1 4Q and FY2025 Financial Highlights .3 January 16, 2026 NYSE: STT

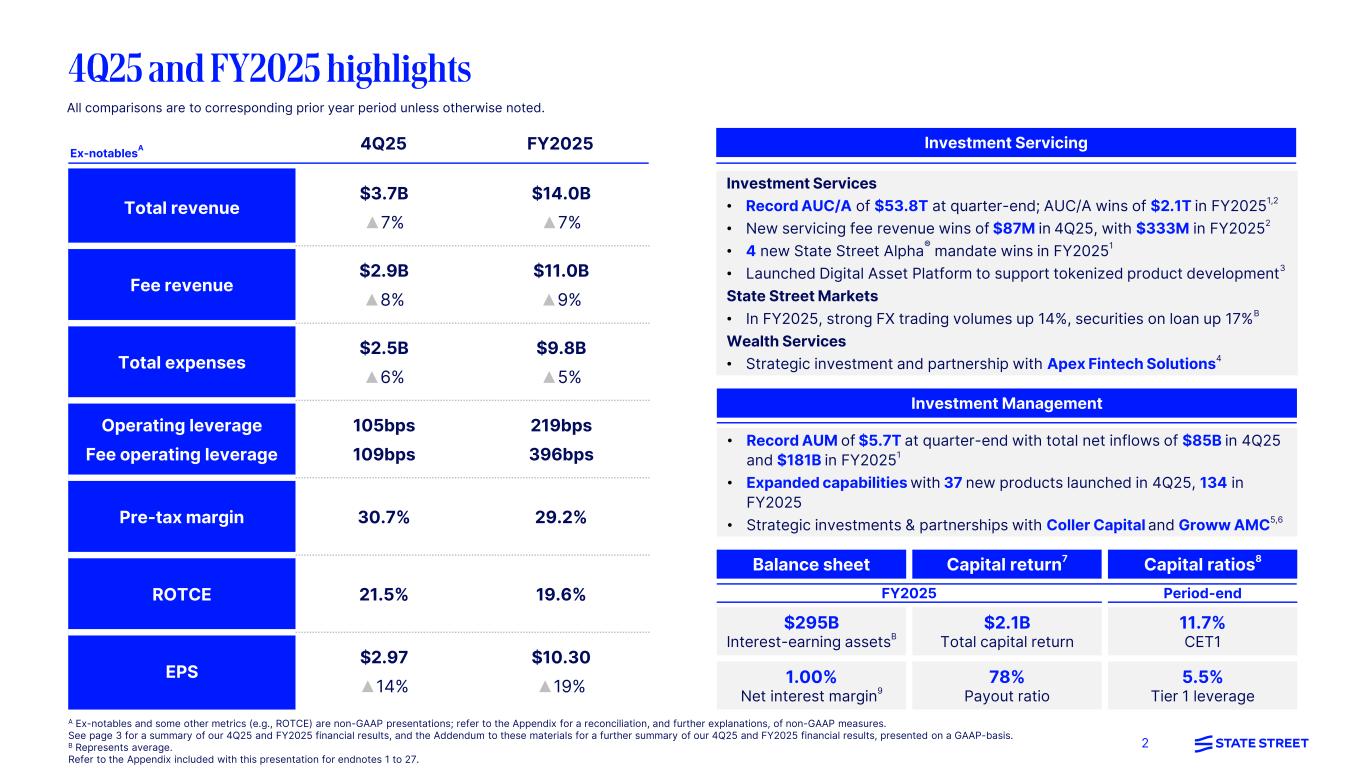

2 4Q25 and FY2025 highlights A Ex-notables and some other metrics (e.g., ROTCE) are non-GAAP presentations; refer to the Appendix for a reconciliation, and further explanations, of non-GAAP measures. See page 3 for a summary of our 4Q25 and FY2025 financial results, and the Addendum to these materials for a further summary of our 4Q25 and FY2025 financial results, presented on a GAAP-basis. B Represents average. Refer to the Appendix included with this presentation for endnotes 1 to 27. All comparisons are to corresponding prior year period unless otherwise noted. • Record AUM of $5.7T at quarter-end with total net inflows of $85B in 4Q25 and $181B in FY20251 • Expanded capabilities with 37 new products launched in 4Q25, 134 in FY2025 • Strategic investments & partnerships with Coller Capital and Groww AMC5,6 Investment Management Investment Services • Record AUC/A of $53.8T at quarter-end; AUC/A wins of $2.1T in FY20251,2 • New servicing fee revenue wins of $87M in 4Q25, with $333M in FY20252 • 4 new State Street Alpha® mandate wins in FY20251 • Launched Digital Asset Platform to support tokenized product development3 State Street Markets • In FY2025, strong FX trading volumes up 14%, securities on loan up 17%B Wealth Services • Strategic investment and partnership with Apex Fintech Solutions4 Investment Servicing4Q25 FY2025 Total revenue $3.7B ▲7% $14.0B ▲7% Fee revenue $2.9B ▲8% $11.0B ▲9% Total expenses $2.5B ▲6% $9.8B ▲5% Operating leverage Fee operating leverage 105bps 109bps 219bps 396bps Pre-tax margin 30.7% 29.2% ROTCE 21.5% 19.6% EPS $2.97 ▲14% $10.30 ▲19% Ex-notablesA Capital return7 Capital ratios8 $2.1B Total capital return 78% Payout ratio 5.5% Tier 1 leverage 11.7% CET1 $295B Interest-earning assetsB 1.00% Net interest margin9 Balance sheet Period-endFY2025

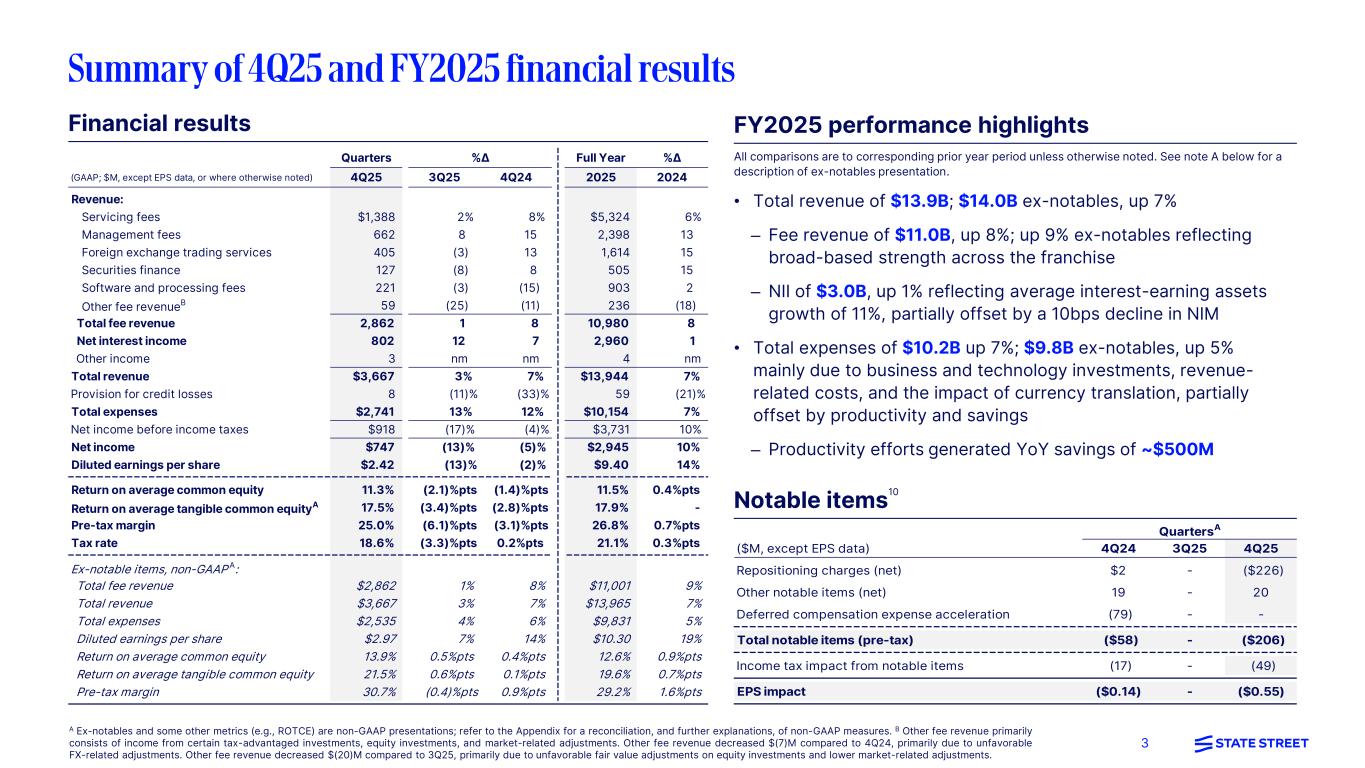

3 ($M, except EPS data) 4Q24 3Q25 4Q25 Repositioning charges (net) $2 - ($226) Other notable items (net) 19 - 20 Deferred compensation expense acceleration (79) - - Total notable items (pre-tax) ($58) - ($206) Income tax impact from notable items (17) - (49) EPS impact ($0.14) - ($0.55) QuartersA Summary of 4Q25 and FY2025 financial results • Total revenue of $13.9B; $14.0B ex-notables, up 7% – Fee revenue of $11.0B, up 8%; up 9% ex-notables reflecting broad-based strength across the franchise – NII of $3.0B, up 1% reflecting average interest-earning assets growth of 11%, partially offset by a 10bps decline in NIM • Total expenses of $10.2B up 7%; $9.8B ex-notables, up 5% mainly due to business and technology investments, revenue- related costs, and the impact of currency translation, partially offset by productivity and savings – Productivity efforts generated YoY savings of ~$500M All comparisons are to corresponding prior year period unless otherwise noted. See note A below for a description of ex-notables presentation. Financial results FY2025 performance highlights A Ex-notables and some other metrics (e.g., ROTCE) are non-GAAP presentations; refer to the Appendix for a reconciliation, and further explanations, of non-GAAP measures. B Other fee revenue primarily consists of income from certain tax-advantaged investments, equity investments, and market-related adjustments. Other fee revenue decreased $(7)M compared to 4Q24, primarily due to unfavorable FX-related adjustments. Other fee revenue decreased $(20)M compared to 3Q25, primarily due to unfavorable fair value adjustments on equity investments and lower market-related adjustments. Notable items10 Full Year %∆ (GAAP; $M, except EPS data, or where otherwise noted) 4Q25 3Q25 4Q24 2025 2024 Revenue: Servicing fees $1,388 2% 8% $5,324 6% Management fees 662 8 15 2,398 13 Foreign exchange trading services 405 (3) 13 1,614 15 Securities finance 127 (8) 8 505 15 Software and processing fees 221 (3) (15) 903 2 Other fee revenueB 59 (25) (11) 236 (18) Total fee revenue 2,862 1 8 10,980 8 Net interest income 802 12 7 2,960 1 Other income 3 nm nm 4 nm Total revenue $3,667 3% 7% $13,944 7% Provision for credit losses 8 (11)% (33)% 59 (21)% Total expenses $2,741 13% 12% $10,154 7% Net income before income taxes $918 (17)% (4)% $3,731 10% Net income $747 (13)% (5)% $2,945 10% Diluted earnings per share $2.42 (13)% (2)% $9.40 14% Return on average common equity 11.3% (2.1)%pts (1.4)%pts 11.5% 0.4%pts Return on average tangible common equityA 17.5% (3.4)%pts (2.8)%pts 17.9% - Pre-tax margin 25.0% (6.1)%pts (3.1)%pts 26.8% 0.7%pts Tax rate 18.6% (3.3)%pts 0.2%pts 21.1% 0.3%pts Ex-notable items, non-GAAP A: Total fee revenue $2,862 1% 8% $11,001 9% Total revenue $3,667 3% 7% $13,965 7% Total expenses $2,535 4% 6% $9,831 5% Diluted earnings per share $2.97 7% 14% $10.30 19% Return on average common equity 13.9% 0.5%pts 0.4%pts 12.6% 0.9%pts Return on average tangible common equity 21.5% 0.6%pts 0.1%pts 19.6% 0.7%pts Pre-tax margin 30.7% (0.4)%pts 0.9%pts 29.2% 1.6%pts Quarters %∆

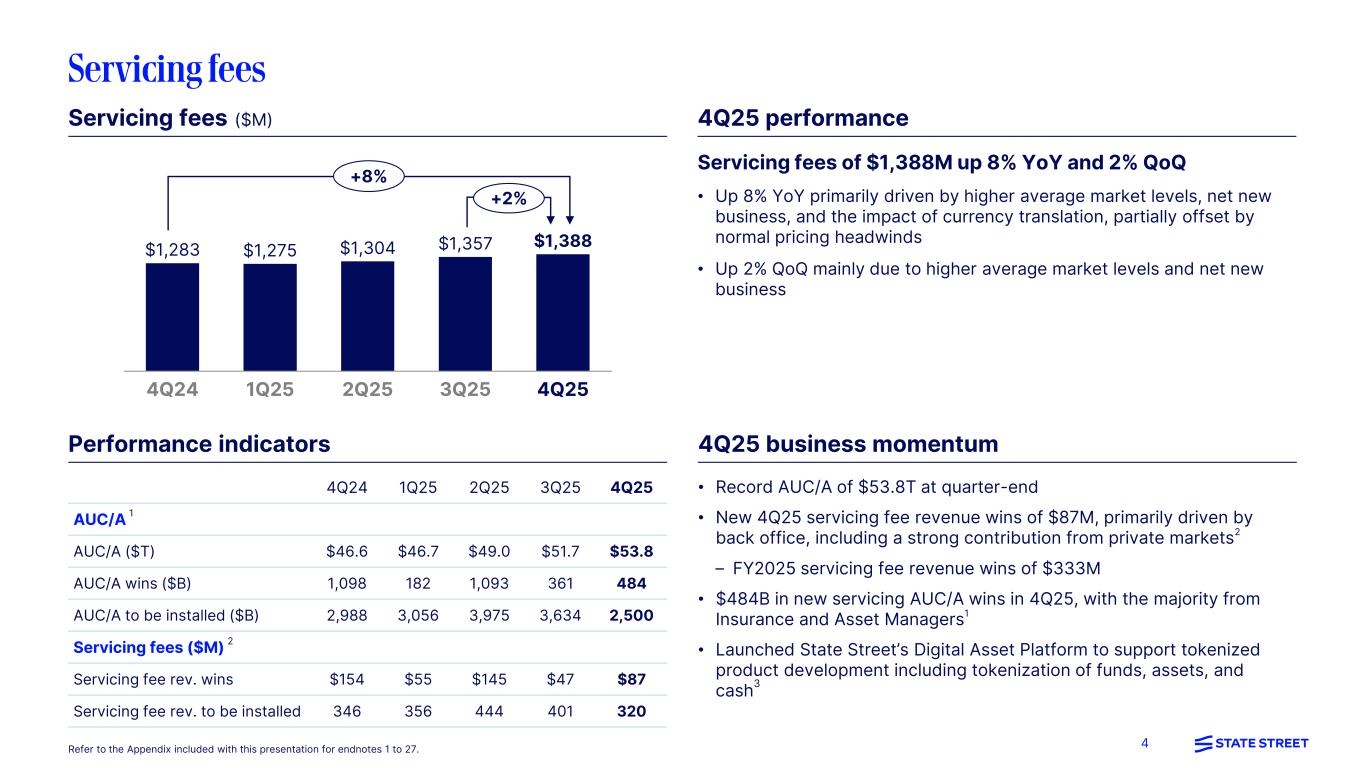

4 Servicing fees Refer to the Appendix included with this presentation for endnotes 1 to 27. 4Q24 1Q25 2Q25 3Q25 4Q25 $1,283 $1,275 $1,304 $1,357 $1,388 +8% +2% 4Q24 1Q25 2Q25 3Q25 4Q25 AUC/A 1 AUC/A ($T) $46.6 $46.7 $49.0 $51.7 $53.8 AUC/A wins ($B) 1,098 182 1,093 361 484 AUC/A to be installed ($B) 2,988 3,056 3,975 3,634 2,500 Servicing fees ($M) 2 Servicing fee rev. wins $154 $55 $145 $47 $87 Servicing fee rev. to be installed 346 356 444 401 320 Servicing fees of $1,388M up 8% YoY and 2% QoQ • Up 8% YoY primarily driven by higher average market levels, net new business, and the impact of currency translation, partially offset by normal pricing headwinds • Up 2% QoQ mainly due to higher average market levels and net new business • Record AUC/A of $53.8T at quarter-end • New 4Q25 servicing fee revenue wins of $87M, primarily driven by back office, including a strong contribution from private markets2 – FY2025 servicing fee revenue wins of $333M • $484B in new servicing AUC/A wins in 4Q25, with the majority from Insurance and Asset Managers1 • Launched State Street’s Digital Asset Platform to support tokenized product development including tokenization of funds, assets, and cash3 Performance indicators 4Q25 business momentum 4Q25 performanceServicing fees ($M)

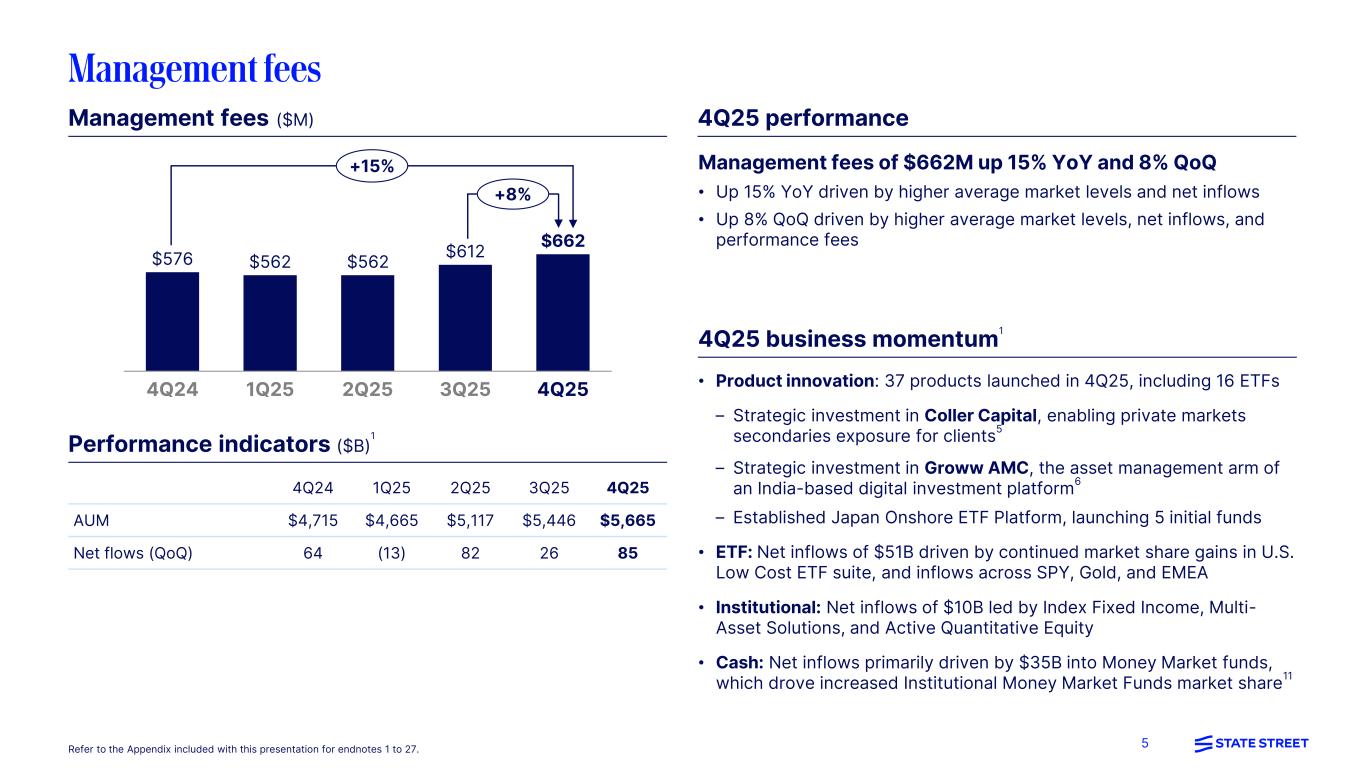

5 Management fees Management fees of $662M up 15% YoY and 8% QoQ • Up 15% YoY driven by higher average market levels and net inflows • Up 8% QoQ driven by higher average market levels, net inflows, and performance fees 4Q24 1Q25 2Q25 4Q25 $576 $562 $562 $662 3Q25 $612 Refer to the Appendix included with this presentation for endnotes 1 to 27. +8% +15% 4Q24 1Q25 2Q25 3Q25 4Q25 AUM $4,715 $4,665 $5,117 $5,446 $5,665 Net flows (QoQ) 64 (13) 82 26 85 • Product innovation: 37 products launched in 4Q25, including 16 ETFs – Strategic investment in Coller Capital, enabling private markets secondaries exposure for clients5 – Strategic investment in Groww AMC, the asset management arm of an India-based digital investment platform6 – Established Japan Onshore ETF Platform, launching 5 initial funds • ETF: Net inflows of $51B driven by continued market share gains in U.S. Low Cost ETF suite, and inflows across SPY, Gold, and EMEA • Institutional: Net inflows of $10B led by Index Fixed Income, Multi- Asset Solutions, and Active Quantitative Equity • Cash: Net inflows primarily driven by $35B into Money Market funds, which drove increased Institutional Money Market Funds market share11 Management fees ($M) 4Q25 performance Performance indicators ($B) 1 4Q25 business momentum1

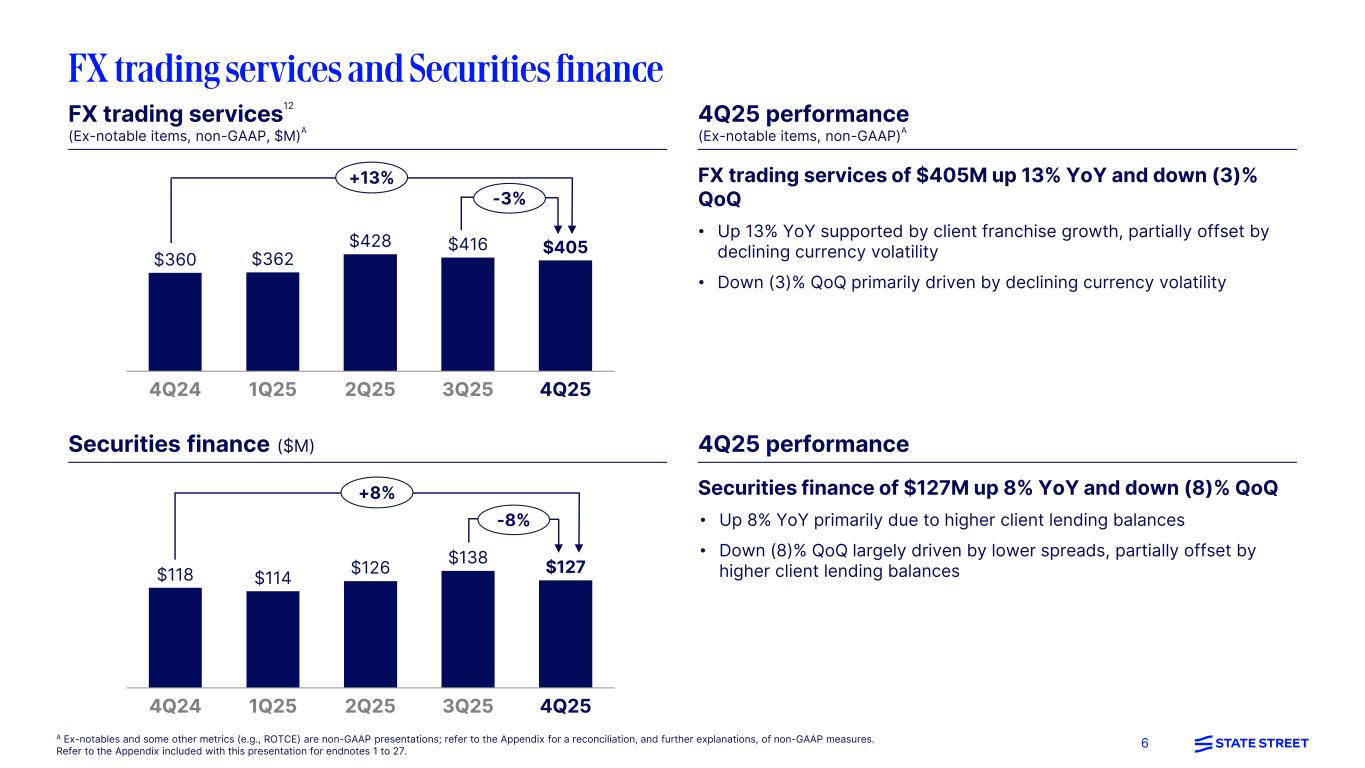

6 FX trading services and Securities finance 4Q24 1Q25 2Q25 4Q25 $360 $362 $428 $405 3Q25 $416 FX trading services of $405M up 13% YoY and down (3)% QoQ • Up 13% YoY supported by client franchise growth, partially offset by declining currency volatility • Down (3)% QoQ primarily driven by declining currency volatility A Ex-notables and some other metrics (e.g., ROTCE) are non-GAAP presentations; refer to the Appendix for a reconciliation, and further explanations, of non-GAAP measures. Refer to the Appendix included with this presentation for endnotes 1 to 27. +13% -3% 4Q24 1Q25 2Q25 4Q25 $118 $114 $126 $127 3Q25 $138 Securities finance of $127M up 8% YoY and down (8)% QoQ • Up 8% YoY primarily due to higher client lending balances • Down (8)% QoQ largely driven by lower spreads, partially offset by higher client lending balances FX trading services12 (Ex-notable items, non-GAAP, $M)A Securities finance ($M) 4Q25 performance (Ex-notable items, non-GAAP)A +8% -8% 4Q25 performance

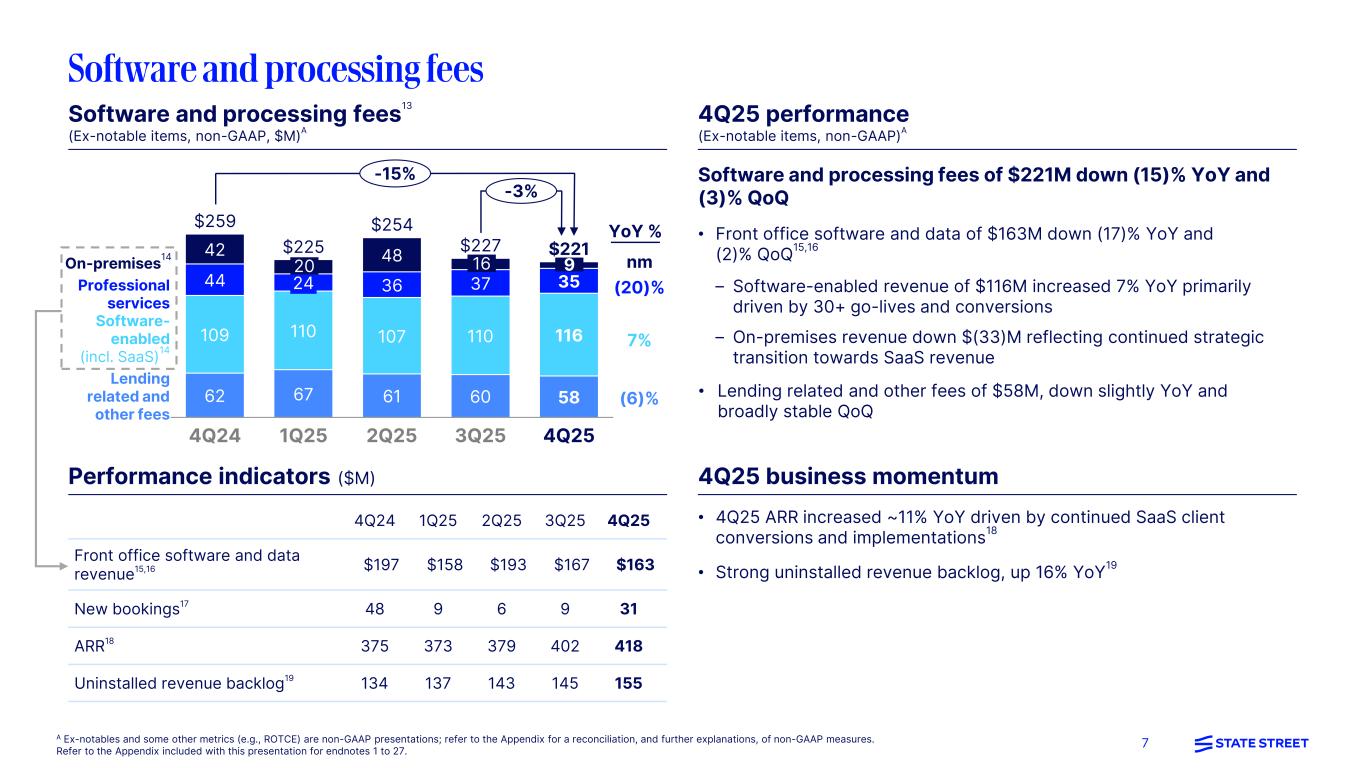

7 4Q24 1Q25 2Q25 3Q25 4Q25 Front office software and data revenue15,16 $197 $158 $193 $167 $163 New bookings17 48 9 6 9 31 ARR18 375 373 379 402 418 Uninstalled revenue backlog19 134 137 143 145 155 Software and processing fees • 4Q25 ARR increased ~11% YoY driven by continued SaaS client conversions and implementations18 • Strong uninstalled revenue backlog, up 16% YoY19 Professional services Software- enabled (incl. SaaS)14 On-premises14 -15% Lending related and other fees 62 67 61 60 58 109 110 107 110 116 44 36 37 35 42 48 4Q24 24 1Q25 2Q25 4Q25 $259 $225 $254 3Q25 $227 $221 nm (20)% YoY % 7% (6)% Software and processing fees of $221M down (15)% YoY and (3)% QoQ • Front office software and data of $163M down (17)% YoY and (2)% QoQ15,16 – Software-enabled revenue of $116M increased 7% YoY primarily driven by 30+ go-lives and conversions – On-premises revenue down $(33)M reflecting continued strategic transition towards SaaS revenue • Lending related and other fees of $58M, down slightly YoY and broadly stable QoQ 920 16 Software and processing fees13 (Ex-notable items, non-GAAP, $M)A 4Q25 performance (Ex-notable items, non-GAAP)A Performance indicators ($M) 4Q25 business momentum A Ex-notables and some other metrics (e.g., ROTCE) are non-GAAP presentations; refer to the Appendix for a reconciliation, and further explanations, of non-GAAP measures. Refer to the Appendix included with this presentation for endnotes 1 to 27. -3%

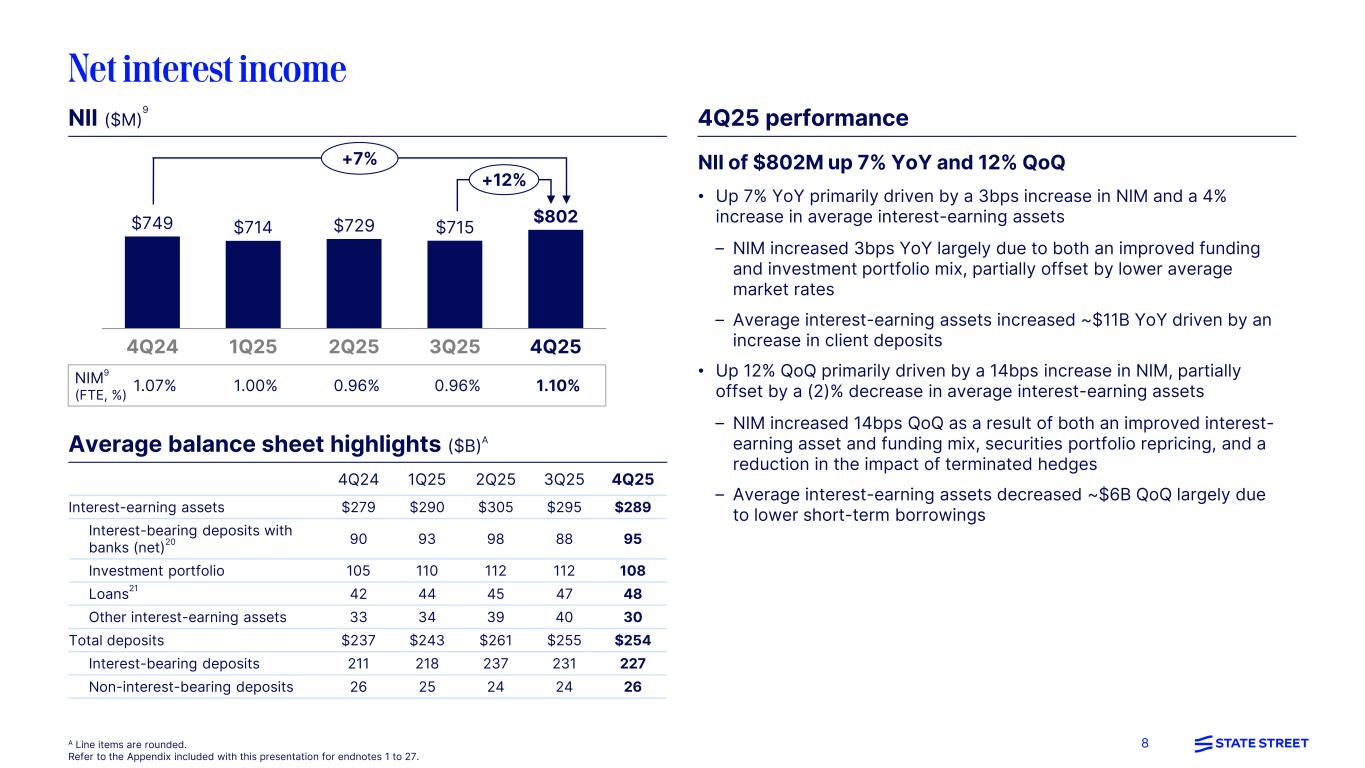

8 Net interest income A Line items are rounded. Refer to the Appendix included with this presentation for endnotes 1 to 27. NII of $802M up 7% YoY and 12% QoQ • Up 7% YoY primarily driven by a 3bps increase in NIM and a 4% increase in average interest-earning assets – NIM increased 3bps YoY largely due to both an improved funding and investment portfolio mix, partially offset by lower average market rates – Average interest-earning assets increased ~$11B YoY driven by an increase in client deposits • Up 12% QoQ primarily driven by a 14bps increase in NIM, partially offset by a (2)% decrease in average interest-earning assets – NIM increased 14bps QoQ as a result of both an improved interest- earning asset and funding mix, securities portfolio repricing, and a reduction in the impact of terminated hedges – Average interest-earning assets decreased ~$6B QoQ largely due to lower short-term borrowings 4Q24 1Q25 2Q25 3Q25 4Q25 Interest-earning assets $279 $290 $305 $295 $289 Interest-bearing deposits with banks (net)20 90 93 98 88 95 Investment portfolio 105 110 112 112 108 Loans21 42 44 45 47 48 Other interest-earning assets 33 34 39 40 30 Total deposits $237 $243 $261 $255 $254 Interest-bearing deposits 211 218 237 231 227 Non-interest-bearing deposits 26 25 24 24 26 NIM9 (FTE, %) 1.07% 1.00% 0.96% 0.96% 1.10% 4Q24 1Q25 2Q25 4Q25 $749 $714 $729 $802 3Q25 $715 +12% +7% NII ($M) 9 4Q25 performance Average balance sheet highlights ($B)A

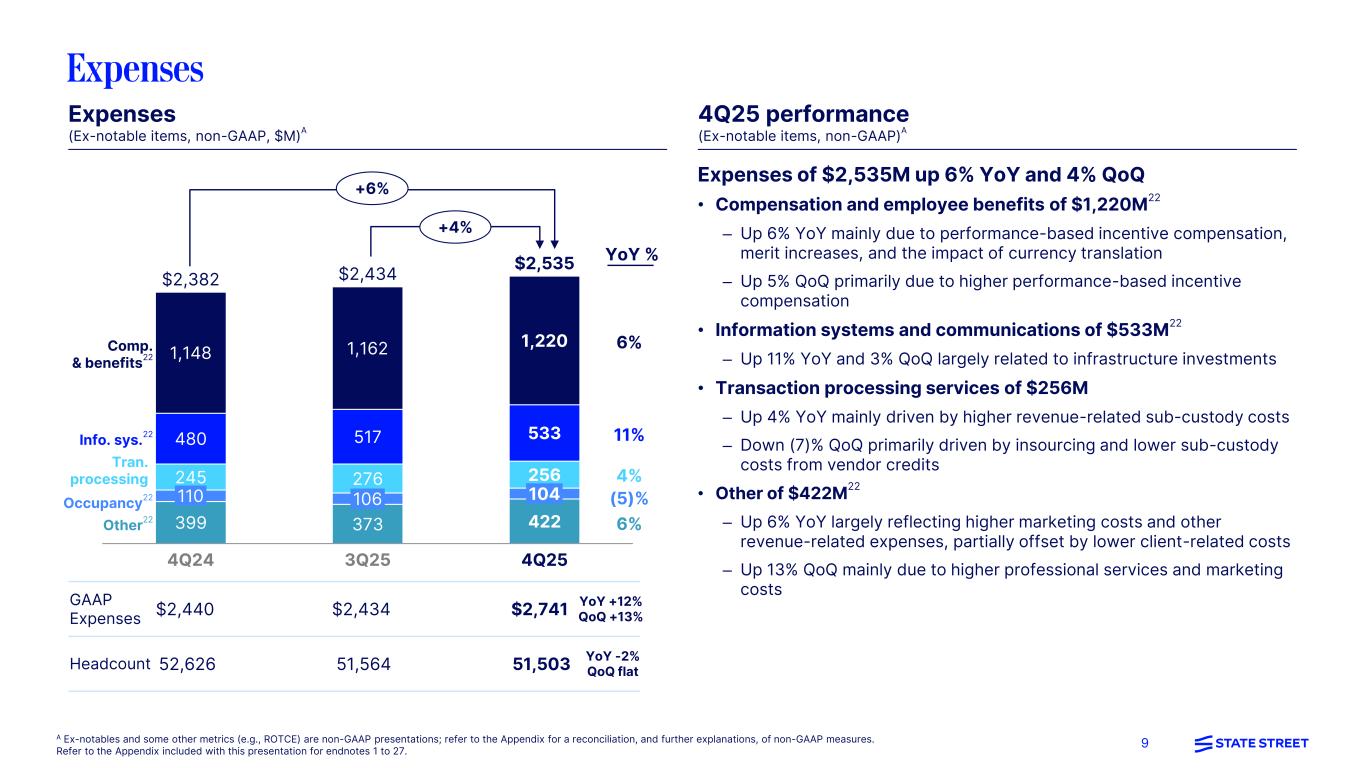

9 Expenses of $2,535M up 6% YoY and 4% QoQ • Compensation and employee benefits of $1,220M22 – Up 6% YoY mainly due to performance-based incentive compensation, merit increases, and the impact of currency translation – Up 5% QoQ primarily due to higher performance-based incentive compensation • Information systems and communications of $533M22 – Up 11% YoY and 3% QoQ largely related to infrastructure investments • Transaction processing services of $256M – Up 4% YoY mainly driven by higher revenue-related sub-custody costs – Down (7)% QoQ primarily driven by insourcing and lower sub-custody costs from vendor credits • Other of $422M22 – Up 6% YoY largely reflecting higher marketing costs and other revenue-related expenses, partially offset by lower client-related costs – Up 13% QoQ mainly due to higher professional services and marketing costs Expenses 399 373 422 245 276 256 480 517 533 1,148 1,162 1,220 110 4Q24 106 3Q25 104 4Q25 $2,382 $2,434 $2,535 Comp. & benefits22 Info. sys.22 Tran. processing Other22 Occupancy22 +6% +4% 6% 11% 4% YoY % (5)% 6% $2,440 $2,434 $2,741 52,626 51,564 51,503 GAAP Expenses Headcount YoY +12% QoQ +13% YoY -2% QoQ flat A Ex-notables and some other metrics (e.g., ROTCE) are non-GAAP presentations; refer to the Appendix for a reconciliation, and further explanations, of non-GAAP measures. Refer to the Appendix included with this presentation for endnotes 1 to 27. Expenses (Ex-notable items, non-GAAP, $M)A 4Q25 performance (Ex-notable items, non-GAAP)A

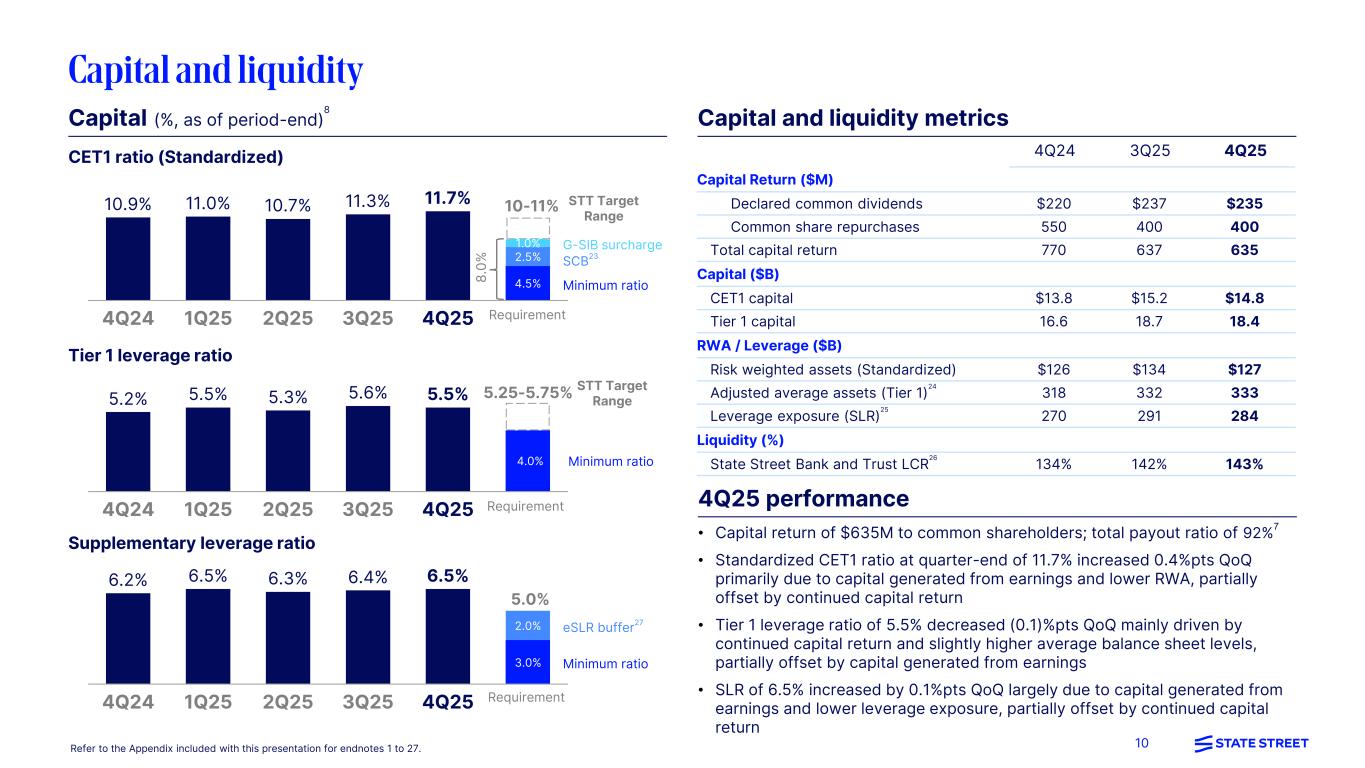

10 eSLR buffer27 • Capital return of $635M to common shareholders; total payout ratio of 92%7 • Standardized CET1 ratio at quarter-end of 11.7% increased 0.4%pts QoQ primarily due to capital generated from earnings and lower RWA, partially offset by continued capital return • Tier 1 leverage ratio of 5.5% decreased (0.1)%pts QoQ mainly driven by continued capital return and slightly higher average balance sheet levels, partially offset by capital generated from earnings • SLR of 6.5% increased by 0.1%pts QoQ largely due to capital generated from earnings and lower leverage exposure, partially offset by continued capital return 4Q24 3Q25 4Q25 Capital Return ($M) Declared common dividends $220 $237 $235 Common share repurchases 550 400 400 Total capital return 770 637 635 Capital ($B) CET1 capital $13.8 $15.2 $14.8 Tier 1 capital 16.6 18.7 18.4 RWA / Leverage ($B) Risk weighted assets (Standardized) $126 $134 $127 Adjusted average assets (Tier 1) 24 318 332 333 Leverage exposure (SLR) 25 270 291 284 Liquidity (%) State Street Bank and Trust LCR 26 134% 142% 143% Capital and liquidity Tier 1 leverage ratio 5.2% 5.5% 5.3% 5.6% 5.5% 4Q24 1Q25 2Q25 3Q25 4Q25 Minimum ratio4.0% STT Target Range5.25-5.75% Refer to the Appendix included with this presentation for endnotes 1 to 27. CET1 ratio (Standardized) 10.9% 11.0% 10.7% 11.3% 11.7% 4.5% 2.5% 4Q24 1Q25 2Q25 3Q25 4Q25 SCB23 Minimum ratio8 .0 % 10-11% G-SIB surcharge1.0% Supplementary leverage ratio Requirement Requirement Requirement 6.2% 6.5% 6.3% 6.4% 6.5% 3.0% 2.0% 4Q24 1Q25 2Q25 3Q25 4Q25 STT Target Range Minimum ratio 5.0% Capital (%, as of period-end) 8 Capital and liquidity metrics 4Q25 performance

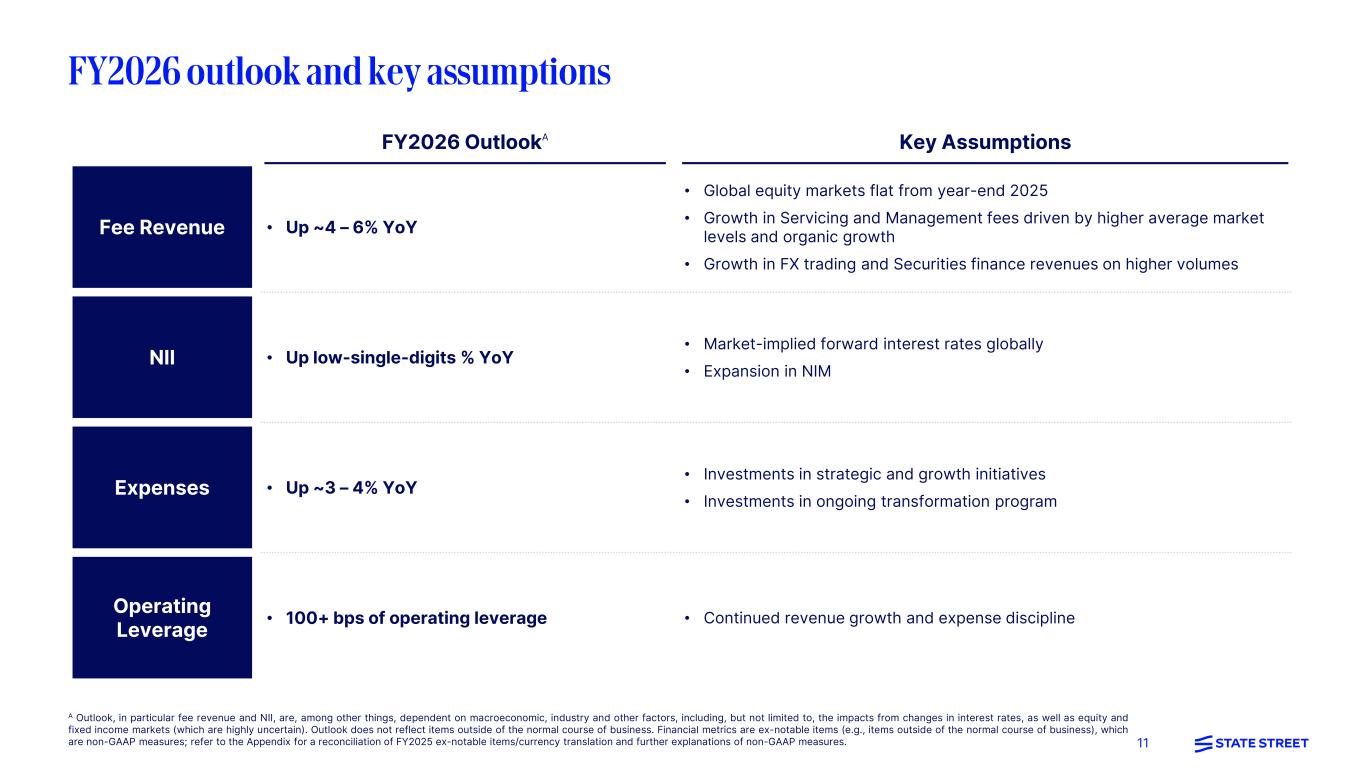

11 A Outlook, in particular fee revenue and NII, are, among other things, dependent on macroeconomic, industry and other factors, including, but not limited to, the impacts from changes in interest rates, as well as equity and fixed income markets (which are highly uncertain). Outlook does not reflect items outside of the normal course of business. Financial metrics are ex-notable items (e.g., items outside of the normal course of business), which are non-GAAP measures; refer to the Appendix for a reconciliation of FY2025 ex-notable items/currency translation and further explanations of non-GAAP measures. FY2026 outlook and key assumptions FY2026 OutlookA Key Assumptions Fee Revenue • Up ~4 – 6% YoY • Global equity markets flat from year-end 2025 • Growth in Servicing and Management fees driven by higher average market levels and organic growth • Growth in FX trading and Securities finance revenues on higher volumes NII • Up low-single-digits % YoY • Market-implied forward interest rates globally • Expansion in NIM Expenses • Up ~3 – 4% YoY • Investments in strategic and growth initiatives • Investments in ongoing transformation program Operating Leverage • 100+ bps of operating leverage • Continued revenue growth and expense discipline

12

13 Appendix Reconciliation of notable items 14 Reconciliation of constant currency impacts 15 Endnotes & other information 16 Forward-looking statements 18 Non-GAAP measures 19 Definitions 20

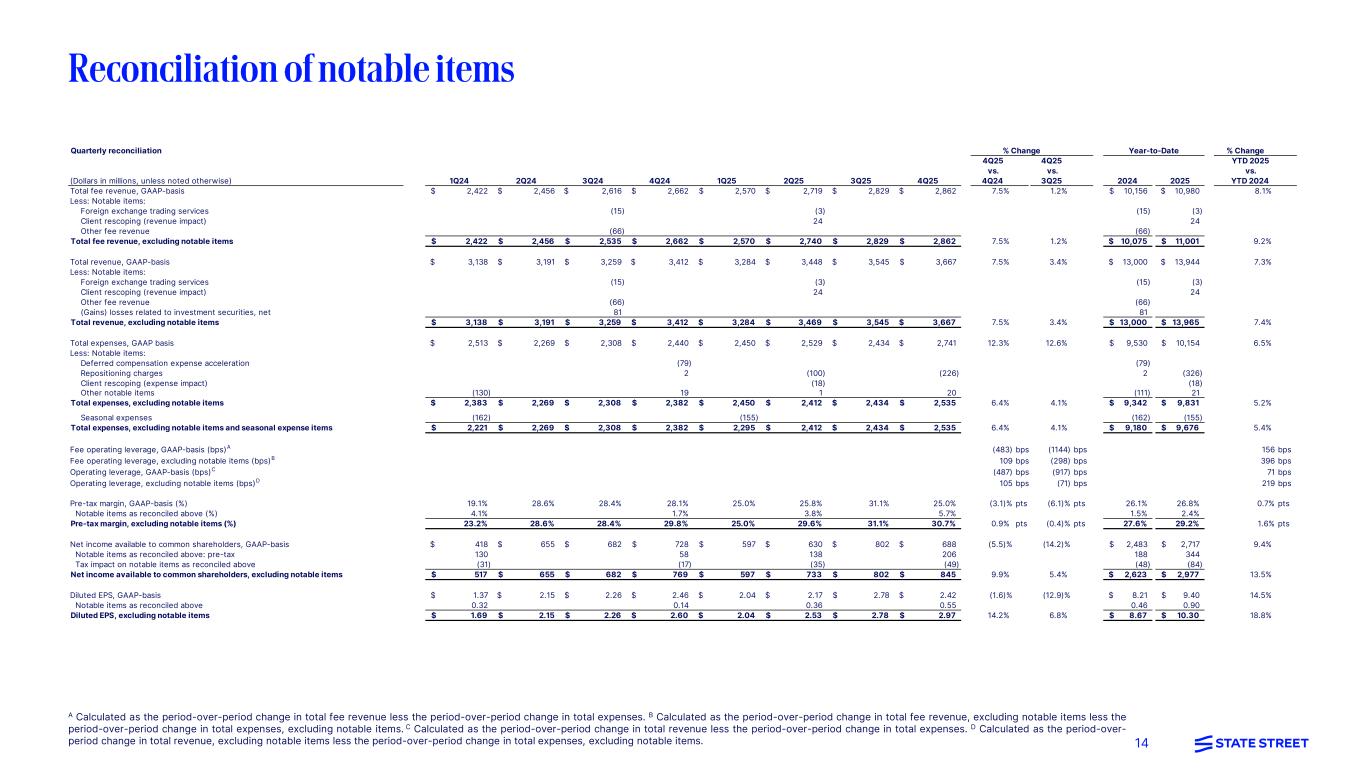

14 Reconciliation of notable items A Calculated as the period-over-period change in total fee revenue less the period-over-period change in total expenses. B Calculated as the period-over-period change in total fee revenue, excluding notable items less the period-over-period change in total expenses, excluding notable items. C Calculated as the period-over-period change in total revenue less the period-over-period change in total expenses. D Calculated as the period-over- period change in total revenue, excluding notable items less the period-over-period change in total expenses, excluding notable items. Quarterly reconciliation % Change (Dollars in millions, unless noted otherwise) 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 4Q25 vs. 4Q24 4Q25 vs. 3Q25 2024 2025 YTD 2025 vs. YTD 2024 Total fee revenue, GAAP-basis 2,422$ 2,456$ 2,616$ 2,662$ 2,570$ 2,719$ 2,829$ 2,862$ 7.5% 1.2% 10,156$ 10,980$ 8.1% Less: Notable items: Foreign exchange trading services (15) (3) (15) (3) Client rescoping (revenue impact) 24 24 Other fee revenue (66) (66) Total fee revenue, excluding notable items 2,422$ 2,456$ 2,535$ 2,662$ 2,570$ 2,740$ 2,829$ 2,862$ 7.5% 1.2% 10,075$ 11,001$ 9.2% Total revenue, GAAP-basis 3,138$ 3,191$ 3,259$ 3,412$ 3,284$ 3,448$ 3,545$ 3,667$ 7.5% 3.4% 13,000$ 13,944$ 7.3% Less: Notable items: Foreign exchange trading services (15) (3) (15) (3) Client rescoping (revenue impact) 24 24 Other fee revenue (66) (66) (Gains) losses related to investment securities, net 81 81 Total revenue, excluding notable items 3,138$ 3,191$ 3,259$ 3,412$ 3,284$ 3,469$ 3,545$ 3,667$ 7.5% 3.4% 13,000$ 13,965$ 7.4% Total expenses, GAAP basis 2,513$ 2,269$ 2,308$ 2,440$ 2,450$ 2,529$ 2,434$ 2,741$ 12.3% 12.6% 9,530$ 10,154$ 6.5% Less: Notable items: Deferred compensation expense acceleration (79) (79) Repositioning charges 2 (100) (226) 2 (326) Client rescoping (expense impact) (18) (18) Other notable items (130) 19 1 20 (111) 21 Total expenses, excluding notable items 2,383$ 2,269$ 2,308$ 2,382$ 2,450$ 2,412$ 2,434$ 2,535$ 6.4% 4.1% 9,342$ 9,831$ 5.2% Seasonal expenses (162) (155) (162) (155) Total expenses, excluding notable items and seasonal expense items 2,221$ 2,269$ 2,308$ 2,382$ 2,295$ 2,412$ 2,434$ 2,535$ 6.4% 4.1% 9,180$ 9,676$ 5.4% Fee operating leverage, GAAP-basis (bps)A (483) bps (1144) bps 156 bps Fee operating leverage, excluding notable items (bps)B 109 bps (298) bps 396 bps Operating leverage, GAAP-basis (bps)C (487) bps (917) bps 71 bps Operating leverage, excluding notable items (bps)D 105 bps (71) bps 219 bps Pre-tax margin, GAAP-basis (%) 19.1% 28.6% 28.4% 28.1% 25.0% 25.8% 31.1% 25.0% (3.1)% pts (6.1)% pts 26.1% 26.8% 0.7% pts Notable items as reconciled above (%) 4.1% 1.7% 3.8% 5.7% 1.5% 2.4% Pre-tax margin, excluding notable items (%) 23.2% 28.6% 28.4% 29.8% 25.0% 29.6% 31.1% 30.7% 0.9% pts (0.4)% pts 27.6% 29.2% 1.6% pts Net income available to common shareholders, GAAP-basis 418$ 655$ 682$ 728$ 597$ 630$ 802$ 688$ (5.5)% (14.2)% 2,483$ 2,717$ 9.4% Notable items as reconciled above: pre-tax 130 58 138 206 188 344 Tax impact on notable items as reconciled above (31) (17) (35) (49) (48) (84) Net income available to common shareholders, excluding notable items 517$ 655$ 682$ 769$ 597$ 733$ 802$ 845$ 9.9% 5.4% 2,623$ 2,977$ 13.5% Diluted EPS, GAAP-basis 1.37$ 2.15$ 2.26$ 2.46$ 2.04$ 2.17$ 2.78$ 2.42$ (1.6)% (12.9)% 8.21$ 9.40$ 14.5% Notable items as reconciled above 0.32 0.14 0.36 0.55 0.46 0.90 Diluted EPS, excluding notable items 1.69$ 2.15$ 2.26$ 2.60$ 2.04$ 2.53$ 2.78$ 2.97$ 14.2% 6.8% 8.67$ 10.30$ 18.8% % Change Year-to-Date

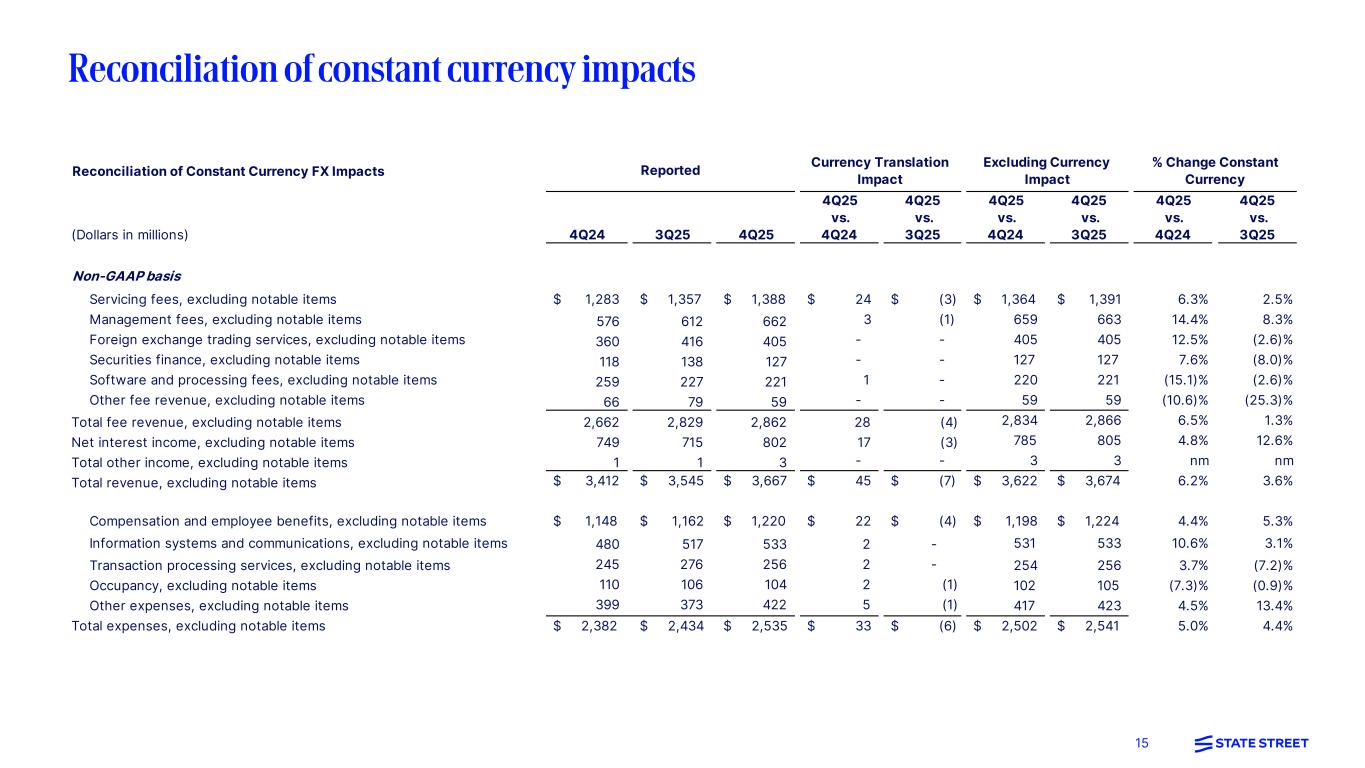

15 Reconciliation of constant currency impacts Reconciliation of Constant Currency FX Impacts (Dollars in millions) 4Q24 3Q25 4Q25 4Q25 vs. 4Q24 4Q25 vs. 3Q25 4Q25 vs. 4Q24 4Q25 vs. 3Q25 4Q25 vs. 4Q24 4Q25 vs. 3Q25 Non-GAAP basis Servicing fees, excluding notable items $ 1,283 $ 1,357 $ 1,388 $ 24 $ (3) $ 1,364 $ 1,391 6.3% 2.5% Management fees, excluding notable items 576 612 662 3 (1) 659 663 14.4% 8.3% Foreign exchange trading services, excluding notable items 360 416 405 - - 405 405 12.5% (2.6)% Securities finance, excluding notable items 118 138 127 - - 127 127 7.6% (8.0)% Software and processing fees, excluding notable items 259 227 221 1 - 220 221 (15.1)% (2.6)% Other fee revenue, excluding notable items 66 79 59 - - 59 59 (10.6)% (25.3)% Total fee revenue, excluding notable items 2,662 2,829 2,862 28 (4) 2,834 2,866 6.5% 1.3% Net interest income, excluding notable items 749 715 802 17 (3) 785 805 4.8% 12.6% Total other income, excluding notable items 1 1 3 - - 3 3 nm nm Total revenue, excluding notable items $ 3,412 $ 3,545 $ 3,667 $ 45 $ (7) $ 3,622 $ 3,674 6.2% 3.6% Compensation and employee benefits, excluding notable items $ 1,148 $ 1,162 $ 1,220 $ 22 $ (4) $ 1,198 $ 1,224 4.4% 5.3% Information systems and communications, excluding notable items 480 517 533 2 - 531 533 10.6% 3.1% Transaction processing services, excluding notable items 245 276 256 2 - 254 256 3.7% (7.2)% Occupancy, excluding notable items 110 106 104 2 (1) 102 105 (7.3)% (0.9)% Other expenses, excluding notable items 399 373 422 5 (1) 417 423 4.5% 13.4% Total expenses, excluding notable items $ 2,382 $ 2,434 $ 2,535 $ 33 $ (6) $ 2,502 $ 2,541 5.0% 4.4% Reported Currency Translation Impact Excluding Currency Impact % Change Constant Currency

16 Endnotes & other information This presentation (and the conference call accompanying it) includes certain highlights of, and also material supplemental to, State Street Corporation’s news release announcing its fourth quarter 2025 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by an Addendum with detailed financial tables. This presentation (and the conference call accompanying it) is designed to be reviewed together with that news release and that Addendum, which are available on State Street’s website, at http://investors.statestreet.com, and are incorporated herein by reference. No other information on our website is incorporated herein by reference. 1. New investment servicing mandates, including announced Alpha front-to-back investment servicing clients, may be subject to completion of definitive agreements, consents or assignments, approval of applicable boards and shareholders, customary regulatory approvals or other conditions, the failure to complete any of which will prevent the relevant mandate from being installed and serviced. New investment servicing mandates and servicing assets/fees remaining to be installed in future periods exclude new business which has been contracted, but for which the client has not yet provided permission to publicly disclose or anonymously disclose and is not yet installed. These excluded assets, which from time to time may be significant, will be included in new investment servicing mandates and reflected in servicing assets/fees remaining to be installed in the period in which the client provides its permission. Servicing mandates, servicing assets remaining to be installed in future periods and servicing fee revenues remaining to be installed in future periods are presented on a gross basis based on factors present on or about the time we determine the business to be won by us and are not updated based on subsequent developments, including changes in assets, market valuations, scope and, potentially termination. Such assets therefore also do not include the impact of clients who have notified us during the period of their intent to terminate or reduce their relationship with State Street, which from time to time may be significant. New business in assets to be serviced is reflected in our AUC/A after we begin servicing the assets, and new business in assets to be managed is reflected in our AUM after we begin managing the assets. As such, only a portion of any new investment servicing and investment management mandates may be reflected in our AUC/A and AUM as of any particular date specified. AUC/A values for certain asset classes are based on a lag, typically one- month. Generally, our servicing fee revenues are affected by several factors, and we provide varied services from our full suite of offerings to different clients. The basis for fees will also differ across regions and clients and can reflect pricing pressures traditionally experienced in our industry. Consequently, no assumption should be drawn as to future revenue run rate from announced servicing wins or new servicing business yet to be installed, as the amount of revenue associated with AUC/A can vary materially. Management fees also are generally affected by various factors, including investment product type and strategy and relationship pricing for clients, and are more sensitive to market valuations than are servicing fees. Therefore, no assumption should be drawn from management fees associated with changes in AUM levels. Levels of AUC/A, AUC/A to be installed, Servicing fee wins to be installed and AUM are always presented as of the end of the relevant period, unless otherwise specifically noted. 2. Servicing fee revenue wins/backlog (i.e., "to be installed") represents estimates of future annual revenue associated with new servicing engagements State Street determines to be won during the current reporting period, which may include anticipated servicing-related revenues associated with acquisitions or structured transactions, based upon factors assessed at the time the engagement is determined by State Street to be won, including asset volumes, number of transactions, accounts and holdings, terms and expected strategy. These and other relevant factors influencing projected servicing fees upon asset implementation/onboarding will change from time to time prior to, upon and following asset implementation/onboarding, among other reasons, due to varying market levels and factors and client and investor activity and preferences. Servicing fee/backlog estimates are not updated to reflect those changes, regardless of the magnitude or direction of, or reason for, any change. Servicing fee revenue wins in any period are highly variable and include estimated fees attributable to both (1) services to be provided for new estimated AUC/A reflected in new investment servicing wins for the period (with AUC/A to be onboarded in the future) and (2) additional services to be provided for AUC/A already included in our end- of period AUC/A (i.e., for which other services are currently provided); and the magnitude of one source of servicing fee revenue wins relative to the other (i.e., (1) relative to (2)) will vary from period to period. Therefore, for these and other reasons, comparisons of estimated servicing fee revenue wins to estimated new investment servicing AUC/A wins for any period will not produce reliable fee per AUC/A estimates. No servicing fees are recognized until the point in the future when we begin performing the associated services with respect to the relevant AUC/A. See also endnote 1 above in reference to considerations applicable to pending servicing engagements, which similarly apply to engagements for which reported servicing fee revenue wins/backlog are attributable. Both AUC/A and servicing fee revenue, when presented on a "backlog" or "to be installed" basis, are presented as of period-end. Separately, quarterly servicing fee revenue wins and AUC/A wins may not sum to full-year totals due to rounding. 3. State Street’s Digital Asset Platform was launched on January 15, 2026. 4. Strategic partnership with Apex Fintech Solutions, including a minority investment by State Street, announced on September 3, 2025. 5. Strategic partnership with Coller Capital, including a minority investment by State Street Investment Management, announced on December 18, 2025. 6. Strategic partnership with Groww Asset Management Limited, including a minority investment by State Street Investment Management, announced on January 14, 2026. 7. Total payout represents capital returned divided by net income available to common shareholders for the applicable period. FY2025 capital returned represents $909M of common stock dividends declared during FY2025 and $1,200M of common share repurchases made in FY2025. The total payout ratio was 78% in FY2025. 4Q25 capital returned represents $235M of common stock dividends declared during 4Q25 and $400M of common share repurchases made in 4Q25. The total payout ratio was 92% in 4Q25. 8. Unless otherwise noted, all capital ratios referenced on this slide and elsewhere in this presentation refer to State Street Corporation, or State Street, and not State Street Bank and Trust Company. All capital ratios are as of quarter-end. The lower of capital ratios calculated under the Basel III advanced approaches and under the Basel III standardized approach are applied in the assessment of our capital adequacy for regulatory purposes. Standardized approach ratios were binding for 4Q24 through 4Q25. Refer to the Addendum for descriptions of these ratios. 4Q25 capital ratios are presented as of quarter-end and are preliminary estimates. 9. NII is presented on a GAAP-basis. NIM is presented on a fully taxable-equivalent (FTE) basis, and is calculated by dividing FTE NII by average total interest-earning assets. Refer to the Addendum for reconciliations of NII FTE- basis to NII GAAP-basis on the Average Statement of Condition.

17 Endnotes & other information (cont.) 10. 4Q24 Repositioning charges (net) of $2M represents a $15M release reflected in Compensation and employee benefits partially offset by a $13M charge reflected in Occupancy. 4Q25 Repositioning charges (net) of $(226)M represents $111M reflected in Compensation and employee benefits primarily from workforce rationalization, $69M reflected in Occupancy costs associated with real estate footprint optimization, and Operating model changes of $24M and $22M reflected in Information Systems and Communications and Other expenses, respectively. 4Q24 Other notable items (net) of $19M reflected in Other expenses associated with FDIC special assessment release of $31M, partially offset by a $12M charge associated with operating model changes. 4Q25 Other notable items (net) of $20M reflected in Other expenses associated with FDIC special assessment release of $60M, partially offset by $40M in Legal and related costs. 4Q24 Deferred compensation expense acceleration of $79M related to prior period incentive compensation awards to align State Street's deferred pay mix with peers. The acceleration allowed for an increase in the immediate versus the deferred portion of the incentive compensation in future periods. 11. Quartile performance data provided by iMoneyNet. Market share based on Global Institutional Money Market Funds and sourced from Money Fund Analyzer, a service provided by iMoneyNet as of the end of December 2025. 12. GAAP FX trading services of $431M in 2Q25 included a notable item related to a revenue-related recovery of $3M associated with the proceeds from a 2018 FX benchmark litigation resolution. Excluding this notable item, 2Q25 adjusted FX trading services was $428M. 13. GAAP Software and processing fees of $230M in 2Q25 included a notable item related to an Alpha-related client rescoping of $24M. Excluding this notable item, 2Q25 adjusted Software and processing fees was $254M. 14. On-premises revenue is revenue derived from locally installed software. Software-enabled revenue includes SaaS, maintenance and support revenue, FIX, brokerage, and value-add services. The revenue recognition pattern for On-premises installations differs from software-enabled revenue. 15. Front office software and data revenue primarily includes revenue from CRD, Alpha Data Platform and Alpha Data Services. Includes Other revenue of $3-4M in each of 4Q24 through 4Q25. Revenue line items may not sum to total due to rounding. 16. GAAP Front office software and data of $169M in 2Q25 included a notable item related to an Alpha-related client rescoping of $24M. Excluding this notable item, 2Q25 adjusted Front office software and data was $193M. 17. Front office bookings represent signed ARR contract values for CRD, CRD for Private Markets, Alpha Data Platform, and Alpha Data Services excluding bookings with affiliates, including State Street Investment Management. Front office revenue derived from affiliate agreements is eliminated in consolidation for financial reporting purposes. 18. Front office software and data annual recurring revenue (ARR), an operating metric, is calculated by annualizing current quarter revenue for CRD and CRD for Private Markets and includes the annualized amount of most software-enabled revenue, including revenue generated from SaaS, maintenance and support revenue, FIX, and value-added services, which are all expected to be recognized ratably over the term of client contracts. Front office software and data ARR does not include software-enabled brokerage revenue, revenue from affiliates and licensing fees (excluding the portion allocated to maintenance and support) from On-premises software. 19. Represents expected ARR from signed client contracts that are scheduled to be largely installed over the next 24 months for CRD, CRD for Private Markets and Alpha Data Services. It includes SaaS revenue, as well as maintenance and support revenue, and excludes the one-time impact of On-premises license revenue, revenue generated from FIX, brokerage, value-add services, and professional services as well as revenue from affiliates. 20. These deposits primarily reflect our maintenance of cash balances at the Federal Reserve, the ECB and other non-U.S. central banks. 21. Average loans are presented on a gross basis. Refer to the Addendum for average loans net of expected credit losses. 22. GAAP Compensation and employee benefits expenses of $1,331M in 4Q25 included a notable item related to a repositioning charge of $111M. GAAP Compensation and employee benefits expenses of $1,212M in 4Q24 included notable items related to a $79M acceleration of deferred compensation charges and a $15M repositioning release. Excluding theses notable items, adjusted 4Q25 Compensation and employee benefits of $1,220M increased 6% compared to adjusted 4Q24 Compensation and employee benefits of $1,148M. GAAP Information systems and communications expenses of $557M in 4Q25 included a notable item related to operating model changes of $24M. Excluding this notable item, adjusted 4Q25 Information systems and communications expenses of $533M increased 11% compared to GAAP 4Q24 Information systems and communications expenses of $480M. GAAP Occupancy expenses of $173M in 4Q25 included a notable item related to a repositioning charge of $69M. GAAP Occupancy expenses of $123M in 4Q24 included a notable item related to a charge of $13M. Excluding these notable items, adjusted 4Q25 Occupancy expenses of $104M decreased 5% compared to adjusted 4Q24 Occupancy expenses of $110M. GAAP Other expenses of $424M in 4Q25 included notable items related to an FDIC special assessment release of $60M, legal and related costs of $40M, and a charge related to operating model changes of $22M. GAAP Other expenses of $380M in 4Q24 included notable items related to an FDIC special assessment release of $31M and operating model changes of $12M. Excluding these notable items, adjusted 4Q25 Other expenses of $422M increased 6% compared to adjusted 4Q24 Other expenses of $399M. 23. The SCB of 2.5% effective on October 1, 2025 is calculated based upon the results of the 2025 Federal Reserve supervisory stress test. 24. Adjusted average assets (Tier 1) is equal to average consolidated assets less applicable Tier 1 leverage capital reductions under regulatory standards. 25. The Tier 1 leverage ratio differs from the SLR primarily in that the denominator of the Tier 1 leverage ratio is a quarterly average of on-balance sheet assets, while the SLR additionally includes off-balance sheet exposures. In addition, STT’s SLR includes regulatory deductions. Refer to the Addendum for additional information on regulatory capital. 26. State Street Corporation LCR in 4Q25 was flat QoQ at ~106%; State Street Bank and Trust's (SSBT) LCR is significantly higher than State Street Corporation's (SSC) LCR, primarily due to application of the transferability restriction in the U.S. LCR Final Rule to the calculation of SSC’s LCR. This restriction limits the amount of HQLA held at SSC’s principal banking subsidiary, SSBT, and available for the calculation of SSC’s LCR to the amount of net cash outflows of SSBT. This transferability restriction does not apply in the calculation of SSBT’s LCR, and therefore SSBT’s LCR reflects the full benefit of all of its HQLA holdings. 27. As a U.S. G-SIB, State Street must maintain a 2% SLR buffer at the holding company and a 3% buffer at State Street Bank in order to avoid any limitations on distributions to shareholders and discretionary bonus payments to certain executives.

18 Forward-looking statements This Presentation contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our strategy, growth and sales prospects, capital management, business, financial and capital condition, results of operations, the financial and market outlook and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as "estimate," "will," "opportunity," "strategy," "future," "driver," “outlook,” “priority,” “expect,” “intend,” “aim,” “outcome,” “future,” “pipeline,” “trajectory,” “target," “guidance,” “objective,” “plan,” “forecast,” “believe,” “anticipate,” “seek,” “may,” “trend,” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this Presentation is first issued. We are subject to intense competition, which could negatively affect our profitability; We are subject to significant pricing pressure and variability in our financial results and our AUC/A and AUM; We could be adversely affected by political, geopolitical, economic and market conditions including, for example, as a result of liquidity or capital deficiencies (actual or perceived) by other financial institutions and related market and government actions, changes in U.S. trade or other policies or those policies of other nations, the ongoing conflicts in Ukraine and in the Middle East, major political shifts domestically or internationally, (including the potential for retaliatory actions by governments, market participants or clients based on diverging perspectives or otherwise), actions taken by central banks in an attempt to address prevailing economic conditions, changes in monetary policy or periods of significant volatility in the markets for equity, fixed income and other asset classes globally or within specific markets; Our development and completion of new products and services, including State Street Alpha® and those related to wealth servicing, alternative investment management or digital assets or incorporating artificial intelligence, may impose costs on us, involve dependencies on third parties and may expose us to increased risks; Our business may be negatively affected by risks associated with strategic initiatives we are undertaking to enhance the effectiveness, including the adoption or integration of new technologies such as artificial intelligence, and efficiency of our operations and of our cybersecurity and technology infrastructure or by our failure to meet the related, resiliency or other expectations of our clients and regulators, or as a result of a cyber-attack or similar vulnerability in our or business partners' infrastructure; Our risk management framework, models and processes may not be effective in identifying or mitigating risk and reducing the potential for related losses, and a failure or circumvention of our controls and procedures, or errors or delays in our operational and transaction processing, or those of third parties, could have an adverse effect on our business, financial condition, operating results and reputation; Acquisitions, strategic alliances, joint ventures and divestitures, and the integration, retention and development of the benefits of these transactions, pose risks for our business; Competition for qualified members of our workforce is intense, and we may not be able to attract and retain the highly skilled people we need to support our business; Our investment securities portfolio, consolidated financial condition and consolidated results of operations could be adversely affected by changes in the financial markets, governmental action or monetary policy. For example, among other risks, changes in prevailing interest rates or market conditions have led, and were they to persist or occur in the future could further lead, to decreases in our NII or to portfolio management decisions resulting in reductions in our capital or liquidity ratios; Our business activities expose us to interest rate risk; We assume significant credit risk of counterparties, who may also have substantial financial dependencies on other financial institutions, and these credit exposures and concentrations could expose us to financial loss; Our fee revenue represents a significant portion of our revenue and is subject to and may decline based on, among other factors, market and currency declines, investment activities and preferences of our clients and their business mix, as well as the timing of new business onboarding; If we are unable to effectively manage our capital and liquidity, our financial condition, capital ratios, results of operations and business prospects could be adversely affected; We may need to raise additional capital or debt in the future, which may not be available to us or may only be available on unfavorable terms; If we experience a downgrade in our credit ratings, or an actual or perceived reduction in our financial strength, our borrowing and capital costs, liquidity and reputation could be adversely affected; Our business and capital-related activities, including common share repurchases, may be adversely affected by regulatory requirements and considerations, including capital, credit and liquidity; We face extensive and changing government regulation and supervision in the U.S. and non-U.S. jurisdictions in which we operate, which may increase our costs and compliance risks and may affect our business activities and strategies; Our businesses may be adversely affected by government enforcement and litigation; Our businesses may be adversely affected by increased and conflicting political, regulatory and client scrutiny of investment management, stewardship and sustainable investment strategies and services offered; Any misappropriation of the confidential information we possess could have an adverse impact on our business and could subject us to regulatory actions, litigation and other adverse effects; Our calculations of risk exposures, total RWA and capital ratios depend on data inputs, formulae, models, correlations and assumptions that are subject to change, which could materially impact our risk exposures, our total RWA and our capital ratios from period to period; Changes in accounting standards may adversely affect our consolidated results of operations and financial condition; Changes in tax laws, rules or regulations, challenges to our tax positions and changes in the composition of our pre-tax earnings may increase our effective tax rate; We could face liabilities for withholding and other non-income taxes, including in connection with our services to clients, as a result of tax authority examinations; Our businesses may be negatively affected by adverse publicity or other reputational harm; Shifting and maintaining operational activities to non-U.S. jurisdictions, changing our operating model, and outsourcing to, or insourcing from, third parties expose us to increased operational risk, geopolitical risk and reputational harm and may not result in expected cost savings or operational improvements; Attacks or unauthorized access to our or our business partners’ or clients’ information technology systems or facilities, such as cyber-attacks or other disruptions to our or their operations, could result in significant costs, reputational damage and impacts on our business activities; Long-term contracts and customizing service delivery for clients expose us to increased operational risk, pricing and performance risk; We may not be able to protect our intellectual property or may infringe upon the rights of third parties; The quantitative models we use to manage our business may contain errors that could adversely impact our business, financial condition, operating results and regulatory compliance, and lapses in disclosure controls and procedures or internal control over financial reporting could occur, any of which could result in material harm; Our reputation and business prospects may be damaged if investors in the collective investment pools we sponsor or manage incur substantial losses in these investment pools or are restricted in redeeming their interests in these investment pools; The impacts of global regulatory requirements and expectations, shifting client preferences, and disclosure requirements related to climate risks and sustainability standards could adversely affect us; and We may incur losses or face negative impacts on our business as a result of unforeseen events, including terrorist attacks, geopolitical events, acute or chronic physical risk events, including natural disasters, pandemics, global conflicts, or a banking crisis, which may have a negative impact on our business and operations. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2024 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this Presentation should not be relied on as representing our expectations or beliefs as of any time subsequent to the time this Presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time.

19 Non-GAAP measures In addition to presenting State Street's financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents certain financial information on a basis that excludes or adjusts one or more items from GAAP. This latter basis is a non-GAAP presentation. In general, our non-GAAP financial results adjust selected GAAP-basis financial results to exclude the impact of revenue and expenses outside of State Street’s normal course of business or other notable items, such as acquisition and restructuring charges, repositioning charges, gains/losses on sales, as well as, for selected comparisons, seasonal items. For example, we sometimes present expenses on a basis we may refer to as “expenses ex-notable items", which exclude notable items and, to provide additional perspective on both prior year quarter and sequential quarter comparisons, may also exclude seasonal items. Management believes that this presentation of financial information facilitates an investor's further understanding and analysis of State Street's financial performance and trends with respect to State Street’s business operations from period-to-period, including providing additional insight into our underlying margin and profitability. In addition, Management may also provide additional non-GAAP measures. For example, we may sometimes present ratios, such as return on tangible common equity, based on an adjusted common shareholder equity metric, "tangible common equity", which reflects a reduction (net of deferred taxes) for goodwill and other intangible assets, as we believe this presentation provides additional context about our use of equity. As an additional example, we may present revenue and expense measures on a constant currency basis to identify the significance of changes in foreign currency exchange rates (which often are variable) in period-to-period comparisons. This presentation represents the effects of applying prior period weighted average foreign currency exchange rates to current period results. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. Refer to the “Reconciliation of notable items” in this Appendix and to the Addendum for reconciliations of our non-GAAP financial information. To access the Addendum go to http://investors.statestreet.com and click on “Filings & Reports – Quarterly Results”.

20 Definitions ARR Annual recurring revenue AUC/A Assets under custody and/or administration AUM Assets under management CET1 ratio Common equity tier 1 ratio CRD Charles River Development Diluted earnings per share (EPS) Net income available to common shareholders divided by diluted average common shares outstanding for the noted period EMEA Europe, Middle East and Africa EPS Earnings per share ESG Environmental, Social, and Governance ETF Exchange-traded fund Fee operating leverage Rate of growth of total fee revenue less the rate of growth of total expenses, relative to the successive prior year period, as applicable FIX The Charles River Network's FIX Network Service (CRN) is an end-to-end trade execution and support service facilitating electronic trading between Charles River's asset management and broker clients Front office uninstalled revenue backlog Represents the annualized recurring revenue from signed client contracts that are scheduled to be fully installed over the next 24 months for CRD, Charles River for Private Markets and Alpha Data Services. It includes SaaS revenue as well as maintenance and support revenue and excludes the one-time impact of on-premises license revenue, revenue generated from FIX, brokerage, value-add services, and professional services as well as revenue from affiliates FTE Fully taxable-equivalent FX Foreign exchange FY Full-year GAAP Generally accepted accounting principles in the United States G-SIB Global systemically important bank HQLA High Quality Liquid Assets IM Investment Management IS Investment Services LCR Liquidity Coverage Ratio Lending related and other Lending related and other fees primarily consist of fee revenue associated with State Street’s fund finance, leveraged loans, municipal finance, insurance and stable value wrap businesses Net interest income (NII) Income earned on interest bearing assets less interest paid on interest bearing liabilities Net interest margin (NIM) (FTE) Fully taxable-equivalent (FTE) Net interest income divided by average total interest-earning assets nm Not meaningful NYSE New York Stock Exchange On-premises On-premises revenue as recognized in Front office software and data Operating leverage Rate of growth of total revenue less the rate of growth of total expenses, relative to the corresponding prior year period, as applicable %Pts Percentage points is the difference from one percentage value subtracted from another Payout ratio Total payout ratio is equal to common stock dividends and common stock purchases as a percentage of net income available to common shareholders Pre-tax margin Income before income tax expense divided by total revenue Quarter-over-Quarter (QoQ) Sequential quarter comparison Return on average equity (ROE) Net income available to common shareholders divided by average common equity Return on average tangible common equity (ROTCE) Net income available to common shareholders divided by average tangible common equity RWA Risk weighted assets SaaS Software as a service SCB Stress capital buffer SEC Securities Exchange Commission SSC State Street Corporation Year-over-Year (YoY) Current period compared to the same period a year ago