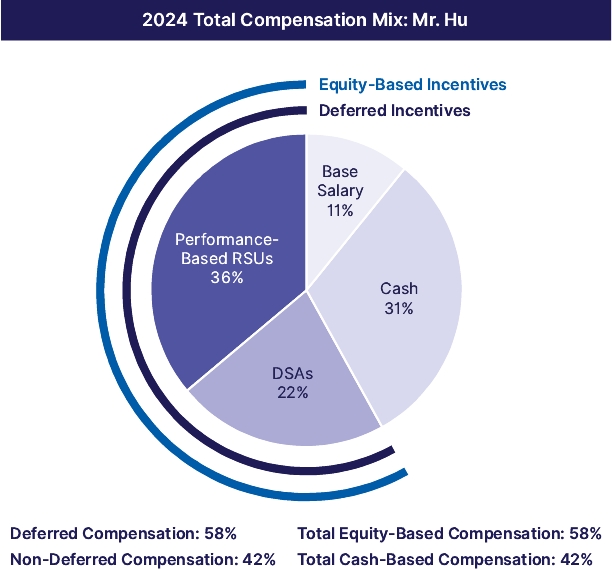

2025 Target Total Compensation Changes. The HRC approved market-based increases to Mr. O’Hanley’s and Mr. Hu’s 2025 target total compensation following a comprehensive review of compensation for their roles in our Compensation Peer Group and the broader market, and taking into consideration other factors, including time in role, internal equity and strong performance over time. The adjustments were each in the form of an increase to target incentive compensation. The HRC approved a target incentive compensation increase for Mr. O’Hanley from $14,800,000 to $16,300,000, resulting in a target total compensation for 2025 of $17,500,000. For Mr. Hu, the HRC approved an increase from $4,800,000 to $5,050,000, resulting in a target total compensation for 2025 of $5,750,000.

Other Elements of Compensation

Adjustment and Recourse Mechanisms

Incentive compensation awards to our NEOs are subject to adjustment and recourse mechanisms, including ex ante adjustment, forfeiture and clawback, which may be applied jointly, or separately, as appropriate.

Ex Ante Adjustment. Before incentive compensation awards are made for a given performance year, all awards for our NEOs, including deferred incentive compensation awards and immediate cash incentive compensation, are subject to downward adjustment, in whole or in part, upon the occurrence of specified events. The HRC, in its discretion, determines whether this ex ante adjustment is appropriate. The events for which ex ante adjustment may occur include:

•

if the executive’s actions exposed State Street to significant inappropriate risks, or

•

if the executive incurred significant or repeated compliance or risk-related violations of State Street’s policies

Forfeiture. Before vesting and delivery to the executive, all deferred incentive compensation awards to our NEOs allow reduction or cancellation of the award, in whole or in part, upon the occurrence of specified events. The HRC, in its discretion, determines whether forfeiture is appropriate. The events for which forfeiture may occur include:

•

if the executive’s actions exposed State Street to inappropriate risks, including in a supervisory capacity, that resulted or could reasonably be expected to result in material losses that are or would be substantial in relation to State Street’s or a relevant business unit’s revenue, capital and overall risk tolerance,

•

if the executive engaged in fraud, gross negligence or any misconduct, including in a supervisory capacity, that was materially detrimental to the interests or business reputation of State Street or any of its businesses,

•

if the executive engaged in conduct that constituted a violation of State Street policies and procedures or our Standard of Conduct in a manner which either caused or could have caused reputational harm that is material to State Street or either placed or could have placed State Street at material legal or financial risk, or

•

if, as a result of a material financial restatement contained in an SEC filing, or miscalculation or inaccuracy in the determination of performance metrics, financial results or other criteria used in determining the amount of the incentive compensation award, the executive would have received a smaller or no award

In addition, all outstanding deferred incentive compensation awards are forfeited if an executive’s employment is terminated by State Street for gross misconduct.

Clawback. All amounts delivered to our NEOs as incentive compensation awards, including deferred incentive compensation awards and immediate cash incentive compensation, are subject to clawback mechanisms providing for the repayment of those amounts, in whole or in part, upon the occurrence of specified events. The HRC, in its discretion, determines whether clawback is appropriate, making that determination within four years (in the case of performance-based RSUs) or three years (in the case of all other incentive compensation awards) of the award’s grant date. The events for which clawback may occur include:

•

if the executive engaged in fraud or willful misconduct, including in a supervisory capacity, that resulted in financial or reputational harm that is material to State Street and resulted in termination of the executive’s employment

•

if, as a result of the occurrence of a material financial restatement by State Street contained in a filing with the SEC or miscalculation or inaccuracy in financial results, performance metrics, or other criteria used in determining the amount of the incentive compensation award, the executive would have received a smaller or no award, or

•

if the executive failed to comply with the terms of any covenant not to compete entered into with State Street