UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2025 Annual Meeting of Shareholders and Proxy Statement

Teradyne, Inc.

May 9, 2025 10:00 A.M. Eastern Time

600 Riverpark Drive North Reading, Massachusetts 01864

|

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS

|

Date and Time May 9, 2025 |

|

Location 600 Riverpark Drive, |

|

Who Can Vote Shareholders of record as of March 14, 2025 are entitled to vote |

To the Shareholders:

The Annual Meeting of Shareholders of Teradyne, Inc., a Massachusetts corporation (“Teradyne,” the “Company,” “we,” “it”, “our” or “us”), will be held on Friday, May 9, 2025 at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864 (the “Annual Meeting”), for the following purposes:

Voting Items |

Board Voting Recommendations |

Page Reference |

1. To elect the seven nominees named in the accompanying proxy statement to the Board of Directors |

FOR each nominated Director |

31 |

2. To approve, on a non-binding, advisory basis, the 2024 compensation of the Company’s named executive officers |

FOR |

42 |

3. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 |

FOR |

85 |

4. To approve an amendment and restatement of the Equity and Cash Compensation Incentive Plan |

FOR |

87 |

5. To vote on a shareholder proposal requiring the Company to prepare a report about political contributions and expenditures |

AGAINST |

100 |

Shareholders will also transact such other business as may properly come before the meeting and any postponements or adjournments thereof. For additional information on how you may attend or vote at the Annual Meeting, please see page 104 of the proxy statement.

On or about March 28, 2025, we mailed to our shareholders of record as of March 14, 2025, a notice containing instructions on how to access this proxy statement and Teradyne’s annual report online and to vote, and printed copies of these proxy materials to shareholders that requested printed copies.

By Order of the Board of Directors, |

Proxy Voting Please promptly sign, date, and return your proxy card or voting instruction form, or submit your proxy and/or voting instructions by telephone or through the Internet so that a quorum may be represented at the meeting. Any person giving a proxy has the power to revoke it at any time, and shareholders who attend the meeting may withdraw their proxies and vote at the meeting. |

Ryan E. Driscoll, Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on May 9, 2025. The proxy statement and the accompanying Annual Report on Form 10-K, Letter to Shareholders, and Notice, are available at www.proxyvote.com.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page iii

Table of Contents

|

|

Page |

|

|

|

|

|

5 |

|

|

|

||

|

6 |

|

|

69 |

||

|

16 |

|

|

69 |

||

|

16 |

|

|

69 |

||

|

26 |

|

|

71 |

||

|

27 |

|

|

|

||

|

31 |

|

|

72 |

||

|

32 |

|

|

|

||

|

36 |

|

|

74 |

||

|

38 |

|

|

74 |

||

|

39 |

|

|

76 |

||

|

41 |

|

|

79 |

||

|

|

|

|

80 |

||

|

42 |

|

|

|

||

|

43 |

|

|

85 |

||

|

43 |

|

|

85 |

||

|

43 |

|

|

86 |

||

|

44 |

|

|

86 |

||

|

45 |

|

|

|

||

|

45 |

|

|

|

||

|

47 |

|

|

87 |

||

|

|

|

|

|

||

|

48 |

|

|

100 |

||

|

49 |

|

|

102 |

||

|

63 |

|

|

104 |

||

|

64 |

|

|

107 |

||

|

65 |

|

|

108 |

||

|

68 |

|

|

109 |

||

|

68 |

|

|

A-1 |

||

|

69 |

|

|

B-1 |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page iv

ABOUT TERADYNE

Teradyne, Inc. (“Teradyne,” the “Company,” “we,” “our” or “us”) was founded in 1960 and is a leading global supplier of automated test equipment and robotics solutions.

We design, develop, manufacture and sell automated test systems and robotics products. Our automated test systems are used to test semiconductors, wireless products, data storage and complex electronics systems in many industries including consumer electronics, wireless, automotive, industrial, computing, communications and aerospace and defense industries. Our robotics products include collaborative robotic arms and autonomous mobile robots used by global manufacturing, logistics and industrial customers to improve quality, increase manufacturing and material handling efficiency and decrease manufacturing and logistics costs. Our automated test equipment and robotics products and services include:

In 2024, Teradyne had revenue of $2.82 billion and today employs approximately 6,500 people worldwide.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 5

PROXY STATEMENT SUMMARY

This summary highlights certain information in the proxy statement, but it does not contain all of the information that you should consider before voting. Please review the entire proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Form 10-K”) carefully. The items to be voted on at the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) along with the recommendations of our Board of Directors’ (the “Board”) are listed below.

Proposals |

Board Vote Recommendation |

Reasons for Recommendation |

For Further Details |

||

|

Management Proposals |

||||

1. |

ELECTION OF DIRECTORS |

|

“FOR” each director nominee |

The Board believes that each of the seven director nominees possesses the necessary qualifications, skills and experiences to provide quality advice and counsel to management and to effectively oversee key business and strategy matters, while carefully considering the long-term success of Teradyne and our shareholders. |

Page 31 |

2. |

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS |

|

“FOR” |

The Compensation Committee believes that the compensation of the Company’s named executive officers for 2024 is reasonable and appropriate and is aligned to, and justified by, the performance of Teradyne and its results against its strategic goals and is aligned with the interests of its shareholders. |

Page 42 |

3. |

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

“FOR” |

Based on the Audit Committee’s assessment of PricewaterhouseCoopers LLP’s qualifications and performance, the Board believes that retention of PricewaterhouseCoopers LLP for the fiscal year 2025 is in the shareholders’ best interests. |

Page 85 |

4. |

APPROVAL OF AMENDMENT AND RESTATEMENT OF THE EQUITY AND CASH COMPENSATION INCENTIVE PLAN |

|

“FOR” |

The amendment and restatement of the Teradyne, Inc. Equity and Cash Compensation Incentive Plan (the “Amended Plan”) will eliminate the term of the 2006 Equity and Cash Compensation Incentive Plan (the “2006 Plan”), which would have otherwise expired in May 2025, and allow us to continue making grants under the plan. The Amended Plan also provides for a number of compensation governance best practices and makes a number of other clarifying and conforming changes, as summarized elsewhere in this proxy statement. |

Page 87 |

|

Shareholder Proposal |

||||

5. |

Support Transparency in Political Spending |

|

“AGAINST” |

The Board recommends that shareholders vote AGAINST a shareholder proposal requiring the Company to prepare a report about political contributions and expenditures because (1) Teradyne has a policy against the use of its corporate funds or assets for political contributions, (2) its related expenditures are limited to membership in trade organizations and information regarding these expenditures is already publicly available, and (3) additional disclosures are not necessary and the cost of preparing such a report would exceed any benefit to shareholders. |

Page 100 |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 6

Proxy Statement Summary

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 7

Proxy Statement Summary

Proposal No. 1 |

Election of Directors

|

See page 31 for further information. |

Director Nominees

|

|

Committee Membership |

||

Name, Age and Primary Occupation |

Director Since |

AC |

CC |

NCGC |

Peter Herweck, 58 Former Chief Executive Officer, Schneider Electric SE |

2020 |

|

|

|

Mercedes Johnson, 71 Former Chief Financial Officer, Avago Technologies |

2014 |

|

|

|

Ernest E. Maddock, 66 Former CFO, Micron Technology |

2022 |

|

|

|

Marilyn Matz, 71 CEO & Board Chair, Paradigm4, Inc. |

2017 |

|

|

|

Gregory S. Smith, 62 President, Chief Executive Officer and a director of Teradyne |

2023 |

|

|

|

Paul J. Tufano, 71 |

2005 |

|

|

|

Bridget van Kralingen, 61 Partner, Motive Partners |

2024 |

|

|

|

|

|

|

|

|

|

Independent |

Member |

Chair |

|||

|

|

|

|

|

|

Independent Chair of the Board |

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 8

Proxy Statement Summary

Proposal No. 2 |

Advisory Vote on Compensation of Named Executive Officers

|

See page 42 for further information. |

Compensation Governance and Our Compensation Philosophy

Our Compensation Philosophy

The objective of our executive compensation program is to provide a competitive level of compensation that achieves the following objectives:

Shareholder Alignment |

Pay-for-Performance |

Risk Management |

Competitive Excellence |

Attract and Retain |

2024 Executive Compensation Summary

Chief Executive Officer |

|

Average of the Other Named Executive Officers |

|

|

We have implemented an executive compensation program that fosters a performance-oriented environment by tying a significant portion of each executive officer’s cash and equity compensation to the achievement of short-term and long-term performance targets that are important to Teradyne and its shareholders. This approach is designed to focus the executive officers on creating shareholder value over the long term and on delivering exceptional performance throughout fluctuations in business cycles.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 9

Proxy Statement Summary

Our Compensation Practices

|

|

|

What We Do |

|

What We Don’t Do |

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2024 Variable Cash Compensation and Performance-Based RSU Funding Outcomes

The Compensation Committee believes that the compensation of Teradyne’s named executive officers for 2024 is reasonable and appropriate and is aligned with, and justified by, the performance of Teradyne and its results against its strategic goals and is aligned with the interests of shareholders.

Variable Cash Compensation Performance (Messrs. Smith, Mehta, and Driscoll)

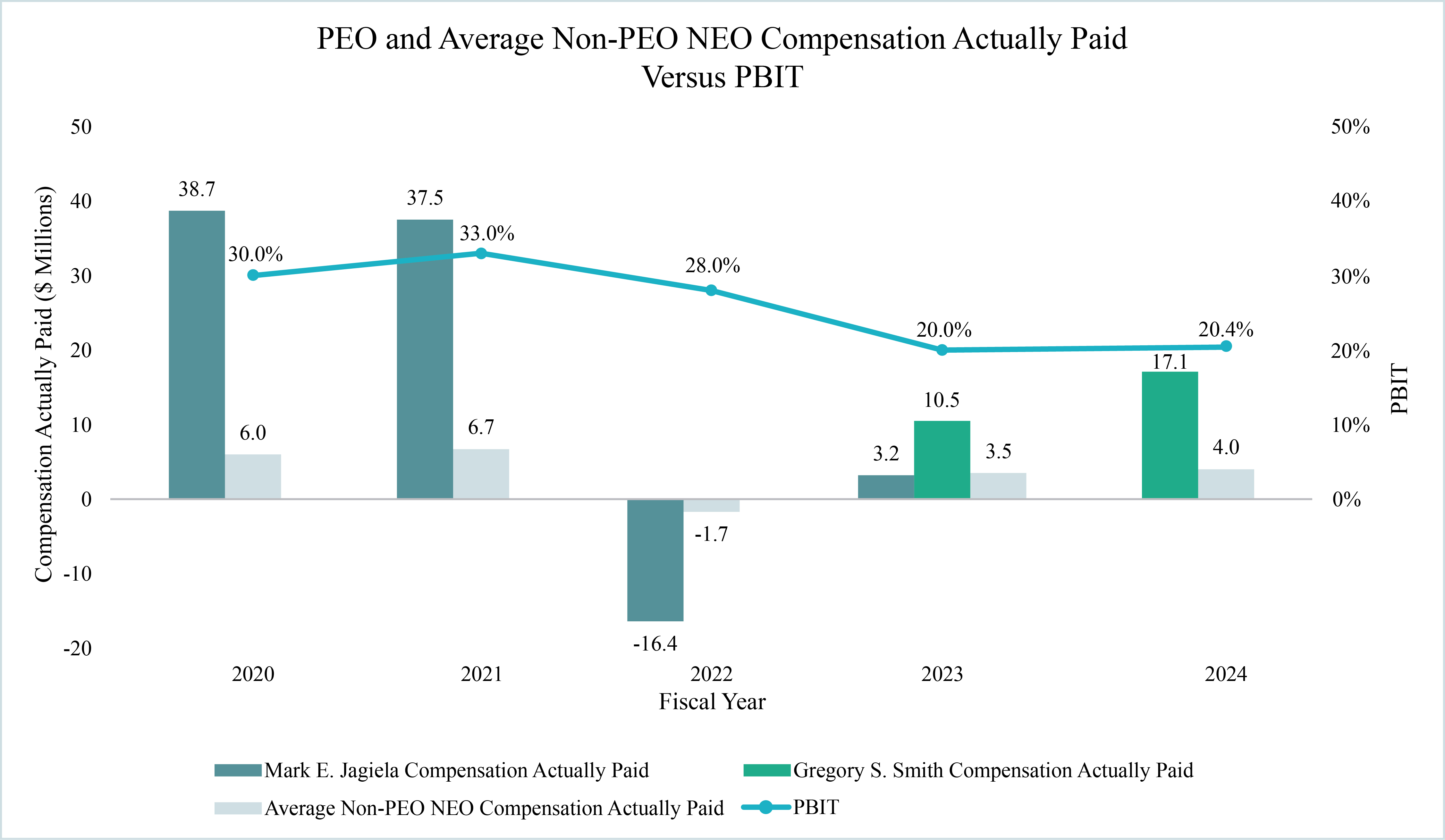

The 2024 variable cash compensation payouts for Messrs. Smith, Mehta and Driscoll were based on total company two-year rolling revenue growth rate, total company non-GAAP profit rate before interest and taxes (“PBIT”), weighted average of the vital goals of all divisions of the Company (the “Vital Goals”), and achievement of company-wide gender representation metrics.

The Vital Goals are comprised of only clear, measurable, and objective metrics that align with the Compensation Committee's pay-for-performance philosophy. The Vital Goals are measurable and are not open to interpretation or discretion. For example, the Vital Goals include strategic design-ins and socket wins at key accounts for our Semiconductor Test division and growth in revenue from key accounts for our Robotics division. These are key elements of Teradyne's long-term value creation strategy. We are not disclosing the specific performance target levels for the Vital Goals because they represent confidential, commercially sensitive information that if disclosed to the public would cause competitive harm.

|

|

|

|

|

|

|

|

|

|

|

|

|

Company-wide |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Goal |

|

Threshold |

|

Target |

|

Maximum |

|

Actual |

|

Weighting |

|

Result |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Growth |

|

(6)% |

|

7% |

|

19% |

|

(5.70)% |

|

29.25% |

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

PBIT(1) |

|

11% |

|

21% |

|

39% |

|

20.4% |

|

19.5% |

|

95% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Vital Goals |

|

N/A |

|

N/A |

|

N/A |

|

N/A |

|

48.75% |

|

136% |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S./Worldwide Gender Representation |

|

N/A |

|

24.8%/19.1% |

|

N/A |

|

24.9%/21.0% |

|

2.5% |

|

200% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Payout |

|

91% |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 10

Proxy Statement Summary

Variable Cash Compensation Performance (Mr. Burns)

The 2024 variable cash compensation payout for Mr. Burns was based on company-wide financial performance and achievement of the company-wide Vital Goals, financial performance of the Semiconductor Test division, achievement of the Semiconductor Test division Vital Goals and achievement of company-wide gender representation metrics. The financial performance of the Semiconductor Test division includes division revenue growth rate and PBIT. The Semiconductor Test division’s Vital Goals, include strategic design-ins, new product releases, key customer and account wins, and certain key financial metrics including inventory metrics. Although we are not disclosing the specific performance target levels for the Vital Goals because they represent confidential, commercially sensitive information that if disclosed to the public would cause competitive harm, the Semiconductor Test Division was at or above target on 14 of 20 Vital Goals. This led to a Semiconductor Test division achievement of 109% of the target and a total payout of 101% of target for Mr. Burns.

|

|

|

|

|

Semiconductor Test Division |

||||

|

|

|

|

|

Goal |

|

Weighting |

|

Result |

|

|

|

|

|

|

|

|

|

|

Company Performance |

|

48.75% |

|

88% |

|

|

|

|

|

Semiconductor Test Division Performance |

|

48.75% |

|

109% |

|

|

|

|

|

Gender Representation |

|

2.5% |

|

200% |

|

|

|

|

|

|

|

|

|

|

Total Payout |

|

101% |

||

|

|

|

|

|

Variable Cash Compensation Performance (Mr. Kumar)

The 2024 variable cash compensation payout for Mr. Kumar was based on the company-wide financial performance and achievement of the company-wide Vital Goals, financial performance of the Robotics division, achievement of the Robotics division Vital Goals, and achievement of company-wide gender representation metrics. The financial performance of the Robotics division includes division revenue growth rate and PBIT. The Robotics division’s Vital Goals include new product releases, key customer and account wins and certain financial metrics, including gross margins and inventory metrics. Although we are not disclosing the specific performance target levels for these Vital Goals because they represent confidential, commercially sensitive information that if disclosed to the public would cause competitive harm, the Robotics division was at or above target on 4 of 13 Vital Goals. This led to a Robotics division achievement of 21% of the target and total payout for Mr. Kumar of 58% of target.

|

|

|

|

|

|

|

Robotics Division |

||||||

|

|

|

|

|

|

|

Goal |

|

Weighting |

|

|

Result |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Performance |

|

48.75% |

|

|

88% |

|

|

|

|

|

|

|

|

Robotics Division Performance |

|

48.75% |

|

|

21% |

|

|

|

|

|

|

|

|

Gender Representation |

|

2.5% |

|

|

200% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Payout |

|

|

58 |

% |

|

|

|

|

|

|

|

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 11

Proxy Statement Summary

Status of Performance-Based RSU Awards

|

2022 |

2023 |

2024 |

|

Goals |

Threshold |

Target |

Maximum |

Performance |

Result(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2022 Relative TSR(2) Performance-Based RSUs (2022-2024 Performance Period) |

100% Completed |

|

TSR |

N/A |

N/A |

N/A |

-39.6% |

0.0% |

|||

Fiscal 2022 PBIT(3) Performance-Based RSUs (2022-2024 Performance Period) |

100% Completed |

|

PBIT |

10% |

23% |

34% |

23% |

100% |

|||

Fiscal 2023 Relative TSR(2) Performance-Based RSUs (2023-2025 Performance Period) |

|

2/3 Completed |

|

TSR |

N/A |

N/A |

N/A |

In progress |

In progress |

||

Fiscal 2023 PBIT(3) Performance-Based RSUs (2023-2025 Performance Period) |

|

2/3 Completed |

|

PBIT |

13% |

24% |

40% |

In progress |

In progress |

||

Fiscal 2024 Relative TSR(2) Performance-Based RSUs (2024-2026 Performance Period) |

|

|

1/3 Completed |

|

TSR |

N/A |

N/A |

N/A |

In progress |

In progress |

|

Fiscal 2024 PBIT(3) Performance-Based RSUs (2024-2026 Performance Period) |

|

|

1/3 Completed |

|

PBIT |

11% |

21% |

39% |

In progress |

In progress |

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 12

Proxy Statement Summary

Proposal No. 3 |

Ratification of Appointment of Independent Registered Public Accounting Firm

|

See page 85 for further information. |

Fees for Services Provided by PricewaterhouseCoopers LLP

The following table sets forth the aggregate fees for services provided by PricewaterhouseCoopers (“PwC”), Teradyne’s independent registered public accounting firm, for the fiscal years ended December 31, 2024 and 2023, respectively.

|

|

2024 |

|

|

2023 |

|

||

Audit Fees(1) |

|

$ |

3,341,800 |

|

|

$ |

3,255,000 |

|

Audit-Related Fees(2) |

|

$ |

500,801 |

|

|

$ |

180,000 |

|

Tax Fees(3) |

|

$ |

1,234,199 |

|

|

$ |

746,313 |

|

All Other Fees(4) |

|

$ |

302,000 |

|

|

$ |

956 |

|

Total: |

|

$ |

5,378,800 |

|

|

$ |

4,182,270 |

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 13

Proxy Statement Summary

Proposal No. 4 |

Approval of Amendment and Restatement of the Equity and Cash Compensation Incentive Plan

|

See page 87 for further information. |

Purpose

The Board amended and restated the 2006 Plan on March 24, 2025 (the “Amended Plan”), subject to shareholder approval, to prevent the 2006 Plan from expiring on May 12, 2025. If shareholders approve the Amended Plan, the number of shares authorized for issuance under the 2006 Plan will not increase.

The purpose of the Amended Plan is to provide equity ownership and compensation opportunities to employees, officers, directors, consultants and advisors of Teradyne and its subsidiaries and to attract, motivate and retain the most qualified talent. The use of equity compensation has historically been a significant part of our overall compensation philosophy and is a practice that is standard for our peers. The Amended Plan serves as an important part of this practice and is a critical component of the overall compensation package that we offer to retain and motivate our employees. In addition, awards under the Amended Plan provide our employees, non-employee directors and other service providers with an opportunity to acquire or increase their ownership stake in us, which we believe aligns their interests with those of our shareholders.

Important Features of the Amended Plan

The Amended Plan is designed to promote compensation governance best practices and play an important part of our pay-for-performance philosophy: |

• No “Evergreen” Provision • No Liberal Recycling or Liberal Share Counting • No Discounted Stock Options or Stock Appreciation Rights • One-Year Minimum Vesting on Awards, with limited exceptions • Repricing Prohibited • Non-Employee Director Compensation Limit • Prohibition on Payment of Dividends and Dividend Equivalents on Unvested Awards • No Automatic Single Trigger Acceleration • No Tax Gross-ups • Limited Transferability and Prohibition on Transfers to Third-Party Financial Institutions • Prohibition on Loans • Awards Subject to Recovery |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 14

Proxy Statement Summary

Proposal No. 5 |

Shareholder Proposal Requesting the Company Prepare a Report About Political Contributions and Expenditures

|

See page 100 for further information. |

We received a shareholder proposal that asks the Company to prepare a report about political contributions and expenditures.

For the reasons set forth below and in “Teradyne’s Statement in Opposition to Shareholder Proposal”, the Board opposes adoption of the shareholder proposal and recommends that you vote AGAINST the proposal.

Key Reasons to Vote Against his Proposal |

Teradyne has a policy against the use of its corporate funds or assets for political contributions. |

Our related expenditures are limited to membership in trade organizations and information regarding these expenditures is already publicly available. |

Additional disclosures are not necessary and would exceed any benefit to shareholders. |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 15

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Corporate Governance and Board Policies

Teradyne is committed to good, transparent corporate governance to ensure that the Company is managed for the long-term benefit of its shareholders.

Teradyne has instituted a variety of policies and practices to foster and maintain good corporate governance. The Board reviews these practices on a regular basis. Teradyne’s current policies and practices include the following:

Sound Governance Practices |

|

Directors elected annually for a one-year term with majority voting for uncontested Board elections

Directors elected annually for a one-year term with majority voting for uncontested Board elections

Executive sessions of independent directors at Board meetings

Executive sessions of independent directors at Board meetings

Robust director and executive officer stock ownership guidelines

Robust director and executive officer stock ownership guidelines

Policy prohibiting employees and directors from hedging and pledging Teradyne stock

Policy prohibiting employees and directors from hedging and pledging Teradyne stock

Board access to management and independent advisors

Board access to management and independent advisors

Independent registered public accounting firm and internal auditor meet regularly with Audit Committee without management

Independent registered public accounting firm and internal auditor meet regularly with Audit Committee without management

Directors may be removed by a shareholder vote with or without cause

Directors may be removed by a shareholder vote with or without cause

Adoption of “Poison Pill” requires shareholder approval

Adoption of “Poison Pill” requires shareholder approval

Policy promoting equal opportunity for all employees

Policy promoting equal opportunity for all employees

Independence and Board Composition |

|

Independent Board Chair

Independent Board Chair

Independent directors constitute a majority of the Board and all members of the Board committees

Independent directors constitute a majority of the Board and all members of the Board committees

Annual Nominating and Corporate Governance Committee review of Board composition, skills, demographics and refreshment and succession plan

Annual Nominating and Corporate Governance Committee review of Board composition, skills, demographics and refreshment and succession plan

Directors must be 74 years or younger as of the date of their election or appointment with no exceptions or conditions

Directors must be 74 years or younger as of the date of their election or appointment with no exceptions or conditions

Review and Oversight |

|

Annual Board and committee self-assessments

Annual Board and committee self-assessments

Annual Board evaluation of CEO performance

Annual Board evaluation of CEO performance

Annual review of non-employee director compensation and cap on the aggregate value of total annual compensation to non-employee directors

Annual review of non-employee director compensation and cap on the aggregate value of total annual compensation to non-employee directors

Nominating and Corporate Governance Committee review of director’s change in position

Nominating and Corporate Governance Committee review of director’s change in position

Board oversight of enterprise risk management, including cybersecurity and data protection, artificial intelligence, and sustainability risks

Board oversight of enterprise risk management, including cybersecurity and data protection, artificial intelligence, and sustainability risks

Annual Board review of executive succession plan

Annual Board review of executive succession plan

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 16

Corporate Governance and Board of Directors

Board Leadership Structure

The Board has the flexibility to decide whether it is best for the Company, at any given point in time, for the roles of the Chief Executive Officer and the Chair of the Board to be separate or combined and, if separate, whether the Chair should be selected from the independent directors, non-management directors, or be an employee.

Since May 2021, Mr. Tufano has served as an independent Chair of the Board. The Board believes that having an independent Chair is currently the appropriate corporate governance structure for the Company because it strikes an effective balance between management and independent leadership participation in the Board process. Additionally, the Board believes that Mr. Tufano’s widespread knowledge of the issues confronting complex technology and manufacturing companies and extensive financial reporting and operational expertise provide the requisite experience needed to effectively serve as the independent Chair of the Board.

While the Chief Executive Officer is tasked with developing policy and strategic direction for the Company and providing management of its day-to-day operations, the duties and responsibilities of the independent Chair of the Board include:

Independent Chair of the Board |

• Coordinate the activities of the Board and ensure the review of both short- and long-term areas of interest to shareholders. • Work with the CEO to develop board agendas and set schedules for Board meetings. • Preside over Board meetings. • Develop agenda for executive sessions of the independent directors. • Moderate the executive sessions of the independent directors. • Discuss executive session subjects with the CEO. • As required, the Chair of the Board serves as a representative of the Board with management and the public. |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 17

Corporate Governance and Board of Directors

Director Independence

Teradyne’s Corporate Governance Guidelines require that at least a majority of the Board shall be independent and set out standards for determining director independence. Under our Corporate Governance Guidelines, to be considered independent, a director must satisfy applicable SEC and Nasdaq listing standard requirements, and, in the Board’s judgment, not have a material relationship with Teradyne.

The Board periodically reviews each director’s status as an independent director and whether any independent director has any relationship with the Company that, in the judgment of the Board, would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities as a director or would be deemed a material relationship with Teradyne.

The Board, in coordination with the Nominating and Corporate Governance Committee, has assessed the independence of each of the members of the Board who served for all or a portion of fiscal year 2024 and each of the director nominees and determined that the following directors are, and former directors were at the time of service, independent under SEC rules, Nasdaq listing standards and the independence standards in our Corporate Governance Guidelines:

In determining the independence of Teradyne’s directors, the Board reviewed and determined that the following relationships did not preclude a determination of independence under applicable standards:

The amounts paid to or received from each party under Teradyne’s business relationships with each of Analog Devices, Inc., Synopsys, Inc., Avnet, Inc., Lattice Semiconductor, Schneider Electric and Marvell Technology, Inc. during the last three fiscal years do not exceed the applicable threshold of Nasdaq listing standards, and the Board determined that each of these directors does not have a material relationship with Teradyne. Teradyne will continue to monitor its business relationships and any significant competitive activity to ensure they have no impact on the independence of its directors.

All members of the Company’s three standing committees—Audit, Compensation, and Nominating and Corporate Governance—have been determined by the Board to be independent pursuant to applicable SEC rules and Nasdaq listing standards, including those applicable to such committees, as well as the independence standards in our Corporate Governance Guidelines.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 18

Corporate Governance and Board of Directors

Director Selection and Nomination Process

1 Identify the Candidate |

The Nominating and Corporate Governance Committee identifies director candidates through numerous sources, including recommendations from existing Board members, executive officers, and shareholders and through engagements with executive search firms. As part of the identification and nomination process, the Committee regularly reviews Board composition to ensure that the Board reflects the knowledge, experience, skills and backgrounds required for the needs of the Board. |

|

2 Evaluate Candidate Qualifications |

Director candidates are evaluated by the Nominating and Corporate Governance Committee, with input from the Chair and the CEO, and all director candidates recommended to be nominees must meet, at a minimum, the Board membership criteria described below. • Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. • Nominees should have demonstrated business acumen, experience and ability to exercise sound judgment and should be willing and able to contribute positively to the decision-making process of the Company. • Nominees should have a commitment to understand the Company and its industry and to attend and participate in Board and committee meetings. • Nominees should ensure that existing and future commitments would not materially interfere their obligations. • Nominees should not have, nor appear to have, any conflicts of interest. • Nominees must be 74 years or younger as of the date of their election or appointment. Additionally, the re-nomination of existing directors is not viewed as automatic but is based on continuing qualification under the criteria set forth above. |

|

3 Recommendation and Nomination |

The Nominating and Corporate Governance Committee recommends to the Board qualified candidates to be nominated by the Board for election or re-election at the annual meeting of shareholders or upon a majority vote of the Board. |

|

4 Shareholder Vote |

Nominees are elected by our shareholders at the annual meeting of shareholders. |

|

5 Implementation |

In the past five years, five of our seven current directors, which included four independent directors, were elected to the Board for the first time by our shareholders, each bringing fresh perspectives and unique skill sets to the Board. Peter Herweck ǀ Ernest E. Maddock ǀ Gregory S. Smith ǀ Ford Tamer ǀ Bridget van Kralingen |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 19

Corporate Governance and Board of Directors

Shareholder Recommendations for Board Candidates

Shareholders wishing to suggest candidates to the Nominating and Corporate Governance Committee for consideration as potential director nominees may do so by submitting the candidate’s name, experience, and other relevant information to the Nominating and Corporate Governance Committee, 600 Riverpark Drive, North Reading, MA 01864. Shareholders wishing to nominate directors may do so by submitting a written notice to the Secretary at the same address in accordance with the nomination procedures set forth in Teradyne’s bylaws. Additional information regarding the director nomination procedure is provided in the section below captioned “Shareholder Proposals for 2026 Annual Meeting.”

Overboarding Policy

The Company maintains an overboarding policy in our Corporate Governance Guidelines to help ensure that directors are able to devote adequate time to their duties to the Company, including preparing for and attending meetings.

The Company’s overboarding policy limits the number of other public company boards on which a director serves to no more than four. Directors should notify the Chair of the Board and the Chair of the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve on another public company board. Additionally, service on boards and/or committees of other organizations shall comply with the Company’s conflict of interest policies.

In renominating directors for election at our Annual Meeting, the Nominating and Corporate Governance Committee and Board have determined that each of our directors is currently in compliance with our Corporate Governance Guidelines and has sufficient time, energy, and attention to serve on the Board.

Director Refreshment and Succession Planning

The Nominating and Corporate Governance Committee is responsible for regularly reviewing Board composition, skills, and refreshment, including the review of director succession planning.

Additionally, directors elected at the annual meeting of shareholders serve until the next annual meeting of shareholders and until his or her successor shall have been duly elected and qualified. Directors who have been elected to fill a vacancy complete the remainder of the former director’s term. There are no limits on the number of terms that a director can serve. Term limits could result in loss of directors who have been able to develop, over a period of time, increasing insight into the Company and its operations and an institutional memory that benefits the entire membership of the Board, as well as management.

In the past five years, five of our seven current directors, including four independent directors, were elected to the Board for the first time to replace directors who retired.

Majority Vote Standard and Director Resignation Policy

Directors are elected by the majority of votes cast. Any director who fails to receive the requisite majority vote at any meeting for an uncontested election shall, promptly following certification of the shareholder vote, offer their resignation to the Board for consideration in accordance with the procedures established in our Corporate Governance Guidelines within 90 days following certification of the shareholder vote.

In addition, non-employee directors must notify the Nominating and Corporate Governance Committee if the director experiences a change of position from that held upon first becoming a member of the Board. Upon any such notification, the Nominating and Corporate Governance Committee will review the potential impact on the director’s independence and the appropriateness of the director’s continued membership on any Board committees under the circumstances.

Board Size

The Company’s bylaws require the Board to consist of not less than three and no more than fifteen members. The number of directors on the Board is fixed each year by the Board and as of the Record Date, the size of the Board was fixed at eight directors. At the conclusion of the Annual Meeting, the board size will be reduced to seven members. Additionally, the Nominating and Corporate Governance Committee is responsible for periodically reviewing and making recommendations to the Board as appropriate regarding the composition and size of the Board to help ensure that the Board is composed of members reflecting the proper expertise, skills, attributes and personal and professional backgrounds for service as a director of the Company, as determined by the Nominating and Corporate Governance Committee.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 20

Corporate Governance and Board of Directors

Board and Committee Self-Assessment

The Board and each of its committees annually undertake a self-assessment, including an evaluation of its composition, mandate and function, as well as soliciting feedback from senior management. The Chair of the Nominating and Corporate Governance Committee manages this annual process and implementation of any action items resulting from the process. For example, as a result of one of the Board’s self-assessments in which the directors expressed their interest in having a separate strategy discussion, an annual strategic session with management was implemented. Additionally, based on the result of another self-assessment, the Board undertook a multi-year refreshment and succession planning process.

CEO Evaluation and Management Succession Planning

The principal responsibility of directors is to oversee the management of the Company, and, in so doing, to serve the best interests of the Company and its shareholders. This includes a responsibility of directors to require and oversee succession plans for the Chief Executive Officer and the other named executive officers. The Board conducts an annual review of executive succession planning. Additionally, the Nominating and Corporate Governance Committee is responsible for periodically reviewing the Company’s succession plans with respect to the Chief Executive Officer and other senior executives.

The independent Chair of the Board, the independent members of the Board of Directors and the Compensation Committee are also responsible for overseeing the evaluation of the Company’s Chief Executive Officer.

Code of Conduct

Teradyne has adopted the Code of Conduct which outlines our ethics policy for directors, officers and all employees. The Audit Committee is responsible overseeing compliance with the Code of Conduct. The Audit Committee reviews the Code of Conduct and training materials and results annually and regularly reviews with management.

The Company deploys Code of Conduct training to all new full and part time employees and contractors as part of the on-boarding process and administers annual Code of Conduct refresher training to all employees and contractors at the end of each year, which includes a video presentation, quiz and compliance certification. The Code of Conduct training covers a variety of topics, including:

The Board has established a means for anyone to report violations of the ethics policy on a confidential or anonymous basis.

Teradyne shall disclose any substantive amendments to or waiver, including an implicit waiver, from the Code of Conduct granted to an executive officer or director within four business days of such determination by disclosing the required information on its website at www.teradyne.com under the “Governance” section of the “Investor Relations” link or in a Current Report on Form 8-K.

Insider Trading Policy

The Board has

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 21

Corporate Governance and Board of Directors

Hedging and Pledging Policy

The Board recognizes there may be an appearance of improper or inappropriate conduct if Teradyne’s employees, executives and directors engage in certain types of transactions, even in circumstances where they may not be aware of any material, nonpublic information. Therefore, the Board has adopted, through the Insider Trading Policy, a policy prohibiting employees, executives and directors from hedging Teradyne stock through short sales, prepaid variable forward contracts, equity swaps, collars and exchange funds. In addition, transactions in put options, call options or other derivative securities, on an exchange or in any other organized market, are prohibited by this policy. The policy also prohibits holding Teradyne securities in a margin account or pledging Teradyne securities as collateral for loans.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 22

Corporate Governance and Board of Directors

Board Oversight of Risk

The Board, as a whole and through its committees, has responsibility for the oversight of risk management. While the full Board has ultimate responsibility for risk oversight, the Board has delegated oversight responsibility for certain risks to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. This approach allows the Board to draw upon the experience and judgment of specific directors comprising each committee who have experience overseeing and managing particular risks that Teradyne faces in various areas of its business.

The Board |

||

The Board oversees management’s processes for identifying and mitigating risks, including operational, cybersecurity and information security, legal, geopolitical, market and competitive risks as well as the risks to the Company, its business and its employees due to climate change and trade regulations, directly and through its committees to help align the Company’s risk exposure with its strategic objectives. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks and participates in regularly scheduled Board discussions with management and outside advisors covering such risks. |

||

|

||

Committee Responsibilities |

||

|

|

|

Audit Committee |

Compensation Committee |

Nominating and |

The Audit Committee is responsible for oversight of enterprise risk management review, including financial risk assessment and management and cybersecurity and technology security risks, including artificial intelligence. The Audit Committee receives regular reports from management including from our Chief Financial Officer, Corporate Controller, Internal Audit, in-house legal counsel, and Chief Information Security Officer on such risks at regularly scheduled meetings and as requested. |

The Compensation Committee is responsible for reviewing and assessing, on an annual basis, the impact of the Company’s compensation programs on Company risk and considering appropriate risk management policies and practices as applied to the Company’s compensation programs. The Compensation Committee receives reports from management including from our human resources and compensation teams and in-house legal counsel on such matters. |

The Nominating and Corporate Governance Committee oversees risks related to corporate governance, including Board and director performance, director recruitment and succession, director education, and our Corporate Governance Guidelines and other governance documents, as well as management succession, our ESG efforts, and, in conjunction with the Audit Committee, artificial intelligence. |

|

||

Management |

||

|

||

Senior Management |

Disclosure Committee |

|

Our senior management regularly attends meetings of the Board and its committees and provides the Board and its committees with reports regarding our operations, strategies, and objectives, and the risks inherent within them, as well as management action plans to monitor and address risk exposures. Board and committee meetings also provide a forum for directors to discuss issues with, request additional information from, and provide guidance to, senior management. In addition, our directors have direct access to senior management to discuss any matters of interest, including those related to risk. |

The Disclosure Committee, which is comprised of a cross-functional team, regularly reviews Teradyne’s financial and business disclosures, including quarterly and annual reports prior to filing with the SEC. There is substantial cross-functional overlap in the membership of the Disclosure Committee to ensure that Teradyne’s required disclosures regarding its risks are accurate, complete, and timely. Teradyne’s internal legal and financial reporting teams seek input and advice from internal subject matter experts and external advisors in drafting specific disclosures, and such input and advice is communicated to the Disclosure Committee. |

|

|

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 23

Corporate Governance and Board of Directors

Oversight of Strategy

Oversight of Teradyne’s business strategy and strategic planning is a key responsibility of our Board, and the responsibility of our directors includes reviewing and approving the Company’s fundamental operating, financial and other corporate plans, strategies and objectives. Directors have an obligation to become and remain informed about the Company and its business, including the principal operational and financial objectives, strategies and plans of the Company and the problems, risks and success factors affecting the Company’s business.

Our Board is deeply engaged and involved in Teradyne’s long-term strategy, including, among other things, senior management development and succession planning, and evaluating key market and strategic opportunities and competitive developments. Our Board takes a multilayered approach to exercising its role in strategy oversight and views its strategy oversight role as a continuous process.

On an annual basis, our Board conducts a coordinated meeting with members of management on the Company’s strategy including a presentation on results, revenue, customer and stakeholder feedback and future plans. Additionally, each quarter the Board receives a substantial presentation from members of management across our different business units, with the Board receiving a deep dive on a different division of the Company each quarter.

Oversight of Cybersecurity

The Board oversees management’s processes for identifying and mitigating risks, including cybersecurity risks, to help align our risk exposure with our strategic objectives. Senior leadership, including our Chief Information Security Officer (the “CISO”), regularly brief the Audit Committee on our cybersecurity and information security posture.

The corporate information security organization, under the CISO, has implemented a governance structure and processes to assess, identify, manage and report cybersecurity risks. The CISO chairs management’s Cybersecurity Steering Committee, which regularly reviews current cyber threats, program performance and ongoing risk mitigations. Cybersecurity-related risks are also integrated into our overall enterprise risk management (“ERM”) process. These risks are among those that the ERM function evaluates to assess top enterprise risks on an annual basis and is reviewed and evaluated by the Board. The Board is also apprised of cybersecurity issues or incidents deemed to have a moderate or higher business impact as they arise, even if considered immaterial.

Oversight of Human Capital

The Board oversees the establishment and maintenance of the Company’s core values and its management of human capital. Additionally, the Compensation Committee is responsible for reviewing and assisting the Board in overseeing certain talent management matters relating to the Company’s workforce. The Board believes that the Company’s future success depends upon its continued ability to attract, develop and retain a high-performance workforce, comprised of people with shared values.

Oversight of Artificial Intelligence

The Board, in coordination with the Nominating and Corporate Governance Committee and the Audit Committee, is responsible for overseeing our Artificial Intelligence (“AI”) governance and risk management processes, which address the development and use of AI products and services and our use of AI in our internal operations. As this is a nascent and rapidly developing area, the Board and management are working together to build a strong AI governance and risk management program, including establishing a cross functional AI Governance and Risk Management Committee led by Teradyne executive management.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 24

Corporate Governance and Board of Directors

Oversight of Sustainability and Human Capital Matters

Teradyne is committed to employee health, safety and welfare, to managing its activities that impact the environment in a responsible and effective manner, and to supporting the communities where its employees live and work. Teradyne strives to drive improvements in environmental sustainability, supply chain responsibility, human capital, and positive social impact.

The Board |

||

The Board oversees the Company’s ESG program. |

||

|

||

Nominating and Corporate Governance Committee |

||

The Nominating and Corporate Governance Committee reviews, and assists the Board in overseeing, ESG matters not assigned to other committees, including the Company’s overall sustainability strategy and goals, climate-related matters, the CSR Report and sustainability initiatives. |

||

|

||

Audit Committee |

|

Compensation Committee |

The Audit Committee reviews, and assists the Board in overseeing, significant information security, cybersecurity and technology security risks. |

|

The Compensation Committee reviews, and assists the Board in overseeing, certain talent management matters relating to the Company’s workforce. |

|

||

Senior Leadership |

||

The CEO and CFO receive reports on the ESG program from the ESG Steering Team. |

||

|

||

ESG Steering Team |

||

The Company’s sustainability-related activities are guided by the Company’s ESG Steering Team. The ESG Steering Team is comprised of a group of senior leaders, meets regularly and reports to the CEO, the CFO and the Board. |

||

|

||

ESG Working Team |

||

The ESG Working Team is a cross-functional team that develops the long-term strategy, annual goals, metrics tracking and reporting processes for the Company’s corporate social responsibility activities and reports to the ESG Steering Team on a regular basis. |

||

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 25

Corporate Governance and Board of Directors

Teradyne is committed to regular and proactive engagement with our shareholders. We believe that listening to and understanding shareholder perspectives and priorities is important for shareholder value and addressing corporate governance. In 2024, we reached out to shareholders representing approximately 53% of our outstanding shares, and we will continue to seek out and consider shareholders’ feedback in the future. As part of our shareholders engagement efforts over the last year, we heard from shareholders on key corporate governance, executive compensation, and business development-related matters. |

|

As a result of our engagement efforts in recent years, we have implemented several corporate governance best practices, including the removal of super-majority shareholder voting requirement from our Articles of Organization and the increase in our shareholding requirements for some of our executives beginning in fiscal year 2025. |

|

Shareholders Engaged (% of Stock Outstanding) |

|

|

|

Shareholder Communications with Board of Directors

Shareholders and other interested parties may communicate with one or more members of the Board, including the Chair, or the non-management directors as a group by writing to the non-management directors, Board of Directors, 600 Riverpark Drive, North Reading, MA 01864 or by electronic mail at nonmanagementdirectors@teradyne.com. Any communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities, such as customer complaints, will be sent to the appropriate executive. Solicitations, junk mail and other similarly frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Board Meetings and Director Attendance

The Board met four times during the year ended December 31, 2024. The non-employee directors, all of whom are independent, held executive sessions in which they met without management after each regularly scheduled meeting during 2024. The Chair of the Board presides over all Board meetings and each executive session. During 2024, each director attended at least 75% of the total number of meetings of the Board and committee meetings held while such person served as a director. Under our Corporate Governance Guidelines, each director is expected to attend each annual meeting of shareholders. All nine then-serving directors attended the 2024 Annual Meeting of Shareholders held on May 9, 2024. |

|

|

|

|

2024 Average Board and Committee Meeting Attendance |

|

|

|

|

||

|

|

||

|

|

||

|

100% |

|

|

|

|

||

|

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 26

Corporate Governance and Board of Directors

Board Committees

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. In accordance with the Nasdaq listing standards, all of the committees are comprised of independent directors. The members of each committee are appointed by the Board based on the recommendation of the Nominating and Corporate Governance Committee. Each committee performs a self-assessment and reviews its charter annually. Actions taken by any committee are reported to the Board, usually at the next Board meeting following the action. The table below shows the current membership of each of the standing committees:

INDEPENDENT DIRECTORS |

|

|

|

Audit Committee |

|

Compensation Committee |

|

Nominating and Corporate Governance Committee |

Peter Herweck |

|

|

|

|

|

|

|

|

Mercedes Johnson |

|

|

|

|

|

|

|

|

Ernest E. Maddock |

|

|

|

|

|

|

|

|

Marilyn Matz |

|

|

|

|

|

|

|

|

Ford Tamer* |

|

|

|

|

|

|

|

|

Paul J. Tufano |

|

|

|

|

|

|

|

|

Bridget van Kralingen |

|

|

|

|

|

|

|

|

INSIDE DIRECTORS |

|

|

|

|

|

|

|

|

Gregory S. Smith |

|

|

|

|

|

|

|

|

|

|

Independent Chair of the Board |

|

|

|

Committee Member |

|

|

Committee Chairperson |

|

|

|

Financial Expert |

* |

|

Mr. Tamer’s service as a Director will end at the conclusion of the Annual Meeting. |

||||

The Board will appoint committee members for the 2025-2026 term following the election of directors at the Annual Meeting.

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 27

Corporate Governance and Board of Directors

Audit Committee

|

Current Members Mercedes Johnson (Chair) Ernest E. Maddock Ford Tamer Independence The Audit Committee has three members, all of whom have been determined by the Board to be independent pursuant to SEC rules, including the independence rules applicable to audit committee members and Nasdaq listing standards, as well as Teradyne’s independence standards. In addition, the Board determined that each member of the Audit Committee is financially literate and an “audit committee financial expert” as defined in the rules and regulations promulgated by the SEC. Meetings Eight meetings during fiscal year 2024. |

|

Responsibilities The Audit Committee’s oversight responsibilities, described in greater detail in its charter (available on our website at www.teradyne.com under “Investor Relations”), include, among other things: • overseeing matters relating to the financial disclosure and reporting process, including the system of internal controls; • reviewing the internal audit function and annual internal audit plan; • supervising compliance with business ethics and legal and regulatory requirements; • reviewing the Company’s cybersecurity program including the Company’s contingency plans in the event of a cybersecurity incident; • reviewing and approving the appointment, compensation, activities and independence of the independent registered public accounting firm including the selection of the lead audit partner who is rotated every five years; and • conducting an enterprise risk management review, including financial risk assessment and management. |

|

2024 Average |

|

|

|

95.8% |

|

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 28

Corporate Governance and Board of Directors

Compensation Committee

|

Current Members Peter Herweck (Chair) Marilyn Matz Paul J. Tufano Bridget van Kralingen Independence The Compensation Committee has four members, all of whom have been determined by the Board to be independent pursuant to SEC rules and Nasdaq listing standards, including the independence standards applicable to compensation committee members, as well as Teradyne’s independence standards. Meetings Five meetings during fiscal year 2024. |

|

Responsibilities The Compensation Committee’s primary responsibilities, discussed in greater detail in its charter (available on our website at www.teradyne.com under “Investor Relations”), include, among other things: • overseeing and assessing the risks associated with Teradyne’s compensation programs, policies and practices; • recommending changes and/or recommending the adoption of new compensation plans to the Board, as appropriate; • reviewing and recommending to the Board each year the compensation for non-employee directors; • evaluating and recommending to the independent directors of the Board the annual cash and equity compensation and benefits to be provided to the Chief Executive Officer; • administering the executive compensation recoupment policy; • overseeing human capital management matters; and • reviewing and approving of the cash and equity compensation and benefit packages of the other executive officers. |

|

2024 Average |

|

|

|

100% |

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 29

Corporate Governance and Board of Directors

Nominating and Corporate Governance Committee

|

Current Members Marilyn Matz (Chair) Peter Herweck Paul J. Tufano Bridget van Kralingen Independence The Nominating and Corporate Governance Committee has four members, all of whom have been determined by the Board to be independent pursuant to SEC rules and Nasdaq listing standards, as well as Teradyne’s independence standards. Meetings Four meetings during fiscal year 2024. |

|

Responsibilities The Nominating and Corporate Governance Committee’s primary responsibilities, discussed in greater detail in its charter (available on our website at www.teradyne.com under “Investor Relations”), include, among other things: • identifying individuals qualified to become Board members and considering nominees proposed by shareholders; • recommending to the Board the nominees for election or re-election as directors at the annual meeting of shareholders; • developing and recommending to the Board a set of corporate governance principles; • overseeing and advising the Board with respect to corporate governance matters; • assisting the Board with reviewing and overseeing the Company’s sustainability strategy, goals and initiatives; • reviewing the Company’s succession plans with respect to the Chief Executive Officer and other senior executives; and • overseeing the evaluation of the Board. |

|

2024 Average |

|

|

|

100% |

|

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 30

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board presently consists of eight members, seven of whom are independent directors. The current terms of the directors expire at the Annual Meeting. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, has nominated all current directors for re-election other than Mr. Tamer who notified the Board in January of 2025 of his decision to not stand for re-election at the Annual Meeting. If elected, each director will hold office until the 2026 Annual Meeting of Shareholders (the “2026 Annual Meeting”) and until his or her successor shall have been duly elected and qualified.

Teradyne has no reason to believe that any of the nominees will be unable to serve; however, if any nominee is unable to serve or for good cause will not serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Board, unless the Board chooses to reduce its own size.

As of the Record Date, the size of the Board was fixed at eight members but shall be reduced to seven members at the conclusion of the Annual Meeting.

The following table sets forth information regarding the nominees to be elected at the Annual Meeting.

Name, Age and Primary Occupation |

Director |

Other Noteworthy Experience |

Other Current Public |

Peter Herweck, 58 |

2020 |

Former CEO of the AVEVA Group plc Automation business |

|

Mercedes Johnson, 71 |

2014 |

Former Interim CFO of Intersil Corporation Former CFO of Lam Research Corporation |

Synopsys, Inc. |

Ernest E. Maddock, 66 |

2022 |

Former CFO of Riverbed Technology, Inc. |

Ultra Clean Holdings, Inc. |

Marilyn Matz, 71 |

2017 |

Co-founder of Paradigm4, Inc. |

|

Gregory S. Smith, 62 |

2023 |

Former President of Robotics at Teradyne Business of Teradyne |

Technoprobe S.p.A. |

Paul J. Tufano, 71 |

2005 |

Former CFO of Alcatel-Lucent |

EnerSys |

Bridget van Kralingen, 61 |

2024 |

Former CEO of IBM’s Global Markets and Global Consulting Divisions with Deloitte Consulting Former Director, Royal Bank of Canada |

Travelers Insurance |

|

Independent |

|

Independent Chair of the Board |

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 31

Proposal No. 1: Election of Directors

Nominees for Director

The following sets forth the principal occupation of the nominees to be elected at the Annual Meeting during at least the past five years, any other public company boards on which the nominee serves or has served in the past five years, and the nominee’s qualifications to serve on the Board.

Peter Herweck |

|

Mercedes Johnson |

||||

Director Since |

Age |

Committees |

|

Director Since |

Age |

Committees |

2020 |

58 |

Compensation (Chair), Nominating & Governance |

|

2014 |

71 |

Audit (Chair) |

Professional Experience |

|

Professional Experience |

||||

Mr. Herweck served as the former Chief Executive Officer of Schneider Electric from May 2023 through November 2024. Prior to serving as Schneider Electric’s Chief Executive Officer, Mr. Herweck served as Chief Executive Officer of the AVEVA Group plc from May 2021 to March 2023. Prior to AVEVA Group, Mr. Herweck served as Executive Vice President of Schneider Electric’s global Industrial Automation business and on Schneider Electric’s Executive Committee from October 2016 to April 2021. Director Qualifications Mr. Herweck contributes valuable executive experience within the global industrial automation industry as well as extensive knowledge of the issues affecting complex industrial automation companies. Former Public Company Directorships Held in Last Five Years • AVEVA Group plc (March 2018 to January 2023) |

|

Ms. Johnson served as Interim Chief Financial Officer of Intersil Corporation from April 2013 to September 2013 and as Senior Vice President and Chief Financial Officer of Avago Technologies Limited from December 2005 to August 2008. Prior to joining Avago, Ms. Johnson was Senior Vice President, Finance, of Lam Research Corporation from June 2004 to January 2005 and Chief Financial Officer of Lam from May 1997 to May 2004. Director Qualifications Ms. Johnson contributes valuable industry and operational experience as a former senior financial executive at semiconductor and semiconductor equipment companies as well as a current member of the boards of directors of global technology companies. Other Current Public Company Directorships • Synopsys, Inc., since February 2017 • Analog Devices, Inc., since August 2021 Former Public Company Directorships Held in Last Five Years • Maxim Integrated Products (September 2019 to August 2021) • Millicom International Cellular S.A. (May 2019 to May 2023) |

||||

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 32

Proposal No. 1: Election of Directors

Nominees for Director

Ernest E. Maddock |

|

Marilyn Matz |

||||

Director Since |

Age |

Committees |

|

Director Since |

Age |

Committees |

2022 |

66 |

Audit |

|

2017 |

71 |

Compensation, Nominating & Governance (Chair) |

Professional Experience |

|

Professional Experience |

||||

Mr. Maddock served as Senior Vice President and Chief Financial Officer of Micron Technology, Inc. from 2015 until his retirement in 2018. Prior to that, he served as Executive Vice President and Chief Financial Officer of Riverbed Technology, Inc. from 2013 to 2015. From 1997 to 2013, Mr. Maddock served in various roles at Lam Research Corporation, culminating in the position of Chief Financial Officer from 2008 to 2013. Director Qualifications Mr. Maddock contributes over 35 years of experience in the technology industry serving in operations, technology and finance roles including 10 years as a public company Chief Financial Officer. Other Current Public Company Directorships • Ultra Clean Holdings, Inc., since June 2018 • Avnet, Inc., since August 2021 • Ouster, Inc., since January 2022 |

|

Ms. Matz is a co-founder of Paradigm4, Inc. and has served as Chief Executive Officer and Chair of the Board of Directors since December 2009. Previously, Ms. Matz was a co-founder of Cognex Corporation where she held a variety of leadership positions in engineering and business operations from March 1981 to December 2008 including her final role as Senior Vice President and Business Unit Manager of its PC Vision Products Group. Director Qualifications Ms. Matz contributes valuable technical expertise and leadership experience from more than 40 years in automation, machine vision and software analytics related industries. |

||||

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 33

Proposal No. 1: Election of Directors

Nominees for Director

Gregory S. Smith |

|

Paul J. Tufano |

||||

Director Since |

Age |

Committees |

|

Director Since |

Age |

Committees |

2023 |

62 |

- |

|

2005 |

71 |

Compensation, |

Professional Experience |

|

Professional Experience |

||||

Mr. Smith is President and Chief Executive Officer of Teradyne. Mr. Smith was President of Robotics at Teradyne from October 2020 through July 2023. Prior to leading Robotics, Mr. Smith was President of the Semiconductor Test Business, Teradyne’s largest operating segment, from February 2016 to October 2020. Mr. Smith began his career at Raytheon as a test engineer and held numerous engineering and management roles in the semiconductor test industry before joining Teradyne in 2006. Director Qualifications Mr. Smith contributes valuable executive experience from his 18 years in multiple management roles, including as President and Chief Executive Officer of Teradyne. Other Current Public Company Directorships • Technoprobe S.p.A., since May 2024 |

|

Mr. Tufano served as President and Chief Executive Officer of Benchmark Electronics, Inc. from September 2016 to March 2019. Mr. Tufano served as Chief Financial Officer of Alcatel-Lucent from December 2008 to September 2013 and Chief Operating Officer of Alcatel-Lucent from January 2013 to September 2013. He was Executive Vice President of Alcatel-Lucent from December 2008 to January 2013. He also served as a consultant for Alcatel-Lucent from September 2013 to April 2014. Mr. Tufano was Executive Vice President and Chief Financial Officer of Solectron Corporation from January 2006 to October 2007 and Interim Chief Executive Officer from February 2007 to October 2007. Prior to joining Solectron, Mr. Tufano worked at Maxtor Corporation where he was President and Chief Executive Officer from February 2003 to November 2004, Executive Vice President and Chief Operating Officer from April 2001 to February 2003 and Chief Financial Officer from July 1996 to February 2003. From 1979 until he joined Maxtor Corporation in 1996, Mr. Tufano held a variety of management positions in finance and operations at International Business Machines Corporation. Director Qualifications Mr. Tufano contributes widespread knowledge of the issues confronting complex technology and manufacturing companies and extensive financial reporting and operational expertise. Other Current Public Company Directorships • EnerSys, since April 2015 |

||||

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 34

Proposal No. 1: Election of Directors

Nominees for Director

Bridget van Kralingen |

||

Director Since |

Age |

Committees |

2024 |

61 |

Compensation, |

Ms. van Kralingen has been a Partner at Motive Partners since November 2022. Prior to Motive Partners, she served in various leadership positions at IBM Corporation from April 2004 through December 2021, including most recently leading IBM’s Global Sales and Markets Division. Before joining IBM in 2004, Ms. van Kralingen served as Managing Partner, US Financial Services with Deloitte Consulting. Director Qualifications Ms. van Kralingen contributes extensive global business experience as a former executive of a global technology company and has significant expertise in information technology services, international operations, and global sales and business development. Other Current Public Company Directorships • Travelers Insurance, since January 2022 • Discovery Limited, since June 2022 Former Public Company Directorships Held in Last Five Years • Royal Bank of Canada, June 2011 to April 2024 |

||

Teradyne, Inc. | 2025 Notice of Annual Meeting & Proxy Statement | Page 35

Proposal No. 1: Election of Directors

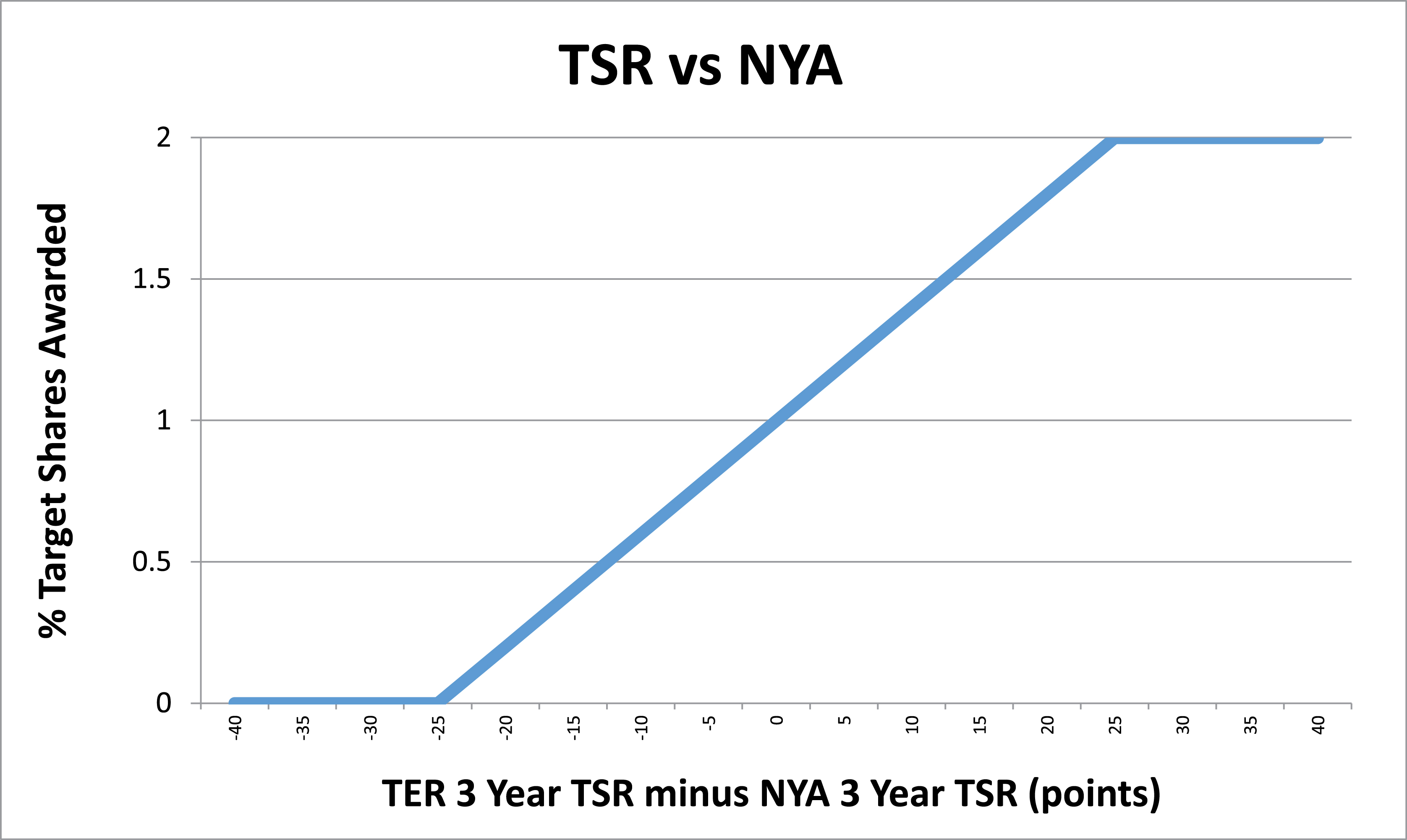

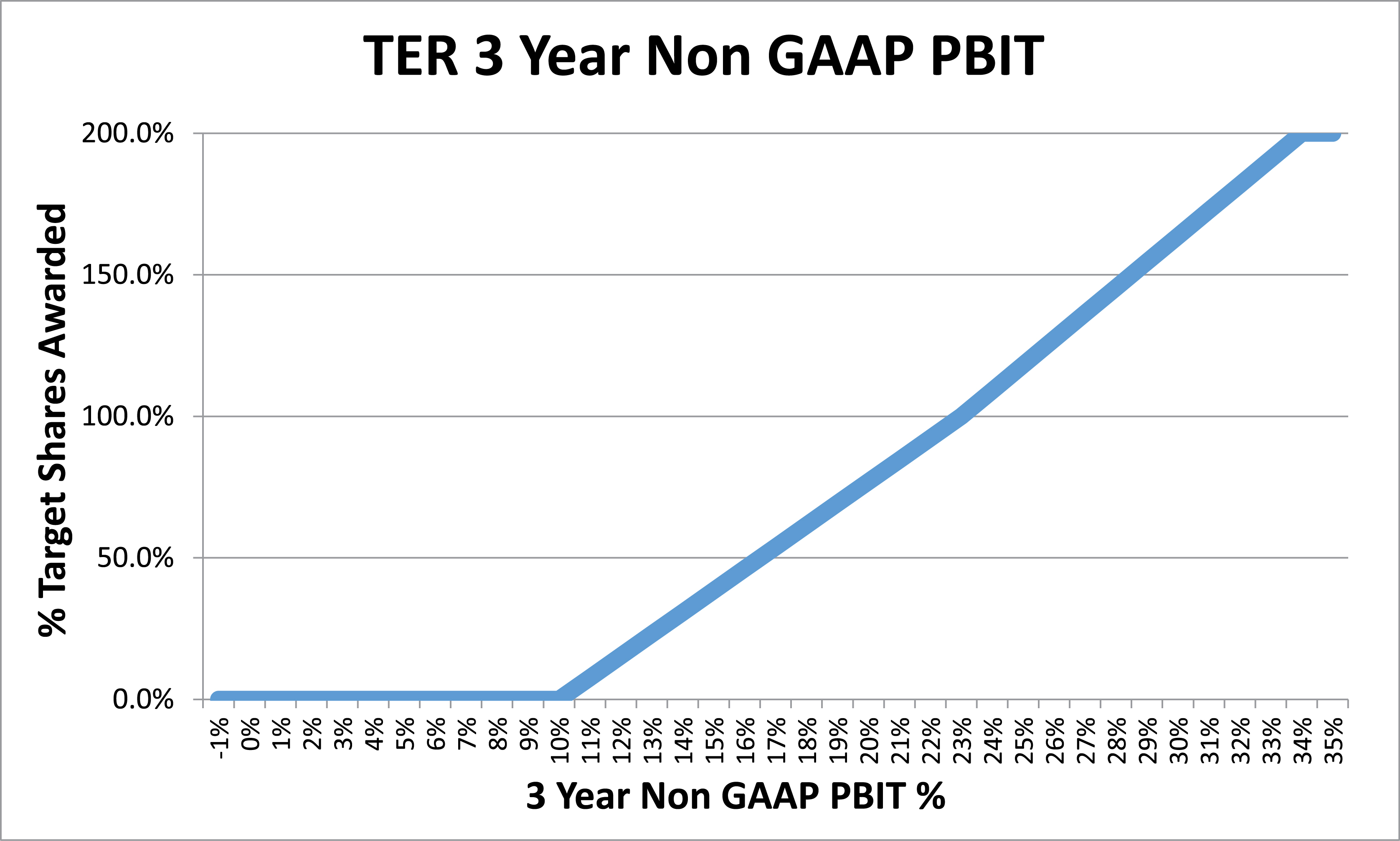

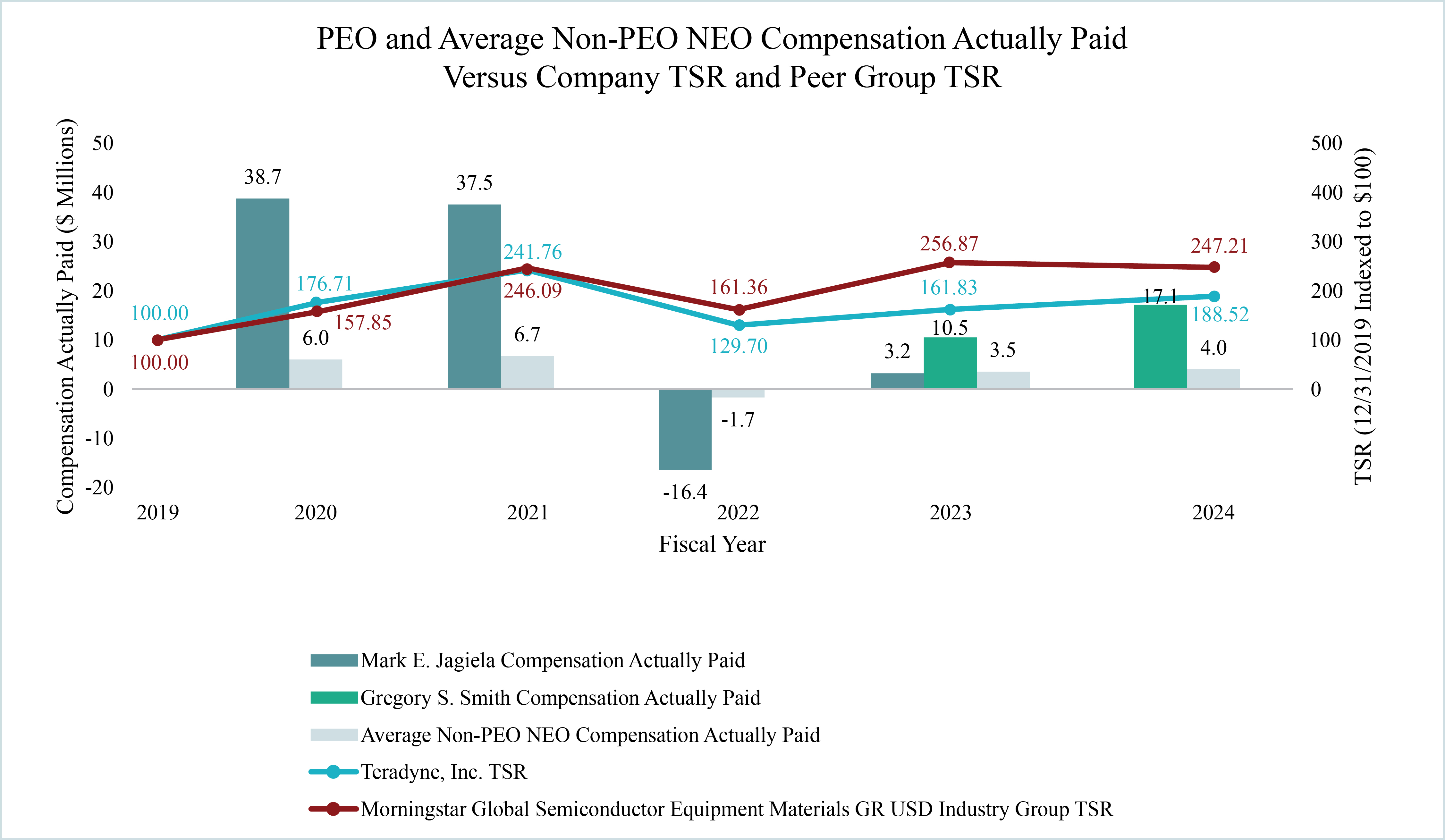

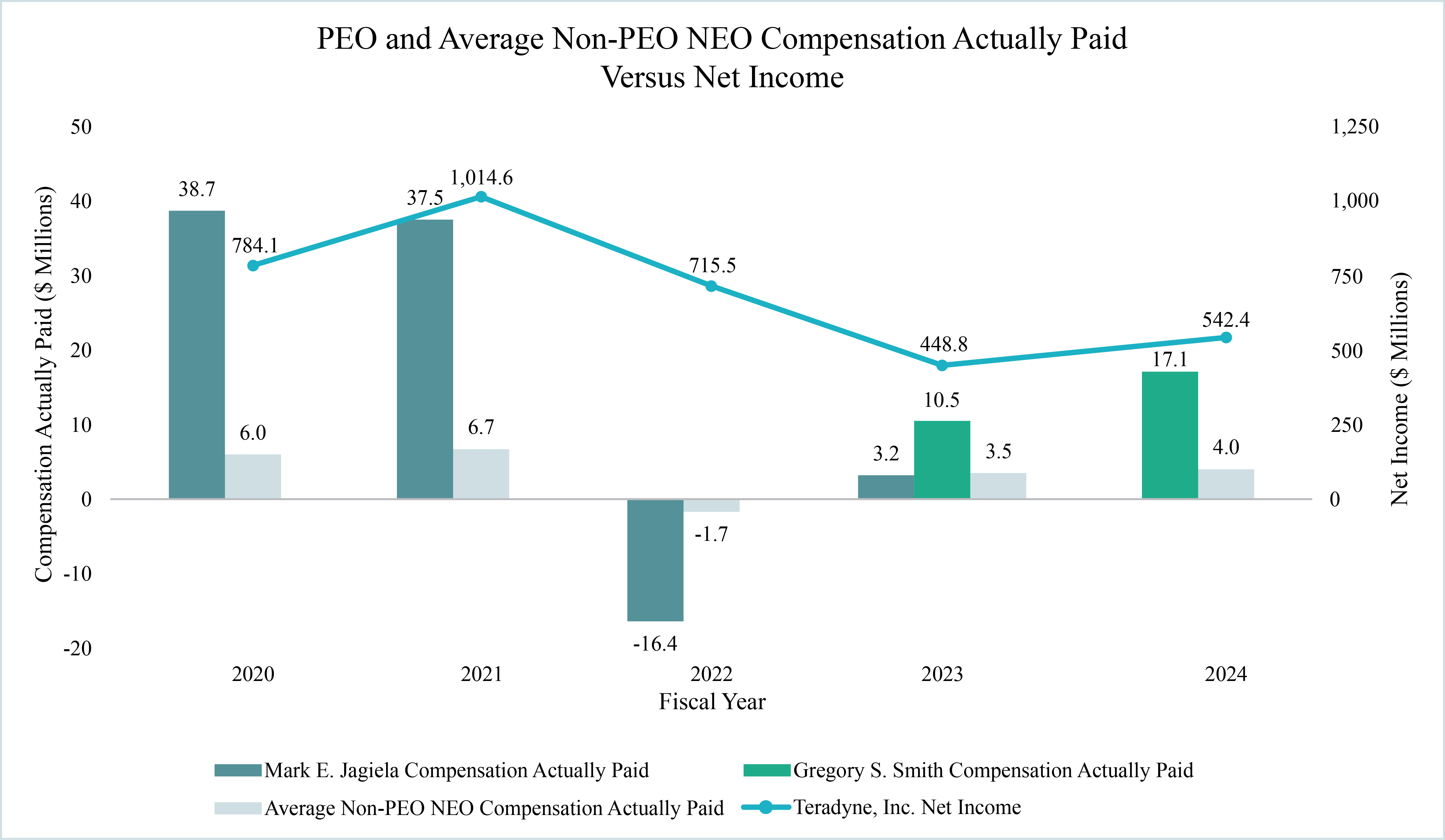

Director Qualifications and Experience