Please wait

Q30000095552--12-31falsehttp://fasb.org/us-gaap/2025#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2025#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2025#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2025#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrent0000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2024-12-310000095552us-gaap:NondesignatedMemberus-gaap:DerivativeMember2025-07-012025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:CurrentAssetMemberus-gaap:InterestRateContractMember2025-09-300000095552us-gaap:RestrictedStockUnitsRSUMemberssup:MergerAgreementMemberus-gaap:SubsequentEventMember2025-12-080000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-06-300000095552ssup:SeniorSecuredTermLoanFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-12-150000095552us-gaap:AccumulatedTranslationAdjustmentMember2025-07-012025-09-300000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-12-310000095552country:MX2024-12-310000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-06-300000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-09-300000095552us-gaap:FairValueInputsLevel3Memberus-gaap:AccruedLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2025-09-300000095552ssup:TermLoanFacilityMember2025-09-300000095552us-gaap:RestrictedStockUnitsRSUMemberssup:LongTermCashIncentivePlanMember2025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:DerivativeMember2025-01-012025-09-300000095552country:PL2024-12-310000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-3100000955522023-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2024-12-3100000955522024-06-300000095552country:MX2025-09-300000095552us-gaap:SubsequentEventMember2025-12-080000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberssup:CurrentAssetMember2024-12-310000095552srt:EuropeMember2024-12-310000095552us-gaap:PerformanceSharesMember2025-01-012025-09-300000095552us-gaap:RetainedEarningsMember2024-12-310000095552country:US2025-01-012025-09-300000095552us-gaap:SeniorNotesMemberssup:SeniorSecuredTermLoanFacilityMember2025-09-300000095552us-gaap:NondesignatedMemberus-gaap:DerivativeMember2024-01-012024-09-300000095552us-gaap:PerformanceSharesMemberssup:LongTermCashIncentivePlanMember2025-01-012025-09-300000095552country:MX2025-07-012025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:DerivativeMember2025-07-012025-09-300000095552us-gaap:FairValueInputsLevel3Memberus-gaap:AccruedLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:CurrentAssetMemberus-gaap:CommodityContractMember2025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:CurrentAssetMemberus-gaap:InterestRateContractMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMemberus-gaap:CommodityContractMember2025-09-3000000955522025-01-012025-09-3000000955522025-04-012025-06-3000000955522025-06-300000095552ssup:AmendedAndRestatedTermLoanAgreementMembersrt:MaximumMember2025-03-312025-03-310000095552ssup:ConvertiblePreferredStockRedemptionPeriodTwoMember2025-09-300000095552us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2025-09-300000095552us-gaap:RetainedEarningsMember2025-01-012025-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberssup:TermLoanFacilityMember2024-08-140000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-07-012024-09-3000000955522022-12-310000095552ssup:CashSettledShareBasedCompensationExpenseBenefitMember2025-07-012025-09-300000095552us-gaap:RetainedEarningsMember2024-07-012024-09-300000095552us-gaap:RestrictedStockUnitsRSUMember2024-12-310000095552srt:NorthAmericaMember2025-01-012025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberssup:NoncurrentAssetMember2024-12-310000095552us-gaap:PerformanceSharesMember2024-12-310000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2025-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-300000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-06-3000000955522025-03-310000095552country:MX2024-07-012024-09-300000095552us-gaap:NondesignatedMemberus-gaap:DerivativeMember2024-07-012024-09-3000000955522025-09-300000095552us-gaap:RetainedEarningsMember2025-06-300000095552ssup:MergerAgreementMemberus-gaap:SubsequentEventMember2025-12-080000095552us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2025-09-300000095552country:DE2025-09-300000095552srt:ScenarioForecastMember2025-01-012025-12-310000095552us-gaap:PerformanceSharesMemberssup:LongTermCashIncentivePlanMember2025-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310000095552us-gaap:DelayedDrawTermLoanMember2025-06-0400000955522024-01-012024-09-300000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-01-012024-09-300000095552ssup:CashSettledShareBasedCompensationExpenseBenefitMember2025-01-012025-09-300000095552us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2025-06-300000095552country:PL2024-01-012024-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberssup:TermLoanFacilityMember2024-08-142024-08-140000095552us-gaap:DesignatedAsHedgingInstrumentMembersrt:NaturalGasReservesMemberus-gaap:CommodityContractMember2024-12-310000095552us-gaap:FairValueInputsLevel3Memberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2024-12-310000095552country:PL2025-09-300000095552ssup:SeniorSecuredTermLoanFacilityMember2025-01-012025-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310000095552srt:EuropeMember2024-01-012024-09-300000095552us-gaap:LoansPayableMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:DerivativeMember2024-07-012024-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberus-gaap:RevolvingCreditFacilityMember2025-09-300000095552us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberssup:CurrentAssetMemberus-gaap:ForeignExchangeContractMember2024-12-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310000095552country:DE2025-01-012025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2025-09-300000095552ssup:CashSettledShareBasedCompensationExpenseBenefitMember2024-01-012024-09-300000095552country:DE2024-12-310000095552us-gaap:AccumulatedTranslationAdjustmentMember2025-09-300000095552country:US2024-07-012024-09-300000095552country:PL2025-07-012025-09-300000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:CurrentAssetMemberus-gaap:CommodityContractMember2024-12-310000095552us-gaap:NondesignatedMemberus-gaap:DerivativeMember2025-01-012025-09-300000095552us-gaap:RetainedEarningsMember2024-09-300000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2025-01-012025-09-300000095552srt:EuropeMember2025-01-012025-09-300000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300000095552srt:EuropeMember2025-07-012025-09-300000095552us-gaap:RetainedEarningsMember2025-07-012025-09-300000095552us-gaap:DelayedDrawTermLoanMember2025-09-3000000955522024-09-300000095552ssup:MergerAgreementMemberus-gaap:SubsequentEventMember2025-12-082025-12-0800000955522024-12-310000095552us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2024-12-310000095552us-gaap:PerformanceSharesMemberssup:MergerAgreementMemberus-gaap:SubsequentEventMember2025-12-0800000955522024-01-012024-03-310000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:DerivativeMember2024-01-012024-09-300000095552country:DE2024-07-012024-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000095552us-gaap:RetainedEarningsMember2024-01-012024-09-300000095552ssup:ShareSettledShareBasedCompensationExpenseBenefitMember2024-01-012024-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMemberus-gaap:CommodityContractMember2024-12-3100000955522023-01-012023-12-310000095552country:PL2024-07-012024-09-3000000955522024-04-012024-06-300000095552us-gaap:OtherNonoperatingIncomeExpenseMember2025-07-012025-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberus-gaap:SeniorNotesMemberus-gaap:RevolvingCreditFacilityMember2025-09-300000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-09-300000095552srt:NorthAmericaMember2024-01-012024-09-3000000955522025-07-012025-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2025-09-300000095552ssup:ShareSettledShareBasedCompensationExpenseBenefitMember2024-07-012024-09-300000095552ssup:ShareSettledShareBasedCompensationExpenseBenefitMember2025-07-012025-09-300000095552us-gaap:OtherNonoperatingIncomeExpenseMember2024-07-012024-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-07-012024-09-3000000955522025-11-070000095552srt:EuropeMember2024-07-012024-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-07-012025-09-300000095552us-gaap:RetainedEarningsMember2023-12-310000095552country:US2024-12-310000095552us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-3100000955522024-07-012024-09-300000095552us-gaap:RevolvingCreditFacilityMember2025-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000095552ssup:FinanceLeasesMember2024-12-310000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-12-310000095552srt:NorthAmericaMember2024-12-310000095552us-gaap:LoansPayableMember2025-09-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2024-09-300000095552country:US2025-07-012025-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberus-gaap:DelayedDrawTermLoanMember2024-08-142024-08-140000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:CurrentAssetMemberus-gaap:ForeignExchangeContractMember2025-09-300000095552srt:MinimumMemberssup:AmendedAndRestatedTermLoanAgreementMember2025-03-312025-03-310000095552us-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-09-300000095552us-gaap:RetainedEarningsMember2025-09-300000095552srt:NorthAmericaMember2025-09-300000095552country:MX2024-01-012024-09-300000095552ssup:SeniorSecuredTermLoanFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-12-152022-12-150000095552us-gaap:LoansPayableMember2025-01-012025-09-300000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2025-07-012025-09-300000095552country:DE2024-01-012024-09-300000095552us-gaap:RestrictedStockUnitsRSUMember2025-09-300000095552country:US2024-01-012024-09-300000095552ssup:CashSettledShareBasedCompensationExpenseBenefitMember2024-07-012024-09-300000095552country:PL2025-01-012025-09-300000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberssup:NoncurrentAssetMemberus-gaap:CommodityContractMember2024-12-310000095552country:DE2025-07-012025-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-01-012025-09-300000095552us-gaap:RevolvingCreditFacilityMember2025-01-012025-09-300000095552srt:NorthAmericaMember2024-07-012024-09-300000095552country:US2025-09-300000095552srt:NorthAmericaMember2025-07-012025-09-300000095552us-gaap:OtherNonoperatingIncomeExpenseMember2025-01-012025-09-300000095552srt:EuropeMember2025-09-300000095552us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberssup:CurrentAssetMember2025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2025-09-300000095552us-gaap:PerformanceSharesMember2025-09-3000000955522024-01-012024-12-3100000955522025-01-012025-03-310000095552us-gaap:RetainedEarningsMember2024-06-300000095552us-gaap:AccumulatedTranslationAdjustmentMember2024-07-012024-09-300000095552us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-09-300000095552us-gaap:FairValueInputsLevel3Memberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2025-09-300000095552ssup:FinanceLeasesMember2025-09-3000000955522024-03-310000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-07-012024-09-3000000955522024-01-012024-01-010000095552us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2025-06-300000095552ssup:ConvertiblePreferredStockRedemptionPeriodTwoMember2025-01-012025-09-300000095552us-gaap:RestrictedStockUnitsRSUMemberssup:LongTermCashIncentivePlanMember2025-01-012025-09-300000095552us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberssup:NoncurrentAssetMember2025-09-300000095552ssup:ShareSettledShareBasedCompensationExpenseBenefitMember2025-01-012025-09-300000095552country:MX2025-01-012025-09-30ssup:TradingDaysxbrli:purexbrli:sharesutr:Btuiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2025

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-06615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

95-2594729 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

26600 Telegraph Road, Suite 400 |

|

Southfield, Michigan |

48033 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (248) 352-7300

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

None |

|

None |

|

None |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large Accelerated Filer |

☐ |

Accelerated Filer |

☒ |

Non-Accelerated Filer |

☐ |

Smaller Reporting Company |

☒ |

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of common stock outstanding as of November 7, 2025: 37,298,422

PART I

FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Dollars in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

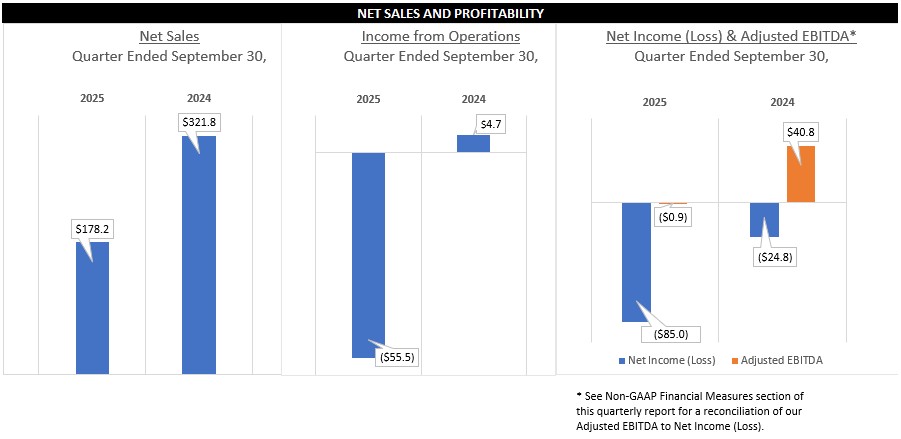

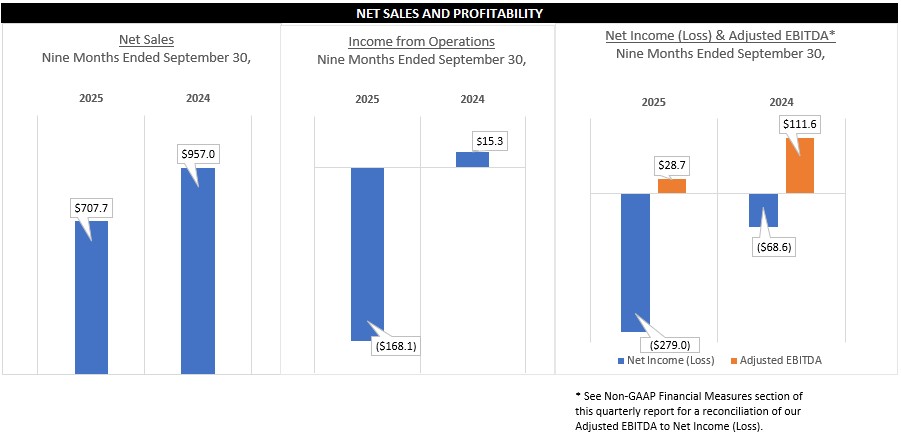

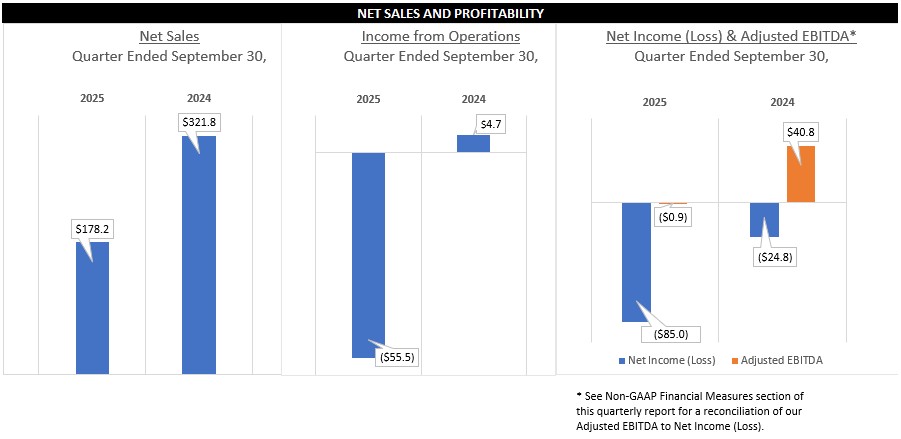

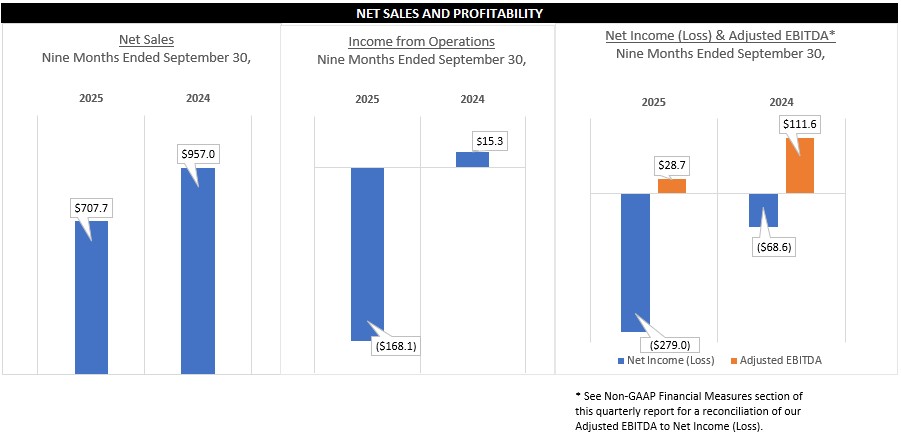

NET SALES |

|

$ |

178,200 |

|

|

$ |

321,757 |

|

|

$ |

707,699 |

|

|

$ |

957,000 |

|

Cost of sales |

|

|

207,381 |

|

|

|

293,123 |

|

|

|

742,228 |

|

|

|

875,600 |

|

GROSS PROFIT (LOSS) |

|

|

(29,181 |

) |

|

|

28,634 |

|

|

|

(34,529 |

) |

|

|

81,400 |

|

Selling, general and administrative expenses |

|

|

26,360 |

|

|

|

23,900 |

|

|

|

66,699 |

|

|

|

66,108 |

|

Impairment of long-lived assets |

|

|

— |

|

|

|

— |

|

|

|

66,906 |

|

|

|

— |

|

INCOME (LOSS) FROM OPERATIONS |

|

|

(55,541 |

) |

|

|

4,734 |

|

|

|

(168,134 |

) |

|

|

15,292 |

|

Interest expense, net |

|

|

(21,445 |

) |

|

|

(17,857 |

) |

|

|

(56,610 |

) |

|

|

(49,558 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

(13,052 |

) |

|

|

— |

|

|

|

(13,052 |

) |

Other income (expense), net |

|

|

(3,147 |

) |

|

|

2,297 |

|

|

|

(9,342 |

) |

|

|

2,635 |

|

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

(80,133 |

) |

|

|

(23,878 |

) |

|

|

(234,086 |

) |

|

|

(44,683 |

) |

Income tax (provision) benefit |

|

|

(4,856 |

) |

|

|

(875 |

) |

|

|

(44,885 |

) |

|

|

(23,943 |

) |

NET INCOME (LOSS) |

|

$ |

(84,989 |

) |

|

$ |

(24,753 |

) |

|

$ |

(278,971 |

) |

|

$ |

(68,626 |

) |

EARNINGS (LOSS) PER SHARE – BASIC |

|

$ |

(3.03 |

) |

|

$ |

(1.24 |

) |

|

$ |

(10.58 |

) |

|

$ |

(3.50 |

) |

EARNINGS (LOSS) PER SHARE – DILUTED |

|

$ |

(3.03 |

) |

|

$ |

(1.24 |

) |

|

$ |

(10.58 |

) |

|

$ |

(3.50 |

) |

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

Net income (loss) |

|

$ |

(84,989 |

) |

|

$ |

(24,753 |

) |

|

$ |

(278,971 |

) |

|

$ |

(68,626 |

) |

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss), net of tax |

|

|

3,745 |

|

|

|

(9,965 |

) |

|

|

52,669 |

|

|

|

(25,713 |

) |

Change in unrecognized gains (losses) on derivative instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of derivatives |

|

|

(6,589 |

) |

|

|

(14,790 |

) |

|

|

(1,184 |

) |

|

|

(32,047 |

) |

Tax (provision) benefit |

|

|

— |

|

|

|

3,179 |

|

|

|

— |

|

|

|

7,154 |

|

Change in unrecognized gains (losses) on derivative instruments, net of tax |

|

|

(6,589 |

) |

|

|

(11,611 |

) |

|

|

(1,184 |

) |

|

|

(24,893 |

) |

Defined benefit pension plan: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of actuarial losses on pension obligation |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

4 |

|

Tax (provision) benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

178 |

|

Pension changes, net of tax |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

182 |

|

Other comprehensive income (loss), net of tax |

|

|

(2,844 |

) |

|

|

(21,575 |

) |

|

|

51,485 |

|

|

|

(50,424 |

) |

Comprehensive income (loss) |

|

$ |

(87,833 |

) |

|

$ |

(46,328 |

) |

|

$ |

(227,486 |

) |

|

$ |

(119,050 |

) |

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

|

December 31,

2024 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

60,619 |

|

|

$ |

40,110 |

|

Accounts receivable, net |

|

|

74,270 |

|

|

|

69,503 |

|

Inventories, net |

|

|

124,158 |

|

|

|

145,736 |

|

Income taxes receivable |

|

|

6,158 |

|

|

|

11,374 |

|

Current derivative financial instruments |

|

|

— |

|

|

|

22,578 |

|

Other current assets |

|

|

18,819 |

|

|

|

19,460 |

|

Total current assets |

|

|

284,024 |

|

|

|

308,761 |

|

Property, plant and equipment, net |

|

|

274,039 |

|

|

|

329,892 |

|

Deferred income tax assets, net |

|

|

2 |

|

|

|

39,046 |

|

Intangibles, net |

|

|

4,516 |

|

|

|

12,612 |

|

Derivative financial instruments |

|

|

— |

|

|

|

14,736 |

|

Other noncurrent assets |

|

|

29,388 |

|

|

|

35,082 |

|

Total assets |

|

$ |

591,969 |

|

|

$ |

740,129 |

|

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

75,216 |

|

|

$ |

120,351 |

|

Short-term debt |

|

|

631,430 |

|

|

|

7,939 |

|

Accrued expenses |

|

|

55,104 |

|

|

|

65,731 |

|

Income taxes payable |

|

|

367 |

|

|

|

1,905 |

|

Total current liabilities |

|

|

762,117 |

|

|

|

195,926 |

|

Long-term debt (less current portion) |

|

|

524 |

|

|

|

481,449 |

|

Noncurrent income tax liabilities |

|

|

3,003 |

|

|

|

5,341 |

|

Deferred income tax liabilities, net |

|

|

— |

|

|

|

1,105 |

|

Other noncurrent liabilities |

|

|

38,253 |

|

|

|

43,581 |

|

Commitments and contingent liabilities (Note 15) |

|

|

|

|

|

|

Mezzanine equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value |

|

|

|

|

|

|

Authorized – 1,000,000 shares |

|

|

|

|

|

|

Issued and outstanding – 150,000 shares outstanding at

September 30, 2025 and December 31, 2024 |

|

|

335,800 |

|

|

|

288,465 |

|

Noncontrolling redeemable equity |

|

|

523 |

|

|

|

480 |

|

Shareholders’ equity (deficit): |

|

|

|

|

|

|

Common stock, $0.01 par value |

|

|

|

|

|

|

Authorized – 100,000,000 shares |

|

|

|

|

|

|

Issued and outstanding – 37,298,422 and 28,886,053 shares at

September 30, 2025 and December 31, 2024 |

|

|

125,231 |

|

|

|

123,039 |

|

Accumulated other comprehensive income (loss) |

|

|

(46,986 |

) |

|

|

(98,471 |

) |

Retained earnings (deficit) |

|

|

(626,496 |

) |

|

|

(300,786 |

) |

Total shareholders’ equity (deficit) |

|

|

(548,251 |

) |

|

|

(276,218 |

) |

Total liabilities, mezzanine equity and shareholders’ equity (deficit) |

|

$ |

591,969 |

|

|

$ |

740,129 |

|

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

(278,971 |

) |

|

$ |

(68,626 |

) |

Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

50,610 |

|

|

|

65,534 |

|

Income tax, noncash changes |

|

|

40,074 |

|

|

|

16,254 |

|

Stock-based compensation |

|

|

2,289 |

|

|

|

6,098 |

|

Amortization of debt issuance costs |

|

|

6,717 |

|

|

|

3,974 |

|

Interest paid-in-kind on long-term debt |

|

|

27,888 |

|

|

|

— |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

13,052 |

|

Impairment of long-lived assets |

|

|

66,906 |

|

|

|

— |

|

Other noncash items |

|

|

10,332 |

|

|

|

(8,978 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(2,630 |

) |

|

|

(54,373 |

) |

Inventories |

|

|

32,605 |

|

|

|

(2,744 |

) |

Other assets and liabilities |

|

|

(8,874 |

) |

|

|

6,283 |

|

Cash proceeds from early termination of derivative instruments |

|

|

37,537 |

|

|

|

— |

|

Accounts payable |

|

|

(58,422 |

) |

|

|

21,411 |

|

Income taxes |

|

|

1,871 |

|

|

|

(5,742 |

) |

NET CASH PROVIDED (USED) BY OPERATING ACTIVITIES |

|

|

(72,068 |

) |

|

|

(7,857 |

) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Additions to property, plant, and equipment |

|

|

(18,933 |

) |

|

|

(20,985 |

) |

NET CASH PROVIDED (USED) BY INVESTING ACTIVITIES |

|

|

(18,933 |

) |

|

|

(20,985 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

— |

|

|

|

337,317 |

|

Proceeds from issuance of short-term debt |

|

|

70,000 |

|

|

|

— |

|

Repayments on term loans and notes |

|

|

(3,475 |

) |

|

|

(466,294 |

) |

Proceeds from borrowings on revolving credit facility |

|

|

65,473 |

|

|

|

28,000 |

|

Repayments of borrowings on revolving credit facility |

|

|

(23,000 |

) |

|

|

(28,000 |

) |

Cash dividends paid |

|

|

(30 |

) |

|

|

(3,413 |

) |

Financing costs paid and other |

|

|

(1,081 |

) |

|

|

(8,967 |

) |

Redemption premium paid on term loan repayment |

|

|

— |

|

|

|

(3,680 |

) |

Payments related to tax withholdings for stock-based compensation |

|

|

(781 |

) |

|

|

(1,345 |

) |

Finance lease payments |

|

|

(664 |

) |

|

|

(452 |

) |

Proceeds from common stock issuance |

|

|

684 |

|

|

|

— |

|

NET CASH PROVIDED (USED) BY FINANCING ACTIVITIES |

|

|

107,126 |

|

|

|

(146,834 |

) |

Effect of exchange rate changes on cash |

|

|

4,384 |

|

|

|

(1,650 |

) |

Net changes in cash and cash equivalents |

|

|

20,509 |

|

|

|

(177,326 |

) |

Cash and cash equivalents at the beginning of the period |

|

|

40,110 |

|

|

|

201,606 |

|

Cash and cash equivalents at the end of the period |

|

$ |

60,619 |

|

|

$ |

24,280 |

|

Supplemental Cash Flow Information |

|

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

22,408 |

|

|

$ |

46,507 |

|

Cash paid during the period for taxes, net of refunds |

|

$ |

4,190 |

|

|

$ |

13,316 |

|

Non-cash asset charge due to customer resourcing actions |

|

$ |

16,001 |

|

|

$ |

— |

|

Non-cash Investing Activities |

|

|

|

|

|

|

Period end balance of accounts payable for property, plant, and equipment |

|

$ |

6,621 |

|

|

$ |

3,860 |

|

Non-cash Financing Activities |

|

|

|

|

|

|

Debt modification |

|

$ |

— |

|

|

$ |

169,683 |

|

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (DEFICIT)

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Amount |

|

|

Cumulative

Translation

Adjustment |

|

|

Hedging Instruments |

|

|

Pension

Obligations |

|

|

Retained

Earnings (Deficit) |

|

|

Total |

|

BALANCE AT JULY 1, 2025 |

|

|

29,698,422 |

|

|

$ |

123,913 |

|

|

$ |

(79,254 |

) |

|

$ |

33,051 |

|

|

$ |

2,061 |

|

|

$ |

(524,476 |

) |

|

$ |

(444,705 |

) |

Net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(84,989 |

) |

|

|

(84,989 |

) |

Change in accumulated other comprehensive

income (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

3,745 |

|

|

|

(6,589 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,844 |

) |

Common stock issued, net of shares

withheld for employee taxes |

|

|

7,600,000 |

|

|

|

684 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

684 |

|

Stock-based compensation |

|

|

— |

|

|

|

634 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

634 |

|

Redeemable preferred 9% dividend

and accretion |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17,025 |

) |

|

|

(17,025 |

) |

Noncontrolling redeemable equity

dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

|

(6 |

) |

BALANCE AT SEPTEMBER 30, 2025 |

|

|

37,298,422 |

|

|

$ |

125,231 |

|

|

$ |

(75,509 |

) |

|

$ |

26,462 |

|

|

$ |

2,061 |

|

|

$ |

(626,496 |

) |

|

$ |

(548,251 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Amount |

|

|

Cumulative

Translation

Adjustment |

|

|

Hedging Instruments |

|

|

Pension

Obligations |

|

|

Retained

Earnings (Deficit) |

|

|

Total |

|

BALANCE AT JANUARY 1, 2025 |

|

|

28,886,053 |

|

|

$ |

123,039 |

|

|

$ |

(128,178 |

) |

|

$ |

27,646 |

|

|

$ |

2,061 |

|

|

$ |

(300,786 |

) |

|

$ |

(276,218 |

) |

Net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(278,971 |

) |

|

|

(278,971 |

) |

Change in accumulated other comprehensive

income (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

52,669 |

|

|

|

(1,184 |

) |

|

|

— |

|

|

|

— |

|

|

|

51,485 |

|

Common stock issued, net of shares

withheld for employee taxes |

|

|

8,412,369 |

|

|

|

684 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

684 |

|

Stock-based compensation |

|

|

— |

|

|

|

1,508 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,508 |

|

Redeemable preferred 9% dividend

and accretion |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(46,722 |

) |

|

|

(46,722 |

) |

Noncontrolling redeemable equity

dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17 |

) |

|

|

(17 |

) |

BALANCE AT SEPTEMBER 30, 2025 |

|

|

37,298,422 |

|

|

$ |

125,231 |

|

|

$ |

(75,509 |

) |

|

$ |

26,462 |

|

|

$ |

2,061 |

|

|

$ |

(626,496 |

) |

|

$ |

(548,251 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Amount |

|

|

Cumulative

Translation

Adjustment |

|

|

Hedging Instruments |

|

|

Pension

Obligations |

|

|

Retained

Earnings (Deficit) |

|

|

Total |

|

BALANCE AT JULY 1, 2024 |

|

|

28,886,053 |

|

|

$ |

118,082 |

|

|

$ |

(98,750 |

) |

|

$ |

46,577 |

|

|

$ |

1,033 |

|

|

$ |

(243,388 |

) |

|

$ |

(176,446 |

) |

Net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(24,753 |

) |

|

|

(24,753 |

) |

Change in accumulated other comprehensive

income (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

(9,965 |

) |

|

|

(11,611 |

) |

|

|

1 |

|

|

|

— |

|

|

|

(21,575 |

) |

Common stock issued, net of shares

withheld for employee taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation |

|

|

— |

|

|

|

2,011 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,011 |

|

Redeemable preferred 9% dividend

and accretion |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,081 |

) |

|

|

(11,081 |

) |

Noncontrolling redeemable equity

dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5 |

) |

|

|

(5 |

) |

BALANCE AT SEPTEMBER 30, 2024 |

|

|

28,886,053 |

|

|

$ |

120,093 |

|

|

$ |

(108,715 |

) |

|

$ |

34,966 |

|

|

$ |

1,034 |

|

|

$ |

(279,227 |

) |

|

$ |

(231,849 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Amount |

|

|

Cumulative

Translation

Adjustment |

|

|

Hedging Instruments |

|

|

Pension

Obligations |

|

|

Retained

Earnings (Deficit) |

|

|

Total |

|

BALANCE AT JANUARY 1, 2024 |

|

|

28,091,440 |

|

|

$ |

115,340 |

|

|

$ |

(83,002 |

) |

|

$ |

59,859 |

|

|

$ |

852 |

|

|

$ |

(178,989 |

) |

|

$ |

(85,940 |

) |

Net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(68,626 |

) |

|

|

(68,626 |

) |

Change in accumulated other comprehensive

income (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

(25,713 |

) |

|

|

(24,893 |

) |

|

|

182 |

|

|

|

— |

|

|

|

(50,424 |

) |

Common stock issued, net of shares

withheld for employee taxes |

|

|

794,613 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation |

|

|

— |

|

|

|

4,753 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,753 |

|

Redeemable preferred 9% dividend

and accretion |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(31,601 |

) |

|

|

(31,601 |

) |

Noncontrolling redeemable equity

dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11 |

) |

|

|

(11 |

) |

BALANCE AT SEPTEMBER 30, 2024 |

|

|

28,886,053 |

|

|

$ |

120,093 |

|

|

$ |

(108,715 |

) |

|

$ |

34,966 |

|

|

$ |

1,034 |

|

|

$ |

(279,227 |

) |

|

$ |

(231,849 |

) |

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

Superior Industries International, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

September 30, 2025

(in thousands, or as otherwise noted)

NOTE 1 – DESCRIPTION OF THE BUSINESS

Description of the Business

The principal business of Superior Industries International, Inc. (referred herein as the “Company” or “Superior”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers (“OEMs”) in North America and Europe, and to the aftermarket in Europe. The Company’s aluminum wheels are primarily sold to OEMs for factory installation on new light vehicles. Aluminum wheels sold in the European aftermarket are under the brands ATS, RIAL, ALUTEC, and ANZIO. North America and Europe represent the primary markets for the Company’s products, but it has a diversified global customer base consisting of North American, European, and Asian OEMs.

Merger

On December 8, 2025 (the “Closing Date”), the Company, SUP Parent Holdings, LLC, a Delaware limited liability company (“Parent”), and SUP Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”) completed the previously announced Merger, contemplated by that certain Agreement and Plan of Merger, dated as of July 8, 2025 (the “Merger Agreement”). At the effective time of the Merger on the Closing Date (the “Effective Time”), in accordance with the Merger Agreement, Merger Sub merged with and into the Company (the “Merger”), with the Company surviving the Merger as a direct wholly owned subsidiary of Parent. Immediately prior to the Effective Time, Parent held Common Shares that represented approximately 17.6% of the total voting power of the Company.

At the Effective Time, in accordance with the terms and conditions set forth in the Merger Agreement, each Common Share and each share of preferred stock, par value $0.01 per share designated as Series A Preferred Shares (the “Series A Preferred Shares” and, together with the Common Shares, the “Shares”), in each case, issued and outstanding immediately prior to the Effective Time (other than Shares owned by (i) Parent or Merger Sub or any of their respective Subsidiaries, (ii) the Company as treasury stock and (iii) holders of Common Shares who have not voted in favor of the Merger or consented thereto and have properly exercised and perfected and not withdrawn, waived or lost a demand for appraisal rights pursuant to Section 262 of the Delaware General Corporation Law) was converted into the right to receive:

•with respect to each Common Share, $0.09 per Common Share in cash, without interest thereon; and

•with respect to each Series A Preferred Share, (1) $39.49 per Series A Preferred Share in cash and (2) 0.23 units of limited liability company interests of Parent per Series A Preferred Share.

At the Effective Time, in accordance with the Merger Agreement:

•each outstanding time-based restricted stock unit (a “Company Restricted Stock Unit”) that was granted under the Company’s 2018 Equity Incentive Plan (the “Company Stock Plan”) that was outstanding as of immediately prior to the Effective Time, whether vested or unvested, became fully vested and terminated and automatically cancelled as of immediately prior to the Effective Time in exchange for the right to receive a lump sum cash payment of an amount equal to $0.09 per Company Restricted Stock Unit; and

•each outstanding performance-based restricted stock unit (a “Company Performance Stock Unit”) that was granted under the Company Stock Plan that was outstanding as of immediately prior to the Effective Time, whether vested or unvested, became fully vested as if the applicable level of performance was achieved at target and terminated and automatically cancelled as of immediately prior to the Effective Time in exchange for the right to receive a lump sum cash payment of an amount equal to $0.09 per Company Performance Stock Unit.

The Company used the proceeds of borrowings under the Third Amendment (as defined in Note 8 “Debt and Other Financing Arrangements”) to pay the cash consideration in the Merger.

Additional information about the Merger is set forth in the Company’s Current Report on Form 8-K filed with the SEC on December 8, 2025.

NOTE 2 – BASIS OF PRESENTATION

Basis of Presentation - Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“U.S. GAAP”) pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for interim financial information. Accordingly, they do not include all the information and notes required by U.S. GAAP for complete financial statements. These unaudited condensed consolidated financial statements include all adjustments, of a normal and recurring nature, which management believes are necessary for fair presentation of the financial statements. This Quarterly Report on Form 10-Q should be read in conjunction with the audited consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on March 6, 2025 (the “2024 Form 10-K”).

These unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions are eliminated in consolidation.

Interim financial reporting standards require the use of estimates that are based on assumptions regarding the outcome of future events and circumstances not known at that time. Inevitably, some assumptions may not materialize, unanticipated events or circumstances may occur which vary from those estimates and such variations may significantly affect future results. Additionally, operating results for the three and nine months ended September 30, 2025 are not necessarily indicative of the results that may be expected for the year ending December 31, 2025.

Going Concern

During the second quarter of 2025, certain of the Company's customers in North America began to resource to other suppliers substantially all outstanding purchase orders and not issue any additional purchase orders to the Company thereafter. Prior to these resourcing actions, the Company estimated these customers to represent approximately 33% of its projected consolidated net sales for the 2025 fiscal year. These customers represented approximately 40% of the Company’s consolidated net sales for the year ended December 31, 2024, and approximately 36% of the Company’s consolidated net sales for the year ended December 31, 2023. During the nine months ended September 30, 2025, the Company borrowed $42.5 million on its revolving credit facility, as the actions described above significantly affected the Company’s ability to generate cash from operating activities or from the sale of trade receivables. In addition, as of September 30, 2025, the Company was in violation of its financial covenants under the Senior Secured Credit Facilities.

On December 8, 2025 the Company completed the previously announced Merger with Parent, and Merger Sub pursuant to the Merger Agreement, and entered into amendments to its Senior Secured Credit Facilities. The Third Amendment to the Company’s Senior Secured Credit Facilities entered into on December 8, 2025, removed certain financial covenants under the Term Loan Facility and waived the financial covenants under the Revolving Credit Facility through June 30, 2026. In addition, the Revolving Credit Facility was amended to mature on June 30, 2026. The Senior Secured Credit Facilities now also contain a monthly minimum liquidity threshold of not less than $10.0 million as of the last business day of each month. Refer to Note 1 “Description of the Business” and Note 8 “Debt and Other Financing Arrangements” for a full description of the transactions.

While the Company has completed the previously announced Merger, it does not expect that it will have the cash and cash equivalents or sufficient liquidity to meet its financial obligations and comply with its minimum liquidity covenant over the next twelve months from the issuance date of these unaudited condensed consolidated financial statements. To address these conditions, management plans to obtain additional sources of funding or amend the applicable provisions in its credit agreements. However, such plans are not solely in the Company’s control and therefore cannot be considered probable of occurring. Therefore, these adverse conditions and events described above raise substantial doubt about the Company’s ability to continue as a going concern as of the issuance date.

The unaudited condensed consolidated financial statements as of September 30, 2025, do not include any adjustments that might result from the outcome of this uncertainty.

Cash and Cash Equivalents

Cash and cash equivalents generally consist of cash, certificates of deposit, fixed deposits, and money market funds with original maturities of three months or less. The Company is required to provide cash collateral in connection with certain contractual arrangements. The Company has $0.8 million and $0.4 million of restricted cash as of September 30, 2025 and December 31, 2024 in support of these arrangements and requirements.

Accounting Standards Issued But Not Yet Adopted

Accounting Standards Update (ASU) 2023-09, “Income Taxes (Topic 740).” In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which is intended to enhance the transparency, decision usefulness, and effectiveness of income tax disclosures. This amendment requires a public entity to disclose a tabular tax rate reconciliation, using both percentages and currency, with specific categories. A public entity is also required to provide a qualitative description of the states and local jurisdictions that make up the majority of the effect of the state and local income tax category and the net amount of income taxes paid, disaggregated by federal, state, and foreign taxes and also disaggregated by individual jurisdictions. The amendment is effective prospectively for annual periods beginning after December 15, 2024, and early adoption and retrospective application are permitted. The Company is currently evaluating the effect of adopting this guidance.

Accounting Standards Update (ASU) 2024-03, “Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures.” In November 2024, the FASB issued ASU 2024-03, “Disaggregation of Income Statement Expenses (Subtopic 220-40): Disaggregation of Income Statement Expenses”, which is intended to provide disaggregated information about a public business entity’s expenses to help financial statement users better understand the entity’s performance, better assess the entity’s prospects for future cash flows, and compare an entity’s performance over time and with that of other entities. The amendment is effective for fiscal years beginning after December 15, 2026 and interim periods within fiscal years beginning after December 15, 2027. Early adoption is permitted. The new standard may be applied either on a prospective or retrospective basis. The Company is currently evaluating the effect of adopting this guidance.

NOTE 3 – REVENUE

The Company disaggregates revenue from contracts by its reportable segments, North America and Europe. Revenues by segment for the three and nine months ended September 30, 2025 and 2024 are summarized in Note 5, “Business Segments.”

The opening and closing balances of the Company’s trade receivables, and current and long-term contract liabilities are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

|

December 31,

2024 |

|

Trade receivables |

|

|

62,077 |

|

|

|

56,690 |

|

Contract liabilities—current |

|

|

4,726 |

|

|

|

6,819 |

|

Contract liabilities—noncurrent |

|

|

5,575 |

|

|

|

6,845 |

|

During the nine months ended September 30, 2025 the Company recorded a non-cash charge of $3.1 million to write-down a customer trade receivable associated with customer resourcing actions.

NOTE 4 - DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE

The Company is exposed to market risks such as fluctuations in foreign currency exchange rates, interest rates, and aluminum and other commodity prices. Derivative financial instruments may be used to offset some of the effects of these market risks on the expected future cash flows and on certain existing assets and liabilities. In certain cases, the Company may or may not designate certain derivative instruments as hedges for accounting purposes. The Company may choose not to hedge certain exposures for a variety of reasons including, but not limited to, accounting considerations and the prohibitive economic cost of hedging particular exposures.

Market Risks

Foreign Currency Exchange Rate Risk

The Company has manufacturing locations primarily in Mexico and Poland and sells its products globally. As a result, the Company’s financial results could be significantly affected by foreign currency exchange rates. To help mitigate gross margin and cash flow fluctuations due to changes in foreign currency exchange rates, certain subsidiaries in Mexico and Poland, whose functional currency is the U.S. dollar or the Euro, may hedge a portion of their forecasted foreign currency exposure denominated in the Mexican Peso and Polish Zloty using foreign currency forward contracts up to 48 months. The Company has designated some of its foreign currency contracts as cash flow hedging instruments.

Interest Rate Risk

The borrowings under the Company’s Senior Secured Credit Facilities (as subsequently defined) are at variable rates of interest and expose it to interest rate risk. If interest rates increase, debt service obligations on the variable rate indebtedness will increase even though the amount borrowed remains the same. The Company hedges a portion of its interest rate risk through interest rate swaps that exchange floating for fixed-rate interest payments and has designated these contracts as cash flow hedging instruments.

Commodity Price Risk

The principal raw material used in manufacturing aluminum wheels is aluminum alloys. While wheel prices under OEM customer contracts are adjusted for fluctuations in the cost of this material, the prices of its aftermarket wheels are generally fixed months in advance of the spring and winter sales seasons. Accordingly, the Company hedges a portion of its aftermarket aluminum purchases to offset the effect of fluctuating aluminum cost on its margins. In addition, the manufacture of aluminum wheels is energy-intensive so, the Company also fixes a portion of its natural gas and electricity purchases with derivatives or contractual arrangements with energy suppliers.

Assets and Fair Values Measured at Fair Value on a Recurring Basis

Asset and Liability Instruments

The carrying amounts for cash and cash equivalents, accounts receivable, accounts payable, and accrued expenses approximate their fair values due to the short period of time until maturity.

Derivative Financial Instruments

During the second quarter of 2025, the Company terminated its outstanding foreign exchange, commodity, and interest rate derivative instruments. The derivative instruments have been derecognized and amounts in accumulated other comprehensive income (loss) remain there until the forecasted transactions affect earnings unless the forecasted transaction becomes probable of not occurring.

The fair value of the Company’s derivative instruments is estimated using the income valuation approach, which projects future cash flows and discounts the future amounts to a present value using market-based expectations for interest rates, foreign exchange rates, commodity prices, and the contractual terms of the derivative instruments (Level 2). The discount rate used is the relevant benchmark rate (e.g., the secured overnight financing rate, “SOFR”) plus an adjustment for counterparty risk.

The fair value of the Company’s embedded derivatives is estimated using either a market based approach or an income based approach, which uses Company-specific inputs and assumptions (Level 3), such as discount rates.

The following tables display the fair value of derivatives by financial statement line item as of September 30, 2025 and December 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

|

|

Fair Value Hierarchy |

|

Current Derivative Financial Instruments |

|

|

Derivative Financial Instruments |

|

|

Accrued

Liabilities |

|

|

Other

Noncurrent

Liabilities |

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange contracts |

|

Level 2 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Commodity contracts |

|

Level 2 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Interest rate contracts |

|

Level 2 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Derivatives not designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange contracts |

|

Level 2 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Embedded derivative contracts |

|

Level 3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

|

Fair Value Hierarchy |

|

Current Derivative Financial Instruments |

|

|

Derivative Financial Instruments |

|

|

Accrued

Liabilities |

|

|

Other

Noncurrent

Liabilities |

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange contracts |

|

Level 2 |

|

$ |

20,443 |

|

|

$ |

14,722 |

|

|

$ |

451 |

|

|

$ |

3,664 |

|

Commodity contracts |

|

Level 2 |

|

|

258 |

|

|

|

14 |

|

|

|

2,341 |

|

|

|

1,233 |

|

Interest rate contracts |

|

Level 2 |

|

|

1,536 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Derivatives not designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange contracts |

|

Level 2 |

|

|

341 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Embedded derivative contracts |

|

Level 3 |

|

|

— |

|

|

|

— |

|

|

|

626 |

|

|

|

1,403 |

|

The following table summarizes the notional amount of the Company’s derivative financial instruments as of September 30, 2025 and December 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

Notional Amount |

|

|

|

September 30,

2025 |

|

|

December 31,

2024 |

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

Foreign exchange contracts |

|

$ |

— |

|

|

$ |

434,327 |

|

Commodity contracts - Natural Gas (1) |

|

|

— |

|

|

3,402 Btu |

|

Commodity contracts - Aluminum (2) |

|

|

— |

|

|

— MT |

|

Interest rate contracts |

|

$ |

— |

|

|

$ |

150,000 |

|

Derivatives not designated as hedging instruments: |

|

|

|

|

|

|

Foreign exchange contracts |

|

$ |

— |

|

|

$ |

25,856 |

|

|

|

|

|

|

|

|

(1) Notional units are in thousands of British thermal units (Btu)

(2) Notional units are in thousands of Metric Tons (MT)

Notional amounts are presented on a net basis. The notional amounts of the derivative financial instruments do not represent amounts exchanged by the parties and, therefore, are not a direct measure of the exposure to the financial risks described above. The amounts exchanged are calculated by reference to the notional amounts and by other terms of the derivatives.

The following table summarizes the gain or loss recognized in other comprehensive income (loss) (“OCI (OCL)”), the amounts reclassified from accumulated OCI or OCL into earnings, and the amounts recognized directly into earnings for the three and nine months ended September 30, 2025 and 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

|

September 30,

2025 |

|

|

September 30,

2024 |

|

Derivatives designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of gain or (loss) recognized in OCI on derivatives, net of tax |

|

$ |

(6,589 |

) |

|

$ |

(11,611 |

) |

|

$ |

(1,184 |

) |

|

$ |

(24,893 |

) |

Amount of pre-tax gain or (loss) reclassified from accumulated OCI into: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

6,186 |

|

|

|

6,291 |

|

|

|

16,169 |

|

|

|

23,106 |

|

Interest expense, net |

|

|

403 |

|

|

|

1,171 |

|

|

|

1,321 |

|

|

|

3,459 |

|

Derivatives not designated as hedging instruments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of pre-tax gain or (loss) recognized in other income (expense), net of tax |

|

|

291 |

|

|

|

(1,054 |

) |

|

|

3,426 |

|

|

|

(2,878 |

) |

The Company estimates approximately $22.5 million included in OCI or OCL at September 30, 2025 will be reclassified into net income (loss) within the following twelve months.

The Company has derivative liabilities associated with embedded features within its redeemable preferred stock (refer to Note 10 “Redeemable Shares”) and its term loan facility (refer to Note 8 “Debt and Other Financing Arrangements”).

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

In addition to items measured at fair value on a recurring basis, assets may be measured at fair value on a nonrecurring basis. These assets include long-lived assets and intangible assets which may be written down to fair value as a result of impairment.

Long-Lived Assets

The Company evaluates its long-lived assets for impairment whenever events or circumstances indicate the value of these long-lived asset groups are not recoverable. As a result of the customer actions described in Note 2 “Basis of Presentation”, the Company concluded certain impairment triggers had occurred for its North America asset group during the second quarter of 2025. After failing the undiscounted cash flow recoverability test, the Company estimated the fair values of the long-lived assets within the North America asset group at June 30, 2025 and compared it to the net carrying value. The fair value measurements related to this long-lived asset group relies primarily on Company-specific inputs and the Company’s assumptions about the use of the assets, as observable inputs are not available (level 3). To determine the fair value of the long-lived asset group, the Company utilized an income-based and market-based approach. The Company believes the assumptions and estimates used to determine the estimated fair values of the long-lived asset group are reasonable; however, the estimates and assumptions are subject to a high degree of uncertainty. Due to the many variables inherent in estimating fair value differences in assumptions could have a material effect on the results of the analyses.

As the fair value of the North America long-lived asset group exceeded its net carrying value, the Company recorded a non-cash impairment charge of $66.9 million to property, plant, and equipment, during the second quarter of 2025.

Financial Instruments Not Carried at Fair Value

Debt Instruments

The carrying values of the Company’s debt instruments vary from their fair values. The fair values are determined by reference to quoted prices for similar instruments (Level 2). The estimated fair value, as well as the carrying value, of the Company’s debt instruments are shown below:

|

|

|

|

|

|

|

|

|