LSI GROUP December 16, 2025 Overview of Planned Acquisition

Notes to Investors FORWARD-LOOKING STATEMENTS. Selected statements in this presentation constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). Worthington Enterprises, Inc. (the “Company” or “Worthington”) wishes to take advantage of the safe harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee” and similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans;; future or expected performance, growth, demand, financial condition or other financial measures; pricing trends for raw materials and finished goods; additions to product lines and opportunities to participate in new markets; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain; the ability to make acquisitions, form joint ventures and consolidate operations and the projected timing, benefits and costs related thereto; expectations for the economy and markets; expectations for shareholder value; effects of pandemics and widespread health crises; and other non-historical matters. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a U.S. withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations; effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts, terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability, foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the U.S. Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations or considerations; the impact of judicial rulings and governmental regulations, both in the U.S. and abroad, including those adopted by the U.S. Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the U.S. and potential changes for such laws, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company’s costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the Company’s filings with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2025, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. It is impossible to predict or identify all potential risk factors. Consequently, readers should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made, which was December 16, 2025. The Company does not undertake, and hereby disclaims, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

LSI Group strengthens our Building Products portfolio and aligns with our acquisition strategy 1 Source: Third party market study and internal estimates Leading player in the commercial metal roofing clips, components and accessories markets with a strong competitive position driven by product quality, innovation and industry leading customer service Attractive niche end markets supported by durable demand in a ~$400 million U.S. metal-roofing components market growing 3-5% annually1, led by resilient commercial and retrofit demand Blue-chip, loyal customer base comprised of the “who’s who” of metal roof OEMs Best-in-class margins and financial profile coupled with low capital intensity driving high free cash flow conversion Meaningful value-creation opportunities through the Worthington Business System, including strengthened commercial capabilities, expanded customer and regional reach, procurement scale benefits and broader engagement across the Building Products portfolio Strong leadership team and a solid cultural fit that closely aligns with Worthington’s philosophy

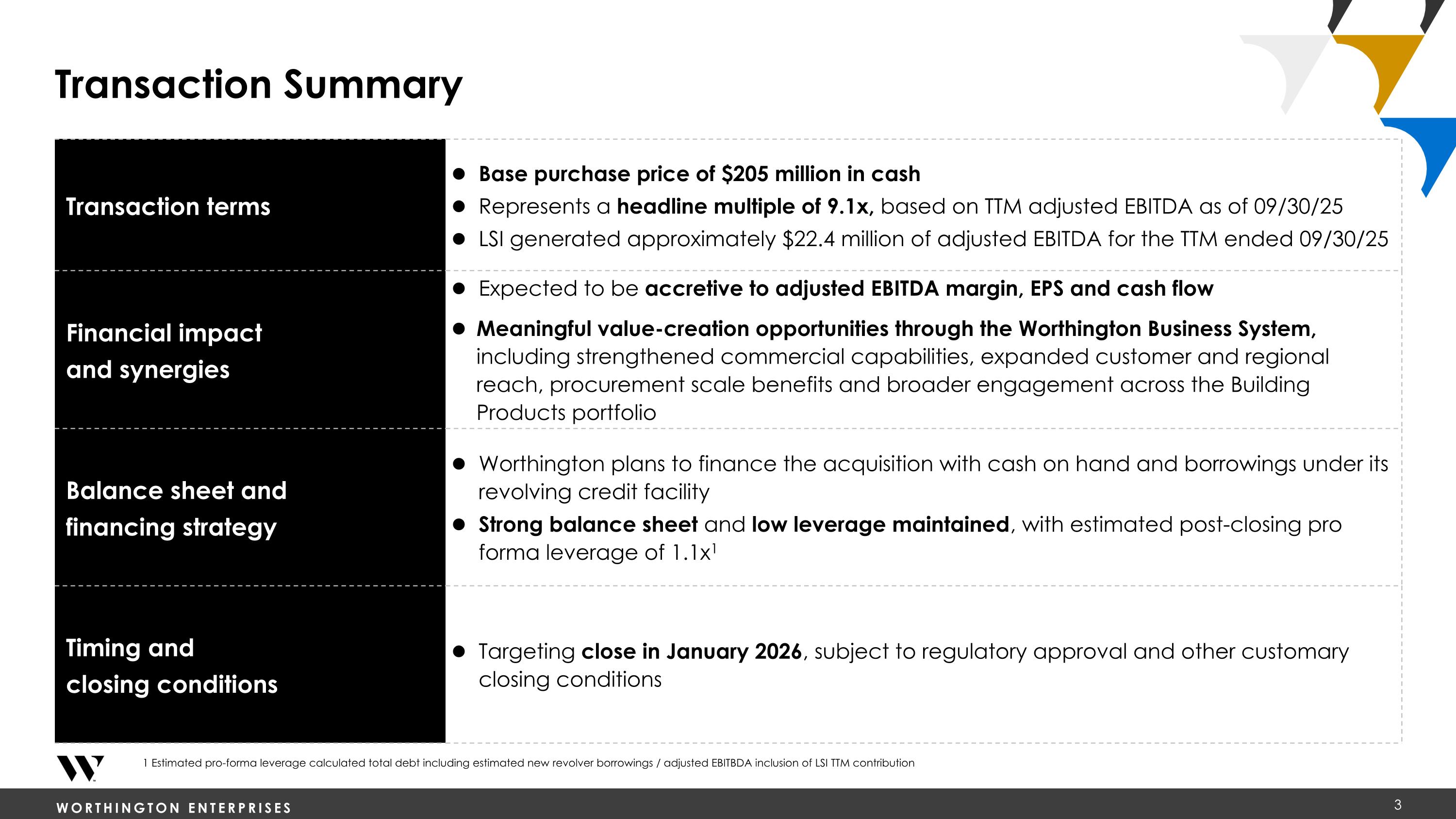

Transaction Summary Transaction terms Base purchase price of $205 million in cash Represents a headline multiple of 9.1x, based on TTM adjusted EBITDA as of 09/30/25 LSI generated approximately $22.4 million of adjusted EBITDA for the TTM ended 09/30/25 Financial impact and synergies Expected to be accretive to adjusted EBITDA margin, EPS and cash flow Meaningful value-creation opportunities through the Worthington Business System, including strengthened commercial capabilities, expanded customer and regional reach, procurement scale benefits and broader engagement across the Building Products portfolio Balance sheet and financing strategy Worthington plans to finance the acquisition with cash on hand and borrowings under its revolving credit facility Strong balance sheet and low leverage maintained, with estimated post-closing pro forma leverage of 1.1x1 Timing and closing conditions Targeting close in January 2026, subject to regulatory approval and other customary closing conditions 1 Estimated pro-forma leverage calculated total debt including estimated new revolver borrowings / adjusted EBITBDA inclusion of LSI TTM contribution

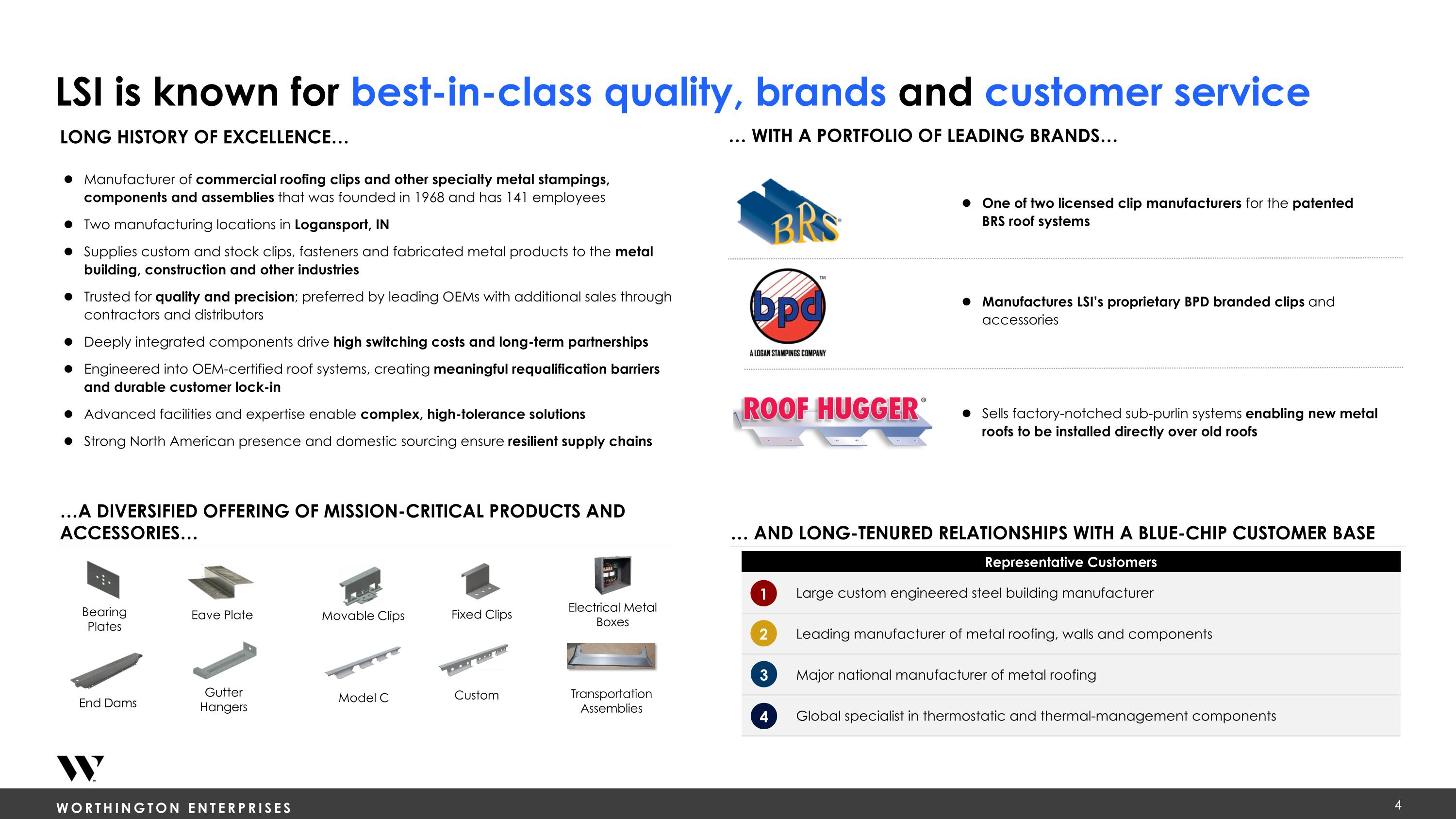

LSI is known for best-in-class quality, brands and customer service long history of excellence… Manufacturer of commercial roofing clips and other specialty metal stampings, components and assemblies that was founded in 1968 and has 141 employees Two manufacturing locations in Logansport, IN Supplies custom and stock clips, fasteners and fabricated metal products to the metal building, construction and other industries Trusted for quality and precision; preferred by leading OEMs with additional sales through contractors and distributors Deeply integrated components drive high switching costs and long-term partnerships Engineered into OEM-certified roof systems, creating meaningful requalification barriers and durable customer lock-in Advanced facilities and expertise enable complex, high-tolerance solutions Strong North American presence and domestic sourcing ensure resilient supply chains One of two licensed clip manufacturers for the patented BRS roof systems Manufactures LSI’s proprietary BPD branded clips and accessories Sells factory-notched sub-purlin systems enabling new metal roofs to be installed directly over old roofs … with a portfolio of leading brands… …a diversified offering of mission-critical products and accessories… … and long-tenured relationships with a blue-chip customer base Fixed Clips Movable Clips Gutter Hangers Bearing Plates End Dams Eave Plate Model C Custom Transportation Assemblies Electrical Metal Boxes Representative Customers Large custom engineered steel building manufacturer Leading manufacturer of metal roofing, walls and components Major national manufacturer of metal roofing Global specialist in thermostatic and thermal-management components 1 2 3 4

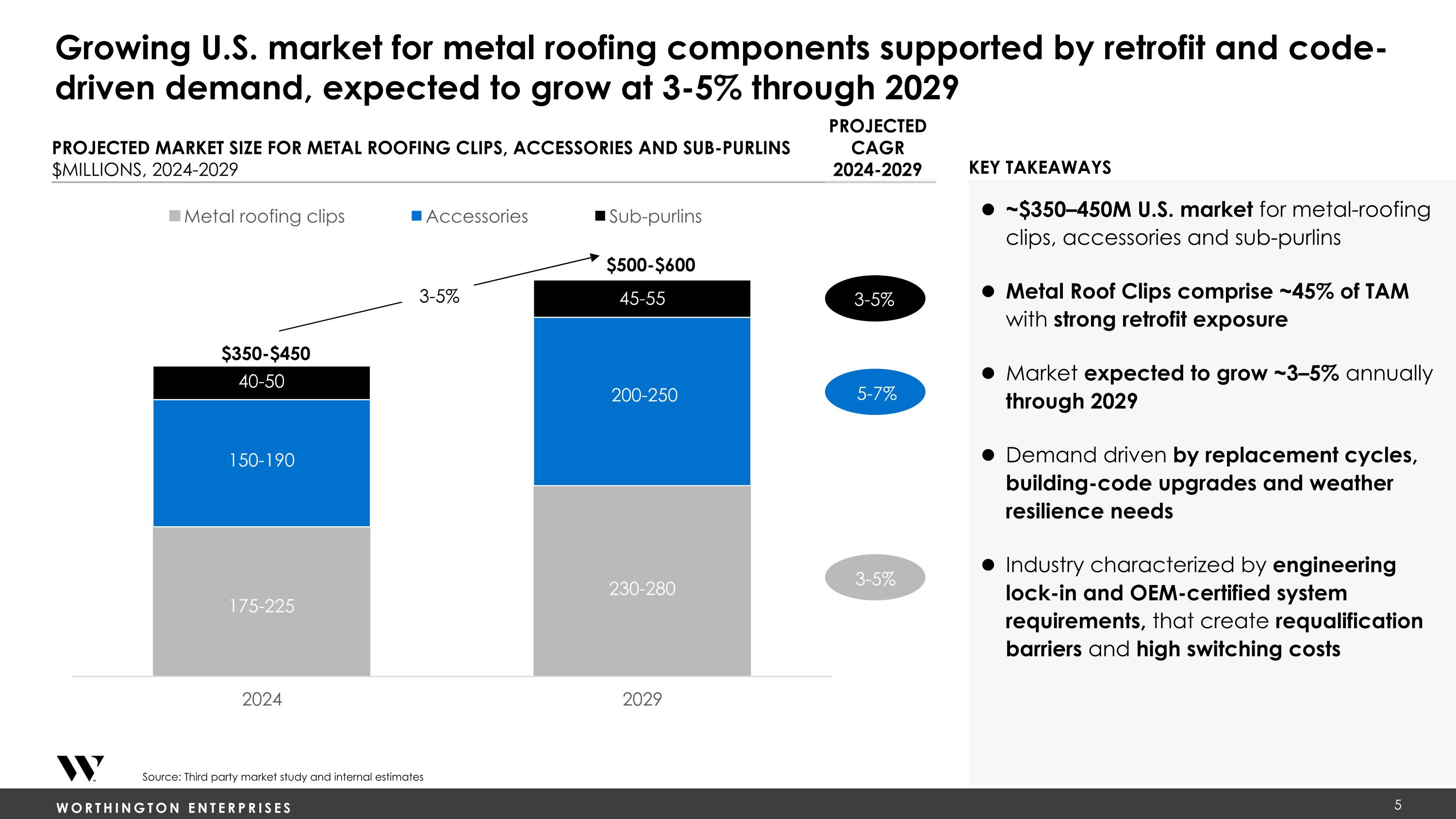

Key takeaways Growing U.S. market for metal roofing components supported by retrofit and code-driven demand, expected to grow at 3-5% through 2029 Source: Third party market study and internal estimates ~$350–450M U.S. market for metal-roofing clips, accessories and sub-purlins Metal Roof Clips comprise ~45% of TAM with strong retrofit exposure Market expected to grow ~3–5% annually through 2029 Demand driven by replacement cycles, building-code upgrades and weather resilience needs Industry characterized by engineering lock-in and OEM-certified system requirements, that create requalification barriers and high switching costs Projected market size for metal roofing clips, accessories and sub-purlins $millions, 2024-2029 175-225 230-280 150-190 40-50 200-250 45-55 $350-$450 $500-$600 3-5% Projected CAGR 2024-2029 3-5% 5-7% 3-5%

LSI aligns with our acquisition strategy to drive profitable growth Market-leading positions in niche markets High margin, high growth brands or products Asset-light or low capital intensity business model Exposure to channels within building or consumer products Additive capabilities that enhance or expand our core competencies Demonstrated sustainable competitive advantage Targeted acquisition criteria: Announced December 2025: Leading provider of commercial metal roof clips, accessories, retrofit systems and other fabricated metal products for metal building, construction, and other industries Acquired June 2025: Leading designer and manufacturer of HVAC parts and components, ductwork and structural framing primarily used by contractors in commercial buildings Recent Building Products acquisitions

Established Portfolio of Market-Leading Brands with High Barriers to Entry Strong Underlying Secular Trends Enabling Steady Long-Term Growth Business Model Drives High Free Cash Flow and Returns Worthington Business System Accelerates Growth and Profitability Innovation For Highly Engineered Products Drives Incremental Sales and Margin Guided by Our Philosophy – a People-First, Performance-Based Culture Low Leverage, Ample Liquidity and Solid Free Cash Flow Provides Financial Flexibility 1955 FOUNDED IN Net sales by segment1 Worthington Enterprises Key Investment Highlights Acquisition of LSI strengthens our position in engineered building systems with resilient, retrofit-driven demand NET SALES OF $1.3 BILLION1 Adj. EBITDA2 of $284 million 1 TTM figures as of Q2 FY2026 ended 11/30/25. Sales exclude pro-rata share of unconsolidated JV sales 2 Adj. EBITDA is a non-GAAP measure. See appendix for reconciliation to most comparable GAAP measure

Appendix

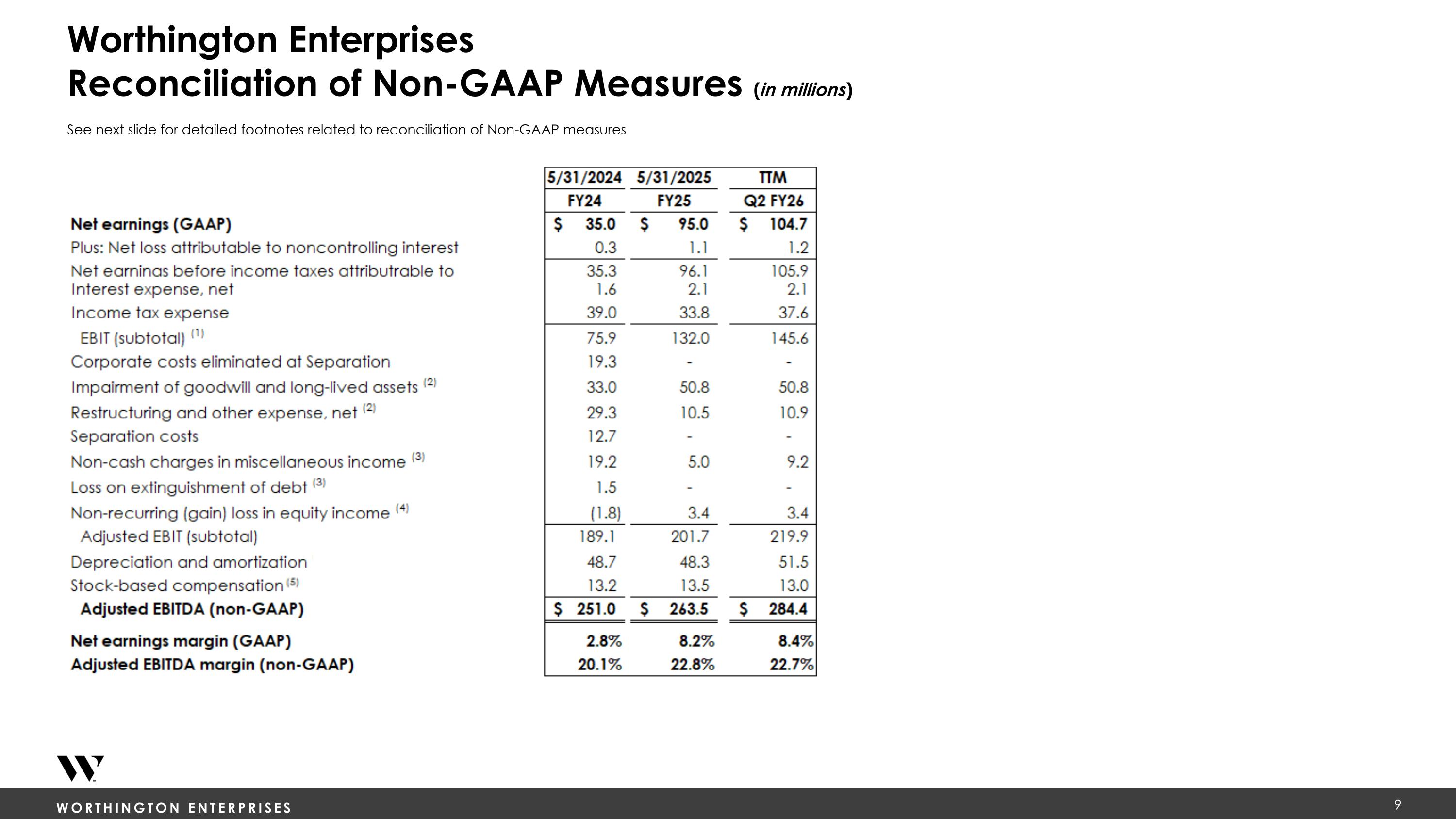

See next slide for detailed footnotes related to reconciliation of Non-GAAP measures Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions)

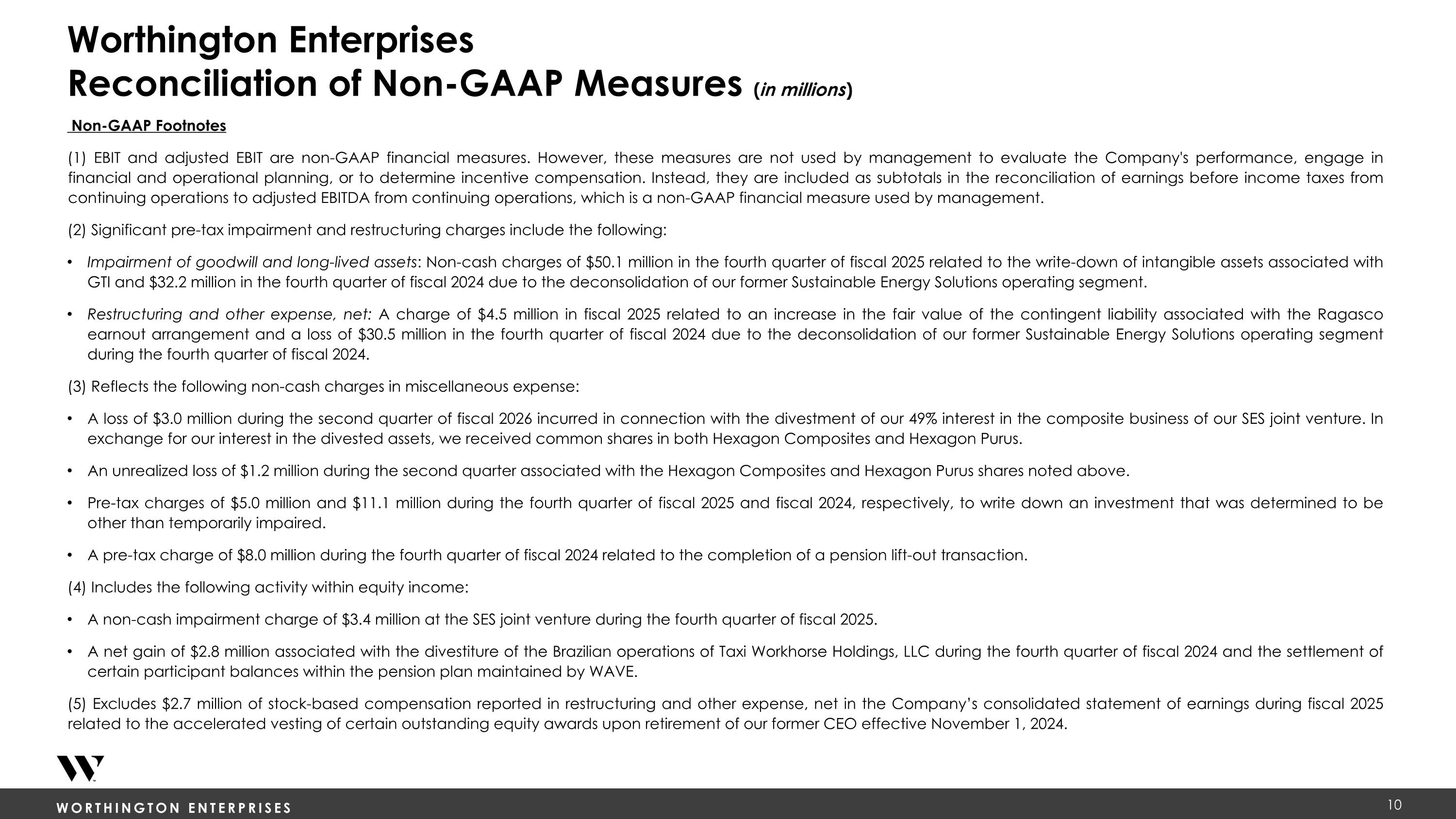

Worthington Enterprises Reconciliation of Non-GAAP Measures (in millions) Non-GAAP Footnotes (1) EBIT and adjusted EBIT are non-GAAP financial measures. However, these measures are not used by management to evaluate the Company's performance, engage in financial and operational planning, or to determine incentive compensation. Instead, they are included as subtotals in the reconciliation of earnings before income taxes from continuing operations to adjusted EBITDA from continuing operations, which is a non-GAAP financial measure used by management. (2) Significant pre-tax impairment and restructuring charges include the following: Impairment of goodwill and long-lived assets: Non-cash charges of $50.1 million in the fourth quarter of fiscal 2025 related to the write-down of intangible assets associated with GTI and $32.2 million in the fourth quarter of fiscal 2024 due to the deconsolidation of our former Sustainable Energy Solutions operating segment. Restructuring and other expense, net: A charge of $4.5 million in fiscal 2025 related to an increase in the fair value of the contingent liability associated with the Ragasco earnout arrangement and a loss of $30.5 million in the fourth quarter of fiscal 2024 due to the deconsolidation of our former Sustainable Energy Solutions operating segment during the fourth quarter of fiscal 2024. (3) Reflects the following non-cash charges in miscellaneous expense: A loss of $3.0 million during the second quarter of fiscal 2026 incurred in connection with the divestment of our 49% interest in the composite business of our SES joint venture. In exchange for our interest in the divested assets, we received common shares in both Hexagon Composites and Hexagon Purus. An unrealized loss of $1.2 million during the second quarter associated with the Hexagon Composites and Hexagon Purus shares noted above. Pre-tax charges of $5.0 million and $11.1 million during the fourth quarter of fiscal 2025 and fiscal 2024, respectively, to write down an investment that was determined to be other than temporarily impaired. A pre-tax charge of $8.0 million during the fourth quarter of fiscal 2024 related to the completion of a pension lift-out transaction. (4) Includes the following activity within equity income: A non-cash impairment charge of $3.4 million at the SES joint venture during the fourth quarter of fiscal 2025. A net gain of $2.8 million associated with the divestiture of the Brazilian operations of Taxi Workhorse Holdings, LLC during the fourth quarter of fiscal 2024 and the settlement of certain participant balances within the pension plan maintained by WAVE. (5) Excludes $2.7 million of stock-based compensation reported in restructuring and other expense, net in the Company’s consolidated statement of earnings during fiscal 2025 related to the accelerated vesting of certain outstanding equity awards upon retirement of our former CEO effective November 1, 2024.