KeyCorp Investor Meetings: Europe September 2025 Brian Mauney Director of Investor Relations Chris Gorman Chairman & Chief Executive Officer Tim Schmidt Corporate Treasurer

Strong Foundation ▪ Sticky, granular client deposit base ▪ Leading capital and liquidity positions among our peers ▪ Risk management excellence: ‒ Low-to-moderate risk profile ‒ 10-year average(1) NCO ratio of 29bps ▪ Highly engaged & talented teammates Distinctive Business Model ▪ Relationship-based business model focused on primacy ▪ Driving growth through targeted scale ▪ Proven and mature underwrite-to- distribute model – raised over $135Bn of capital on behalf of our clients(2) ▪ Expense management discipline supports ongoing investments Positioned for Future ▪ Strengths align with market developments ▪ Clearly defined structural NII tailwinds – across a variety of rate scenarios ▪ Significant organic momentum across capital-light, fee-based businesses ▪ Accelerated investments in people and technology, which will drive future organic growth ▪ De-risked credit profile KEY: Well-Positioned to Achieve Our Next Leg of Growth Strong foundation positions Key to execute on its targeted scale strategy to deliver sound, profitable growth 2 (1) For 2015-2024; (2) Trailing 12-months basis, 3Q24 through 2Q25 Business & Strategy

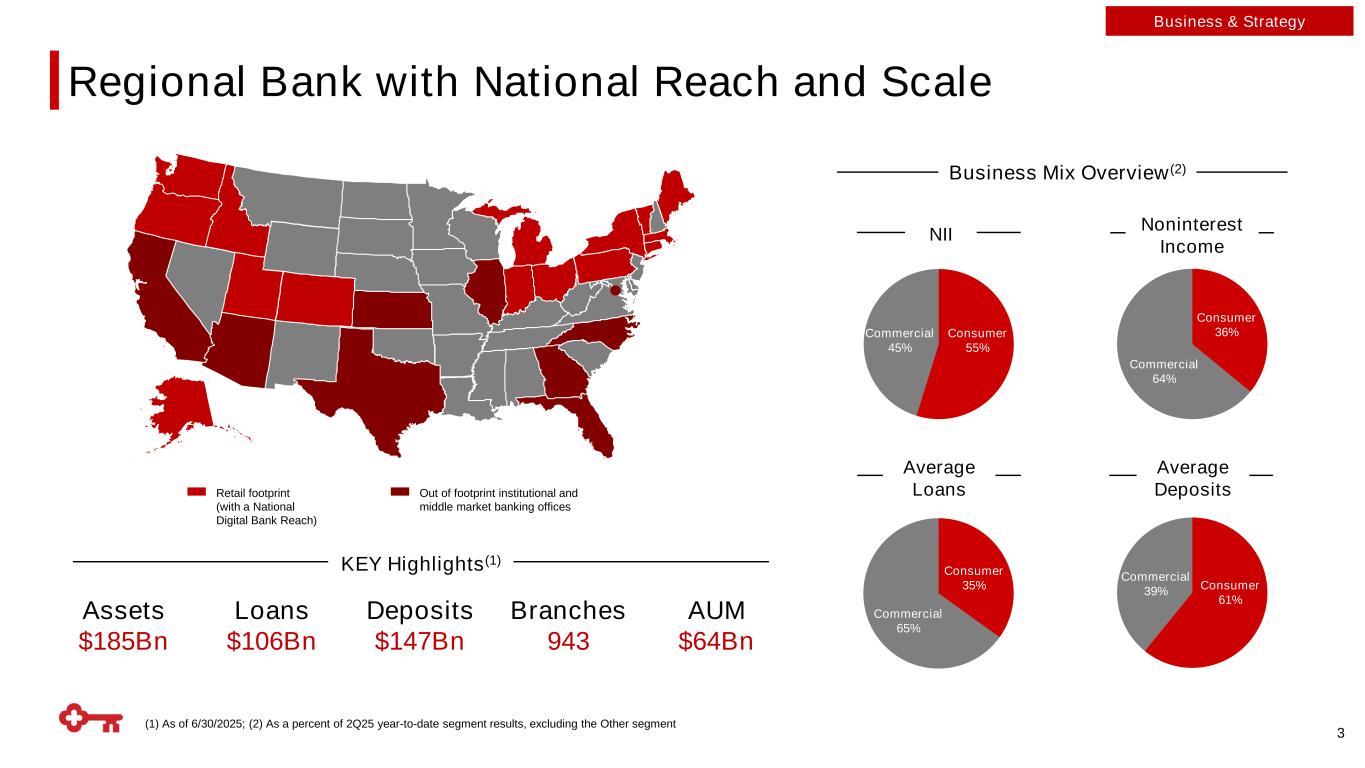

(1) As of 6/30/2025; (2) As a percent of 2Q25 year-to-date segment results, excluding the Other segment Regional Bank with National Reach and Scale Business Mix Overview(2) Retail footprint (with a National Digital Bank Reach) Assets $185Bn Deposits $147Bn KEY Highlights(1) Loans $106Bn Branches 943 AUM $64Bn Out of footprint institutional and middle market banking offices 3 Consumer 55% Commercial 45% NII Commercial 64% Consumer 36% Noninterest Income Consumer 35% Commercial 65% Average Loans Consumer 61% Commercial 39% Average Deposits Business & Strategy

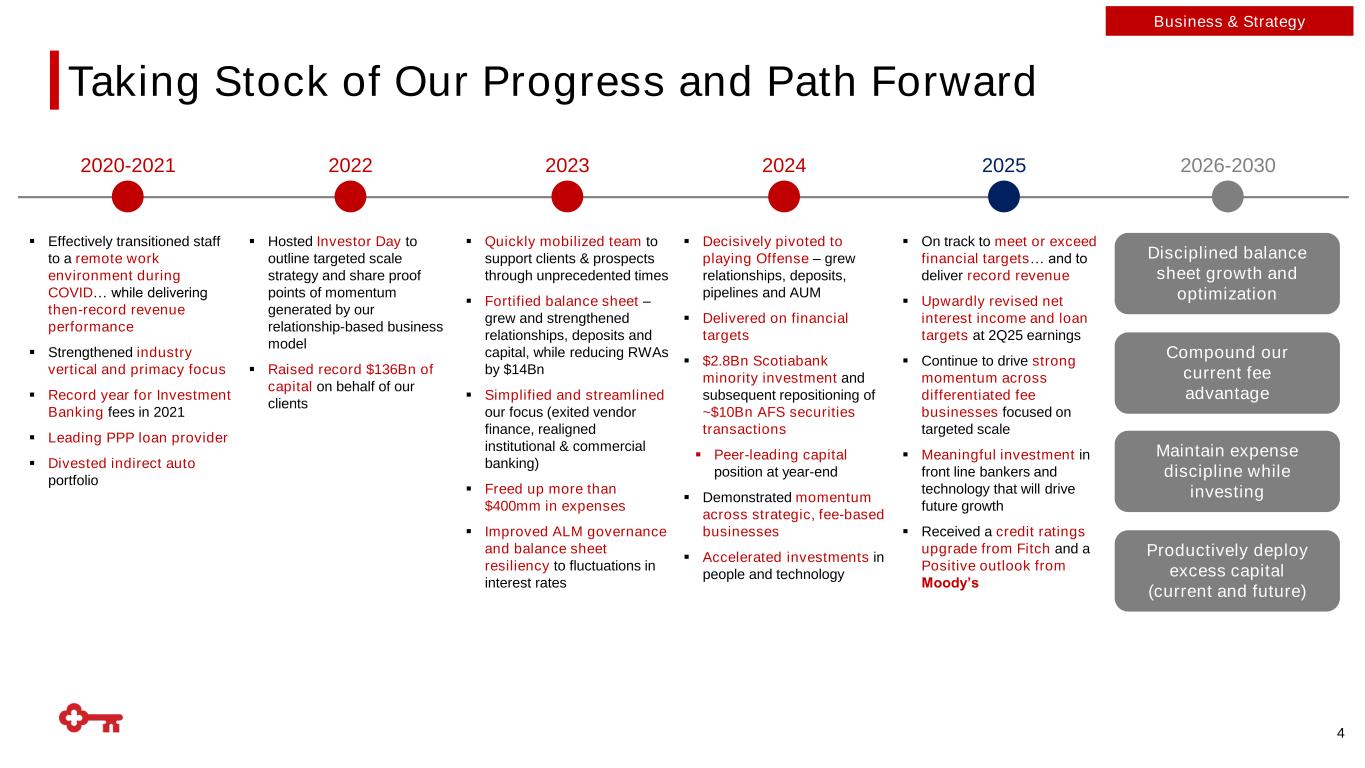

Taking Stock of Our Progress and Path Forward 2020-2021 2022 2023 2024 2025 2026-2030 ▪ Quickly mobilized team to support clients & prospects through unprecedented times ▪ Fortified balance sheet – grew and strengthened relationships, deposits and capital, while reducing RWAs by $14Bn ▪ Simplified and streamlined our focus (exited vendor finance, realigned institutional & commercial banking) ▪ Freed up more than $400mm in expenses ▪ Improved ALM governance and balance sheet resiliency to fluctuations in interest rates ▪ Effectively transitioned staff to a remote work environment during COVID… while delivering then-record revenue performance ▪ Strengthened industry vertical and primacy focus ▪ Record year for Investment Banking fees in 2021 ▪ Leading PPP loan provider ▪ Divested indirect auto portfolio ▪ Hosted Investor Day to outline targeted scale strategy and share proof points of momentum generated by our relationship-based business model ▪ Raised record $136Bn of capital on behalf of our clients ▪ Decisively pivoted to playing Offense – grew relationships, deposits, pipelines and AUM ▪ Delivered on financial targets ▪ $2.8Bn Scotiabank minority investment and subsequent repositioning of ~$10Bn AFS securities transactions ▪ Peer-leading capital position at year-end ▪ Demonstrated momentum across strategic, fee-based businesses ▪ Accelerated investments in people and technology ▪ On track to meet or exceed financial targets… and to deliver record revenue ▪ Upwardly revised net interest income and loan targets at 2Q25 earnings ▪ Continue to drive strong momentum across differentiated fee businesses focused on targeted scale ▪ Meaningful investment in front line bankers and technology that will drive future growth ▪ Received a credit ratings upgrade from Fitch and a Positive outlook from Moody’s Disciplined balance sheet growth and optimization Maintain expense discipline while investing Compound our current fee advantage Productively deploy excess capital (current and future) 4 Business & Strategy

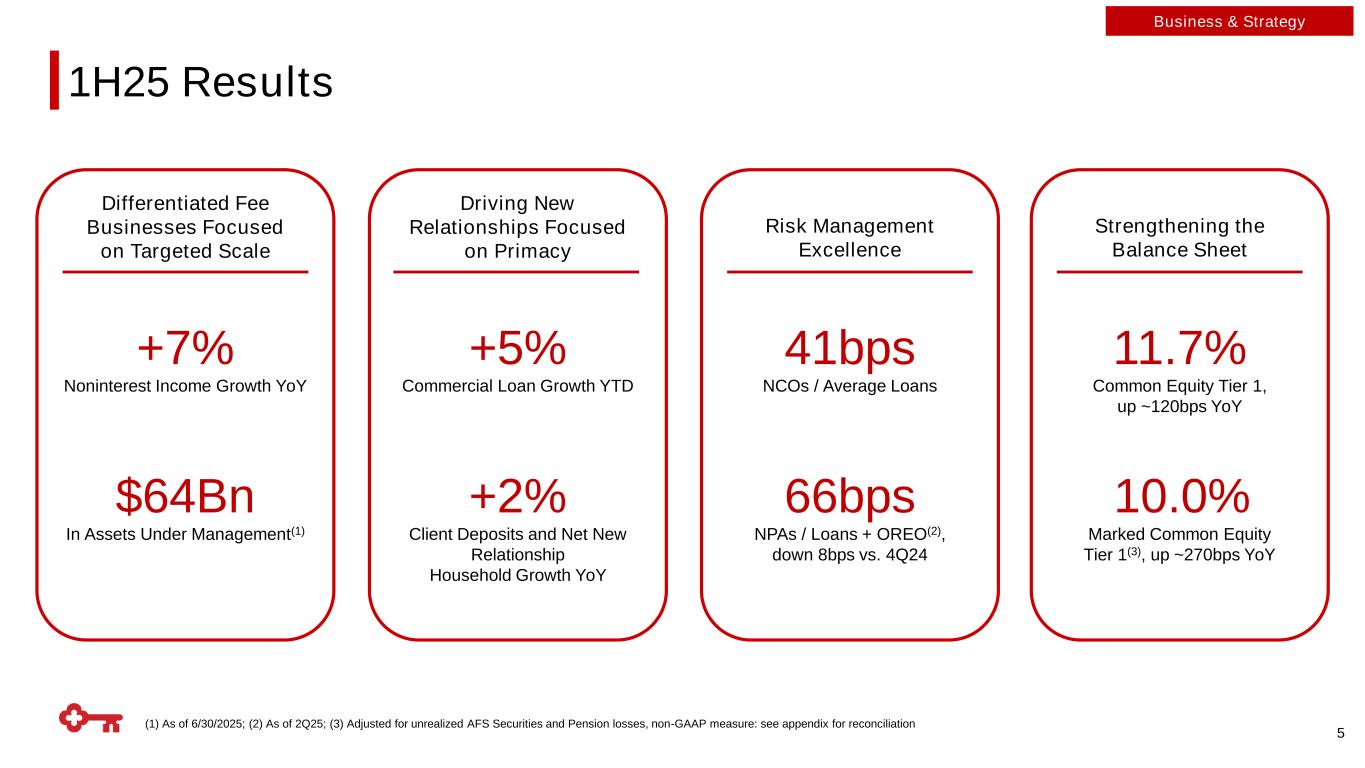

(1) As of 6/30/2025; (2) As of 2Q25; (3) Adjusted for unrealized AFS Securities and Pension losses, non-GAAP measure: see appendix for reconciliation +7% Noninterest Income Growth YoY $64Bn In Assets Under Management(1) Differentiated Fee Businesses Focused on Targeted Scale +5% Commercial Loan Growth YTD +2% Client Deposits and Net New Relationship Household Growth YoY Driving New Relationships Focused on Primacy 11.7% Common Equity Tier 1, up ~120bps YoY 10.0% Marked Common Equity Tier 1(3), up ~270bps YoY Strengthening the Balance Sheet Risk Management Excellence 66bps NPAs / Loans + OREO(2), down 8bps vs. 4Q24 41bps NCOs / Average Loans 5 Business & Strategy 1H25 Results

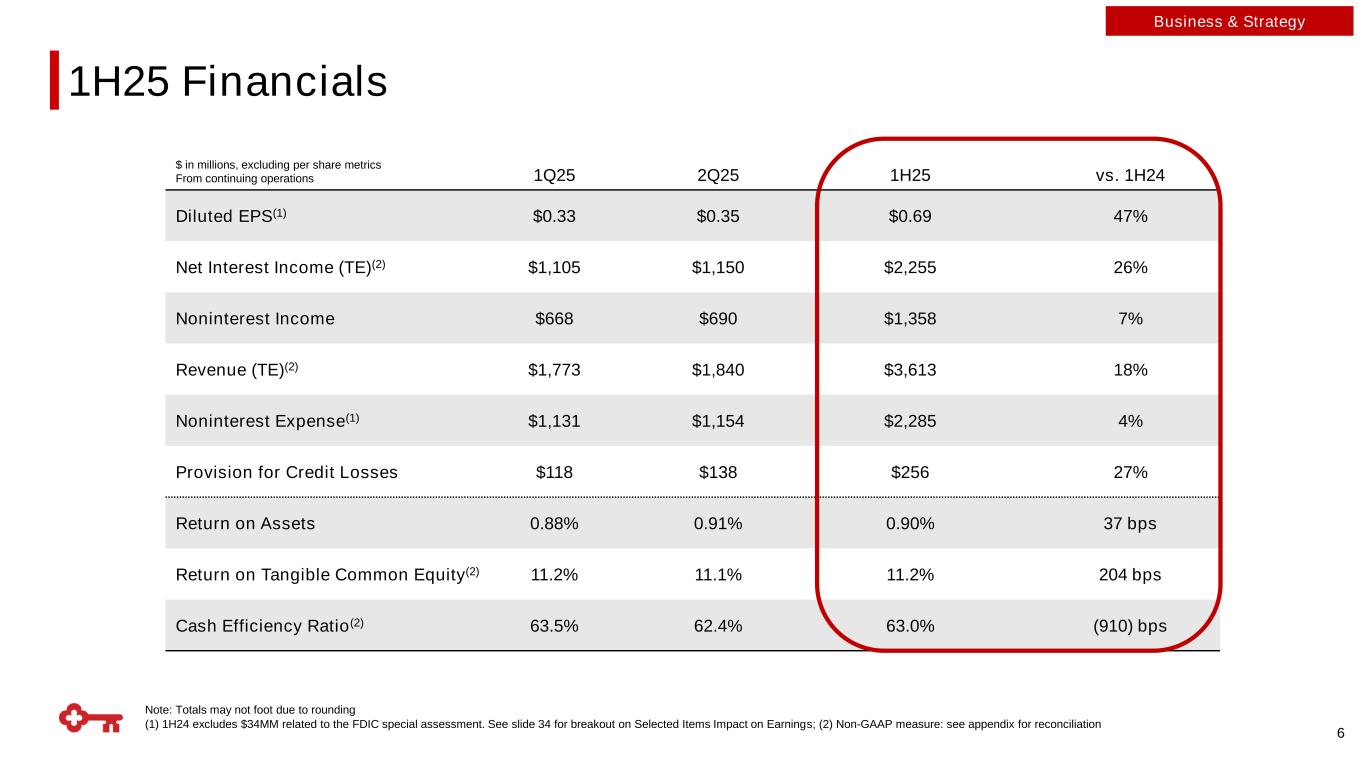

Note: Totals may not foot due to rounding (1) 1H24 excludes $34MM related to the FDIC special assessment. See slide 34 for breakout on Selected Items Impact on Earnings; (2) Non-GAAP measure: see appendix for reconciliation 6 Business & Strategy 1H25 Financials $ in millions, excluding per share metrics From continuing operations 1Q25 2Q25 1H25 vs. 1H24 Diluted EPS(1) $0.33 $0.35 $0.69 47% Net Interest Income (TE)(2) $1,105 $1,150 $2,255 26% Noninterest Income $668 $690 $1,358 7% Revenue (TE)(2) $1,773 $1,840 $3,613 18% Noninterest Expense(1) $1,131 $1,154 $2,285 4% Provision for Credit Losses $118 $138 $256 27% Return on Assets 0.88% 0.91% 0.90% 37 bps Return on Tangible Common Equity(2) 11.2% 11.1% 11.2% 204 bps Cash Efficiency Ratio(2) 63.5% 62.4% 63.0% (910) bps

Business & Strategy (1) Change in total population from 2024 through 2029 2016-2019 Avg Annual Growth 2020-2024 Avg Annual Growth population growth in Key’s Western markets vs. non-footprint states over the next 4 years(1) ~2x of new households in 2025 are under the age of 45 60% We have a relationship-focused business model with unique, targeted capabilities to best serve consumer and commercial clients A Differentiated Full-Service Commercial Platform Capabilities Scaled Holistic Platform (Commercial Payments, Capital Markets, and Wealth) Industry Expertise (Healthcare, Technology, Energy, Industrials, Consumer, Real Estate, Public Sector) Integrated Delivery Model Regional Banks Trillionaire Banks Boutiques Middle Market Focus Strong Consumer Foundation Relationship Household Progress 7 National Digital Bank Reach Retail footprint Strong Foundation Provides Opportunities For Growth <1% >3% of relationship households acquired since 2019 22% Growth in Consumer Deposits since 4Q19 +$14Bn

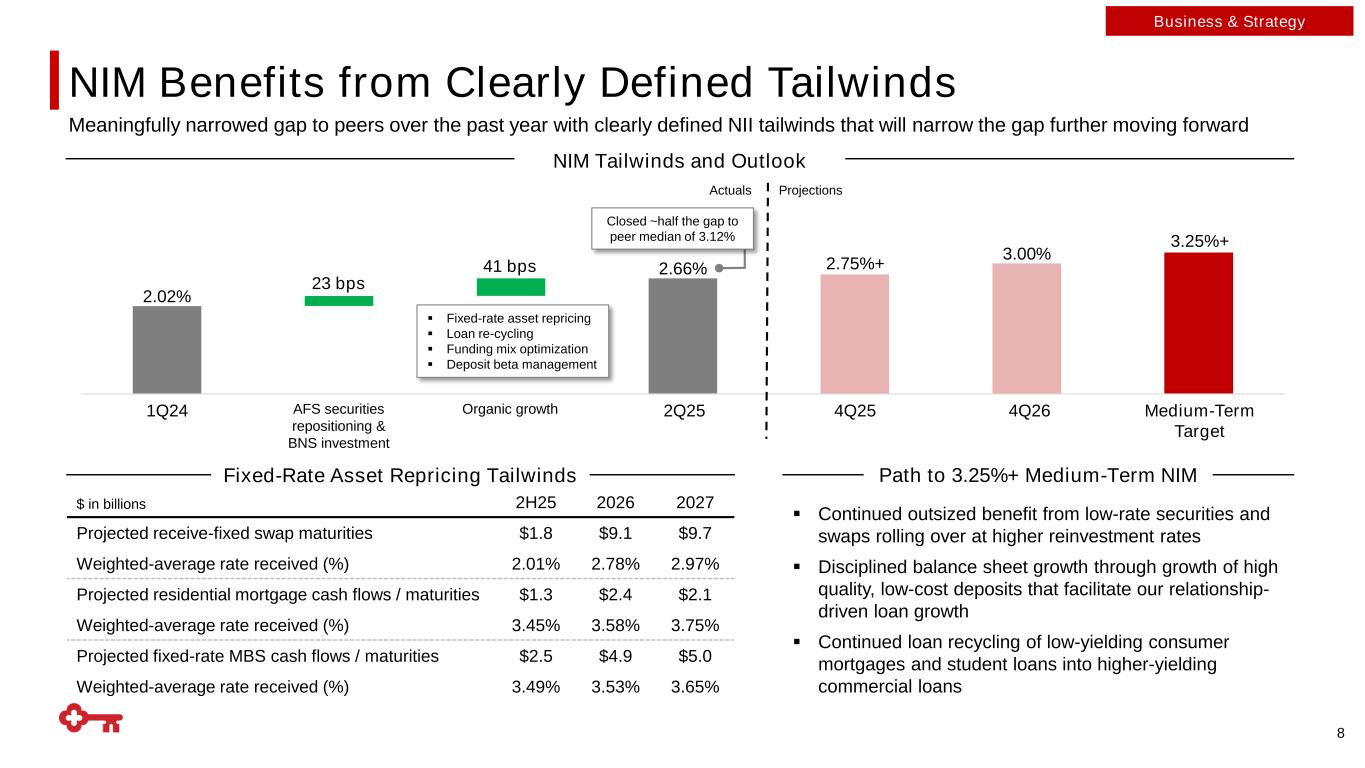

2.02% 2.66% 3.00% 1Q24 AFS repositioning & BNS … Organic growth 2Q25 4Q25 4Q26 Medium-Term Target NIM Benefits from Clearly Defined Tailwinds 8 NIM Tailwinds and Outlook Business & Strategy 1Q24 AFS securities repositioning & BNS investment Organic growth 5 23 bps 41 bps $ in billions 2H25 2026 2027 Projected receive-fixed swap maturities $1.8 $9.1 $9.7 Weighted-average rate received (%) 2.01% 2.78% 2.97% Projected residential mortgage cash flows / maturities $1.3 $2.4 $2.1 Weighted-average rate received (%) 3.45% 3.58% 3.75% Projected fixed-rate MBS cash flows / maturities $2.5 $4.9 $5.0 Weighted-average rate received (%) 3.49% 3.53% 3.65% Fixed-Rate Asset Repricing Tailwinds Meaningfully narrowed gap to peers over the past year with clearly defined NII tailwinds that will narrow the gap further moving forward Closed ~half the gap to peer median of 3.12% 2.75%+ 3.25%+ 4Q25 6 Medium-Term Target Path to 3.25%+ Medium-Term NIM ▪ Continued outsized benefit from low-rate securities and swaps rolling over at higher reinvestment rates ▪ Disciplined balance sheet growth through growth of high quality, low-cost deposits that facilitate our relationship- driven loan growth ▪ Continued loan recycling of low-yielding consumer mortgages and student loans into higher-yielding commercial loans ▪ Fixed-rate asset repricing ▪ Loan re-cycling ▪ Funding mix optimization ▪ Deposit beta management ProjectionsActuals

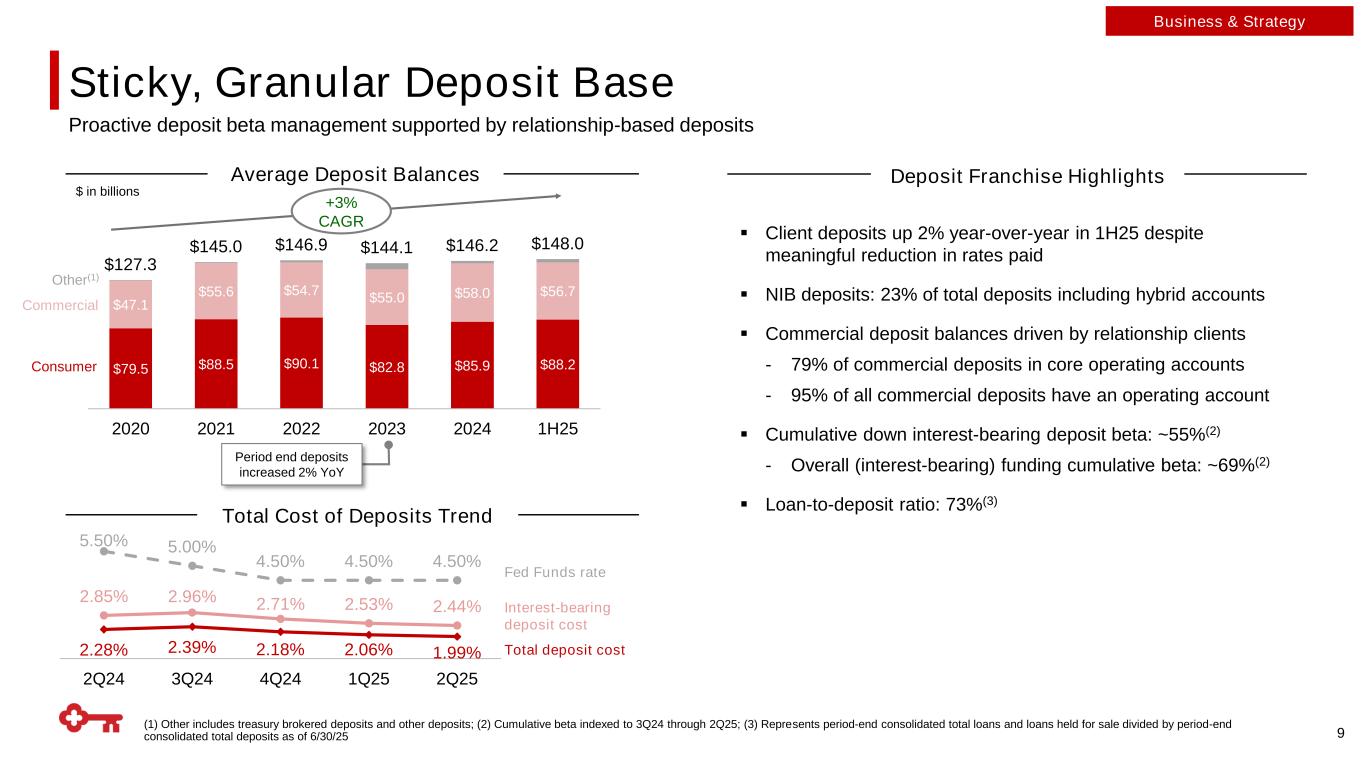

Sticky, Granular Deposit Base 9 (1) Other includes treasury brokered deposits and other deposits; (2) Cumulative beta indexed to 3Q24 through 2Q25; (3) Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits as of 6/30/25 Average Deposit Balances Deposit Franchise Highlights Total Cost of Deposits Trend $ in billions 2.28% 2.39% 2.18% 2.06% 1.99% 2.85% 2.96% 2.71% 2.53% 2.44% 5.50% 5.00% 4.50% 4.50% 4.50% 1.80% 2.80% 3.80% 4.80% 5.80% 1.10% 2.10% 3.10% 4.10% 5.10% 2Q24 3Q24 4Q24 1Q25 2Q25 Business & Strategy $79.5 $88.5 $90.1 $82.8 $85.9 $88.2 $47.1 $55.6 $54.7 $55.0 $58.0 $56.7 $127.3 $145.0 $146.9 $144.1 $146.2 $148.0 2020 2021 2022 2023 2024 1H25 ▪ Client deposits up 2% year-over-year in 1H25 despite meaningful reduction in rates paid ▪ NIB deposits: 23% of total deposits including hybrid accounts ▪ Commercial deposit balances driven by relationship clients - 79% of commercial deposits in core operating accounts - 95% of all commercial deposits have an operating account ▪ Cumulative down interest-bearing deposit beta: ~55%(2) - Overall (interest-bearing) funding cumulative beta: ~69%(2) ▪ Loan-to-deposit ratio: 73%(3) Proactive deposit beta management supported by relationship-based deposits Total deposit cost Fed Funds rate +3% CAGR Period end deposits increased 2% YoY Consumer Other(1) Commercial Interest-bearing deposit cost

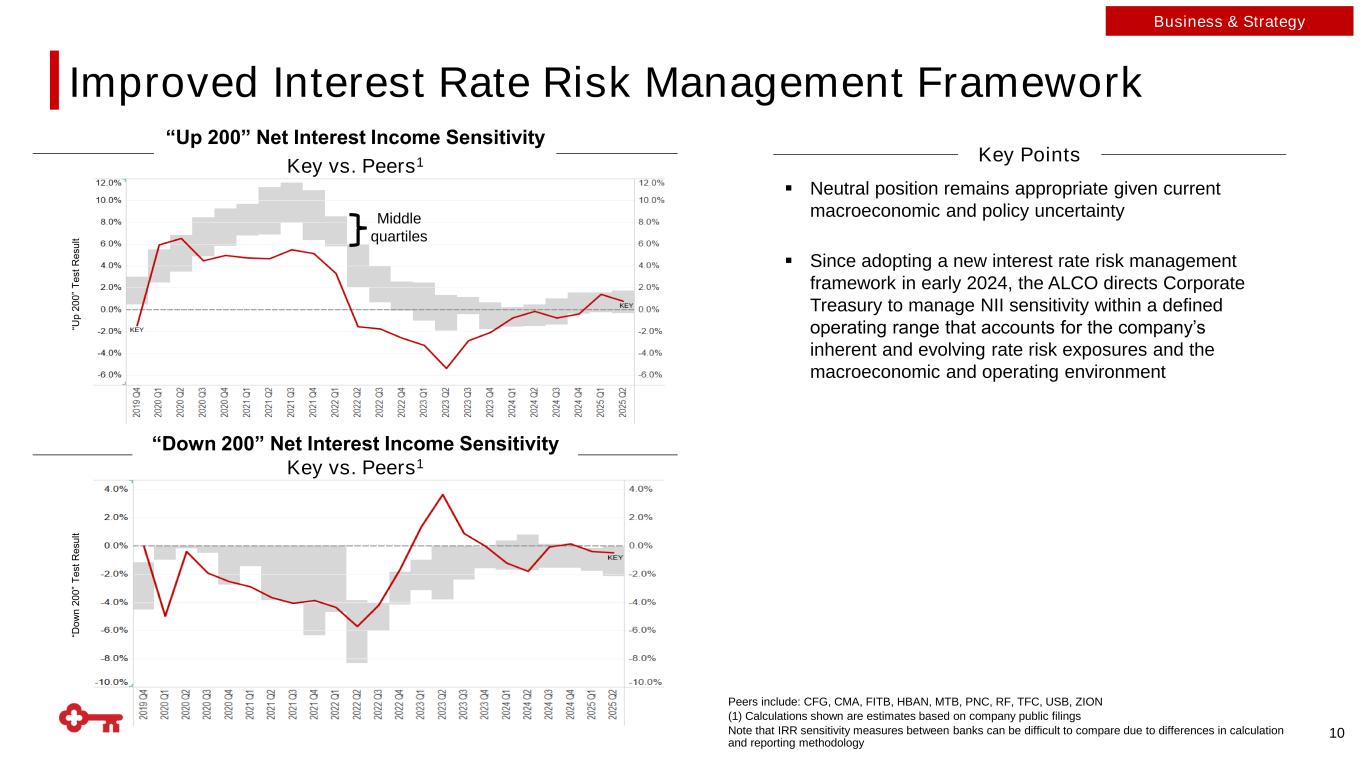

“Down 200” Net Interest Income Sensitivity Key vs. Peers1 Improved Interest Rate Risk Management Framework Middle quartiles ▪ Neutral position remains appropriate given current macroeconomic and policy uncertainty ▪ Since adopting a new interest rate risk management framework in early 2024, the ALCO directs Corporate Treasury to manage NII sensitivity within a defined operating range that accounts for the company’s inherent and evolving rate risk exposures and the macroeconomic and operating environment Key Points “Up 200” Net Interest Income Sensitivity Key vs. Peers1 Peers include: CFG, CMA, FITB, HBAN, MTB, PNC, RF, TFC, USB, ZION (1) Calculations shown are estimates based on company public filings Note that IRR sensitivity measures between banks can be difficult to compare due to differences in calculation and reporting methodology “U p 2 0 0 ” T e s t R e s u lt “D o w n 2 0 0 ” T e s t R e s u lt 10 Business & Strategy

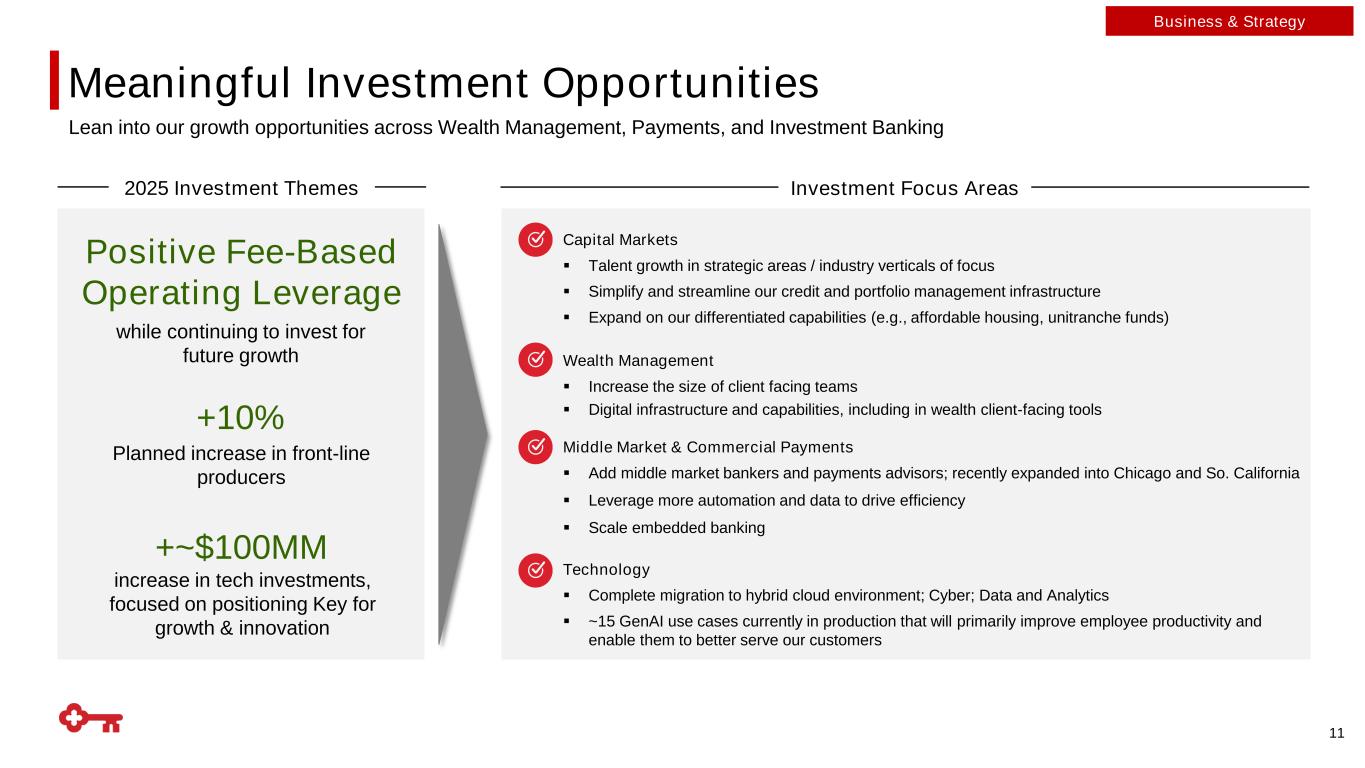

Capital Markets ▪ Talent growth in strategic areas / industry verticals of focus ▪ Simplify and streamline our credit and portfolio management infrastructure ▪ Expand on our differentiated capabilities (e.g., affordable housing, unitranche funds) Wealth Management ▪ Increase the size of client facing teams ▪ Digital infrastructure and capabilities, including in wealth client-facing tools Middle Market & Commercial Payments ▪ Add middle market bankers and payments advisors; recently expanded into Chicago and So. California ▪ Leverage more automation and data to drive efficiency ▪ Scale embedded banking Technology ▪ Complete migration to hybrid cloud environment; Cyber; Data and Analytics ▪ ~15 GenAI use cases currently in production that will primarily improve employee productivity and enable them to better serve our customers Positive Fee-Based Operating Leverage while continuing to invest for future growth +~$100MM increase in tech investments, focused on positioning Key for growth & innovation Meaningful Investment Opportunities Lean into our growth opportunities across Wealth Management, Payments, and Investment Banking 11 Investment Focus Areas2025 Investment Themes +10% Planned increase in front-line producers Business & Strategy

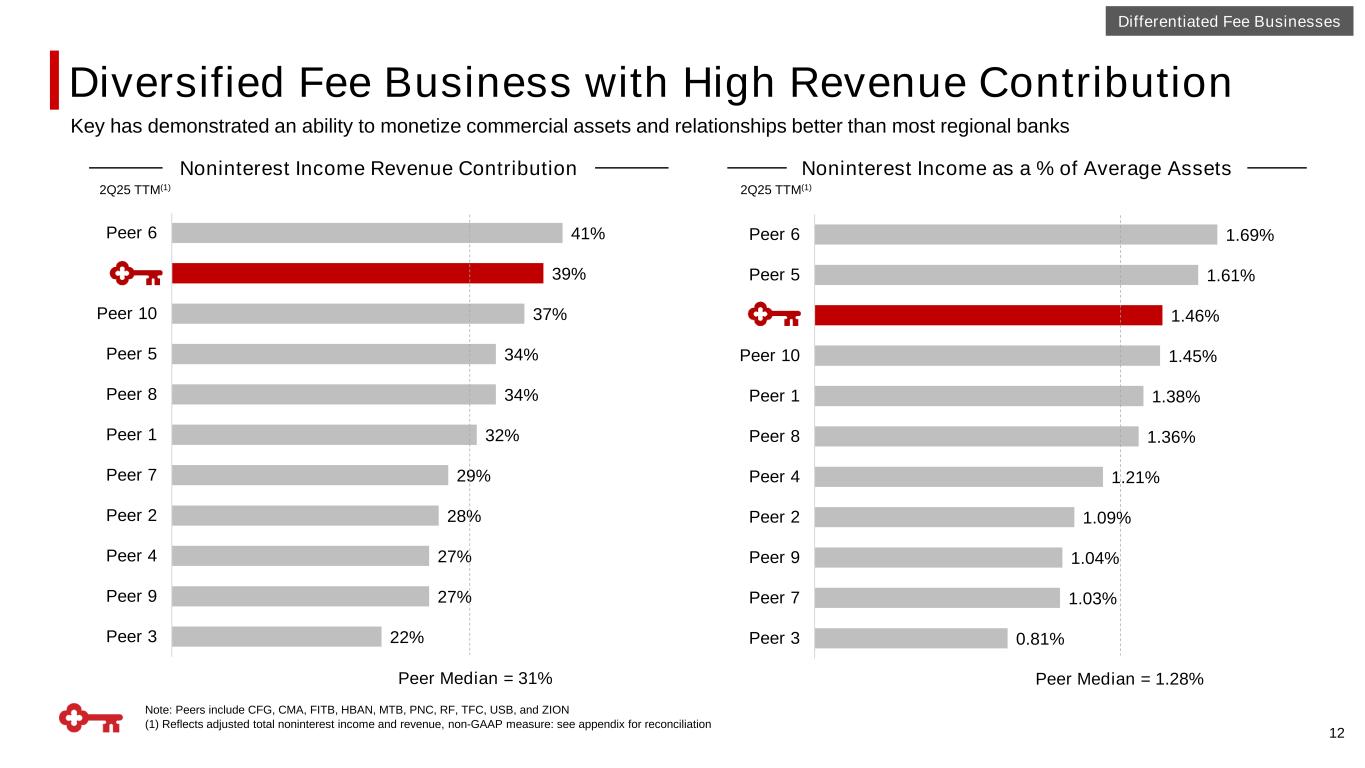

Diversified Fee Business with High Revenue Contribution 12 Noninterest Income as a % of Average Assets 0.81% 1.03% 1.04% 1.09% 1.21% 1.36% 1.38% 1.45% 1.46% 1.61% 1.69% Peer 3 Peer 7 Peer 9 Peer 2 Peer 4 Peer 8 Peer 1 Peer 10 Peer 5 Peer 6 Peer Median = 1.28% Differentiated Fee Businesses 22% 27% 27% 28% 29% 32% 34% 34% 37% 39% 41% Peer 3 Peer 9 Peer 4 Peer 2 Peer 7 Peer 1 Peer 8 Peer 5 Peer 10 Peer 6 Peer Median = 31% Noninterest Income Revenue Contribution 2Q25 TTM(1) Note: Peers include CFG, CMA, FITB, HBAN, MTB, PNC, RF, TFC, USB, and ZION (1) Reflects adjusted total noninterest income and revenue, non-GAAP measure: see appendix for reconciliation 2Q25 TTM(1) Key has demonstrated an ability to monetize commercial assets and relationships better than most regional banks

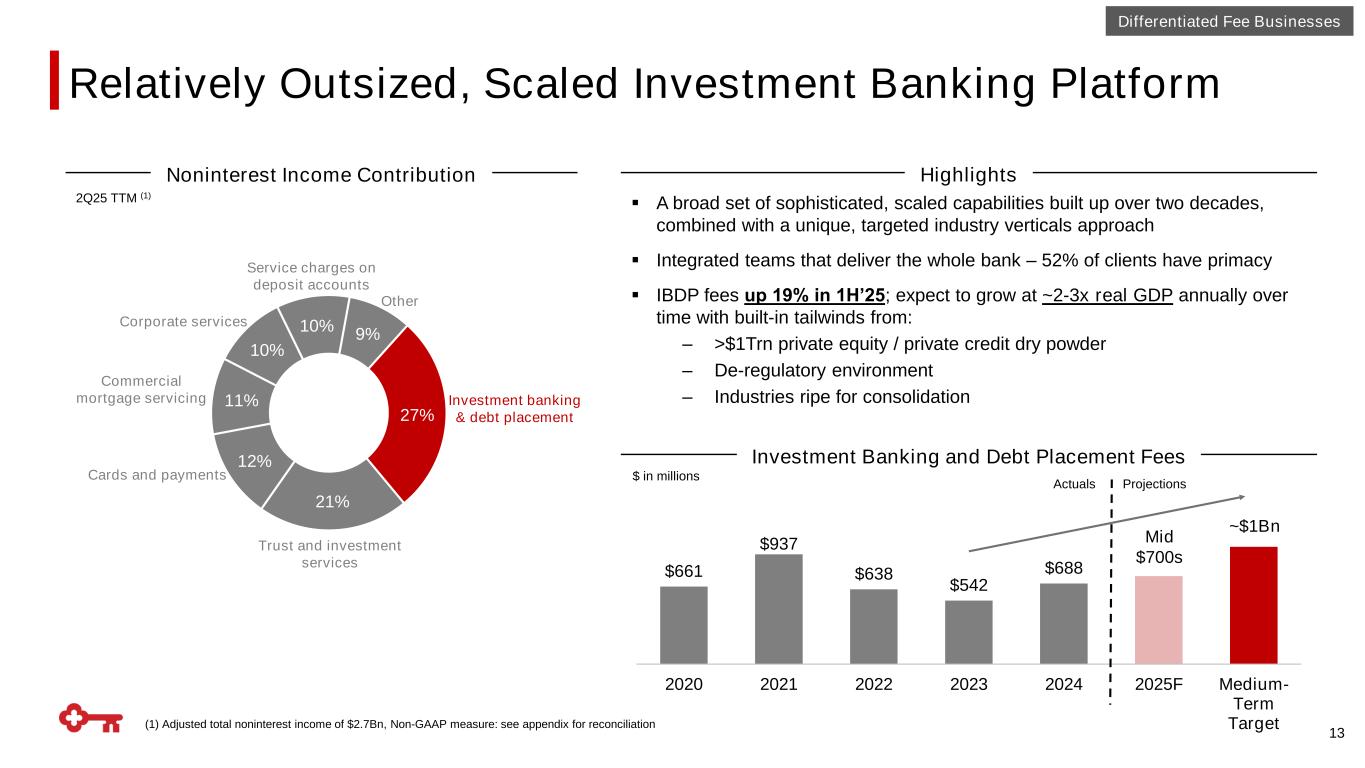

Differentiated Fee Businesses Relatively Outsized, Scaled Investment Banking Platform 13 27% 21% 12% 11% 10% 10% 9% Noninterest Income Contribution Investment banking & debt placement 2Q25 TTM (1) Trust and investment services Cards and payments Service charges on deposit accounts Corporate services Commercial mortgage servicing Other Highlights Investment Banking and Debt Placement Fees $661 $937 $638 $542 $688 2020 2021 2022 2023 2024 2025F Medium- Term Target ▪ A broad set of sophisticated, scaled capabilities built up over two decades, combined with a unique, targeted industry verticals approach ▪ Integrated teams that deliver the whole bank – 52% of clients have primacy ▪ IBDP fees up 19% in 1H’25; expect to grow at ~2-3x real GDP annually over time with built-in tailwinds from: ‒ >$1Trn private equity / private credit dry powder ‒ De-regulatory environment ‒ Industries ripe for consolidation $ in millions Mid $700s ~$1Bn (1) Adjusted total noninterest income of $2.7Bn, Non-GAAP measure: see appendix for reconciliation ProjectionsActuals

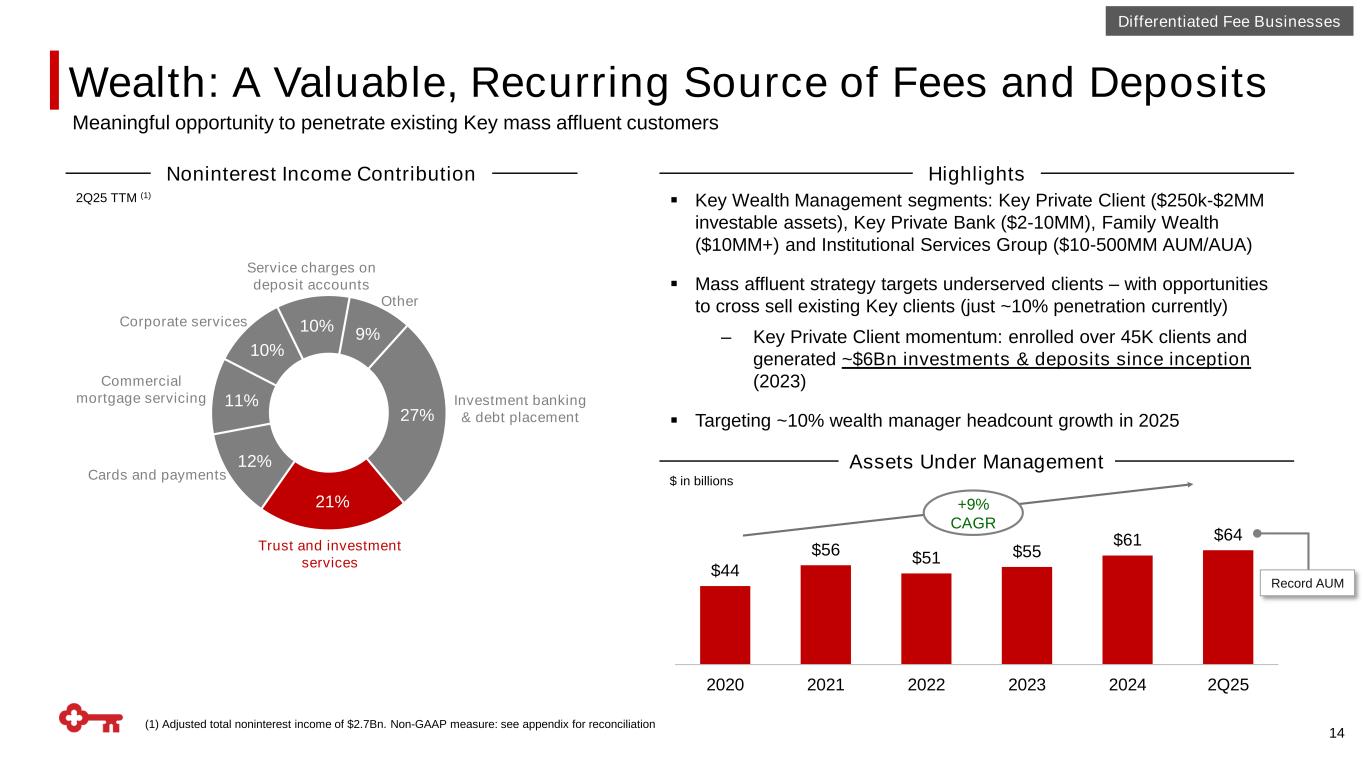

Wealth: A Valuable, Recurring Source of Fees and Deposits 14 2Q25 TTM (1) Highlights Assets Under Management $44 $56 $51 $55 $61 $64 2020 2021 2022 2023 2024 2Q25 +9% CAGR ▪ Key Wealth Management segments: Key Private Client ($250k-$2MM investable assets), Key Private Bank ($2-10MM), Family Wealth ($10MM+) and Institutional Services Group ($10-500MM AUM/AUA) ▪ Mass affluent strategy targets underserved clients – with opportunities to cross sell existing Key clients (just ~10% penetration currently) ‒ Key Private Client momentum: enrolled over 45K clients and generated ~$6Bn investments & deposits since inception (2023) ▪ Targeting ~10% wealth manager headcount growth in 2025 $ in billions Record AUM Noninterest Income Contribution (1) Adjusted total noninterest income of $2.7Bn. Non-GAAP measure: see appendix for reconciliation 27% 21% 12% 11% 10% 10% 9% Investment banking & debt placement Trust and investment services Cards and payments Service charges on deposit accounts Corporate services Commercial mortgage servicing Other Meaningful opportunity to penetrate existing Key mass affluent customers Differentiated Fee Businesses

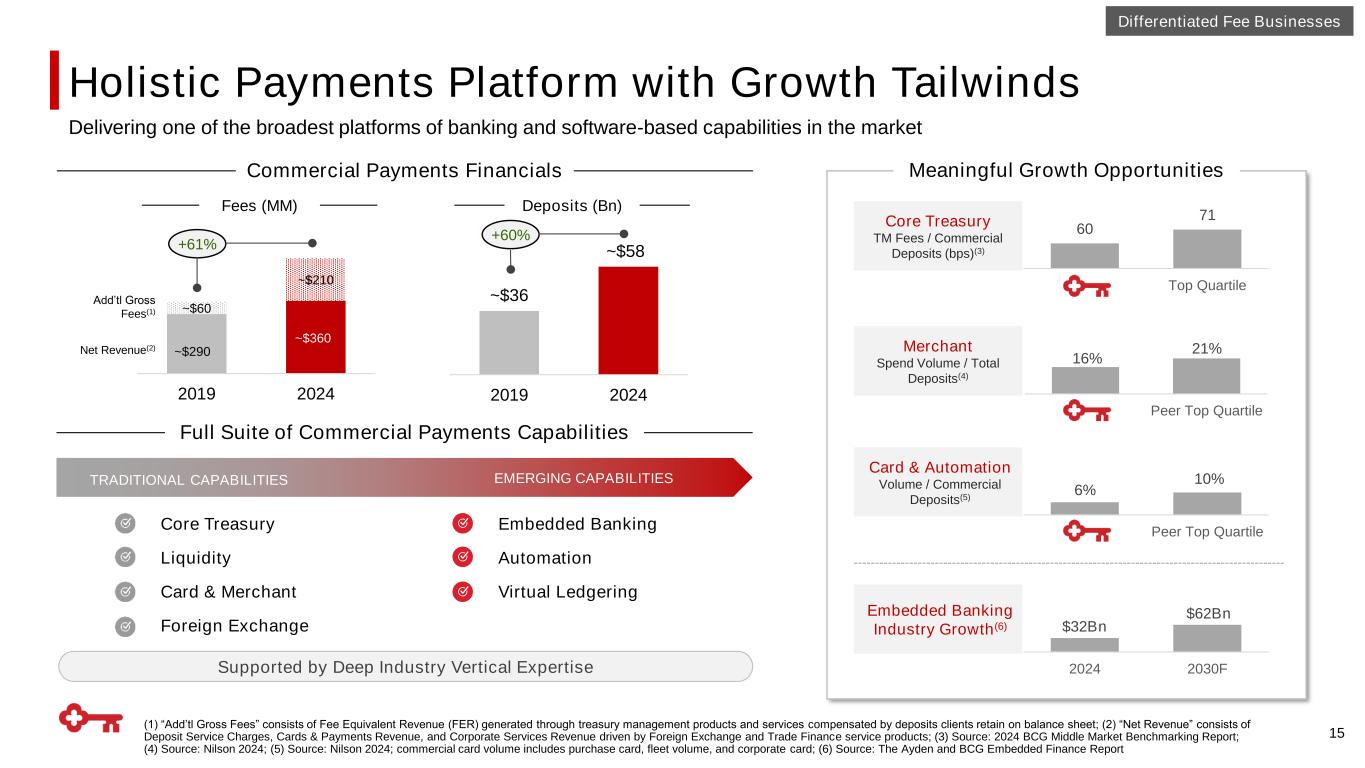

Full Suite of Commercial Payments Capabilities TRADITIONAL CAPABILITIES EMERGING CAPABILITIES Core Treasury Liquidity Card & Merchant Foreign Exchange Embedded Banking Automation Virtual Ledgering Supported by Deep Industry Vertical Expertise Holistic Payments Platform with Growth Tailwinds 15 (1) “Add’tl Gross Fees” consists of Fee Equivalent Revenue (FER) generated through treasury management products and services compensated by deposits clients retain on balance sheet; (2) “Net Revenue” consists of Deposit Service Charges, Cards & Payments Revenue, and Corporate Services Revenue driven by Foreign Exchange and Trade Finance service products; (3) Source: 2024 BCG Middle Market Benchmarking Report; (4) Source: Nilson 2024; (5) Source: Nilson 2024; commercial card volume includes purchase card, fleet volume, and corporate card; (6) Source: The Ayden and BCG Embedded Finance Report Delivering one of the broadest platforms of banking and software-based capabilities in the market Commercial Payments Financials Meaningful Growth Opportunities Core Treasury TM Fees / Commercial Deposits (bps)(3) 60 71 Key Top Quartile Merchant Spend Volume / Total Deposits(4) 16% 21% Key Peer Top Quartile Card & Automation Volume / Commercial Deposits(5) 6% 10% Key Peer Top Quartile Embedded Banking Industry Growth(6) $32Bn $62Bn 2024 2030F ~$36 ~$58 2019 2024 Fees (MM) Deposits (Bn) +60% ~$290 ~$360 ~$60 ~$210 2019 2024 +61% Net Revenue(2) Add’tl Gross Fees(1) Differentiated Fee Businesses

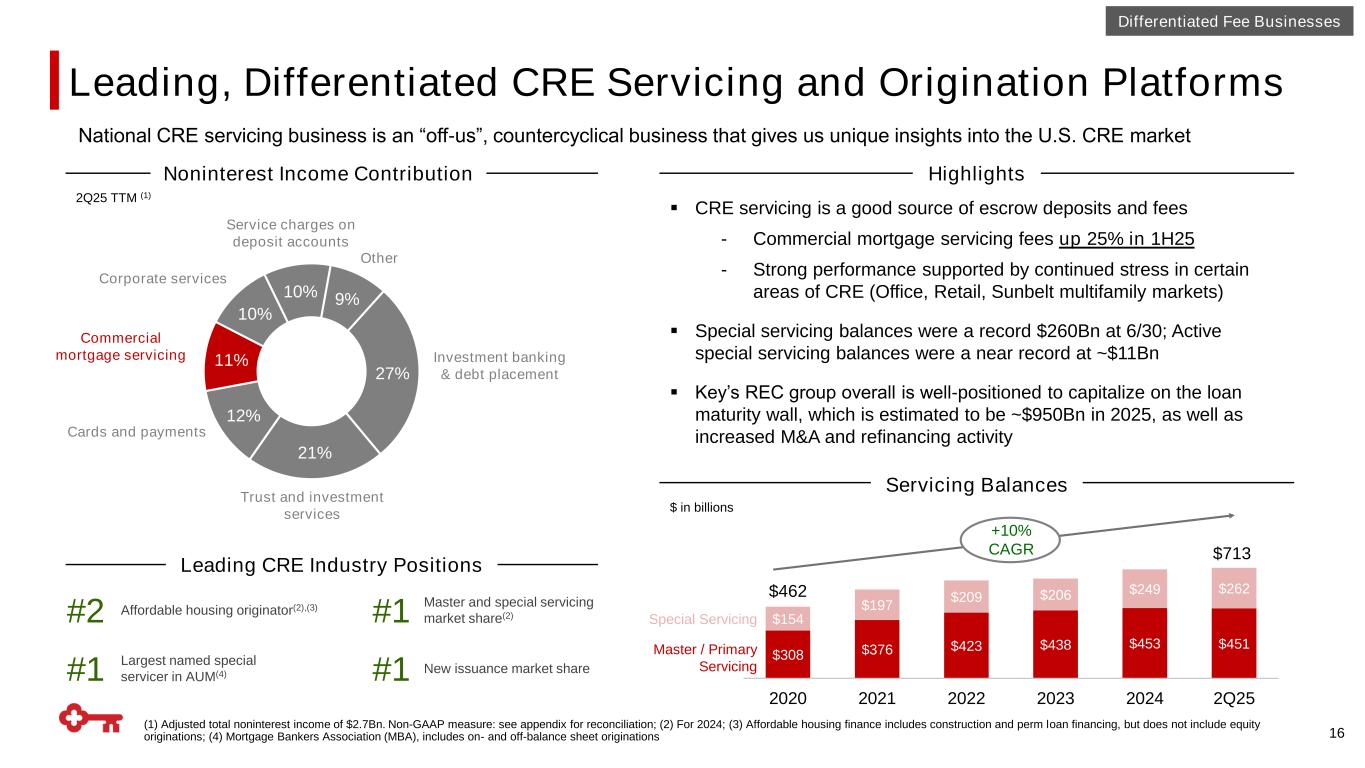

▪ CRE servicing is a good source of escrow deposits and fees - Commercial mortgage servicing fees up 25% in 1H25 - Strong performance supported by continued stress in certain areas of CRE (Office, Retail, Sunbelt multifamily markets) ▪ Special servicing balances were a record $260Bn at 6/30; Active special servicing balances were a near record at ~$11Bn ▪ Key’s REC group overall is well-positioned to capitalize on the loan maturity wall, which is estimated to be ~$950Bn in 2025, as well as increased M&A and refinancing activity Leading, Differentiated CRE Servicing and Origination Platforms 16 National CRE servicing business is an “off-us”, countercyclical business that gives us unique insights into the U.S. CRE market Differentiated Fee Businesses $308 $376 $423 $438 $453 $451 $154 $197 $209 $206 $249 $262 2020 2021 2022 2023 2024 2Q25 +10% CAGR Affordable housing originator(2),(3)#2 New issuance market share Leading CRE Industry Positions HighlightsNoninterest Income Contribution 2Q25 TTM (1) #1 Master and special servicing market share(2) Largest named special servicer in AUM(4) #1 #1 (1) Adjusted total noninterest income of $2.7Bn. Non-GAAP measure: see appendix for reconciliation; (2) For 2024; (3) Affordable housing finance includes construction and perm loan financing, but does not include equity originations; (4) Mortgage Bankers Association (MBA), includes on- and off-balance sheet originations Servicing Balances $ in billions 27% 21% 12% 11% 10% 10% 9% Investment banking & debt placement Trust and investment services Cards and payments Service charges on deposit accounts Corporate services Commercial mortgage servicing Other Special Servicing Master / Primary Servicing $713 $462

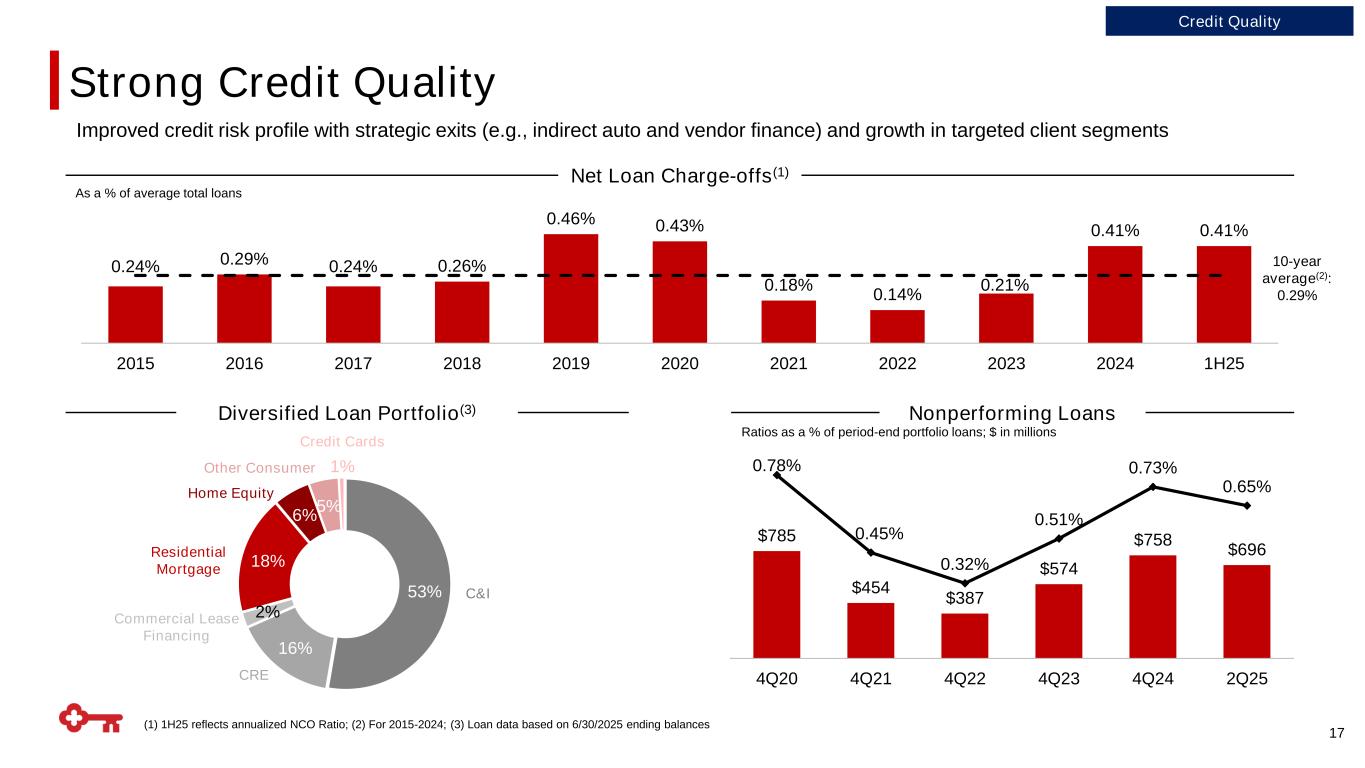

0.24% 0.29% 0.24% 0.26% 0.46% 0.43% 0.18% 0.14% 0.21% 0.41% 0.41% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 1H25 Strong Credit Quality 17 (1) 1H25 reflects annualized NCO Ratio; (2) For 2015-2024; (3) Loan data based on 6/30/2025 ending balances 53% 16% 2% 18% 6% 5% 1% Diversified Loan Portfolio(3) Home Equity C&I Credit Cards Commercial Lease Financing Other Consumer CRE Residential Mortgage Nonperforming Loans Net Loan Charge-offs(1) As a % of average total loans 10-year average(2): 0.29% Credit Quality Improved credit risk profile with strategic exits (e.g., indirect auto and vendor finance) and growth in targeted client segments Ratios as a % of period-end portfolio loans; $ in millions $785 $454 $387 $574 $758 $696 0.78% 0.45% 0.32% 0.51% 0.73% 0.65% 100 300 500 700 900 1100 1300 0.000 0.002 0.004 0.006 0.008 4Q20 4Q21 4Q22 4Q23 4Q24 2Q25

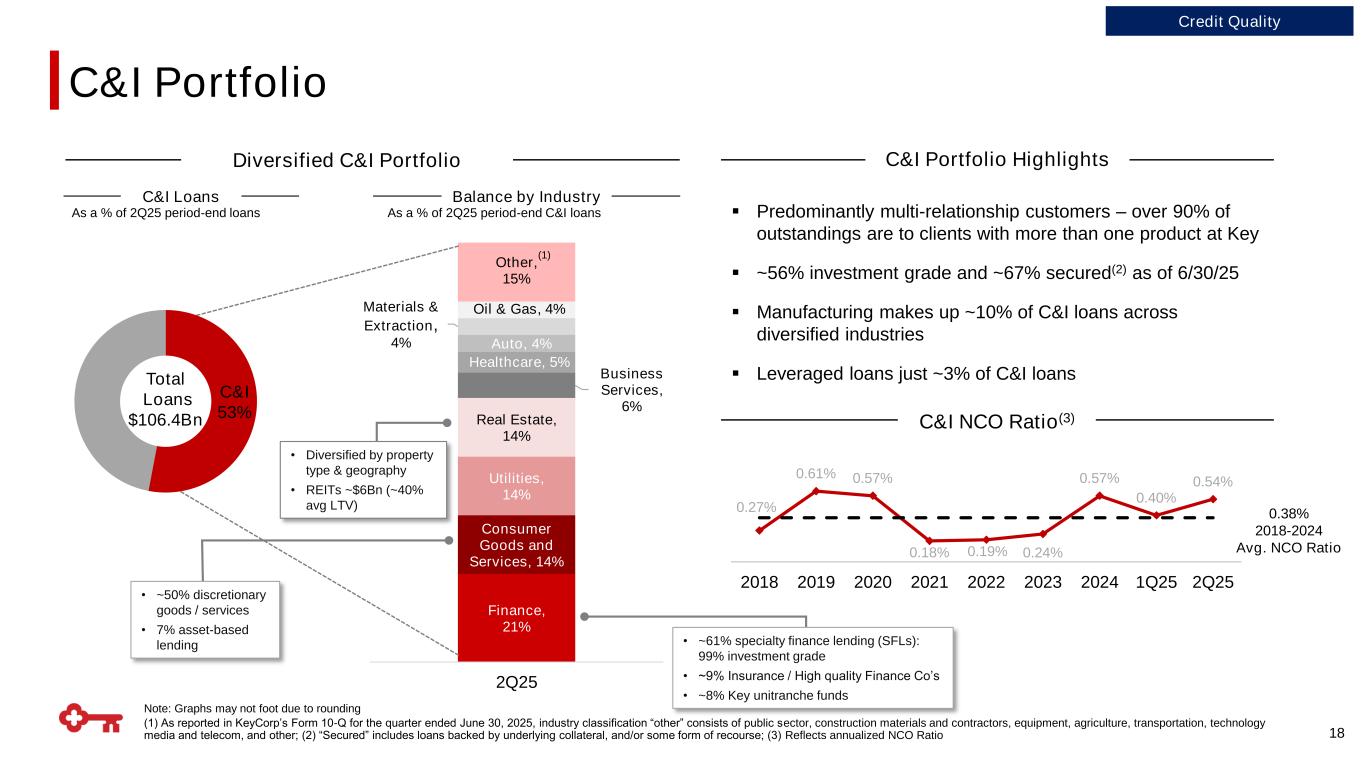

Finance, 21% Consumer Goods and Services, 14% Utilities, 14% Real Estate, 14% Business Services, 6% Healthcare, 5% Auto, 4% Materials & Extraction, 4% Oil & Gas, 4% Other, 15% 2Q25 18 Note: Graphs may not foot due to rounding (1) As reported in KeyCorp’s Form 10-Q for the quarter ended June 30, 2025, industry classification “other” consists of public sector, construction materials and contractors, equipment, agriculture, transportation, technology media and telecom, and other; (2) “Secured” includes loans backed by underlying collateral, and/or some form of recourse; (3) Reflects annualized NCO Ratio 0.27% 0.61% 0.57% 0.18% 0.19% 0.24% 0.57% 0.40% 0.54% 2018 2019 2020 2021 2022 2023 2024 1Q25 2Q25 C&I NCO Ratio(3) Diversified C&I Portfolio Total Loans $106.4Bn C&I Portfolio Highlights ▪ Predominantly multi-relationship customers – over 90% of outstandings are to clients with more than one product at Key ▪ ~56% investment grade and ~67% secured(2) as of 6/30/25 ▪ Manufacturing makes up ~10% of C&I loans across diversified industries ▪ Leveraged loans just ~3% of C&I loans C&I 53% 0.38% 2018-2024 Avg. NCO Ratio • Diversified by property type & geography • REITs ~$6Bn (~40% avg LTV) Credit Quality C&I Portfolio C&I Loans As a % of 2Q25 period-end loans Balance by Industry As a % of 2Q25 period-end C&I loans (1) • ~50% discretionary goods / services • 7% asset-based lending • ~61% specialty finance lending (SFLs): 99% investment grade • ~9% Insurance / High quality Finance Co’s • ~8% Key unitranche funds

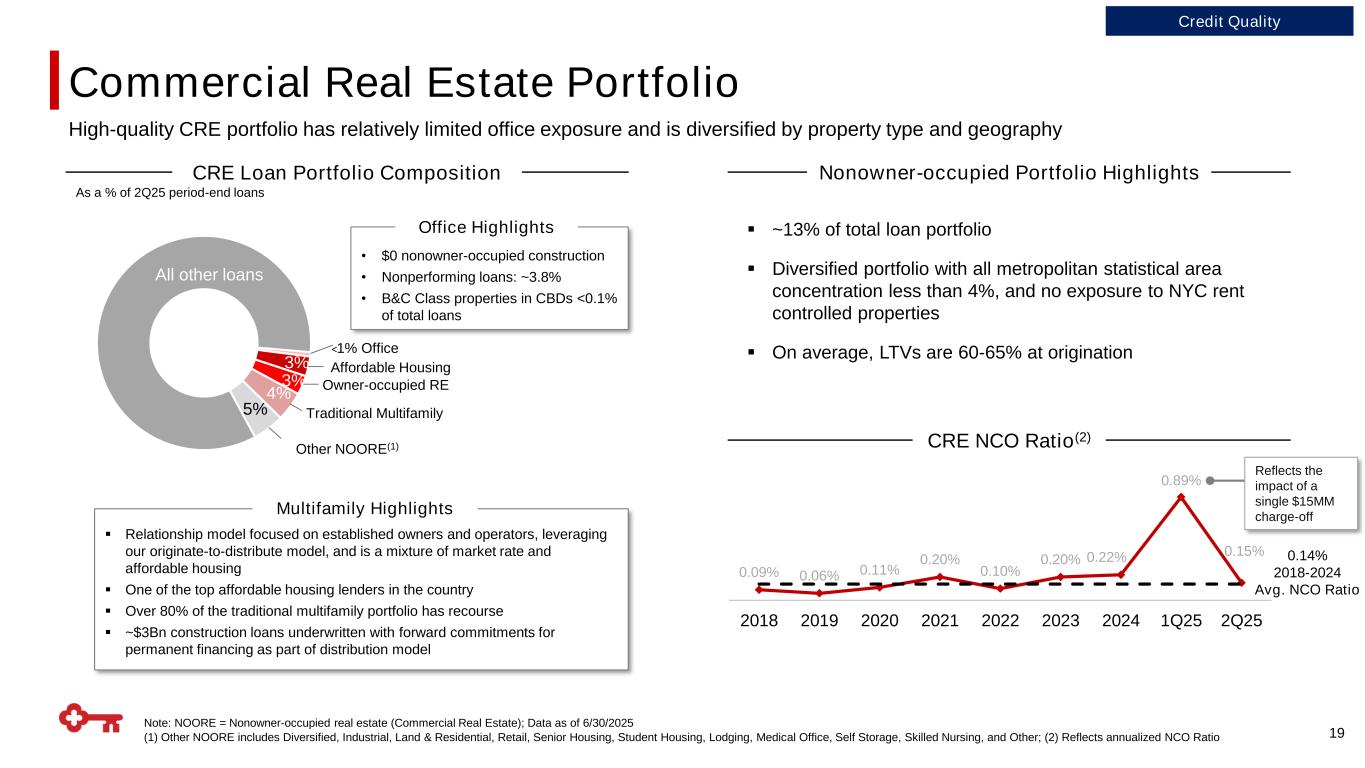

19 Note: NOORE = Nonowner-occupied real estate (Commercial Real Estate); Data as of 6/30/2025 (1) Other NOORE includes Diversified, Industrial, Land & Residential, Retail, Senior Housing, Student Housing, Lodging, Medical Office, Self Storage, Skilled Nursing, and Other; (2) Reflects annualized NCO Ratio High-quality CRE portfolio has relatively limited office exposure and is diversified by property type and geography 1% Office 3% 3% 4% 5% < All other loans • $0 nonowner-occupied construction • Nonperforming loans: ~3.8% • B&C Class properties in CBDs <0.1% of total loans ▪ Relationship model focused on established owners and operators, leveraging our originate-to-distribute model, and is a mixture of market rate and affordable housing ▪ One of the top affordable housing lenders in the country ▪ Over 80% of the traditional multifamily portfolio has recourse ▪ ~$3Bn construction loans underwritten with forward commitments for permanent financing as part of distribution model Office Highlights Multifamily Highlights Affordable Housing Traditional Multifamily Other NOORE(1) CRE Loan Portfolio Composition CRE NCO Ratio(2) ▪ ~13% of total loan portfolio ▪ Diversified portfolio with all metropolitan statistical area concentration less than 4%, and no exposure to NYC rent controlled properties ▪ On average, LTVs are 60-65% at origination As a % of 2Q25 period-end loans Owner-occupied RE 0.09% 0.06% 0.11% 0.20% 0.10% 0.20% 0.22% 0.89% 0.15% 2018 2019 2020 2021 2022 2023 2024 1Q25 2Q25 0.14% 2018-2024 Avg. NCO Ratio Commercial Real Estate Portfolio Nonowner-occupied Portfolio Highlights Credit Quality Reflects the impact of a single $15MM charge-off

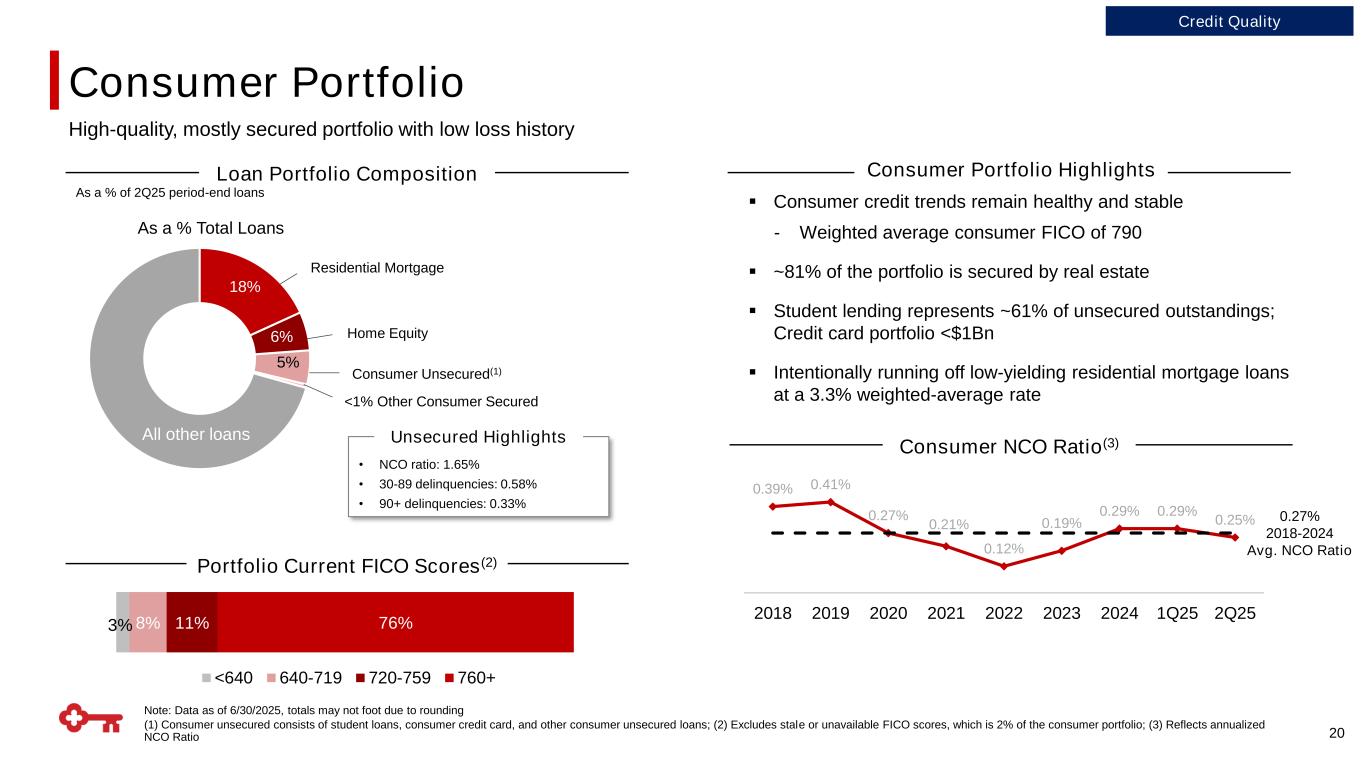

20 Note: Data as of 6/30/2025, totals may not foot due to rounding (1) Consumer unsecured consists of student loans, consumer credit card, and other consumer unsecured loans; (2) Excludes stale or unavailable FICO scores, which is 2% of the consumer portfolio; (3) Reflects annualized NCO Ratio High-quality, mostly secured portfolio with low loss history 3% 8% 11% 76% <640 640-719 720-759 760+ 18% 6% 5% All other loans As a % Total Loans Loan Portfolio Composition Consumer Portfolio Highlights ▪ Consumer credit trends remain healthy and stable - Weighted average consumer FICO of 790 ▪ ~81% of the portfolio is secured by real estate ▪ Student lending represents ~61% of unsecured outstandings; Credit card portfolio <$1Bn ▪ Intentionally running off low-yielding residential mortgage loans at a 3.3% weighted-average rate Residential Mortgage Home Equity Consumer Unsecured(1) <1% Other Consumer Secured • NCO ratio: 1.65% • 30-89 delinquencies: 0.58% • 90+ delinquencies: 0.33% Unsecured Highlights Portfolio Current FICO Scores(2) As a % of 2Q25 period-end loans 0.39% 0.41% 0.27% 0.21% 0.12% 0.19% 0.29% 0.29% 0.25% 2018 2019 2020 2021 2022 2023 2024 1Q25 2Q25 0.27% 2018-2024 Avg. NCO Ratio Consumer Portfolio Credit Quality Consumer NCO Ratio(3)

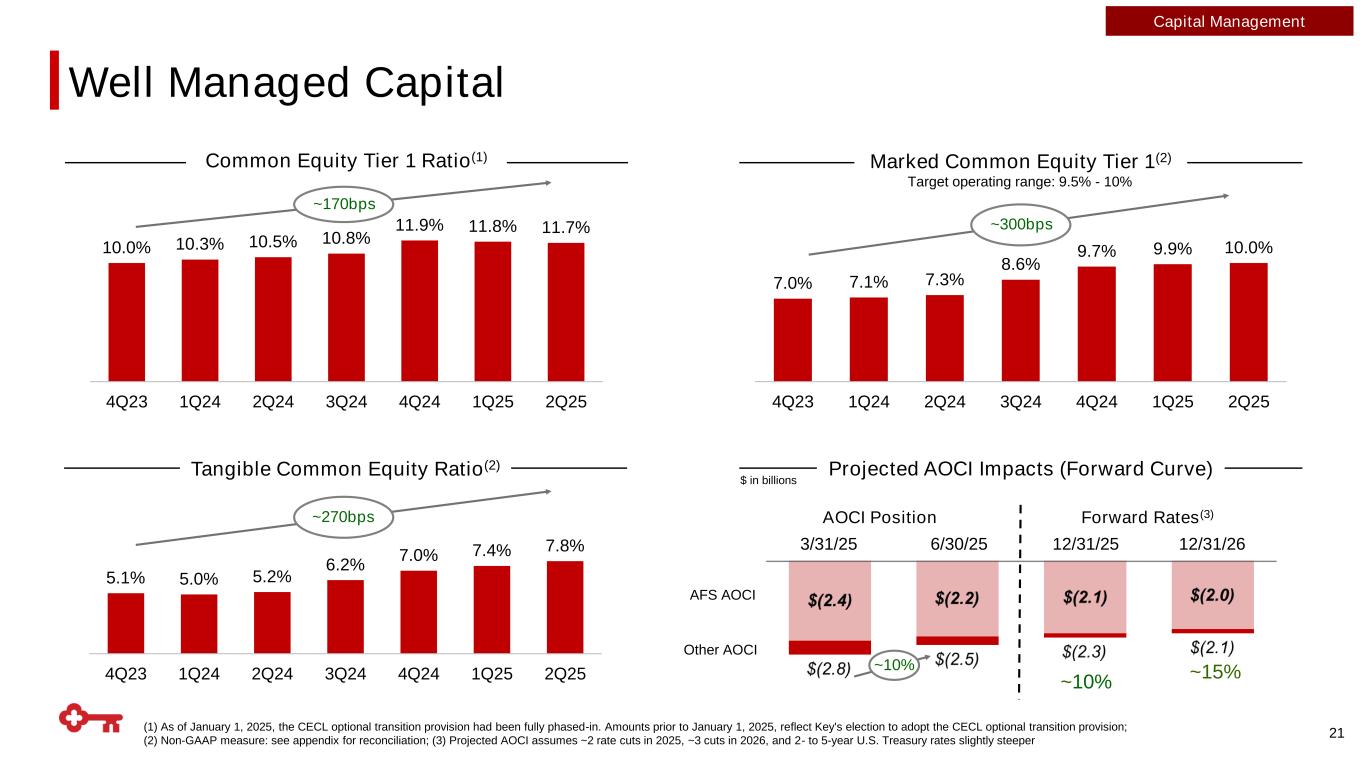

7.0% 7.1% 7.3% 8.6% 9.7% 9.9% 10.0% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 5.1% 5.0% 5.2% 6.2% 7.0% 7.4% 7.8% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 10.0% 10.3% 10.5% 10.8% 11.9% 11.8% 11.7% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Capital Management (1) As of January 1, 2025, the CECL optional transition provision had been fully phased-in. Amounts prior to January 1, 2025, reflect Key's election to adopt the CECL optional transition provision; (2) Non-GAAP measure: see appendix for reconciliation; (3) Projected AOCI assumes ~2 rate cuts in 2025, ~3 cuts in 2026, and 2- to 5-year U.S. Treasury rates slightly steeper Tangible Common Equity Ratio(2) Common Equity Tier 1 Ratio(1) Marked Common Equity Tier 1(2) ~170bps ~300bps $ in billions Projected AOCI Impacts (Forward Curve) ~15% Forward Rates(3)AOCI Position 3/31/25 ~10% 12/31/25 12/31/26 AFS AOCI Other AOCI 6/30/25 ~10% Target operating range: 9.5% - 10% 21 ~270bps Well Managed Capital

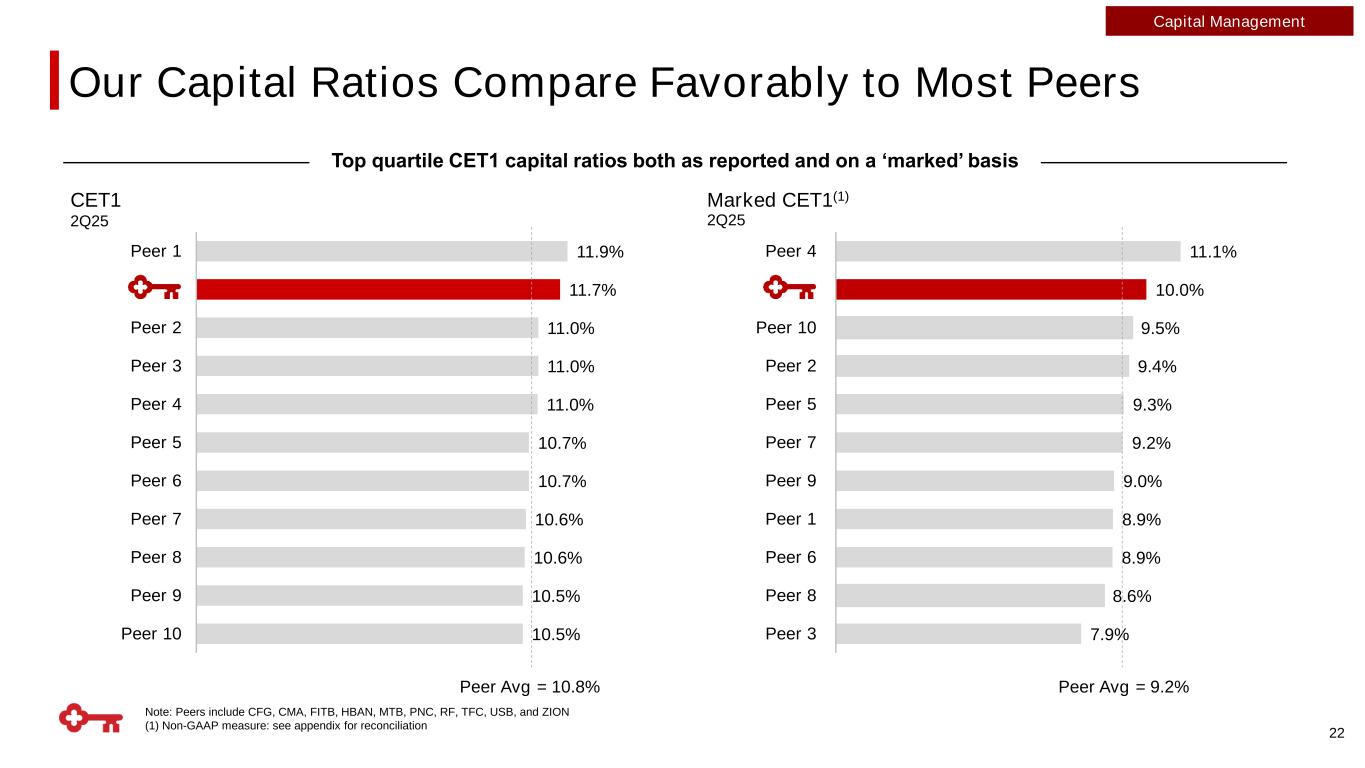

Note: Peers include CFG, CMA, FITB, HBAN, MTB, PNC, RF, TFC, USB, and ZION (1) Non-GAAP measure: see appendix for reconciliation Top quartile CET1 capital ratios both as reported and on a ‘marked’ basis 22 11.1% 10.0% 9.5% 9.4% 9.3% 9.2% 9.0% 8.9% 8.9% 8.6% 7.9% Peer 4 Peer 10 Peer 2 Peer 5 Peer 7 Peer 9 Peer 1 Peer 6 Peer 8 Peer 3 2Q25 2Q25 CET1 Marked CET1(1) Peer Avg = 9.2%Peer Avg = 10.8% 11.9% 11.7% 11.0% 11.0% 11.0% 10.7% 10.7% 10.6% 10.6% 10.5% 10.5% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Capital Management Our Capital Ratios Compare Favorably to Most Peers

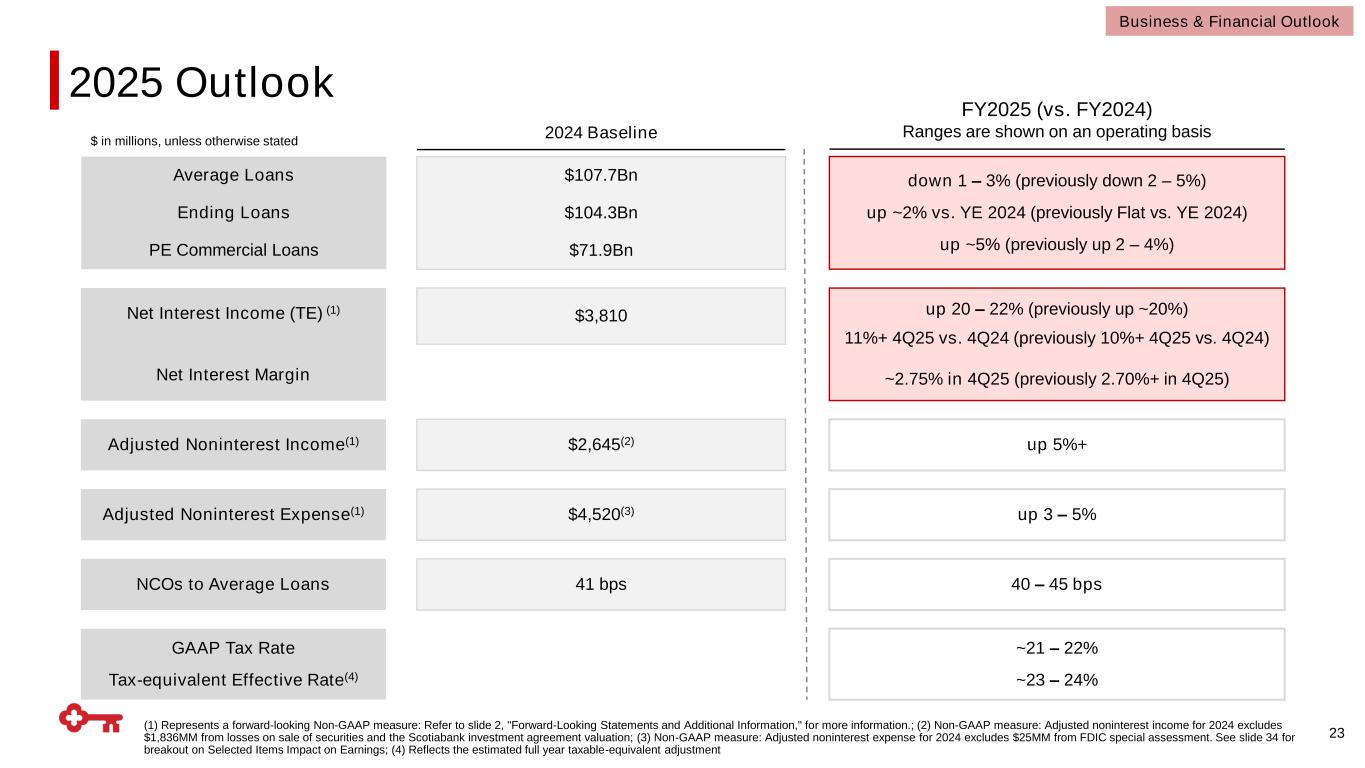

(1) Represents a forward-looking Non-GAAP measure: Refer to slide 2, "Forward-Looking Statements and Additional Information," for more information.; (2) Non-GAAP measure: Adjusted noninterest income for 2024 excludes $1,836MM from losses on sale of securities and the Scotiabank investment agreement valuation; (3) Non-GAAP measure: Adjusted noninterest expense for 2024 excludes $25MM from FDIC special assessment. See slide 34 for breakout on Selected Items Impact on Earnings; (4) Reflects the estimated full year taxable-equivalent adjustment FY2025 (vs. FY2024) Ranges are shown on an operating basis $ in millions, unless otherwise stated 2024 Baseline $107.7Bn $104.3Bn $71.9Bn down 1 – 3% (previously down 2 – 5%) up ~2% vs. YE 2024 (previously Flat vs. YE 2024) up ~5% (previously up 2 – 4%) Average Loans Ending Loans PE Commercial Loans $2,645(2) up 5%+Adjusted Noninterest Income(1) $4,520(3) up 3 – 5%Adjusted Noninterest Expense(1) $3,810 up 20 – 22% (previously up ~20%) 11%+ 4Q25 vs. 4Q24 (previously 10%+ 4Q25 vs. 4Q24) ~2.75% in 4Q25 (previously 2.70%+ in 4Q25) Net Interest Income (TE) (1) Net Interest Margin ~21 – 22% ~23 – 24% GAAP Tax Rate Tax-equivalent Effective Rate(4) 41 bps 40 – 45 bpsNCOs to Average Loans 23 Business & Financial Outlook 2025 Outlook

24 ▪ Positioned to grow high-quality, low-cost deposits that fuel relationship-driven loan growth ▪ Effectively manage risks across the entire company to maintain safety and soundness and maximize profitability ▪ Scaling investment banking, wealth, and payments for the benefit of clients and shareholders ▪ Relationship business model continues to generate organic growth by expanding engagement with existing clients and attracting new customers ▪ Diverse fee mix with high contribution to revenue ▪ Focused on generating positive operating leverage annually ▪ Simplify and streamline – honing our focus to drive an outstanding client experience that is both scalable and efficient ▪ Target 1-2% cost savings annually to fund continued investments in people and technology that will drive future growth ▪ Manage capital to support client needs and drive long-term shareholder value ▪ Pursue niche “tuck in” fee-based acquisitions that we’ve proven we can integrate quickly / effectively ▪ Board authorized $1Bn share repurchase program Disciplined balance sheet growth and optimization Maintain expense discipline while investing Compound our current fee advantage Productively deploy excess capital (current and future) Well-positioned to deliver 15%+ ROTCE over the medium term Business & Financial Outlook Positioned for the Future

Appendix

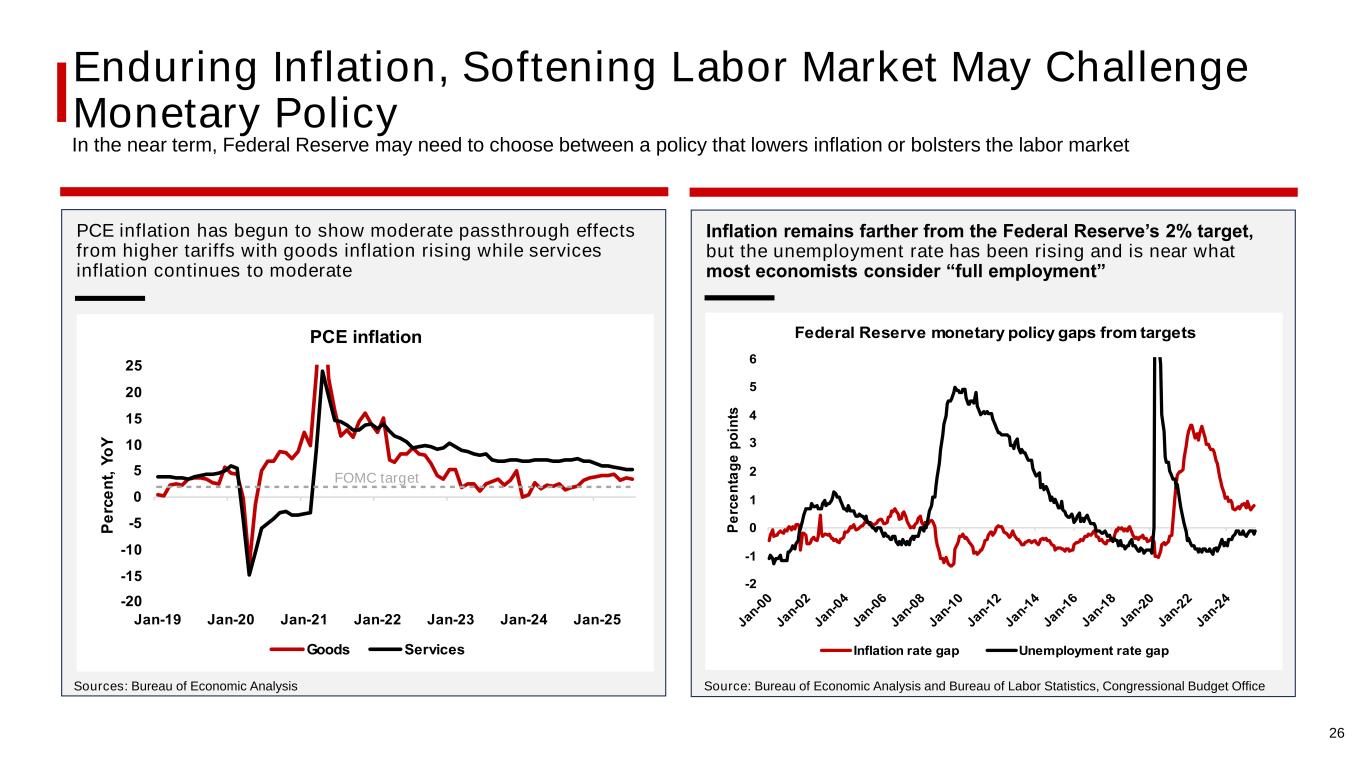

Enduring Inflation, Softening Labor Market May Challenge Monetary Policy In the near term, Federal Reserve may need to choose between a policy that lowers inflation or bolsters the labor market PCE inflation has begun to show moderate passthrough effects from higher tariffs with goods inflation rising while services inflation continues to moderate Inflation remains farther from the Federal Reserve’s 2% target, but the unemployment rate has been rising and is near what most economists consider “full employment” Sources: Bureau of Economic Analysis Source: Bureau of Economic Analysis and Bureau of Labor Statistics, Congressional Budget Office 20 15 10 5 0 5 10 15 20 25 an 19 an 20 an 21 an 22 an 2 an 2 an 25 e rc e n t, o CE inflation oods Services FOMC target 2 1 0 1 2 5 e rc e n ta g e p o in ts Federal Reserve monetary policy gaps from targets Inflation rate gap Unemployment rate gap 26

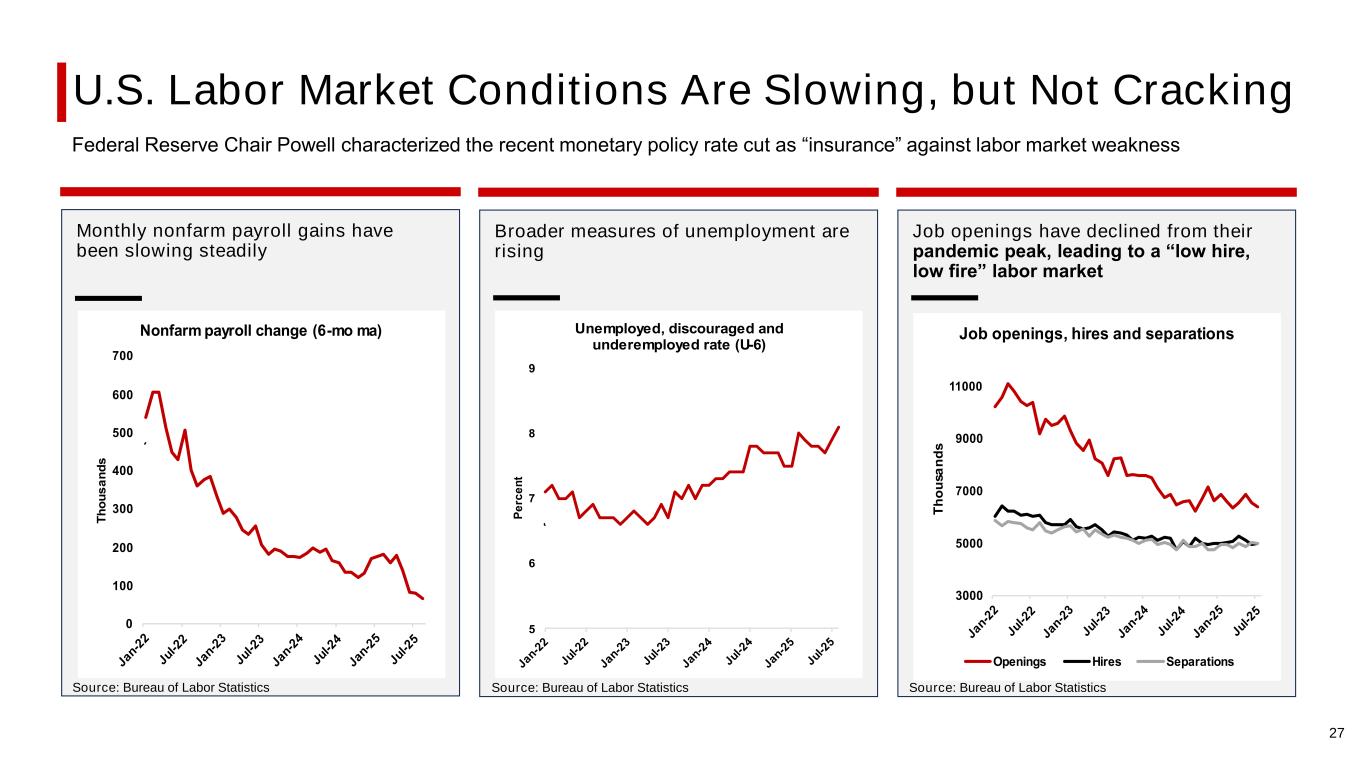

U.S. Labor Market Conditions Are Slowing, but Not Cracking Monthly nonfarm payroll gains have been slowing steadily Broader measures of unemployment are rising Job openings have declined from their pandemic peak, leading to a “low hire, low fire” labor market Source: Bureau of Labor Statistics Source: Bureau of Labor Statistics 0 100 200 00 00 500 00 00 T h o u s a n d s Nonfarm payroll change mo ma 5 9 e rc e n t Unemployed, discouraged and underemployed rate U 000 5000 000 9000 11000 T h o u s a n d s ob openings, hires and separations penings Hires Separations Source: Bureau of Labor Statistics Federal Reserve Chair Powell characterized the recent monetary policy rate cut as “insurance” against labor market weakness 27

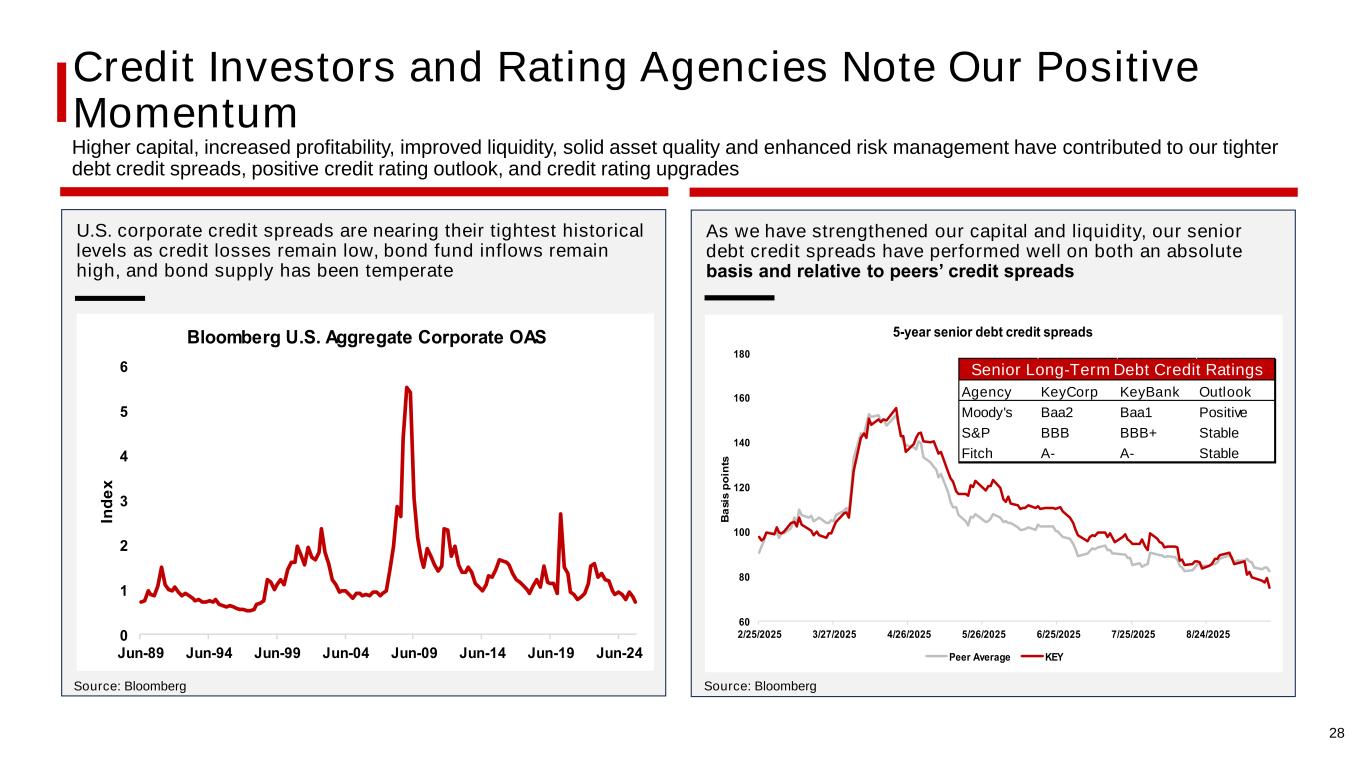

Credit Investors and Rating Agencies Note Our Positive Momentum Higher capital, increased profitability, improved liquidity, solid asset quality and enhanced risk management have contributed to our tighter debt credit spreads, positive credit rating outlook, and credit rating upgrades U.S. corporate credit spreads are nearing their tightest historical levels as credit losses remain low, bond fund inflows remain high, and bond supply has been temperate As we have strengthened our capital and liquidity, our senior debt credit spreads have performed well on both an absolute basis and relative to peers’ credit spreads Source: Bloomberg Source: Bloomberg 0 1 2 5 un 9 un 9 un 99 un 0 un 09 un 1 un 19 un 2 In d e loomberg U S ggregate Corporate S 0 0 100 120 1 0 1 0 1 0 2 25 2025 2 2025 2 2025 5 2 2025 25 2025 25 2025 2 2025 a s is p o in ts 5 year senior debt credit spreads eer verage E 28 Agency KeyCorp KeyBank Outlook Moody's Baa2 Baa1 Positive S&P BBB BBB+ Stable Fitch A- A- Stable Senior Long-Term Debt Credit Ratings

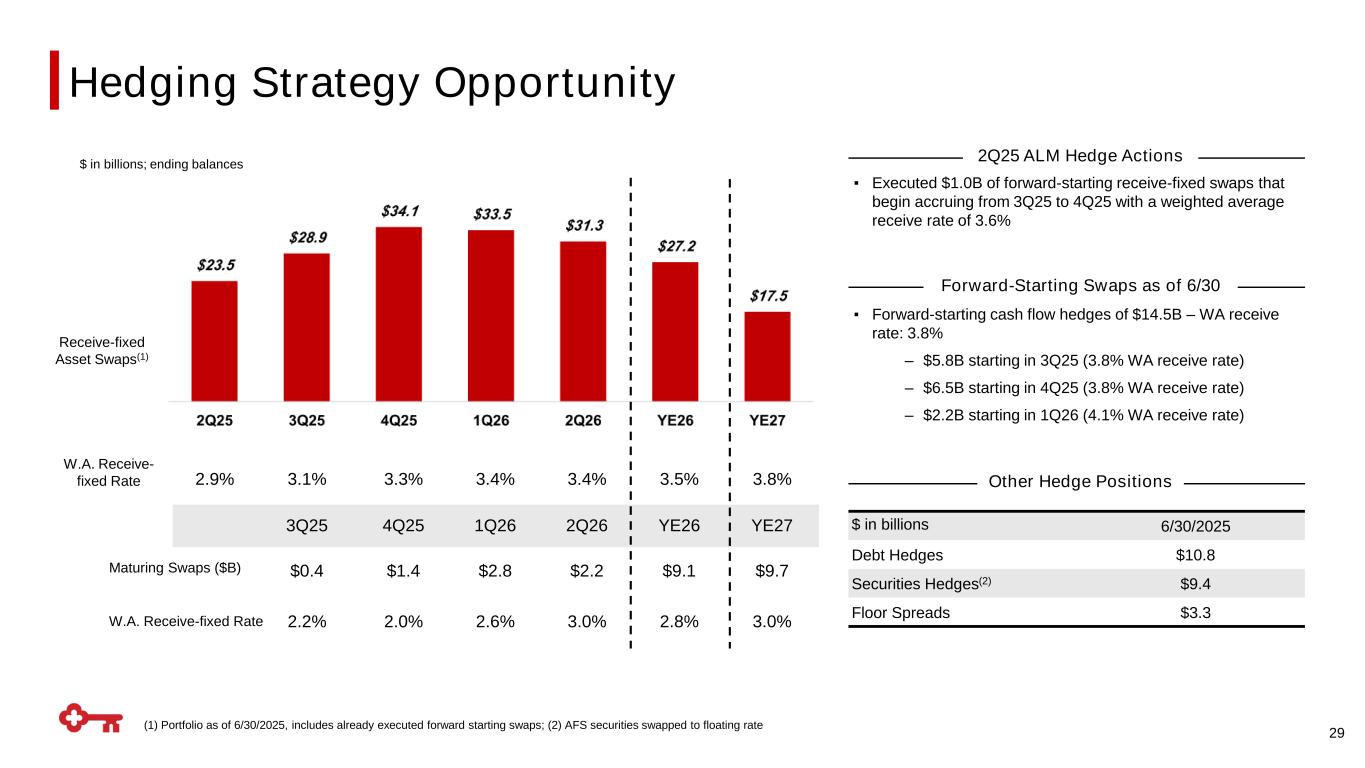

29 (1) Portfolio as of 6/30/2025, includes already executed forward starting swaps; (2) AFS securities swapped to floating rate $ in billions 6/30/2025 Debt Hedges $10.8 Securities Hedges(2) $9.4 Floor Spreads $3.3 Other Hedge Positions ▪ Executed $1.0B of forward-starting receive-fixed swaps that begin accruing from 3Q25 to 4Q25 with a weighted average receive rate of 3.6% 2Q25 ALM Hedge Actions 2.9% 3.1% 3.3% 3.4% 3.4% 3.5% 3.8% 3Q25 4Q25 1Q26 2Q26 YE26 YE27 $0.4 $1.4 $2.8 $2.2 $9.1 $9.7 2.2% 2.0% 2.6% 3.0% 2.8% 3.0% W.A. Receive- fixed Rate Maturing Swaps ($B) W.A. Receive-fixed Rate Receive-fixed Asset Swaps(1) $ in billions; ending balances ▪ Forward-starting cash flow hedges of $14.5B – WA receive rate: 3.8% – $5.8B starting in 3Q25 (3.8% WA receive rate) – $6.5B starting in 4Q25 (3.8% WA receive rate) – $2.2B starting in 1Q26 (4.1% WA receive rate) Forward-Starting Swaps as of 6/30 Hedging Strategy Opportunity

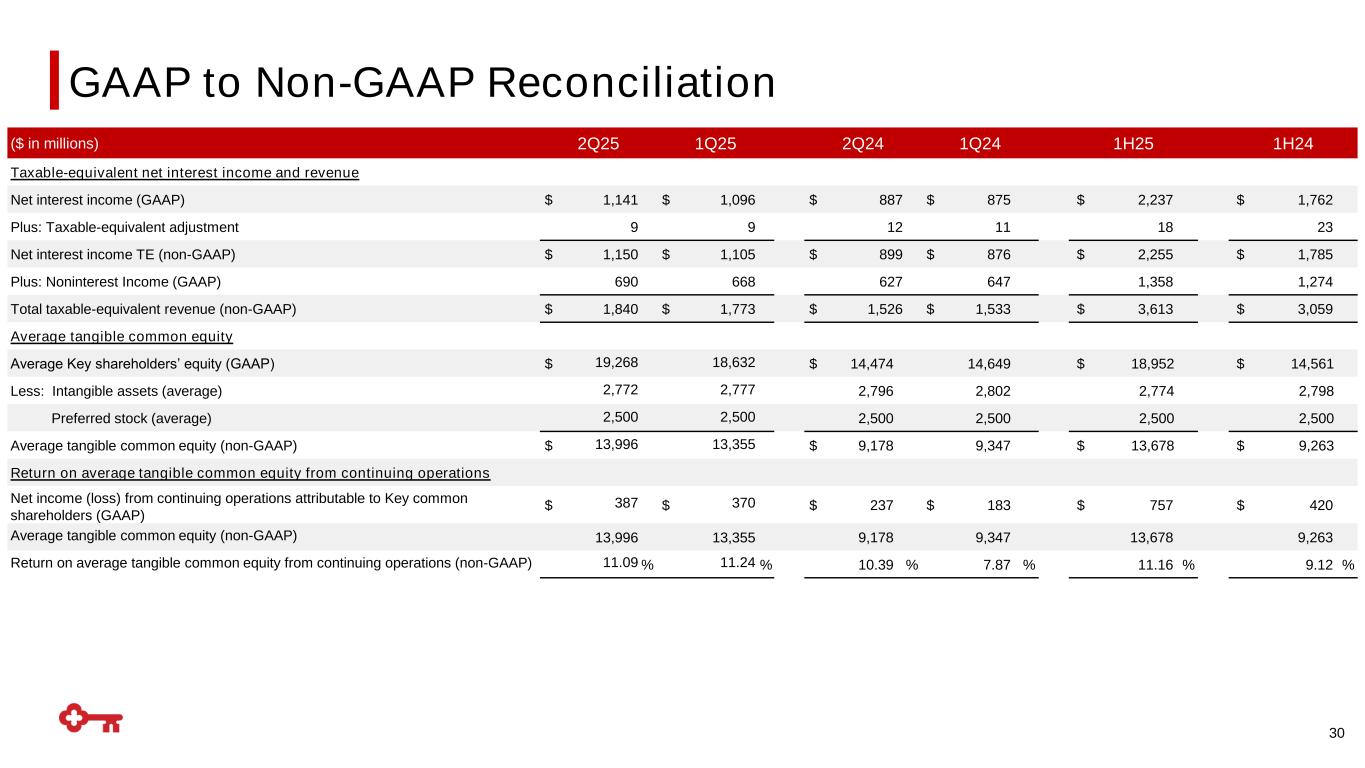

30 ($ in millions) 2Q25 1Q25 2Q24 1Q24 1H25 1H24 Taxable-equivalent net interest income and revenue Net interest income (GAAP) $ 1,141 $ 1,096 $ 887 $ 875 $ 2,237 $ 1,762 Plus: Taxable-equivalent adjustment 9 9 12 11 18 23 Net interest income TE (non-GAAP) $ 1,150 $ 1,105 $ 899 $ 876 $ 2,255 $ 1,785 Plus: Noninterest Income (GAAP) 690 668 627 647 1,358 1,274 Total taxable-equivalent revenue (non-GAAP) $ 1,840 $ 1,773 $ 1,526 $ 1,533 $ 3,613 $ 3,059 Average tangible common equity Average Key shareholders’ equity (GAAP) $ 19,268 18,632 $ 14,474 14,649 $ 18,952 $ 14,561 Less: Intangible assets (average) 2,772 2,777 2,796 2,802 2,774 2,798 Preferred stock (average) 2,500 2,500 2,500 2,500 2,500 2,500 Average tangible common equity (non-GAAP) $ 13,996 13,355 $ 9,178 9,347 $ 13,678 $ 9,263 Return on average tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ 387 $ 370 $ 237 $ 183 $ 757 $ 420 Average tangible common equity (non-GAAP) 13,996 13,355 9,178 9,347 13,678 9,263 Return on average tangible common equity from continuing operations (non-GAAP) 11.09 % 11.24 % 10.39 % 7.87 % 11.16 % 9.12 % GAAP to Non-GAAP Reconciliation

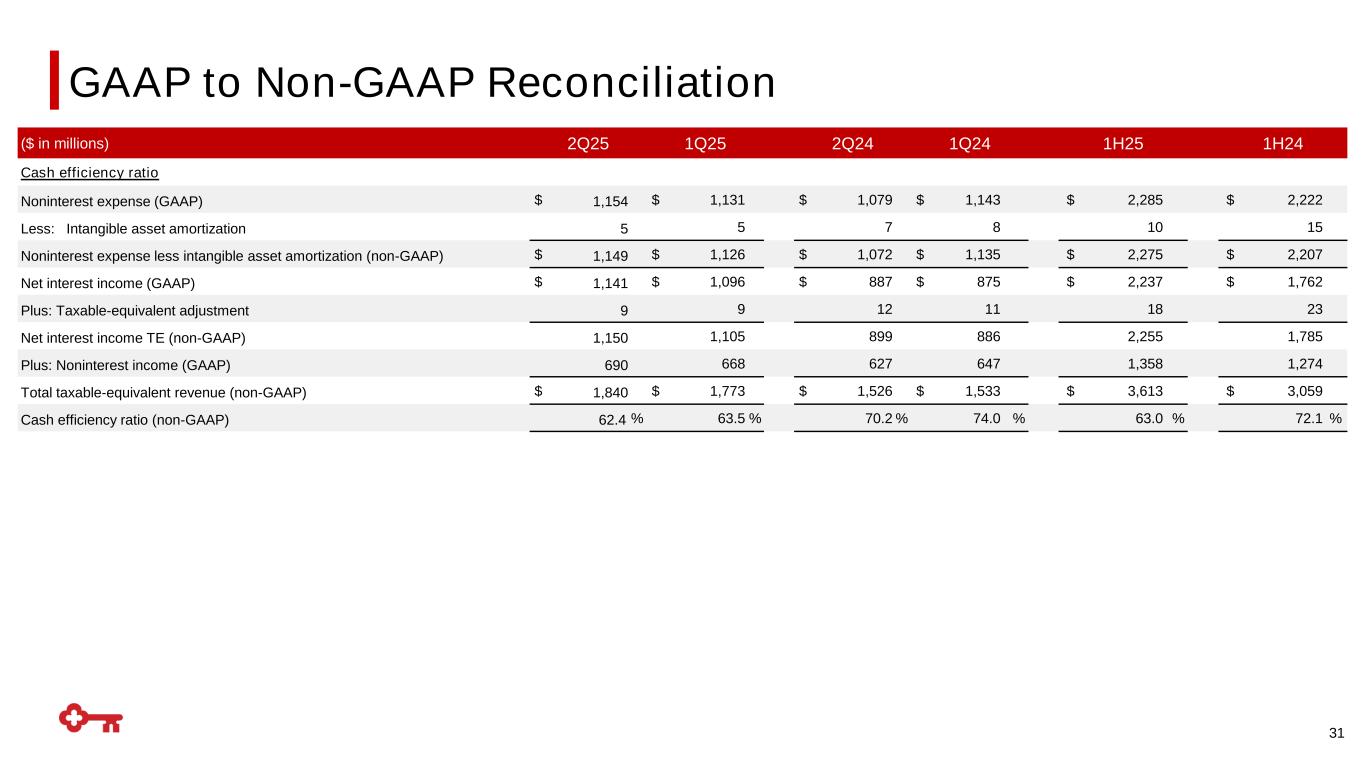

31 ($ in millions) 2Q25 1Q25 2Q24 1Q24 1H25 1H24 Cash efficiency ratio Noninterest expense (GAAP) $ 1,154 $ 1,131 $ 1,079 $ 1,143 $ 2,285 $ 2,222 Less: Intangible asset amortization 5 5 7 8 10 15 Noninterest expense less intangible asset amortization (non-GAAP) $ 1,149 $ 1,126 $ 1,072 $ 1,135 $ 2,275 $ 2,207 Net interest income (GAAP) $ 1,141 $ 1,096 $ 887 $ 875 $ 2,237 $ 1,762 Plus: Taxable-equivalent adjustment 9 9 12 11 18 23 Net interest income TE (non-GAAP) 1,150 1,105 899 886 2,255 1,785 Plus: Noninterest income (GAAP) 690 668 627 647 1,358 1,274 Total taxable-equivalent revenue (non-GAAP) $ 1,840 $ 1,773 $ 1,526 $ 1,533 $ 3,613 $ 3,059 Cash efficiency ratio (non-GAAP) 62.4 % 63.5 % 70.2 % 74.0 % 63.0 % 72.1 % GAAP to Non-GAAP Reconciliation

32 ($ in millions) 2Q25 1Q25 4Q24 3Q24 2Q25 TTM Noninterest income adjusted for selected items Noninterest income (GAAP) $ 690 $ 668 $ (196) $ (269) $ 893 Plus: Selected items(1) - - 918 918 1,836 Noninterest income adjusted for selected items (non-GAAP) $ 690 $ 668 $ 722 $ 649 $ 2,729 Net interest income (GAAP) 1,141 1,096 1,051 952 4,240 Plus: Taxable-equivalent adjustment 9 9 10 12 40 Total taxable-equivalent revenue adjusted for selected items (non-GAAP) $ 1,840 $ 1,773 $ 1,783 $ 1,613 $ 7,009 GAAP to Non-GAAP Reconciliation (1) See slide 34 for breakout on Selected Items Impact on Earnings

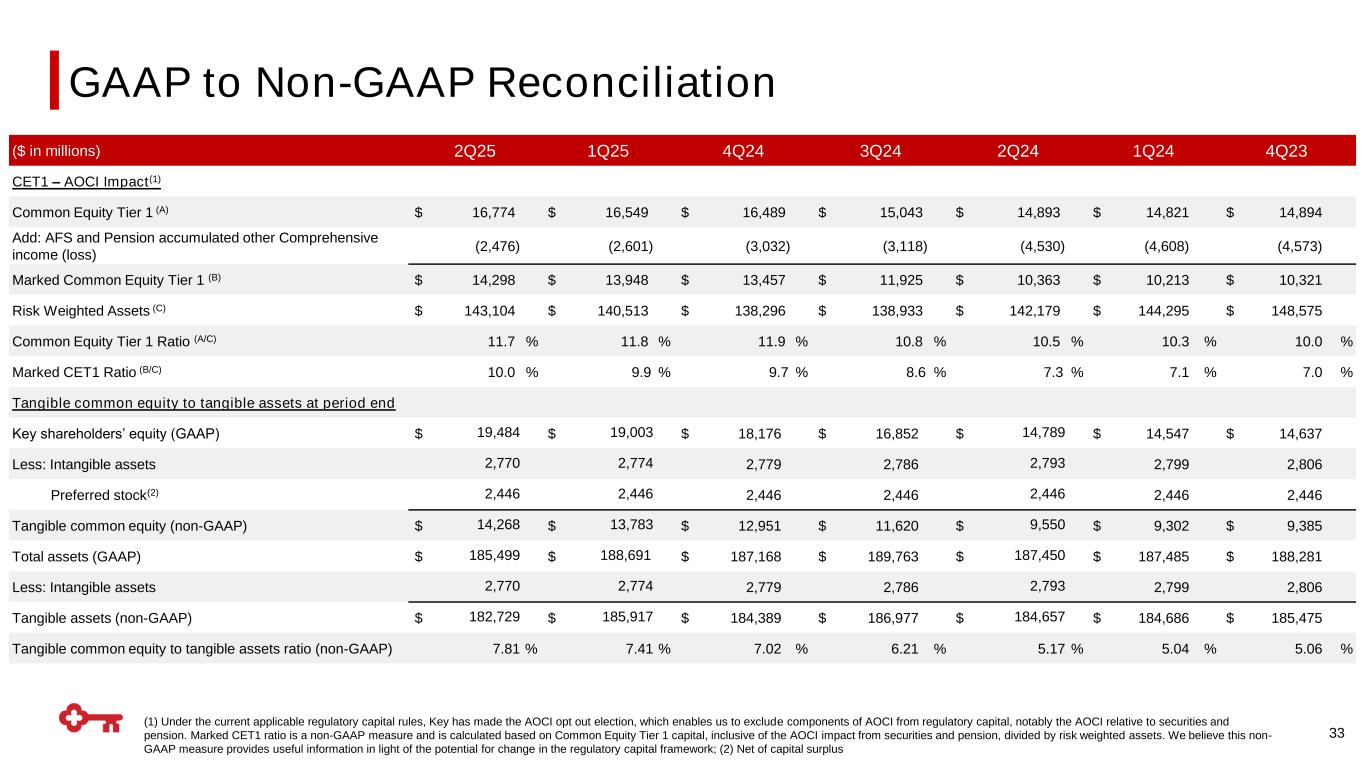

(1) Under the current applicable regulatory capital rules, Key has made the AOCI opt out election, which enables us to exclude components of AOCI from regulatory capital, notably the AOCI relative to securities and pension. Marked CET1 ratio is a non-GAAP measure and is calculated based on Common Equity Tier 1 capital, inclusive of the AOCI impact from securities and pension, divided by risk weighted assets. We believe this non- GAAP measure provides useful information in light of the potential for change in the regulatory capital framework; (2) Net of capital surplus 33 ($ in millions) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 CET1 – AOCI Impact(1) Common Equity Tier 1 (A) $ 16,774 $ 16,549 $ 16,489 $ 15,043 $ 14,893 $ 14,821 $ 14,894 Add: AFS and Pension accumulated other Comprehensive income (loss) (2,476) (2,601) (3,032) (3,118) (4,530) (4,608) (4,573) Marked Common Equity Tier 1 (B) $ 14,298 $ 13,948 $ 13,457 $ 11,925 $ 10,363 $ 10,213 $ 10,321 Risk Weighted Assets (C) $ 143,104 $ 140,513 $ 138,296 $ 138,933 $ 142,179 $ 144,295 $ 148,575 Common Equity Tier 1 Ratio (A/C) 11.7 % 11.8 % 11.9 % 10.8 % 10.5 % 10.3 % 10.0 % Marked CET1 Ratio (B/C) 10.0 % 9.9 % 9.7 % 8.6 % 7.3 % 7.1 % 7.0 % Tangible common equity to tangible assets at period end Key shareholders’ equity (GAAP) $ 19,484 $ 19,003 $ 18,176 $ 16,852 $ 14,789 $ 14,547 $ 14,637 Less: Intangible assets 2,770 2,774 2,779 2,786 2,793 2,799 2,806 Preferred stock(2) 2,446 2,446 2,446 2,446 2,446 2,446 2,446 Tangible common equity (non-GAAP) $ 14,268 $ 13,783 $ 12,951 $ 11,620 $ 9,550 $ 9,302 $ 9,385 Total assets (GAAP) $ 185,499 $ 188,691 $ 187,168 $ 189,763 $ 187,450 $ 187,485 $ 188,281 Less: Intangible assets 2,770 2,774 2,779 2,786 2,793 2,799 2,806 Tangible assets (non-GAAP) $ 182,729 $ 185,917 $ 184,389 $ 186,977 $ 184,657 $ 184,686 $ 185,475 Tangible common equity to tangible assets ratio (non-GAAP) 7.81 % 7.41 % 7.02 % 6.21 % 5.17 % 5.04 % 5.06 % GAAP to Non-GAAP Reconciliation

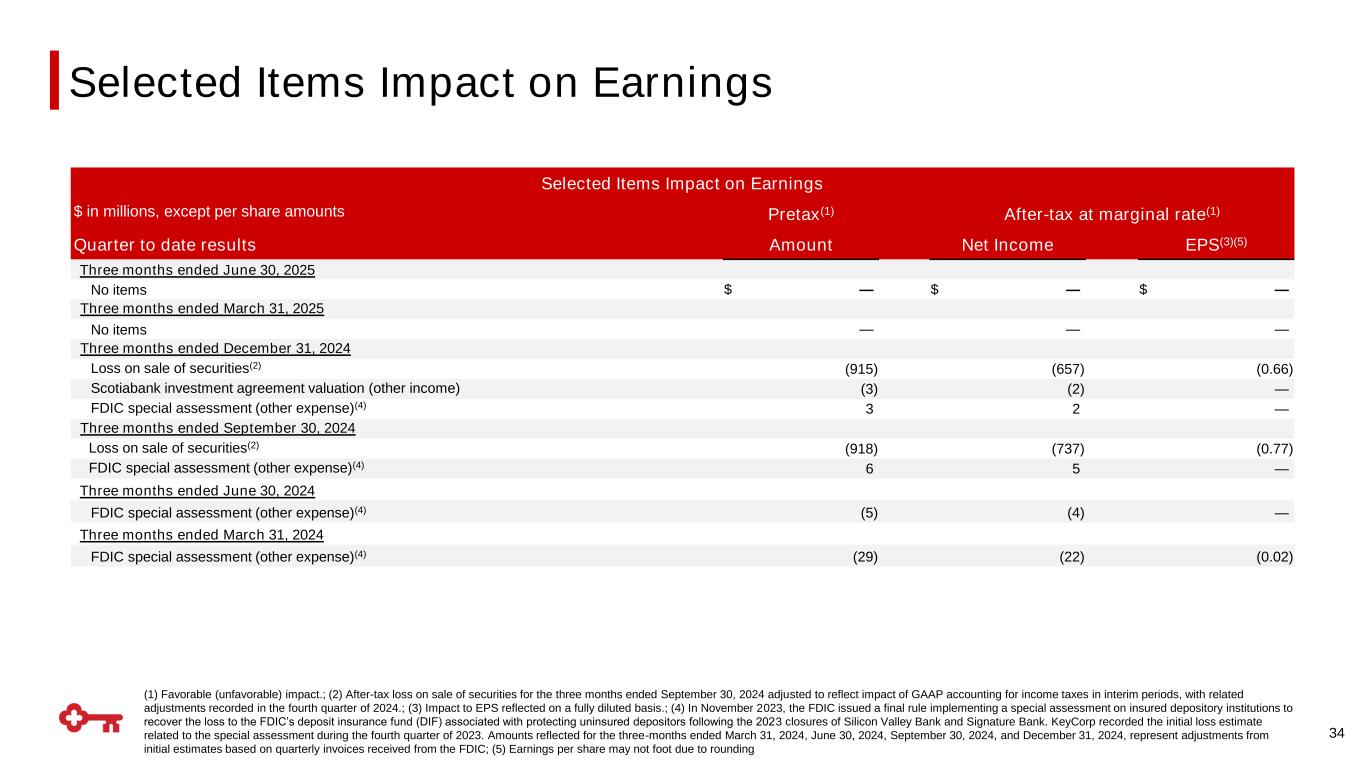

(1) Favorable (unfavorable) impact.; (2) After-tax loss on sale of securities for the three months ended September 30, 2024 adjusted to reflect impact of GAAP accounting for income taxes in interim periods, with related adjustments recorded in the fourth quarter of 2024.; (3) Impact to EPS reflected on a fully diluted basis.; (4) In November 2023, the FDIC issued a final rule implementing a special assessment on insured depository institutions to recover the loss to the FDIC’s deposit insurance fund (DIF) associated with protecting uninsured depositors following the 2023 closures of Silicon Valley Bank and Signature Bank. KeyCorp recorded the initial loss estimate related to the special assessment during the fourth quarter of 2023. Amounts reflected for the three-months ended March 31, 2024, June 30, 2024, September 30, 2024, and December 31, 2024, represent adjustments from initial estimates based on quarterly invoices received from the FDIC; (5) Earnings per share may not foot due to rounding Selected Items Impact on Earnings $ in millions, except per share amounts Pretax(1) After-tax at marginal rate(1) Quarter to date results Amount Net Income EPS(3)(5) Three months ended June 30, 2025 No items $ — $ — $ — Three months ended March 31, 2025 No items — — — Three months ended December 31, 2024 Loss on sale of securities(2) (915) (657) (0.66) Scotiabank investment agreement valuation (other income) (3) (2) — FDIC special assessment (other expense)(4) 3 2 — Three months ended September 30, 2024 Loss on sale of securities(2) (918) (737) (0.77) FDIC special assessment (other expense)(4) 6 5 — Three months ended June 30, 2024 FDIC special assessment (other expense)(4) (5) (4) — Three months ended March 31, 2024 FDIC special assessment (other expense)(4) (29) (22) (0.02) 34 Selected Items Impact on Earnings

Forward-looking Statements and Additional Information 35 This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control). Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2024, and in subsequent filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. Non-GAAP Measures. This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Key’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measures, as well as the reconciliation to the comparable GAAP financial measures, can be found in the appendix to this presentation. Forward-Looking Non-GAAP Measures. This document contains forward-looking non-GAAP measures. We are unable to provide a reconciliation of forward-looking non-GAAP measures to their most directly comparable GAAP financial measures because we are unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficultly in forecasting and quantifying future amounts or when they may occur. Such unavailable information could be significant for future results. Annualized Data. Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts. Taxable Equivalent. Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at the federal statutory rate. This adjustment puts all earning assets, most notably tax-exempt municipal securities, and certain lease assets, on a common basis that facilitates comparison of results to results of peers. Earnings Per Share Equivalent. Certain income or expense items may be expressed on a per common share basis. This is done for analytical and decision-making purposes to better discern underlying trends in total consolidated earnings per share performance excluding the impact of such items. When the impact of certain income or expense items is disclosed separately, the after-tax amount is computed using the marginal tax rate, unless otherwise specified, with this then being the amount used to calculate the earnings per share equivalent. GAAP: Generally Accepted Accounting Principles