Third Quarter 2025 Earnings Conference Call 11/6/2025 Teleflex Incorporated .2

The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on Investors) An audio replay of the call will be available beginning at 11:00 am Eastern Time on November 6, 2025 either on the Teleflex website or by telephone. The call can be accessed by dialing 1 800 770 2030 (U.S.) or 1 609 800 9909 (all other locations). The confirmation code is 69028. Conference Call Logistics

Today’s Speakers TELEFLEX EARNINGS CONFERENCE CALL 11/6/2025 Lawrence Keusch VP, Investor Relations and Strategy Development Liam Kelly Chairman, President and CEO John Deren Executive VP and CFO

TELEFLEX EARNINGS CONFERENCE CALL 11/6/20254 Additional Notes This document contains certain highlights with respect to our third quarter 2025 and developments and does not purport to be a complete summary thereof. Accordingly, we encourage you to read our Earnings Release for the quarter ended September 28, 2025 located in the investor section of our website at www.teleflex.com and our Quarterly Report on Form 10-Q for the quarter ended September 28, 2025 to be filed with the Securities and Exchange Commission. Unless otherwise noted, the following slides reflect continuing operations. This presentation contains forward-looking statements, including, but not limited to, our forecasted 2025: GAAP, adjusted revenue and adjusted constant currency growth, GAAP and adjusted gross and operating margins and GAAP and adjusted earnings per share and, in each case, our estimates with respect to the items expected to impact those forecasted results; statements with respect to our plans to separate certain of our businesses into RemainCo and NewCo, the benefits and synergies of the transaction, strategic and competitive advantages of each company, and future growth and other opportunities for each company; statements regarding the potential sale of Newco; statements regarding the future performance of the Vascular Intervention business we recently acquired from BIOTRONIK; statements regarding projected costs, savings and timing with respect to restructuring activities related to the integration of the Vascular Intervention business; statements related to our BIOMAG-II study; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. Any forward-looking statements contained herein are based on our management’s current beliefs and expectations, but are subject to a number of risks, uncertainties and changes in circumstances, which may cause actual results or company actions to differ materially from what is expressed or implied by these statements. These risks and uncertainties are identified and described in more detail in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K. We expressly disclaim any obligation to update these forward-looking statements, except as otherwise explicitly stated by us or as required by law or regulation. You should not place undue reliance on these statements or the scientific data presented. Note on Forward-Looking Statements Note on Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures, including, but not limited to, adjusted revenue, adjusted constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained within this presentation and the appendices at the end of this presentation.

Liam Kelly Chairman, President and CEO Executive Overview

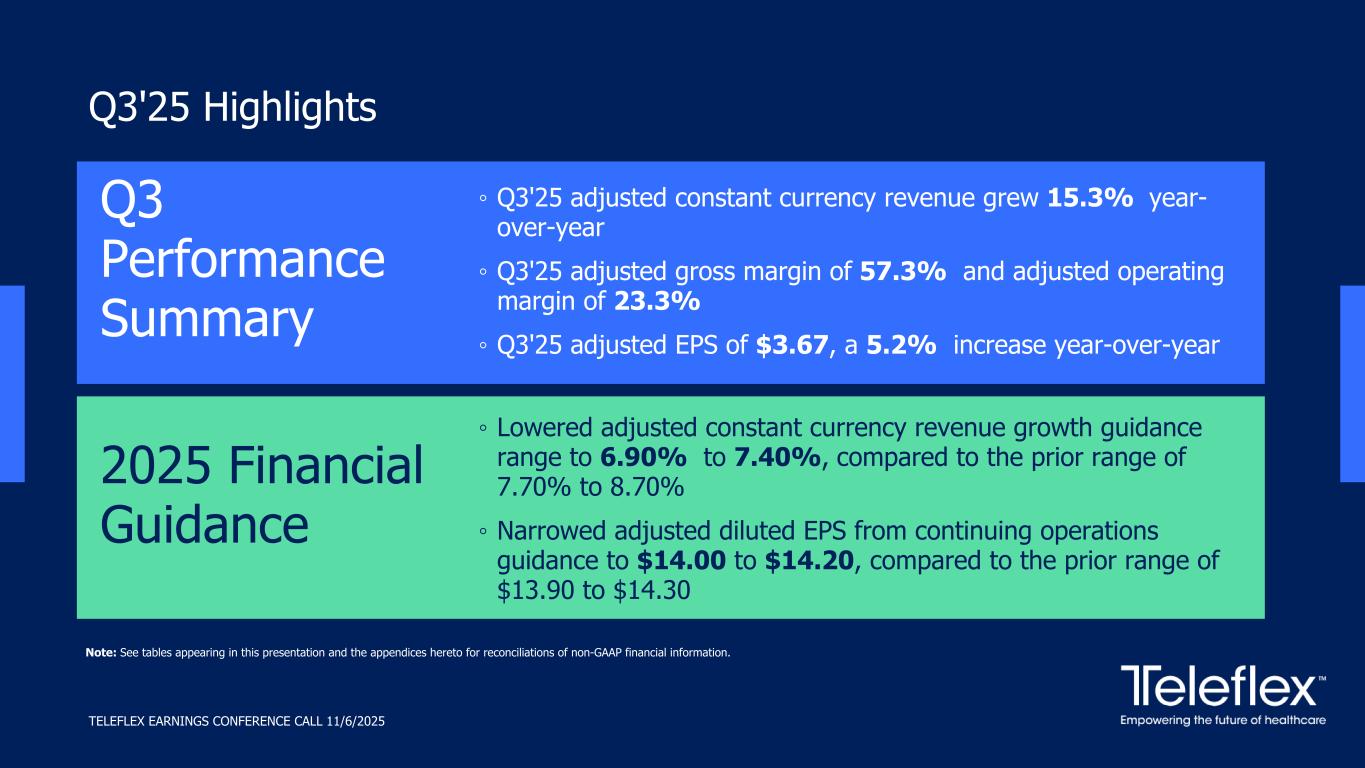

Q3 Performance Summary ◦ Lowered adjusted constant currency revenue growth guidance range to 6.90% to 7.40%, compared to the prior range of 7.70% to 8.70% ◦ Narrowed adjusted diluted EPS from continuing operations guidance to $14.00 to $14.20, compared to the prior range of $13.90 to $14.30 ◦ Q3'25 adjusted constant currency revenue grew 15.3% year- over-year ◦ Q3'25 adjusted gross margin of 57.3% and adjusted operating margin of 23.3% ◦ Q3'25 adjusted EPS of $3.67, a 5.2% increase year-over-year Q3'25 Highlights 2025 Financial Guidance Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information. TELEFLEX EARNINGS CONFERENCE CALL 11/6/2025

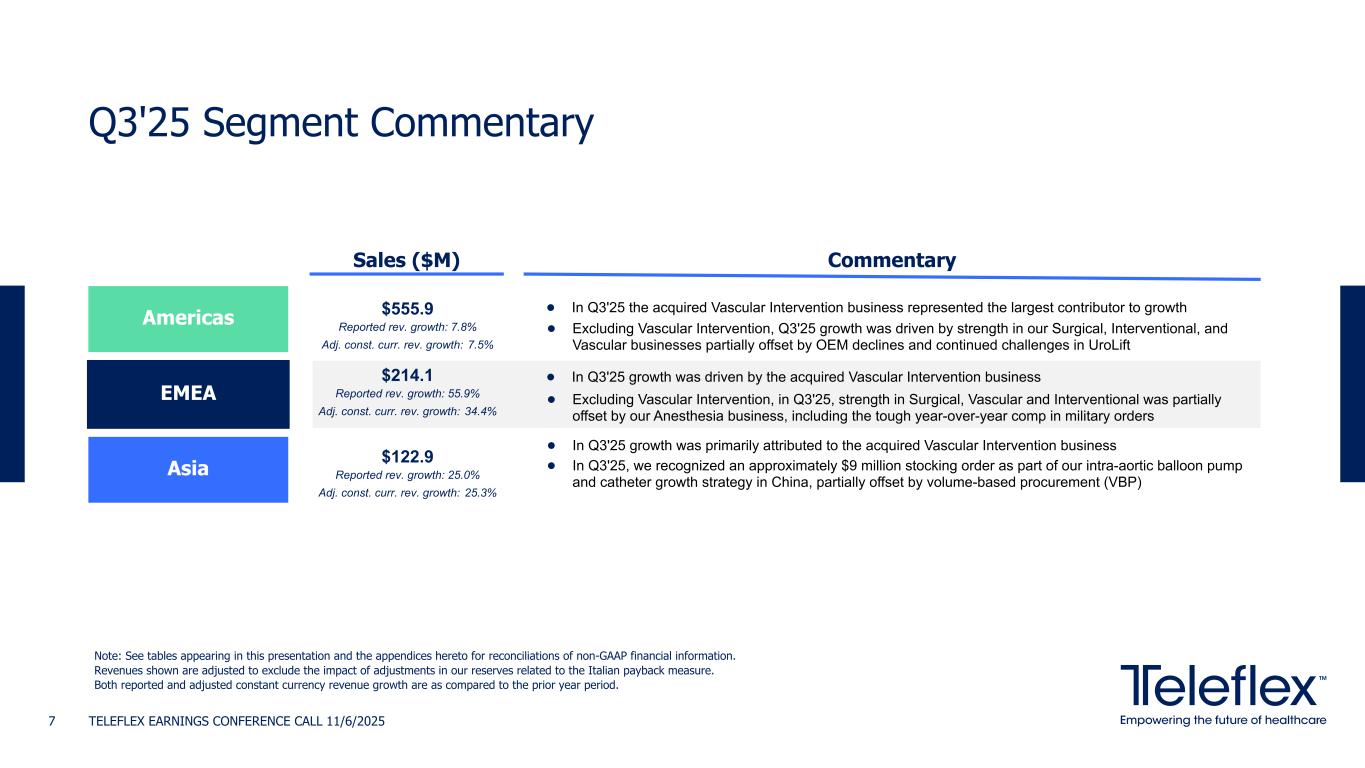

Q3'25 Segment Commentary TELEFLEX EARNINGS CONFERENCE CALL 11/6/20257 Americas Asia EMEA Sales ($M) Commentary • Excluding Vascular Intervention, Q3'25 growth was driven by strength in our Surgical, Interventional, and Vascular businesses partially offset by OEM declines and continued challenges in UroLift $555.9 Reported rev. growth: 7.8% Adj. const. curr. rev. growth: 7.5% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information. Revenues shown are adjusted to exclude the impact of adjustments in our reserves related to the Italian payback measure. Both reported and adjusted constant currency revenue growth are as compared to the prior year period. $214.1 Reported rev. growth: 55.9% Adj. const. curr. rev. growth: 34.4% $122.9 Reported rev. growth: 25.0% Adj. const. curr. rev. growth: 25.3% • Excluding Vascular Intervention, in Q3'25, strength in Surgical, Vascular and Interventional was partially offset by our Anesthesia business, including the tough year-over-year comp in military orders • In Q3'25, we recognized an approximately $9 million stocking order as part of our intra-aortic balloon pump and catheter growth strategy in China, partially offset by volume-based procurement (VBP) • In Q3'25 the acquired Vascular Intervention business represented the largest contributor to growth • In Q3'25 growth was driven by the acquired Vascular Intervention business • In Q3'25 growth was primarily attributed to the acquired Vascular Intervention business

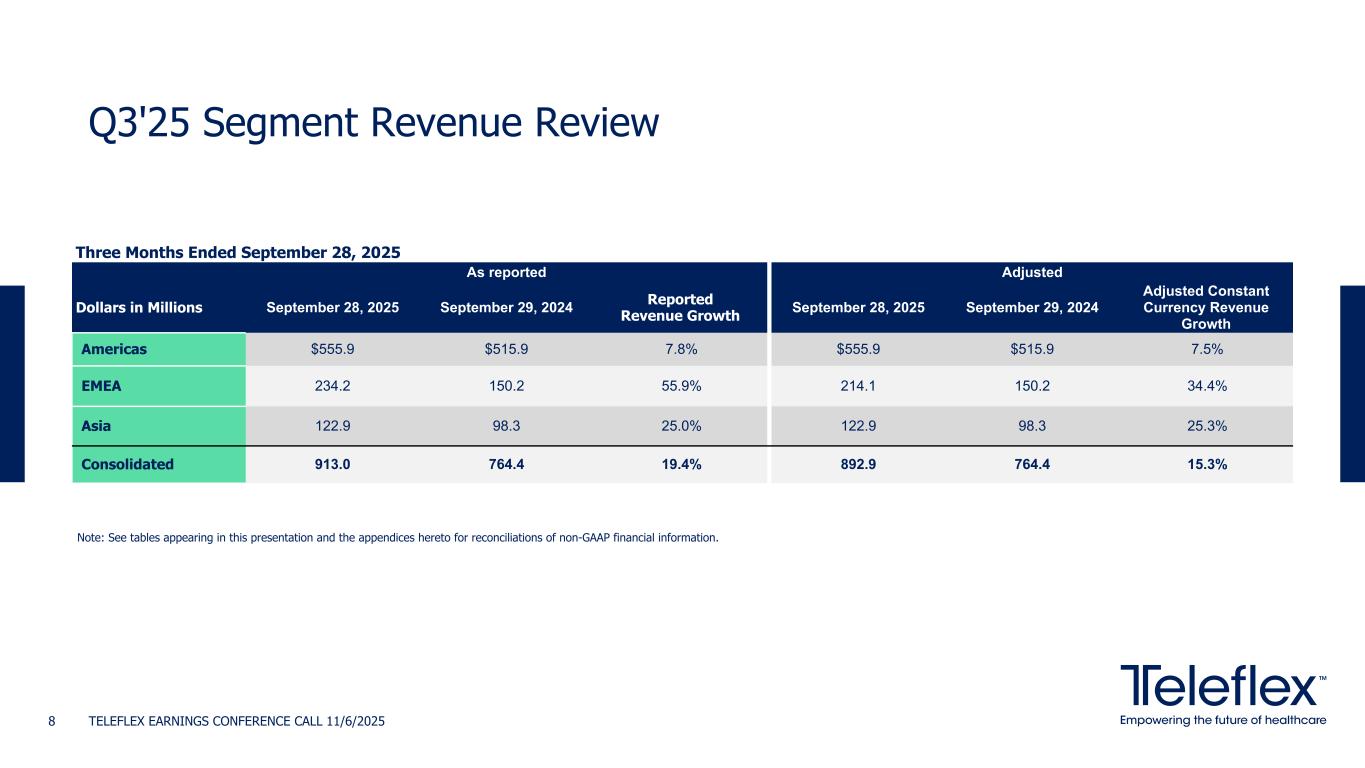

Q3'25 Segment Revenue Review TELEFLEX EARNINGS CONFERENCE CALL 11/6/20258 Three Months Ended September 28, 2025 As reported Adjusted Dollars in Millions September 28, 2025 September 29, 2024 Reported Revenue Growth September 28, 2025 September 29, 2024 Adjusted Constant Currency Revenue Growth Americas $555.9 $515.9 7.8% $555.9 $515.9 7.5% EMEA 234.2 150.2 55.9% 214.1 150.2 34.4% Asia 122.9 98.3 25.0% 122.9 98.3 25.3% Consolidated 913.0 764.4 19.4% 892.9 764.4 15.3% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information.

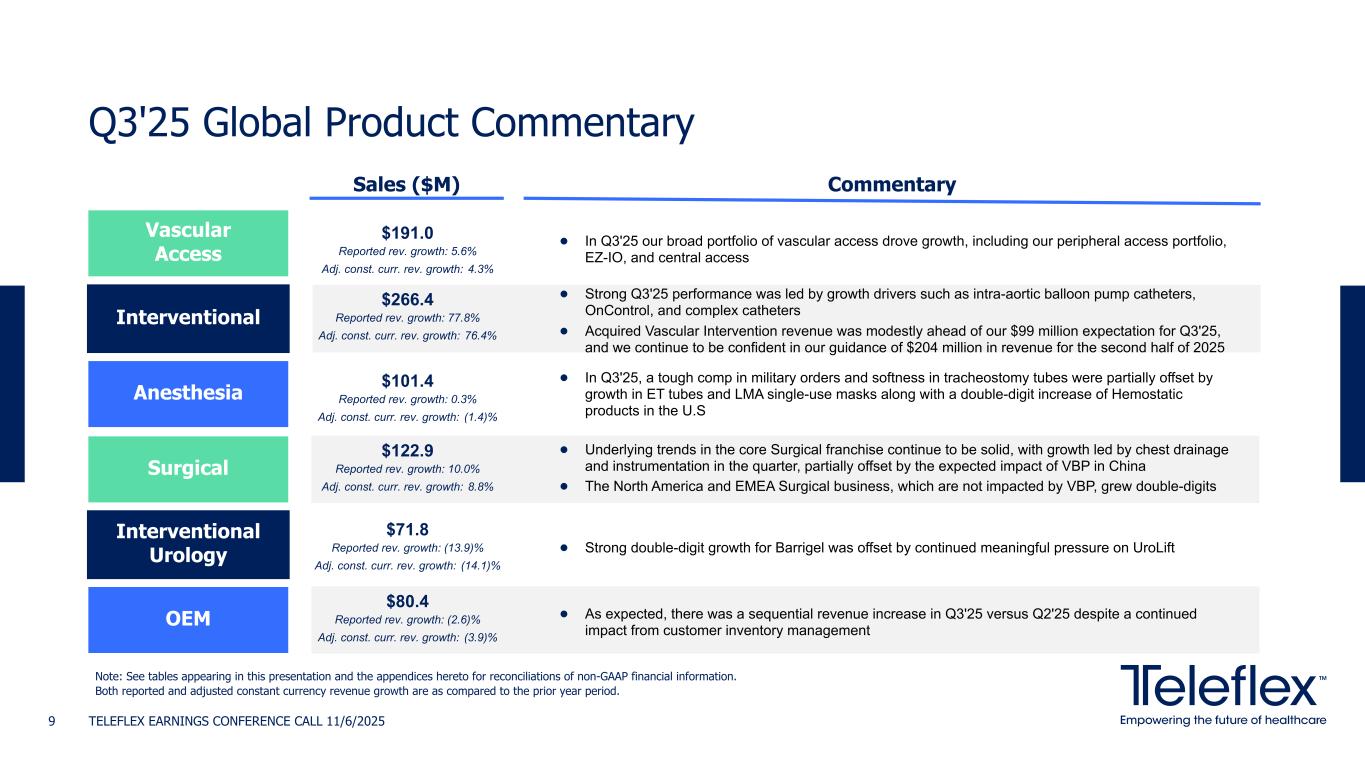

Q3'25 Global Product Commentary TELEFLEX EARNINGS CONFERENCE CALL 11/6/20259 Vascular Access Anesthesia Interventional Sales ($M) Commentary • In Q3'25 our broad portfolio of vascular access drove growth, including our peripheral access portfolio, EZ-IO, and central access Surgical OEM Interventional Urology • Strong Q3'25 performance was led by growth drivers such as intra-aortic balloon pump catheters, OnControl, and complex catheters $191.0 Reported rev. growth: 5.6% Adj. const. curr. rev. growth: 4.3% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information. Both reported and adjusted constant currency revenue growth are as compared to the prior year period. $266.4 Reported rev. growth: 77.8% Adj. const. curr. rev. growth: 76.4% $101.4 Reported rev. growth: 0.3% Adj. const. curr. rev. growth: (1.4)% $122.9 Reported rev. growth: 10.0% Adj. const. curr. rev. growth: 8.8% $71.8 Reported rev. growth: (13.9)% Adj. const. curr. rev. growth: (14.1)% $80.4 Reported rev. growth: (2.6)% Adj. const. curr. rev. growth: (3.9)% • In Q3'25, a tough comp in military orders and softness in tracheostomy tubes were partially offset by growth in ET tubes and LMA single-use masks along with a double-digit increase of Hemostatic products in the U.S • Underlying trends in the core Surgical franchise continue to be solid, with growth led by chest drainage and instrumentation in the quarter, partially offset by the expected impact of VBP in China • The North America and EMEA Surgical business, which are not impacted by VBP, grew double-digits • Strong double-digit growth for Barrigel was offset by continued meaningful pressure on UroLift • As expected, there was a sequential revenue increase in Q3'25 versus Q2'25 despite a continued impact from customer inventory management • Acquired Vascular Intervention revenue was modestly ahead of our $99 million expectation for Q3'25, and we continue to be confident in our guidance of $204 million in revenue for the second half of 2025

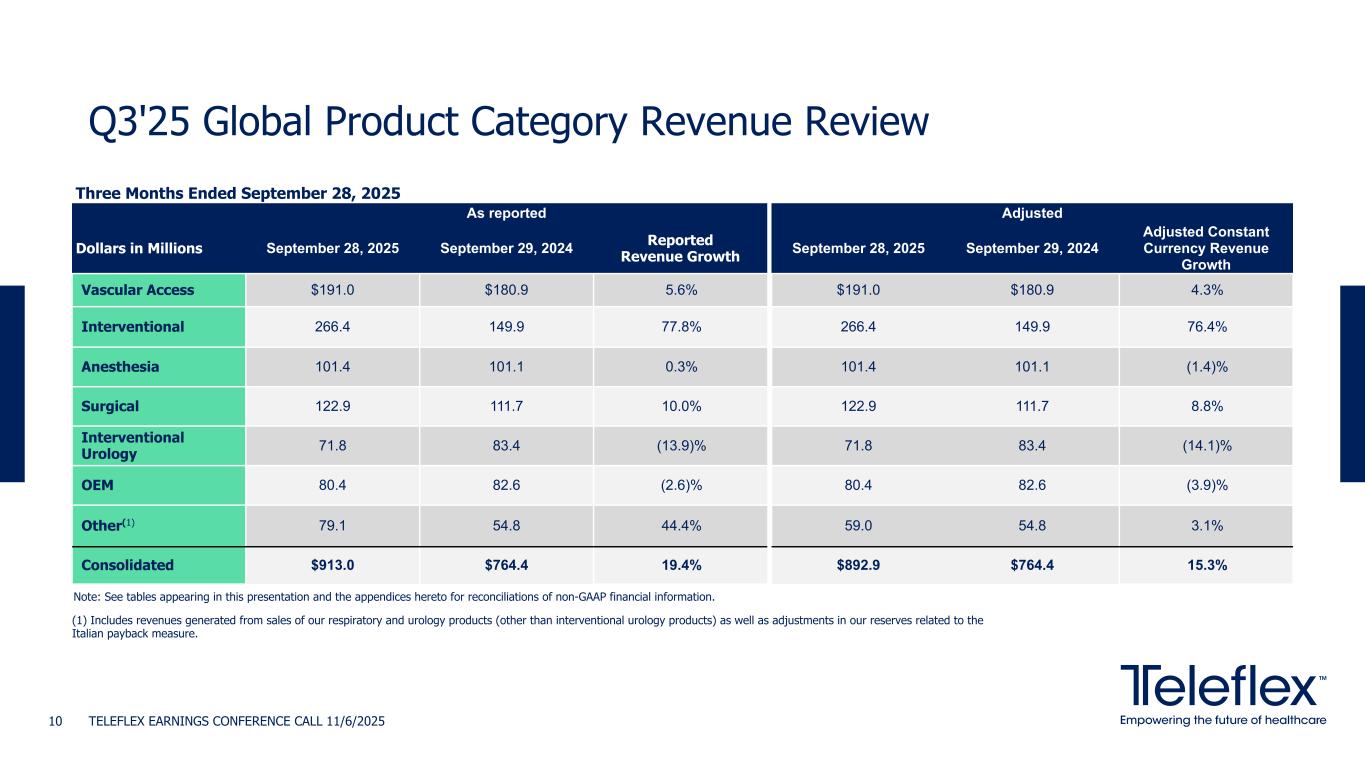

Q3'25 Global Product Category Revenue Review TELEFLEX EARNINGS CONFERENCE CALL 11/6/202510 (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) as well as adjustments in our reserves related to the Italian payback measure. Three Months Ended September 28, 2025 As reported Adjusted Dollars in Millions September 28, 2025 September 29, 2024 Reported Revenue Growth September 28, 2025 September 29, 2024 Adjusted Constant Currency Revenue Growth Vascular Access $191.0 $180.9 5.6% $191.0 $180.9 4.3% Interventional 266.4 149.9 77.8% 266.4 149.9 76.4% Anesthesia 101.4 101.1 0.3% 101.4 101.1 (1.4)% Surgical 122.9 111.7 10.0% 122.9 111.7 8.8% Interventional Urology 71.8 83.4 (13.9)% 71.8 83.4 (14.1)% OEM 80.4 82.6 (2.6)% 80.4 82.6 (3.9)% Other(1) 79.1 54.8 44.4% 59.0 54.8 3.1% Consolidated $913.0 $764.4 19.4% $892.9 $764.4 15.3% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information.

CAUTION: Federal (USA) law restricts these devices to sale or use by or on the order of a physician. Refer to the Instructions for Use for a complete listing of the indications, contraindications, warnings, and precautions. Information in this document is not a substitute for the product Instructions for Use. Not all products may be available in all countries. Separation of Teleflex into RemainCo and NewCo – Regarding the separation of Teleflex, decisive actions have continued to be made to unlock value within the business – In-line with Teleflex's commitment to maximizing value for its shareholders, Teleflex Board and management have been continuing to actively advance the process for a potential sale of NewCo, which is now the priority, and is pleased with the momentum and stage in the process – Once separated, each business will be best positioned for the future - with more focused strategic direction, simplified operating models, streamlined manufacturing footprints, and individually tailored capital allocation strategies aligned with their respective growth philosophy and objectives – As a reminder, the creation of RemainCo will create an optimized portfolio focused on highly complementary business units; Vascular Access, Interventional, and Surgical – NewCo will be able to identify, invest in, and capitalize on opportunities that are unique to Urology; Acute Care, including intra-aortic balloon pumps and catheters; and OEM end-markets – Teleflex will continue to act in the best interests of the company and its shareholders as this process progresses – Should a sale be consummated, Teleflex currently intends to utilize proceeds to balance pay down of debt and return capital to shareholders BIOTRONIK Vascular Intervention Acquisition – Acquired Vascular Intervention business revenue was modestly ahead of the communicated $99 million expectation for Q3 2025, and increased 6.9% year-over-year on a comparable basis, reflecting the impact of fluctuations in foreign currency exchange rates – Teleflex remains confident in the Vascular Intervention guidance of $204 million in revenue for the second half of 2025 – The integration activities for the acquired Vascular Intervention business are well underway and remain on track – A planned restructuring is aimed at reducing costs and increasing operational efficiency, and will include workforce reductions and the relocation of certain manufacturing operations to existing lower-cost locations – The restructuring activities are expected to be substantially completed by the end of 2028 Strategic Updates 11 TELEFLEX EARNINGS CONFERENCE CALL 11/6/2025

CAUTION: Federal (USA) law restricts this device to sale or use by or on the order of a physician. Refer to the Instructions for Use for a complete listing of the indications, contraindications, warnings, and precautions. Information in this document is not a substitute for the product Instructions for Use. Not all products may be available in all countries. 1,000 Patients Enrolled in the BIOMAG-II Trial – BIOMAG-II, a European randomized controlled trial for the FreesolveTM resorbable magnesium scaffold, has reached the patient enrollment midpoint ahead of schedule with over 1,000 patients now enrolled – BIOMAG-II is a prospective, multicenter, randomized controlled trial designed to evaluate the safety and clinical performance of FreesolveTM compared to a contemporary drug-eluting stent – The primary endpoint is Target Lesion Failure rate at 12 months – The data read-out for the BIOMAG-II study is expected in 2027 Barrigel™ Rectal Spacer Launched in Japan Following Regulatory Approval, Insurance Coverage, and Appropriate Use Criteria Issuance – In 2022, prostate cancer was the most common cancer among men in Japan with over 104,000 new cases, accounting for 18% of all cancer diagnoses nationwide1 – A U.S. clinical study found that 98 percent of men who were treated with Barrigel™ rectal spacer met the primary endpoint of achieving at least a 25 percent reduction in radiation to the rectum2 – Patients who met the primary endpoint averaged an 85 percent reduction in rectal V54 Gy radiation to the rectum, and Barrigel™ rectal spacer is proven superior in the reduction of acute and long-term Grade 1+ GI toxicity at 3 and 6 months compared to control2,3 Clinical and Commercial Updates TELEFLEX EARNINGS CONFERENCE CALL 11/6/202512 1. Ferlay J, Ervik M, Lam F, Laversanne M, Colombet M, Mery L, Piñeros M, Znaor A, Soerjomataram I, Bray F (2024). Global Cancer Observatory: Cancer Today. Lyon, France: International Agency for Research on Cancer. 2. Mariados NF, Orio PF III, King MT et al. JAMA Oncol (2023).* 3. Data on file. As of 4/01/2025.

John Deren Executive VP and CFO Financial Overview

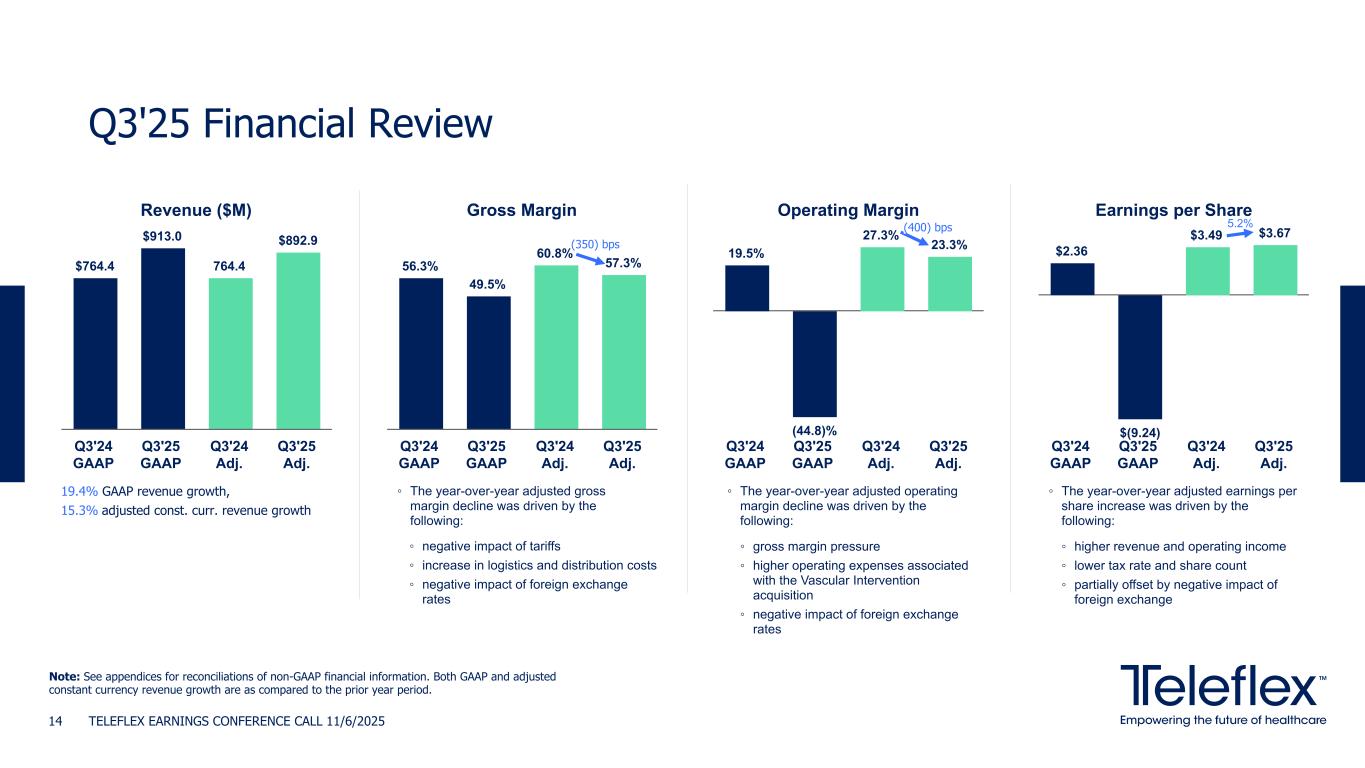

Earnings per Share $2.36 $(9.24) $3.49 $3.67 Q3'24 GAAP Q3'25 GAAP Q3'24 Adj. Q3'25 Adj. Q3'25 Financial Review TELEFLEX EARNINGS CONFERENCE CALL 11/6/202514 Note: See appendices for reconciliations of non-GAAP financial information. Both GAAP and adjusted constant currency revenue growth are as compared to the prior year period. Revenue ($M) $764.4 $913.0 764.4 $892.9 Q3'24 GAAP Q3'25 GAAP Q3'24 Adj. Q3'25 Adj. 19.4% GAAP revenue growth, 15.3% adjusted const. curr. revenue growth Gross Margin 56.3% 49.5% 60.8% 57.3% Q3'24 GAAP Q3'25 GAAP Q3'24 Adj. Q3'25 Adj. ◦ The year-over-year adjusted operating margin decline was driven by the following: Operating Margin 19.5% (44.8)% 27.3% 23.3% Q3'24 GAAP Q3'25 GAAP Q3'24 Adj. Q3'25 Adj. ◦ The year-over-year adjusted gross margin decline was driven by the following: ◦ The year-over-year adjusted earnings per share increase was driven by the following: (350) bps (400) bps 5.2% ◦ negative impact of tariffs ◦ increase in logistics and distribution costs ◦ negative impact of foreign exchange rates ◦ gross margin pressure ◦ higher operating expenses associated with the Vascular Intervention acquisition ◦ negative impact of foreign exchange rates ◦ higher revenue and operating income ◦ lower tax rate and share count ◦ partially offset by negative impact of foreign exchange

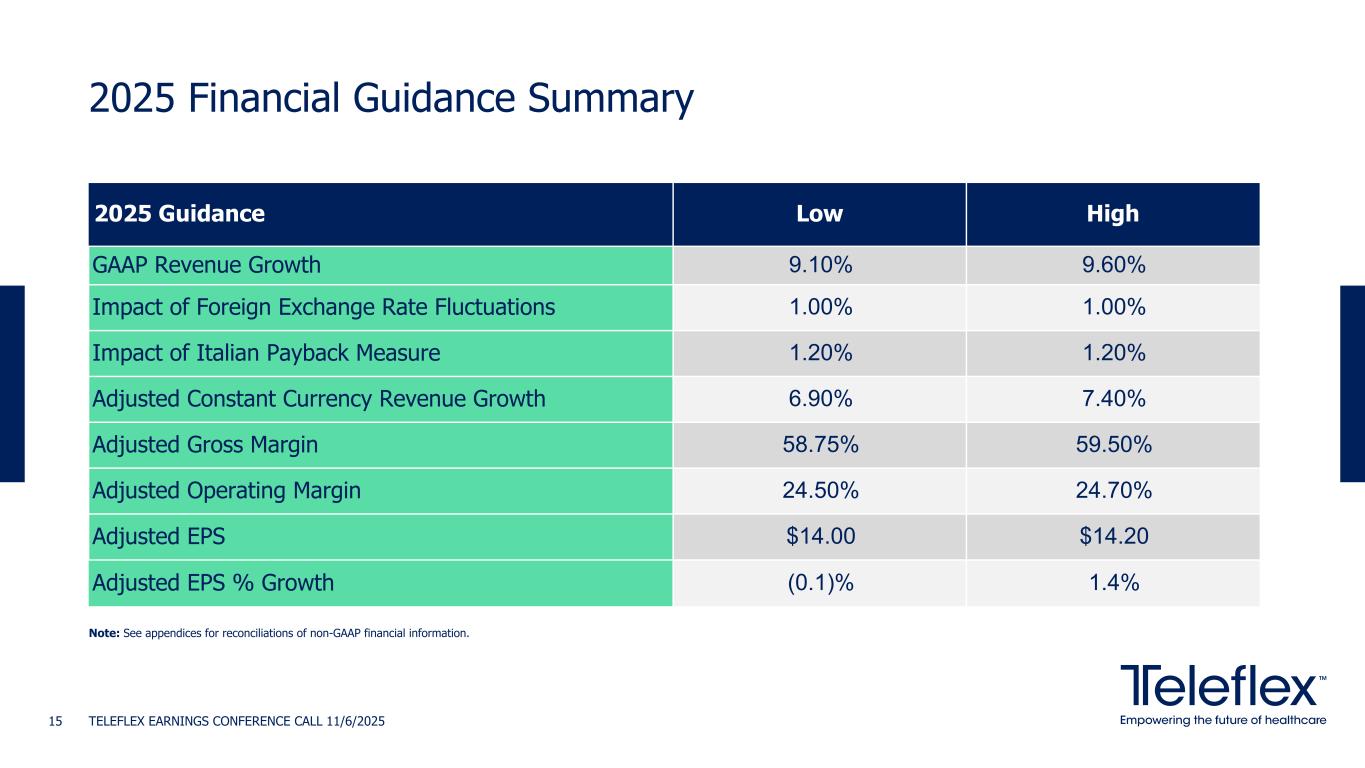

2025 Financial Guidance Summary TELEFLEX EARNINGS CONFERENCE CALL 11/6/202515 2025 Guidance Low High GAAP Revenue Growth 9.10% 9.60% Impact of Foreign Exchange Rate Fluctuations 1.00% 1.00% Impact of Italian Payback Measure 1.20% 1.20% Adjusted Constant Currency Revenue Growth 6.90% 7.40% Adjusted Gross Margin 58.75% 59.50% Adjusted Operating Margin 24.50% 24.70% Adjusted EPS $14.00 $14.20 Adjusted EPS % Growth (0.1)% 1.4% Note: See appendices for reconciliations of non-GAAP financial information.

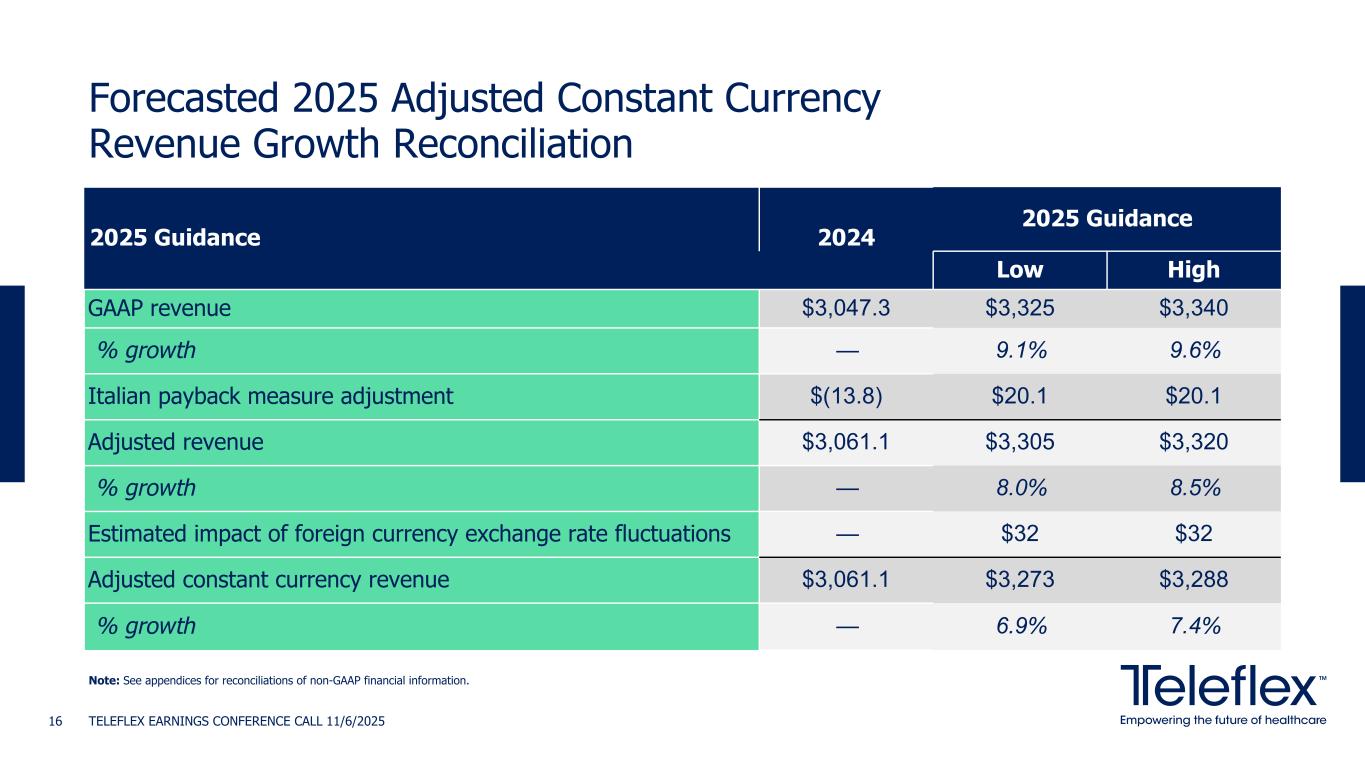

Forecasted 2025 Adjusted Constant Currency Revenue Growth Reconciliation TELEFLEX EARNINGS CONFERENCE CALL 11/6/202516 2025 Guidance 2024 2025 Guidance Low High GAAP revenue $3,047.3 $3,325 $3,340 % growth — 9.1% 9.6% Italian payback measure adjustment $(13.8) $20.1 $20.1 Adjusted revenue $3,061.1 $3,305 $3,320 % growth — 8.0% 8.5% Estimated impact of foreign currency exchange rate fluctuations — $32 $32 Adjusted constant currency revenue $3,061.1 $3,273 $3,288 % growth — 6.9% 7.4% Note: See appendices for reconciliations of non-GAAP financial information.

TELEFLEX EARNINGS CONFERENCE CALL 11/6/202517 Key Takeaways We continued to make significant progress in executing our strategy. Third quarter revenue was in the range of guidance, while operating margin and EPS exceeded our expectations. For RemainCo, we are pleased with the performance for the first nine months of 2025 and it is encouraging for our longer- term growth outlook. The Vascular Intervention business performed well in the quarter with revenue exceeding our guidance. We will host a virtual investor event on November 14 at 8am ET dedicated to the Vascular Intervention business with a focus on the comprehensive coronary and peripheral product portfolio and new product opportunities, including the Freesolve bioabsorbable magnesium scaffold. We continue to advance our strategic objectives. Our focus is on enhanced operational execution, accelerating growth, and strengthening our diverse product portfolio to better serve our customers. We are pleased with the progress on the separation of Teleflex, including prioritization of a potential sale of NewCo, supported by our guiding principle of continuing to focus on maximizing shareholder value through this process.

TELEFLEX EARNINGS CONFERENCE CALL 11/6/202518 Thank You!

Appendices

The presentation to which these appendices are attached and the following appendices include, among other things, tables reconciling the following applicable non-GAAP financial measures to the most comparable GAAP financial measure: Adjusted revenue. This non-GAAP measure is based upon net revenues, adjusted to exclude the impact of adjustments in our reserves and the corresponding revenue impact related to the Italian payback measure. The Italian payback measure is a law that requires suppliers of medical devices to the Italian National Healthcare System to make payments to the Italian government if medical device expenditures in a given year exceed regional expenditure ceilings established for that year. As a result of a ruling from the Italian courts, we recognized a decrease in our reserves during the year ended December 31, 2024, of which $13.8 million related to prior years. In August 2025, the Italian Parliament enacted a modification to the previously enacted legislation that reduced the payment amounts due from the affected companies, including Teleflex, to approximately 25% of the amounts originally invoiced for the years 2015 through 2018. Payment of the reduced amount precludes the pursuit of further legal action related to the obligation to pay the amounts relating to such years. During the third quarter of 2025, we remitted payment to the related regions to settle the years 2015 through 2018. As a result of the modification in the legislation, along with an adjustment to our calculation of the reserves related to years 2019 through 2025, we recognized a $23.7 million decrease in our reserve (and corresponding increase to revenue for the three and nine months ended September 28, 2025), of which $20.1 million pertains to prior periods. The amounts do not represent normal adjustments to revenue and are not recurring in nature, making it difficult to contribute to a meaningful evaluation of our period over period operating performance. Accordingly, management has excluded the $20.1 million favorable adjustment recognized in the current period and the unfavorable adjustment of $13.8 million in the prior period. Adjusted constant currency revenue growth. This non-GAAP measure is based upon net revenues, adjusted to exclude, depending on the period presented, the items described in Adjusted revenue and to eliminate the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. The impact of changes in foreign currency may vary significantly from period to period, and such changes generally are outside of the control of our management. We believe that this measure facilitates a comparison of our operating performance exclusive of currency exchange rate fluctuations that do not reflect our underlying performance or business trends. Adjusted diluted earnings per share. This non-GAAP measure is based upon diluted earnings per share from continuing operations, the most directly comparable GAAP measure, adjusted to exclude, depending on the period presented, the impact of (i) restructuring and rationalization charges; (ii) impairment charges; (iii) acquisition, integration and divestiture related items; (iv) separation costs; (v) Italian payback measure; (vi) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (vii) pension termination and related charges; (viii) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (ix) intangible amortization expense; (x) tax adjustments; and (xi) dilutive share impact. Management does not believe that any of the excluded items are indicative of our underlying core performance or business trends. Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impacts of (i) restructuring and rationalization charges; (ii) impairment charges; (iii) acquisition, integration and divestiture related items and (iv) Italian payback measure. Adjusted operating profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring and rationalization charges; (ii) impairment charges; (iii) acquisition, integration and divestiture related items; (iv) separation costs; (v) Italian payback measure; (vi) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (vii) pension termination and related charges; (viii) intangible amortization expense; and (ix) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation. Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring and rationalization charges; (ii) impairment charges; (iii) acquisition, integration and divestiture related items; (iv) separation costs; (v) Italian payback measure; (vi) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (vii) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (viii) intangible amortization expense; and (ix) tax adjustments. Non-GAAP Financial Measures TELEFLEX EARNINGS CONFERENCE CALL 11/6/202520

The following is an explanation of certain of the adjustments that are applied with respect to one or more of the non-GAAP financial measures that appear in the presentation to which these appendices are attached: Restructuring and rationalization charges - Restructuring and rationalization charges include expenses associated with discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies, integrate acquired businesses and optimize product portfolios through targeted rationalization efforts. These changes include qualified restructuring costs (which may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement), restructuring related (which may include accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of a restructuring program) and product line exit charges. Impairment charges - Impairment charges, including those related to goodwill, and other assets occur if, due to events or changes in circumstances, we determine that the carrying value of an asset exceeds its fair value. Impairment charges do not directly affect our liquidity, but could have a material adverse effect on our reported financial results. Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; temporary financing costs directly associated with the transaction, such as bridge loan financing fees, ticking fees, and similar charges, and the impact of derivative instruments executed to hedge foreign currency exposure or other risks associated with the purchase price. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of a divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. Separation costs - These adjustments represents direct costs related to our recently announced strategic actions to separate Teleflex into RemainCo and NewCo and primarily consist of consulting, legal, tax, and other professional advisory services. These charges and costs do not represent normal and recurring operating expenses, will be inconsistent in amounts and frequency, and are not expected to recur after the transaction has been completed. Italian payback measure - These adjustments represent the exclusion of adjustments in our reserves related to the Italian payback measure as described in Adjusted revenue. Other - These are discrete items that occur sporadically and can affect period-to-period comparisons. Pension termination and related charges - These adjustments represent charges associated with the planned termination of the Teleflex Incorporated Retirement Income Plan, a frozen U.S. defined benefit pension plan, and related direct incremental expenses including certain charges stemming from the liquidation of surplus plan assets. These charges and costs do not represent normal and recurring operating expenses, will be inconsistent in amounts and frequency, and are not expected to recur once the plan termination process has been completed. Accordingly, management has excluded these amounts to facilitate an evaluation of our current operating performance and a comparison to our past operating performance. Non-GAAP Adjustments TELEFLEX EARNINGS CONFERENCE CALL 11/6/202521

European medical device regulation - The European Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”), which replaces the existing Medical Devices Directive (“MDD”) and imposes more stringent requirements for the marketing and sale of medical devices in the EU, including requirements affecting clinical evaluations, quality systems and post- market surveillance. The MDR requirements became effective in May 2021, although certain devices that previously satisfied MDD requirements can continue to be marketed in the EU until December 2027 for highest-risk devices and December 2028 for lower-risk devices, subject to certain limitations. Significantly, the MDR will require the re-registration of previously approved medical devices. As a result, Teleflex will incur expenditures in connection with the new registration of medical devices that previously had been registered under the MDD. Therefore, these expenditures are not considered to be ordinary course expenditures in connection with regulatory matters (in contrast, no adjustment has been made to exclude expenditures related to the registration of medical devices that were not registered previously under the MDD). Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. ERP implementation - These adjustments represent direct and incremental costs incurred in connection with our implementation of a new global enterprise resource planning ("ERP") solution and related IT transition costs. An implementation of this scale is a significant undertaking and will require substantial time and attention of management and key employees. The associated costs do not represent normal and recurring operating expenses and will be inconsistent in amounts and frequency making it difficult to contribute to a meaningful evaluation of our operating performance. Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law or certain other discrete changes affecting our deferred tax liability. Dilutive shares impact – Adjustment reflects the impact to adjusted diluted earnings per share from continuing operations of including potentially dilutive shares in the calculation of weighted average diluted common shares outstanding. Non-GAAP Adjustments TELEFLEX EARNINGS CONFERENCE CALL 11/6/202522

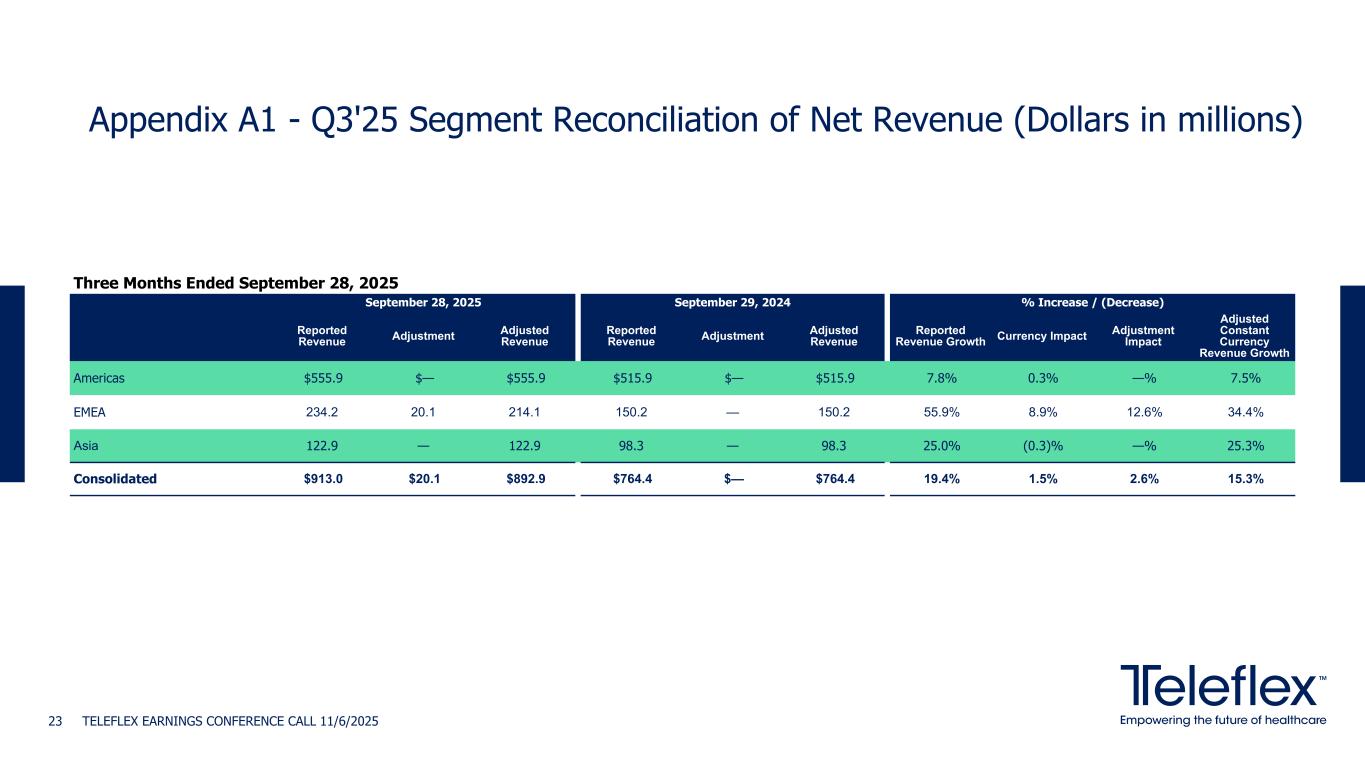

Three Months Ended September 28, 2025 September 28, 2025 September 29, 2024 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Americas $555.9 $— $555.9 $515.9 $— $515.9 7.8% 0.3% —% 7.5% EMEA 234.2 20.1 214.1 150.2 — 150.2 55.9% 8.9% 12.6% 34.4% Asia 122.9 — 122.9 98.3 — 98.3 25.0% (0.3)% —% 25.3% Consolidated $913.0 $20.1 $892.9 $764.4 $— $764.4 19.4% 1.5% 2.6% 15.3% TELEFLEX EARNINGS CONFERENCE CALL 11/6/202523 Appendix A1 - Q3'25 Segment Reconciliation of Net Revenue (Dollars in millions)

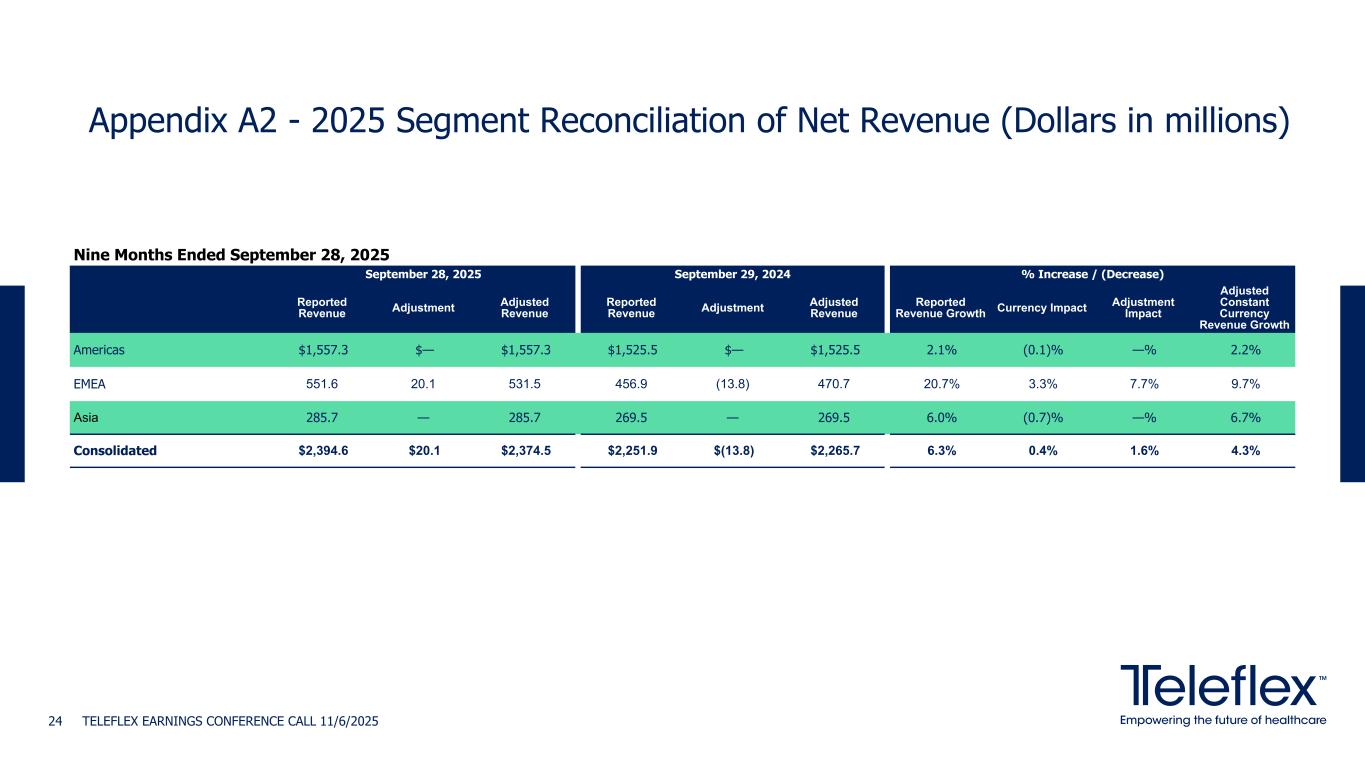

Nine Months Ended September 28, 2025 September 28, 2025 September 29, 2024 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Americas $1,557.3 $— $1,557.3 $1,525.5 $— $1,525.5 2.1% (0.1)% —% 2.2% EMEA 551.6 20.1 531.5 456.9 (13.8) 470.7 20.7% 3.3% 7.7% 9.7% Asia 285.7 — 285.7 269.5 — 269.5 6.0% (0.7)% —% 6.7% Consolidated $2,394.6 $20.1 $2,374.5 $2,251.9 $(13.8) $2,265.7 6.3% 0.4% 1.6% 4.3% TELEFLEX EARNINGS CONFERENCE CALL 11/6/202524 Appendix A2 - 2025 Segment Reconciliation of Net Revenue (Dollars in millions)

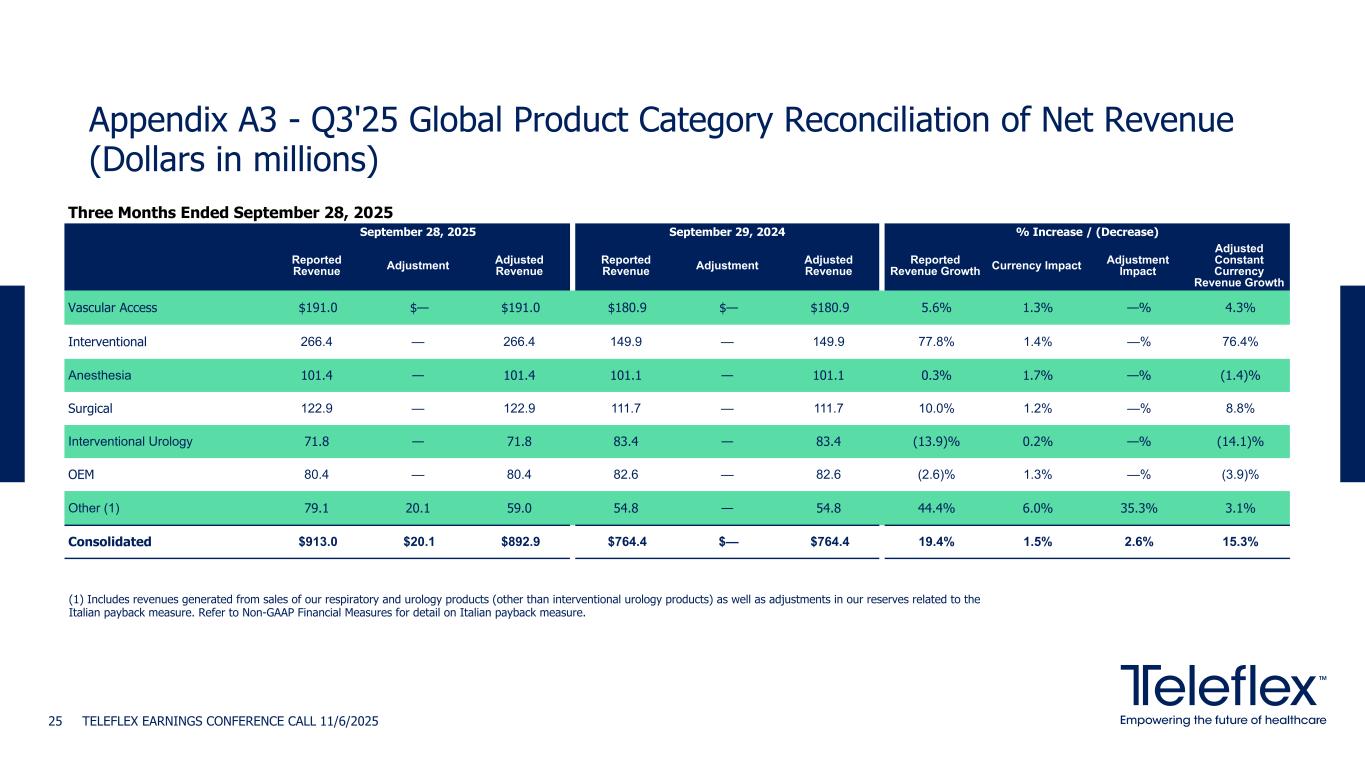

Three Months Ended September 28, 2025 September 28, 2025 September 29, 2024 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Vascular Access $191.0 $— $191.0 $180.9 $— $180.9 5.6% 1.3% —% 4.3% Interventional 266.4 — 266.4 149.9 — 149.9 77.8% 1.4% —% 76.4% Anesthesia 101.4 — 101.4 101.1 — 101.1 0.3% 1.7% —% (1.4)% Surgical 122.9 — 122.9 111.7 — 111.7 10.0% 1.2% —% 8.8% Interventional Urology 71.8 — 71.8 83.4 — 83.4 (13.9)% 0.2% —% (14.1)% OEM 80.4 — 80.4 82.6 — 82.6 (2.6)% 1.3% —% (3.9)% Other (1) 79.1 20.1 59.0 54.8 — 54.8 44.4% 6.0% 35.3% 3.1% Consolidated $913.0 $20.1 $892.9 $764.4 $— $764.4 19.4% 1.5% 2.6% 15.3% TELEFLEX EARNINGS CONFERENCE CALL 11/6/202525 Appendix A3 - Q3'25 Global Product Category Reconciliation of Net Revenue (Dollars in millions) (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) as well as adjustments in our reserves related to the Italian payback measure. Refer to Non-GAAP Financial Measures for detail on Italian payback measure.

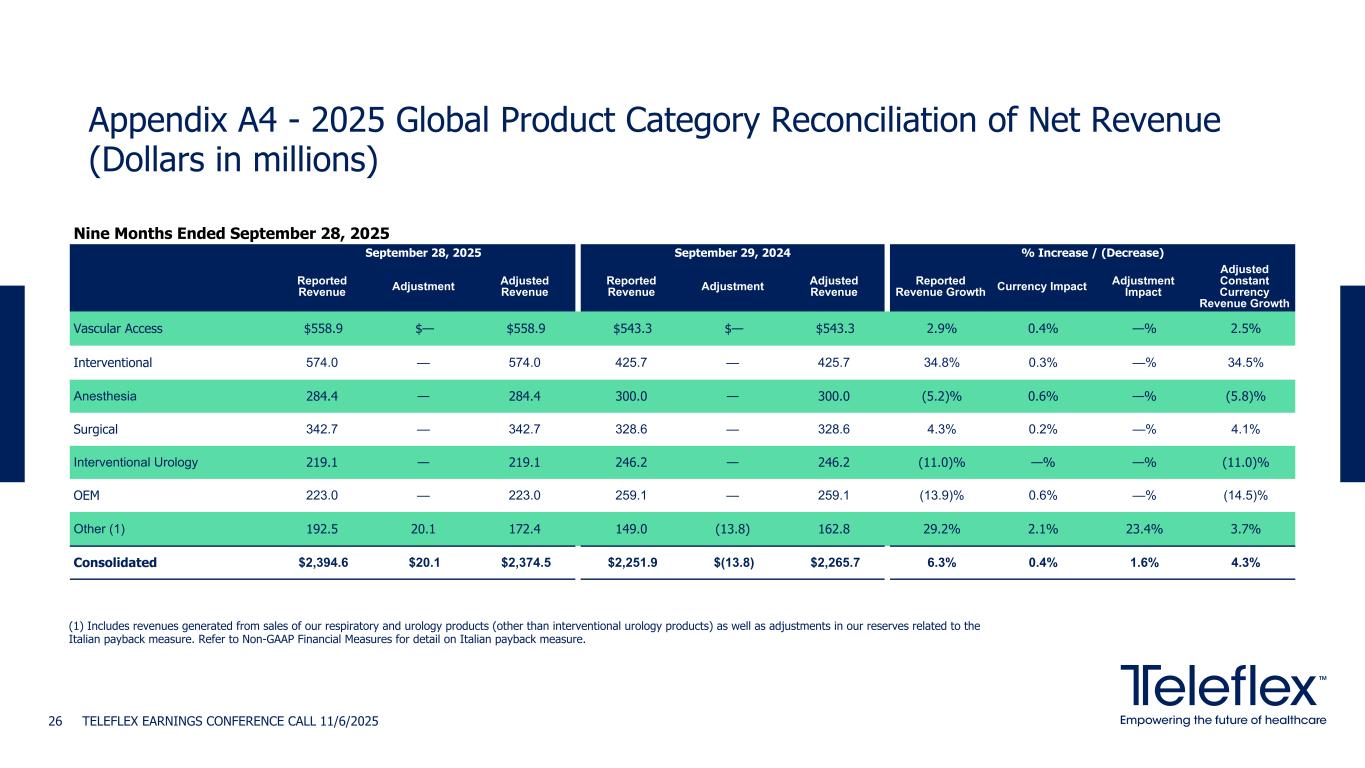

Nine Months Ended September 28, 2025 September 28, 2025 September 29, 2024 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Vascular Access $558.9 $— $558.9 $543.3 $— $543.3 2.9% 0.4% —% 2.5% Interventional 574.0 — 574.0 425.7 — 425.7 34.8% 0.3% —% 34.5% Anesthesia 284.4 — 284.4 300.0 — 300.0 (5.2)% 0.6% —% (5.8)% Surgical 342.7 — 342.7 328.6 — 328.6 4.3% 0.2% —% 4.1% Interventional Urology 219.1 — 219.1 246.2 — 246.2 (11.0)% —% —% (11.0)% OEM 223.0 — 223.0 259.1 — 259.1 (13.9)% 0.6% —% (14.5)% Other (1) 192.5 20.1 172.4 149.0 (13.8) 162.8 29.2% 2.1% 23.4% 3.7% Consolidated $2,394.6 $20.1 $2,374.5 $2,251.9 $(13.8) $2,265.7 6.3% 0.4% 1.6% 4.3% TELEFLEX EARNINGS CONFERENCE CALL 11/6/202526 Appendix A4 - 2025 Global Product Category Reconciliation of Net Revenue (Dollars in millions) (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) as well as adjustments in our reserves related to the Italian payback measure. Refer to Non-GAAP Financial Measures for detail on Italian payback measure.

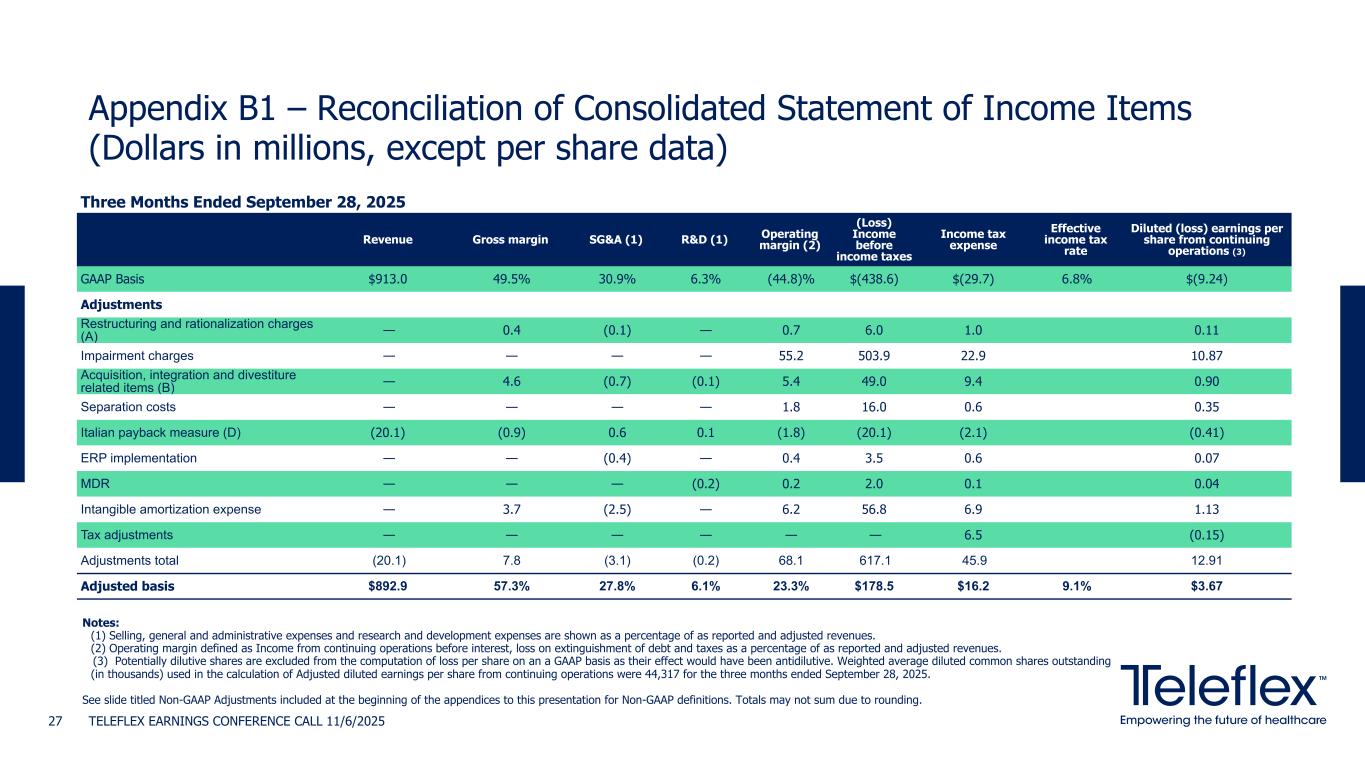

Appendix B1 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data) TELEFLEX EARNINGS CONFERENCE CALL 11/6/202527 Three Months Ended September 28, 2025 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) (Loss) Income before income taxes Income tax expense Effective income tax rate Diluted (loss) earnings per share from continuing operations (3) GAAP Basis $913.0 49.5% 30.9% 6.3% (44.8)% $(438.6) $(29.7) 6.8% $(9.24) Adjustments Restructuring and rationalization charges (A) — 0.4 (0.1) — 0.7 6.0 1.0 0.11 Impairment charges — — — — 55.2 503.9 22.9 10.87 Acquisition, integration and divestiture related items (B) — 4.6 (0.7) (0.1) 5.4 49.0 9.4 0.90 Separation costs — — — — 1.8 16.0 0.6 0.35 Italian payback measure (D) (20.1) (0.9) 0.6 0.1 (1.8) (20.1) (2.1) (0.41) ERP implementation — — (0.4) — 0.4 3.5 0.6 0.07 MDR — — — (0.2) 0.2 2.0 0.1 0.04 Intangible amortization expense — 3.7 (2.5) — 6.2 56.8 6.9 1.13 Tax adjustments — — — — — — 6.5 (0.15) Adjustments total (20.1) 7.8 (3.1) (0.2) 68.1 617.1 45.9 12.91 Adjusted basis $892.9 57.3% 27.8% 6.1% 23.3% $178.5 $16.2 9.1% $3.67 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of as reported and adjusted revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of as reported and adjusted revenues. (3) Potentially dilutive shares are excluded from the computation of loss per share on an a GAAP basis as their effect would have been antidilutive. Weighted average diluted common shares outstanding (in thousands) used in the calculation of Adjusted diluted earnings per share from continuing operations were 44,317 for the three months ended September 28, 2025. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding.

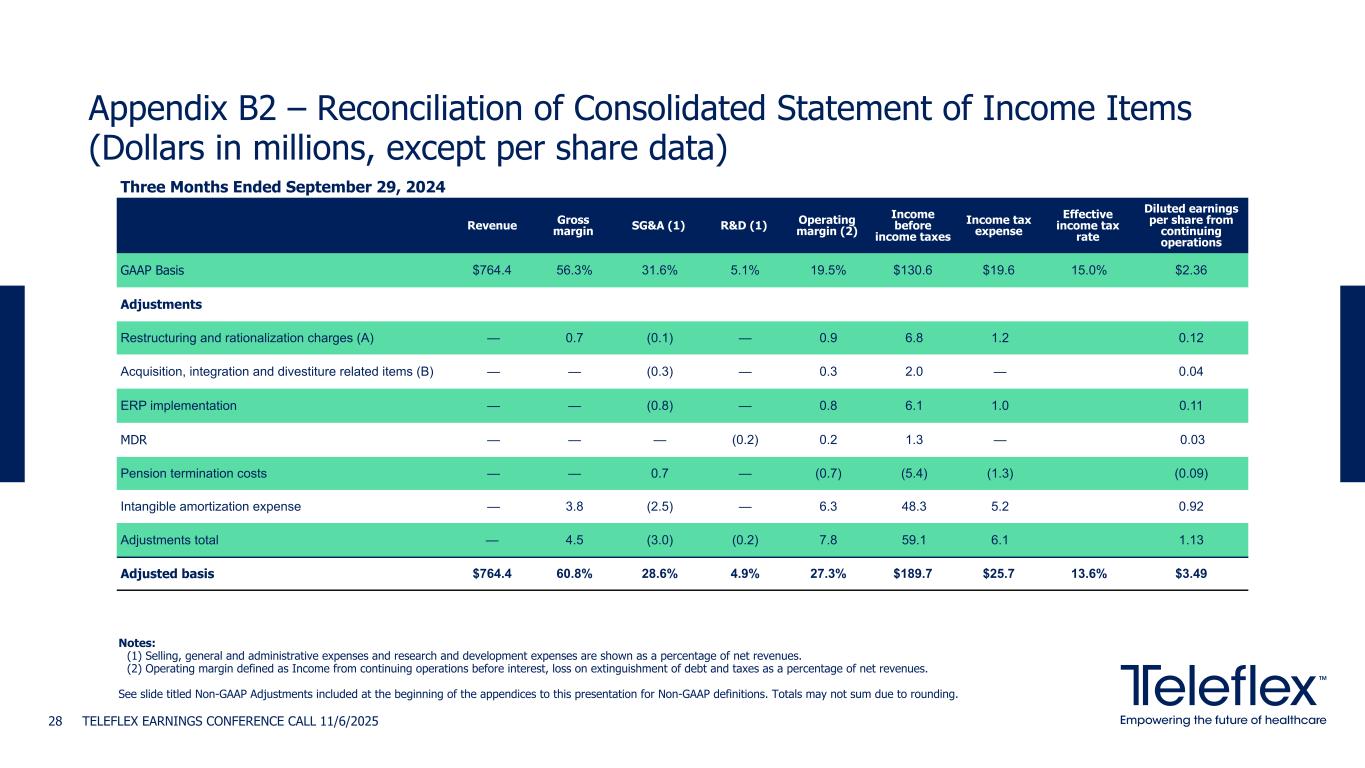

Three Months Ended September 29, 2024 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis $764.4 56.3% 31.6% 5.1% 19.5% $130.6 $19.6 15.0% $2.36 Adjustments Restructuring and rationalization charges (A) — 0.7 (0.1) — 0.9 6.8 1.2 0.12 Acquisition, integration and divestiture related items (B) — — (0.3) — 0.3 2.0 — 0.04 ERP implementation — — (0.8) — 0.8 6.1 1.0 0.11 MDR — — — (0.2) 0.2 1.3 — 0.03 Pension termination costs — — 0.7 — (0.7) (5.4) (1.3) (0.09) Intangible amortization expense — 3.8 (2.5) — 6.3 48.3 5.2 0.92 Adjustments total — 4.5 (3.0) (0.2) 7.8 59.1 6.1 1.13 Adjusted basis $764.4 60.8% 28.6% 4.9% 27.3% $189.7 $25.7 13.6% $3.49 TELEFLEX EARNINGS CONFERENCE CALL 11/6/202528 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of net revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of net revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding. Appendix B2 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data)

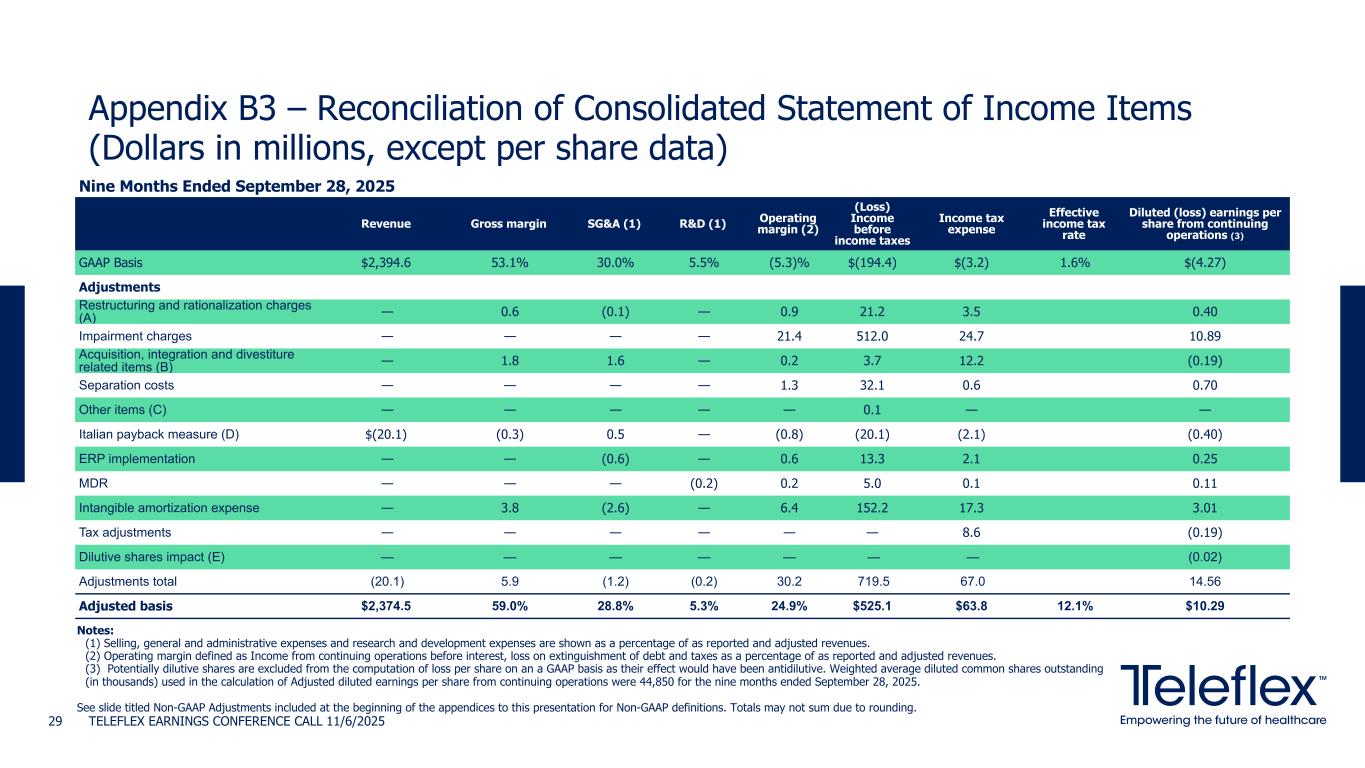

Appendix B3 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data) TELEFLEX EARNINGS CONFERENCE CALL 11/6/202529 Nine Months Ended September 28, 2025 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) (Loss) Income before income taxes Income tax expense Effective income tax rate Diluted (loss) earnings per share from continuing operations (3) GAAP Basis $2,394.6 53.1% 30.0% 5.5% (5.3)% $(194.4) $(3.2) 1.6% $(4.27) Adjustments Restructuring and rationalization charges (A) — 0.6 (0.1) — 0.9 21.2 3.5 0.40 Impairment charges — — — — 21.4 512.0 24.7 10.89 Acquisition, integration and divestiture related items (B) — 1.8 1.6 — 0.2 3.7 12.2 (0.19) Separation costs — — — — 1.3 32.1 0.6 0.70 Other items (C) — — — — — 0.1 — — Italian payback measure (D) $(20.1) (0.3) 0.5 — (0.8) (20.1) (2.1) (0.40) ERP implementation — — (0.6) — 0.6 13.3 2.1 0.25 MDR — — — (0.2) 0.2 5.0 0.1 0.11 Intangible amortization expense — 3.8 (2.6) — 6.4 152.2 17.3 3.01 Tax adjustments — — — — — — 8.6 (0.19) Dilutive shares impact (E) — — — — — — — (0.02) Adjustments total (20.1) 5.9 (1.2) (0.2) 30.2 719.5 67.0 14.56 Adjusted basis $2,374.5 59.0% 28.8% 5.3% 24.9% $525.1 $63.8 12.1% $10.29 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of as reported and adjusted revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of as reported and adjusted revenues. (3) Potentially dilutive shares are excluded from the computation of loss per share on an a GAAP basis as their effect would have been antidilutive. Weighted average diluted common shares outstanding (in thousands) used in the calculation of Adjusted diluted earnings per share from continuing operations were 44,850 for the nine months ended September 28, 2025. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding.

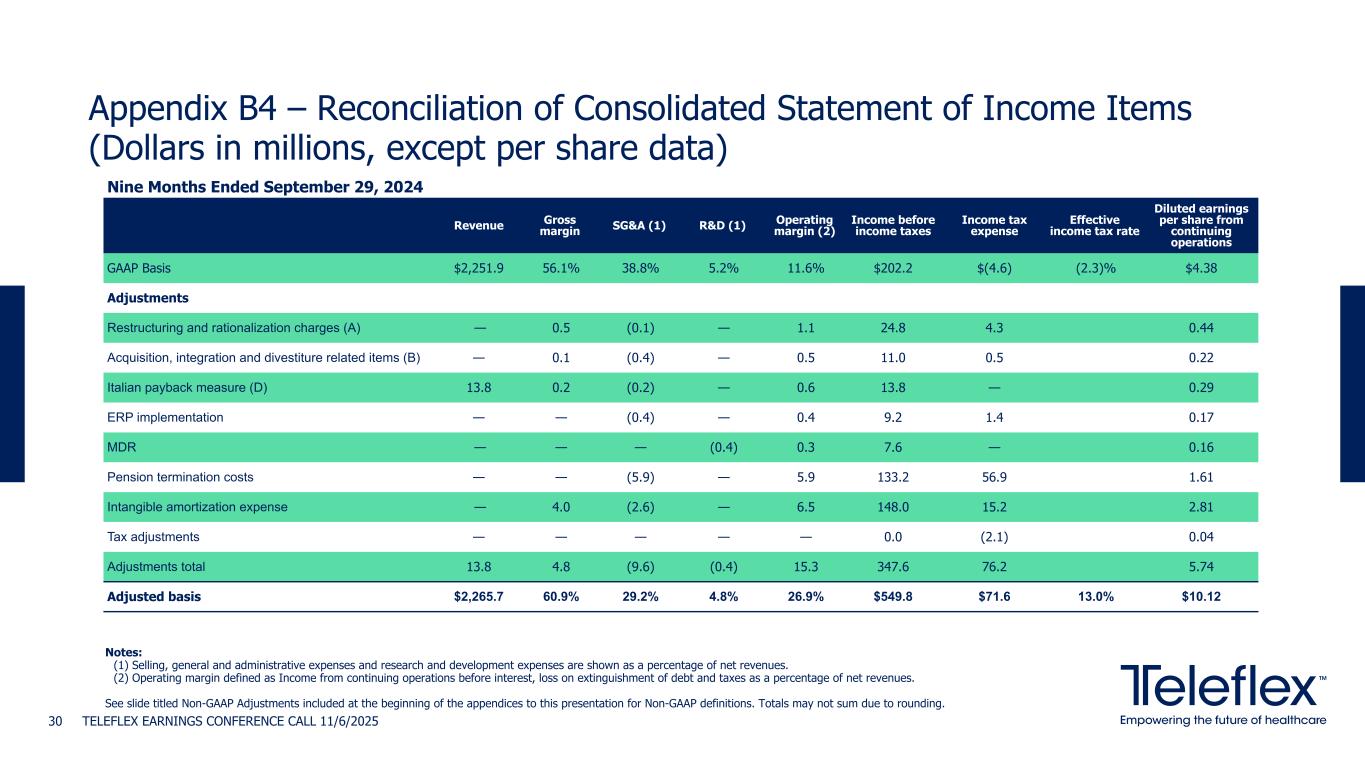

Nine Months Ended September 29, 2024 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis $2,251.9 56.1% 38.8% 5.2% 11.6% $202.2 $(4.6) (2.3)% $4.38 Adjustments Restructuring and rationalization charges (A) — 0.5 (0.1) — 1.1 24.8 4.3 0.44 Acquisition, integration and divestiture related items (B) — 0.1 (0.4) — 0.5 11.0 0.5 0.22 Italian payback measure (D) 13.8 0.2 (0.2) — 0.6 13.8 — 0.29 ERP implementation — — (0.4) — 0.4 9.2 1.4 0.17 MDR — — — (0.4) 0.3 7.6 — 0.16 Pension termination costs — — (5.9) — 5.9 133.2 56.9 1.61 Intangible amortization expense — 4.0 (2.6) — 6.5 148.0 15.2 2.81 Tax adjustments — — — — — 0.0 (2.1) 0.04 Adjustments total 13.8 4.8 (9.6) (0.4) 15.3 347.6 76.2 5.74 Adjusted basis $2,265.7 60.9% 29.2% 4.8% 26.9% $549.8 $71.6 13.0% $10.12 TELEFLEX EARNINGS CONFERENCE CALL 11/6/202530 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of net revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of net revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding. Appendix B4 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data)

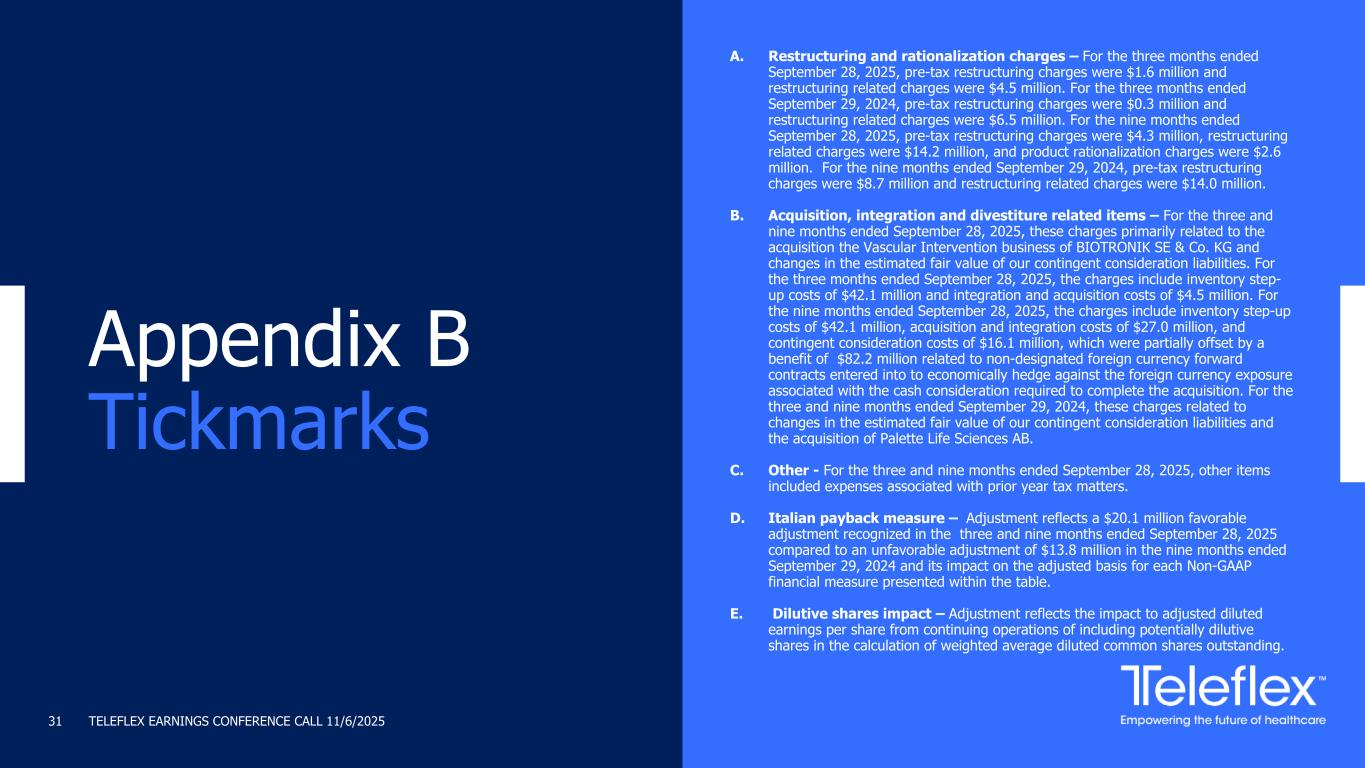

TELEFLEX EARNINGS CONFERENCE CALL 11/6/202531 A. Restructuring and rationalization charges – For the three months ended September 28, 2025, pre-tax restructuring charges were $1.6 million and restructuring related charges were $4.5 million. For the three months ended September 29, 2024, pre-tax restructuring charges were $0.3 million and restructuring related charges were $6.5 million. For the nine months ended September 28, 2025, pre-tax restructuring charges were $4.3 million, restructuring related charges were $14.2 million, and product rationalization charges were $2.6 million. For the nine months ended September 29, 2024, pre-tax restructuring charges were $8.7 million and restructuring related charges were $14.0 million. B. Acquisition, integration and divestiture related items – For the three and nine months ended September 28, 2025, these charges primarily related to the acquisition the Vascular Intervention business of BIOTRONIK SE & Co. KG and changes in the estimated fair value of our contingent consideration liabilities. For the three months ended September 28, 2025, the charges include inventory step- up costs of $42.1 million and integration and acquisition costs of $4.5 million. For the nine months ended September 28, 2025, the charges include inventory step-up costs of $42.1 million, acquisition and integration costs of $27.0 million, and contingent consideration costs of $16.1 million, which were partially offset by a benefit of $82.2 million related to non-designated foreign currency forward contracts entered into to economically hedge against the foreign currency exposure associated with the cash consideration required to complete the acquisition. For the three and nine months ended September 29, 2024, these charges related to changes in the estimated fair value of our contingent consideration liabilities and the acquisition of Palette Life Sciences AB. C. Other - For the three and nine months ended September 28, 2025, other items included expenses associated with prior year tax matters. D. Italian payback measure – Adjustment reflects a $20.1 million favorable adjustment recognized in the three and nine months ended September 28, 2025 compared to an unfavorable adjustment of $13.8 million in the nine months ended September 29, 2024 and its impact on the adjusted basis for each Non-GAAP financial measure presented within the table. E. Dilutive shares impact – Adjustment reflects the impact to adjusted diluted earnings per share from continuing operations of including potentially dilutive shares in the calculation of weighted average diluted common shares outstanding. Appendix B Tickmarks

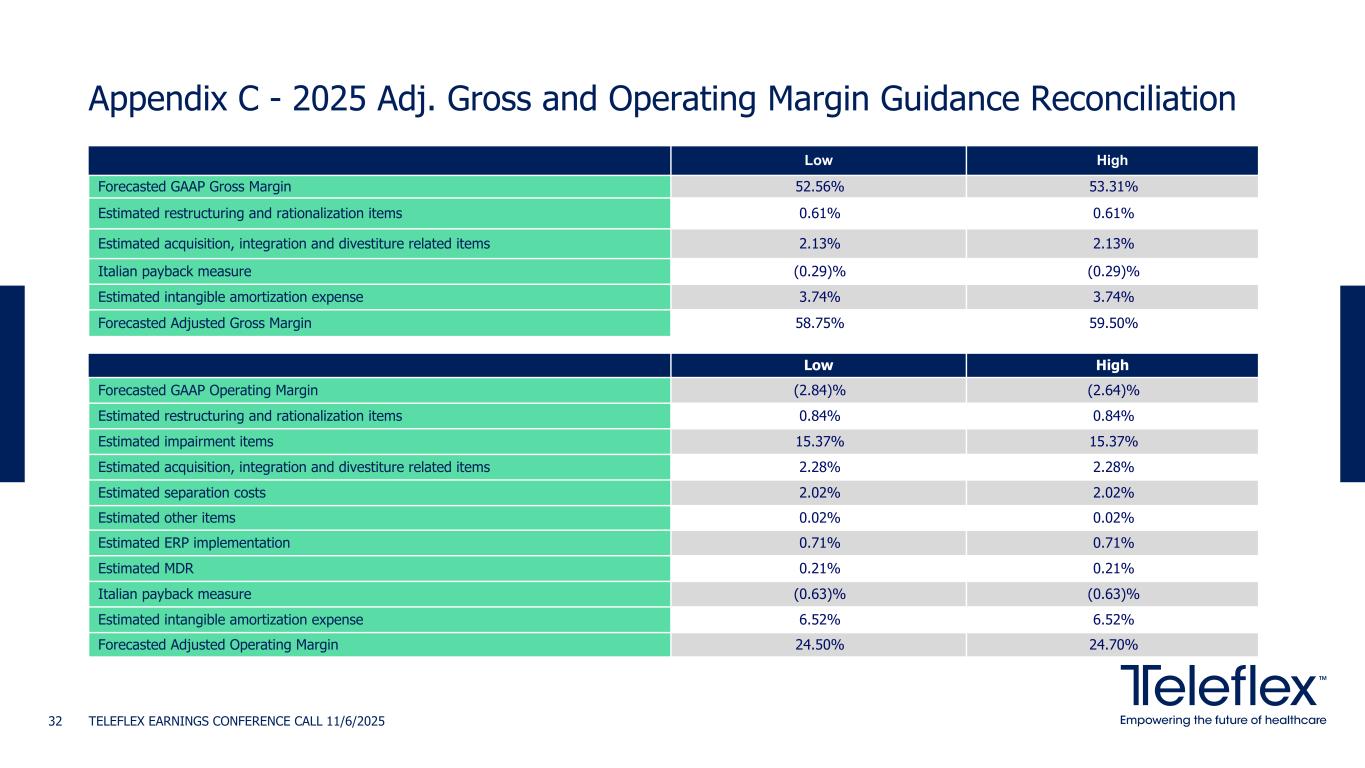

Appendix C - 2025 Adj. Gross and Operating Margin Guidance Reconciliation TELEFLEX EARNINGS CONFERENCE CALL 11/6/202532 Low High Forecasted GAAP Gross Margin 52.56% 53.31% Estimated restructuring and rationalization items 0.61% 0.61% Estimated acquisition, integration and divestiture related items 2.13% 2.13% Italian payback measure (0.29)% (0.29)% Estimated intangible amortization expense 3.74% 3.74% Forecasted Adjusted Gross Margin 58.75% 59.50% Low High Forecasted GAAP Operating Margin (2.84)% (2.64)% Estimated restructuring and rationalization items 0.84% 0.84% Estimated impairment items 15.37% 15.37% Estimated acquisition, integration and divestiture related items 2.28% 2.28% Estimated separation costs 2.02% 2.02% Estimated other items 0.02% 0.02% Estimated ERP implementation 0.71% 0.71% Estimated MDR 0.21% 0.21% Italian payback measure (0.63)% (0.63)% Estimated intangible amortization expense 6.52% 6.52% Forecasted Adjusted Operating Margin 24.50% 24.70%

Appendix D - Reconciliation of Forecasted 2025 Adjusted Earnings Per Share Guidance TELEFLEX EARNINGS CONFERENCE CALL 11/6/202533 Low High Forecasted GAAP Diluted Earnings Per Share from continuing operations $(4.42) $(4.22) Restructuring and rationalization items, net of tax $0.51 $0.51 Impairment items, net of tax $10.89 $10.89 Acquisition, integration and divestiture related items, net of tax $1.19 $1.19 Separation costs, net of tax $1.48 $1.48 Other costs, net of tax $0.01 $0.01 ERP implementation, net of tax $0.44 $0.44 MDR, net of tax $0.16 $0.16 Italian payback measure, net of tax $(0.40) $(0.40) Intangible amortization expense, net of tax $4.33 $4.33 Tax adjustments $(0.19) $(0.19) Forecasted Adjusted Diluted Earnings Per Share from continuing operations, net of tax $14.00 $14.20

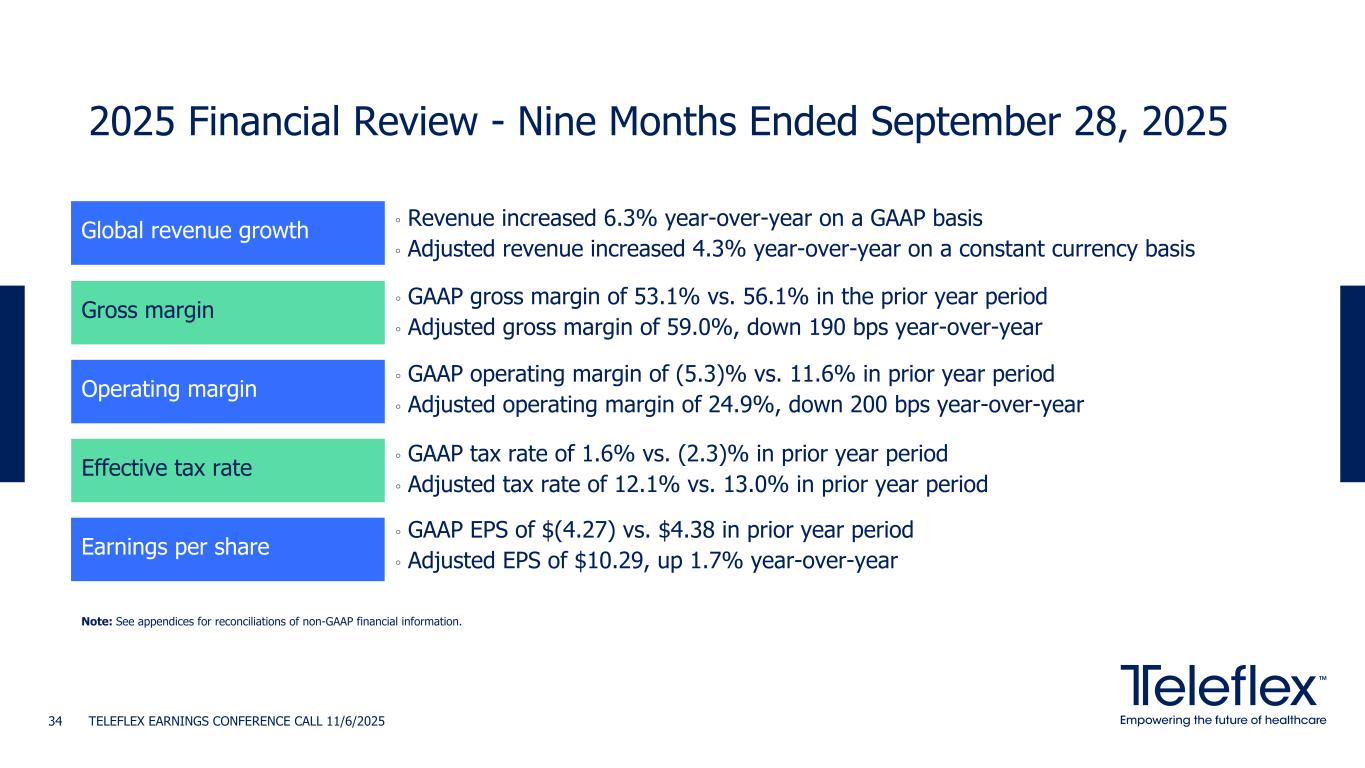

2025 Financial Review - Nine Months Ended September 28, 2025 TELEFLEX EARNINGS CONFERENCE CALL 11/6/202534 Gross margin Operating margin Effective tax rate Earnings per share ◦ GAAP gross margin of 53.1% vs. 56.1% in the prior year period ◦ Adjusted gross margin of 59.0%, down 190 bps year-over-year ◦ GAAP operating margin of (5.3)% vs. 11.6% in prior year period ◦ Adjusted operating margin of 24.9%, down 200 bps year-over-year ◦ GAAP tax rate of 1.6% vs. (2.3)% in prior year period ◦ Adjusted tax rate of 12.1% vs. 13.0% in prior year period ◦ GAAP EPS of $(4.27) vs. $4.38 in prior year period ◦ Adjusted EPS of $10.29, up 1.7% year-over-year Global revenue growth ◦ Revenue increased 6.3% year-over-year on a GAAP basis ◦ Adjusted revenue increased 4.3% year-over-year on a constant currency basis Note: See appendices for reconciliations of non-GAAP financial information.