Investor Presentation: January 2026 Moves. Cleans. Protects.

2 This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward-looking statements and may contain words such as “may,” “will,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “project,” “estimate,” and “objective” or similar terminology, concerning the company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. Forward-looking statements should not be relied upon as a predictor of actual results. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include but are not limited to: economic and political uncertainty, risks and adverse economic effects associated with geopolitical conflicts including tariffs and other trade conflicts, legal and regulatory developments, foreign currency exchange rate changes, inflationary pressures, product and price competition, supply chain disruptions, availability and pricing of raw materials, interest rate changes, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, work stoppages, increases in pension funding requirements, cybersecurity risks, increased legal expenses and litigation results, and other risks and uncertainties described in filings with the Securities and Exchange Commission (SEC). Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and/or in the Appendix to this presentation. All financial figures in the presentation refer to FY2024 annual results unless otherwise noted. Safe Harbor Statement

1) Average cash conversion for the five years from 2020 to 2024, with cash conversion computed as net cash provided by operating activities divided by net income. Non-GAAP Measure. See appendix for additional information, including reconciliation to GAAP measure 2) ESG and SSG segment net sales as a % of 2024 consolidated net sales 3) Net cash provided by operating activities divided by net income (as a %) 4) Non-GAAP Measure. See appendix for additional information, including reconciliation to GAAP measure 5) As of January 2026 Environmental Solutions Group (“ESG”) Safety and Security Systems Group (“SSG”) 16% of FY24 Net Sales2 84% of FY24 Net Sales2 1901 Founded Downers Grove, IL Headquarters ~5,800 Global Employees5 14 Acquisitions Since 20165 106% 5-Year Cash Conversion1 Avg. 3 Federal Signal at a Glance: Leading Safety Equipment & Specialty Vehicle OEM ➢ Healthy product portfolio mix ➢ Resilient end market exposure ➢ Disciplined M&A strategy ➢ Targeting 100% annual cash conversion3 ➢ Q3 2025 LTM Net Debt Leverage: 0.4x4 26 Manufacturing Locations5

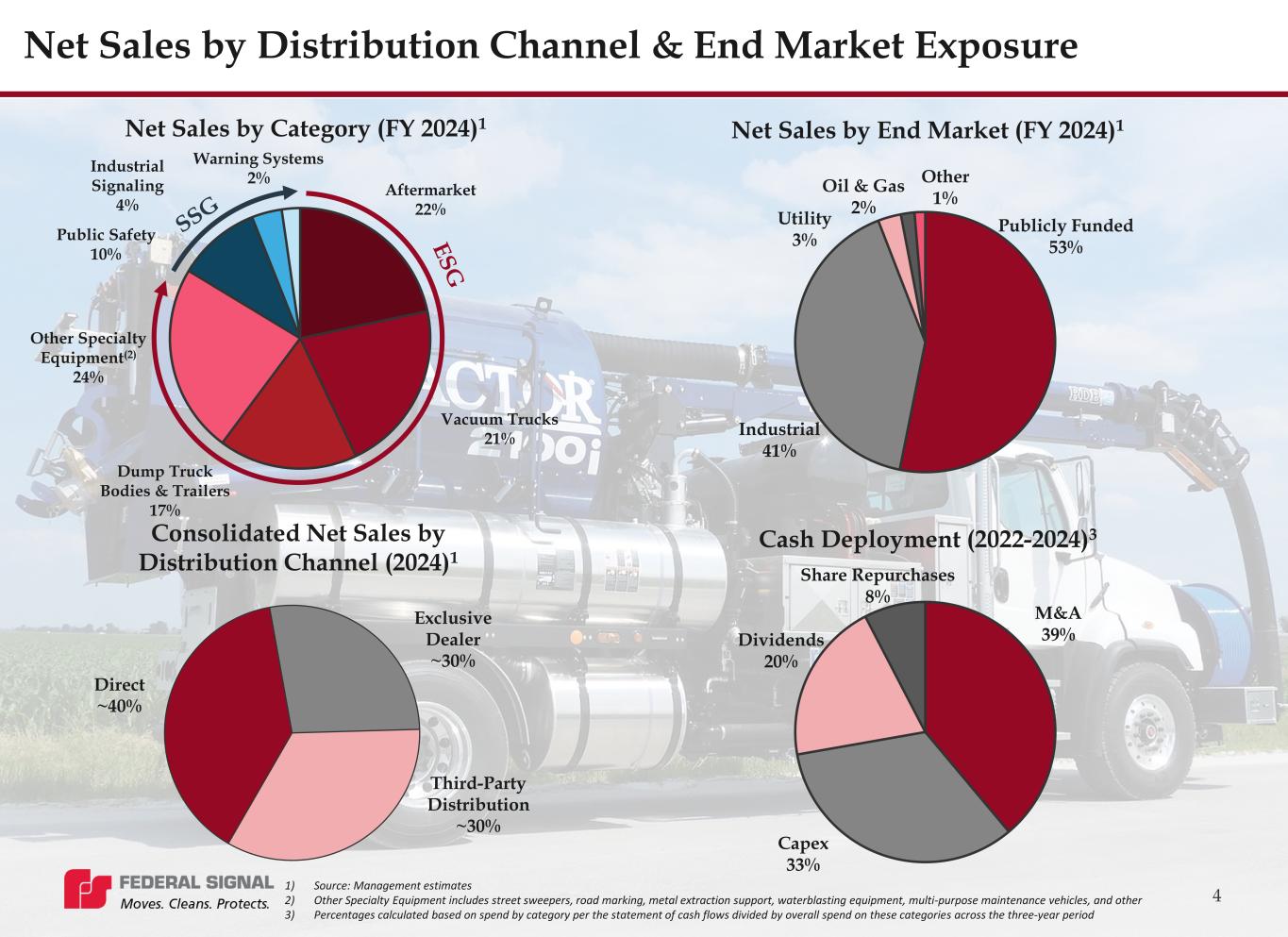

Consolidated Net Sales by Distribution Channel (2024)1 Exclusive Dealer ~30% Direct ~40% Third-Party Distribution ~30% 4 Net Sales by Distribution Channel & End Market Exposure M&A 39% Capex 33% Dividends 20% Share Repurchases 8% Cash Deployment (2022-2024)3 1) Source: Management estimates 2) Other Specialty Equipment includes street sweepers, road marking, metal extraction support, waterblasting equipment, multi-purpose maintenance vehicles, and other 3) Percentages calculated based on spend by category per the statement of cash flows divided by overall spend on these categories across the three-year period Net Sales by Category (FY 2024)1 Industrial Signaling 4% Warning Systems 2% Vacuum Trucks 21% Public Safety 10% Aftermarket 22% Dump Truck Bodies & Trailers 17% Other Specialty Equipment(2) 24% Net Sales by End Market (FY 2024)1 Publicly Funded 53% Industrial 41% Utility 3% Oil & Gas 2% Other 1%

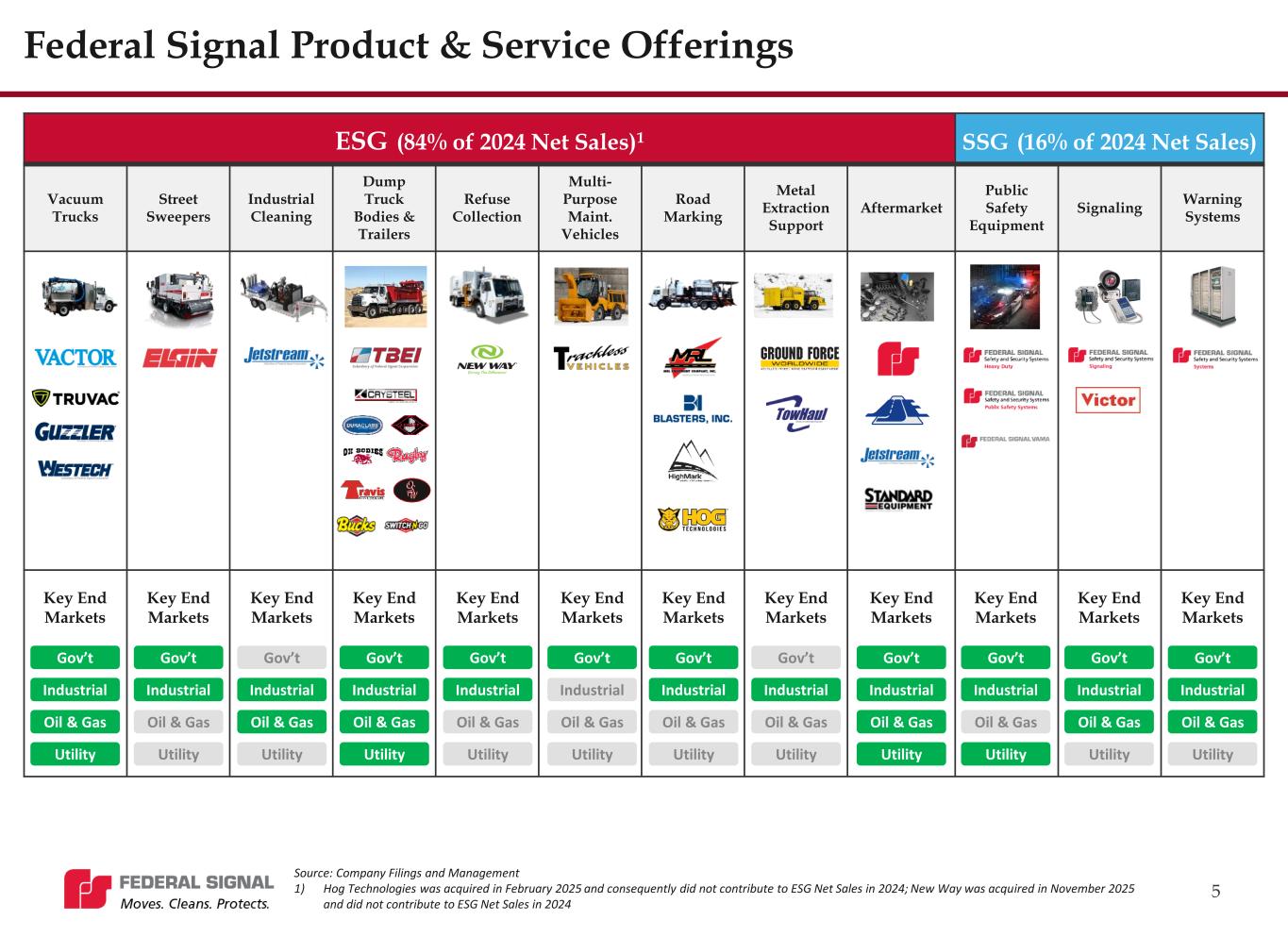

5 5 Federal Signal Product & Service Offerings ESG (84% of 2024 Net Sales)1 SSG (16% of 2024 Net Sales) Vacuum Trucks Street Sweepers Industrial Cleaning Dump Truck Bodies & Trailers Refuse Collection Multi- Purpose Maint. Vehicles Road Marking Metal Extraction Support Aftermarket Public Safety Equipment Signaling Warning Systems Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Key End Markets Gov’t Industrial Oil & Gas Utility Source: Company Filings and Management 1) Hog Technologies was acquired in February 2025 and consequently did not contribute to ESG Net Sales in 2024; New Way was acquired in November 2025 and did not contribute to ESG Net Sales in 2024

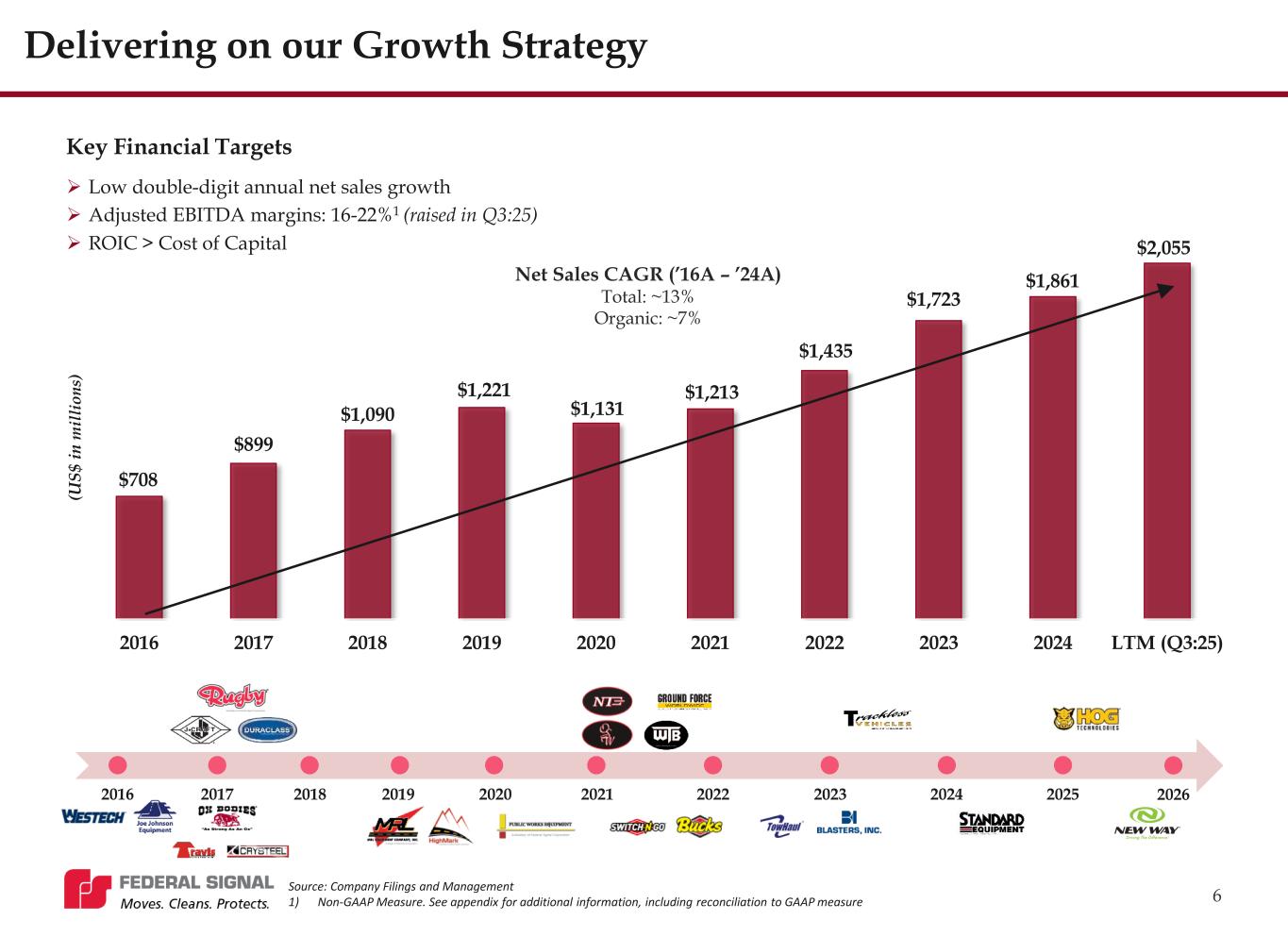

6 $708 $899 $1,090 $1,221 $1,131 $1,213 $1,435 $1,723 $1,861 $2,055 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (Q3:25) Net Sales CAGR (’16A – ’24A) Total: ~13% Organic: ~7% ➢ Low double-digit annual net sales growth ➢ Adjusted EBITDA margins: 16-22%1 (raised in Q3:25) ➢ ROIC > Cost of Capital (U S $ in m il li o n s) Key Financial Targets Delivering on our Growth Strategy Source: Company Filings and Management 1) Non-GAAP Measure. See appendix for additional information, including reconciliation to GAAP measure 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

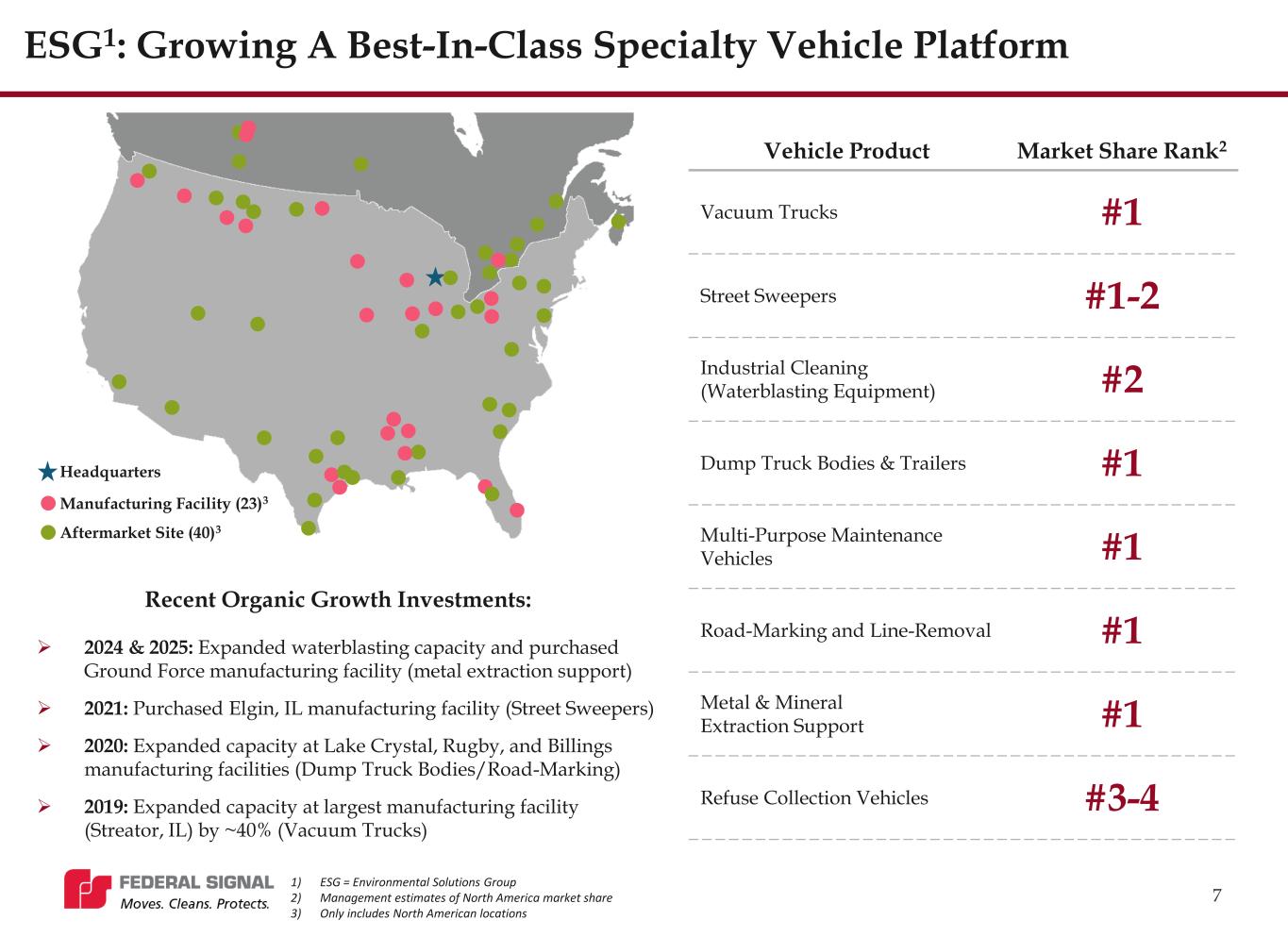

7 Vehicle Product Market Share Rank2 Vacuum Trucks #1 Street Sweepers #1-2 Industrial Cleaning (Waterblasting Equipment) #2 Dump Truck Bodies & Trailers #1 Multi-Purpose Maintenance Vehicles #1 Road-Marking and Line-Removal #1 Metal & Mineral Extraction Support #1 Refuse Collection Vehicles #3-4 Manufacturing Facility (23)3 Headquarters Aftermarket Site (40)3 ESG1: Growing A Best-In-Class Specialty Vehicle Platform Recent Organic Growth Investments: ➢ 2024 & 2025: Expanded waterblasting capacity and purchased Ground Force manufacturing facility (metal extraction support) ➢ 2021: Purchased Elgin, IL manufacturing facility (Street Sweepers) ➢ 2020: Expanded capacity at Lake Crystal, Rugby, and Billings manufacturing facilities (Dump Truck Bodies/Road-Marking) ➢ 2019: Expanded capacity at largest manufacturing facility (Streator, IL) by ~40% (Vacuum Trucks) 1) ESG = Environmental Solutions Group 2) Management estimates of North America market share 3) Only includes North American locations

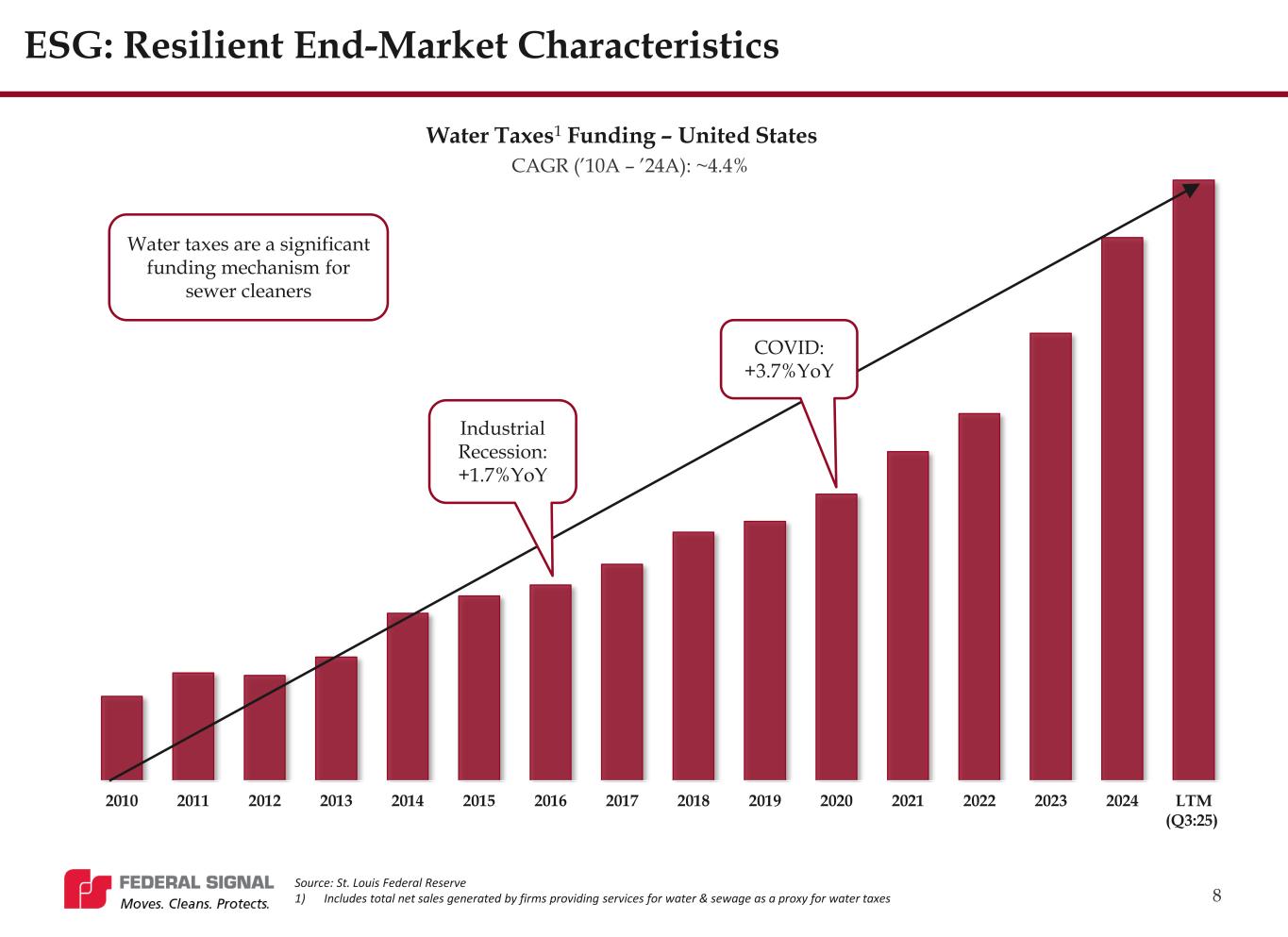

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (Q3:25) 8 ESG: Resilient End-Market Characteristics Water Taxes1 Funding – United States CAGR (’10A – ’24A): ~4.4% Industrial Recession: +1.7%YoY COVID: +3.7%YoY Source: St. Louis Federal Reserve 1) Includes total net sales generated by firms providing services for water & sewage as a proxy for water taxes Water taxes are a significant funding mechanism for sewer cleaners

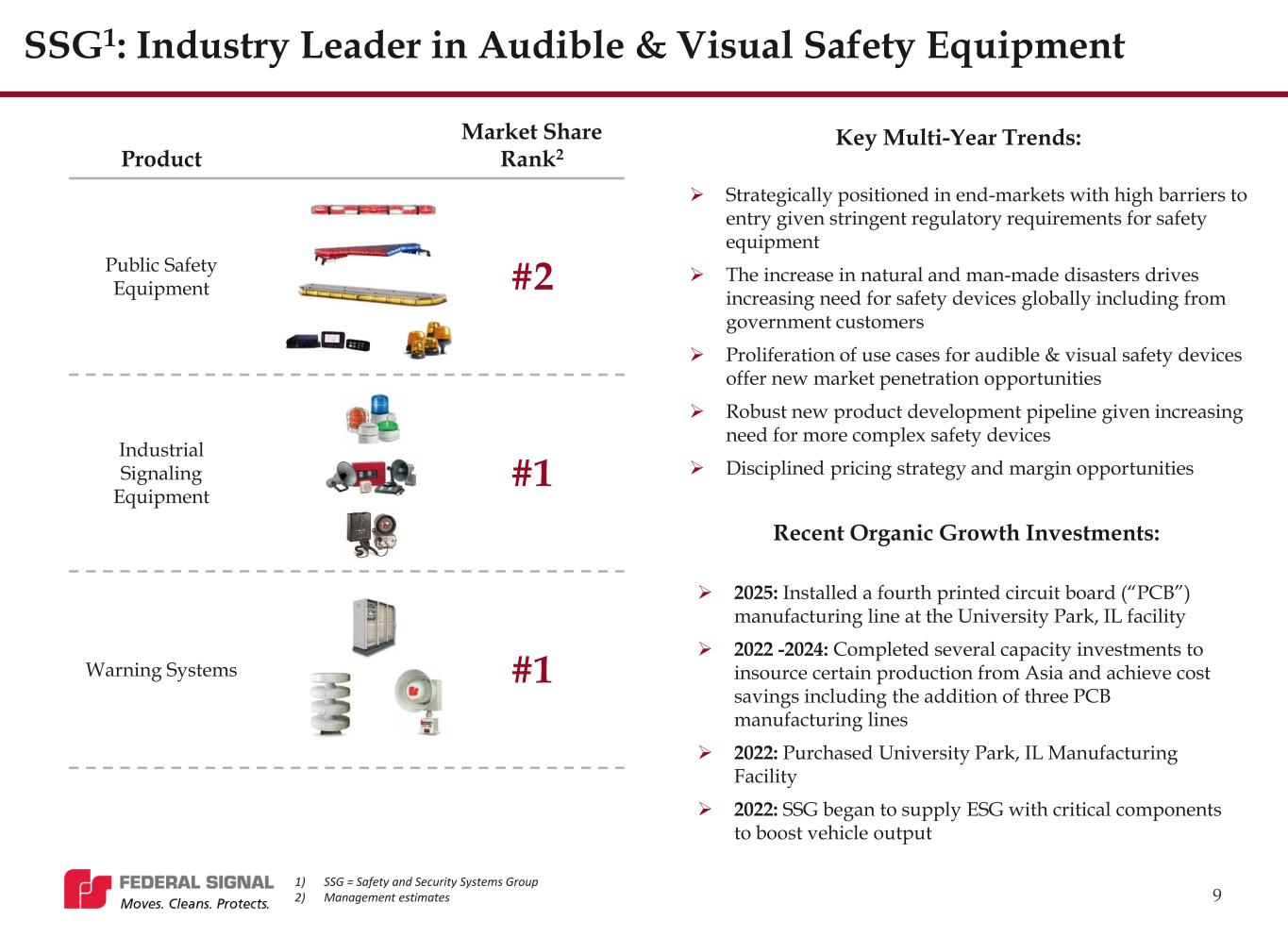

9 Product Market Share Rank2 Public Safety Equipment #2 Industrial Signaling Equipment #1 Warning Systems #1 ➢ Strategically positioned in end-markets with high barriers to entry given stringent regulatory requirements for safety equipment ➢ The increase in natural and man-made disasters drives increasing need for safety devices globally including from government customers ➢ Proliferation of use cases for audible & visual safety devices offer new market penetration opportunities ➢ Robust new product development pipeline given increasing need for more complex safety devices ➢ Disciplined pricing strategy and margin opportunities SSG1: Industry Leader in Audible & Visual Safety Equipment ➢ 2025: Installed a fourth printed circuit board (“PCB”) manufacturing line at the University Park, IL facility ➢ 2022 -2024: Completed several capacity investments to insource certain production from Asia and achieve cost savings including the addition of three PCB manufacturing lines ➢ 2022: Purchased University Park, IL Manufacturing Facility ➢ 2022: SSG began to supply ESG with critical components to boost vehicle output Key Multi-Year Trends: 1) SSG = Safety and Security Systems Group 2) Management estimates Recent Organic Growth Investments:

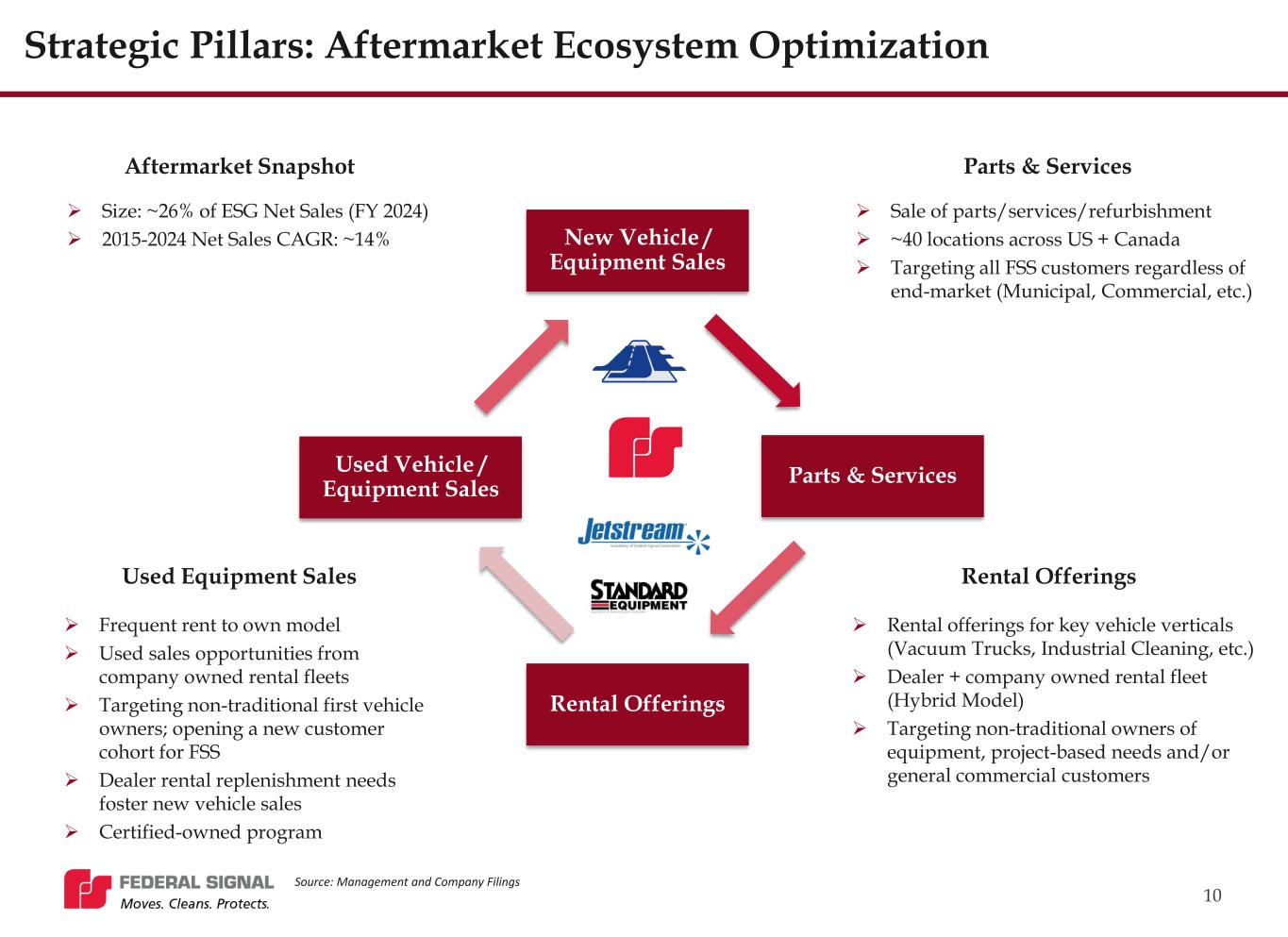

10 Strategic Pillars: Aftermarket Ecosystem Optimization New Vehicle / Equipment Sales Parts & Services Rental Offerings Used Vehicle / Equipment Sales Parts & ServicesAftermarket Snapshot Used Equipment Sales Rental Offerings ➢ Size: ~26% of ESG Net Sales (FY 2024) ➢ 2015-2024 Net Sales CAGR: ~14% ➢ Sale of parts/services/refurbishment ➢ ~40 locations across US + Canada ➢ Targeting all FSS customers regardless of end-market (Municipal, Commercial, etc.) ➢ Frequent rent to own model ➢ Used sales opportunities from company owned rental fleets ➢ Targeting non-traditional first vehicle owners; opening a new customer cohort for FSS ➢ Dealer rental replenishment needs foster new vehicle sales ➢ Certified-owned program ➢ Rental offerings for key vehicle verticals (Vacuum Trucks, Industrial Cleaning, etc.) ➢ Dealer + company owned rental fleet (Hybrid Model) ➢ Targeting non-traditional owners of equipment, project-based needs and/or general commercial customers Source: Management and Company Filings

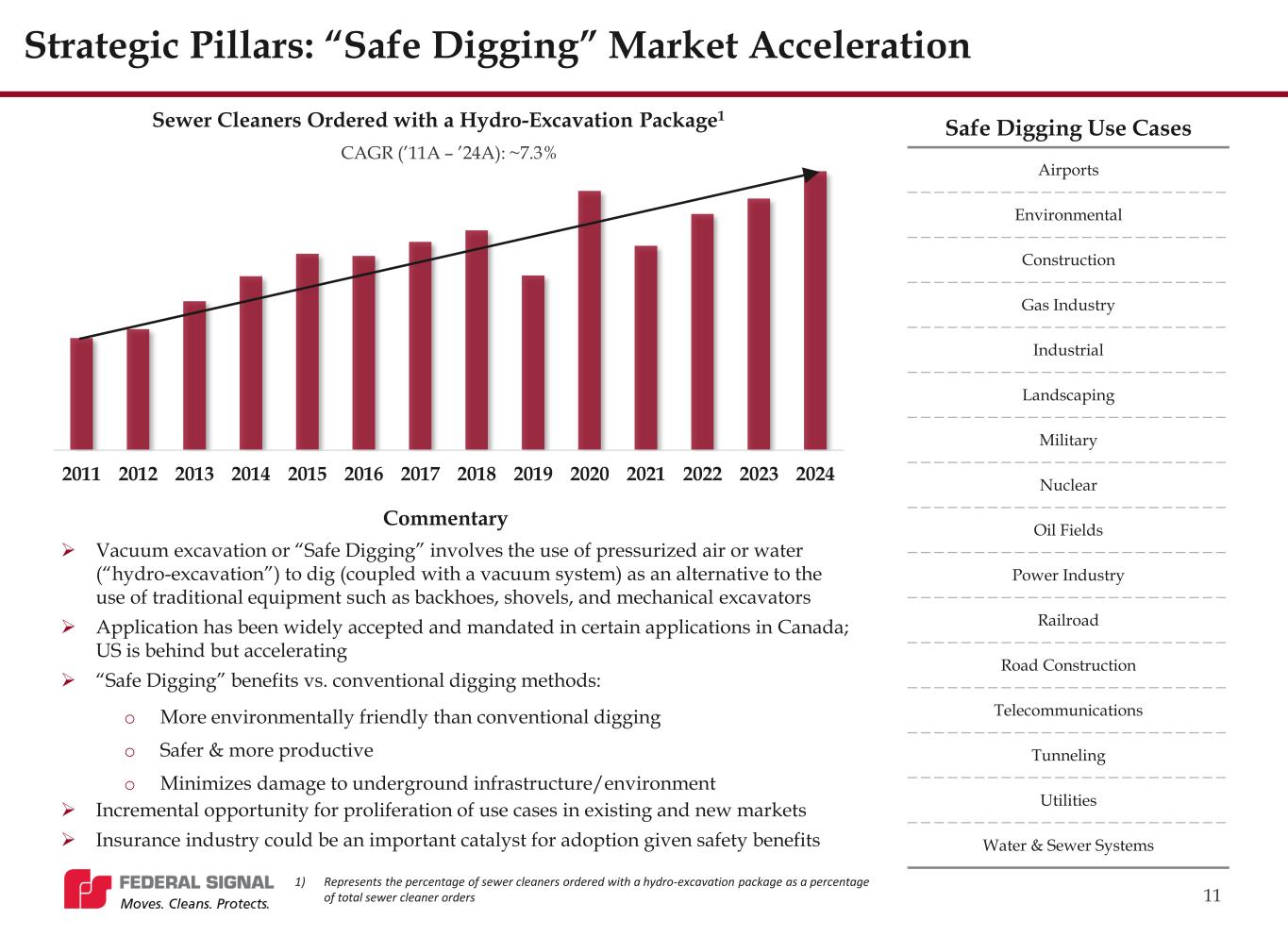

11 ➢ Vacuum excavation or “Safe Digging” involves the use of pressurized air or water (“hydro-excavation”) to dig (coupled with a vacuum system) as an alternative to the use of traditional equipment such as backhoes, shovels, and mechanical excavators ➢ Application has been widely accepted and mandated in certain applications in Canada; US is behind but accelerating ➢ “Safe Digging” benefits vs. conventional digging methods: o More environmentally friendly than conventional digging o Safer & more productive o Minimizes damage to underground infrastructure/environment ➢ Incremental opportunity for proliferation of use cases in existing and new markets ➢ Insurance industry could be an important catalyst for adoption given safety benefits Sewer Cleaners Ordered with a Hydro-Excavation Package1 Strategic Pillars: “Safe Digging” Market Acceleration Commentary 1) Represents the percentage of sewer cleaners ordered with a hydro-excavation package as a percentage of total sewer cleaner orders Safe Digging Use Cases Airports Environmental Construction Gas Industry Industrial Landscaping Military Nuclear Oil Fields Power Industry Railroad Road Construction Telecommunications Tunneling Utilities Water & Sewer Systems 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 CAGR (’11A – ’24A): ~7.3%

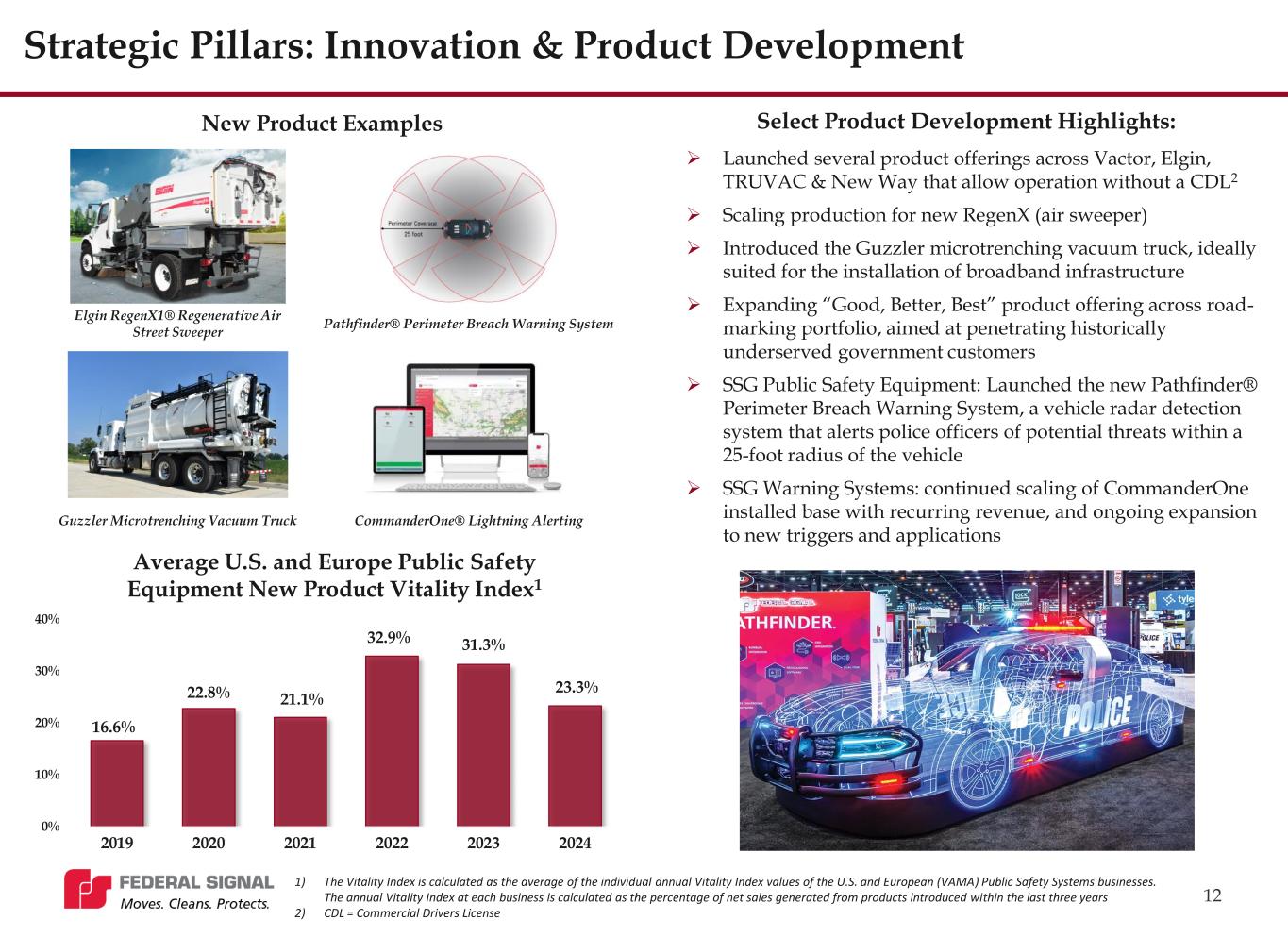

12 Strategic Pillars: Innovation & Product Development Elgin RegenX1® Regenerative Air Street Sweeper Select Product Development Highlights: ➢ Launched several product offerings across Vactor, Elgin, TRUVAC & New Way that allow operation without a CDL2 ➢ Scaling production for new RegenX (air sweeper) ➢ Introduced the Guzzler microtrenching vacuum truck, ideally suited for the installation of broadband infrastructure ➢ Expanding “Good, Better, Best” product offering across road- marking portfolio, aimed at penetrating historically underserved government customers ➢ SSG Public Safety Equipment: Launched the new Pathfinder® Perimeter Breach Warning System, a vehicle radar detection system that alerts police officers of potential threats within a 25-foot radius of the vehicle ➢ SSG Warning Systems: continued scaling of CommanderOne installed base with recurring revenue, and ongoing expansion to new triggers and applications Average U.S. and Europe Public Safety Equipment New Product Vitality Index1 16.6% 22.8% 21.1% 32.9% 31.3% 23.3% 0% 10% 20% 30% 40% 2019 2020 2021 2022 2023 2024 Guzzler Microtrenching Vacuum Truck New Product Examples Pathfinder® Perimeter Breach Warning System 1) The Vitality Index is calculated as the average of the individual annual Vitality Index values of the U.S. and European (VAMA) Public Safety Systems businesses. The annual Vitality Index at each business is calculated as the percentage of net sales generated from products introduced within the last three years 2) CDL = Commercial Drivers License CommanderOne® Lightning Alerting

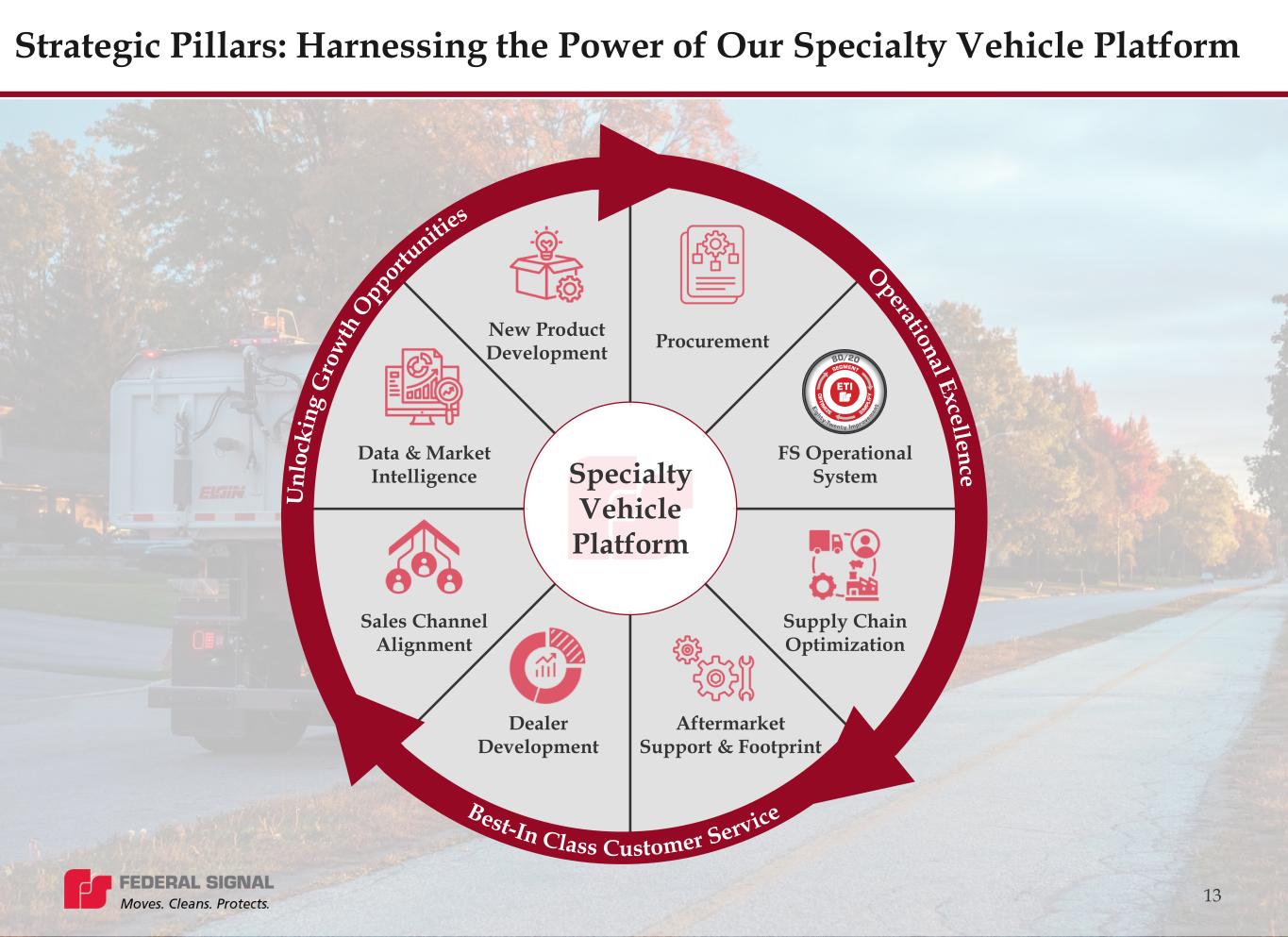

13 Strategic Pillars: Harnessing the Power of Our Specialty Vehicle Platform U n lo ck in g G ro w th O pport uniti es Best-In Class Customer Service O peration al E xcellen ceSpecialty Vehicle Platform Aftermarket Support & Footprint Dealer Development Supply Chain Optimization FS Operational System Procurement New Product Development Data & Market Intelligence Sales Channel Alignment

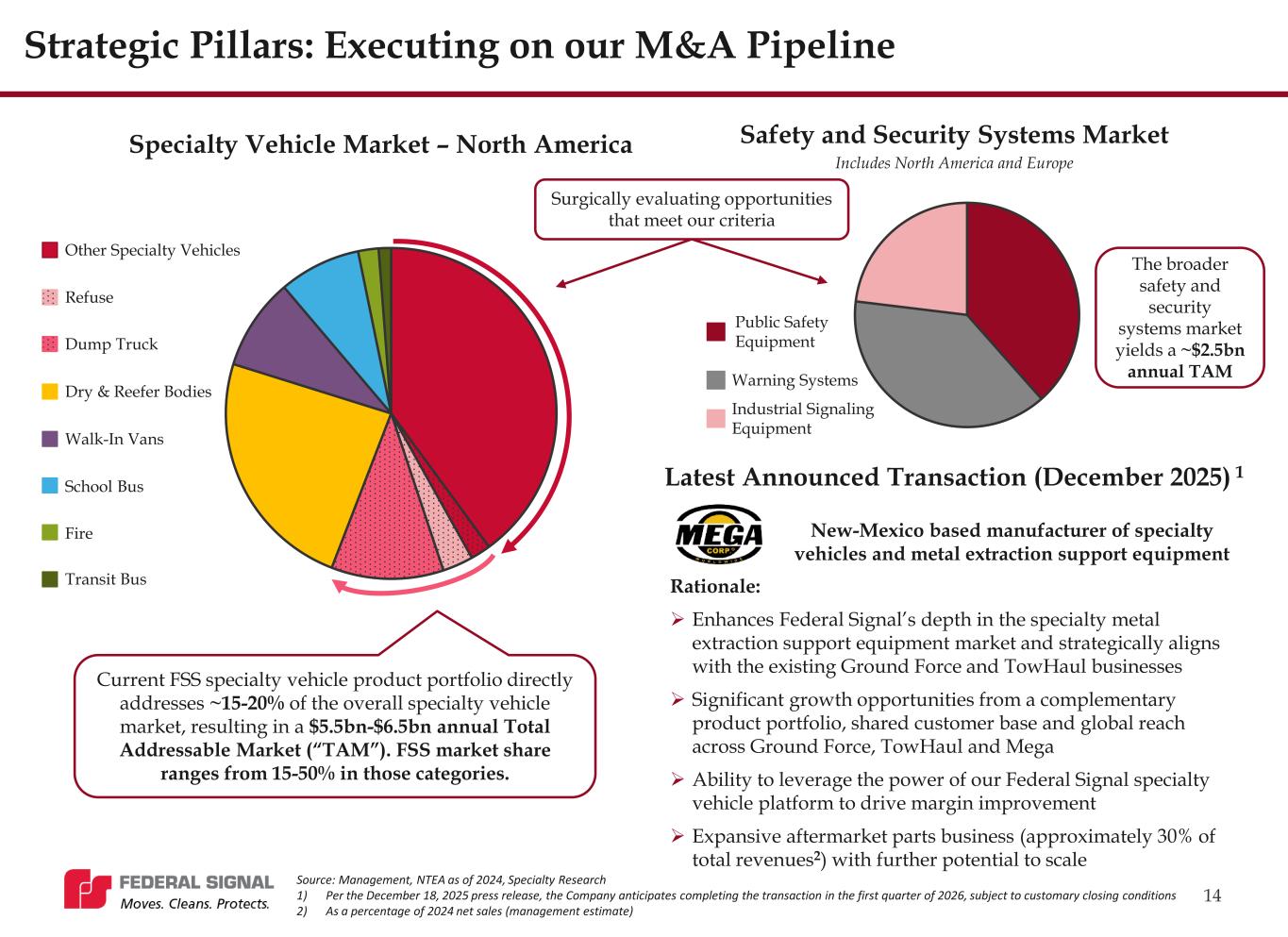

14 Strategic Pillars: Executing on our M&A Pipeline Safety and Security Systems Market Latest Announced Transaction (December 2025) 1 Rationale: ➢ Enhances Federal Signal’s depth in the specialty metal extraction support equipment market and strategically aligns with the existing Ground Force and TowHaul businesses ➢ Significant growth opportunities from a complementary product portfolio, shared customer base and global reach across Ground Force, TowHaul and Mega ➢ Ability to leverage the power of our Federal Signal specialty vehicle platform to drive margin improvement ➢ Expansive aftermarket parts business (approximately 30% of total revenues2) with further potential to scale New-Mexico based manufacturer of specialty vehicles and metal extraction support equipment Specialty Vehicle Market – North America Current FSS specialty vehicle product portfolio directly addresses ~15-20% of the overall specialty vehicle market, resulting in a $5.5bn-$6.5bn annual Total Addressable Market (“TAM”). FSS market share ranges from 15-50% in those categories. Source: Management, NTEA as of 2024, Specialty Research 1) Per the December 18, 2025 press release, the Company anticipates completing the transaction in the first quarter of 2026, subject to customary closing conditions 2) As a percentage of 2024 net sales (management estimate) Includes North America and Europe The broader safety and security systems market yields a ~$2.5bn annual TAM Surgically evaluating opportunities that meet our criteria Public Safety Equipment Warning Systems Industrial Signaling Equipment Other Specialty Vehicles Dump Truck Dry & Reefer Bodies Walk-In Vans School Bus Transit Bus Fire Refuse

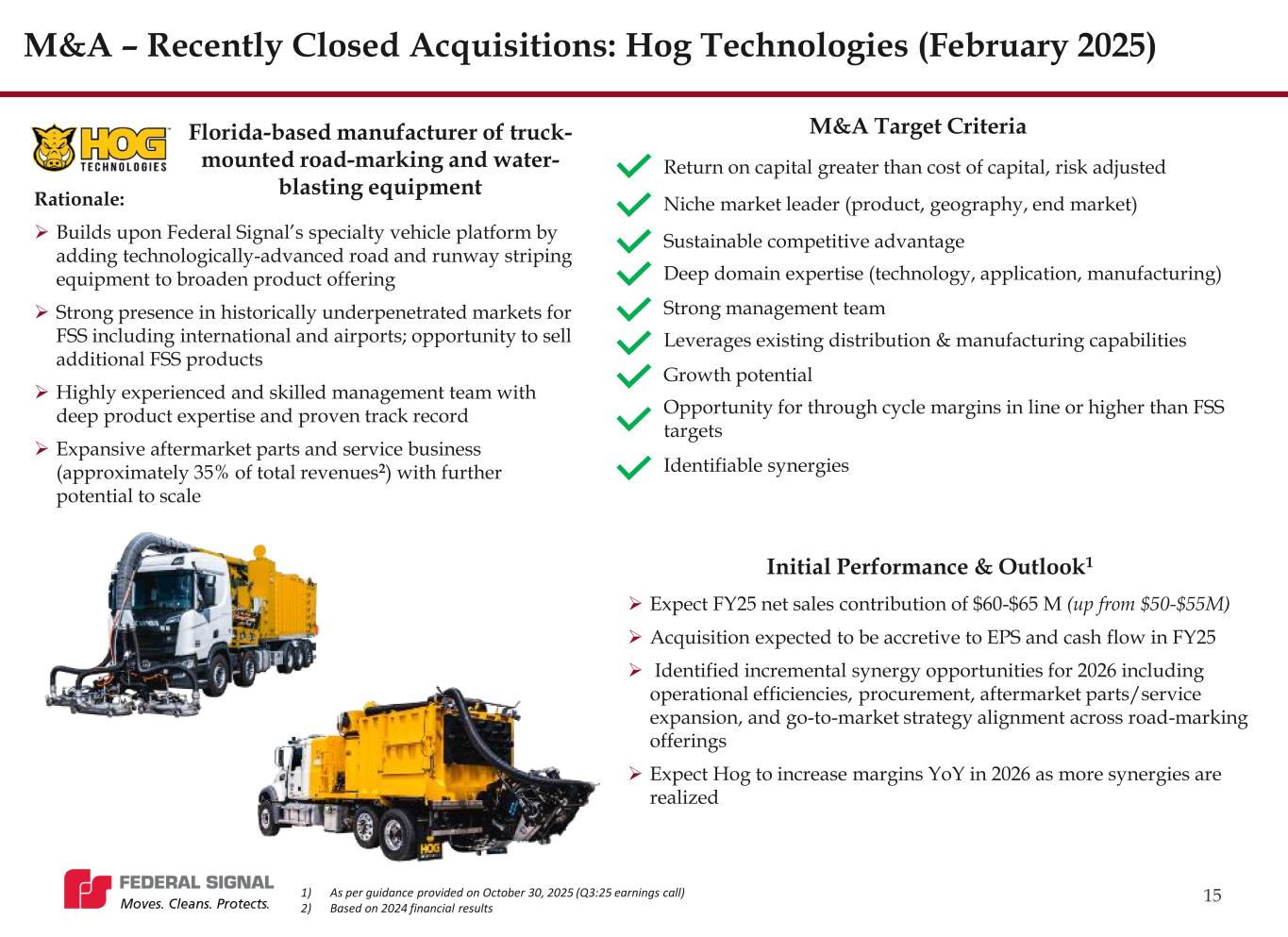

15 M&A – Recently Closed Acquisitions: Hog Technologies (February 2025) M&A Target Criteria Return on capital greater than cost of capital, risk adjusted Niche market leader (product, geography, end market) Sustainable competitive advantage Deep domain expertise (technology, application, manufacturing) Strong management team Leverages existing distribution & manufacturing capabilities Growth potential Opportunity for through cycle margins in line or higher than FSS targets Identifiable synergies Florida-based manufacturer of truck- mounted road-marking and water- blasting equipment Rationale: ➢ Builds upon Federal Signal’s specialty vehicle platform by adding technologically-advanced road and runway striping equipment to broaden product offering ➢ Strong presence in historically underpenetrated markets for FSS including international and airports; opportunity to sell additional FSS products ➢ Highly experienced and skilled management team with deep product expertise and proven track record ➢ Expansive aftermarket parts and service business (approximately 35% of total revenues2) with further potential to scale Initial Performance & Outlook1 ➢ Expect FY25 net sales contribution of $60-$65 M (up from $50-$55M) ➢ Acquisition expected to be accretive to EPS and cash flow in FY25 ➢ Identified incremental synergy opportunities for 2026 including operational efficiencies, procurement, aftermarket parts/service expansion, and go-to-market strategy alignment across road-marking offerings ➢ Expect Hog to increase margins YoY in 2026 as more synergies are realized 1) As per guidance provided on October 30, 2025 (Q3:25 earnings call) 2) Based on 2024 financial results

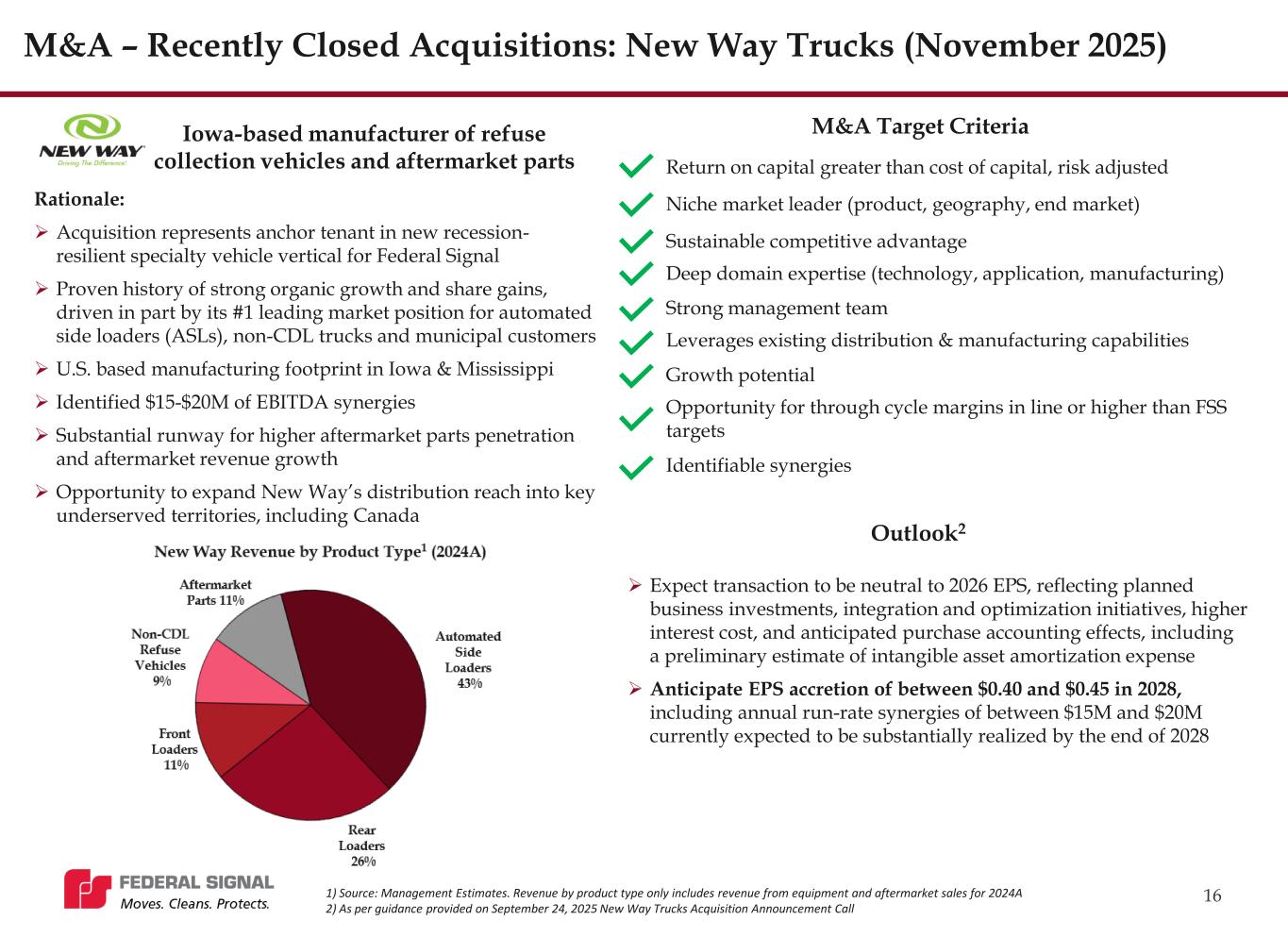

16 M&A – Recently Closed Acquisitions: New Way Trucks (November 2025) M&A Target Criteria Return on capital greater than cost of capital, risk adjusted Niche market leader (product, geography, end market) Sustainable competitive advantage Deep domain expertise (technology, application, manufacturing) Strong management team Leverages existing distribution & manufacturing capabilities Growth potential Opportunity for through cycle margins in line or higher than FSS targets Identifiable synergies Iowa-based manufacturer of refuse collection vehicles and aftermarket parts Rationale: ➢ Acquisition represents anchor tenant in new recession- resilient specialty vehicle vertical for Federal Signal ➢ Proven history of strong organic growth and share gains, driven in part by its #1 leading market position for automated side loaders (ASLs), non-CDL trucks and municipal customers ➢ U.S. based manufacturing footprint in Iowa & Mississippi ➢ Identified $15-$20M of EBITDA synergies ➢ Substantial runway for higher aftermarket parts penetration and aftermarket revenue growth ➢ Opportunity to expand New Way’s distribution reach into key underserved territories, including Canada Outlook2 ➢ Expect transaction to be neutral to 2026 EPS, reflecting planned business investments, integration and optimization initiatives, higher interest cost, and anticipated purchase accounting effects, including a preliminary estimate of intangible asset amortization expense ➢ Anticipate EPS accretion of between $0.40 and $0.45 in 2028, including annual run-rate synergies of between $15M and $20M currently expected to be substantially realized by the end of 2028 1) Source: Management Estimates. Revenue by product type only includes revenue from equipment and aftermarket sales for 2024A 2) As per guidance provided on September 24, 2025 New Way Trucks Acquisition Announcement Call

17 Update on Current Environment Tight Commercial Driver’s License Labor Pool ➢ The qualified CDL driver market for many specialty vehicle applications remains tight, exacerbated by the legalization of marijuana across North America. This is leading to rising customer needs for ease in equipment functionality, design and training Rising Complexity of Vehicles ➢ Investments in autonomous infrastructure and increasing “smart” features in vehicles are driving increased need for our road- marking and line removal offerings ➢ Higher mineral content in electric vehicles is driving demand for Federal Signal’s metal extraction support equipment Infrastructure Investment and Jobs Act ➢ $550bn of incremental spending over multiple years to improve the nation’s transportation, water, electric power and infrastructure ➢ Expect multi-year positive demand impact in the form of both new equipment sales & higher demand for our aftermarket offerings North American-Centric Supply Chain and Diversified Revenue Streams ➢ We are closely monitoring the impact from tariff policy changes and associated mitigation plans. Our supply chain is predominantly North American-centric (in country for country), with less than 1% of COGS sourced directly from China ➢ Net sales derived from publicly-funded customers comprise a diverse funding mix inclusive of water taxes, U.S. municipal budgets, local and state police budgets, Canadian local and provincial budgets, European federal, state and local budgets and U.S. federal funds. We estimate our total direct federal U.S. exposure to be less than $10M per year1 Source: White House website, U.S. Department of Transportation, and Western Pacific Trucking School 1) Direct federal U.S. exposure calculated as of 2024

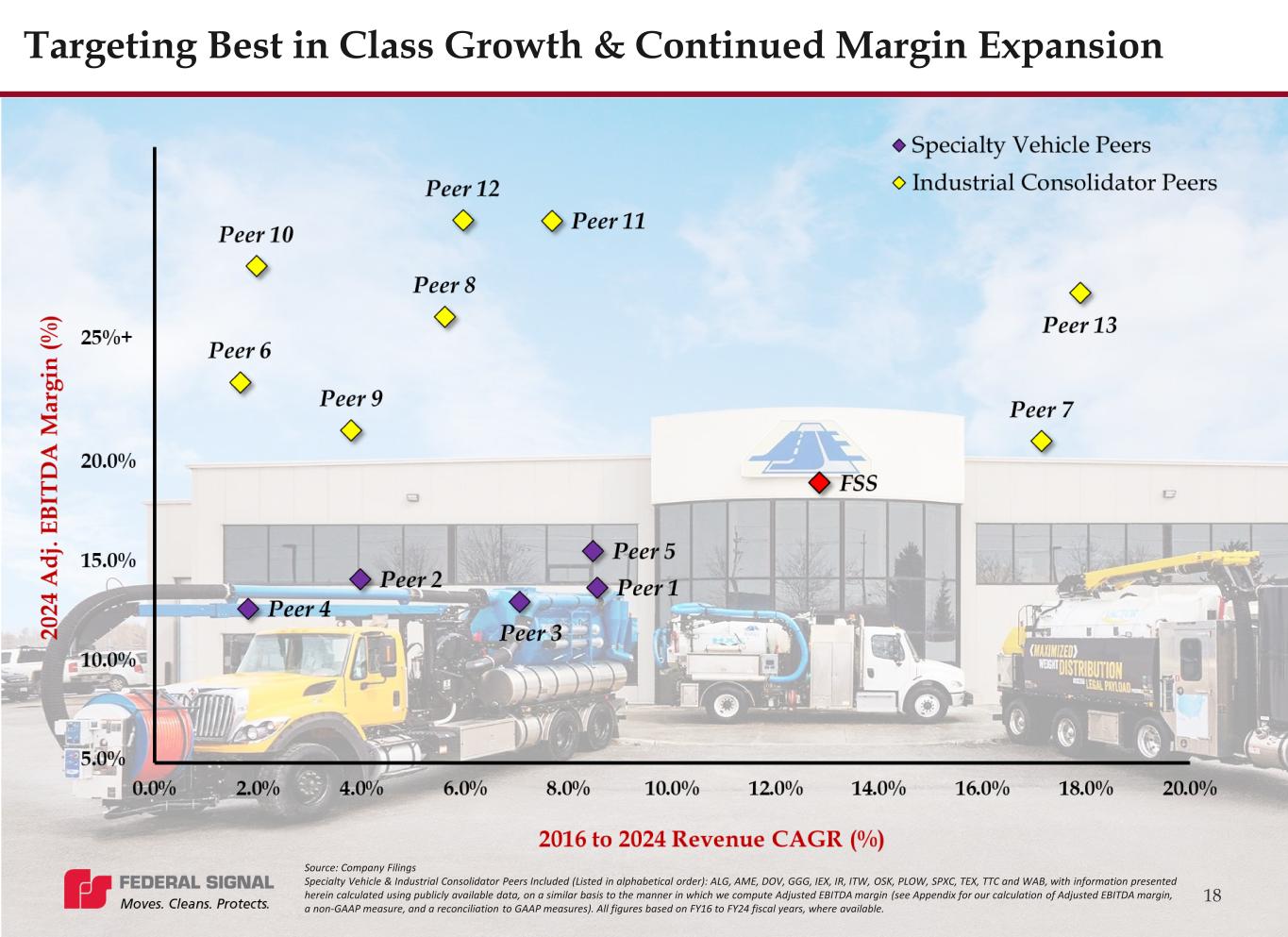

18 Targeting Best in Class Growth & Continued Margin Expansion Source: Company Filings Specialty Vehicle & Industrial Consolidator Peers Included (Listed in alphabetical order): ALG, AME, DOV, GGG, IEX, IR, ITW, OSK, PLOW, SPXC, TEX, TTC and WAB, with information presented herein calculated using publicly available data, on a similar basis to the manner in which we compute Adjusted EBITDA margin (see Appendix for our calculation of Adjusted EBITDA margin, a non-GAAP measure, and a reconciliation to GAAP measures). All figures based on FY16 to FY24 fiscal years, where available.

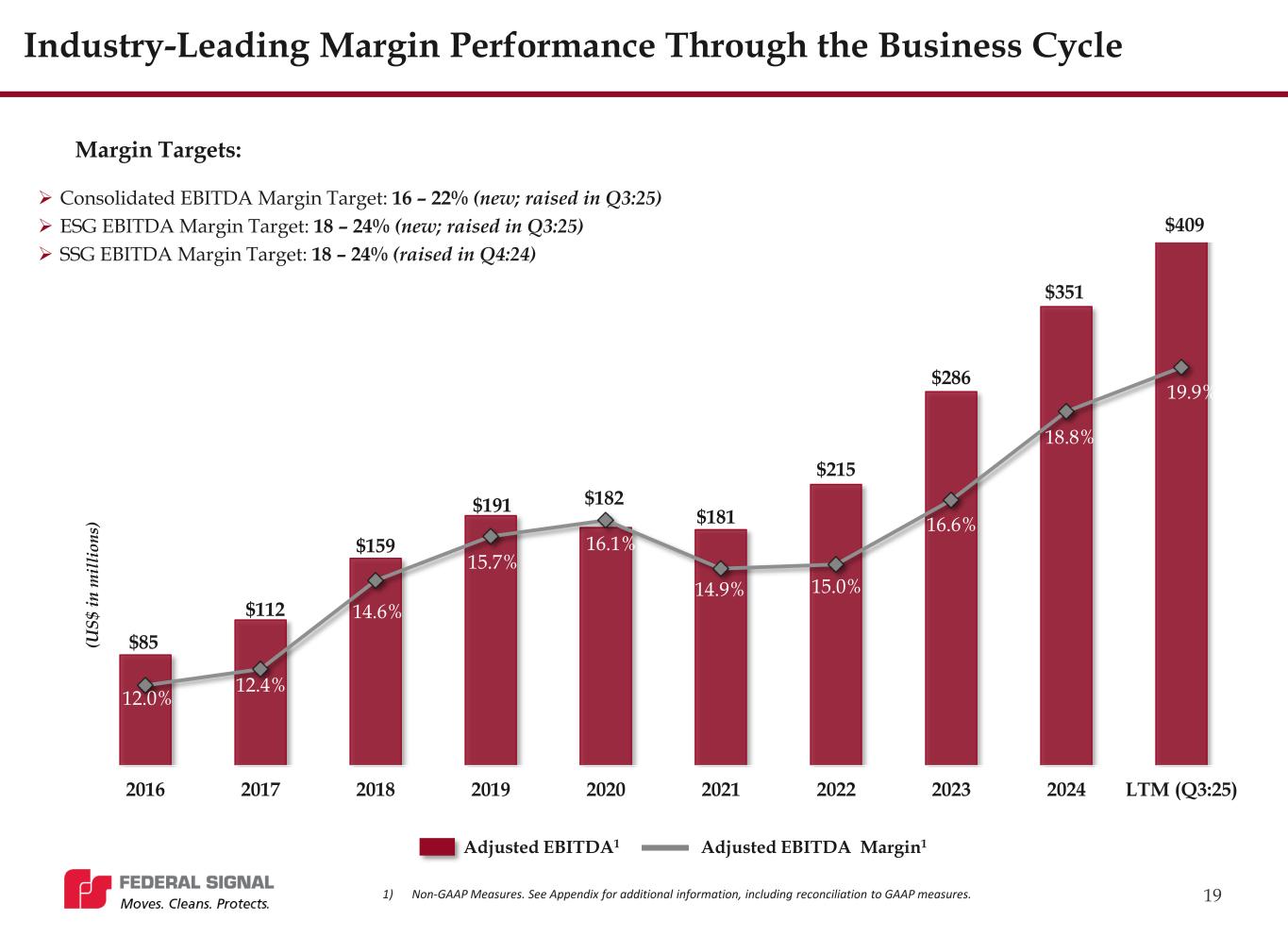

$85 $112 $159 $191 $182 $181 $215 $286 $351 $409 12.0% 12.4% 14.6% 15.7% 16.1% 14.9% 15.0% 16.6% 18.8% 19.9% 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (Q3:25) 19 Industry-Leading Margin Performance Through the Business Cycle (U S $ in m il li o n s) Adjusted EBITDA1 Adjusted EBITDA Margin1 ➢ Consolidated EBITDA Margin Target: 16 – 22% (new; raised in Q3:25) ➢ ESG EBITDA Margin Target: 18 – 24% (new; raised in Q3:25) ➢ SSG EBITDA Margin Target: 18 – 24% (raised in Q4:24) Margin Targets: 1) Non-GAAP Measures. See Appendix for additional information, including reconciliation to GAAP measures.

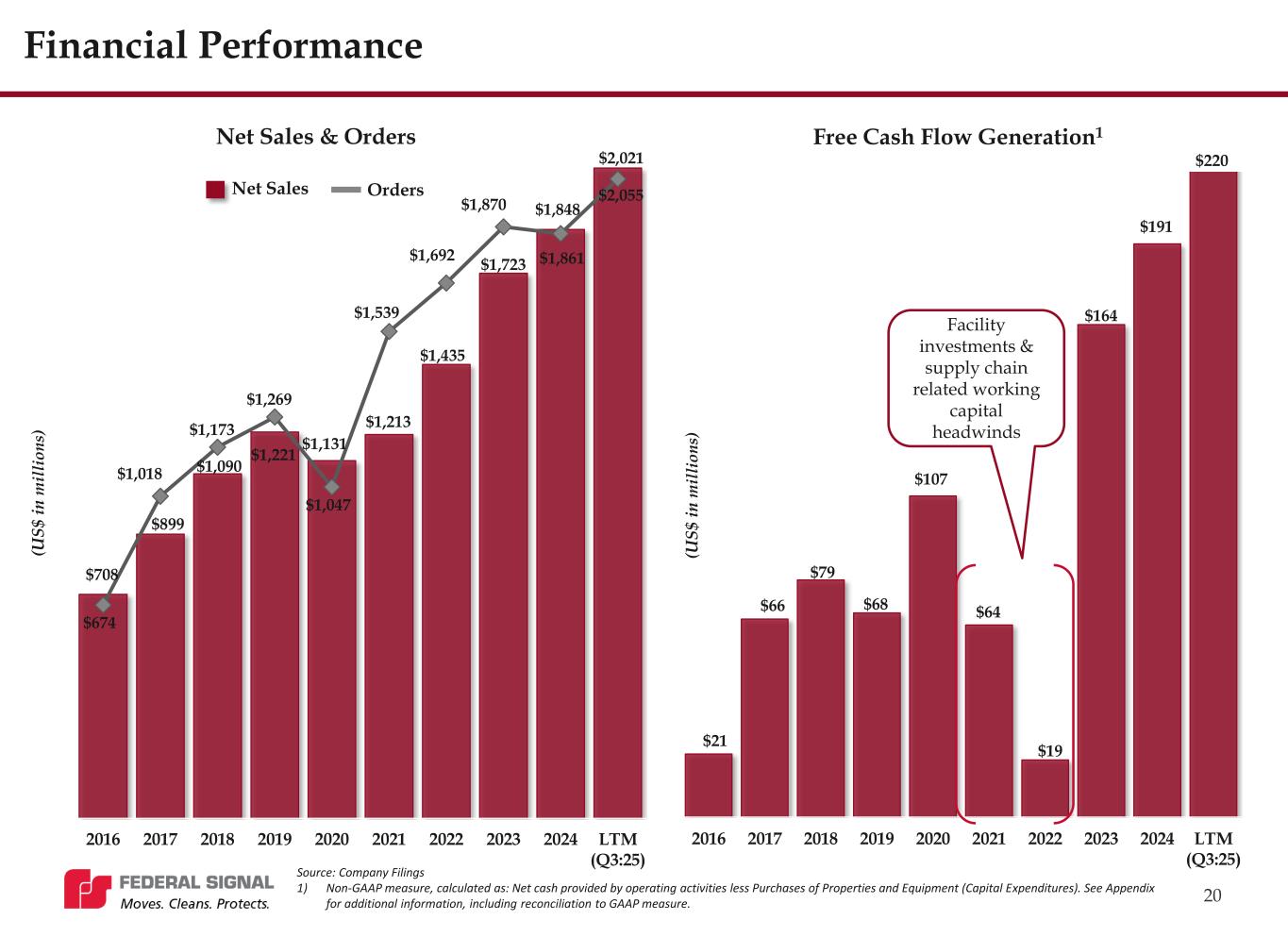

$21 $66 $79 $68 $107 $64 $19 $164 $191 $220 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (Q3:25) $708 $899 $1,090 $1,221 $1,131 $1,213 $1,435 $1,723 $1,861 $2,055 $674 $1,018 $1,173 $1,269 $1,047 $1,539 $1,692 $1,870 $1,848 $2,021 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (Q3:25) 20 Financial Performance Net Sales & Orders Free Cash Flow Generation1 Net Sales Orders Source: Company Filings 1) Non-GAAP measure, calculated as: Net cash provided by operating activities less Purchases of Properties and Equipment (Capital Expenditures). See Appendix for additional information, including reconciliation to GAAP measure. (U S $ in m il li o n s) (U S $ in m il li o n s) Facility investments & supply chain related working capital headwinds

➢ On November 26, 2025, we raised the Full-Year Adjusted EPS2 Outlook to a new range of $4.12 to $4.20 ➢ Increased from the prior range of $4.09-$4.17 ➢ We also raised the Full-year Net Sales Outlook to a new range of $2.12 B to $2.16 B ➢ Increase from the prior range of $2.10 B to $2.14 B 21 2025 Financial Outlook1 1. 2025 financial outlook is as of November 26, 2025. 2. Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. In the three and nine months ended September 30, 2025 and 2024, we made adjustments to exclude the impact of acquisition and integration-related expenses, net, purchase accounting effects, and certain special income tax items, where applicable. In prior years, we have also made adjustments to exclude the impact of environmental remediation costs of a discontinued operation, pension-related charges, debt settlement charges, and certain other unusual or non-recurring items. Should any similar items occur in the remainder of 2025, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B).

22 I. Our Portfolio of Brands & Products II. Extensive Geographic Footprint Across North America III. Federal Signal Operating System IV. Sustainability Initiatives V. Non-GAAP Measures VI. Executive Compensation VII. Investor Information Appendix

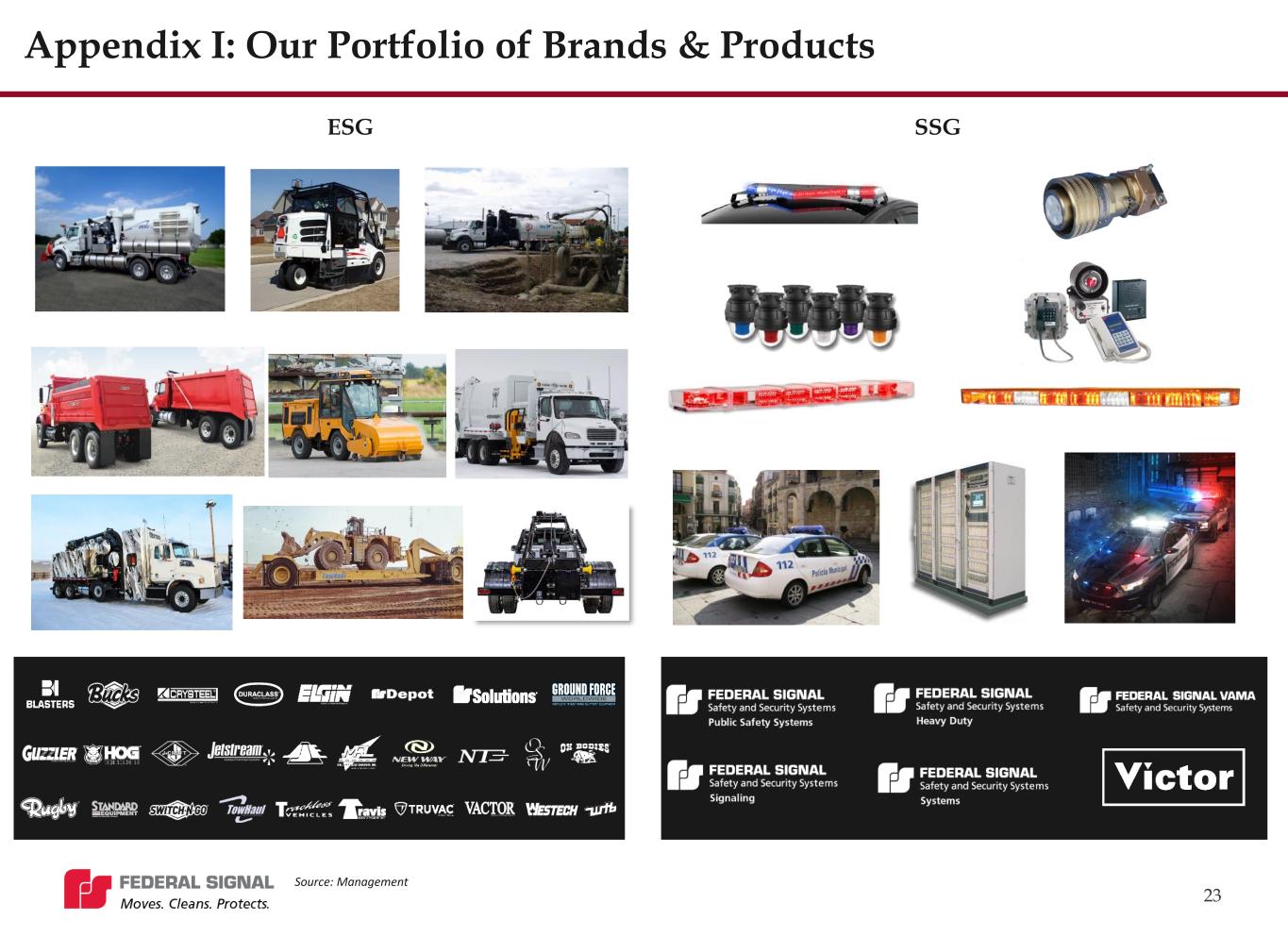

23 Appendix I: Our Portfolio of Brands & Products ESG SSG Source: Management

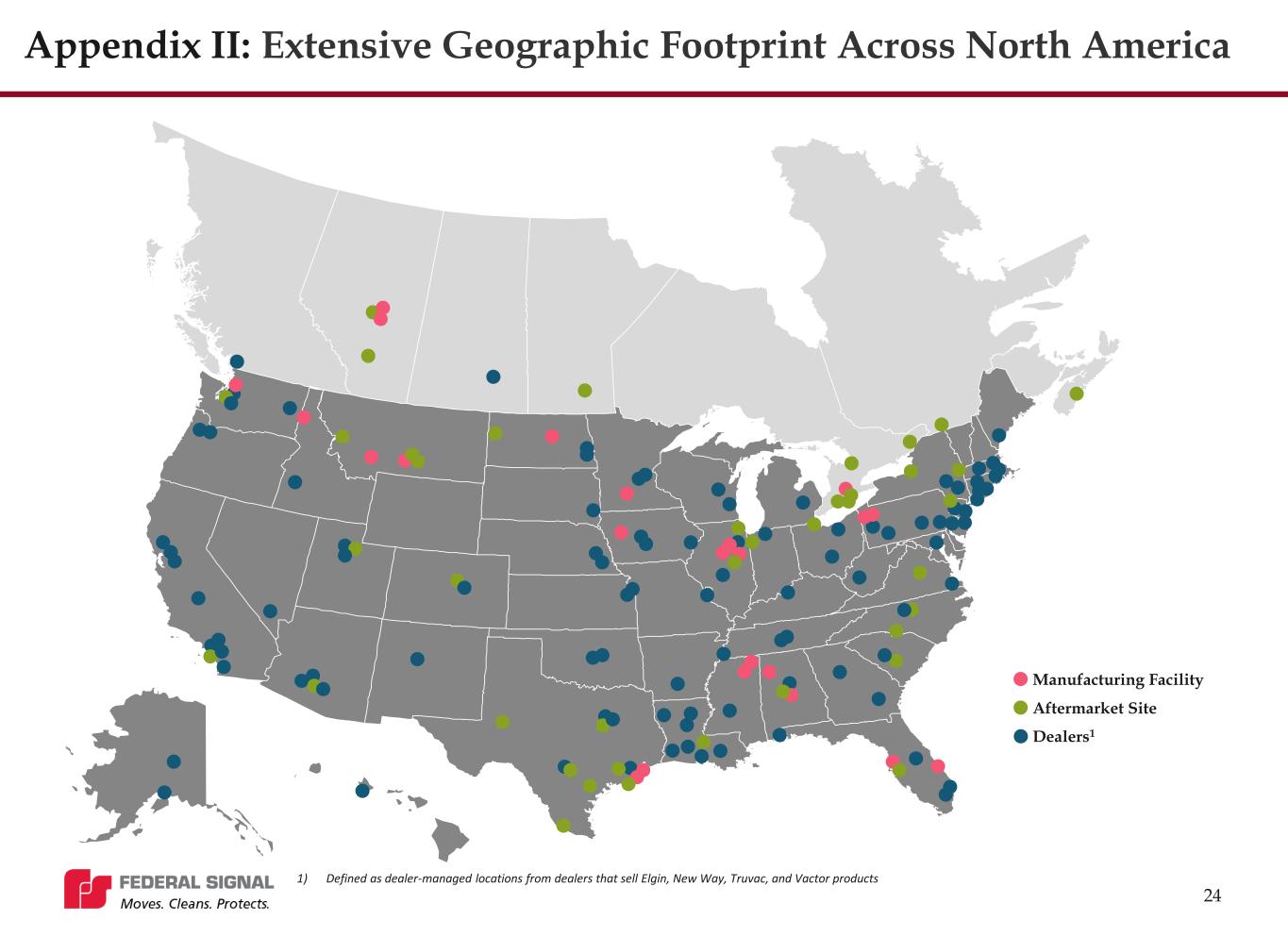

24 Dealers1 Manufacturing Facility Aftermarket Site 1) Defined as dealer-managed locations from dealers that sell Elgin, New Way, Truvac, and Vactor products Appendix II: Extensive Geographic Footprint Across North America

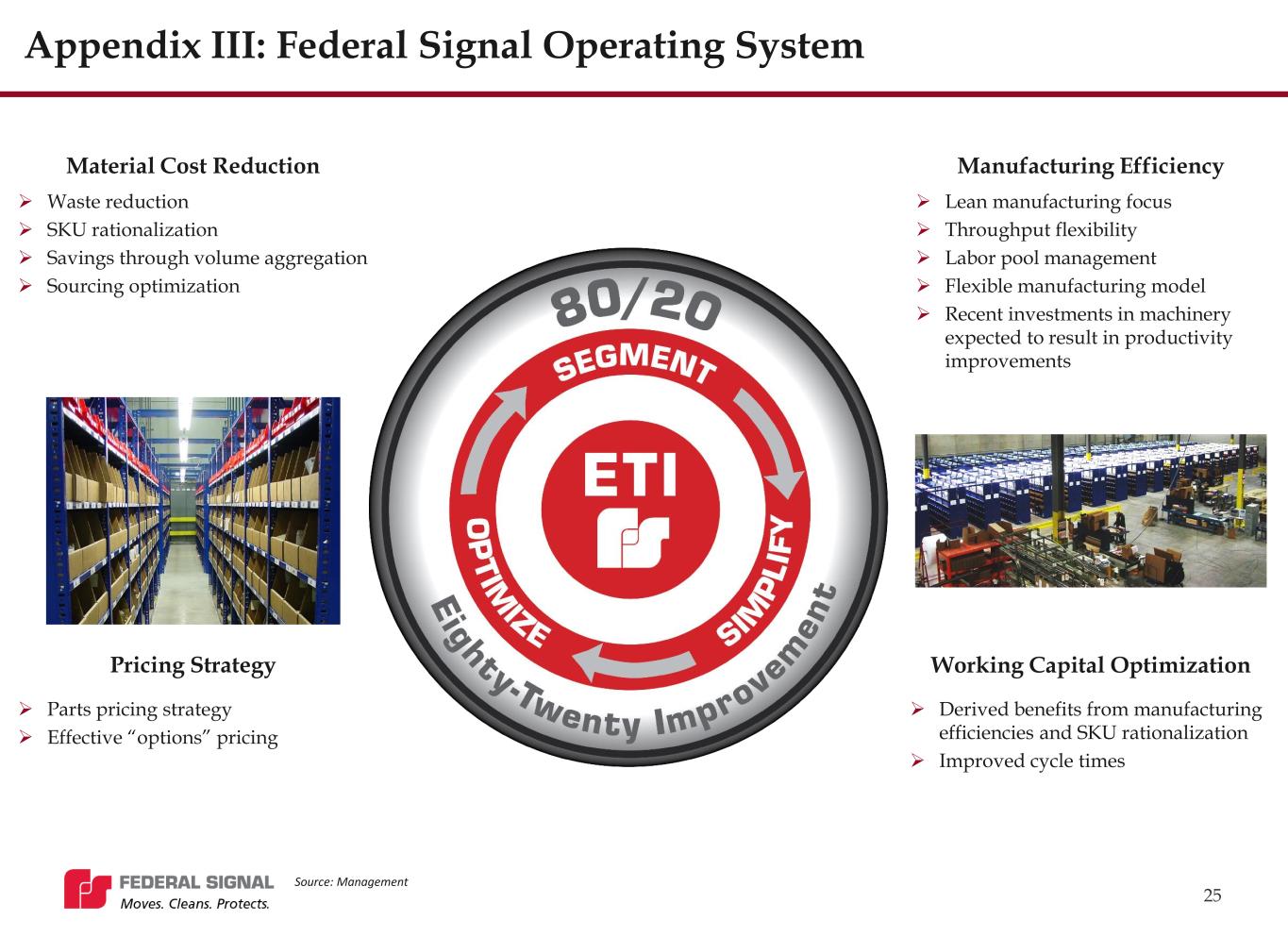

25 Appendix III: Federal Signal Operating System Material Cost Reduction ➢ Waste reduction ➢ SKU rationalization ➢ Savings through volume aggregation ➢ Sourcing optimization Manufacturing Efficiency ➢ Lean manufacturing focus ➢ Throughput flexibility ➢ Labor pool management ➢ Flexible manufacturing model ➢ Recent investments in machinery expected to result in productivity improvements Working Capital Optimization ➢ Derived benefits from manufacturing efficiencies and SKU rationalization ➢ Improved cycle times Pricing Strategy ➢ Parts pricing strategy ➢ Effective “options” pricing Source: Management

26 Appendix IV: Sustainability Initiatives ➢ Resource Consumption o Ongoing energy consumption assessments and adopting energy efficient measures to reduce CO2 emissions and energy intensity o During 2024, our electricity, water, and natural gas consumption intensity, along with our CO2 production intensity, were each more than 15% below our 2022 baseline, achieving our stated goal early o Announced goals in 2024 to reduce energy, fuels and water consumption, and carbon production by 10% by 2030, using 2022 as the baseline o Launched environmental education and awareness programs to implement best practices o Enhanced measuring and reporting practices and energy consumption audits ➢ Community Engagement o Active participation with local charities, promoting and participating in educational and wellness programs o Volunteering in local communities o Federal Signal and our employees are committed to giving back and improving our surrounding areas at a national and local level ➢ Sustainability Report o Published 2025 Sustainability Report in Q2 2025 o Completed annual Materiality Assessment o Held Environmental Compliance Oversight Committee review Source: Management and Company Filings ➢ Products o Continue to search for ways to integrate electrification into our suite of products, with a focus on improved air quality and a reduced carbon footprint o Booked several orders for fully electric and hybrid street sweepers

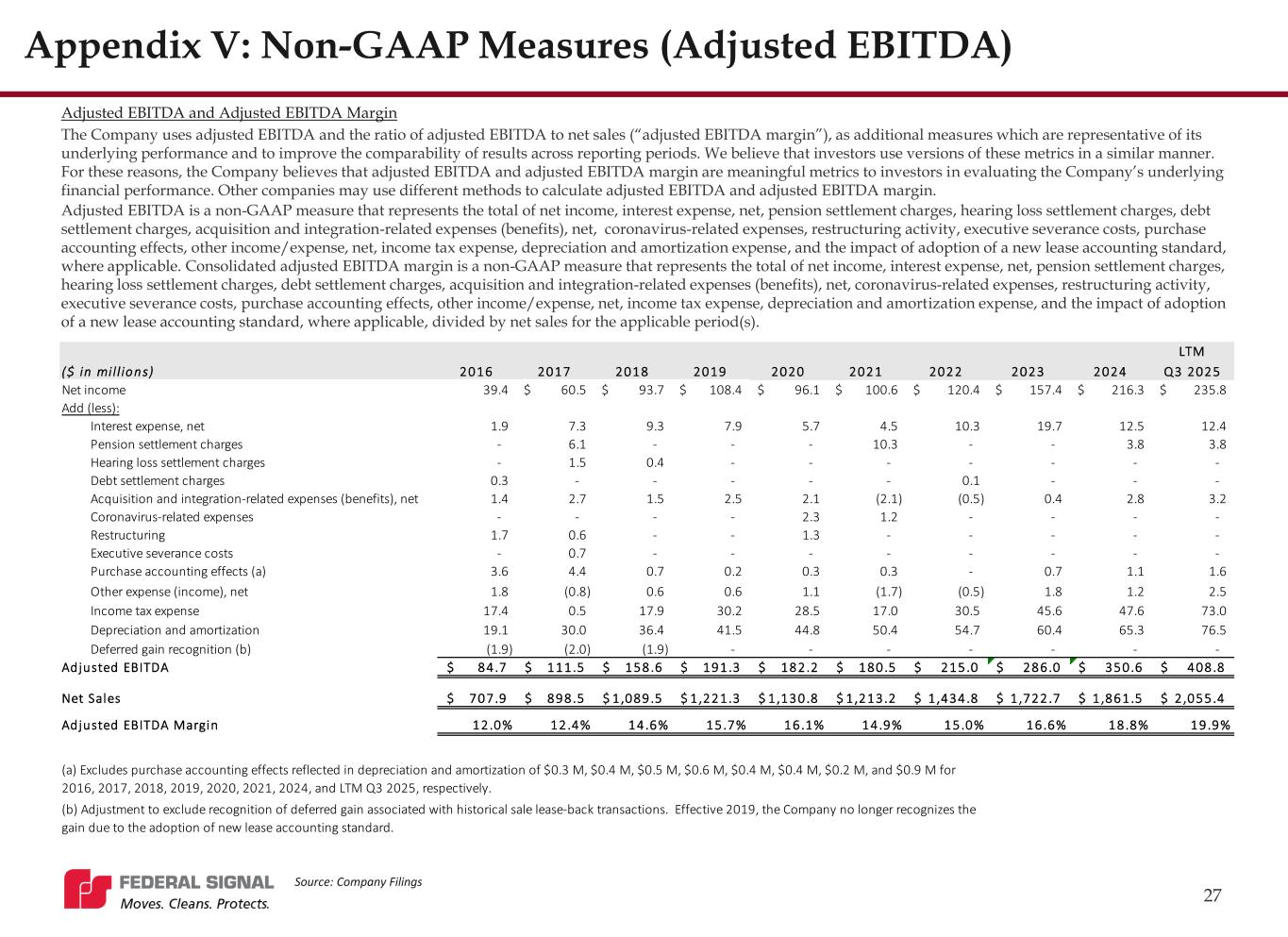

27 Appendix V: Non-GAAP Measures (Adjusted EBITDA) Source: Company Filings Adjusted EBITDA and Adjusted EBITDA Margin The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”), as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin are meaningful metrics to investors in evaluating the Company’s underlying financial performance. Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. Adjusted EBITDA is a non-GAAP measure that represents the total of net income, interest expense, net, pension settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and integration-related expenses (benefits), net, coronavirus-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other income/expense, net, income tax expense, depreciation and amortization expense, and the impact of adoption of a new lease accounting standard, where applicable. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of net income, interest expense, net, pension settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and integration-related expenses (benefits), net, coronavirus-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other income/expense, net, income tax expense, depreciation and amortization expense, and the impact of adoption of a new lease accounting standard, where applicable, divided by net sales for the applicable period(s). LTM ($ in mil l ions) 2016 2017 2018 2019 2020 2021 2022 2023 2024 Q3 2025 Net income 39.4 60.5$ 93.7$ 108.4$ 96.1$ 100.6$ 120.4$ 157.4$ 216.3$ 235.8$ Add (less): Interest expense, net 1.9 7.3 9.3 7.9 5.7 4.5 10.3 19.7 12.5 12.4 Pension settlement charges - 6.1 - - - 10.3 - - 3.8 3.8 Hearing loss settlement charges - 1.5 0.4 - - - - - - - Debt settlement charges 0.3 - - - - - 0.1 - - - Acquisition and integration-related expenses (benefits), net 1.4 2.7 1.5 2.5 2.1 (2.1) (0.5) 0.4 2.8 3.2 Coronavirus-related expenses - - - - 2.3 1.2 - - - - Restructuring 1.7 0.6 - - 1.3 - - - - - Executive severance costs - 0.7 - - - - - - - - Purchase accounting effects (a) 3.6 4.4 0.7 0.2 0.3 0.3 - 0.7 1.1 1.6 Other expense (income), net 1.8 (0.8) 0.6 0.6 1.1 (1.7) (0.5) 1.8 1.2 2.5 Income tax expense 17.4 0.5 17.9 30.2 28.5 17.0 30.5 45.6 47.6 73.0 Depreciation and amortization 19.1 30.0 36.4 41.5 44.8 50.4 54.7 60.4 65.3 76.5 Deferred gain recognition (b) (1.9) (2.0) (1.9) - - - - - - - Adjusted EBITDA 84.7$ 111.5$ 158.6$ 191.3$ 182.2$ 180.5$ 215.0$ 286.0$ 350.6$ 408.8$ Net Sales 707.9$ 898.5$ 1 ,089.5$ 1 ,221.3$ 1 ,130.8$ 1 ,213.2$ 1 ,434.8$ 1 ,722.7$ 1 ,861.5$ 2 ,055.4$ Adjusted EBITDA Margin 12.0% 12.4% 14.6% 15.7% 16.1% 14.9% 15.0% 16.6% 18.8% 19.9% (a) Excludes purchase accounting effects reflected in depreciation and amortization of $0.3 M, $0.4 M, $0.5 M, $0.6 M, $0.4 M, $0.4 M, $0.2 M, and $0.9 M for 2016, 2017, 2018, 2019, 2020, 2021, 2024, and LTM Q3 2025, respectively. (b) Adjustment to exclude recognition of deferred gain associated with historical sale lease-back transactions. Effective 2019, the Company no longer recognizes the gain due to the adoption of new lease accounting standard.

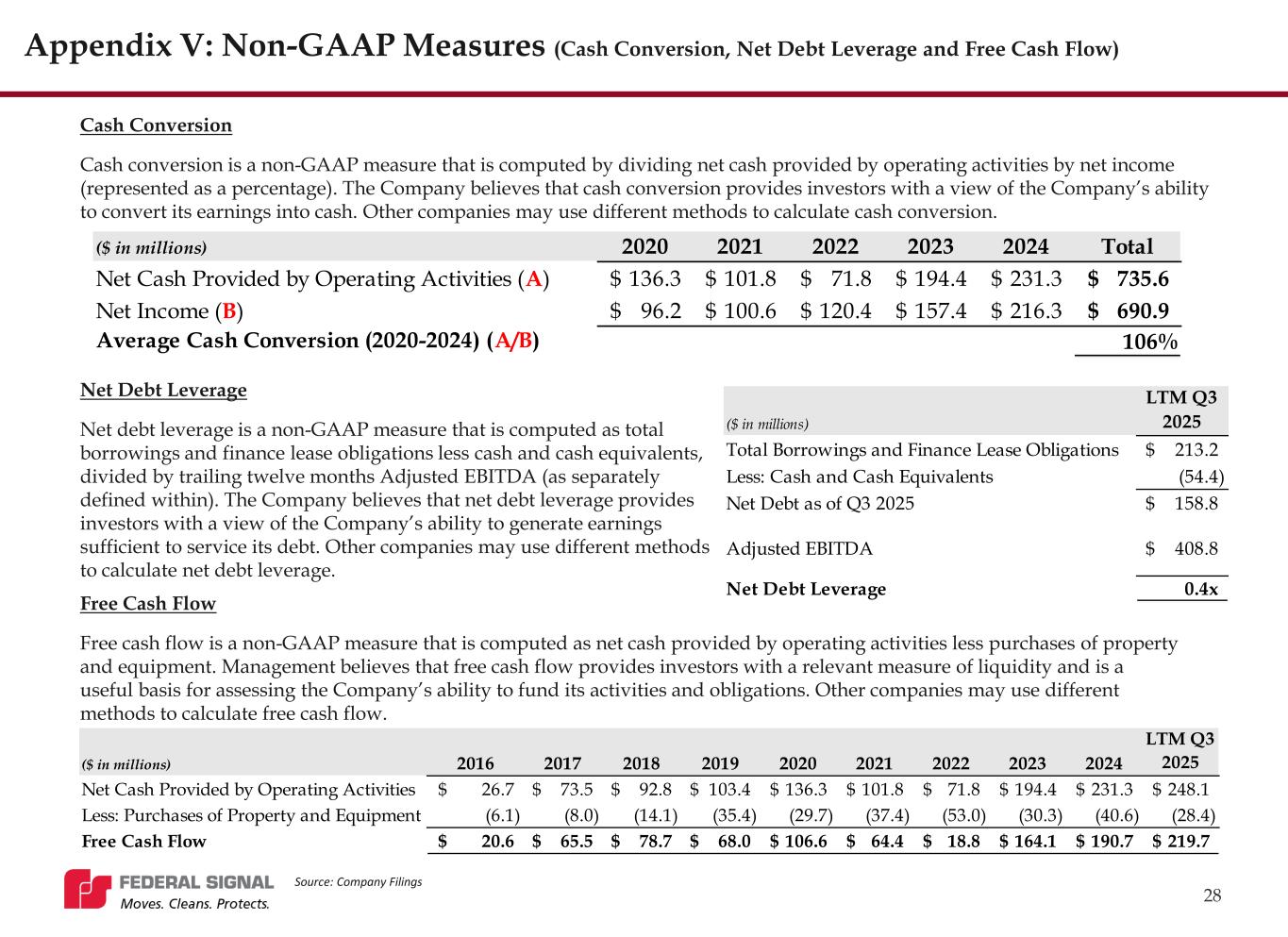

28 Cash Conversion Cash conversion is a non-GAAP measure that is computed by dividing net cash provided by operating activities by net income (represented as a percentage). The Company believes that cash conversion provides investors with a view of the Company’s ability to convert its earnings into cash. Other companies may use different methods to calculate cash conversion. Free Cash Flow Free cash flow is a non-GAAP measure that is computed as net cash provided by operating activities less purchases of property and equipment. Management believes that free cash flow provides investors with a relevant measure of liquidity and is a useful basis for assessing the Company’s ability to fund its activities and obligations. Other companies may use different methods to calculate free cash flow. Source: Company Filings Net Debt Leverage Net debt leverage is a non-GAAP measure that is computed as total borrowings and finance lease obligations less cash and cash equivalents, divided by trailing twelve months Adjusted EBITDA (as separately defined within). The Company believes that net debt leverage provides investors with a view of the Company’s ability to generate earnings sufficient to service its debt. Other companies may use different methods to calculate net debt leverage. Appendix V: Non-GAAP Measures (Cash Conversion, Net Debt Leverage and Free Cash Flow) ($ in millions) 2020 2021 2022 2023 2024 Total Net Cash Provided by Operating Activities (A) 136.3$ 101.8$ 71.8$ 194.4$ 231.3$ 735.6$ Net Income (B) 96.2$ 100.6$ 120.4$ 157.4$ 216.3$ 690.9$ Average Cash Conversion (2020-2024) (A/B) 106% ($ in millions) LTM Q3 2025 Total Borrowings and Finance Lease Obligations 213.2$ Less: Cash and Cash Equivalents (54.4) Net Debt as of Q3 2025 158.8$ Adjusted EBITDA 408.8$ Net Debt Leverage 0.4x ($ in millions) 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM Q3 2025 Net Cash Provided by Operating Activities 26.7$ 73.5$ 92.8$ 103.4$ 136.3$ 101.8$ 71.8$ 194.4$ 231.3$ 248.1$ Less: Purchases of Property and Equipment (6.1) (8.0) (14.1) (35.4) (29.7) (37.4) (53.0) (30.3) (40.6) (28.4) Free Cash Flow 20.6$ 65.5$ 78.7$ 68.0$ 106.6$ 64.4$ 18.8$ 164.1$ 190.7$ 219.7$

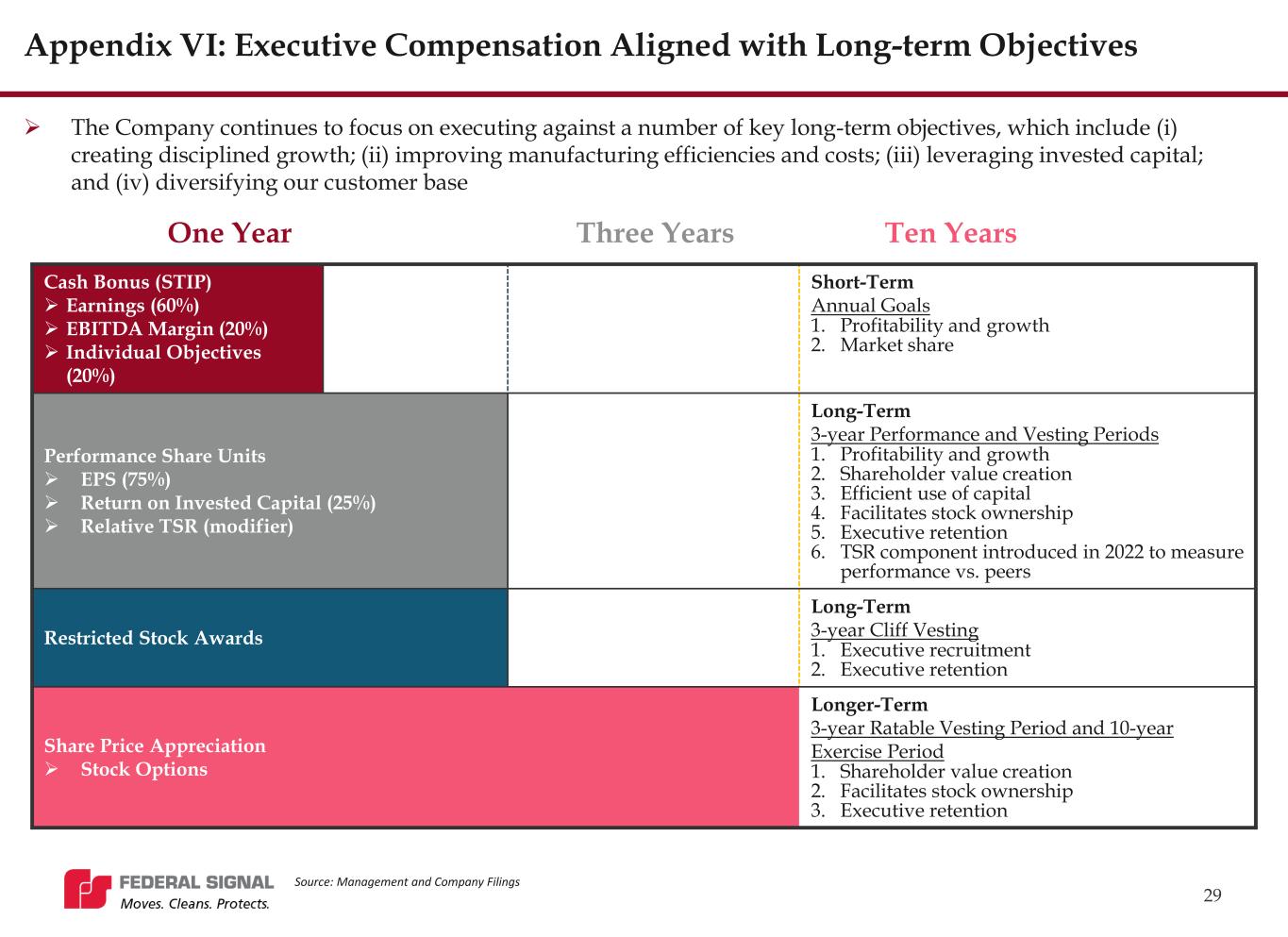

29 ➢ The Company continues to focus on executing against a number of key long-term objectives, which include (i) creating disciplined growth; (ii) improving manufacturing efficiencies and costs; (iii) leveraging invested capital; and (iv) diversifying our customer base Cash Bonus (STIP) ➢ Earnings (60%) ➢ EBITDA Margin (20%) ➢ Individual Objectives (20%) Short-Term Annual Goals 1. Profitability and growth 2. Market share Performance Share Units ➢ EPS (75%) ➢ Return on Invested Capital (25%) ➢ Relative TSR (modifier) Long-Term 3-year Performance and Vesting Periods 1. Profitability and growth 2. Shareholder value creation 3. Efficient use of capital 4. Facilitates stock ownership 5. Executive retention 6. TSR component introduced in 2022 to measure performance vs. peers Restricted Stock Awards Long-Term 3-year Cliff Vesting 1. Executive recruitment 2. Executive retention Share Price Appreciation ➢ Stock Options Longer-Term 3-year Ratable Vesting Period and 10-year Exercise Period 1. Shareholder value creation 2. Facilitates stock ownership 3. Executive retention One Year Three Years Ten Years Source: Management and Company Filings Appendix VI: Executive Compensation Aligned with Long-term Objectives

30 Appendix VII: Investor Information Stock Ticker: NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1333 Butterfield Road, Suite 500 Downers Grove, IL 60515 Felix Boeschen VP Corporate Strategy & Investor Relations fboeschen@federalsignal.com