.2 February 4, 2026 UNIFI, Inc. Second Quarter Fiscal 2026 Earnings Conference Call (Unaudited results) (Amounts and dollars in millions, unless otherwise noted)

Cautionary Statements Forward-Looking Statements Certain statements included herein contain “forward-looking statements” within the meaning of federal securities laws about the financial condition and results of operations of the Company that are based on management’s beliefs, assumptions, and expectations about our future economic performance, considering the information currently available to management. An example of such forward-looking statements include, among others, guidance pertaining to our financial outlook. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “plan,” “estimate,” “project,” “expect,” “intend,” “seek,” “strive,” and words of similar import, or the negative of such words, identify or signal the presence of forward-looking statements. These statements are not statements of historical fact, and they involve risks and uncertainties that may cause our actual results, performance, or financial condition to differ materially from the expectations of future results, performance, or financial condition that we express or imply in any forward-looking statement. Factors that could contribute to such differences include, but are not limited to: the competitive nature of the textile industry and the impact of global competition; changes in the trade regulatory environment and governmental policies and legislation; the availability, sourcing, and pricing of raw materials; general domestic and international economic and industry conditions in markets where the Company competes, including economic and political factors over which the Company has no control; changes in consumer spending, customer preferences, fashion trends, and end-uses for UNIFI’s products; the financial condition of the Company’s customers; the loss of a significant customer or brand partner; natural disasters, industrial accidents, power or water shortages; extreme weather conditions, and other disruptions at one of our facilities; the disruption of operations, global demand, or financial performance as a result of catastrophic or extraordinary events, including, but not limited to, epidemics or pandemics; the success of the Company’s strategic business initiatives; the volatility of financial and credit markets, including the impacts of counterparty risk (e.g., deposit concentration and recent depositor sentiment and activity); the ability to service indebtedness and fund capital expenditures and strategic business initiatives; the availability of and access to credit on reasonable terms; changes in foreign currency exchange, interest, and inflation rates; fluctuations in production costs; the ability to protect intellectual property; the strength and reputation of our brands; employee relations; the ability to attract, retain, and motivate key employees; the impact of climate change or environmental, health, and safety regulations; and the impact of tax laws, the judicial or administrative interpretations of tax laws, and/or changes in such laws or interpretations. All such factors are difficult to predict, contain uncertainties that may materially affect actual results, and may be beyond our control. New factors emerge from time to time, and it is not possible for management to predict all such factors or to assess the impact of each such factor on the Company. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, except as may be required by federal securities laws. The above and other risks and uncertainties are described in the Company’s most recent Annual Report on Form 10-K, and additional risks or uncertainties may be described from time to time in other reports filed by the Company with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended. Non-GAAP Financial Measures Certain non-GAAP financial measures are designed to complement the financial information presented in accordance with GAAP. These non-GAAP financial measures include Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”), Adjusted EBITDA, Adjusted Net (Loss) Income, Adjusted EPS, Adjusted Working Capital, and Net Debt (collectively, the “non-GAAP financial measures”). The non-GAAP financial measures are not determined in accordance with GAAP and should not be considered a substitute for performance measures determined in accordance with GAAP. The calculations of the non-GAAP financial measures are subjective, based on management’s belief as to which items should be included or excluded in order to provide the most reasonable and comparable view of the underlying operating performance of the business. The Company may, from time to time, modify the amounts used to determine its non-GAAP financial measures. We believe that these non-GAAP financial measures better reflect the Company’s underlying operations and performance and that their use, as operating performance measures, provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets, among otherwise comparable companies. In evaluating non-GAAP financial measures, investors should be aware that, in the future, we may incur expenses similar to the adjustments included herein. Our presentation of non-GAAP financial measures should not be construed as indicating that our future results will be unaffected by unusual or non-recurring items. Each of our non-GAAP financial measures has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results or liquidity measures as reported under GAAP. Some of these limitations are (i) it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; (ii) it does not reflect the impact of earnings or charges resulting from matters we consider not indicative of our ongoing operations; (iii) it does not reflect changes in, or cash requirements for, our working capital needs; (iv) it does not reflect the cash requirements necessary to make payments on our debt; (v) it does not reflect our future requirements for capital expenditures or contractual commitments; (vi) it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and (vii) other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, these non-GAAP financial measures should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations, including those under our outstanding debt obligations. You should compensate for these limitations by relying primarily on our GAAP results and using these measures only as supplemental information.

Today’s Speakers Al Carey Executive Chairman Eddie Ingle CEO and Director A.J. Eaker EVP, CFO, and Treasurer

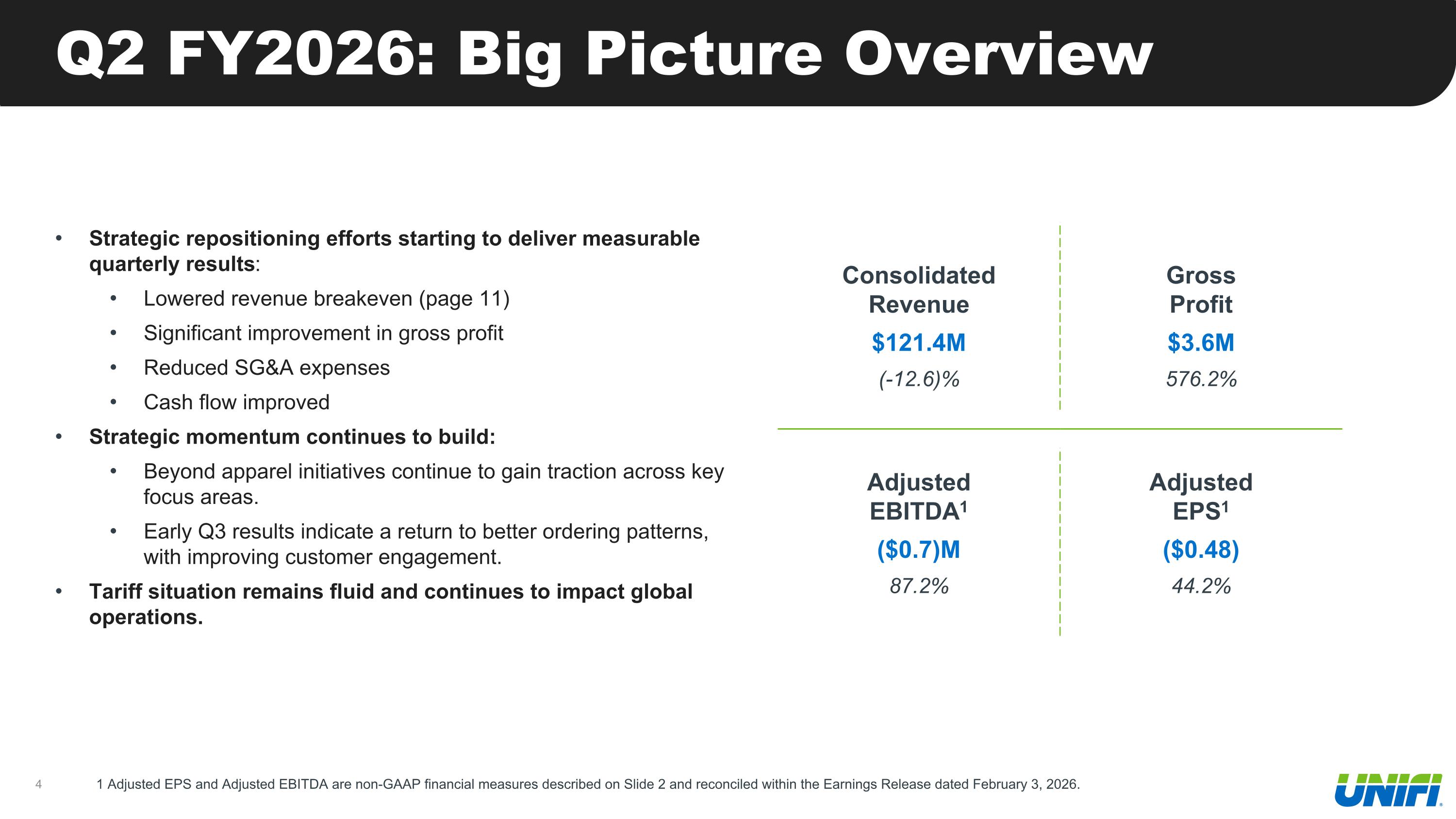

Q2 FY2026: Big Picture Overview Strategic repositioning efforts starting to deliver measurable quarterly results: Lowered revenue breakeven (page 11) Significant improvement in gross profit Reduced SG&A expenses Cash flow improved Strategic momentum continues to build: Beyond apparel initiatives continue to gain traction across key focus areas. Early Q3 results indicate a return to better ordering patterns, with improving customer engagement. Tariff situation remains fluid and continues to impact global operations. 1 Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures described on Slide 2 and reconciled within the Earnings Release dated February 3, 2026. Consolidated Revenue $121.4M (-12.6)% Gross Profit $3.6M 576.2% Adjusted EBITDA1 ($0.7)M 87.2% Adjusted EPS1 ($0.48) 44.2%

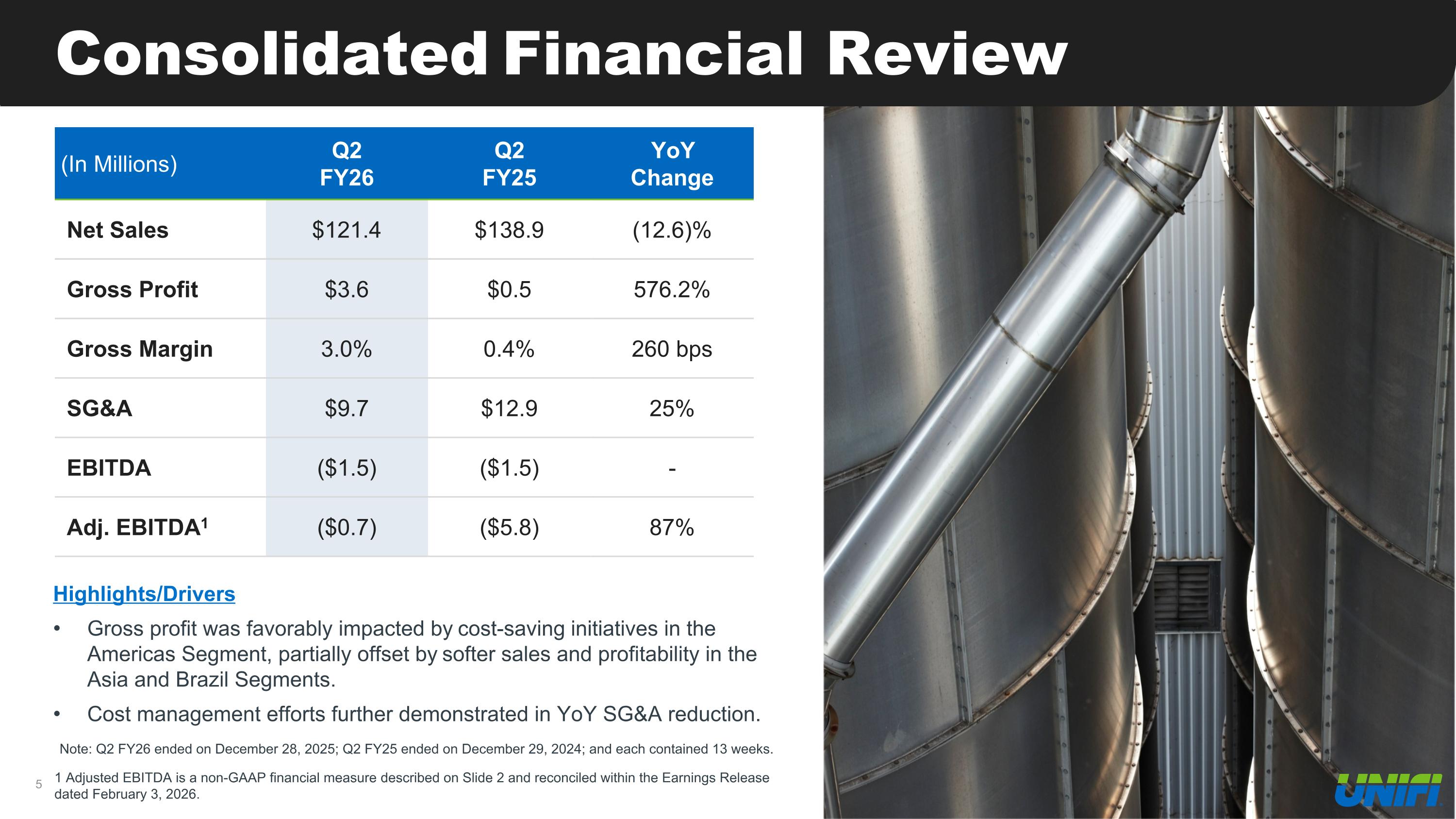

Consolidated Financial Review (In Millions) Q2 FY26 Q2 FY25 YoY Change Net Sales $121.4 $138.9 (12.6)% Gross Profit $3.6 $0.5 576.2% Gross Margin 3.0% 0.4% 260 bps SG&A $9.7 $12.9 25% EBITDA ($1.5) ($1.5) - Adj. EBITDA1 ($0.7) ($5.8) 87% Highlights/Drivers Gross profit was favorably impacted by cost-saving initiatives in the Americas Segment, partially offset by softer sales and profitability in the Asia and Brazil Segments. Cost management efforts further demonstrated in YoY SG&A reduction. Note: Q2 FY26 ended on December 28, 2025; Q2 FY25 ended on December 29, 2024; and each contained 13 weeks. 1 Adjusted EBITDA is a non-GAAP financial measure described on Slide 2 and reconciled within the Earnings Release dated February 3, 2026.

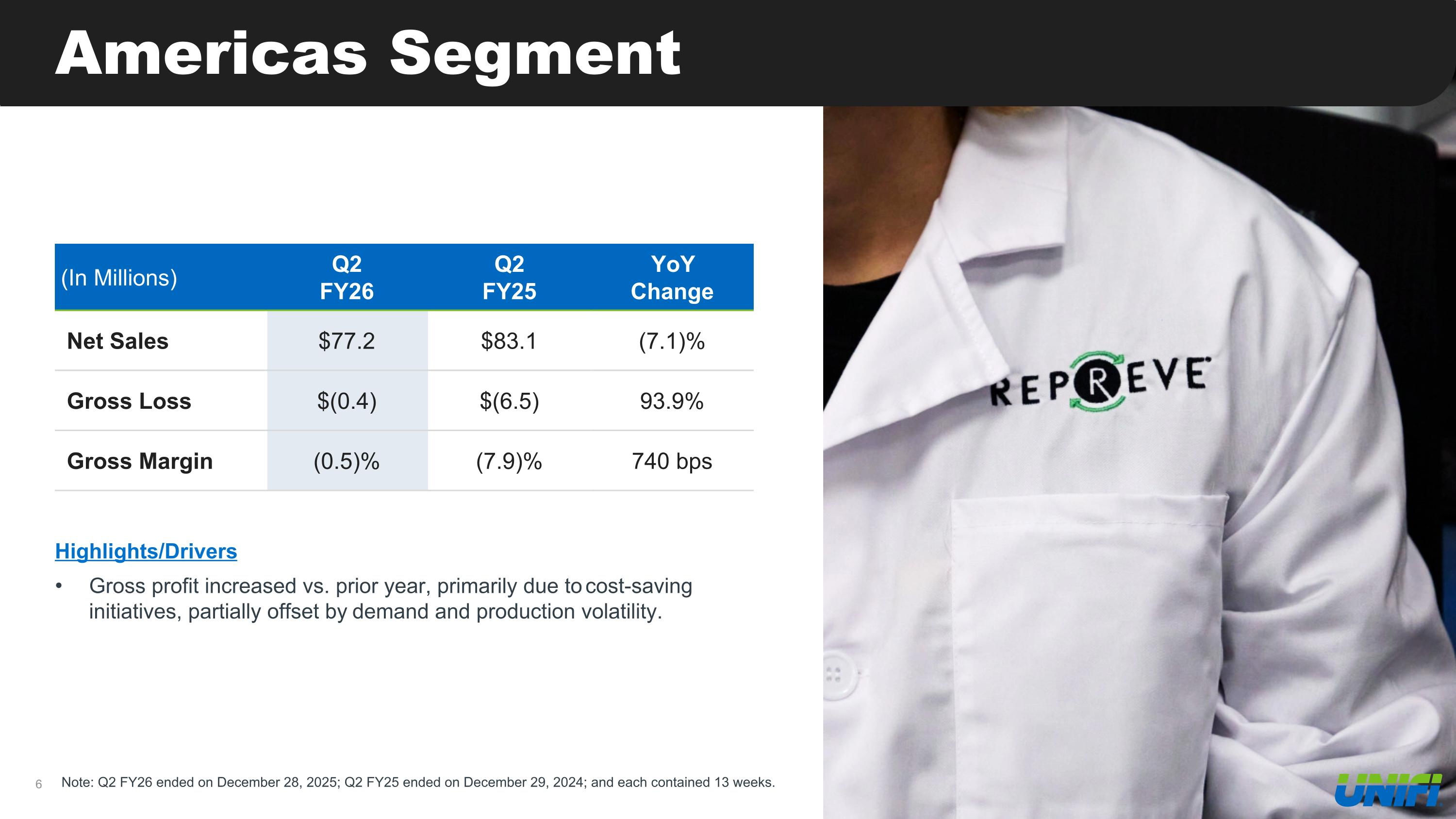

Americas Segment Note: Q2 FY26 ended on December 28, 2025; Q2 FY25 ended on December 29, 2024; and each contained 13 weeks. (In Millions) Q2 FY26 Q2 FY25 YoY Change Net Sales $77.2 $83.1 (7.1)% Gross Loss $(0.4) $(6.5) 93.9% Gross Margin (0.5)% (7.9)% 740 bps Highlights/Drivers Gross profit increased vs. prior year, primarily due to cost-saving initiatives, partially offset by demand and production volatility.

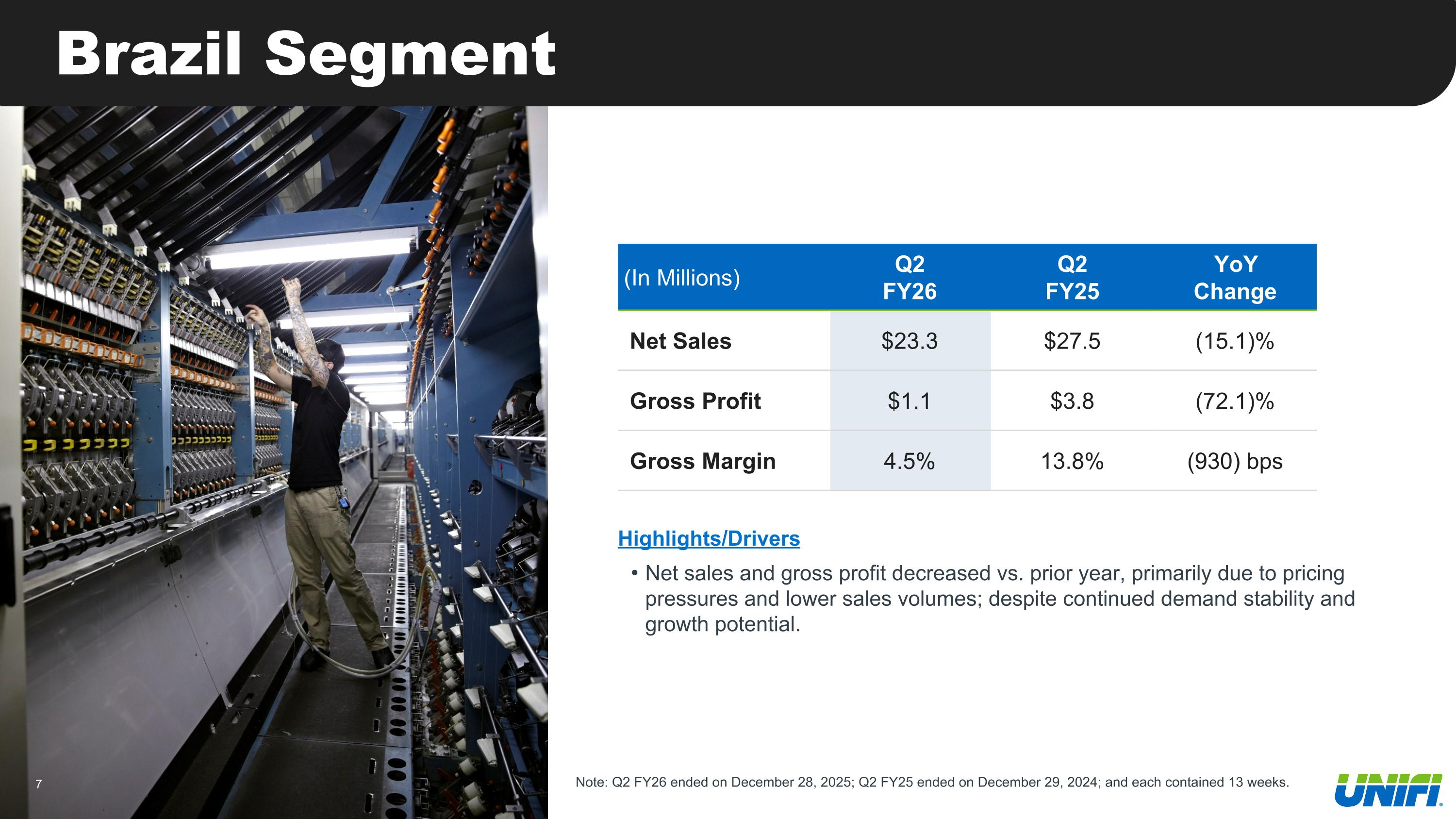

Brazil Segment (In Millions) Q2 FY26 Q2 FY25 YoY Change Net Sales $23.3 $27.5 (15.1)% Gross Profit $1.1 $3.8 (72.1)% Gross Margin 4.5% 13.8% (930) bps Highlights/Drivers Net sales and gross profit decreased vs. prior year, primarily due to pricing pressures and lower sales volumes; despite continued demand stability and growth potential. Note: Q2 FY26 ended on December 28, 2025; Q2 FY25 ended on December 29, 2024; and each contained 13 weeks.

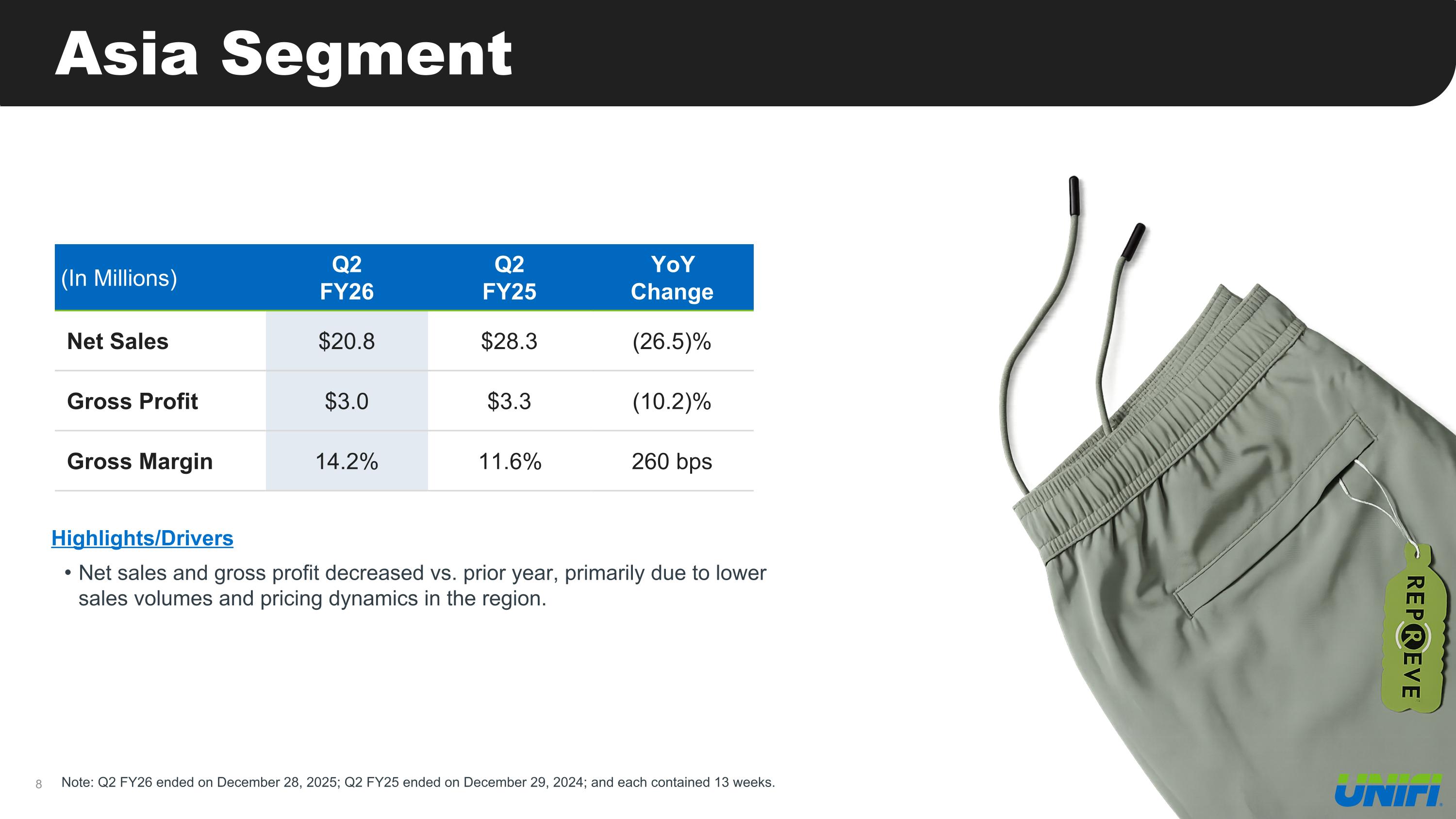

Asia Segment (In Millions) Q2 FY26 Q2 FY25 YoY Change Net Sales $20.8 $28.3 (26.5)% Gross Profit $3.0 $3.3 (10.2)% Gross Margin 14.2% 11.6% 260 bps Highlights/Drivers Net sales and gross profit decreased vs. prior year, primarily due to lower sales volumes and pricing dynamics in the region. Note: Q2 FY26 ended on December 28, 2025; Q2 FY25 ended on December 29, 2024; and each contained 13 weeks.

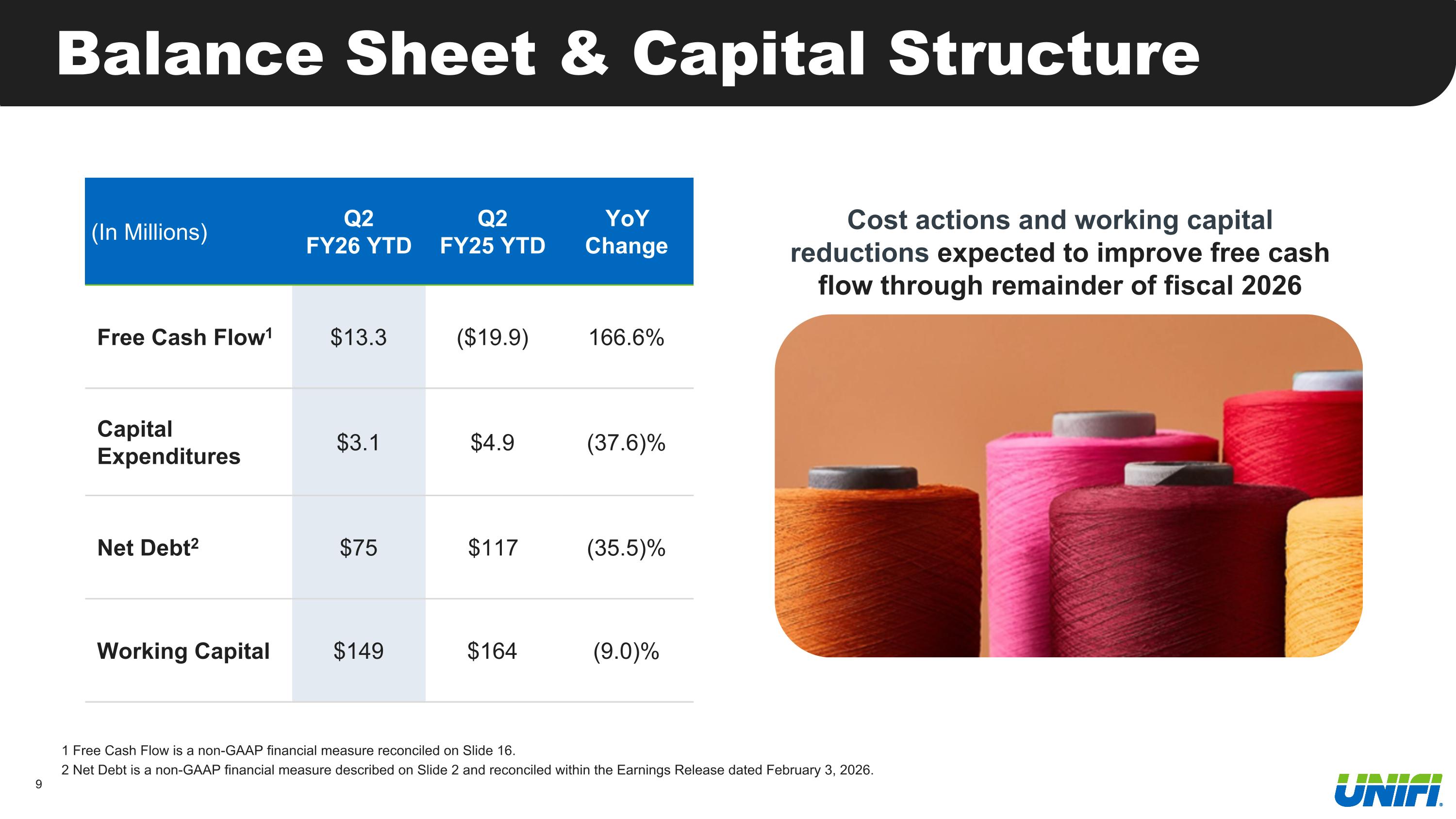

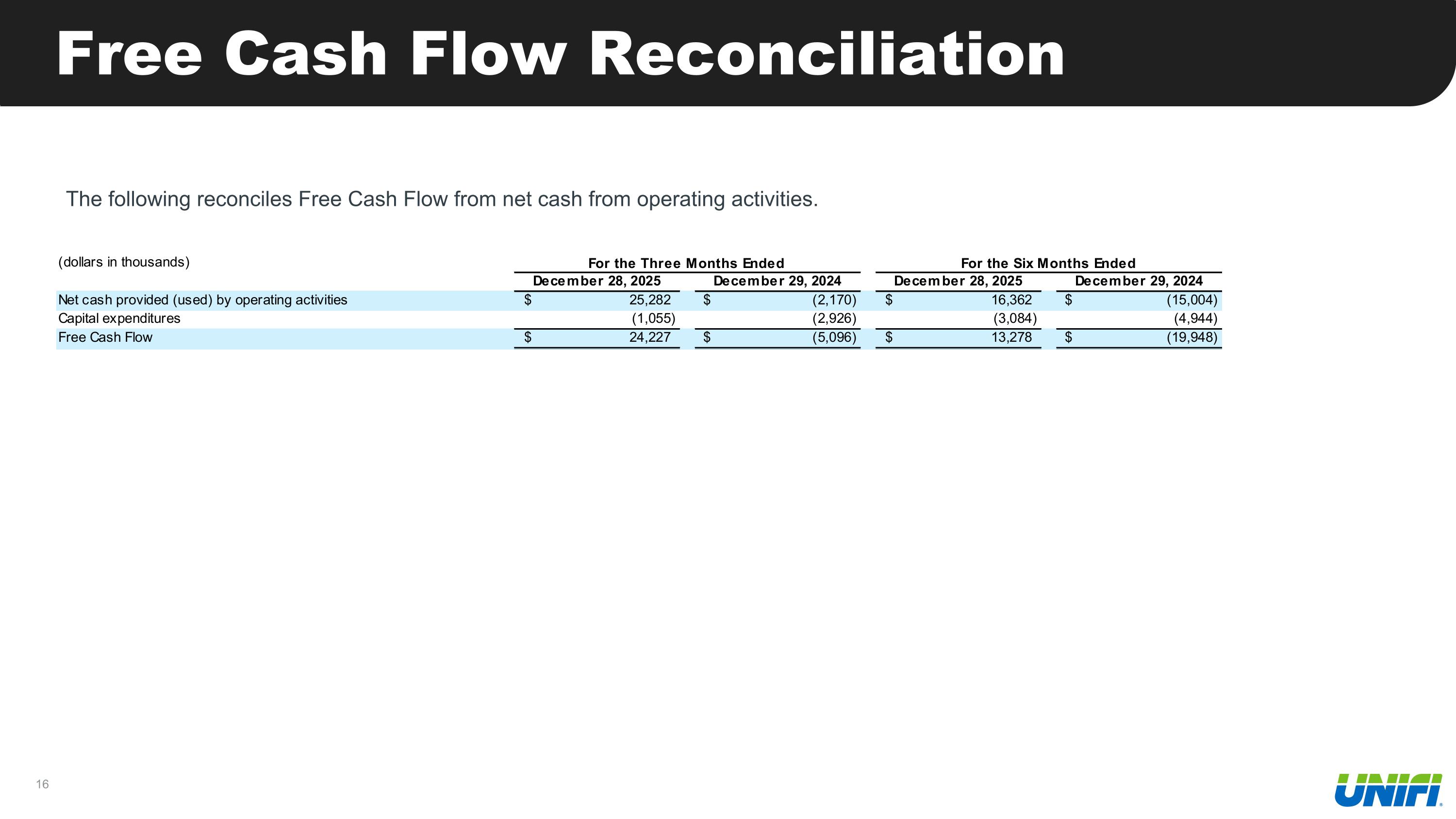

Balance Sheet & Capital Structure 1 Free Cash Flow is a non-GAAP financial measure reconciled on Slide 16. 2 Net Debt is a non-GAAP financial measure described on Slide 2 and reconciled within the Earnings Release dated February 3, 2026. (In Millions) Q2 FY26 YTD Q2 FY25 YTD YoY Change Free Cash Flow1 $13.3 ($19.9) 166.6% Capital Expenditures $3.1 $4.9 (37.6)% Net Debt2 $75 $117 (35.5)% Working Capital $149 $164 (9.0)% Cost actions and working capital reductions expected to improve free cash flow through remainder of fiscal 2026

FY 2026: Second Half Priorities 1. Continue to leverage lower revenue breakeven by further executing on cost realignment initiatives. 2. Invest in ourselves to further strengthen and scale our innovative platforms. 3. Prioritize customer adoption of innovative products to support future growth. 4. Convert operational progress into sustained financial momentum. Continued Focus on Returning to Long-term Growth and Expanded Profitability

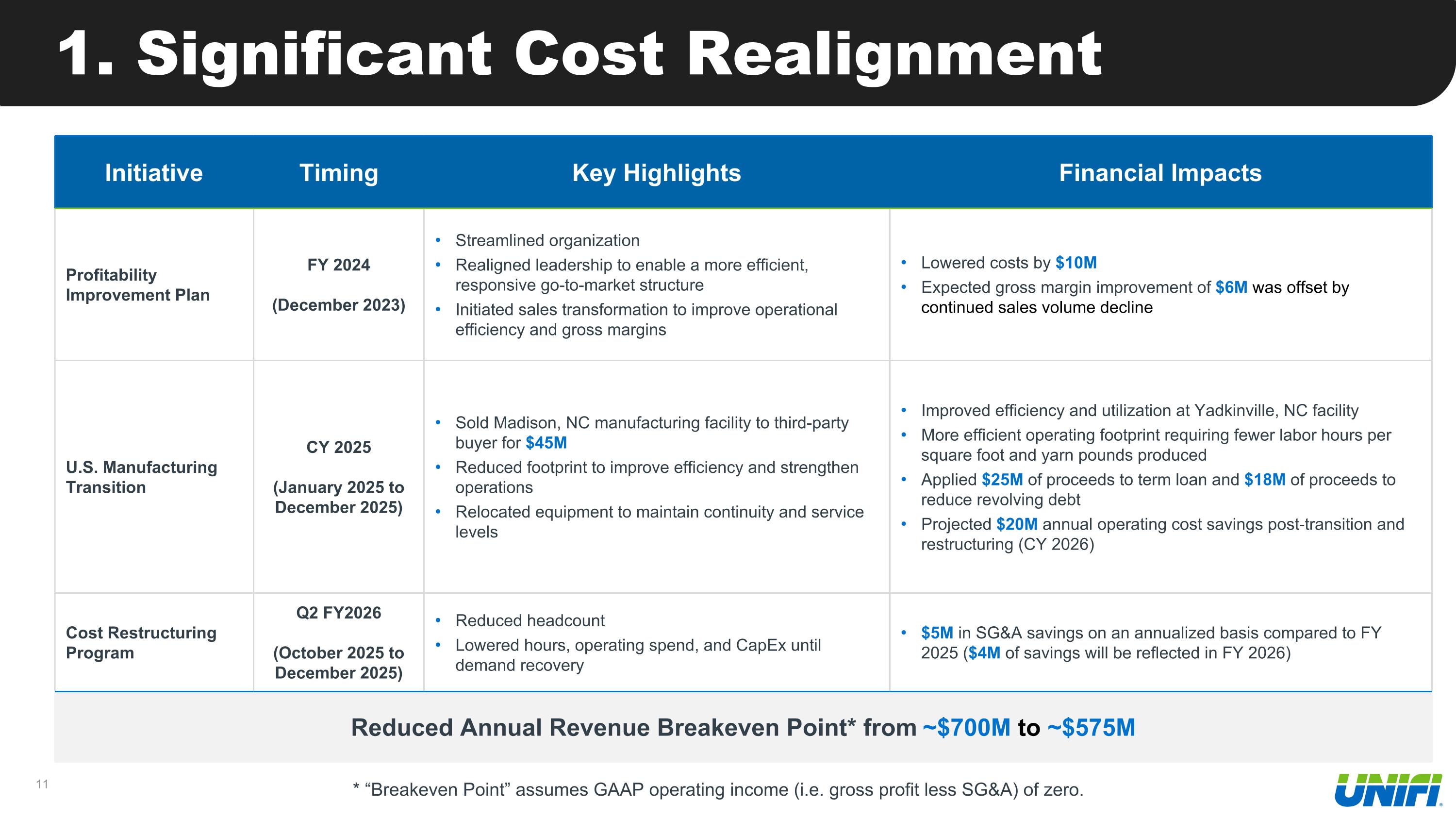

1. Significant Cost Realignment Initiative Timing Key Highlights Financial Impacts Profitability Improvement Plan FY 2024 (December 2023) Streamlined organization Realigned leadership to enable a more efficient, responsive go-to-market structure Initiated sales transformation to improve operational efficiency and gross margins Lowered costs by $10M Expected gross margin improvement of $6M was offset by continued sales volume decline U.S. Manufacturing Transition CY 2025 (January 2025 to December 2025) Sold Madison, NC manufacturing facility to third-party buyer for $45M Reduced footprint to improve efficiency and strengthen operations Relocated equipment to maintain continuity and service levels Improved efficiency and utilization at Yadkinville, NC facility More efficient operating footprint requiring fewer labor hours per square foot and yarn pounds produced Applied $25M of proceeds to term loan and $18M of proceeds to reduce revolving debt Projected $20M annual operating cost savings post-transition and restructuring (CY 2026) Cost Restructuring Program Q2 FY2026 (October 2025 to December 2025) Reduced headcount Lowered hours, operating spend, and CapEx until demand recovery $5M in SG&A savings on an annualized basis compared to FY 2025 ($4M of savings will be reflected in FY 2026) Reduced Annual Revenue Breakeven Point* from ~$700M to ~$575M * “Breakeven Point” assumes GAAP operating income (i.e. gross profit less SG&A) of zero.

2. Scaling Our Innovative Brand

3. Drive Adoption of Advanced Products Recently Announced Innovative Products Integr8™ - Performance-enhancing filament yarn REPREVE with CiCLO® Technology, - Biodegradable recycled polyester & nylon Fortisyn™ - Durable yarn for military and tactical gear A.M.Y.® Peppermint - Naturally deodorizing yarn with improved sustainability characteristics ThermaLoop™ - Down-like fiber, fiberball, and padding insulation REPREVE Takeback White Filament Yarn - Dyeable, high-performance polyester for critical applications Continued investment efforts during fiscal 2025 and 2026 to expand offerings and serve customers’ needs 100% Textile Waste 100% Textile Waste

4. Sustained Financial Momentum Focused on positive free cash flow generation and balance sheet strength 1. After Q2 FY26, expect to see the full benefits of cost reduction actions and improved working capital turns, providing a stronger pathway to positive operating cash flows. 2. Expect the global trade situation to become clearer over time, which should support revenue improvement in calendar 2026. 3. Continuing margin accretive efforts with focus on REPREVE®, value-added products, and beyond apparel.

Appendix 100% Textile Waste 100% Textile Waste

Free Cash Flow Reconciliation The following reconciles Free Cash Flow from net cash from operating activities.

Contact Investor Relations: UFI@alpha-ir.com