West Pharmaceutical Services, Inc. Eric M. Green President & CEO, Chair of the Board Bob W. McMahon Senior VP & Chief Financial Officer Fourth-Quarter and Full-Year 2025 Earnings Call February 12, 2026 | 8 a.m. Eastern Time

2 West Analyst Conference Call February 12, 2026 8 a.m. Eastern Time These presentation materials are intended to accompany and serve as a reference for today’s press release announcing the Company’s results for the fourth quarter and full year 2025 and management’s discussion of those results during today’s conference call. A webcast of today’s call can be accessed in the “Investors” section of the Company’s website at www.investor.westpharma.com. To participate on the call by asking questions to Management, please register in advance by clicking here. Registered telephone participants will receive the dial-in number along with a unique PIN number that will enable them to ask questions on the call. A replay of the webcast will be available on the Company’s website for approximately 90 days after the event. REGISTER TODAY

3 Safe Harbor Statement This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development, operational performance and expectations regarding future events. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under our “Forward Looking Statements” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, therefore you should not rely on these forward-looking statements as representing our views as of any date other than today. Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Non-U.S. GAAP Financial Measures” and the accompanying tables at the end of this presentation for more information. Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 Non-U.S. GAAP Financial Measures Trademarks and registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other jurisdictions, unless noted otherwise. Daikyo Crystal Zenith® and Daikyo CZ® are registered trademarks of Daikyo Seiko, Ltd. Daikyo Crystal Zenith technologies are licensed from Daikyo Seiko, Ltd. Trademarks

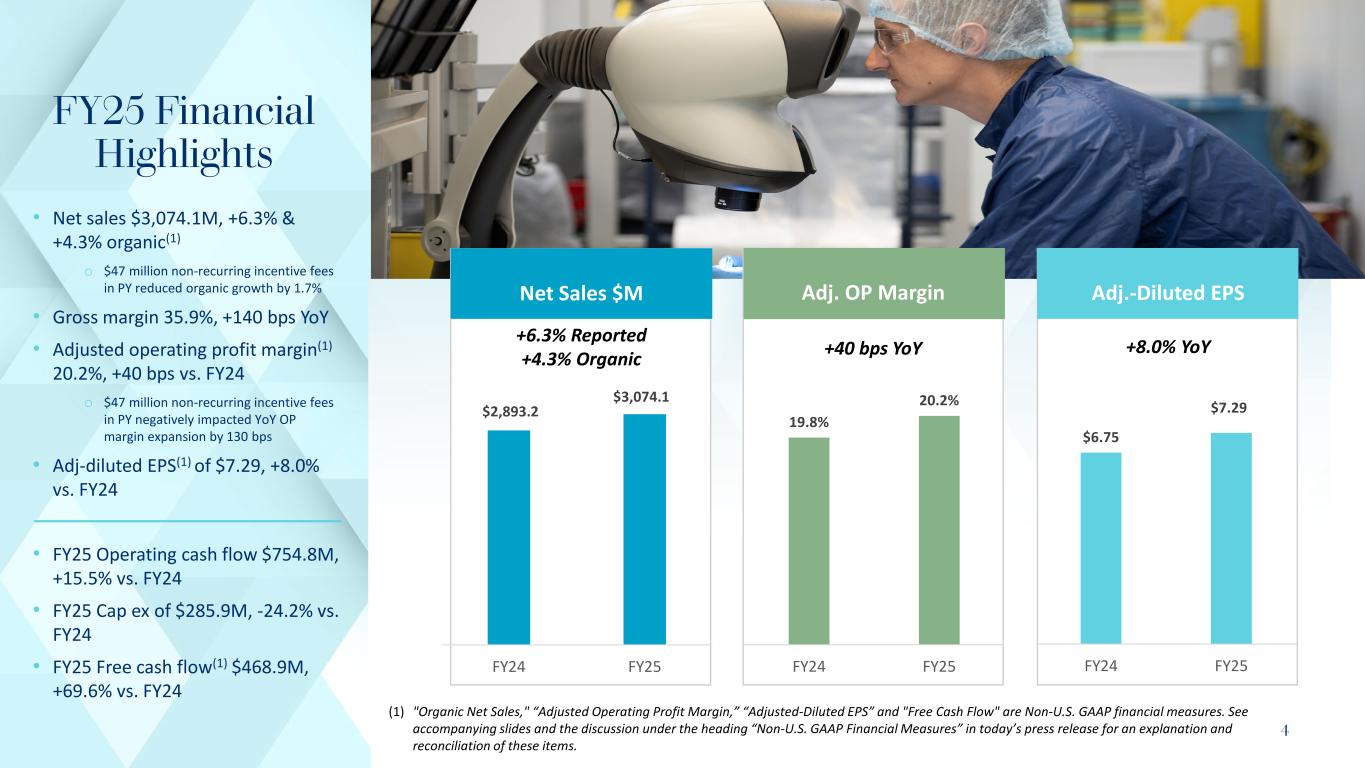

4 • Net sales $3,074.1M, +6.3% & +4.3% organic(1) o $47 million non-recurring incentive fees in PY reduced organic growth by 1.7% • Gross margin 35.9%, +140 bps YoY • Adjusted operating profit margin(1) 20.2%, +40 bps vs. FY24 o $47 million non-recurring incentive fees in PY negatively impacted YoY OP margin expansion by 130 bps • Adj-diluted EPS(1) of $7.29, +8.0% vs. FY24 • FY25 Operating cash flow $754.8M, +15.5% vs. FY24 • FY25 Cap ex of $285.9M, -24.2% vs. FY24 • FY25 Free cash flow(1) $468.9M, +69.6% vs. FY24 "Organic Net Sales," “Adjusted Operating Profit Margin,” “Adjusted-Diluted EPS” and "Free Cash Flow" are Non-U.S. GAAP financial measures. See accompanying slides and the discussion under the heading “Non-U.S. GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. (1) FY25 Financial Highlights 19.8% 20.2% FY24 FY25 $6.75 $7.29 FY24 FY25 $2,893.2 $3,074.1 FY24 FY25 Net Sales $M Adj. OP Margin Adj.-Diluted EPS +8.0% YoY+40 bps YoY +6.3% Reported +4.3% Organic

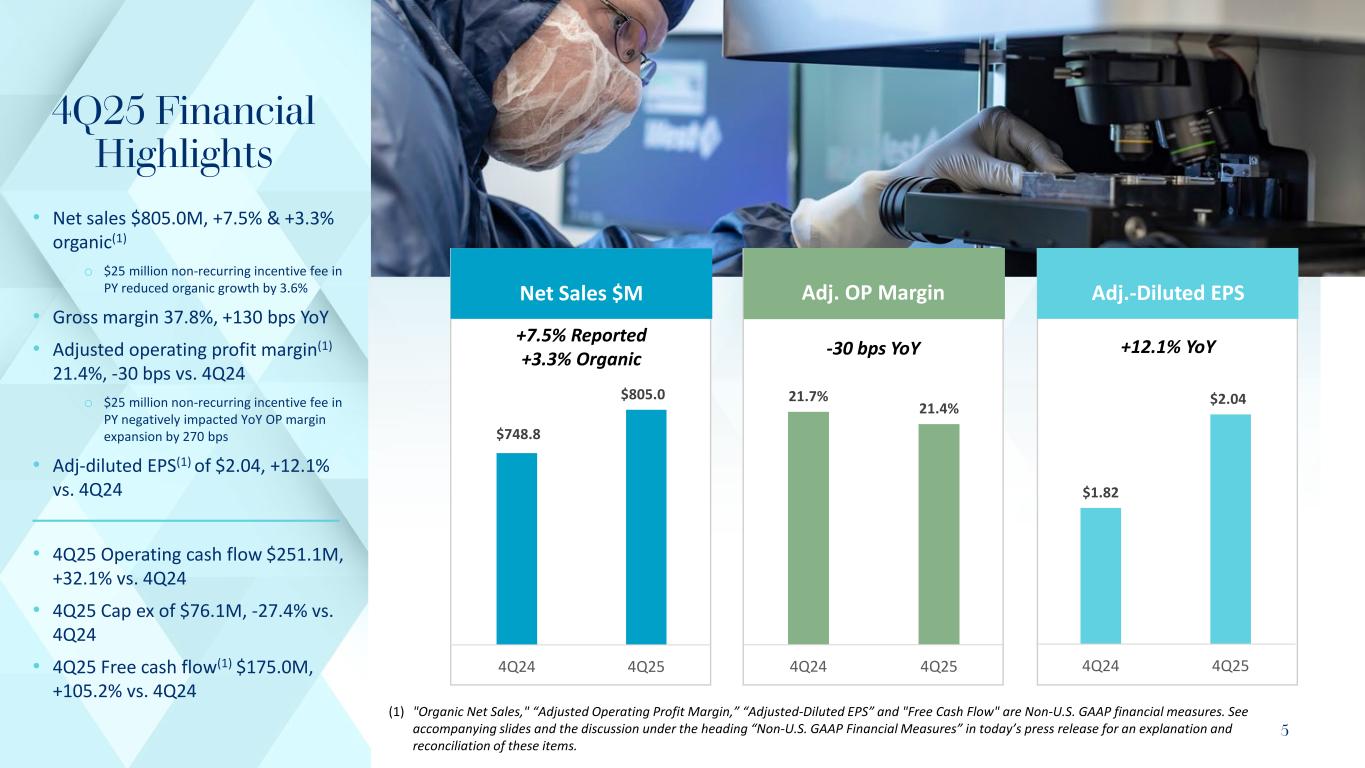

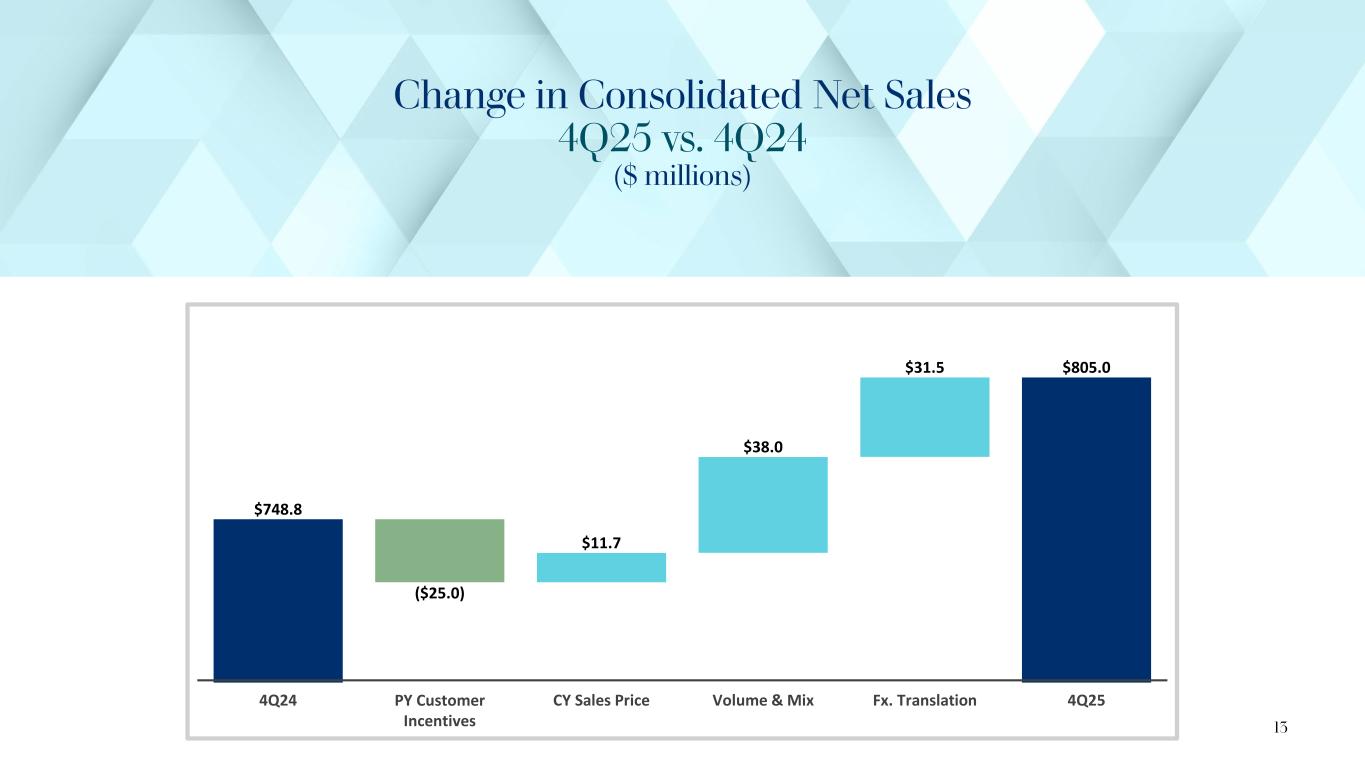

5 • Net sales $805.0M, +7.5% & +3.3% organic(1) o $25 million non-recurring incentive fee in PY reduced organic growth by 3.6% • Gross margin 37.8%, +130 bps YoY • Adjusted operating profit margin(1) 21.4%, -30 bps vs. 4Q24 o $25 million non-recurring incentive fee in PY negatively impacted YoY OP margin expansion by 270 bps • Adj-diluted EPS(1) of $2.04, +12.1% vs. 4Q24 • 4Q25 Operating cash flow $251.1M, +32.1% vs. 4Q24 • 4Q25 Cap ex of $76.1M, -27.4% vs. 4Q24 • 4Q25 Free cash flow(1) $175.0M, +105.2% vs. 4Q24 "Organic Net Sales," “Adjusted Operating Profit Margin,” “Adjusted-Diluted EPS” and "Free Cash Flow" are Non-U.S. GAAP financial measures. See accompanying slides and the discussion under the heading “Non-U.S. GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. (1) 4Q25 Financial Highlights 21.7% 21.4% 4Q24 4Q25 $1.82 $2.04 4Q24 4Q25 $748.8 $805.0 4Q24 4Q25 Net Sales $M Adj. OP Margin Adj.-Diluted EPS +12.1% YoY-30 bps YoY +7.5% Reported +3.3% Organic

6 Capitalizing on Key Growth Drivers Across Our Business Biologics Expanding market – driving High- Value Products Annex 1 Global regulatory framework upgrade opportunity GLP-1 Fastest growing category, multi-year opportunity – 17% of Net Sales Capacity Expansion Across 8 locations: 4 in U.S; 3 in Europe; 1 in Asia • 42% of West’s revenue in 4Q25 • Fuels mix shift to high-margin HVP • Continued strong participation rate in new drug launches • ~6 billion components potential opportunity to upgrade quality levels • ~700 Annex 1 projects – over half of the projects completed and now generating revenues, representing ~15% of the current opportunity. 325 projects are ongoing. • Achieved our Annex 1 target in 2025 • GLP-1 elastomers are 10% of 4Q25 total company revenues • GLP-1 Contract Manufacturing revenues are 7% of 4Q25 total company revenues • CM future revenue growth/ margin expansion opportunity from drug handling • Capex aligned to growth opportunities in biologics, Annex 1 and GLP-1 • Network optimization: improving service levels/managing tariff exposure • Opportunity to capitalize on near shoring trend Business O pportunity, Im pact & Results Driver

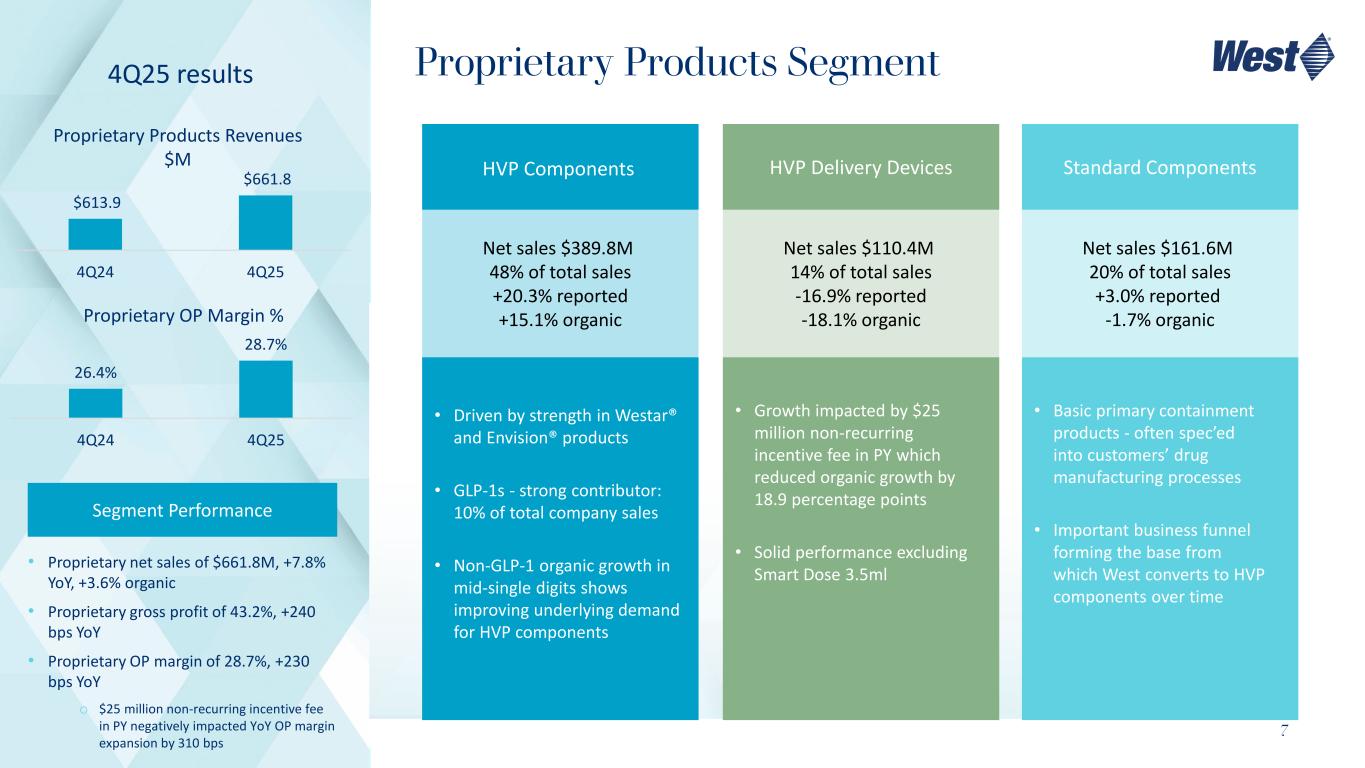

7 Proprietary Products Segment Segment Performance • Proprietary net sales of $661.8M, +7.8% YoY, +3.6% organic • Proprietary gross profit of 43.2%, +240 bps YoY • Proprietary OP margin of 28.7%, +230 bps YoY o $25 million non-recurring incentive fee in PY negatively impacted YoY OP margin expansion by 310 bps Proprietary Products Revenues $M $613.9 $661.8 4Q24 4Q25 4Q25 results Proprietary OP Margin % 26.4% 28.7% 4Q24 4Q25 Net sales $389.8M 48% of total sales +20.3% reported +15.1% organic Net sales $110.4M 14% of total sales -16.9% reported -18.1% organic Net sales $161.6M 20% of total sales +3.0% reported -1.7% organic • Driven by strength in Westar® and Envision® products • GLP-1s - strong contributor: 10% of total company sales • Non-GLP-1 organic growth in mid-single digits shows improving underlying demand for HVP components • Growth impacted by $25 million non-recurring incentive fee in PY which reduced organic growth by 18.9 percentage points • Solid performance excluding Smart Dose 3.5ml • Basic primary containment products - often spec’ed into customers’ drug manufacturing processes • Important business funnel forming the base from which West converts to HVP components over time HVP Components HVP Delivery Devices Standard Components

8 Contract Manufacturing Segment Segment Performance • CM net sales of $143.2M, +6.2% YoY & +1.9% organic • CM gross profit 12.7%, -430 bps YoY • CM OP margin 6.8%, -520 bps YoY Contract Manufacturing Revenues $M $134.9 $143.2 4Q24 4Q25 4Q25 results CM OP Margin % 12.0% 6.8% 4Q24 4Q25 Net sales $143.2M, 18% of total sales, +6.2% reported, +1.9% organic • Revenue and margin impacted by temporary facility disruption in Arizona facility, which has been remediated. Operating margins expected to be back to historical levels in 1Q26. • Commenced Commercial drug handling operations at Dublin facility. 4Q25 Performance

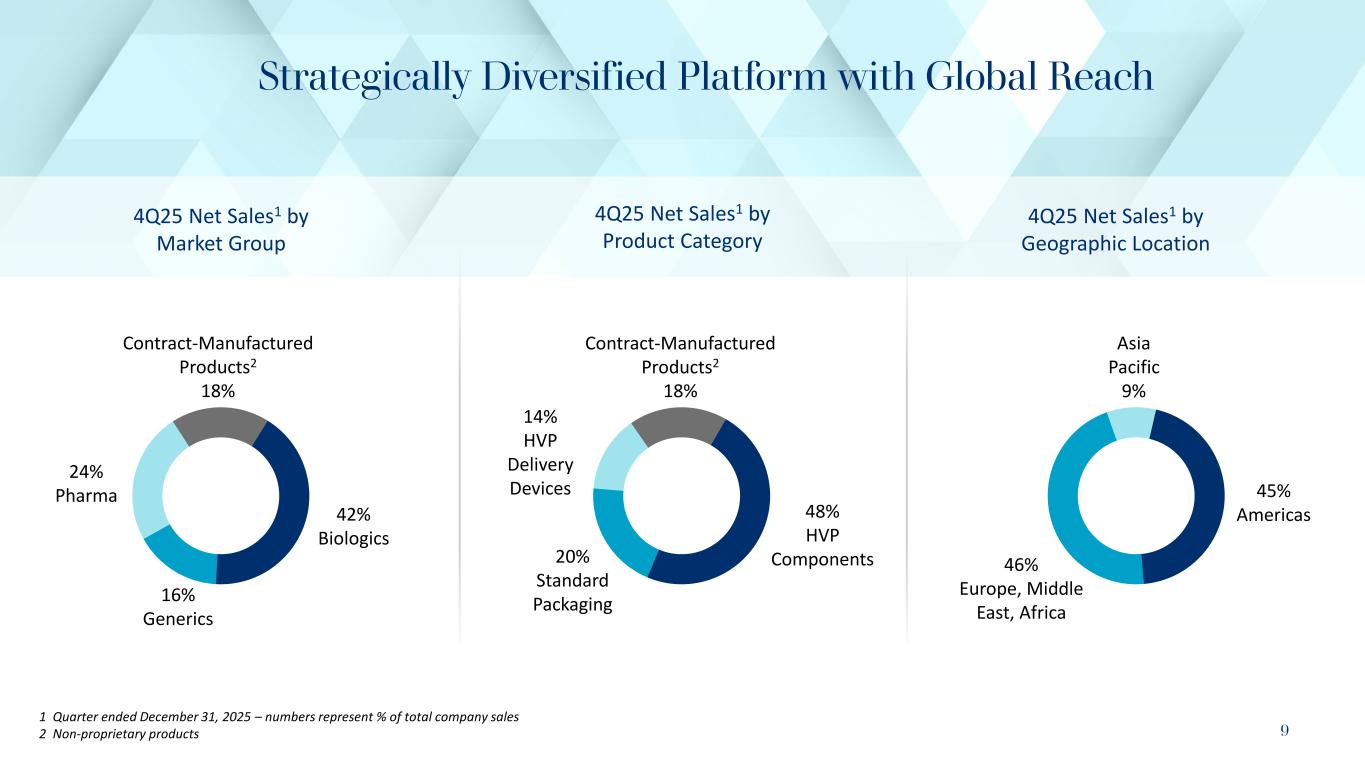

9 Strategically Diversified Platform with Global Reach 1 Quarter ended December 31, 2025 – numbers represent % of total company sales 2 Non-proprietary products 45% Americas 46% Europe, Middle East, Africa Asia Pacific 9% 4Q25 Net Sales1 by Geographic Location 48% HVP Components20% Standard Packaging 14% HVP Delivery Devices Contract-Manufactured Products2 18% 4Q25 Net Sales1 by Product Category 42% Biologics 16% Generics 24% Pharma 4Q25 Net Sales1 by Market Group Contract-Manufactured Products2 18%

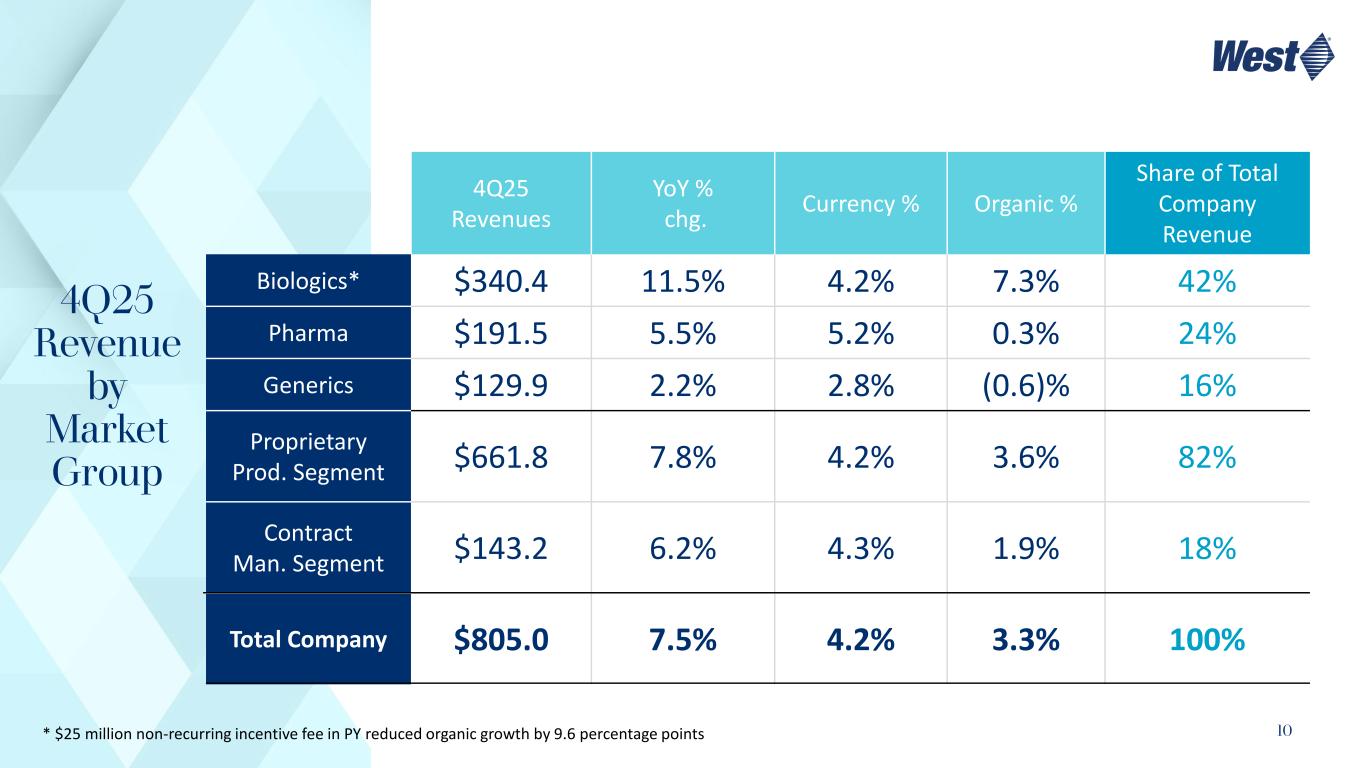

10 4Q25 Revenue by Market Group 4Q25 Revenues YoY % chg. Currency % Organic % Share of Total Company Revenue Biologics* $340.4 11.5% 4.2% 7.3% 42% Pharma $191.5 5.5% 5.2% 0.3% 24% Generics $129.9 2.2% 2.8% (0.6)% 16% Proprietary Prod. Segment $661.8 7.8% 4.2% 3.6% 82% Contract Man. Segment $143.2 6.2% 4.3% 1.9% 18% Total Company $805.0 7.5% 4.2% 3.3% 100% * $25 million non-recurring incentive fee in PY reduced organic growth by 9.6 percentage points

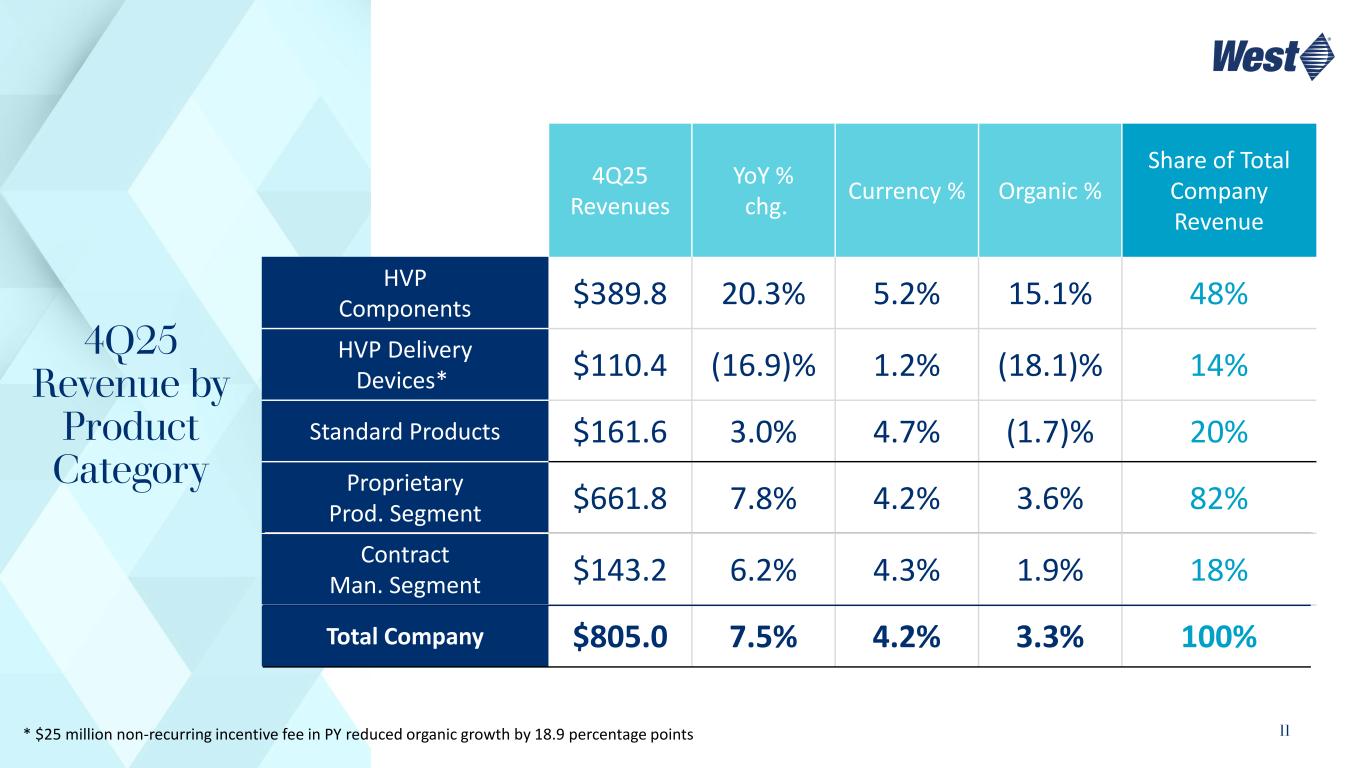

11 4Q25 Revenue by Product Category 4Q25 Revenues YoY % chg. Currency % Organic % Share of Total Company Revenue HVP Components $389.8 20.3% 5.2% 15.1% 48% HVP Delivery Devices* $110.4 (16.9)% 1.2% (18.1)% 14% Standard Products $161.6 3.0% 4.7% (1.7)% 20% Proprietary Prod. Segment $661.8 7.8% 4.2% 3.6% 82% Contract Man. Segment $143.2 6.2% 4.3% 1.9% 18% Total Company $805.0 7.5% 4.2% 3.3% 100% * $25 million non-recurring incentive fee in PY reduced organic growth by 18.9 percentage points

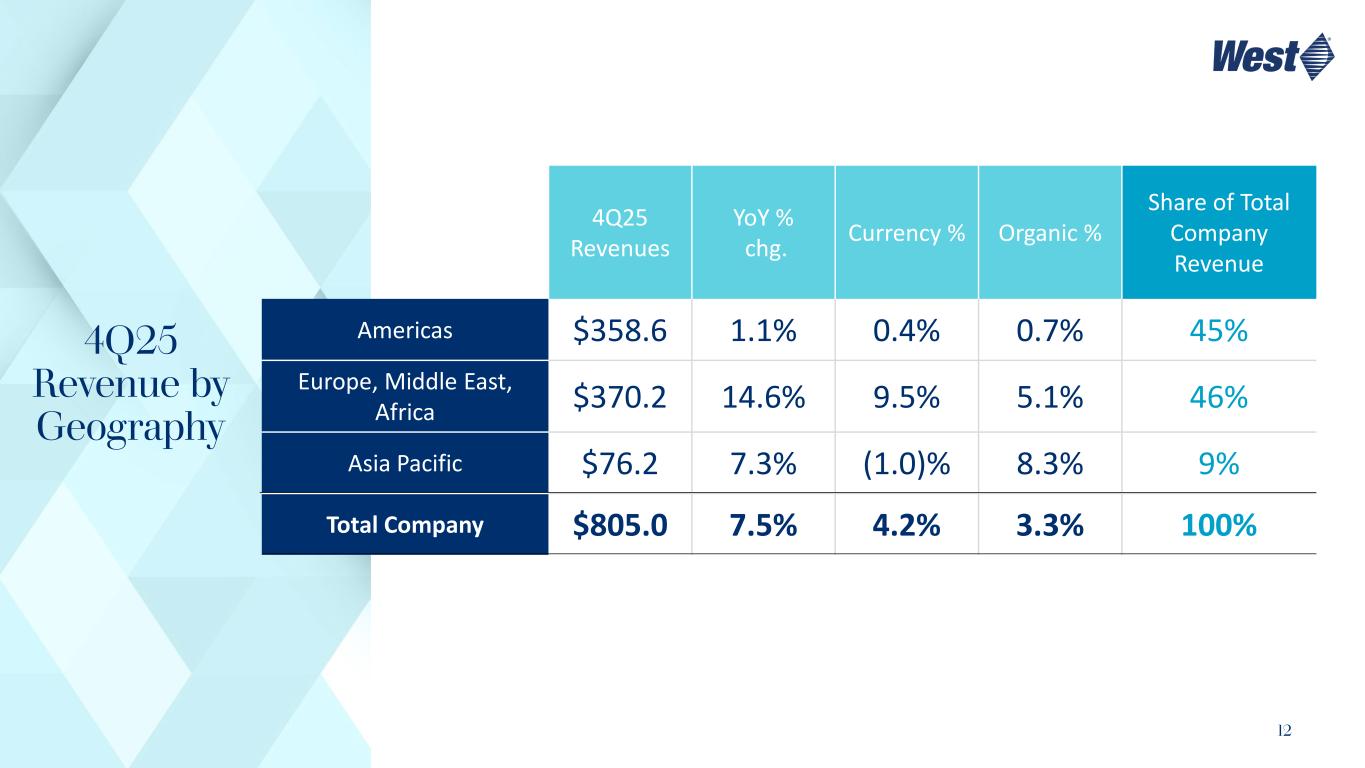

12 4Q25 Revenue by Geography 4Q25 Revenues YoY % chg. Currency % Organic % Share of Total Company Revenue Americas $358.6 1.1% 0.4% 0.7% 45% Europe, Middle East, Africa $370.2 14.6% 9.5% 5.1% 46% Asia Pacific $76.2 7.3% (1.0)% 8.3% 9% Total Company $805.0 7.5% 4.2% 3.3% 100%

Change in Consolidated Net Sales 4Q25 vs. 4Q24 ($ millions) $748.8 ($25.0) $11.7 $38.0 $31.5 $805.0 4Q24 PY Customer Incentives CY Sales Price Volume & Mix Fx. Translation 4Q25 13

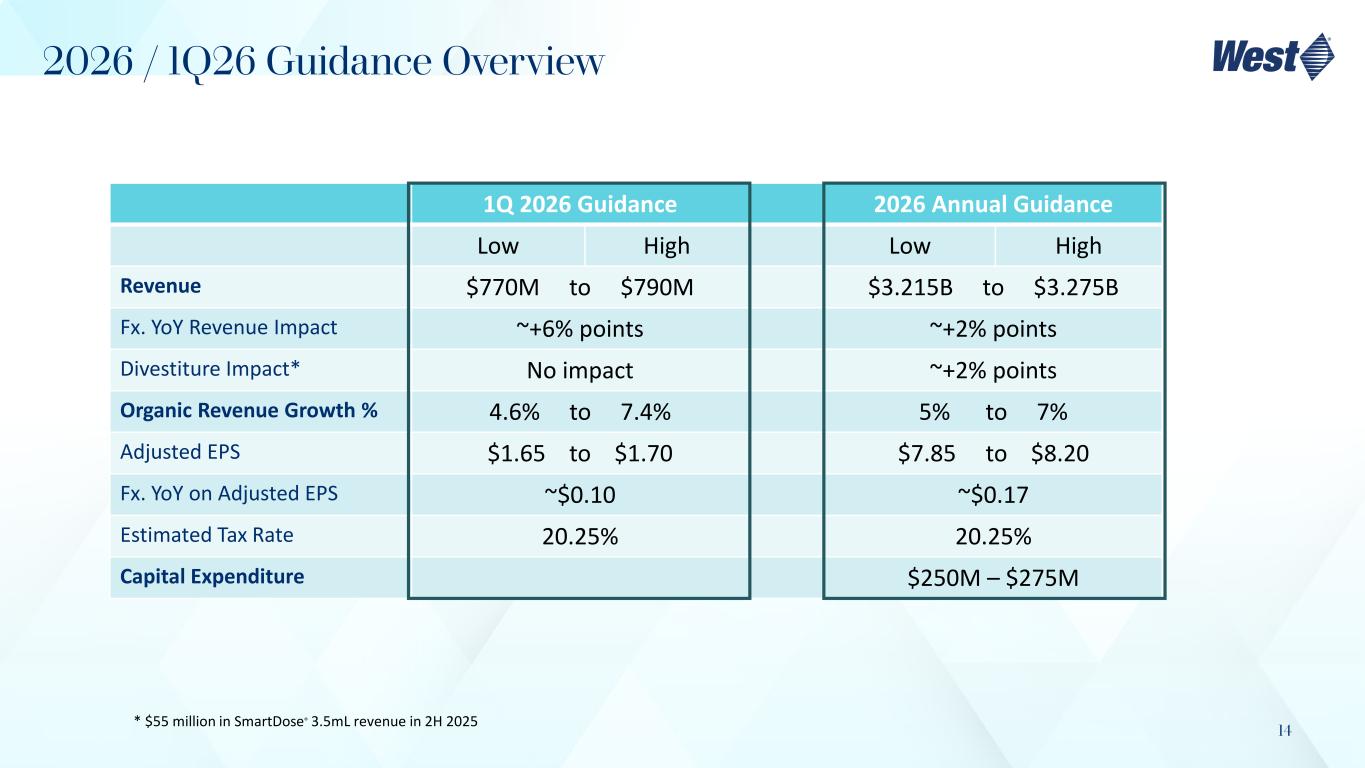

14 1Q 2026 Guidance 2026 Annual Guidance Low High Low High Revenue $770M to $790M $3.215B to $3.275B Fx. YoY Revenue Impact ~+6% points ~+2% points Divestiture Impact* No impact ~+2% points Organic Revenue Growth % 4.6% to 7.4% 5% to 7% Adjusted EPS $1.65 to $1.70 $7.85 to $8.20 Fx. YoY on Adjusted EPS ~$0.10 ~$0.17 Estimated Tax Rate 20.25% 20.25% Capital Expenditure $250M – $275M 2026 / 1Q26 Guidance Overview * $55 million in SmartDose® 3.5mL revenue in 2H 2025

Investor Relations contact: https://investor.westpharma.com /contact-investor-relations www.westpharma.com

Notes to Non-U.S. GAAP Financial Measures The Non-U.S. GAAP financial measures are incorporated into our discussion and analysis as management uses them in evaluating our results of operations and believes that this information provides users a valuable insight into our overall performance and financial position. A reconciliation of these adjusted Non-U.S. GAAP financial measures to the comparable U.S. GAAP financial measures is included in the accompanying tables and today's press release. For the purpose of aiding the comparison of our year-over-year results, we may refer to net sales and other financial results excluding the effects of changes in foreign currency exchange rates. Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. We may also refer to financial results excluding the effects of unallocated items. The re-measured results excluding effects from currency translation, the impact from acquisitions and/or divestitures, and the effects of unallocated items are not in conformity with U.S. GAAP and should not be used as a substitute for the comparable U.S. GAAP financial measures.

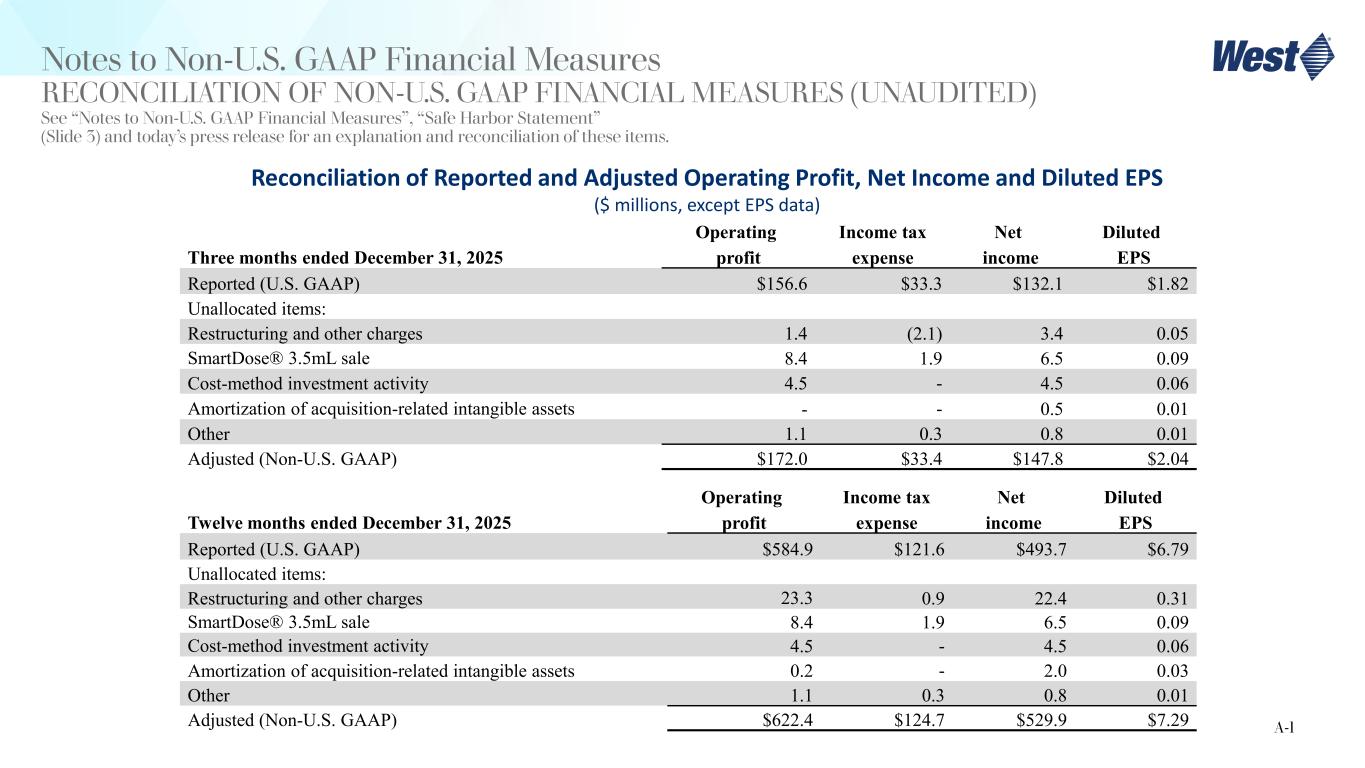

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended December 31, 2025 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $156.6 $33.3 $132.1 $1.82 Unallocated items: Restructuring and other charges 1.4 (2.1) 3.4 0.05 SmartDose® 3.5mL sale 8.4 1.9 6.5 0.09 Cost-method investment activity 4.5 - 4.5 0.06 Amortization of acquisition-related intangible assets - - 0.5 0.01 Other 1.1 0.3 0.8 0.01 Adjusted (Non-U.S. GAAP) $172.0 $33.4 $147.8 $2.04 Twelve months ended December 31, 2025 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $584.9 $121.6 $493.7 $6.79 Unallocated items: Restructuring and other charges 23.3 0.9 22.4 0.31 SmartDose® 3.5mL sale 8.4 1.9 6.5 0.09 Cost-method investment activity 4.5 - 4.5 0.06 Amortization of acquisition-related intangible assets 0.2 - 2.0 0.03 Other 1.1 0.3 0.8 0.01 Adjusted (Non-U.S. GAAP) $622.4 $124.7 $529.9 $7.29 A-1

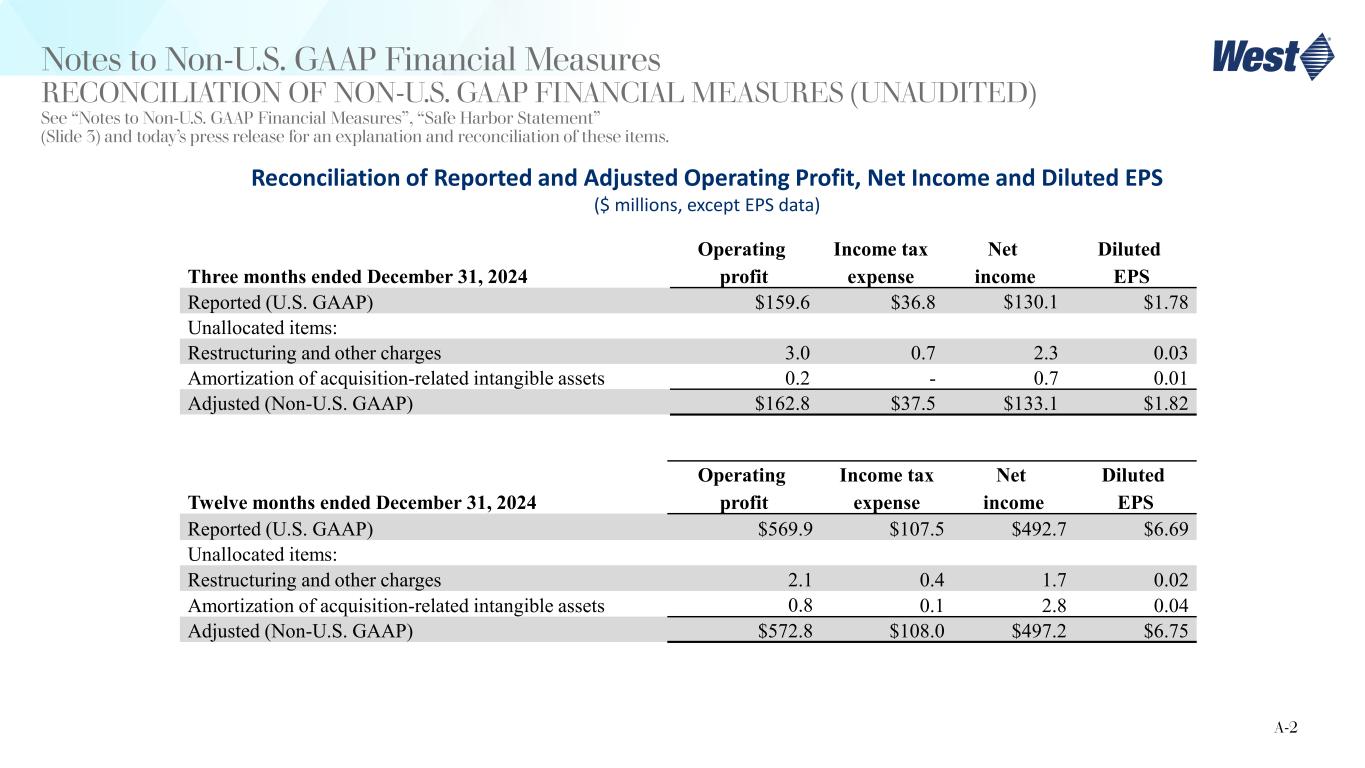

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended December 31, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $159.6 $36.8 $130.1 $1.78 Unallocated items: Restructuring and other charges 3.0 0.7 2.3 0.03 Amortization of acquisition-related intangible assets 0.2 - 0.7 0.01 Adjusted (Non-U.S. GAAP) $162.8 $37.5 $133.1 $1.82 Twelve months ended December 31, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $569.9 $107.5 $492.7 $6.69 Unallocated items: Restructuring and other charges 2.1 0.4 1.7 0.02 Amortization of acquisition-related intangible assets 0.8 0.1 2.8 0.04 Adjusted (Non-U.S. GAAP) $572.8 $108.0 $497.2 $6.75 A-2

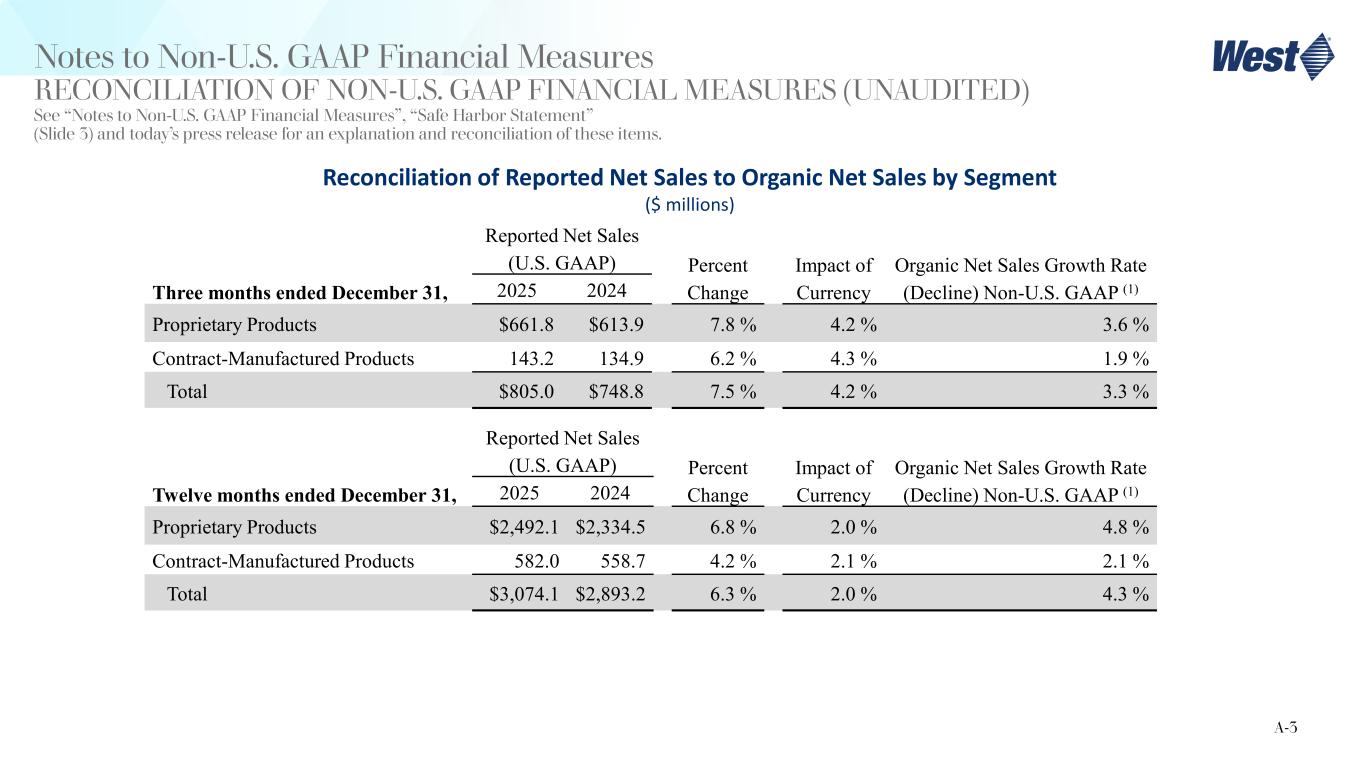

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported Net Sales to Organic Net Sales by Segment ($ millions) Three months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Proprietary Products $661.8 $613.9 7.8 % 4.2 % 3.6 % Contract-Manufactured Products 143.2 134.9 6.2 % 4.3 % 1.9 % Total $805.0 $748.8 7.5 % 4.2 % 3.3 % Twelve months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Proprietary Products $2,492.1 $2,334.5 6.8 % 2.0 % 4.8 % Contract-Manufactured Products 582.0 558.7 4.2 % 2.1 % 2.1 % Total $3,074.1 $2,893.2 6.3 % 2.0 % 4.3 % A-3

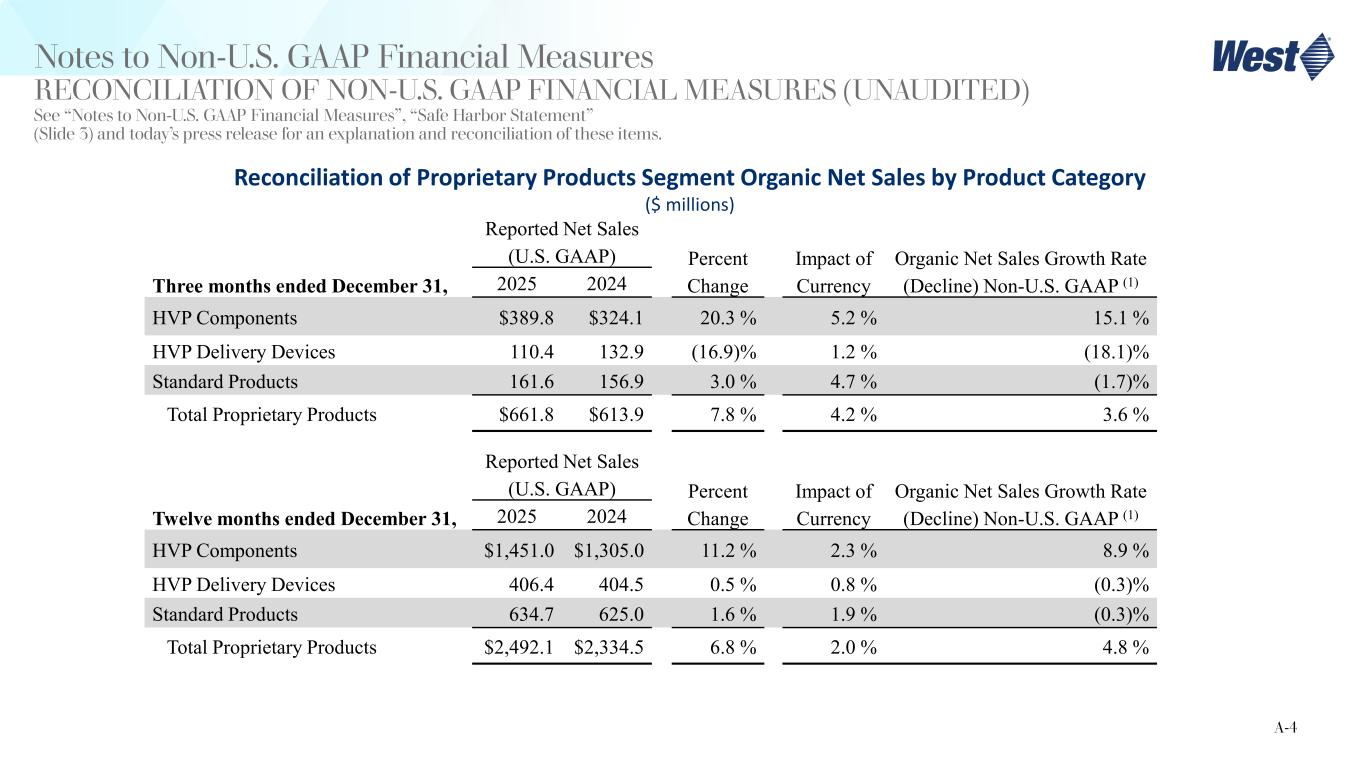

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Proprietary Products Segment Organic Net Sales by Product Category ($ millions) Three months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 HVP Components $389.8 $324.1 20.3 % 5.2 % 15.1 % HVP Delivery Devices 110.4 132.9 (16.9)% 1.2 % (18.1)% Standard Products 161.6 156.9 3.0 % 4.7 % (1.7)% Total Proprietary Products $661.8 $613.9 7.8 % 4.2 % 3.6 % Twelve months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 HVP Components $1,451.0 $1,305.0 11.2 % 2.3 % 8.9 % HVP Delivery Devices 406.4 404.5 0.5 % 0.8 % (0.3)% Standard Products 634.7 625.0 1.6 % 1.9 % (0.3)% Total Proprietary Products $2,492.1 $2,334.5 6.8 % 2.0 % 4.8 % A-4

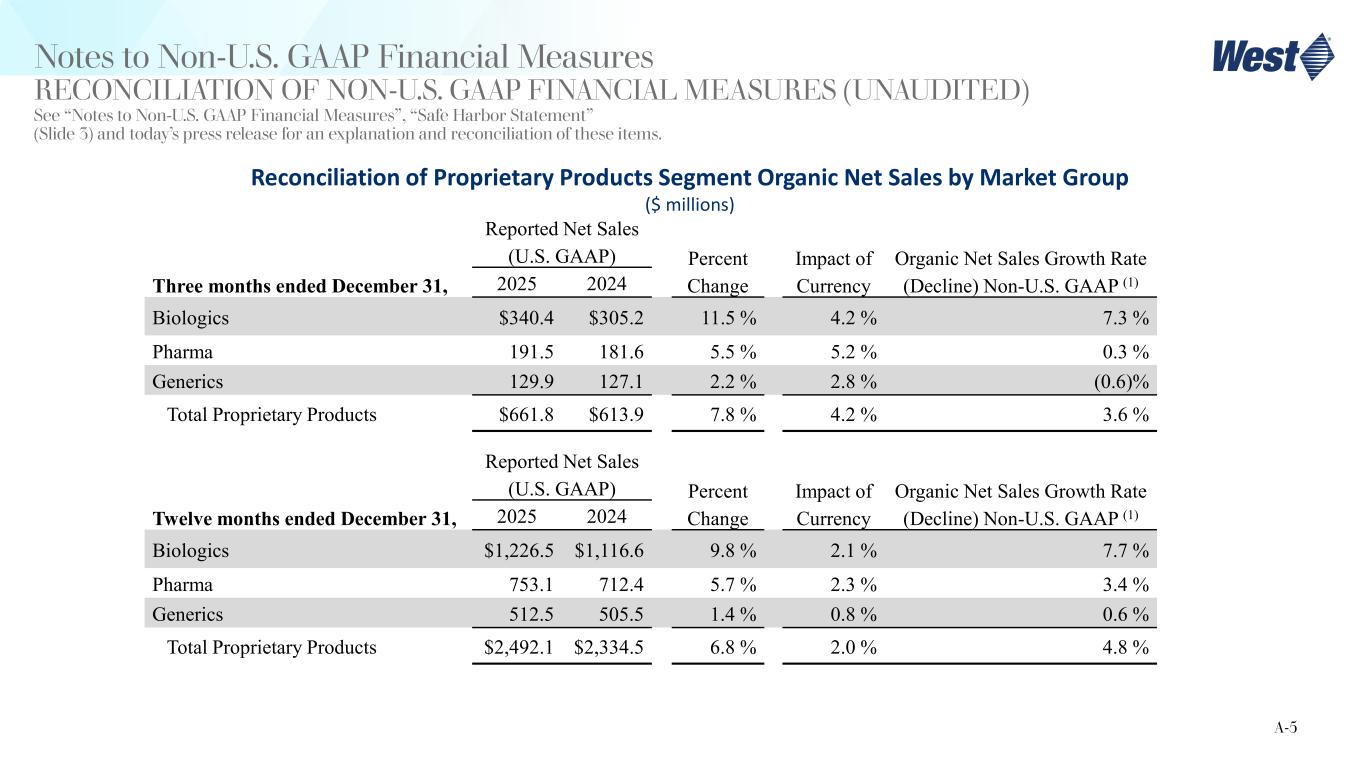

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Proprietary Products Segment Organic Net Sales by Market Group ($ millions) Three months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Biologics $340.4 $305.2 11.5 % 4.2 % 7.3 % Pharma 191.5 181.6 5.5 % 5.2 % 0.3 % Generics 129.9 127.1 2.2 % 2.8 % (0.6)% Total Proprietary Products $661.8 $613.9 7.8 % 4.2 % 3.6 % Twelve months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Biologics $1,226.5 $1,116.6 9.8 % 2.1 % 7.7 % Pharma 753.1 712.4 5.7 % 2.3 % 3.4 % Generics 512.5 505.5 1.4 % 0.8 % 0.6 % Total Proprietary Products $2,492.1 $2,334.5 6.8 % 2.0 % 4.8 % A-5

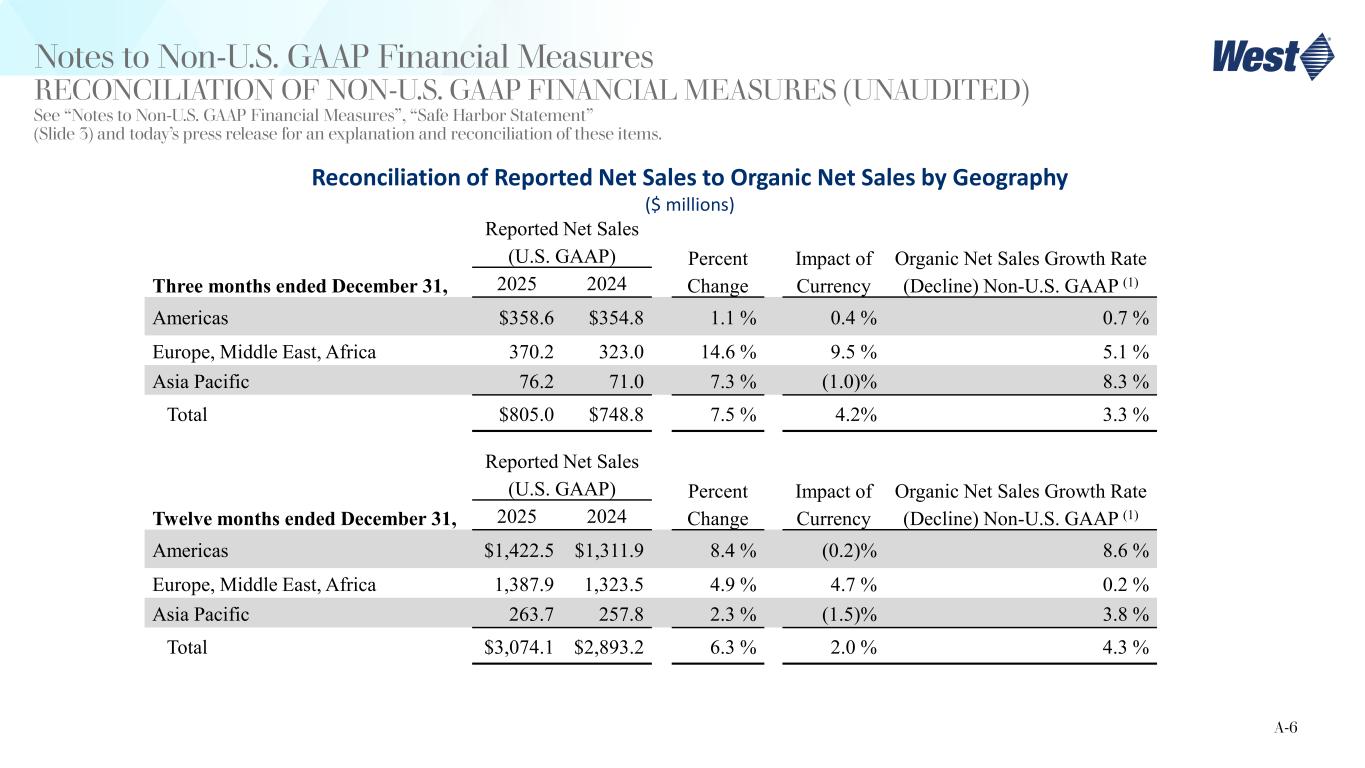

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported Net Sales to Organic Net Sales by Geography ($ millions) Three months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Americas $358.6 $354.8 1.1 % 0.4 % 0.7 % Europe, Middle East, Africa 370.2 323.0 14.6 % 9.5 % 5.1 % Asia Pacific 76.2 71.0 7.3 % (1.0)% 8.3 % Total $805.0 $748.8 7.5 % 4.2% 3.3 % Twelve months ended December 31, Reported Net Sales (U.S. GAAP) Percent Change Impact of Currency Organic Net Sales Growth Rate (Decline) Non-U.S. GAAP (1)2025 2024 Americas $1,422.5 $1,311.9 8.4 % (0.2)% 8.6 % Europe, Middle East, Africa 1,387.9 1,323.5 4.9 % 4.7 % 0.2 % Asia Pacific 263.7 257.8 2.3 % (1.5)% 3.8 % Total $3,074.1 $2,893.2 6.3 % 2.0 % 4.3 % A-6

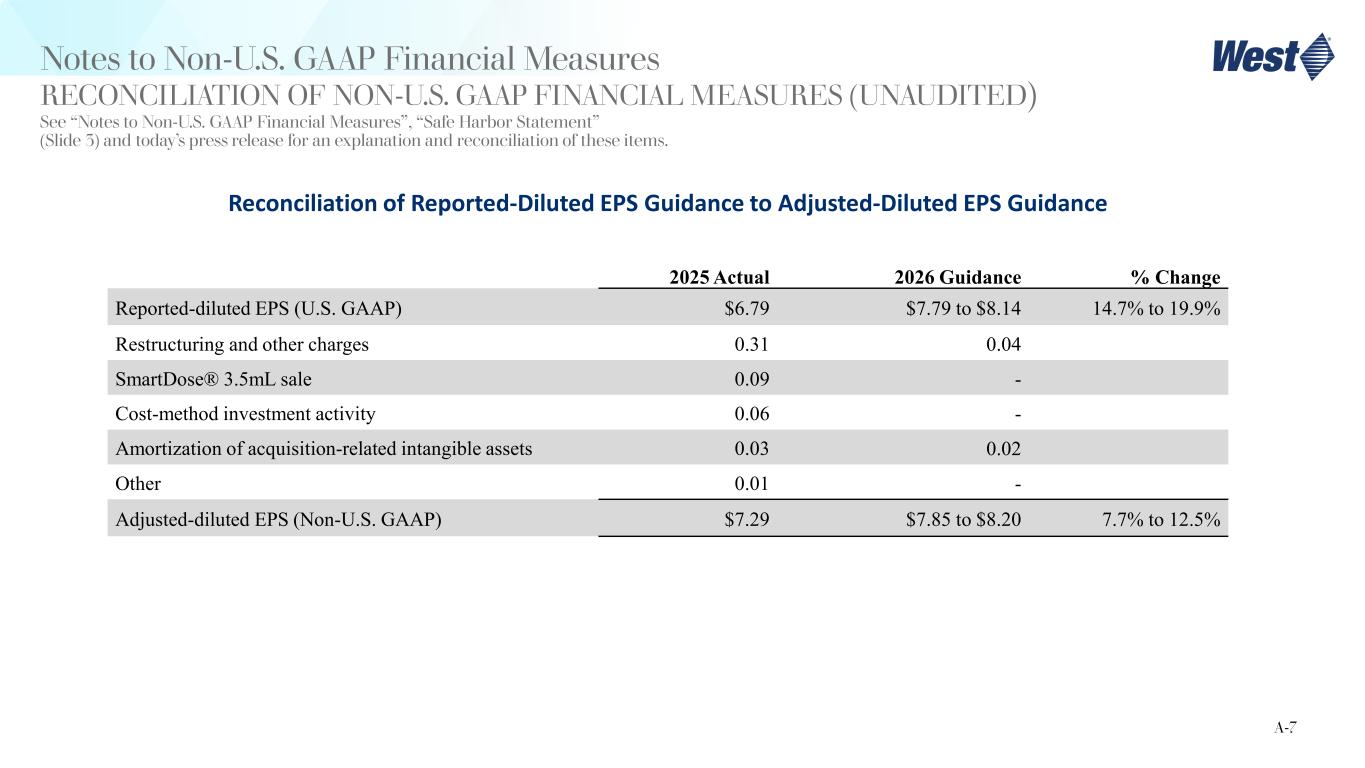

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 3) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported-Diluted EPS Guidance to Adjusted-Diluted EPS Guidance 2025 Actual 2026 Guidance % Change Reported-diluted EPS (U.S. GAAP) $6.79 $7.79 to $8.14 14.7% to 19.9% Restructuring and other charges 0.31 0.04 SmartDose® 3.5mL sale 0.09 - Cost-method investment activity 0.06 - Amortization of acquisition-related intangible assets 0.03 0.02 Other 0.01 - Adjusted-diluted EPS (Non-U.S. GAAP) $7.29 $7.85 to $8.20 7.7% to 12.5% A-7

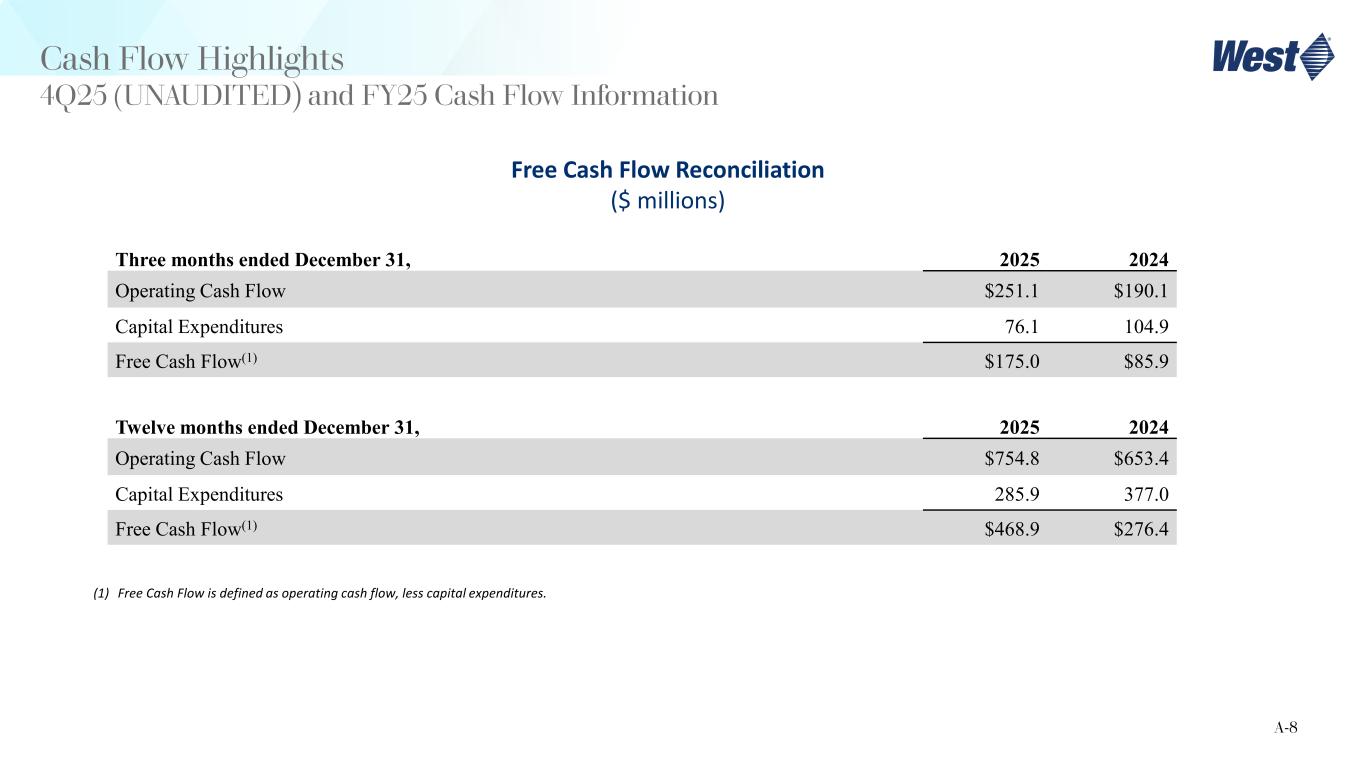

Cash Flow Highlights 4Q25 (UNAUDITED) and FY25 Cash Flow Information Free Cash Flow Reconciliation ($ millions) Three months ended December 31, 2025 2024 Operating Cash Flow $251.1 $190.1 Capital Expenditures 76.1 104.9 Free Cash Flow(1) $175.0 $85.9 (1) Free Cash Flow is defined as operating cash flow, less capital expenditures. A-8 Twelve months ended December 31, 2025 2024 Operating Cash Flow $754.8 $653.4 Capital Expenditures 285.9 377.0 Free Cash Flow(1) $468.9 $276.4