(I) Calculation Agent

The term “Calculation Agent” shall mean Deutsche Bank Trust Company Americas, until a successor replaces it pursuant to the applicable provisions of the Indenture and, thereafter, shall mean such successor.

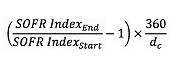

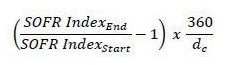

(J) Compounded SOFR

“Compounded SOFR” shall be determined by the Calculation Agent in accordance with the following formula (and the resulting percentage shall be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point):

where:

“SOFR IndexStart” = For periods other than the initial Interest Period, the SOFR Index value on the preceding Interest Determination Date, and, for the initial Interest Period, the SOFR Index value on December 5, 2025;

“SOFR IndexEnd” = The SOFR Index value on the Interest Determination Date relating to the applicable Interest Payment Date (or, in the final Interest Period, relating to the maturity date or, in the case of a redemption or repayment of the Notes, relating to the applicable redemption or repayment date); and

“dc” is the number of calendar days in the relevant Observation Period.

For the purposes of determining Compounded SOFR:

“Observation Period” means, in respect of each Interest Period for the Notes, the period from and including the date that is two U.S. Government Securities Business Days preceding the first date in such Interest Period to but excluding the date that is two U.S. Government Securities Business Days preceding the Interest Payment Date for such Interest Period (or, in the final Interest Period, preceding the maturity date or, in the case of a redemption or repayment of the Notes, relating to the applicable redemption or repayment date).

“SOFR” means the daily secured overnight financing rate as provided by the SOFR Administrator on the SOFR Administrator’s Website.

“SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of SOFR).

“SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, currently at http://www.newyorkfed.org, or any successor source.

“SOFR Index” means, with respect to any U.S. Government Securities Business Day, the SOFR Index value as published by the SOFR Administrator as such index appears on the SOFR Administrator’s Website at 3:00 p.m. (New York time) on such U.S. Government Securities Business Day (the “SOFR Index Determination Time”); provided that if a SOFR Index value does not so appear as specified above at the SOFR Index Determination Time, then: (i) if a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to the “SOFR Index Unavailable Provisions” described below, or (ii) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to the “Effect of Benchmark Transition Event” provisions set out in Section 2.02(D) below.

4