© Sensient Technologies 2025 sensient.com 2025 Baird’s Investor Day

with Sensient Technologies August 13, 2025

Non-GAAP Financial Measures Within this document, the Company reports certain

non-GAAP financial measures, including: (1) percentage changes in local currency revenue, which eliminates the effects that result from translating its international operations into U.S. dollars, and (2) adjusted EBITDA and adjusted EBITDA

margin (which excludes Portfolio Optimization Plan costs and non-cash share based compensation expense). The Company has included each of these non-GAAP measures in order to provide additional information regarding our underlying operating

results and comparable year-over-year performance. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures should not

be considered in isolation. Rather, they should be considered together with GAAP measures and the rest of the information included in this report. Management internally reviews each of these non-GAAP measures to evaluate performance on a

comparative period-to-period basis and to gain additional insight into underlying operating and performance trends, and the Company believes the information can be beneficial to investors for the same purposes. These non-GAAP measures may

not be comparable to similarly titled measures used by other companies. Forward Looking Statements This document contains statements that may constitute “forward-looking statements” within the meaning of Federal securities lawsincluding

under “2025 Financial Outlook” and “Long-Term Growth Focus” in this presentation. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, and other factors concerning the

Company’s operations and business environment. Important factors that could cause actual results to differ materially from those suggested by these forward-looking statements and that could adversely affect the Company’s future financial

performance include the following: the Company’s ability to manage general business, economic, and capital market conditions, including actions taken by customers in response to such market conditions, and the impact of recessions and

economic downturns; the impact of macroeconomic and geopolitical volatility, including inflation and shortages impacting the availability and cost of raw materials, energy, and other supplies, disruptions and delays in the Company’s supply

chain, and the conflicts between Russia and Ukraine and in the Middle East; industry, regulatory, legal, and economic factors related to the Company’s domestic and international business; the effects of tariffs, trade barriers, and disputes;

the availability and cost of labor, logistics, and transportation; the pace and nature of new product introductions by the Company and the Company’s customers; the Company’s ability to anticipate and respond to changing consumer preferences,

changing technologies, and changing regulations; the Company’s ability to successfully implement its growth strategies; the outcome of the Company’s various productivity-improvement and cost-reduction efforts, acquisition and divestiture

activities, and Portfolio Optimization Plan; growth in markets for products in which the Company competes; industry and customer acceptance of price increases; actions by competitors; the Company’s ability to enhance its innovation efforts

and drive cost efficiencies; currency exchange rate fluctuations; and other factors included in “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and in other documents that the Company files

with the SEC. The risks and uncertainties identified above are not the only risks the Company faces. Additional risks and uncertainties not presently known to the Company or that it currently believes to be immaterial also may adversely

affect the Company. Should any known or unknown risks and uncertainties develop into actual events, these developments could have material adverse effects on our business, financial condition, and results of operations. This presentation

contains time-sensitive information that reflects management’s best analysis only as of the date of this presentation. Except to the extent required by applicable laws, the Company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied herein will not be realized. sensient.com 2 © Sensient Technologies 2025

© Sensient Technologies 2025 sensient.com Sensient Overview 3 Paul Manning,

Chairman of the Board, President & Chief Executive Officer Tobin Tornehl, Vice President & Chief Financial Officer

Who is Sensient? sensient.com 4 © Sensient Technologies 2025 OUR MISSION We

bring life to products Our mission is to develop, produce, and supply innovative ingredients for food, pharmaceuticals, and personal care products to the world in a safe and sustainable way. SENSory IngredIENTs (NYSE: SXT) Est. 1882

Milwaukee, WI OUR PURPOSE We focus on what matters most to our customers We utilize our team of experts and portfolio of solutions to partner with our customers to create enticing and visually appealing food, beverage, pharmaceutical, and

personal care products. Transparency is key to our business—our honesty and clear communication form the basis of our commitment to customers. We believe in a holistic approach to product development. We show how our extensive portfolio

works in the target application, and we utilize our comprehensive marketing insight to help make it a success. We focus our innovation efforts on answering consumer demand and addressing market gaps. We pride ourselves on always being

thorough and responsive. This is possible because of our commitment to top-tier customer service KPIs—from samples and document turnaround, to commercialization and on time delivery of goods.

Who we serve A leading provider of customized solutions in two key product

verticals Personal Care Food & Pharmaceutical sensient.com 4 © Sensient Technologies 2025

A global strategic advantage A leading innovator in natural colors A

worldwide authority in dehydrated natural ingredients Top ten global flavor and flavor technology provider manufacturing facilities and R&D labs in more than 20 countries 35+ NORTH AMERICA Global HQ 13 sites LATIN AMERICA 7

sites EUROPE/AFRICA/ MIDDLE EAST 19 sites ASIA PACIFIC 13 sites 4,000 employees serving customers in more than 150 countries Over A global player In color cosmetics sensient.com 4 © Sensient Technologies 2025

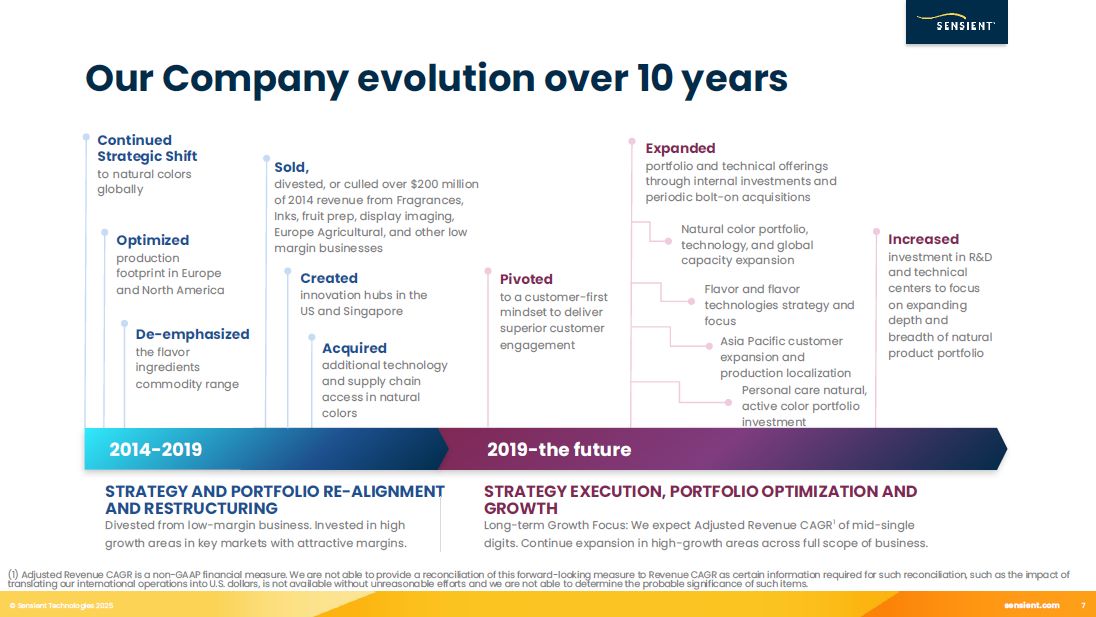

Our Company evolution over 10 years AND RESTRUCTURING Divested from low-margin

business. Invested in high growth areas in key markets with attractive margins. De-emphasized the flavor ingredients commodity range Optimized production footprint in Europe and North America Created innovation hubs in the US and

Singapore Continued Strategic Shift to natural colors globally Acquired additional technology and supply chain access in natural colors Expanded portfolio and technical offerings through internal investments and periodic bolt-on

acquisitions Increased investment in R&D and technical centers to focus on expanding depth and breadth of natural product portfolio 2019-the future STRATEGY EXECUTION, PORTFOLIO OPTIMIZATION AND GROWTH Long-term Growth Focus: We

expect Adjusted Revenue CAGR1 of mid-single digits. Continue expansion in high-growth areas across full scope of business. 2014-2019 STRATEGY AND PORTFOLIO RE-ALIGNMENT Natural color portfolio, technology, and global capacity

expansion Flavor and flavor technologies strategy and focus Asia Pacific customer expansion and production localization Personal care natural, active color portfolio investment (1) Adjusted Revenue CAGR is a non-GAAP financial measure. We

are not able to provide a reconciliation of this forward-looking measure to Revenue CAGR as certain information required for such reconciliation, such as the impact of translating our international operations into U.S. dollars, is not

available without unreasonable efforts and we are not able to determine the probable significance of such items. Pivoted to a customer-first mindset to deliver superior customer engagement Sold, divested, or culled over $200 million of

2014 revenue from Fragrances, Inks, fruit prep, display imaging, Europe Agricultural, and other low margin businesses sensient.com 4 © Sensient Technologies 2025

Investment Thesis Global leader in several food and beverage segments Our

commitment to a “customer first” mindset across the organization has solidified our position with customers and raised the bar among our competitors Sensient’s products constitute a small percentage of the cost of end products but carry the

brand- defining characteristics Our products tend to be sticky and difficult to swap out Operations across the world, ensuring we are where our customers need us Serving local, regional, and multinational customers Customer support from

idea conception to launch-ready products Food and beverages and personal care products are a key part of consumer spending These markets provide a solid foundation for the business to capitalize on growth opportunities We invest in areas

that help launch products our customers desire and deliver topline growth at accretive returns Strong Competitive Position Defensible Business Global Scale & Presence Stable & Growing Categories Profitability

& Growth sensient.com 4 © Sensient Technologies 2025

A leading provider of customized solutions for food and beverage,

pharmaceutical, and personal care customers 2024 Revenue: $648M Core Areas of Focus: Food and Pharmaceutical Personal Care Color Group 2024 Revenue: $163M Core Areas of Focus: Flavors and Colors for food and beverage Asia Pacific

Group 2024 Revenue: $794M Core Areas of Focus: Flavors, Extracts, and Flavor Ingredients Flavors & Extracts Group sensient.com 4 © Sensient Technologies 2025

74% 26% 2024 Group Revenue Food & Pharmaceutical Personal Care Color

Group Overview 2024 Adjusted EBITDA Margin1 22.1% +110 bps YOY Food and Pharmaceutical Market is on the cusp of converting to natural colors in food and beverage Unique value proposition for Pharmaceutical customers includes colors,

flavors, coatings, and extracts +7.0% 2024 Local Currency Revenue1 change by division Personal Care Demand for innovative and sustainable, multifunctional beauty solutions Product portfolio includes natural and synthetic dyes, pigments,

and sensorial cosmetic ingredients for makeup, skin and sun care, fragrance, and hair color and care +8.0% $648M ~60% Natural Colors ~40% Synthetic Colors 1 Please see our GAAP to Non-GAAP Reconciliation at the end of this

document. sensient.com 10 © Sensient Technologies 2025

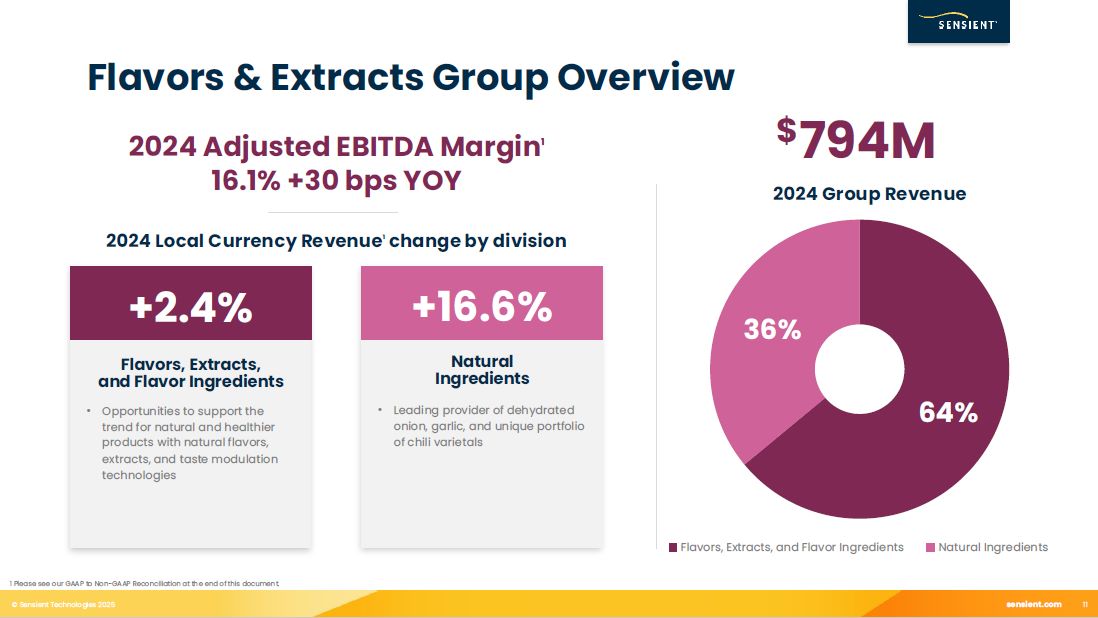

64% 36% 2024 Group Revenue Flavors, Extracts, and Flavor Ingredients Natural

Ingredients Flavors & Extracts Group Overview 2024 Adjusted EBITDA Margin1 $794M Flavors, Extracts, and Flavor Ingredients Opportunities to support the trend for natural and healthier products with natural flavors, extracts, and

taste modulation technologies +2.4% 2024 Local Currency Revenue1 change by division Natural Ingredients Leading provider of dehydrated onion, garlic, and unique portfolio of chili varietals +16.6% 16.1% +30 bps YOY 1 Please see our

GAAP to Non-GAAP Reconciliation at the end of this document. sensient.com 10 © Sensient Technologies 2025

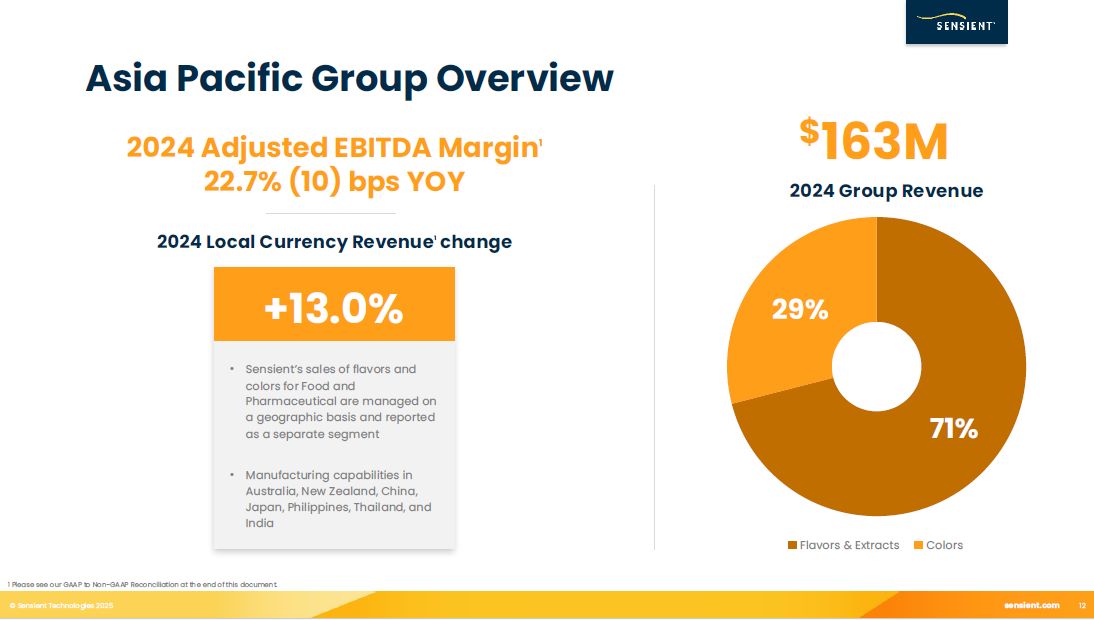

Asia Pacific Group Overview 2024 Adjusted EBITDA Margin1 22.7% (10) bps

YOY $163M 2024 Group Revenue 71% 29% Flavors & Extracts Colors Sensient’s sales of flavors and colors for Food and Pharmaceutical are managed on a geographic basis and reported as a separate segment Manufacturing capabilities in

Australia, New Zealand, China, Japan, Philippines, Thailand, and India +13.0% 2024 Local Currency Revenue1 change 1 Please see our GAAP to Non-GAAP Reconciliation at the end of this document. sensient.com 10 © Sensient Technologies

2025

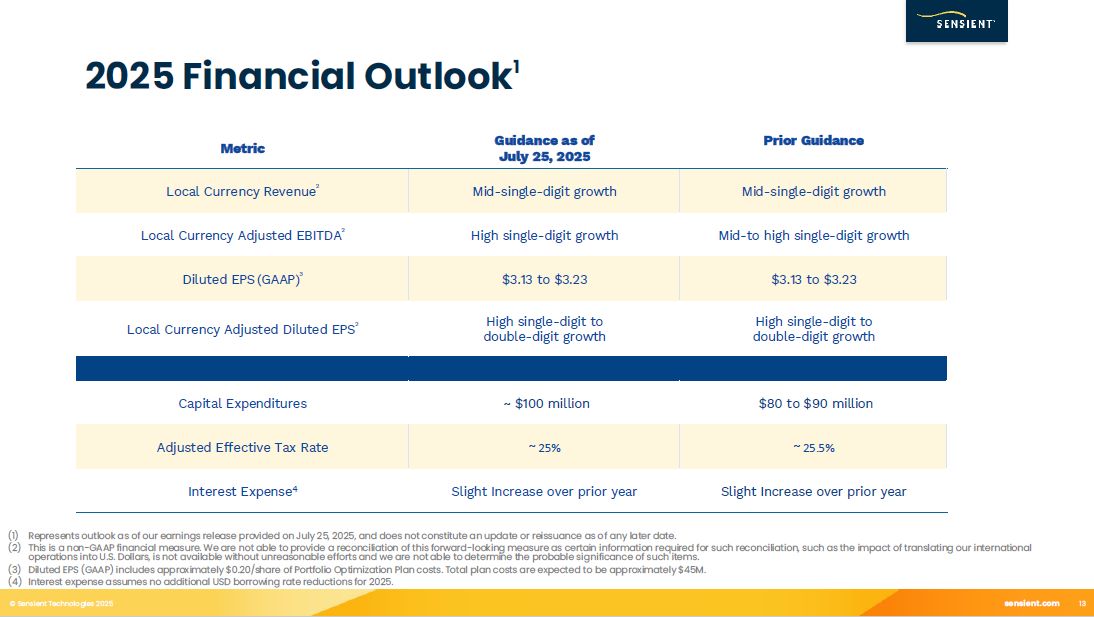

Represents outlook as of our earnings release provided on July 25, 2025, and

does not constitute an update or reissuance as of any later date. This is a non-GAAP financial measure. We are not able to provide a reconciliation of this forward-looking measure as certain information required for such reconciliation, such

as the impact of translating our international operations into U.S. Dollars, is not available without unreasonable efforts and we are not able to determine the probable significance of such items. Diluted EPS (GAAP) includes approximately

$0.20/share of Portfolio Optimization Plan costs. Total plan costs are expected to be approximately $45M. Interest expense assumes no additional USD borrowing rate reductions for 2025. sensient.com 13 © Sensient Technologies 2025 2025

Financial Outlook1 Metric Guidance as of July 25, 2025 Prior Guidance Local Currency Revenue2 Mid-single-digit growth Mid-single-digit growth Local Currency Adjusted EBITDA2 High single-digit growth Mid-to high single-digit

growth Diluted EPS (GAAP)3 $3.13 to $3.23 $3.13 to $3.23 Local Currency Adjusted Diluted EPS2 High single-digit to double-digit growth High single-digit to double-digit growth Capital Expenditures ~ $100 million $80 to $90

million Adjusted Effective Tax Rate ~ 25% ~ 25.5% Interest Expense4 Slight Increase over prior year Slight Increase over prior year

© Sensient Technologies 2025 sensient.com Natural Colors 14 Paul Manning,

Chairman of the Board, President & Chief Executive Officer David Rigg, General Manager, Food Colors US

St. Louis Color Headquarters sensient.com 20 © Sensient Technologies 2025

Natural color demand provides growth opportunity for

Sensient sensient.com 20 © Sensient Technologies 2025 Healthy, clean label consumer trends are driving market demand for natural color Globally, approximately 80% of new launches use natural color Usage rate of natural color is higher

in the end-product versus synthetic Sensient is well positioned for growth with a broad product portfolio and commitment to innovation Natural color trend provides a long runway for profitable growth Regulatory changes also contribute to

market growth

Shifting regulatory environment provides opportunity sensient.com 20 ©

Sensient Technologies 2025 Current Synthetic Color Regulatory Actions – U.S. Food and Beverage First School Lunch Ban: West Virginia Effective August 2025 Red 3 Ban: U.S. Federal Ban Effective January 2027 First State-wide Synthetic

Color Ban: West Virginia Effective January 2028 Synthetic to Natural Color Conversion In the U.S., and selectively throughout Latin America, our synthetic colors revenue for the food and nutraceutical market is approximately

$100M Conversion from synthetic to natural can result in a conversion factor of nearly 10-to-1 Natural colors continue to grow above overall company mid- term outlook

Understanding the supply chain problem sensient.com 20 © Sensient

Technologies 2025 Currently, US/Canada represents roughly one third of global natural color market. Because of increased usage rates and cost differentials, we expect that mass conversion will effectively quadruple the US/Canada natural

color market and almost double the global market. To address the increased demand for natural colors, we are working with our target customers to create the supply to meet growing demand.

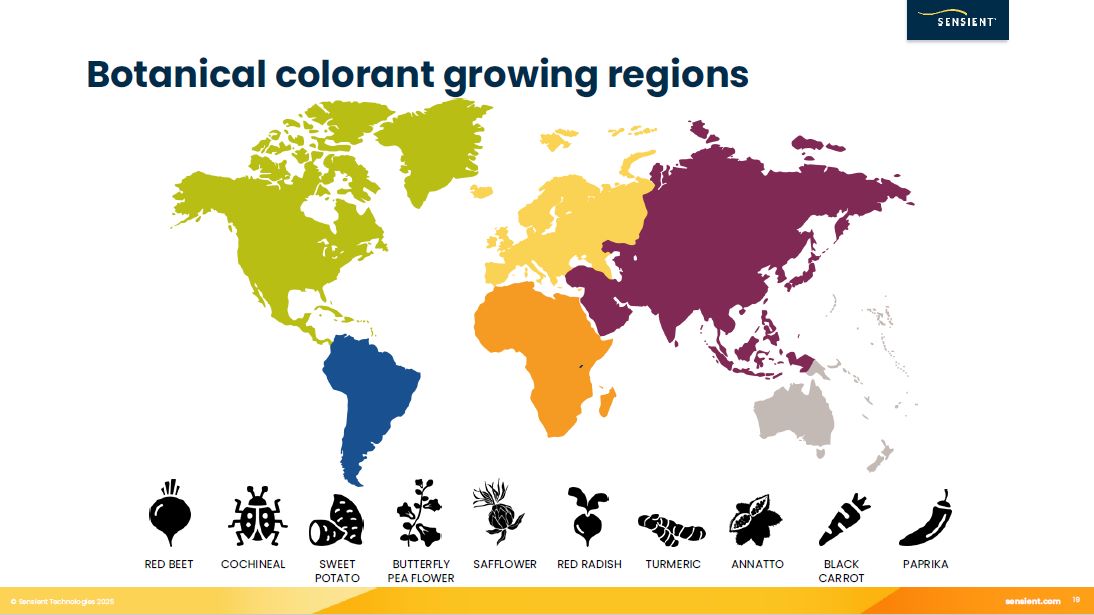

RED BEET COCHINEAL SWEET POTATO BUTTERFLY PEA FLOWER SAFFLOWER RED

RADISH TURMERIC ANNATTO BLACK CARROT PAPRIKA Botanical colorant growing regions sensient.com 20 © Sensient Technologies 2025

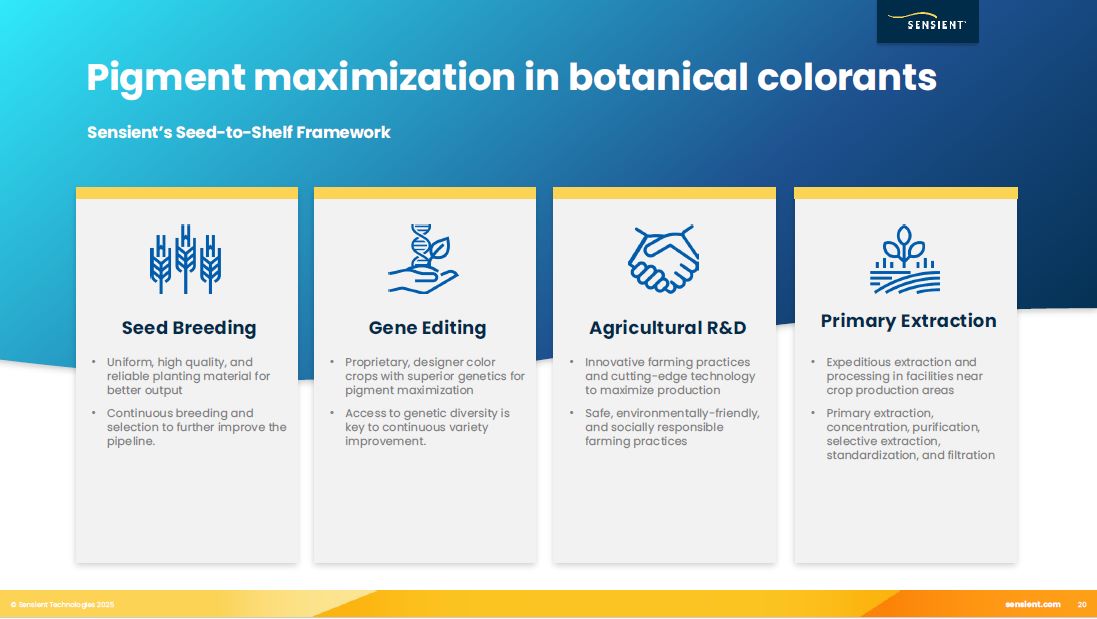

Pigment maximization in botanical colorants Primary Extraction Expeditious

extraction and processing in facilities near crop production areas Primary extraction, concentration, purification, selective extraction, standardization, and filtration Sensient’s Seed-to-Shelf Framework Agricultural R&D Innovative

farming practices and cutting-edge technology to maximize production Safe, environmentally-friendly, and socially responsible farming practices Gene Editing Proprietary, designer color crops with superior genetics for pigment

maximization Access to genetic diversity is key to continuous variety improvement. Seed Breeding Uniform, high quality, and reliable planting material for better output Continuous breeding and selection to further improve the

pipeline. sensient.com 20 © Sensient Technologies 2025

Botanical colorant long-term improvement sensient.com 20 © Sensient

Technologies 2025 Sensient is capable of sourcing full raw material requirements. Strong botanical material resulting from agronomic improvements can reduce cost-in-use long-term. Long-term improvement in the following areas will take

several years: Seed breeding for cost-in-use reduction Seed production Multi-hemisphere growing diversification Extraction capacity expansion Increased processing capacity & finished good processing Alternate & novel

technologies

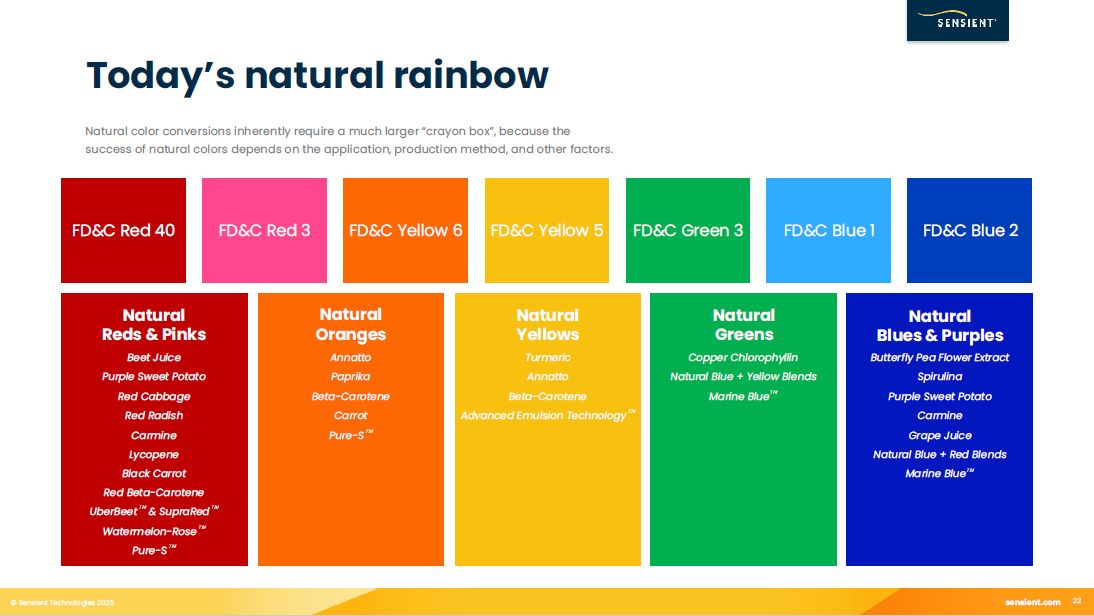

Today’s natural rainbow Natural color conversions inherently require a much

larger “crayon box”, because the success of natural colors depends on the application, production method, and other factors. Natural Reds & Pinks Beet Juice Purple Sweet Potato Red Cabbage Red Radish Carmine Lycopene Black Carrot Red

Beta-Carotene UberBeet & SupraRed Watermelon-Rose Pure-S Natural Oranges Annatto Paprika Beta-Carotene Carrot Pure-S Natural Blues & Purples Butterfly Pea Flower Extract Spirulina Purple Sweet Potato Carmine Grape

Juice Natural Blue + Red Blends Marine Blue Natural Greens Copper Chlorophyllin Natural Blue + Yellow Blends Marine Blue Natural Yellows Turmeric Annatto Beta-Carotene Advanced Emulsion Technology FD&C Red 40 sensient.com 20 ©

Sensient Technologies 2025 FD&C Blue 1 FD&C Yellow 5 FD&C Yellow 6 FD&C Green 3 FD&C Red 3 FD&C Blue 2

Particle Size Control Management of particle size within a color system or

solution improves color intensity and stability. Cost-in-Use and Sustainability Working with the environment instead of against it offers new opportunities for growth and efficiency. Novel Color Sources New botanical or mineral- based

sources for color expand the rainbow. Stabilization & Purification Systems Technologies designed to fortify color performance extend applicability in end products. Natural color innovation platforms sensient.com 20 © Sensient

Technologies 2025

EXCELLENCE COMPETENCIES FEATURED Agronomy Analytical Science Sensory

Product Evaluation Development First Plant-Derived Natural Blue The food industry has been looking for natural blue coloring for a long time. Sensient answered the call. Through our investment in our “seed to shelf” agronomy program, we

developed higher pigment flower petals. By combining demineralized water with dried butterfly pea flower petals, running it through an ultrafiltration process and concentrating and pasteurizing the liquid, we created a highly stable natural

blue coloring. Product highlights: sensient.com 20 © Sensient Technologies 2025 Overcomes challenges in stability and vibrancy over a range of product conditions and shelf-life requirements Provides exceptional heat stability Became

the first plant-derived natural blue source approved by the FDA

EXCELLENCE COMPETENCIES

FEATURED Agronomy Analytical Science Sensory Evaluation Product Development Fills Natural Blue Beverage Category Gap As conversion becomes a necessity and natural innovation continues to grow, the market demand for a bright natural

blue to replace FD&C Blue 1 in beverages is stronger than ever. Sensient developed a unique stabilized spirulina solution to answer this need. Customers can now create bright blues, greens, and purples in beverages and other water-based

applications with clean label colors. Product highlights: sensient.com 20 © Sensient Technologies 2025 Clean label alternative to Blue 1 Stable in beverages and other water- based, acidic environments Provides a unique hue, closing a

gap in the natural rainbow

© Sensient Technologies 2025 sensient.com Appendix* 26 *Amounts in thousands,

except percentages

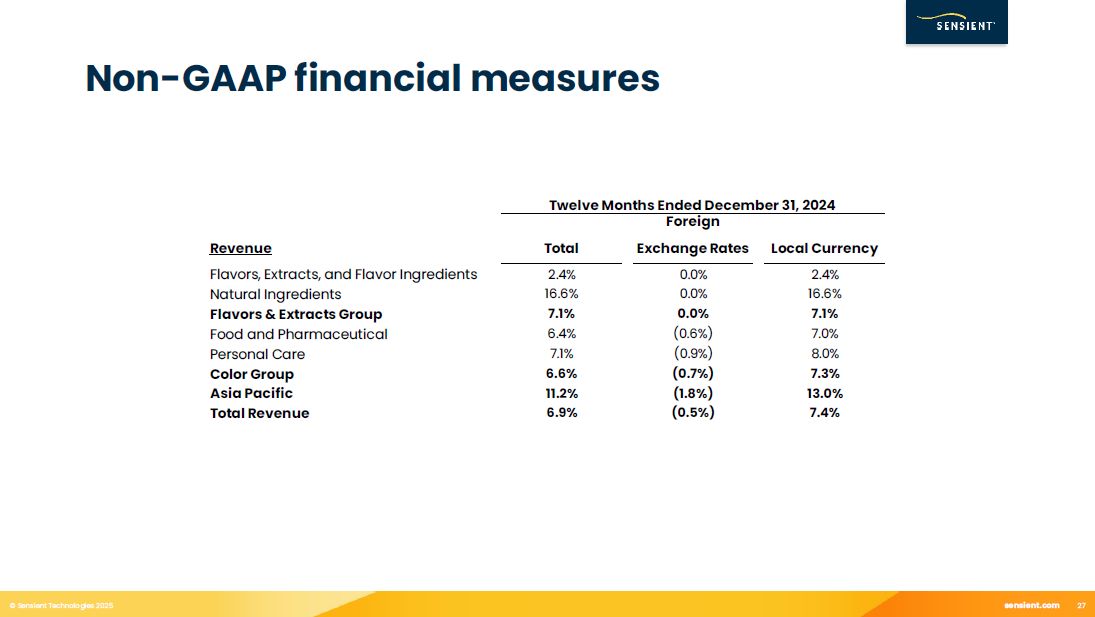

Non-GAAP financial measures sensient.com 28 © Sensient Technologies

2025 Revenue Total Exchange Rates Local Currency Flavors, Extracts, and Flavor Ingredients 2.4% 0.0% 2.4% Natural Ingredients 16.6% 0.0% 16.6% Flavors & Extracts Group 7.1% 0.0% 7.1% Food and

Pharmaceutical 6.4% (0.6%) 7.0% Personal Care 7.1% (0.9%) 8.0% Color Group 6.6% (0.7%) 7.3% Asia Pacific 11.2% (1.8%) 13.0% Total Revenue 6.9% (0.5%) 7.4% Twelve Months Ended December 31, 2024 Foreign

Non-GAAP financial measures (cont’d) sensient.com 28 © Sensient Technologies

2025 Flavors & Extracts Group 2024 2023 Operating Income (GAAP) $ 97,094 $ 87,773 Depreciation and amortization 30,437 29,400 Adjusted EBITDA $ 127,531 $ 117,173 Segment Revenue $ 793,698 $ 741,072 Operating

Income Margin (GAAP) 12.2% 11.8% Adjusted EBITDA Margin 16.1% 15.8% Twelve Months Ended December 31,

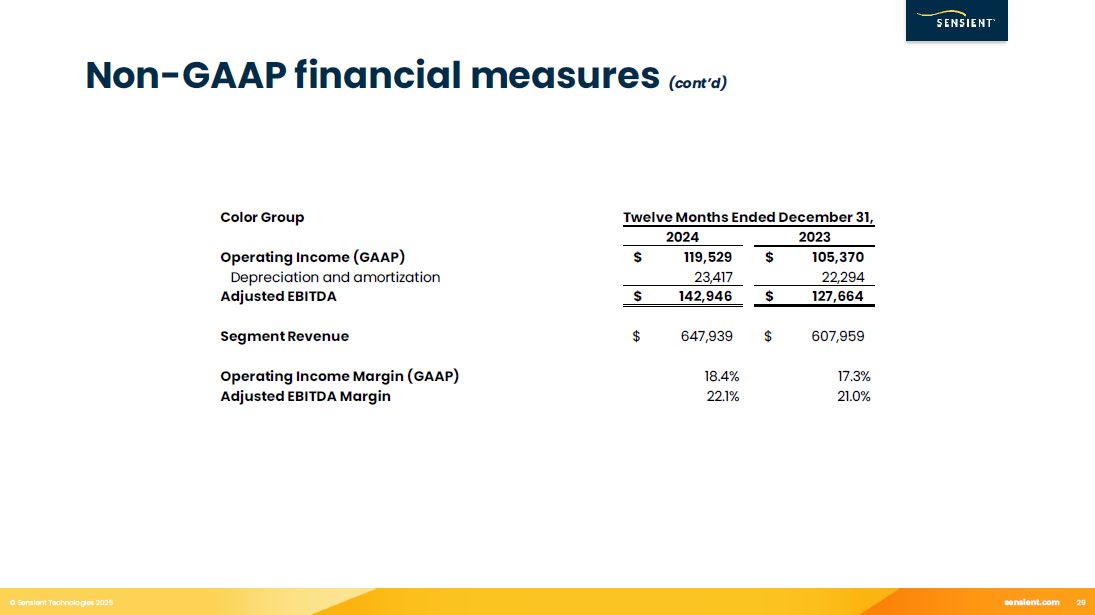

Non-GAAP financial measures (cont’d) sensient.com 28 © Sensient Technologies

2025 Color Group 2024 2023 Operating Income (GAAP) $ 119,529 $ 105,370 Depreciation and amortization 23,417 22,294 Adjusted EBITDA $ 142,946 $ 127,664 Segment Revenue $ 647,939 $ 607,959 Operating Income Margin

(GAAP) 18.4% 17.3% Adjusted EBITDA Margin 22.1% 21.0% Twelve Months Ended December 31,

Non-GAAP financial measures (cont’d) sensient.com 28 © Sensient Technologies

2025 Asia Pacific Group 2024 2023 Operating Income (GAAP) $ 34,458 $ 30,800 Depreciation and amortization 2,472 2,548 Adjusted EBITDA $ 36,930 $ 33,348 Segment Revenue $ 162,525 $ 146,090 Operating Income Margin

(GAAP) 21.2% 21.1% Adjusted EBITDA Margin 22.7% 22.8% Twelve Months Ended December 31,

© Sensient Technologies 2025 sensient.com Thank you Phone: +1

414-347-3827 Email: investor.relations@sensient.com sensient.com CONTACT INFORMATION