Federal Signal Q3 2025 Earnings Call October 30, 2025 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer Felix Boeschen, VP, Corporate Strategy & Investor Relations Safe Harbor This presentation contains unaudited financial information and various forward-looking statements as of the date hereof and we undertake no obligation to update these forward- looking statements regardless of new developments or otherwise. Statements in this presentation that are not historical are forward-looking statements. Forward-looking statements should not be relied upon as a predictor of actual results. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include but are not limited to: our ability to successfully close and implement the acquisition of New Way, our ability to achieve anticipated revenue and cost benefits associated with the New Way acquisition, economic and political uncertainty, risks and adverse economic effects associated with geopolitical conflicts including tariffs and other trade conflicts, legal and regulatory developments, foreign currency exchange rate changes, inflationary pressures, product and price competition, supply chain disruptions, availability and pricing of raw materials, interest rate changes, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, work stoppages, increases in pension funding requirements, cybersecurity risks, increased legal expenses and litigation results, and other risks and uncertainties described in filings with the Securities and Exchange Commission (SEC). This presentation also contains references to certain non-GAAP financial information. Such items are reconciled herein, in our earnings news release provided as of the date of this presentation, or in other investor materials filed with the SEC. 2 Q3 Highlights ** 3 * Non-GAAP financial measure. See appendix for additional information on non-GAAP measures, including reconciliation to GAAP measures **Comparisons versus Q3 of 2024 • Net sales of $555 M, up $81 M, or 17% • Organic growth of $51 M, or 11% • Operating income of $94.0 M, up $18.1 M, or 24% • Adjusted EBITDA* of $116.2 M, up $23.2 M, or 25% • Adjusted EBITDA margin* of 20.9%, vs. 19.6% • GAAP diluted EPS of $1.11, up $0.24, or 28% • Adjusted EPS* of $1.14, up $0.26, or 30% • Orders of $467 M, up $41 M, or 10% • Backlog of $992 M 4 Group and Corporate Results * Non-GAAP financial measure. See appendix for additional information on non- GAAP measures, including reconciliation to GAAP measures $ millions, except % Q3 2025 Q3 2024 % Change ESG Orders 371.1$ 352.7$ 5% Net sales 465.5 398.2 17% Operating income 85.3 71.5 19% Operating margin 18.3% 18.0% Adjusted EBITDA* 104.9 87.2 20% Adjusted EBITDA margin* 22.5% 21.9% SSG Orders 95.8 73.2 31% Net sales 89.5 76.0 18% Operating income 21.9 16.8 30% Operating margin 24.5% 22.1% Adjusted EBITDA* 22.9 17.8 29% Adjusted EBITDA margin* 25.6% 23.4% Corporate expenses 13.2 12.4 6% Consolidated Orders 466.9 425.9 10% Net sales 555.0 474.2 17% Operating income 94.0 75.9 24% Operating margin 16.9% 16.0% Adjusted EBITDA* 116.2 93.0 25% Adjusted EBITDA margin* 20.9% 19.6%

Consolidated Statement of Operations 5 * Non-GAAP financial measure. See appendix for additional information on non- GAAP measures, including reconciliation to GAAP measures $ millions, except % and per share Q3 2025 Q3 2024 $ Change % Change Net sales 555.0$ 474.2$ 80.8$ 17% Cost of sales 393.5 333.8 59.7 18% Gross profit 161.5 140.4 21.1 15% SEG&A expenses 61.4 60.1 1.3 2% Amortization expense 4.5 3.8 0.7 18% Acquisition and integration-related expenses, net 1.6 0.6 1.0 167% Operating income 94.0 75.9 18.1 24% Interest expense, net 2.8 3.0 (0.2) -7% Other expense, net 0.7 0.3 0.4 133% Income tax expense 22.4 18.7 3.7 20% Net income 68.1$ 53.9$ 14.2$ 26% Diluted EPS 1.11$ 0.87$ 0.24$ 28% Adjusted EPS* 1.14$ 0.88$ 0.26$ 30% Gross Margin 29.1% 29.6% SEG&A expenses as a % of net sales 11.1% 12.7% Effective tax rate 24.8% 25.8% 6 Adjusted Earnings per Share * * Non-GAAP financial measure. See appendix for additional information on non-GAAP measures. ($ in millions) 2025 2024 2025 2024 Net income, as reported 68.1$ 53.9$ 185.8$ 166.3$ Add: Income tax expense 22.4 18.7 60.1 34.7 Income before income taxes 90.5 72.6 245.9 201.0 Add: Acquisition and integration-related expenses, net 1.6 0.6 2.7 2.3 Purchase accounting effects (1) 0.5 - 1.2 - Adjusted income before income taxes 92.6 73.2 249.8 203.3 Adjusted income tax expense (2) (3) (22.9) (19.0) (61.2) (50.8) Adjusted net income 69.7$ 54.2$ 188.6$ 152.5$ Diluted EPS, as reported 1.11$ 0.87$ 3.02$ 2.70$ Adjusted EPS* 1.14$ 0.88$ 3.07$ 2.47$ Three Months Ended September 30, Nine Months Ended September 30, (3) Adjusted income tax expense for the three and nine months ended September 30, 2024 w as recomputed after excluding the tax impacts of acquisition and integration-related expenses, net. Adjusted income tax expense for the nine months ended September 30, 2024 also excludes $15.6 million of discrete tax benefits that w ere recognized in connection w ith the amendment of certain federal and state tax returns to claim a w orthless stock deduction. (2) Adjusted income tax expense for the three and nine months ended September 30, 2025 w as recomputed after excluding the tax impacts of acquisition and integration-related expenses, net, and purchase accounting effects. Adjusted income tax expense for the nine months ended September 30, 2025 also excludes a $0.2 million discrete tax benefit recognized in connection w ith the amendment of certain state tax returns to claim a w orthless stock deduction. (1) Purchase accounting effects in the three and nine months ended September 30, 2025 relate to adjustments to exclude the step-up in the valuation of inventory acquired in connection w ith acquisitions that w as sold subsequent to the acquisition date and the depreciation of the step-up in the valuation of rental equipment acquired in the Standard Equipment Company transaction, w here applicable. Such costs are included as a component of Cost of sales on the Condensed Consolidated Statements of Operations. 7 Financial Strength and Flexibility * * Dollar amounts as of, or for the quarter ending 9/30/2025, unless otherwise noted ** Net debt is a non-GAAP measure and is computed as total debt of $213.2 M, less total cash and cash equivalents of $54.4 M • Cash and cash equivalents of $54 M • Net debt of ~$159 M ** • In October 2025, executed a new five-year, $1.5 B credit agreement, represented by a $1.1 B revolving credit facility and a $400 M delayed draw term loan, with opportunity to increase further, subject to lenders’ approval • Net debt leverage remains low • Compliant with all covenants with significant headroom Strong capital structure • Generated ~$61 M of cash from operations in Q3 this year, bringing year-to- date operating cash generation to ~$158 M, an increase of $17 M, or 12%, vs. the prior-year period • Paid down ~$55 M of debt during Q3 • ~$570 M of availability under previous revolving credit facility • In September 2025, executed agreement to acquire New Way for initial consideration of $396 M; also acquiring New Way’s manufacturing facilities and associated real estate rights for additional $30 M • Anticipating cap ex of $40 M - $50 M in 2025 • Paid $8.5 M for dividends in Q3, reflecting dividend of $0.14 per share; recently declared similar dividend for Q4 2025 • ~$157 M of authorization remaining under share repurchase programs (~2% of market cap) Healthy cash flow and access to cash facilitate organic growth investment, M&A and cash returns to stockholders CEO Remarks – Q3 Performance ** 8 • Outstanding execution by both groups contributed to a record-setting Q3 across net sales, adjusted EPS* and adjusted EBITDA margin* • Environmental Solutions Group highlights: YoY net sales growth of 17%; 20% increase in adjusted EBITDA* 60-basis point YoY increase in adjusted EBITDA margin* to 22.5% Double-digit net sales growth YoY in safe digging trucks, sewer cleaners, and street sweepers Aftermarket revenues +14% YoY; represented 26% of ESG net sales in Q3 Recent acquisitions contributed to YoY growth; Hog contributed ~$20 M of net sales, while Standard added ~$10 M of incremental net sales • Safety and Security Systems Group highlights: YoY net sales growth of 18% YoY, 29% increase in adjusted EBITDA* 220-basis point YoY increase in adjusted EBITDA margin* to 25.6% Successfully installed 4th printed circuit board (PCB) manufacturing in line at University Park, Illinois manufacturing facility • Generated ~$61 M of cash from operations Continue to target 100% cash conversion*** on annual basis * Non-GAAP financial measure. See appendix for additional information on non-GAAP measures, including reconciliation to GAAP measures ** Comparisons versus Q3 of 2024 *** Computed as net cash provided by operating activities divided by net income.

CEO Remarks – Market Conditions * 9 • Demand for our products remains strong, as evidenced by record Q3 orders of $467 M, up 10% YoY • Q3 backlog at ~$992 M, provides excellent visibility to rest of 2025 and well into 2026 for certain key product lines • SSG order intake of $96 M in Q3 (+31% YoY) SSG backlog of $88 M includes ~$20 M of shipments ear-marked for 2026 delivery Led by higher demand for public safety equipment and warning systems • Industrial orders increased YoY Led by higher demand for safe-digging trucks * Comparisons versus Q3 of 2024 CEO Remarks – Update on Strategic Growth Initiatives 10 Hog Technologies – Initial Performance & Outlook • Expect FY25 net sales contribution of $60-$65 M (up from $50-$55M) • Identified incremental synergy opportunities for 2026 including operational efficiencies, procurement, aftermarket parts/service expansion, and go-to- market strategy alignment across road-marking offerings • Expect Hog to increase margins YoY in 2026 as more synergies are realized Investing & Harnessing the Power of our Specialty Vehicle Platform • Look to drive organic growth in excess of end-market growth as we harness the power of our specialty vehicle platform • Investing in the scaling of our internal centers of excellence • Identified sales channel optimization and dealer development opportunities across 2026 (Trackless, Switch-N-Go, TRUVAC, Dump Trucks) Aftermarket “Build More Parts” Growth Initiatives • Scale “Build More Parts” initiative, whereby Federal Signal is selectively vertically integrating certain parts production to drive increased recurring revenue streams, higher aftermarket share, and margin expansion • Initiative is still in early stages (<$10 M in annual sales); expecting double- digit growth in 2025 YoY and further growth in 2026 Execution on M&A Strategy • Expect acquisition of New Way Trucks to close in Q4:25, subject to regulatory approval and customary closing conditions • Actively evaluating M&A opportunities across both our ESG and SSG segments, consistent with our stated M&A target criteria • Modest debt leverage, strong visibility to cash flow, and internal integration structure provide sufficient flexibility for additional M&A opportunities Stripe Hog Raising 2025 Financial Outlook 11 • Raising Full-Year Adjusted EPS1 Outlook to a new range of $4.09 to $4.17 • Increased from the prior range of $3.92 to $4.10 • At the midpoint, new range would represent ~24% YoY growth, and the highest EPS level in our history • Raising Full-year Net Sales Outlook to a new range of $2.10 B to $2.14 B • Increase from the prior range of $2.07 B to $2.13 B • New range would represent YoY growth of 13% - 15% • Double-digit improvement in pre-tax earnings • Capital expenditures of $40 M to $50 M Assumptions 1. Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. In the three and nine months ended September 30, 2025 and 2024, we made adjustments to exclude the impact of acquisition and integration-related expenses, net, purchase accounting effects, and certain special income tax items, where applicable. In prior years, we have also made adjustments to exclude the impact of environmental remediation costs of a discontinued operation, pension-related charges, debt settlement charges, and certain other unusual or non-recurring items. Should any similar items occur in the remainder of 2025, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B). • Interest expense of ~$12 M - $13 M, without additional M&A • Other expense up ~$1.5 M YoY, due to higher non-operating pension costs • Q4 2025 effective tax rate of 25% - 26%, excluding additional discrete items • ~62 M weighted average shares outstanding • Depreciation and amortization expense of ~$77 M - $79 M • Assumes current trade agreements and tariff policies remain in place Federal Signal Q3 2025 Earnings Call 12 Q&A October 30, 2025 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer Felix Boeschen, VP, Corporate Strategy & Investor Relations

Investor Information Stock Ticker - NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1333 Butterfield Road, Suite 500 Downers Grove, IL 60515 INVESTOR RELATIONS 630-954-2000 Felix Boeschen VP, Corporate Strategy and Investor Relations fboeschen@federalsignal.com 13 Federal Signal Q3 2025 Earnings Call 14 Appendix Non-GAAP Measures • Adjusted net income and earnings per share (“EPS”) - The Company believes that modifying its 2025 and 2024 net income and diluted EPS provides additional measures to assist it in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that management believes are not representative of its underlying performance and to improve the comparability of results across reporting periods. During the three and nine months ended September 30, 2025 and 2024 adjustments were made to reported GAAP net income and diluted EPS to exclude the impact of acquisition and integration-related expenses, net, purchase accounting effects, and certain special income tax items, where applicable. • Adjusted EBITDA and adjusted EBITDA margin - The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”), at both the consolidated and segment level, as additional measures to assist in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that management believes are not representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin, at both the consolidated and segment level, are meaningful metrics to investors in evaluating the Company’s underlying financial performance. • Consolidated adjusted EBITDA is a non-GAAP measure that represents the total of net income, interest expense, net, acquisition and integration-related expenses, net, purchase accounting effects, other expense, net, income tax expense, and depreciation and amortization expense, as applicable. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of net income, interest expense, net, acquisition and integration-related expenses, net, purchase accounting effects, other expense, net, income tax expense, and depreciation and amortization expense, as applicable, divided by net sales for the applicable period(s). • Segment adjusted EBITDA is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, net, purchase accounting effects, and depreciation and amortization expense, as applicable. Segment adjusted EBITDA margin is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, net, purchase accounting effects, and depreciation and amortization expense, as applicable, divided by segment net sales for the applicable period(s). Segment operating income includes all revenues, costs and expenses directly related to the segment involved. In determining segment operating income, neither corporate nor interest expenses are included. Segment depreciation and amortization expense relates to those assets, both tangible and intangible, that are utilized by the respective segment. Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. 15 Consolidated Adjusted EBITDA 16 $ millions, except % Q3 2025 Q3 2024 Net income 68.1$ 53.9$ Add: Interest expense, net 2.8 3.0 Acquisition and integration-related expenses, net 1.6 0.6 Purchase accounting effects * 0.3 - Other expense, net 0.7 0.3 Income tax expense 22.4 18.7 Depreciation and amortization 20.3 16.5 Consolidated adjusted EBITDA 116.2$ 93.0$ Net Sales 555.0$ 474.2$ Consolidated adjusted EBITDA margin 20.9% 19.6% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.2 million for the three months ended September 30, 2025

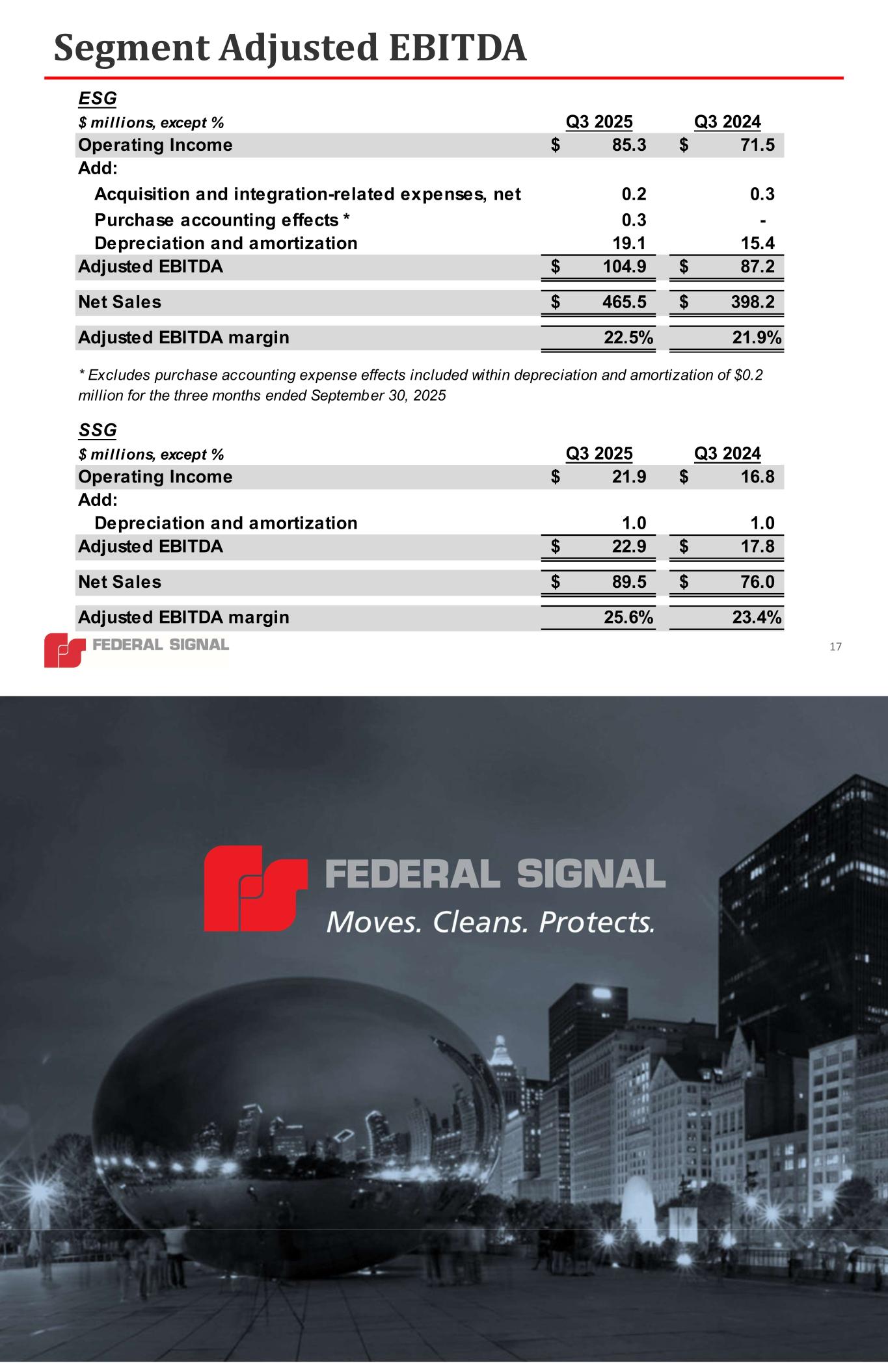

Segment Adjusted EBITDA 17 ESG $ millions, except % Q3 2025 Q3 2024 Operating Income 85.3$ 71.5$ Add: Acquisition and integration-related expenses, net 0.2 0.3 Purchase accounting effects * 0.3 - Depreciation and amortization 19.1 15.4 Adjusted EBITDA 104.9$ 87.2$ Net Sales 465.5$ 398.2$ Adjusted EBITDA margin 22.5% 21.9% SSG $ millions, except % Q3 2025 Q3 2024 Operating Income 21.9$ 16.8$ Add: Depreciation and amortization 1.0 1.0 Adjusted EBITDA 22.9$ 17.8$ Net Sales 89.5$ 76.0$ Adjusted EBITDA margin 25.6% 23.4% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.2 million for the three months ended September 30, 2025