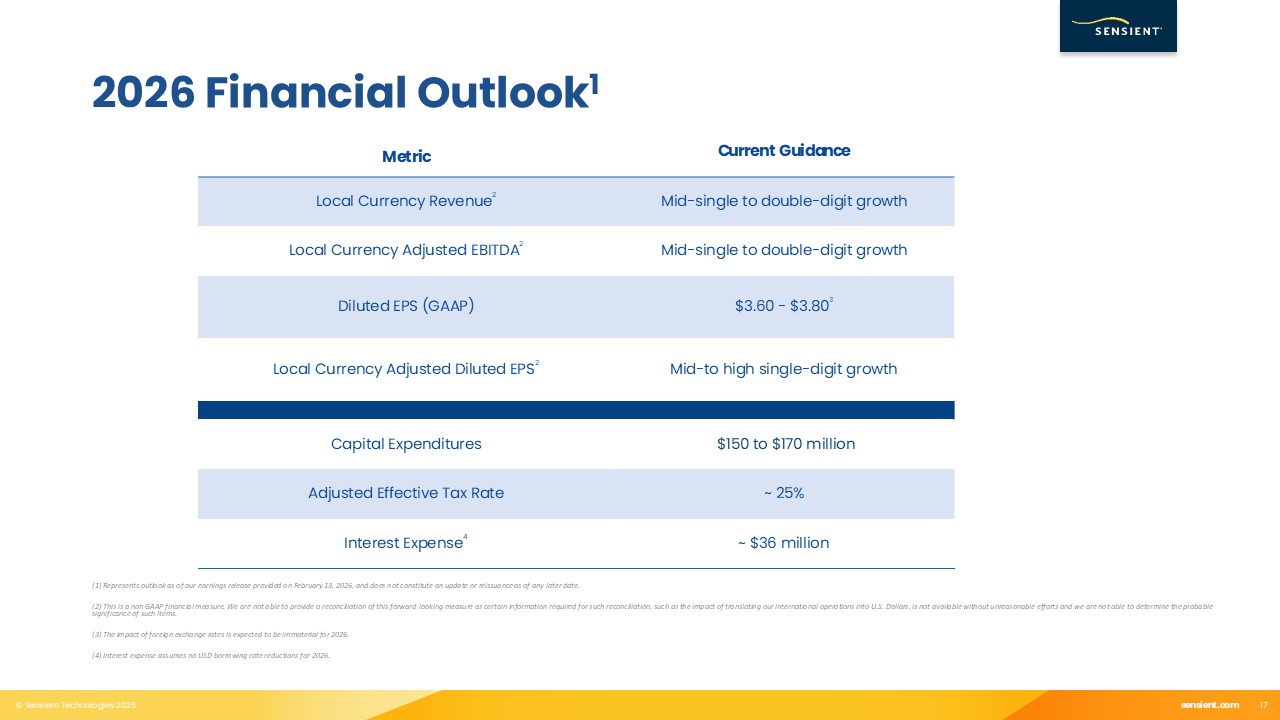

3 Forward Looking Statements This presentation contains statements that may

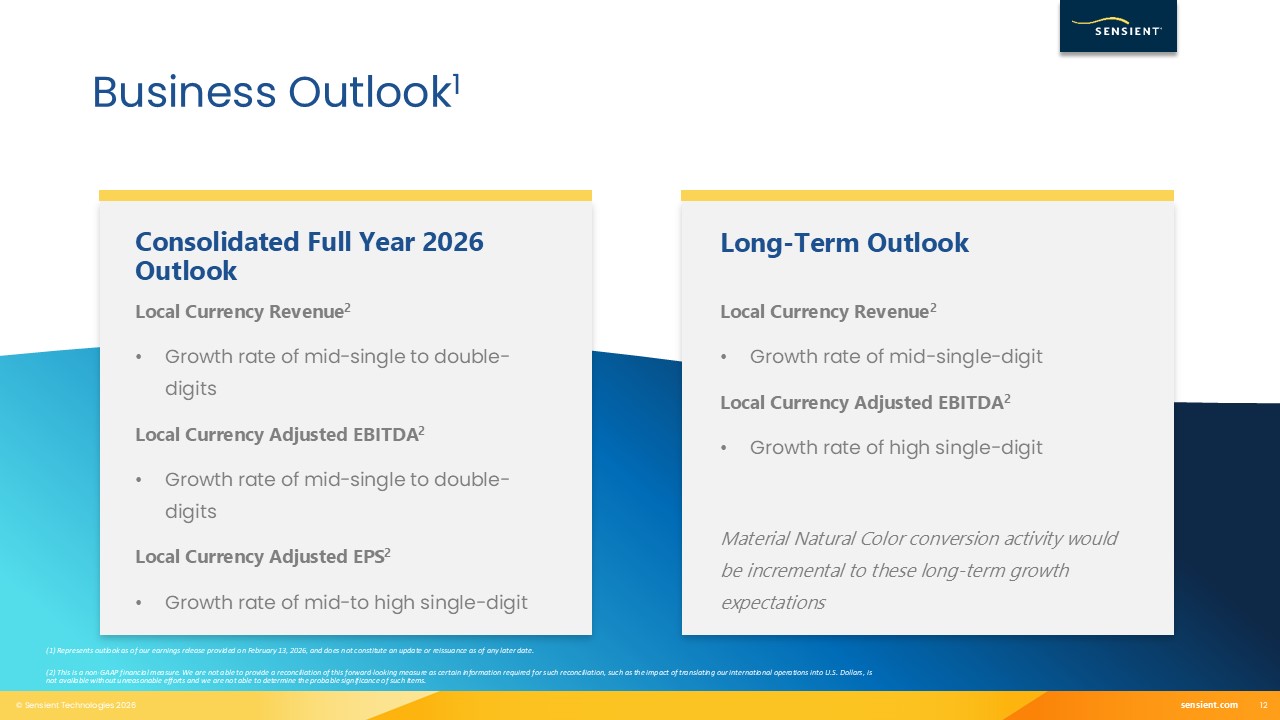

constitute “forward-looking statements” within the meaning of Federal securities laws including under “2026 Financial Outlook”, “Long-Term Outlook”, and “Consolidated Full Year 2026 Outlook”. Such forward-looking statements are not guarantees of

future performance and involve known and unknown risks, uncertainties, and other factors concerning the Company’s operations and business environment. Important factors that could cause actual results to differ materially from those suggested by

these forward-looking statements and that could adversely affect the Company’s future financial performance include the following: the Company’s ability to manage general business, economic, and capital market conditions, including actions taken

by customers in response to such market conditions, and the impact of recessions and economic downturns; the impact of macroeconomic and geopolitical volatility, including inflation and shortages impacting the availability and cost of raw

materials, energy, and other supplies, disruptions and delays in the Company’s supply chain, and the conflicts between Russia and Ukraine and in the Middle East; industry, regulatory, legal, and economic factors related to the Company’s domestic

and international business; the effects of tariffs, trade barriers, and disputes; the availability and cost of labor, logistics, and transportation; the pace and nature of new product introductions by the Company and the Company’s customers; the

Company’s ability to anticipate and respond to changing consumer preferences, changing technologies, and changing regulations; the Company’s ability to successfully implement its growth strategies; the outcome of the Company’s various

productivity-improvement and cost-reduction efforts, acquisition and divestiture activities, and Portfolio Optimization Plan; growth in markets for products in which the Company competes; industry and customer acceptance of price increases;

actions by competitors; the Company’s ability to enhance its innovation efforts and drive cost efficiencies; currency exchange rate fluctuations; and other factors included in “Risk Factors” in the Company's Annual Report on Form 10-K for the

year ended December 31, 2025, and in other documents that the Company files with the SEC. The risks and uncertainties identified above are not the only risks the Company faces. Additional risks and uncertainties not presently known to the Company

or that it currently believes to be immaterial also may adversely affect the Company. Should any known or unknown risks and uncertainties develop into actual events, these developments could have material adverse effects on our business,

financial condition, and results of operations. This presentation contains time-sensitive information that reflects management’s best analysis only as of the date of this presentation. Except to the extent required by applicable laws, the Company

does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied herein will not be realized.