KeyCorp Third Quarter 2025 Earnings Review October 16, 2025 Chris Gorman Chairman and Chief Executive Officer Clark Khayat Chief Financial Officer

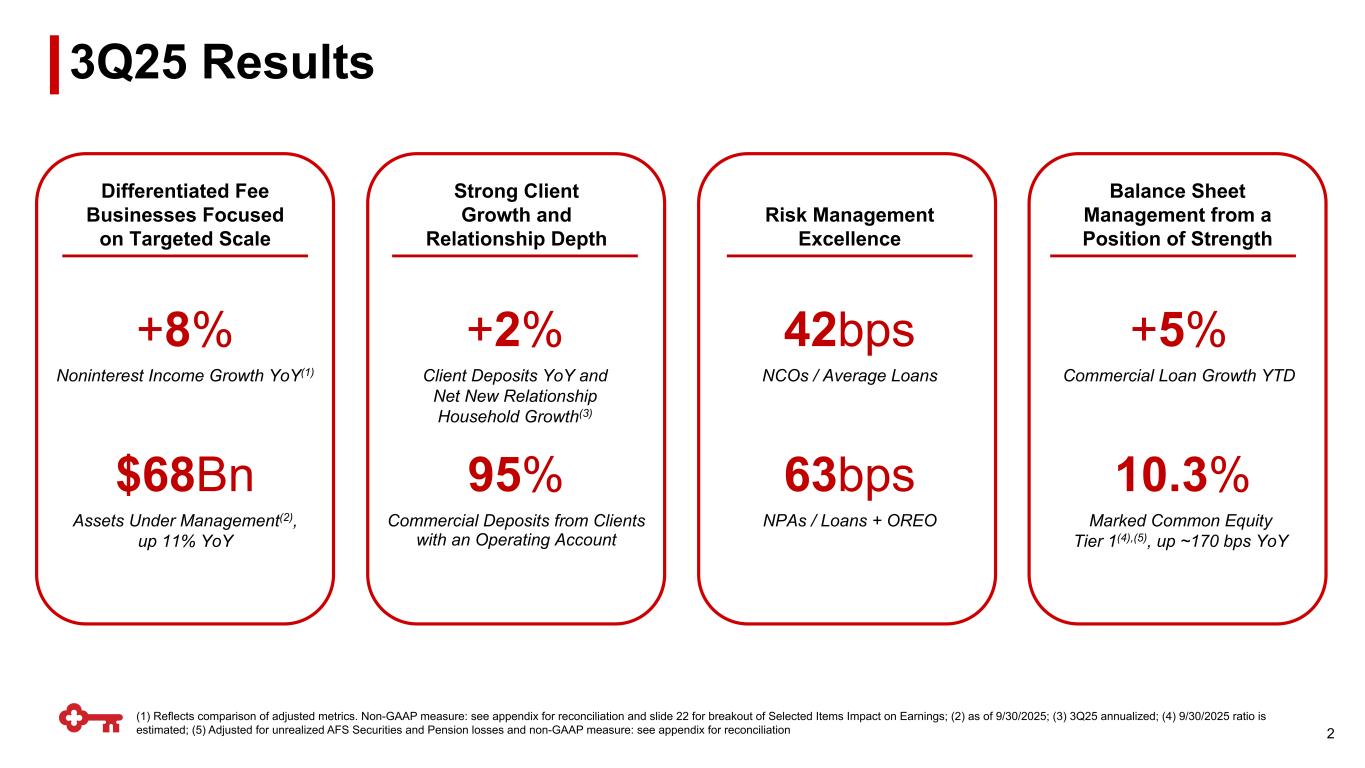

3Q25 Results +8% Noninterest Income Growth YoY(1) $68Bn Assets Under Management(2), up 11% YoY Differentiated Fee Businesses Focused on Targeted Scale +2% Client Deposits YoY and Net New Relationship Household Growth(3) Strong Client Growth and Relationship Depth Balance Sheet Management from a Position of Strength Risk Management Excellence 63bps NPAs / Loans + OREO 42bps NCOs / Average Loans 2 (1) Reflects comparison of adjusted metrics. Non-GAAP measure: see appendix for reconciliation and slide 22 for breakout of Selected Items Impact on Earnings; (2) as of 9/30/2025; (3) 3Q25 annualized; (4) 9/30/2025 ratio is estimated; (5) Adjusted for unrealized AFS Securities and Pension losses and non-GAAP measure: see appendix for reconciliation 95% Commercial Deposits from Clients with an Operating Account +5% Commercial Loan Growth YTD 10.3% Marked Common Equity Tier 1(4),(5), up ~170 bps YoY

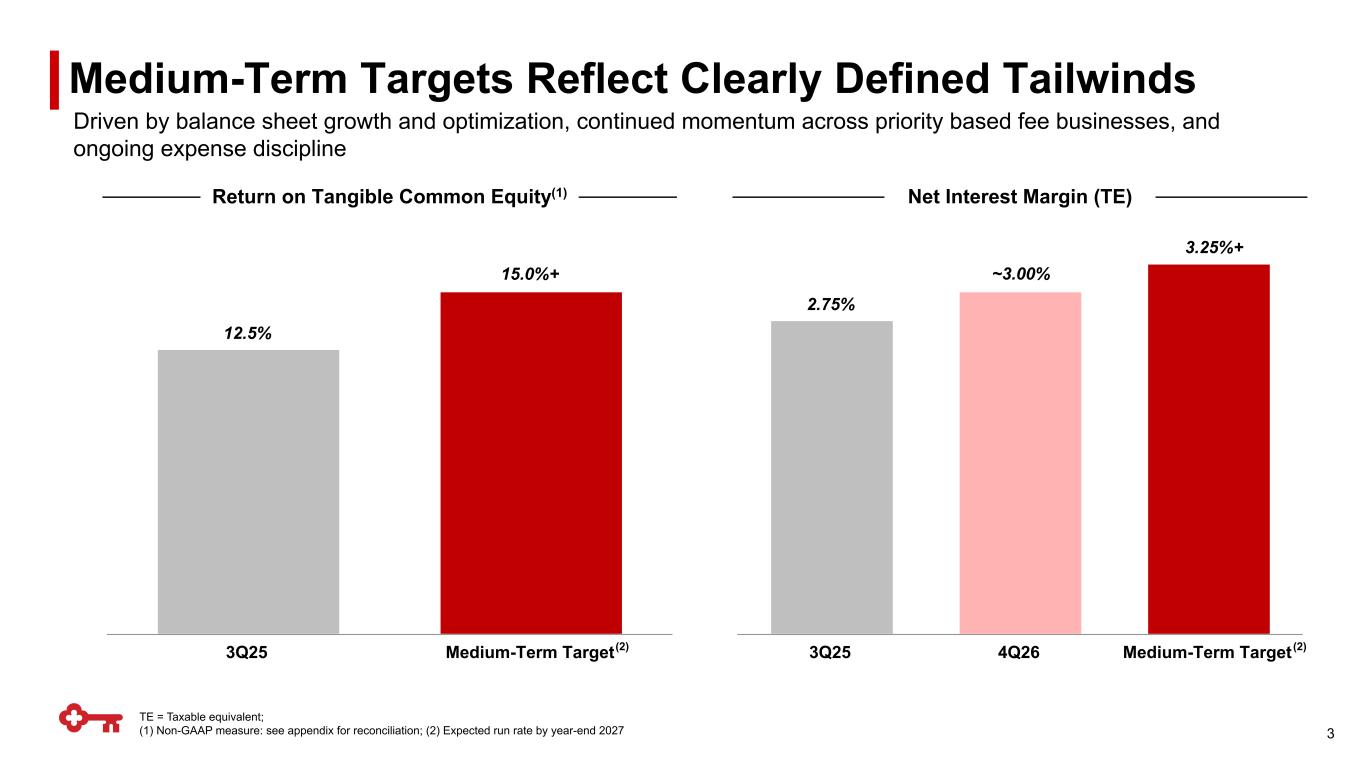

12.5% 15.0% 3Q25 Medium-Term Target Medium-Term Targets Reflect Clearly Defined Tailwinds Return on Tangible Common Equity(1) Net Interest Margin (TE) 2.75% 3.00% 3.25% 3Q25 4Q26 Medium-Term Target ~3. 0%15.0%+ . + Driven by balance sheet growth and optimization, continued momentum across priority based fee businesses, and ongoing expense discipline TE = Taxable equivalent; (1) Non-GAAP measure: see appendix for reconciliation; (2) Expected run rate by year-end 2027 (2) (2) 3

Financial Review

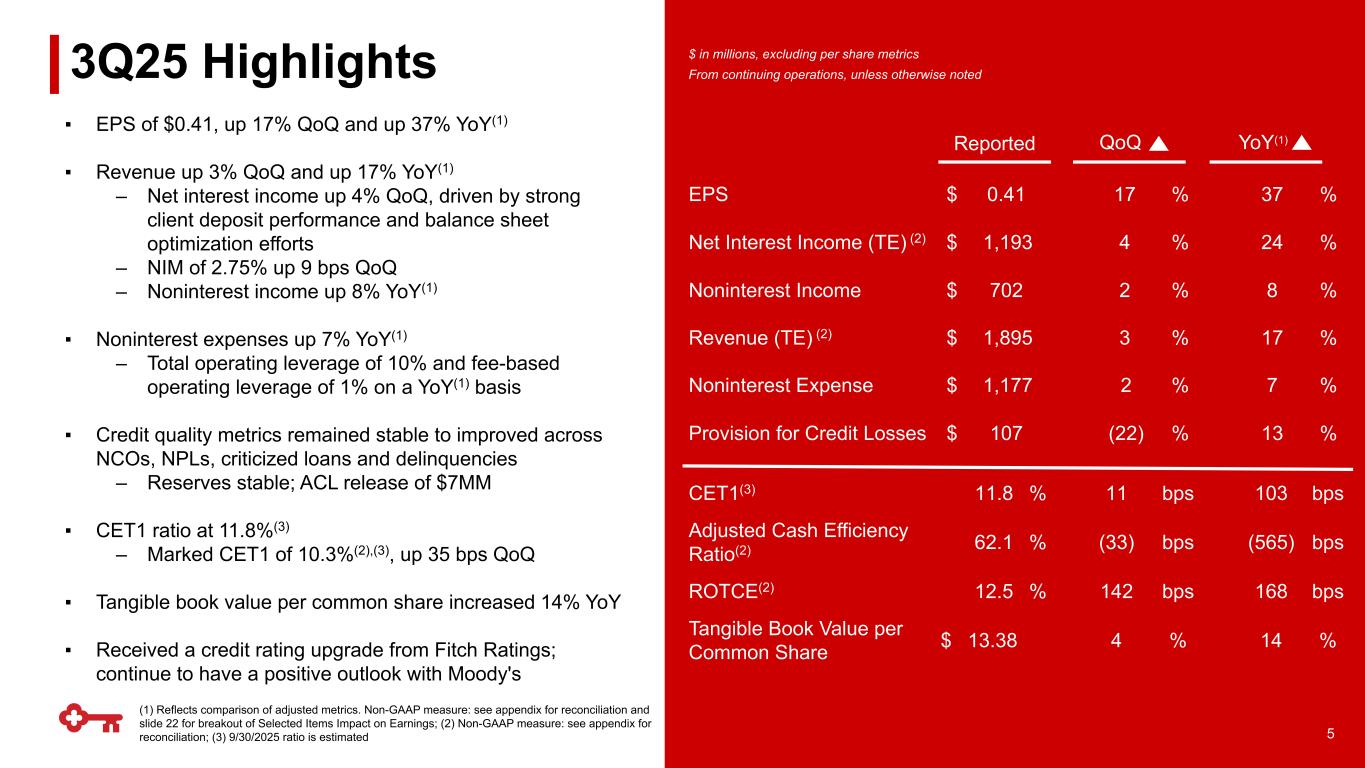

▪ EPS of $0.41, up 17% QoQ and up 37% YoY(1) ▪ Revenue up 3% QoQ and up 17% YoY(1) – Net interest income up 4% QoQ, driven by strong client deposit performance and balance sheet optimization efforts – NIM of 2.75% up 9 bps QoQ – Noninterest income up 8% YoY(1) ▪ Noninterest expenses up 7% YoY(1) – Total operating leverage of 10% and fee-based operating leverage of 1% on a YoY(1) basis ▪ Credit quality metrics remained stable to improved across NCOs, NPLs, criticized loans and delinquencies – Reserves stable; ACL release of $7MM ▪ CET1 ratio at 11.8%(3) – Marked CET1 of 10.3%(2),(3), up 35 bps QoQ ▪ Tangible book value per common share increased 14% YoY ▪ Received a credit rating upgrade from Fitch Ratings; continue to have a positive outlook with Moody's 3Q25 Highlights Reported QoQ YoY(1) $ in millions, excluding per share metrics From continuing operations, unless otherwise noted EPS $ 0.41 17 % 37 % Net Interest Income (TE) (2) $ 1,193 4 % 24 % Noninterest Income $ 702 2 % 8 % Revenue (TE) (2) $ 1,895 3 % 17 % Noninterest Expense $ 1,177 2 % 7 % Provision for Credit Losses $ 107 (22) % 13 % CET1(3) 11.8 % 11 bps 103 bps Adjusted Cash Efficiency Ratio(2) 62.1 % (33) bps (565) bps ROTCE(2) 12.5 % 142 bps 168 bps Tangible Book Value per Common Share $ 13.38 4 % 14 % 5 (1) Reflects comparison of adjusted metrics. Non-GAAP measure: see appendix for reconciliation and slide 22 for breakout of Selected Items Impact on Earnings; (2) Non-GAAP measure: see appendix for reconciliation; (3) 9/30/2025 ratio is estimated

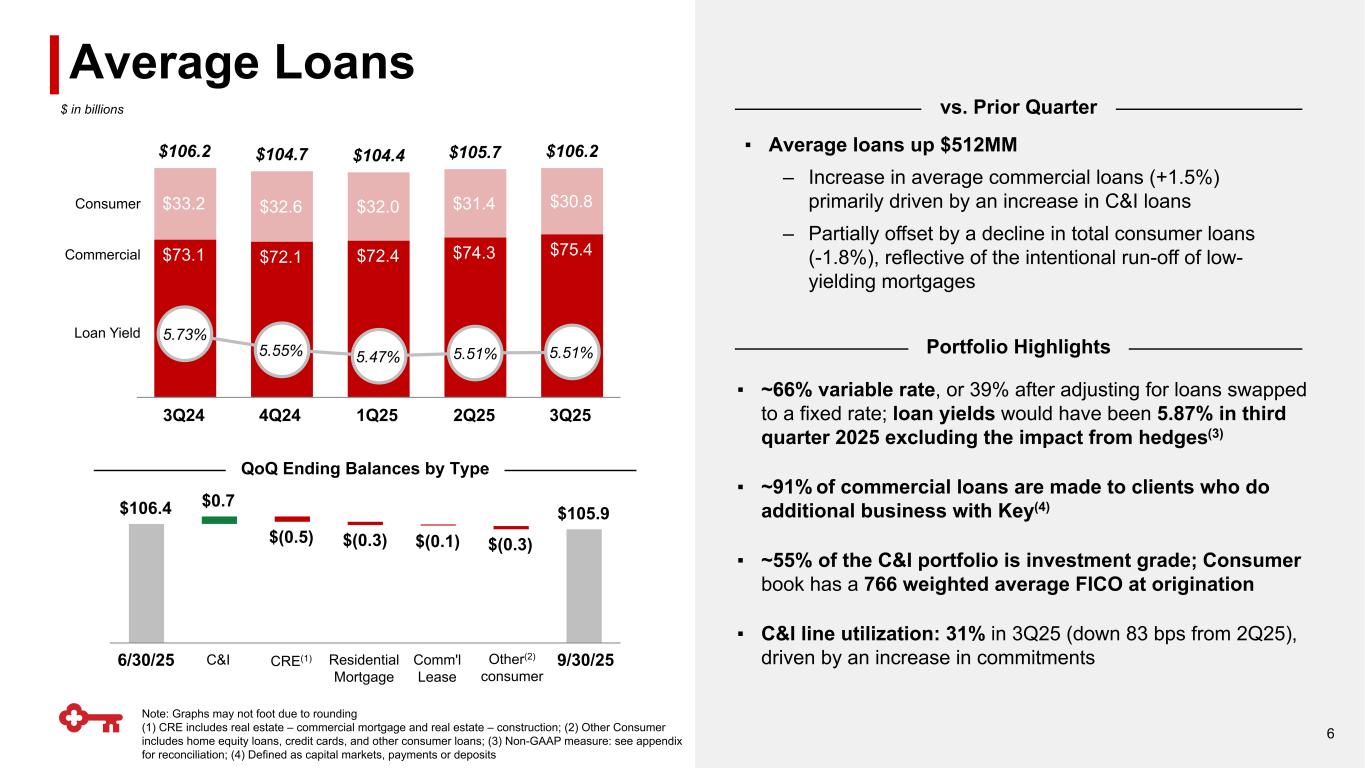

$106.4 $0.7 $(0.5) $(0.3) $(0.1) $(0.3) $105.9 6/30/25 C&I CRE Residential Mortgage Comm'l Lease Other Consumer 9/30/25 ▪ ~66% variable rate, or 39% after adjusting for loans swapped to a fixed rate; loan yields would have been 5.87% in third quarter 2025 excluding the impact from hedges(3) ▪ ~91% of commercial loans are made to clients who do additional business with Key(4) ▪ ~55% of the C&I portfolio is investment grade; Consumer book has a 766 weighted average FICO at origination ▪ C&I line utilization: 31% in 3Q25 (down 83 bps from 2Q25), driven by an increase in commitments ▪ Average loans up $512MM – Increase in average commercial loans (+1.5%) primarily driven by an increase in C&I loans – Partially offset by a decline in total consumer loans (-1.8%), reflective of the intentional run-off of low- yielding mortgages vs. Prior Quarter Portfolio Highlights Note: Graphs may not foot due to rounding (1) CRE includes real estate – commercial mortgage and real estate – construction; (2) Other Consumer includes home equity loans, credit cards, and other consumer loans; (3) Non-GAAP measure: see appendix for reconciliation; (4) Defined as capital markets, payments or deposits Average Loans Consumer Commercial Loan Yield $ in billions QoQ Ending Balances by Type 6 $106.2 $104.7 $104.4 $105.7 $106.2 $73.1 $72.1 $72.4 $74.3 $75.4 $33.2 $32.6 $32.0 $31.4 $30.8 5.73% 5.55% 5.47% 5.51% 5.51% 3Q24 4Q24 1Q25 2Q25 3Q25 6/ 5 /25CRE(1) ther(2) c

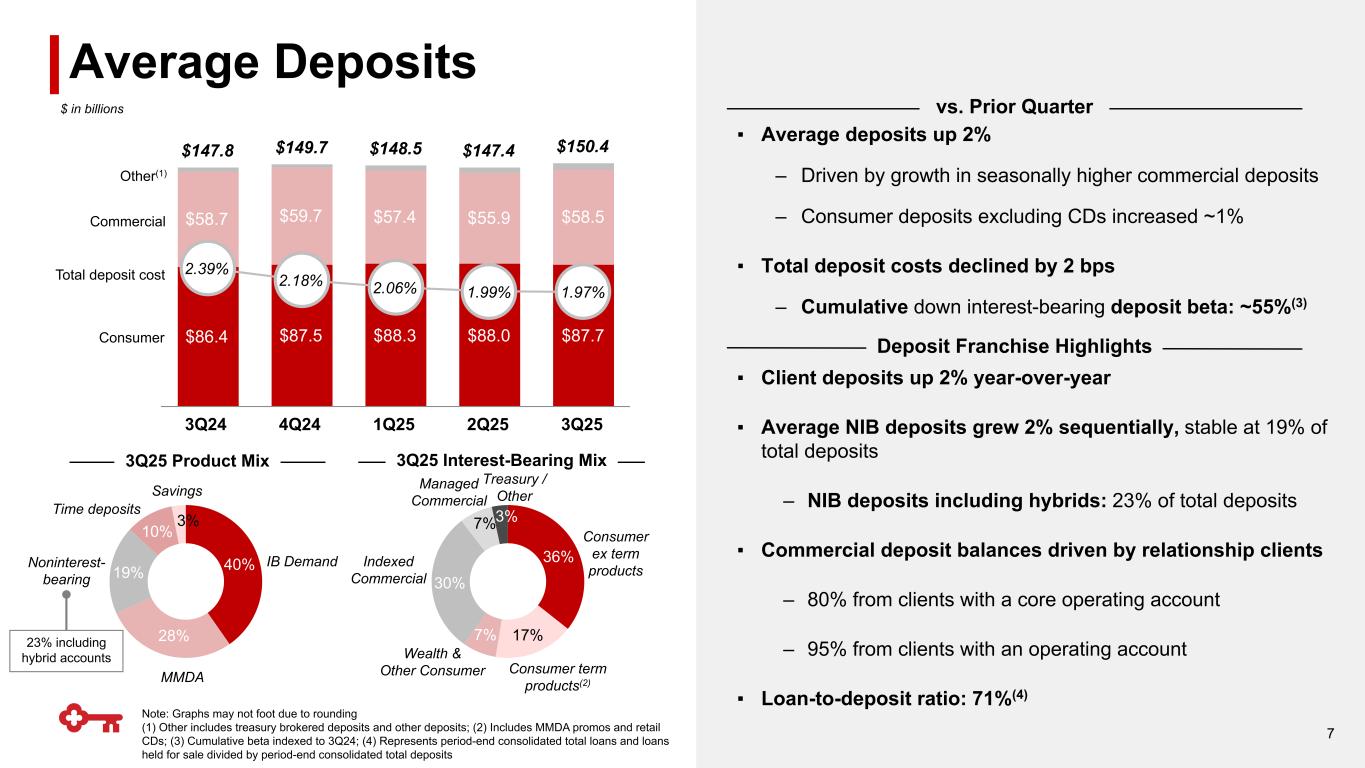

▪ Average deposits up 2% – Driven by growth in seasonally higher commercial deposits – Consumer deposits excluding CDs increased ~1% ▪ Total deposit costs declined by 2 bps – Cumulative down interest-bearing deposit beta: ~55%(3) 36% 17%7% 30% 7%3% 40% 28% 19% 10% 3% vs. Prior Quarter Deposit Franchise Highlights ▪ Client deposits up 2% year-over-year ▪ Average NIB deposits grew 2% sequentially, stable at 19% of total deposits – NIB deposits including hybrids: 23% of total deposits ▪ Commercial deposit balances driven by relationship clients – 80% from clients with a core operating account – 95% from clients with an operating account ▪ Loan-to-deposit ratio: 71%(4) 3Q25 Product Mix Time deposits Savings Noninterest- bearing IB Demand 3Q25 Interest-Bearing Mix Consumer ex term products 21% MMDA Managed Commercial Indexed Commercial Wealth & Other Consumer Average Deposits Consumer Other(1) Commercial Total deposit cost Consumer term products(2) Note: Graphs may not foot due to rounding (1) Other includes treasury brokered deposits and other deposits; (2) Includes MMDA promos and retail CDs; (3) Cumulative beta indexed to 3Q24; (4) Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits 23% including hybrid accounts Treasury / Other 7 $147.8 $149.7 $148.5 $147.4 $150.4 $86.4 $87.5 $88.3 $88.0 $87.7 $58.7 $59.7 $57.4 $55.9 $58.5 2.39% 2.18% 2.06% 1.99% 1.97% 3Q24 4Q24 1Q25 2Q25 3Q25 $ in billions

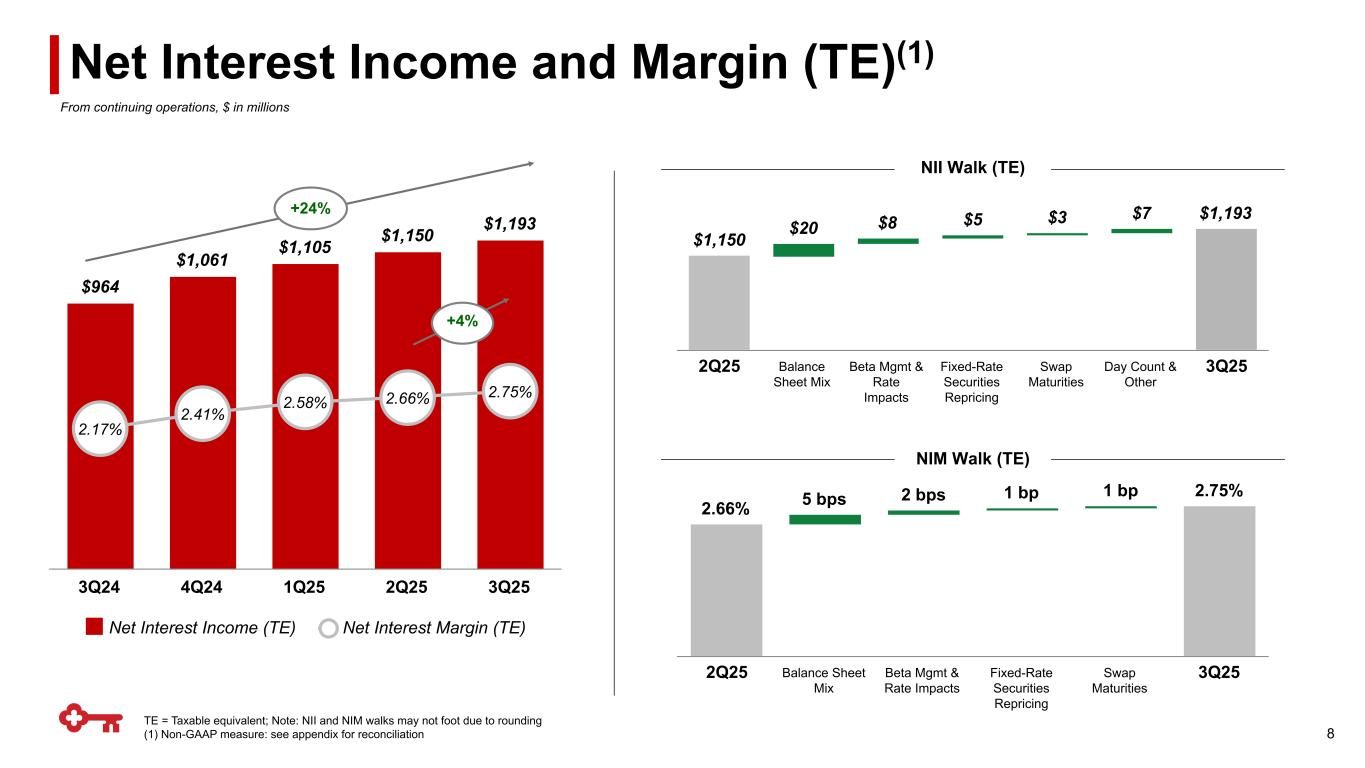

$1,150 $20 $8 $5 $3 $7 $1,193 Balance Sheet Mix Beta Mgmt & Rate Impacts Fixed-Rate Securities Repricing Swap Maturities Day Count & Other $964 $1,061 $1,105 $1,150 $1,193 2.17% 2.41% 2.58% 2.66% 2.75% Net Interest Income (TE) Net Interest Margin (TE) 3Q24 4Q24 1Q25 2Q25 3Q25 TE = Taxable equivalent; Note: NII and NIM walks may not foot due to rounding (1) Non-GAAP measure: see appendix for reconciliation Net Interest Income and Margin (TE)(1) +4% +24% NII Walk (TE) NIM Walk (TE) 8 2.66% 5 bps 2 bps 1 bp 1 bp 2.75% Balance Sheet Mix Beta Mgmt & Rate Impacts Fixed-Rate Securities Repricing Swap Maturities From continuing operations, $ in millions 2Q25 3Q25 2Q25 3Q25

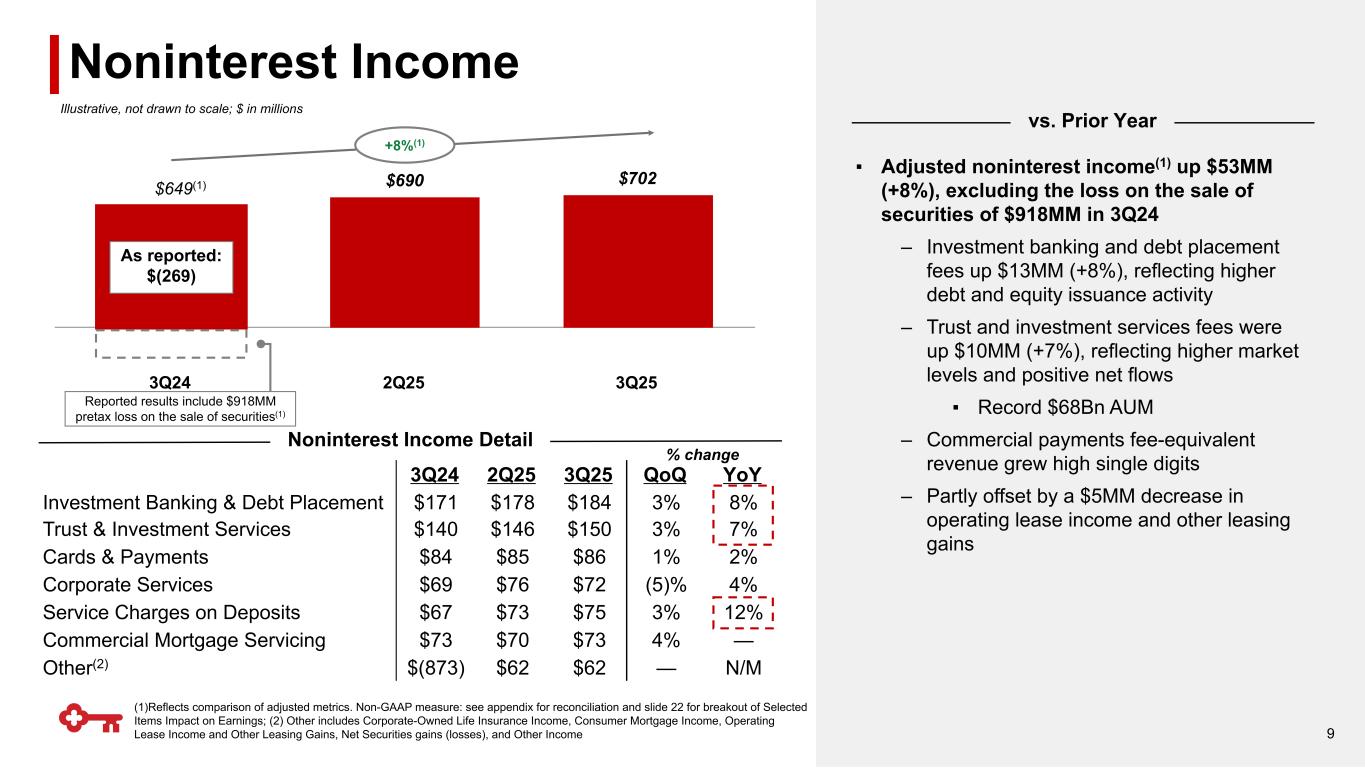

$649 $690 $702 3Q24 2Q25 3Q25 3Q24 2Q25 3Q25 QoQ YoY Investment Banking & Debt Placement $171 $178 $184 3% 8% Trust & Investment Services $140 $146 $150 3% 7% Cards & Payments $84 $85 $86 1% 2% Corporate Services $69 $76 $72 (5)% 4% Service Charges on Deposits $67 $73 $75 3% 12% Commercial Mortgage Servicing $73 $70 $73 4% — Other(2) $(873) $62 $62 — N/M (1)Reflects comparison of adjusted metrics. Non-GAAP measure: see appendix for reconciliation and slide 22 for breakout of Selected Items Impact on Earnings; (2) Other includes Corporate-Owned Life Insurance Income, Consumer Mortgage Income, Operating Lease Income and Other Leasing Gains, Net Securities gains (losses), and Other Income Noninterest Income Noninterest Income Detail % change vs. Prior Year ▪ Adjusted noninterest income(1) up $53MM (+8%), excluding the loss on the sale of securities of $918MM in 3Q24 – Investment banking and debt placement fees up $13MM (+8%), reflecting higher debt and equity issuance activity – Trust and investment services fees were up $10MM (+7%), reflecting higher market levels and positive net flows ▪ Record $68Bn AUM – Commercial payments fee-equivalent revenue grew high single digits – Partly offset by a $5MM decrease in operating lease income and other leasing gains 9 Illustrative, not drawn to scale; $ in millions As reported: $(269) Reported results include $918MM pretax loss on the sale of securities(1) (1) +8%(1)

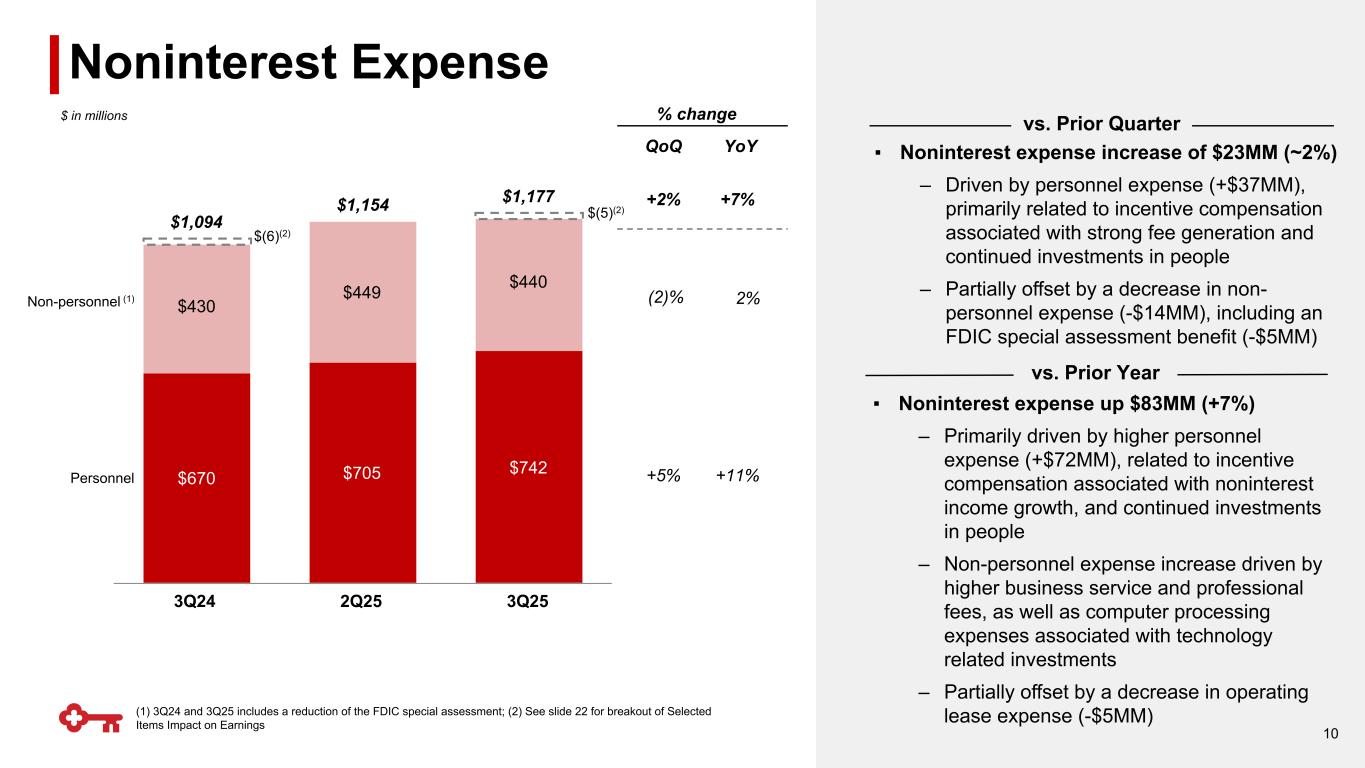

$1,094 $1,154 $1,177 $670 $705 $742 $430 $449 $440 3Q24 2Q25 3Q25 ▪ Noninterest expense up $83MM (+7%) – Primarily driven by higher personnel expense (+$72MM), related to incentive compensation associated with noninterest income growth, and continued investments in people – Non-personnel expense increase driven by higher business service and professional fees, as well as computer processing expenses associated with technology related investments – Partially offset by a decrease in operating lease expense (-$5MM) 2% Personnel Non-personnel (1) YoY +11% +7% QoQ (2)% +5% +2% $ in millions Noninterest Expense vs. Prior Quarter ▪ Noninterest expense increase of $23MM (~2%) – Driven by personnel expense (+$37MM), primarily related to incentive compensation associated with strong fee generation and continued investments in people – Partially offset by a decrease in non- personnel expense (-$14MM), including an FDIC special assessment benefit (-$5MM) % change vs. Prior Year (1) 3Q24 and 3Q25 includes a reduction of the FDIC special assessment; (2) See slide 22 for breakout of Selected Items Impact on Earnings 10 $(6)(2) $(5)(2)

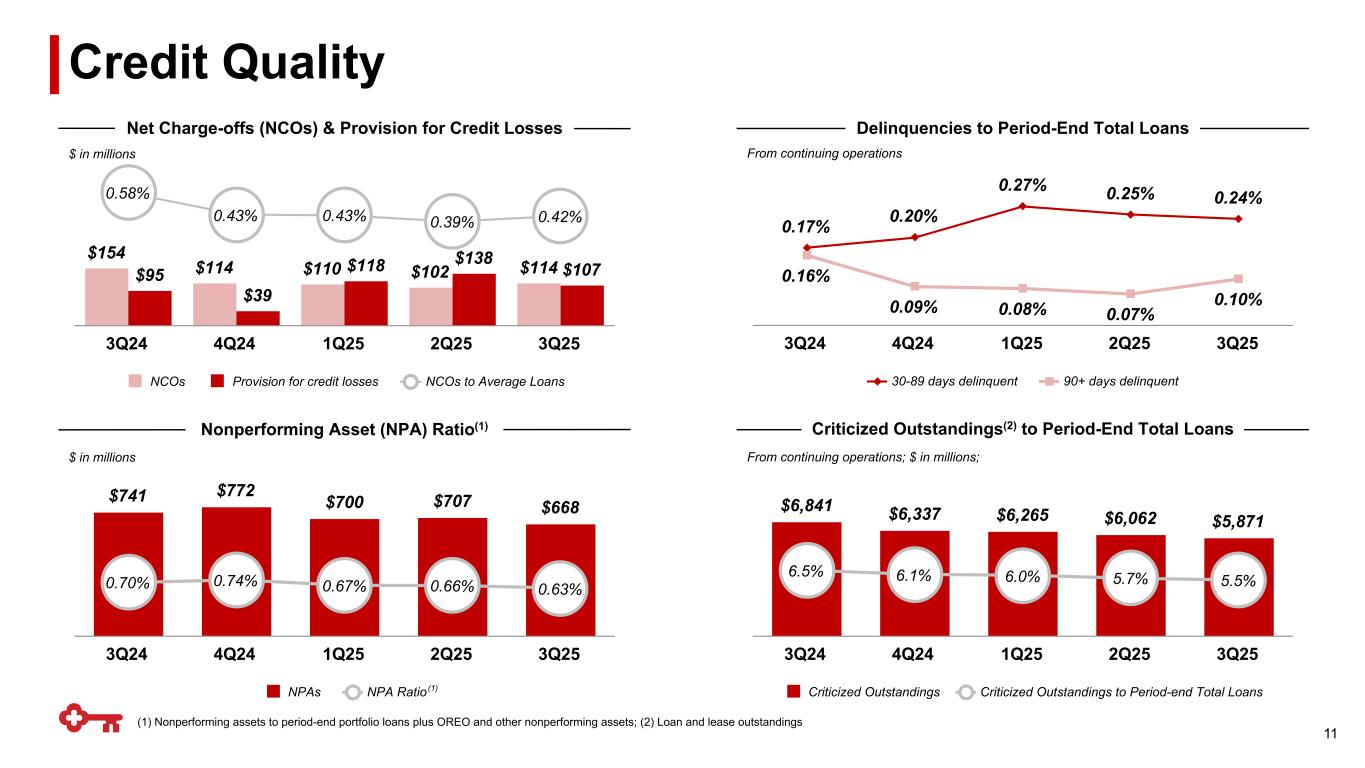

0.17% 0.20% 0.27% 0.25% 0.24% 0.16% 0.09% 0.08% 0.07% 0.10% 30-89 days delinquent 90+ days delinquent 3Q24 4Q24 1Q25 2Q25 3Q25 $6,841 $6,337 $6,265 $6,062 $5,871 6.5% 6.1% 6.0% 5.7% 5.5% Criticized Outstandings Criticized Outstandings to Period-end Total Loans 3Q24 4Q24 1Q25 2Q25 3Q25 $741 $772 $700 $707 $668 0.70% 0.74% 0.67% 0.66% 0.63% NPAs NPA Ratio 3Q24 4Q24 1Q25 2Q25 3Q25 (1) Nonperforming assets to period-end portfolio loans plus OREO and other nonperforming assets; (2) Loan and lease outstandings $ in millions Net Charge-offs (NCOs) & Provision for Credit Losses Delinquencies to Period-End Total Loans Criticized Outstandings(2) to Period-End Total Loans From continuing operations; $ in millions; Nonperforming Asset (NPA) Ratio(1) $ in millions Credit Quality From continuing operations 11 $154 $114 $110 $102 $114$95 $39 $118 $138 $107 0.58% 0.43% 0.43% 0.39% 0.42% NCOs Provision for credit losses NCOs to Average Loans 3Q24 4Q24 1Q25 2Q25 3Q25 (1)

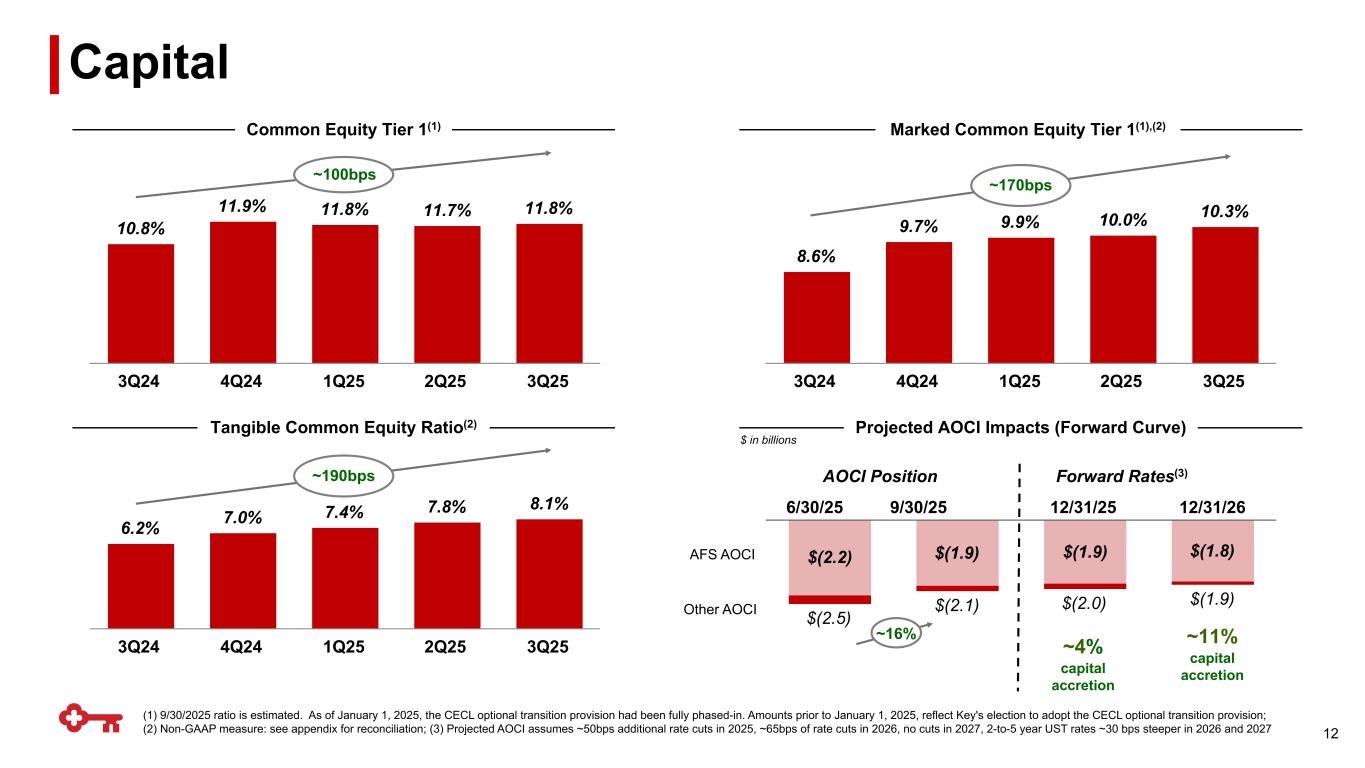

$(2.5) $(2.1) $(2.0) $(1.9) $(2.2) $(1.9) $(1.9) $(1.8) ~4% capital accretion 8.6% 9.7% 9.9% 10.0% 10.3% 3Q24 4Q24 1Q25 2Q25 3Q25 10.8% 11.9% 11.8% 11.7% 11.8% 3Q24 4Q24 1Q25 2Q25 3Q25 6.2% 7.0% 7.4% 7.8% 8.1% 3Q24 4Q24 1Q25 2Q25 3Q25 $ in billions Tangible Common Equity Ratio(2) Common Equity Tier 1(1) Projected AOCI Impacts (Forward Curve) (1) 9/30/2025 ratio is estimated. As of January 1, 2025, the CECL optional transition provision had been fully phased-in. Amounts prior to January 1, 2025, reflect Key's election to adopt the CECL optional transition provision; (2) Non-GAAP measure: see appendix for reconciliation; (3) Projected AOCI assumes ~50bps additional rate cuts in 2025, ~65bps of rate cuts in 2026, no cuts in 2027, 2-to-5 year UST rates ~30 bps steeper in 2026 and 2027 Capital ~11% capital accretion Forward Rates(3)AOCI Position 6/30/25 12/31/25 12/31/26 AFS AOCI Other AOCI Marked Common Equity Tier 1(1),(2) 9/30/25 ~100bps ~16% ~190bps ~170bps 12

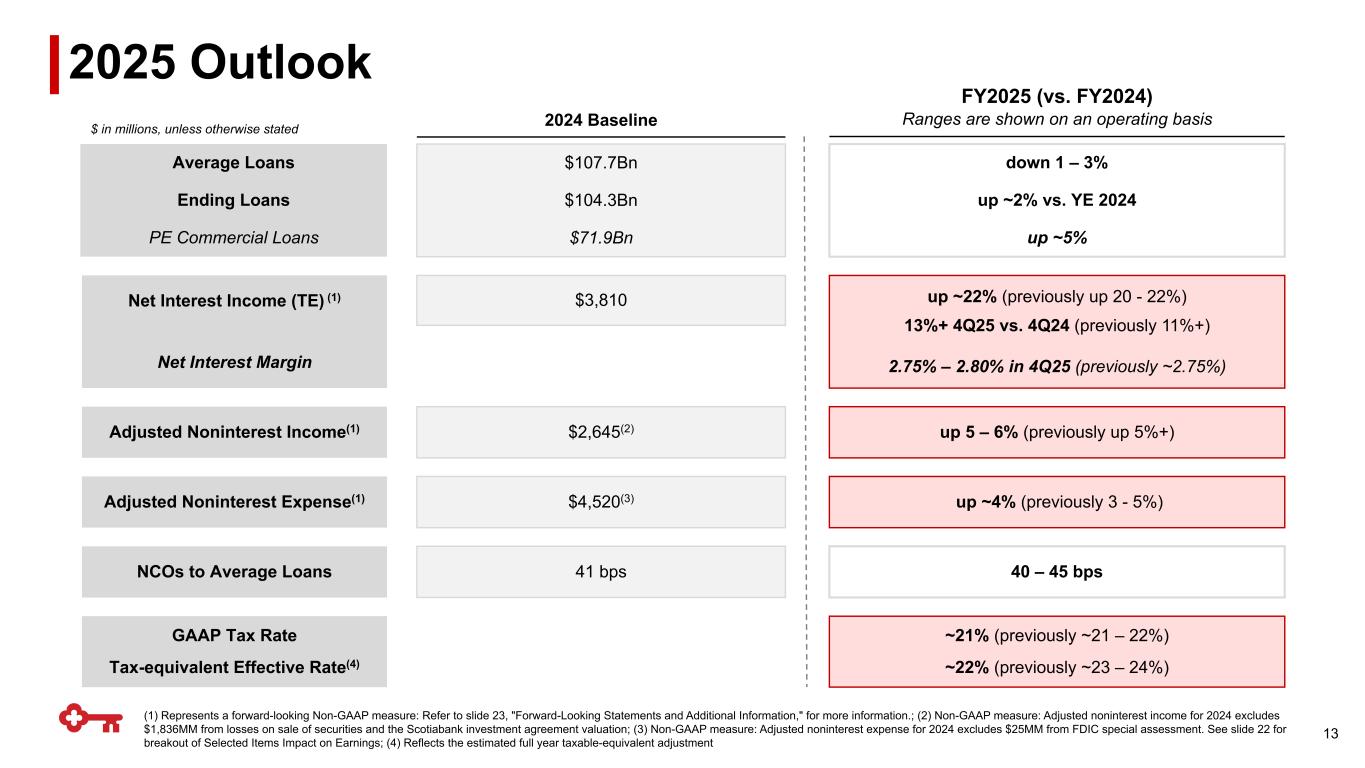

down 1 – 3% up ~2% vs. YE 2024 up ~5% 2025 Outlook FY2025 (vs. FY2024) Ranges are shown on an operating basis (1) Represents a forward-looking Non-GAAP measure: Refer to slide 23, "Forward-Looking Statements and Additional Information," for more information.; (2) Non-GAAP measure: Adjusted noninterest income for 2024 excludes $1,836MM from losses on sale of securities and the Scotiabank investment agreement valuation; (3) Non-GAAP measure: Adjusted noninterest expense for 2024 excludes $25MM from FDIC special assessment. See slide 22 for breakout of Selected Items Impact on Earnings; (4) Reflects the estimated full year taxable-equivalent adjustment $ in millions, unless otherwise stated 2024 Baseline $107.7Bn $104.3Bn $71.9Bn Average Loans Ending Loans PE Commercial Loans $2,645(2) up 5 – 6% (previously up 5%+)Adjusted Noninterest Income(1) $4,520(3) up ~4% (previously 3 - 5%)Adjusted Noninterest Expense(1) $3,810 up ~22% (previously up 20 - 22%) 13%+ 4Q25 vs. 4Q24 (previously 11%+) 2.75% – 2.80% in 4Q25 (previously ~2.75%) Net Interest Income (TE) (1) Net Interest Margin ~21% (previously ~21 – 22%) ~22% (previously ~23 – 24%) GAAP Tax Rate Tax-equivalent Effective Rate(4) 41 bps 40 – 45 bpsNCOs to Average Loans 13

Appendix

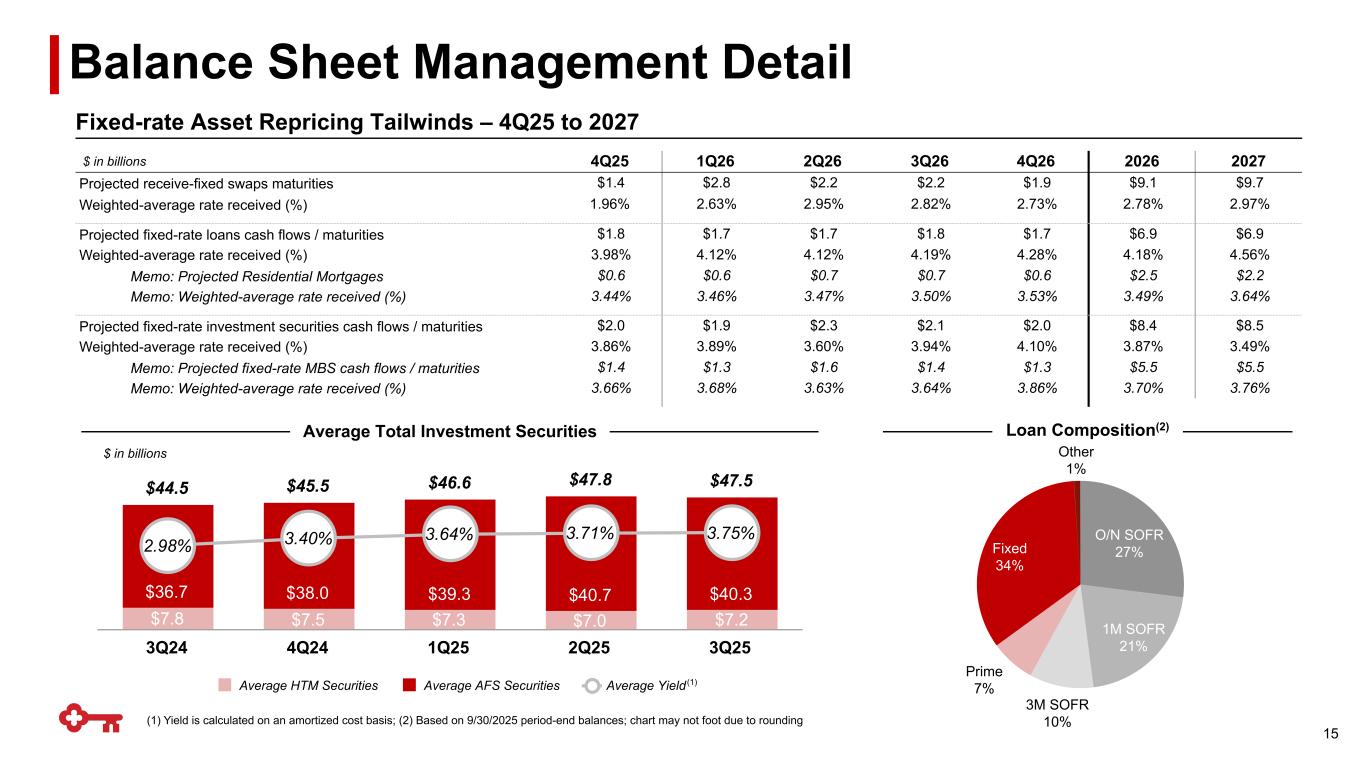

(1) Yield is calculated on an amortized cost basis; (2) Based on 9/30/2025 period-end balances; chart may not foot due to rounding Loan Composition(2) $ in billions Average Total Investment Securities Fixed-rate Asset Repricing Tailwinds – 4Q25 to 2027 Balance Sheet Management Detail 15 $44.5 $45.5 $46.6 $47.8 $47.5 $7.8 $7.5 $7.3 $7.0 $7.2 $36.7 $38.0 $39.3 $40.7 $40.3 2.98% 3.40% 3.64% 3.71% 3.75% Average HTM Securities Average AFS Securities Average Yield 3Q24 4Q24 1Q25 2Q25 3Q25 3M SOFR 10% Other 1% (1) $ in billions 4Q25 1Q26 2Q26 3Q26 4Q26 2026 2027 Projected receive-fixed swaps maturities $1.4 $2.8 $2.2 $2.2 $1.9 $9.1 $9.7 Weighted-average rate received (%) 1.96% 2.63% 2.95% 2.82% 2.73% 2.78% 2.97% Projected fixed-rate loans cash flows / maturities $1.8 $1.7 $1.7 $1.8 $1.7 $6.9 $6.9 Weighted-average rate received (%) 3.98% 4.12% 4.12% 4.19% 4.28% 4.18% 4.56% Memo: Projected Residential Mortgages $0.6 $0.6 $0.7 $0.7 $0.6 $2.5 $2.2 Memo: Weighted-average rate received (%) 3.44% 3.46% 3.47% 3.50% 3.53% 3.49% 3.64% Projected fixed-rate investment securities cash flows / maturities $2.0 $1.9 $2.3 $2.1 $2.0 $8.4 $8.5 Weighted-average rate received (%) 3.86% 3.89% 3.60% 3.94% 4.10% 3.87% 3.49% Memo: Projected fixed-rate MBS cash flows / maturities $1.4 $1.3 $1.6 $1.4 $1.3 $5.5 $5.5 Memo: Weighted-average rate received (%) 3.66% 3.68% 3.63% 3.64% 3.86% 3.70% 3.76% 1M SOFR 21% O/N SOFR 27%Fixed 34% Prime 7%

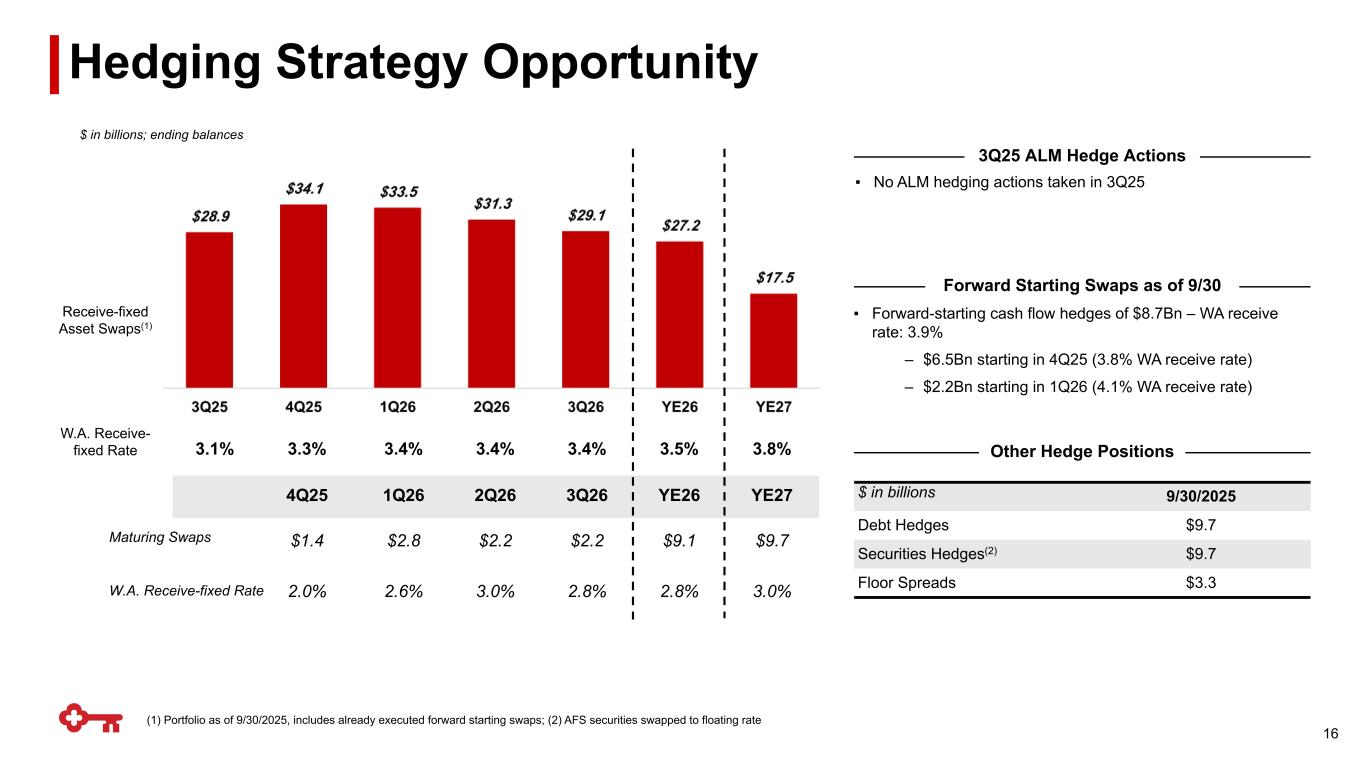

Hedging Strategy Opportunity 16 (1) Portfolio as of 9/30/2025, includes already executed forward starting swaps; (2) AFS securities swapped to floating rate $ in billions 9/30/2025 Debt Hedges $9.7 Securities Hedges(2) $9.7 Floor Spreads $3.3 Other Hedge Positions ▪ No ALM hedging actions taken in 3Q25 3Q25 ALM Hedge Actions 3.1% 3.3% 3.4% 3.4% 3.4% 3.5% 3.8% 4Q25 1Q26 2Q26 3Q26 YE26 YE27 $1.4 $2.8 $2.2 $2.2 $9.1 $9.7 2.0% 2.6% 3.0% 2.8% 2.8% 3.0% W.A. Receive- fixed Rate Maturing Swaps W.A. Receive-fixed Rate Receive-fixed Asset Swaps(1) $ in billions; ending balances ▪ Forward-starting cash flow hedges of $8.7Bn – WA receive rate: 3.9% – $6.5Bn starting in 4Q25 (3.8% WA receive rate) – $2.2Bn starting in 1Q26 (4.1% WA receive rate) Forward Starting Swaps as of 9/30

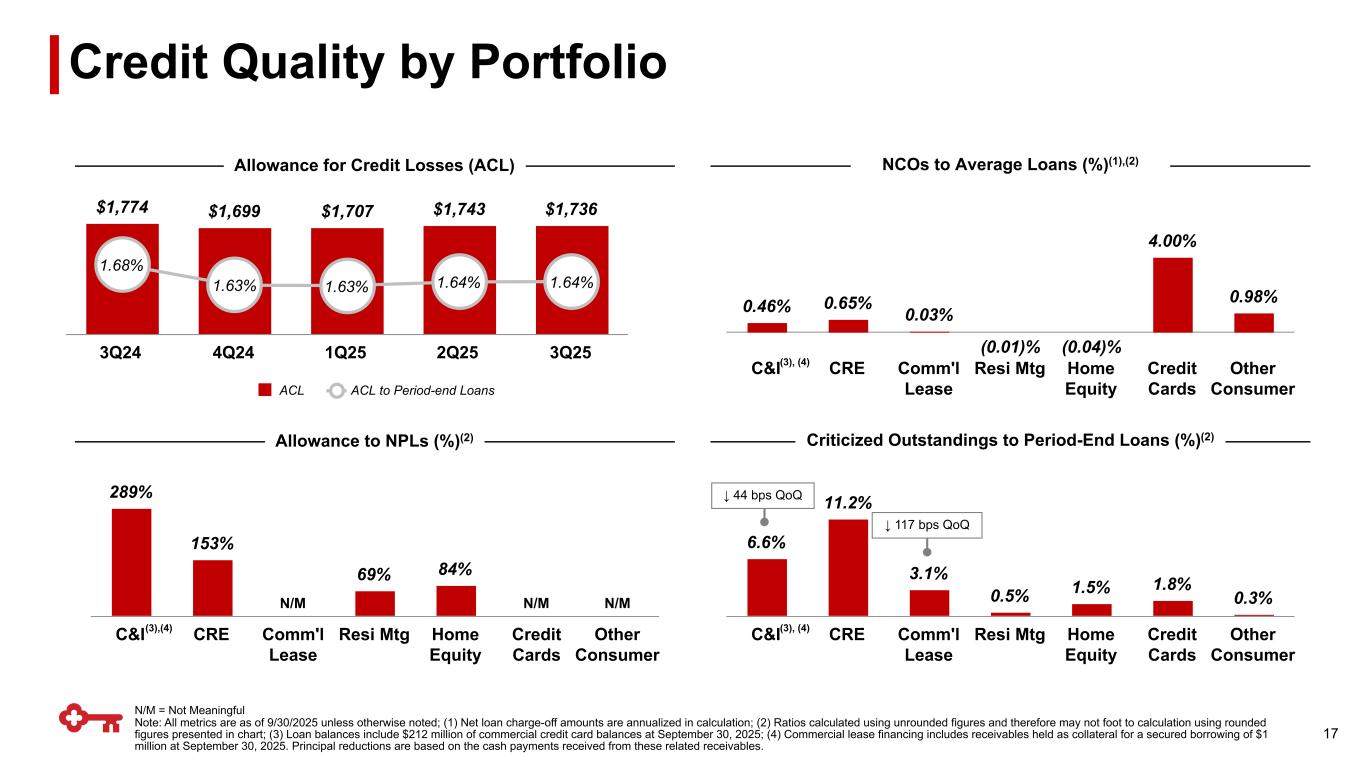

289% 153% 69% 84% N/M N/M N/M C&I CRE Comm'l Lease Resi Mtg Home Equity Credit Cards Other Consumer $1,774 $1,699 $1,707 $1,743 $1,736 1.68% 1.63% 1.63% 1.64% 1.64% ACL ACL to Period-end Loans 3Q24 4Q24 1Q25 2Q25 3Q25 6.6% 11.2% 3.1% 0.5% 1.5% 1.8% 0.3% C&I CRE Comm'l Lease Resi Mtg Home Equity Credit Cards Other Consumer 0.46% 0.65% 0.03% 4.00% 0.98% (0.01)% (0.04)% C&I CRE Comm'l Lease Resi Mtg Home Equity Credit Cards Other Consumer Credit Quality by Portfolio (3),(4) (3), (4) (3), (4) N/M = Not Meaningful Note: All metrics are as of 9/30/2025 unless otherwise noted; (1) Net loan charge-off amounts are annualized in calculation; (2) Ratios calculated using unrounded figures and therefore may not foot to calculation using rounded figures presented in chart; (3) Loan balances include $212 million of commercial credit card balances at September 30, 2025; (4) Commercial lease financing includes receivables held as collateral for a secured borrowing of $1 million at September 30, 2025. Principal reductions are based on the cash payments received from these related receivables. NCOs to Average Loans (%)(1),(2) ↓ 44 bps QoQ 17 Allowance for Credit Losses (ACL) Allowance to NPLs (%)(2) Criticized Outstandings to Period-End Loans (%)(2) ↓ 117 bps QoQ

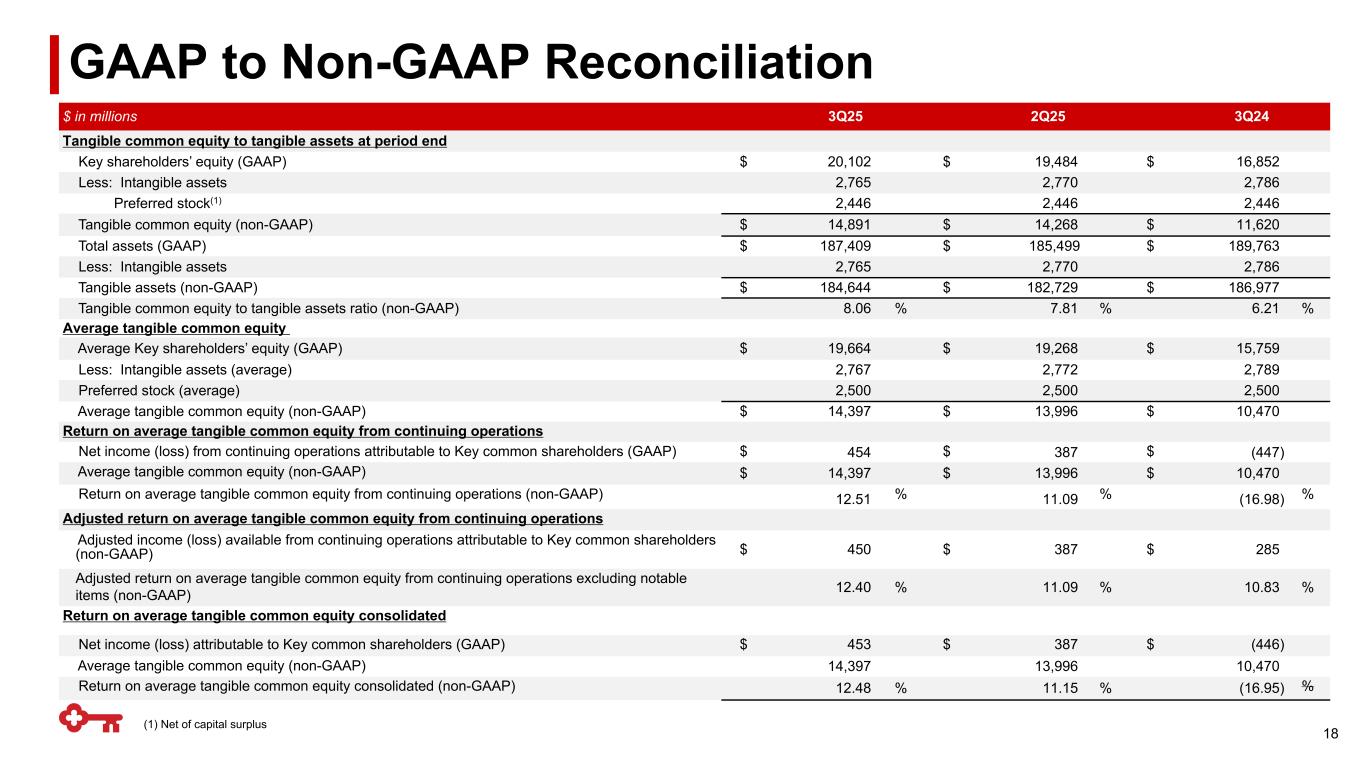

GAAP to Non-GAAP Reconciliation $ in millions 3Q25 2Q25 3Q24 Tangible common equity to tangible assets at period end Key shareholders’ equity (GAAP) $ 20,102 $ 19,484 $ 16,852 Less: Intangible assets 2,765 2,770 2,786 Preferred stock(1) 2,446 2,446 2,446 Tangible common equity (non-GAAP) $ 14,891 $ 14,268 $ 11,620 Total assets (GAAP) $ 187,409 $ 185,499 $ 189,763 Less: Intangible assets 2,765 2,770 2,786 Tangible assets (non-GAAP) $ 184,644 $ 182,729 $ 186,977 Tangible common equity to tangible assets ratio (non-GAAP) 8.06 % 7.81 % 6.21 % Average tangible common equity Average Key shareholders’ equity (GAAP) $ 19,664 $ 19,268 $ 15,759 Less: Intangible assets (average) 2,767 2,772 2,789 Preferred stock (average) 2,500 2,500 2,500 Average tangible common equity (non-GAAP) $ 14,397 $ 13,996 $ 10,470 Return on average tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ 454 $ 387 $ (447) Average tangible common equity (non-GAAP) $ 14,397 $ 13,996 $ 10,470 Return on average tangible common equity from continuing operations (non-GAAP) 12.51 % 11.09 % (16.98) % Adjusted return on average tangible common equity from continuing operations Adjusted income (loss) available from continuing operations attributable to Key common shareholders (non-GAAP) $ 450 $ 387 $ 285 Adjusted return on average tangible common equity from continuing operations excluding notable items (non-GAAP) 12.40 % 11.09 % 10.83 % Return on average tangible common equity consolidated Net income (loss) attributable to Key common shareholders (GAAP) $ 453 $ 387 $ (446) Average tangible common equity (non-GAAP) 14,397 13,996 10,470 Return on average tangible common equity consolidated (non-GAAP) 12.48 % 11.15 % (16.95) % (1) Net of capital surplus 18

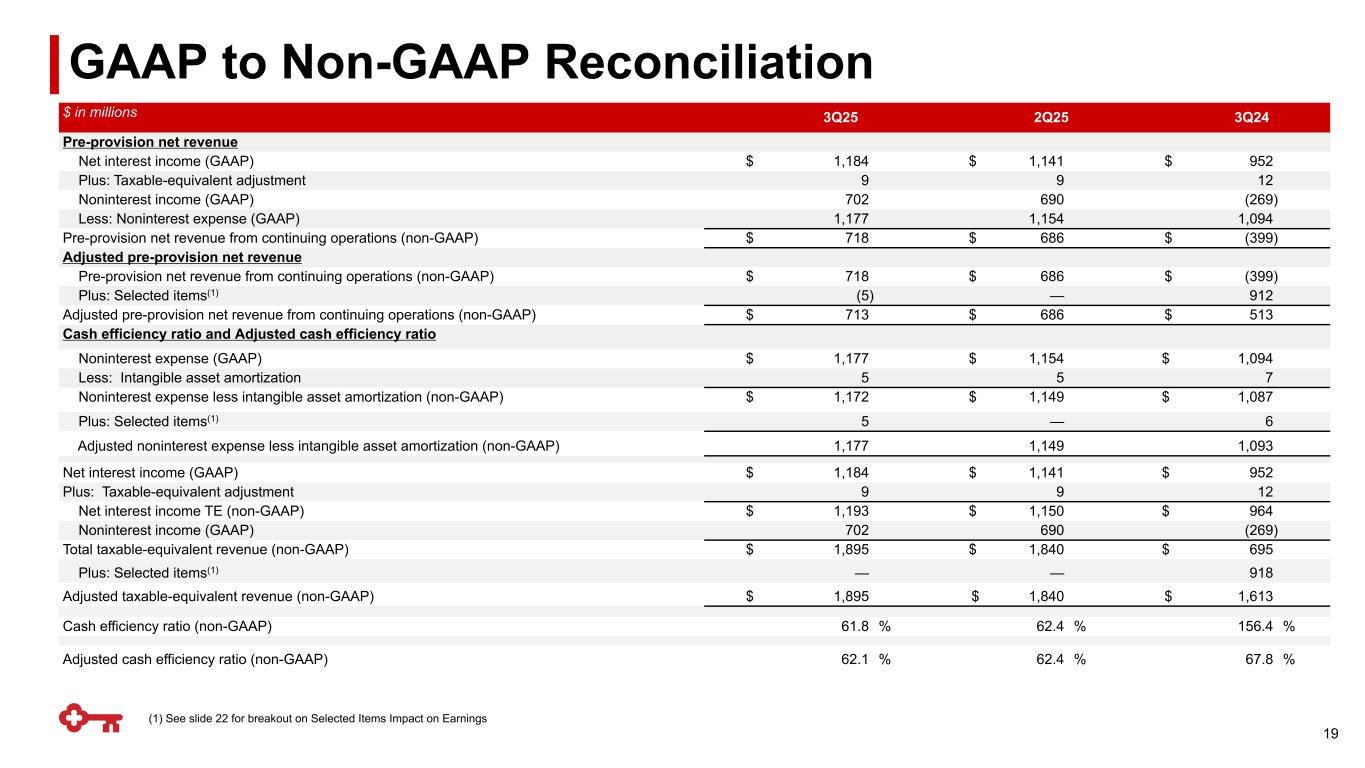

$ in millions 3Q25 2Q25 3Q24 Pre-provision net revenue Net interest income (GAAP) $ 1,184 $ 1,141 $ 952 Plus: Taxable-equivalent adjustment 9 9 12 Noninterest income (GAAP) 702 690 (269) Less: Noninterest expense (GAAP) 1,177 1,154 1,094 Pre-provision net revenue from continuing operations (non-GAAP) $ 718 $ 686 $ (399) Adjusted pre-provision net revenue Pre-provision net revenue from continuing operations (non-GAAP) $ 718 $ 686 $ (399) Plus: Selected items(1) (5) — 912 Adjusted pre-provision net revenue from continuing operations (non-GAAP) $ 713 $ 686 $ 513 Cash efficiency ratio and Adjusted cash efficiency ratio Noninterest expense (GAAP) $ 1,177 $ 1,154 $ 1,094 Less: Intangible asset amortization 5 5 7 Noninterest expense less intangible asset amortization (non-GAAP) $ 1,172 $ 1,149 $ 1,087 Plus: Selected items(1) 5 — 6 Adjusted noninterest expense less intangible asset amortization (non-GAAP) 1,177 1,149 1,093 Net interest income (GAAP) $ 1,184 $ 1,141 $ 952 Plus: Taxable-equivalent adjustment 9 9 12 Net interest income TE (non-GAAP) $ 1,193 $ 1,150 $ 964 Noninterest income (GAAP) 702 690 (269) Total taxable-equivalent revenue (non-GAAP) $ 1,895 $ 1,840 $ 695 Plus: Selected items(1) — — 918 Adjusted taxable-equivalent revenue (non-GAAP) $ 1,895 $ 1,840 $ 1,613 Cash efficiency ratio (non-GAAP) 61.8 % 62.4 % 156.4 % Adjusted cash efficiency ratio (non-GAAP) 62.1 % 62.4 % 67.8 % (1) See slide 22 for breakout on Selected Items Impact on Earnings 19 GAAP to Non-GAAP Reconciliation

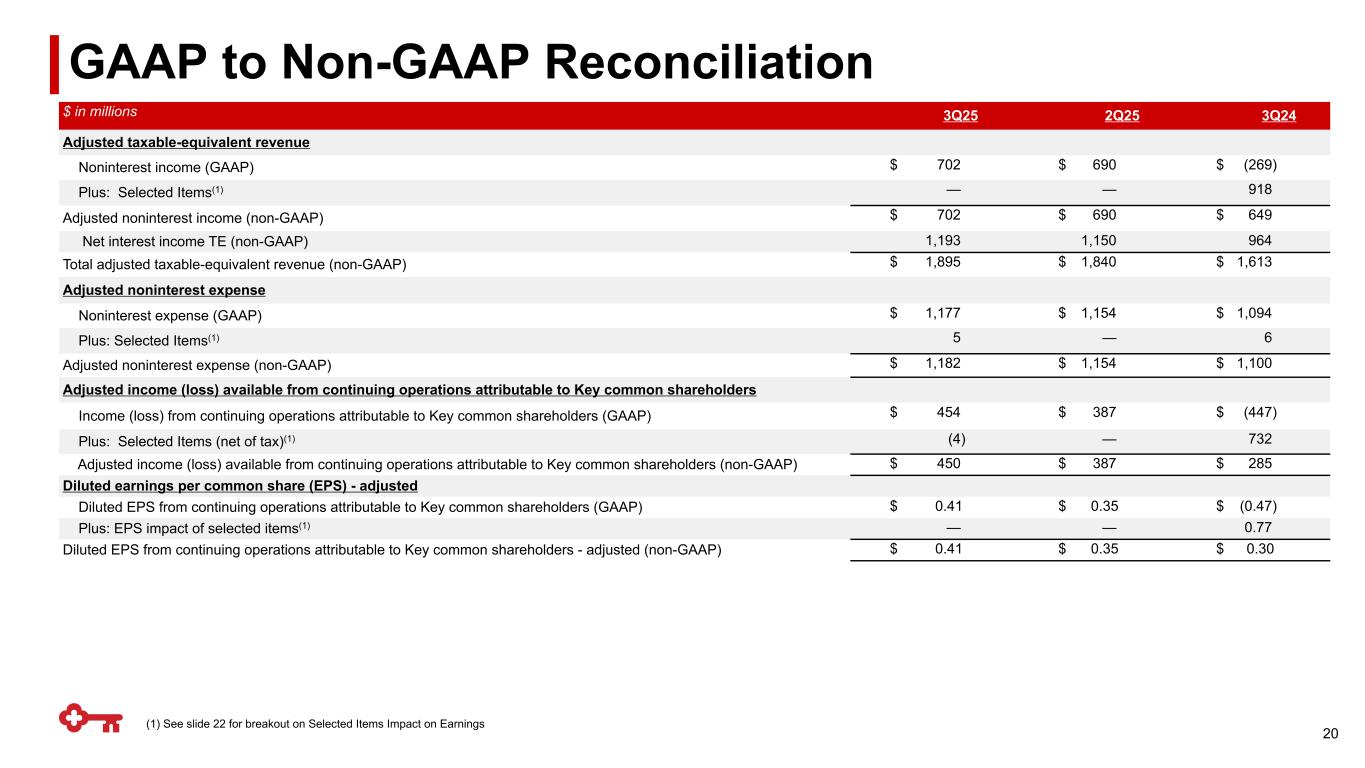

$ in millions 3Q25 2Q25 3Q24 Adjusted taxable-equivalent revenue Noninterest income (GAAP) $ 702 $ 690 $ (269) Plus: Selected Items(1) — — 918 Adjusted noninterest income (non-GAAP) $ 702 $ 690 $ 649 Net interest income TE (non-GAAP) 1,193 1,150 964 Total adjusted taxable-equivalent revenue (non-GAAP) $ 1,895 $ 1,840 $ 1,613 Adjusted noninterest expense Noninterest expense (GAAP) $ 1,177 $ 1,154 $ 1,094 Plus: Selected Items(1) 5 — 6 Adjusted noninterest expense (non-GAAP) $ 1,182 $ 1,154 $ 1,100 Adjusted income (loss) available from continuing operations attributable to Key common shareholders Income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ 454 $ 387 $ (447) Plus: Selected Items (net of tax)(1) (4) — 732 Adjusted income (loss) available from continuing operations attributable to Key common shareholders (non-GAAP) $ 450 $ 387 $ 285 Diluted earnings per common share (EPS) - adjusted Diluted EPS from continuing operations attributable to Key common shareholders (GAAP) $ 0.41 $ 0.35 $ (0.47) Plus: EPS impact of selected items(1) — — 0.77 Diluted EPS from continuing operations attributable to Key common shareholders - adjusted (non-GAAP) $ 0.41 $ 0.35 $ 0.30 (1) See slide 22 for breakout on Selected Items Impact on Earnings 20 GAAP to Non-GAAP Reconciliation

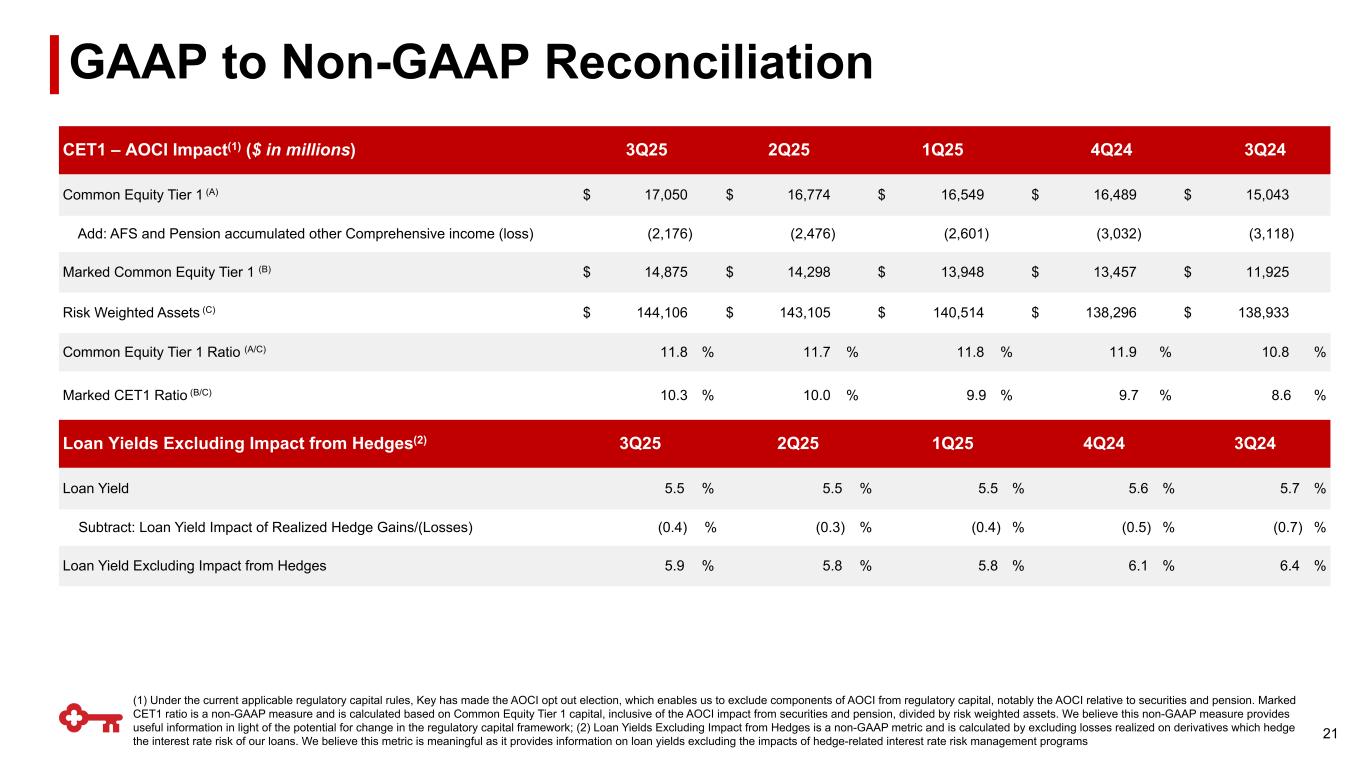

CET1 – AOCI Impact(1) ($ in millions) 3Q25 2Q25 1Q25 4Q24 3Q24 Common Equity Tier 1 (A) $ 17,050 $ 16,774 $ 16,549 $ 16,489 $ 15,043 Add: AFS and Pension accumulated other Comprehensive income (loss) (2,176) (2,476) (2,601) (3,032) (3,118) Marked Common Equity Tier 1 (B) $ 14,875 $ 14,298 $ 13,948 $ 13,457 $ 11,925 Risk Weighted Assets (C) $ 144,106 $ 143,105 $ 140,514 $ 138,296 $ 138,933 Common Equity Tier 1 Ratio (A/C) 11.8 % 11.7 % 11.8 % 11.9 % 10.8 % Marked CET1 Ratio (B/C) 10.3 % 10.0 % 9.9 % 9.7 % 8.6 % (1) Under the current applicable regulatory capital rules, Key has made the AOCI opt out election, which enables us to exclude components of AOCI from regulatory capital, notably the AOCI relative to securities and pension. Marked CET1 ratio is a non-GAAP measure and is calculated based on Common Equity Tier 1 capital, inclusive of the AOCI impact from securities and pension, divided by risk weighted assets. We believe this non-GAAP measure provides useful information in light of the potential for change in the regulatory capital framework; (2) Loan Yields Excluding Impact from Hedges is a non-GAAP metric and is calculated by excluding losses realized on derivatives which hedge the interest rate risk of our loans. We believe this metric is meaningful as it provides information on loan yields excluding the impacts of hedge-related interest rate risk management programs Loan Yields Excluding Impact from Hedges(2) 3Q25 2Q25 1Q25 4Q24 3Q24 Loan Yield 5.5 % 5.5 % 5.5 % 5.6 % 5.7 % Subtract: Loan Yield Impact of Realized Hedge Gains/(Losses) (0.4) % (0.3) % (0.4) % (0.5) % (0.7) % Loan Yield Excluding Impact from Hedges 5.9 % 5.8 % 5.8 % 6.1 % 6.4 % 21 GAAP to Non-GAAP Reconciliation

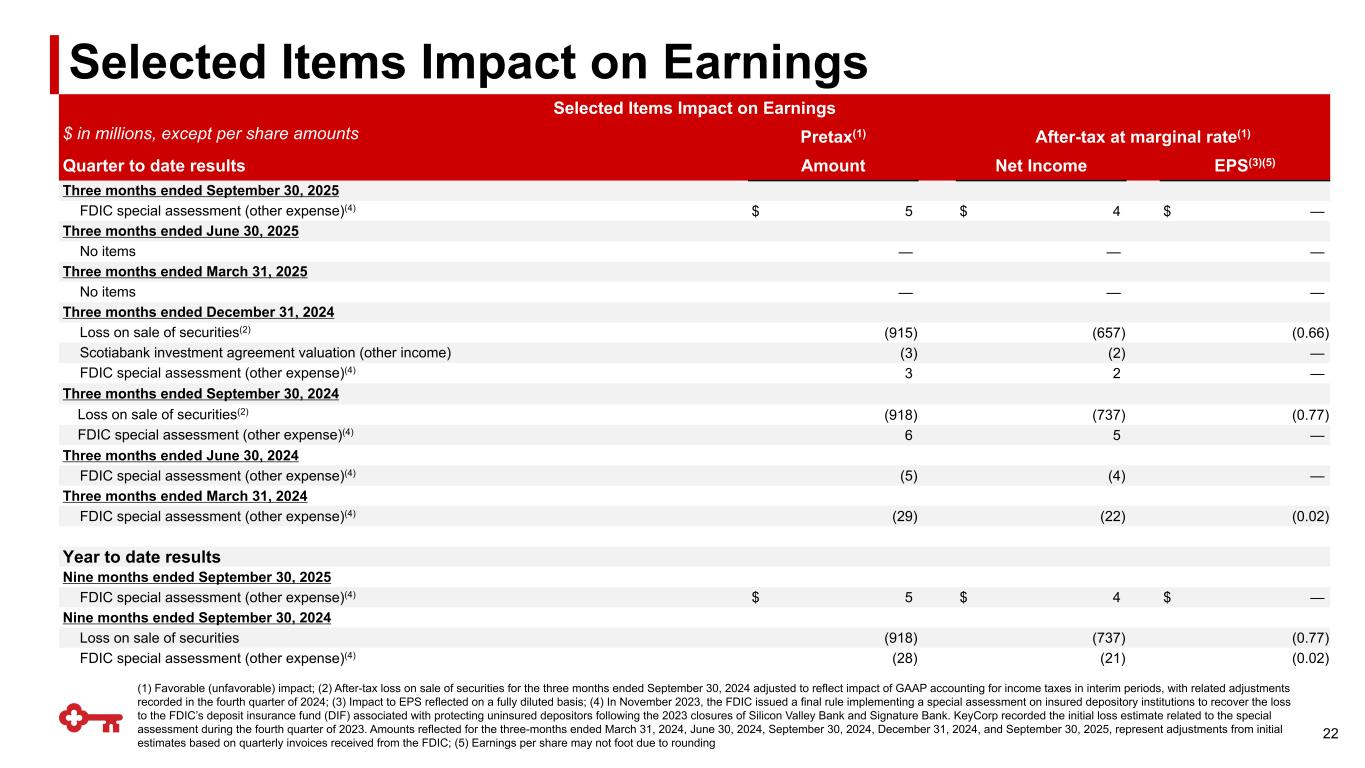

(1) Favorable (unfavorable) impact; (2) After-tax loss on sale of securities for the three months ended September 30, 2024 adjusted to reflect impact of GAAP accounting for income taxes in interim periods, with related adjustments recorded in the fourth quarter of 2024; (3) Impact to EPS reflected on a fully diluted basis; (4) In November 2023, the FDIC issued a final rule implementing a special assessment on insured depository institutions to recover the loss to the FDIC’s deposit insurance fund (DIF) associated with protecting uninsured depositors following the 2023 closures of Silicon Valley Bank and Signature Bank. KeyCorp recorded the initial loss estimate related to the special assessment during the fourth quarter of 2023. Amounts reflected for the three-months ended March 31, 2024, June 30, 2024, September 30, 2024, December 31, 2024, and September 30, 2025, represent adjustments from initial estimates based on quarterly invoices received from the FDIC; (5) Earnings per share may not foot due to rounding Selected Items Impact on Earnings $ in millions, except per share amounts Pretax(1) After-tax at marginal rate(1) Quarter to date results Amount Net Income EPS(3)(5) Three months ended September 30, 2025 FDIC special assessment (other expense)(4) $ 5 $ 4 $ — Three months ended June 30, 2025 No items — — — Three months ended March 31, 2025 No items — — — Three months ended December 31, 2024 Loss on sale of securities(2) (915) (657) (0.66) Scotiabank investment agreement valuation (other income) (3) (2) — FDIC special assessment (other expense)(4) 3 2 — Three months ended September 30, 2024 Loss on sale of securities(2) (918) (737) (0.77) FDIC special assessment (other expense)(4) 6 5 — Three months ended June 30, 2024 FDIC special assessment (other expense)(4) (5) (4) — Three months ended March 31, 2024 FDIC special assessment (other expense)(4) (29) (22) (0.02) Year to date results Nine months ended September 30, 2025 FDIC special assessment (other expense)(4) $ 5 $ 4 $ — Nine months ended September 30, 2024 Loss on sale of securities (918) (737) (0.77) FDIC special assessment (other expense)(4) (28) (21) (0.02) 22 Selected Items Impact on Earnings

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control). Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2024, and in subsequent filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. Non-GAAP Measures. This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Key’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the appendix to this presentation, the financial supplement, or the press release related to this presentation, all of which can be found on Key’s website (www.key.com/ir). Forward-Looking Non-GAAP Measures. From time to time we may discuss forward-looking non-GAAP financial measures. We are unable to provide a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures because we are unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts or when they may occur. Such unavailable information could be significant for future results. Annualized Data. Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts. Taxable Equivalent. Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at the federal statutory rate. This adjustment puts all earning assets, most notably tax-exempt municipal securities, and certain lease assets, on a common basis that facilitates comparison of results to results of peers. Earnings Per Share Equivalent. Certain income or expense items may be expressed on a per common share basis. This is done for analytical and decision-making purposes to better discern underlying trends in total consolidated earnings per share performance excluding the impact of such items. When the impact of certain income or expense items is disclosed separately, the after-tax amount is computed using the marginal tax rate, unless otherwise specified, with this then being the amount used to calculate the earnings per share equivalent. GAAP: Generally Accepted Accounting Principles Forward-looking Statements and Additional Information 23