Please wait

00001008852025FYfalse66.6733.33http://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccountsPayableAndAccruedLiabilitiesCurrent377iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesutr:miunp:segmentxbrli:pureunp:asset_classunp:siteunp:state00001008852025-01-012025-12-3100001008852025-06-3000001008852026-01-300000100885us-gaap:CargoAndFreightMember2025-01-012025-12-310000100885us-gaap:CargoAndFreightMember2024-01-012024-12-310000100885us-gaap:CargoAndFreightMember2023-01-012023-12-310000100885us-gaap:ProductAndServiceOtherMember2025-01-012025-12-310000100885us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310000100885us-gaap:ProductAndServiceOtherMember2023-01-012023-12-3100001008852024-01-012024-12-3100001008852023-01-012023-12-3100001008852025-12-3100001008852024-12-3100001008852023-12-3100001008852022-12-310000100885stpr:CA2025-01-012025-12-310000100885us-gaap:StateAndLocalTaxJurisdictionOtherMember2025-01-012025-12-310000100885us-gaap:StateAndLocalTaxJurisdictionOtherMember2024-01-012024-12-310000100885us-gaap:StateAndLocalTaxJurisdictionOtherMember2023-01-012023-12-310000100885us-gaap:CommonStockMember2022-12-310000100885us-gaap:TreasuryStockCommonMember2022-12-310000100885us-gaap:AdditionalPaidInCapitalMember2022-12-310000100885us-gaap:RetainedEarningsMember2022-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000100885us-gaap:RetainedEarningsMember2023-01-012023-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000100885us-gaap:CommonStockMember2023-01-012023-12-310000100885us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000100885us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000100885us-gaap:CommonStockMember2023-12-310000100885us-gaap:TreasuryStockCommonMember2023-12-310000100885us-gaap:AdditionalPaidInCapitalMember2023-12-310000100885us-gaap:RetainedEarningsMember2023-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000100885us-gaap:RetainedEarningsMember2024-01-012024-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000100885us-gaap:CommonStockMember2024-01-012024-12-310000100885us-gaap:TreasuryStockCommonMember2024-01-012024-12-310000100885us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000100885us-gaap:CommonStockMember2024-12-310000100885us-gaap:TreasuryStockCommonMember2024-12-310000100885us-gaap:AdditionalPaidInCapitalMember2024-12-310000100885us-gaap:RetainedEarningsMember2024-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000100885us-gaap:RetainedEarningsMember2025-01-012025-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-12-310000100885us-gaap:CommonStockMember2025-01-012025-12-310000100885us-gaap:TreasuryStockCommonMember2025-01-012025-12-310000100885us-gaap:AdditionalPaidInCapitalMember2025-01-012025-12-310000100885us-gaap:CommonStockMember2025-12-310000100885us-gaap:TreasuryStockCommonMember2025-12-310000100885us-gaap:AdditionalPaidInCapitalMember2025-12-310000100885us-gaap:RetainedEarningsMember2025-12-310000100885us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-12-310000100885country:MX2025-01-012025-12-310000100885country:MX2024-01-012024-12-310000100885country:MX2023-01-012023-12-310000100885unp:BulkMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:BulkMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:BulkMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:IndustrialMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:IndustrialMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:IndustrialMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:PremiumMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:PremiumMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:PremiumMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885us-gaap:CargoAndFreightMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885us-gaap:CargoAndFreightMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885us-gaap:CargoAndFreightMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:OtherSubsidiaryRevenuesMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:OtherSubsidiaryRevenuesMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:OtherSubsidiaryRevenuesMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:AccessorialRevenuesMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:AccessorialRevenuesMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:AccessorialRevenuesMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:OtherMiscellaneousProductAndServiceRevenuesMemberunp:ReportableSegmentMember2025-01-012025-12-310000100885unp:OtherMiscellaneousProductAndServiceRevenuesMemberunp:ReportableSegmentMember2024-01-012024-12-310000100885unp:OtherMiscellaneousProductAndServiceRevenuesMemberunp:ReportableSegmentMember2023-01-012023-12-310000100885unp:ReportableSegmentMember2025-01-012025-12-310000100885unp:ReportableSegmentMember2024-01-012024-12-310000100885unp:ReportableSegmentMember2023-01-012023-12-310000100885unp:UnionPacificCorporation2000DirectorsPlanMember2000-04-300000100885unp:UnionPacificCorporation2000DirectorsPlanMember2025-12-310000100885unp:UnionPacificCorporation2013StockIncentivePlanMember2013-05-310000100885unp:UnionPacificCorporation2013StockIncentivePlanMember2025-12-310000100885unp:UnionPacificCorporation2021StockIncentivePlanMember2021-05-310000100885unp:UnionPacificCorporation2021StockIncentivePlanMember2025-12-310000100885unp:UnionPacificCorporation2021EmployeeStockPurchasePlanMember2021-05-310000100885unp:UnionPacificCorporation2021EmployeeStockPurchasePlanMember2025-01-012025-12-310000100885us-gaap:EmployeeStockOptionMember2025-01-012025-12-310000100885us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000100885us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000100885unp:RetentionAwardsMember2025-01-012025-12-310000100885unp:RetentionAwardsMember2024-01-012024-12-310000100885unp:RetentionAwardsMember2023-01-012023-12-310000100885us-gaap:EmployeeStockMember2025-01-012025-12-310000100885us-gaap:EmployeeStockMember2024-01-012024-12-310000100885us-gaap:EmployeeStockMember2023-01-012023-12-310000100885us-gaap:EmployeeStockOptionMember2025-12-310000100885unp:RetentionAwardsMember2024-12-310000100885unp:RetentionAwardsMember2025-12-310000100885unp:PerformanceStockUnitAwardsMember2025-02-012025-02-280000100885unp:PerformanceStockUnitAwardsMember2024-12-310000100885unp:PerformanceStockUnitAwardsMember2025-01-012025-12-310000100885unp:PerformanceStockUnitAwardsMember2025-12-310000100885us-gaap:EmployeeStockMember2025-06-092025-06-090000100885us-gaap:EmployeeStockMember2025-06-102025-06-100000100885us-gaap:EmployeeStockMember2025-12-310000100885unp:PerformanceStockUnitAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2025-02-012025-02-280000100885unp:PerformanceStockUnitAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2025-02-012025-02-280000100885us-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:PensionPlansDefinedBenefitMember2023-12-310000100885us-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000100885us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000100885us-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000100885us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000100885us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-12-310000100885us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000100885us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2025-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2025-12-310000100885us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2025-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2025-12-310000100885us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:DefinedBenefitPlanRealEstateMember2025-12-310000100885us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:DefinedBenefitPlanRealEstateMember2025-12-310000100885us-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885srt:ScenarioForecastMemberus-gaap:PensionPlansDefinedBenefitMember2026-01-012026-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:VentureCapitalAndBuyoutPartnershipsMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:RealEstateFundsMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:CollectiveTrustAndOtherFundsMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:DefinedBenefitPlanOtherAssetsLiabilitiesMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMember2025-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:VentureCapitalAndBuyoutPartnershipsMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:RealEstateFundsMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:CollectiveTrustAndOtherFundsMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberunp:DefinedBenefitPlanOtherAssetsLiabilitiesMember2024-12-310000100885us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000100885us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-12-310000100885us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000100885us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-01-012025-12-310000100885us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310000100885us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000100885unp:FourZeroOneThriftPlanBefore2018Member2025-01-012025-12-310000100885unp:FourZeroOneThriftPlan2018BeyondMember2025-01-012025-12-310000100885us-gaap:CollectiveBargainingArrangementOtherMember2025-01-012025-12-310000100885us-gaap:CollectiveBargainingArrangementOtherMember2024-01-012024-12-310000100885us-gaap:CollectiveBargainingArrangementOtherMember2023-01-012023-12-310000100885unp:RealEstateTransactionMember2025-01-012025-12-310000100885unp:RealEstateTransactionMember2023-01-012023-12-310000100885stpr:KS2025-01-012025-12-310000100885unp:LouisianaAndArkansasMember2024-01-012024-12-310000100885unp:NebraskaLowaKansasAndArkansasMember2023-01-012023-12-310000100885us-gaap:EmployeeStockOptionMember2025-01-012025-12-310000100885us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000100885us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000100885us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000100885us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310000100885us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310000100885us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-12-310000100885us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-12-310000100885us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-01-012025-12-310000100885us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-12-310000100885us-gaap:AccumulatedTranslationAdjustmentMember2025-12-310000100885us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-12-310000100885us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000100885us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000100885us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000100885us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310000100885us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310000100885us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-3100001008852025-07-2800001008852025-07-282025-07-2800001008852025-07-270000100885us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember2025-01-012025-12-310000100885us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember2024-01-012024-12-310000100885us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember2023-01-012023-12-310000100885us-gaap:LandMember2025-12-310000100885unp:RoadrailAndOtherTrackMaterialMember2025-12-310000100885unp:RoadTiesMember2025-12-310000100885unp:RoadBallastMember2025-12-310000100885unp:RoadOtherMember2025-12-310000100885unp:RoadMember2025-12-310000100885unp:EquipmentLocomotivesMember2025-12-310000100885unp:EquipmentFreightCarsMember2025-12-310000100885unp:EquipmentWorkEquipmentAndOtherMember2025-12-310000100885us-gaap:EquipmentMember2025-12-310000100885us-gaap:TechnologyEquipmentMember2025-12-310000100885us-gaap:ConstructionInProgressMember2025-12-310000100885us-gaap:LandMember2024-12-310000100885unp:RoadrailAndOtherTrackMaterialMember2024-12-310000100885unp:RoadTiesMember2024-12-310000100885unp:RoadBallastMember2024-12-310000100885unp:RoadOtherMember2024-12-310000100885unp:RoadMember2024-12-310000100885unp:EquipmentLocomotivesMember2024-12-310000100885unp:EquipmentFreightCarsMember2024-12-310000100885unp:EquipmentWorkEquipmentAndOtherMember2024-12-310000100885us-gaap:EquipmentMember2024-12-310000100885us-gaap:TechnologyEquipmentMember2024-12-310000100885us-gaap:ConstructionInProgressMember2024-12-310000100885us-gaap:OtherExpenseMemberunp:ChassisAssetsMember2024-04-012024-06-300000100885us-gaap:RailroadTransportationEquipmentMember2025-01-012025-12-310000100885unp:RailroadTransportationTrackAssetsMember2025-01-012025-12-310000100885us-gaap:FairValueInputsLevel2Member2025-12-310000100885us-gaap:FairValueInputsLevel2Member2024-12-310000100885srt:MinimumMemberus-gaap:NotesPayableToBanksMember2025-12-310000100885srt:MaximumMemberus-gaap:NotesPayableToBanksMember2025-12-310000100885us-gaap:NotesPayableToBanksMember2025-12-310000100885us-gaap:NotesPayableToBanksMember2024-12-310000100885srt:MinimumMemberus-gaap:EquipmentTrustCertificateMember2025-12-310000100885srt:MaximumMemberus-gaap:EquipmentTrustCertificateMember2025-12-310000100885us-gaap:EquipmentTrustCertificateMember2025-12-310000100885us-gaap:EquipmentTrustCertificateMember2024-12-310000100885srt:MinimumMemberunp:FinanceLeaseMember2025-12-310000100885srt:MaximumMemberunp:FinanceLeaseMember2025-12-310000100885unp:FinanceLeaseMember2025-12-310000100885unp:FinanceLeaseMember2024-12-310000100885us-gaap:EquipmentTrustCertificateMemberunp:RailroadAssetsEquipmentMember2024-12-310000100885us-gaap:EquipmentTrustCertificateMemberunp:RailroadAssetsEquipmentMember2025-12-310000100885us-gaap:RevolvingCreditFacilityMember2025-12-310000100885us-gaap:RevolvingCreditFacilityMember2025-01-012025-12-310000100885us-gaap:RevolvingCreditFacilityMember2024-12-310000100885unp:UnsecuredNotesDueFebruary202035Memberus-gaap:UnsecuredDebtMember2025-02-130000100885unp:UnsecuredNotesDueDecember12054Memberus-gaap:UnsecuredDebtMember2025-02-130000100885us-gaap:SecuredDebtMember2025-12-310000100885us-gaap:SecuredDebtMember2024-12-310000100885us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2025-12-310000100885srt:MinimumMemberunp:PersonalInjuryMember2025-12-310000100885srt:MaximumMemberunp:PersonalInjuryMember2025-12-310000100885unp:PersonalInjuryMember2024-12-310000100885unp:PersonalInjuryMember2023-12-310000100885unp:PersonalInjuryMember2022-12-310000100885unp:PersonalInjuryMember2025-01-012025-12-310000100885unp:PersonalInjuryMember2024-01-012024-12-310000100885unp:PersonalInjuryMember2023-01-012023-12-310000100885unp:PersonalInjuryMember2025-12-3100001008852025-04-0100001008852025-04-012025-12-3100001008852022-04-0100001008852022-04-012025-03-3100001008852025-01-012025-03-3100001008852024-01-012024-03-3100001008852025-04-012025-06-3000001008852024-04-012024-06-3000001008852025-07-012025-09-3000001008852024-07-012024-09-3000001008852025-10-012025-12-3100001008852024-10-012024-12-310000100885unp:A2025AcceleratedShareRepurchaseMember2025-01-012025-12-310000100885unp:A2025AcceleratedShareRepurchaseMember2025-01-012025-03-310000100885unp:A2025AcceleratedShareRepurchaseMember2025-04-012025-06-300000100885unp:A2025AcceleratedShareRepurchaseMember2025-02-182025-02-180000100885unp:TTXCompanyMemberunp:UPRRMember2025-12-310000100885unp:TTXCompanyMemberunp:UPRRMember2024-12-310000100885unp:UPRRMemberus-gaap:EquityMethodInvesteeMember2025-01-012025-12-310000100885unp:UPRRMemberus-gaap:EquityMethodInvesteeMember2024-01-012024-12-310000100885unp:UPRRMemberus-gaap:EquityMethodInvesteeMember2023-01-012023-12-310000100885unp:UPRRMemberus-gaap:EquityMethodInvesteeMember2025-12-310000100885unp:UPRRMemberus-gaap:EquityMethodInvesteeMember2024-12-310000100885unp:NorfolkSouthernMember2025-07-280000100885srt:ScenarioForecastMemberunp:NorfolkSouthernMember2027-01-012027-03-310000100885srt:ScenarioForecastMemberunp:NorfolkSouthernMember2027-03-310000100885srt:ScenarioForecastMember2027-03-310000100885unp:PurchasedServicesAndMaterialsMemberunp:NorfolkSouthernMember2025-01-012025-12-310000100885unp:OtherAcquisitionRelatedCostsMemberunp:NorfolkSouthernMember2025-01-012025-12-310000100885unp:NorfolkSouthernMember2025-01-012025-12-310000100885unp:NorfolkSouthernMember2025-12-310000100885unp:NorfolkSouthernMember2025-07-280000100885unp:EricG.GehringerMember2025-10-012025-12-310000100885unp:EricG.GehringerMember2025-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number 1-6075

UNION PACIFIC CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Utah | | 13-2626465 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | |

1400 Douglas Street, Omaha, Nebraska | 68179 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (402) 544-5000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock (Par Value $2.50 per share) | UNP | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☑ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | Accelerated Filer | ☐ | Non-Accelerated Filer | ☐ |

| Smaller Reporting Company | ☐ | Emerging Growth Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐Yes ☑ No

As of June 30, 2025, the aggregate market value of the registrant’s Common Stock held by non-affiliates (using the New York Stock Exchange closing price) was $136.1 billion.

The number of shares outstanding of the registrant’s Common Stock as of January 30, 2026, was 593,391,460.

Documents Incorporated by Reference – Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 14, 2026, are incorporated by reference into Part III of this report. The registrant’s Proxy Statement will be filed with the Securities and Exchange Commission (SEC) within 120 days after the end of the fiscal year that this report relates pursuant to Regulation 14A.

UNION PACIFIC CORPORATION

TABLE OF CONTENTS

February 6, 2026

Fellow Shareholders:

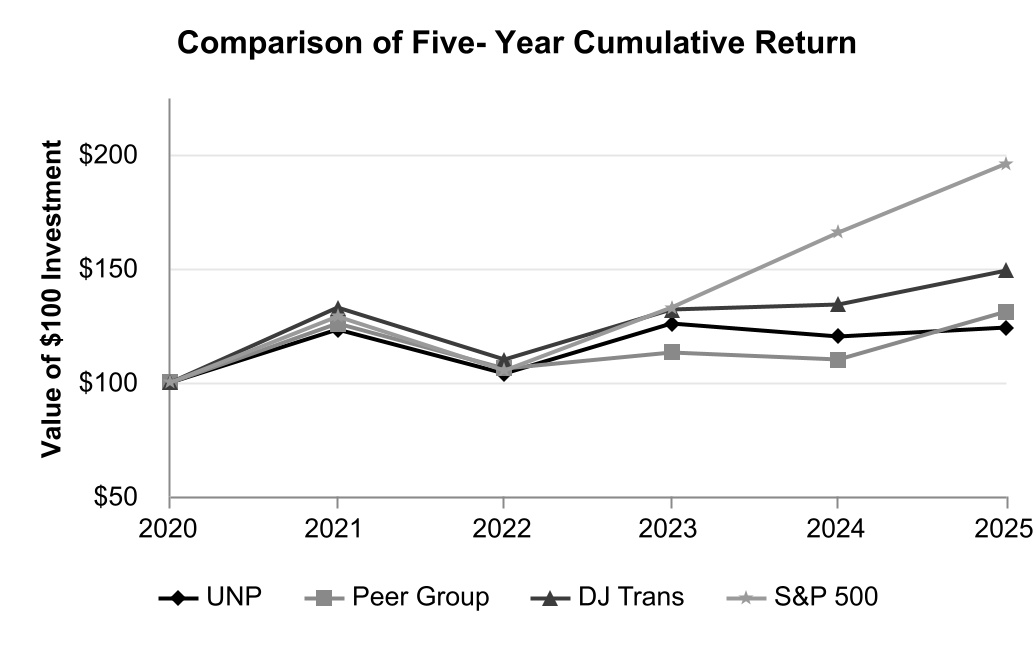

The Union Pacific team continued to build on ‘what’s possible’ in 2025, and we delivered best-ever full year results across safety, service, and operating performance while growing our volumes. These results demonstrate that we are committed to our strategy – Safety, Service, and Operational Excellence leads to Growth – and understand what we need to do to set the Company up for future success. We know success can be measured in many ways, but to us it’s about serving our customers, communities, and employees while driving value to our owners.

In 2025, we reported an 8% increase in earnings per share versus 2024. Total volume increased 1% versus 2024, driven by coal, industrial chemicals and plastics, grain and grain products, and rock shipments, partially offset by weaker demand for automotive and energy and specialized markets shipments. We achieved an operating ratio of 59.8%, a 10-basis point improvement versus 2024. This improvement is the result of the entire team’s commitment to building a safer, more consistent and cost-efficient network, so we can grow with our customers.

Safety is the foundation of everything we do. Our unwavering commitment is for every employee to go home safe, every day. In 2025, we meaningfully improved our personal injury and derailment rates and reported the best safety results in Company history. Additionally, our employee safety results were the best in the industry. These outcomes demonstrate the effectiveness of continued investments in training, safety programs, infrastructure, and technology. Though we are proud of our improvements, we will not waiver on our goal to be the best in safety for our employees and the communities we serve.

Service is what we sold our customers. Our full year operating metrics demonstrate we’ve built a solid foundation, as freight car velocity improved 8% and intermodal and manifest Service Performance Index (SPI) improved 9 and 11 points to 99% and 100%, respectively. We also invested $3.5 billion in capital to harden our infrastructure, modernize older locomotives, grow our business, improve service, and embed new technologies into our processes. We will benefit long-term from our investments in the Kansas City, Inland Empire, and Lathrop intermodal terminals; Texas Gulf Coast manifest terminals; and Pacific Northwest and Southwest main lines; while also modernizing transportation planning systems and providing our customers expanded visibility and self-service tools.

Operational Excellence is about operating efficiently and productively. We drive value with our available resources but also maintain a buffer so our service is resilient, managing the inevitable ups and downs that come with weather, fluctuating volumes, and securing growth. We effectively responded to shifts in business mix throughout 2025 as we handled elevated international intermodal shipments in the first half of the year coupled with strong bulk shipments throughout the year. As customer demand changed and international intermodal volumes declined in the second half of the year, we effectively modified our resources to match demand while improving our service performance. We managed our costs by operating a very efficient network, removing car handlings, and reducing dwell. Our performance in workforce productivity, locomotive productivity, terminal dwell, train length, and fuel consumption was at best-ever levels in 2025.

The execution of our strategy led to Growth in 2025. Operating revenues grew 1% driven by strong core pricing and higher volume, which more than offset business mix, lower fuel surcharge revenues, and reduced other revenues. Excluding the impact of fuel, our freight revenues grew 3%. We remain agile and maintain a buffer of resources, positioning us to respond quickly to demand and win with our customers.

As we start the year in 2026, it’s clear the Union Pacific team is consistently delivering at the highest levels across Safety, Service, and Operational Excellence. Our priority is to continue to improve and run a great railroad. We also have a historic opportunity with Norfolk Southern to create America’s first transcontinental railroad. As we work toward regulatory approval, we are focused on maintaining a strong financial position so we can continue to grow for many years to come.

Thank you for your ownership of Union Pacific.

Chief Executive Officer

DIRECTORS AND SENIOR MANAGEMENT

| | | | | | | | | | | | | | |

| BOARD OF DIRECTORS | | | | |

| | | | |

David B. Dillon Former Chairman and CEO - The Kroger Company Board Committees: Audit; Corporate Governance, Nominating, and Sustainability Sheri H. Edison Former Executive Vice President and General Counsel - Amcor plc Board Committees: Compensation and Talent; Corporate Governance, Nominating, and Sustainability (Chair) Teresa M. Finley Former Chief Marketing and Business Services Officer - United Parcel Service, Inc. Board Committees: Audit; Compensation and Talent

Deborah C. Hopkins Former Chief Executive Officer - Citi Ventures and Former Chief Innovation Officer - Citi Board Committees: Compensation and Talent; Finance (Chair) | | Jane H. Lute Strategic Advisor - SICPA, North America Board Committees: Audit (Chair); Corporate Governance, Nominating, and Sustainability Michael R. McCarthy Chairman - Union Pacific Corporation and Union Pacific Railroad Company; Chairman - McCarthy Group, LLC; and Chairman - Bridges Trust Company Board Committees: Corporate Governance, Nominating, and Sustainability; Finance Doyle R. Simons Former President and CEO - Weyerhaeuser Company Board Committees: Compensation and Talent (Chair); Corporate Governance, Nominating, and Sustainability

John K. Tien, Jr. Former Deputy Secretary - U.S. Department of Homeland Security Board Committees: Audit; Finance | | V. James Vena Chief Executive Officer - Union Pacific Corporation and Union Pacific Railroad Company John P. Wiehoff Former Chairman, President, and CEO - C.H. Robinson Worldwide, Inc. Board Committees: Audit; Compensation and Talent W Anthony Will Former President and CEO - CF Industries Holdings, Inc. Board Committees: Audit; Finance Christopher J. Williams Chairman - Siebert Williams Shank & Co. Board Committees: Corporate Governance, Nominating, and Sustainability; Finance |

| | | | |

| SENIOR MANAGEMENT | | | | |

| | | | |

V. James Vena Chief Executive Officer Christina B. Conlin Executive Vice President, Chief Legal Officer, and Corporate Secretary Chris C. Fairchild Vice President - Tax Eric J. Gehringer Executive Vice President - Operations Rebecca B. Gregory Vice President and Chief of Staff | | Jennifer L. Hamann Executive Vice President and Chief Financial Officer Rahul Jalali Executive Vice President and Chief Information Officer Michael V. Miller Vice President and Treasurer Joshua K. Perkes Senior Vice President and Chief Human Resources Officer | | Carrie J. Powers Vice President, Controller, and Chief Accounting Officer Kenny G. Rocker Executive Vice President - Marketing and Sales

|

| | | | |

PART I

Item 1. Business

GENERAL

Union Pacific Railroad Company is the principal operating company of Union Pacific Corporation. One of America's most recognized companies, Union Pacific Railroad Company connects 23 states in the western two-thirds of the country by rail, providing a critical link in the global supply chain. The Railroad’s diversified business mix includes Bulk, Industrial, and Premium. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to Eastern gateways, connects with Canada's rail systems, and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to customers by delivering products in a safe, reliable, fuel-efficient, and environmentally responsible manner.

Union Pacific Corporation was incorporated in Utah in 1969 and maintains its principal executive offices at 1400 Douglas Street, Omaha, NE 68179. The telephone number at that address is (402) 544-5000. The common stock of Union Pacific Corporation is listed on the New York Stock Exchange (NYSE) under the symbol “UNP”.

For purposes of this report, unless the context otherwise requires, all references herein to "Union Pacific", “UPC”, “Corporation”, “Company”, “we”, “us”, and “our” shall mean Union Pacific Corporation and its subsidiaries, including Union Pacific Railroad Company, which we separately refer to as “UPRR” or the “Railroad”.

STRATEGY

Safety, Service, and Operational Excellence supports the Company's long-term initiative to Grow its freight volumes. Together as a team, the Company will focus on achieving the best safety record in the industry, being known for superior service, grounded in operational excellence, which, in turn, drives growth.

Safety is paramount and, as our first area of focus, sets the foundation for achieving the Company's objectives. The mindset and culture are built around a personal commitment by all employees to prioritize safety so everyone goes home safely.

Service is all about delivering what we sold our customers. We work with our customers to understand the service they need to win in their markets and then drive how we win together. We commit to these service levels and do it with excellence.

Operational Excellence is about operating efficiently and productively. We will drive value with our available resources but also maintain a buffer so our service is resilient, managing the inevitable ups and downs that come with weather, fluctuating volumes, and securing growth.

Growth is the outcome of executing our strategy to be the industry leader in both safety and service resulting in improved margins and greater cash generation, creating long term enterprise value. The expected outcome of successfully executing our strategy will be an industry leading operating ratio and return on invested capital.

As we work to transform our railroad, our core values continue to guide us. Our passion for performance will help us win; our high ethical standards ensure we win in a way that supports all of our stakeholders; and our teamwork ensures we win together.

OPERATIONS

The Railroad, along with its subsidiaries and rail affiliates, is our one reportable operating segment. Although we provide and analyze revenues by commodity group, we treat the financial results of the Railroad as one segment due to the integrated nature of our rail network. Additional information regarding our business and operations, including revenues, financial information and data, and other information regarding environmental matters, is presented in Risk Factors, Item 1A; Legal Proceedings, Item 3; Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7; and the Financial Statements and Supplementary Data, Item 8.

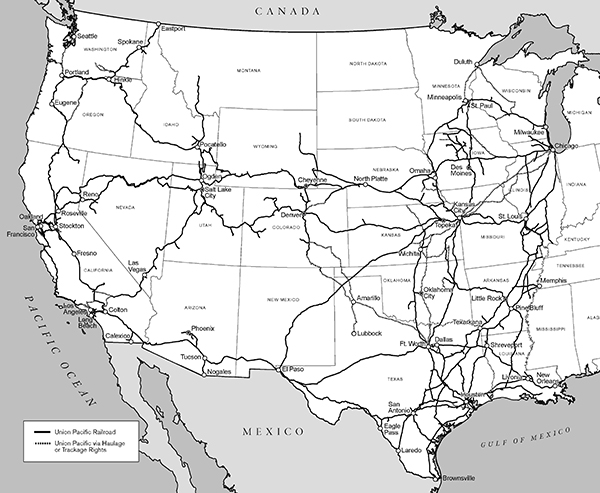

Operations – UPRR is a Class I railroad operating in the U.S. We have 32,889 route miles, connecting Pacific Coast and Gulf Coast ports with the Midwest and Eastern U.S. gateways and providing several corridors to key Mexican and Canadian gateways. We serve the western two-thirds of the country and maintain coordinated schedules with other rail carriers to move freight to and from the Atlantic Coast, the Pacific Coast, the Southeast, the Southwest, Canada, and Mexico. Export and import traffic moves through Gulf Coast, Pacific Coast, and East Coast ports and across the Mexican and Canadian borders. In 2025, we generated freight revenues totaling $23.2 billion from the following three commodity groups:

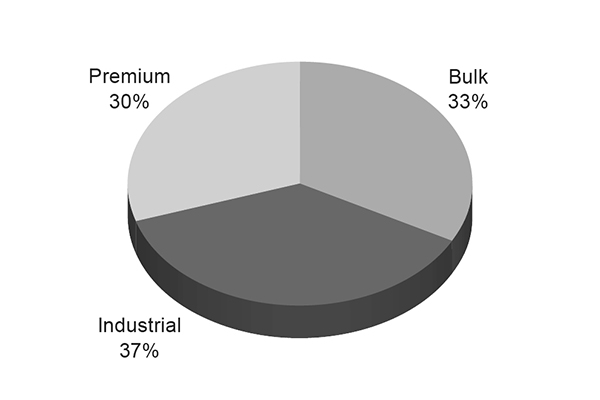

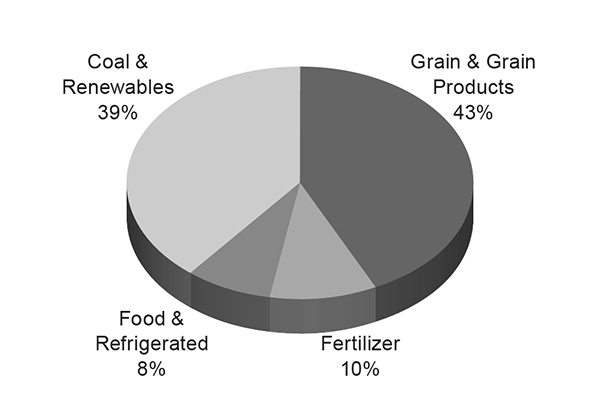

Bulk – The Company's Bulk shipments consist of grain and grain products, fertilizer, food and refrigerated, and coal and renewables. In 2025, this group generated 33% of our freight revenues. We access most major grain markets, connecting the Midwest and Western U.S. producing areas to export terminals in the Pacific Northwest and Gulf Coast ports as well as Mexico. We also serve significant domestic markets, including grain processors, animal feeders, ethanol, and renewable biofuel producers in the Midwest and West. Fertilizer movements originate in the Gulf Coast region, Midwest, Western U.S., and Canada (through interline access) for delivery to major agricultural users in those areas as well as abroad. The Railroad’s network supports the transportation of coal shipments to independent and regulated power companies and industrial facilities throughout the U.S. Through interchange gateways and ports, UPRR’s reach extends to Eastern U.S. utilities as well as to Mexico and other international destinations. Coal traffic originating in the Powder River Basin (PRB) area of Wyoming is the largest portion of the Railroad’s coal business.

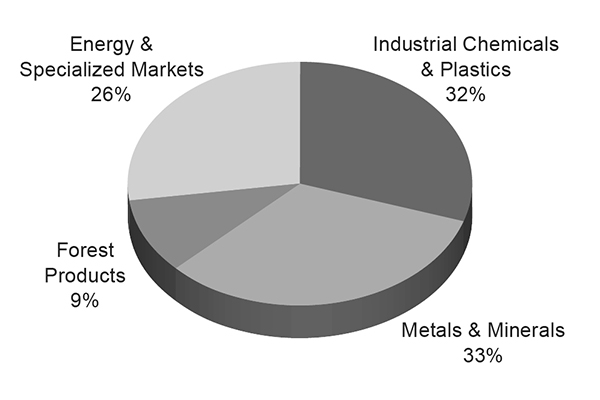

Industrial – Our extensive network facilitates the movement of numerous commodities between thousands of origin and destination points throughout North America. The Industrial group consists of several categories, including construction, industrial chemicals, plastics, forest products, specialized products (primarily waste, salt, and roofing), metals and ores, petroleum, liquid petroleum gases (LPG), soda ash, and sand. Transportation of these products accounted for 37% of our freight revenues in 2025. Commercial, residential, and governmental infrastructure investments drive shipments of steel, aggregates, cement, and wood products. Industrial and light manufacturing plants receive steel, nonferrous materials, minerals, and other raw materials.

The industrial chemicals market consists of a vast number of chemical compounds that support the manufacturing of more complex chemicals. Plastics shipments support automotive, housing, and the durable and disposable consumer goods markets. Forest product shipments include lumber and paper commodities. Lumber shipments originate primarily in the Pacific Northwest or Western Canada and move throughout the U.S. for use in new home construction and repairs and remodeling. Paper shipments primarily support packaging needs. Oil and gas drilling generates demand for raw steel, finished pipe, stone, and drilling fluid commodities. The Company’s petroleum and LPG shipments are primarily impacted by refinery utilization rates, regional crude pricing differentials, pipeline capacity, and the use of asphalt for road programs. Soda ash originates in southwestern Wyoming and California, destined for chemical and glass producing markets in North America and abroad.

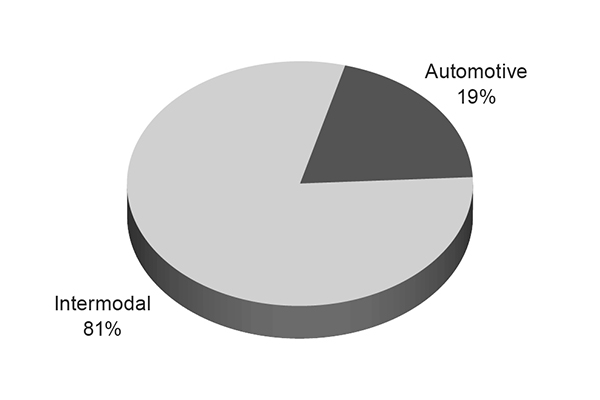

Premium – In 2025, Premium shipments generated 30% of Union Pacific’s total freight revenues. Premium includes finished automobiles, automotive parts, and merchandise in intermodal containers, both domestic and international. International business consists of import and export traffic moving in 20 or 40-foot shipping containers, that mainly pass through West Coast ports, destined for one of the Company's many inland intermodal terminals. Domestic business includes container and trailer traffic picked up and delivered within North America for intermodal marketing companies (primarily shipper agents and logistics companies) as well as truckload carriers.

We are the largest automotive carrier west of the Mississippi River and operate or access more than 40 vehicle distribution centers. The Railroad’s extensive franchise accesses six vehicle assembly plants and connects to West Coast ports, all six major Mexico gateways, and the Port of Houston to accommodate both import and export shipments. In addition to transporting finished vehicles, the Company provides expedited handling of automotive parts in both boxcars and intermodal containers destined for Mexico, the U.S., and Canada.

Seasonality – Some of the commodities we carry have peak shipping seasons, reflecting either or both the nature of the commodity (such as certain agricultural and food products that have specific growing and harvesting seasons) and the demand cycle for the commodity (such as intermodal traffic that generally peaks during the third quarter to meet back-to-school and holiday-related demand for consumer goods during the fourth quarter). The peak shipping seasons for these commodities can vary considerably each year depending upon various factors, including the strength of domestic and international economies and currencies; consumer demand; the strength of harvests, which can be adversely affected by severe weather; market prices for agricultural products; and supply chain disruptions.

Proud & engaged workforce – Our employees are central to our strategy of Safety, Service, and Operational Excellence leading to Growth, and investing in our workforce is key to our success.

Our people: Our award-winning, multigenerational workforce includes talented people from all walks of life, in many stages of life. Made up of management and craft professionals, we are focused on attracting, retaining, and developing talent across our entire system. We employed an average of 29,287 employees during 2025.

Union Pacific works with 13 major rail unions, representing approximately 83% of our workforce. Pursuant to the Railway Labor Act (RLA), a federal statute enacted in 1926, our collective bargaining agreements are subject to modification every five years. Existing agreements remain in effect until new agreements are ratified or until the RLA procedures are exhausted. The RLA is designed to bring the railroads and unions to agreement without disruptions to rail transportation. We have concluded the majority of our local negotiations, which began on January 1, 2025, related to years 2025-2029. There are two negotiations ongoing at one of our subsidiaries.

Our culture: At Union Pacific, The How Matters – high ethical standards guide the decisions we make and action we take to protect our employees, communities, and customers. Our passion for performance drives our safety, customer experience, and financial results while we work as a team to create opportunity for all.

Safety is central to everything we do at Union Pacific. Together, we are committed to cultivating a safety-focused culture, so our employees return home safely every day. To achieve this, our employees identify risks, initiate action to mitigate those risks, and have the courage to care to keep each other safe.

Our success is measured by our personal injury rate (the number of reportable injuries for every 200,000 employee-hours worked) and our derailment incident rate (the number of reportable derailment incidents per million train miles). Reportable personal injuries are defined as on duty incidents or occupational illnesses that result in employees losing time away from work, modifying or restricting their normal duties, or receiving any medical treatment above and beyond first aid. Reportable derailment incidents are defined as any occurrence where a wheel of a locomotive or rail car falls off the track and causes damage to track, equipment, or structures above the Federal Railroad Administration (FRA) reporting threshold, regardless of ownership ($12,400 for 2025 and $12,600 for 2026). Personal injuries and derailment incidents that meet reportable criteria are reported to the FRA.

Our 2025 personal injury rate of 0.68 improved 24%, and our derailment incident rate of 1.75 improved 19% versus 2024. (See further discussion in Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, of this report.)

Union Pacific is committed to creating an environment where people can be their best, personally and professionally. We believe that a supportive culture increases employee engagement, improves morale, and allows qualified employees to succeed and contribute to Union Pacific's success. All of this supports our safety strategy and improves the quality of decision-making, problem-solving, and strategic thinking.

The employee journey: From recruitment to retirement and milestones in between, we are relentlessly focused on supporting and engaging employees throughout their Union Pacific journey. We view it as imperative to invest in our employees with meaningful benefit offerings, developmental experiences, and career opportunities.

The process begins with recruitment, where we strive to attract the most talented employees to join our team. Then, we focus on training and development, which includes courses and programs designed to help our employees grow into new roles and/or learn a new skill in their current role so that we can retain our workforce over time.

Providing competitive compensation and meaningful benefits is key to attracting and retaining talented employees. Union Pacific is committed to continuously reviewing its compensation programs and comprehensive benefits programs to promote programs that are fair and competitive. Both are key to enhancing the value of working for Union Pacific and demonstrating the Company’s commitment to the health and wealth of employees during their career. Benefits vary based on the applicable collective bargaining agreement or an employee’s management status. The final stage of the employee journey is a fulfilling retirement, which is enabled during their Union Pacific career through our compensation and benefit programs, particularly contributions to 401(k) plans and the employee stock purchase plan (ESPP).

Our Board of Directors evaluates our non-union compensation plans and reviews recommendations from the Compensation and Talent Committee, while collective bargaining agreements govern compensation for our union employees. The median annual compensation for all employees employed as of December 31, 2025, was $107,889 (excluding the CEO).

Talent is critical - our ability to recruit and retain employees is directly tied to our railroad’s success, as proven by our 2025 retention rate of 89%, our robust benefit offerings, and work environment that creates meaningful family-supporting careers. We are focused on effectively managing workforce levels to the demands of the business and improving quality of life for our employees.

Railroad security – Our security efforts consist of a wide variety of measures, including employee training, engagement with our customers, training of emergency responders, and partnerships with numerous federal, state, and local government agencies. While federal law requires us to protect the confidentiality of our security plans designed to safeguard against terrorism and other security incidents, the following provides a general overview of our security initiatives.

UPRR security measures – We maintain a comprehensive security plan designed to both deter and respond to any potential or actual threats as they arise. The plan includes four levels of alert status, each with its own set of countermeasures. We employ our own police force, consisting of commissioned and highly-trained officers. The police are certified state law enforcement officers with investigative and arrest powers. The Union Pacific Police Department has achieved accreditation under the Commission on Accreditation for Law Enforcement Agencies, Inc. (CALEA) for complying with the highest law enforcement standards. Our employees undergo recurrent security and preparedness training as well as federally mandated hazardous materials and security training. We regularly review the sufficiency of our employee training programs. We maintain the capability to move critical operations to back-up facilities in different locations.

We operate an emergency response management center 24 hours a day. The center receives reports of emergencies, dangerous or potentially dangerous conditions, and other safety and security issues from our employees, the public, law enforcement, and other government officials. In cooperation with government officials, we monitor both threats and public events, and, as necessary, we may alter rail traffic flow at times of concern to minimize risk to communities and our operations. We comply with the hazardous materials routing rules and other requirements imposed by federal law. We design our operating plan to expedite the movement of Rail Security Sensitive Materials (RSSM), a subset of particularly hazardous materials, to minimize the time rail cars remain idle at yards and terminals located in or near major population centers. Additionally, in compliance with Transportation Security Administration (TSA) regulations, we deployed information systems and instructed employees in tracking and documenting the handoff of RSSM with customers and interchange partners.

We established a number of our own innovative safety and security-oriented initiatives ranging from various investments in technology to The Officer on Train program, which provides local law enforcement officers with the opportunity to ride with train crews to enhance their understanding of railroad operations and risks. Our staff of information security professionals continually assess cybersecurity risks and implement mitigation programs that evolve with the changing technology threat environment. To date, we have not experienced any material disruption of our operations due to a cyber threat or incident directed at us.

Cooperation with federal, state, and local government agencies – We work closely on physical and cybersecurity initiatives with government agencies, including the U.S. Department of Transportation (DOT); the Federal Bureau of Investigation (FBI); the Department of Homeland Security (DHS), along with its Cybersecurity and Infrastructure Security Agency (CISA), and the TSA; as well as local police departments, fire departments, and other first responders.

In compliance with TSA regulations established in 2022, we designated a Cybersecurity Coordinator to oversee our cybersecurity initiatives and report required incidents to the CISA. We communicated our Cybersecurity Incident Response Plan and conducted a Cybersecurity Vulnerability Assessment to identify potential risks. Our Cybersecurity Implementation Plan outlines the specific actions taken to meet the TSA prevention, detection, and response requirements. Additionally, an ongoing assessment program has been implemented to proactively and regularly evaluate the effectiveness of our cybersecurity program to identify and mitigate emerging risks. These efforts have been validated by the TSA, confirming our adherence to their standards.

In conjunction with the Association of American Railroads (AAR), we sponsor Ask Rail, a mobile application that provides first responders with secure links to electronic information, including commodity and emergency response information required by emergency personnel to respond to accidents and other situations. We also participate in the National Joint Terrorism Task Force, a multi-agency effort established by the U.S. Department of Justice and the FBI to combat and prevent terrorism.

We work with the Coast Guard, U.S. Customs and Border Protection (CBP), and the Military Transport Management Command, which monitor shipments entering the UPRR rail network at U.S. border crossings and ports. We were the first railroad in the U.S. to be named a partner in CBP’s Customs-Trade Partnership Against Terrorism, a partnership designed to develop, enhance, and maintain effective security processes throughout the global supply chain.

Cooperation with customers and trade associations – Through TransCAER (Transportation Community Awareness and Emergency Response), we work with the AAR, the American Chemistry Council, the American Petroleum Institute, and other chemical trade groups to provide communities with preparedness tools, including the training of emergency responders. In cooperation with the FRA and other interested groups, we are also working to develop additional improvements to tank car design that will further limit the risk of releases of hazardous materials.

Sustainable future – Union Pacific believes it is important that we act as environmental stewards, reducing greenhouse gas (GHG) emissions and supporting the transition to a more sustainable future. While we work to further reduce our environmental footprint, it is important to note that railroads are already one of the most fuel-efficient means of transportation. Freight rail leads other forms of surface transportation when it comes to minimizing GHG emissions, and we expect rail will continue to play a critical role in mitigating and abating the impacts of climate change. According to the AAR, moving freight by rail instead of truck reduces GHG emissions as freight railroads are, on average, three to four times more fuel efficient than trucks. Therefore, converting freight transportation from truck to rail typically results in an immediate reduction in our customers' scope 3 GHG emissions.

Competition – see “We Face Competition from Other Railroads and Other Transportation Providers” in the Risk Factors in Item 1A of this report.

Key suppliers – see “We Are Dependent on Certain Key Suppliers of Locomotives and Rail” in the Risk Factors in Item 1A of this report.

Available information – Our Internet website is www.up.com. We make available free of charge on our website (under the “Investors” caption link) our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our current reports on Form 8-K; our proxy statements; Forms 3, 4, and 5, filed on behalf of our directors and certain executive officers; and amendments to such reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the Exchange Act). We provide these reports and statements as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available on our website previously filed SEC reports and exhibits via a link to EDGAR on the SEC’s Internet site at www.sec.gov. Additionally, our corporate governance materials, including By-Laws, Board Committee charters, governance guidelines and policies, and codes of conduct and ethics for directors, officers, and employees are available on our website. From time to time, the corporate governance materials on our website may be updated as necessary to comply with rules issued by the SEC and the NYSE or as desirable to promote the effective and efficient governance of our Company. Any security holder wishing to receive, without charge, a copy of any of our SEC filings or corporate governance materials should send a written request to: Secretary, Union Pacific Corporation, 1400 Douglas Street, Omaha, NE 68179.

References to our website address, in this report, including references in Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, are provided as a convenience and do not constitute, and should not be deemed, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

GOVERNMENTAL AND ENVIRONMENTAL REGULATION

Governmental regulation – Our operations are subject to a variety of federal, state, and local regulations, generally applicable to all businesses. (See also the discussion of certain regulatory proceedings in Legal Proceedings, Item 3.)

The operations of the Railroad are subject to the regulations of the FRA and other federal and state agencies as well as the regulatory jurisdiction of the Surface Transportation Board (STB). The STB has jurisdiction over rates charged on certain regulated rail traffic; common carrier service of regulated traffic; freight car compensation; transfer, extension, or abandonment of rail lines; and acquisition of control of rail common carriers (see Note 20 to the Financial Statements and Supplementary Data, Item 8, for information regarding the pending acquisition of Norfolk Southern). The STB is reviewing proposed rulemaking in various areas, including reciprocal switching and commodity exemptions. The STB also continues to explore changes to the methodology for determining railroad revenue adequacy, the possible uses of revenue adequacy in regulating railroad rates, and ways to regulate service, including by use of emergency service orders. The STB posts quarterly reports on rate reasonableness cases, maintains a database on service complaints, and has the authority to initiate investigations, among other things.

The DOT, the Occupational Safety and Health Administration, the Pipeline and Hazardous Materials Safety Administration, and the DHS, along with other federal agencies, have jurisdiction over certain aspects of safety, movement of hazardous materials and hazardous waste, emissions requirements, and equipment standards. Additionally, various state and local agencies have jurisdiction over disposal of hazardous waste and seek to regulate movement of hazardous materials in ways not preempted by federal law.

Environmental regulation – We are subject to extensive federal and state environmental statutes and regulations pertaining to public health and the environment. The statutes and regulations are administered and monitored by the Environmental Protection Agency (EPA) and by various state environmental agencies, such as the California Air Resources Board (CARB) and the Texas Commission on Environmental Quality (TCEQ), among others. The primary laws affecting our operations are the Resource Conservation and Recovery Act, regulating the management and disposal of solid and hazardous wastes; the Comprehensive Environmental Response, Compensation, and Liability Act, regulating the cleanup of contaminated properties; the Clean Air Act, regulating air emissions; and the Clean Water Act, regulating wastewater discharges.

Information concerning environmental claims and contingencies and estimated remediation costs is set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates - Environmental, Item 7, and Note 17 to the Financial Statements and Supplementary Data, Item 8.

Item 1A. Risk Factors

The following discussion addresses significant factors, events, and uncertainties that make an investment in our securities risky and provides important information for the understanding of our “forward-looking statements,” which are discussed immediately preceding Item 7A of this Form 10-K and elsewhere. The risk factors set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, and Financial Statements and Supplementary Data, Item 8.

We urge you to consider carefully the factors described below and the risks that they present for our operations as well as the risks addressed in other reports and materials that we file with the SEC and the other information included or incorporated by reference in this Form 10-K. When the factors, events, and contingencies described below or elsewhere in this Form 10-K materialize, our business, reputation, financial condition, results of operations, cash flows, or prospects can be materially adversely affected. In such case, the trading price of our common stock could decline, and you could lose part or all of your investment. The disclosures in this section reflect our beliefs and opinions as to factors that could materially and adversely affect us in the future. References to past events are provided by way of example only and are not intended to be a complete listing or a representation as to whether or not such factors have occurred in the past or their likelihood of occurring in the future. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business, reputation, financial condition, results of operations, cash flows, and prospects.

Strategic and operational risks

We must manage fluctuating demand for our services and network capacity – Significant reductions in demand for rail services with respect to one or more commodities or changes in consumer preferences that affect the businesses of our customers can lead to increased costs associated with resizing our operations, including higher unit operating costs and costs for the storage of locomotives, rail cars, and other equipment; workforce adjustments; and other related activities, which could have a material adverse effect on our results of operations, financial condition, and liquidity. If there is significant demand for our services that exceeds the designed capacity of our network or shifts in traffic flow that are contrary to the designed capacity of our network, we can experience challenges, including congestion and reduced velocity, that could compromise the level of service we provide to our customers. This level of demand also can compound the impact of weather and weather-related events on our operations and velocity. We cannot be sure that our efforts to improve our transportation plan, add capacity, improve operations at our yards and other facilities, and improve our ability to address surges in demand for any reason by carrying a resource buffer will fully or adequately address any service shortcomings resulting from demand exceeding our planned capacity. From time to time we also experience other operational or service challenges related to network capacity, dramatic and unplanned fluctuations in our customers’ demand for rail service with respect to one or more commodities or operating regions, or other events that could negatively impact our operational efficiency, any or all of which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We transport hazardous materials – We transport certain hazardous materials and other materials, including crude oil, ethanol, and toxic inhalation hazard (TIH) materials, such as chlorine, that pose certain risks in the event of a release or combustion. Additionally, U.S. laws impose common carrier obligations on railroads that require us to transport certain hazardous materials regardless of risk or potential exposure to loss. An accident or other incident on our network, at our facilities, or at the facilities of our customers involving the release or combustion of hazardous materials can involve significant costs and claims for personal injury, property damage, and environmental penalties and remediation in excess of our insurance coverage for these risks, which could harm our reputation or have a material adverse effect on our results of operations, financial condition, and liquidity.

The ability to update or maintain technology could adversely affect our operations – We rely on information technology in all aspects of our business, including technology systems operated by us (whether created by us or purchased), under control of third parties, and open-source software. If we do not have sufficient capital or do not deploy sufficient capital in a timely manner to acquire, develop, or implement new technology or maintain or upgrade current systems, such as Positive Train Control (PTC), NetControl, or the latest version of our transportation control systems, we may suffer a rail service outage or competitive disadvantage within the rail industry and with companies providing other modes of transportation service, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We are subject to cybersecurity risks – We rely on information technology in all aspects of our business, including technology systems operated by us (whether created by us or purchased), under control of third parties, and open-source software. We have experienced and will likely continue to experience varying degrees of cyber incidents in the normal course of business. There can be no assurance that the resources we devote to protect our technology systems and proprietary data or the systems we have designed to identify, prevent, or limit the effects of cyber incidents will be sufficient to prevent or detect such incidents, or to avoid a material adverse impact on our systems after such incidents do occur. Furthermore, due to the rising numbers and increasing sophistication of cyber-attacks, an increasingly complex information technology supply chain, and the nature of zero-day exploits, we may be unable to anticipate or implement adequate measures to prevent a security breach, including by ransomware or as a result of human error or other cyber-attack methods, from materially affecting our systems or the systems of third-parties upon which we rely. The rapid evolution and increased availability of artificial intelligence may intensify cybersecurity risks by making cyber-attacks more sophisticated and cybersecurity incidents more difficult to detect, contain, and mitigate. A cyber incident that results in significant service interruption; safety failure; other operational difficulties; unauthorized access to (or the loss of access to) competitively sensitive, confidential, or other critical data or systems; loss of customers; financial losses; regulatory fines; reputational harm; or misuse or corruption of critical data and proprietary information, could have a material adverse impact on our results of operations, financial condition, and liquidity. We may experience security breaches that could remain undetected for an extended period and, therefore, have a greater impact on us. Additionally, we may be exposed to increased cybersecurity risk because we are a component of the critical U.S. infrastructure.

Severe weather and natural events could result in significant business interruptions and expenditures – As a railroad with a vast network, we are exposed to severe weather conditions and other natural phenomena, including earthquakes, hurricanes, fires, floods, mudslides or landslides, extreme temperatures, avalanches, and significant precipitation, and climate change may cause or contribute to the severity or frequency of such weather conditions. Line outages and other interruptions caused by these conditions have in the past and could in the future adversely affect parts or all of our rail network, potentially negatively affecting revenues, costs, and liabilities, despite efforts we undertake to plan for these events. Our revenues can also be adversely affected by severe weather that causes damage and disruptions to our customers. These impacts caused by severe weather or other natural phenomena could have a material adverse effect on our results of operations, financial condition, and liquidity.

A significant portion of our revenues involves transportation of commodities to and from international markets – Although revenues from our operations are attributable to transportation services provided in the U.S., a significant portion of our revenues involves the transportation of commodities to and from international markets, including Mexico, Canada, and Southeast Asia, by various carriers and, at times, various modes of transportation. Significant and sustained interruptions of trade with Mexico, Canada, or countries in Southeast Asia, including China, could adversely affect customers and other entities that, directly or indirectly, purchase or rely on rail transportation services in the U.S. as part of their operations, and any such interruptions, including international armed conflicts, such as the Russia-Ukraine and Israel-Hamas wars, could have a material adverse effect on our results of operations, financial condition, and liquidity. Any one or more of the following could cause a significant and sustained interruption of trade with Mexico, Canada, or countries in Southeast Asia: (a) a deterioration of security for international trade and businesses; (b) the adverse impact of new laws, rules, and regulations or the interpretation or enforcement of laws, rules, and regulations by government entities, courts, or regulatory bodies, including the United States-Mexico-Canada Agreement (USMCA) or other international trade agreements; (c) actions of taxing authorities that affect our customers doing business in or with foreign countries; (d) any significant adverse economic developments, such as extended periods of high inflation, material disruptions in the banking sector or in the capital markets of these foreign countries, and significant changes in the valuation of the currencies of these foreign countries that could materially affect the cost or value of imports or exports; (e) shifts in patterns of international trade, including as a result of changes to international trade agreements or policies, that adversely affect import and export markets; (f) a material reduction in foreign direct investment in these countries; and (g) public health crises, including the outbreak of pandemic or contagious disease, such as the coronavirus and its variant strains (COVID). Changes to trade policy both U.S. and foreign, including imposition of tariffs on imports, could cause demand for shipping from international markets to decrease, and if the declines are significant enough, it could have a material adverse effect on our results of operations, financial condition, and liquidity.

We are dependent on certain key suppliers of locomotives and rail – Due to the capital-intensive nature and sophistication of locomotive equipment, parts, and maintenance, potential new suppliers face high barriers to entry. Therefore, if any of our two domestic suppliers of locomotives discontinues manufacturing locomotives, supplying parts, or providing maintenance for any reason, including bankruptcy or insolvency or the inability to manufacture locomotives that meet efficiency or regulatory emissions standards, we could experience significant cost increases and reduced availability of the locomotives that are necessary for our operations. Additionally, we utilize a limited number of steel producers that meet our rail specifications. Rail is critical to our operations for rail replacement programs, maintenance, and for adding additional network capacity, new rail and storage yards, and expansions of existing facilities. This industry similarly has high barriers to entry, and if there is any significant consolidations or mergers in this industry, or one of these suppliers discontinues operations for any reason, including bankruptcy or insolvency, we could experience both significant cost increases for rail purchases and difficulty obtaining sufficient rail for maintenance and other projects. Changes to trade agreements or policies that result in increased tariffs on goods imported into the United States could also result in significant cost increases for rail purchases and difficulty obtaining sufficient rail.

Workforce risks

Strikes or work stoppages could adversely affect our operations – The U.S. Class I railroads are party to collective bargaining agreements with various labor unions. The majority of our employees belong to labor unions and are subject to these agreements. Disputes over the terms of these or future agreements or the terms of such agreements, or our potential inability to negotiate acceptable contracts with these unions or the renegotiation of them or their term can lead to, among other things, strikes, work stoppages, slowdowns, or lockouts, any or all of which could compromise our service reliability or cause a significant disruption of our operations, and could increase our costs for wages, health care, and other benefits, which could have a material adverse effect on our results of operations, financial condition, and liquidity. Labor disputes, work stoppages, slowdowns, or lockouts at loading/unloading facilities, ports, or other transport access points, or by employees of our customers or our suppliers, could compromise our service reliability and have a material adverse impact on our results of operations, financial condition, and liquidity.

The availability of qualified personnel could adversely affect our operations – Changes in demographics, training requirements, and pandemic illnesses or restrictions could negatively affect the availability of qualified personnel for us, our customers, and throughout the supply chain. Our ability to quickly react to other factors that affect our ability to attract and retain employees may be restricted due to limited flexibility to make unilateral changes to collective bargaining agreements, which cover the majority of our workforce. Unpredictable increases in demand for rail services and a lack of network fluidity may exacerbate our risks related to having insufficient qualified personnel, which could have a negative impact on our operational efficiency and otherwise have a material adverse effect on our results of operations, financial condition, and liquidity.