Q3 2025 Investor Presentation .3 October 30, 2025 – based on financial results as of September 30, 2025

2Investor Presentation 2 Forward Looking Statements Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements, including, but not limited to, future financial and operating performance, future opportunities and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future, including the potential impacts of the shutdown of the U.S. government. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “projected,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this material, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by federal securities laws. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, and such forward-looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in Trinity’s Annual Report on Form 10-K for the most recent fiscal year, as may be revised and updated by Trinity’s Quarterly Reports on Form 10-Q, and Trinity’s Current Reports on Form 8-K. This presentation also includes references to calculations that are not based on generally accepted accounting principles (“GAAP”). Reconciliations of each of these non-GAAP measures to the most directly comparable GAAP measures have been included in the Appendix. When forward-looking non-GAAP measures are provided, Trinity does not provide quantitative reconciliations of forward-looking non-GAAP measures to the most directly comparable GAAP measures because it cannot, without unreasonable effort, predict the timing and amounts of certain items included in the computations of each of these measures. These factors include, but are not limited to: the product mix of expected railcar deliveries; the timing and amount of significant transactions and investments, such as lease portfolio sales, capital expenditures, and returns of capital to shareholders; and the amount and timing of certain other items outside the normal course of our core business operations. Except where noted, financial data is presented as of the Company’s most recent fiscal quarter ending September 30, 2025. “LTM” represents Last Twelve Months(1) financial information from October 1, 2024 to September 30, 2025. See appendix for footnotes

3Investor Presentation I. Quarter Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 II. Company Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 III. Financial Positioning and Strategic Initiatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 IV. Appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 Investor Presentation – Q3 2025

4Investor Presentation Quarter Results

5Investor Presentation Key Takeaways from Q3 2025 Quarterly EPS from continuing operations of $0.38, up $0.19 sequentially Strength in repricing lease rates; FLRD +8.7%, utilization 96.8% New railcar orders of 350 and railcar deliveries of 1,680; backlog of $1.8B Raising and tightening full year EPS guidance to a range of $1.55 to $1.70 attributed to higher secondary market gains and margin performance

6Investor Presentation Financial Results Highlights Cash Flow from Cont. Operations $45M $(39)M Revenues $454M (43)% EPS $0.38 $(0.06) Q3 2025 – Year over Year Adjusted ROE* 10.2% LTM Q3-25 * See appendix for reconciliation of non-GAAP measures

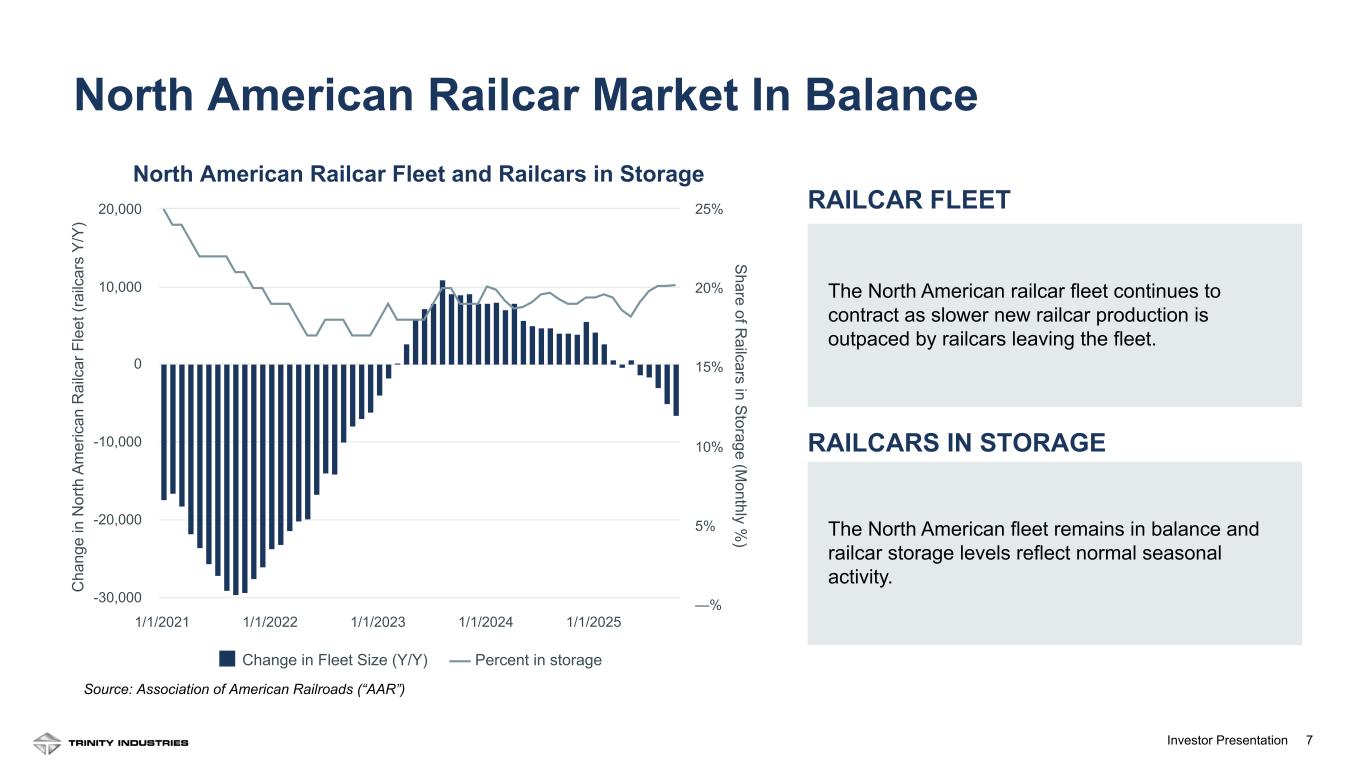

7Investor Presentation North American Railcar Market In Balance C ha ng e in N or th A m er ic an R ai lc ar F le et (r ai lc ar s Y /Y ) S hare of R ailcars in S torage (M onthly % ) Change in Fleet Size (Y/Y) Percent in storage 1/1/2021 1/1/2022 1/1/2023 1/1/2024 1/1/2025 -30,000 -20,000 -10,000 0 10,000 20,000 —% 5% 10% 15% 20% 25% North American Railcar Fleet and Railcars in Storage Source: Association of American Railroads (“AAR”) RAILCAR FLEET The North American railcar fleet continues to contract as slower new railcar production is outpaced by railcars leaving the fleet. RAILCARS IN STORAGE The North American fleet remains in balance and railcar storage levels reflect normal seasonal activity.

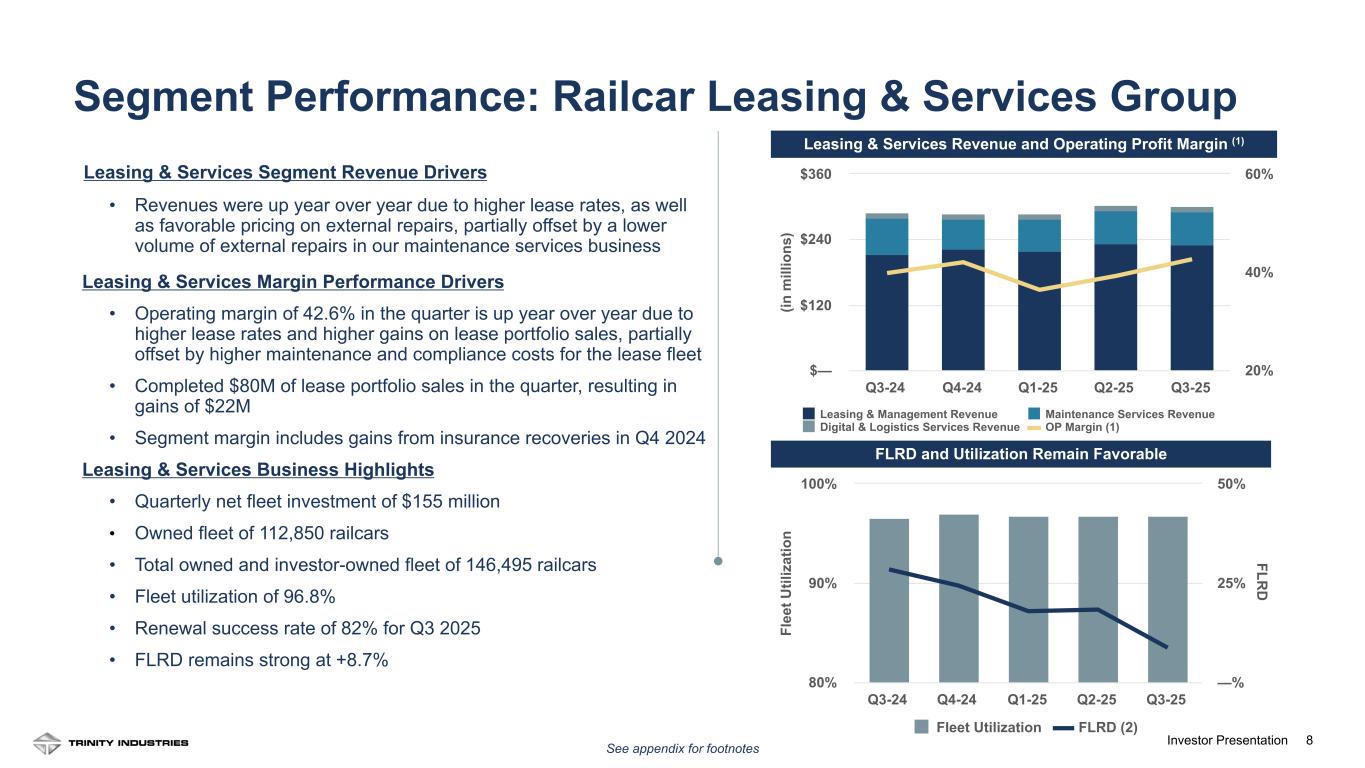

8Investor Presentation8 Leasing & Services Revenue and Operating Profit Margin (1) (in m ill io ns ) Leasing & Management Revenue Maintenance Services Revenue Digital & Logistics Services Revenue OP Margin (1) Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $— $120 $240 $360 20% 40% 60%Leasing & Services Segment Revenue Drivers • Revenues were up year over year due to higher lease rates, as well as favorable pricing on external repairs, partially offset by a lower volume of external repairs in our maintenance services business Leasing & Services Margin Performance Drivers • Operating margin of 42.6% in the quarter is up year over year due to higher lease rates and higher gains on lease portfolio sales, partially offset by higher maintenance and compliance costs for the lease fleet • Completed $80M of lease portfolio sales in the quarter, resulting in gains of $22M • Segment margin includes gains from insurance recoveries in Q4 2024 Leasing & Services Business Highlights • Quarterly net fleet investment of $155 million • Owned fleet of 112,850 railcars • Total owned and investor-owned fleet of 146,495 railcars • Fleet utilization of 96.8% • Renewal success rate of 82% for Q3 2025 • FLRD remains strong at +8.7% See appendix for footnotes Segment Performance: Railcar Leasing & Services Group Fl ee t U til iz at io n FLR D Fleet Utilization FLRD (2) Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 80% 90% 100% —% 25% 50% FLRD and Utilization Remain Favorable

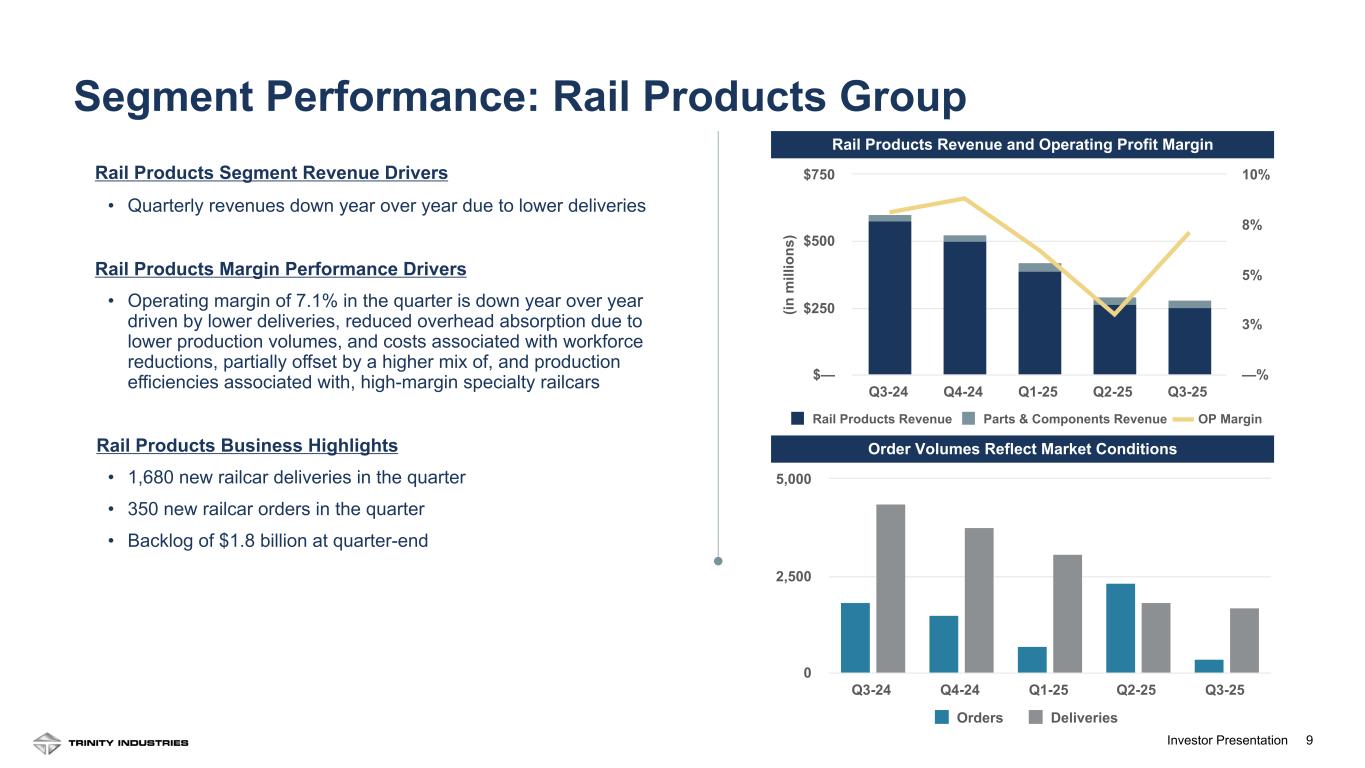

9Investor Presentation9 Rail Products Segment Revenue Drivers • Quarterly revenues down year over year due to lower deliveries Rail Products Margin Performance Drivers • Operating margin of 7.1% in the quarter is down year over year driven by lower deliveries, reduced overhead absorption due to lower production volumes, and costs associated with workforce reductions, partially offset by a higher mix of, and production efficiencies associated with, high-margin specialty railcars Rail Products Business Highlights • 1,680 new railcar deliveries in the quarter • 350 new railcar orders in the quarter • Backlog of $1.8 billion at quarter-end Rail Products Revenue and Operating Profit Margin (in m ill io ns ) Rail Products Revenue Parts & Components Revenue OP Margin Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $— $250 $500 $750 —% 3% 5% 8% 10% Segment Performance: Rail Products Group Orders Deliveries Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 0 2,500 5,000 Order Volumes Reflect Market Conditions

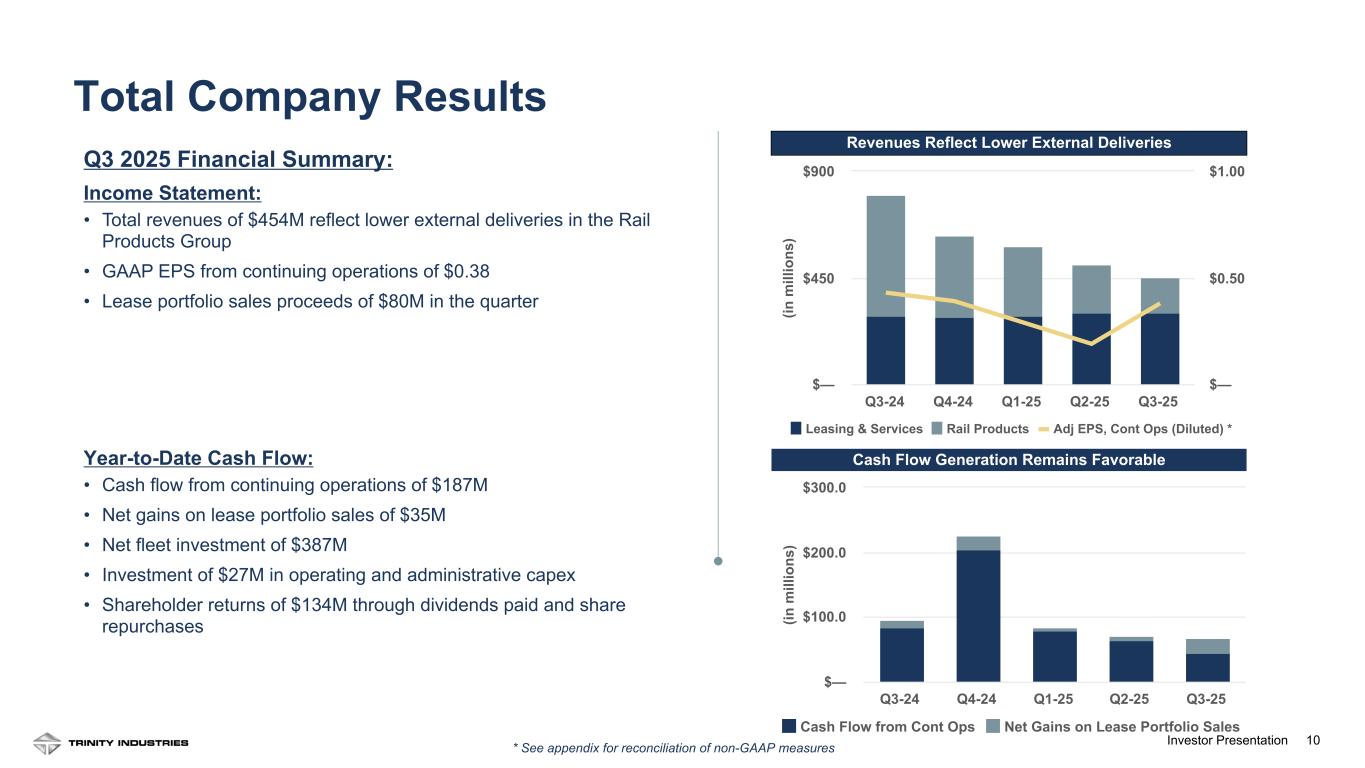

10Investor Presentation Revenues Reflect Lower External Deliveries Q3 2025 Financial Summary: Income Statement: • Total revenues of $454M reflect lower external deliveries in the Rail Products Group • GAAP EPS from continuing operations of $0.38 • Lease portfolio sales proceeds of $80M in the quarter 10 Cash Flow Generation Remains Favorable * See appendix for reconciliation of non-GAAP measures (in m ill io ns ) Leasing & Services Rail Products Adj EPS, Cont Ops (Diluted) * Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $— $450 $900 $— $0.50 $1.00 (in m ill io ns ) Cash Flow from Cont Ops Net Gains on Lease Portfolio Sales Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $— $100.0 $200.0 $300.0 Total Company Results Year-to-Date Cash Flow: • Cash flow from continuing operations of $187M • Net gains on lease portfolio sales of $35M • Net fleet investment of $387M • Investment of $27M in operating and administrative capex • Shareholder returns of $134M through dividends paid and share repurchases

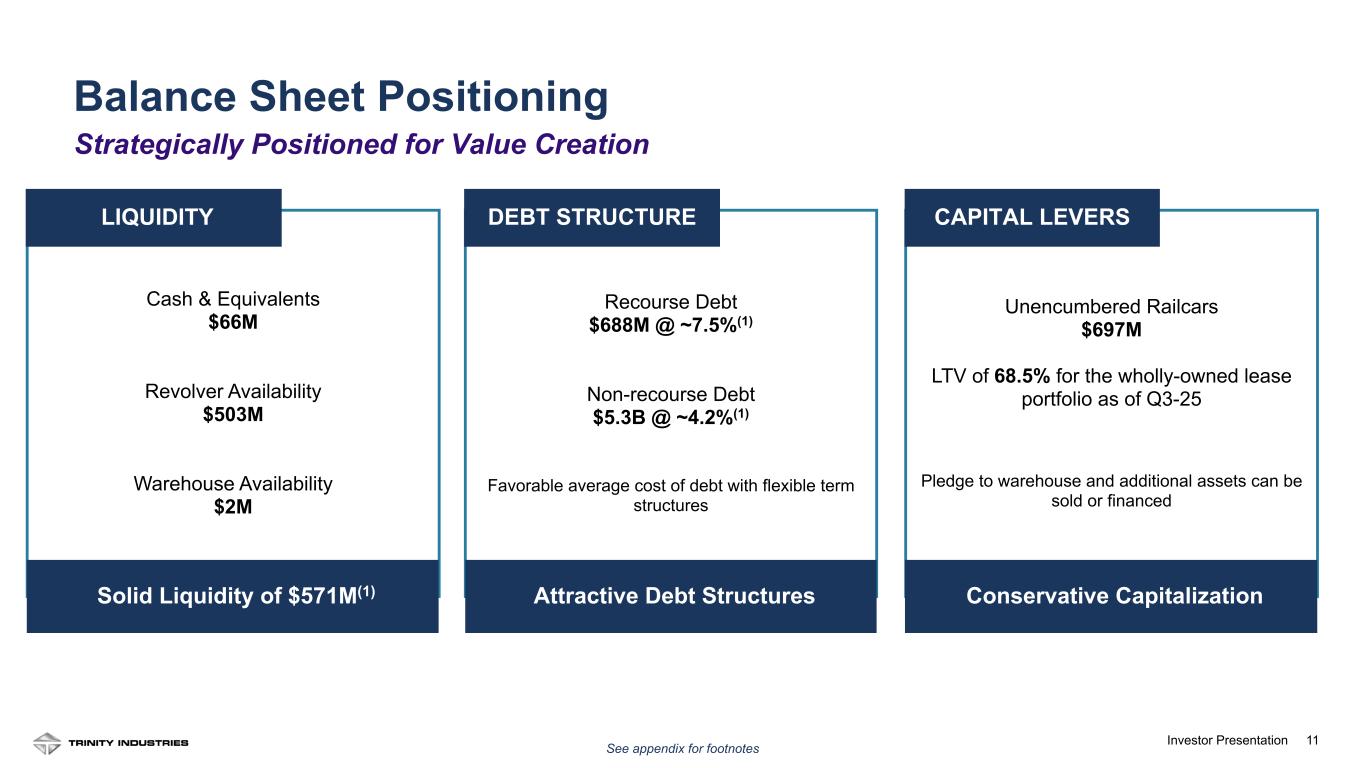

11Investor Presentation Unencumbered Railcars $697M LTV of 68.5% for the wholly-owned lease portfolio as of Q3-25 Pledge to warehouse and additional assets can be sold or financed CAPITAL LEVERS Recourse Debt $688M @ ~7.5%(1) Non-recourse Debt $5.3B @ ~4.2%(1) Favorable average cost of debt with flexible term structures DEBT STRUCTURE Cash & Equivalents $66M Revolver Availability $503M Warehouse Availability $2M LIQUIDITY Solid Liquidity of $571M(1) Attractive Debt Structures Conservative Capitalization See appendix for footnotes Balance Sheet Positioning Strategically Positioned for Value Creation

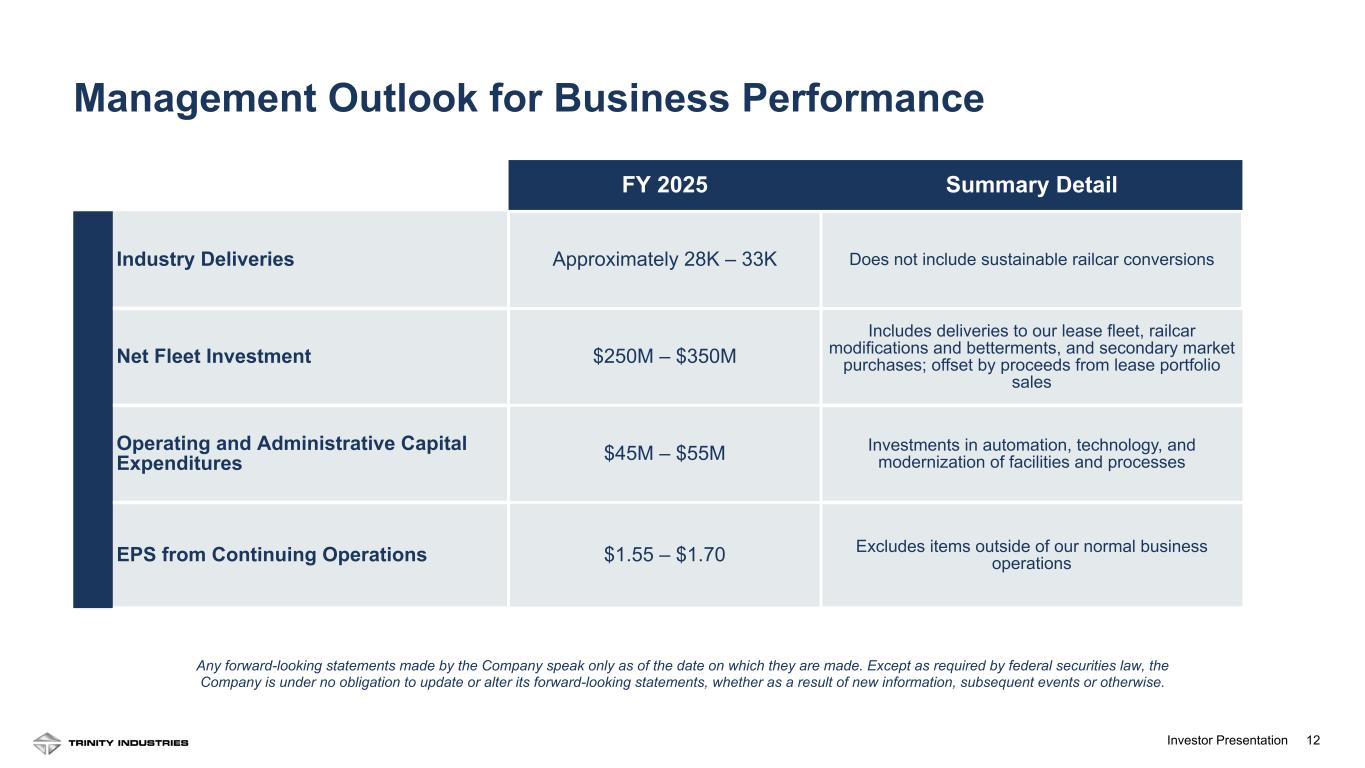

12Investor Presentation C ap ita l A llo ca tio n FY 2025 Summary Detail Industry Deliveries Approximately 28K – 33K Does not include sustainable railcar conversions Net Fleet Investment $250M – $350M Includes deliveries to our lease fleet, railcar modifications and betterments, and secondary market purchases; offset by proceeds from lease portfolio sales Operating and Administrative Capital Expenditures $45M – $55M Investments in automation, technology, and modernization of facilities and processes EPS from Continuing Operations $1.55 – $1.70 Excludes items outside of our normal business operations Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. Management Outlook for Business Performance

13Investor Presentation Company Overview

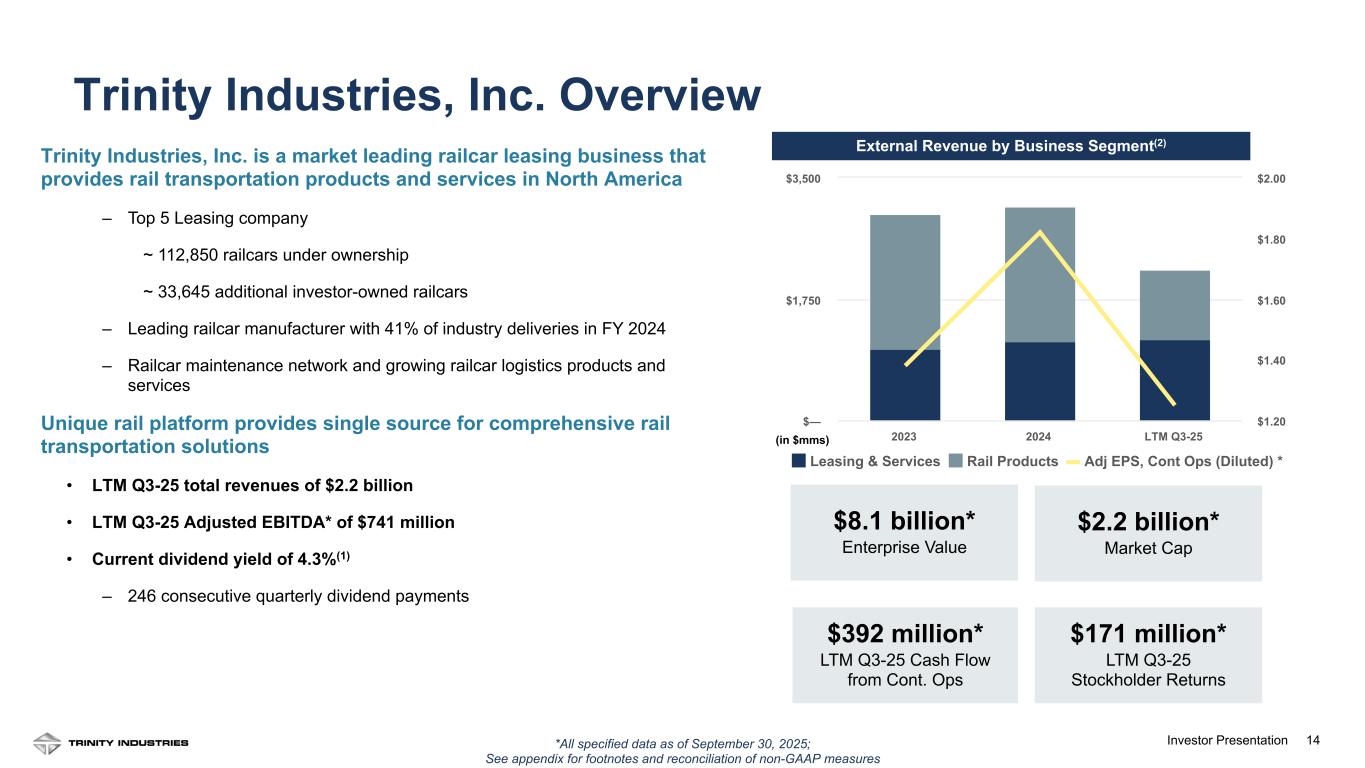

14Investor Presentation Trinity Industries, Inc. is a market leading railcar leasing business that provides rail transportation products and services in North America – Top 5 Leasing company ~ 112,850 railcars under ownership ~ 33,645 additional investor-owned railcars – Leading railcar manufacturer with 41% of industry deliveries in FY 2024 – Railcar maintenance network and growing railcar logistics products and services Unique rail platform provides single source for comprehensive rail transportation solutions • LTM Q3-25 total revenues of $2.2 billion • LTM Q3-25 Adjusted EBITDA* of $741 million • Current dividend yield of 4.3%(1) – 246 consecutive quarterly dividend payments External Revenue by Business Segment(2) *All specified data as of September 30, 2025; See appendix for footnotes and reconciliation of non-GAAP measures $8.1 billion* Enterprise Value $171 million* LTM Q3-25 Stockholder Returns $392 million* LTM Q3-25 Cash Flow from Cont. Ops $2.2 billion* Market Cap Leasing & Services Rail Products Adj EPS, Cont Ops (Diluted) * 2023 2024 LTM Q3-25 $— $1,750 $3,500 $1.20 $1.40 $1.60 $1.80 $2.00 (in $mms) Trinity Industries, Inc. Overview

15Investor Presentation Optimize customers’ ownership and usage of railcar equipment Cross-sell to deliver innovative solutions and differentiated experience Create an unmatched rail platform that provides a full suite of customer solutions to make a Trinity leased railcar the “railcar of choice” for our shipper customers for higher fleet utilization, more value streams per railcar, and higher shareholder returns Trinity’s Platform Built for Superior Performance

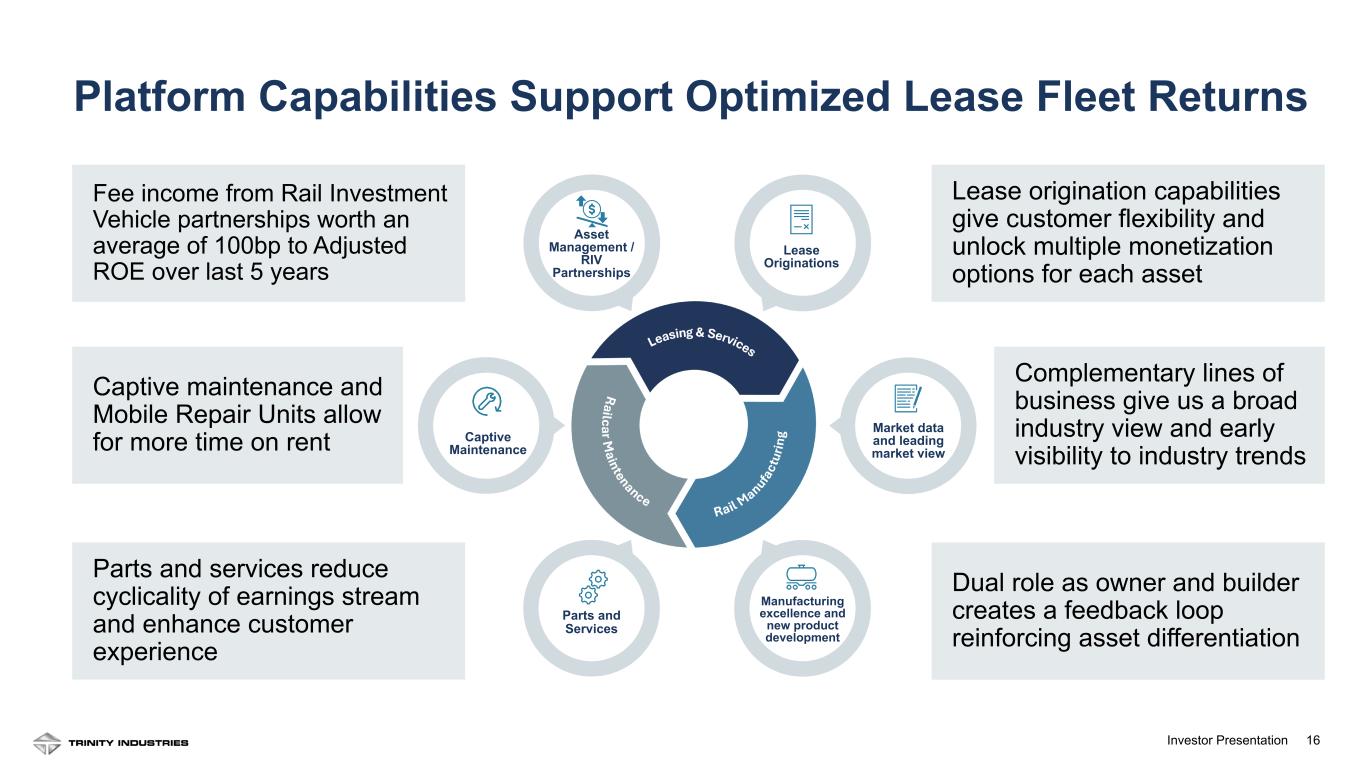

16Investor Presentation Platform Capabilities Support Optimized Lease Fleet Returns Lease Originations Captive Maintenance Parts and Services Manufacturing excellence and new product development Market data and leading market view Asset Management / RIV Partnerships Dual role as owner and builder creates a feedback loop reinforcing asset differentiation Complementary lines of business give us a broad industry view and early visibility to industry trends Lease origination capabilities give customer flexibility and unlock multiple monetization options for each asset Fee income from Rail Investment Vehicle partnerships worth an average of 100bp to Adjusted ROE over last 5 years Captive maintenance and Mobile Repair Units allow for more time on rent Parts and services reduce cyclicality of earnings stream and enhance customer experience

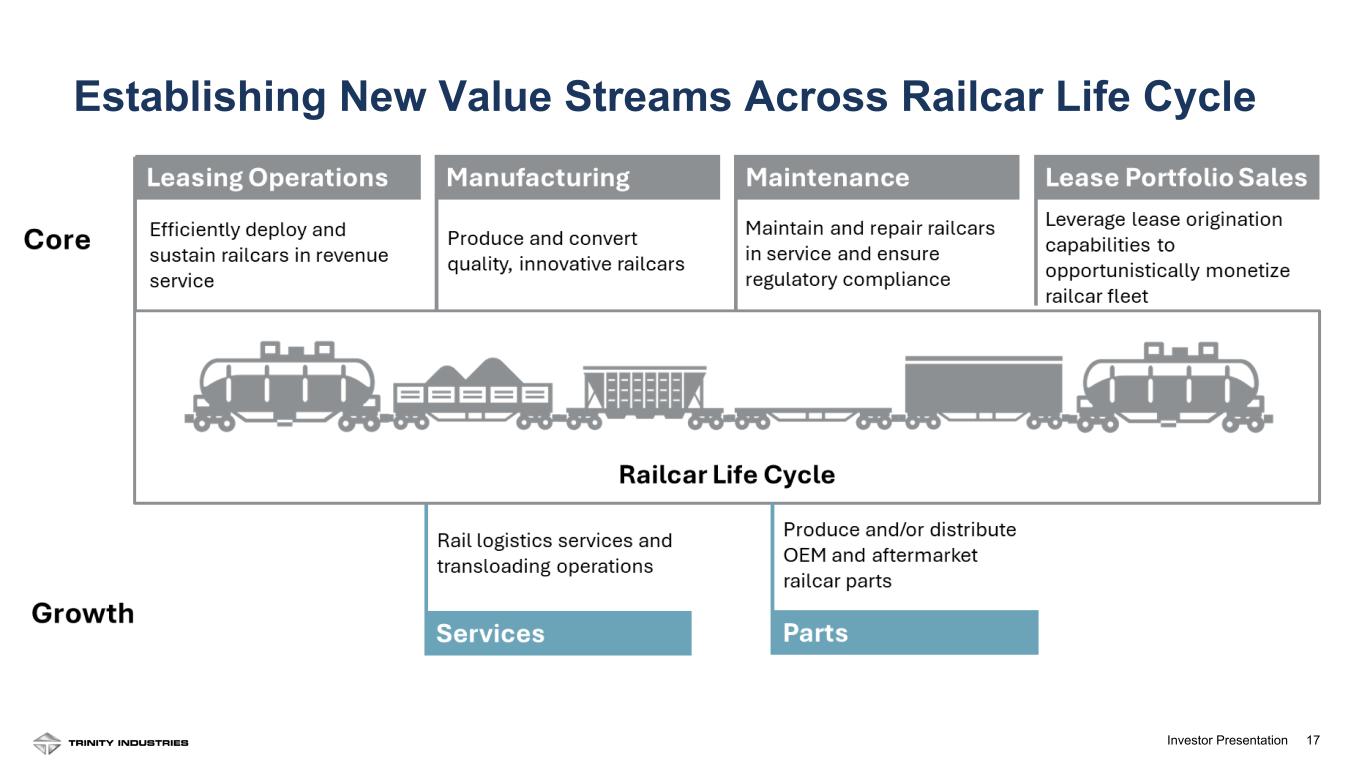

17Investor Presentation Establishing New Value Streams Across Railcar Life Cycle

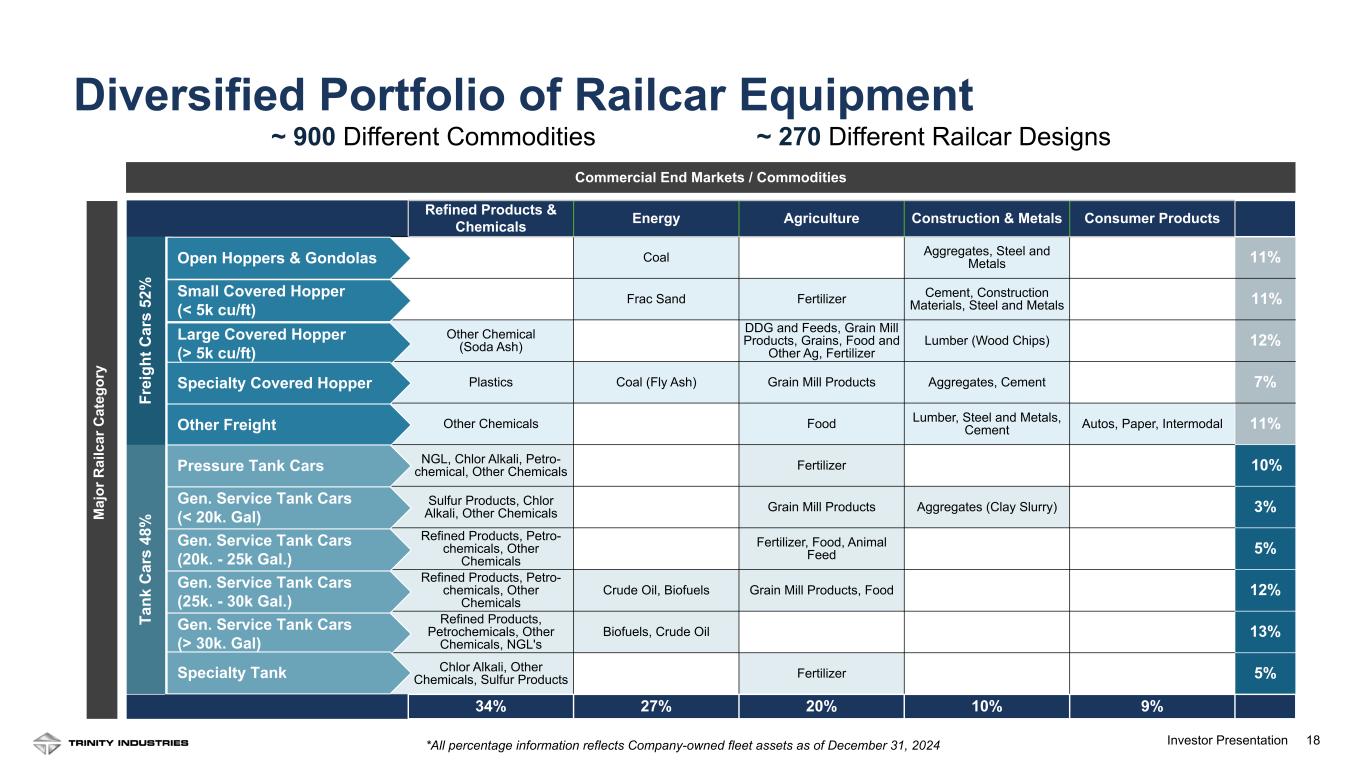

18Investor Presentation Diversified Portfolio of Railcar Equipment ~ 900 Different Commodities ~ 270 Different Railcar Designs Refined Products & Chemicals Energy Agriculture Construction & Metals Consumer Products Fr ei gh t C ar s 52 % Open Hoppers & Gondolas Coal Aggregates, Steel and Metals 11% Small Covered Hopper (< 5k cu/ft) Frac Sand Fertilizer Cement, Construction Materials, Steel and Metals 11% Large Covered Hopper (< 5k cu/ft) Other Chemical (Soda Ash) DDG and Feeds, Grain Mill Products, Grains, Food and Other Ag, Fertilizer Lumber (Wood Chips) 12% Specialty Covered Hopper Plastics Coal (Fly Ash) Grain Mill Products Aggregates, Cement 7% Other Freight Other Chemicals Food Lumber, Steel and Metals, Cement Autos, Paper, Intermodal 11% Ta nk C ar s 48 % Pressure Tank Cars NGL, Chlor Alkali, Petro- chemical, Other Chemicals Fertilizer 10% Gen. Service Tank Cars (< 20k. Gal) Sulfur Products, Chlor Alkali, Other Chemicals Grain Mill Products Aggregates (Clay Slurry) 3% Gen. Service Tank Cars (20k. - 25k Gal.) Refined Products, Petro- chemicals, Other Chemicals Fertilizer, Food, Animal Feed 5% Gen. Service Tank Cars (25k. - 30k Gal.) Refined Products, Petro- chemicals, Other Chemicals Crude Oil, Biofuels Grain Mill Products, Food 12% Gen. Service Tank Cars (> 30k. Gal) Refined Products, Petrochemicals, Other Chemicals, NGL's Biofuels, Crude Oil 13% Specialty Tank Chlor Alkali, Other Chemicals, Sulfur Products Fertilizer 5% 34% 27% 20% 10% 9% Commercial End Markets / Commodities M aj or R ai lc ar C at eg or y r l ll r r (< 5k cu/ft) Large overed opper (> 5k cu/ft) i lt r r t r r i t r r r . r i r (< 20k. Gal) . r i r (20k. - 25k Gal.) . r i r (25k. - 30k Gal.) . r i r (> 30k. Gal) i lt *All percentage information reflects Company-owned fleet assets as of December 31, 2024

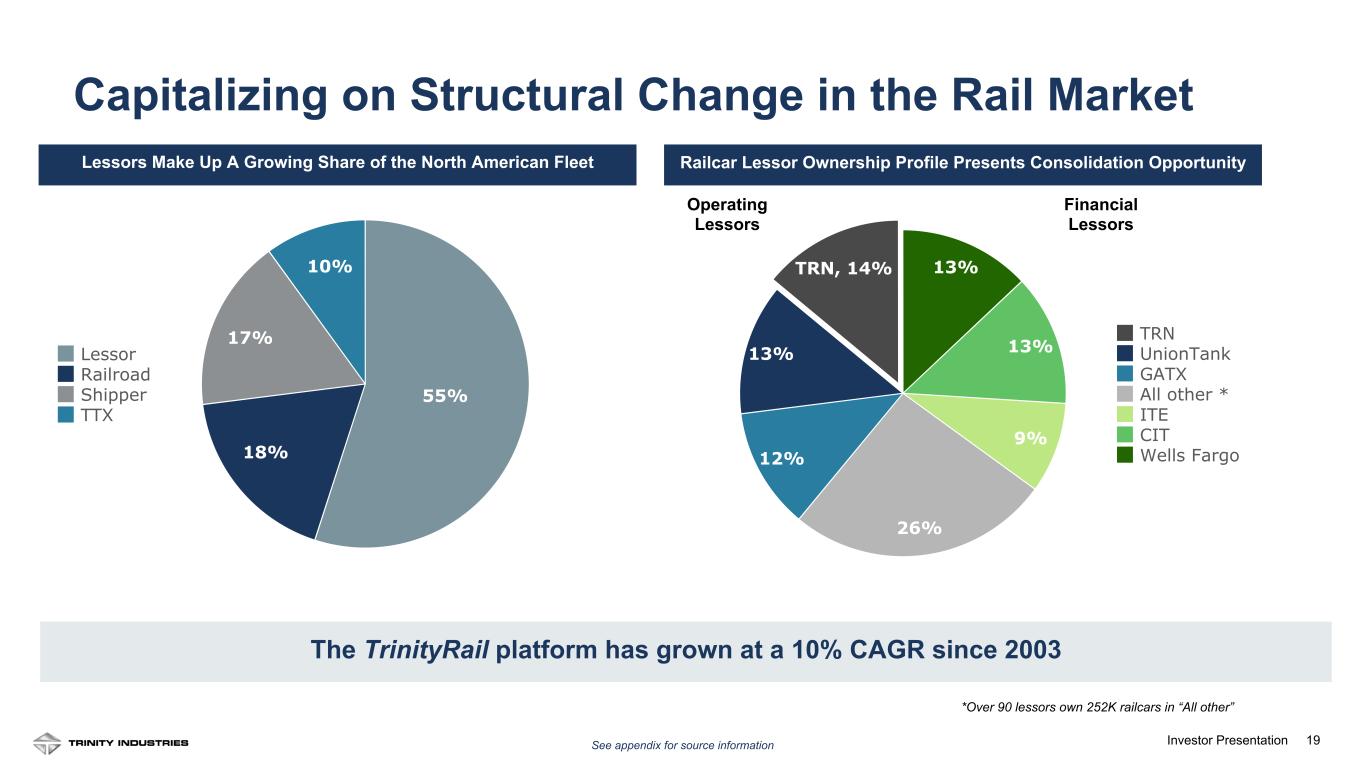

19Investor Presentation 13% 13% 9% 26% 12% 13% TRN, 14% TRN UnionTank GATX All other * ITE CIT Wells Fargo The TrinityRail platform has grown at a 10% CAGR since 2003 Lessors Make Up A Growing Share of the North American Fleet Railcar Lessor Ownership Profile Presents Consolidation Opportunity Operating Lessors *Over 90 lessors own 252K railcars in “All other” 19 Financial Lessors 55% 18% 17% 10% Lessor Railroad Shipper TTX See appendix for source information Capitalizing on Structural Change in the Rail Market

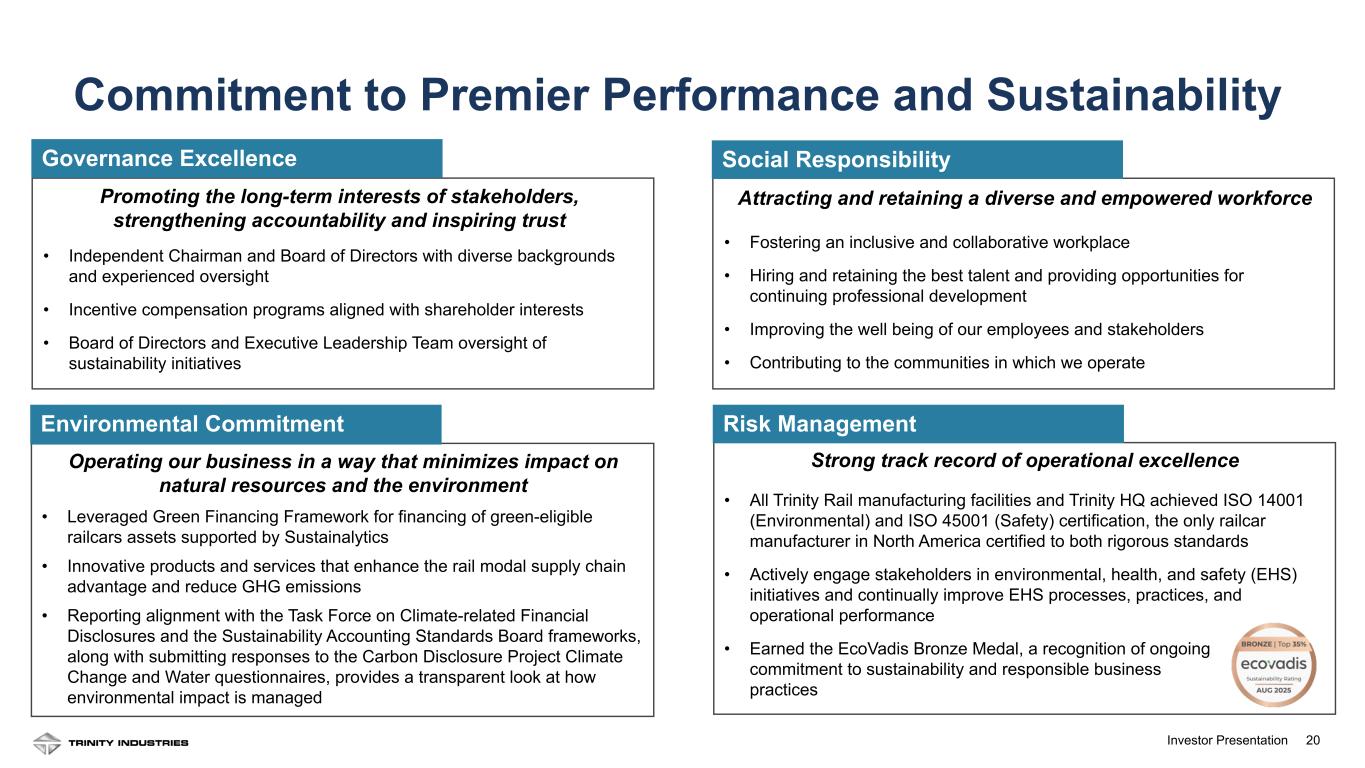

20Investor Presentation Promoting the long-term interests of stakeholders, strengthening accountability and inspiring trust • Independent Chairman and Board of Directors with diverse backgrounds and experienced oversight • Incentive compensation programs aligned with shareholder interests • Board of Directors and Executive Leadership Team oversight of sustainability initiatives Attracting and retaining a diverse and empowered workforce • Fostering an inclusive and collaborative workplace • Hiring and retaining the best talent and providing opportunities for continuing professional development • Improving the well being of our employees and stakeholders • Contributing to the communities in which we operate Operating our business in a way that minimizes impact on natural resources and the environment • Leveraged Green Financing Framework for financing of green-eligible railcars assets supported by Sustainalytics • Innovative products and services that enhance the rail modal supply chain advantage and reduce GHG emissions • Reporting alignment with the Task Force on Climate-related Financial Disclosures and the Sustainability Accounting Standards Board frameworks, along with submitting responses to the Carbon Disclosure Project Climate Change and Water questionnaires, provides a transparent look at how environmental impact is managed Strong track record of operational excellence • All Trinity Rail manufacturing facilities and Trinity HQ achieved ISO 14001 (Environmental) and ISO 45001 (Safety) certification, the only railcar manufacturer in North America certified to both rigorous standards • Actively engage stakeholders in environmental, health, and safety (EHS) initiatives and continually improve EHS processes, practices, and operational performance • Earned the EcoVadis Bronze Medal, a recognition of ongoing commitment to sustainability and responsible business practices Commitment to Premier Performance and Sustainability Governance Excellence Social Responsibility Environmental Commitment Risk Management

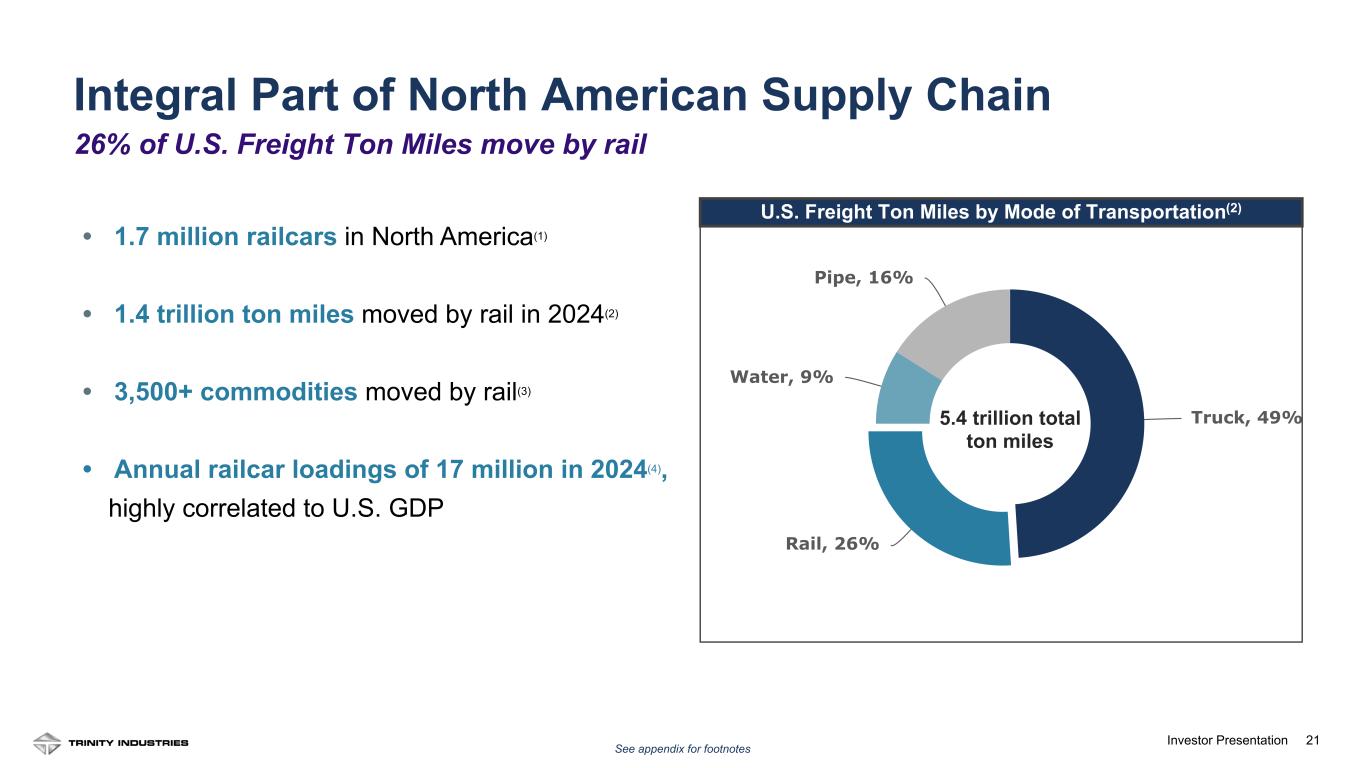

21Investor Presentation • 1.7 million railcars in North America(1) • 1.4 trillion ton miles moved by rail in 2024(2) • 3,500+ commodities moved by rail(3) • Annual railcar loadings of 17 million in 2024(4), highly correlated to U.S. GDP U.S. Freight Ton Miles by Mode of Transportation(2) See appendix for footnotes 21 Truck, 49% Rail, 26% Water, 9% Pipe, 16% 5.4 trillion total ton miles Integral Part of North American Supply Chain 26% of U.S. Freight Ton Miles move by rail

22Investor Presentation Financial Positioning and Strategic Initiatives

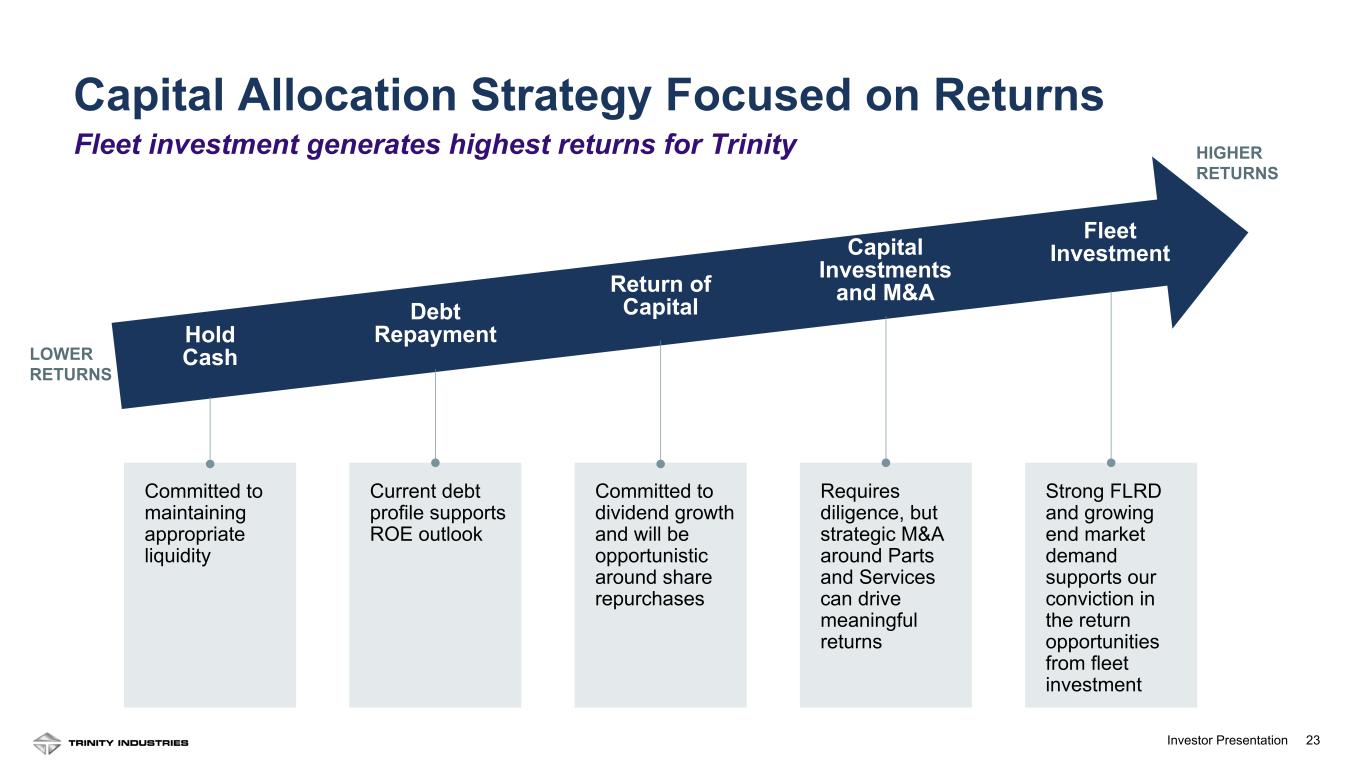

23Investor Presentation Fleet investment generates highest returns for Trinity Strong FLRD and growing end market demand supports our conviction in the return opportunities from fleet investment Requires diligence, but strategic M&A around Parts and Services can drive meaningful returns Committed to dividend growth and will be opportunistic around share repurchases Current debt profile supports ROE outlook Committed to maintaining appropriate liquidity Capital Allocation Strategy Focused on Returns HIGHER RETURNS LOWER RETURNS Fleet InvestmentCapital Investments and M&AReturn of CapitalDebt RepaymentHold Cash

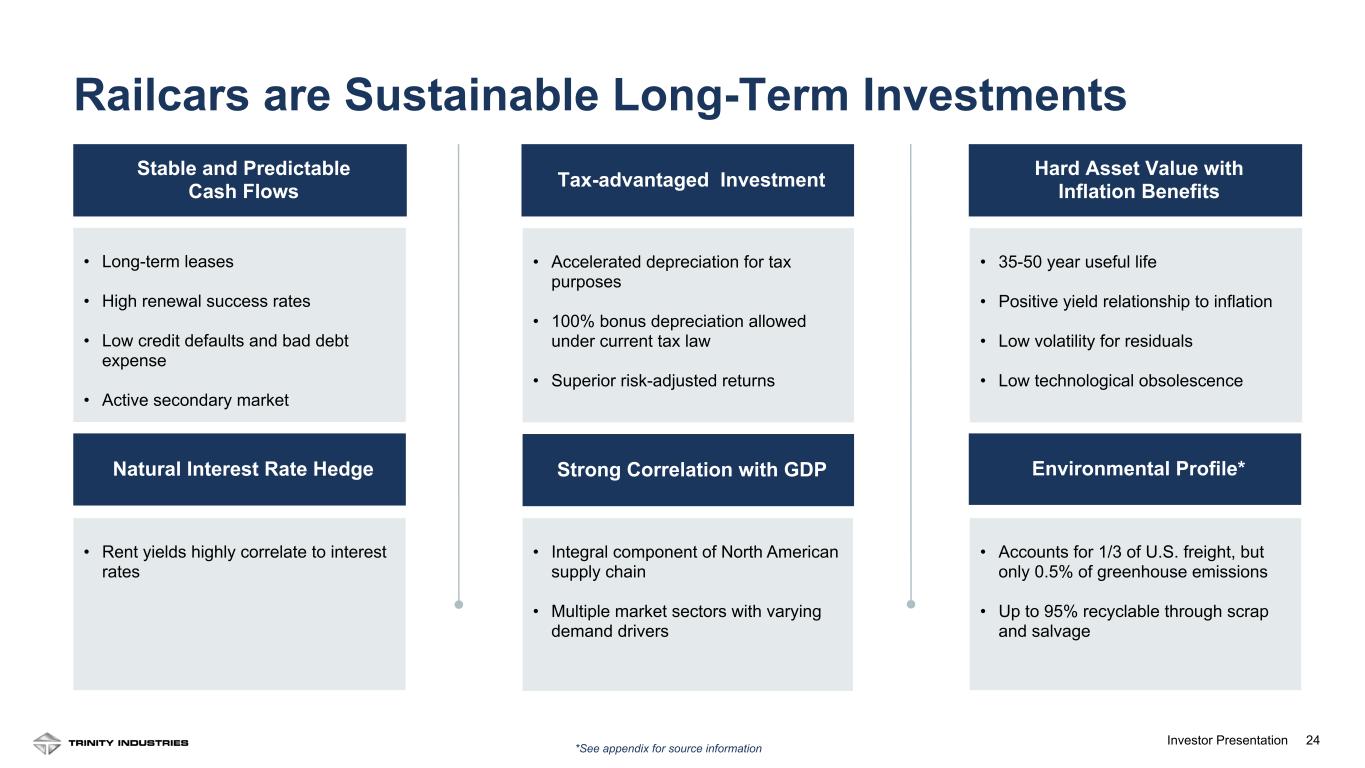

24Investor Presentation • Long-term leases • High renewal success rates • Low credit defaults and bad debt expense • Active secondary market Stable and Predictable Cash Flows • 35-50 year useful life • Positive yield relationship to inflation • Low volatility for residuals • Low technological obsolescence Hard Asset Value with Inflation Benefits • Integral component of North American supply chain • Multiple market sectors with varying demand drivers Strong Correlation with GDP • Rent yields highly correlate to interest rates Natural Interest Rate Hedge • Accelerated depreciation for tax purposes • 100% bonus depreciation allowed under current tax law • Superior risk-adjusted returns Tax-advantaged Investment • Accounts for 1/3 of U.S. freight, but only 0.5% of greenhouse emissions • Up to 95% recyclable through scrap and salvage Environmental Profile* *See appendix for source information 24 Railcars are Sustainable Long-Term Investments

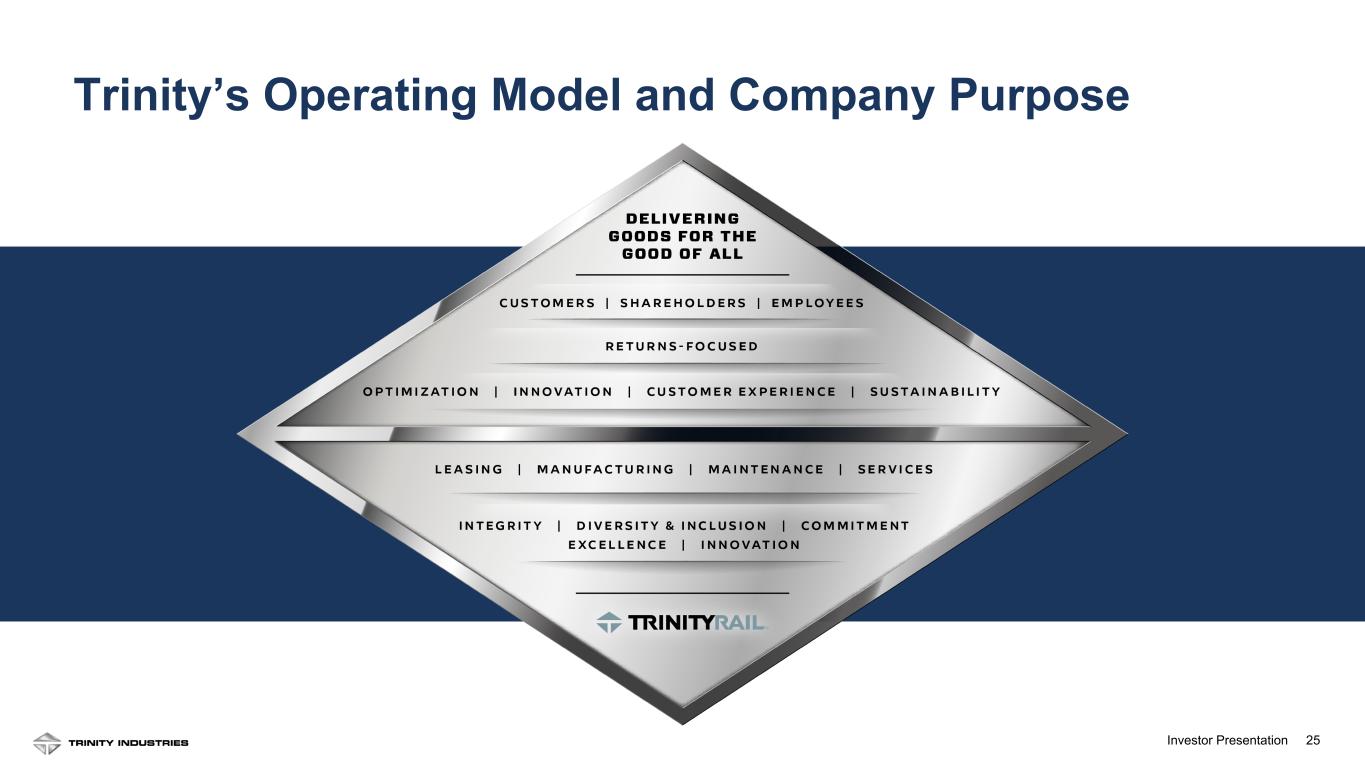

25Investor Presentation Trinity’s Operating Model and Company Purpose

26Investor Presentation Appendix

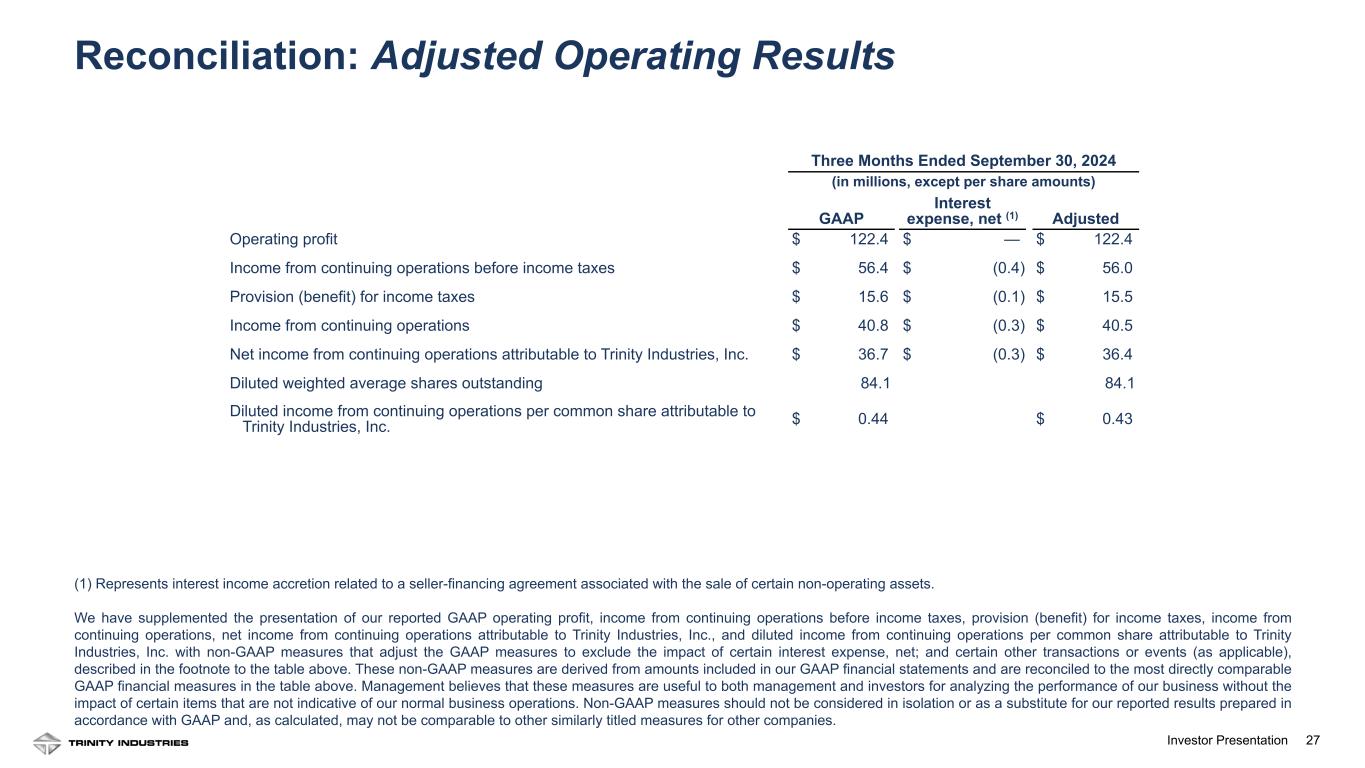

27Investor Presentation 27 Three Months Ended September 30, 2024 (in millions, except per share amounts) GAAP Interest expense, net (1) Adjusted Operating profit $ 122.4 $ — $ 122.4 Income from continuing operations before income taxes $ 56.4 $ (0.4) $ 56.0 Provision (benefit) for income taxes $ 15.6 $ (0.1) $ 15.5 Income from continuing operations $ 40.8 $ (0.3) $ 40.5 Net income from continuing operations attributable to Trinity Industries, Inc. $ 36.7 $ (0.3) $ 36.4 Diluted weighted average shares outstanding 84.1 84.1 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 0.44 $ 0.43 (1) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain interest expense, net; and certain other transactions or events (as applicable), described in the footnote to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Reconciliation: Adjusted Operating Results

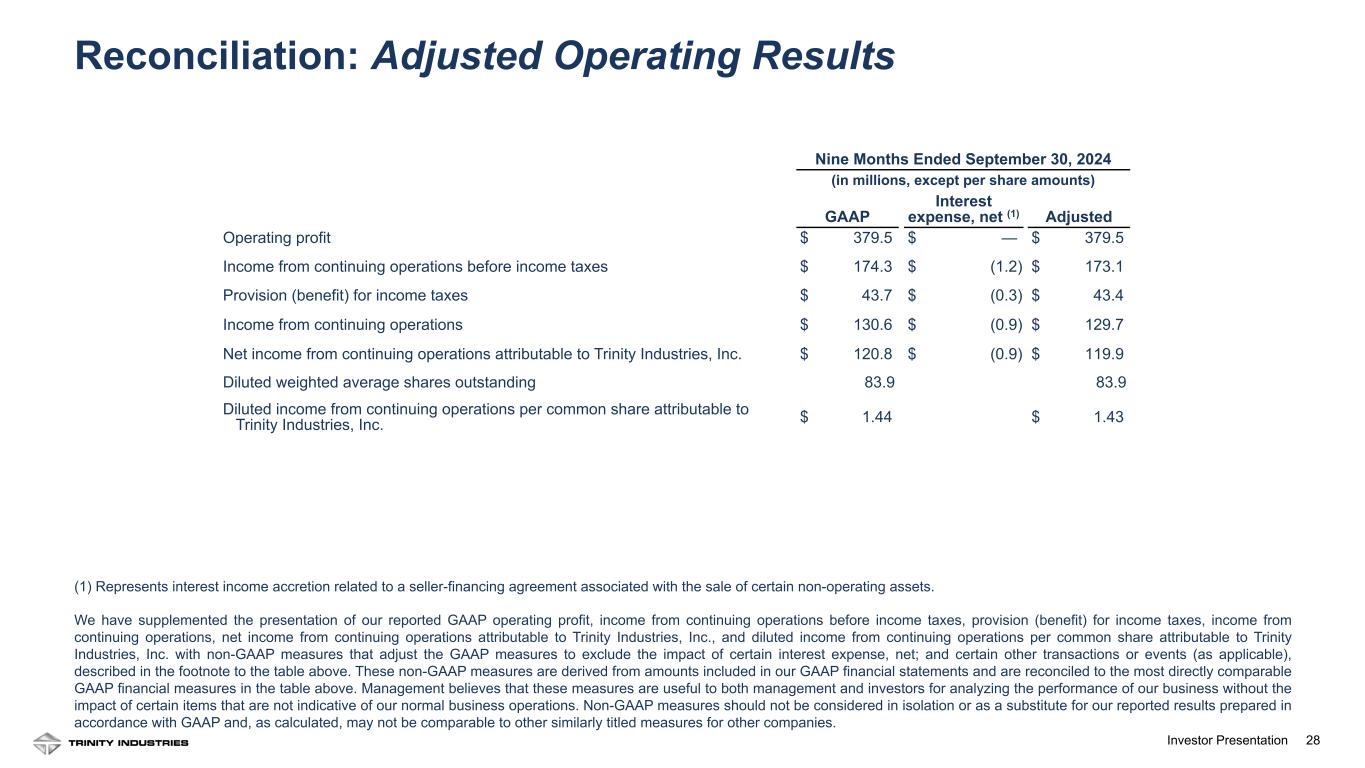

28Investor Presentation 28 Reconciliation: Adjusted Operating Results (1) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain interest expense, net; and certain other transactions or events (as applicable), described in the footnote to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Nine Months Ended September 30, 2024 (in millions, except per share amounts) GAAP Interest expense, net (1) Adjusted Operating profit $ 379.5 $ — $ 379.5 Income from continuing operations before income taxes $ 174.3 $ (1.2) $ 173.1 Provision (benefit) for income taxes $ 43.7 $ (0.3) $ 43.4 Income from continuing operations $ 130.6 $ (0.9) $ 129.7 Net income from continuing operations attributable to Trinity Industries, Inc. $ 120.8 $ (0.9) $ 119.9 Diluted weighted average shares outstanding 83.9 83.9 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.44 $ 1.43

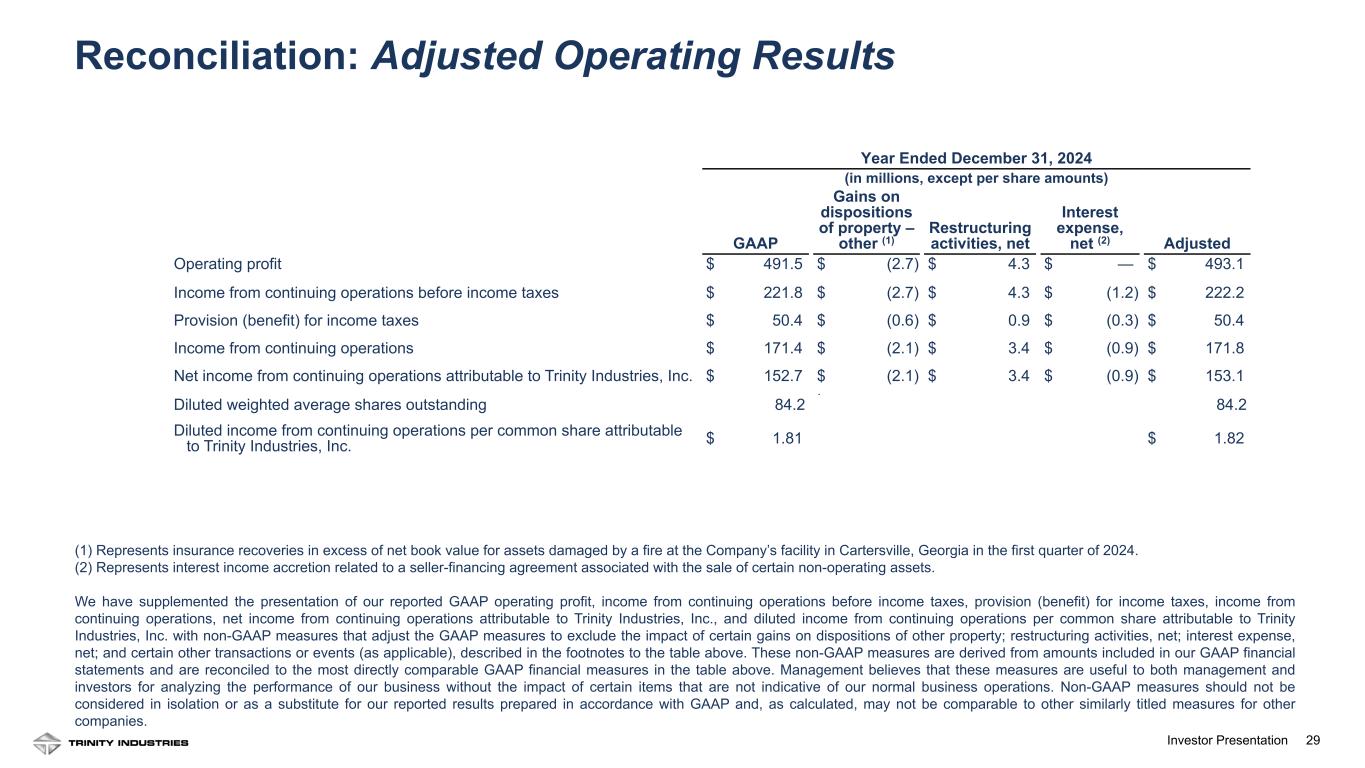

29Investor Presentation 29 Year Ended December 31, 2024 (in millions, except per share amounts) GAAP Gains on dispositions of property – other (1) Restructuring activities, net Interest expense, net (2) Adjusted Operating profit $ 491.5 $ (2.7) $ 4.3 $ — $ 493.1 Income from continuing operations before income taxes $ 221.8 $ (2.7) $ 4.3 $ (1.2) $ 222.2 Provision (benefit) for income taxes $ 50.4 $ (0.6) $ 0.9 $ (0.3) $ 50.4 Income from continuing operations $ 171.4 $ (2.1) $ 3.4 $ (0.9) $ 171.8 Net income from continuing operations attributable to Trinity Industries, Inc. $ 152.7 $ (2.1) $ 3.4 $ (0.9) $ 153.1 . Diluted weighted average shares outstanding 84.2 84.2 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.81 $ 1.82 Reconciliation: Adjusted Operating Results (1) Represents insurance recoveries in excess of net book value for assets damaged by a fire at the Company’s facility in Cartersville, Georgia in the first quarter of 2024. (2) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain gains on dispositions of other property; restructuring activities, net; interest expense, net; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies.

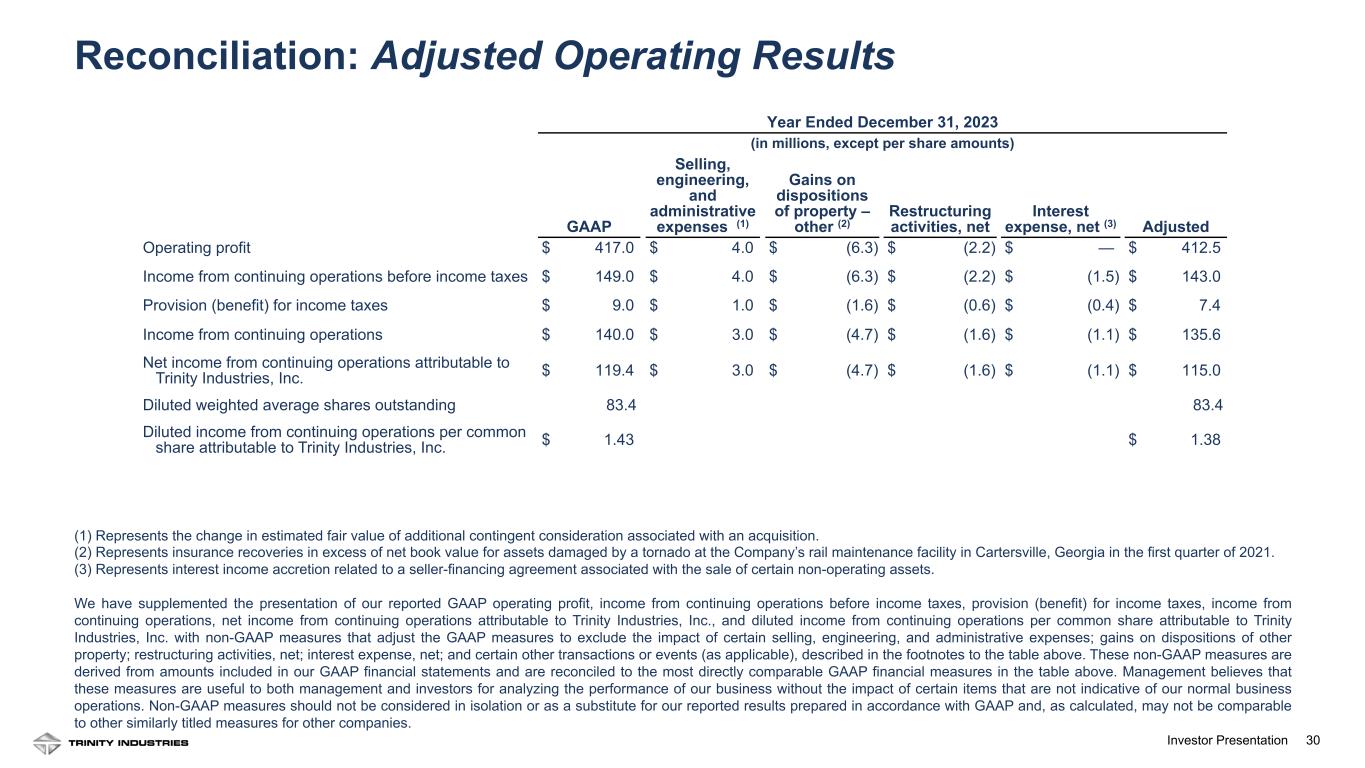

30Investor Presentation 30 (1) Represents the change in estimated fair value of additional contingent consideration associated with an acquisition. (2) Represents insurance recoveries in excess of net book value for assets damaged by a tornado at the Company’s rail maintenance facility in Cartersville, Georgia in the first quarter of 2021. (3) Represents interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. We have supplemented the presentation of our reported GAAP operating profit, income from continuing operations before income taxes, provision (benefit) for income taxes, income from continuing operations, net income from continuing operations attributable to Trinity Industries, Inc., and diluted income from continuing operations per common share attributable to Trinity Industries, Inc. with non-GAAP measures that adjust the GAAP measures to exclude the impact of certain selling, engineering, and administrative expenses; gains on dispositions of other property; restructuring activities, net; interest expense, net; and certain other transactions or events (as applicable), described in the footnotes to the table above. These non-GAAP measures are derived from amounts included in our GAAP financial statements and are reconciled to the most directly comparable GAAP financial measures in the table above. Management believes that these measures are useful to both management and investors for analyzing the performance of our business without the impact of certain items that are not indicative of our normal business operations. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. Year Ended December 31, 2023 (in millions, except per share amounts) GAAP Selling, engineering, and administrative expenses (1) Gains on dispositions of property – other (2) Restructuring activities, net Interest expense, net (3) Adjusted Operating profit $ 417.0 $ 4.0 $ (6.3) $ (2.2) $ — $ 412.5 Income from continuing operations before income taxes $ 149.0 $ 4.0 $ (6.3) $ (2.2) $ (1.5) $ 143.0 Provision (benefit) for income taxes $ 9.0 $ 1.0 $ (1.6) $ (0.6) $ (0.4) $ 7.4 Income from continuing operations $ 140.0 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 135.6 Net income from continuing operations attributable to Trinity Industries, Inc. $ 119.4 $ 3.0 $ (4.7) $ (1.6) $ (1.1) $ 115.0 Diluted weighted average shares outstanding 83.4 83.4 Diluted income from continuing operations per common share attributable to Trinity Industries, Inc. $ 1.43 $ 1.38 Reconciliation: Adjusted Operating Results

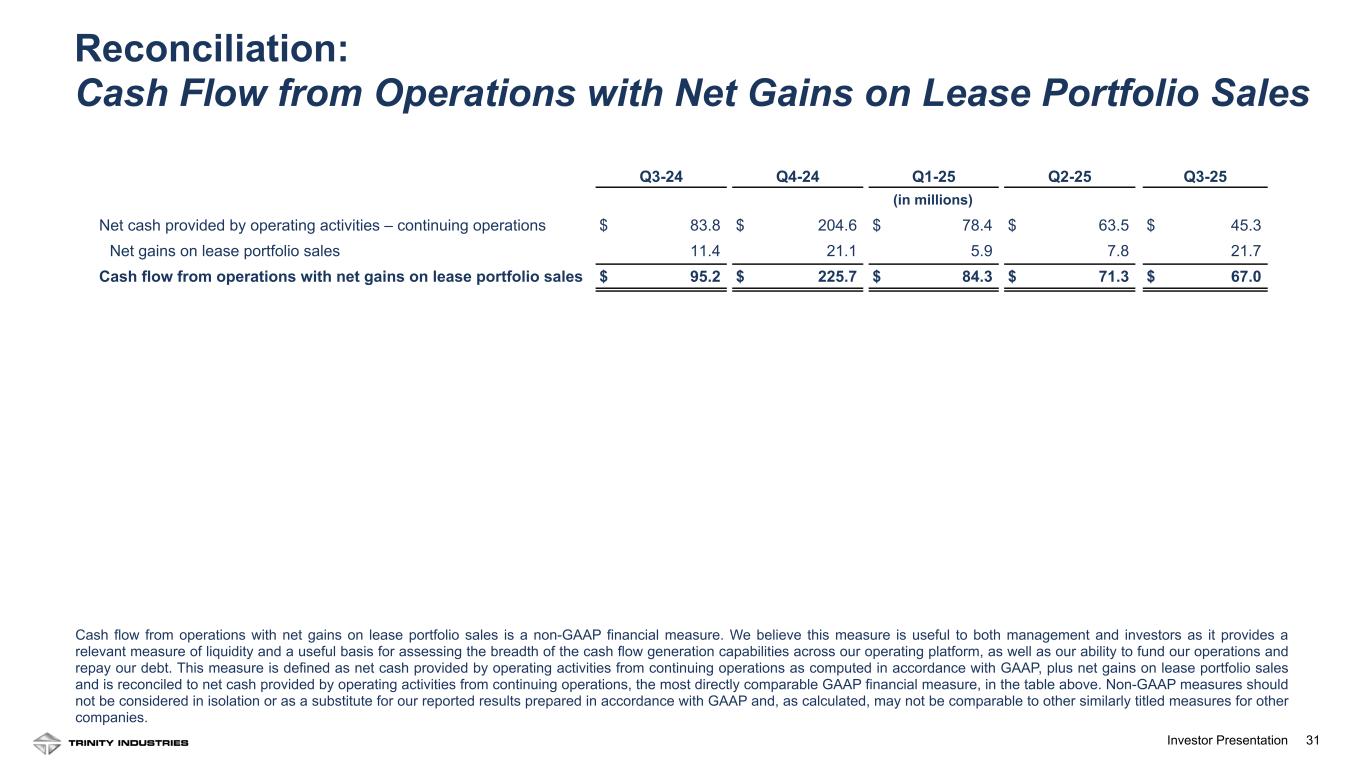

31Investor Presentation Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 (in millions) Net cash provided by operating activities – continuing operations $ 83.8 $ 204.6 $ 78.4 $ 63.5 $ 45.3 Net gains on lease portfolio sales 11.4 21.1 5.9 7.8 21.7 Cash flow from operations with net gains on lease portfolio sales $ 95.2 $ 225.7 $ 84.3 $ 71.3 $ 67.0 Reconciliation: Cash Flow from Operations with Net Gains on Lease Portfolio Sales Cash flow from operations with net gains on lease portfolio sales is a non-GAAP financial measure. We believe this measure is useful to both management and investors as it provides a relevant measure of liquidity and a useful basis for assessing the breadth of the cash flow generation capabilities across our operating platform, as well as our ability to fund our operations and repay our debt. This measure is defined as net cash provided by operating activities from continuing operations as computed in accordance with GAAP, plus net gains on lease portfolio sales and is reconciled to net cash provided by operating activities from continuing operations, the most directly comparable GAAP financial measure, in the table above. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies.

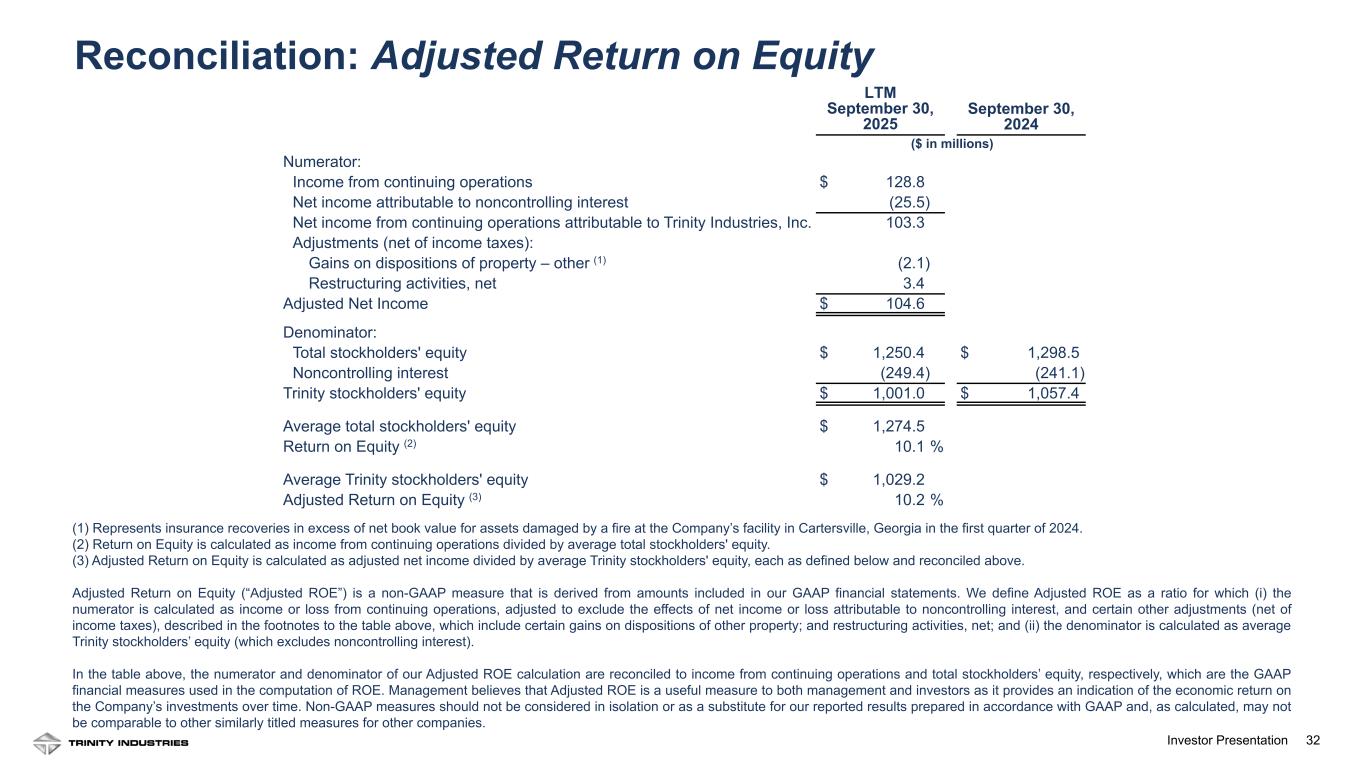

32Investor Presentation (1) Represents insurance recoveries in excess of net book value for assets damaged by a fire at the Company’s facility in Cartersville, Georgia in the first quarter of 2024. (2) Return on Equity is calculated as income from continuing operations divided by average total stockholders' equity. (3) Adjusted Return on Equity is calculated as adjusted net income divided by average Trinity stockholders' equity, each as defined below and reconciled above. Adjusted Return on Equity (“Adjusted ROE”) is a non-GAAP measure that is derived from amounts included in our GAAP financial statements. We define Adjusted ROE as a ratio for which (i) the numerator is calculated as income or loss from continuing operations, adjusted to exclude the effects of net income or loss attributable to noncontrolling interest, and certain other adjustments (net of income taxes), described in the footnotes to the table above, which include certain gains on dispositions of other property; and restructuring activities, net; and (ii) the denominator is calculated as average Trinity stockholders’ equity (which excludes noncontrolling interest). In the table above, the numerator and denominator of our Adjusted ROE calculation are reconciled to income from continuing operations and total stockholders’ equity, respectively, which are the GAAP financial measures used in the computation of ROE. Management believes that Adjusted ROE is a useful measure to both management and investors as it provides an indication of the economic return on the Company’s investments over time. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. LTM September 30, 2025 September 30, 2024 ($ in millions) Numerator: Income from continuing operations $ 128.8 Net income attributable to noncontrolling interest (25.5) Net income from continuing operations attributable to Trinity Industries, Inc. 103.3 Adjustments (net of income taxes): Gains on dispositions of property – other (1) (2.1) Restructuring activities, net 3.4 Adjusted Net Income $ 104.6 Denominator: Total stockholders' equity $ 1,250.4 $ 1,298.5 Noncontrolling interest (249.4) (241.1) Trinity stockholders' equity $ 1,001.0 $ 1,057.4 Average total stockholders' equity $ 1,274.5 Return on Equity (2) 10.1 % Average Trinity stockholders' equity $ 1,029.2 Adjusted Return on Equity (3) 10.2 % Reconciliation: Adjusted Return on Equity

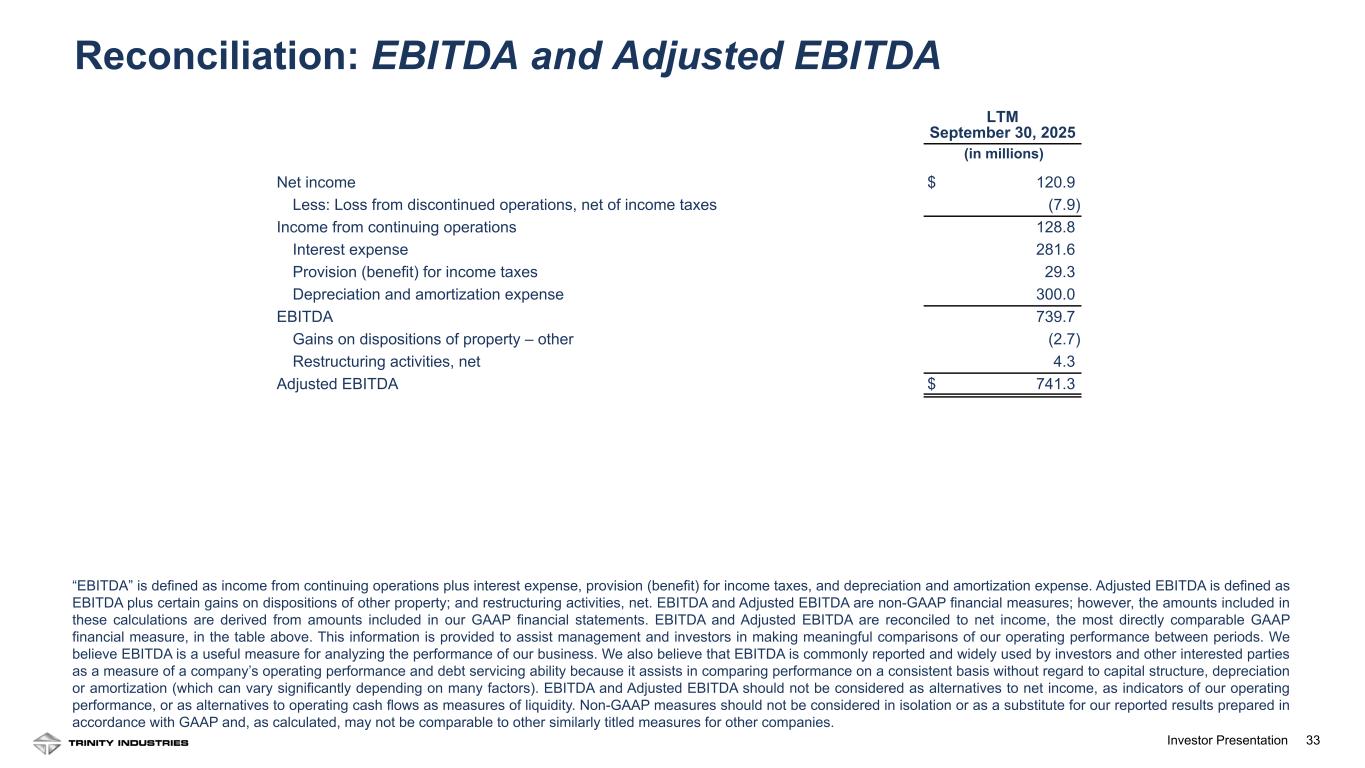

33Investor Presentation “EBITDA” is defined as income from continuing operations plus interest expense, provision (benefit) for income taxes, and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA plus certain gains on dispositions of other property; and restructuring activities, net. EBITDA and Adjusted EBITDA are non-GAAP financial measures; however, the amounts included in these calculations are derived from amounts included in our GAAP financial statements. EBITDA and Adjusted EBITDA are reconciled to net income, the most directly comparable GAAP financial measure, in the table above. This information is provided to assist management and investors in making meaningful comparisons of our operating performance between periods. We believe EBITDA is a useful measure for analyzing the performance of our business. We also believe that EBITDA is commonly reported and widely used by investors and other interested parties as a measure of a company’s operating performance and debt servicing ability because it assists in comparing performance on a consistent basis without regard to capital structure, depreciation or amortization (which can vary significantly depending on many factors). EBITDA and Adjusted EBITDA should not be considered as alternatives to net income, as indicators of our operating performance, or as alternatives to operating cash flows as measures of liquidity. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. LTM September 30, 2025 (in millions) Net income $ 120.9 Less: Loss from discontinued operations, net of income taxes (7.9) Income from continuing operations 128.8 Interest expense 281.6 Provision (benefit) for income taxes 29.3 Depreciation and amortization expense 300.0 EBITDA 739.7 Gains on dispositions of property – other (2.7) Restructuring activities, net 4.3 Adjusted EBITDA $ 741.3 Reconciliation: EBITDA and Adjusted EBITDA

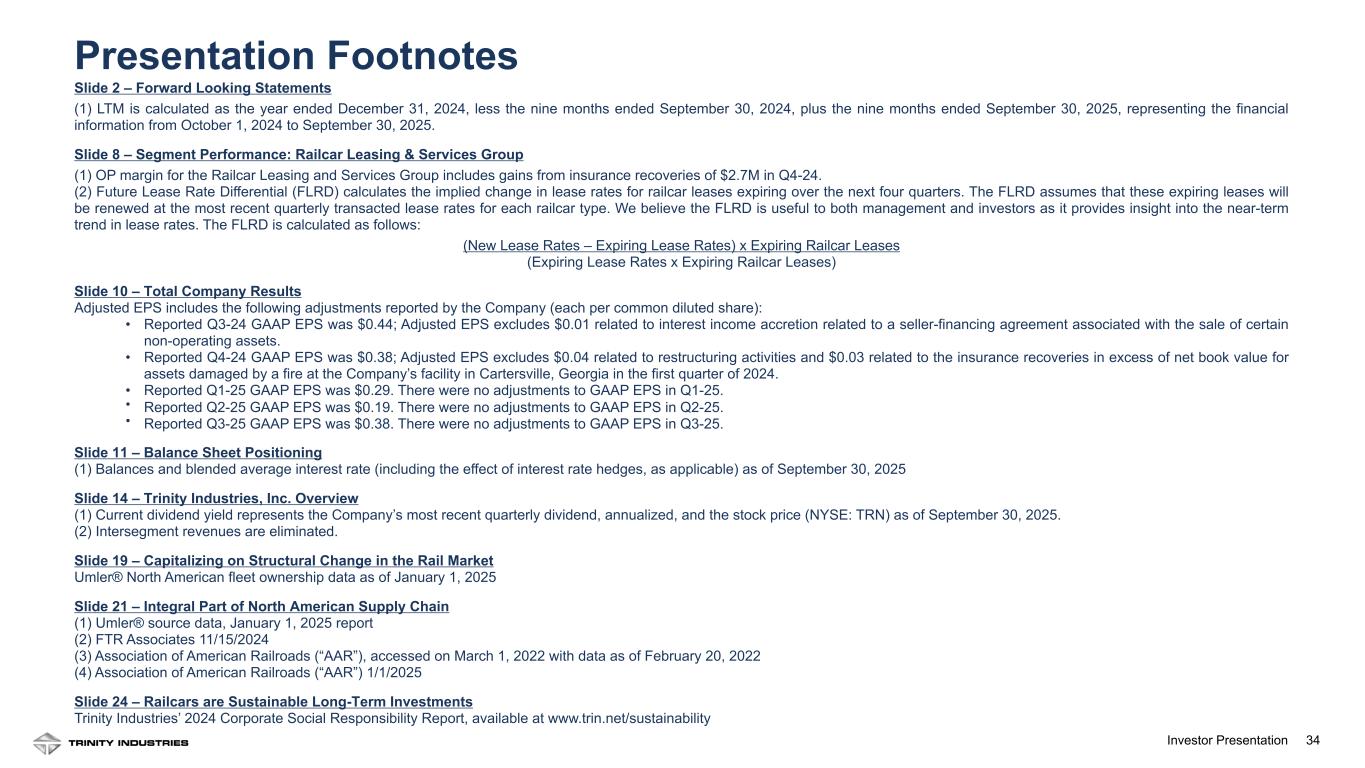

34Investor Presentation Slide 2 – Forward Looking Statements (1) LTM is calculated as the year ended December 31, 2024, less the nine months ended September 30, 2024, plus the nine months ended September 30, 2025, representing the financial information from October 1, 2024 to September 30, 2025. Slide 8 – Segment Performance: Railcar Leasing & Services Group (1) OP margin for the Railcar Leasing and Services Group includes gains from insurance recoveries of $2.7M in Q4-24. (2) Future Lease Rate Differential (FLRD) calculates the implied change in lease rates for railcar leases expiring over the next four quarters. The FLRD assumes that these expiring leases will be renewed at the most recent quarterly transacted lease rates for each railcar type. We believe the FLRD is useful to both management and investors as it provides insight into the near-term trend in lease rates. The FLRD is calculated as follows: (New Lease Rates – Expiring Lease Rates) x Expiring Railcar Leases (Expiring Lease Rates x Expiring Railcar Leases) Slide 10 – Total Company Results Adjusted EPS includes the following adjustments reported by the Company (each per common diluted share): • Reported Q3-24 GAAP EPS was $0.44; Adjusted EPS excludes $0.01 related to interest income accretion related to a seller-financing agreement associated with the sale of certain non-operating assets. • Reported Q4-24 GAAP EPS was $0.38; Adjusted EPS excludes $0.04 related to restructuring activities and $0.03 related to the insurance recoveries in excess of net book value for assets damaged by a fire at the Company’s facility in Cartersville, Georgia in the first quarter of 2024. • Reported Q1-25 GAAP EPS was $0.29. There were no adjustments to GAAP EPS in Q1-25. • Reported Q2-25 GAAP EPS was $0.19. There were no adjustments to GAAP EPS in Q2-25. • Reported Q3-25 GAAP EPS was $0.38. There were no adjustments to GAAP EPS in Q3-25. Slide 11 – Balance Sheet Positioning (1) Balances and blended average interest rate (including the effect of interest rate hedges, as applicable) as of September 30, 2025 Slide 14 – Trinity Industries, Inc. Overview (1) Current dividend yield represents the Company’s most recent quarterly dividend, annualized, and the stock price (NYSE: TRN) as of September 30, 2025. (2) Intersegment revenues are eliminated. Slide 19 – Capitalizing on Structural Change in the Rail Market Umler® North American fleet ownership data as of January 1, 2025 Slide 21 – Integral Part of North American Supply Chain (1) Umler® source data, January 1, 2025 report (2) FTR Associates 11/15/2024 (3) Association of American Railroads (“AAR”), accessed on March 1, 2022 with data as of February 20, 2022 (4) Association of American Railroads (“AAR”) 1/1/2025 Slide 24 – Railcars are Sustainable Long-Term Investments Trinity Industries’ 2024 Corporate Social Responsibility Report, available at www.trin.net/sustainability Presentation Footnotes

35Investor Presentation Leigh Anne Mann, Vice President of Investor Relations 214-631-4420 TrinityInvestorRelations@trin.net Investor Website: www.trin.net/investor-relations Contact Information