UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | ☒ |

| Filed by a party other than the Registrant | ☐ |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11. |

May 5, 2025

Dear fellow stockholders,

As we turn the page on 2024 and look ahead to the future, I want to begin by thanking you for your continued support and trust. Each year, I am reminded of just how important our shareholder community is to the success and evolution of Innovative Food Holdings, Inc. (“IVFH”). Thank you for your continued support and confidence during this year of significant transformation and growth.

2024 was a pivotal year. We moved beyond stabilization and into strategic execution, accelerating our progress across multiple fronts. When I joined IVFH, we laid out a clear roadmap to long-term value creation. That roadmap remains our north star:

| 1. | Phase 1: Stabilization – Restructure the business, strengthen the balance sheet, and improve gross margins. |

| 2. | Phase 2: Lay the Foundation for Growth – Optimize operations, focus the business, and execute strategic acquisitions. |

| 3. | Phase 3: Build and Scale – Expand markets, scale revenue, and activate a profitable flywheel. |

I’m proud to share that Phase 1 is now complete, and Phase 2 is well underway. The business is healthier, more focused, and more dynamic than it has been in years.

Executing on Strategy

Our 2024 achievements speak for themselves:

| ● | We divested all non-core operations, including igourmet.com and Mouth.com, eliminating distractions and financial drag. |

| ● | We improved our financial flexibility by selling our Florida headquarters and rightsizing our cost structure. |

| ● | We focused entirely on our core foodservice distribution business, which delivered organic revenue growth (excluding the impact of divestitures and acquisitions) of 44.3% in Q4 2024, most of which was driven by the new retail business we launched this year. |

| ● | We completed our first two acquisitions, the first in five years—Golden Organics and LoCo Foods—that are both profitable and synergistic. |

| ● | We launched a national retail distribution partnership, creating a new revenue stream with immediate and material scale. |

Despite a year of structural change, we grew revenue to $72.1 million—up 2.5% year-over-year. GAAP net income improved by $6.2 million to $2.5 million. These gains are especially meaningful given our continued investment in growth-related expenses in our new retail platform and integration costs from our recent acquisitions.

Disciplined, Synergistic M&A

We continue to evaluate acquisitions through four key lenses:

| 1. | Immediately accretive profitability |

| 2. | Attractive valuation, before considering synergies |

| 3. | Strategic fit |

| 4. | Right-sized for integration |

1

Golden Organics and LoCo Foods were clear fits. Already, their integration has unlocked real value—lower logistics costs (down 60%), reduced driver hours (down 50%), and elimination of a $158,000 annual facility expense. There is significant work ahead as we focus on fully integrating the companies to our platform, and begin to prove their long-term flywheel effect, but the early progress demonstrates the speed at which we’re moving.

In 2025, our focus will remain squarely on integrating these acquisitions, building scalable systems, and strengthening the foundation. While we do not expect to pursue additional M&A this year, we are laying the groundwork for the next chapter in Phase 3.

Founder Mode: A Renewed Focus on Digital Channels

Our legacy drop ship business is an important part of our platform; however sales continued to decline year-over-year in 2024. To accelerate its rebound, I have taken direct ownership of the team and infused a renewed sense of urgency, with a focus on 1) accelerating catalog expansion through cutting-edge AI tools, 2) adding headcount in sales to deepen relationships at both the distributor and local market levels, and 3) integrating the catalogs from our new acquisitions to begin driving a flywheel effect. We are applying the same founder-like energy that helped this business succeed in its early days, and I am confident in the results to come.

Momentum Across the Portfolio

Beyond our core businesses, we are seeing strength in several additional channels:

| ● | Artisan Specialty Foods: sustained double-digit growth |

| ● | Airline catering: sustained double-digit growth |

| ● | Amazon: triple-digit revenue growth |

Each of these verticals plays a role in our diversified growth strategy, and each contributes to a less concentrated, more balanced and resilient business.

The Road Ahead

We ended 2024 with clear momentum. We strengthened our focus, delivered profitable growth, and built the early pieces of a scalable platform. And we did it while remaining disciplined and aligned to our long-term vision.

Looking forward, our priorities are clear:

| ● | Drive profitable growth across foodservice and retail |

| ● | Successfully integrate Golden Organics and LoCo Foods |

| ● | Continue scaling operational excellence and technology enablement |

| ● | Position the company for Phase 3 acceleration |

We are building a stronger, more durable IVFH. Our long-term ambition—a $1 billion revenue company—is bold, but our roadmap is grounded in real progress.

As part of this road ahead, three of our long-time board members are stepping down: Sam Klepfish, Hank Cohn, and Jefferson Gramm. We are incredibly grateful for their tremendous contributions to the company. Accordingly, we are shrinking the size of the board from eight members to five, with each of our remaining directors standing for re-election. I have full confidence in our remaining board members, who are all stockholders themselves, and who bring diverse expertise and a shared commitment to driving our company forward over the long term.

Finally, I want to thank our employees, customers, board members, and you—our stockholders. We are grateful for your trust and excited about what we can achieve together.

With deep appreciation and confidence in the future,

| /s/ Robert W. (Bill) Bennett | |

| Robert W. (Bill) Bennett | |

| Chief Executive Officer | |

| Innovative Food Holdings, Inc. |

2

May 5, 2025

To the stockholders of IVFH,

Revenue grew to $72.1 million (+2.5%) and Adjusted Net Income $2.1 million (+61.2%) in fiscal 2024. Sadly, share count also grew from 49.7 million shares to 53.2 million shares by the end of the year. Not incredibly bad, but also not flat or declining. Debt was well managed, decreasing to $8.9 million and continued to be backed by our property in Pennsylvania.

Overall, I view the year as satisfactory on a financial basis over the prior year, but we need to start making progress more aggressively on our growth. I repeat one line from last year’s Chairman letter: “I don’t expect every year to have growth in cash flow per share. I want to be clear. I am perfectly fine with that number going down in any one year (as I am sure it will), if we are investing for growth in future years.”

It’s incredibly important that stockholders understand - we are willing to invest “above the line” expenses in one year, to grow the top line in future years. Said a different way: lackluster operating income growth should result in higher revenue growth; if we are in the right business and growing it correctly. That’s what you should see from us.

Acquisitions

Acquisitions can be fraught with danger. We completed two in Q4 that we feel have expense synergies that were easily recognizable and revenue synergies that we can get to.

Over multiple years, I would expect this part of our business (acquisitions) to be moderately predictable (how often we buy), but over any one year, it’s a crap shoot.

If the opportunities don’t come, we won’t push it.

Organic Growth

Bill and his team latched onto a large growth opportunity in Q4, and have been striving to find others. This opportunity is a great example of invest a little up front in “above the line” expenses, and get a lot later (and more opportunities even later than that).

The retail partner that we are working with is in a space that is also tangential to our Digital Channels and Local Distribution business, which means we hope for cross pollination. This cross pollination will eventually be our secret sauce, but for now, it’s a work in progress.

Cost of Capital

We will continue to be dubious of debt. The debt we have today was used for a real estate purchase prior to this Board’s institution. While we are comfortable with it, in a perfect world, we would be debt free. It would not be a surprise to me to find us without debt at some point in the coming years.

Equity cost of capital is an illusive figure. Only to those that have a good sense of a business’s future, should have a good sense of the equity cost capital. It’s not an equation like WACC or CAPM (Weighted Average Cost of Capital or Capital Asset Pricing Model).

The equity cost of capital has more to do with what you believe your growth in value per share will be over the coming years vs. the price today. One person’s view of the future may be significantly different than others. It is incredibly personal and has to do with their collective experiences in life and business (not to mention, their own confidence in the future of the business).

3

Two people with equal experiences in the business shouldn’t be that far apart. We are always assessing our own equity cost of capital vs our growth trajectory.

Food Distribution Gyrations and Our Segments

The food distribution business is going through its typical gyrations (albeit, smaller gyrations than most industries). I wouldn’t expect much to change dramatically over the next 12 or 24 months, but over say 5 to 10 years, there can be a shift.

In our case, specifically in our Digital Channels business, we have a good business that needs adjustments and if we can get them right, the upside is significant in both revenue and cash flow.

Once we can conquer Digital Channels, it seems we will be in an enviable position of having three similar but separate business that can feed off each other; digital, national and local.

In our annual report on Form 10-K for 2024, you can see our revenue contribution from each segment broken out:

| Year Ended | ||||||||

| December 31, | ||||||||

| 2024 | 2023 | |||||||

| Digital Channels | $ | 37,861,972 | $ | 39,403,270 | ||||

| National Distribution | 17,984,274 | 10,742,556 | ||||||

| Local Distribution | 12,089,900 | 9,929,068 | ||||||

| Direct-to-Consumer | 3,097,994 | 9,160,288 | ||||||

| Other Services | 1,100,236 | 1,153,780 | ||||||

| Total | $ | 72,134,376 | $ | 70,388,962 | ||||

Even sitting here in May, it’s hard to say which segment will have more growth, but it’s certain that we are trying on all. 2025 into 2026 will determine which we lean into – and that’s what I look forward to speaking to you most about in 2026.

Scale and Profitability

Every move we make is to build our scale and profitability at the same time. Eventually, you have to show good profit on every dollar of sales, and eventually good ROI on the entire company. This is our goal.

Annual Meeting

Last year we had a solid group of stockholders and a solid group of questions. We hope for the same this year.

Sincerely,

| /s/ James Pappas | |

| James Pappas | |

| Chairman of the Board |

4

INNOVATIVE FOOD HOLDINGS, INC.

2528 S 27th AVE

BROADVIEW, IL 60155

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 28, 2025

We are pleased to invite you to attend the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Innovative Food Holdings, Inc. (the “Company,” “we,” “us” or “our”) to be held at 114 West 40th Street, New York, NY 10018 on Wednesday, May 28, 2025 at 10:00 a.m. Eastern Time.

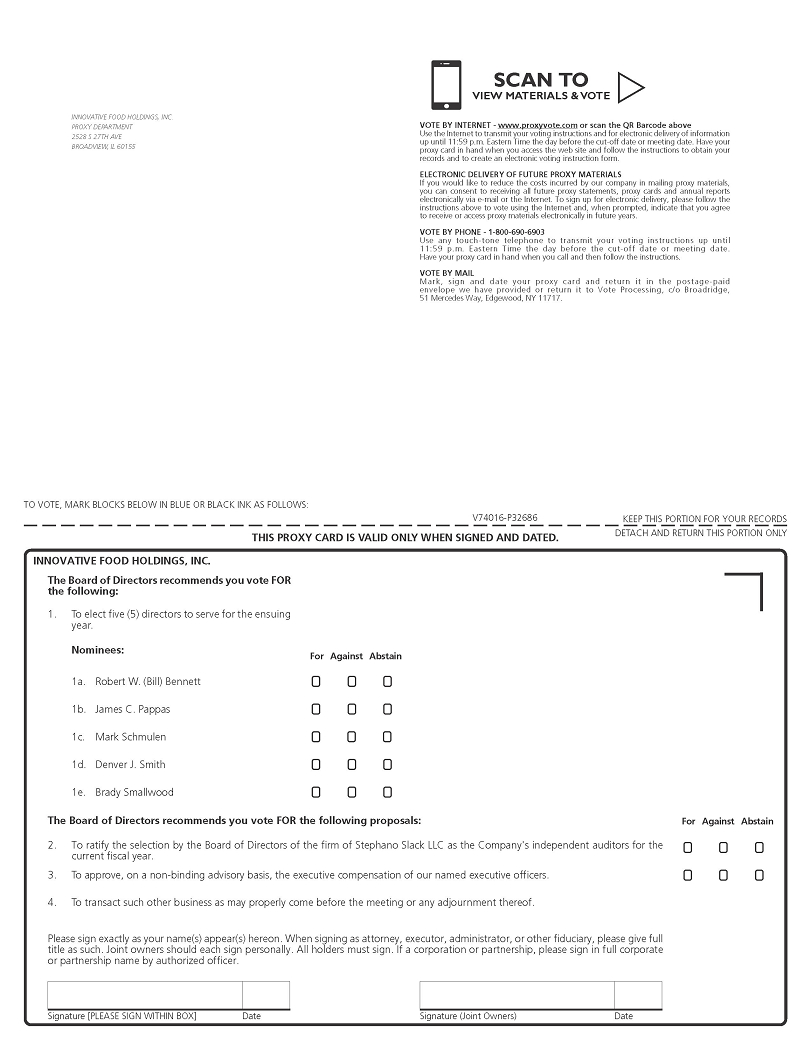

The purpose of the Annual Meeting is to consider and act upon the following four (4) proposals (the “Proposals”):

| (1) | To elect five (5) directors to serve for the ensuing year, | |

| (2) | To ratify the selection by the Board of Directors of the firm of Stephano Slack LLC as the Company’s independent auditors for the current fiscal year, | |

| (3) | To conduct an advisory vote on executive compensation, and | |

| (4) | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Stockholders of record as of the close of business on May 1, 2025 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

After careful consideration, our Board of Directors has approved each of the Proposals and has determined that each Proposal is advisable, fair and in the best interests of the Company and its stockholders. Accordingly, our Board of Directors recommends that stockholders vote “FOR” the approval of each of the director nominees in Proposal 1, and vote “FOR” each of Proposal 2 and Proposal 3.

For the ten days prior to the Annual Meeting, a list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder of record for purposes germane to the Annual Meeting. You may make a request by calling our corporate headquarters at (239) 596-0204 during regular business hours. If we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request.

Details regarding admission to the Annual Meeting and the business to be conducted at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

More information about the Company and the Proposals to be voted on at the Annual Meeting are contained in the accompanying proxy statement. The Company urges you to read the accompanying proxy statement carefully and in its entirety.

By Order of the Board of Directors,

| /s/ Robert W. (Bill) Bennett | |

| Robert W. (Bill) Bennett | |

| Broadview, Illinois | |

| May 5, 2025 |

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. IF YOU HAVE TELEPHONE OR INTERNET ACCESS, YOU MAY SUBMIT YOUR PROXY CARD BY FOLLOWING THE INSTRUCTIONS PROVIDED IN THIS PROXY STATEMENT AND ON THE ENCLOSED PROXY CARD. YOU MAY REVOKE THE PROXY AT ANY TIME BEFORE THE AUTHORITY GRANTED THEREIN IS EXERCISED.

5

INNOVATIVE FOOD HOLDINGS, INC.

2528 S 27th AVE

BROADVIEW, IL 60155

PROXY STATEMENT FOR THE 2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 28, 2025

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Innovative Food Holdings, Inc. (the “Company”) for use at the 2025 Annual Meeting of Stockholders to be held on May 28, 2025 at 114 West 40th Street, New York, NY 10018, and at any adjournment of that meeting (the “Annual Meeting”). Throughout this Proxy Statement, “we,” “us” and “our” are used to refer to the Company.

Voting Securities and Votes Required

At the close of business on May 1, 2025, the record date for the determination of stockholders entitled to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 54,284,896 shares of our common stock, par value $0.0001 per share. All holders of our common stock are entitled to one vote per share.

A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy at the Annual Meeting will constitute a quorum at the meeting for all matters to be voted on by the holders of our common stock. All shares of our common stock represented in person or by proxy (including shares which abstain or do not vote for any reason with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the number of shares present and entitled to vote with respect to any particular matter but will not be counted as a vote in favor of such matter.

Proposal No. 1 (Election of Directors) - With respect to the election of directors, the affirmative vote of the holders of a majority of the shares of stock having voting power present in person or represented by proxy at the Annual Meeting is required for election of directors.

Proposal No. 2 (Ratification of Auditors) - With respect to the approval of the auditors, the affirmative vote of the holders of a majority of the shares of stock having voting power present in person or represented by proxy at the meeting is required for approval.

Proposal No. 3 (Say-on-Pay) - With respect to the approval of our executive compensation, while our Board and its Compensation Committee (the “Compensation Committee”) will carefully consider the outcome of the vote expressed by our stockholders when making future executive compensation decisions, the vote will not be binding upon them. The Company will deem the affirmative vote of the holders of a majority of the shares of stock having voting power present in person or represented by proxy at the Annual Meeting to be approved.

Abstentions and Broker Non-Votes

Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the number of shares present and entitled to vote with respect to any particular matter but will not be counted as a vote in favor of such matter. Accordingly, an abstention from voting will have the effect of a vote against a proposal.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Each of Proposal No. 1 (Election of Directors) and Proposal No. 3 (Say-on-Pay) are a “non-routine” matter. A “broker non-vote” will have no effect on the vote on the above mentioned proposals. Proposal No. 2 (Ratification of Auditors) is a “routine” matter on which your broker can exercise voting discretion.

6

Meeting Protocols

How to Vote

If you are a stockholder of the Company and your shares of our common stock are registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record, and the proxy materials and proxy card are being sent directly to you by the Company. If you are a stockholder of record of the Company, you may attend the Annual Meeting and vote your shares in person, rather than signing and returning your proxy. Similarly, if your shares of our common stock are held by a bank, broker or other nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials are being forwarded to you, together with a voting instruction card, by such bank, broker or other nominee. As the beneficial owner, you are also invited to attend the Annual Meeting and you may vote these shares in person at the Annual Meeting.

If on the record date you are a stockholder with shares registered in your name with the Company’s transfer agent, Computershare Trust Company, N.A., or if you are a beneficial owner of shares of the Company’ common stock, you may vote in person at the Annual Meeting or vote by proxy, by telephone, by internet or by mail. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

● In Person. If you are a stockholder of record, you may vote in person at the Meeting. The Company will give you a ballot when you arrive. If you are a beneficial owner of shares of Common Stock held in street name and you wish to vote in person at the Meeting, you must obtain a legal proxy from the brokerage firm, bank, broker-dealer or other similar organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy.

● Via the Internet. To vote via the Internet without attending the Annual Meeting, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Proxy Card. Your Internet vote must be received by 11:59 p.m., Eastern Time on May 27, 2025 to be counted.

● Via Telephone. To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on May 27, 2025 to be counted.

● By Mail. You may submit your proxy by mail by completing and signing the enclosed proxy card and mailing it in the enclosed envelope. Provided your proxy card is received prior to the Annual Meeting your shares will be voted as you have instructed.

We provide Internet proxy voting to allow you to vote your shares online via proxy prior to the Annual Meeting with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. Since Proposal No. 1 (Election of Directors) and Proposal No. 3 (Say-on-Pay) are each considered “non-routine” matters, your broker will not be able to vote your shares of our common stock without specific instructions from you. Proposal 2 (Ratification of Auditors) is a “routine” matter on which your broker can exercise voting discretion.

If you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or other agent.

Any stockholder of record voting by proxy has the right to revoke his, her or its proxy at any time before the polls close at the Annual Meeting by sending a written notice stating that he, she or it would like to revoke his, her or its proxy to the corporate secretary of the Company, by providing a duly executed proxy card bearing a later date than the proxy being revoked, or by voting in person. Attendance alone at the Annual Meeting will not revoke a proxy. If a stockholder of the Company has instructed a broker to vote his, her or its shares of our common stock that are held in “street name,” the stockholder must follow directions received from his, her or its broker to change those instructions.

7

General Information

In voting by proxy, you may vote in favor of or against the proposals, or you may abstain from voting on the proposals. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the approval of each of the director nominees in Proposal 1, “FOR” each of Proposal 2 and Proposal 3. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

There are no statutory or contractual rights of appraisal or similar remedies available to those stockholders who dissent from any matter to be acted on at the Annual Meeting.

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

A proxy may be revoked by the stockholder at any time before it is exercised by delivery of written revocation or a subsequently dated proxy to our corporate secretary or by voting in-person during the Annual Meeting.

We are complying with the U.S. Securities and Exchange Commission (the “SEC”) rules with respect to required information about the Company. As a result, accompanying this Proxy Statement is a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024. We are mailing these proxy materials on or about May 5, 2025.

For the ten days prior to the Annual Meeting, a list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder of record for purposes germane to the Annual Meeting. You may make a request by calling our corporate headquarters at (239) 596-0204 during regular business hours. If we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request. In addition, during the Annual Meeting, that list of stockholders will be available for examination by any stockholder in attendance.

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, which we will file with the SEC within four (4) business days after the meeting.

ELECTION OF DIRECTORS

(Proposal No. 1)

The persons named in the enclosed proxy will vote to elect as directors the five nominees named below, unless authority to vote for the election of any or all of the nominees is abstained by marking the proxy to that effect. All of the nominees have indicated their willingness to serve, if elected, but if any nominee should be unable to serve or for good cause will not serve, the proxies may be voted for a substitute nominee designated by management. Each director will be elected to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. There are no family relationships between or among any of our executive officers or directors.

Nominees

Set forth below for each nominee as director is the nominee’s name, age, and position with us, his principal occupation and business experience during at least the past five years and the date of the commencement of his term as a director.

| Name | Age | Position with the Company | Director Since | |||

| Robert W. (Bill) Bennett | 43 | Chief Executive Officer and Director | 2023 | |||

| Brady Smallwood | 40 | Chief Operating Officer and Director | 2023 | |||

| James C. Pappas | 43 | Chairman | 2020 | |||

| Mark Schmulen | 44 | Director | 2020 | |||

| Denver J. Smith | 37 | Director | 2023 |

8

Robert W. (Bill) Bennett, Chief Executive Officer and Director

Robert W. (Bill) Bennett has been a director and our CEO since February 28, 2023. Prior thereto, Mr. Bennett was most recently Vice President of eCommerce for The Kroger Co. from 2020 until 2023. In this role, he was responsible for the company’s $10 billion eCommerce business, leading cross-functional partners in marketing, merchandising, product management, supply chain, technology, and analytics to develop and lead a robust eCommerce go-to-market and growth strategy across the enterprise. Mr. Bennett joined Kroger from Walmart Stores, Inc. (“Walmart”) where he served for seven years, from 2013 to 2020, in a variety of eCommerce and store leadership roles, including finance, merchandising, strategy, analytics, and product management. Prior to Walmart, from 2011 to 2013, Mr. Bennett led the pricing strategy team at S.C. Johnson and served in a variety of leadership roles at General Mills from 2006 to 2011. Mr. Bennett received a bachelor’s degree in Business Management with an emphasis in Finance from Brigham Young University and an MBA from the Fuqua School of Business at Duke University.

Brady Smallwood, Chief Operating Officer and Director

Mr. Smallwood has been our Chief Operating Officer since May 15, 2023, and he has been a director since May 17, 2023. Prior to joining the Company, Mr. Smallwood was most recently Senior Director - eCommerce Strategy, Planning and Operations for The Kroger Company, the largest supermarket operator by revenue in the U.S., from 2020 until 2023. In this role, he launched a new, profitable rapid grocery delivery business, implemented new management systems, and directed strategy development, pilot execution, and scaling for dozens of innovative initiatives. Prior thereto, Mr. Smallwood was Director - Omni Merchandising Planning & Analytics at Walmart from 2019 to 2020, and he served as the head of eCommerce Insights and Analytics at Younique Products, an Online beauty and personal care products company which was a subsidiary of Coty, Inc., from 2017 to 2019. Prior to these positions. Mr. Smallwood held various managerial roles at Walmart, Yum! Brands (Pizza Hut U.S.), and he held analyst roles at American Capital, LLC and at The Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac. Mr. Smallwood received a bachelor’s degree in business management from Brigham Young University and an MBA from The University of Chicago Booth School of Business, where he was an honors graduate, and a Marketing scholarship recipient.

Mr. Smallwood was appointed as the director designee of Mr. Bennett, the CEO and a director of the Company, pursuant to the employment agreement, dated January 30, 2023, between the Company and Mr. Bennett (the “RWB Agreement”). Under the RWB Agreement, the Board or its Nominating and Corporate Governance Committee must nominate to the Board an individual designated by Mr. Bennett in good faith, subject to the Board’s fiduciary judgement and applicable legal or regulatory requirements and limitations. Under the terms of the RWB Agreement, as Mr. Bennett’s director designee, Mr. Smallwood may be removed or be asked to resign from his position on the Board in the event that Mr. Bennett’s employment with the Company is terminated.

James C. Pappas, Chairman

James C. Pappas has been a director since January 30, 2020. Mr. Pappas has served as the Managing Member of JCP Investment Management, LLC (“JCP Management”), an investment firm, and the sole member of JCP Investment Holdings, LLC (“JCP Holdings”), since June 2009. Mr. Pappas has also served as a director of Tandy Leather Factory, Inc. (NASDAQ: TLF), a retailer and wholesale distributor of a broad line of leather and related products, from 2016 to 2025. In addition, Mr. Pappas has served as an independent director of United Natural Foods, Inc. (NYSE: UNFI), a leading distributor of natural, organic, and specialty foods, since September 2023, and has served on the board of directors of Red Robin Gourmet Burgers, Inc. (NASDAQ: RRGB), a full-service restaurant chain, since December 2024. Mr. Pappas previously served as a director of each of Jamba, Inc. (formerly NASDAQ: JMBA), a leading health and wellness brand and the leading retailer of freshly squeezed juice, from January 2015 until the completion of its sale in September 2018, U.S. Geothermal Inc. (formerly NYSEMKT: HTM), a leading geothermal energy company, from September 2016 until the completion of its sale in April 2018, and The Pantry, Inc. (formerly NASDAQ: PTRY), a leading independently operated convenience store chain in the southeastern United States and one of the largest independently operated convenience store chains in the country, from March 2014 until the completion of its sale in March 2015. He also previously served as Chairman of the board of directors of Morgan’s Foods, Inc. (formerly OTC: MRFD), a then publicly traded company, from January 2013 until May 2014, when the company was acquired by Apex Restaurant Management, Inc., after originally joining its board as a director in February 2012. From 2005 until 2007, Mr. Pappas worked for The Goldman Sachs Group, Inc. (NYSE: GS) (“Goldman Sachs”), a multinational investment banking and securities firm, in its Investment Banking / Leveraged Finance Division. As part of the Goldman Sachs Leveraged Finance Group, Mr. Pappas advised private equity groups and corporations on appropriate leveraged buyout, recapitalization and refinancing alternatives. Prior to Goldman Sachs, Mr. Pappas worked at Bank of America Securities, the investment banking arm of Bank of America Corporation (NYSE: BAC), a multinational banking and financial services corporation, where he focused on Consumer and Retail Investment Banking, providing advice on a wide range of transactions including mergers and acquisitions, financings, restructurings and buy-side engagements. Mr. Pappas received a BBA and a Masters in Finance from Texas A&M University.

9

Mark Schmulen, Director

Mark Schmulen has been a director since January 30, 2020. Mr. Schmulen is a co-founder of PropMatic, a venture-backed software-as-a-service company serving the real estate market and currently serves as the Company’s CEO and President. He also serves as a Director of CaterX, a software-as-a-service company serving the Food Services industry. Mr. Schmulen has been the managing director of Jelly Capital, LLC, a private investment fund focused on early-stage technology and real estate investments, since May 2015, and has been an investment advisor representative for Forum Financial, LP, an independent investment advisor, since November 2016. Previously, Mr. Schmulen was co-founder and CEO of Chirp Systems, Inc., a venture-backed smart access solution for multifamily property owners that was acquired by RealPage, Inc in 2020. At RealPage, Mr. Schmulen served as a Vice President and General Manager for the Company’s Smart Building business unit until June 2024. Additionally, Mr. Schmulen served as the General Manager of Social Media for Constant Contact, Inc., a provider of digital marketing solutions, from May 2010 until May 2014. Prior to this, he was a co-founder and CEO of Nutshell Mail, Inc., a social media marketing solution, from 2008 until it was acquired by Constant Contact, Inc. in 2010. Mr. Schmulen began his career as an investment banking analyst with JPMorgan Chase Bank. He has served on the board of directors for the Shlenker School since August 2017 and has been a Director of the HHF Foundation, which benefits early childhood education since December 2014. Mr. Schmulen holds a B.S. from the University of Pennsylvania and an M.S. in Management from Stanford’s Graduate School of Business.

Denver Smith, Director

Denver Smith has been a director since March 13, 2023. Mr. Smith is the Chief Investment Officer and Managing Member of Carlson Ridge Capital (“Carlson Ridge”), a hedge fund manager, which was founded in 2015. Additionally, Mr. Smith advises the Aspen Family Trust on its asset allocation and strategic level decisions for various entities it owns. He was previously a portfolio manager and the Chief Investment Officer for 73114 Investments, LLC, for a period of 9 years. In 2015, he prompted and helped negotiate the sale of 73114 Investments’ parent company, a government contracting company, to a multi-billion dollar publicly traded REIT for over $150 million. Mr. Smith serves on the board of trustees of Lifestyle Management Inc, a non-profit organization. He graduated from the University of Oklahoma with a BBA in Finance and Economics. He also earned an MBA from the University of Oklahoma. Mr. Smith is a CFA Charterholder.

Qualifications for All Directors

In considering potential candidates for election to the Board, the Nominating and Corporate Governance Committee observes the following guidelines, among other considerations: (i) the Board must include a majority of independent directors; (ii) each candidate shall be selected without discrimination against age, sex, race, religion or national origin; (iii) each candidate should have the highest level of personal and professional ethics and integrity and have the ability to work well with others; (iv) each candidate should only be involved in activities or interests that do not conflict or interfere with the proper performance of the responsibilities of a director; (v) each candidate should possess substantial and significant experience that would be of particular importance to the Company in the performance of the duties of a director; and (vi) each candidate should have sufficient time available, and a willingness to devote the necessary time, to the affairs of the Company in order to carry out the responsibilities of a director, including, without limitation, consistent attendance at board and committee meetings and advance review of board and committee materials. The Chief Executive Officer will then interview such candidate. The Nominating and Corporate Governance Committee then determines whether to recommend to the Board that a candidate be nominated for approval by the Company’s stockholders. The manner in which the Nominating and Corporate Governance Committee evaluates a potential candidate does not differ based on whether the candidate is recommended by a stockholder of the Company. With respect to nominating existing directors, the Nominating and Corporate Governance Committee reviews relevant information available to it, including the most recent individual director evaluations for such candidates, the number of meetings attended, his or her level of participation, biographical information, professional qualifications and overall contributions to the Company.

The Board has identified the following qualifications, attributes, experience and skills that are important to be represented on the Board as a whole: (i) management, leadership and strategic vision; (ii) financial expertise; (iii) marketing and consumer experience; and (iv) capital management.

We believe that all of our directors are qualified for their positions, and that each brings a benefit to the Board. Mr. Bennett, as an executive officer, is uniquely qualified to bring management’s perspective to the Board’s deliberations. Mr. Smallwood, with his experience with The Kroger Company and Walmart, and Mr. Schmulen, with his private equity experience bring a well-rounded background and wealth of general business experience to our Board. Mr. Pappas brings both his investment and corporate finance background and food industry experience to the Board. Mr. Smith brings extensive experience in business strategy and capital markets.

10

The Board has determined that three of the five directors who serve on the Board as of the date of this Proxy Statement and who are standing for nomination (Messrs. Pappas, Schmulen, and Smith) are “independent,” as defined under the rules of The Nasdaq Stock Market LLC (“Nasdaq”) (although the Company is not subject to such standards). Messrs. Bennett and Smallwood, by virtue of being an officer of the Company, are not independent. Messrs. Bennett and Smallwood do not participate in board discussions concerning their compensation. In making the determination of independence, the Board or the Nominating and Corporate Governance Committee, as applicable, considered all relevant facts and circumstances (including, without limitation, commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships) to ascertain whether any such person had a relationship that, in its opinion, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Management recommends that stockholders vote for the election of each of the above-mentioned nominees under this Proposal 1.

GOVERNANCE OF THE COMPANY

Directors and Executive Officers

The following table sets forth information concerning our executive officers and directors and their ages as of the date of this Proxy Statement:

| Name | Age | Position with the Company | Director Since | |||

| Robert W. (Bill) Bennett | 43 | Chief Executive Officer and Director | 2023 | |||

| Brady Smallwood | 40 | Chief Operating Officer and Director | 2023 | |||

| Sam Klepfish | 49 | Director | 2005 | |||

| Hank Cohn | 54 | Director | 2010 | |||

| James C. Pappas | 43 | Chairman | 2020 | |||

| Mark Schmulen | 44 | Director | 2020 | |||

| Denver J. Smith | 37 | Director | 2023 | |||

| Jefferson Gramm | 49 | Director | 2021 | |||

| Gary Schubert | 47 | Chief Financial Officer | - |

Robert W. (Bill) Bennett, Chief Executive Officer and Director

Robert W. (Bill) Bennett has been a director and our CEO since February 28, 2023. Prior thereto, Mr. Bennett was most recently Vice President of eCommerce for The Kroger Co. from 2020 until 2023. In this role, he was responsible for the company’s $10 billion eCommerce business, leading cross-functional partners in marketing, merchandising, product management, supply chain, technology, and analytics to develop and lead a robust eCommerce go-to-market and growth strategy across the enterprise. Mr. Bennett joined Kroger from Walmart where he served for seven years, from 2013 to 2020, in a variety of eCommerce and store leadership roles, including finance, merchandising, strategy, analytics, and product management. Prior to Walmart, from 2011 to 2013, Mr. Bennett led the pricing strategy team at S.C. Johnson and served in a variety of leadership roles at General Mills from 2006 to 2011. Mr. Bennett received a bachelor’s degree in Business Management with an emphasis in Finance from Brigham Young University and an MBA from the Fuqua School of Business at Duke University.

Brady Smallwood, Chief Operating Officer and Director

Mr. Smallwood has been our Chief Operating Officer since May 15, 2023, and he has been a director since May 17, 2023. Prior to joining the Company, Mr. Smallwood was most recently Senior Director - eCommerce Strategy, Planning and Operations for The Kroger Company, the largest supermarket operator by revenue in the U.S., from 2020 until 2023. In this role, he launched a new, profitable rapid grocery delivery business, implemented new management systems, and directed strategy development, pilot execution, and scaling for dozens of innovative initiatives. Prior thereto, Mr. Smallwood was Director - Omni Merchandising Planning & Analytics at Walmart from 2019 to 2020, and he served as the head of eCommerce Insights and Analytics at Younique Products, an Online beauty and personal care products company which was a subsidiary of Coty, Inc., from 2017 to 2019. Prior to these positions. Mr. Smallwood held various managerial roles at Walmart, Yum! Brands (Pizza Hut U.S.), and he held analyst roles at American Capital, LLC and at The Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac. Mr. Smallwood received a bachelor’s degree in business management from Brigham Young University and an MBA from The University of Chicago Booth School of Business, where he was an honors graduate, and a Marketing scholarship recipient.

11

Mr. Smallwood was appointed as the director designee of Mr. Bennett, the CEO and a director of the Company, pursuant to the RWB Agreement. Under the RWB Agreement, the Board or its Nominating and Corporate Governance Committee must nominate to the Board an individual designated by Mr. Bennett in good faith, subject to the Board’s fiduciary judgement and applicable legal or regulatory requirements and limitations. Under the terms of the RWB Agreement, as Mr. Bennett’s director designee, Mr. Smallwood may be removed or be asked to resign from his position on the Board in the event that Mr. Bennett’s employment with the Company is terminated.

Sam Klepfish, Director

Mr. Klepfish has been a director since December 1, 2005. From November 2007 to February 28, 2023 Mr. Klepfish was the CEO of Innovative Food Holdings and its subsidiaries. From March 2006 to November 2007 Mr. Klepfish was the interim president of the Company and its subsidiary. Since February 2005 Mr. Klepfish was also a Managing Partner at ISG Capital, a merchant bank. From May 2004 through February 2005 Mr. Klepfish served as a Managing Director of Technoprises, Ltd. From January 2001 to May 2004 he was a corporate finance analyst and consultant at Phillips Nizer, a New York law firm. Since January 2001 Mr. Klepfish has been a member of the steering committee of Tri-State Ventures, a New York investment group. From 1998 to December 2000, Mr. Klepfish was an asset manager for several investors in small-cap entities.

Hank Cohn, Director

Mr. Cohn has been a director since October 29, 2010. Hank Cohn is currently CEO of P1 Billing, LLC, a revenue cycle management services provider to ambulatory medical clinics. P1 Billing is a spinoff of PracticeOne Inc., (formerly PracticeXpert, Inc., an OTCBB traded company), an integrated PMS and EMR software and services company for physicians. Mr. Cohn served as President and Chief Executive Officer of PracticeOne from December 2009 until December 2009, at which time he sold the company to Francison Partners, one of the largest, global technology focused, private equity firms in Silicon Valley. Prior to that, Mr. Cohn worked with a number of public companies. A partial list of his past and present board memberships include: Analytical Surveys, Inc., Kaching, Inc., and International Food and Wine, Inc., currently Evolution Resources Inc. Mr. Cohn also served as the executive vice president of Galaxy Ventures, LLC a closely-held investment fund concentrating in the areas of bond trading and early stage technology investments, where he acted as portfolio manager for investments.

James C. Pappas, Chairman

James C. Pappas has been a director since January 30, 2020. Mr. Pappas has served as the Managing Member of JCP Management, an investment firm, and the sole member of JCP Holdings, since June 2009. Mr. Pappas has also served as a director of Tandy Leather Factory, Inc. (NASDAQ: TLF), a retailer and wholesale distributor of a broad line of leather and related products, from 2016 to 2025. In addition, Mr. Pappas has served as an independent director of United Natural Foods, Inc. (NYSE: UNFI), a leading distributor of natural, organic, and specialty foods, since September 2023, and has served on the board of directors of Red Robin Gourmet Burgers, Inc. (NASDAQ: RRGB), a full-service restaurant chain, since December 2024. Mr. Pappas previously served as a director of each of Jamba, Inc. (formerly NASDAQ: JMBA), a leading health and wellness brand and the leading retailer of freshly squeezed juice, from January 2015 until the completion of its sale in September 2018, U.S. Geothermal Inc. (formerly NYSEMKT: HTM), a leading geothermal energy company, from September 2016 until the completion of its sale in April 2018, and The Pantry, Inc. (formerly NASDAQ: PTRY), a leading independently operated convenience store chain in the southeastern United States and one of the largest independently operated convenience store chains in the country, from March 2014 until the completion of its sale in March 2015. He also previously served as Chairman of the board of directors of Morgan’s Foods, Inc. (formerly OTC: MRFD), a then publicly traded company, from January 2013 until May 2014, when the company was acquired by Apex Restaurant Management, Inc., after originally joining its board as a director in February 2012. From 2005 until 2007, Mr. Pappas worked for Goldman Sachs (NYSE: GS), a multinational investment banking and securities firm, in its Investment Banking / Leveraged Finance Division. As part of the Goldman Sachs Leveraged Finance Group, Mr. Pappas advised private equity groups and corporations on appropriate leveraged buyout, recapitalization and refinancing alternatives. Prior to Goldman Sachs, Mr. Pappas worked at Bank of America Securities, the investment banking arm of Bank of America Corporation (NYSE: BAC), a multinational banking and financial services corporation, where he focused on Consumer and Retail Investment Banking, providing advice on a wide range of transactions including mergers and acquisitions, financings, restructurings and buy-side engagements. Mr. Pappas received a BBA and a Masters in Finance from Texas A&M University.

12

Mark Schmulen, Director

Mark Schmulen has been a Director since January 30, 2020. Mr. Schmulen is a co-founder of PropMatic, a venture-backed software-as-a-service company serving the real estate market and currently serves as the Company’s CEO and President. He also serves as a Director of CaterX, a software-as-a-service company serving the Food Services industry. Mr. Schmulen has been the managing director of Jelly Capital, LLC, a private investment fund focused on early-stage technology and real estate investments, since May 2015, and has been an investment advisor representative for Forum Financial, LP, an independent investment advisor, since November 2016. Previously, Mr Schmulen was co-founder and CEO of Chirp Systems, Inc., a venture-backed smart access solution for multifamily property owners that was acquired by RealPage, Inc in 2020. At RealPage, Mr Schmulen served as a Vice President and General Manager for the Company’s Smart Building business unit until June 2024. Additionally, Mr Schmulen served as the General Manager of Social Media for Constant Contact, Inc., a provider of digital marketing solutions, from May 2010 until May 2014. Prior to this, he was a co-founder and CEO of Nutshell Mail, Inc., a social media marketing solution, from 2008 until it was acquired by Constant Contact, Inc. in 2010. Mr. Schmulen began his career as an investment banking analyst with JPMorgan Chase Bank. He has served on the board of directors for the Shlenker School since August 2017 and has been a Director of the HHF Foundation, which benefits early childhood education since December 2014. Mr. Schmulen holds a B.S. from the University of Pennsylvania and an M.S. in Management from Stanford’s Graduate School of Business.

Denver Smith, Director

Denver Smith has been a Director since March 13, 2023. Mr. Smith is Chief Investment Officer and Managing Member of Carlson Ridge Capital (“Carlson Ridge”), a hedge fund manager, which was founded in 2015. Additionally, Mr. Smith advises the Aspen Family Trust on its asset allocation and strategic level decisions for various entities it owns. He was previously a portfolio manager and the Chief Investment Officer for 73114 Investments, LLC, for a period of 9 years. In 2015, he prompted and helped negotiate the sale of 73114 Investments’ parent company, a government contracting company, to a multi-billion dollar publicly traded REIT for over $150 million. Mr. Smith serves on the board of trustees of Lifestyle Management Inc, a non-profit organization. He graduated from the University of Oklahoma with a BBA in Finance and Economics. He also earned an MBA from the University of Oklahoma. Mr. Smith is a CFA Charterholder.

Jefferson Gramm, Director

Jefferson Gramm has been a Director since September 10, 2021. Mr. Gramm is a co-founder, partner and portfolio manager at Bandera Partners LLC (“Bandera”), a New York based investment fund founded in 2006. Prior to founding Bandera in 2006, he served as Managing Director of Arklow Capital, LLC, a hedge fund focused on distressed and value investments. Mr. Gramm has extensive board experience and currently serves as the Chairman of the board of directors of Tandy Leather Factory, Inc. and he is a director of Rubicon Technology Inc. Mr. Gramm previously served on the board of directors of Ambassadors Group Inc., Morgan’s Foods Inc., and Peerless Systems Corp. He received an M.B.A. from Columbia University in 2003 and a B.A. in Philosophy from the University of Chicago in 1996.

Gary Schubert, Chief Financial Officer

Mr. Schubert has been the Chief Financial Officer of the Company since January 2024.. Prior to joining the Company as Chief Financial Officer, Mr. Schubert spent fifteen years at Walmart, and three years at Tyson Foods, Inc. (“Tyson”), the second largest protein processer in the world. From June 2021 through August 2023, Mr. Schubert was the Senior Director of eCommerce Finance & Transformation Strategy at Walmart. In this role, he was responsible for generating long-term sustainable growth by increasing customer share of Walmart’s electronic wallet, driving retention, and improving end-to-end omni-channel economics for Walmart’s $75 billion eCommerce business. From February 2017 through June 2021, Mr. Schubert served as the financial lead for Walmart’s Neighborhood Market business, the sixth largest grocery chain in the United States, with over $20 billion in annual sales across 700 locations. In addition, his financial leadership experience at Walmart spanned merchandising, operations, eCommerce, and strategy roles. During his time at Tyson, Mr. Schubert had various roles in Financial Planning & Analysis, Corporate Treasury, and Investor Relations. Mr. Schubert received a Bachelor of Science in Business Administration from the University of Arkansas, majoring in financial management, and minoring in accounting. While attending the University of Arkansas, Mr. Schubert also managed the growth of a multi-million-dollar trust fund on behalf of the university.

13

Board Leadership Structure; Executive Sessions

Our Board structure features (i) a separate Chairman of the Board and Chief Executive Officer and (ii) non-management, active and effective directors of equal importance and with an equal vote. The Board intends having non-management Board members meet without management present at least twice a year.

Family Relationships

Except as disclosed herein, none of the directors or executive officers have a family relationship as defined in Item 401 of Regulation S-K.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executives has, during the past ten years, been involved in any legal proceedings in subscription (f) of Item 401 of Regulation S-K.

Role of the Board in Risk Oversight

The Board is responsible for assessing the risks facing our company and considers risk in every business decision and as part of our business strategy. The Board recognizes that it is neither possible nor prudent to eliminate all risk, and that strategic and appropriate risk-taking is essential for us to compete in our industry and in the global market and to achieve our growth and profitability objectives. Effective risk oversight, therefore, is an important priority of the Board.

While the Board oversees our risk management, management is responsible for day-to-day risk management processes. Our Board expects management to consider risk and risk management in each business decision, to proactively develop and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies that are adopted by the Board. The Board reviews and adjusts our risk management strategies at regular intervals, or as needed.

Insider Trading Policy

On February 21, 2024, we adopted insider trading policies and procedures governing the purchase, sale, and/or other dispositions of our securities by directors, officers, and employees, which are reasonably designed to promote compliance with insider trading laws, rules and regulations, and applicable Nasdaq listing standards.

Agreements with Directors

Prior to Mr. Pappas’ appointment to the Board, as described in a Current Report on Form 8-K filed on January 30, 2020 (the “January 8-K”), the Company and Mr. Pappas entered into a two year Agreement dated as of January 28, 2020 (the “Pappas Agreement”) which, among other things, provided that (i) the Company (x) will support the continued directorships of the Mr. Pappas, Mr. Schmulen along with a nominee of JCP (collectively as the “New Directors”) at the next two annual meetings and (y) after 18 months will appoint another nominee of JCP Investment Partnership, LP, JCP Investment Partners, LP, JCP Investment Holdings, LLC, and JCP Investment Management, LLC (collectively as “JCP”) to the Board and support such nominee at the next annual meeting, provided that such nominee shall be subject to the approval (which shall not be unreasonably withheld) of the Nominating and Corporate Governance Committee of the Board and the Board after exercising their good faith customary due diligence process and fiduciary duties; and (ii) JCP and the Company agreed to certain standstill provisions, as more fully described in the Pappas Agreement. As of the date hereof, the New Directors referred to in the Pappas Agreement are Messrs. Pappas and Schmulen.

Effective November 28, 2022 the Company entered into a Board Observer Agreement with Denver J. Smith (the “Smith Agreement”). Mr. Smith is part of a Schedule 13D group (the “Group”) which holds approximately 8.3% of our outstanding common stock. The Group had threatened a proxy contest, and to avoid expense and disruption associated with a proxy contest the company has signed the Smith Agreement with the Group. The Smith Agreement provides, among other things, that for up to eight (8) months, with certain minor limitations, Mr. Smith will have observer status at all meetings held by our Board as well as meetings held by the various Committees of our Board. In addition, the Smith Agreement provides for Mr. Smith to become a member of our Board on or before the eight (8) month anniversary of the Smith Agreement subject to fulfillment of the Board’s fiduciary responsibilities. The Smith Agreement contains certain “standstill” provisions regarding proxy contests, Board membership and joining certain ownership groups. The Smith Agreement is conditional upon the Group maintaining certain minimum ownership of our common stock as well as imposing duties of confidentiality and securities law compliance. On February 3, 2023, the Company entered into a Severance Note, an Agreement and General Release, and a Side Letter thereto with Sam Klepfish (the “SK Agreements”). The SK Agreements provide, among other things, for Mr. Kelpfish’s resignation from all positions with the Company and its subsidiaries on February 28, 2023, except that Mr. Klepfish will remain a director and member of the board of the Company, confidentiality and non-disparagement conditions, nomination of Mr. Klepfish for future election to the board of directors at least through the 2024 general meeting of stockholders based on certain minimum stock ownership and Board Observer rights when Mr. Klepfish is no longer a director but maintains certain minimum agreed upon stock ownership. Effective March 13, 2023, our Board determined to appoint Mr. Smith to our Board.

14

On January 30, 2023, the Company entered into the RWB Agreement with Mr. Bennett, pursuant to which Mr. Smallwood was appointed as the director designee of Mr. Bennett. Under the RWB Agreement, the Board or its Nominating and Corporate Governance Committee must nominate to the Board an individual designated by Mr. Bennett in good faith, subject to the Board’s fiduciary judgement and applicable legal or regulatory requirements and limitations. Under the terms of the RWB Agreement, as Mr. Bennett’s director designee, Mr. Smallwood may be removed or be asked to resign from his position on the Board in the event that Mr. Bennett’s employment with the Company is terminated.

Committees of the Board of Directors

The Board of Directors currently has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

The following table sets forth the current composition of the three standing committees of our Board:

| Name | Board | Audit | Compensation |

Nominating and Governance |

||||

| Robert W. (Bill) Bennett | X | |||||||

| Brady Smallwood | X | |||||||

| Sam Klepfish | X | X | X | |||||

| Hank Cohn | X | X | Chair | |||||

| James C. Pappas | X | X | X | |||||

| Mark Schmulen | X | X | X | Chair | ||||

| Denver J. Smith (audit committee financial expert) | X | Chair | X | X |

Audit Committee.

The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”) and is currently comprised of Messrs. Smith (Chairman), Cohn, and Schmulen, each of whom the Board of Directors has determined satisfies the applicable SEC independence requirements for audit committee members. The Board of Directors has also determined that Mr. Smith is an “audit committee financial expert,” as defined by the applicable rules of the SEC.

The Audit Committee is responsible for, among other things:

| ● | reviewing the independence, qualifications, services, fees and performance of our independent registered public accounting firm; | |

| ● | appointing, replacing and discharging our independent registered public accounting firm; | |

| ● | pre-approving the professional services provided by our independent registered public accounting firm; | |

| ● | reviewing the scope of the annual audit and reports and recommendations submitted by our independent registered public accounting firm; and | |

| ● | reviewing our financial reporting and accounting policies, including any significant changes, with our management and our independent registered public accounting firm. |

Our Board has adopted a written charter for the Audit Committee and the Audit Committee reviews and reassesses the adequacy of that charter on an annual basis. The full text of the charter is available on our website at www.ivfh.com.

Compensation Committee.

The functions of the Compensation Committee are to make recommendations to the Board regarding compensation of management employees and to administer plans and programs relating to employee benefits, incentives, compensation and awards.

The Compensation Committee currently consists of Messrs. Cohn (Chairman), Schmulen, Klepfish, Smith, and Pappas, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements (although the Company is not currently subject to such rules). In addition, each member of the Compensation Committee has been determined to be a non-employee director under Rule 16b-3 as promulgated under the Exchange Act.

15

None of our executive officers has served as a director or member of a compensation committee (or other board committee performing equivalent functions) of any other entity, one of whose executive officers served as a director or a member of our Compensation Committee.

A copy of the Compensation Committee’s Charter is available on our website at www.ivfh.com. Executive officers that are members of our Board make recommendations to the Compensation Committee with respect to the compensation of other executive officers who are not on the Board. Except as otherwise prohibited, the Committee may delegate its responsibilities to subcommittees or individuals. The Compensation Committee has the authority, in its sole discretion, to retain or obtain advice from a compensation consultant, legal counsel or other advisor and is directly responsible for the appointment, compensation and oversight of such persons. The Company will provide the appropriate funding to such persons as determined by the Compensation Committee. The Compensation Committee also annually reviews the overall compensation of our executive officers for the purpose of determining whether discretionary bonuses should be granted.

Nominating and Corporate Governance Committee.

The functions of the Nominating and Corporate Governance Committee are to develop our corporate governance system and to review proposed new members of our Board, including those recommended by our stockholders.

Messrs. Schmulen (Chairman), Klepfish, Smith, and Pappas are the current members of our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to a written charter adopted by the Board. The full text of the charter is available on our website at www.ivfh.com. The Board has determined that each member of this Committee, is “independent,” as defined under the rules of the Nasdaq (although the Company is not currently subject to such rules). The Nominating and Corporate Governance Committee will review, on an annual basis, the composition of our Board and the ability of its current members to continue effectively as directors for the upcoming fiscal year. In the ordinary course, absent special circumstances or a change in the criteria for Board membership, the Nominating and Corporate Governance Committee will consider renominating incumbent directors who continue to be qualified for Board service and who are willing to continue as directors if it determines that such renomination is in the best interests of the Company and its stockholders. If that Committee decides it is in our best interests to nominate a new individual as a director in connection with an annual meeting of stockholders, or if a vacancy on the Board occurs between annual stockholder meetings or an incumbent director chooses not to run, the Nominating and Corporate Governance Committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, our senior management and, if the Committee deems appropriate, a third-party search firm. The Nominating and Corporate Governance Committee will evaluate each candidate’s qualifications and check relevant references and each candidate will be interviewed by at least one member of that Committee. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the Nominating and Corporate Governance Committee will evaluate whether a prospective candidate is qualified to serve as a director and whether the Committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

Meetings of the Board of Directors and Board Member Attendance at Annual Stockholder Meeting

From January 1, 2024 through December 31, 2024, the Board of Directors met six times and acted without a formal meeting pursuant to unanimous written consent three times. All directors attended at least 75% of all Board meetings. From January 1, 2024 through December 31, 2024, the Audit Committee, the Compensation Committee, and Nominating and Corporate Governance Committee met four, two, and two times, respectively.

We do not have a formal written policy with respect to Board members’ attendance at annual stockholders meetings, although we do encourage each of them to attend. All of the directors then serving and nominated for re-election attended our last annual meeting of stockholders held on May 15, 2024.

16

Stockholder Communications

Stockholders interested in communicating with the Board may do so by writing to any or all directors, care of our Secretary, at our principal executive offices. Our Secretary will log all stockholder correspondence and forward to the director addressee(s) all communications that, in her judgment, are appropriate for consideration by the directors. Any director may review the correspondence log and request copies of any correspondence. Examples of communications that would be considered inappropriate for consideration by the directors include, but are not limited to, commercial solicitations, trivial, obscene, or profane items, administrative matters, ordinary business matters, or personal grievances. Correspondence that is not appropriate for Board review will be handled by our Secretary. All appropriate matters pertaining to accounting or internal controls will be brought promptly to the attention of our Audit Committee Chair.

Stockholder recommendations for director nominees are welcome and should be sent to our Secretary, who will forward such recommendations to the Nominating and Corporate Governance Committee, and should include the following information: (a) all information relating to each nominee that is required to be disclosed pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of each nominee, and must be submitted in the time frame described under the caption, “Stockholder Proposals for 2026 Annual Meeting” below. The Nominating and Corporate Governance Committee will evaluate candidates recommended by stockholders in the same manner as candidates recommended by other sources, using additional criteria, if any, approved by the Board from time to time. Our stockholder communication policy may be amended at any time with the consent of the Nominating and Corporate Governance Committee.

Code of Ethics

We have adopted a Code of Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is available on our website, www.ivfh.com, and it has been publicly filed with, and is available for free from the SEC.

Pursuant to our Code of Ethics, all of our employees (including officers and executives) and directors are required to disclose to the Board or any committee established by the Board to receive such information, any material transaction or relationship that reasonably could be expected to give rise to actual or apparent conflicts of interest between any of them, personally, and the Company. Our Code of Ethics also directs all employees and directors to avoid any self-interested transactions without full disclosure.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than ten percent of our common stock, file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater-than-ten percent stockholders are required by SEC regulations to furnish us with all Section 16(a) forms they file. Based solely on our review of the copies of the forms received by us and written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the year ended December 31, 2024, all of our executive officers, directors and greater-than-ten percent stockholders complied with all Section 16(a) filing requirements.

17

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of May 1, 2025 with respect to the beneficial ownership of our common stock by (1) each person known by us to own beneficially more than 5% of the outstanding shares of our common stock, (2) each of our directors, (3) each of our executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation”, below, and (4) all our directors and executive officers as a group. Unless otherwise noted, the mailing address of each listed beneficial owner is c/o Innovative Food Holdings Inc., 2528 S 27th Ave, Broadview, IL 60155. Pursuant to SEC rules, the following table includes shares that the person has the right to receive within 60 days from May 1, 2025.

| Name of Beneficial Owners | Number of Shares of Common Stock Beneficially Owned |

Percent of Class |

||||||

| Officers and directors | ||||||||

| James C. Pappas (Director) (1) | 9,909,167 | 18.3 | % | |||||

| Hank Cohn (Director) (2) | 2,797,831 | 5.2 | % | |||||

| Mark Schmulen (Director) | 56,344 | * | ||||||

| Sam Klepfish (Director) | 2,303,101 | 4.2 | % | |||||

| Robert W. (Bill) Bennett (Chief Executive Officer, Director) (3) | 2,706,541 | 5.0 | % | |||||

| Brady Smallwood (Chief Operating Officer, Director) (4) | 432,385 | * | ||||||

| Denver J. Smith (Director) (5) | 4,338,575 | 8.0 | % | |||||

| Gary Schubert (Chief Financial Officer) (10) | 437,590 | * | ||||||

| Jefferson Gramm (Director) (8) | 6,193,349 | 11.4 | % | |||||

| All officers and directors as a whole (9 persons) (7) | 29,174,883 | 53.7 | % | |||||

| 5% or more stockholders | ||||||||

| Intelligent Fanatics Capital Management LLC (9) | 2,712,785 | 5.0 | % | |||||

| A group consisting of Denver J. Smith, CRC Founders Fund, LP, Donald E. Smith, Richard G. Hill, Samuel N. Jurrens, 73114 Investments, LLC, Youth Properties, LLC, and Paratus Capital, LLC (6) | 4,428,039 | 8.2 | % | |||||

* Less than 1%.

| (1) | Includes 8,290,675 shares held by JCP Investment Partnership, LP (“JCP Partnership”) and 1,618,492 shares held in an account managed by JCP Investment Management, LLC (“JCP Management”). JCP Investment Partners, LP (“JCP Partners”) is the general partner of JCP Partnership and JCP Investment Holdings, LLC (“JCP Holdings”) is the general partner of JCP Partners. Mr. Pappas is the managing member of JCP Management and sole member of JCP Holdings. The address of Mr. Pappas, JCP Partnership and JCP Management, LLC is 1177 West Loop South, Suite 1320, Houston, TX 77027. Information gathered from a Form 4 filed with the SEC on February 15, 2023. |

| (2) | Includes 1,525,000 shares which are held indirectly through SV Asset Management LLC. |

| (3) | Includes 104,910 shares of common stock owned by Mr. Bennett’s spouse, ownership of which is disclaimed by Mr. Bennett; also includes 487,566 shares of common stock issuable to Mr. Bennett pursuant to his compensation plan, a portion of which are expected to be sold for the payment of income taxes. |

| (4) | Includes 147,470 shares issuable to Mr. Smallwood under his compensation plan, a portion of which are expected to be sold for payment of income taxes. |

| (5) | Consists of 703,851 shares owned by Mr. Smith and 3,634,724 shares owned by various funds or businesses for which he provides investment advice. Includes all but 89,464 shares described in note (6). |

| (6) | Pursuant to a Schedule 13D/A filed on July 22, 2024 with the SEC, for a group of investors which includes Mr. Denver Smith (see footnote 5). Mr. Smith disclaims beneficial interest over 89,464 shares owned by certain members of the group for which he has no voting power. The group uses an address of 350 S Race Street, Denver, CO, 80209. |

| (7) | Consists of 24,649,994 shares of common stock held by officers and directors, 487,566 shares issuable to Mr. Bennett under his compensation plan, 147,470 issuable to Mr. Smallwood under his compensation plan, and 163,855 shares issuable to Mr. Shubert under his compensation plan. |

| (8) | Bandera Master Fund L.P., a Cayman Islands exempted limited partnership (“Bandera Master Fund”), is the record holder of 6,193,349 shares of Common Stock. Bandera Partners LLC, a Delaware limited liability company (“Bandera Partners”), is the investment manager of Bandera Master Fund. Mr. Gramm is Managing Partner, Managing Director and Portfolio Manager of Bandera Partners. Information gathered from a Form 4 filed with the SEC on December 6, 2024. |

| (9) | Pursuant to a Schedule 13G filed on October 07, 2024 with the SEC, for a group of investors which includes Intelligent Fanatics Capital Management LLC (“IFCM”), IFCM MicroCap Fund LP (“Fund”) and Ian Cassel. Mr. Cassel is the sole managing member of IFCM. Mr. Cassel has shared voting and investment power with respect to and therefore may be deemed to be the beneficial owner of the shares beneficially owned by the Fund and other discretionary investment clients of IFCM. The group uses an address of 350 Rumford Road, Lititz, Pennsylvania 17543. |

| (10) | Includes 163,855 shares issuable to Mr. Schubert under his compensation plan, a portion of which are expected to be sold for payment of income taxes. |

18

Certain Relationships and Related Transactions

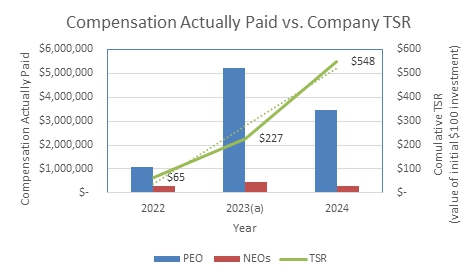

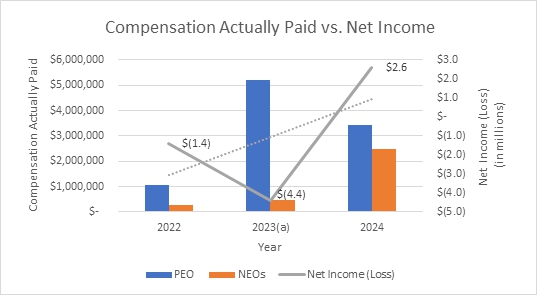

Hiring of CEO