Accelerating Growth Rooted In Excellence Weyerhaeuser 2025 Investor Day December 11, 2025

Strategic Overview Strategic Overview DEVIN STOCKFISH | CHIEF EXECUTIVE OFFICER

Forward-Looking Statements & Non-GAAP Financial Measures

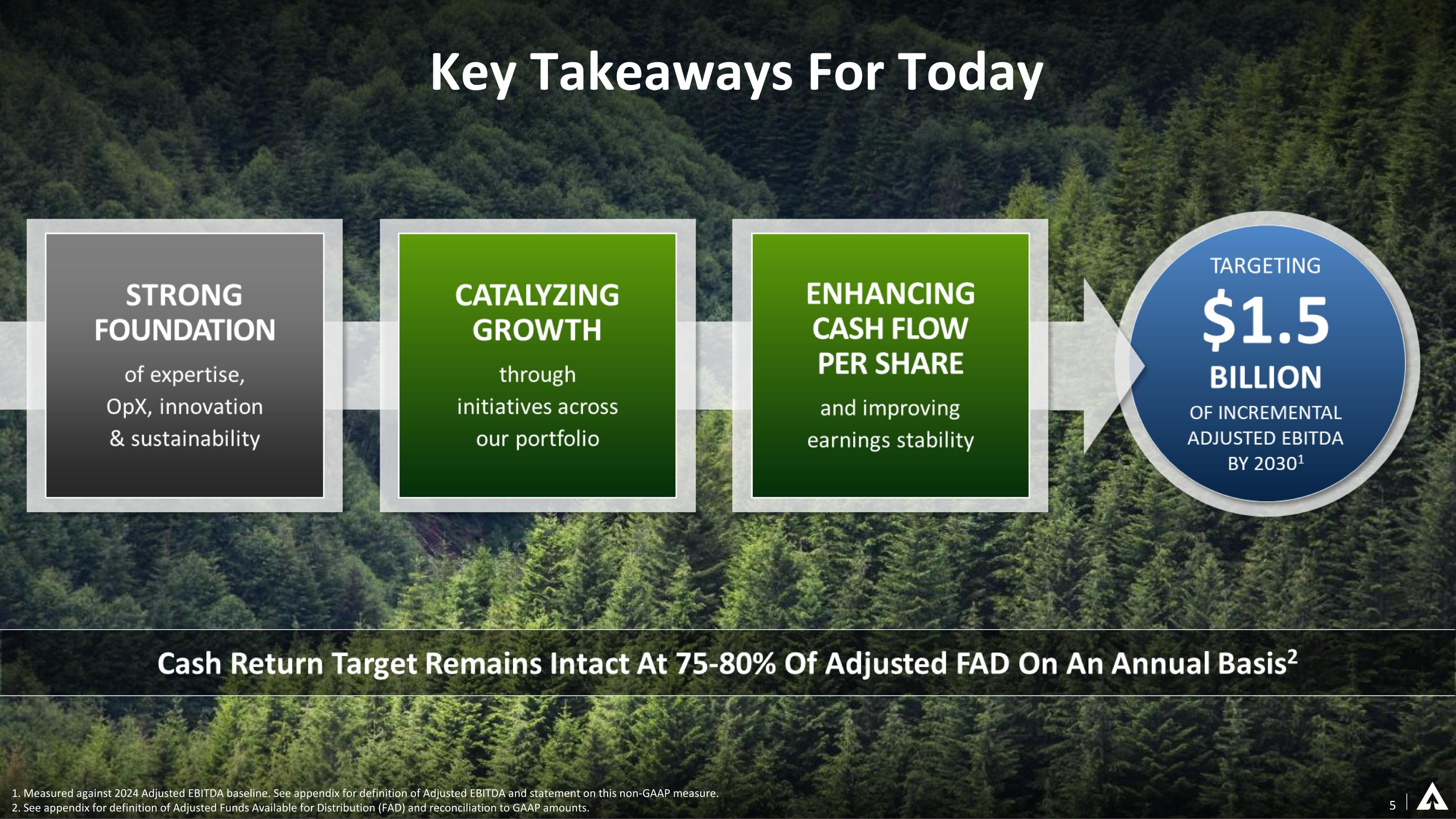

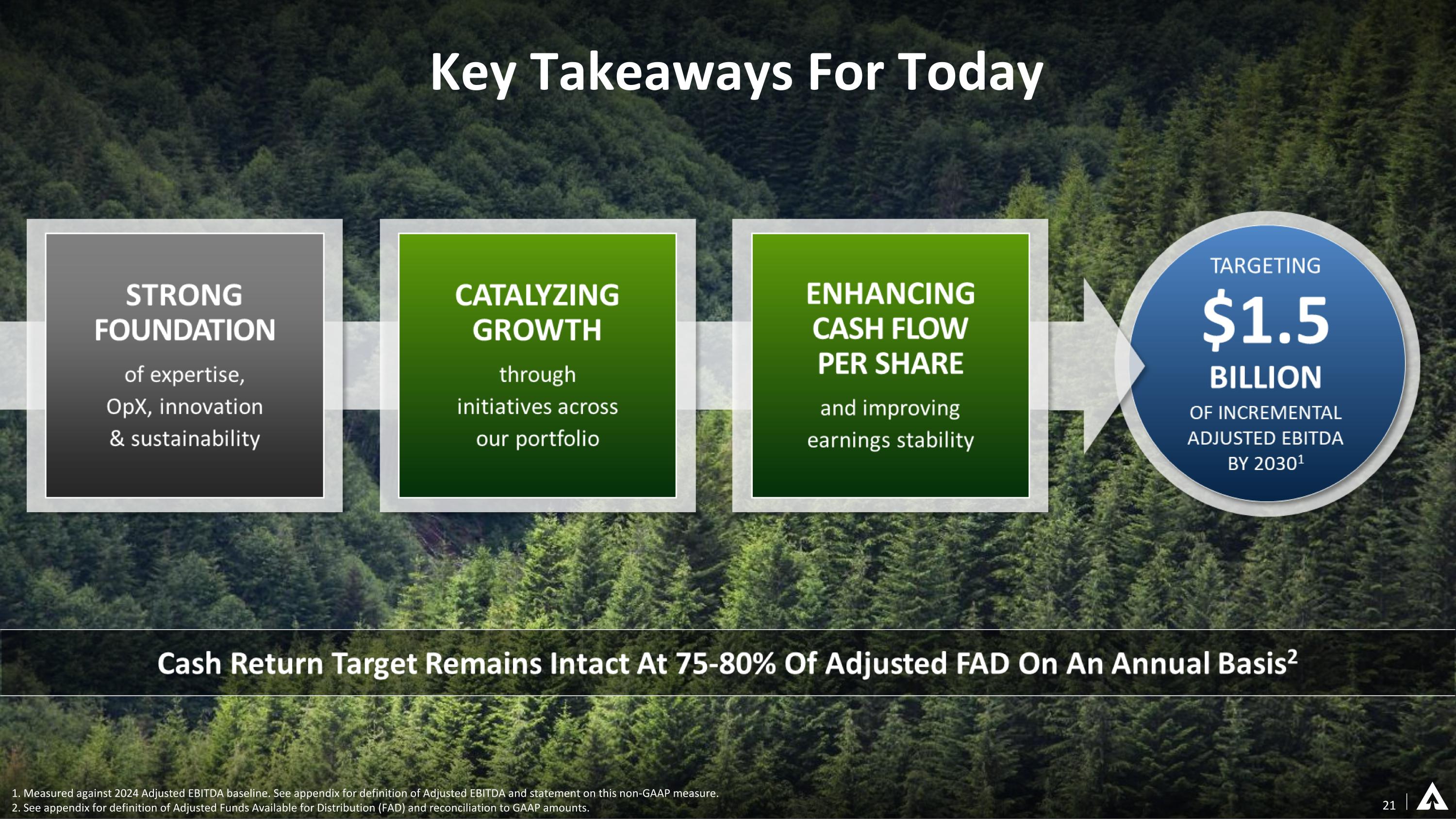

Key Takeaways For Today 5 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 2. See appendix for definition of Adjusted Funds Available for Distribution (FAD) and reconciliation to GAAP amounts.

Unmatched Portfolio With Complementary Industry-Leading Businesses 6 Our Foundation Is World Class New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. Approximate acreage, based on year-end 2024 and adjusted for completed and in-progress large-scale timberlands transactions announced in 2025. Excludes timber licenses in British Columbia, which are expected to be transferred to the buyer of WY’s former lumber mill in Princeton, B.C.

We Have A Strong Track Record Of Performance Improvement Solidified Credibility Through Repeatedly Setting & Meeting Aggressive Targets 2013 OpX Targets → Achieved • 2016 Plum Creek Synergy Targets → Achieved • 2021 Investor Day Targets → Achieved 7

We Are In A Class By Ourselves With Distinct Competitive Advantages

Our Integrated Model Is Intentional, Strategic & Integral To Driving Our Growth Plan $100+ Million Of Annual Uplift Opportunity Through Our Integrated Portfolio 1 1. Realizing approximately half of this amount today. Remaining opportunity to achieve $100+ million is reflected in our 2030 Adjusted EBITDA growth target, captured in Enterprise Initiatives.

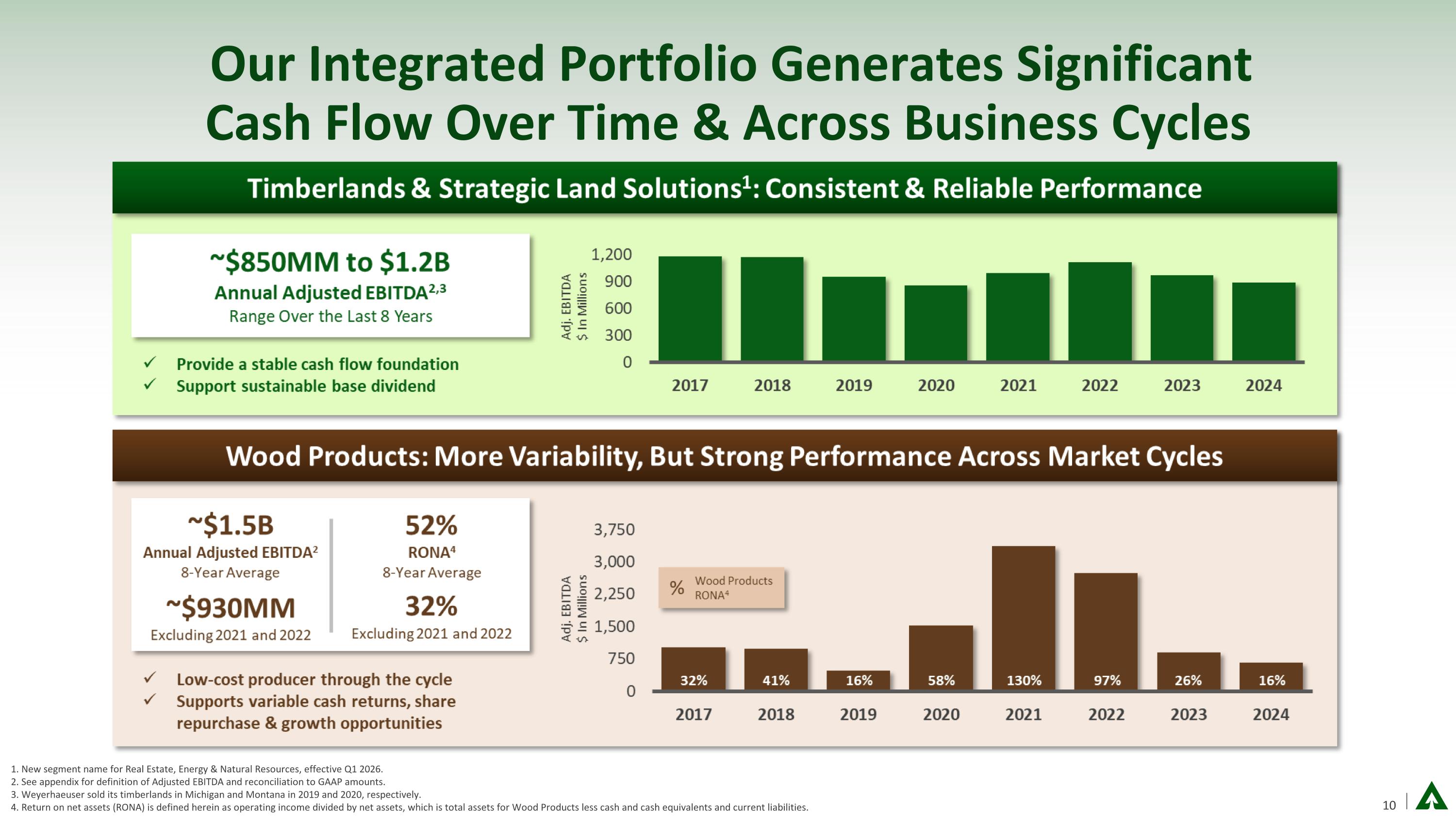

Our Integrated Portfolio Generates Significant Cash Flow Over Time & Across Business Cycles 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. See appendix for definition of Adjusted EBITDA and reconciliation to GAAP amounts. 3. Weyerhaeuser sold its timberlands in Michigan and Montana in 2019 and 2020, respectively. 4. Return on net assets (RONA) is defined herein as operating income divided by net assets, which is total assets for Wood Products less cash and cash equivalents and current liabilities.

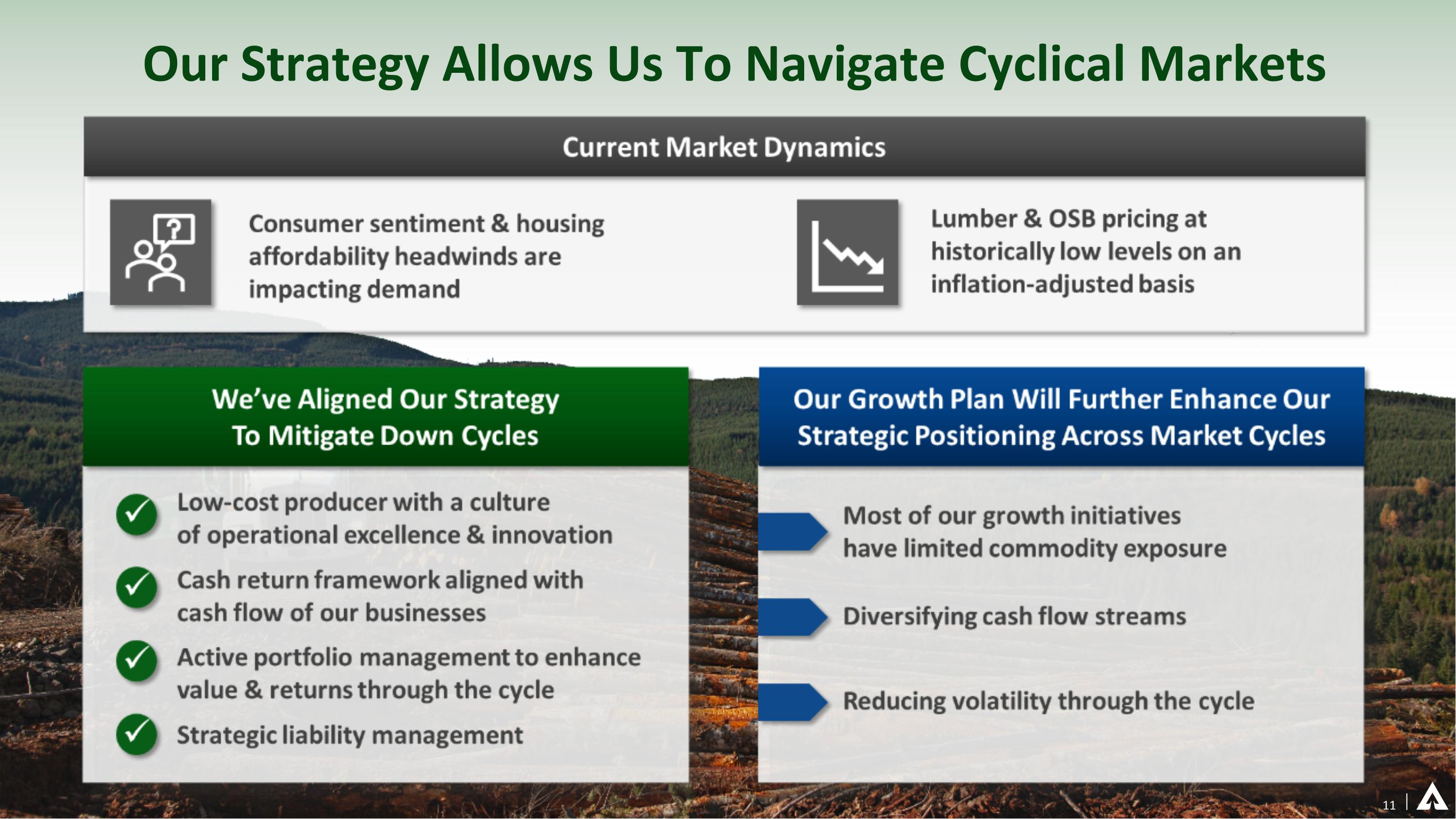

Our Strategy Allows Us To Navigate Cyclical Markets 11

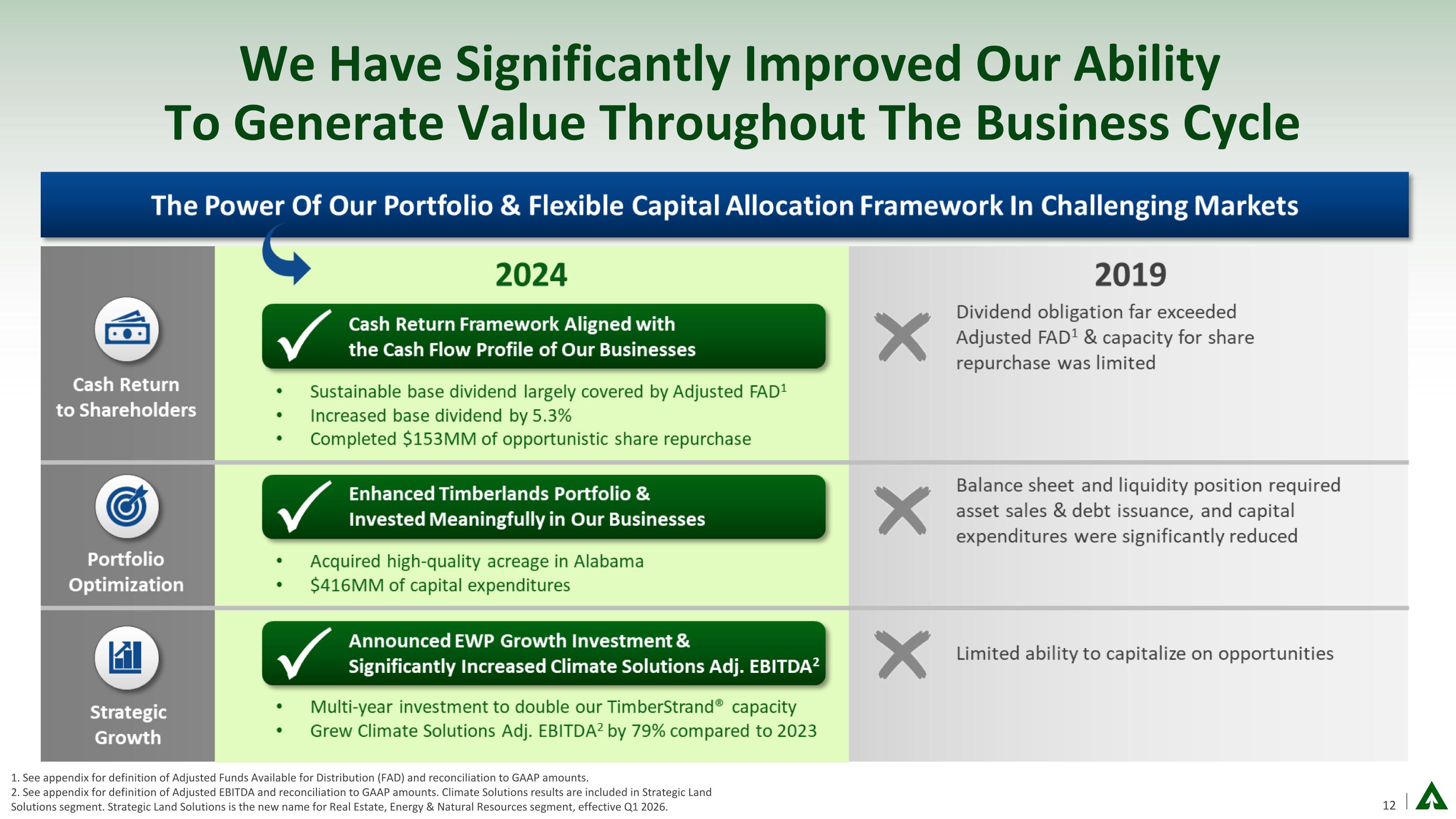

We Have Significantly Improved Our Ability To Generate Value Throughout The Business Cycle 1. See appendix for definition of Adjusted Funds Available for Distribution (FAD) and reconciliation to GAAP amounts. 2. See appendix for definition of Adjusted EBITDA and reconciliation to GAAP amounts. Climate Solutions results are included in Strategic Land Solutions segment. Strategic Land Solutions is the new name for Real Estate, Energy & Natural Resources segment, effective Q1 2026.

1. Multi-year targets established at previous Investor Day in September 2021. All targets are through year-end 2025. 2. Includes recently announced divestiture in Virginia, expected to close in early 2026. 3. See appendix for definition of Adjusted EBITDA and reconciliation to GAAP amounts. Climate Solutions results are included in Strategic Land Solutions segment. Strategic Land Solutions is the new name for Real Estate, Energy & Natural Resources segment, effective Q1 2026. 4. Compared to peers, which include Boise Cascade, Canfor, Interfor, Louisiana Pacific and West Fraser. Based on public filings for 2022-2024 and includes only North American operations. Lumber Adj. EBITDA margin includes expenses for softwood lumber countervailing and anti-dumping duties for all companies. 5. 2025 YTD includes all base dividend payments for the year and $150 million of share repurchase, which was our YTD repurchase activity as of September 30, 2025. We Achieved Our Multi-Year Targets 1

We Are Accelerating Growth Through 2030 14 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

15 Our Comprehensive Growth Plan Is Designed To Increase Cash Flow Across Market Cycles

We Have Numerous Growth Levers To Drive Success & Many Are Already Under Way 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. Represents incremental Adjusted EBITDA measured against 2024 baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

17 Our Growth Roadmap To 2030 Measured Against 2024 Baseline 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 3. See slides 18 and 94 for product pricing uplift considerations and assumptions.

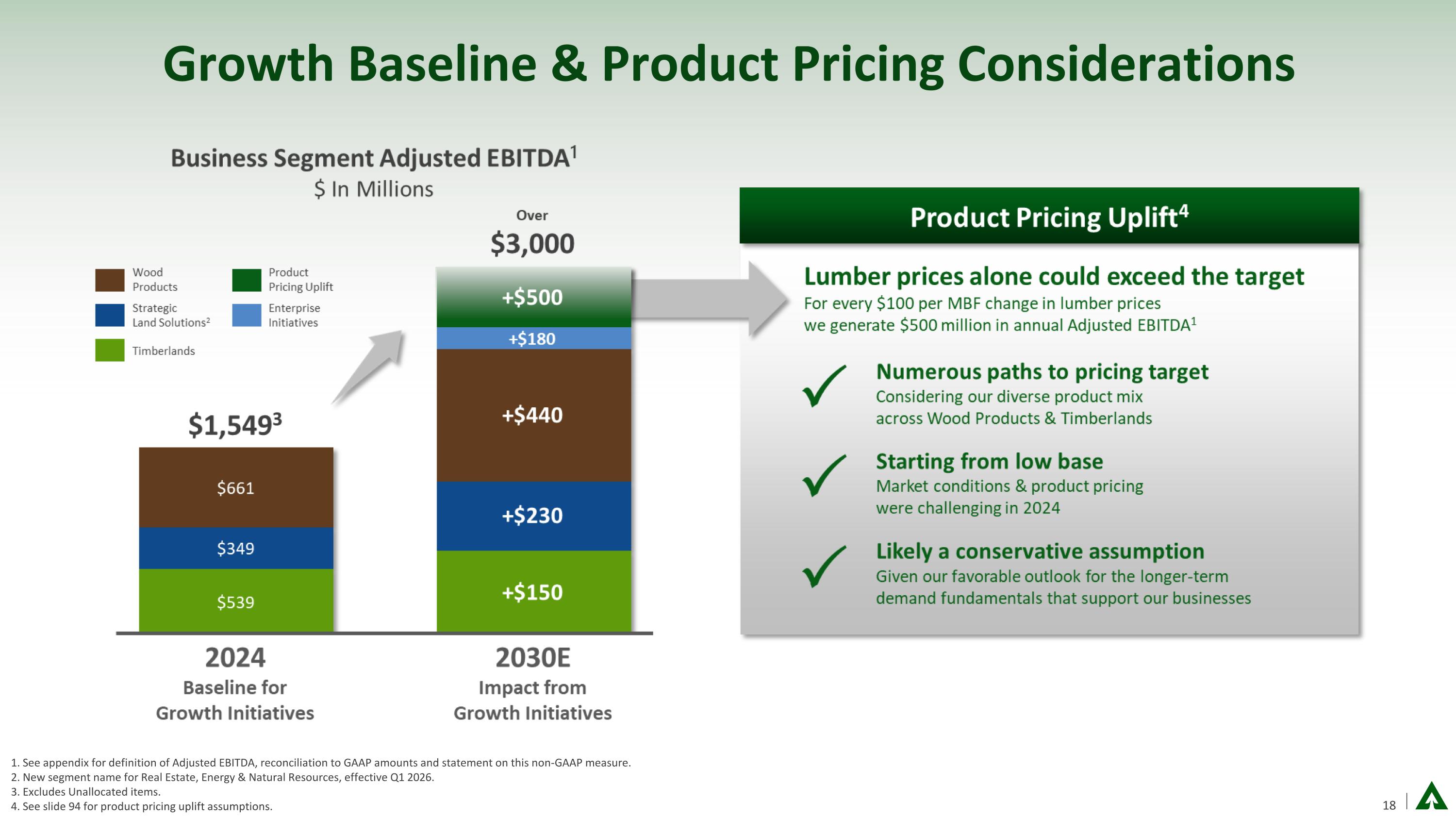

Growth Baseline & Product Pricing Considerations 1. See appendix for definition of Adjusted EBITDA, reconciliation to GAAP amounts and statement on this non-GAAP measure. 2. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 3. Excludes Unallocated items. 4. See slide 94 for product pricing uplift assumptions.

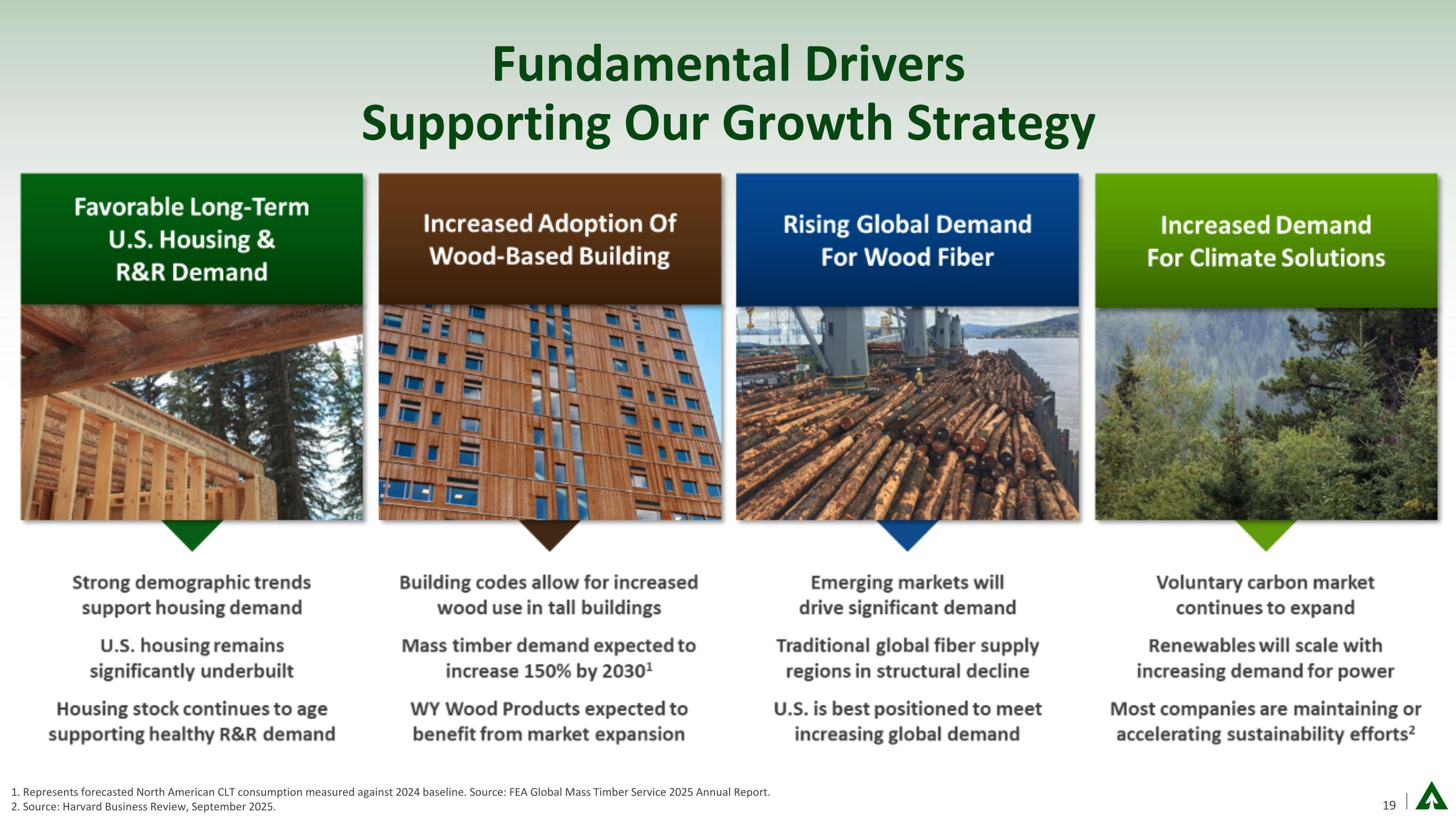

Fundamental Drivers Supporting Our Growth Strategy 1. Represents forecasted North American CLT consumption measured against 2024 baseline. Source: FEA Global Mass Timber Service 2025 Annual Report. 2. Source: Harvard Business Review, September 2025.

Achieving Excellence In People Development & Sustainability 20

Key Takeaways For Today 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 2. See appendix for definition of Adjusted Funds Available for Distribution (FAD) and reconciliation to GAAP amounts. 21

Timberlands TRAVIS KEATLEY | SENIOR VICE PRESIDENT

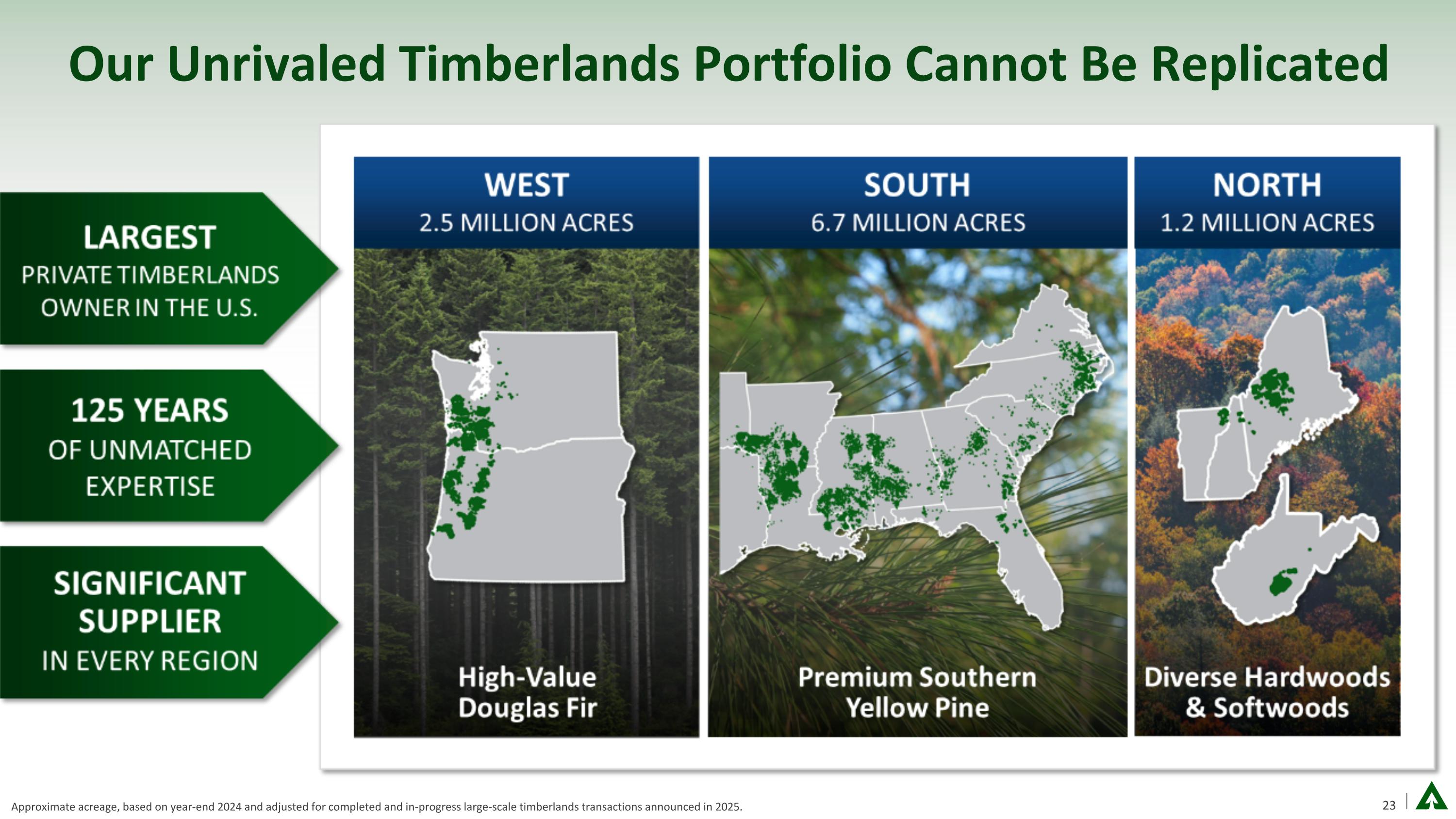

Our Unrivaled Timberlands Portfolio Cannot Be Replicated Approximate acreage, based on year-end 2024 and adjusted for completed and in-progress large-scale timberlands transactions announced in 2025.

Our Customer Mix Is Intentional & Strategic

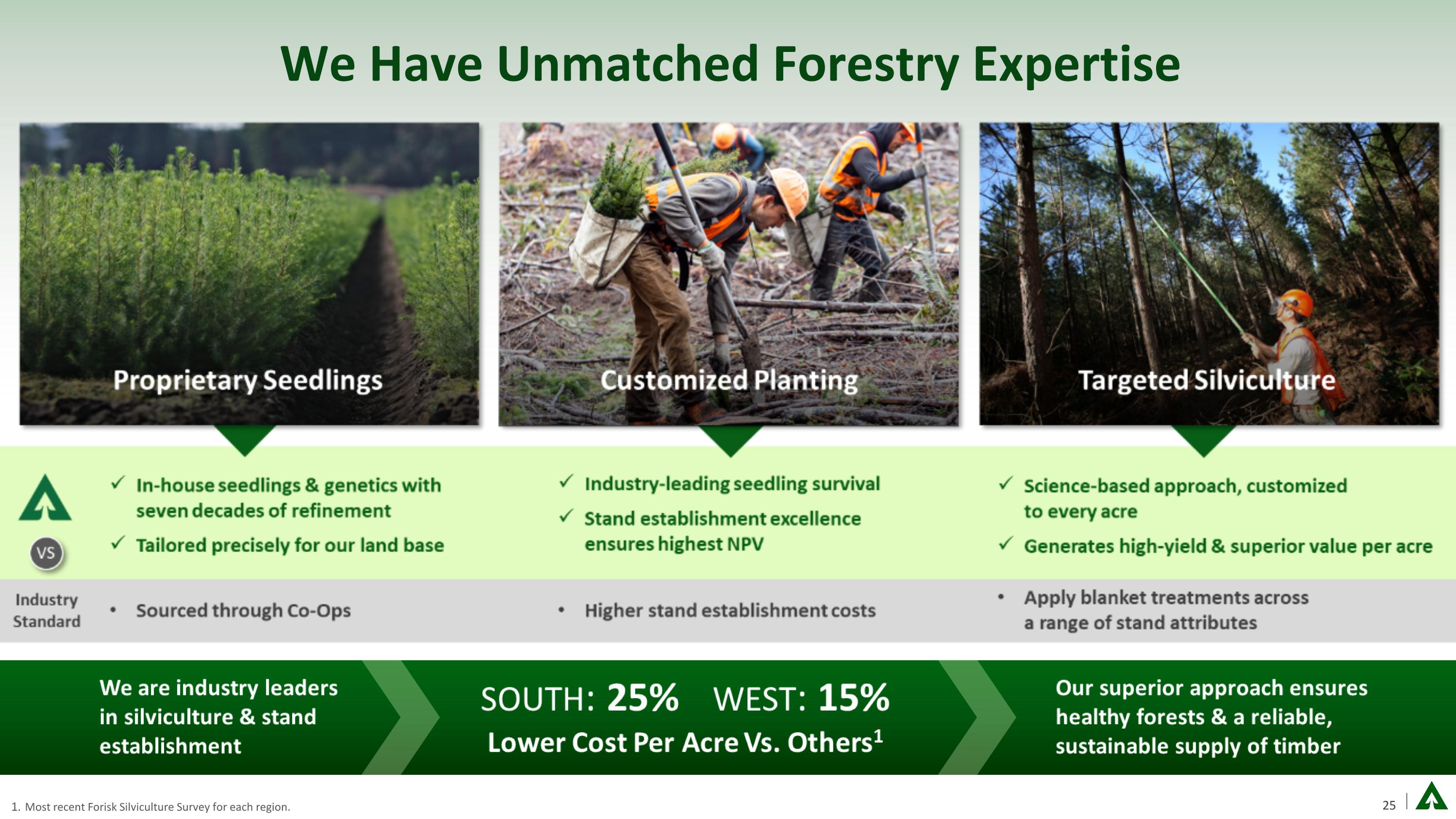

We Have Unmatched Forestry Expertise Most recent Forisk Silviculture Survey for each region.

Our Supply Chain Is Best In Class Most recent Forisk Silviculture Survey for each region.

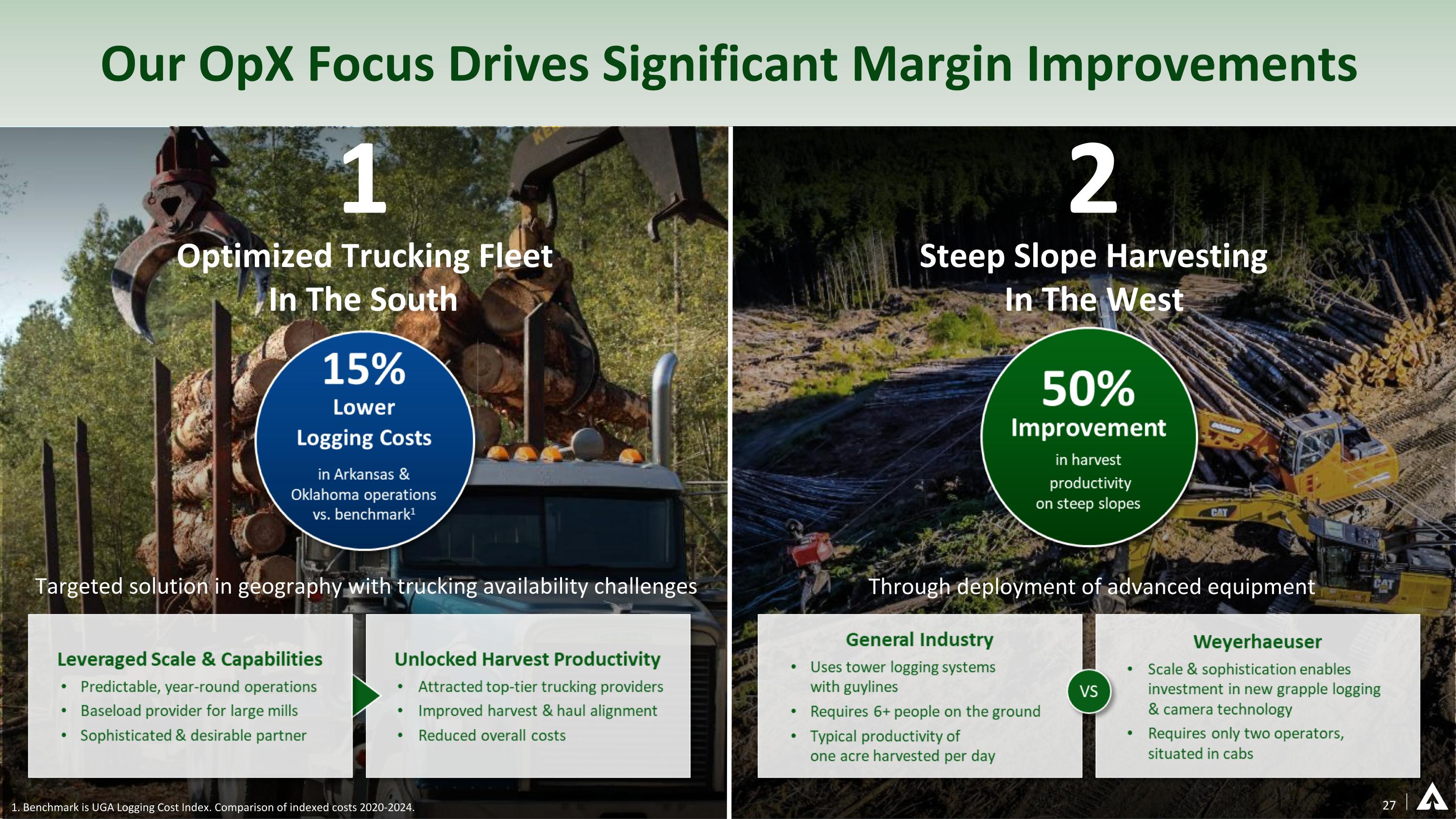

Our OpX Focus Drives Significant Margin Improvements 1 Optimized Trucking Fleet In The South 2 Steep Slope Harvesting In The West 27 Targeted solution in geography with trucking availability challenges Through deployment of advanced equipment 1. Benchmark is UGA Logging Cost Index. Comparison of indexed costs 2020-2024.

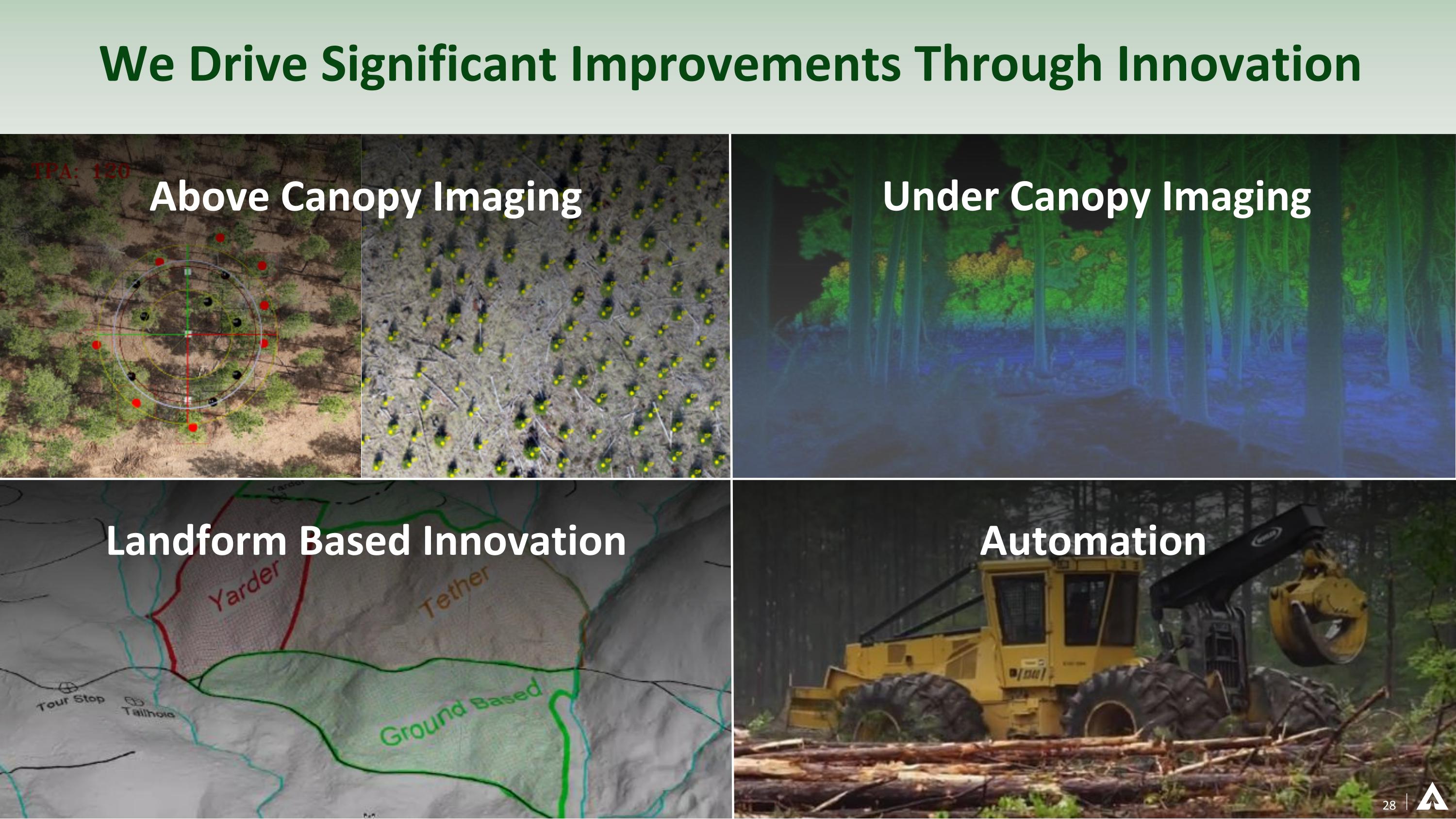

We Drive Significant Improvements Through Innovation Above Canopy Imaging Under Canopy Imaging Landform Based Innovation Automation 28

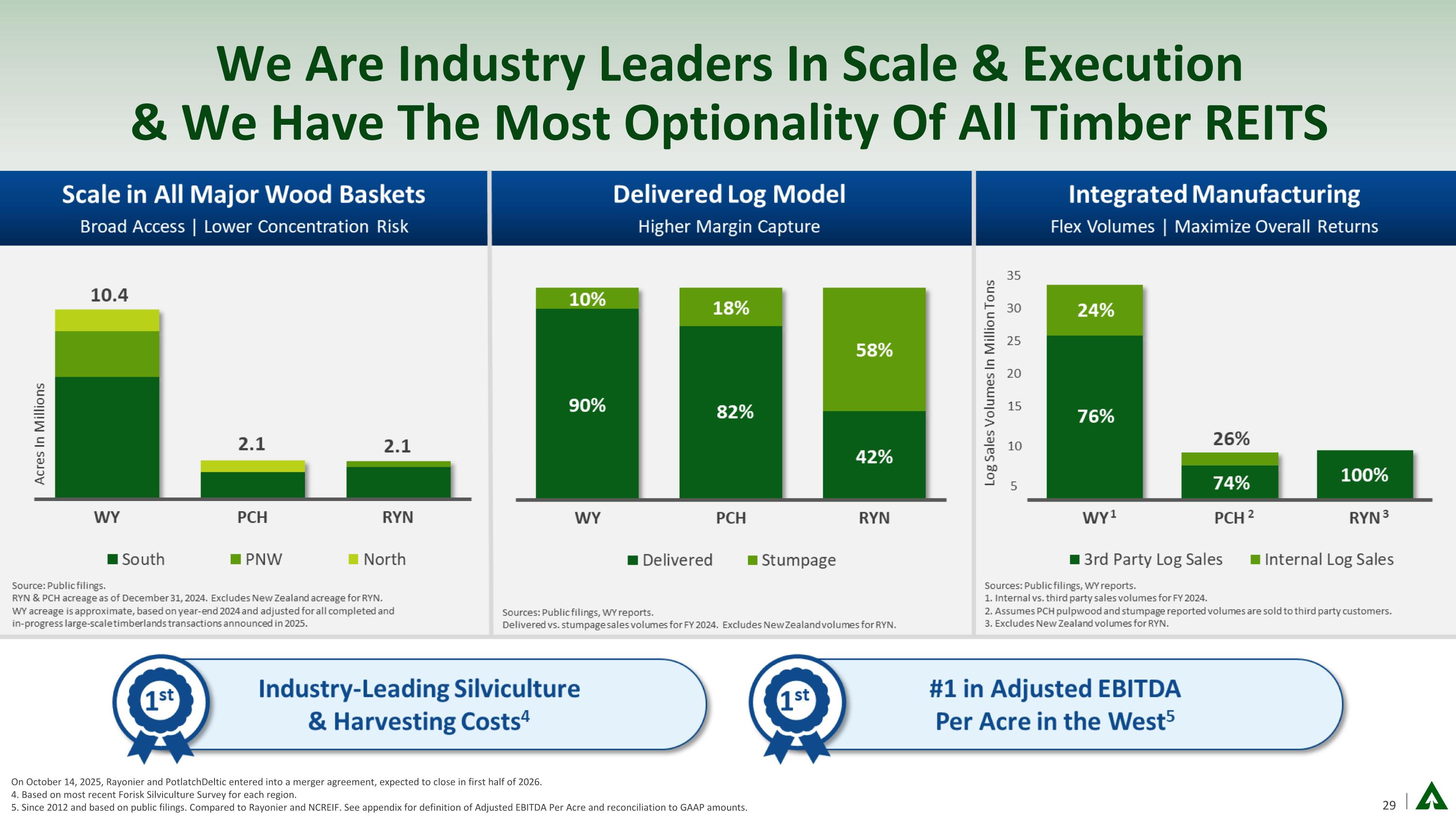

We Are Industry Leaders In Scale & Execution & We Have The Most Optionality Of All Timber REITS On October 14, 2025, Rayonier and PotlatchDeltic entered into a merger agreement, expected to close in first half of 2026. 4. Based on most recent Forisk Silviculture Survey for each region. 5. Since 2012 and based on public filings. Compared to Rayonier and NCREIF. See appendix for definition of Adjusted EBITDA Per Acre and reconciliation to GAAP amounts.

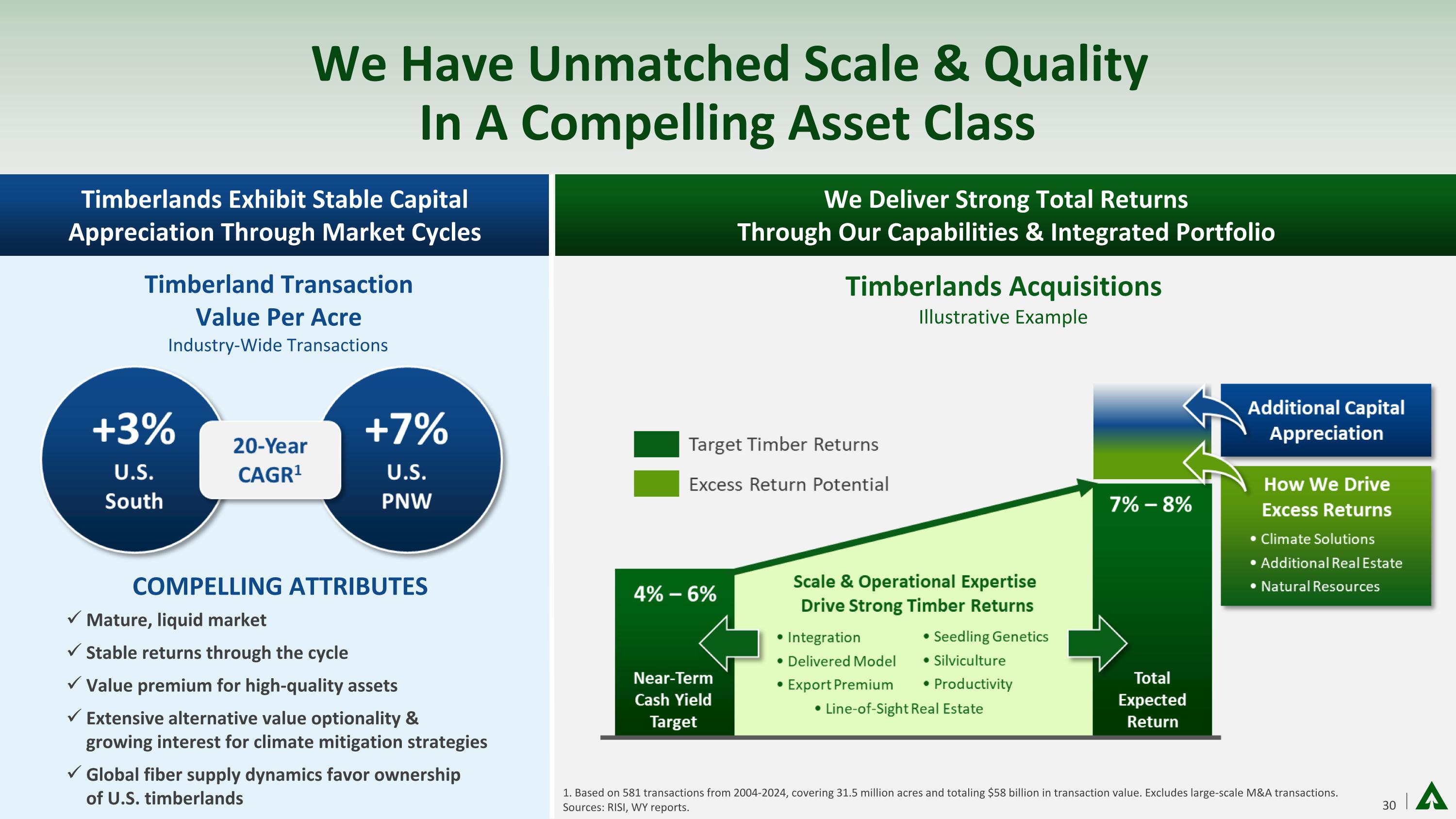

We Have Unmatched Scale & Quality In A Compelling Asset Class We Deliver Strong Total Returns Through Our Capabilities & Integrated Portfolio Timberlands Acquisitions Illustrative Example Timberland Transaction Value Per Acre Industry-Wide Transactions Mature, liquid market Stable returns through the cycle Value premium for high-quality assets Extensive alternative value optionality & growing interest for climate mitigation strategies Global fiber supply dynamics favor ownership of U.S. timberlands 1. Based on 581 transactions from 2004-2024, covering 31.5 million acres and totaling $58 billion in transaction value. Excludes large-scale M&A transactions. Sources: RISI, WY reports. COMPELLING ATTRIBUTES Timberlands Exhibit Stable Capital Appreciation Through Market Cycles 30

Unleashing The Next Phase Of Growth 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 1 Growth Initiatives: 4 2 3

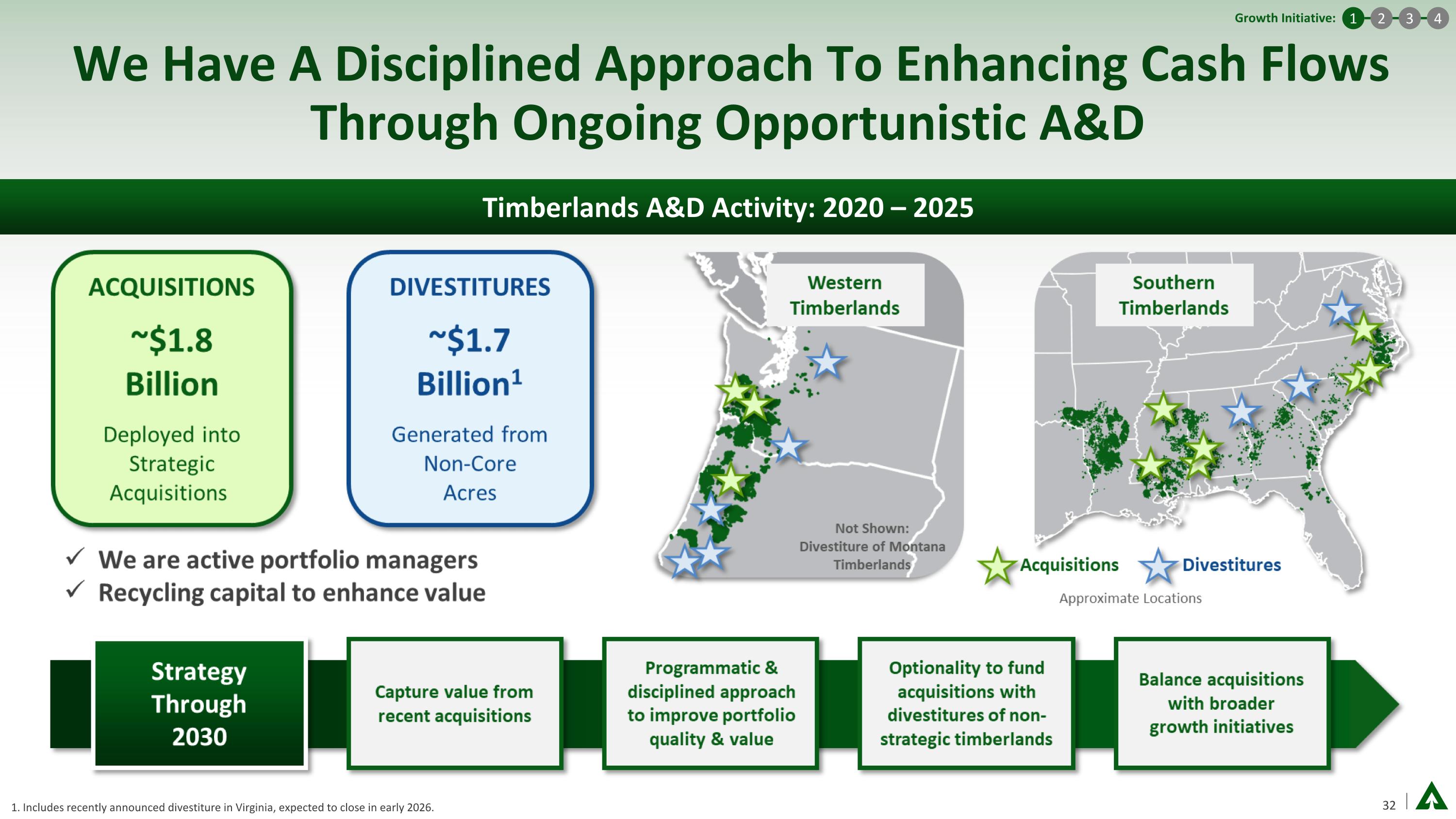

We Have A Disciplined Approach To Enhancing Cash Flows Through Ongoing Opportunistic A&D Timberlands A&D Activity: 2020 – 2025 1. Includes recently announced divestiture in Virginia, expected to close in early 2026. 1 Growth Initiative: 4 2 3

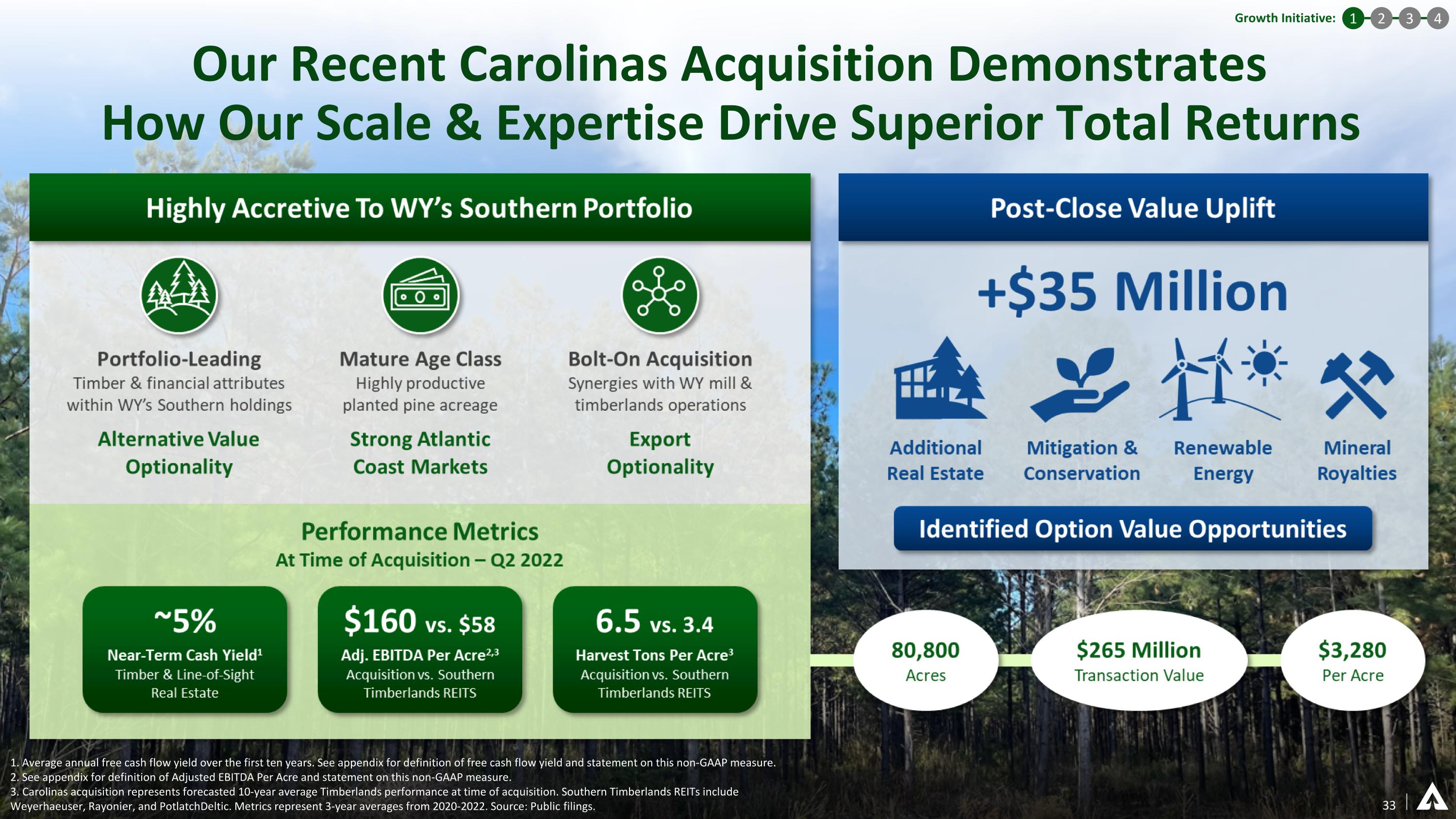

Our Recent Carolinas Acquisition Demonstrates How Our Scale & Expertise Drive Superior Total Returns 1. Average annual free cash flow yield over the first ten years. See appendix for definition of free cash flow yield and statement on this non-GAAP measure. 2. See appendix for definition of Adjusted EBITDA Per Acre and statement on this non-GAAP measure. 3. Carolinas acquisition represents forecasted 10-year average Timberlands performance at time of acquisition. Southern Timberlands REITs include Weyerhaeuser, Rayonier, and PotlatchDeltic. Metrics represent 3-year averages from 2020-2022. Source: Public filings. 33 1 Growth Initiative: 4 2 3

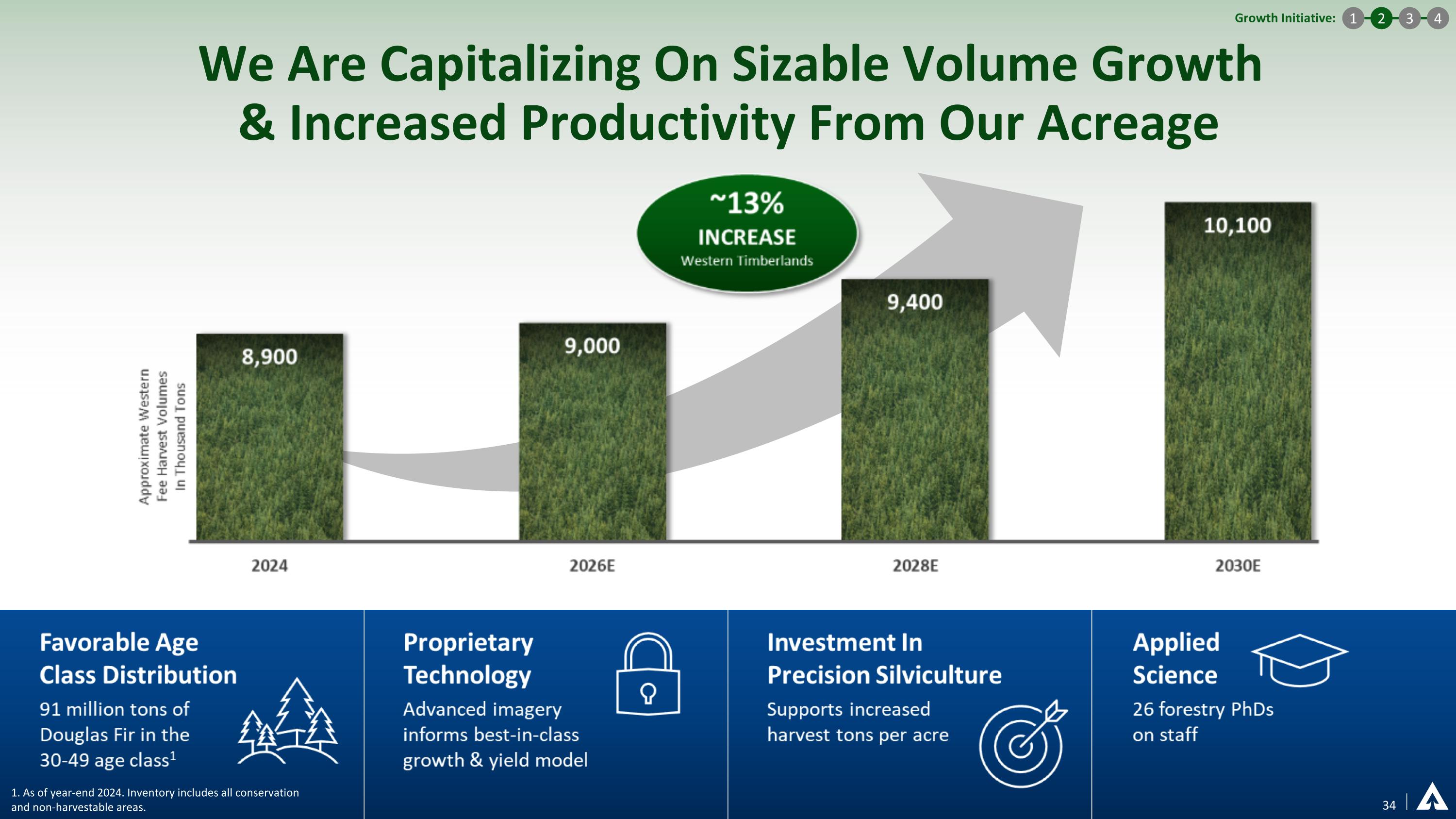

We Are Capitalizing On Sizable Volume Growth & Increased Productivity From Our Acreage 34 1. As of year-end 2024. Inventory includes all conservation and non-harvestable areas. 1 Growth Initiative: 4 2 3

We Are Creating New Markets & Benefiting From Increasing Log Demand In The South 1 Growth Initiative: 4 2 3

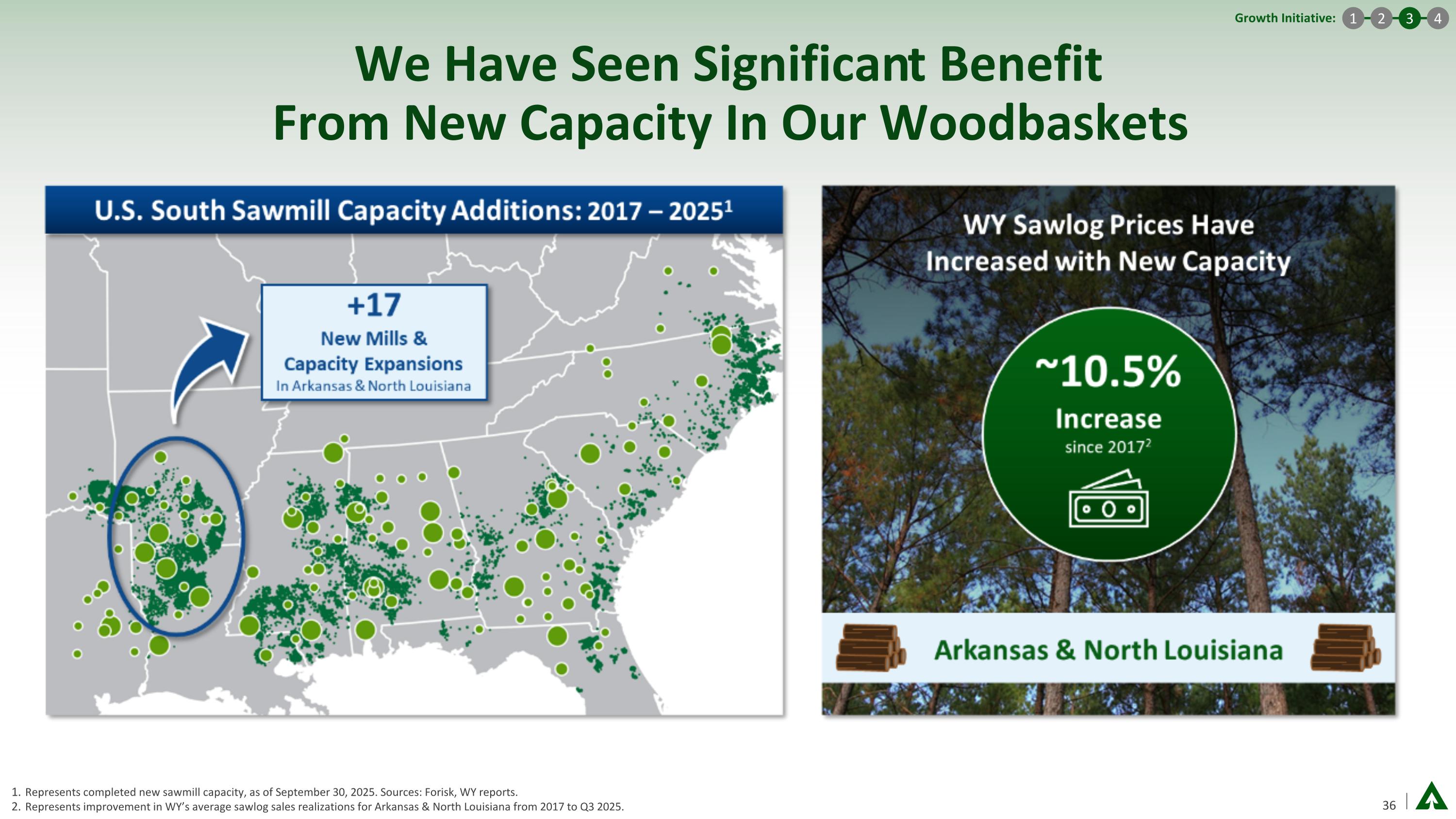

We Have Seen Significant Benefit From New Capacity In Our Woodbaskets Represents completed new sawmill capacity, as of September 30, 2025. Sources: Forisk, WY reports. Represents improvement in WY’s average sawlog sales realizations for Arkansas & North Louisiana from 2017 to Q3 2025. 1 Growth Initiative: 4 2 3

We Are Leveraging Our Expertise, Scale & Reliability To Target New Geographies With Southern Exports 1 Growth Initiative: 4 2 3 Sources: Oxford Economics, Forest Economic Advisors. 1. Baseline year is 2024. 3 BEST POSITIONED To Address Global Supply Gap With Unrivaled Southern Portfolio SIGNIFICANT Emerging Export Opportunity In the South 2 UNMATCHED Export Competitive Advantage In the West 1

We Are Leveraging Decades Of Experience In Export Markets 1 Growth Initiative: 4 2 3

Timberlands Strategy For Success 39 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

Wood Products BRIAN CHANEY | SENIOR VICE PRESIDENT

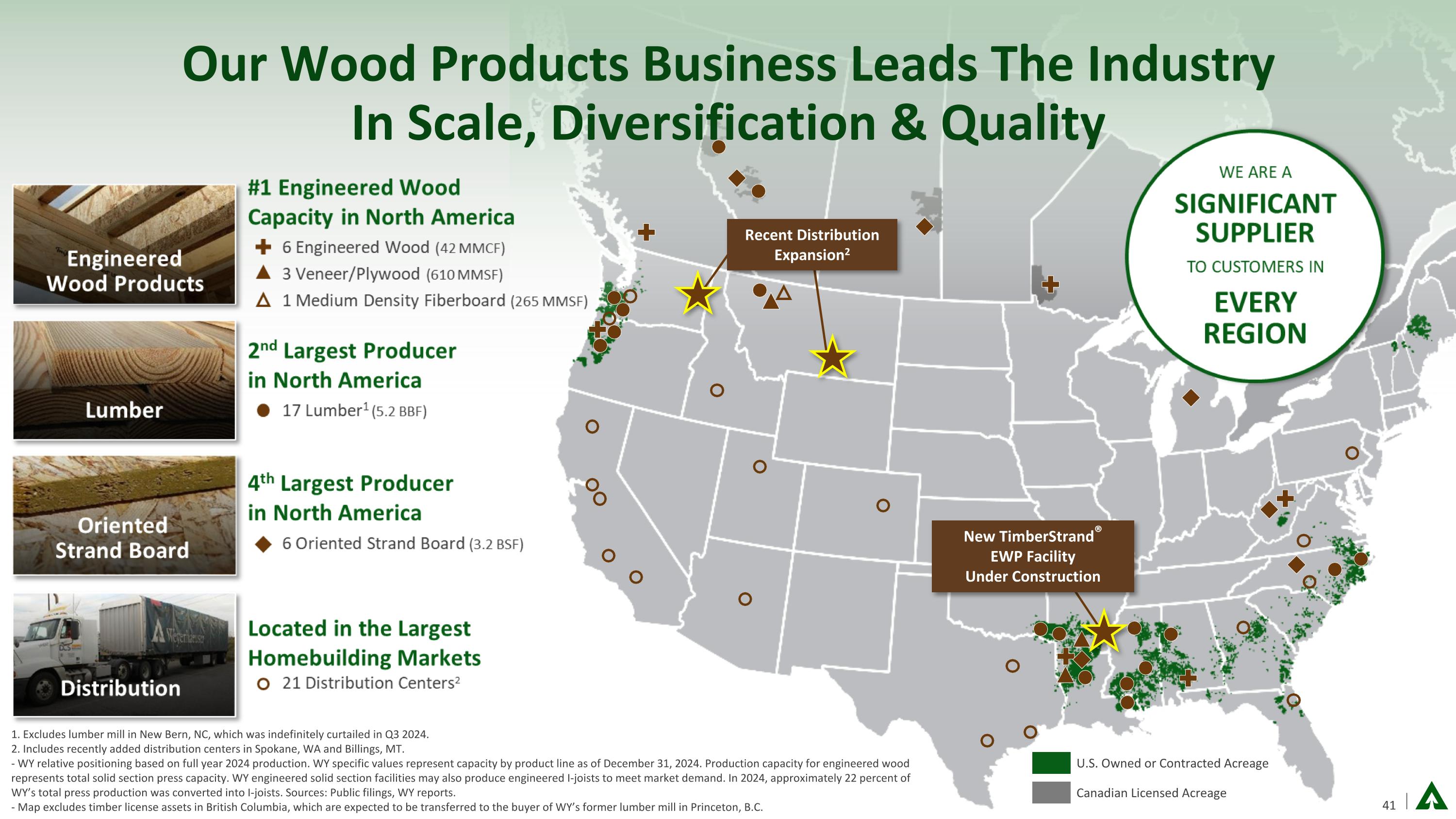

1. Excludes lumber mill in New Bern, NC, which was indefinitely curtailed in Q3 2024. 2. Includes recently added distribution centers in Spokane, WA and Billings, MT. - WY relative positioning based on full year 2024 production. WY specific values represent capacity by product line as of December 31, 2024. Production capacity for engineered wood represents total solid section press capacity. WY engineered solid section facilities may also produce engineered I-joists to meet market demand. In 2024, approximately 22 percent of WY’s total press production was converted into I-joists. Sources: Public filings, WY reports. - Map excludes timber license assets in British Columbia, which are expected to be transferred to the buyer of WY’s former lumber mill in Princeton, B.C. Our Wood Products Business Leads The Industry In Scale, Diversification & Quality U.S. Owned or Contracted Acreage Canadian Licensed Acreage Recent Distribution Expansion2 New TimberStrand® EWP Facility Under Construction

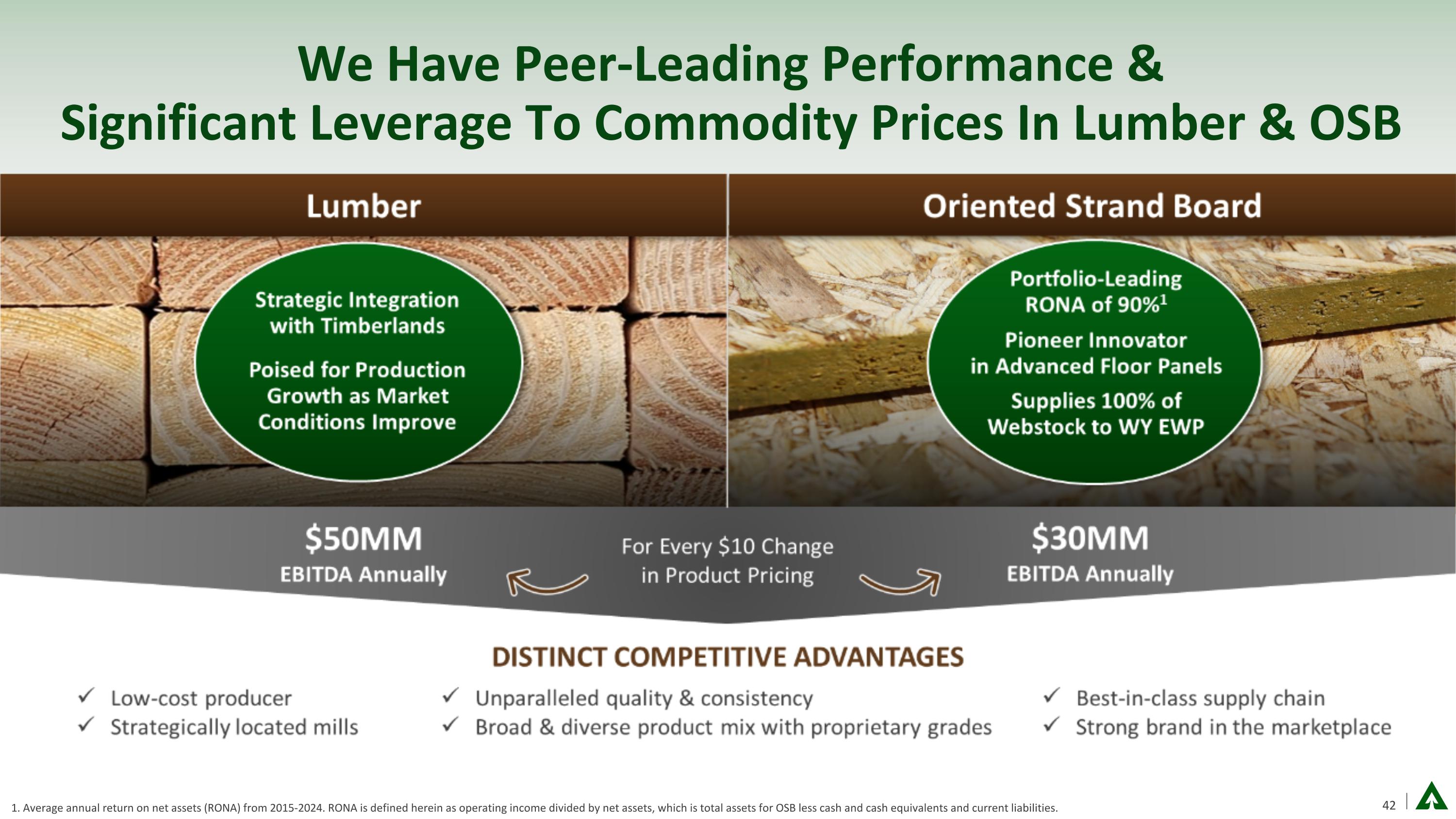

We Have Peer-Leading Performance & Significant Leverage To Commodity Prices In Lumber & OSB 1. Average annual return on net assets (RONA) from 2015-2024. RONA is defined herein as operating income divided by net assets, which is total assets for OSB less cash and cash equivalents and current liabilities.

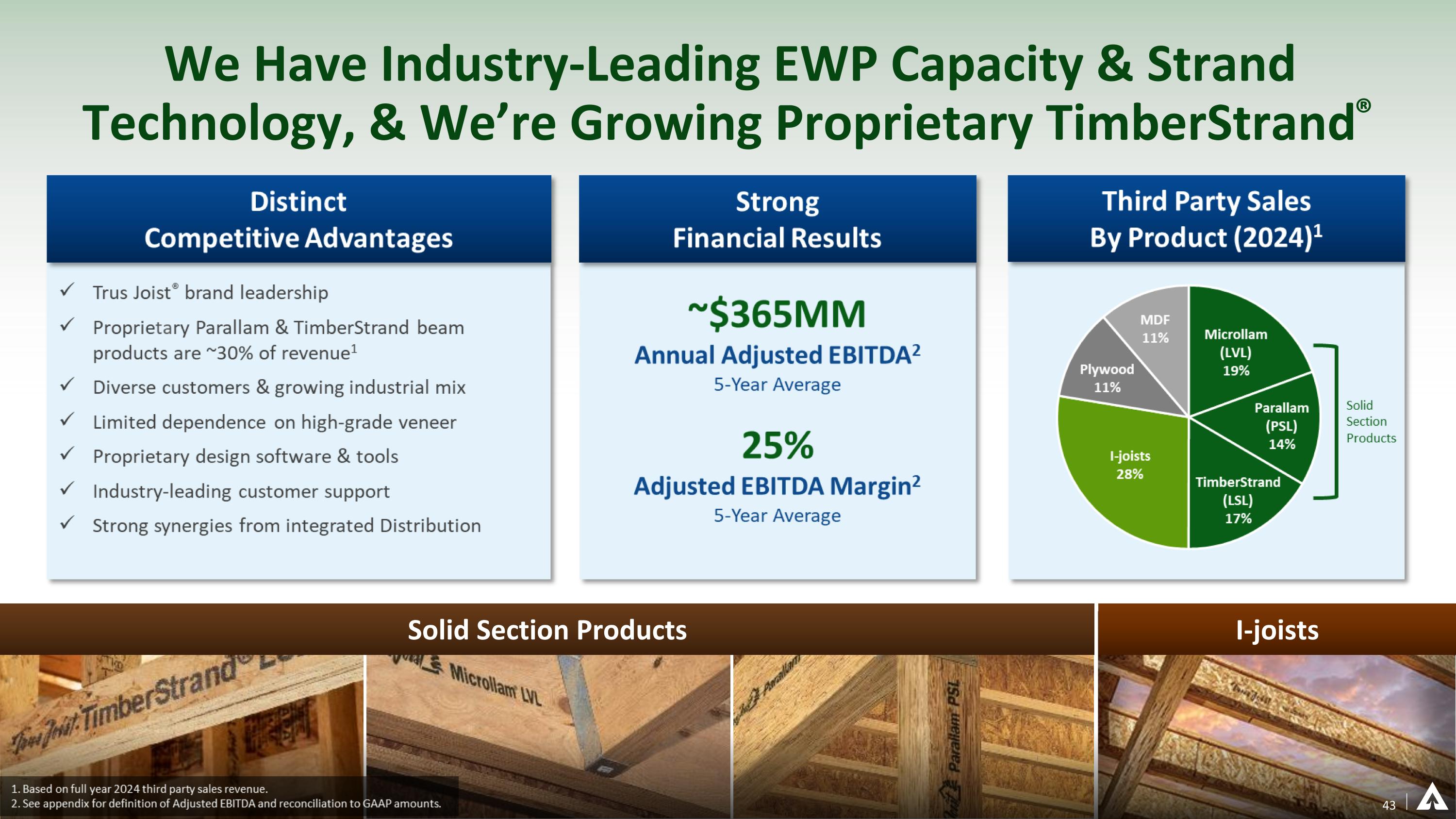

We Have Industry-Leading EWP Capacity & Strand Technology, & We’re Growing Proprietary TimberStrand ® Solid Section Products I-joists 43

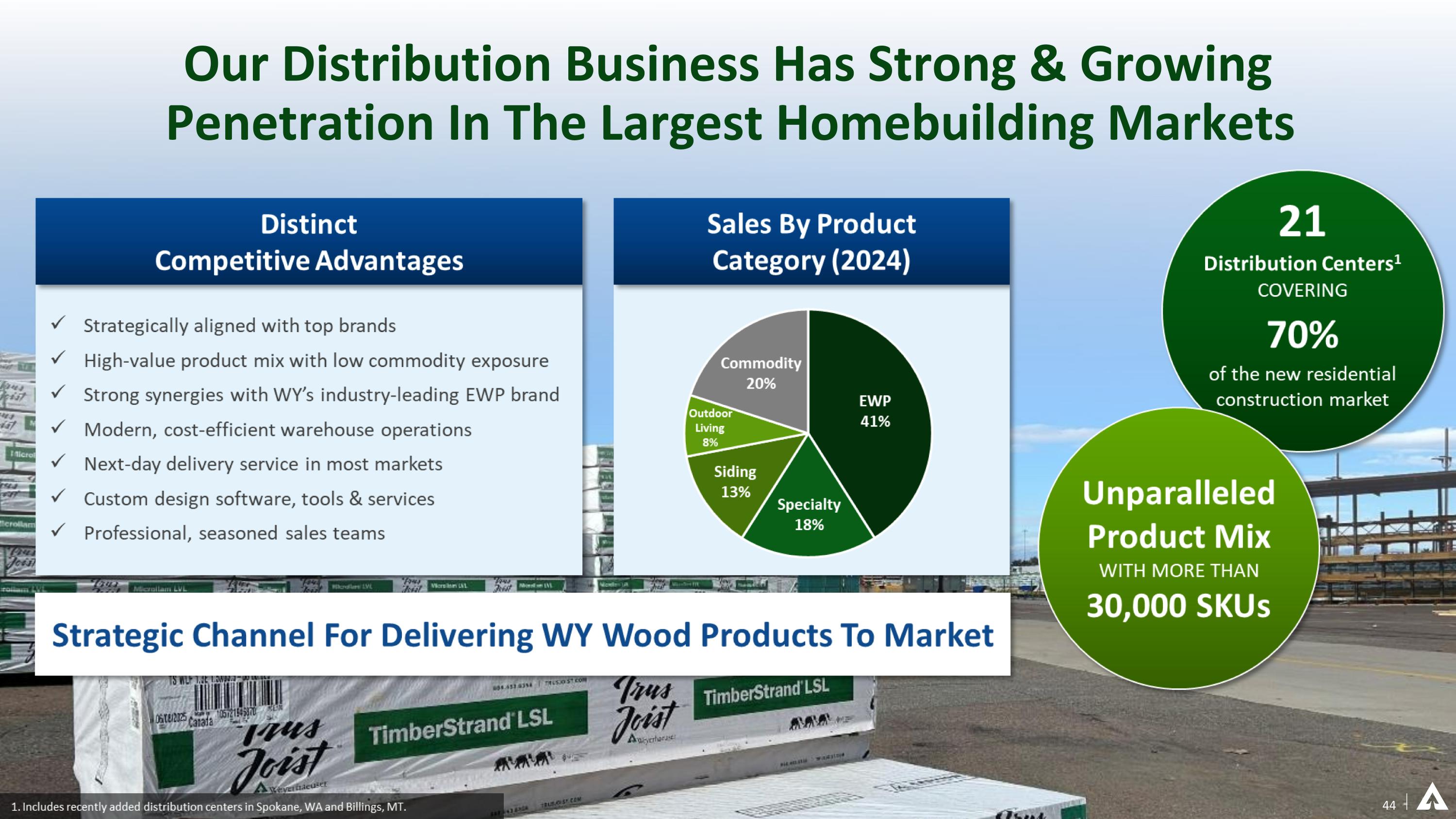

Our Distribution Business Has Strong & Growing Penetration In The Largest Homebuilding Markets 44

Our EWP & Distribution Businesses Are Integrated With Strong Synergies & An Aligned Growth Strategy 1. Percentage based on full year 2024 third party sales revenue.

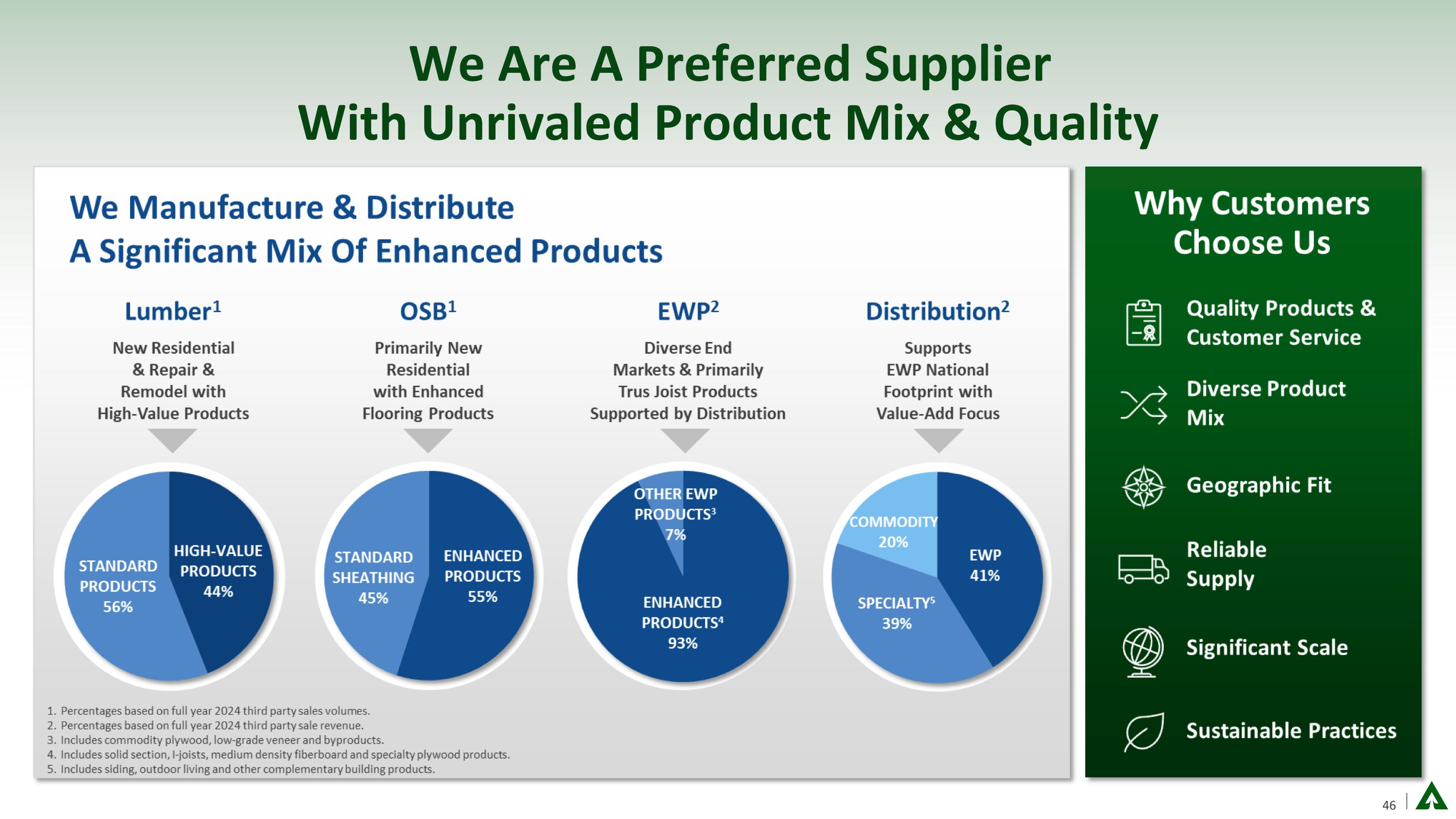

We Are A Preferred Supplier With Unrivaled Product Mix & Quality

We Generate Sustainable Value Through OpX 47

We Enhance Performance & Reliability With Cutting Edge Technology

We Have A Strong Track Record Of Delivering Superior Performance & Serving Our Customers See appendix for definition of Adjusted EBITDA and reconciliation to GAAP amounts. Compared to peers, which include BlueLinx, Boise Cascade, Canfor, Interfor, Louisiana-Pacific and West Fraser. From public filings and includes only North American operations. Performance for manufacturing businesses based on 2022-2024. Lumber Adjusted EBITDA margin includes expenses for softwood lumber countervailing and anti-dumping duties for all companies. 49

Accelerating Growth To Enhance Returns We Have A Focused Wood Products Growth Strategy Leveraging Our Foundational Strengths

Unleashing The Next Phase Of Growth 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 1 Growth Initiatives: 4 2 3

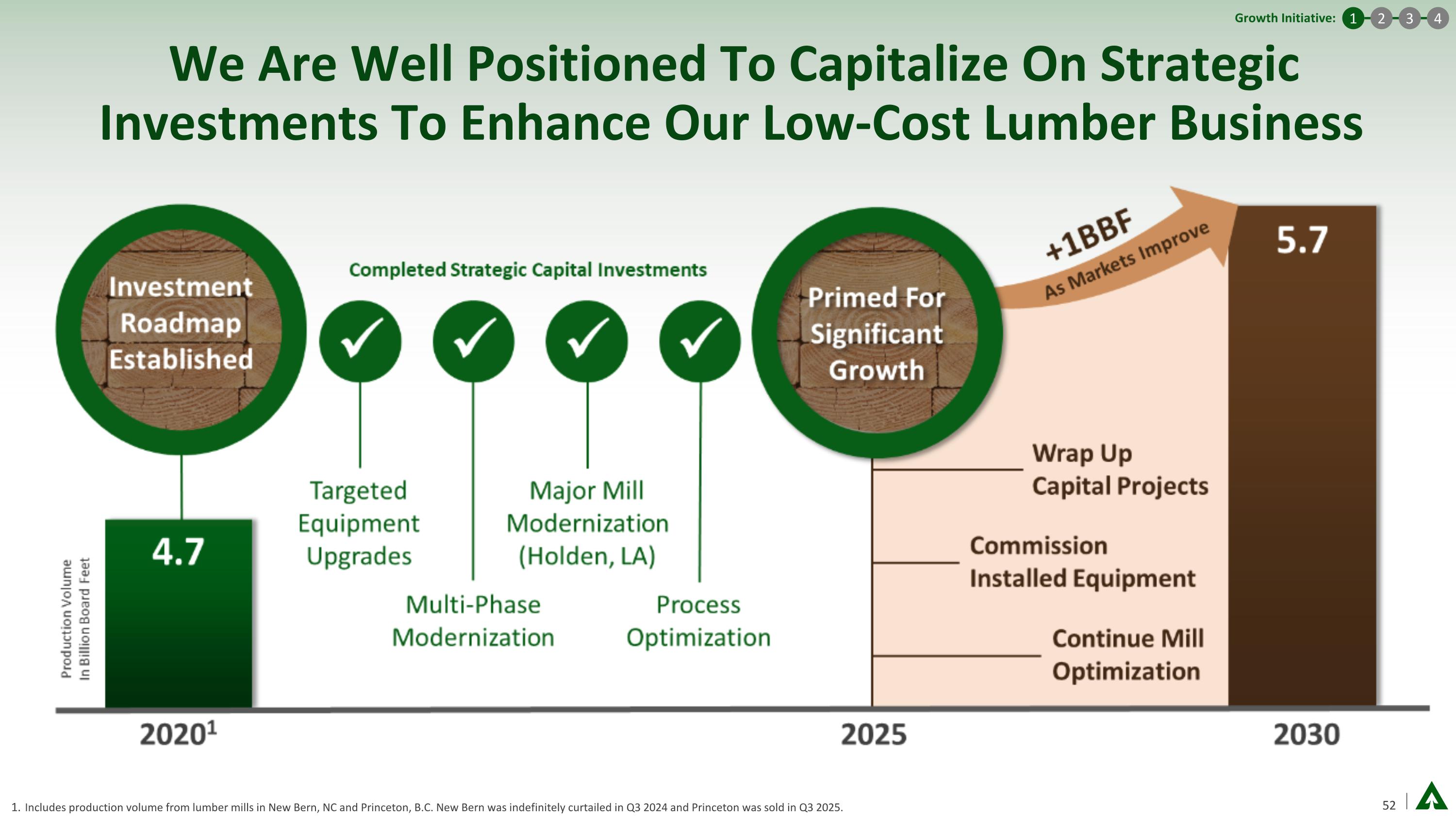

We Are Well Positioned To Capitalize On Strategic Investments To Enhance Our Low-Cost Lumber Business Includes production volume from lumber mills in New Bern, NC and Princeton, B.C. New Bern was indefinitely curtailed in Q3 2024 and Princeton was sold in Q3 2025. 1 Growth Initiative: 4 2 3

Improves Our EWP Offerings In The U.S. South $100+ MILLION Annual Adjusted EBITDA2 Expected At Full Operating Capacity Additional upside from portfolio integration benefits Construction commenced in 2025, with startup expected in 2027 ~$500 million investment between 2025 and 2027 Addresses underserved & growing market for TimberStrand Serves strong & expanding customer base in the region DOUBLES OUR TIMBERSTRAND CAPACITY INCREASES TOTAL COMPANY EWP CAPACITY BY ~24%1 53 Delivers Significant Portfolio Benefits Strategically aligned with WY’s Timberlands & Distribution businesses ~80% of raw material sourcing will come from WY fee timberlands Based on full year 2024 production capacity. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. Growing In Our Highest-Margin Proprietary Product 1 Growth Initiative: 4 2 3

There Is A Compelling Case For Leveraging Our Proprietary TimberStrand® Technology There Is Further Growth Potential Beyond Monticello 1 Growth Initiative: 4 2 3

We Are Expanding Our Distribution Footprint Into High-Value Markets & Increasing Reach At Existing Sites 1 Growth Initiative: 4 2 3 Recently added distribution centers in Spokane, WA and Billings, MT. See appendix for definition of return on investment (ROI) and statement on this non-GAAP measure.

We Have A Long History Of Successful Product Innovation 1 Growth Initiative: 4 2 3

We Are Re-Energizing Our Focus On New Product Development Aggressive Targets, Timelines & Resourcing To Accelerate Results 1 Growth Initiative: 4 2 3

We Are Leveraging Technology In Sales & Marketing To Drive Growth 1 Growth Initiative: 4 2 3

Wood Products Strategy For Success 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

Strategic Land Solutions PAUL HOSSAIN | SENIOR VICE PRESIDENT

Our Strategic Land Solutions Business1 New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. Approximate acreage, based on year-end 2024 and adjusted for completed and in-progress large-scale timberlands transactions announced in 2025.

We Generate Value Through End-To-End Portfolio Management & Distinct Competitive Advantages Hundreds of value-enhancing activities & assets operating across our portfolio today We have 10.4 million acres1 to drive future growth from diverse real estate, climate solutions & natural resource markets In-house teams and technology platform enable rapid identification & capitalization of new opportunities We have deep technical expertise and strong business development capabilities, supported by proprietary AI & machine learning tools Scale & quality opportunities enable partnerships with market leaders across a variety of businesses We partner with well-capitalized entities with strong reputations & proven success Scale Expertise & Technology Partnerships Approximate acreage, based on year-end 2024 and adjusted for completed and in-progress large-scale timberlands transactions announced in 2025.

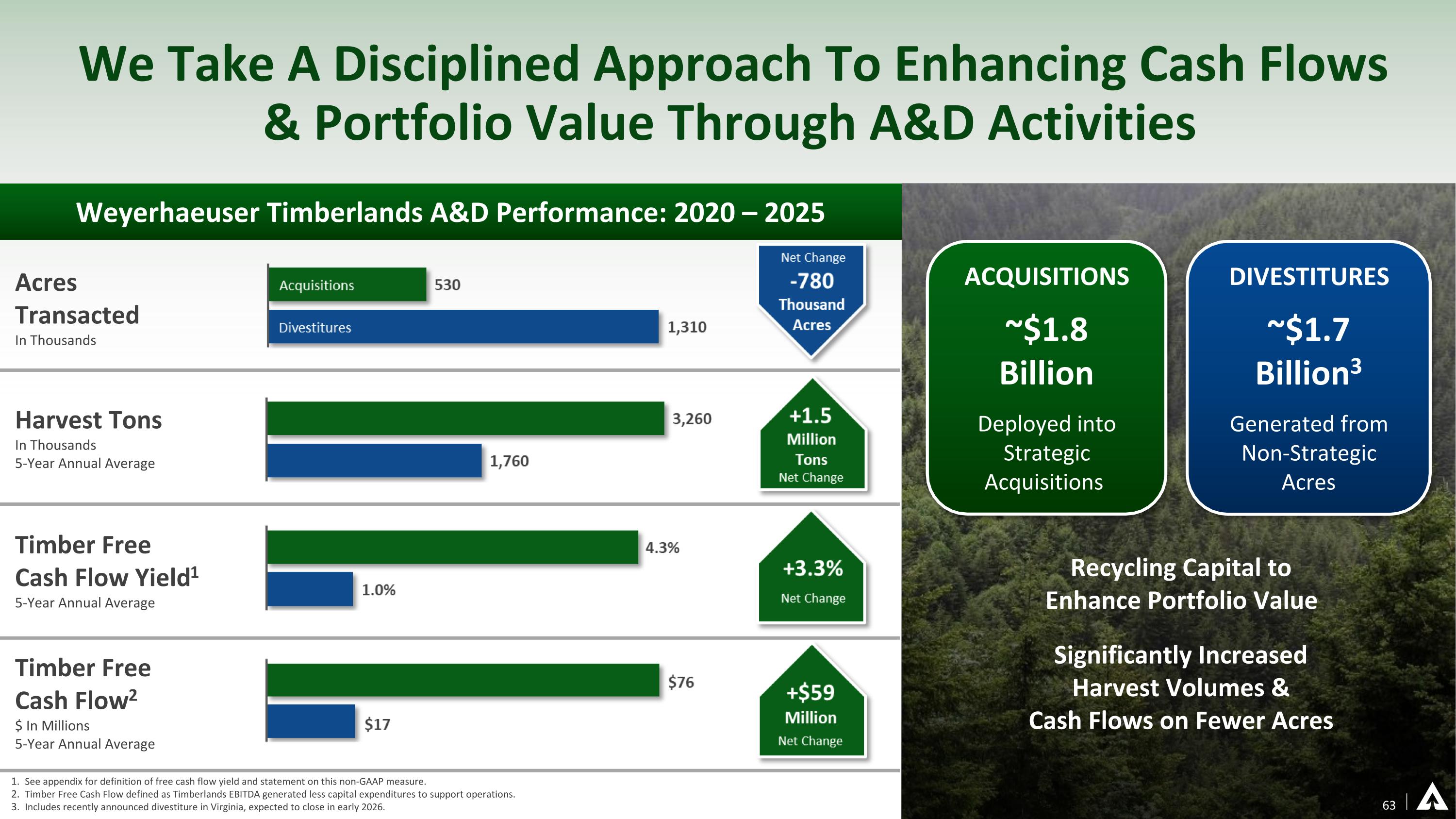

Timber Free Cash Flow2 $ In Millions 5-Year Annual Average Timber Free Cash Flow Yield1 5-Year Annual Average Harvest Tons In Thousands 5-Year Annual Average Acres Transacted In Thousands Significantly Increased Harvest Volumes & Cash Flows on Fewer Acres Weyerhaeuser Timberlands A&D Performance: 2020 – 2025 See appendix for definition of free cash flow yield and statement on this non-GAAP measure. Timber Free Cash Flow defined as Timberlands EBITDA generated less capital expenditures to support operations. Includes recently announced divestiture in Virginia, expected to close in early 2026. Recycling Capital to Enhance Portfolio Value We Take A Disciplined Approach To Enhancing Cash Flows & Portfolio Value Through A&D Activities 63 DIVESTITURES ~$1.7 Billion3 Generated from Non-Strategic Acres ACQUISITIONS ~$1.8 Billion Deployed into Strategic Acquisitions

We Are Going On Offense To Develop Options Across Our Land Base Woodbasket Optimization Leverages Foundational Strengths Deep expertise across the value chain | Proprietary technology platform 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026.

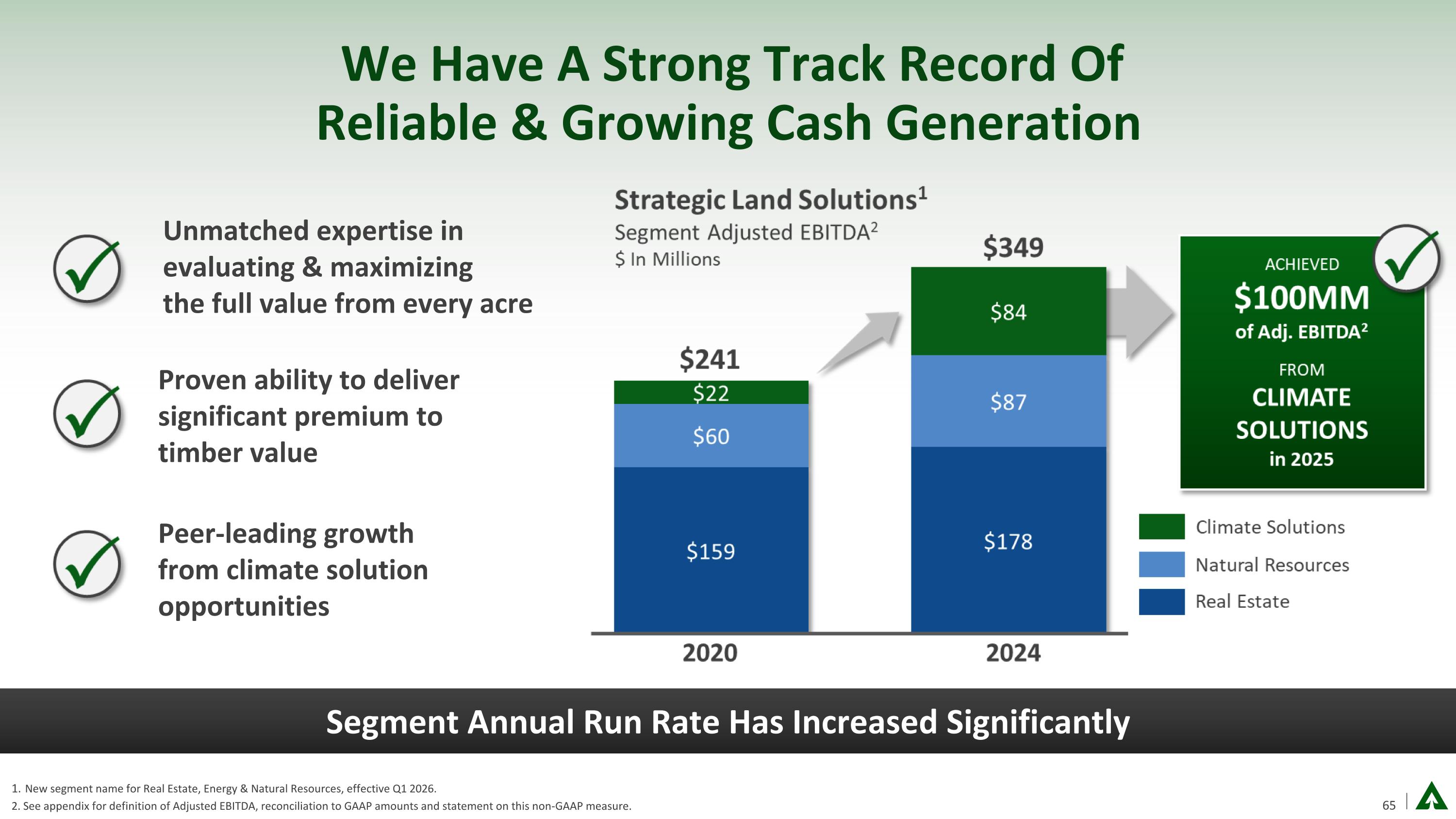

We Have A Strong Track Record Of Reliable & Growing Cash Generation Unmatched expertise in evaluating & maximizing the full value from every acre Proven ability to deliver significant premium to timber value Peer-leading growth from climate solution opportunities New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. See appendix for definition of Adjusted EBITDA, reconciliation to GAAP amounts and statement on this non-GAAP measure.. Segment Annual Run Rate Has Increased Significantly

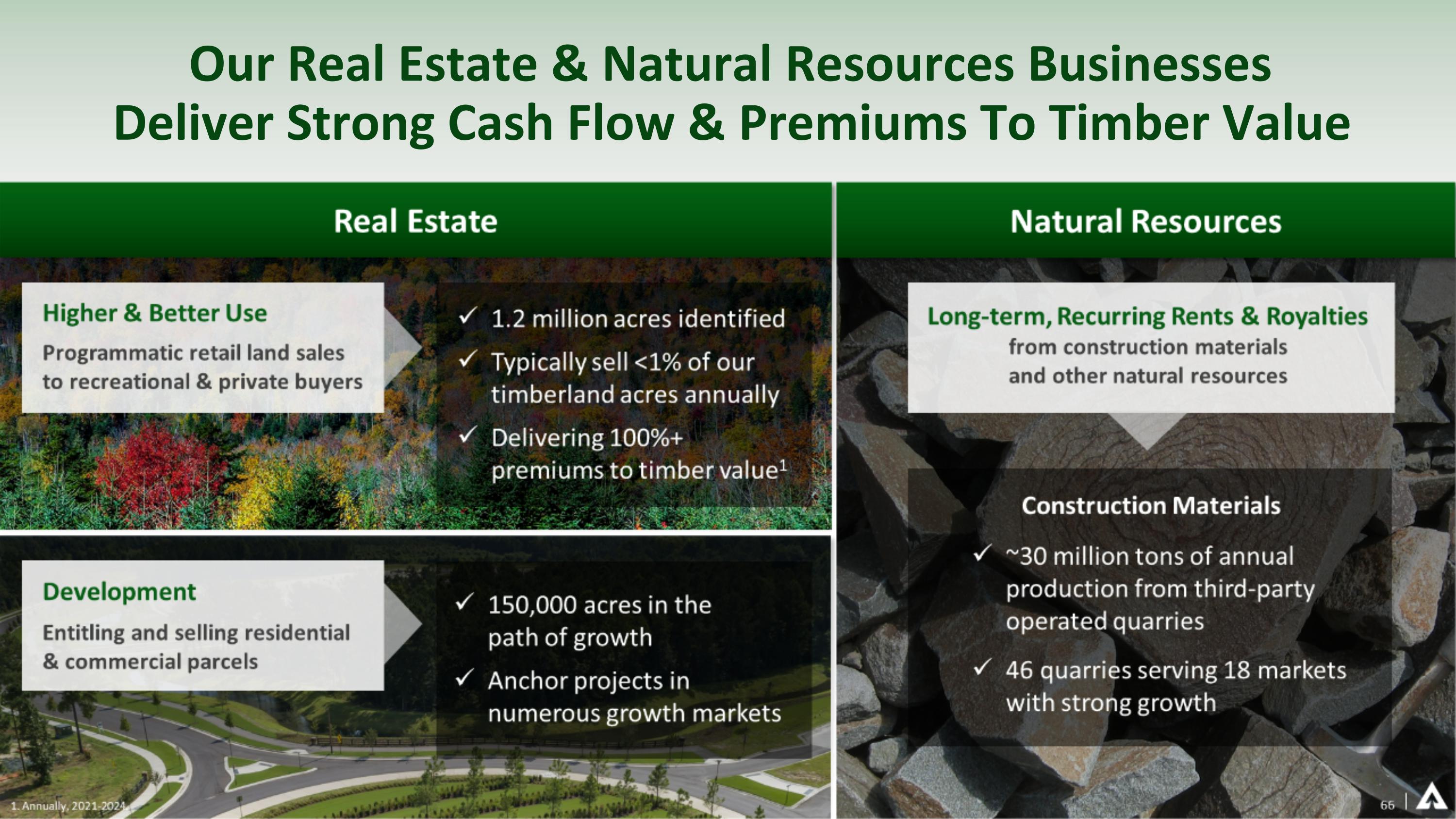

Our Real Estate & Natural Resources Businesses Deliver Strong Cash Flow & Premiums To Timber Value

Our Climate Solutions Business Delivers Tangible Results & Peer-Leading Performance First Mover In Our Space With Unmatched Ability To Deliver Value At Scale

Unleashing The Next Phase Of Growth 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 1 Growth Initiatives: 4 2 3 5 6 7

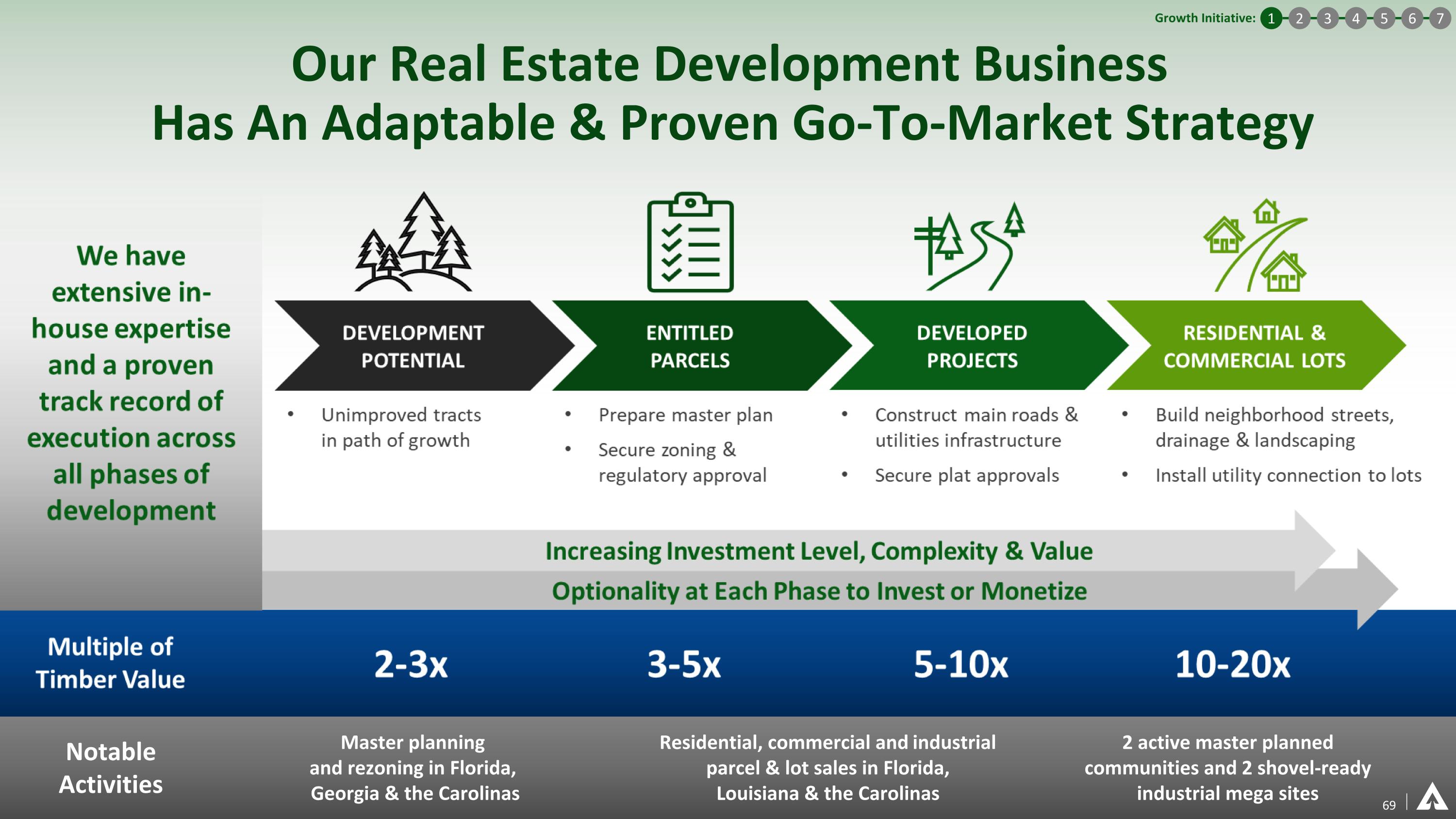

Our Real Estate Development Business Has An Adaptable & Proven Go-To-Market Strategy Notable Activities 2 active master planned communities and 2 shovel-ready industrial mega sites Residential, commercial and industrial parcel & lot sales in Florida, Louisiana & the Carolinas Master planning and rezoning in Florida, Georgia & the Carolinas 69 1 Growth Initiative: 4 2 3 5 6 7

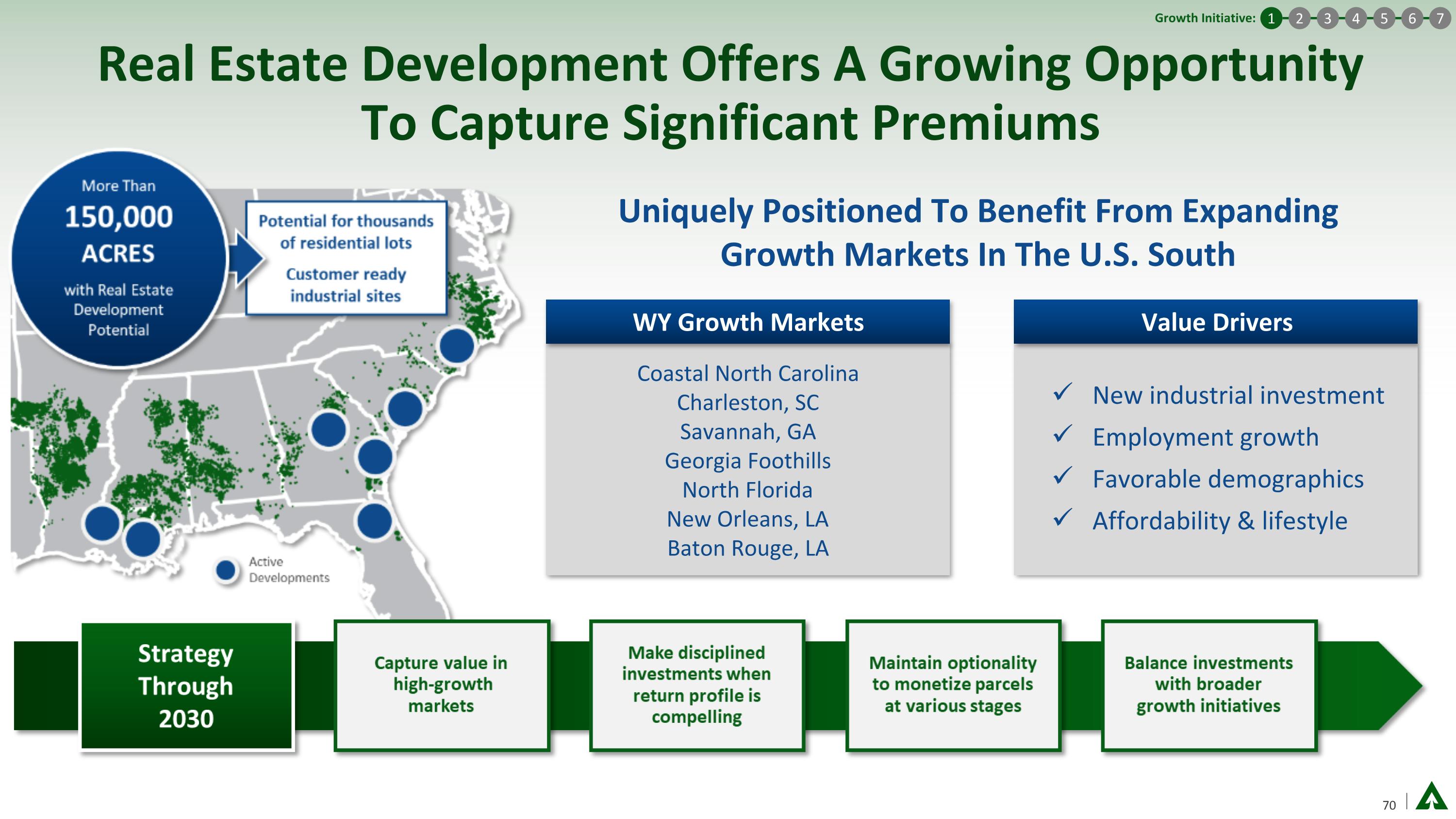

Real Estate Development Offers A Growing Opportunity To Capture Significant Premiums Uniquely Positioned To Benefit From Expanding Growth Markets In The U.S. South WY Growth Markets Coastal North Carolina Charleston, SC Savannah, GA Georgia Foothills North Florida New Orleans, LA Baton Rouge, LA Value Drivers New industrial investment Employment growth Favorable demographics Affordability & lifestyle 1 Growth Initiative: 4 2 3 5 6 7

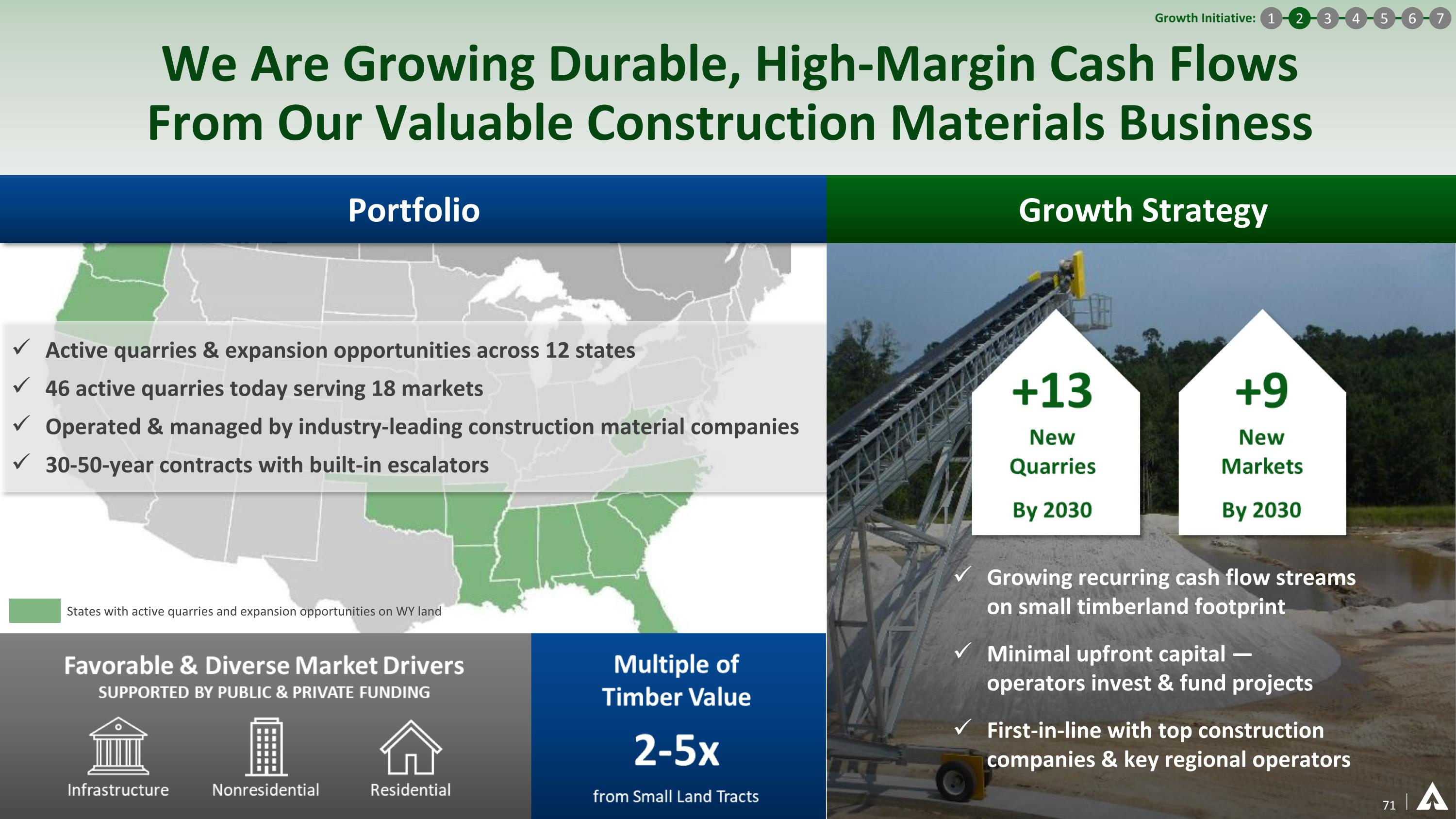

We Are Growing Durable, High-Margin Cash Flows From Our Valuable Construction Materials Business Portfolio Active quarries & expansion opportunities across 12 states 46 active quarries today serving 18 markets Operated & managed by industry-leading construction material companies 30-50-year contracts with built-in escalators States with active quarries and expansion opportunities on WY land Growing recurring cash flow streams on small timberland footprint Minimal upfront capital — operators invest & fund projects First-in-line with top construction companies & key regional operators 71 Growth Strategy 1 Growth Initiative: 4 2 3 5 6 7

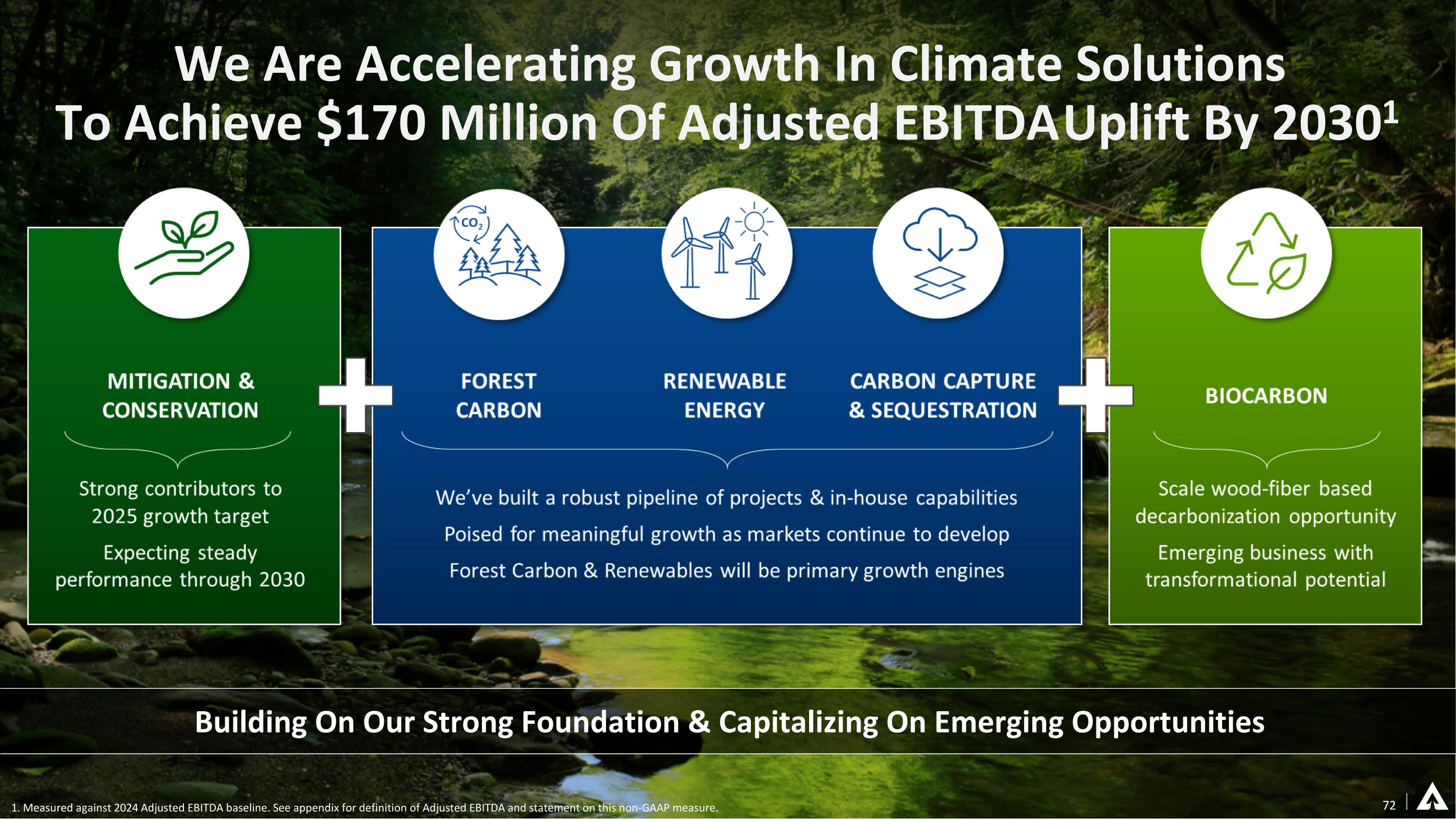

We Are Accelerating Growth In Climate Solutions To Achieve $170 Million Of Adjusted EBITDA Uplift By 20301 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. Building On Our Strong Foundation & Capitalizing On Emerging Opportunities 72

We Have Demonstrated Leadership In Developing Forest Carbon As A New Market 73 1 Growth Initiative: 4 2 3 5 6 7

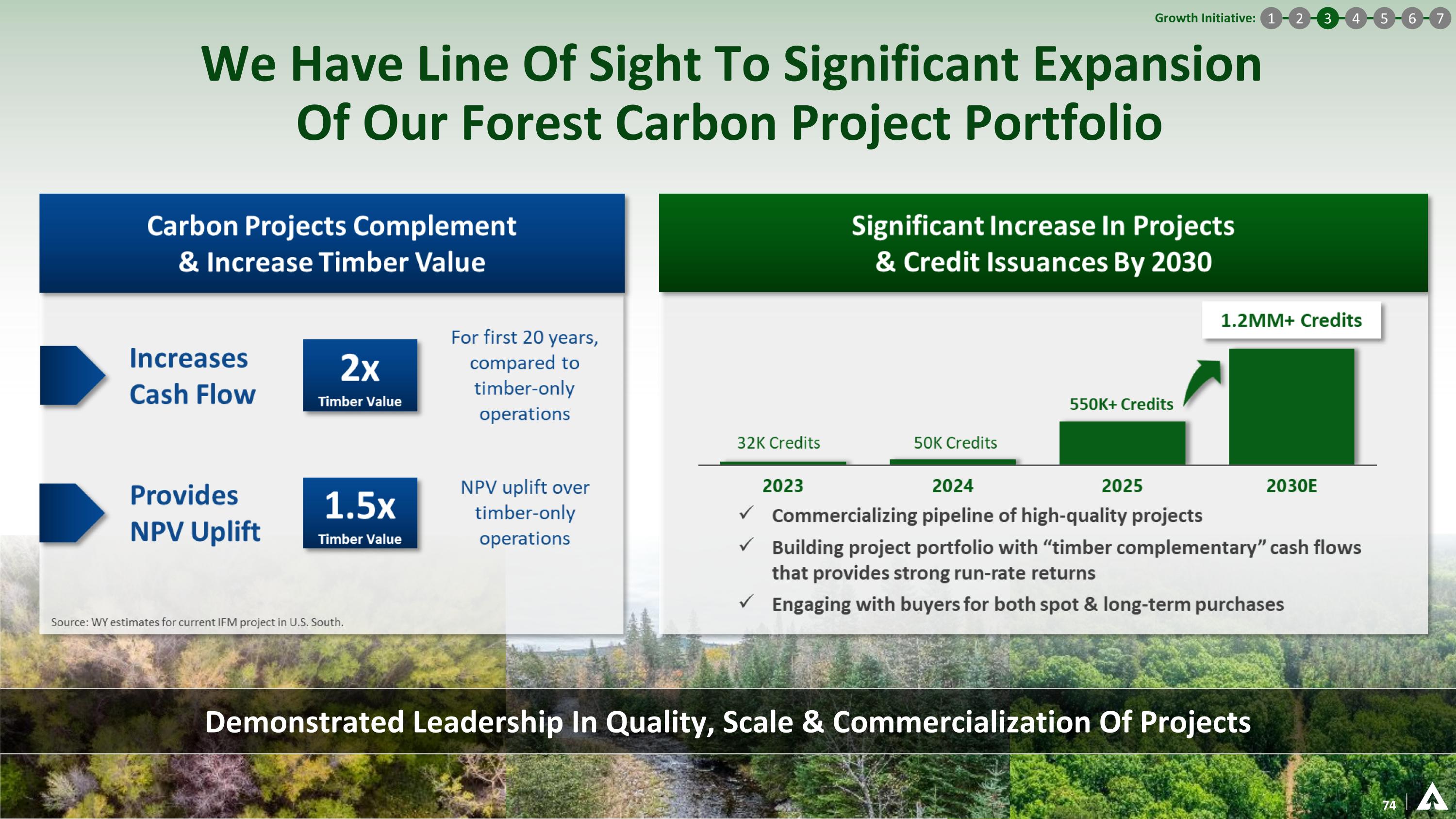

We Have Line Of Sight To Significant Expansion Of Our Forest Carbon Project Portfolio Demonstrated Leadership In Quality, Scale & Commercialization Of Projects 74 1 Growth Initiative: 4 2 3 5 6 7

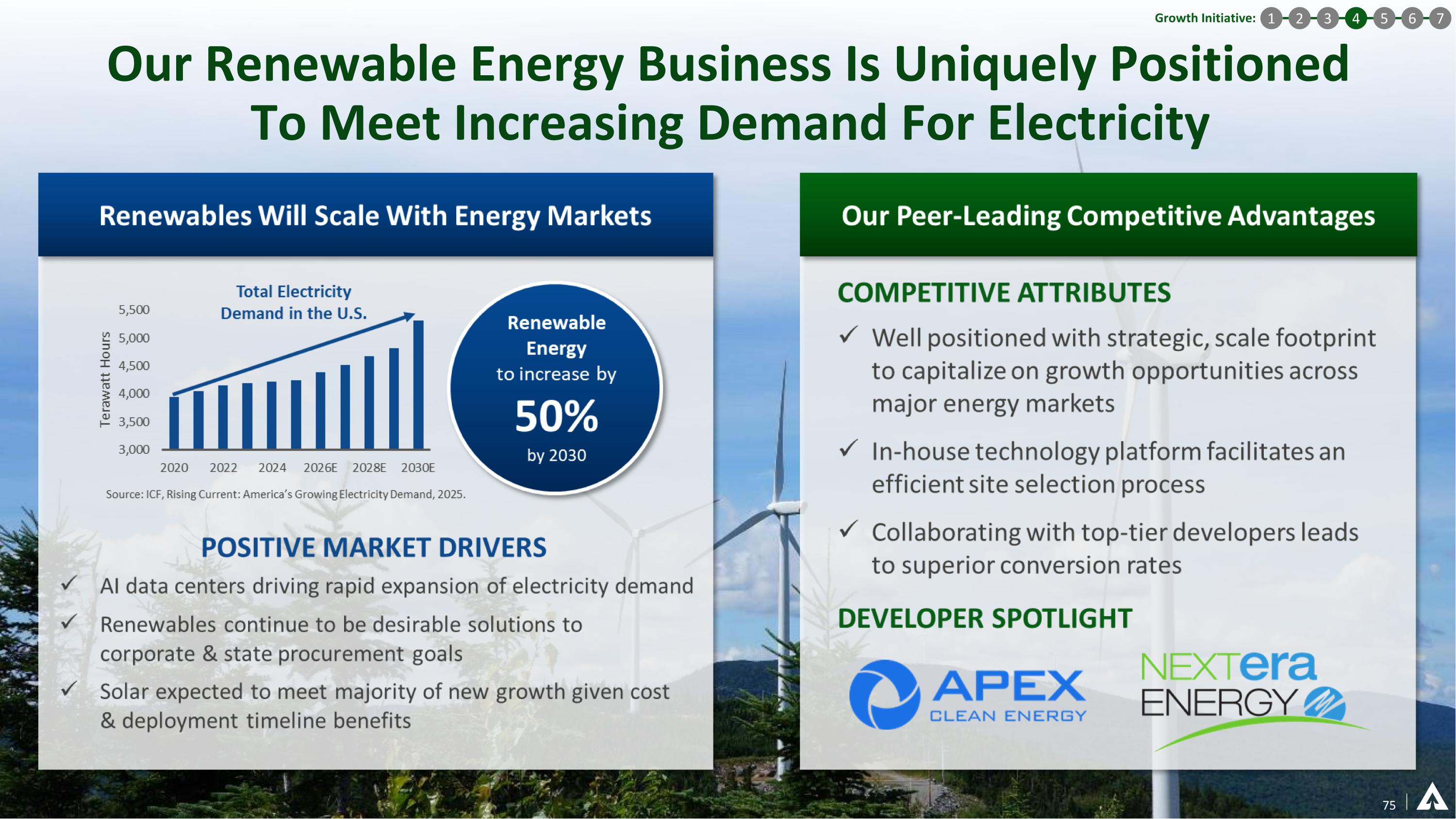

Our Renewable Energy Business Is Uniquely Positioned To Meet Increasing Demand For Electricity 75 1 Growth Initiative: 4 2 3 5 6 7

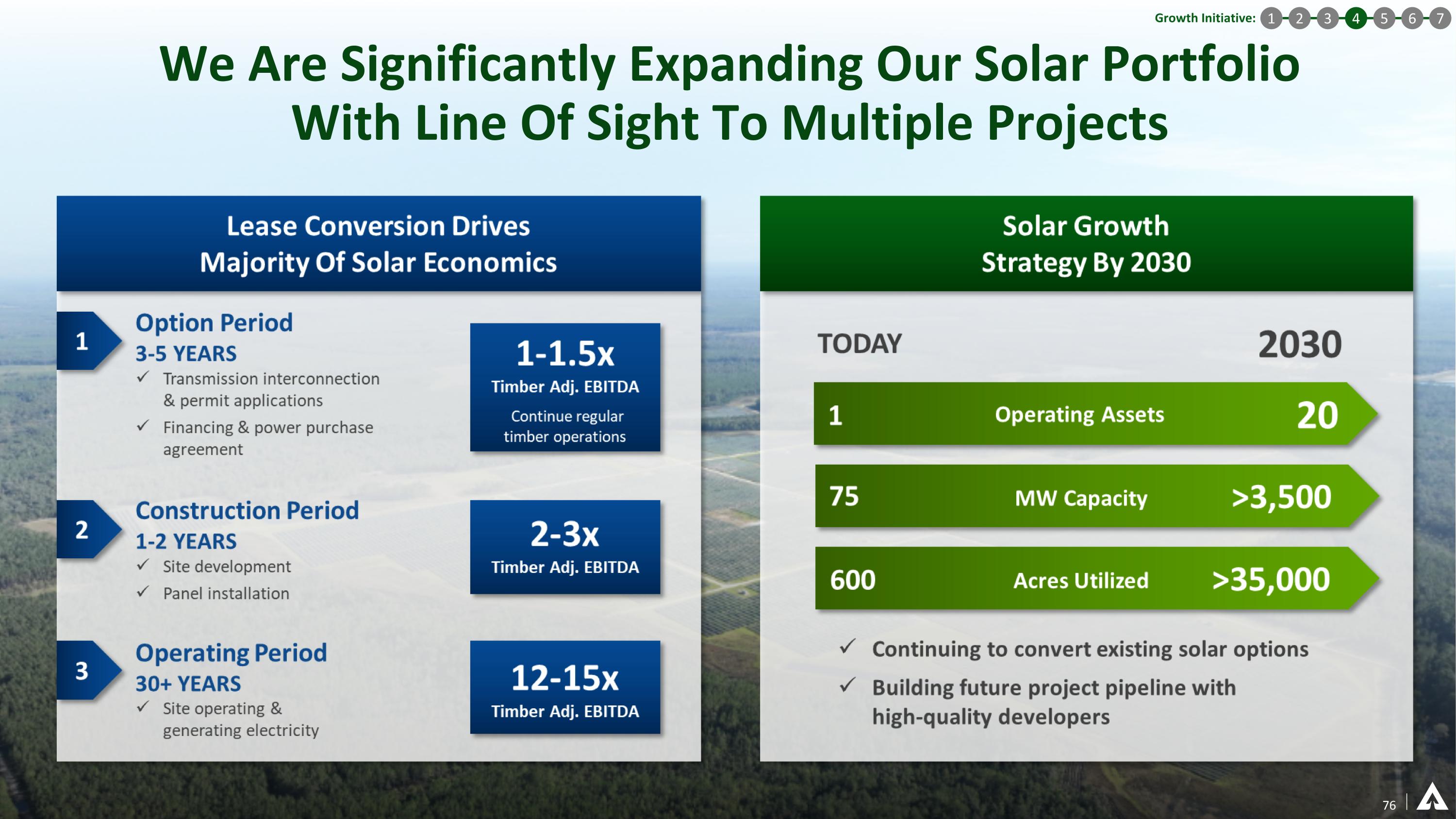

We Are Significantly Expanding Our Solar Portfolio With Line Of Sight To Multiple Projects 76 1 Growth Initiative: 4 2 3 5 6 7

Carbon Capture & Sequestration Creates A Material Growth Opportunity Across Our Timber Holdings 1 Growth Initiative: 4 2 3 5 6 7 77

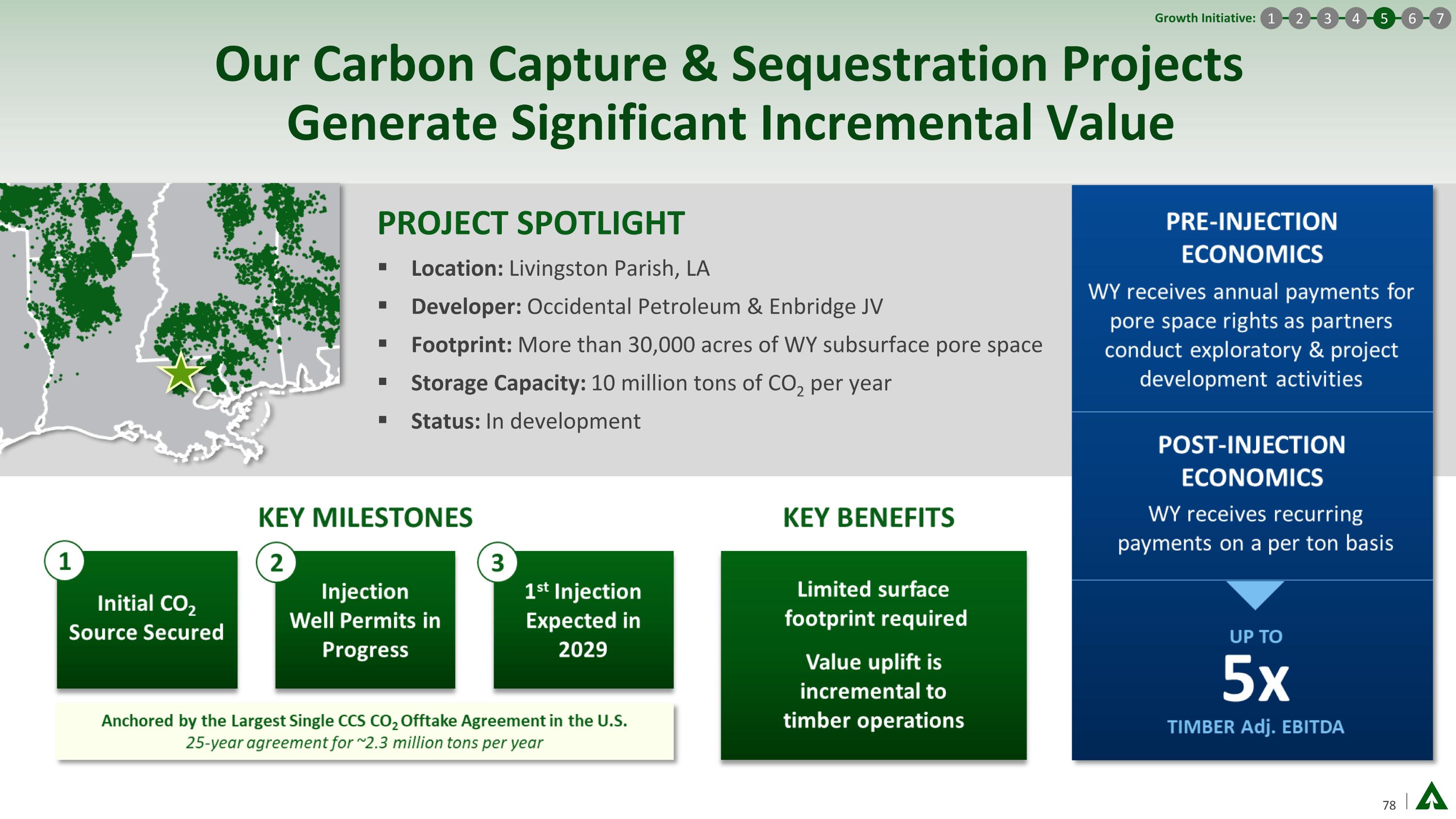

Our Carbon Capture & Sequestration Projects Generate Significant Incremental Value PROJECT SPOTLIGHT Location: Livingston Parish, LA Developer: Occidental Petroleum & Enbridge JV Footprint: More than 30,000 acres of WY subsurface pore space Storage Capacity: 10 million tons of CO2 per year Status: In development 1 Growth Initiative: 4 2 3 5 6 7

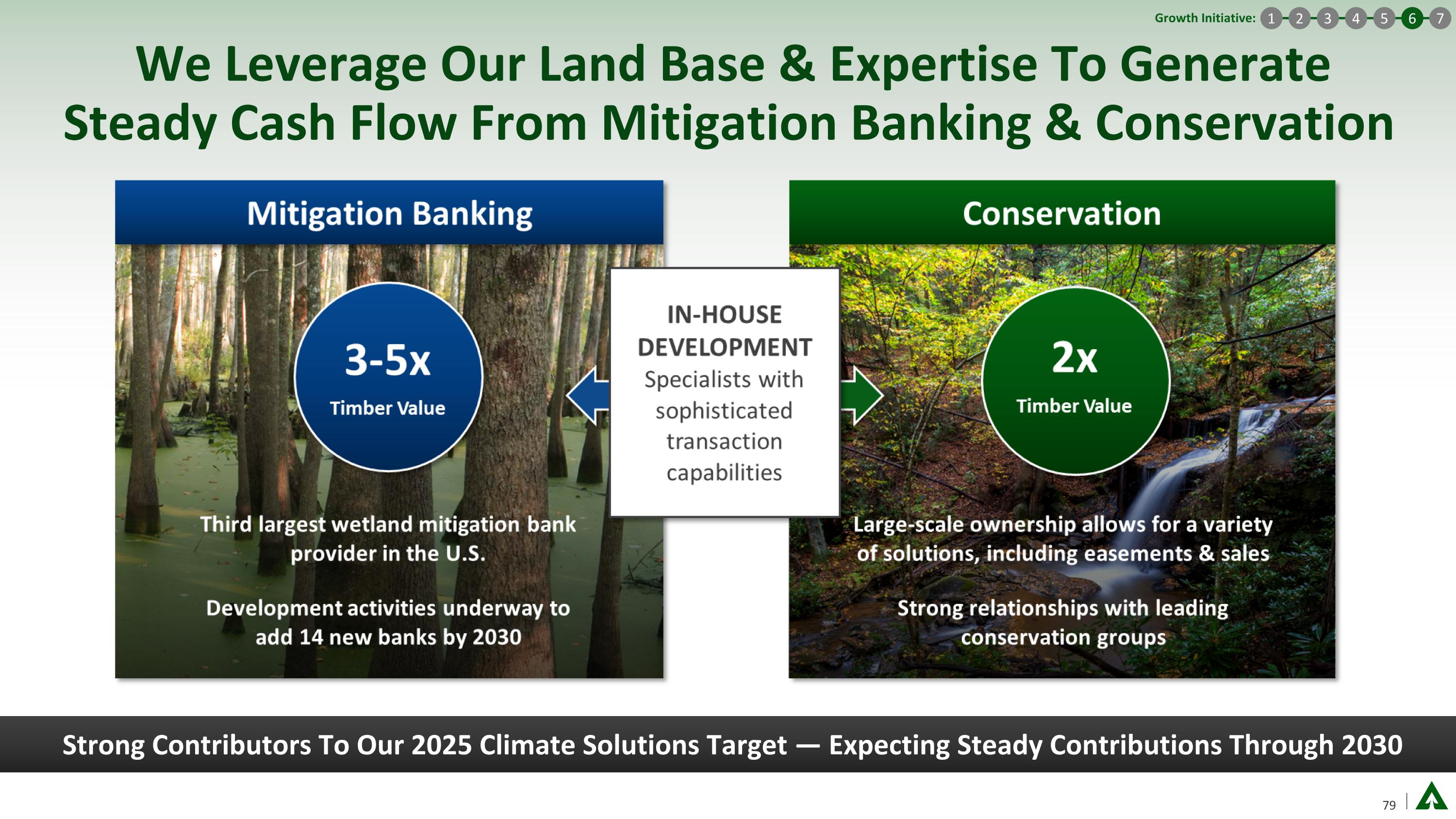

We Leverage Our Land Base & Expertise To Generate Steady Cash Flow From Mitigation Banking & Conservation Strong Contributors To Our 2025 Climate Solutions Target — Expecting Steady Contributions Through 2030 1 Growth Initiative: 4 2 3 5 6 7

Metallurgical Biocarbon Creates An Exciting New Market For Our Pulpwood & Residuals 1 Growth Initiative: 4 2 3 5 6 7 80

We Are Partnering With Aymium To Launch A New Climate Solutions Business With Significant Growth Potential 1 Growth Initiative: 4 2 3 5 6 7 = Memorandum of understanding in place. 2030 target subject to finalization of definitive agreements.

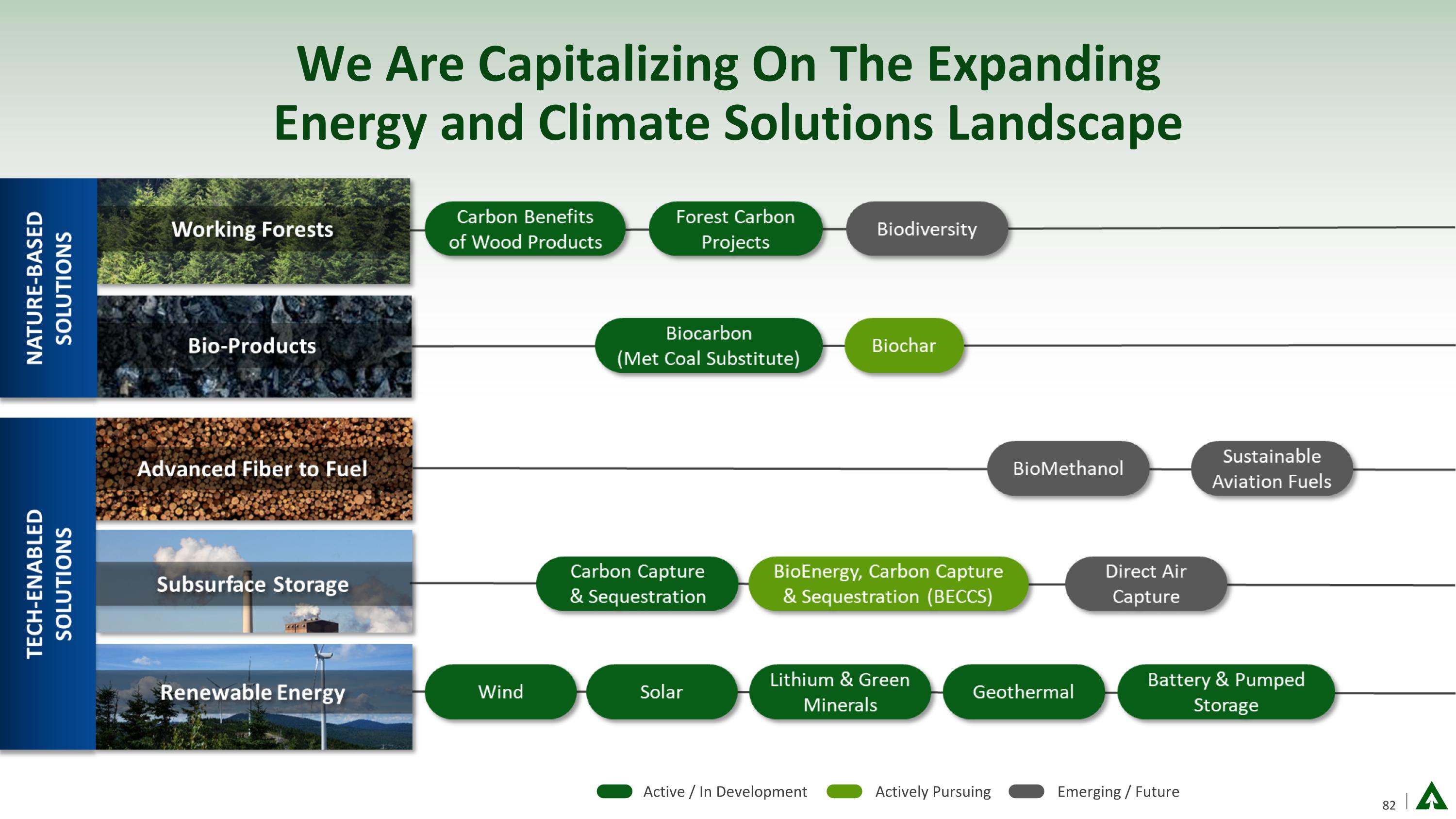

We Are Capitalizing On The Expanding Energy and Climate Solutions Landscape Active / In Development Actively Pursuing Emerging / Future

Strategic Land Solutions1 Strategy For Success 83 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

Enterprise Initiatives DAVIE WOLD | CHIEF FINANCIAL OFFICER

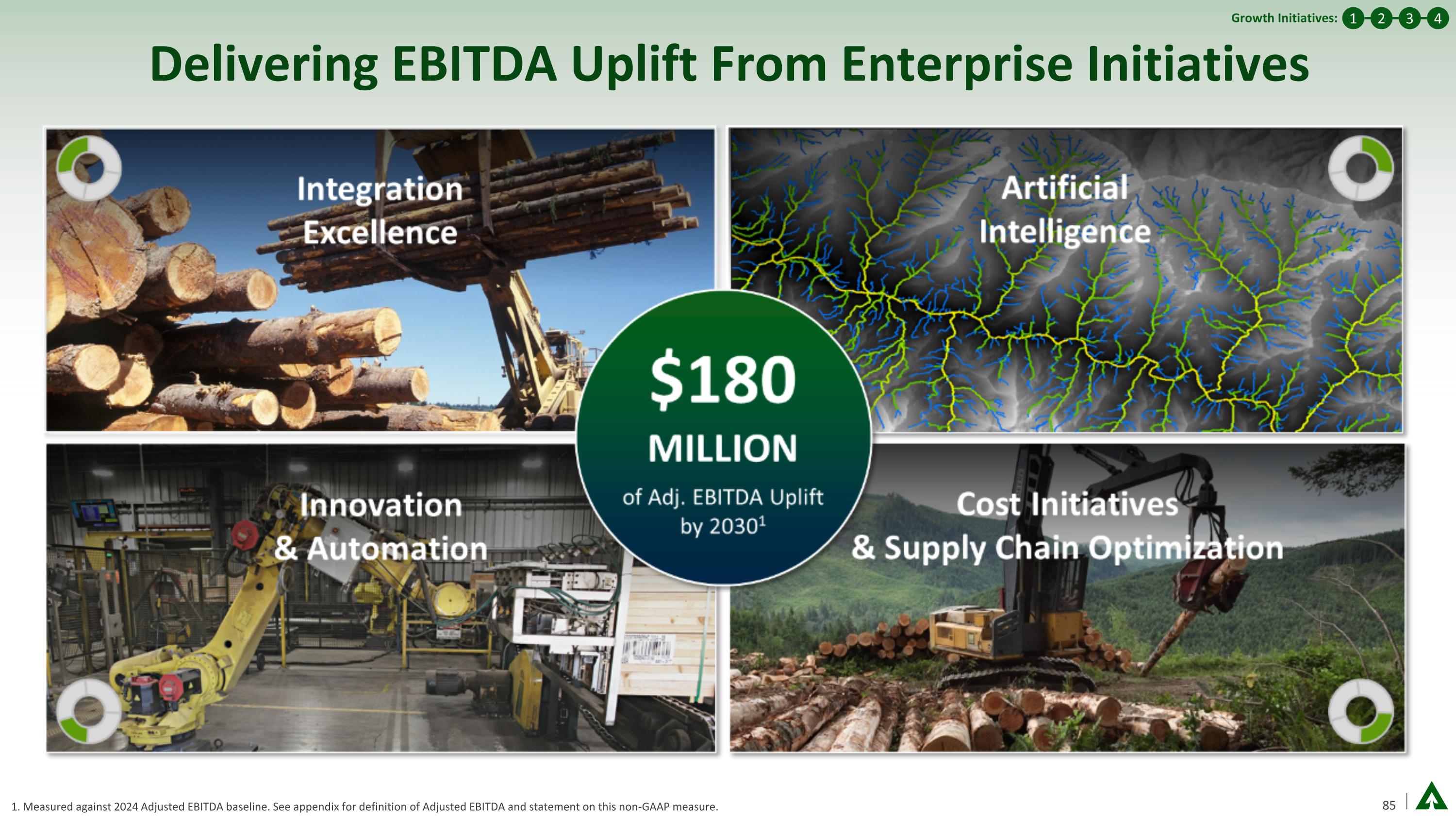

Delivering EBITDA Uplift From Enterprise Initiatives 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 1 Growth Initiatives: 4 2 3

Our Integrated Model Is Strategic, Intentional & It Drives Significant Value 1 Growth Initiative: 4 2 3 Creating & Capturing Value Across Our Portfolio & Supply Chain

We Have Built Internal Expertise & Are Advancing Artificial Intelligence Initiatives 1 Growth Initiative: 4 2 3 Leveraging Emerging Technology To Accelerate Growth

We Are Taking Innovation & Operational Excellence To The Next Level 1 Growth Initiative: 4 2 3

Accelerated Growth Plan DAVIE WOLD | CHIEF FINANCIAL OFFICER

90 Our Growth Roadmap To 2030 Measured Against 2024 Baseline 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 3. See slides 18 and 94 for product pricing uplift considerations and assumptions.

Our Growth Initiatives Are Under Way & Most Are Within Our Control 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026.

92 We Are Well Positioned To Execute Our Accelerated Growth Plan Executing Strategic Growth Plan While Maintaining A Strong Balance Sheet

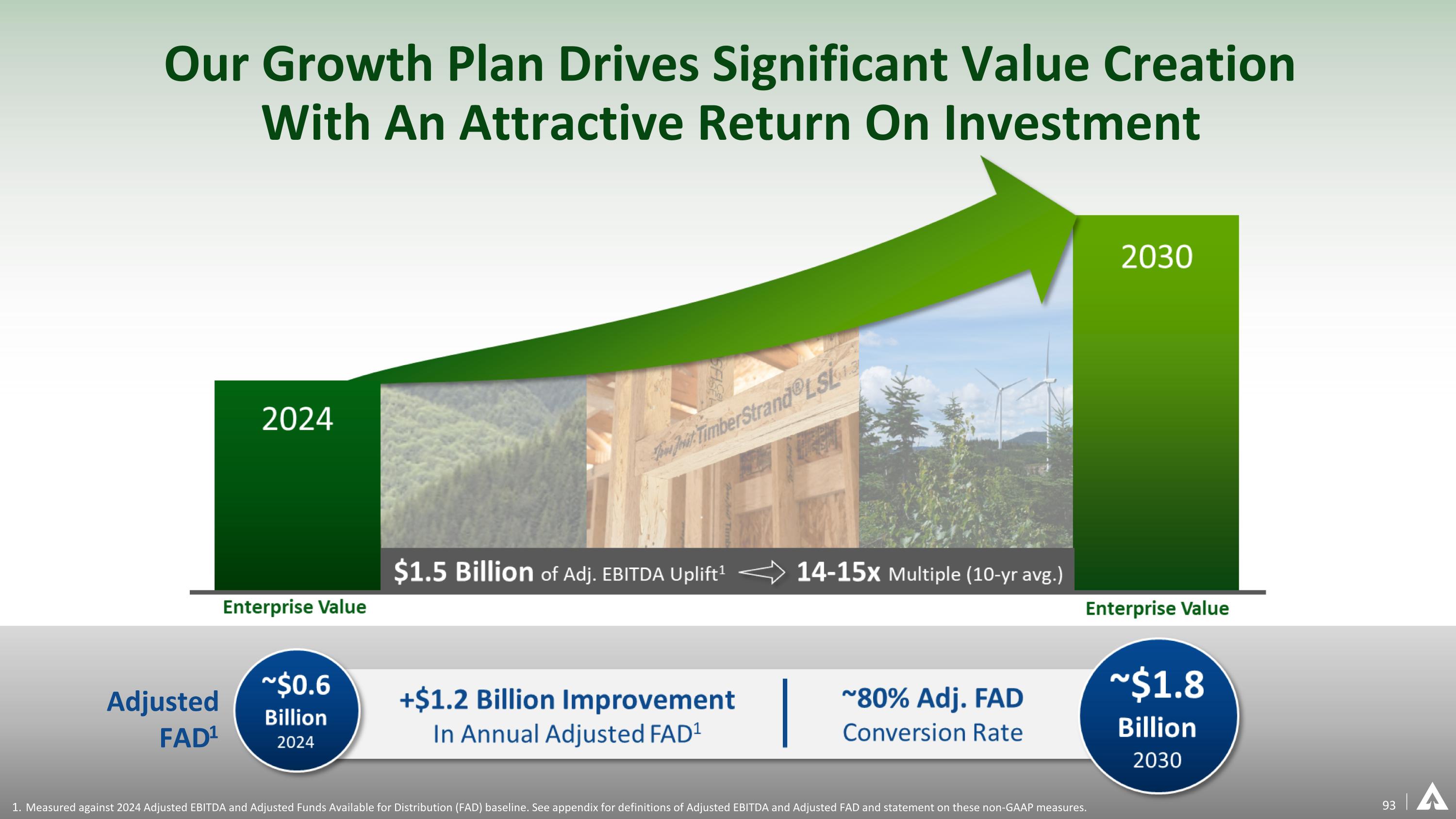

Our Growth Plan Drives Significant Value Creation With An Attractive Return On Investment Measured against 2024 Adjusted EBITDA and Adjusted Funds Available for Distribution (FAD) baseline. See appendix for definitions of Adjusted EBITDA and Adjusted FAD and statement on these non-GAAP measures. Adjusted FAD1 93

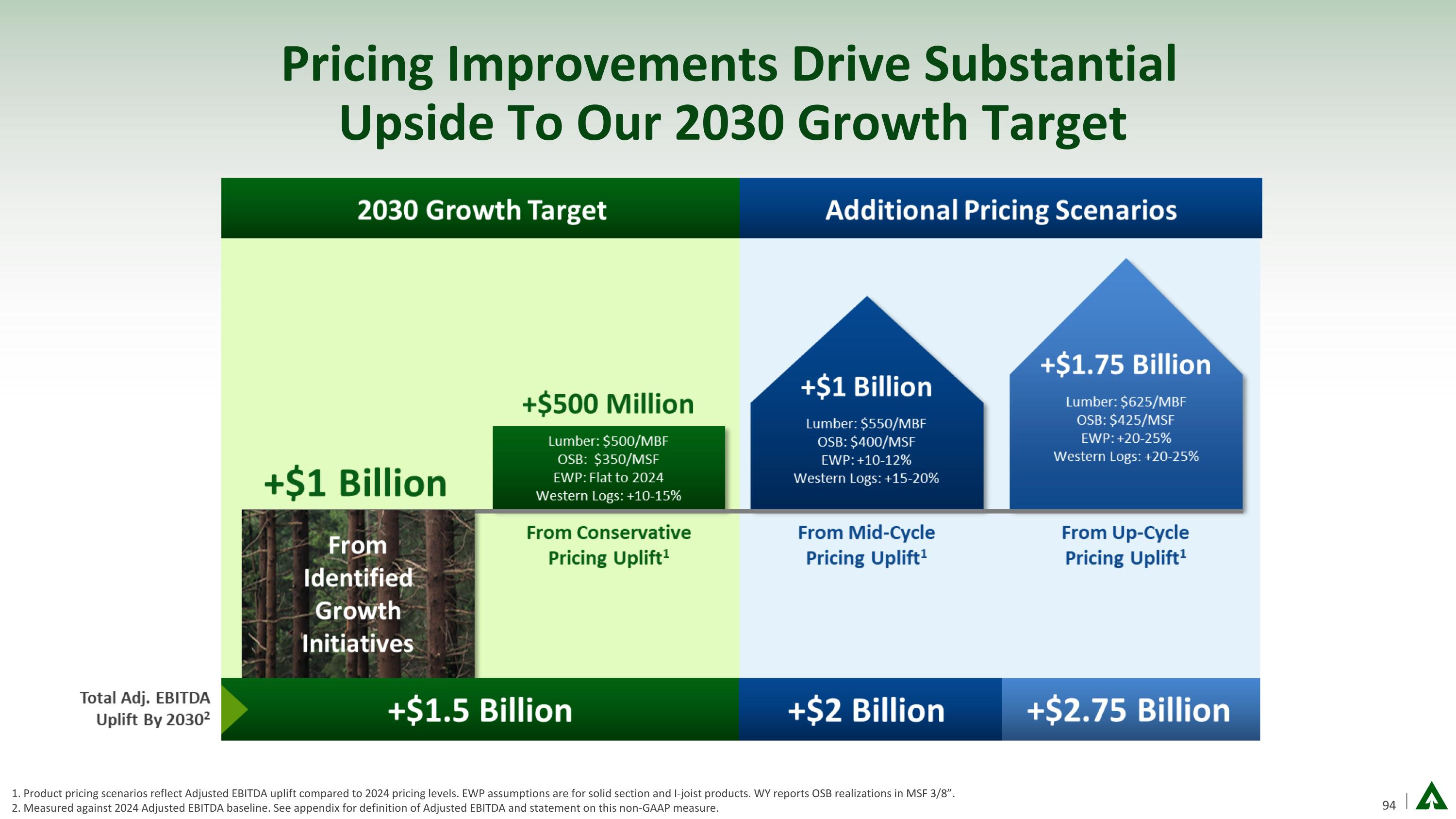

Pricing Improvements Drive Substantial Upside To Our 2030 Growth Target 1. Product pricing scenarios reflect Adjusted EBITDA uplift compared to 2024 pricing levels. EWP assumptions are for solid section and I-joist products. WY reports OSB realizations in MSF 3/8”. 2. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure.

Capital Allocation DAVIE WOLD | CHIEF FINANCIAL OFFICER

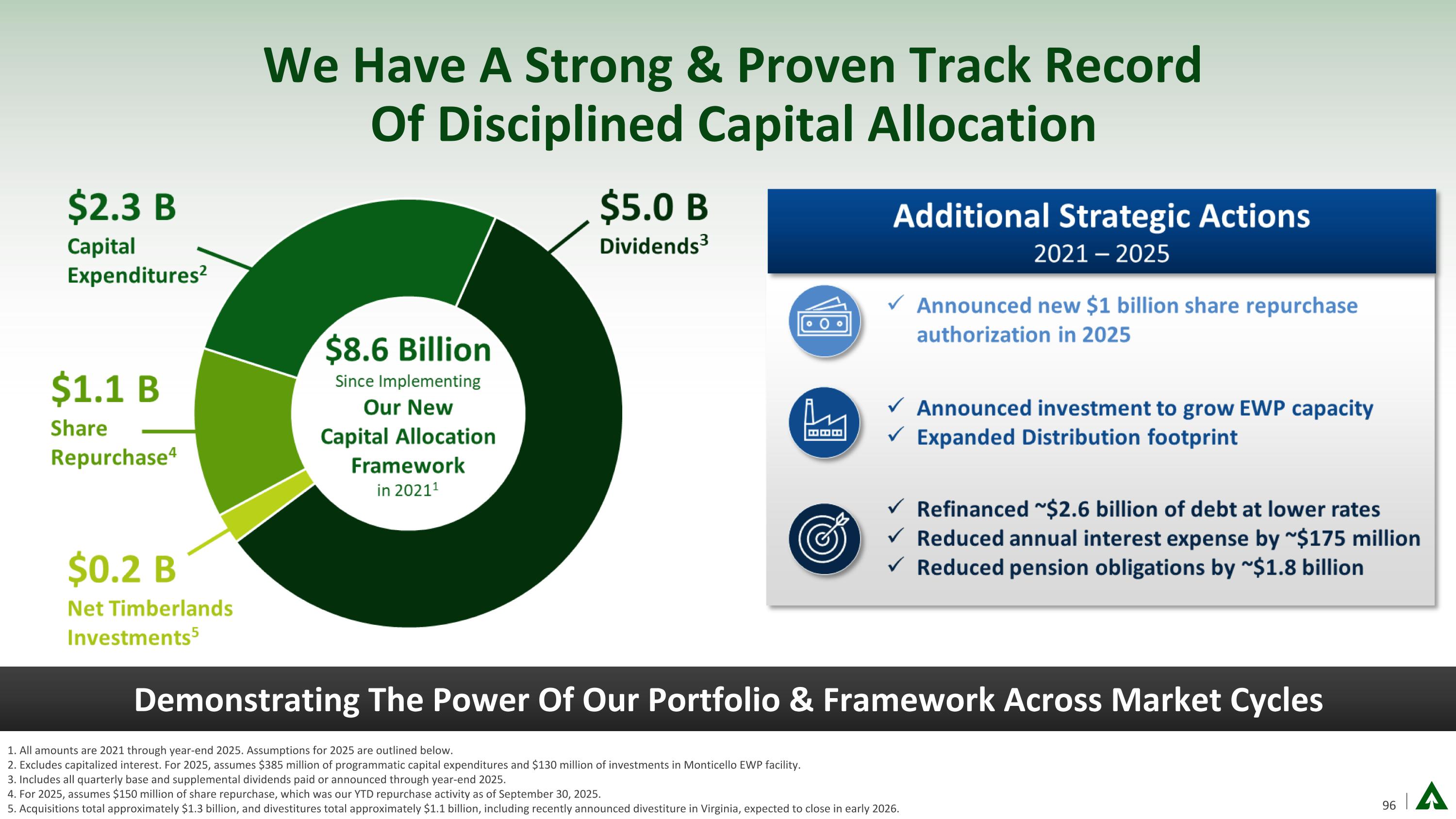

We Have A Strong & Proven Track Record Of Disciplined Capital Allocation 1. All amounts are 2021 through year-end 2025. Assumptions for 2025 are outlined below. 2. Excludes capitalized interest. For 2025, assumes $385 million of programmatic capital expenditures and $130 million of investments in Monticello EWP facility. 3. Includes all quarterly base and supplemental dividends paid or announced through year-end 2025. 4. For 2025, assumes $150 million of share repurchase, which was our YTD repurchase activity as of September 30, 2025. 5. Acquisitions total approximately $1.3 billion, and divestitures total approximately $1.1 billion, including recently announced divestiture in Virginia, expected to close in early 2026. Demonstrating The Power Of Our Portfolio & Framework Across Market Cycles

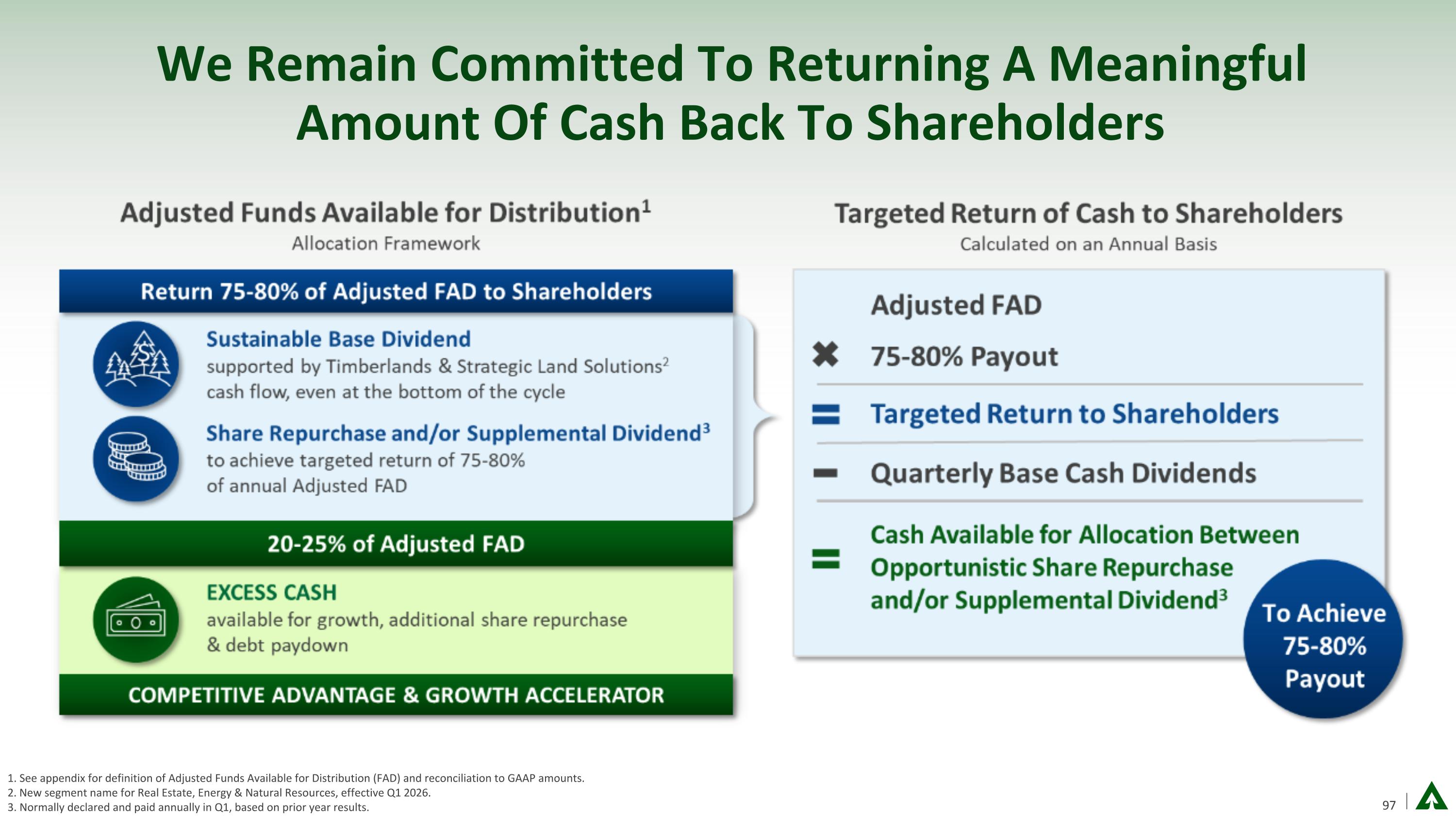

We Remain Committed To Returning A Meaningful Amount Of Cash Back To Shareholders 1. See appendix for definition of Adjusted Funds Available for Distribution (FAD) and reconciliation to GAAP amounts. 2. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 3. Normally declared and paid annually in Q1, based on prior year results.

We Have Many Levers To Drive Value Allocating & Executing To Deliver Exceptional Shareholder Returns 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. See appendix for definition of return on investment (ROI) and statement on this non-GAAP measure.

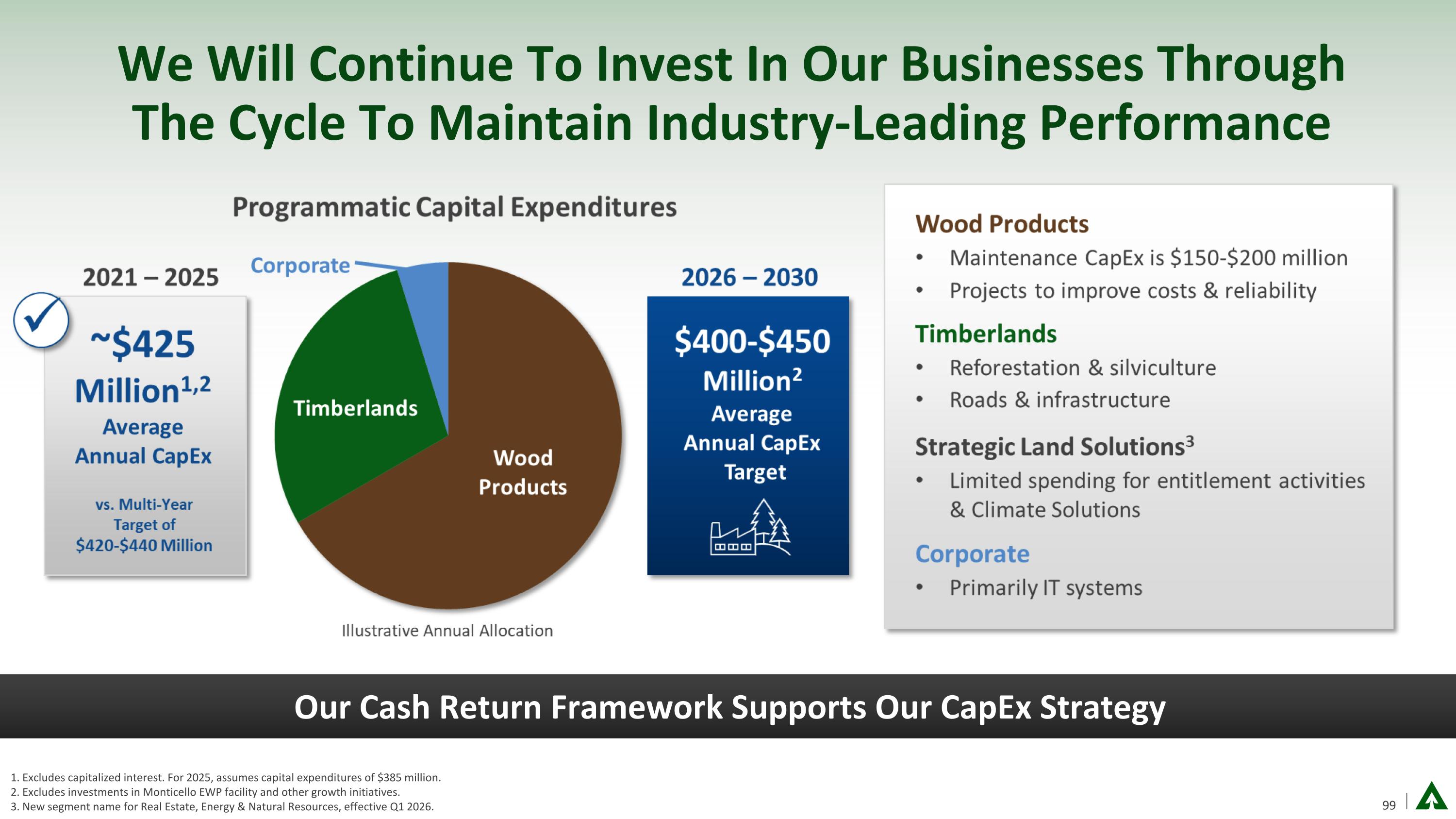

We Will Continue To Invest In Our Businesses Through The Cycle To Maintain Industry-Leading Performance 1. Excludes capitalized interest. For 2025, assumes capital expenditures of $385 million. 2. Excludes investments in Monticello EWP facility and other growth initiatives. 3. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. Our Cash Return Framework Supports Our CapEx Strategy

Our M&A Strategy Is Focused 100 100

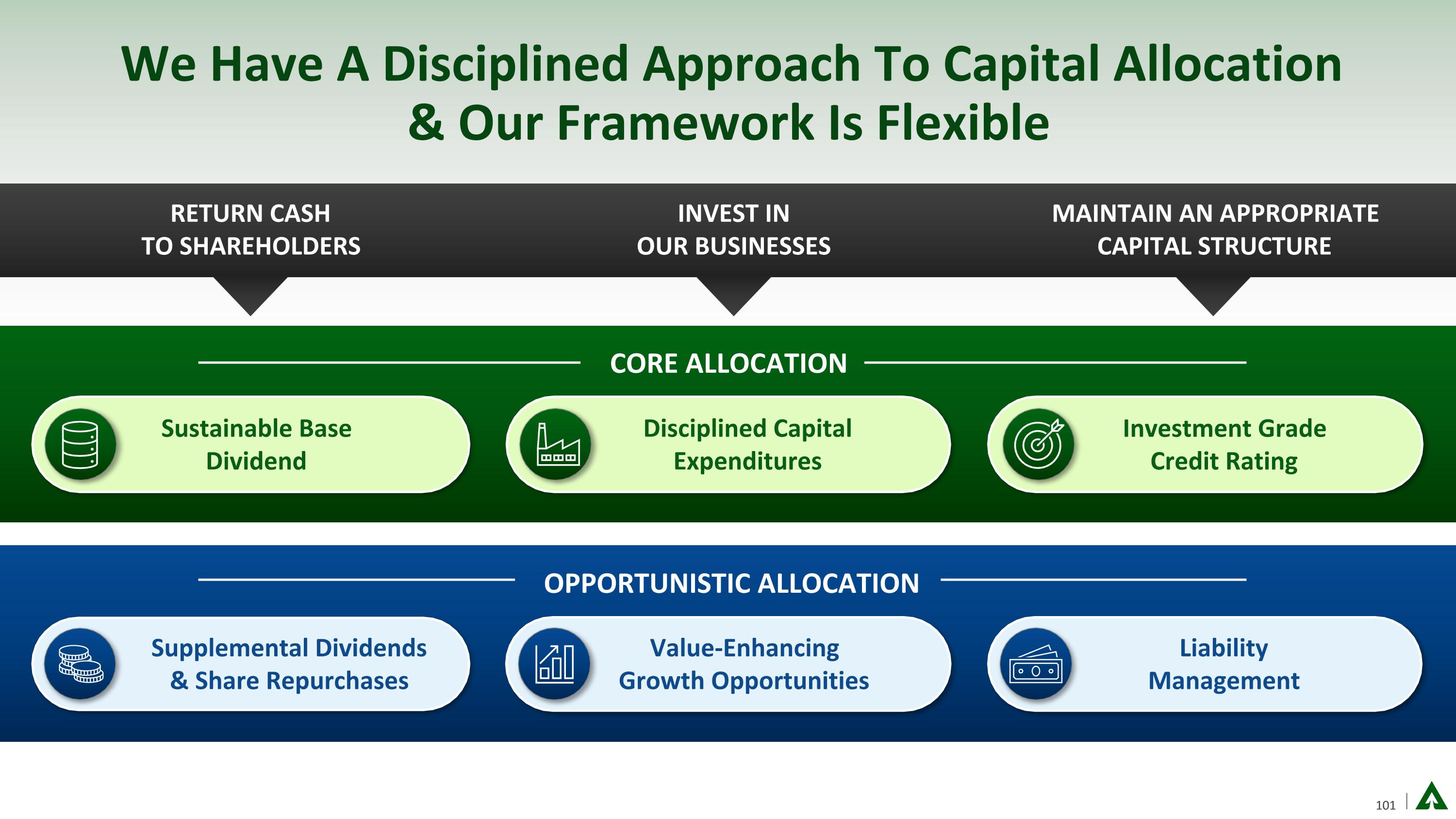

We Have A Disciplined Approach To Capital Allocation & Our Framework Is Flexible INVEST IN OUR BUSINESSES RETURN CASH TO SHAREHOLDERS MAINTAIN AN APPROPRIATE CAPITAL STRUCTURE CORE ALLOCATION Investment Grade Credit Rating Disciplined Capital Expenditures Sustainable Base Dividend OPPORTUNISTIC ALLOCATION Value-Enhancing Growth Opportunities Liability Management Supplemental Dividends & Share Repurchases

Closing Remarks DEVIN STOCKFISH | CHIEF EXECUTIVE OFFICER

103 Our Investment Thesis Drives Superior Shareholder Value Unmatched Portfolio Industry-Leading Performance Accelerated Growth Disciplined Capital Allocation Foundational Strengths Expertise | Sustainability | Operational Excellence | Innovation

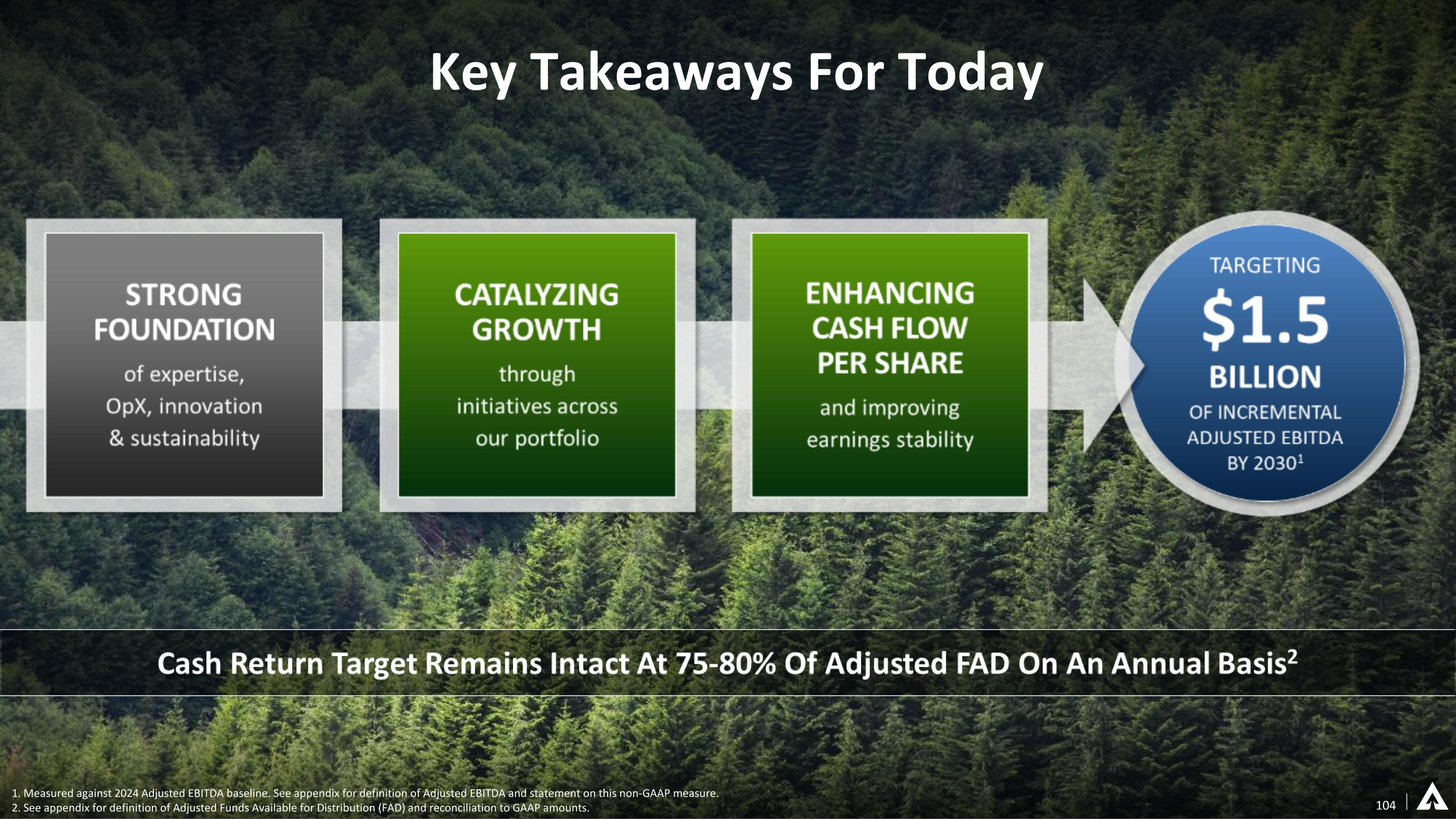

Key Takeaways For Today 104 1. Measured against 2024 Adjusted EBITDA baseline. See appendix for definition of Adjusted EBITDA and statement on this non-GAAP measure. 2. See appendix for definition of Adjusted Funds Available for Distribution (FAD) and reconciliation to GAAP amounts.

15-Minute Break Q&A SESSION WILL BEGIN SHORTLY

106 Our Investment Thesis Drives Superior Shareholder Value Unmatched Portfolio Industry-Leading Performance Accelerated Growth Disciplined Capital Allocation Foundational Strengths Expertise | Sustainability | Operational Excellence | Innovation

Appendix

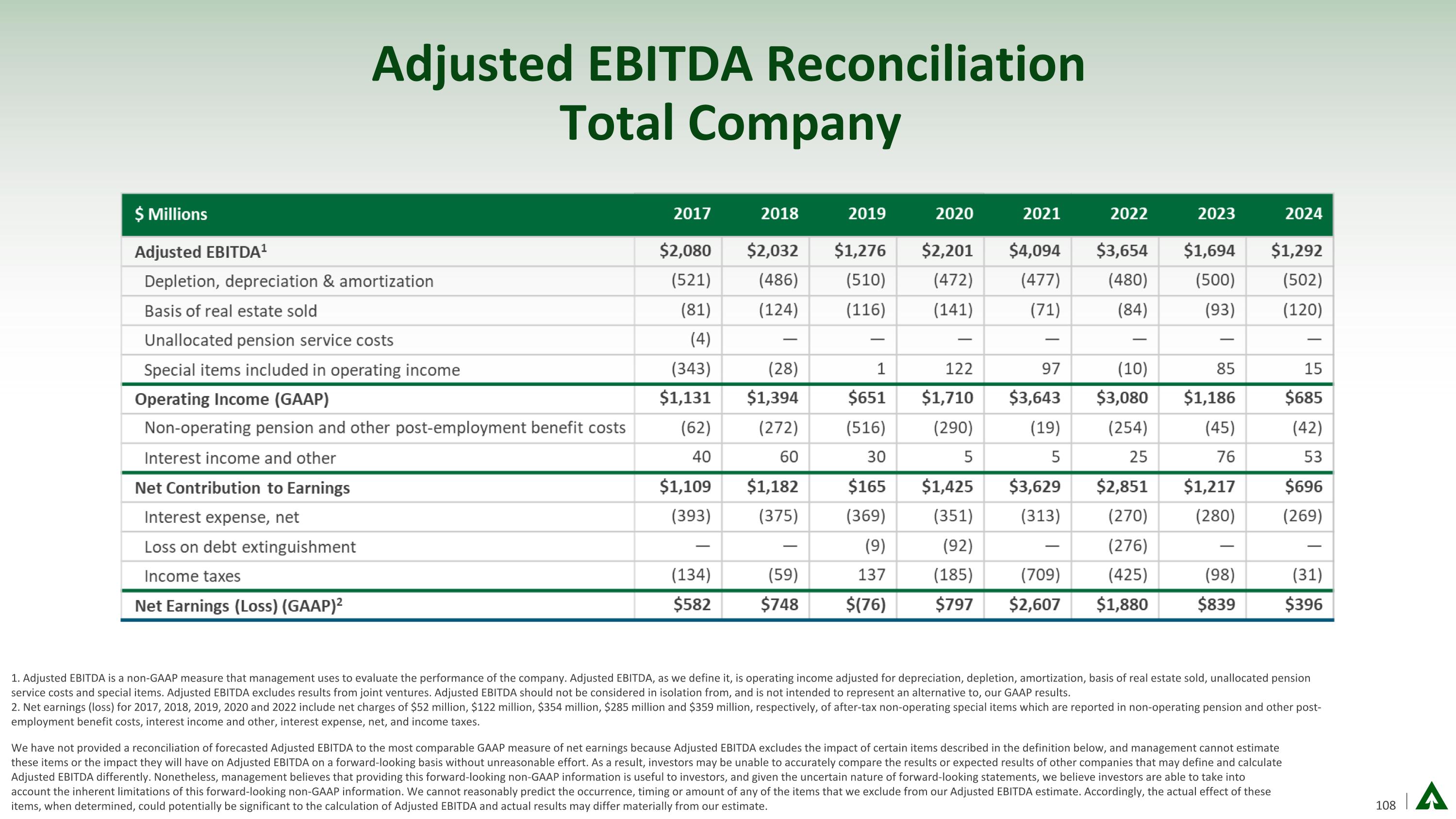

Adjusted EBITDA Reconciliation Total Company 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. 2. Net earnings (loss) for 2017, 2018, 2019, 2020 and 2022 include net charges of $52 million, $122 million, $354 million, $285 million and $359 million, respectively, of after-tax non-operating special items which are reported in non-operating pension and other post-employment benefit costs, interest income and other, interest expense, net, and income taxes. We have not provided a reconciliation of forecasted Adjusted EBITDA to the most comparable GAAP measure of net earnings because Adjusted EBITDA excludes the impact of certain items described in the definition below, and management cannot estimate these items or the impact they will have on Adjusted EBITDA on a forward-looking basis without unreasonable effort. As a result, investors may be unable to accurately compare the results or expected results of other companies that may define and calculate Adjusted EBITDA differently. Nonetheless, management believes that providing this forward-looking non-GAAP information is useful to investors, and given the uncertain nature of forward-looking statements, we believe investors are able to take into account the inherent limitations of this forward-looking non-GAAP information. We cannot reasonably predict the occurrence, timing or amount of any of the items that we exclude from our Adjusted EBITDA estimate. Accordingly, the actual effect of these items, when determined, could potentially be significant to the calculation of Adjusted EBITDA and actual results may differ materially from our estimate.

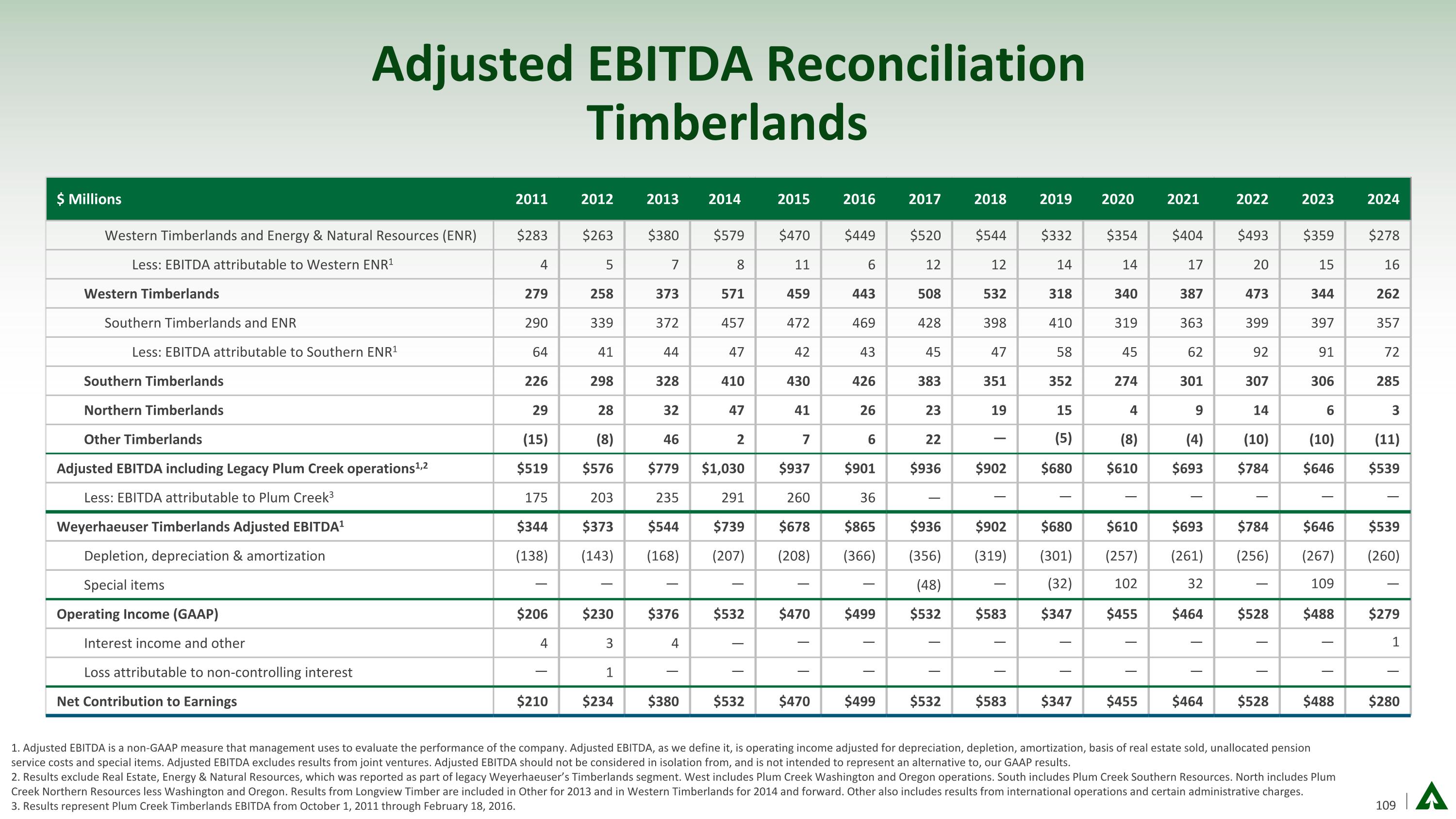

Adjusted EBITDA Reconciliation Timberlands 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. 2. Results exclude Real Estate, Energy & Natural Resources, which was reported as part of legacy Weyerhaeuser’s Timberlands segment. West includes Plum Creek Washington and Oregon operations. South includes Plum Creek Southern Resources. North includes Plum Creek Northern Resources less Washington and Oregon. Results from Longview Timber are included in Other for 2013 and in Western Timberlands for 2014 and forward. Other also includes results from international operations and certain administrative charges. 3. Results represent Plum Creek Timberlands EBITDA from October 1, 2011 through February 18, 2016. $ Millions 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Western Timberlands and Energy & Natural Resources (ENR) $283 $263 $380 $579 $470 $449 $520 $544 $332 $354 $404 $493 $359 $278 Less: EBITDA attributable to Western ENR1 4 5 7 8 11 6 12 12 14 14 17 20 15 16 Western Timberlands 279 258 373 571 459 443 508 532 318 340 387 473 344 262 Southern Timberlands and ENR 290 339 372 457 472 469 428 398 410 319 363 399 397 357 Less: EBITDA attributable to Southern ENR1 64 41 44 47 42 43 45 47 58 45 62 92 91 72 Southern Timberlands 226 298 328 410 430 426 383 351 352 274 301 307 306 285 Northern Timberlands 29 28 32 47 41 26 23 19 15 4 9 14 6 3 Other Timberlands (15) (8) 46 2 7 6 22 — (5) (8) (4) (10) (10) (11) Adjusted EBITDA including Legacy Plum Creek operations1,2 $519 $576 $779 $1,030 $937 $901 $936 $902 $680 $610 $693 $784 $646 $539 Less: EBITDA attributable to Plum Creek3 175 203 235 291 260 36 — — — — — — — — Weyerhaeuser Timberlands Adjusted EBITDA1 $344 $373 $544 $739 $678 $865 $936 $902 $680 $610 $693 $784 $646 $539 Depletion, depreciation & amortization (138) (143) (168) (207) (208) (366) (356) (319) (301) (257) (261) (256) (267) (260) Special items — — — — — — (48) — (32) 102 32 — 109 — Operating Income (GAAP) $206 $230 $376 $532 $470 $499 $532 $583 $347 $455 $464 $528 $488 $279 Interest income and other 4 3 4 — — — — — — — — — — 1 Loss attributable to non-controlling interest — 1 — — — — — — — — — — — — Net Contribution to Earnings $210 $234 $380 $532 $470 $499 $532 $583 $347 $455 $464 $528 $488 $280

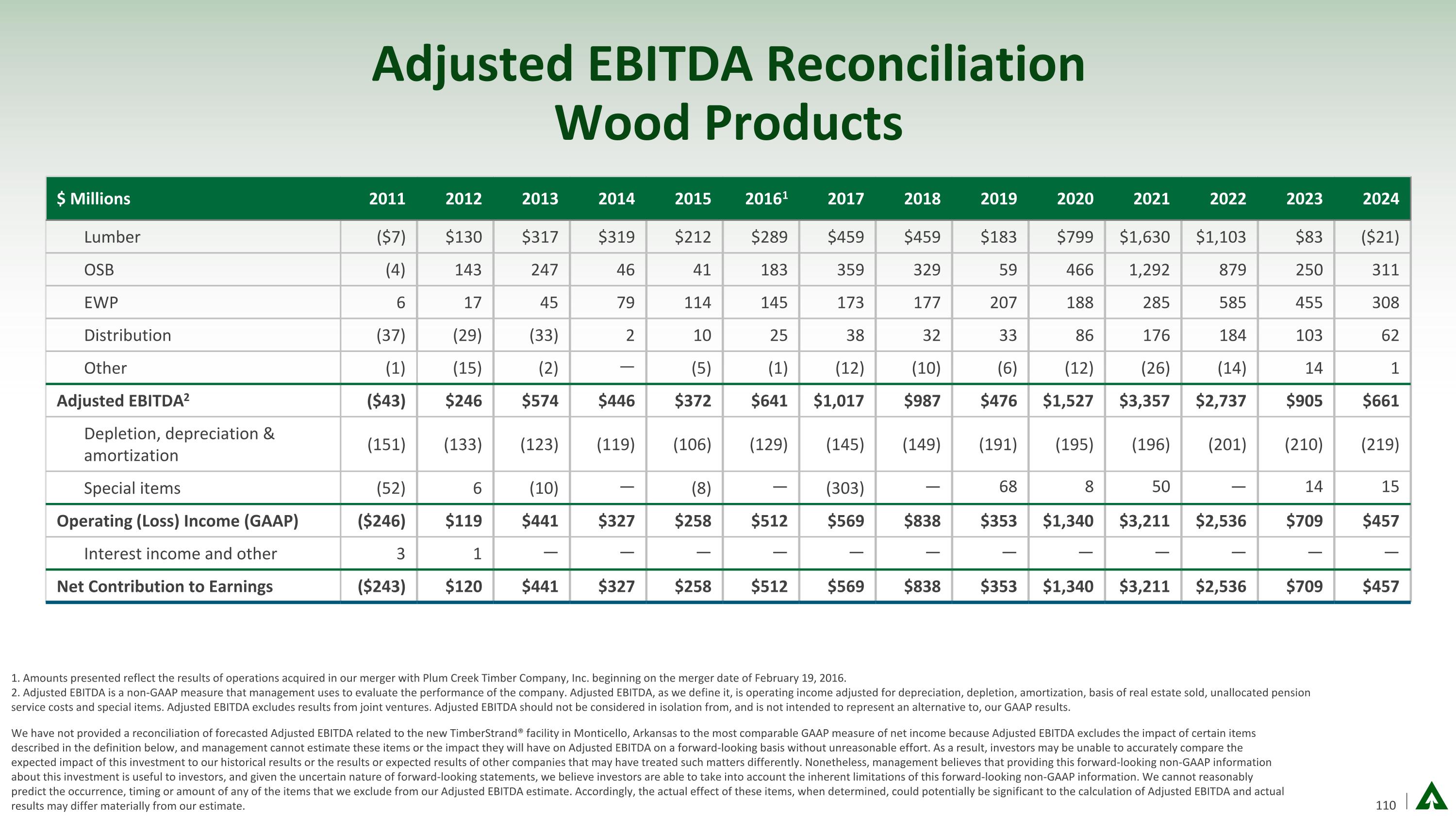

Adjusted EBITDA Reconciliation Wood Products 1. Amounts presented reflect the results of operations acquired in our merger with Plum Creek Timber Company, Inc. beginning on the merger date of February 19, 2016. 2. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. We have not provided a reconciliation of forecasted Adjusted EBITDA related to the new TimberStrand® facility in Monticello, Arkansas to the most comparable GAAP measure of net income because Adjusted EBITDA excludes the impact of certain items described in the definition below, and management cannot estimate these items or the impact they will have on Adjusted EBITDA on a forward-looking basis without unreasonable effort. As a result, investors may be unable to accurately compare the expected impact of this investment to our historical results or the results or expected results of other companies that may have treated such matters differently. Nonetheless, management believes that providing this forward-looking non-GAAP information about this investment is useful to investors, and given the uncertain nature of forward-looking statements, we believe investors are able to take into account the inherent limitations of this forward-looking non-GAAP information. We cannot reasonably predict the occurrence, timing or amount of any of the items that we exclude from our Adjusted EBITDA estimate. Accordingly, the actual effect of these items, when determined, could potentially be significant to the calculation of Adjusted EBITDA and actual results may differ materially from our estimate. $ Millions 2011 2012 2013 2014 2015 20161 2017 2018 2019 2020 2021 2022 2023 2024 Lumber ($7) $130 $317 $319 $212 $289 $459 $459 $183 $799 $1,630 $1,103 $83 ($21) OSB (4) 143 247 46 41 183 359 329 59 466 1,292 879 250 311 EWP 6 17 45 79 114 145 173 177 207 188 285 585 455 308 Distribution (37) (29) (33) 2 10 25 38 32 33 86 176 184 103 62 Other (1) (15) (2) — (5) (1) (12) (10) (6) (12) (26) (14) 14 1 Adjusted EBITDA2 ($43) $246 $574 $446 $372 $641 $1,017 $987 $476 $1,527 $3,357 $2,737 $905 $661 Depletion, depreciation & amortization (151) (133) (123) (119) (106) (129) (145) (149) (191) (195) (196) (201) (210) (219) Special items (52) 6 (10) — (8) — (303) — 68 8 50 — 14 15 Operating (Loss) Income (GAAP) ($246) $119 $441 $327 $258 $512 $569 $838 $353 $1,340 $3,211 $2,536 $709 $457 Interest income and other 3 1 — — — — — — — — — — — — Net Contribution to Earnings ($243) $120 $441 $327 $258 $512 $569 $838 $353 $1,340 $3,211 $2,536 $709 $457

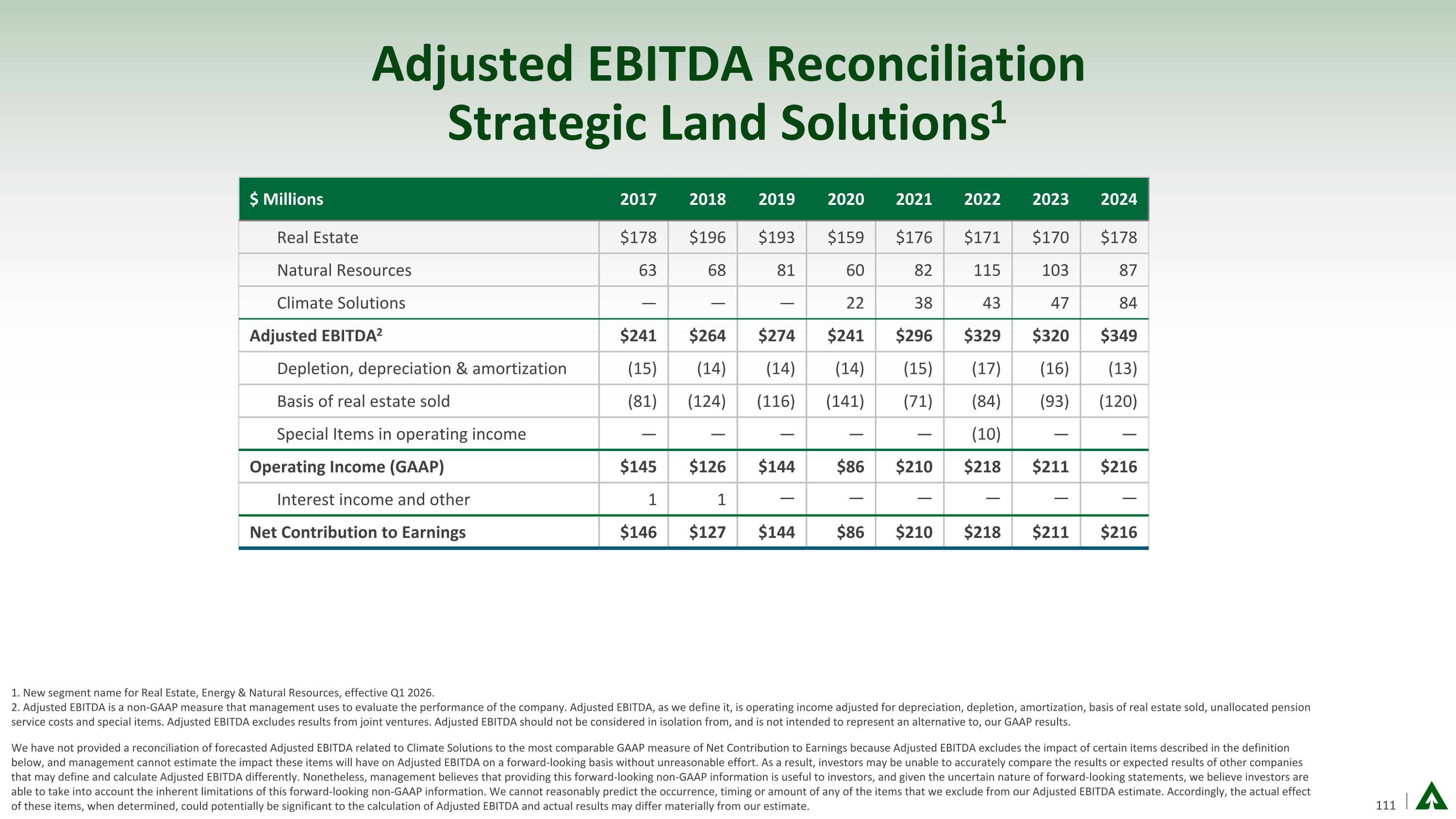

Adjusted EBITDA Reconciliation Strategic Land Solutions1 1. New segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 2. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. We have not provided a reconciliation of forecasted Adjusted EBITDA related to Climate Solutions to the most comparable GAAP measure of Net Contribution to Earnings because Adjusted EBITDA excludes the impact of certain items described in the definition below, and management cannot estimate the impact these items will have on Adjusted EBITDA on a forward-looking basis without unreasonable effort. As a result, investors may be unable to accurately compare the results or expected results of other companies that may define and calculate Adjusted EBITDA differently. Nonetheless, management believes that providing this forward-looking non-GAAP information is useful to investors, and given the uncertain nature of forward-looking statements, we believe investors are able to take into account the inherent limitations of this forward-looking non-GAAP information. We cannot reasonably predict the occurrence, timing or amount of any of the items that we exclude from our Adjusted EBITDA estimate. Accordingly, the actual effect of these items, when determined, could potentially be significant to the calculation of Adjusted EBITDA and actual results may differ materially from our estimate. $ Millions 2017 2018 2019 2020 2021 2022 2023 2024 Real Estate $178 $196 $193 $159 $176 $171 $170 $178 Natural Resources 63 68 81 60 82 115 103 87 Climate Solutions — — — 22 38 43 47 84 Adjusted EBITDA2 $241 $264 $274 $241 $296 $329 $320 $349 Depletion, depreciation & amortization (15) (14) (14) (14) (15) (17) (16) (13) Basis of real estate sold (81) (124) (116) (141) (71) (84) (93) (120) Special Items in operating income — — — — — (10) — — Operating Income (GAAP) $145 $126 $144 $86 $210 $218 $211 $216 Interest income and other 1 1 — — — — — — Net Contribution to Earnings $146 $127 $144 $86 $210 $218 $211 $216

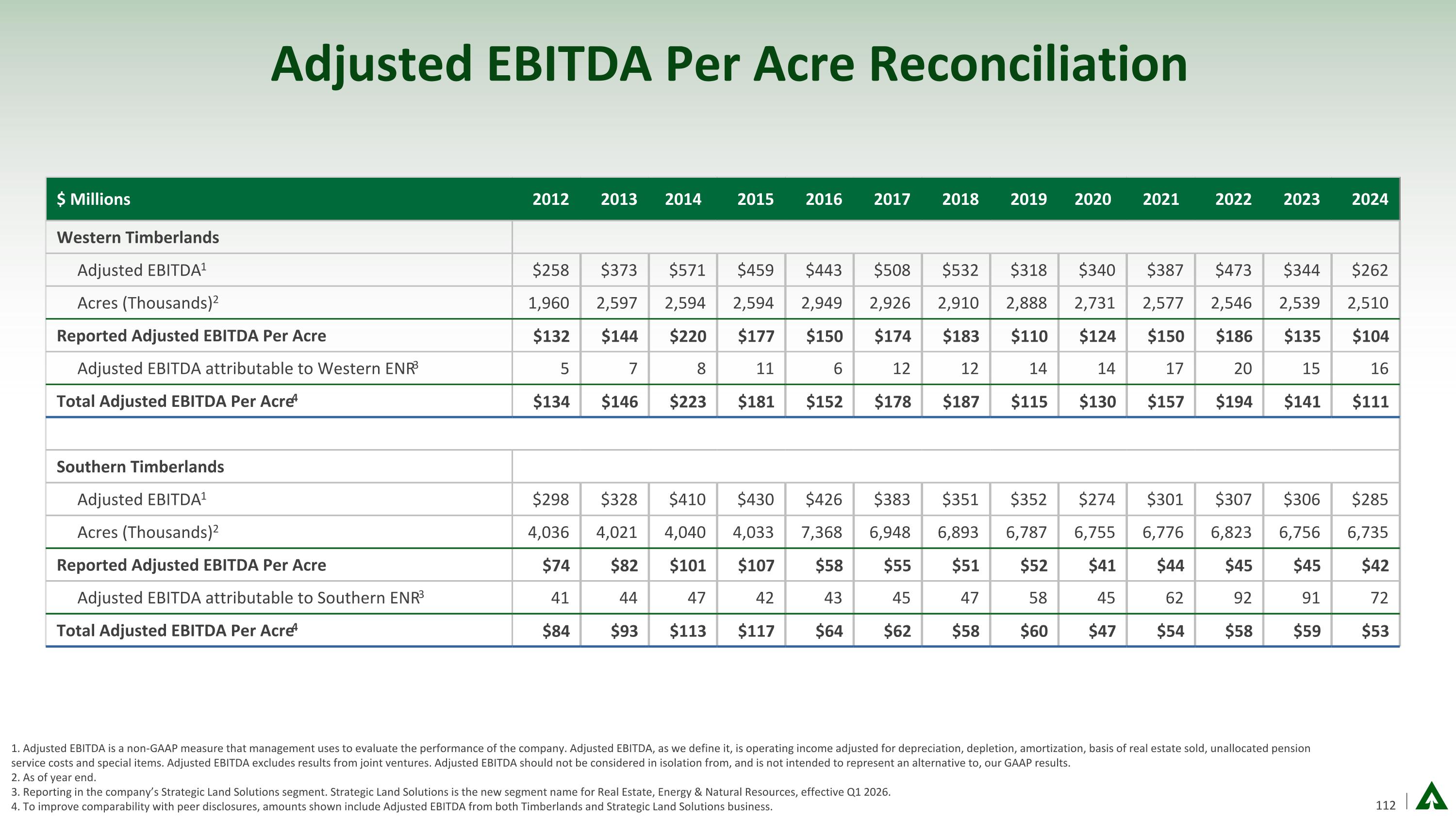

Adjusted EBITDA Per Acre Reconciliation $ Millions 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Western Timberlands Adjusted EBITDA1 $258 $373 $571 $459 $443 $508 $532 $318 $340 $387 $473 $344 $262 Acres (Thousands)2 1,960 2,597 2,594 2,594 2,949 2,926 2,910 2,888 2,731 2,577 2,546 2,539 2,510 Reported Adjusted EBITDA Per Acre $132 $144 $220 $177 $150 $174 $183 $110 $124 $150 $186 $135 $104 Adjusted EBITDA attributable to Western ENR3 5 7 8 11 6 12 12 14 14 17 20 15 16 Total Adjusted EBITDA Per Acre4 $134 $146 $223 $181 $152 $178 $187 $115 $130 $157 $194 $141 $111 Southern Timberlands Adjusted EBITDA1 $298 $328 $410 $430 $426 $383 $351 $352 $274 $301 $307 $306 $285 Acres (Thousands)2 4,036 4,021 4,040 4,033 7,368 6,948 6,893 6,787 6,755 6,776 6,823 6,756 6,735 Reported Adjusted EBITDA Per Acre $74 $82 $101 $107 $58 $55 $51 $52 $41 $44 $45 $45 $42 Adjusted EBITDA attributable to Southern ENR3 41 44 47 42 43 45 47 58 45 62 92 91 72 Total Adjusted EBITDA Per Acre4 $84 $93 $113 $117 $64 $62 $58 $60 $47 $54 $58 $59 $53 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. 2. As of year end. 3. Reporting in the company’s Strategic Land Solutions segment. Strategic Land Solutions is the new segment name for Real Estate, Energy & Natural Resources, effective Q1 2026. 4. To improve comparability with peer disclosures, amounts shown include Adjusted EBITDA from both Timberlands and Strategic Land Solutions business.

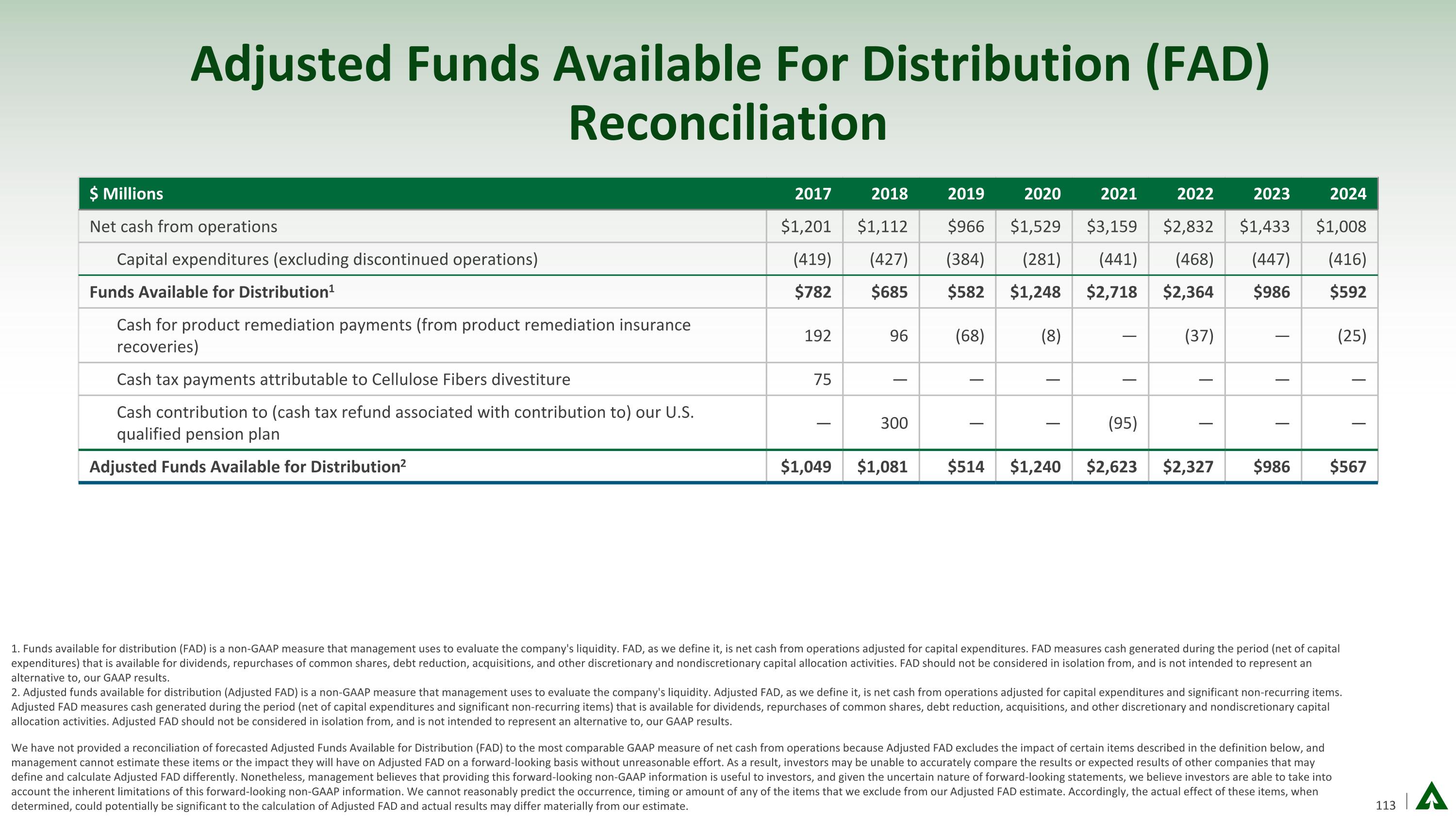

Adjusted Funds Available For Distribution (FAD) Reconciliation 1. Funds available for distribution (FAD) is a non-GAAP measure that management uses to evaluate the company's liquidity. FAD, as we define it, is net cash from operations adjusted for capital expenditures. FAD measures cash generated during the period (net of capital expenditures) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. 2. Adjusted funds available for distribution (Adjusted FAD) is a non-GAAP measure that management uses to evaluate the company's liquidity. Adjusted FAD, as we define it, is net cash from operations adjusted for capital expenditures and significant non-recurring items. Adjusted FAD measures cash generated during the period (net of capital expenditures and significant non-recurring items) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. Adjusted FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. $ Millions 2017 2018 2019 2020 2021 2022 2023 2024 Net cash from operations $1,201 $1,112 $966 $1,529 $3,159 $2,832 $1,433 $1,008 Capital expenditures (excluding discontinued operations) (419) (427) (384) (281) (441) (468) (447) (416) Funds Available for Distribution1 $782 $685 $582 $1,248 $2,718 $2,364 $986 $592 Cash for product remediation payments (from product remediation insurance recoveries) 192 96 (68) (8) — (37) — (25) Cash tax payments attributable to Cellulose Fibers divestiture 75 — — — — — — — Cash contribution to (cash tax refund associated with contribution to) our U.S. qualified pension plan — 300 — — (95) — — — Adjusted Funds Available for Distribution2 $1,049 $1,081 $514 $1,240 $2,623 $2,327 $986 $567 We have not provided a reconciliation of forecasted Adjusted Funds Available for Distribution (FAD) to the most comparable GAAP measure of net cash from operations because Adjusted FAD excludes the impact of certain items described in the definition below, and management cannot estimate these items or the impact they will have on Adjusted FAD on a forward-looking basis without unreasonable effort. As a result, investors may be unable to accurately compare the results or expected results of other companies that may define and calculate Adjusted FAD differently. Nonetheless, management believes that providing this forward-looking non-GAAP information is useful to investors, and given the uncertain nature of forward-looking statements, we believe investors are able to take into account the inherent limitations of this forward-looking non-GAAP information. We cannot reasonably predict the occurrence, timing or amount of any of the items that we exclude from our Adjusted FAD estimate. Accordingly, the actual effect of these items, when determined, could potentially be significant to the calculation of Adjusted FAD and actual results may differ materially from our estimate.

Other Non-GAAP Financial Measures This presentation references forward-looking estimates of free cash flow yield, Adjusted EBITDA multiple and return on investment, each of which is a non-GAAP financial measure that management uses to evaluate the performance of the company and certain investments. Free cash flow yield, as we define it, is calculated by dividing free cash flow — defined as Adjusted EBITDA generated less capital expenditures to support operations — by the purchase price of the investment. Adjusted EBITDA multiple is calculated by dividing the purchase price by the company's forecasted Adjusted EBITDA. Return on investment (ROI) is calculated by dividing forecasted cash flow by invested capital. These measures should not be considered in isolation from, and are not intended to represent alternatives to, our GAAP results. We have not provided a reconciliation of these forward-looking non-GAAP financial measures to the most comparable GAAP measure of net cash from operations (in the case of free cash flow), net earnings (in the case of Adjusted EBITDA multiple) and return on assets (in the case of ROI), because they each exclude the impact of certain items that are inherently difficult to forecast, such as changes in working capital, capital expenditures, and asset sales. Management cannot estimate these items or their impact on free cash flow yield, Adjusted EBITDA multiple or ROI on a forward-looking basis without unreasonable effort. As a result, investors may be unable to accurately compare our historical results to those of other companies that may define or calculate free cash flow yield, Adjusted EBITDA multiple, or ROI differently. Nonetheless, management believes that providing this forward-looking non-GAAP information is useful to investors. Given the uncertain nature of forward-looking statements, we believe investors are able to take into account the inherent limitations of this forward-looking non-GAAP information. Actual results may differ materially from our estimates due to the potential significance of the excluded items.