Second Quarter 2026 Earnings Review NYSE: WLY DEC 04, 2025

SAFE HARBOR STATEMENT This release contains certain forward-looking statements concerning the Company's operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward- looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company and are subject to change based on many important factors. Such factors include, but are not limited to: (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company's journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key online retailers; (vi) the seasonal nature of the Company's educational business and the impact of the used book market; (vii) worldwide economic and political conditions; (viii) the Company's ability to protect its copyrights and other intellectual property worldwide (ix) the ability of the Company to successfully integrate acquired operations and realize expected opportunities; (x) the ability to realize operating savings over time and in fiscal year 2026 in connection with our multiyear Global Restructuring Program and completed dispositions; (xi) cyber risk and the failure to maintain the integrity of our operational or security systems or infrastructure, or those of third parties with which we do business; (xii) as a result of acquisitions, we have and may record a significant amount of goodwill and other identifiable intangible assets and we may never realize the full carrying value of these assets; (xiii) our ability to leverage artificial intelligence technologies in our products and services, including generative artificial intelligence, large language models, machine learning, and other artificial intelligence tools; and (xiv) other factors detailed from time to time in our filings with the SEC. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances. NON-GAAP FINANCIAL MEASURES Wiley provides non-GAAP financial measures and performance results such as: Adjusted Revenue Adjusted Earnings Per Share (“Adjusted EPS”); Free Cash Flow; Adjusted Operating Income and margin; Adjusted Income Before Taxes Adjusted Income Tax Provision Adjusted Effective Tax Rate EBITDA (earnings before interest, taxes, depreciation and amortization), Adjusted EBITDA and margin; and Results on a constant currency (“CC”) basis. Management believes non-GAAP financial measures, which exclude the impact of restructuring charges and credits and certain other items, and the impact of divestitures and acquisitions provide a useful comparable basis to analyze operating results and earnings. See the reconciliations of non-GAAP financial measures and explanations of the uses of non-GAAP measures in the supplementary information. We have not provided our 2026 outlook for the most directly comparable U.S. GAAP financial measures, as they are not available without unreasonable effort due to the high variability, complexity, and low visibility with respect to certain items, including restructuring charges and credits, gains and losses on foreign currency, and other gains and losses. These items are uncertain, depend on various factors, and could be material to our consolidated results computed in accordance with U.S. GAAP. 2

Unleashing the Power of Science

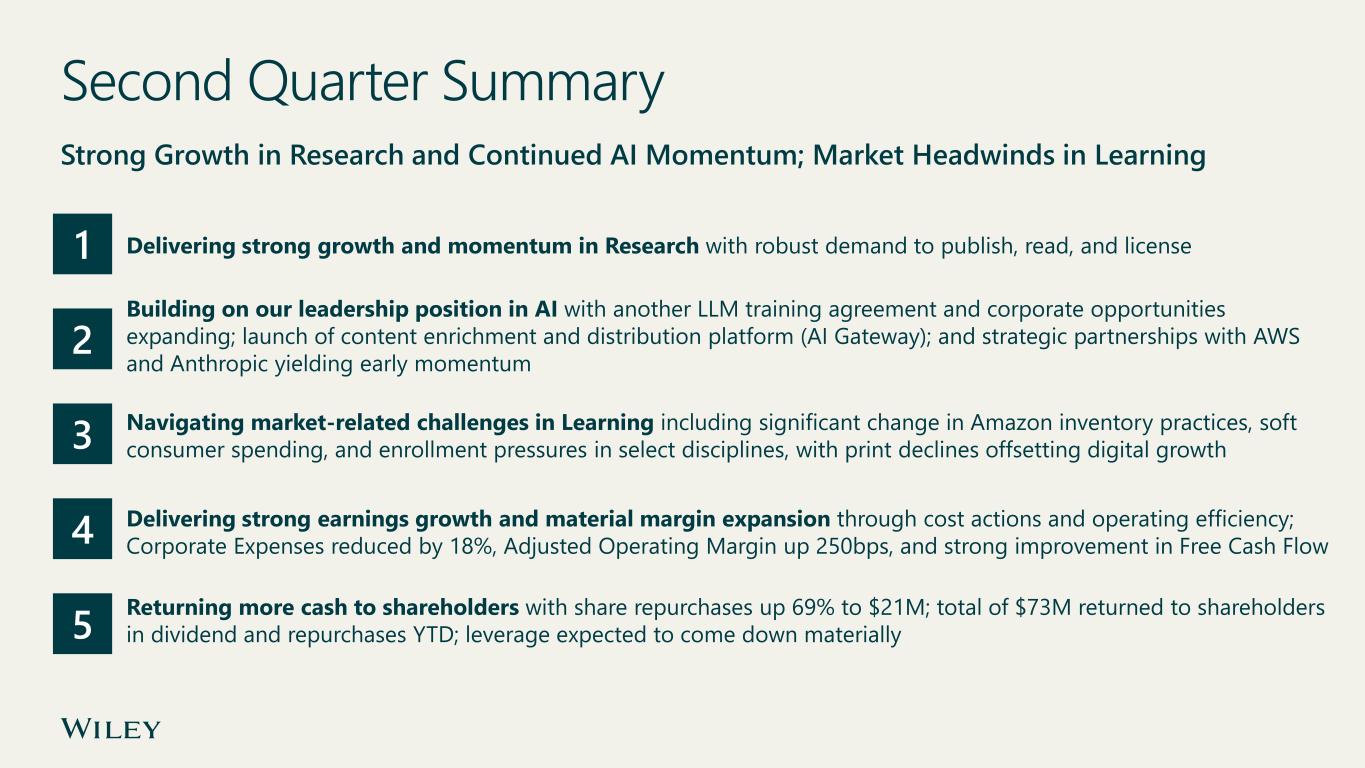

Second Quarter Summary Delivering strong growth and momentum in Research with robust demand to publish, read, and license Building on our leadership position in AI with another LLM training agreement and corporate opportunities expanding; launch of content enrichment and distribution platform (AI Gateway); and strategic partnerships with AWS and Anthropic yielding early momentum Navigating market-related challenges in Learning including significant change in Amazon inventory practices, soft consumer spending, and enrollment pressures in select disciplines, with print declines offsetting digital growth Delivering strong earnings growth and material margin expansion through cost actions and operating efficiency; Corporate Expenses reduced by 18%, Adjusted Operating Margin up 250bps, and strong improvement in Free Cash Flow Returning more cash to shareholders with share repurchases up 69% to $21M; total of $73M returned to shareholders in dividend and repurchases YTD; leverage expected to come down materially 1 2 4 3 5 Strong Growth in Research and Continued AI Momentum; Market Headwinds in Learning

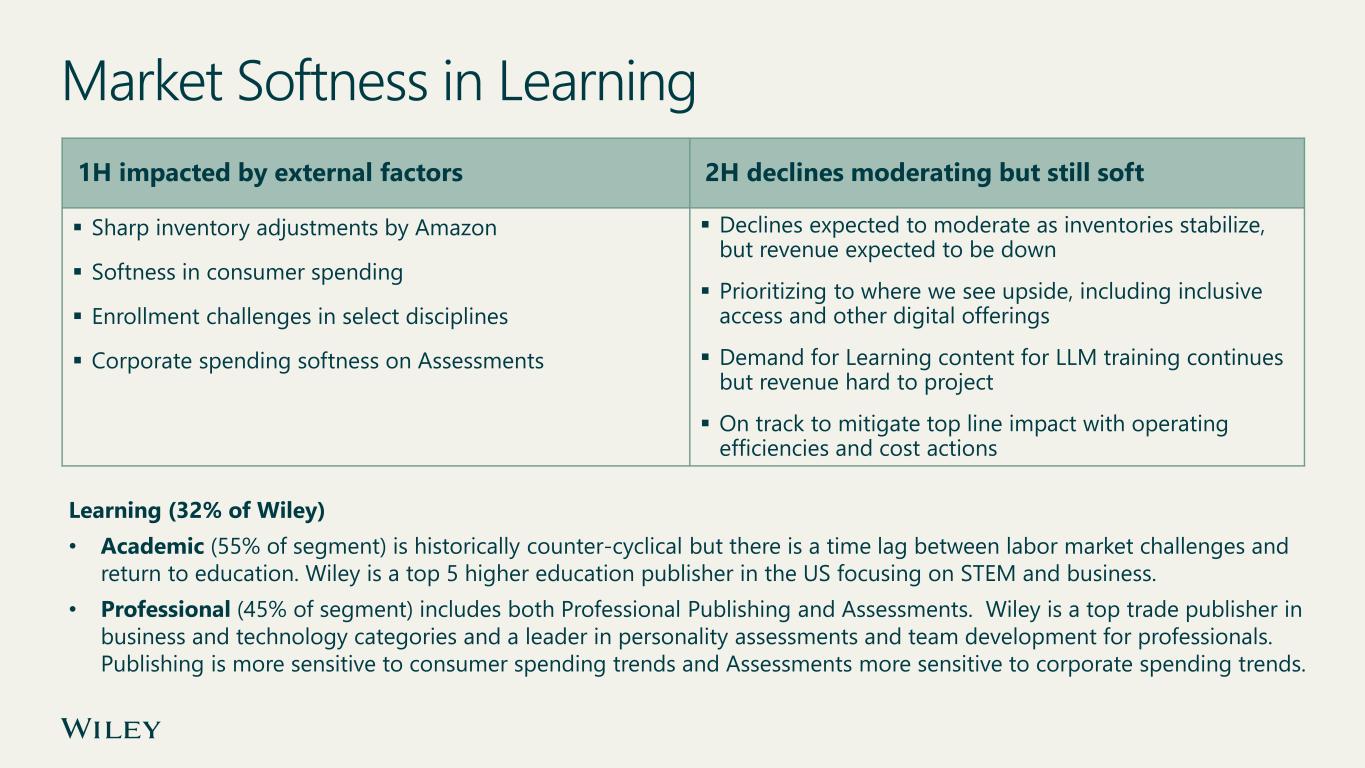

1H impacted by external factors 2H declines moderating but still soft Sharp inventory adjustments by Amazon Softness in consumer spending Enrollment challenges in select disciplines Corporate spending softness on Assessments Declines expected to moderate as inventories stabilize, but revenue expected to be down Prioritizing to where we see upside, including inclusive access and other digital offerings Demand for Learning content for LLM training continues but revenue hard to project On track to mitigate top line impact with operating efficiencies and cost actions Market Softness in Learning Learning (32% of Wiley) • Academic (55% of segment) is historically counter-cyclical but there is a time lag between labor market challenges and return to education. Wiley is a top 5 higher education publisher in the US focusing on STEM and business. • Professional (45% of segment) includes both Professional Publishing and Assessments. Wiley is a top trade publisher in business and technology categories and a leader in personality assessments and team development for professionals. Publishing is more sensitive to consumer spending trends and Assessments more sensitive to corporate spending trends.

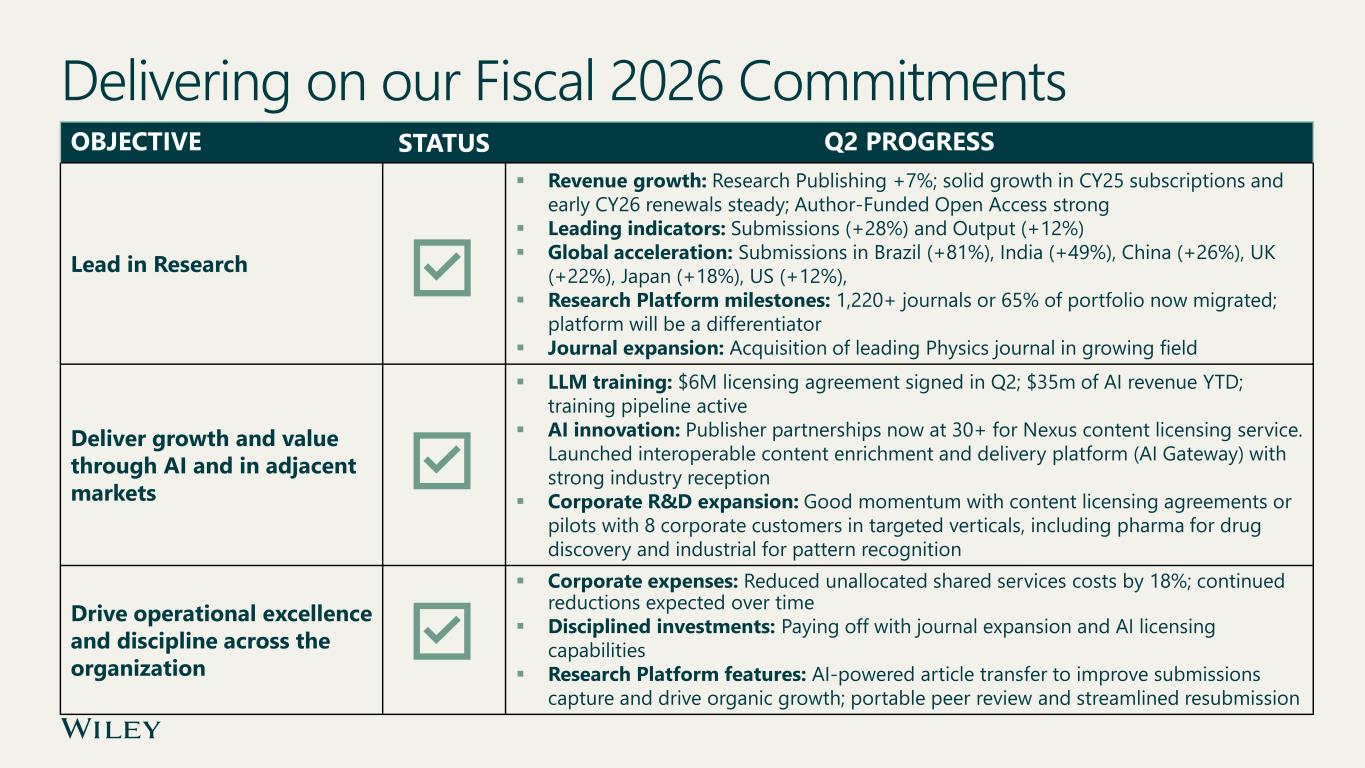

Delivering on our Fiscal 2026 Commitments OBJECTIVE STATUS Q2 PROGRESS Lead in Research Revenue growth: Research Publishing +7%; solid growth in CY25 subscriptions and early CY26 renewals steady; Author-Funded Open Access strong Leading indicators: Submissions (+28%) and Output (+12%) Global acceleration: Submissions in Brazil (+81%), India (+49%), China (+26%), UK (+22%), Japan (+18%), US (+12%), Research Platform milestones: 1,220+ journals or 65% of portfolio now migrated; platform will be a differentiator Journal expansion: Acquisition of leading Physics journal in growing field Deliver growth and value through AI and in adjacent markets LLM training: $6M licensing agreement signed in Q2; $35m of AI revenue YTD; training pipeline active AI innovation: Publisher partnerships now at 30+ for Nexus content licensing service. Launched interoperable content enrichment and delivery platform (AI Gateway) with strong industry reception Corporate R&D expansion: Good momentum with content licensing agreements or pilots with 8 corporate customers in targeted verticals, including pharma for drug discovery and industrial for pattern recognition Drive operational excellence and discipline across the organization Corporate expenses: Reduced unallocated shared services costs by 18%; continued reductions expected over time Disciplined investments: Paying off with journal expansion and AI licensing capabilities Research Platform features: AI-powered article transfer to improve submissions capture and drive organic growth; portable peer review and streamlined resubmission

Research: Resilience and Moat Continuing Peer review publishers set the global standard for scientific excellence Research content is must have for institutions and increasingly, corporations Publishing is essential for a researcher's career and for global recognition of scientific achievement Research output is ever-increasing driven by global R&D spend; the rate of scientific research and advancement is expected to further accelerate with AI Research is constantly evolving; new knowledge and recency are vital for AI models Published research is protected under IP copyright law

Wiley’s Competitive Advantages in an AI Economy Provides access to much of world’s trusted scientific, technical, and medical content Big 3 publisher and differentiated by top position in fast growing domains Unique, longstanding relationships with researchers, institutions, societies, and funders Strong position and first mover with corporations building out AI applications and models Strategic partnerships with the world’s most advanced AI innovators and other publishers Capex-light and open platform approach leveraging partnerships and existing assets

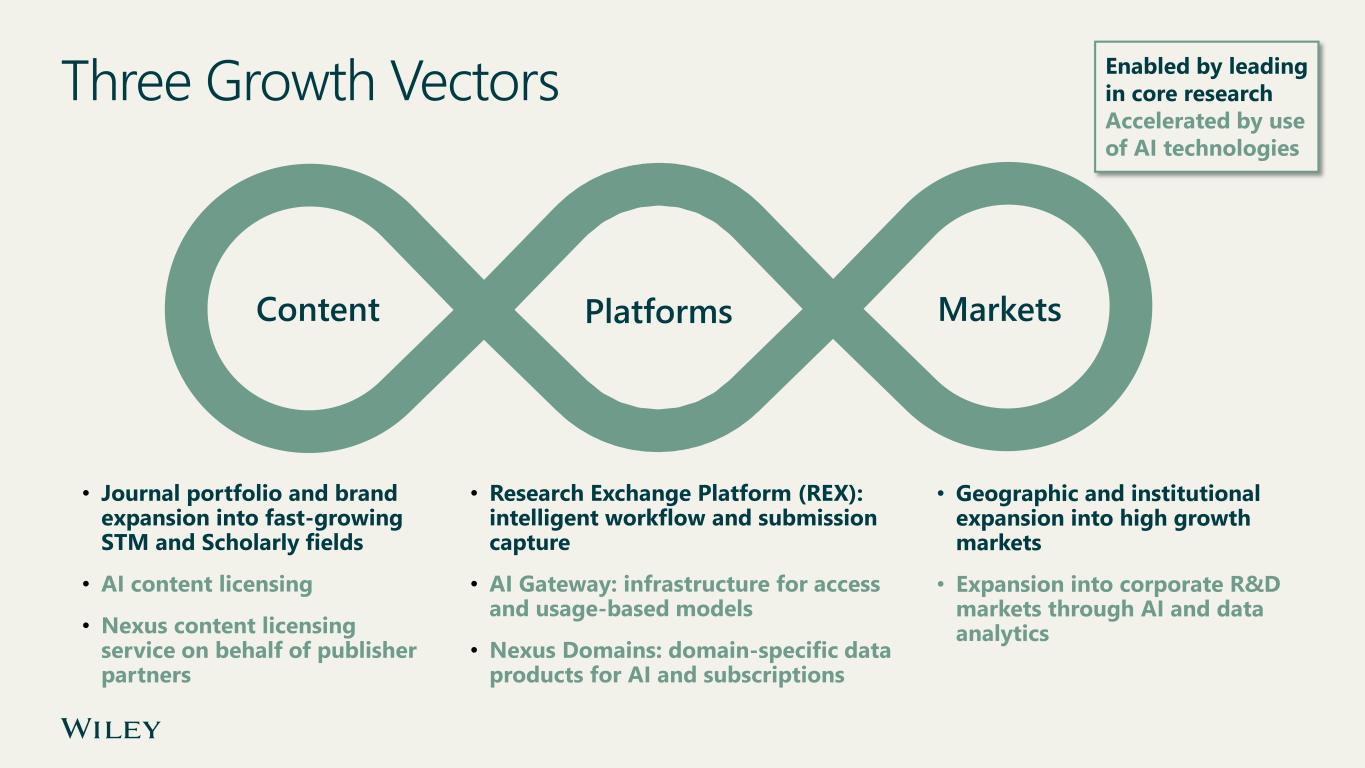

Content Platforms Markets Three Growth Vectors • Research Exchange Platform (REX): intelligent workflow and submission capture • AI Gateway: infrastructure for access and usage-based models • Nexus Domains: domain-specific data products for AI and subscriptions • Journal portfolio and brand expansion into fast-growing STM and Scholarly fields • AI content licensing • Nexus content licensing service on behalf of publisher partners • Geographic and institutional expansion into high growth markets • Expansion into corporate R&D markets through AI and data analytics Enabled by leading in core research Accelerated by use of AI technologies

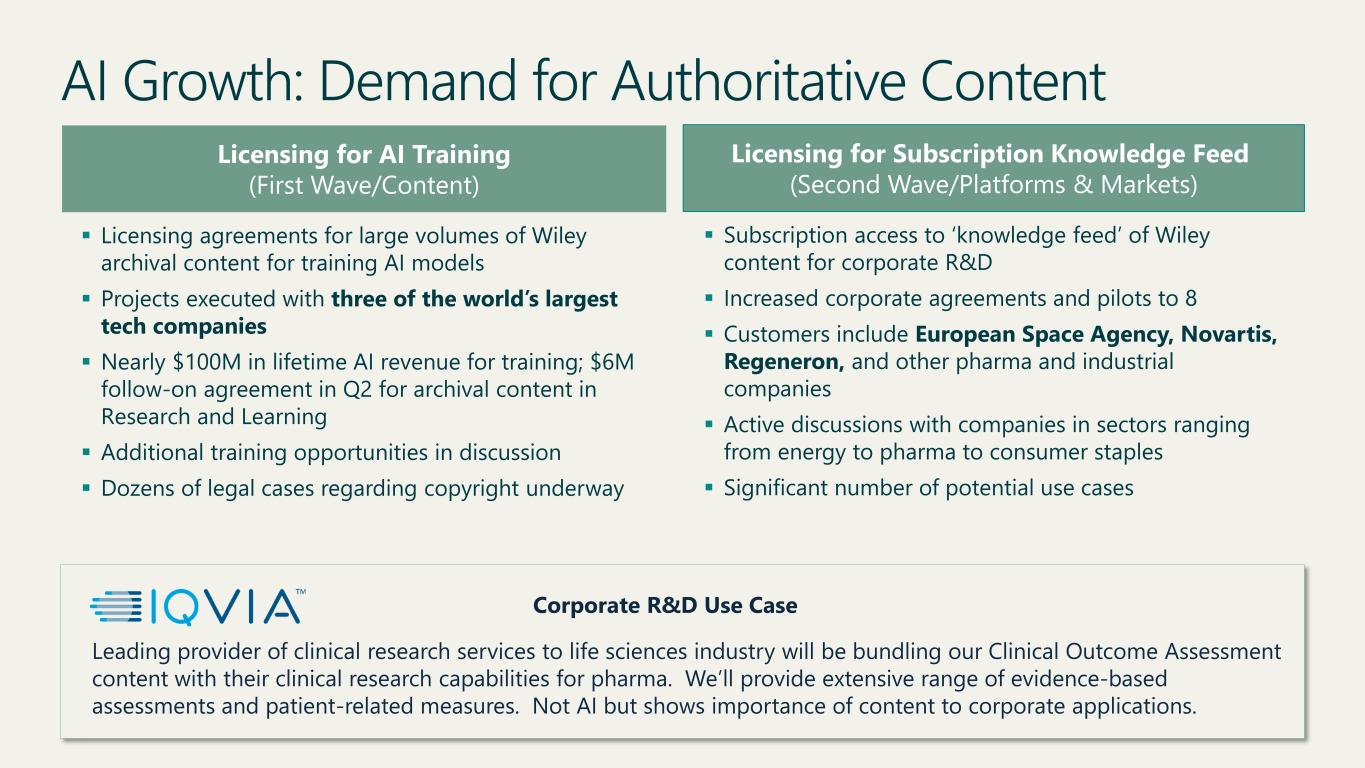

AI Growth: Demand for Authoritative Content Licensing for AI Training (First Wave/Content) Licensing agreements for large volumes of Wiley archival content for training AI models Projects executed with three of the world’s largest tech companies Nearly $100M in lifetime AI revenue for training; $6M follow-on agreement in Q2 for archival content in Research and Learning Additional training opportunities in discussion Dozens of legal cases regarding copyright underway Licensing for Subscription Knowledge Feed (Second Wave/Platforms & Markets) Subscription access to ‘knowledge feed’ of Wiley content for corporate R&D Increased corporate agreements and pilots to 8 Customers include European Space Agency, Novartis, Regeneron, and other pharma and industrial companies Active discussions with companies in sectors ranging from energy to pharma to consumer staples Significant number of potential use cases Leading provider of clinical research services to life sciences industry will be bundling our Clinical Outcome Assessment content with their clinical research capabilities for pharma. We’ll provide extensive range of evidence-based assessments and patient-related measures. Not AI but shows importance of content to corporate applications. Corporate R&D Use Case

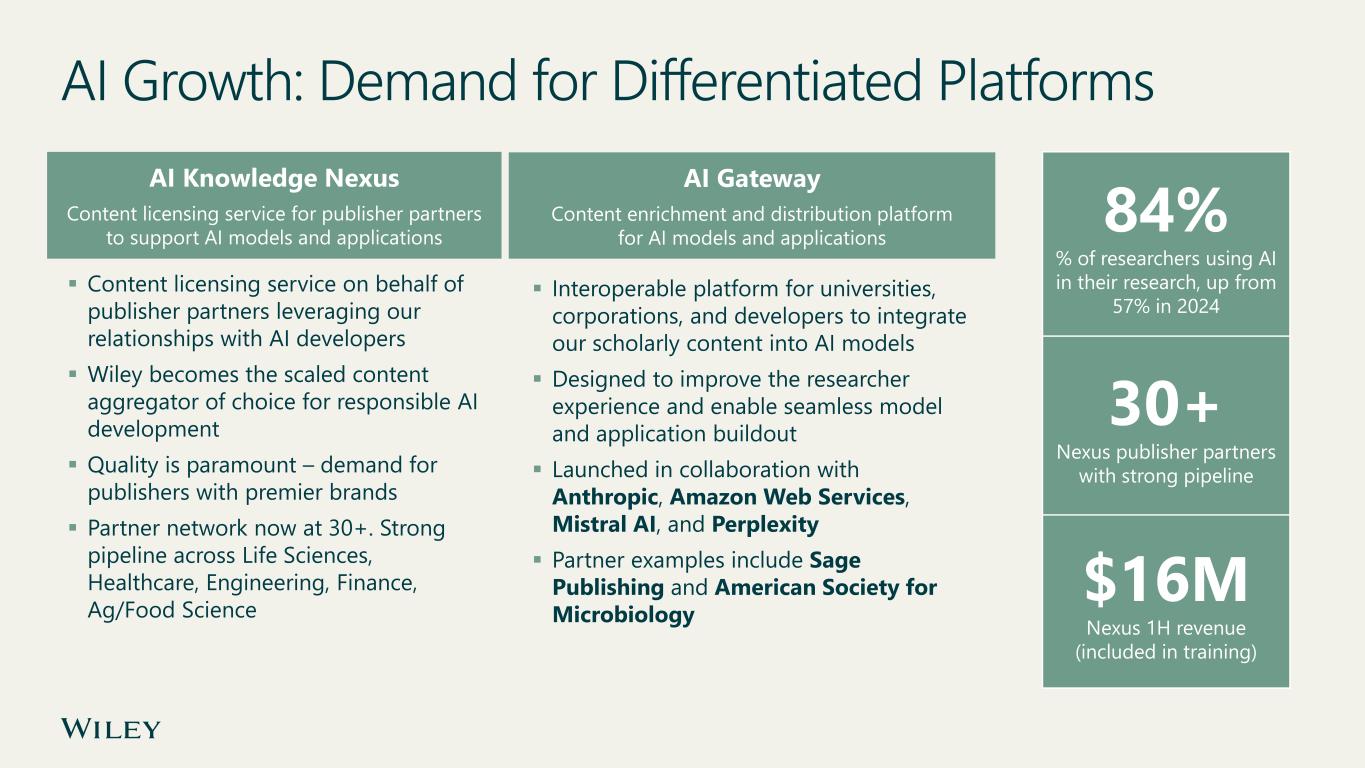

AI Knowledge Nexus Content licensing service for publisher partners to support AI models and applications Content licensing service on behalf of publisher partners leveraging our relationships with AI developers Wiley becomes the scaled content aggregator of choice for responsible AI development Quality is paramount – demand for publishers with premier brands Partner network now at 30+. Strong pipeline across Life Sciences, Healthcare, Engineering, Finance, Ag/Food Science AI Gateway Content enrichment and distribution platform for AI models and applications Interoperable platform for universities, corporations, and developers to integrate our scholarly content into AI models Designed to improve the researcher experience and enable seamless model and application buildout Launched in collaboration with Anthropic, Amazon Web Services, Mistral AI, and Perplexity Partner examples include Sage Publishing and American Society for Microbiology AI Growth: Demand for Differentiated Platforms 84% % of researchers using AI in their research, up from 57% in 2024 30+ Nexus publisher partners with strong pipeline $16M Nexus 1H revenue (included in training)

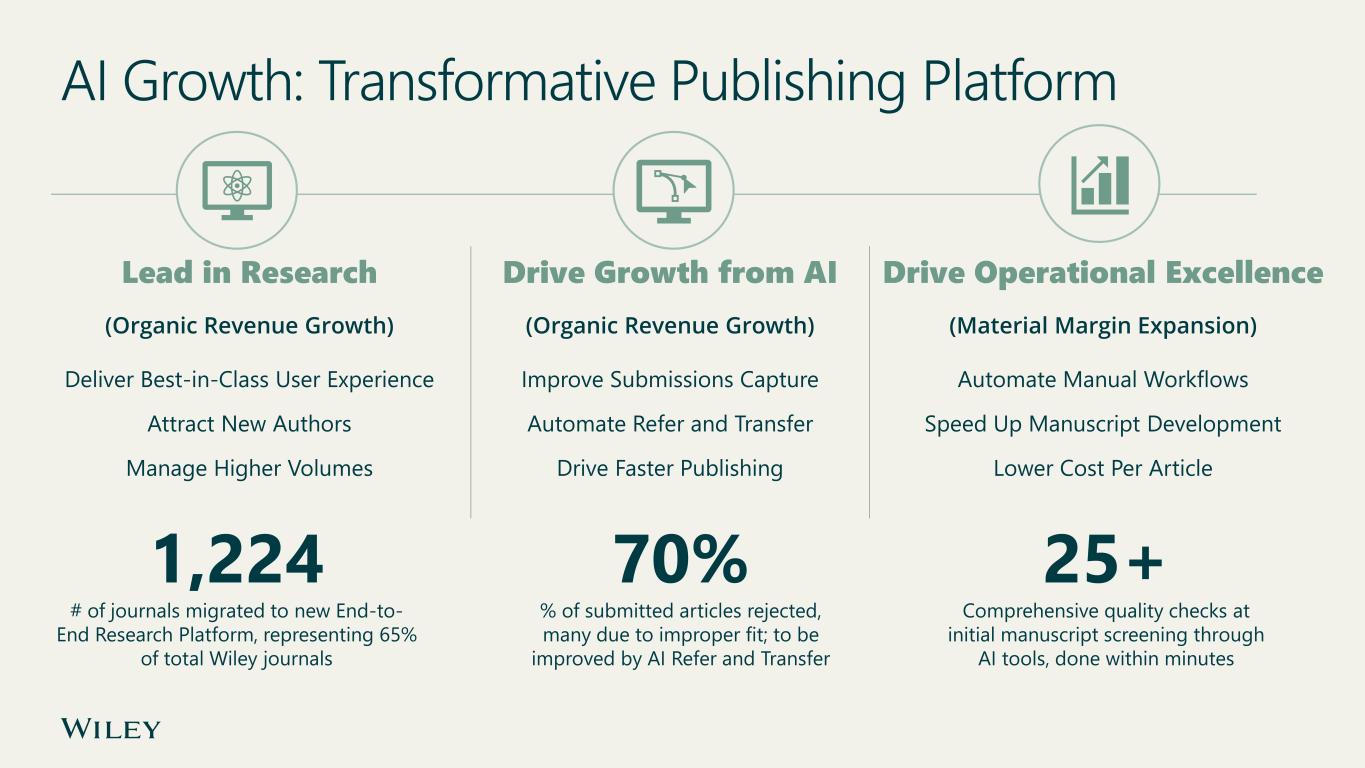

AI Growth: Transformative Publishing Platform Lead in Research (Organic Revenue Growth) Drive Growth from AI (Organic Revenue Growth) Drive Operational Excellence (Material Margin Expansion) Deliver Best-in-Class User Experience Attract New Authors Manage Higher Volumes Improve Submissions Capture Automate Refer and Transfer Drive Faster Publishing Automate Manual Workflows Speed Up Manuscript Development Lower Cost Per Article 1,224 # of journals migrated to new End-to- End Research Platform, representing 65% of total Wiley journals 25+ Comprehensive quality checks at initial manuscript screening through AI tools, done within minutes 70% % of submitted articles rejected, many due to improper fit; to be improved by AI Refer and Transfer

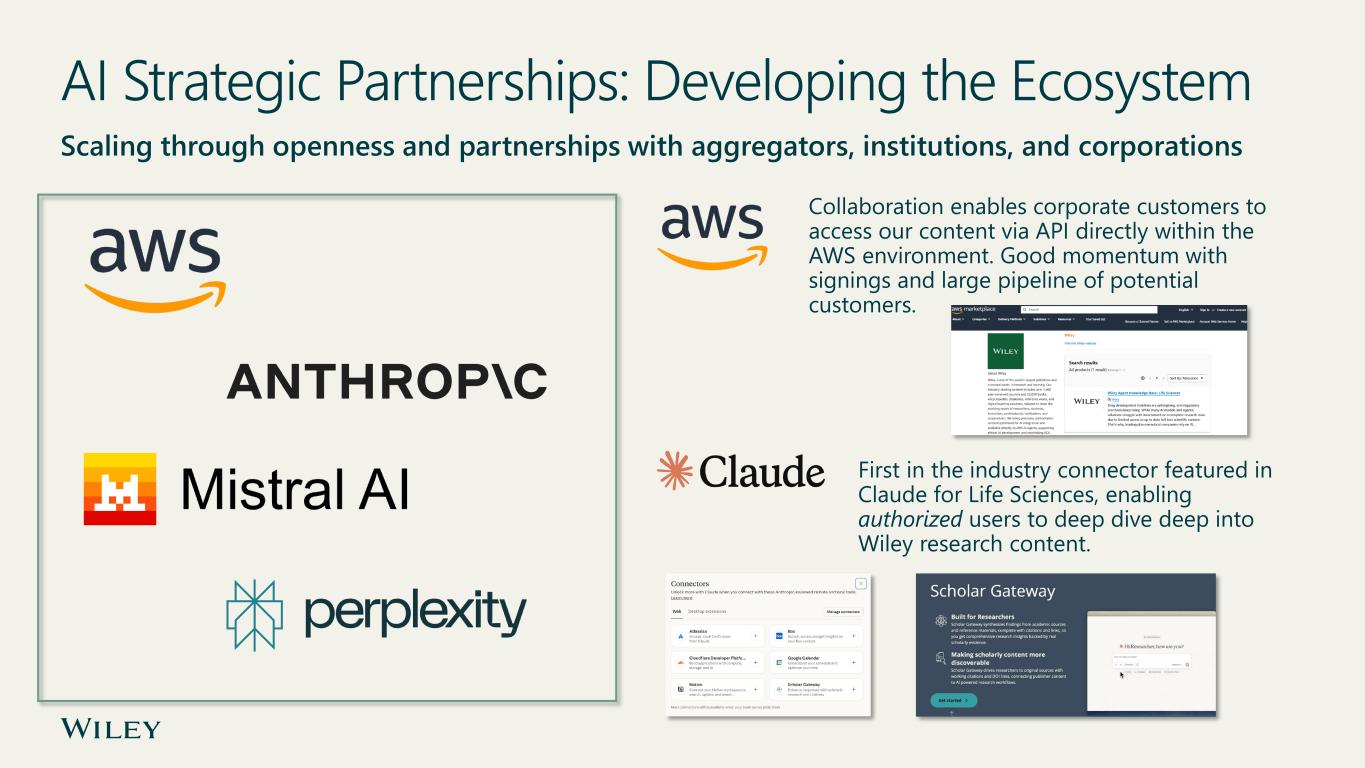

AI Strategic Partnerships: Developing the Ecosystem Scaling through openness and partnerships with aggregators, institutions, and corporations Collaboration enables corporate customers to access our content via API directly within the AWS environment. Good momentum with signings and large pipeline of potential customers. First in the industry connector featured in Claude for Life Sciences, enabling authorized users to deep dive deep into Wiley research content.

Performance Financial Position Outlook

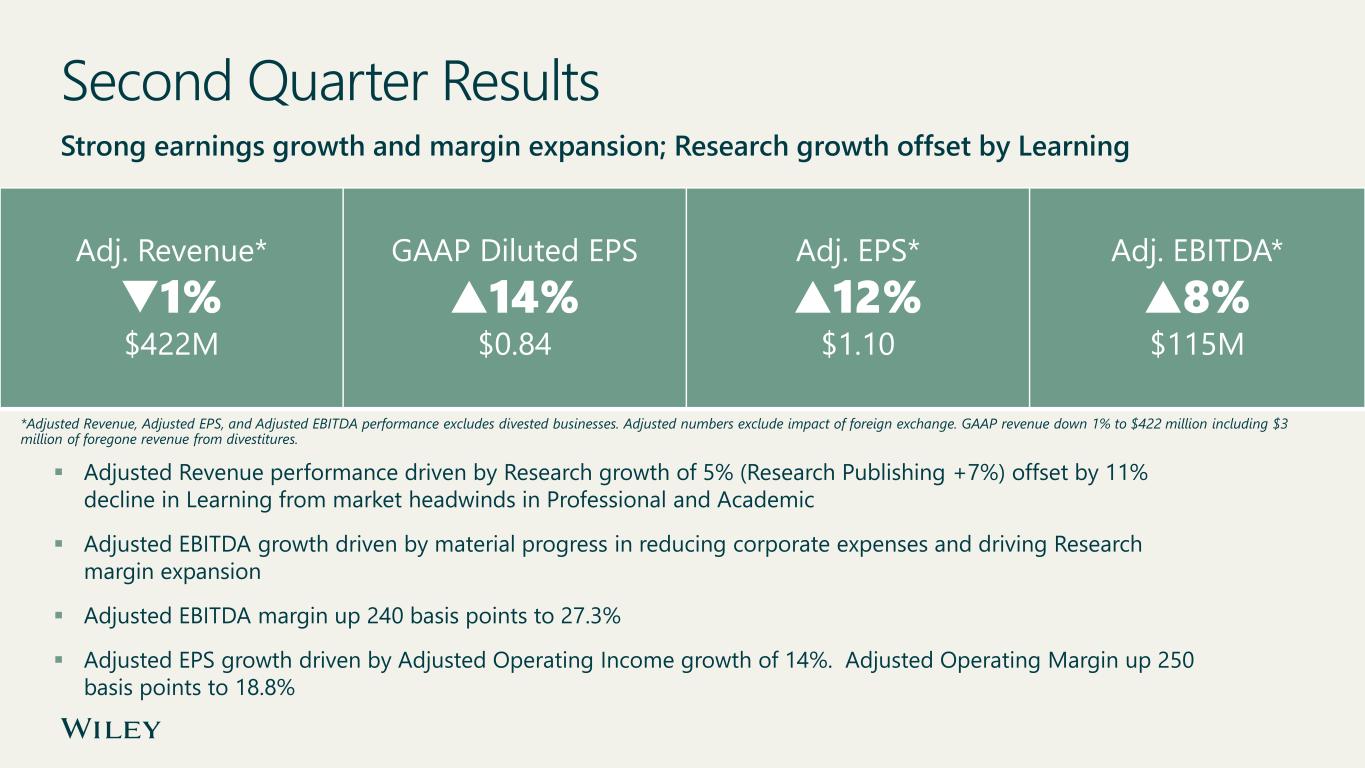

Second Quarter Results Adj. Revenue* ▼1% $422M GAAP Diluted EPS ▲14% $0.84 Adj. EPS* ▲12% $1.10 Adj. EBITDA* ▲8% $115M *Adjusted Revenue, Adjusted EPS, and Adjusted EBITDA performance excludes divested businesses. Adjusted numbers exclude impact of foreign exchange. GAAP revenue down 1% to $422 million including $3 million of foregone revenue from divestitures. Adjusted Revenue performance driven by Research growth of 5% (Research Publishing +7%) offset by 11% decline in Learning from market headwinds in Professional and Academic Adjusted EBITDA growth driven by material progress in reducing corporate expenses and driving Research margin expansion Adjusted EBITDA margin up 240 basis points to 27.3% Adjusted EPS growth driven by Adjusted Operating Income growth of 14%. Adjusted Operating Margin up 250 basis points to 18.8% Strong earnings growth and margin expansion; Research growth offset by Learning

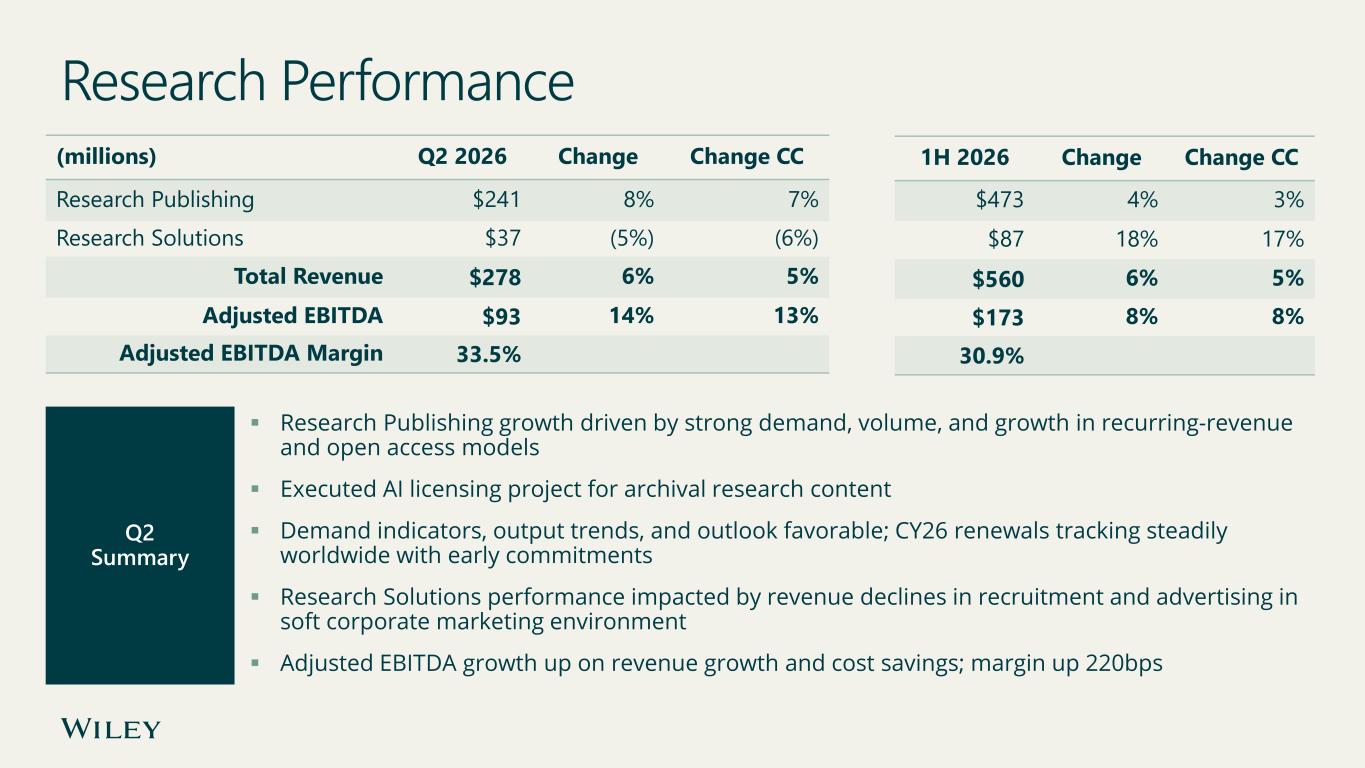

Research Performance Research Publishing growth driven by strong demand, volume, and growth in recurring-revenue and open access models Executed AI licensing project for archival research content Demand indicators, output trends, and outlook favorable; CY26 renewals tracking steadily worldwide with early commitments Research Solutions performance impacted by revenue declines in recruitment and advertising in soft corporate marketing environment Adjusted EBITDA growth up on revenue growth and cost savings; margin up 220bps Q2 Summary (millions) Q2 2026 Change Change CC Research Publishing $241 8% 7% Research Solutions $37 (5%) (6%) Total Revenue $278 6% 5% Adjusted EBITDA $93 14% 13% Adjusted EBITDA Margin 33.5% 1H 2026 Change Change CC $473 4% 3% $87 18% 17% $560 6% 5% $173 8% 8% 30.9%

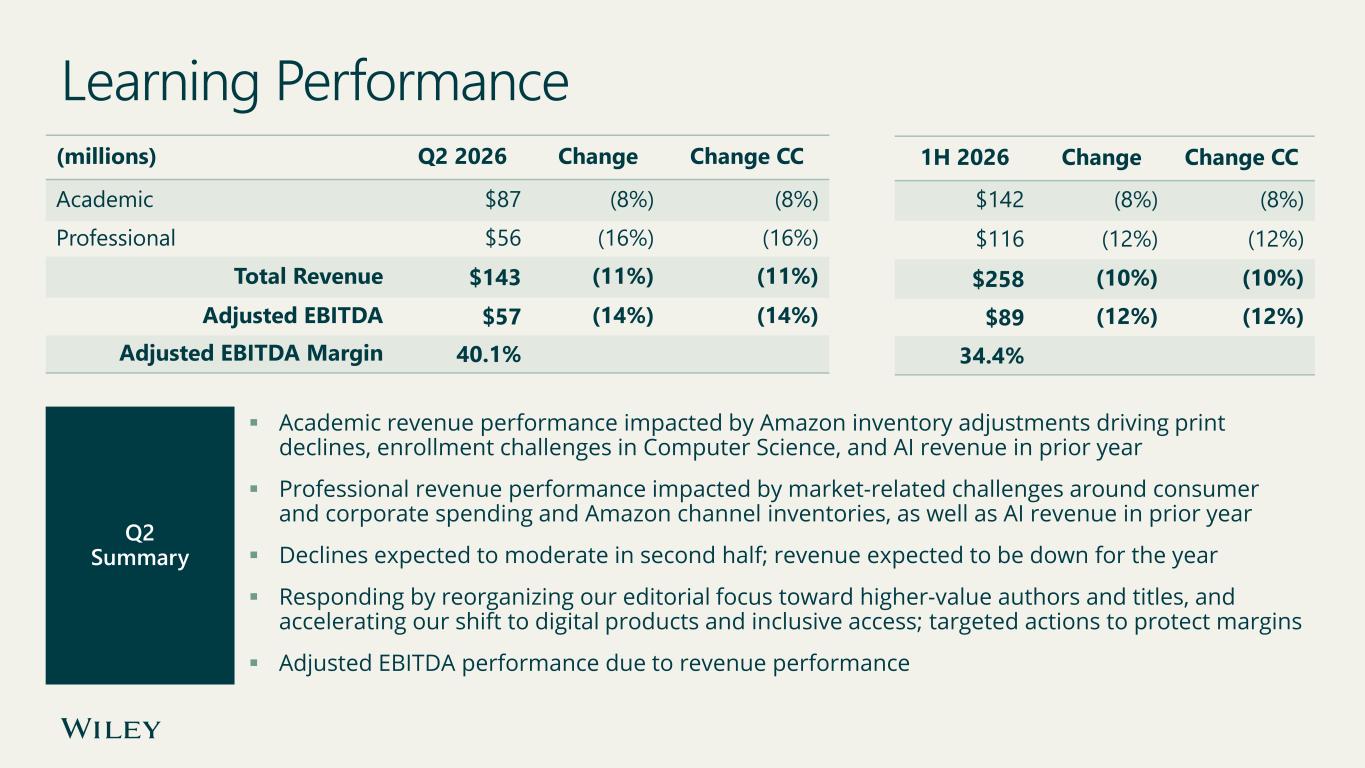

Learning Performance Academic revenue performance impacted by Amazon inventory adjustments driving print declines, enrollment challenges in Computer Science, and AI revenue in prior year Professional revenue performance impacted by market-related challenges around consumer and corporate spending and Amazon channel inventories, as well as AI revenue in prior year Declines expected to moderate in second half; revenue expected to be down for the year Responding by reorganizing our editorial focus toward higher-value authors and titles, and accelerating our shift to digital products and inclusive access; targeted actions to protect margins Adjusted EBITDA performance due to revenue performance (millions) Q2 2026 Change Change CC Academic $87 (8%) (8%) Professional $56 (16%) (16%) Total Revenue $143 (11%) (11%) Adjusted EBITDA $57 (14%) (14%) Adjusted EBITDA Margin 40.1% 1H 2026 Change Change CC $142 (8%) (8%) $116 (12%) (12%) $258 (10%) (10%) $89 (12%) (12%) 34.4% Q2 Summary

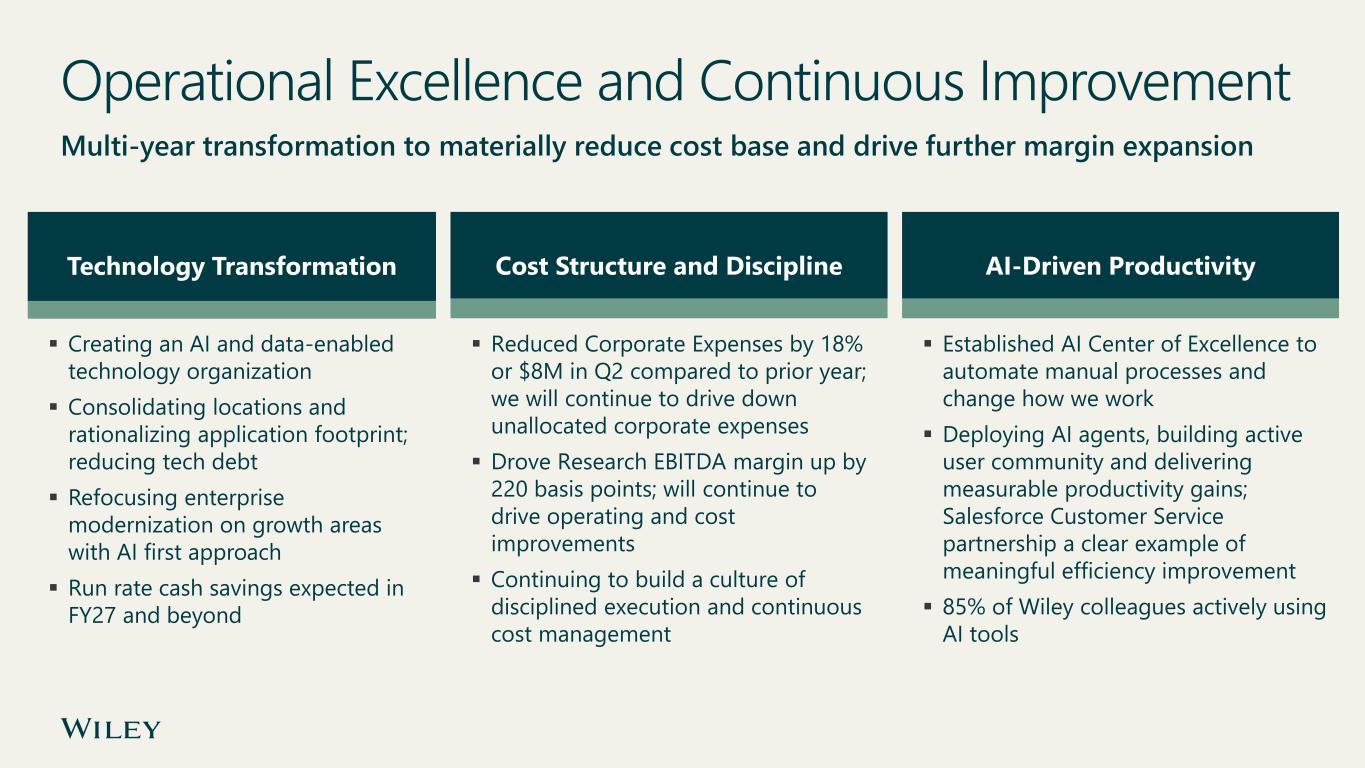

Technology Transformation Creating an AI and data-enabled technology organization Consolidating locations and rationalizing application footprint; reducing tech debt Refocusing enterprise modernization on growth areas with AI first approach Run rate cash savings expected in FY27 and beyond AI-Driven Productivity Established AI Center of Excellence to automate manual processes and change how we work Deploying AI agents, building active user community and delivering measurable productivity gains; Salesforce Customer Service partnership a clear example of meaningful efficiency improvement 85% of Wiley colleagues actively using AI tools Cost Structure and Discipline Reduced Corporate Expenses by 18% or $8M in Q2 compared to prior year; we will continue to drive down unallocated corporate expenses Drove Research EBITDA margin up by 220 basis points; will continue to drive operating and cost improvements Continuing to build a culture of disciplined execution and continuous cost management Operational Excellence and Continuous Improvement Multi-year transformation to materially reduce cost base and drive further margin expansion

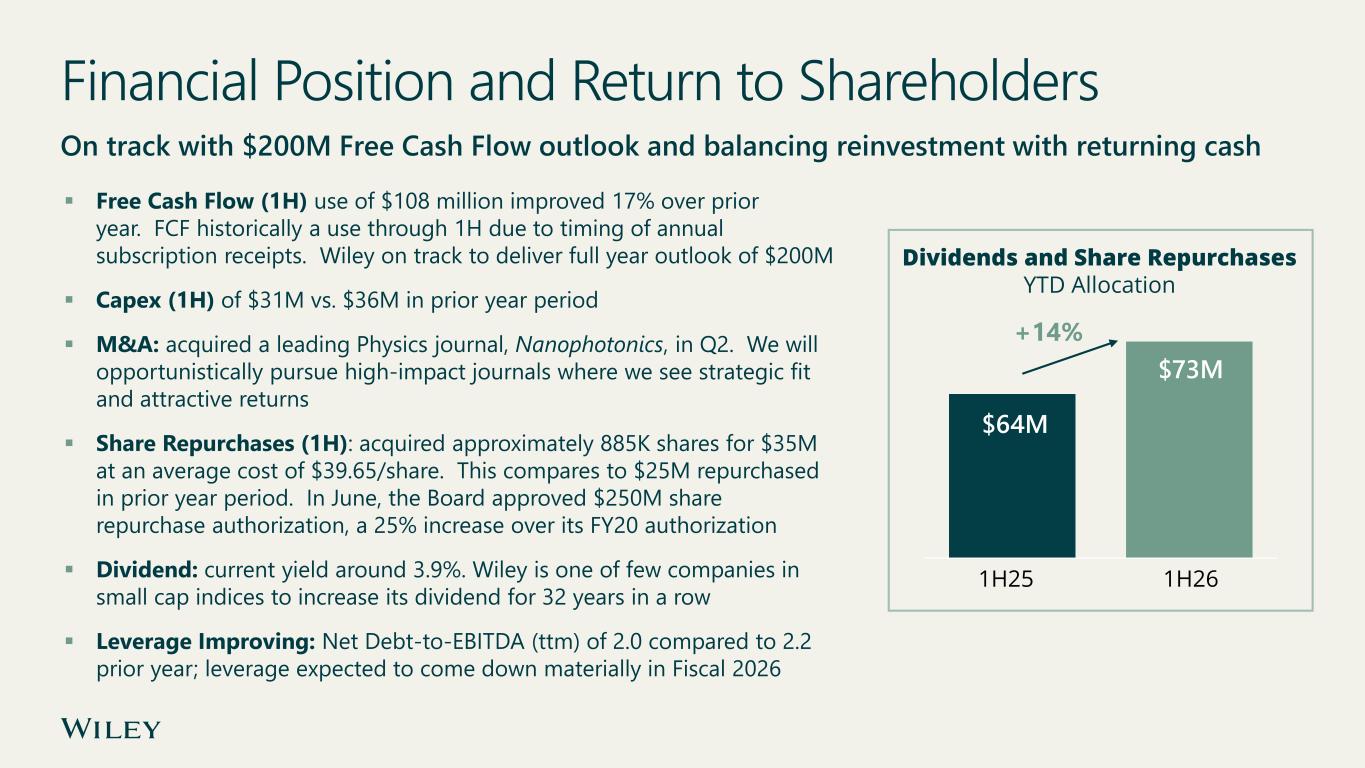

Financial Position and Return to Shareholders $73M $64M Free Cash Flow (1H) use of $108 million improved 17% over prior year. FCF historically a use through 1H due to timing of annual subscription receipts. Wiley on track to deliver full year outlook of $200M Capex (1H) of $31M vs. $36M in prior year period M&A: acquired a leading Physics journal, Nanophotonics, in Q2. We will opportunistically pursue high-impact journals where we see strategic fit and attractive returns Share Repurchases (1H): acquired approximately 885K shares for $35M at an average cost of $39.65/share. This compares to $25M repurchased in prior year period. In June, the Board approved $250M share repurchase authorization, a 25% increase over its FY20 authorization Dividend: current yield around 3.9%. Wiley is one of few companies in small cap indices to increase its dividend for 32 years in a row Leverage Improving: Net Debt-to-EBITDA (ttm) of 2.0 compared to 2.2 prior year; leverage expected to come down materially in Fiscal 2026 Dividends and Share Repurchases YTD Allocation 1H25 1H26 +14% On track with $200M Free Cash Flow outlook and balancing reinvestment with returning cash

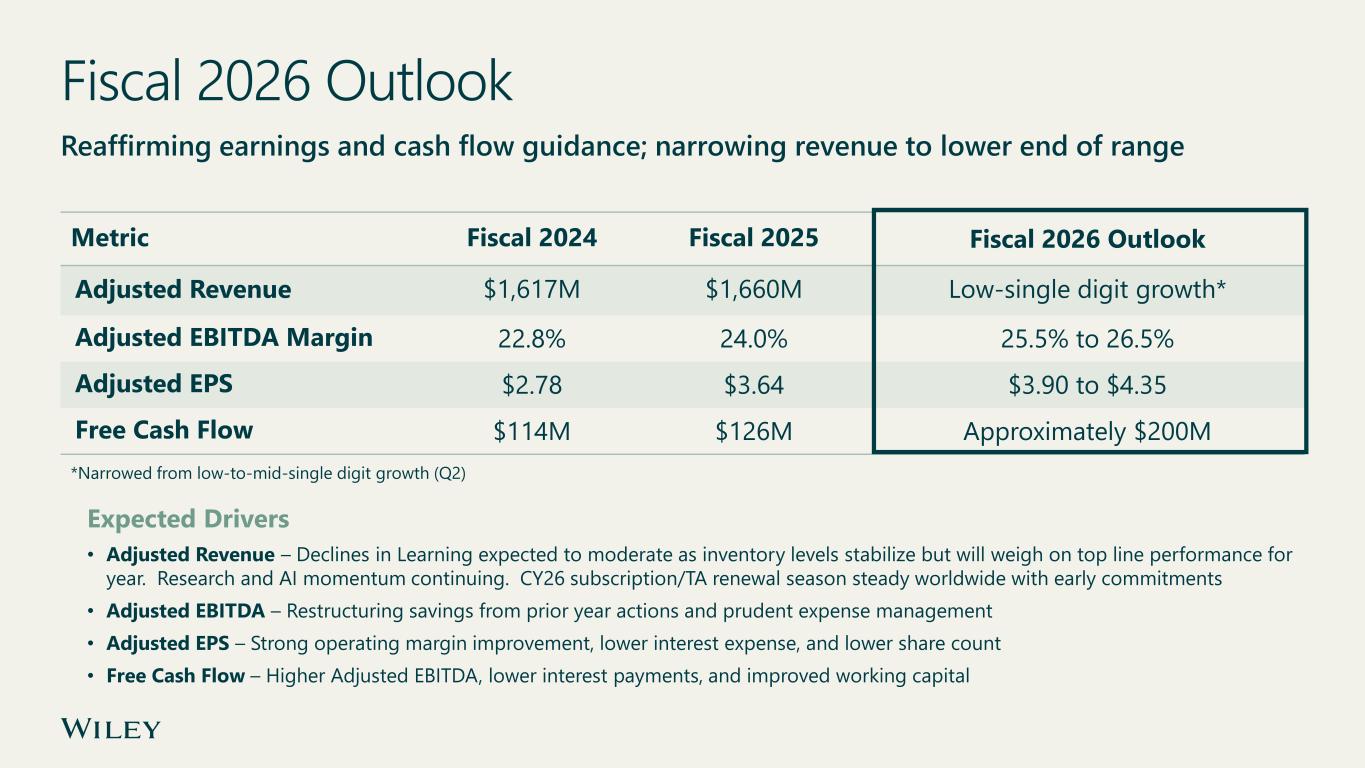

Fiscal 2026 Outlook Metric Fiscal 2024 Fiscal 2025 Fiscal 2026 Outlook Adjusted Revenue $1,617M $1,660M Low-single digit growth* Adjusted EBITDA Margin 22.8% 24.0% 25.5% to 26.5% Adjusted EPS $2.78 $3.64 $3.90 to $4.35 Free Cash Flow $114M $126M Approximately $200M Expected Drivers • Adjusted Revenue – Declines in Learning expected to moderate as inventory levels stabilize but will weigh on top line performance for year. Research and AI momentum continuing. CY26 subscription/TA renewal season steady worldwide with early commitments • Adjusted EBITDA – Restructuring savings from prior year actions and prudent expense management • Adjusted EPS – Strong operating margin improvement, lower interest expense, and lower share count • Free Cash Flow – Higher Adjusted EBITDA, lower interest payments, and improved working capital *Narrowed from low-to-mid-single digit growth (Q2) Reaffirming earnings and cash flow guidance; narrowing revenue to lower end of range

Strong growth and momentum in Research from global demand to publish, read, and license, and our disciplined execution; enduring moat and well positioned for AI Leadership position in AI continuing with another LLM training agreement; increasing momentum in corporate sector; partnerships with AI innovators yielding results Strong earnings growth, margin expansion, and cash flow improvement from the execution of our cost savings programs and efficiency improvements Returned more to shareholders with Q2 share repurchases up 69% to $21M with $73M allocated to repurchases and dividends YTD. Leverage to come down materially Confident long-term direction driven by favorable position and trends in Research and transformative opportunities in AI; continued focus on margin and cash flow expansion 1 2 4 3 5 Executive Summary

Thank you for joining us For more information or follow-up: investors.wiley.com brian.campbell@wiley.com

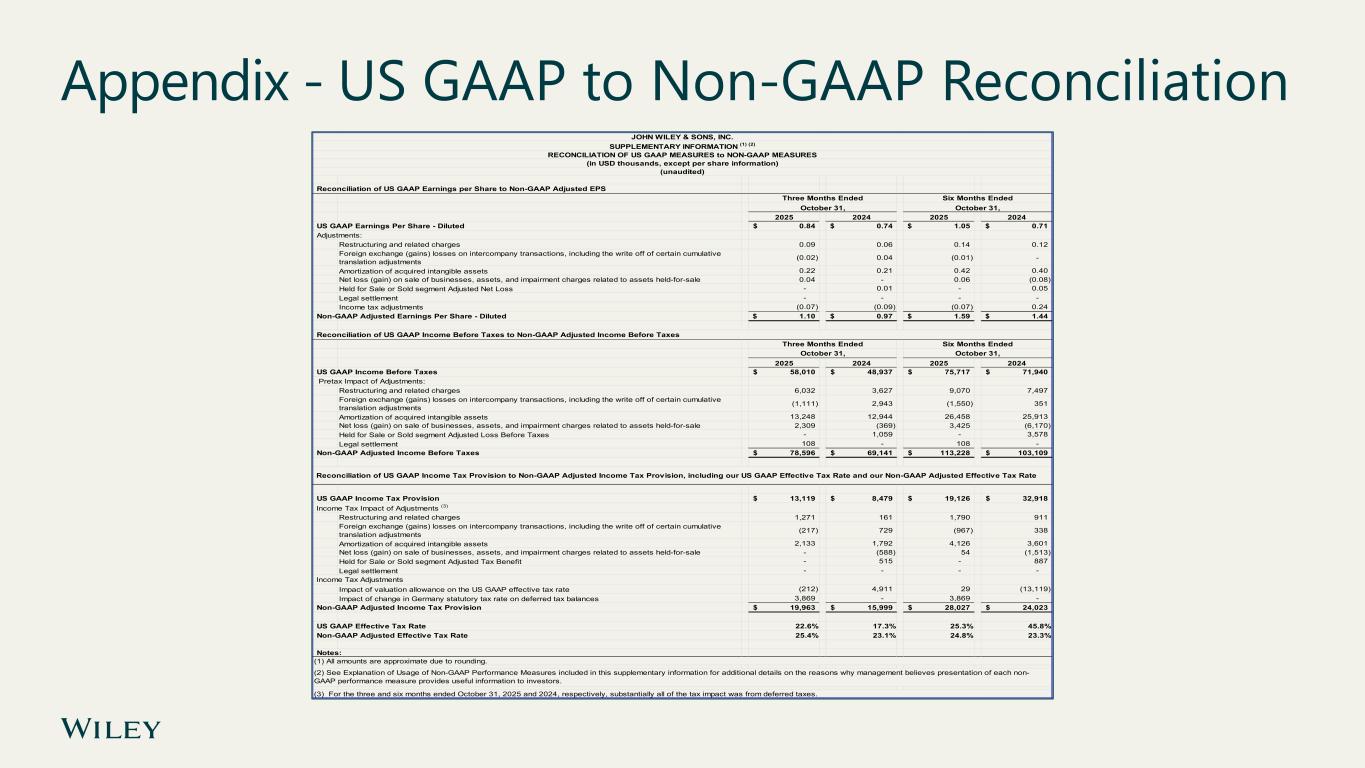

Appendix - US GAAP to Non-GAAP Reconciliation Reconciliation of US GAAP Earnings per Share to Non-GAAP Adjusted EPS 2025 2024 2025 2024 US GAAP Earnings Per Share - Diluted 0.84$ 0.74$ 1.05$ 0.71$ Adjustments: Restructuring and related charges 0.09 0.06 0.14 0.12 Foreign exchange (gains) losses on intercompany transactions, including the write off of certain cumulative translation adjustments (0.02) 0.04 (0.01) - Amortization of acquired intangible assets 0.22 0.21 0.42 0.40 Net loss (gain) on sale of businesses, assets, and impairment charges related to assets held-for-sale 0.04 - 0.06 (0.08) Held for Sale or Sold segment Adjusted Net Loss - 0.01 - 0.05 Legal settlement - - - - Income tax adjustments (0.07) (0.09) (0.07) 0.24 Non-GAAP Adjusted Earnings Per Share - Diluted 1.10$ 0.97$ 1.59$ 1.44$ 2025 2024 2025 2024 US GAAP Income Before Taxes 58,010$ 48,937$ 75,717$ 71,940$ Restructuring and related charges 6,032 3,627 9,070 7,497 Foreign exchange (gains) losses on intercompany transactions, including the write off of certain cumulative translation adjustments (1,111) 2,943 (1,550) 351 Amortization of acquired intangible assets 13,248 12,944 26,458 25,913 Net loss (gain) on sale of businesses, assets, and impairment charges related to assets held-for-sale 2,309 (369) 3,425 (6,170) Held for Sale or Sold segment Adjusted Loss Before Taxes - 1,059 - 3,578 Legal settlement 108 - 108 - Non-GAAP Adjusted Income Before Taxes 78,596$ 69,141$ 113,228$ 103,109$ US GAAP Income Tax Provision 13,119$ 8,479$ 19,126$ 32,918$ Restructuring and related charges 1,271 161 1,790 911 Foreign exchange (gains) losses on intercompany transactions, including the write off of certain cumulative translation adjustments (217) 729 (967) 338 Amortization of acquired intangible assets 2,133 1,792 4,126 3,601 Net loss (gain) on sale of businesses, assets, and impairment charges related to assets held-for-sale - (588) 54 (1,513) Held for Sale or Sold segment Adjusted Tax Benefit - 515 - 887 Legal settlement - - - - Impact of valuation allowance on the US GAAP effective tax rate (212) 4,911 29 (13,119) Impact of change in Germany statutory tax rate on deferred tax balances 3,869 - 3,869 - Non-GAAP Adjusted Income Tax Provision 19,963$ 15,999$ 28,027$ 24,023$ US GAAP Effective Tax Rate 22.6% 17.3% 25.3% 45.8% Non-GAAP Adjusted Effective Tax Rate 25.4% 23.1% 24.8% 23.3% Notes: (3) For the three and six months ended October 31, 2025 and 2024, respectively, substantially all of the tax impact was from deferred taxes. Pretax Impact of Adjustments: Reconciliation of US GAAP Income Tax Provision to Non-GAAP Adjusted Income Tax Provision, including our US GAAP Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate Income Tax Impact of Adjustments (3) Income Tax Adjustments (1) All amounts are approximate due to rounding. (2) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non- GAAP performance measure provides useful information to investors. October 31, October 31, October 31, October 31, Reconciliation of US GAAP Income Before Taxes to Non-GAAP Adjusted Income Before Taxes Three Months Ended Six Months Ended Three Months Ended Six Months Ended JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) (2) RECONCILIATION OF US GAAP MEASURES to NON-GAAP MEASURES (in USD thousands, except per share information) (unaudited)

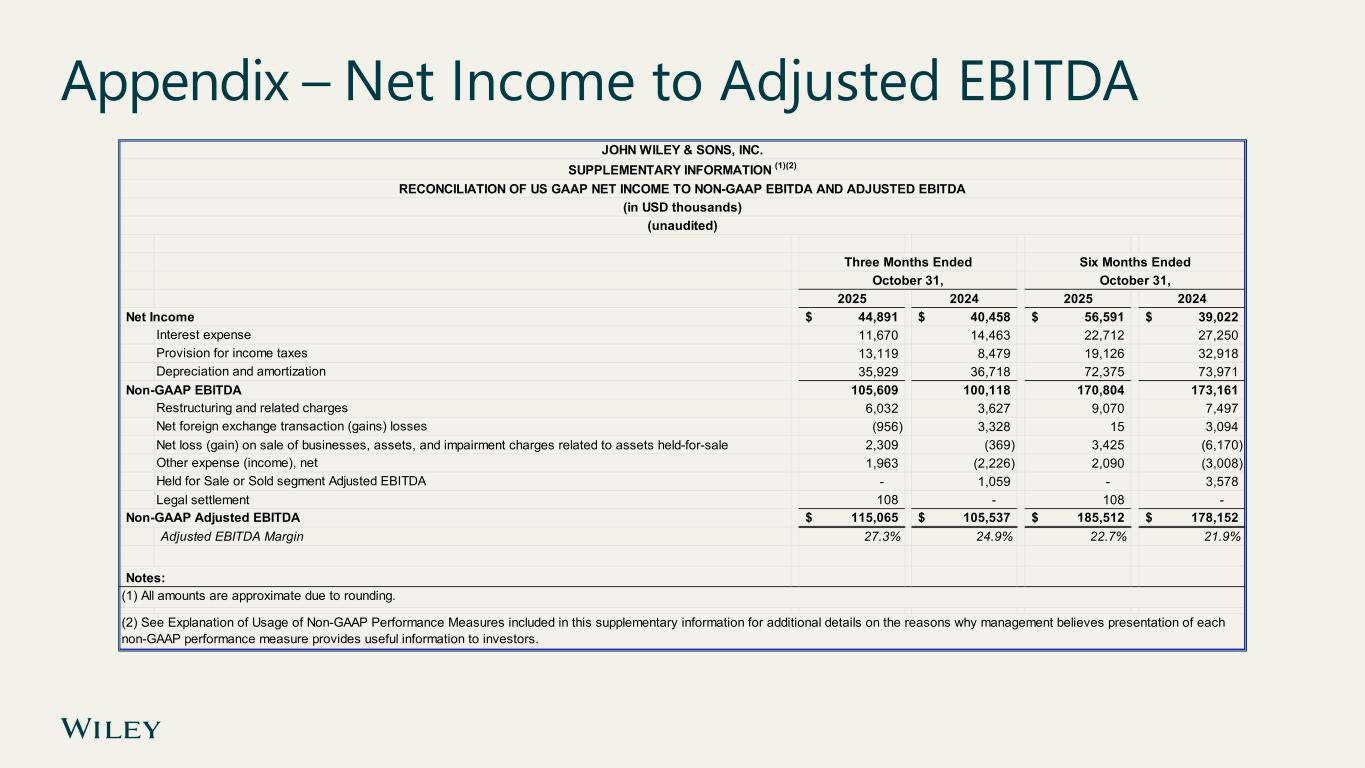

Appendix – Net Income to Adjusted EBITDA 2025 2024 2025 2024 Net Income 44,891$ 40,458$ 56,591$ 39,022$ Interest expense 11,670 14,463 22,712 27,250 Provision for income taxes 13,119 8,479 19,126 32,918 Depreciation and amortization 35,929 36,718 72,375 73,971 Non-GAAP EBITDA 105,609 100,118 170,804 173,161 Restructuring and related charges 6,032 3,627 9,070 7,497 Net foreign exchange transaction (gains) losses (956) 3,328 15 3,094 Net loss (gain) on sale of businesses, assets, and impairment charges related to assets held-for-sale 2,309 (369) 3,425 (6,170) Other expense (income), net 1,963 (2,226) 2,090 (3,008) Held for Sale or Sold segment Adjusted EBITDA - 1,059 - 3,578 Legal settlement 108 - 108 - Non-GAAP Adjusted EBITDA 115,065$ 105,537$ 185,512$ 178,152$ Adjusted EBITDA Margin 27.3% 24.9% 22.7% 21.9% Notes: (1) All amounts are approximate due to rounding. (2) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. October 31, October 31, Three Months Ended Six Months Ended JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1)(2) RECONCILIATION OF US GAAP NET INCOME TO NON-GAAP EBITDA AND ADJUSTED EBITDA (in USD thousands) (unaudited)