Tri-Continental Corporation

IRA Distribution Request Form

Use this form when requesting a distribution from an Individual Retirement Account (IRA).

For questions about tax implications, you may wish to consult with a financial advisor or tax advisor about any applicable taxes and/or penalties. Tax implications vary based on the type of distribution. Distribution rules for an Inherited IRA are based on several factors. We encourage you to review the Individual Retirement Account Custodial Agreement for beneficiary provisions.

| Part 1 | Depositor Information: (Please type or print.) |

| IRA Depositor/Stockholder Name (First, Middle Initial, Last) Date of Birth (MM/DD/YYYY) Social Security Number |

Please check if you are changing your address of record. A Medallion Signature Guarantee is required.

| Street Address or APO/FPO | City State ZIP Code | |

| Mobile Phone Number | Home Phone Number | |

| Note: If you are changing your address to a PO Box, a residential address is also required. Please provide your residential address below. | ||

| Street Address | City State ZIP Code | |

| Part 2 | IRA Account Registration: (Please choose only one.) |

| ☐ Traditional IRA ☐ Roth IRA ☐ SEP IRA* ☐ SARSEP IRA* ☐ Rollover IRA ☐SIMPLE IRA* (A 25% penalty may apply if the SIMPLE IRA has been open and funded for less than two years.)

*Plan number, if applicable

| ||

| Part 3 | Type Of Distribution: (Please choose only one.) | |

| ☐ Normal Distribution — age 591/2 or older ☐ Required Minimum Distribution | ☐ Premature Distribution* ☐ Death ☐ Disability | |

| ☐ Excess Contribution — current tax year: Date of excess / / | ☐ Premature Distribution with Exception (SEPP)* | |

| ☐ Excess Contribution — prior tax year ☐ Divorce

*Penalties may apply. You may wish to consult with a tax advisor. |

☐ Other | |

| Part 4 | Federal and State Income Tax Withholding: (Choose A or B below.) |

The law requires that federal income tax be withheld from certain IRA distributions unless you elect not to have withholding apply. If you elect not to have withholding apply, you may be responsible for payment of estimated tax. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient. Your withdrawal may also be subject to state income tax withholding in certain states. The I undersigned individual authorizes the withdrawal specified and the withholding election completed below. The undersigned acknowledges that the box checked is correct; and that it is the undersigned’s responsibility to determine the correct amount of tax that may be due based on all IRA accounts the undersigned may own (including those unknown by or not under the control of the Custodian; the undersigned agrees to indemnify and hold harmless Tri-Continental Corporation, Columbia Management Investment Services Corp., the Custodian and their respective affiliates, officers, directors, agents and employees from any losses or expenses incurred if such information is not correct. The undersigned acknowledges that it is his/her responsibility to properly calculate, report, and pay all taxes due with respect to the withdrawal specified, and to file IRS Form 5329 to claim any exemption from the early withdrawal penalty. IRS Form 5329 is used to report additional taxes on IRAs. You may wish to consult with a tax advisor for more information.

Please make your election below. Elections pertaining to the Systematic Withdrawal Plan, in the section for Distribution Options, may be revoked at any time. All other elections will be for this one-time use. Please note, if no federal election is made, 10% of your distribution will be withheld for federal income taxes (applicable state taxes may also apply).

☐ A. Do not withhold federal income tax from my distribution.

☐ B. Withhold federal income tax from my distribution at the rate of (not less than 10%.)

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

CT-FR/113352 C (12/20)

Page 1 of 6

| Part 5 | Payment Instructions: (Please choose one election in either section A or B and complete section C if applicable.) |

A. Stockholder or Authorized Individual Election:

| ☐ 1. | Make the check payable to me and mail to the address of record. |

| ☐ 2. | Make check payable to and mail as indicated below in section C. Payee Information A Medallion Signature Guarantee is required. |

| ☐ 3. | Deposit directly to my bank account via Automated Clearing House (ACH). No fee is deducted from the mutual fund account. |

| ☐ a. | Into my existing bank instructions on file. No Medallion Signature Guarantee is required. |

| ☐ b. | Into new bank instructions. Complete Part 7 Bank Information. A Medallion Signature Guarantee is required. |

| ☐ 4. Deposit | directly to my bank account via Fedwire (must be $500.00 or greater). A fee of $7.50 will be deducted from the mutual fund account (additional bank fees may apply). |

| ☐ a. | Into my existing bank instructions on file. No Medallion Signature Guarantee is required. |

| ☐ b. | Into new bank instructions. Complete Part 7 Bank Information. A Medallion Signature Guarantee is required. |

| ☐ 5. | Invest my distribution into the non-IRA account referenced below: |

| ☐ a. | Existing Tri-Continental Corporation non-IRA. Fund number Account number |

| ☐ b. | Existing Columbia Threadneedle Investments non-IRA. Fund number Account number |

| ☐ c. | New Columbia Threadneedle Investments non-IRA. (Please attach a new account application.) |

| ☐ 6. | Transfer my shares to the Tri-Continental Corporation IRA account referenced below. (Due to divorce only.): |

A Medallion Signature Guarantee is required. Please include a copy of the final Divorce Decree. The language within the final

Divorce Decree must specifically state how the Tri-Continental Corporation IRA account(s) are to be distributed. Please reference the dollar amount, percentage or number shares of each account under the section for Distribution Options.

| ☐ a. | Existing Tri-Continental Corporation IRA. Fund number Account number |

| ☐ b. | New Tri-Continental Corporation IRA. (Former spouse must complete and attach an IRA application.) |

B. Estate or Beneficiary Election: (Complete this section and section C. Payee Information, if you are acting as the Executor or Beneficiary.

If you are acting as the Executor, a Signature Guarantee is required. If you are acting as the Beneficiary, a MSG or Signature Guarantee is required.

A certified copy of the death certificate is required for the stockholder.)

| ☐ 1. | Lump sum distribution. Please choose a payment option below: |

| ☐ a. | Make check payable to and mail as indicated below in section C. Payee Information. |

| ☐ b. | Direct deposit by ACH to the bank account listed in section C. Payee Information. No fee is deducted from the mutual fund account. |

| ☐ c. | Direct deposit by Fedwire (must be $500.00 or greater) to the bank account listed in section C. Payee Information. A fee of $7.50 will be deducted from the mutual fund account (additional bank fees may apply). |

| ☐ 2. | Transfer the entire value to the spousal IRA account referenced below. (For spousal beneficiaries only.): |

| ☐ a. | Existing Tri-Continental Corporation IRA. Fund number Account number |

| ☐ b. | New Tri-Continental Corporation IRA. (Please attach an IRA application.) |

| ☐ 3. | Transfer the inherited portion to the IRA account referenced below: |

| ☐ a. | Existing Tri-Continental Corporation Inherited IRA. Fund number Account number |

| ☐ b. | New Tri-Continental Corporation Inherited IRA. (Please attach an IRA application.) |

| ☐ 4. | Invest the inherited portion to the non-IRA account referenced below: |

| ☐ a. | Existing Tri-Continental Corporation non-IRA. Fund number Account number |

| ☐ b. | Existing Columbia Threadneedle Investments non-IRA. Fund number Account number |

| ☐ c. | New Columbia Threadneedle Investments non-IRA. (Please attach a new account application.) |

C. Payee Information: (Tax Identification Number and Date of Birth required for death distributions.)

Beneficiary or Estate Beneficiary

Payee or Beneficiary Name (First, Middle Initial, Last) Tax Identification Number Date of Birth (MM/DD/YYYY)

Street Address City State Zip Code

| Daytime Phone Number | Relationship to IRA Stockholder | Date of Death for IRA Stockholder (MM/DD/YYYY) |

Bank Account Information (If applicable)

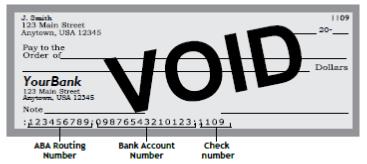

Name of Bank Bank ABA Routing Number Bank Account Number

Federal law requires us to obtain certain information from you, which we may use to verify your identity. If we are unable to verify this information, we reserve the right to close or limit your account.

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

CT-FR/113352 C (12/20)

Page 2 of 6

| Part 6 | Distribution Options: (Complete section A and/or B.) |

About the sale of Tri-Continental Corporation shares:

| • | If you have outstanding stock certificates, you must send your stock certificates to the Service Agent (this is one of the requirements for your sell order to be considered received in “good form”). We recommend using registered mail when returning outstanding certificates for 2% of the current market value of the shares. The recommended insurance amount is based on the premium for a lost certificate bond in the event the certificate is lost in transit. |

| • | Distributions for Tri-continental are generally priced one time per week, typically each Wednesday. A sell order received in “good form” on a Thursday will not be processed (and your shares not sold) until the following Wednesday, provided that the New York Stock Exchange is open for business on such day. |

I authorize Tri-Continental Corporation or its Service Agent to liquidate the amount indicated from the account number(s) listed below.

A. One-time Full or Partial Distribution:

| Fund Number | Account Number | Dollar Amount | or | Percent | or | Number of Shares | ||||||

| $ | % | |||||||||||

| $ | % |

B. Recurring Distribution (Complete section 1 and/or 2.)

Fund Selection

Fund Number Account Number

1. Systematic Withdrawal Plan (Check only one.) ☐ Add option ☐ Update the existing option ☐ Discontinue the existing option

Month Year

| a. | Begin distributions in . |

| b. | Select frequency of periodic distributions (does not apply to cash dividends and capital gains.) |

Note: Distributions will be processed on the 1st or 15th day of the month(s), regardless of whether or not the 1st or 15th falls on a Wednesday. If the selected date falls on a weekend or holiday, the transaction will be processed on the previous business date. Please specify the day you prefer. If no date is specified, your payment will default to the 15th of the month. .

| ☐ All months or check all that apply. | ☐ January | ☐ February | ☐ March | ☐ April | ☐ May | ☐ June | ||||||

| ☐ July | ☐ August | ☐ September | ☐ October | ☐ November | ☐ December |

| c. | Specify distribution method: |

| ☐ | Dollar amount $ |

| ☐ | Fixed period of years. (not to exceed the joint life expectancy of stockholder and beneficiary) |

| ☐ | Life expectancy (will apply to all accounts) |

| ☐ | Required minimum distribution based on the uniform lifetime table in IRS regulations |

| ☐ | Required minimum distribution based upon stockholder and beneficiary’s joint life expectancy (In order to use this method, your spouse must be your sole primary beneficiary and more than 10 years younger than you.) |

Life expectancy payments based on the single life expectancy table for beneficiaries in IRS regulations.

2. Distribution Payment Options (Penalties and taxes may apply if you are under the age of 591/2. You may wish to consult with a tax advisor.)

| ☐ | a. Credited 75% to my account in shares and 25% paid to me in cash. |

| ☐ | b. Credited 50% to my account in shares and 50% paid in cash. |

| ☐ | c. 100% paid to me in cash. |

| Indicate | payment method: |

| ☐ | a. Check to Address of Record |

| ☐ | b. Direct Deposit to Bank by ACH (Complete the section for Bank Information) |

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

CT-FR/113352 C (12/20)

Page 3 of 6

Note: If you choose to close your account, you will be subject to the $20 termination fee at that time. This fee is not prorated for periods of less than one full year.

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

CT-FR/113352 C (12/20)

Page 4 of 6

| Part 7 | (Bank Information |

Please complete this section if you are requesting to have redemption proceeds or dividends/capital gain distributions sent to a bank account not on file. A Medallion Signature Guarantee may be required. The bank information will be permanently added to your account, unless you indicate below, this is a one-time wire or ACH request.

☐ Yes, this is a one-time wire or ACH request. Do not add bank information to my account at this time.

Bank Account Type: ☐ Checking ☐ Savings

Bank Account Information:

| Bank ABA Routing Number (Enter nine digit number; see below) | Bank Account Number (Do not use spaces or dashes; see below) | |

| For Further Credit to the Account of (if applicable; for wire transfers): | ||

| Name of Bank | Bank Phone Number | |

| Name of Bank Account Owner | Name of Joint Bank Account Owner (if applicable) | |

| Bank Account Owner(s) Authorization Signature of Bank Account Owner (required) |

Signature of Joint Bank Account Owner (required) X | |

| X

When wiring to a foreign bank account, please contact a representative to confirm additional bank instructions. | ||

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

CT-FR/113352 C (12/20)

Page 5 of 6

| Part 8 | Signature and Taxpayer Identification Number Certification |

| Under | penalties of perjury, I certify that: |

| (1) | The number shown on this form is my correct taxpayer identification number; and |

| (2) | I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and |

| (3) | I am a U.S. citizen or other U.S. person (defined in the Form W-9 instructions, which are available upon request or at www.irs.gov); |

| (4) | The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct |

Certification Instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

I certify that I am the proper party to receive payment(s) from this IRA and that all information provided by me is true and accurate. If acting in a special capacity (executor, administrator, custodian, trustee, corporate officer, etc.) the capacity (title) must be indicated. I further certify that no tax advice has been given to me by Tri-Continental Corporation (the Fund), Columbia Management Investment Services Corp, (the Service Agent), the Custodian and their respective affiliates, officers, directors, agents and employees. All decisions regarding this sell order are my own. I expressly assume the responsibility for any adverse consequences which may arise from this sell order and I agree that the Fund, the Service Agent, the Custodian and their respective affiliates, officers, directors, agents and employees shall in no way be held responsible.

I understand that if this distribution is from an inherited IRA, the account must be distributed in full by December 31 of the fifth year following the stockholder’s death, unless I am the surviving spouse or I have elected to take life expectancy payments.

For your account safety and security, please enter the information from Part 1 of this form below. The registered stockholder or authorized individual must sign below.

| IRA Depositor/Stockholder Name (First, Middle Initial, Last) | Date of Birth | (MM/DD/YYYY) | Social Security Number | |||

| Street Address or APO/FPO | City | State ZIP Code | ||||

| The Internal Revenue Service does not require your consent to any provision of the document other than the certification required to avoid backup withholding. | ||||||

| Print Name of IRA Depositor/Stockholder or Authorized Individual | Capacity (if applicable) | |||||

| Signature of IRA Depositor/Stockholder or Authorized Individual X |

Date (MM/DD/YYYY) | |||||

| Affix Medallion Signature Guarantee stamp here.

Guarantor, please do not affix the guarantee unless all of the information on this page has been complete. |

The Service Agent may require a Medallion Signature Guarantee (MSG) or Signature Guarantee stamp for your signature in order to process certain transactions. A MSG or Signature Guarantee stamp may be executed by any eligible institution, including, but not limited to, the following: brokers or dealers, banks, credit unions, and savings associations. A MSG or Signature Guarantee helps assure that a signature is genuine and not a forgery. Notarization by a notary public is not an acceptable signature guarantee. The Service Agent reserves the right to reject a signature guarantee and to request additional documentation for any transaction. You may refer to the Fund’s prospectus for more information.

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

.

CT-FR/113352 C (12/20)

Page 6 of 6

| Part 9 | Return Instructions |

| Regular mail Tri-Continental Corporation |

Overnight mail Tri-Continental Corporation | |

| PO Box 219371 |

c/o DST Asset Manager Solutions, Inc. | |

| Kansas City, MO 64121-9371 |

430 W 7th Street, STE 219371 | |

| Kansas City, MO 64105-1407 |

For assistance completing this form, please contact a representative at 800.345.6611 option 3, Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies. Columbia Management Investment Services Corp. is the Service Agent for Tri-Continental Corporation.

© 2020 Columbia Management Investment Advisers, LLC. All rights reserved. 3328236 (12/20) CT-FR/113352 C (12/20)

Page 6 of 6