UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

SCHEDULE

_________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

_____________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF SIMMONS FIRST NATIONAL CORPORATION:

NOTICE IS HEREBY GIVEN that the annual meeting of the shareholders of Simmons First National Corporation (“Company”) will be held in the auditorium of the Company’s Little Rock, Arkansas, corporate offices (601 E. 3rd Street, Little Rock, Arkansas, 72201) at 8:00 A.M. Central Time, on Wednesday, May 7, 2025, for the following purposes:

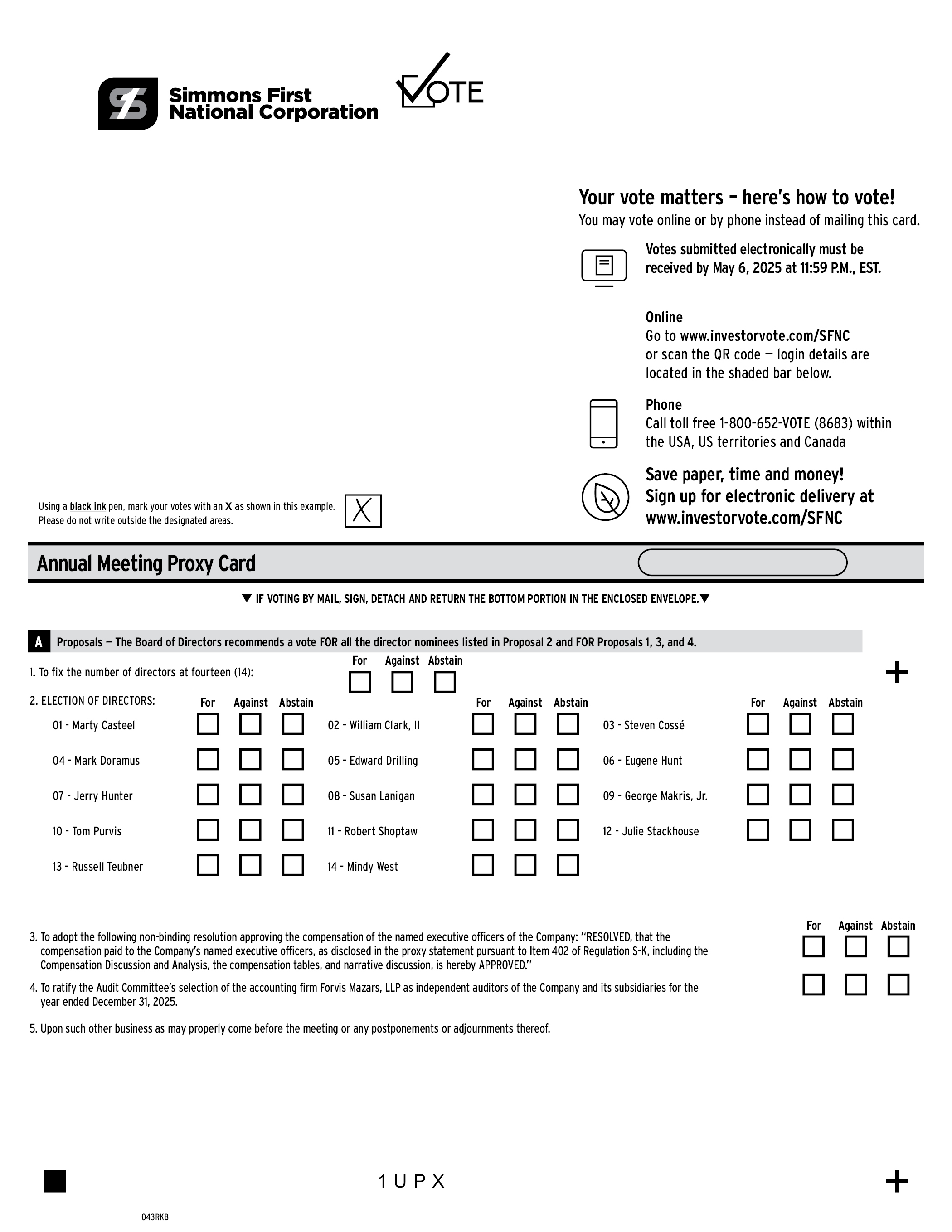

1. To fix at 14 the number of directors to be elected at the meeting;

2. To elect 14 persons as directors to serve until the next annual shareholders’ meeting and until their successors have been duly elected and qualified;

3. To consider adoption of a non-binding resolution approving the compensation of the named executive officers of the Company;

4. To consider ratification of the Audit Committee’s selection of the accounting firm FORVIS MAZARS, LLP as independent auditors of the Company and its subsidiaries for the year ended December 31, 2025; and

5. To transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

Only shareholders of record at the close of business on March 5, 2025, will be entitled to vote at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS:

George A. Makris III, Secretary

Pine Bluff, Arkansas

April 2, 2025

ANNUAL MEETING OF SHAREHOLDERS

SIMMONS FIRST NATIONAL CORPORATION

P. O. Box 7009

Pine Bluff, Arkansas 71611

PROXY STATEMENT

Meeting to be held on May 7, 2025

Proxy and Proxy Statement furnished on or about April 2, 2025

The enclosed proxy is solicited on behalf of the Board of Directors (“Board”) of Simmons First National Corporation (“Company”) for use at the annual meeting of the shareholders of the Company to be held on Wednesday, May 7, 2025, at 8:00 a.m. Central Time, in the auditorium of the Company’s Little Rock, Arkansas, corporate offices (601 E. 3rd Street, Little Rock, Arkansas 72201) or at any postponements or adjournments thereof. When such proxy is properly executed and submitted, the shares represented by it will be voted at the meeting in accordance with any directions noted thereon, or if no direction is indicated, will be voted “For” all of the director nominees in Proposal 2 and “For” Proposals 1, 3, and 4.

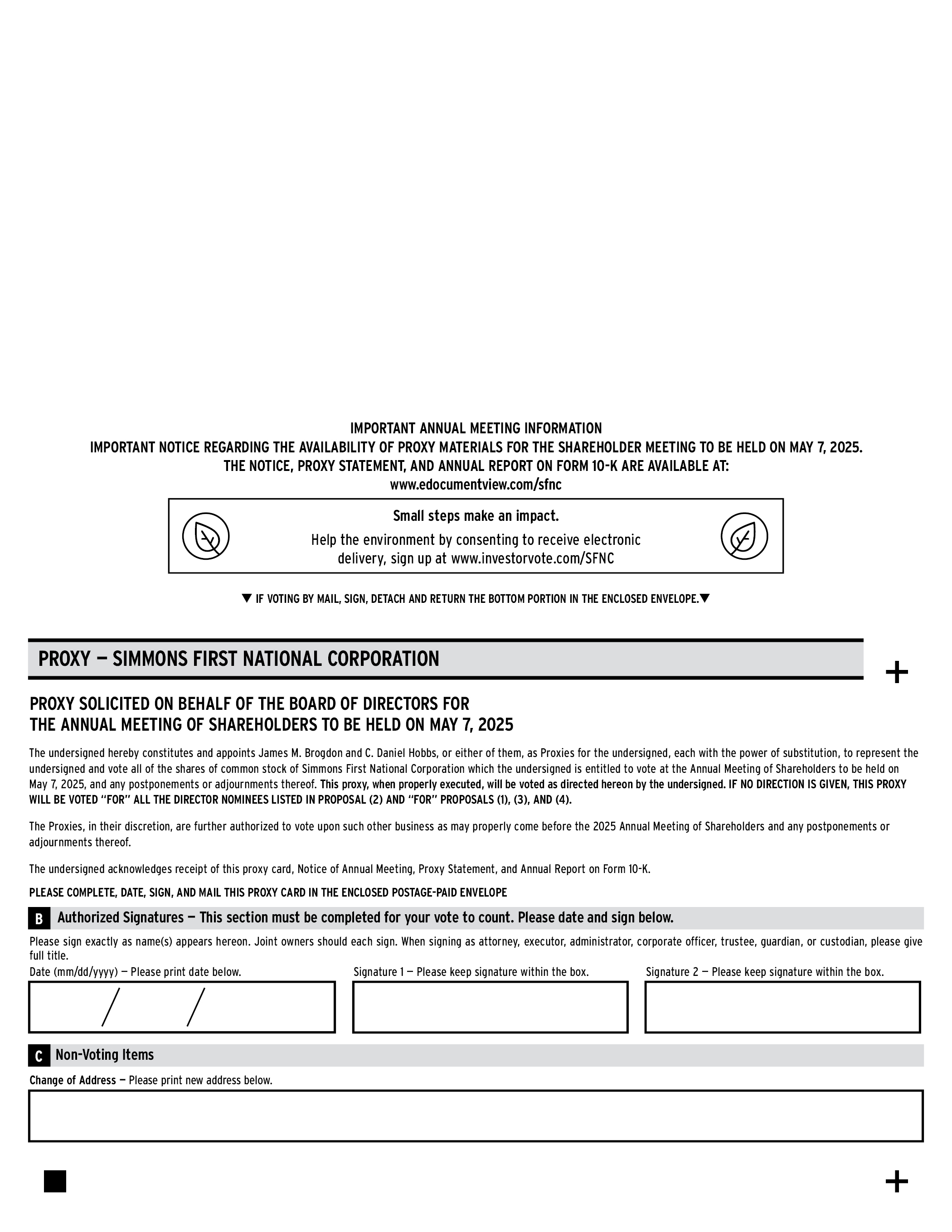

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting To Be Held on May 7, 2025:

The Notice, Proxy Statement, and Annual Report on Form 10-K

are available at www.edocumentview.com/sfnc.

REVOCABILITY OF PROXY

Any shareholder giving a proxy has the power to change or revoke it at any time before it is voted.

COSTS AND METHOD OF SOLICITATION

The costs of soliciting proxies will be borne by the Company. In addition to the use of the mails, solicitation may be made by employees of the Company by telephone, electronic communications, and personal interview. These persons will receive no compensation other than their regular salaries, but they will be reimbursed by the Company for their actual expenses incurred in such solicitations.

OUTSTANDING SECURITIES AND VOTING RIGHTS

At the meeting, holders of the Class A Common Stock, par value $0.01 per share, of the Company (the “Common Stock”) will be entitled to one vote, in person or by proxy, for each share of Common Stock owned of record as of the close of business on March 5, 2025. On that date, the Company had 125,918,825 shares of Common Stock outstanding and entitled to vote at the meeting. 4,137,332 of such shares were held by the trust division of Simmons Bank (“Bank”) in a fiduciary capacity, of which 159,750 shares cannot be voted by the Bank at the meeting.

All actions requiring a vote of the shareholders must be taken at a meeting at which a quorum is present in person or by proxy. A quorum consists of a majority of the outstanding shares entitled to vote upon a matter. With respect to each of Proposals 1, 3, and 4, approval requires that the votes cast “for” the proposal exceed the votes cast “against” it.

With respect to Proposal 2, the Company’s articles of incorporation and by-laws provide that, in an “uncontested election,” which is an election in which the number of nominees for director is less than or equal to the number of directors to be elected, a nominee for director shall be elected by a majority of the votes cast by the shares present in person or represented by proxy at the meeting and entitled to vote thereon. This means that the votes cast “for” a director nominee must exceed the votes cast “against” such nominee. If an incumbent nominee does not receive the required votes for election at the meeting, the Company’s by-laws require that the director immediately tender his or her resignation to the Board. The Board, through a process managed by the Board’s Nominating and Corporate Governance Committee (“NCGC”), will consider whether to accept the director’s offer of resignation and will publicly disclose its decision.

To be elected in a “contested election,” which is an election in which the number of nominees for director is greater than the number of directors to be elected, a nominee for director must receive a plurality of the votes cast by the shares present in person or represented by proxy at the meeting and entitled to vote thereon.

1

All proxies submitted will be tabulated by Computershare, the transfer agent for the Common Stock.

The enclosed proxy card also provides a method for shareholders to abstain from voting on each matter presented. By abstaining with respect to any of Proposals 1 through 4, shares will not be voted either “for” or “against” the subject proposal but will be counted for quorum purposes. Abstentions, therefore, will not affect the outcome of the vote on any of Proposals 1 through 4. While there may be instances in which a shareholder may wish to abstain from voting on any particular matter, the Board encourages all shareholders to vote their shares in their best judgment and to participate in the voting process to the fullest extent possible.

If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials have been forwarded to you by your broker or other nominee (the “record holder”) along with a voting instruction form. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received a voting instruction from the beneficial owner and does not have discretionary voting power with respect to that item. Due to various regulatory requirements, brokers or other nominees may not exercise discretionary voting power on the election of directors, executive compensation or other non-routine matters. While brokers or other nominees might still be permitted to exercise discretionary voting power for Proposal 4 (the ratification of FORVIS MAZARS, LLP as our independent auditor), brokers and other nominees may not exercise discretionary voting power for Proposals 1 through 3 (number of directors, election of directors, and approval of executive compensation). As a result, if you do not provide specific voting instructions to your record holder, the record holder may not vote your shares on Proposals 1 through 3. Accordingly, it is particularly important that you provide voting instructions to your broker or other nominee so that your shares may be voted on the matters presented at the meeting.

If your shares are treated as a broker non-vote, your shares will be counted in the number of shares represented for purposes of determining whether a quorum is present. However, broker non-votes will not be included in vote totals (neither “for” nor “against”). Therefore, with respect to Proposals 1 through 4, broker non-votes will not affect the outcome of the vote.

In the event a shareholder executes the proxy but does not mark the proxy to vote (or abstain) on any one or more of the proposals, the proxy will be voted “For” all of the director nominees in Proposal 2 and “For” Proposals 1, 3, and 4, as applicable. Further, if any matter, other than the matters shown on the proxy, is properly presented at the meeting which may be acted upon without special notice under Arkansas law, the proxy solicited hereby confers discretionary authority to the named proxies to vote in their sole discretion with respect to such matters, as well as other matters incident to the conduct of the meeting. On the date of the mailing of this proxy statement, the Board has no knowledge of any such other matter which will come before the meeting. To obtain directions to attend the annual meeting of shareholders and vote in person, please contact Ed Bilek, Director of Investor and Media Relations, at investorrelations@simmonsbank.com or 501-263-7483.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth (except as otherwise indicated, as of February 7, 2025) (1) all persons known to management who own, beneficially or of record, more than 5% of the outstanding Common Stock, (2) the number of shares of Common Stock owned by the named executive officers in the Summary Compensation Table, (3) the number of shares of Common Stock owned by each current director and director nominee (as reported by each director and nominee), and (4) the number of shares of Common Stock owned by all current directors and current executive officers as a group.

|

Name and Address of Beneficial Owner |

Shares Owned |

Percent of Class[b] |

|||

|

BlackRock, Inc.[c] |

18,043,806 |

14.33 |

% |

||

|

The Vanguard Group[d] |

15,207,448 |

12.08 |

% |

||

|

Dimensional Fund Advisors LP[e] |

6,566,353 |

5.21 |

% |

||

|

State Street Corporation[f] |

6,940,079 |

5.51 |

% |

||

|

Robert A. Fehlman[g] |

214,006 |

* |

|

||

|

C. Daniel Hobbs |

2,547 |

* |

|

||

|

George A. Makris Jr.[h] |

781,802 |

* |

|

||

|

James M. Brogdon[i] |

36,451 |

* |

|

||

|

George A. Makris III[j] |

43,103 |

* |

|

||

|

Marty D. Casteel[k] |

205,521 |

* |

|

||

|

William E. Clark, II[l] |

33,100 |

* |

|

||

|

Steven A. Cossé[m] |

88,762 |

* |

|

||

|

Mark C. Doramus[n] |

49,898 |

* |

|

||

|

Edward Drilling |

34,806 |

* |

|

||

|

Eugene Hunt |

31,430 |

* |

|

||

|

Jerry Hunter |

20,460 |

* |

|

||

|

Susan Lanigan |

27,273 |

* |

|

||

|

Tom Purvis |

35,740 |

* |

|

||

|

Robert L. Shoptaw[o] |

87,516 |

* |

|

||

|

Julie Stackhouse |

12,273 |

* |

|

||

|

Russell W. Teubner[p] |

114,666 |

* |

|

||

|

Mindy West |

21,134 |

* |

|

||

|

All directors and officers as a group (22 persons) |

1,813,282 |

1.44 |

% |

||

________________________

* The shares beneficially owned represent less than 1% of the outstanding common shares.

[a] Under the applicable rules, “beneficial ownership” of a security means, directly or indirectly, through any contract, relationship, arrangement, understanding or otherwise, having or sharing voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security, or the right to acquire beneficial ownership of the security within 60 days (“exercisable stock options”). Unless otherwise indicated, each beneficial owner named has sole voting and investment power with respect to the shares identified.

[b] The percentage of Common Stock beneficially owned was calculated based on the number of shares of Common Stock outstanding as of March 5, 2025.

3

[c] Based solely on information as of December 31, 2023, contained in Amendment No. 2 to Schedule 13G, filed with the U.S. Securities and Exchange Commission (“SEC”) on January 23, 2024. These shares may be owned by one or more of the following entities controlled by BlackRock, Inc.: BlackRock Life Limited, BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock (Netherlands) B.V., BlackRock Fund Advisors (which beneficially owns 5% or more of the shares of Common Stock outstanding), BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited, and BlackRock Fund Managers Ltd.

[d] Based solely on information as of December 29, 2023, contained in Amendment No. 10 to Schedule 13G, filed with the SEC on February 13, 2024, including that The Vanguard Group has shared investment power as to 238,601 shares, sole voting power as to 0 shares, and shared voting power as to 105,794 shares. These shares may be owned by The Vanguard Group, Inc.’s clients, including investment companies registered under the Investment Company Act of 1940 and other managed accounts.

[e] Based solely on information as of December 29, 2023, contained in Amendment No. 6 to Schedule 13G, filed with the SEC on February 9, 2024. These shares may be owned by investment companies, commingled funds, group trusts, and separate accounts for which Dimensional Fund Advisors LP or its subsidiaries serves as investment adviser, sub-adviser, and/or investment manager.

[f] Based solely on information as of December 31, 2024, contained in Schedule 13G, filed with the SEC on February 5, 2025, including that State Street Corporation has shared investment power as to 6,940,079 shares, sole voting power as to 0 shares, and shared voting power as to 835,261 shares. These shares may be owned by one or more of the following entities controlled by State Street Corporation: SSGA Funds Management, Inc. (IA); State Street Global Advisors Europe Limited (IA); State Street Global Advisors Limited (IA); State Street Global Advisors Trust Company (IA); State Street Global Advisors, Australia, Limited (IA); and State Street Global Advisors, Ltd. (IA).

[g] Mr. Fehlman owns of record 143,162 shares; 15,273 shares were held in his fully vested account in the Company’s 401(k) Plan; 1,851 shares were held in his account in the SFNC Employee Stock Purchase Plan; 52,220 shares were deemed held through exercisable stock options; and 1,500 shares were held by his daughter.

[h] Mr. Makris, Jr. owns of record 34,331 shares; 581,167 shares are held jointly with his spouse; 9,270 shares are held in his IRA; 10,990 shares are held in his wife’s IRA; 12,000 shares held in a trust for his benefit; 1,016 shares were held in his fully vested account in the Company’s 401(k) Plan; 1,158 shares were held in his account in the SFNC Employee Stock Purchase Plan; and 131,870 shares were deemed held through exercisable stock options.

[i] Mr. Brogdon owns of record 21,384 shares, and 15,067 are held jointly with his spouse.

[j] Mr. Makris III owns of record 41,323 shares, and 1,780 shares are held by his spouse.

[k] Mr. Casteel owns of record 169,091 shares; 8,766 shares are owned jointly with his wife; 22,434 shares are held in his fully vested account in the Company’s 401(k) Plan; and 5,230 shares are held in his account in the SFNC Employee Stock Purchase Plan.

[l] Mr. Clark owns of record 30,100 shares, and 3,000 shares are owned jointly with his spouse.

[m] Mr. Cossé owns 88,762 shares jointly with his spouse.

[n] Mr. Doramus owns 49,898 shares jointly with his spouse.

[o] Mr. Shoptaw owns of record 46,716 shares; 36,000 shares are held jointly with his spouse; and 4,800 shares are held in his IRA.

[p] Mr. Teubner owns of record 19,668 shares; 64,572 shares are held in his IRA; 2,478 shares are held in his wife’s IRA; and 27,948 shares are held by Mr. Teubner’s foundation.

4

PROPOSAL 1 — FIX THE NUMBER OF DIRECTORS

At the 2024 annual shareholders’ meeting, the number of directors was set at fourteen (14), and the fourteen (14) nominees were elected. The Board has considered the number of directors that should serve on the Board for the ensuing year and has set the number of directors to be elected at the 2025 annual shareholders’ meeting at fourteen (14). The Board is presenting its decision to set the number of directors to be elected to the Board at the annual shareholders’ meeting at fourteen (14) to the shareholders for ratification.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR PROPOSAL 1 TO RATIFY THE ACTION OF THE BOARD TO FIX THE NUMBER OF DIRECTORS AT FOURTEEN (14).

5

PROPOSAL 2 — ELECTION OF DIRECTORS

Each of the persons named below is presently serving as a director of the Company for a term which ends on May 7, 2025, or such other date upon which a successor is duly elected and qualified. The Board has evaluated the independence of each director serving on the Board and its audit, compensation, and nominating and corporate governance committees under applicable law and regulations and the NASDAQ listing standards. The table below summarizes the findings of the Board (and reflects the present composition of each of the named committees). The Board also determined that former directors Dean Bass, Jay Burchfield and W. Scott McGeorge, who did not stand for re-election at the 2024 annual shareholders’ meeting were independent during the period of 2024 when they served as directors.

|

Name |

Board of |

Audit |

Compensation |

Nominating & |

||||

|

Marty D. Casteel |

Independent |

* |

* |

* |

||||

|

William E. Clark, II |

Independent |

* |

* |

* |

||||

|

Steven A. Cossé |

Independent |

Independent |

Independent |

Independent |

||||

|

Mark C. Doramus |

Independent |

* |

* |

* |

||||

|

Edward Drilling |

Independent |

* |

* |

Independent |

||||

|

Eugene Hunt |

Independent |

* |

* |

* |

||||

|

Jerry Hunter |

Independent |

Independent |

Independent |

* |

||||

|

Susan Lanigan |

Independent |

Independent |

Independent |

Independent |

||||

|

George A. Makris, Jr. |

Not Independent |

* |

* |

* |

||||

|

Tom Purvis |

Independent |

* |

* |

Independent |

||||

|

Robert L. Shoptaw |

Independent |

Independent |

Independent |

Independent |

||||

|

Julie Stackhouse |

Independent |

* |

* |

* |

||||

|

Russell W. Teubner |

Independent |

* |

* |

* |

||||

|

Mindy West |

Independent |

Independent |

Independent |

* |

________________________

* The director is not a member of the Committee.

In the evaluation of Mr. Doramus’s independence, the Board considered investment banking and brokerage services provided to the Company and its subsidiaries by Stephens Inc., as well as insurance services provided to the Company and its subsidiaries by insurance agency affiliates of Stephens Inc. (Mr. Doramus is the Chief Financial Officer of Stephens Inc.). In each of these cases, the fees paid were below the independence thresholds of the NASDAQ listing standards, and the Board determined that the relationship did not interfere with the director’s ability to exercise independent judgment as a director of the Company.

The proxies hereby solicited will be voted for the election of the nominees shown below, as directors, to serve until the next annual meeting of the shareholders and until their successors are duly elected and qualified, unless otherwise designated in the proxy. If at the time of the meeting any of the nominees should be unable or unwilling to serve, the discretionary authority granted in the proxy may be exercised to vote for the election of a substitute or substitutes selected by the Board. Management has no reason to believe that any substitute nominee or nominees will be required.

6

The nominees possess a wide range of qualifications and perspectives that contribute to strong oversight. The tables below highlight each nominee’s skills, experience, and background, as well as certain demographic, diversity, and tenure information.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR ALL OF THE BELOW-NAMED NOMINEES FOR ELECTION TO THE BOARD.

Marty D. Casteel

Mr. Casteel, 74, was elected to the Board in 2020. Until his retirement in 2020, Mr. Casteel was employed by the Company’s lead subsidiary, Simmons Bank, for over 30 years. During that time, he held various leadership roles, including serving as Simmons Bank’s Chairman, President, and Chief Executive Officer from 2013 to 2020. In addition, Mr. Casteel was a Senior Executive Vice President of the Company from 2013 to 2020. Mr. Casteel received a B.S.B.A. degree in Marketing from University of Arkansas in 1974. Mr. Casteel also served in the U.S. Army from 1974 to 1978.

Mr. Casteel has served on numerous boards during his career. He is currently a member of the boards of directors of Jefferson Regional Medical Center, the Arkansas Research Alliance, and the Arkansas Championship Trust, and he is a past member of the board of directors of the Economic Development Alliance of Jefferson County. He is also a past president of the Mortgage Bankers Association of Arkansas.

The Board believes that Mr. Casteel’s deep understanding of current and historical bank operations, as well as his experience as the Chairman, President, and Chief Executive Officer of Simmons Bank, provide needed skills and insight into the banking and financial services business conducted by the Company and its subsidiaries, including the assessment of lending and deposit activities, the management of financial regulatory affairs, the evaluation of bank policies and practices, and the mitigation of enterprise risks.

William E. Clark, II

Mr. Clark, 55, was elected to the Board in 2008. He is the Chief Executive Officer of Clark Contractors, LLC, a general contractor involved in commercial construction throughout the United States. Prior to the formation of Clark Contractors, LLC in 2009, he was employed by CDI Contractors from 1994 through 2009, where he served in various capacities culminating in his serving as Chief Executive Officer from 2007 to 2009. Mr. Clark received a B.S.B.A. degree in Business Management from the University of Arkansas in 1991.

He is a member of Fifty for the Future, a board member of CARTI, a past chairman of the UAMS Foundation Fund Board of Directors, a past President/Chairman for the UAMS Consortium, Arkansas Children’s Hospital Committee for the Future, and St. Vincent Foundation, a former member of the Young Presidents Organization, and a member of the Dean’s Executive Advisory Board for the Walton College of Business at the University of Arkansas and the Arkansas Executive Forum.

7

The Board believes that Mr. Clark’s experience within the commercial construction industry provides needed skills in the assessment of the construction industry utilized by the Company in setting policies involving the allocation of credit and lending priorities.

Steven A. Cossé

Mr. Cossé, 77, was elected to the Board in 2004. In 2013, he retired as President and Chief Executive Officer of Murphy Oil Corporation, a Fortune 500 company listed on the New York Stock Exchange (“NYSE”). Mr. Cossé has also previously served as the Executive Vice President and General Counsel for Murphy Oil Corporation. He had served as General Counsel since 1991 and had also previously served as Senior Vice President, Vice President and Principal Financial Officer. Prior to joining Murphy Oil Corporation as General Counsel, he served for eight years as General Counsel for Ocean Drilling & Exploration Company in New Orleans, Louisiana, a NYSE-listed, majority-owned subsidiary of Murphy Oil Corporation. Mr. Cossé received a B.A. degree in Government from Southeastern Louisiana University in 1969 and a Juris Doctorate degree from Loyola University in 1974.

Mr. Cossé also currently serves on the boards of South Arkansas Regional Hospital and SHARE Foundation. He is a former member of the board of directors of Murphy Oil Corporation, the Board of Trustees of Loyola University New Orleans, and he is past chairman of the South Arkansas Chapter of the American Red Cross. Mr. Cossé is a member of the Louisiana Bar Association, Arkansas Bar Association, and Union County Bar Association.

The Board believes that Mr. Cossé’s experience as an executive officer, general counsel and principal financial officer provides needed skills in the assessment of the oil industry utilized by the Company in setting policies involving the allocation of credit and lending priorities and in the legal, financial and general business issues facing publicly traded companies.

Mark C. Doramus

Mr. Doramus, 66, was elected to the Board in 2015. He serves as Chief Financial Officer of Stephens Inc. (“Stephens”), an independent financial services firm headquartered in Little Rock, Arkansas. He has served in several capacities at Stephens, including in the corporate finance department from 1988 to 1994, Assistant to the President from 1994 to 1996, and Chief Financial Officer since 1996.

He began his career in 1980 with Arthur Andersen & Co. in Dallas, Texas, where he worked as a Certified Public Accountant. He joined the Dallas, Texas, office of Trammell Crow Company in 1983, where he worked until he joined Stephens in 1988.

Mr. Doramus was a member of the CHI St. Vincent Infirmary Board of Directors from 2007 to 2016, serving as chairman from 2012 to 2014. Mr. Doramus was a member of the University of Arkansas at Little Rock Board of Visitors from 2004 to 2016. Mr. Doramus served on the Winthrop Rockefeller Foundation board from 2004 to 2009, serving as Chairman in 2009.

Mr. Doramus graduated from Rhodes College in Memphis, Tennessee, with a B.A. degree in Economics and Business in 1980 and received his M.A. degree in Real Estate and Regional Science from Southern Methodist University in Dallas, Texas, in 1982.

The Board believes that Mr. Doramus’s experience in accounting and the financial services industry provides needed skills for assisting in the management of the Company’s business, including risk management, internal controls, and capital management.

Edward Drilling

Mr. Drilling, 69, was elected to the Board in 2008. In 2020, he retired as Senior Vice President of External and Regulatory Affairs for AT&T. He joined AT&T (then Southwestern Bell Telephone Company) in 1979 and served in various operations positions including customer service, sales and marketing, and the external affairs organization. He was named President of AT&T’s Arkansas Division in 2002 and was appointed as AT&T’s Senior Vice President of External and Regulatory Affairs for all fifty states in 2017. Mr. Drilling received a B.S. degree in Marketing from the Walton College at the University of Arkansas in 1978 and graduated from the Emory University Advanced Management Program in 1991. In 2022, he completed the Berkeley Law executive education program “ESG: Navigating the Board’s Role”.

8

Mr. Drilling has served on numerous boards over the last 40 years, including as past chairman of the Arkansas State Chamber of Commerce, Arkansas Children’s Hospital Board of Trustees, University of Arkansas Board of Advisors, former president of the Little Rock Chamber of Commerce Board of Directors, UAMS Arkansas BioVentures Advisory Board, founding member of the Arkansas Research Alliance, former president of Fifty for the Future, and former vice chairman of the Arkansas Economic Development Commission. He also currently serves on the Arkansas Game and Fish Foundation Board and the Nature Conservancy Board.

The Board believes that Mr. Drilling’s experience as an executive within the telecommunication and information technology industry (having participated in various industry transitions, mergers and technology changes) provides needed skills in the assessment of the technology risks of the Company and the security measures to address these risks, as well as valuable insights involving the executive management of a large, highly-regulated enterprise.

Eugene Hunt

Mr. Hunt, 79, was elected to the Board in 2009. He is an attorney in private practice in Pine Bluff, Arkansas. Mr. Hunt began his practice in 1972 and has thereafter been involved in the active practice of law within Arkansas, primarily in southeast Arkansas. He served as Judge on the Arkansas Court of Appeals from August through December 2008 and has also previously served as a Special Circuit Judge and Special Justice on the Arkansas Supreme Court. Additionally, he served as Director of the Child Support Enforcement Unit, Jefferson County, Arkansas from 1990 to 2001. Mr. Hunt received a B.A. degree in History and Government from Arkansas AM&N College in 1969 and a Juris Doctorate degree from the University of Arkansas Law School in 1971.

Mr. Hunt also serves on the boards of The Economic Development Corporation of Jefferson County, Arkansas; Jefferson Hospital; and Youth Partners. He has also been involved with the Arkansas Ethics Commission, Jefferson County United Way, and the Arkansas Criminal Code Revision Commission. He is a Life Member of the NAACP and has served as an NAACP Legal Defense Fund Affiliate Attorney since 1978.

The Board believes that Mr. Hunt’s experience as an attorney and his long-term familiarity with the business and social environment in southeastern Arkansas provide needed skills in, and insight into, the small business and consumer needs of the Company’s banking customers in one of its major markets, southeastern Arkansas.

Jerry Hunter

Mr. Hunter, 72, was elected to the Board in 2017. He is Senior Counsel in the Commercial Litigation and Labor & Employment Law Client Service Groups of the international law firm Bryan Cave Leighton Paisner LLP, where he previously was a partner from 1994 until 2020. Mr. Hunter previously served as Labor Counsel for the Kellwood Company, Director of the Missouri Department of Labor and Industrial Relations, and General Counsel of the National Labor Relations Board. Mr. Hunter received a bachelor’s degree in History and Government with a minor in Mathematics from the University of Arkansas at Pine Bluff in 1974 and a Juris Doctor degree from Washington University School of Law in St. Louis, Missouri in 1977. Mr. Hunter also attended the Program for Senior Executives in State and Local Government at the John F. Kennedy School of Government, Harvard University in 1987.

On November 14, 2022, Mr. Hunter was elected to the Board of Directors of Missouri-American Water Company. Mr. Hunter has served on the boards of the Kellwood Company, Boys Hope Girls Hope International, Associated Industries of Missouri, St. Louis Regional Convention and Sports Complex Authority, U.S. Congress Office of Compliance, American Arbitration Association, Maryville University, the U.S. Senate Small Business Committee Advisory Council, and Washington University Law School Board of Advisors.

The Board believes that Mr. Hunter’s experience as an attorney in senior-level governmental and private-sector roles, as well as his deep knowledge of labor and employment matters, provide needed skills and insight into the legal and regulatory environment in which the Company operates.

Susan Lanigan

Ms. Lanigan, 62, was elected to the Board in 2017. She is on the Board of Directors of Kirkland’s Inc. (a Nasdaq-listed company), where she chairs the Compensation Committee. She previously served on the Board of Directors of Vi-Jon, Inc., where she chaired the Nominating Committee until December 31, 2022.

9

Ms. Lanigan previously served as Executive Vice President and General Counsel of Chico’s FAS, Inc. (then a NYSE-listed company) from May 2016 until her retirement in July 2018. She also served as Chair of the Tennessee Education Lottery Commission, a position to which she was appointed by the Governor of the State of Tennessee and approved by the State Legislature, from 2014 to 2021. Prior to that, she was Executive Vice President and General Counsel of Dollar General Corporation (a NYSE-listed company) (“Dollar General”), a Fortune 200 company, where she worked from July 2002 until May 2013. Prior to joining Dollar General, Ms. Lanigan served as Senior Vice President and General Counsel of Zale Corporation. She started her career as a litigation attorney for Troutman Sanders, LLP (now Troutman Pepper Locke LLP) in Atlanta, GA. Ms. Lanigan received her undergraduate degree from the University of Georgia and her law degree from the University of Georgia School of Law.

The Board believes that Ms. Lanigan’s experiences as a senior executive officer and general counsel, and as a board member, of large corporations provide needed skills and insight in addressing legal, governance, and general business issues facing publicly traded companies.

George A. Makris, Jr.

Mr. Makris, Jr., 68, was elected to the Board in 1997. He currently serves as Chairman and Chief Executive Officer of the Company, as well as the Chairman and Chief Executive Officer of the Company’s lead subsidiary, Simmons Bank. Except for a two-year period from January 1, 2023 through December 31, 2024, during which time he served as the Executive Chairman and Chairman of the Board of the Company and Simmons Bank, Mr. Makris, Jr. has served as Chairman and Chief Executive Officer of the Company since joining the Company on January 2, 2013. Prior to his employment by the Company, Mr. Makris, Jr. had been employed by M. K. Distributors, Inc. since 1980 and had served as its President since 1985. Mr. Makris, Jr. previously served as a member of the Board of Directors of Worthen National Bank — Pine Bluff and its successors from 1985 to 1996 and served as Chairman of the Board from 1994 to 1996. Mr. Makris, Jr. received a B.A. degree in Business Administration from Rhodes College in 1978 and an M.B.A. from the University of Arkansas in 1980.

Mr. Makris, Jr. also serves as a member of the Board of Trustees of Jefferson Regional Medical Center and the Board of Visitors of the University of Arkansas at Little Rock. In 2023, he represented the Eighth District of the Federal Reserve on the Federal Advisory Council to the Federal Reserve Board. He is a past Chairman of the Board of Directors of The Economic Development Corporation of Jefferson County, Arkansas. He has previously served as Chairman of the Board of Trustees of the Arts and Science Center for Southeast Arkansas, Chairman of the Board of Directors of the Economic Development Alliance for Jefferson County, Chairman of the Board of Directors of the Greater Pine Bluff Chamber of Commerce, Chairman of the King Cotton Classic Basketball Tournament, Chairman of the Board of Trustees of Trinity Episcopal School, a director of the Wholesale Beer Distributors of Arkansas, a director of the National Beer Wholesalers Association, a director of CHI St. Vincent. and a member of the Board of Visitors of the University of Arkansas at Pine Bluff and the University of Arkansas for Medical Sciences, College of Medicine.

The Board believes that Mr. Makris, Jr.’s experience as the Chairman and Chief Executive Officer of the Company and former Executive Chairman and Chairman of the Board of the Company, and his experience as a business executive and long-term resident of central and southeastern Arkansas provide needed skills and insight into the banking and financial services business conducted by the Company as well as the executive management of a successful business enterprise.

Tom Purvis

Mr. Purvis, 66, was elected to the Board in 2017. He is a partner in a number of real estate development entities and is a partner in L2L Development Advisors, LLC. His career has spanned over 40 years in real estate and related services. Mr. Purvis previously served on the Board of Directors of First Texas BHC, Inc., which was acquired by the Company in 2017.

Mr. Purvis currently serves as a director of the Fort Worth Zoo, Fort Worth Streams and Valleys, and Fort Worth Tax Increment Financing District. He attended the Business College at the University of Texas and Texas Christian University, where he received a B.B.A. degree in 1982.

The Board believes that Mr. Purvis’s experience in real estate development and financing provides needed skills for analyzing the real estate industry and setting policies involving the allocation of credit and lending priorities within the Texas and other geographic markets of the Company.

10

Robert L. Shoptaw

Mr. Shoptaw, 78, was elected to the Board in 2006. Mr. Shoptaw retired as President of Arkansas Blue Cross Blue Shield (“ABCBS”), a mutual health insurance company, in 2008, terminating his 39 years of service to that organization. During the 1970’s and 1980’s, he served in various management and executive capacities with a primary focus in medical services management, professional relations, and government programs administration (Medicare administrative operations). In 1987, Mr. Shoptaw became the Executive Vice President and Chief Operating Officer of ABCBS and was named President and Chief Executive Officer in 1994. After retiring as President and Chief Executive Officer in 2008, he served as Chairman of the Board of Directors of ABCBS from 2009 to 2016. Thereafter, he continued on the ABCBS Board of Directors and served as Chairman of the Audit Committee until March of 2022.

Mr. Shoptaw received a B.A. in Economics from Arkansas Tech University in 1968, an M.B.A. from Webster University in Business Administration and Health Services Management and completed the Advanced Management Program at Harvard University Business School in 1991.

Mr. Shoptaw currently serves as Chairman of the board of commissioners of the Little Rock Metrocentre Improvement District. In the recent past, he served as a founding board member of the Arkansas Research Alliance, chaired the Board of Visitors of the University of Arkansas College of Medicine, and completed a 20-year tenure on the board of the Arkansas Center for Health Improvement.

The Board believes that Mr. Shoptaw’s experience and past performance as the president of a large mutual health insurance company provide needed skills and insight into the health care industry and the financial and executive management of a large, successful business enterprise.

Julie Stackhouse

Ms. Stackhouse, 66, was elected to the Board in 2021. In 2020, she retired as an Executive Vice President at the Federal Reserve Bank of St. Louis, where she was responsible for bank regulation, including supervision of bank holding companies and state member banks, as well as discount window lending, community development, and learning innovation functions. Prior to joining the Federal Reserve Bank of St. Louis in 2002, Ms. Stackhouse held managerial roles at the Federal Reserve Banks of Kansas City and Minneapolis. Ms. Stackhouse graduated summa cum laude from Drake University in 1980 with a B.S. degree.

Ms. Stackhouse currently serves on the City of Fort Collins Planning and Zoning Commission, the board of the League of Women Voters of Larimer County, the audit committee of the Colorado State University Foundation, the audit committee of Friendship Bridge, and the Conference of State Bank Supervisors’ State Banking Department Accreditation Review Team.

The Board believes that Ms. Stackhouse’s extensive financial regulatory experience, deep knowledge of financial operations and risks, and leadership roles within government organizations provide needed skills and insight to assist in the oversight of legal, regulatory, compliance, and other matters associated with a large financial institution.

Russell W. Teubner

Mr. Teubner, 68, was elected to the Board in 2017. He was the Co-Founder and Chief Executive Officer of HostBridge Technology, LLC, a computer software company, for 20 years. Following the acquisition of HostBridge Technology, LLC by Broadcom, Inc. in 2022, Mr. Teubner now serves as a Distinguished Engineer within Broadcom’s Mainframe Software Division. Mr. Teubner previously served as a Chairman of Southwest Bancorp, Inc., which was acquired by the Company in 2017.

The Stillwater, Oklahoma, Chamber of Commerce honored Mr. Teubner as Citizen of the Year in 1992, Small Business Person of the Year in 1991 – 92, and Small Business Exporter of the Year in 1992 – 93. In 1997, Oklahoma State University (OSU) named Mr. Teubner as a recipient of its Distinguished Alumni award. During 1996 and 1997 he served on the Citizen’s Commission on the Future of Oklahoma Higher Education. In 1998, he was inducted into the OSU College of Business Hall of Fame. Currently, he serves on the Board of Advisors of the OSU Innovation Foundation and its commercialization subsidiary, Cowboy Technology. In 2019, the Governor of Oklahoma appointed him to serve on the Board of the Oklahoma Center for the Advancement of Science and Technology (OCAST). In 2022, the Governor of Oklahoma appointed him to serve on the Oklahoma Broadband Governing Board. Mr. Teubner is a past director of the Oklahoma City branch of the Federal Reserve Bank of Kansas City.

11

The Board believes that Mr. Teubner’s experience in the technology industry provides needed skills for assessing the role of information technology within the Company and its subsidiaries, as well as addressing technology-related risks within the financial industry.

Mindy West

Ms. West, 56, was elected to the Board in 2017. She currently serves as the Executive Vice President and Chief Operating Officer at Murphy USA Inc., a NYSE-listed retailer of gasoline products and convenience store merchandise and has held that role since February 2024. From August 2013 to February 2024, she served as the Executive Vice President, Chief Financial Officer and Treasurer for Murphy USA Inc. (and, in addition to those duties, served as Executive Vice President of Fuels from June 2018 to February 2024). Ms. West was previously employed by Murphy Oil Corporation, joining the company in 1996 and holding positions in accounting, employee benefits, planning and investor relations. She was Murphy Oil Corporation’s Director of Investor Relations from July 2001 until December 2006 and its Vice President and Treasurer from January 2007 until August 2013, when she joined Murphy USA Inc. Ms. West holds a bachelor’s degree in Finance from the University of Arkansas and a bachelor’s degree in Accounting from Southern Arkansas University. She is a Certified Public Accountant (Inactive) and a Certified Treasury Professional. Ms. West also currently serves on the Board of Directors of SHARE Foundation of El Dorado, Arkansas, the Board of Directors of the Razorback Foundation, and its executive committee, as well as the Board of Directors of Ducks Unlimited Inc. and Wetlands America Trust, where she serves on the finance committee and board governance committee. Ms. West serves on the Natural State Advisory Council and is a former member of the South Arkansas University Business Advisory Council.

The Board believes that Ms. West’s experience in accounting and finance, as well as her leadership roles in large, public companies, provide needed skills for assisting in the oversight of the Company’s business, including audit, risk management, internal controls and capital management.

The table below sets forth the name, age, principal occupation or employment during the last five years, and prior service as a director of the Company with respect to each director nominee proposed:

|

Name |

Age |

Principal Occupation |

Director |

|||

|

Marty D. Casteel |

74 |

Retired SEVP of the Company; Retired Chairman, President and CEO of the Bank |

2020 |

|||

|

William E. Clark, II |

55 |

Founder and CEO, Clark Contractors, LLC (Construction) |

2008 |

|||

|

Steven A. Cossé |

77 |

Retired President and CEO Murphy Oil Corporation |

2004 |

|||

|

Mark C. Doramus |

66 |

Chief Financial Officer, Stephens Inc. (Financial Services) |

2015 |

|||

|

Edward Drilling |

69 |

Retired SVP of External and Regulatory Affairs, AT&T Inc. |

2008 |

|||

|

Eugene Hunt |

79 |

Attorney, Hunt Law Firm |

2009 |

|||

|

Jerry Hunter |

72 |

Senior Counsel, Bryan Cave Leighton Paisner LLP |

2017 |

|||

|

Susan Lanigan |

62 |

Retired EVP & General Counsel, Chico’s FAS, Inc. |

2017 |

|||

|

George A. Makris, Jr. |

68 |

Chairman and Chief Executive Officer of the Company and the Bank |

1997 |

|||

|

Tom Purvis |

66 |

Partner, L2L Development Advisors, LLC (Real Estate) |

2017 |

|||

|

Robert L. Shoptaw |

78 |

Retired Executive, Arkansas Blue Cross and Blue Shield |

2006 |

|||

|

Julie Stackhouse |

66 |

Retired Executive Vice President, Federal Reserve Bank of St. Louis |

2021 |

|||

|

Russell W. Teubner |

68 |

Distinguished Engineer, Broadcom, Inc. |

2017 |

|||

|

Mindy West |

56 |

Executive Vice President and Chief Operating Officer, Murphy USA Inc. (Retailer of Gasoline Products and Convenience Store Merchandise) |

2017 |

12

Committees and Related Matters

During 2024, the Executive Committee, which was composed of Steven Cossé (Chair), Jay D. Burchfield (until April 23, 2024), Marty Casteel, Mark Doramus, Susan Lanigan, George A. Makris, Jr. (as of March 15, 2024), Robert Shoptaw, and Mindy West, met 4 times.

During 2024, the Audit Committee was composed of Robert L. Shoptaw (Chair), Jay D. Burchfield (from January 23, 2024 until April 23, 2024), Steven Cossé, Jerry Hunter, Susan Lanigan (as of February 29, 2024), and Mindy West (Vice Chair). The Board has determined that Messrs. Shoptaw and Cossé, along with Ms. West, constitute financial experts on the Audit Committee. This committee provides assistance to the Board in fulfilling its responsibilities concerning accounting and reporting practices by regularly reviewing the adequacy of the internal and external auditors, the disclosure of the financial affairs of the Company and its subsidiaries, the control systems of management and internal accounting controls. During 2024, this committee met 9 times.

The Compensation Committee, which was composed of Jay Burchfield (Chair until February 29, 2024; member until April 23, 2024), Susan Lanigan (Chair as of February 29, 2024), Steven Cossé, Jerry Hunter, Robert L. Shoptaw, and Mindy West, met 6 times during 2024.

The NCGC, which was composed of Steven Cossé (Chair), Edward Drilling, Susan Lanigan, Tom Purvis, and Robert L. Shoptaw, met 4 times during 2024.

The Risk Committee, which was composed of Mark C. Doramus (Chair), Marty Casteel, Edward Drilling, Eugene Hunt, Tom Purvis, and Julie Stackhouse, met 4 times during 2024.

The Company encourages all Board members to attend the annual shareholders’ meeting. Historically, the directors of the Company and its subsidiaries are introduced and acknowledged at the annual shareholders’ meeting. All fourteen of the directors who stood for election at the 2024 annual shareholders’ meeting (and the three directors who did not stand for reelection) attended the Company’s 2024 annual shareholders’ meeting.

The Board met 8 times during 2024, including regular and special meetings. All incumbent directors attended at least 75% of the aggregate of all meetings of the Board and all meetings of the committees on which, and during the time period in which, they served.

Board Leadership Structure

The Company’s Corporate Governance Principles do not mandate the separation of the offices of Chairman of the Board and Chief Executive Officer. Currently and for most of the last several decades, the offices of Chairman of the Board and Chief Executive Officer were held by the same person. From January 1, 2023 through the end of 2024, the offices of Chairman and Chief Executive Officer were held by different persons. Specifically, Robert Fehlman served as Chief Executive Officer, and George Makris, Jr. served as Executive Chairman and Chairman of the Board. In connection with Mr. Fehlman’s resignation from his position as Chief Executive Officer, effective January 1, 2025, the Board decided to return to a unified leadership structure. Given our current operating environment and operating strategies, we believe having a combined Chairman of the Board and Chief Executive Officer, as well as having a Lead Director, is the most appropriate structure for the Company and its shareholders at this time. The Board believes this structure demonstrates clear leadership to the Company’s employees, shareholders, and other interested parties.

In addition, to provide independent oversight of management and open communication, Steven Cossé has served as Lead Director and Chair of the Executive Committee for a number of years, including while the roles of Chairman of the Board and Chief Executive Officer were separated in 2023 and 2024. Following the combination of the Chairman of the Board and Chief Executive Officer roles in 2025, Mr. Cossé has continued to serve as Lead Director and Chair of the Executive Committee. Mr. Cossé, as independent Lead Director, chairs executive sessions of the Board conducted without management. These sessions are generally held in connection with regularly scheduled Board meetings. Management also periodically meets with the Lead Director to discuss Board and Executive Committee agenda items, and the Lead Director serves as a liaison between the Chairman of the Board and the independent directors.

13

The Board believes that it is in the best interest of the Company to provide flexibility in the Company’s leadership structure to address differences in the Company’s operating environment as well as differences in the experience, skills, and capabilities of the executive management team serving the Company from time to time. While the Board believes the unification of the Chairman of the Board and Chief Executive Officer positions is currently in the Company’s and shareholders’ best interests, the Board is authorized to separate these positions should circumstances change in the future.

Codes of Ethics

Code of Ethics — General. The Company has adopted a general Code of Ethics applicable to all directors, advisory directors, officers, and associates of the Company. The Code of Ethics is designed to promote conducting the business of the Company in accordance with the highest ethical standards of conduct and to promote the ethical handling of conflicts of interest, full and fair disclosure, and compliance with laws, rules, and regulations. Additionally, under the Code of Ethics, directors, advisory directors, officers, and associates who learn of a business opportunity in the course of their service for the Company generally cannot appropriate that opportunity for themselves or for others, but must allow the Company to take advantage of the opportunity. The Company’s Code of Ethics is designed to provide guidance and resources to help ensure that:

• The Company and its directors, advisory directors, officers, and associates comply with applicable laws and regulations;

• The Company’s assets are used efficiently and appropriately;

• Confidential and proprietary information is protected;

• The Company’s directors, advisory directors, officers, and associates comply with the Company’s Insider Trading Policy, as well as the laws, rules, and regulations that regulate transactions in the Company’s stock;

• Inappropriate gifts or favors are not accepted; and

• Actual or perceived conflicts of interest are appropriately addressed.

Any material departure from a provision of the Code of Ethics by a director, advisory director, officer, or associate may be waived by the Ethics Committee (in the case of an officer or associate (other than an executive officer)) or the NCGC (in the case of a director, advisory director, or executive officer) and shall, as appropriate, be reported to the Board, and any such waiver will be promptly disclosed on its website to the extent required by applicable law, rule, or regulation. The Company will disclose any amendments with respect to its Code of Ethics on its website.

Code of Ethics for Finance Group. The Board has adopted a separate Finance Group Code of Ethics that supplements the Code of Ethics and applies to the Company’s Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller, and all other officers and associates in the Finance and Accounting, Treasury, and Tax Departments of the Company and its subsidiaries. To the extent required by applicable law, rule, or regulation, the Company will disclose any amendments or waivers with respect to its Finance Group Code of Ethics on its website.

Both of these Codes of Ethics may be found on the Company’s website at www.simmonsbank.com within the “Investor Relations” page under “ESG — Governance — Governance Documents”.

Insider Trading Policy

The Company has adopted an Insider Trading Policy governing, among other thing, the purchase, sale, and/or other dispositions of Company securities by directors, officers, and employees. We believe the Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules, and regulations and NASDAQ listing standards. A copy of the Company’s Insider Trading Policy is included as an exhibit to the Company’s annual report on Form 10-K filed with the SEC on February 27, 2025.

14

Transactions with Related Persons

From time to time, the Bank and such other banking subsidiaries of the Company as are, or may have been, in operation from time to time, have made loans and other extensions of credit to directors, officers, employees, members of their immediate families, and certain other related interests; and from time to time directors, officers, employees, members of their immediate families, and certain other related interests have placed deposits with these banks. These loans, extensions of credit, and deposits were made in the ordinary course of business on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with other persons not related to the Company and did not involve more than the normal risk of collectability or present other unfavorable features. The Company generally considers banking relationships with directors and their affiliates to be immaterial and as not affecting a director’s independence so long as the terms of the credit relationship are similar to those with other comparable borrowers not related to the Company.

In assessing the impact of a credit relationship on a director’s independence, the Company deems any extension of credit which complies with Federal Reserve Regulation O to be consistent with director independence. The Company believes that normal, arm’s-length banking relationships entered into in the ordinary course of business do not affect a director’s independence.

Regulation O requires such loans to be made on substantially the same terms, including interest rates and collateral, and following credit-underwriting procedures that are no less stringent than those prevailing at the time for comparable transactions by the subsidiary bank of the Company with other persons not related to the Company. Such loans also may not involve more than the normal risk of repayment or present other unfavorable features. Additionally, no event of default may have occurred, nor may any such loans be classified or disclosed as non-accrual, past due, restructured, or a potential problem loan. The Company’s Board will review any credit to a director or his or her affiliates that is criticized by internal loan review or a bank regulatory agency in order to determine the impact that such classification may have on the director’s independence.

An immediate family member of George A. Makris, Jr., Chairman of the Board and Chief Executive Officer, is employed by the Company. In 2024, Mr. Makris, Jr.’s son, George A. Makris III, served as Executive Vice President, General Counsel, and Secretary and received cash and equity compensation as set forth in the Summary Compensation Table. Such compensation is determined on a basis consistent with the Company’s human resources policies and is reviewed and approved by the Compensation Committee.

Policies and Procedures for Approval of Related Party Transactions

Related party transactions may present potential or actual conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interest of the Company and its shareholders. The Company’s Code of Ethics and Related Party Transactions Policy address matters concerning related party business dealings. Management carefully reviews all proposed related party transactions, other than routine banking transactions, to determine if the transaction is on terms comparable to terms that could be obtained in an arm’s-length transaction with an unrelated third party. Management reports to the NCGC on proposed material related party transactions. Upon the presentation of a proposed related party transaction to the NCGC, the related party is excused from participation in discussion and voting on the matter. The NCGC (or, as applicable, the Compensation Committee) also periodically reviews ongoing related party transactions.

Role of Board in Risk Oversight

The Board has responsibility for the oversight of risk management. The Board, either as a whole or through its committees, regularly discusses with management the Company’s major risk exposures, their potential impact on the Company, and the steps being taken to monitor and manage them.

While the Board is ultimately responsible for risk oversight, the Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Risk Committee assists the Board in assessing and managing the various risks of the Company (including, among others, asset, liability, liquidity, and credit risks, as well as certain risks associated with fraud, third-party vendors, cybersecurity, and information technology). To aid the Risk Committee in its responsibilities, Company management has formed an Enterprise Risk Management Committee of senior executives and has allocated responsibilities for the administration of the risk management program to the Company’s chief risk officer. The Board has adopted a charter for the Risk Committee that outlines its duties.

15

The Audit Committee, composed of independent directors, focuses on financial risk exposures, including internal controls, and discusses with management, the internal auditors, and the independent registered public accountants the Company’s policies with respect to financial risk assessment and management, including risks related to fraud and liquidity. The Compensation Committee, also composed of independent directors, focuses on the oversight of risks associated with compensation policies and programs.

Additional Governance and Ethics Considerations

• The Company’s directors possess a variety of skills, experiences, and knowledge that provide for diverse perspectives.

• Thirteen out of fourteen Company directors are independent, and all members of our Audit Committee, Compensation Committee, and NCGC are independent.

• The Company has a strong, independent lead director who chairs the Executive Committee and presides over executive sessions of the Board.

• The Board periodically meets in executive sessions with only its independent directors.

• The Board and each of its committees may engage outside advisors when and as appropriate.

• The Company maintains anti-hedging and anti-pledging policies for directors and certain employees.

• The Company maintains stock ownership policies for directors and executive officers.

• The Company maintains a resignation policy for directors in the event they do not receive a majority of votes cast in an uncontested director election.

• Each share of Common Stock has equal voting rights with one vote per share.

• All Company directors are elected annually.

• Directors undertake annual self-assessments of the Board and its Committees to evaluate how each of those bodies is functioning.

• We believe in, and believe we maintain, a culture that promotes integrity and compliance with laws and regulations.

• The Company’s associates are required to undertake annual compliance training on a variety of important policies, procedures, and regulations, including, among others, anti-money laundering (BSA/AML) and corruption training, Regulation O training, Fair Lending training, Community Reinvestment Act training, and anti-bribery training. In addition, multiple ethics courses have also been distributed from time to time across the organization with several topics targeting specific roles.

• We maintain a Code of Ethics designed to promote conducting the business of the Company in accordance with the highest ethical standards of conduct and to promote the ethical handling of conflicts of interest, full and fair disclosure, and compliance with laws, rules, and regulations. All associates are required to read and acknowledge the code each year.

• We maintain a whistleblower policy that is designed to provide associates with a way to report to the Company activity that is considered to be illegal, dishonest, or fraudulent. The whistleblower program includes telephone and web-based reporting channels. The whistleblower policy addresses protections for whistleblowers, including maintaining, to the extent possible, confidentiality and restrictions concerning retaliation. The policy also provides for certain Board reporting and oversight.

• We also maintain a Related Party Transactions Policy to address matters with respect to related party business dealings.

16

Policy Regarding Employee, Officer and Director Hedging and Pledging

We have a policy that prohibits directors of the Company or any of its affiliates, as well as officers of those entities who are at least senior vice presidents, from engaging in transactions (including, without limitation, prepaid variable forward contracts, short sales, call or put options, equity swaps, collars, units of exchange funds, and other derivatives) that are designed to hedge or offset, or that may reasonably be expected to have the effect of hedging or offsetting, a decrease in the market value of any Company securities. In addition, such persons are prohibited from pledging, hypothecating, or otherwise encumbering Company securities as collateral for indebtedness. Any exception to the policy requires the prior approval of the NCGC.

Communication with Directors

Shareholders may communicate directly with the Board by sending correspondence to the address shown below. If the shareholder desires to communicate with a specific director, the correspondence should be addressed to such director. Correspondence addressed to the Board will be forwarded to the Chairman of the Board for review. The receipt of the correspondence and the nature of its content will be reported at the next Board (or appropriate committee of the Board) meeting and appropriate action, if any, will be taken. Correspondence addressed to a specific director will be delivered to such director promptly after receipt by the Company. Each such director shall review the correspondence received and, if appropriate, report the receipt of the correspondence and the nature of its content to the Board at its next meeting so that the appropriate action, if any, may be taken.

|

Correspondence should be addressed to: |

Simmons First National Corporation |

|

|

Board of Directors |

||

|

Attention: (Chairman or Specific Director) |

||

|

P. O. Box 7009 |

||

|

Pine Bluff, Arkansas 71611 |

17

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The NCGC is currently composed of Steven Cossé (Chair), Edward Drilling, Susan Lanigan, Tom Purvis, and Robert L. Shoptaw. The Board appoints each member of the NCGC and has determined that each member is, and each member who served during 2024 was, independent in accordance with the NASDAQ listing rules. A function of the NCGC regarding nominations is to identify and recommend individuals to be presented for election or re-election as directors of the Company.

Director Nominations and Qualifications

The Board is responsible for recommending nominees for directors to the shareholders for election at the annual shareholders’ meeting. The Board has delegated the identification and evaluation of proposed director nominees to the NCGC. The NCGC charter, which is available for review within the “Investor Relations” page of the Company’s web site, www.simmonsbank.com (under “ESG — Governance — Governance Documents”), the Company’s by-laws, and certain corporate governance principles and procedures govern the nominations and criteria for proposing or recommending proposed nominees for election and re-election to the Board and its subsidiaries.

The identification of potential directors and the evaluation of existing and potential directors is a continuing responsibility of the NCGC. The NCGC has not retained any third party to assist it in performing its duties. A proposed director may be recommended to the Board at any time; however, director nominations by shareholders must be made in accordance with the procedures set forth in the Company’s by-laws and described in this proxy statement under the heading “Proposals for 2026 Annual Meeting.”

The NCGC has not set any minimum qualifications for a proposed nominee to be eligible for recommendation to be elected as a director of the Company. The corporate governance principles provide that the NCGC shall consider the following criteria, without any specified priority or weighting, in evaluating proposed nominees for director:

|

• Geographic location of residence and business interests |

• Type of business interests |

|||

|

• Age |

• Business and financial expertise |

|||

|

• Community involvement |

• Leadership profile |

|||

|

• Ability to think independently |

• Personal and professional ethics and integrity |

|||

|

• Ability to fit with the Company’s corporate culture |

• Equity ownership in the Company |

The NCGC has no specific quotas for diversity. In evaluating potential nominees to serve as a director for the Company or the Bank, under the criteria set forth above, the NCGC seeks nominees with diverse business and professional experience, skills, and gender, age, place of residence, and ethnic/racial backgrounds, as appropriate, in light of the current composition of the boards. Additionally, the NCGC seeks geographical diversity and insights into its local and regional markets by primarily seeking potential director nominees who reside within the markets in which the Company has a significant business presence.

Recommendations from Shareholders

The NCGC will consider individuals recommended by shareholders for service as a director with respect to elections to be held at an annual meeting. In order for the NCGC to consider nominating a shareholder-recommended individual for election at the annual meeting, the shareholder must recommend the individual in sufficient time for consideration and action by the NCGC. While no specific deadline has been set for notice of such recommendations, recommendations provided to the NCGC by a shareholder on or before November 14, 2025 (for the 2026 Annual Meeting of Shareholders) should provide adequate time for consideration and action by the NCGC prior to the December 31, 2025, anticipated deadline for reporting proposed nominations to the Board. Recommendations submitted after such date will be considered by the NCGC, but no assurance can be made that such consideration will be completed and committee action taken by the NCGC in time for the next annual shareholders’ meeting.

The Chairman of the Board, other directors, and executive officers may also recommend director candidates to the NCGC. The committee will evaluate individuals recommended by shareholders, the Chairman of the Board, other directors, and executive officers against the same criteria, described above, used to evaluate other nominees.

18

Annual Self-Evaluations

Board effectiveness remains a key area of focus for us. In furtherance of that goal and in accordance with the Company’s Corporate Governance Principles, the Board, with the oversight of the NCGC, undertakes annual Board and committee self-evaluation processes that involve each director completing detailed questionnaires that assist in the assessment of the performance of the Board, its Audit, Compensation, Nominating and Corporate Governance, and Risk committees, and their members. The NCGC reports its findings to the Board following completion of the evaluations and oversees any needed follow-up action.

Compensation Committee Interlocks and Insider Participation

During 2024, the Compensation Committee was composed of Jay Burchfield (Chair) (through April 22, 2024), Steven Cossé, Jerry Hunter, Susan Lanigan (Chair, beginning April 23, 2024), Robert L. Shoptaw, and Mindy West, none of whom were employed by the Company. In addition, none of the committee members were formerly officers of the Company.

Compensation Committee Processes and Procedures

Decisions regarding the compensation of the executive officers are generally made by the Compensation Committee, which has adopted a charter that is available for review within the “Investor Relations” page of the Company’s web site, www.simmonsbank.com (under “ESG — Governance — Governance Documents”). Specifically, the Compensation Committee has strategic responsibility for a broad range of issues, including the Company’s compensation program to compensate key management employees effectively and in a manner consistent with the Company’s stated compensation strategy and the requirements of the appropriate regulatory bodies. The Board appoints each member of the Compensation Committee and has determined that each member is, and each member who served during 2024 was, independent in accordance with the NASDAQ listing rules.

The Compensation Committee oversees the administration of executive compensation plans, including the design, performance measures and award opportunities for the executive incentive programs and certain employee benefits, subject to final action by the Board in certain cases. Typically, during the first quarter of each calendar year, the committee undertakes a specific review focusing on performance and awards for the most recently completed fiscal year and the completion of the process of setting the performance goals for the incentive compensation programs for the current year.

To assist in meeting the objectives outlined above, Pearl Meyer & Partners, LLC, a compensation and benefits consulting firm, has been retained to advise the Compensation Committee on a regular basis concerning the Company’s compensation programs. The committee engaged the consultant to provide general compensation consulting services, including executive and director compensation. In addition, the consultant may perform special compensation projects and consulting services upon request by the Compensation Committee or Company.

The Board, upon approval and recommendation from the Compensation Committee, determines and approves all compensation and awards to the CEO and the Executive Chairman, when the Board has a separate Executive Chairman. The Compensation Committee reviews the performance of the CEO and, if applicable, the Executive Chairman and reviews and approves compensation of the other executive officers. The CEO and/or Executive Chairman also review the performance and compensation of the other executive officers, including the other named executive officers, and report any significant issues or deficiencies, and make recommendations, to the Compensation Committee. The members of the Company’s human resources department assist in such reviews. The human resources department regularly reviews the compensation classification system of the Company, which determines the compensation of all employees of the Company and its affiliates. The Company’s compensation program is based in part on market data. The Compensation Committee also acts upon the proposed grants of stock-based compensation recommended by the CEO and/or Executive Chairman for other executive officers and, as applicable, other employees of the Company and its affiliates.

In determining the amount of executive officer compensation each year, the Compensation Committee reviews competitive market data from the banking industry as a whole and the peer group specifically. It makes specific compensation decisions and grants based on a review of such data, Company performance, and individual performance and circumstances. For performance-based incentives, the Compensation Committee sets performance targets using management’s internal business plan, industry and market conditions, and other factors.

19

Role of Compensation Consultants

The Company periodically engages compensation consultants to aid in the review of its compensation programs. From time to time, the Company engages compensation consultants to provide national and regional general statistical information regarding compensation within the banking industry. The data reviewed may include base salary, bonus, incentive programs, equity compensation, retirement, and other benefits. This information is used to validate the Company’s classification of positions and salaries within its compensation policies.

The Compensation Committee also uses compensation consultants to evaluate its executive and director compensation programs. Presently, the consultant assists such reviews by providing data regarding market practices and making specific recommendations for changes to plan and award designs and policies consistent with the Company’s stated philosophies and objectives.

The Compensation Committee assessed the relationships between Pearl Meyer & Partners, LLC, the Company, the Compensation Committee and the executive officers of the Company for conflicts of interest. In this assessment, the Compensation Committee reviewed the criteria set forth in the SEC’s Reg. 240.10C-1(b)(4)(i)-(vi), NASDAQ Rule 5605(d)(3)(D)(i)-(vi) and such other criteria as it deemed appropriate. The Compensation Committee did not identify any conflicts of interest for Pearl Meyer & Partners, LLC.

Executive Officers

The Board elects executive officers at least annually. All of the executive officers shown in the table below have been officers of the Company and/or the Bank for at least five years, except for Messrs. Brogdon, Hobbs, and Van Steenberg. The table below sets forth the name, age, officer position with the Company and Bank, principal occupation or employment during the last five years, and tenure of service with the Company for each of the executive officers:

|

Name |

Age |

Position |

Years |

|||

|

George A. Makris, Jr.[1] |

68 |

Chairman and Chief Executive Officer* |

12 |

|||

|

James M. Brogdon[2] |

44 |

President* |

3 |

|||

|

C. Daniel Hobbs[3] |

51 |

Executive Vice President and Chief Financial Officer* |

1 |

|||

|

Christopher Van Steenberg[4] |

54 |

Executive Vice President and Chief Operating Officer* |

0 |

|||

|

George A. Makris III[5] |

39 |

Executive Vice President, General Counsel and Secretary* |

9 |

|||

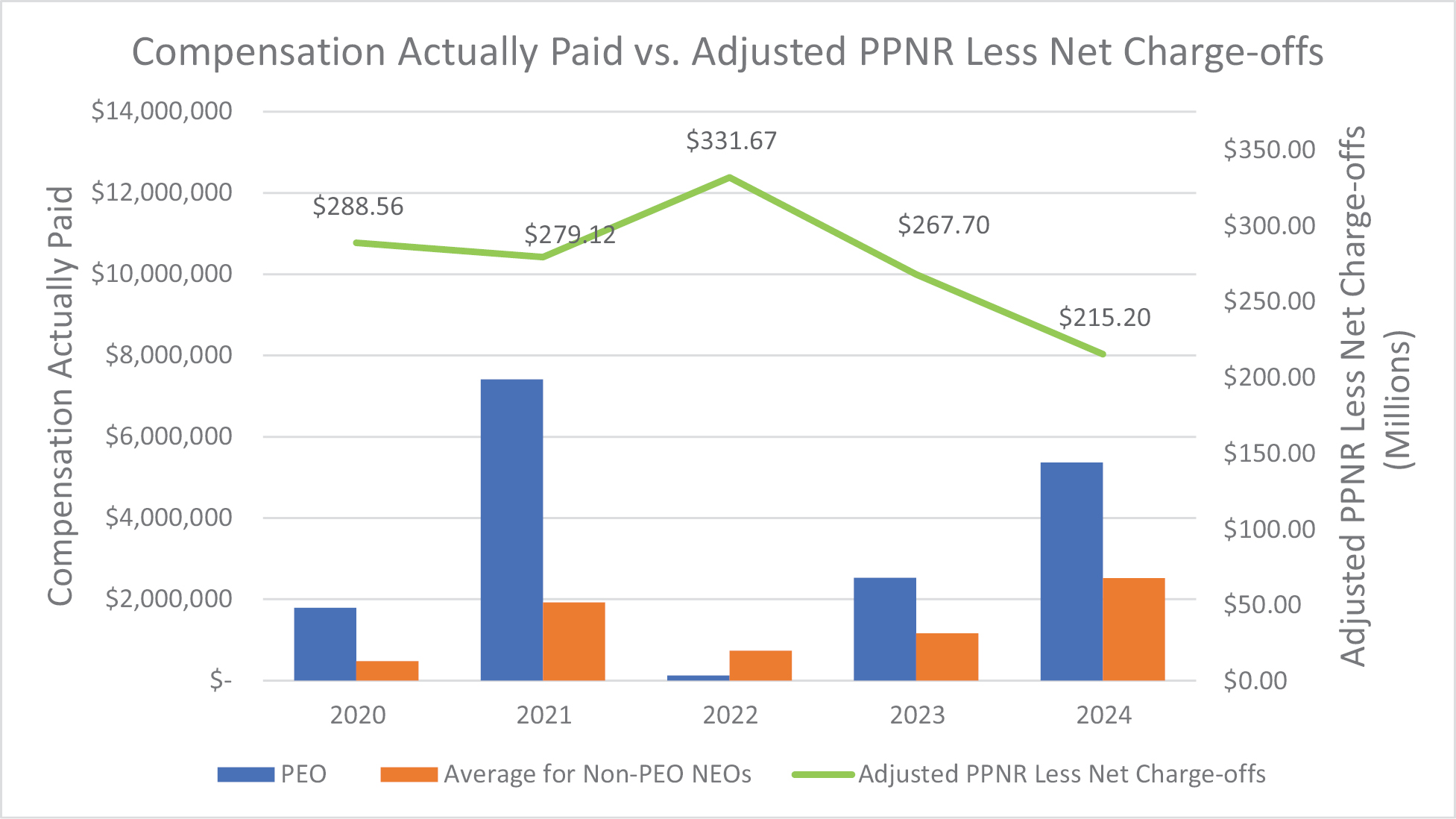

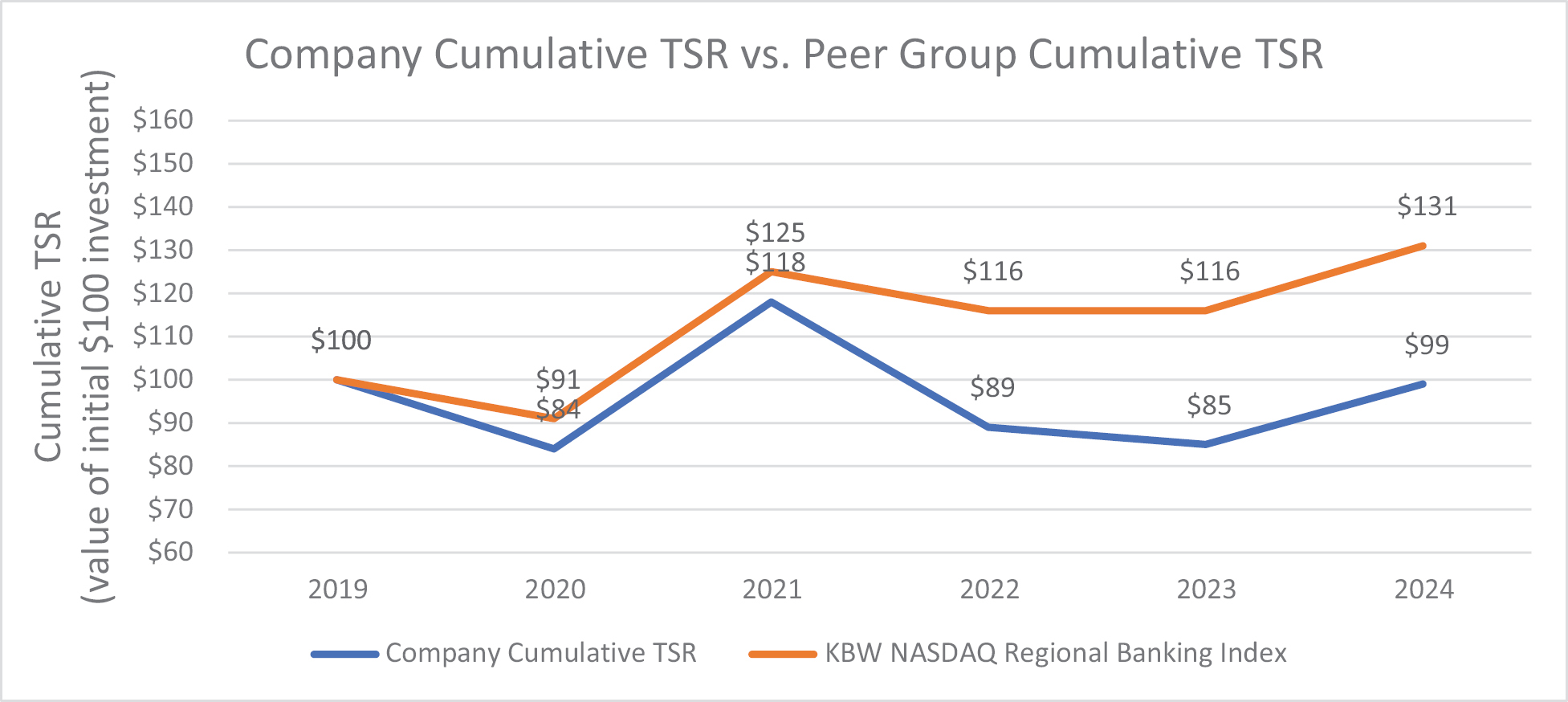

|