC;

-

To review and approve, or make recommendations to the Board with respect to, the terms of our incentive compensation plans and equity-based plans (collectively, the "Benefit Plans") and oversee the activities of the individuals responsible for administering the Benefit Plans;

-

To review and approve all awards pursuant to the Benefit Plans;

-

To evaluate the Benefit Plans and specifically to consider whether the Benefit Plans appropriately reward and provide incentive to participants commensurate with their cost to the Company;

-

To make recommendations to the Board with respect to the amendment, termination or replacement of the Benefit Plans;

-

To recommend to the Board the compensation for directors;

-

To appoint, compensate and oversee any independent compensation consultant to assist with determining or recommending the amount or form of executive and director compensation and to approve all services provided to the Company by such compensation consultant or any of its affiliates;

-

To retain or replace any independent counsel or other experts or advisors that the Compensation Committee believes to be necessary or appropriate; and

-

To recommend to the Board adjustments to director and officer insurance coverage, as appropriate.

The Compensation Committee met 2 times during 2024 and all board members were in attendance.

Nominating & Corporate Governance Committee. The Nominating & Corporate Governance Committee operates pursuant to a charter approved by our Board of Directors, which the Nominating & Corporate Governance Committee reviews periodically to determine if revisions are necessary or appropriate. A copy of the charter is posted on our website at https://hkholdingco.com/corporate-documents/. In addition, a copy of the charter is available upon written request to our General Counsel and Secretary at our principal executive office (470 Park Ave S., New York, New York 10016). The Nominating and Corporate Governance Committee's ("Committee") role is to determine the appropriate composition of the Board and on that basis recommend a slate of director nominees for election to the Board, to identify and recommend candidates to fill vacancies between annual meetings of shareholders, and to review, evaluate, and recommend changes to our corporate governance framework. The principal responsibilities and functions of the Nominating & Corporate Governance Committee are to:

-

Seek and identify individuals qualified to become members of the Board, consistent with its nominating criteria;

-

Consider and nominate nominees for election at each annual meeting of our shareholders;

-

Review with the Board at least annually the qualifications of new and existing members of the Board, considering the level of independence of individual members, together with such other factors as the Board may deem appropriate, including overall skills, financial literacy and experience, to ensure our ongoing compliance with applicable standards; and

-

At the direction of the Board, consider various corporate governance policies and procedures.

The Nominating & Corporate Governance Committee met once during 2024 and all board members were in attendance.

9

Board Leadership Structure

We have chosen to combine the position of Chairman of the Board and Chief Executive Officer. Mr. Stahl currently serves as Chairman of the Board, Chief Executive Officer and Chief Investment Officer. The Board of Directors determined that Mr. Stahl's knowledge of the Company and the Company's industry, combined with his extensive experience with the Company, made him the logical and natural choice to serve as Chairman of the Board. We believe the Board also benefits from the continuity that Mr. Stahl provides in chairing the Board.

In addition, the Board has designated Daniel J. Roller, one of our non-management directors, to serve as our lead independent director. The lead independent director serves as the liaison between management and the non-management directors. The lead independent director and each of the other directors communicate regularly with Mr. Stahl regarding appropriate agenda topics and other matters related to the Board.

Board's Role in Risk Oversight

The Board's role in our risk oversight process includes receiving regular reports from members of our management regarding areas of material risk to the Company, including operational, financial, legal and regulatory, cybersecurity, and strategic risks. The Audit Committee is responsible for oversight of risks relating to accounting matters, financial reporting, cybersecurity, and legal and regulatory compliance. To satisfy these oversight responsibilities, the Audit Committee meets regularly with management and our independent registered public accounting firm. The Compensation Committee is responsible for overseeing risks relating to employment policies and our compensation and benefits programs. To satisfy these oversight responsibilities, the Compensation Committee meets regularly with management to understand the implications of compensation decisions, particularly the risks our compensation policies may pose to our financial condition and stockholders. The Nominating & Corporate Governance Committee is responsible for overseeing risks relating to overall corporate governance. To satisfy these oversight responsibilities, the Nominating & Corporate Governance Committee annually reviews Board composition, as well as Board and committee performance, and periodically reports to the Board on corporate governance matters.

Risks Related to Compensation Policies and Practices

As part of its oversight of our executive and non-executive compensation programs, the Compensation Committee considers the impact on our risk profile of our compensation programs, including incentive awards. The Compensation Committee reviews factors that may influence excessive risk-taking, to determine whether they present a material risk to the Company. The Compensation Committee also utilizes these risk mitigating factors:

• Overall compensation levels that are competitive with market;

• Discretionary authority to reduce annual cash incentive awards;

• Internal controls over financial reporting and other financial, operational and compliance policies and practices that are intended to prevent manipulation of performance; and

• Maintain key risk mitigating policies, including a clawback policy to recover incentives for financial restatements due to misconduct or fraud.

Stockholder Recommendations for Director Candidates

The Board of Directors has delegated specific responsibilities to the Nominating & Corporate Governance Committee relating to selection of directors to serve on the Board. The Nominating & Corporate Governance Committee is responsible for seeking and identifying individuals qualified to become members of the Board, consistent with its nominating criteria, and considering and nominating nominees for election at each annual meeting of our shareholders. The Nominating & Corporate Governance Committee seeks to identify director candidates who (i) have significant business experience that is relevant and beneficial to the Board and HKHC, (ii) are willing and able to make a sufficient time commitment to the affairs of HKHC to effectively perform the duties of a director, including regular attendance at Board and committee meetings, (iii) are committed to the long-term growth and profitability of HKHC, (iv) are individuals of character and integrity, (v) are individuals with inquiring minds willing to challenge and stimulate management, and (vi) represent the interests of HKHC as a whole and not just the interests of a particular stockholder or group. The Nominating & Corporate Governance Committee believes these criteria are the key factors in identifying qualified director candidates.

10

The Nominating & Corporate Governance Committee has a policy for considering new director candidates recommended by our stockholders if such recommendations are made in compliance with applicable laws, rules and regulations, our Bylaws, and procedures established by the Nominating & Corporate Governance Committee. Director candidates recommended by stockholders are evaluated by the Nominating & Corporate Governance Committee using the same criteria described in the previous paragraph. Stockholders may submit their recommendations to the attention of the Board of Directors by following the procedures provided below under the heading "Communications with the Board."

Under our Bylaws, stockholders can nominate persons for election to our Board of Directors. Any director nomination must comply with the requirements set forth in our Bylaws and must be received by our Secretary at our principal executive offices between the close of business on February 20, 2026 and the close of business on March 23, 2026.

Communications with the Board

Stockholders or other interested parties may communicate with the Board of Directors or particular Board members by mailing a written communication to our General Counsel and Secretary at our principal executive office at 470 Park Ave S., New York, New York 10016, by email to legal@horizonkinetics.com, or by telephone to (646) 291-2300. Our General Counsel and Secretary will forward correspondence to its intended addressee.

The Board encourages stockholder communication with the Board and company management. The Company conducts ongoing stockholder outreach and holds meetings or calls with requesting stockholders.

Stockholders may also communicate with Board members at the Company's annual meeting of stockholders, as it is our policy that Board members should attend such meetings and make themselves available to address any matters properly brought before the meetings. Instructions for methods to communicate with Board members at any annual meeting of stockholders will be explained at the outset of the meeting.

Director Compensation

On August 13, 2024, the Board set the compensation for non-management directors at $100,000 per year, inclusive of service on all committees, paid in cash on a quarterly basis.

2024 Director Summary Compensation Table

The following table reflects information concerning the compensation of our directors earned during the last completed fiscal year ended December 31, 2024. Directors who are also officers of the Company do not receive any additional compensation for their services on the Board.

|

Name |

Fees Earned or |

Stock Awards |

Total ($) |

|

Murray Stahl(1) |

- |

- |

- |

|

Steven Bregman(1) |

- |

- |

- |

|

Peter Doyle(1) |

- |

- |

- |

|

Daniel J. Roller |

$50,000 |

- |

$50,000 |

|

Alice C. Brennan |

$50,000 |

- |

$50,000 |

|

Allison Nagelberg |

$50,000 |

- |

$50,000 |

|

Brent D. Rosenthal |

$50,000 |

- |

$50,000 |

___________

(1) Messrs. Stahl, Bregman and Doyle did not receive any additional compensation for service on the Board. For a description of Mr. Stahl's compensation with respect to his services rendered to us as our Chief Executive Officer and Chief Investment Officer during 2024, see the Summary Compensation Table below.

11

EXECUTIVE OFFICERS

Biographical information regarding our executive officers during 2024 is as follows:

Murray Stahl, age 71. See biographical information in the "Proposal 1 - Election of Directors" section.

Steven Bregman, age 66. See biographical information in the "Proposal 1 - Election of Directors" section.

Peter Doyle, age 62. See biographical information in the "Proposal 1 - Election of Directors" section.

Mark Herndon, age 55, is our Chief Financial Officer. Mr. Herndon joined Horizon Kinetics as Chief Financial Officer in 2024. He is responsible for overseeing all financial reporting functions of the Company. Previously, Mr. Herndon was Senior Vice President and Chief Financial Officer at Safeguard Scientifics, Inc. (NASDAQ: SFE) from 2018 to 2023, a company that provided capital and relevant expertise to a portfolio of private entities. Prior to 2018, Mr. Herndon spent 27 years at PricewaterhouseCoopers serving in a variety of client service and national office roles, including as Assurance Partner from 2006 through 2018. Mr. Herndon earned a BBA in Accounting from Georgia Southern University and an MBA from Emory University's Goizueta Business School.

Alun Williams, age 53, is our Chief Operating Officer. He joined Horizon Kinetics in 2009 and, after 12 years as the firm's Director of Trading and Operations, took over the role of Chief Operating Officer in 2021. As Chief Operating Officer, Mr. Williams is responsible for overseeing daily operations and administrative functions for the Company. Prior to 2009, Mr. Williams was at Goldman Sachs where he was the head of GSAM Operations Salt Lake City. He joined Goldman Sachs in 1996 and in his time there held a number of operational and control positions within the equity, private wealth and asset management divisions. He is also a member of the Board of Directors and the President of CMSC (Consensus Mining & Seigniorage Corp.) and a member of the Board of Directors of the Horizon Kinetics ICAV, a regulated UCITS fund. Mr. Williams received a BSc in Business Administration from Bath University, England.

Jay Kesslen, age 52, is our General Counsel and Secretary. He joined Horizon Kinetics in 1999 and previously served as General Counsel, Managing Director and a member of the Board of Horizon Kinetics. He oversees all aspects of the Company's legal affairs, advises on all material compliance matters, and is responsible for the firm's corporate governance. Mr. Kesslen is Horizon Kinetics' Anti-Money Laundering Officer and also serves as a director for several private funds managed by subsidiaries of Horizon Kinetics. He is also Vice President and Assistant Secretary for Kinetics Mutual Funds, Inc., and Vice President for RENN Fund, Inc., a closed-end fund. Mr. Kesslen also serves as the General Counsel of FRMO Corp. (OTC Pink: FRMO) and Consensus Mining and Seigniorage Corporation. Mr. Kesslen holds a BA in Economics from the State University of New York at Plattsburgh (cum laude) and a JD from Albany Law School.

Russell Grimaldi, age 45, is our Chief Compliance Officer. He joined Horizon Kinetics in 2005 and previously served as the Chief Compliance Officer and Associate General Counsel of Horizon Kinetics. He oversees Horizon Kinetics' compliance program and supports all legal and regulatory functions. He also serves as Secretary and Chief Compliance Officer for RENN Fund, Inc., a closed-end fund, and for Consensus Mining and Seigniorage Corporation. Mr. Grimaldi holds a BA in Legal Studies from Quinnipiac University (cum laude) and a JD from Albany Law School.

David Arndt, age 40, is the President of our Consumer Products Division. He served as President and Principal Executive Officer of Scott's from December 2023 until August 2024. He also held the titles of Chief Financial Officer, Principal Accounting Officer, Treasurer and Corporate Secretary of Scott's between October 2021 and August 2024. Mr. Arndt was employed by Scott's beginning in 2017, serving as the VP of Finance of Scott's since April 2021 and, prior to that, serving as Director of FP&A and Treasury, Controller, and Director of Financial Reporting. Before joining Scott's, Mr. Arndt was employed by EKS&H LLLP (now Plante & Moran, PLLC) for seven years, serving in a number of positions, including Audit Manager, and serving several clients in the manufacturing and consumer products industries. Mr. Arndt earned a B.S. in Accounting and a MAcc from the University of Kansas.

There are no family relationships among the directors and executive officers of HKHC.

12

EXECUTIVE COMPENSATION

Executive Summary

The Company is a "smaller reporting company" under Item 10 of Regulation S-K, and the following compensation disclosure is intended to comply with the requirements applicable to smaller reporting companies.

Named Executive Officers

This section provides information regarding our executive compensation program in 2024 for the following executive officers of the Company (collectively, the "named executive officers" or "NEO"):

|

Name |

Position |

|

Murray Stahl |

Chief Executive Officer and Chief Investment Officer |

|

Jay Kesslen |

General Counsel and Secretary |

|

Alun Williams |

Chief Operating Officer |

|

Mark Herndon |

Chief Financial Officer |

Fiscal Year 2024 Performance Highlights

The Company delivered strong financial and strategic results during 2024.

Highlights of the Company's 2024 financial results include the following:

• The Company's total revenues grew 18% in 2024 as a result of increasing assets under management ("AUM") at our mutual funds and separately managed accounts due to their favorable 2024 performance.

• The Company earned incentive fees of $51.7 million from the Company's proprietary funds. While these incentive fees, and other management fees, collected from proprietary funds are eliminated from consolidated revenues the positive economic benefit continues to be reflected in net income attributable to the Company.

• AUM for the year ended December 31, 2024 increased by approximately $3.3 billion, or 51%, to $9.8 billion.

Highlights of the Company's 2024 strategic results include the following:

• On August 1, 2024, the Company, formerly known as "Scott's Liquid Gold-Inc.," completed its previously announced merger in accordance with the terms and conditions of the Agreement and Plan of Merger, dated December 19, 2023, as amended (collectively, the "Merger Agreement"), by and among Scott's, Horizon Kinetics and HKNY One, LLC, a Delaware limited liability company and wholly-owned subsidiary of Scott's ("Merger Sub"). In accordance with the Merger Agreement, Merger Sub merged with and into Horizon Kinetics, with Horizon Kinetics surviving the merger as a wholly-owned subsidiary of the Company (the "Merger"). As a result of the Merger, the Company became a publicly traded company on the OTC markets (HKHC).

• The Company launched several new funds and strategies.

Overview of Our Executive Compensation Program

The intellectual capabilities of our employees are among our most important assets. Our financial results depend on the level of assets we manage, our ability to provide outstanding client service, develop new client relationships, generate competitive long-term investment performance, and build strong relationships with clients, investment consulting firms, and other financial intermediaries.

We believe that the expertise and commitment of our NEO are critical to delivering superior long-term results to our clients and stockholders and to achieving our overall business objectives.

13

On November 5, 2024, the Compensation Committee approved the Company's executive compensation program (the "Program") for the remainder of the 2024 calendar year and for the 2025 calendar year. The material elements of the Program include base salaries and discretionary bonuses. Base salaries are used to provide a fixed amount of compensation for an executive officer's regular work, are reviewed annually and may be adjusted from time to time by the Compensation Committee. Bonuses are discretionary, are paid in the form of cash awards only and are paid out of a general pool for executive officers other than Messrs. Murray Stahl, Steven Bregman and Peter Doyle. For the 2025 calendar year, the bonus pool will be based on a percentage of incentive fees earned by the Company, which may be adjusted from time to time at the discretion of the Compensation Committee. The Company does not currently intend to pay its executive officers in the form of stock awards, options, or any other form of equity-based compensation, but will reassess at appropriate times in the future. The Company has no employment agreements with any of its executive officers.

On November 5, 2024, the Compensation Committee approved the compensatory arrangements set forth in the following table:

| 2024 | |||||||||

| Name and Title | Salary | Bonus | Total | ||||||

| Murray Stahl, Chief Executive Officer and Chief Investment Officer* | $ | 386,400 | $ | - | $ | 405,990 | |||

| Jay Kesslen, General Counsel and Secretary | $ | 775,000 | $ | 375,000 | $ | 1,150,000 | |||

| Alun Williams, Chief Operating Officer | $ | 550,000 | $ | 600,000 | $ | 1,150,000 | |||

| Mark Herndon, Chief Financial Officer# | $ | 350,000 | $ | 260,000 | $ | 610,000 | |||

________________________________________________

|

* |

Includes expenses associated with healthcare benefits paid by the Company for Mr. Stahl in the amount of $19,590. |

|

# |

Salary figure is annualized as Mr. Herndon was hired in March 2024. |

| 2025 | |||||||||

| Name and Title | Salary | Bonus | Total | ||||||

| Murray Stahl, Chief Executive Officer and Chief Investment Officer** | $ | 410,000 | TBD | $ | 410,000 | ||||

| Jay Kesslen, General Counsel and Secretary | $ | 1,000,000 | TBD | $ | 1,000,000 | ||||

| Alun Williams, Chief Operating Officer | $ | 1,000,000 | TBD | $ | 1,000,000 | ||||

| Mark Herndon, Chief Financial Officer | $ | 525,000 | TBD | $ | 525,000 | ||||

________________________________________________

|

** |

In addition to the amounts listed for Mr. Stahl, the Company will pay expenses associated with healthcare benefits for Mr. Stahl estimated to be approximately $20,000. |

Compensation Philosophy and Objectives

In designing and implementing our executive compensation program, the Compensation Committee is guided by the following philosophy and objectives:

• Supporting the Company's overall business strategy and ensuring it is designed to attract, retain and motivate highly qualified professionals within the Company's industry;

• Reviewing compensation practices and trends to assess the adequacy and competitiveness of the Company's executive compensation program as compared to companies in the same or similar industries; and

• Evaluating the efficacy of the Company's compensation policy and strategy in achieving expected benefits to the Company;

14

Market Compensation Data.

In making its pay decisions, the Compensation Committee considered market compensation data from a group of similarly situated publicly traded asset managers that the Compensation Committee felt constituted a proper peer group.

2024 Summary Compensation Table

The following table summarizes all compensation earned by our NEO for the years indicated.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Non-qualified Deferred Compensation Earnings ($) |

All Other Compensation(1) ($) |

Total ($) |

| Murray Stahl | |||||||||

| Chief Executive Officer and Chief Investment Officer | 2024 | $386,400 | $0 | $0 | $0 | $0 | $0 | $19,590 | $ |

| Jay Kesslen | |||||||||

| General Counsel and Secretary | 2024 | $775,000 | $375,000 | $0 | $0 | $0 | $0 | $0 | $ |

| Alun Williams | |||||||||

| Chief Operating Officer | 2024 | $550,000 | $600,000 | $0 | $0 | $0 | $0 | $0 | $ |

| Mark Herndon | |||||||||

| Chief Financial Officer | 2024 | $350,000 | $260,000 | $0 | $0 | $0 | $0 | $0 | $ |

___________

(1) The Company has paid expenses associated with the healthcare benefits for Mr. Stahl in the amount of $19,590.

Narrative Disclosure to Summary Compensation Table

For 2024, the principal components of compensation for our NEO were base salary and bonuses.

Base Salaries

Base salaries are used to provide a fixed amount of compensation for an executive officer's regular work, are reviewed annually and may be adjusted from time to time by the Compensation Committee.

Bonuses

Bonuses are discretionary, are paid in the form of cash awards only and are paid out of a general pool for executive officers other than Messrs. Murray Stahl, Steven Bregman and Peter Doyle. For the 2025 fiscal year, the bonus pool will be based on a percentage of incentive fees earned by the Company, which may be adjusted from time to time at the discretion of the Compensation Committee.

No Equity-Based Compensation or Employment Agreements

The Company does not currently intend to pay its executive officers in the form of stock awards, options, or any other form of equity-based compensation, but will reassess at appropriate times in the future. The Company has no employment agreements with any of its executive officers.

Other Benefits and Perquisites

Employee Benefits

We offer employee and post-retirement benefits to all full-time employees, including NEO, in order to provide them with financial support in the event of injury, illness, or disability and to help them accumulate retirement savings on a tax-favored basis. Our employees are generally eligible to participate in benefit programs including medical, dental, vision, disability, life insurance, and health savings or flexible spending accounts. The cost of health insurance and savings plans is partially borne by the Company, including costs for NEO. We pay for disability insurance and a set amount of term life insurance for all employees.

15

Perquisites

We did not provide perquisites to our NEO during 2024.

Outstanding Equity Awards at December 31, 2024

Our NEO did not have any outstanding equity awards as of December 31, 2024.

We

Insider Trading Policy

The Company has

Pay-Versus-Performance Disclosure(1)

In accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding the relationship between executive compensation and our financial performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

| Year | Summary Compensation Total for PEO |

Compensation Actually Paid to PEO |

Average Summary Compensation Total for Non- PEO NEO's |

Average Compensation Actually Paid to Non-PEO |NEO's |

Total Shareholder Return (1) |

Net Income(2) | |||||||||||

| 2024 | $ | $ | $ | $ | $ | $ | |||||||||||

___________

(1)

(2)

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Company Performance

The chart above sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEO, and the Company's cumulative TSR for the fiscal year listed.

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income

We are required to describe the relationship between the “Compensation Actually Paid” to our PEO and non-PEO NEO, as calculated in accordance with SEC disclosure rules, and (i) total shareholder return and (ii) our net income. There was no public market for our common stock prior to August 1, 2024, and as such, no total shareholder return value can be calculated for the Company for any year prior to 2024. For the period from August 1, 2024 (the date of the completion of the Merger) through December 31, 2024, the cumulative total shareholder return on an assumed initial investment of $100 in our common stock at the start of the period, assuming reinvestment of dividends, was $169.86. For the full fiscal year ended December 31, 2024, our Net Income was approximately $92.5 million. Our compensation actually paid to our CEO for the full fiscal year ended December 31, 2024 was $405,990.00, and our average compensation actually paid to our other NEO for the full fiscal year ended December 31, 2024 was $970,000.00.

16

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF CBIZ CPAS P.C. AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed CBIZ CPAs P.C., formerly Marcum LLP, as our independent registered public accounting firm for the year ending December 31, 2025. Representatives of CBIZ CPAs P.C. will attend the annual meeting to answer questions and may make a statement, if they so desire.

Previous Independent Registered Public Accounting Firm

On August 13, 2024, the Audit Committee dismissed Weinberg & Company ("Weinberg") as the Company's independent registered public accounting firm. Weinberg had served in that capacity since December 2023, after Scott's previous independent registered public accounting firm, Plante & Moran, PLLC ("Plante & Moran"), had provided notice that it would not stand for re-appointment. Collectively, we refer to Weinberg and Plante & Moran as the "Prior Auditors."

On August 13, 2024, the Audit Committee appointed Marcum LLP as the Company’s independent registered public accounting firm, and on November 1, 2024, CBIZ CPAs P.C. acquired the attest business from Marcum LLP. Accordingly, on April 28, 2025, the Company replaced Marcum LLP with CBIZ CPAs P.C. as the Company’s independent registered public accounting firm.

Weinberg's report on Scott's consolidated financial statements for the year ended December 31, 2023 did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

During the two years ended December 31, 2023 and 2022, and during the subsequent interim period through August 13, 2024, (i) there were no disagreements (within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) between the Company and the Prior Auditors on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the relevant Prior Auditor's satisfaction, would have caused such Prior Auditor to make reference to the subject matter of the disagreements in connection with its report on the Company's consolidated financial statements for the relevant year, and (ii) there were no reportable events (as defined by Item 304(a)(1)(v) of Regulation S-K), except for the material weaknesses in internal control over financial reporting (A) first identified as of June 30, 2023 related to Scott's finance department lacking a sufficient number of trained professionals with technical accounting expertise to process and account for complex, non-routine transactions in accordance with GAAP, which continued to exist at June 30, 2024; and (B) first identified on June 30, 2022 related to the operating effectiveness of the review of the impairment assessment of goodwill prepared by a third-party firm.

During the Company's two years ended December 31, 2023 and 2022, and during the subsequent interim period through August 13, 2024, neither the Company nor anyone on its behalf consulted with CBIZ CPAs P.C. regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, and neither a written report nor oral advice was provided to the Company that CBIZ CPAs P.C. concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instruction thereto), or (iii) any reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

In accordance with Item 304(a)(3) of Regulation S-K, the Company provided Weinberg with a copy of the disclosure set forth above and requested that Weinberg furnish the Company with a letter addressed to the SEC stating whether Weinberg agrees with the statements made by the Company with respect to Weinberg in the disclosure, and, if not, stating the respects in which it does not agree. A copy of Weinberg's letter is filed as Exhibit 16.1 to the Company's Current Report on Form 8-K filed with the SEC on August 19, 2024.

Audit and Non-Audit Fees

Aggregate fees that we were billed for the fiscal years ended December 31, 2024 and 2023 by our independent registered public accounting firm, CBIZ CPAs P.C., were as follows:

17

| Fiscal Year ended December 31, | ||||||

| 2024 | 2023(1) | |||||

| Audit fees(2) | $ | 520,150 | $ | 375,950 | ||

| Audit-related fees(3) | $ | 413,920 | ||||

| Total audit and audit-related fees | $ | 934,070 | ||||

| Tax fees(4) | $ | 5,897 | ||||

| All other fees | $ | 0 | ||||

| Total | $ | 939,967 | $ | 375,950 | ||

___________

(1) Fees paid to the prior accounting firm. CBIZ CPAs P.C. was not engaged for any portion of 2023.

(2) Includes the aggregate fees billed for professional services in connection with the audit of our 2024 and 2023 annual financial statements, the review of the financial statements included in our Form 10-Qs, as well as for services that are normally provided in connection with statutory or regulatory filings or engagements.

(3) Includes the aggregate fees billed for professional services in connection with the audit of the Company's proprietary funds.

(4) Includes the aggregate fees for pre-approved services associated with tax compliance and tax consulting.

Pre-approval policies and procedures for audit and non-audit services. The Audit Committee has established a policy regarding pre-approval of all audit and non-audit services provided by our independent registered public accounting firm. Each year, the Audit Committee considers for approval the independent registered public accounting firm's engagement to render audit services, as well as a list prepared by management of anticipated non-audit services and related budget estimates. During the course of the year, our management and the independent registered public accounting firm are responsible for tracking all services and fees to ensure that they are within the scope pre-approved by the Audit Committee. To ensure prompt handling of unexpected matters, the Audit Committee has delegated to its chairperson the authority to represent the Audit Committee in reviewing and approving audit and non-audit services; however, the Audit Committee must ratify any such actions by the chairperson.

The Audit Committee or the chairperson acting on its behalf pre-approved all non-audit services provided by CBIZ CPAs P.C. for the year ended December 31, 2024.

Vote Sought and Recommendation

Although stockholder action on this matter is not required, the appointment of CBIZ CPAs P.C. is being recommended to the stockholders for ratification. The ratification of the appointment of CBIZ CPAs P.C. as HKHC's independent registered public accounting firm for the year ending December 31, 2025 requires the affirmative "FOR" vote of a majority of the shares present in person or represented by proxy at the annual meeting (meaning that of the shares represented at the annual meeting and entitled to vote, a majority of them must be voted "FOR" the proposal for it to be approved). You may vote "FOR," "AGAINST," or "ABSTAIN" with respect to this proposal. This proposal is considered a "routine" matter for which banks, brokers, and other nominees may vote in their discretion on behalf of beneficial owners who have not provided voting instructions. Abstentions will have the same effect as a vote "AGAINST" this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF CBIZ CPAs P.C. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2025.

18

PROPOSAL 3:

APPROVAL, ON A NON-BINDING, ADVISORY BASIS, OF THE COMPENSATION OF HKHC'S NAMED EXECUTIVE OFFICERS

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are providing stockholders with an opportunity to vote, on a non-binding advisory basis, on the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules. The advisory vote on executive compensation described in this proposal is commonly referred to as a "say-on-pay vote."

As described under "Executive Compensation - Overview of Our Executive Compensation Program" elsewhere in this proxy statement, the material elements of our executive compensation program include base salaries and discretionary bonuses. Base salaries are used to provide a fixed amount of compensation for an executive officer's regular work, are reviewed annually and may be adjusted from time to time by the Compensation Committee. Bonuses are discretionary, are paid in the form of cash awards only and are paid out of a general pool for executive officers other than Messrs. Murray Stahl, Steven Bregman and Peter Doyle. The Company does not currently intend to pay its executive officers in the form of stock awards, options, or any other form of equity-based compensation, but will reassess at appropriate times in the future. The Company has no employment agreements with any of its executive officers.

This proposal gives our stockholders the opportunity to express their views on the overall compensation of our named executive officers provided by us and the philosophy, policies and practices described in this proxy statement. For the reasons discussed above, we are asking our stockholders to indicate their support for the compensation of our named executive officers by voting "FOR" the following resolution at the Annual Meeting:

"RESOLVED, that the Company's stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the SEC (which disclosure includes the executive compensation section, the compensation tables, and the narrative discussion)."

The say-on-pay vote is advisory only, and therefore it will not bind the Company or the Board. However, the Board and the Compensation Committee will consider the voting results as appropriate when making future decisions regarding executive compensation.

Vote Sought and Recommendation

The proposal to approve, on a non-binding, advisory basis, the compensation of HKHC's named executive officers requires the affirmative "FOR" vote of a majority of the shares present in person or represented by proxy at the annual meeting. You may vote "FOR," "AGAINST," or "ABSTAIN" with respect to this proposal. Abstentions will have the same effect as a vote "AGAINST" this proposal, and broker non-votes will have no effect on the vote for this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR APPROVAL, ON A

NON-BINDING, ADVISORY BASIS, OF THE COMPENSATION PAID TO THE NEO, AS DISCLOSED

IN THIS PROXY STATEMENT PURSUANT TO THE COMPENSATION DISCLOSURE RULES OF THE SEC.

19

PROPOSAL 4:

APPROVAL, ON A NON-BINDING, ADVISORY BASIS, OF THE FREQUENCY OF FUTURE

NON-BINDING, ADVISORY VOTES ON THE COMPENSATION OF HKHC'S NAMED EXECUTIVE

OFFICERS

Pursuant to Section 14A of the Exchange Act, we are asking stockholders whether future say-on-pay votes should be held every year, every two years or every three years. After careful consideration, the Board has determined that holding an advisory vote on the compensation of our named executive officers every year is the most appropriate policy for us at this time, and the Board therefore recommends that stockholders vote for future advisory votes on the compensation of our named executive officers to occur every year.