2025 PROXY STATEMENT

AND

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 15, 2025

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Under Rule l4a-l2 |

x | No fee required. |

o | Fee paid previously with preliminary materials. |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules l4a-6(i)(1) and 0-11. |

Sincerely, | |

Eric P. Sills | |

Chairman of the Board, | |

Chief Executive Officer & President |

By Order of the Board of Directors | |

Carmine J. Broccole | |

Chief Legal Officer & Secretary |

A-1 |

Proposal | Voting Options | Board of Director’s Recommendation | ||

For All, Withhold All, or For All Except Any Individual Nominee | For All | |||

2. Approval of the Standard Motor Products, Inc. 2025 Omnibus Incentive Plan | For, Against, or Abstain | For | ||

For, Against, or Abstain | For | |||

For, Against, or Abstain | For |

J. Burke | A. Capparelli | P. Forbes Lieberman | P. McClymont | J. McDonnell | A. Norris | P. Puryear | E. Sills | |

KNOWLEDGE, SKILLS & EXPERIENCE | ||||||||

Executive Management Experience | ● | ● | ● | ● | ● | ● | ● | ● |

Financial Acumen | ● | ● | ● | ● | ● | ● | ● | ● |

Risk Management | ● | ● | ● | ● | ● | ● | ● | ● |

Automotive Industry | ● | ● | ● | ● | ||||

Strategic Planning/Oversight | ● | ● | ● | ● | ● | ● | ● | ● |

Mergers & Acquisitions | ● | ● | ● | ● | ||||

International | ● | ● | ● | ● | ● | ● | ● | ● |

Sustainability/Culture and Engagement | ● | ● | ● | ● | ● | ● | ||

Information Technology/ Information Security | ● | ● | ● | ● | ● | |||

Board Composition | |||

INDEPENDENCE | TENURE | AGE | DEMOGRAPHICS |

75% | 8 years | 62 | 50% |

Independent under NYSE standards and SEC rules | Average years of service | Average age | Gender or race/ethnicity |

Burn Rate Information | 2024 | 2023 | 2022 |

Restricted Stock Granted | 199,510 | 165,125 | 179,825 |

Performance Shares Earned & Vested | 30,753 | 76,887 | 73,317 |

Total Equity Awards (1) | 230,263 | 242,012 | 253,142 |

Weighted Average Common Shares Outstanding (Basic) | 21,801,141 | 21,716,177 | 21,683,719 |

Burn Rate (2) | 1.1% | 1.1% | 1.2% |

Dilution Information | 2024 |

Total Equity Awards Outstanding (1) | 929,024 |

Total Number of Shares Available for Future Grant under the Existing Plans and the new Plan | 1,050,000 |

Common Shares Outstanding as of the Record Date | 22,741,511 |

Dilution (2) | 8.01% |

Plan Term: | May 15, 2025 to May 15, 2035 |

Eligible Participants: | All of our employees, directors, consultants, agents, advisors and independent contractors are eligible to receive awards under the Plan, provided they render services to the Company. The Compensation Committee will determine which individuals will participate in the Plan. As of April 4, 2025, there were approximately three hundred and twenty employees and six non- employee directors who would be eligible to participate in the Plan. |

Shares Authorized: | Subject to adjustment for certain corporate events or transactions, as described below, the maximum number of shares authorized for issuance under the Plan will be 1,050,000 less one share for every one share subject to an award granted under the Existing Plans after December 31, 2024 and prior to May 15, 2025. Shares related to awards granted under the Existing Plans or this Plan which terminate by expiration, forfeiture, cancellation, or otherwise without the issuance of such shares, which are settled in cash in lieu of shares, or which are exchanged with the Compensation Committee’s approval, in all cases prior to the issuance of shares, for awards not involving shares, shall be available again for grant under the Plan. In no event, however, will the following shares again become available for awards or increase the number of shares available for grant under the Plan: (i) shares tendered by the participant in payment of the exercise price of an option; (ii) shares withheld from exercised awards for tax withholding purposes; (iii) shares subject to a SAR that are not issued in connection with the settlement of that SAR; and (iv) shares repurchased by the Company with proceeds received from the exercise of an option. Of the shares available in the pool, the maximum number of shares that may be issued pursuant to incentive stock options under this Plan shall be 1,050,000 shares. |

Award Types: | (a) Non-qualified and incentive stock options; (b) Stock appreciation rights (“SARs”); (c) Restricted stock and restricted stock units; (d) Performance shares and performance units; (e) Cash-based awards; and (f) Other stock-based awards. |

Minimum Vesting Requirements: | Vesting schedules will be determined by the Compensation Committee at the time that each award is granted, subject to the minimum vesting requirements described below. Awards granted under the Plan (other than cash-based awards) shall vest no earlier than the first anniversary of the date on which the award is granted; provided, that the following awards shall not be subject to the foregoing minimum vesting requirement: any (i) substitute awards granted in connection with awards that are assumed, converted or substituted pursuant to a merger, acquisition or similar transaction entered into by the Company or any of its subsidiaries, (ii) shares delivered in lieu of fully vested cash obligations, (iii) awards to non-employee directors that vest on the earlier of the one-year anniversary of the date of grant and the next annual meeting of shareholders which is at least 50 weeks after the immediately preceding year’s annual meeting, and (iv) any additional awards the Compensation Committee may grant, up to a maximum of five percent (5%) of the available share reserve authorized for issuance under the Plan, subject to adjustment to reflect stock splits and other corporate events or transactions; and, provided, further, that the foregoing restriction does not apply to the Compensation Committee’s discretion to provide for accelerated exercisability or vesting of any award, including in cases of retirement, death, disability, other termination of employment, or a change in control. |

Award Terms: | Each option granted shall expire at such time as the Compensation Committee shall determine at the time of grant but shall not be exercisable later than the tenth (10th) anniversary date of its grant. The term of any SAR granted shall be determined by the Compensation Committee but shall not be exercisable later than the tenth (10th) anniversary date of its grant. Notwithstanding the foregoing, in the event that on the last business day of the term of any SAR or an option (other than an incentive stock option) (x) the exercise of the SAR or option is prohibited by applicable law or (y) shares may not be purchased or sold by certain executive officers, employees or other eligible participants due to the “black-out period” of a Company policy or a “lock-up” agreement undertaken in connection with an issuance of securities by the Company, the Compensation Committee may provide that the term of the SAR or option shall be extended but not beyond a period of thirty (30) days following the end of the legal prohibition, black-out period or lock-up agreement and provided further that no extension will be made if the grant price of such SAR or option at the date the initial term would otherwise expire is above the fair market value. |

Repricing Prohibited: | Options and SARs granted under the Plan may not be repriced, repurchased (including by cash buyout), replaced or regranted through cancellation or by lowering the option price of a previously granted option or the grant price of a previously granted SAR, without the approval of our shareholders. |

Name and Position | Dollar Value ($) | Number of Shares |

Non-employee directors as a group | $750,000 | Fair market value on date of grant |

2024 | 2023 | ||

Audit fees | $2,207,100 | $2,179,600 | |

Audit-related fees(1) | 30,600 | 32,800 | |

Tax fees(2) | 222,000 | 178,800 | |

All other fees | — | — | |

Total | $2,459,700 | $2,391,200 |

Name and Address | Amount and Nature of Beneficial Ownership (1) | Percentage of Class | |||

BlackRock, Inc. | 3,561,806 | (2) | 15.7% | ||

55 East 52nd Street | |||||

New York, NY 10055 | |||||

The Vanguard Group | 1,655,886 | (3) | 7.3% | ||

100 Vanguard Blvd. | |||||

Malvern, PA 19355 | |||||

Dimensional Fund Advisors LP | 1,492,360 | (4) | 6.6% | ||

Palisades West, Bldg. One | |||||

6300 Bee Cave Road | |||||

Austin, TX 78746 | |||||

Royce & Associates, LP | 1,295,997 | (5) | 5.7% | ||

745 Fifth Avenue | |||||

New York, NY 10151 | |||||

GAMCO Investors, Inc. | 1,133,675 | (6) | 5.0% | ||

One Corporate Center | |||||

Rye, NY 10580 | |||||

Eric P. Sills | 609,857 | (7) | * | ||

James J. Burke | 87,947 | * | |||

Carmine J. Broccole | 86,722 | * | |||

Dale Burks | 62,656 | * | |||

Pamela Forbes Lieberman | 52,406 | * | |||

Joseph W. McDonnell | 31,947 | * | |||

Nathan R. Iles | 29,655 | * | |||

Alisa C. Norris | 25,247 | * | |||

Patrick S. McClymont | 23,368 | * | |||

Alejandro C. Capparelli | 10,564 | * | |||

Pamela S. Puryear | 9,336 | * | |||

Directors and Officers as a group (15 persons) | 1,130,538 | 5.0% | |||

Name | Audit Committee | Compensation and Management Development Committee | Nominating and Corporate Governance Committee | Strategic Planning Committee |

Eric P. Sills | ─ | ─ | ─ | ─ |

Alisa C. Norris | Member | Member | Member | Member |

James J. Burke | ─ | ─ | ─ | ─ |

Alejandro C. Capparelli | Member | Member | Member | Co-Chair |

Pamela Forbes Lieberman | Chair | Member | Member | Member |

Patrick S. McClymont | Member | Member | Member | Co-Chair |

Joseph W. McDonnell | Member | Member | Chair | Member |

Pamela S. Puryear | Member | Chair | Member | Member |

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | All Other Compensation (3) | Total | ||||

Alisa C. Norris | $115,000 | $92,160 | $— | $207,160 | ||||

Alejandro C. Capparelli | 105,000 | 92,160 | — | 197,160 | ||||

Pamela Forbes Lieberman | 110,000 | 92,160 | 17,261 | 219,421 | ||||

Patrick S. McClymont | 105,000 | 92,160 | — | 197,160 | ||||

Joseph W. McDonnell | 105,000 | 92,160 | — | 197,160 | ||||

Pamela S. Puryear | 105,000 | 92,160 | — | 197,160 |

Name | Outstanding (Unvested) Restricted Stock Awards | |

Alisa C. Norris | 1,000 | |

Alejandro C. Capparelli | 1,000 | |

Pamela Forbes Lieberman | 1,000 | |

Patrick McClymont | 1,000 | |

Joseph W. McDonnell | 1,000 | |

Pamela S. Puryear | 1,000 |

Dale Burks Chief Commercial Officer & Executive Vice President Age 65 | Mr. Burks has served as our Chief Commercial Officer and Executive Vice President since March 2016. Prior to his current appointment, Mr. Burks served as our Vice President Global Sales and Marketing from 2013 to March 2016, our Vice President Corporate Sales and Marketing from 2011 to 2013, our Vice President Temperature Control Division from 2006 to 2011, our General Manager – Temperature Control Division from 2003 to 2006, and in various capacities throughout our Company from 1984 to 2003, including as our Director – Sales & Marketing, Regional Manager and Territory Manager. Mr. Burks has completed Executive Education programs at Ross School of Business, University of Michigan, and Kellogg School of Management, Northwestern University, and holds a B.S. from Oregon State University. |

Nathan R. Iles Chief Financial Officer Age 48 | Mr. Iles has served as our Chief Financial Officer since September 2019. Prior to his appointment as our Chief Financial Officer, Mr. Iles served as Vice President and Chief Financial Officer at UCI International Holdings, Inc. (“UCI”) from 2016 to 2019, Chief Financial Officer of UCI’s ASC/Airtex Performance Pumps business from 2015 to 2016, and Vice President Corporate Finance of UCI-FRAM Auto Brands from 2011 to 2015. Mr. Iles has also held finance and accounting positions at Sears Holdings Corporation and Deloitte & Touche. Mr. Iles holds an M.B.A. from the University of Chicago Booth School of Business, and a B.B.A. from Eastern Kentucky University. Mr. Iles is a Certified Public Accountant. |

Carmine J. Broccole Chief Legal Officer & Secretary Age 59 | Mr. Broccole has served as our Chief Legal Officer since September 2021 and as our Secretary since 2006. Prior to his current appointment, Mr. Broccole served as our Senior Vice President General Counsel from 2016 to September 2021, as our Vice President General Counsel from 2006 to 2016, and as our General Counsel from 2004 to 2006. Prior to such time, Mr. Broccole was a Partner of Kelley Drye & Warren LLP. Mr. Broccole holds a Juris Doctor degree from Stanford Law School and a B.A. from Cornell University, and is a member of the Bars of New York and California. |

Kristine Frost Chief Human Resources Officer Age 49 | Ms. Frost has served as our Chief Human Resources Officer since July 2023. Ms. Frost has also served as our Vice President of Human Resources from August 2022 to July 2023. Prior to that time, Ms. Frost served as the Global Human Resources Executive of Motion Technologies at ITT, Inc. from August 2019 to August 2022, the Vice President of Global Human Resources at Certus Automotive, Inc. from 2017 to July 2019, the Interim Vice President of Human Resources of North America at Kamax LP from 2016 to 2017, the Vice President of Human Resources & Legal Affairs at Webasto Group from 2011 to 2016, and in various leadership positions within human resources at Webasto Group from 2001 to 2011. Ms. Frost holds a Juris Doctor degree from Wayne State University Law School and a Bachelor of Science degree from Oakland University, and is a member of the Michigan Bar and the Bar of the Supreme Court of the United States. |

Ray Nicholas Chief Information Officer & Vice President Information Technology Age 61 | Mr. Nicholas has served as our Chief Information Officer since 2013 and as our Vice President Information Technology since 2006. From 1990 to 2006, Mr. Nicholas served as the Manager and Director of Information Systems for our Temperature Control Division. Mr. Nicholas completed the Automotive Aftermarket Professional program at University of the Aftermarket, Northwood University, and an Executive Education program at University of Virginia, Darden School of Business, and holds a B.S. from Northeast Louisiana University. |

Erin Pawlish Treasurer Age 49 | Ms. Pawlish has served as our Treasurer since 2015. Prior to her appointment as our Treasurer, Ms. Pawlish served as our Financial Director from 2013 to 2015, and as a Senior Manager at KPMG LLP from 1998 to 2012. Ms. Pawlish holds a B.B.A. from Pace University. Ms. Pawlish is also a Certified Public Accountant. |

Esther Parker Chief Accounting Officer Age 49 | Ms. Parker has served as our Chief Accounting Officer since April 2024. Prior to her appointment as our Chief Accounting Officer, Ms. Parker served in various controllership leadership positions at PepsiCo, Inc. from 2018 to April 2024 and General Electric Company from 2011 to 2018. Prior to such time, Ms. Parker began her career at KPMG in the United Kingdom, and later joined PriceWaterhouseCoopers LLP in the New York City region, where she held the position of Senior Manager. Ms. Parker holds a BA from the University of Durham, United Kingdom. She is a Certified Public Accountant, a Chartered Accountant in England & Wales, and a Chartered Global Management Accountant. |

Eric P. Sills Chairman of the Board, Chief Executive Officer & President | Nathan R. Iles Chief Financial Officer |

James J. Burke Chief Operating Officer | Carmine J. Broccole Chief Legal Officer & Secretary |

Dale Burks Chief Commercial Officer & Executive Vice President |

Cooper-Standard Holdings Inc. | Gentherm Inc. | Methode Electronics, Inc. |

CTS Corp. | Distribution Solutions Group, Inc. (formerly known as Lawson Products, Inc.) | Modine Manufacturing Co. |

Dorman Products, Inc. | Stoneridge, Inc. | |

EnPro Industries, Inc. | The Shyft Group, Inc. |

Astec Industries, Inc. | Dorman Products, Inc. | Methode Electronics, Inc. |

Atmus Filtration Technologies Inc. | Enpro Inc. | Motorcar Parts of America, Inc. |

Barnes Group Inc. | Fox Factory Holding | Park-Ohio Holdings Corp. |

Columbus McKinnon Corporation | Gentherm Incorporated | The Shyft Group, Inc. |

Cooper-Standard Holdings Inc. | Helios Technologies, Inc. | Stoneridge, Inc. |

CTS Corp. | Kimball Electronics, Inc. | VSE Corporation |

Pamela S. Puryear, Ph.D. (Chair) | Patrick S. McClymont |

Alejandro C. Capparelli | Joseph W. McDonnell |

Pamela Forbes Lieberman | Alisa C. Norris |

Name and Principal Position | Year | Salary | Stock Awards (1) | Non-Equity Incentive Plan Compensation (2) | All Other Compensation (3) | Total | ||||||

Eric P. Sills | 2024 | $742,000 | $119,787 | $611,183 | $95,067 | $1,568,037 | ||||||

Chairman of the Board, | 2023 | 720,000 | 100,200 | 219,006 | 117,272 | 1,156,478 | ||||||

Chief Executive Officer & | 2022 | 688,000 | 105,520 | 515,211 | 138,862 | 1,447,593 | ||||||

President | ||||||||||||

James J. Burke | 2024 | $728,000 | $119,787 | $599,604 | $86,444 | $1,533,835 | ||||||

Chief Operating Officer | 2023 | 705,000 | 100,200 | 215,197 | 107,889 | 1,128,286 | ||||||

2022 | 675,000 | 105,520 | 505,200 | 130,035 | 1,415,755 | |||||||

Dale Burks | 2024 | $599,000 | $176,183 | $492,916 | $72,772 | $1,340,871 | ||||||

Chief Commercial Officer & | 2023 | 582,000 | 150,040 | 176,157 | 89,189 | 997,386 | ||||||

Executive Vice President | 2022 | 557,000 | 171,695 | 413,183 | 108,384 | 1,250,262 | ||||||

Nathan R. Iles | 2024 | $576,000 | $176,183 | $473,894 | $71,415 | $1,297,492 | ||||||

Chief Financial Officer | 2023 | 558,000 | 150,040 | 169,968 | 90,800 | 968,808 | ||||||

2022 | 534,000 | 171,695 | 399,607 | 100,326 | 1,205,628 | |||||||

Carmine J. Broccole | 2024 | $550,000 | $146,248 | $325,156 | $60,737 | $1,082,141 | ||||||

Chief Legal Officer & | 2023 | 533,000 | 124,990 | 116,645 | 73,524 | 848,159 | ||||||

Secretary | 2022 | 510,000 | 145,315 | 273,307 | 85,212 | 1,013,834 |

Name | 401(K) | ESOP | SERP | |||

Eric Sills | $22,425 | $6,055 | $51,129 | |||

James Burke | $22,425 | $6,055 | $49,650 | |||

Dale Burks | $22,425 | $6,055 | $35,703 | |||

Nathan Iles | $22,425 | $6,055 | $33,280 | |||

Carmine Broccole | $22,425 | $6,055 | $26,697 |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of Shares of Stock or Units (#) (3) | Grant Date Fair Value (4) | |||||||||||||||

Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||

Eric P. Sills | 10/23/24 | — | — | — | — | 2,553 | 5,106 | — | $59,893 | |||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 59,893 | ||||||||||

$0 | $472,960 | $945,920 | — | — | — | — | — | |||||||||||

James J. Burke | 10/23/24 | — | — | — | — | 2,553 | 5,106 | — | $59,893 | |||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 59,893 | ||||||||||

$0 | $464,000 | $928,000 | — | — | — | — | — | |||||||||||

Dale Burks | 10/23/24 | — | — | — | — | 2,553 | 5,106 | — | $59,893 | |||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 59,893 | ||||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 56,396 | ||||||||||

$0 | $381,440 | $762,880 | — | — | — | — | — | |||||||||||

Nathan R. Iles | 10/23/24 | — | — | — | — | 2,553 | 5,106 | — | $59,893 | |||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 59,893 | ||||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 56,396 | ||||||||||

Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of Shares of Stock or Units (#) (3) | Grant Date Fair Value (4) | |||||||||||||||

Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||

$0 | $366,720 | $733,440 | — | — | — | — | — | |||||||||||

Carmine J. Broccole | 10/23/24 | — | — | — | — | 1,915 | 3,830 | — | $44,926 | |||||||||

10/23/24 | — | — | — | — | — | — | 1,915 | 44,926 | ||||||||||

10/23/24 | — | — | — | — | — | — | 2,553 | 56,396 | ||||||||||

$0 | $251,620 | $503,240 | — | — | — | — | — | |||||||||||

Stock Awards | |||||||||||

Name | Grant Date | Number of Shares or Units of Stock that Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested (1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (2) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (1) | ||||||

Eric P. Sills | 12/1/2010 | 5,000 | (4) | $154,900 | — | — | |||||

Stock Awards | |||||||||||

Name | Grant Date | Number of Shares or Units of Stock that Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested (1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (2) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (1) | ||||||

Eric P. Sills (continued) | 9/20/2011 | 5,000 | (4) | $154,900 | — | — | |||||

10/9/2012 | 5,000 | (4) | $154,900 | — | — | ||||||

10/8/2013 | 5,000 | (4) | $154,900 | — | — | ||||||

10/7/2014 | 5,000 | (4) | $154,900 | — | — | ||||||

10/13/2015 | 4,000 | (4) | $123,920 | — | — | ||||||

9/22/2022 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/25/2023 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/23/2024 | 2,553 | (3) | $79,092 | 2,553 | $79,092 | ||||||

James J. Burke | 9/22/2022 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | |||||

10/25/2023 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/23/2024 | 2,553 | (3) | $79,092 | 2,553 | $79,092 | ||||||

Dale Burks | 12/1/2010 | 2,812 | (4) | $87,116 | — | — | |||||

9/20/2011 | 2,812 | (4) | $87,116 | — | — | ||||||

10/9/2012 | 2,812 | (4) | $87,116 | — | — | ||||||

10/8/2013 | 2,812 | (4) | $87,116 | — | — | ||||||

10/7/2014 | 2,812 | (4) | $87,116 | — | — | ||||||

10/13/2015 | 2,250 | (4) | $69,705 | — | — | ||||||

10/20/2016 | 2,250 | (4) | $69,705 | — | — | ||||||

10/20/2017 | 1,406 | (4) | $43,558 | — | — | ||||||

10/11/2018 | 1,125 | (4) | $34,853 | — | — | ||||||

9/24/2019 | 1,125 | (4) | $34,853 | — | — | ||||||

9/29/2020 | 1,406 | (4) | $43,558 | — | — | ||||||

9/21/2021 | 1,406 | (4) | $43,558 | — | — | ||||||

9/22/2022 | 1,250 | (4) | $38,725 | — | — | ||||||

9/22/2022 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/25/2023 | 1,000 | (4) | $30,980 | — | |||||||

10/25/2023 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/23/2024 | 2,553 | (4) | $79,092 | ||||||||

10/23/2024 | 2,553 | (3) | $79,092 | 2,553 | $79,092 | ||||||

Nathan R. Iles | 9/24/2019 | 2,500 | (4) | $77,450 | — | — | |||||

9/29/2020 | 2,500 | (4) | $77,450 | — | — | ||||||

9/21/2021 | 2,500 | (4) | $77,450 | — | — | ||||||

9/22/2022 | 2,500 | (4) | $77,450 | — | — | ||||||

9/22/2022 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/25/2023 | 2,000 | (4) | $61,960 | — | — | ||||||

10/25/2023 | 2,000 | (3) | $61,960 | 2,000 | $61,960 | ||||||

10/23/2024 | 2,553 | (4) | $79,092 | — | — | ||||||

10/23/2024 | 2,553 | (3) | $79,092 | 2,553 | $79,092 | ||||||

Carmine J. Broccole | 12/1/2010 | 5,000 | (4) | $154,900 | — | — | |||||

9/20/2011 | 5,000 | (4) | $154,900 | — | — | ||||||

10/9/2012 | 5,000 | (4) | $154,900 | — | — | ||||||

10/8/2013 | 5,000 | (4) | $154,900 | — | — | ||||||

10/7/2014 | 5,000 | (4) | $154,900 | — | — | ||||||

Stock Awards | |||||||||||

Name | Grant Date | Number of Shares or Units of Stock that Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested (1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (2) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (1) | ||||||

Carmine J. Broccole (continued) | 10/13/2015 | 4,000 | (4) | $123,920 | — | — | |||||

10/20/2016 | 4,000 | (4) | $123,920 | — | — | ||||||

10/20/2017 | 2,500 | (4) | $77,450 | — | — | ||||||

10/11/2018 | 2,000 | (4) | $61,960 | — | — | ||||||

9/24/2019 | 2,000 | (4) | $61,960 | — | — | ||||||

9/29/2020 | 2,500 | (4) | $77,450 | — | — | ||||||

9/21/2021 | 2,500 | (4) | $77,450 | — | — | ||||||

9/22/2022 | 2,500 | (4) | $77,450 | — | — | ||||||

9/22/2022 | 1,500 | (3) | $46,470 | 1,500 | $46,470 | ||||||

10/25/2023 | 2,000 | (4) | $61,960 | — | — | ||||||

10/25/2023 | 1,500 | (3) | $46,470 | 1,500 | $46,470 | ||||||

10/23/2024 | 2,553 | (4) | $79,092 | — | — | ||||||

10/23/2024 | 1,915 | (3) | $59,327 | 1,915 | $59,327 | ||||||

Stock Awards | ||||

Name (1) | Number of Shares Acquired on Vesting | Value Realized on Vesting (2) | ||

Eric P. Sills | 3,366 | $117,743 | ||

James J. Burke | 3,366 | $117,743 | ||

Dale Burks | 4,366 | $152,723 | ||

Nathan R. Iles | 3,366 | $117,743 | ||

Carmine J. Broccole | 2,525 | $88,325 | ||

Name | Executive Contributions in Last FY (1) | Registrant Contributions in Last FY (1) | Aggregate Earnings in Last FY (2) | Aggregate Withdrawals/ Distribution | Aggregate Balance at Last FYE | |||||

Eric P. Sills | $67,271 | $75,133 | $202,298 | — | $1,790,586 | |||||

James J. Burke | — | $73,057 | $382,598 | — | $2,857,750 | |||||

Dale Burks | — | $55,211 | $208,048 | — | $1,395,412 | |||||

Nathan R. Iles | $28,650 | $52,091 | $210,485 | — | $1,484,971 | |||||

Carmine J. Broccole | — | $39,533 | $151,678 | — | $1,039,991 |

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans | |||||

Equity compensation plans approved by security holders | 929,024 | (1) | $26.82 | 186,973 | (2) | |||

Equity compensation plans not approved by security holders | ─ | $— | ─ | |||||

All plans | 929,024 | (1) | $26.82 | 186,973 | (2) | |||

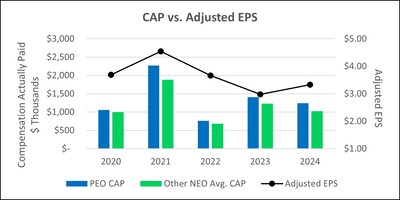

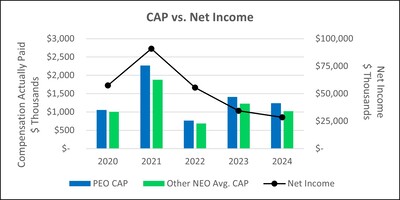

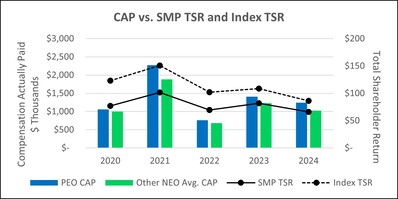

Fiscal Year | Summary Compensation Table Total for PEO(1) | Compensation Actually Paid to PEO(1) | Average Summary Compensation Table Total for Non- PEO Named Executive Officers(2) | Average Compensation Actually Paid to Non-PEO Named Executive Officers(2) | Value of Initial Fixed $100 Investment Based On | Net Income (Dollars in thousands) | Adjusted EPS | |||||||||

Company Total Shareholder Return(3) | Index Total Shareholder Return(3) | |||||||||||||||

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | ||||||||

2024 | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||

2023 | ||||||||||||||||

2022 | ||||||||||||||||

2021 | ||||||||||||||||

2020 | ||||||||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | ||||||

Adjustments for Stock Awards | ||||||||||

SCT Total | $ | $ | $ | $ | $ | |||||

(Deduct): Aggregate grant date fair value for stock awards included in SCT Total for the covered fiscal year. | ( | ( | ( | ( | ( | |||||

Add: Fair value at covered fiscal year end of awards granted during the covered fiscal year that were outstanding and unvested at covered fiscal year end. | ||||||||||

Add (Deduct): Change as of the covered fiscal year end (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year that were outstanding and unvested at covered fiscal year end. | ( | ( | ( | |||||||

Add (Deduct): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which all vesting conditions were satisfied during the covered fiscal year. | ( | ( | ||||||||

(Deduct): Fair value at the end of the prior fiscal year of awards granted in any prior fiscal year that failed to meet the applicable vesting conditions during the covered fiscal year. | ( | |||||||||

CAP Amounts | $ | $ | $ | $ | $ |

2024* | 2023* | 2022* | 2021* | 2020* | ||||||

Adjustments for Stock Awards | ||||||||||

SCT Total | $ | $ | $ | $ | $ | |||||

(Deduct): Aggregate grant date fair value for stock awards included in SCT Total for the covered fiscal year. | ( | ( | ( | ( | ( | |||||

Add: Fair value at covered fiscal year end of awards granted during the covered fiscal year that were outstanding and unvested at covered fiscal year end. | ||||||||||

Add (Deduct): Change as of the covered fiscal year end (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year that were outstanding and unvested at covered fiscal year end. | ( | ( | ( | |||||||

Add (Deduct): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which all vesting conditions were satisfied during the covered fiscal year. | ( | ( | ( | |||||||

(Deduct): Fair value at the end of the prior fiscal year of awards granted in any prior fiscal year that failed to meet the applicable vesting conditions during the covered fiscal year. | ( | |||||||||

CAP Amounts | $ | $ | $ | $ | $ |

Name | Severance Compensation Agreement Amount (1) | SERP Amount (2) | Early Vesting of Restricted Stock (3) | Other (4) | Total | |||||

Eric P. Sills | $— | $1,790,586 | $1,101,432 | $— | $2,892,018 | |||||

James J. Burke | 3,576,000 | 2,857,750 | 203,012 | 158,672 | 6,795,434 | |||||

Dale Burks | — | 1,395,412 | 1,127,176 | — | 2,522,588 | |||||

Nathan R. Iles | — | 1,484,971 | 653,864 | — | 2,138,835 | |||||

Carmine J. Broccole | — | 1,039,991 | 1,749,379 | — | 2,789,370 |

Pamela Forbes Lieberman (Chair) | Joseph W. McDonnell |

Alejandro C. Capparelli | Alisa C. Norris |

Patrick S. McClymont | Pamela S. Puryear, Ph.D. |

By Order of the Board of Directors | |

Carmine J. Broccole | |

Chief Legal Officer & Secretary |

Article 1. Establishment, Purpose, and Duration | 1 |

Article 2. Definitions | 2 |

Article 3. Administration | 7 |

Article 4. Shares Subject to this Plan and Maximum Awards | 7 |

Article 5. Eligibility and Participation | 8 |

Article 6. Stock Options | 9 |

Article 7. Stock Appreciation Rights | 10 |

Article 8. Restricted Stock and Restricted Stock Units | 11 |

Article 9. Performance Units/Performance Shares | 12 |

Article 10. Cash-Based Awards and Other Stock-Based Awards | 13 |

Article 11. Transferability of Awards | 13 |

Article 12. Performance Measures | 13 |

Article 13. Nonemployee Director Awards | 15 |

Article 14. Treatment of Dividends and Dividend Equivalents | 15 |

Article 15. Beneficiary Designation | 15 |

Article 16. Rights of Participants | 15 |

Article 17. Change of Control | 16 |

Article 18. Amendment, Modification, Suspension, and Termination | 17 |

Article 19. Withholding | 18 |

Article 20. Successors | 18 |

Article 21. General Provisions | 18 |

2.1 | “Affiliate” shall mean any corporation or other entity (including, but not limited to, a partnership or a limited liability company), that is affiliated with the Company through stock or equity ownership or otherwise, and is designated as an Affiliate for purposes of this Plan by the Committee. |

2.2 | “Award” means, individually or collectively, a grant under this Plan of Nonqualified Stock Options, Incentive Stock Options, SARs, Restricted Stock, Restricted Stock Units, Performance Shares, Performance Units, Cash-Based Awards, or Other Stock-Based Awards, in each case subject to the terms of this Plan. |

2.3 | “Award Agreement” means either (i) a written agreement entered into by the Company and a Participant setting forth the terms and provisions applicable to an Award granted under this Plan, or (ii) a written or electronic statement issued by the Company to a Participant describing the terms and provisions of such Award, including any amendment or modification thereof. The Committee may provide for the use of electronic, internet or other non-paper Award Agreements, and the use of electronic, internet or other non-paper means for the acceptance thereof and actions thereunder by a Participant. |

2.4 | “Beneficial Owner” or “Beneficial Ownership” shall have the meaning ascribed to such term in Rule 13d-3 of the General Rules and Regulations under the Exchange Act. |

2.5 | “Board” or “Board of Directors” means the Board of Directors of the Company. |

2.6 | “Cash-Based Award” means an Award, denominated in cash, granted to a Participant as described in Article 10. |

2.7 | “Cause” means, unless otherwise specified in an Award Agreement or in an applicable employment agreement (or similar agreement) between the Company, or an Affiliate, and a Participant, with respect to any Participant, as determined by the Committee in its sole discretion: |

(a) | Willful failure to substantially perform his or her duties as an Employee (for reasons other than physical or mental illness) or Director after reasonable notice to the Participant of that failure; |

(b) | Misconduct that materially injures the Company or any Subsidiary or Affiliate; |

(c) | Conviction of, or entering into a plea of nolo contendere to, a felony; or |

(d) | Material breach of any written covenant or agreement with the Company or any Subsidiary or Affiliate. |

2.8 | “Change of Control” means the occurrence of any one of the following events with respect to the Company: |

(a) | The acquisition by any Person of Beneficial Ownership of thirty percent (30%) or more of the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of Directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this Section 2.8, the following acquisitions shall not constitute a Change of Control: (i) any acquisition by a Person who on the Effective Date is the Beneficial Owner of thirty percent (30%) or more of the Outstanding Company Voting Securities, (ii) any acquisition directly from the Company, including without limitation, a public offering of securities, (iii) any acquisition by the Company, (iv) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any of its subsidiaries, or (v) any acquisition by any corporation pursuant to a transaction which complies with subparagraphs (i), (ii), and (iii) of Section 2.8(c); provided, however, the acquisition by any Person of Beneficial Ownership of thirty percent (30%) or more of the combined voting power shall not constitute a Change of Control if Standard Motor Products, Inc. maintains a Beneficial Ownership of more than fifty percent (50%) of the then-outstanding voting securities of the Company entitled to vote generally in the election of Directors; |

(b) | Individuals who constitute the Board as of the Effective Date hereof (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board during any 12- month period, provided that any individual becoming a Director subsequent to the Effective Date whose election, or nomination for election by the Company’s shareholders, was approved by a vote of at least a majority of the Directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board; |

(c) | Consummation of a reorganization, merger, or consolidation to which the Company is a party (a “Business Combination”), in each case unless, following such Business Combination all or substantially all of the individuals and entities who were the Beneficial Owners of Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than fifty percent (50%) of the combined voting power of the outstanding voting securities entitled to vote generally in the election of directors of the corporation resulting from the Business Combination (including, without limitation, a corporation which as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries); or |

(d) | Any Person acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than 40 percent of the total gross fair market value of all of the assets of the Company immediately prior to such acquisition(s); provided, however, that a transfer of assets by the Company is not treated as a Change of Control if the assets are transferred to (A) a shareholder of the Company (immediately before the asset transfer) in exchange for or with respect to its stock; (B) an entity, fifty percent (50%) or more of the total value or voting power of which is owned, directly or indirectly, by the Company; (C) a Person that owns, directly or indirectly, fifty percent (50%) or more of the total value or voting power of all outstanding stock of the Company; or (D) an entity, at least fifty percent (50%) of the total value or voting power of which is owned, directly or indirectly, by a person described in the previous subsection (C). For purposes of this paragraph, (1) gross fair market value means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets, and (2) a Person’s status is determined immediately after the transfer of the assets; or | |

(e) | The approval by the shareholders of the Company and consummation of a complete liquidation or dissolution of the Company, provided that such event either (i) constitutes a Change in Control as such term is defined for purposes of Code Section 409A; or (ii) satisfaction of the requirements for the event to constitute a Change in Control under Code Section 409A is not required. |

2.9 | “Code” means the U.S. Internal Revenue Code of 1986, as amended from time to time. For purposes of this Plan, references to sections of the Code shall be deemed to include references to any applicable regulations thereunder and any successor or similar provision. |

2.10 | “Committee” means the Compensation and Management Development Committee of the Board or a subcommittee thereof, or any other committee designated by the Board to administer this Plan. The members of the Committee shall (i) be appointed from time to time by and shall serve at the discretion of the Board, and (ii) consist of “non-employee directors” as defined in Section 16 of the Exchange Act. If the Committee does not exist or cannot function for any reason, the Board may take any action under the Plan that would otherwise be the responsibility of the Committee. |

2.11 | “Company” or “Corporation” means Standard Motor Products, Inc., a New York corporation, and any successor thereto as provided in Article 20 herein. |

2.12 | “Director” means any individual who is a member of the Board of Directors of the Company. |

2.13 | “Disability” or “Disabled” means that an individual is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, or is, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than 3 months under an accident and health plan covering employees of the Company. |

2.14 | “Effective Date” has the meaning set forth in Section 1.1. |

2.15 | “Employee” means any individual performing services for the Company, an Affiliate, or a Subsidiary and designated as an employee of the Company, its Affiliates, and/or its Subsidiaries on the payroll records thereof. An Employee shall not include any individual during any period he or she is classified or treated by the Company, Affiliate, and/or Subsidiary as an independent contractor, a consultant, or any employee of an employment, consulting, or temporary agency or any other entity other than the Company, Affiliate, and/or Subsidiary, without regard to whether such individual is subsequently determined to have been, or is subsequently retroactively reclassified as a common-law employee of the Company, Affiliate, and/or Subsidiary during such period. |

2.16 | “Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time, or any successor act thereto. |

2.17 | “Existing Equity Plans” means the Standard Motor Products, Inc. Amended and Restated 2016 Omnibus Incentive Plan (as amended and restated effective May 21, 2021) and the 2006 Omnibus Incentive Plan. |

2.18 | “Fair Market Value” or “FMV” means, on any given date, the closing price of a Share as reported on the New York Stock Exchange (“NYSE”) on such date, or if Shares were not traded on NYSE on such day, then on the next preceding day that Shares were traded on NYSE; in the event Shares are traded only on an exchange other than NYSE, references herein to NYSE shall mean such other exchange. |

2.19 | “Full Value Award” means an Award other than in the form of an ISO, NQSO, or SAR, and which is settled by the issuance of Shares. |

2.20 | “Grant Date” means the date an Award is granted to a Participant pursuant to the Plan. |

2.21 | “Grant Price” means the price established at the time of grant of an SAR pursuant to Article 7, used to determine whether there is any payment due upon exercise of the SAR. |

2.22 | “Incentive Stock Option” or “ISO” means an Option to purchase Shares granted under Article 6 to an Employee and that is designated as an Incentive Stock Option and that is intended to meet the requirements of Code Section 422, or any successor provision. |

2.23 | “Insider” shall mean an individual who is, on the relevant date, an officer or Director of the Company, or a more than ten percent (10%) Beneficial Owner of any class of the Company’s equity securities that is registered pursuant to Section 12 of the Exchange Act, as determined by the Board in accordance with Section 16 of the Exchange Act. |

2.24 | “Net Income” means the consolidated net income before taxes for the Plan Year, as reported in the Company’s annual report to shareholders or as otherwise reported to shareholders. |

2.25 | “Nonemployee Director” means a Director who is not an Employee. |

2.26 | “Nonemployee Director Award” means any NQSO, SAR, or Full Value Award granted, whether singly, in combination, or in tandem, to a Participant who is a Nonemployee Director pursuant to such applicable terms, conditions, and limitations as the Board or Committee may establish in accordance with this Plan. |

2.27 | “Nonqualified Stock Option” or “NQSO” means an Option that is not intended to meet the requirements of Code Section 422, or that otherwise does not meet such requirements. |

2.28 | “Option” means an Incentive Stock Option or a Nonqualified Stock Option, as described in Article 6. |

2.29 | “Option Price” means the price at which a Share may be purchased by a Participant pursuant to an Option. |

2.30 | “Other Stock-Based Award” means an equity-based or equity-related Award not otherwise described by the terms of this Plan, granted pursuant to Article 10. |

2.31 | “Participant” means any eligible individual as set forth in Article 5 to whom an Award is granted. |

2.32 | “Performance-Based Compensation” means compensation under an Award that is subject to performance-based criteria as a component of the Award. |

2.33 | “Performance Measures” means measures as described in Article 12 on which the performance goals are based and which are approved by the Company’s shareholders pursuant to this Plan. |

2.34 | “Performance Period” means the period of time during which the performance goals must be met in order to determine the degree of payout and/or vesting with respect to an Award which period may not be less than one (1) year, or, if less than one (1) year, such period of time designated by the Committee. |

2.35 | “Performance Share” means an Award under Article 9 herein and subject to the terms of this Plan, denominated in Shares, the value of which at the time it is payable is determined as a function of the extent to which corresponding performance criteria have been achieved. |

2.36 | “Performance Unit” means an Award under Article 9 herein and subject to the terms of this Plan, denominated in units, the value of which at the time it is payable is determined as a function of the extent to which corresponding performance criteria have been achieved. |

2.37 | “Period of Restriction” means the period when Restricted Stock or Restricted Stock Units are subject to a substantial risk of forfeiture (based on the passage of time, the achievement of performance goals, or upon the occurrence of other events as determined by the Committee, in its discretion), as provided in Article 8. |

2.38 | “Person” shall have the meaning ascribed to such term in Section 3(a)(9) of the Exchange Act and used in Sections 13(d) and 14(d) thereof, including a “group” as defined in Section 13(d) thereof. |

2.39 | “Plan” means this Standard Motor Products, Inc. 2025 Omnibus Incentive Plan. |

2.40 2.41 | “Plan Year” means the calendar year. “Qualifying Retirement” means a Participant’s termination of Service occurring on or after the Participant reaches age 65. A termination of Service will not be a Qualifying Retirement unless the Participant (i) provides at least 30 days advance notice to the Company of the Participant’s intent to terminate Service, which requirement may be waived at the Company’s discretion; (ii) obtains approval from the Company for such termination of Service; and (iii) cooperates in good faith with all reasonable requests from the Company in connection with the transfer of the Participant’s work and responsibilities to a successor. |

2.42 | “Restricted Stock” means an Award granted to a Participant pursuant to Article 8. |

2.43 | “Restricted Stock Unit” means an Award granted to a Participant pursuant to Article 8, except no Shares are actually awarded to the Participant on the Grant date. |

2.44 | “Service” means a Participant’s employment or service within the Company, Affiliate, and/or Subsidiary, whether as an Employee, Nonemployee Director, or a Third Party Service Provider. Unless otherwise provided by the Committee, a Participant’s Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant renders such Service, provided that there is no interruption or termination of the Participant’s Service. |

2.45 | “Share” means a share of common stock of the Company, $2.00 par value per share. |

2.46 | “Stock Appreciation Right” or “SAR” means an Award, designated as an SAR, pursuant to the terms of Article 7 herein. |

2.47 | “Subsidiary” means any corporation or other entity, whether domestic or foreign, in which the Company has or obtains, directly or indirectly, a proprietary interest of more than fifty percent (50%) by reason of stock ownership or otherwise. |

2.48 | “Third Party Service Provider” means any consultant, agent, advisor, or independent contractor who renders services to the Company, a Subsidiary, or an Affiliate that (a) are not in connection with the offer and sale of Company’s securities in a capital raising transaction, and (b) do not directly or indirectly promote or maintain a market for the Company’s securities. |

(a) | The excess of the Fair Market Value of a Share on the date of exercise over the Grant Price; by |

(b) | The number of Shares with respect to which the SAR is exercised. |

(a) | Net earnings or net income (before or after taxes); |

(b) | Earnings per share (basic or diluted); |

(c) | Net sales or revenue growth; |

(d) | Net operating profit; | |

(e) | Return measures (including, but not limited to, return on assets, capital, invested capital, equity, sales, or revenue); |

(f) | Cash flow (including, but not limited to, throughput, operating cash flow, free cash flow, cash flow return on equity, and cash flow return on investment); |

(g) | Earnings before or after taxes, interest, depreciation, and/or amortization; |

(h) | Earnings before taxes; |

(i) | Gross or operating margins; |

(j) | Corporate value measures; |

(k) | Capital expenditures; |

(l) | Unit volumes; |

(m) | Productivity ratios; |

(n) | Share price (including, but not limited to, growth measures and total shareholder return); |

(o) | Cost or expense; |

(p) | Margins (including, but not limited to, debt or profit); |

(q) | Operating efficiency; |

(r) | Working capital targets or any element thereof; |

(s) | Expense targets; |

(t) | Economic value added or EVA® (net operating profit after tax minus the sum of capital multiplied by the cost of capital); |

(u) | Strategic milestones (including, but not limited to, debt reduction, improvement of cost of debt, equity or capital, completion of projects, achievement of synergies or integration objectives, or improvements to credit rating, inventory turnover, weighted average cost of capital, implementation of significant new processes, productivity or production, product quality, and any combination of the foregoing); |

(v) | Strategic sustainability metrics (including, but not limited to, corporate governance, consumer advocacy, enterprise risk management, employee development, and portfolio restructuring); and |

(w) | Gross, operating, stockholder equity, or net worth. |

(a) | All Awards to a Participant who is an officer subject to Section 16 of the Exchange Act, including the Chief Executive Officer and Chief Financial Officer of the Company, or as otherwise defined by the Securities and Exchange Commission, shall be subject to forfeiture as provided under the Company’s recoupment and clawback policies in effect from time to time, including the Company’s Clawback Policy (“Policy”), adopted as of October 3, 2023, as amended from time to time in the discretion of the Company. The Policy shall be provided to affected Participants and which shall be considered incorporated into and made a part of this Plan and any Award Agreement issued to an affected Participant. Additionally, the Company shall also comply with any required reimbursement, forfeiture, or claw back rules issued in final form by the Securities and Exchange Commission or other applicable agency. |

(b) | The Committee may specify in an Award Agreement that the Participant’s rights, payments, and benefits with respect to an Award shall be subject to reduction, cancellation, forfeiture, or recoupment upon the occurrence of certain specified events, in addition to any otherwise applicable vesting or performance conditions of an Award. Such events may include, but shall not be limited to, circumstances or events provided for under applicable securities laws, rules or statutes, termination of employment for Cause, termination of the Participant’s Service, violation of material Company, Affiliate, and/or Subsidiary policies, breach of noncompetition, confidentiality, or other restrictive covenants that may apply to the Participant, or other conduct by the Participant that is detrimental to the business or reputation of the Company, its Affiliates, and/or its Subsidiaries. |

(a) | Obtaining any approvals from governmental agencies that the Company determines are necessary or advisable; and |

(b) | Completion of any registration or other qualification of the Shares under any applicable national or foreign law or ruling of any governmental body that the Company determines to be necessary or advisable. |

(a) | Determine which Affiliates and Subsidiaries shall be covered by this Plan; |

(b) | Determine which Employees and/or Directors or Third Party Service Providers outside the United States are eligible to participate in this Plan; |

(c) | Modify the terms and conditions of any Award granted to Employees and/or Directors or Third Party Service Providers outside the United States to comply with applicable foreign laws; |

(d) | Establish subplans and modify exercise procedures and other terms and procedures, to the extent such actions may be necessary or advisable. Any subplans and modifications to Plan terms and procedures established under this Section 21.9 by the Committee shall be attached to this Plan document as appendices; and |

(e) | Take any action, before or after an Award is made, that it deems advisable to obtain approval or comply with any necessary local government regulatory exemptions or approvals. |

STANDARD MOTOR PRODUCTS, INC. | ||

By: | ||

Name: | Nathan R. Iles | |

Title: | Chief Financial Officer | |