November 13, 2025 2025 Global Industrial Conference Joe Hayek – CEO Colin Souza - CFO

Notes to Investors FORWARD-LOOKING STATEMENTS. Selected statements in this presentation constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). Worthington Enterprises, Inc. (the “Company” or “Worthington”) wishes to take advantage of the safe harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee” and similar words or phrases. These forward-looking statements include, without limitation, statements relating to: expected cash positions, liquidity and ability to access financial markets and capital; outlooks, strategies or business plans; anticipated benefits of the separation of the Company’s steel processing business (the “Separation); expected financial and operational performance of, and future opportunities for, the Company following the Separation; the Company’s performance on a pro forma basis to illustrate the estimated effects of the Separation on historical periods; the tax treatment of the Separation transaction; expected performance, growth, demand, financial condition or other financial measures; pricing trends for raw materials and finished goods; additions to product lines and opportunities to participate in new markets; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain; the ability to make acquisitions, form joint ventures and consolidate operations and the projected timing, benefits and costs related thereto; expectations for the economy and markets; expectations for shareholder value; effects of the novel coronavirus (“COVID-19”) pandemic; and other non-historical matters. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: the uncertainty of obtaining regulatory approvals in connection with the Separation, including rulings from the Internal Revenue Service; the ability to successfully realize the anticipated benefits of the Separation; the impacts of the COVID-19 pandemic; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a U.S. withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of the COVID-19 pandemic and Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the U.S. Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations or considerations; the impact of judicial rulings and governmental regulations, both in the U.S. and abroad, including those adopted by the U.S. Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the U.S. and potential changes for such laws, especially in light of the COVID-19 pandemic, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company’s costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the Company’s filings with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2024, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. It is impossible to predict or identify all potential risk factors. Consequently, readers should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made, which was November 13, 2025. The Company does not undertake, and hereby disclaims, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

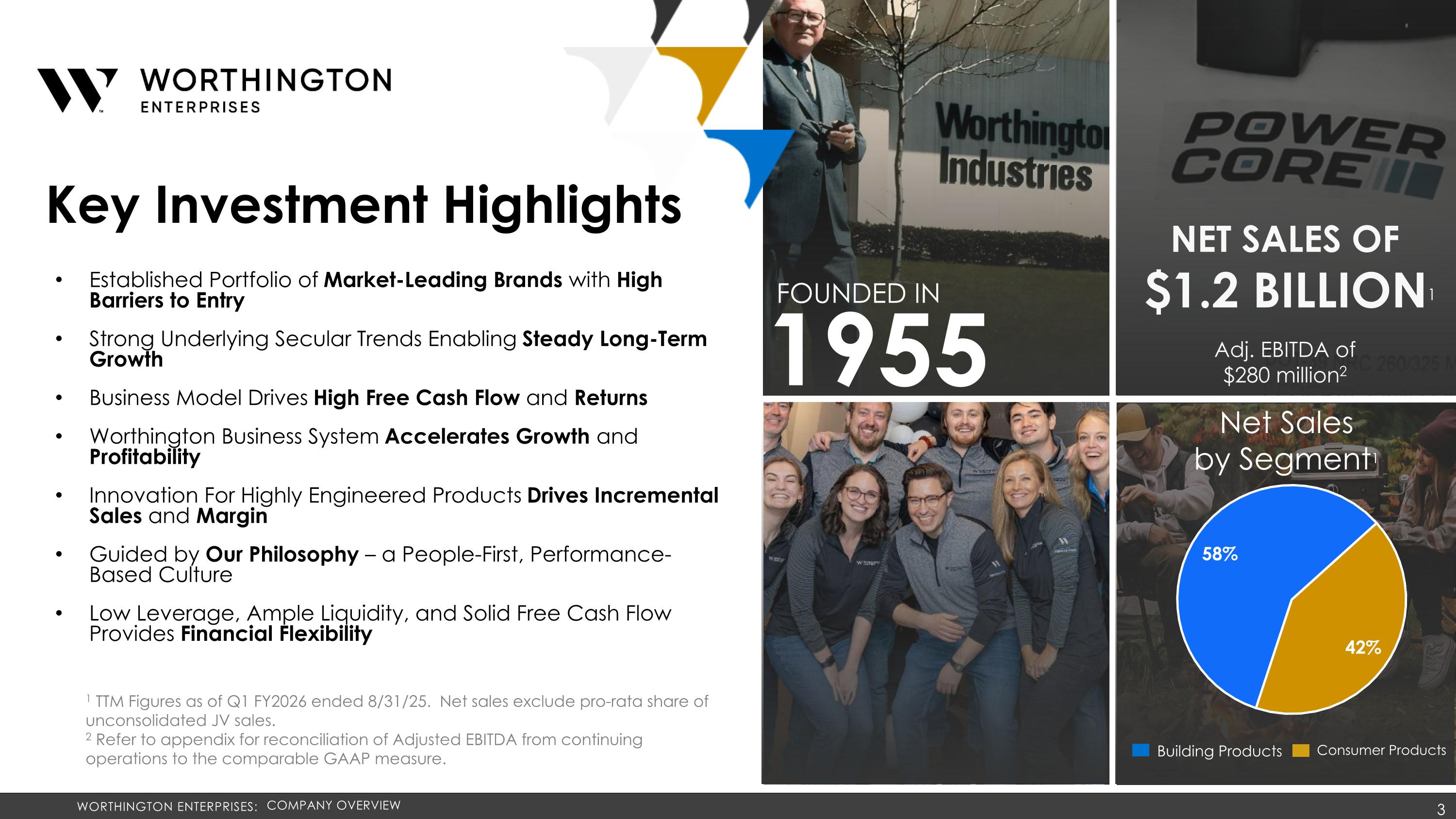

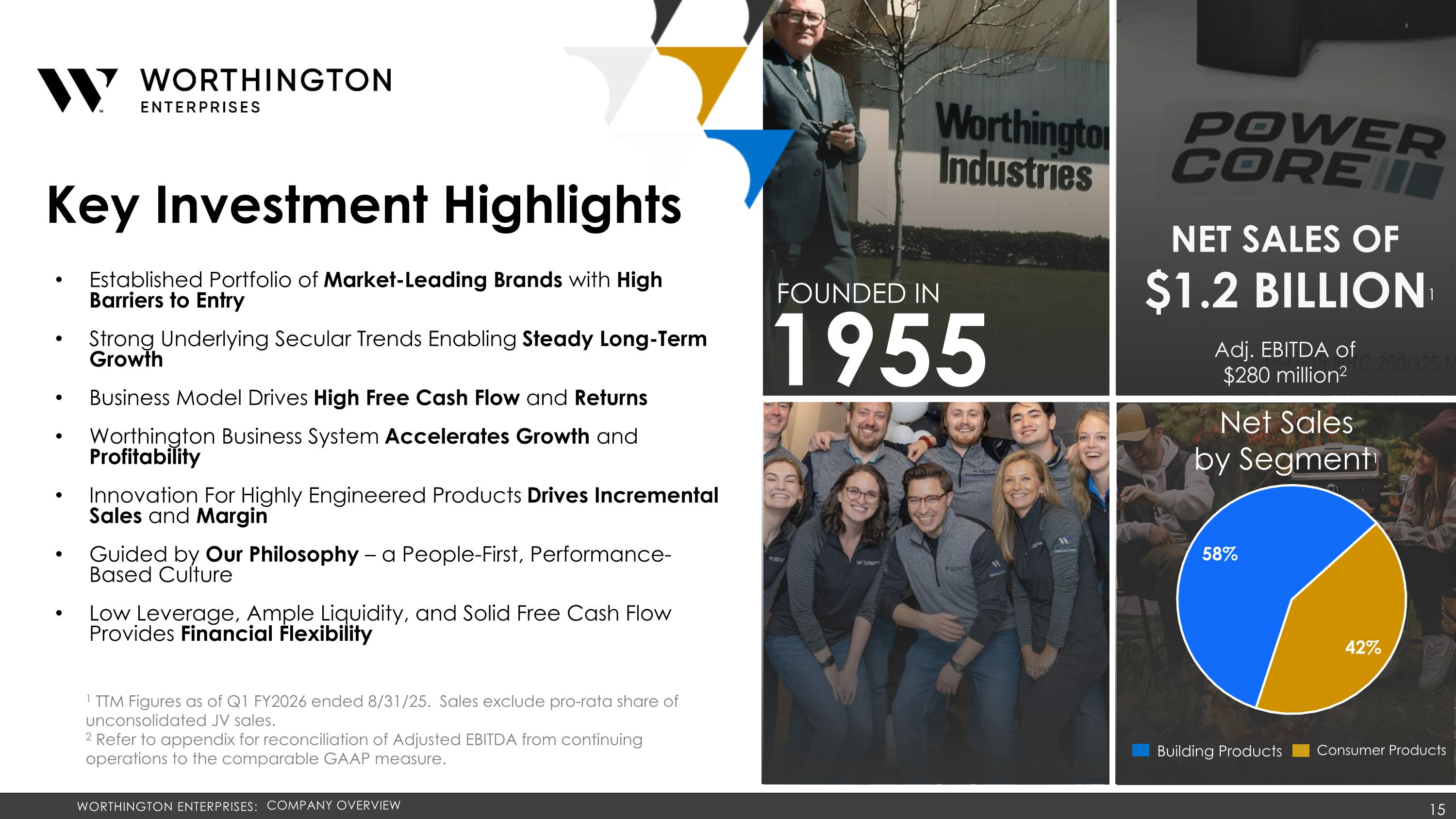

1955 Established Portfolio of Market-Leading Brands with High Barriers to Entry Strong Underlying Secular Trends Enabling Steady Long-Term Growth Business Model Drives High Free Cash Flow and Returns Worthington Business System Accelerates Growth and Profitability Innovation For Highly Engineered Products Drives Incremental Sales and Margin Guided by Our Philosophy – a People-First, Performance-Based Culture Low Leverage, Ample Liquidity, and Solid Free Cash Flow Provides Financial Flexibility Key Investment Highlights Company Overview Founded in 1 TTM Figures as of Q1 FY2026 ended 8/31/25. Net sales exclude pro-rata share of unconsolidated JV sales. 2 Refer to appendix for reconciliation of Adjusted EBITDA from continuing operations to the comparable GAAP measure. NET SALES OF $1.2 BILLION1 Adj. EBITDA of $280 million2 Net Sales by Segment1 Building Products Consumer Products

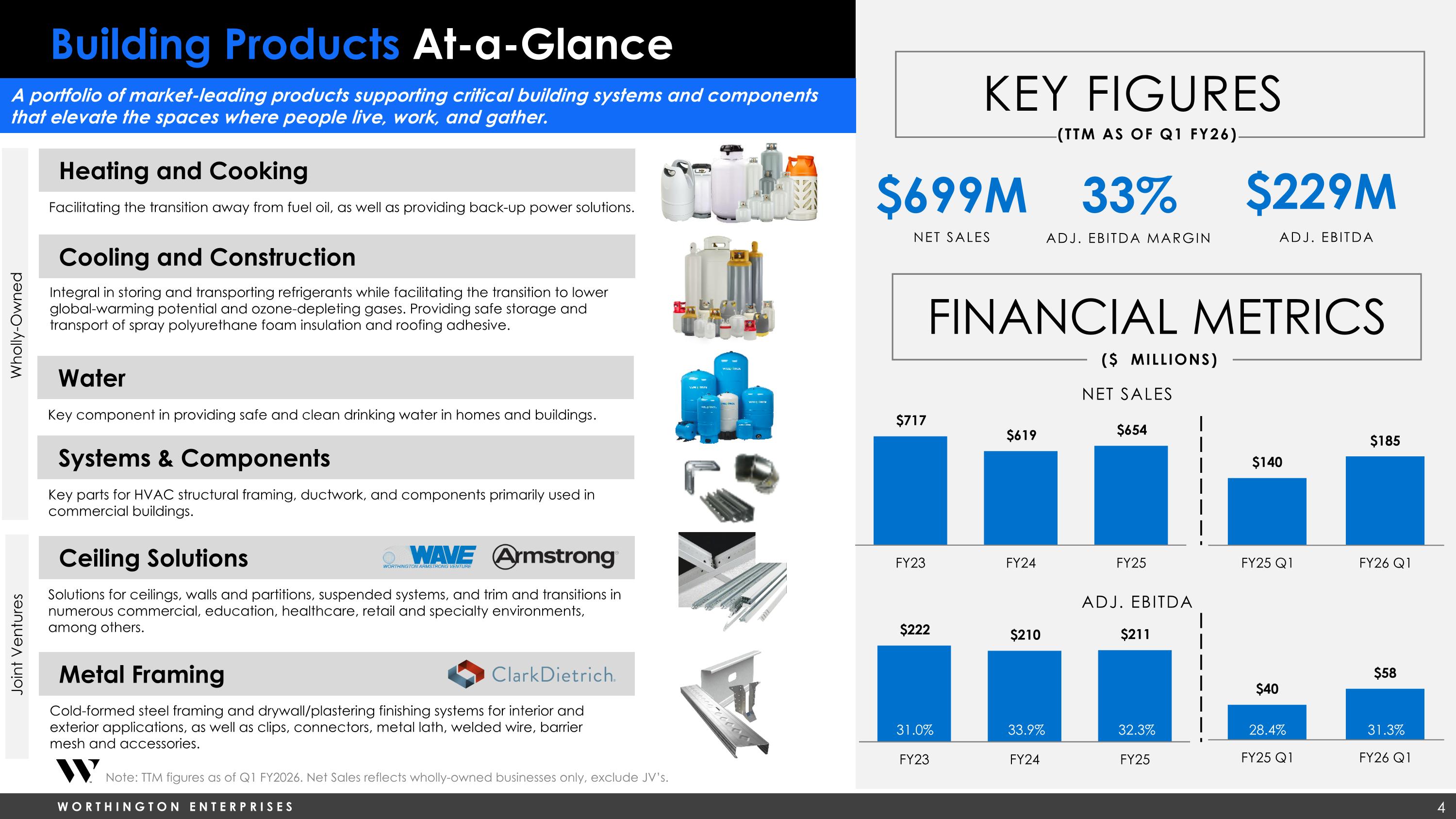

Key Figures (TTM as of Q1 FY26) ($ Millions) Financial Metrics Net Sales Adj. EBITDA 33% Adj. EBITDA Margin $229M Adj. EBITDA $699M Net Sales Building Products At-a-Glance Heating and Cooking Cooling and Construction Facilitating the transition away from fuel oil, as well as providing back-up power solutions. Integral in storing and transporting refrigerants while facilitating the transition to lower global-warming potential and ozone-depleting gases. Providing safe storage and transport of spray polyurethane foam insulation and roofing adhesive. Water Key component in providing safe and clean drinking water in homes and buildings. Ceiling Solutions Solutions for ceilings, walls and partitions, suspended systems, and trim and transitions in numerous commercial, education, healthcare, retail and specialty environments, among others. Metal Framing Cold-formed steel framing and drywall/plastering finishing systems for interior and exterior applications, as well as clips, connectors, metal lath, welded wire, barrier mesh and accessories. Wholly-Owned Joint Ventures 31% 31% 34% 36% 32% A portfolio of market-leading products supporting critical building systems and components that elevate the spaces where people live, work, and gather. 31.0% 33.9% 32.3% 28.4% 31.3% Systems & Components Key parts for HVAC structural framing, ductwork, and components primarily used in commercial buildings. Note: TTM figures as of Q1 FY2026. Net Sales reflects wholly-owned businesses only, exclude JV’s.

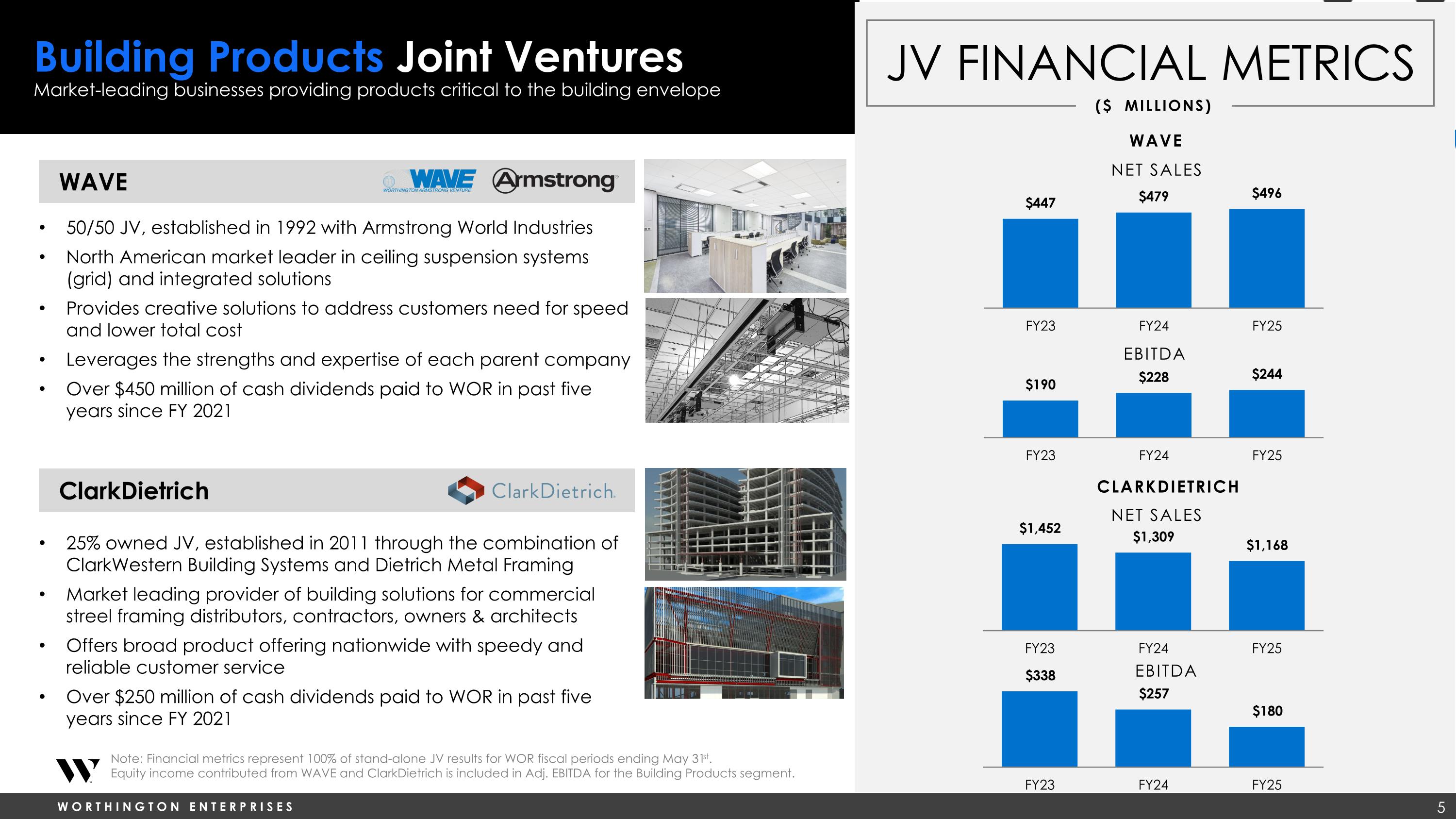

Note: Financial metrics represent 100% of stand-alone JV results for WOR fiscal periods ending May 31st. Equity income contributed from WAVE and ClarkDietrich is included in Adj. EBITDA for the Building Products segment. Building Products Joint Ventures Market-leading businesses providing products critical to the building envelope WAVE ClarkDietrich 50/50 JV, established in 1992 with Armstrong World Industries North American market leader in ceiling suspension systems (grid) and integrated solutions Provides creative solutions to address customers need for speed and lower total cost Leverages the strengths and expertise of each parent company Over $450 million of cash dividends paid to WOR in past five years since FY 2021 ($ Millions) JV Financial Metrics Net Sales EBITDA 25% owned JV, established in 2011 through the combination of ClarkWestern Building Systems and Dietrich Metal Framing Market leading provider of building solutions for commercial streel framing distributors, contractors, owners & architects Offers broad product offering nationwide with speedy and reliable customer service Over $250 million of cash dividends paid to WOR in past five years since FY 2021 Net Sales EBITDA WAVE ClarkDietrich

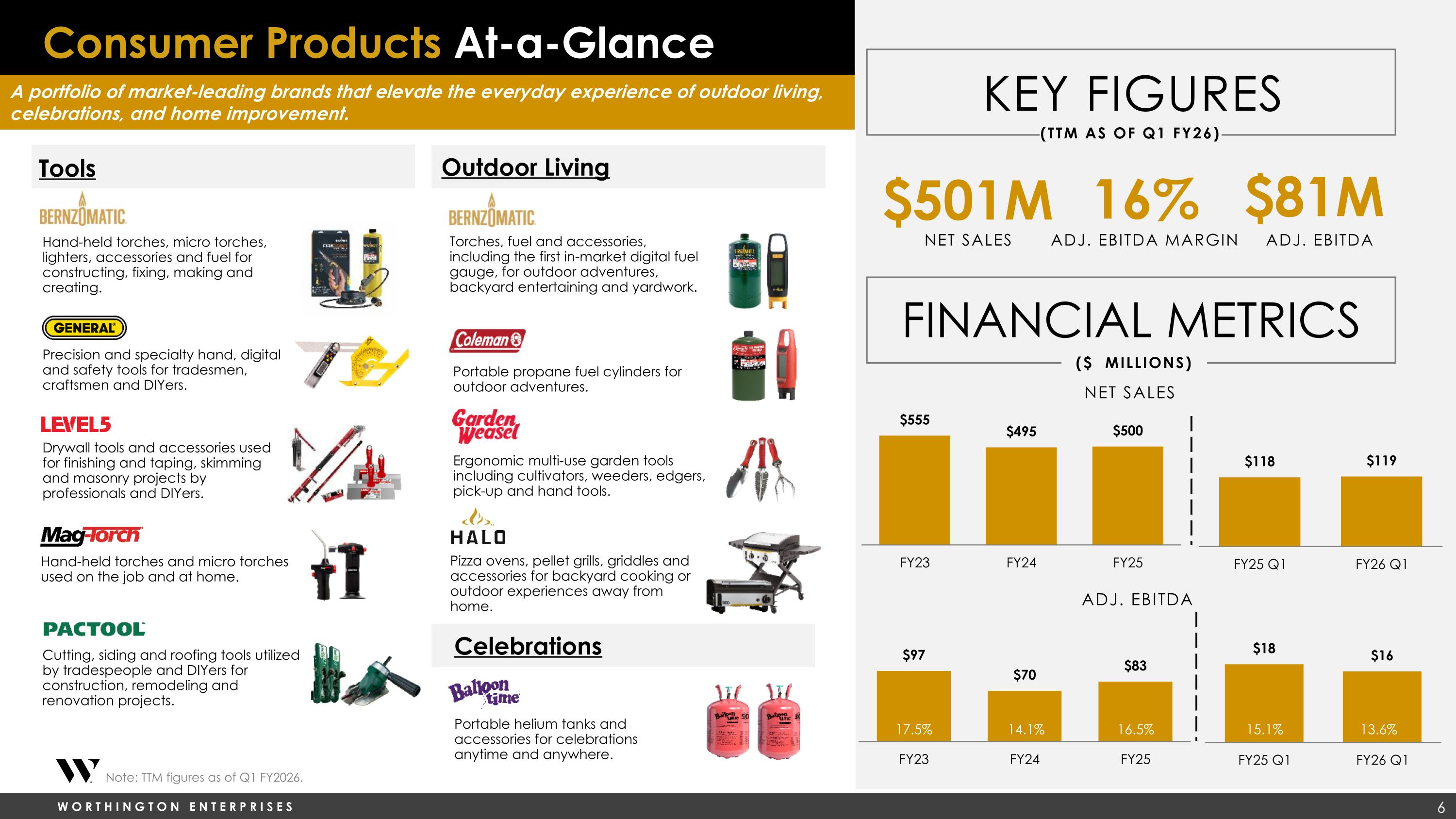

Consumer Products At-a-Glance $501M Net Sales 16% Adj. EBITDA Margin $81M Adj. EBITDA Net Sales Adj. EBITDA Key Figures (ttm AS OF Q1 FY26) ($ Millions) Financial Metrics Hand-held torches, micro torches, lighters, accessories and fuel for constructing, fixing, making and creating. Precision and specialty hand, digital and safety tools for tradesmen, craftsmen and DIYers. Drywall tools and accessories used for finishing and taping, skimming and masonry projects by professionals and DIYers. Hand-held torches and micro torches used on the job and at home. Cutting, siding and roofing tools utilized by tradespeople and DIYers for construction, remodeling and renovation projects. Torches, fuel and accessories, including the first in-market digital fuel gauge, for outdoor adventures, backyard entertaining and yardwork. Portable propane fuel cylinders for outdoor adventures. Ergonomic multi-use garden tools including cultivators, weeders, edgers, pick-up and hand tools. Pizza ovens, pellet grills, griddles and accessories for backyard cooking or outdoor experiences away from home. Portable helium tanks and accessories for celebrations anytime and anywhere. Tools Outdoor Living Celebrations 18% 14% 16% 19% 20% A portfolio of market-leading brands that elevate the everyday experience of outdoor living, celebrations, and home improvement. 17.5% 14.1% 16.5% 15.1% 13.6% Note: TTM figures as of Q1 FY2026.

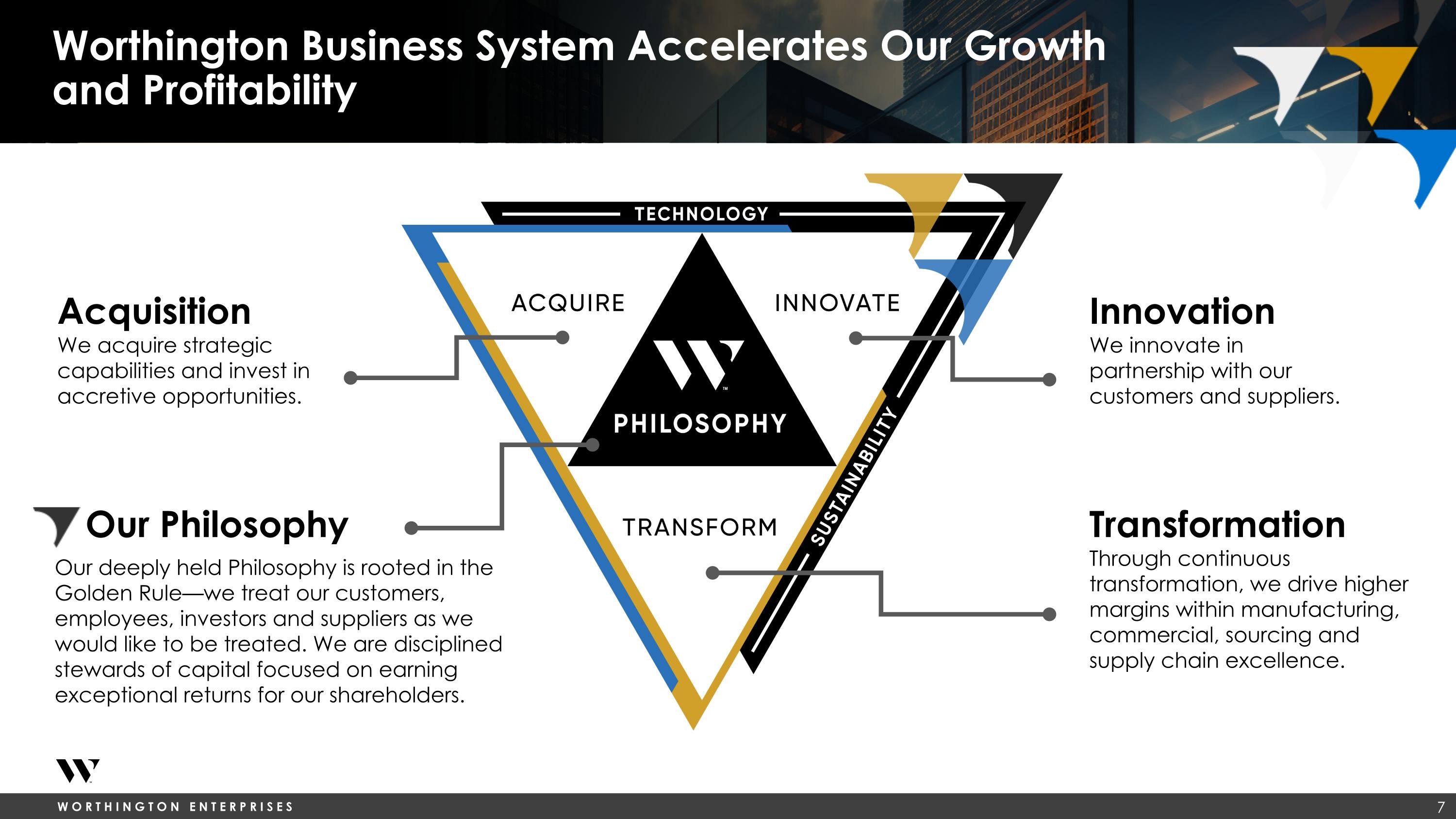

Innovation We innovate in partnership with our customers and suppliers. Transformation Through continuous transformation, we drive higher margins within manufacturing, commercial, sourcing and supply chain excellence. Acquisition We acquire strategic capabilities and invest in accretive opportunities. Our Philosophy Our deeply held Philosophy is rooted in the Golden Rule—we treat our customers, employees, investors and suppliers as we would like to be treated. We are disciplined stewards of capital focused on earning exceptional returns for our shareholders. Worthington Business System Accelerates Our Growth and Profitability

Delivering organic growth through innovation, new product development and strategic market share wins INNOVATION & NEW PRODUCT DEVELOPMENT STRATEGIC SHARE WINS AND PRODUCT PLACEMENT SureSense – IoT-enabled propane level sensor designed to improve efficiency for propane marketers Level5 Tools – gained placement for drywall tools at Sherwin-Williams and now available in 3,500 locations nationwide Halo – extended placement of innovative Halo Griddle to select Walmart stores Consumer and Building Products commercial teams worked closely together to expand relationship with Tractor Supply to gain share and expand offerings available. Balloon Time mini helium tank – compact product requiring less shelf-space and improving channel access PowerCore cylinder – corrosion resistant spray cylinder for water-based adhesives SureSense™ Select recent examples of innovation, share and product placement wins

Acquisition Strategy Focused on Driving Profitable Growth Market-leading positions in niche markets High margin, high growth brands or products Asset-light or low capital intensity business model Exposure to channels within building or consumer products Additive capabilities that enhance or expand our core competencies Demonstrated sustainable competitive advantage Targeted acquisition criteria: Recent Acquisitions Building Products: Leading manufacturer of LPG composite cylinders 2024 2022 Consumer Products: Innovative outdoor cooking equipment Consumer Products: Leading provider of drywall tools, offering a complete lineup for finishing professionals and DIYers 2025 Building Products: Leading designer and manufacturer of HVAC parts and components, ductwork and structural framing primarily used by contractors in commercial buildings

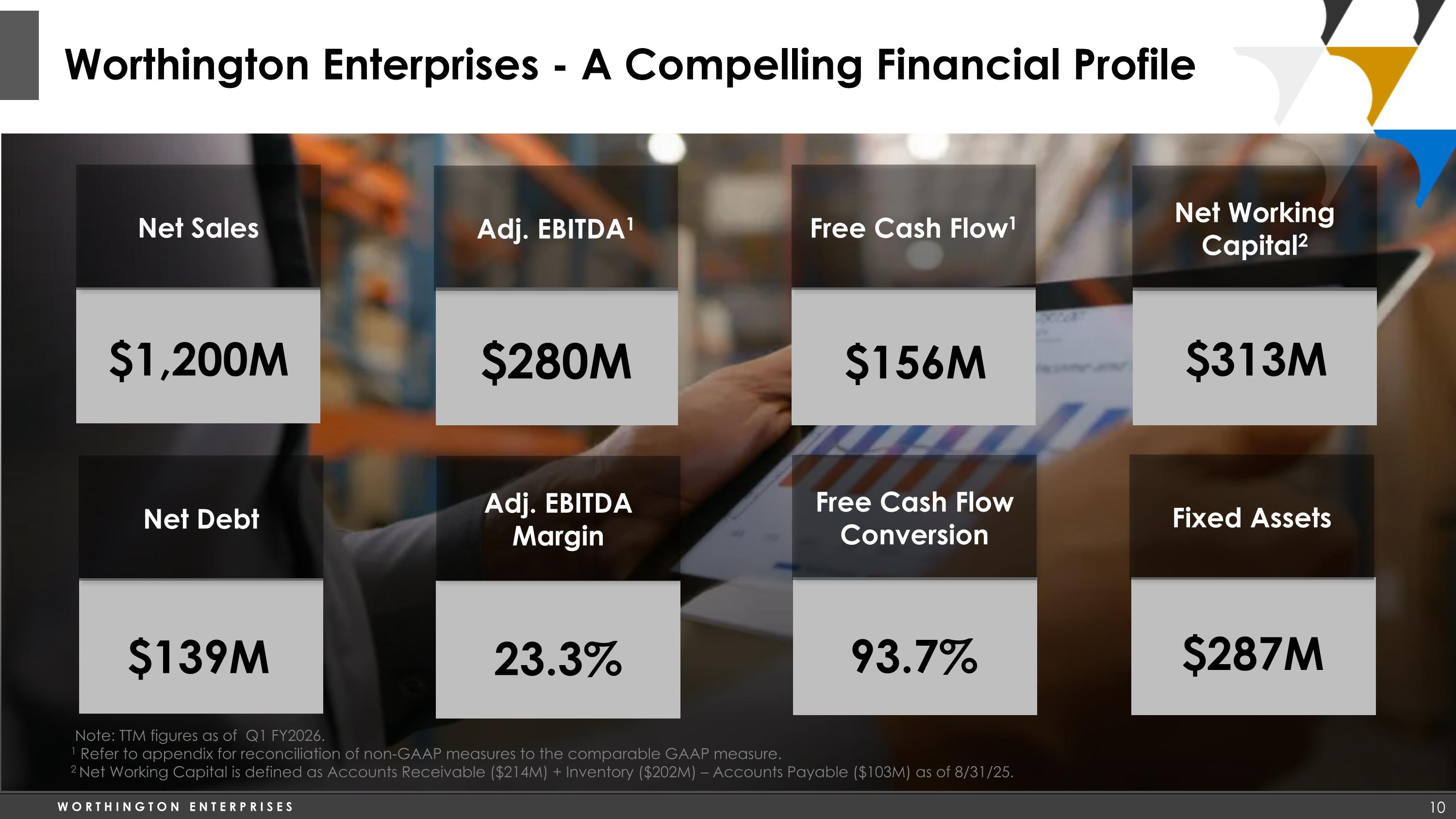

Worthington Enterprises - A Compelling Financial Profile Net Sales $1,200M Free Cash Flow1 $156M Adj. EBITDA1 $280M Note: TTM figures as of Q1 FY2026. 1 Refer to appendix for reconciliation of non-GAAP measures to the comparable GAAP measure. 2 Net Working Capital is defined as Accounts Receivable ($214M) + Inventory ($202M) – Accounts Payable ($103M) as of 8/31/25. Net Debt $139M Free Cash Flow Conversion 93.7% Adj. EBITDA Margin 23.3% Net Working Capital2 $313M Fixed Assets $287M

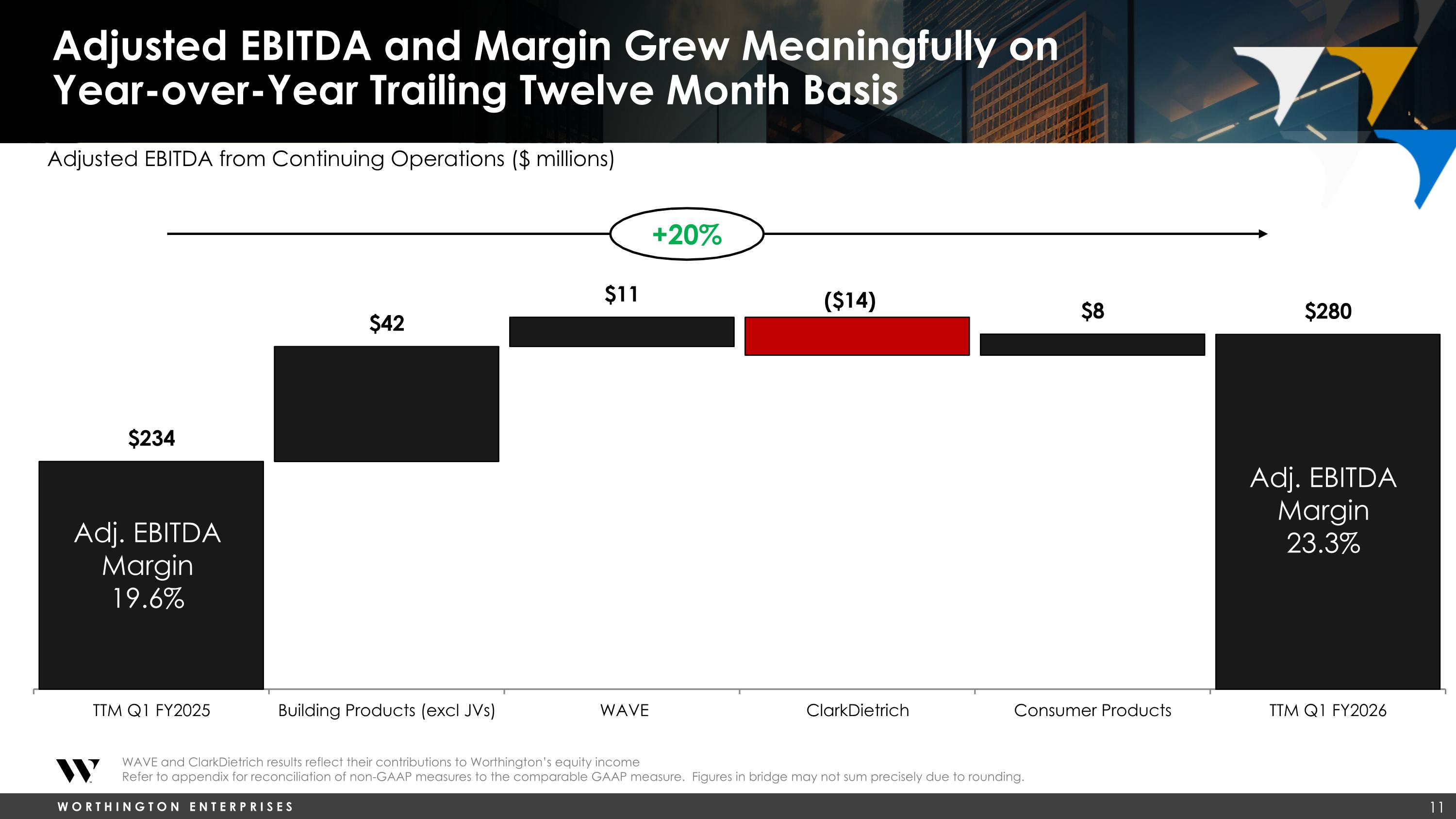

Adjusted EBITDA and Margin Grew Meaningfully on Year-over-Year Trailing Twelve Month Basis Adj. EBITDA Margin 23.3% Adj. EBITDA Margin 19.6% +20% Adjusted EBITDA from Continuing Operations ($ millions) WAVE and ClarkDietrich results reflect their contributions to Worthington’s equity income Refer to appendix for reconciliation of non-GAAP measures to the comparable GAAP measure. Figures in bridge may not sum precisely due to rounding.

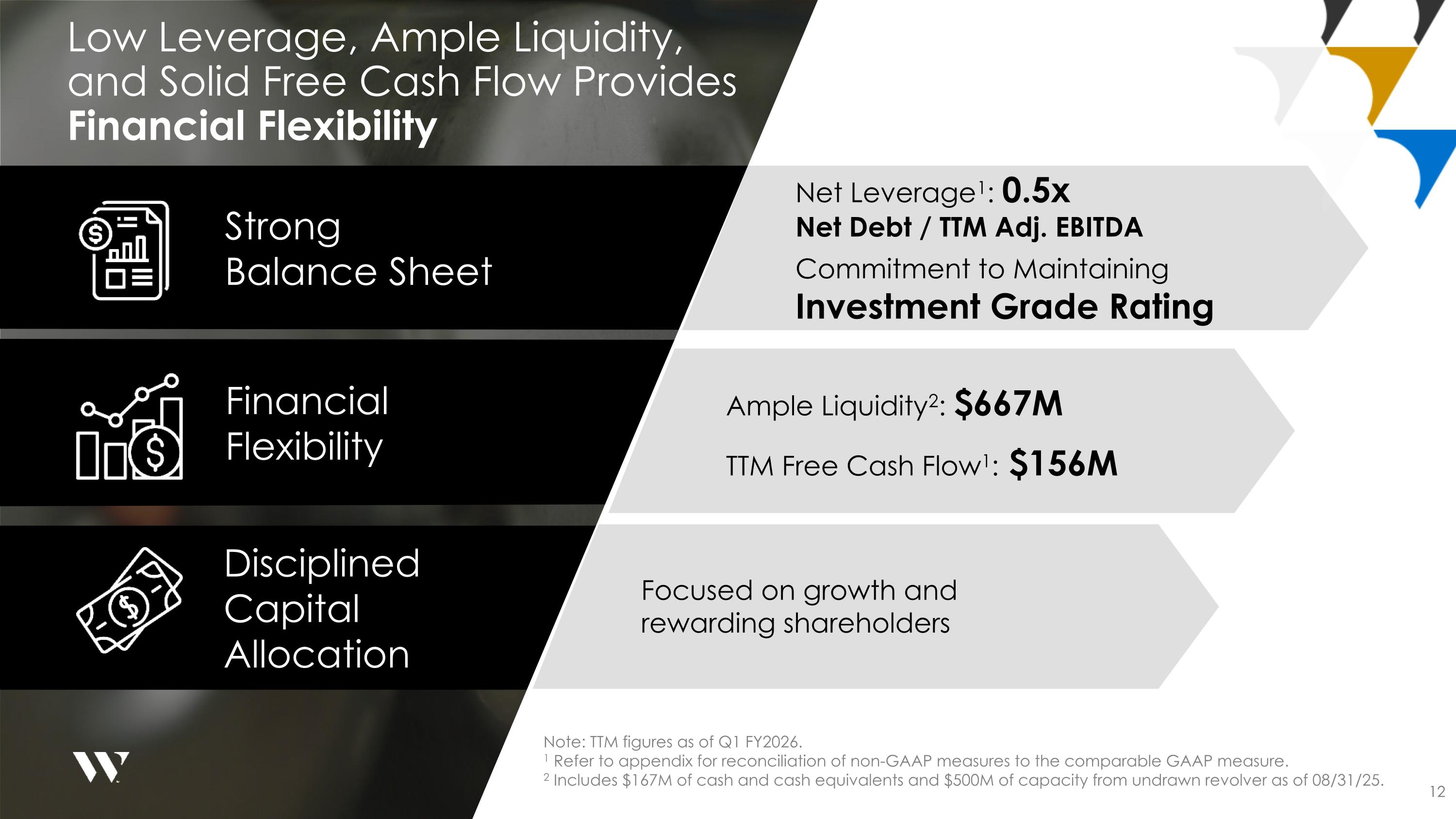

Low Leverage, Ample Liquidity, and Solid Free Cash Flow Provides Financial Flexibility Strong Balance Sheet 12 Financial Flexibility Disciplined Capital Allocation Ample Liquidity2: $667M TTM Free Cash Flow1: $156M Focused on growth and rewarding shareholders Net Leverage1: 0.5x Net Debt / TTM Adj. EBITDA Commitment to Maintaining Investment Grade Rating 12 Note: TTM figures as of Q1 FY2026. 1 Refer to appendix for reconciliation of non-GAAP measures to the comparable GAAP measure. 2 Includes $167M of cash and cash equivalents and $500M of capacity from undrawn revolver as of 08/31/25.

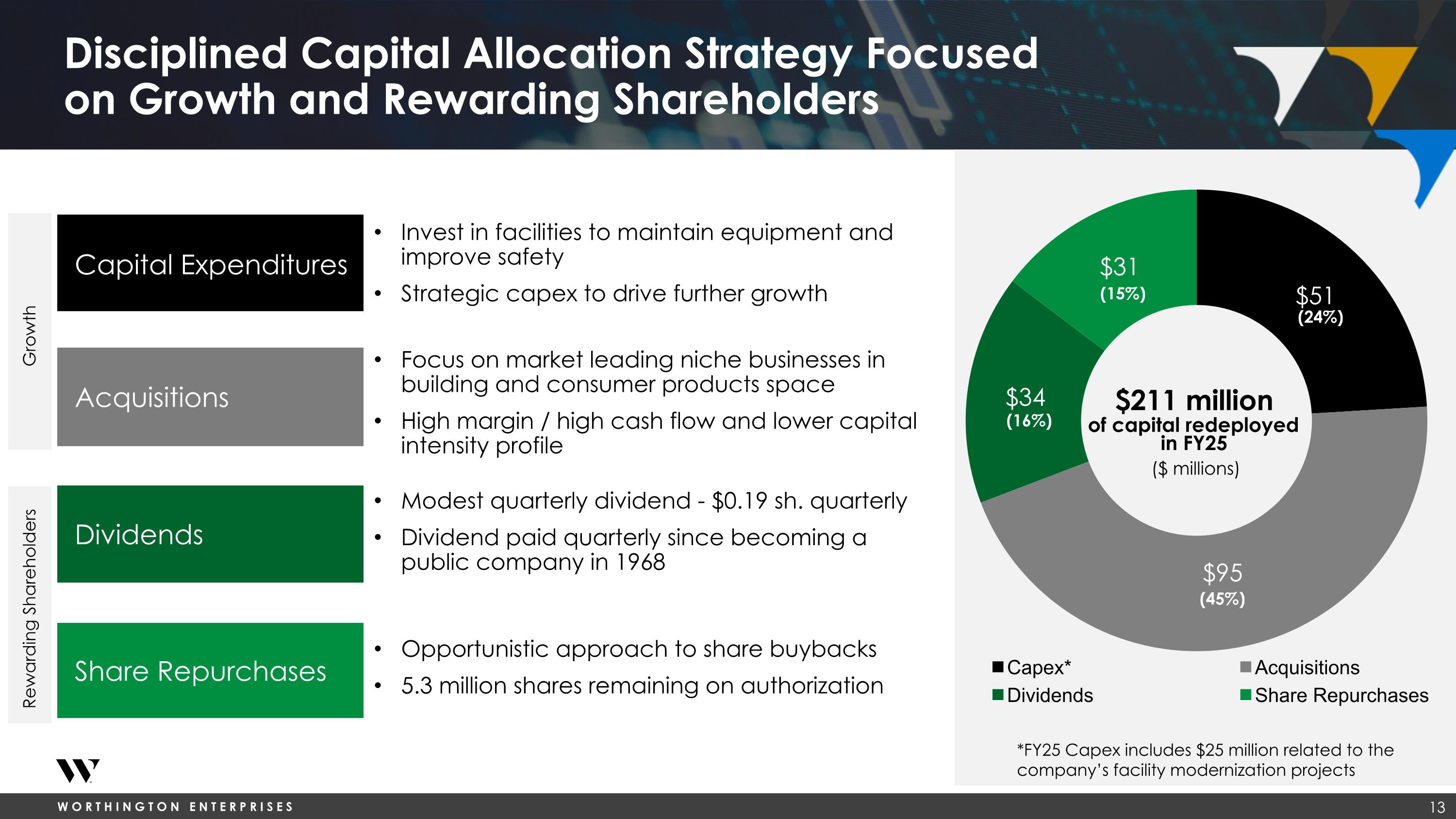

Disciplined Capital Allocation Strategy Focused on Growth and Rewarding Shareholders Invest in facilities to maintain equipment and improve safety Strategic capex to drive further growth $211 million of capital redeployed in FY25 ($ millions) *FY25 Capex includes $25 million related to the company’s facility modernization projects Capital Expenditures Acquisitions Dividends Share Repurchases Focus on market leading niche businesses in building and consumer products space High margin / high cash flow and lower capital intensity profile Modest quarterly dividend - $0.19 sh. quarterly Dividend paid quarterly since becoming a public company in 1968 Opportunistic approach to share buybacks 5.3 million shares remaining on authorization Rewarding Shareholders Growth (24%) (45%) (15%) (16%)

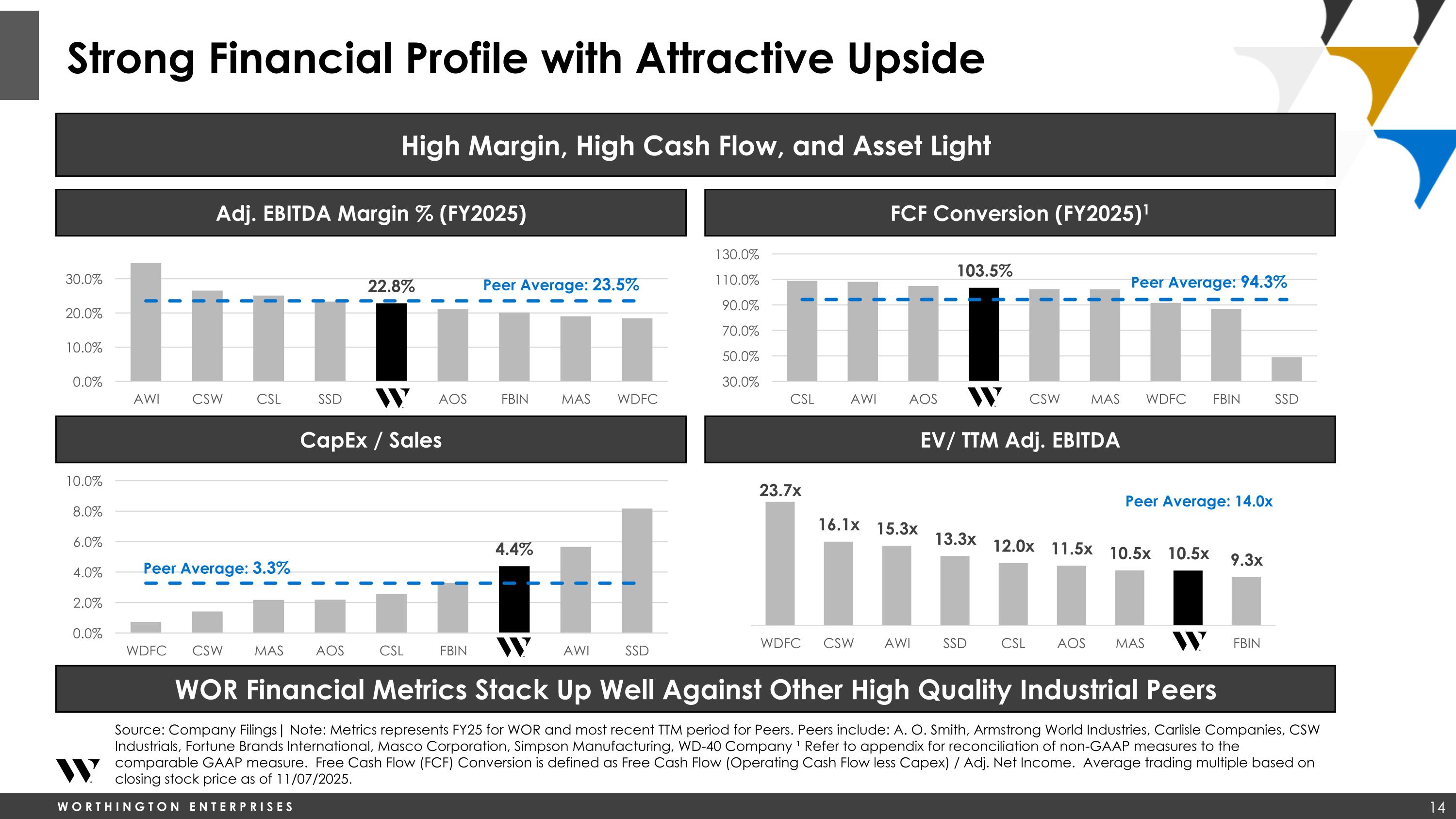

Strong Financial Profile with Attractive Upside Source: Company Filings| Note: Metrics represents FY25 for WOR and most recent TTM period for Peers. Peers include: A. O. Smith, Armstrong World Industries, Carlisle Companies, CSW Industrials, Fortune Brands International, Masco Corporation, Simpson Manufacturing, WD-40 Company ¹ Refer to appendix for reconciliation of non-GAAP measures to the comparable GAAP measure. Free Cash Flow (FCF) Conversion is defined as Free Cash Flow (Operating Cash Flow less Capex) / Adj. Net Income. Average trading multiple based on closing stock price as of 11/07/2025. High Margin, High Cash Flow, and Asset Light WOR Financial Metrics Stack Up Well Against Other High Quality Industrial Peers Adj. EBITDA Margin % (FY2025) FCF Conversion (FY2025)1 CapEx / Sales EV/ TTM Adj. EBITDA Peer Average: 23.5% Peer Average: 94.3% Peer Average: 3.3% Peer Average: 14.0x

1955 Established Portfolio of Market-Leading Brands with High Barriers to Entry Strong Underlying Secular Trends Enabling Steady Long-Term Growth Business Model Drives High Free Cash Flow and Returns Worthington Business System Accelerates Growth and Profitability Innovation For Highly Engineered Products Drives Incremental Sales and Margin Guided by Our Philosophy – a People-First, Performance-Based Culture Low Leverage, Ample Liquidity, and Solid Free Cash Flow Provides Financial Flexibility Key Investment Highlights Company Overview Founded in 1 TTM Figures as of Q1 FY2026 ended 8/31/25. Sales exclude pro-rata share of unconsolidated JV sales. 2 Refer to appendix for reconciliation of Adjusted EBITDA from continuing operations to the comparable GAAP measure. NET SALES OF $1.2 BILLION1 Adj. EBITDA of $280 million2 Net Sales by Segment1 Building Products Consumer Products

Appendix

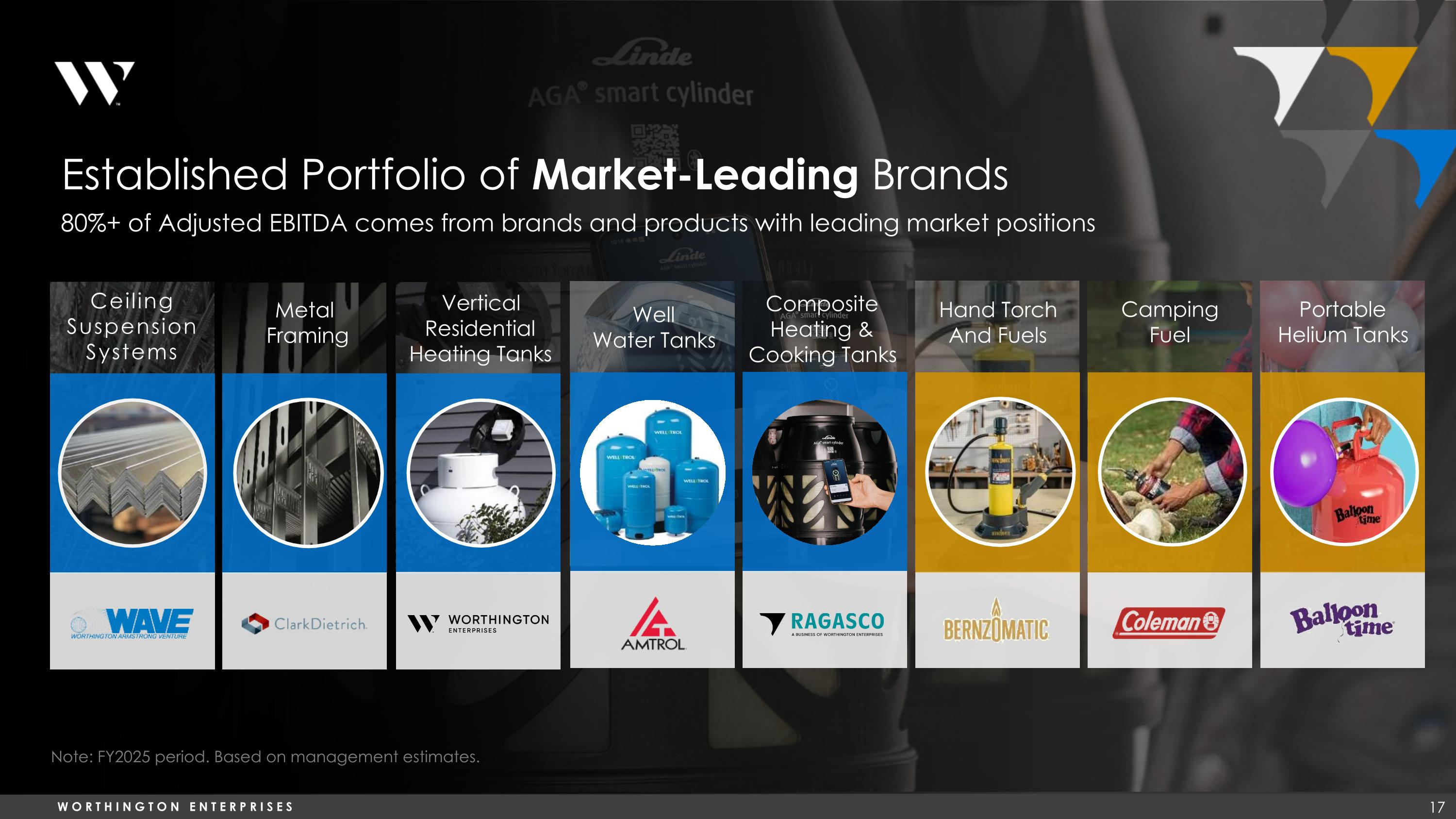

Established Portfolio of Market-Leading Brands Vertical Residential Heating Tanks Well Water Tanks Ceiling Suspension Systems Camping Fuel Metal Framing Portable Helium Tanks Hand Torch And Fuels 80%+ of Adjusted EBITDA comes from brands and products with leading market positions Note: FY2025 period. Based on management estimates. Composite Heating & Cooking Tanks

STRONG CULTURE Engaged employees who lead with safety, demonstrate a transformative mindset and maintain deep relationships with suppliers and customers. MANUFACTURING OPERATIONS Highly engineered, precise and compliant metal manufacturing with uncompromised safety and quality. REGULATORY EXPERTISE Deep knowledge of regulations, building codes, and highly specified applications and hazardous materials creates meaningful barriers to entry. PRODUCT INNOVATION Established processes and principles. Technology enabled beyond competition. Strategic Moat …With a well-established strategic moat COMMERCIAL EXCELLENCE Stickiness created from strong brands and market leadership, strategic relationships with retail/wholesale partners, providing valuable data analytics and price risk capabilities to add value to our customers’ supply chains.

Foam & Adhesive Re-shoring and Near Shoring Manufacturing investment in the U.S. in early stages of multi-year resurgence Metal Framing Industrial Products HVAC Products Serving Markets that are Well Positioned to Capitalize on Strong Secular Trends Housing undersupply and population trends support increased need for new and re-modeled homes Housing supply Lawn & Garden BBQ / Grill Products Foam & Adhesive Ceiling Solutions Tools HVAC Products Metal Framing Multiple Federal funding bills support long-term construction and supply chain investment U.S. Infrastructure investment

Ensuring curbside recyclability 100% FY25 Highlights Workforce Development Corporate Citizenship & Sustainability LEADING THE WAY PEOPLE PARTNERS PRODUCTS PROCESS & PLANET DONATED TO NON-PROFIT ORGANIZATIONS FROM THE WORTHINGTON COMPANIES FOUNDATION OF SUPPLIERS INDIRECTLY MONITORED AND 75% OF OUR SUPPLIER SPEND DIRECTLY ENGAGED Increasing transparency NEW ENVIRONMENTAL PRODUCT DECLARATION FOR RAGASCO PRODUCTS Outperforming safety total case incident rate (TCIR) 40% LOWER THAN INDUSTRY AVERAGE AVOIDED COSTS THROUGH RISK REDUCTION ACTIONS OVER THE LAST 3 YEARS Introducing corporate recycling and organics diversion programs TRANSITIONED GARDEN WEASEL SHIPPING CARTON MATERIAL AND CHANGED DESIGN, RESULTING IN INCREASED UNITS PER PALLET Sourcing domestically 86% PROCUREMENT WITH LOCAL U.S. SUPPLIERS Supporting communities $3.1M Fostering an engaged and inclusive workforce 85% PARTICIPATION IN EMPLOYEE ENGAGEMENT SURVEY Engaging suppliers 100% Reducing our environmental footprint 88% TOTAL WASTE RECYCLED OR RECOVERED Building climate resilience $6.05M

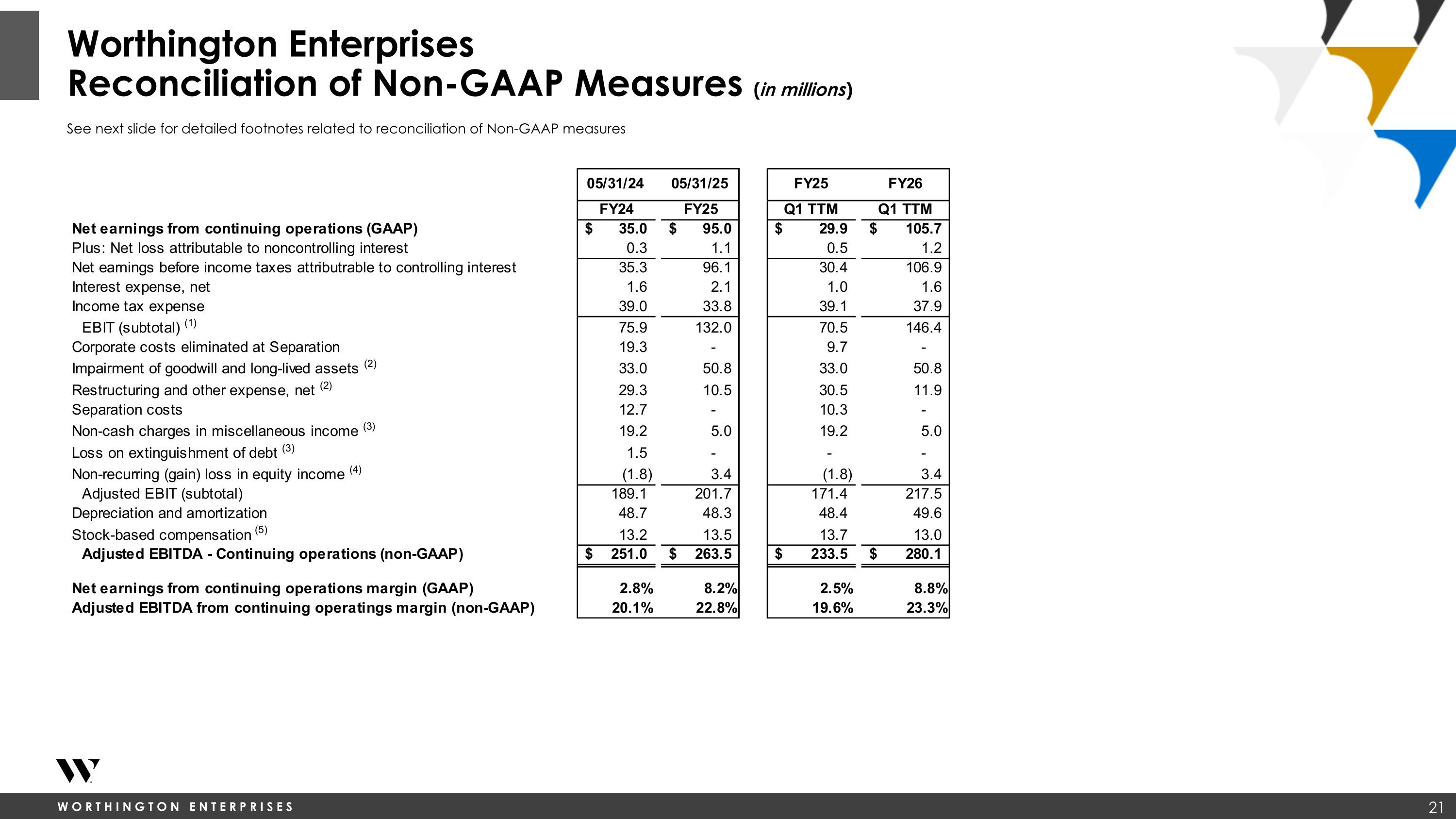

Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions) See next slide for detailed footnotes related to reconciliation of Non-GAAP measures

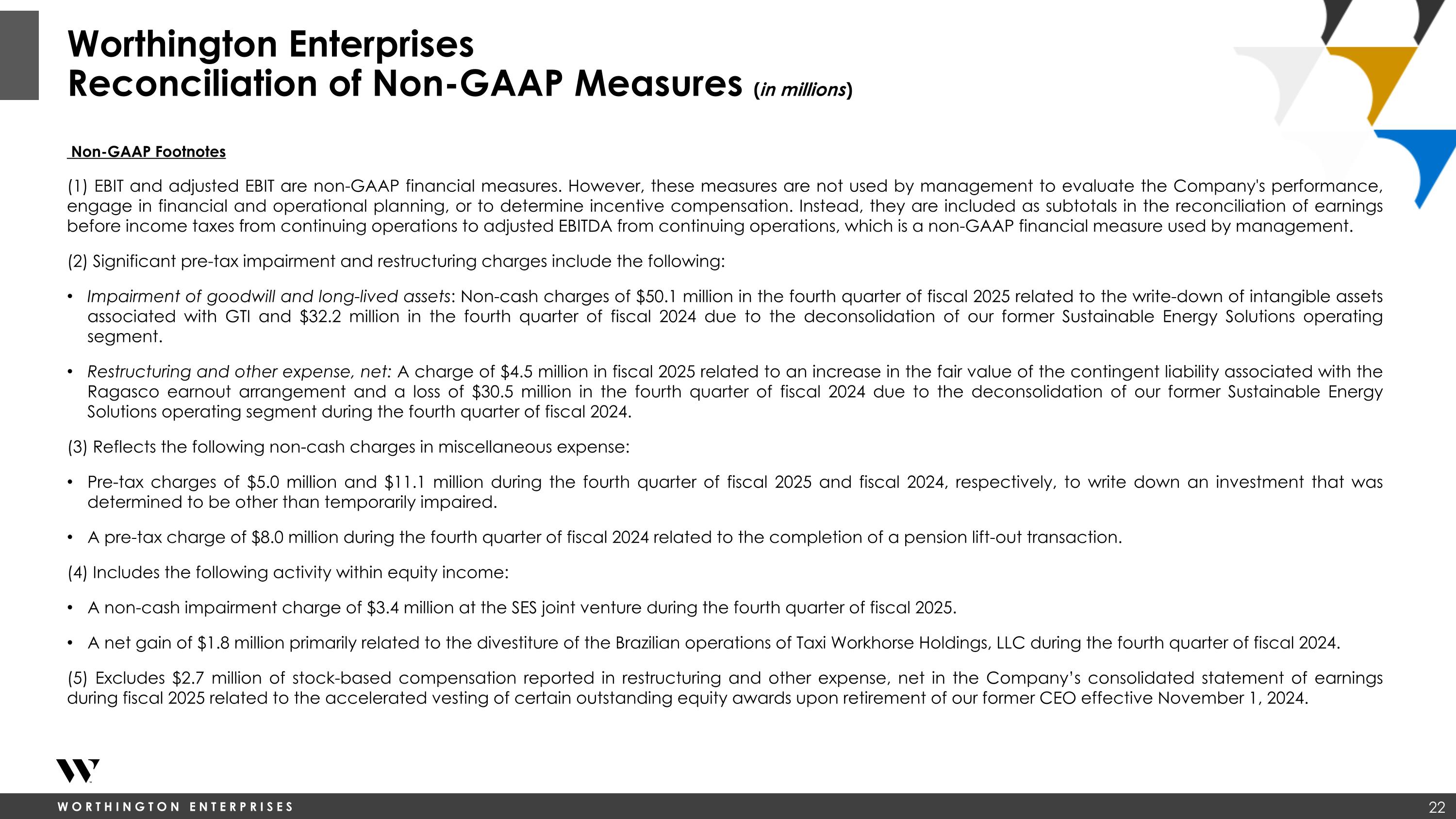

Non-GAAP Footnotes (1) EBIT and adjusted EBIT are non-GAAP financial measures. However, these measures are not used by management to evaluate the Company's performance, engage in financial and operational planning, or to determine incentive compensation. Instead, they are included as subtotals in the reconciliation of earnings before income taxes from continuing operations to adjusted EBITDA from continuing operations, which is a non-GAAP financial measure used by management. (2) Significant pre-tax impairment and restructuring charges include the following: Impairment of goodwill and long-lived assets: Non-cash charges of $50.1 million in the fourth quarter of fiscal 2025 related to the write-down of intangible assets associated with GTI and $32.2 million in the fourth quarter of fiscal 2024 due to the deconsolidation of our former Sustainable Energy Solutions operating segment. Restructuring and other expense, net: A charge of $4.5 million in fiscal 2025 related to an increase in the fair value of the contingent liability associated with the Ragasco earnout arrangement and a loss of $30.5 million in the fourth quarter of fiscal 2024 due to the deconsolidation of our former Sustainable Energy Solutions operating segment during the fourth quarter of fiscal 2024. (3) Reflects the following non-cash charges in miscellaneous expense: Pre-tax charges of $5.0 million and $11.1 million during the fourth quarter of fiscal 2025 and fiscal 2024, respectively, to write down an investment that was determined to be other than temporarily impaired. A pre-tax charge of $8.0 million during the fourth quarter of fiscal 2024 related to the completion of a pension lift-out transaction. (4) Includes the following activity within equity income: A non-cash impairment charge of $3.4 million at the SES joint venture during the fourth quarter of fiscal 2025. A net gain of $1.8 million primarily related to the divestiture of the Brazilian operations of Taxi Workhorse Holdings, LLC during the fourth quarter of fiscal 2024. (5) Excludes $2.7 million of stock-based compensation reported in restructuring and other expense, net in the Company’s consolidated statement of earnings during fiscal 2025 related to the accelerated vesting of certain outstanding equity awards upon retirement of our former CEO effective November 1, 2024. Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions)

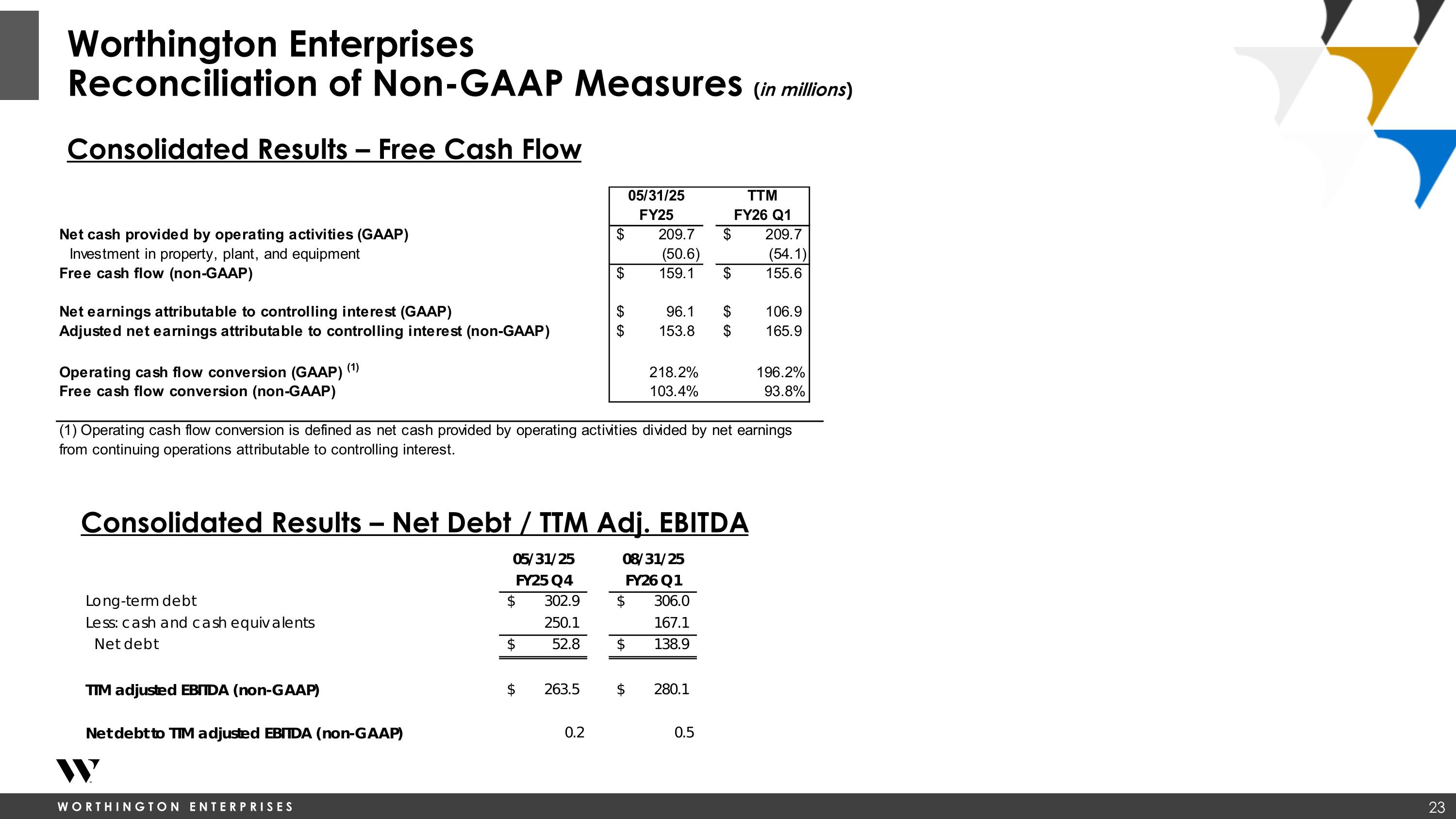

Consolidated Results – Free Cash Flow Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions) Consolidated Results – Net Debt / TTM Adj. EBITDA

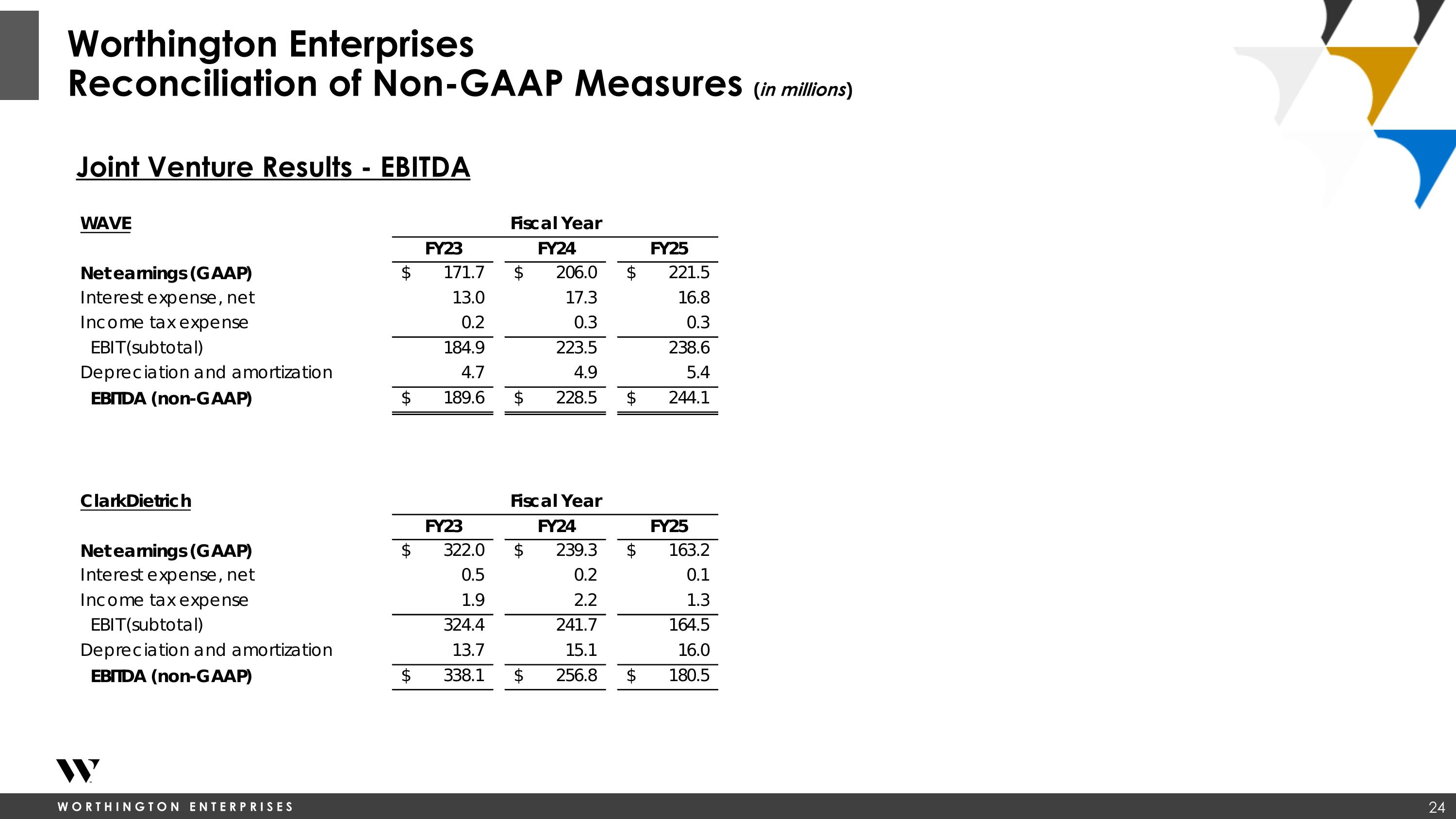

Joint Venture Results - EBITDA Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions)

Use of Non-GAAP Measures and Definitions NON-GAAP FINANCIAL MEASURES. These materials include certain financial measures that are not calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Non-GAAP financial measures typically exclude items that management believes are not reflective of, and thus should not be included when evaluating the performance of the Company’s ongoing operations. Management uses these non-GAAP financial measures to evaluate ongoing performance, engage in financial and operational planning, and determine incentive compensation. Management believes these non-GAAP financial measures provide useful supplemental information regarding the performance of the Company’s ongoing operations and should not be considered as an alternative to the comparable GAAP financial measure. Additionally, management believes these non-GAAP financial measures allow for meaningful comparisons and analysis of trends in the Company’s businesses and enables investors to evaluate operations and future prospects in the same manner as management. All non-GAAP financial measures presented herin are reported on a continuing operations basis. The following provides an explanation of each non-GAAP financial measure presented in these materials (on a continuing operations basis, where applicable): Adjusted operating income is defined as operating income (loss) excluding the items listed below, to the extent naturally included in operating income (loss). Adjusted net earnings is defined as net earnings attributable to controlling interest excluding the after-tax effect of the excluded items outlined below. Adjusted diluted EPS is defined as adjusted net earnings divided by diluted weighted-average shares outstanding for the applicable period. Adjusted earnings per diluted share (“Adjusted EPS”) is defined as adjusted net earnings divided by diluted weighted-average shares outstanding. Adjusted EBITDA is the measure by which management evaluates segment performance and overall profitability. EBITDA is defined as earnings before interest, taxes, depreciation, and amortization. Adjusted EBITDA excludes additional items including, but not limited to, those listed below, as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of ongoing operations. Adjusted EBITDA also excludes stock-based compensation due to its non-cash nature, which is consistent with how management assesses operating performance and determines incentive compensation. At the segment level, adjusted EBITDA includes expense allocations for centralized corporate back-office functions that exist to support the day-to-day business operations. Public company and other governance costs are held at the corporate level within the unallocated corporate and other category. Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by net sales. Free cash flow is a non-GAAP financial liquidity measure that is used by the Company to assess its ability to generate cash beyond what is required for its business operations and capital expenditures. The Company defines free cash flow as net cash flows from operating activities less investment in property, plant, and equipment. Free cash flow conversion is a non-GAAP financial measure that is used by the Company to measure how much of its adjusted net earnings attributable to controlling interest is converted into cash. The company defines free cash flow conversion as free cash flow divided by net earnings. Net debt to trailing twelve months (TTM) adjusted EBITDA (Net Leverage) which is a non-GAAP financial measure that is used by the Company as a measure of leverage. Net debt is calculated by subtracting cash and cash equivalents from total debt (defined as the aggregate of short-term borrowings, current maturities of long-term debt and long-term debt) the sum of which is divided by TTM adjusted EBITDA.

Use of Non-GAAP Measures and Definitions (Continued) EXCLUSIONS FROM NON-GAAP FINANCIAL MEASURES Management believes it is useful to exclude the following items from its non-GAAP financial measures for its own and investors’ assessment of the business for the reasons identified below. Additionally, management may exclude other items from non-GAAP financial measures that do not occur in the ordinary course of the Company’s ongoing business operations and note them in the reconciliation from net earnings from continuing operations to the non-GAAP financial measure adjusted EBITDA from continuing operations. Impairment charges are excluded because they do not occur in the ordinary course of the Company’s ongoing business operations, are inherently unpredictable in timing and amount, and are non-cash, which management believes facilitates the comparison of historical, current and forecasted financial results. Restructuring activities consists of established programs that are intended to fundamentally change the Company’s operations, and as such are excluded from its non-GAAP financial measures. The Company’s restructuring programs may include closing or consolidating production facilities or moving manufacturing of a product to another location, realignment of the management structure of a business unit in response to changing market conditions or general rationalization of headcount. The Company’s restructuring activities generally give rise to employee-related costs, such as severance pay, and facility-related costs, such as exit costs and gains or losses on asset disposals but may include other incremental costs associated with the Company’s restructuring activities. Restructuring and other expense, net, may also include other nonrecurring items included in operating income but incremental to the Company’s normal business activities. These items are excluded because they are not part of the ongoing operations of the Company’s underlying business. Separation costs, which consist of direct and incremental costs incurred in connection with the completed Separation are excluded as they are one-time in nature and are not expected to occur in periods following the Separation. These costs include fees paid to third-party advisors, such as investment banking, audit and other advisory services as well as direct and incremental costs associated with the Separation of shared corporate functions. Results in fiscal 2024 also include incremental compensation expense associated with the modification of unvested short and long-term incentive compensation awards, as required under the employee matters agreement executed in conjunction with the Separation. Non-cash charges in miscellaneous expense are excluded due to their non-cash nature and the fact that they do not occur in the normal course of business and may obscure analysis of trends and financial performance. Loss on extinguishment of debt is excluded because it does not occur in the normal course of business and may obscure analysis of trends and financial performance. Additionally, the amount and frequency of this type of charge is not consistent and is significantly impacted by the timing and size of debt extinguishment transactions. Corporate costs eliminated at Separation reflect certain corporate overhead costs that no longer exist post-Separation. These costs were included in continuing operations as they represent general corporate overhead that was historically allocated to the Company’s former steel processing business but did not meet the requirements to be presented as discontinued operations. Pension settlement charges are excluded due to their non-cash nature and the fact that they do not occur in the normal course of business and may obscure analysis of trends and financial performance. These transactions typically result from the transfer of all or a portion of the total projected benefit obligation to third-party insurance companies. One-time tax effects of Separation are charges to income tax expense primarily related to non-deductible transaction costs. They are excluded because they are one-time in nature and not expected to occur in periods following the Separation. Non-recurring loss in equity income is excluded because it does not occur in the normal course of business and is inherently unpredictable in timing and amount.