13 |

Our management

1 |

2 |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Shares - par value EURO (EUR) 0.20 per share | ||

3 |

Class | Outstanding at December 31, 2025 |

KONINKLIJKE PHILIPS NV | |

Common Shares par value EUR |

4 |

U.S. GAAP o | Accounting Standards Board x | Other o |

5 |

6 |

7 |

8 |

Item | Form 20-F caption | Location in this document |

Part 1 | ||

1 | Identity of directors, senior management and advisors | Not applicable |

2 | Offer statistics and expected timetable | Not applicable |

3 | Key information | |

A [Reserved] | Not applicable | |

B Capitalization and indebtedness | Not applicable | |

C Reason for the offer and use of proceeds | Not applicable | |

D Risk factors | ||

Item | Form 20-F caption | Location in this document |

4 | Information on the Company | |

A History and development of the company | ||

Introduction – Documents on display | ||

Factors impacting performance – Operating model | ||

Results of operations – Discontinued operations | ||

other items | ||

Investor contact – How to reach us | ||

B Business Overview | ||

Business – Our business structure; Diagnosis and Treatment segment; Connected Care segment; Personal Health segment; Segment other | ||

subheading "Outlook") | ||

Results of operations – Sales per geographic area | ||

9 |

Item | Form 20-F caption | Location in this document |

C Organizational structure | ||

D Property, plant and equipment | ||

Our Regions – 2025 developments North America; 2025 developments Greater China | ||

Assets classified as held for sale | ||

Note 19 – Provisions - Environmental provisions | ||

Note 24 – Contingencies - Environmental remediation | ||

4A | Unresolved staff comments | Not applicable |

5 | Operating and financial review and prospects | |

A Operating results | ||

subheading "Outlook") | ||

other items | ||

- Foreign currency transactions: Foreign operations | ||

Note 8 – Income taxes - Deferred tax assets and liabilities | ||

Note 29 – Details of treasury and other financial risks - Currency risk | ||

Item | Form 20-F caption | Location in this document |

B Liquidity and capital resources | ||

Financial performance – Supply chain resilience | ||

C Research and development, patents and licenses, etc. | ||

Business – Innovation & Design; IP Royalties | ||

Business – 2025 developments North America; 2025 developments Greater China | ||

Results of operations – Research and development expenses | ||

Financial performance – Supply chain resilience | ||

D Trend information | ||

Performance summary – The year 2025 | ||

E Critical accounting estimates | Not applicable | |

6 | Directors, senior management and employees | |

A Directors and senior management | Members of the Board of Management | |

composition | ||

Supervisory Board – Appointment and composition | ||

10 |

Item | Form 20-F caption | Location in this document |

B Compensation | ||

Chair | ||

C Board practices | ||

Members of the Board of Management | ||

Governance – Annual financial statements and external audit | ||

Chair, Main elements of the Remuneration Policy; Services agreements | ||

composition | ||

Supervisory Board – Appointment and composition; Supervisory Board committees | ||

Other Corporate governance – Committees of our Supervisory Board | ||

D Employees | ||

Note 6 – Income from operations – Employees | ||

E Share ownership | ||

Remuneration report 2025 – Remuneration of the Board of Management in 2025 | ||

Other Board-related matters – Remuneration and share ownership | ||

Further information – Voting rights; Equity compensation plans | ||

Note 27 – Information on remuneration - Supervisory Board members’ and Board of Management members’ interest in Philips shares | ||

F Disclosure of registrant's action to recover erroneously awarded compensation | Not applicable |

Item | Form 20-F caption | Location in this document |

7 | Major shareholders and related party transactions | |

A Major shareholders | General Meeting of Shareholders – Share capital; issue and repurchase of (rights to) shares (second and third paragraphs) | |

Other Corporate governance – Voting Rights (last sentence) | ||

B Related party transactions | Other Board-related matters – Conflicts of interest; Remuneration and share ownership (fifth paragraph) | |

C Interests of experts and counsel | Not applicable | |

8 | Financial information | |

A Consolidated statements and other financial information | Dividend – Dividend policy | |

B Significant changes | ||

9 | The offer and listing | |

A Offer and listing details | ||

B Plan of distribution | Not applicable | |

C Markets | ||

D Selling shareholders | Not applicable | |

E Dilution | Not applicable | |

F Expenses of the issue | Not applicable | |

10 | Additional information | |

A Share capital | Not applicable | |

B Memorandum and articles of association | composition | |

Supervisory Board – Appointment and composition | ||

Other Board-related matters – Remuneration and share ownership (fifth paragraph); Conflicts of interest |

11 |

Item | Form 20-F caption | Location in this document |

General Meeting of Shareholders – Meetings; Main powers of the General Meeting of Shareholders | ||

Other Corporate governance – Articles of association | ||

Index of exhibits – Exhibit 1; Exhibit 2 | ||

C Material contracts | Remuneration report 2025 – Letter from the Remuneration Committee Chair (sixth paragraph); Services agreements | |

composition (third paragraph) | ||

Supervisory Board – Appointment and composition (last paragraph) | ||

Index of exhibits – Exhibit 4(a) | ||

Index of exhibits – Exhibit 4(b) | ||

Index of exhibits – Exhibit 4(c) | ||

Index of exhibits – Exhibit 4(d) | ||

Index of exhibits – Exhibit 4(e) | ||

D Exchange controls | Other Corporate governance – Exchange controls | |

Note 29 – Details of treasury and other financial risks - Liquidity risk | ||

E Taxation | ||

F Dividends and paying agents | Not applicable | |

G Statements by experts | Not applicable | |

H Documents on display | Introduction - Documents on display | |

I Subsidiary information | Not applicable | |

J Annual Report to Security Holders | The Company intends to submit any annual report provided to security holders in electronic format as an exhibit to a current report on Form 6-K. |

Item | Form 20-F caption | Location in this document |

11 | Quantitative and qualitative disclosure about market risk | |

A Quantitative information about market risk | ||

B Qualitative information about market risk | ||

C Interim periods | Not applicable | |

D Safe harbor | ||

E Smaller reporting companies | Not applicable | |

12 | Description of securities other than equity securities | |

A Debt securities | Not applicable | |

B Warrant and rights | Not applicable | |

C Other securities | Not applicable | |

D American depository shares | ||

Part 2 | ||

13 | Defaults, dividend arrearages and delinquencies | Not applicable |

14 | Material modifications to the rights of security holders and use of proceeds | Not applicable |

15 | Controls and procedures | |

A Disclosure controls and procedures | ||

B Management's Annual Report on internal control over financial reporting | ||

C Attestation report of the registered public accounting firm |

12 |

Item | Form 20-F caption | Location in this document |

D Changes in internal control over financial reporting | ||

16A | Audit Committee Financial Expert | Supervisory Board - Supervisory Board Committees (fifth paragraph) |

16B | Code of Ethics | |

16C | Principal Accountant Fees and Services | |

Note 6 – Income from operations - Audit and audit-related fees | ||

16D | Exemptions from the Listing Standards for Audit Committees | Not applicable |

16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | Shareholders’ equity – Share repurchase methods for long-term incentive plans and capital reduction purposes |

16F | Change in Registrant’s Certifying Accountant | Annual financial statements and external audit (second paragraph, last sentence) |

16G | Corporate Governance | Other Corporate governance – Significant differences in corporate governance practices |

16H | Mine Safety Disclosure | Not applicable |

16I | Disclosure regarding Foreign Jurisdictions that prevent inspections | Not applicable |

16J | ||

Index of exhibits - Exhibit 11 | ||

16K | Cybersecurity | |

Part 3 | ||

17 | Financial statements | Not applicable |

18 | Financial statements | |

19 | Exhibits | |

13 |

14 |

“We delivered for those who count on us and strengthened our foundations. Looking ahead, we are energized by our plan to drive profitable growth to deliver sustainable value.” |

Roy Jakobs CEO Royal Philips |

15 |

16 |

| 14 members |  | 50% female 50% male | |

| 8 nationalities |  | Average 25+ years leadership experience within healthcare | |

Members of the Board of Management* | ||||

|  |  | ||

Roy Jakobs Born 1974, Dutch and German Chief Executive Officer (CEO) Chairman of the Board of Management and the Executive Committee (since October 2022) Roy joined Philips in 2010 and has held various global leadership positions across the company, starting as Chief Marketing & Strategy Officer for Philips Lighting. In 2012, he became Market Leader for Philips Middle East & Turkey, leading the Healthcare, Consumer, and Lighting businesses out of Dubai. Subsequently, he became global Business Leader of Domestic Appliances, based in Shanghai, in 2015. In 2018, Roy joined the Executive Committee as Chief Business Leader of Personal Health and in early 2020 he started as Chief Business Leader of Connected Care. As Chief Executive Officer and Chairman of the Board of Management and the Executive Committee, he also holds direct responsibility for Patient Safety and Quality, Medical Office, and Internal Audit. Prior to his career at Philips, he held various management positions at Royal Dutch Shell and RELX. | Charlotte Hanneman Born 1978, Dutch Chief Financial Officer Member of the Board of Management and the Executive Committee (since October 2024) Charlotte joined Philips in 2024 and is responsible for Finance, including Investor Relations, Strategy and M&A, as well as Real Estate and Security. Prior to joining Philips, Charlotte served as Controller and Head of Financial Planning & Analysis at global medical technology company Stryker. In this role, she was responsible for external reporting, enterprise financial planning and analysis, and business development finance. She also oversaw indirect procurement and had direct responsibility for finance teams across Europe, the Middle East and Africa, Canada, and Latin America. Earlier in her career, Charlotte held several international finance leadership roles at Stryker and other multinational healthcare companies, including Merck, Schering- Plough and Organon. She has extensive experience working in the US and has lived in multiple countries across Asia and Europe. | Marnix van Ginneken Born 1973, Dutch Chief ESG & Legal Officer Member of the Board of Management and the Executive Committee (since November 2017) Marnix became a member of the Executive Committee in 2014 and was appointed a member of Philips’ Board of Management in 2017. He is responsible for driving Environmental, Social and Governance efforts across the company, including sustainability. Marnix is also responsible for Legal, Intellectual Property & Standards, Government & Public Affairs and Communications & Brand. He became Chair of the Board of the Philips Foundation in 2024. He has also been a Professor of International Corporate Governance at the Erasmus School of Law in Rotterdam since 2011. In 2025, Marnix was appointed to the Dutch Monitoring Committee Corporate Governance Code by the Minister of Economic Affairs. Before joining Philips in 2007, Marnix worked for Akzo Nobel, and prior to that he was an attorney in private practice. | ||

17 |

Other members of the Executive Committee* | ||||||||||

|  |  |  |  |  | |||||

Willem Appelo Born 1964, Dutch Executive Vice President Chief Operations Officer Wim joined Philips in 2022, bringing over 30 years of experience in technology and the medical device technology industry, in finance and supply chain management. | Steve C de Baca Born 1968, American Executive Vice President Chief Patient Safety & Quality Officer Steve joined Philips in 2023 and brings over 30 years of quality and regulatory affairs experience in the medical technology industry. | Jeff DiLullo Born 1969, American Executive Vice President Chief Region Leader, Philips North America Jeff joined Philips in 2019, drawing on more than 30 years of leadership experience in the US Army and the information technology industry. | Özlem Fidanci Born 1970, Turkish Executive Vice President Chief of International Region Özlem rejoined in 2025 and has been with Philips more than 27 years. She has extensive expertise and proven leadership across multiple geographies in both the health systems and personal health domains. | Deeptha Khanna Born 1976, Singaporean Executive Vice President Chief Business Leader Personal Health Deeptha joined Philips in 2020. She has over 25 years of leadership experience working across Europe, the US and Asia on major global brands and across personal care and the consumer health industry. | Ling Liu Born 1974, Chinese Executive Vice President Chief Region Leader, Philips Greater China Ling joined Philips in 1998 and has more than 28 years of experience in leadership roles in Greater China, the Netherlands and North America. | |||||

|  |  |  |  | ||||||

Bert van Meurs Born 1961, Dutch Executive Vice President Chief Business Leader Diagnosis and Treatment Bert joined Philips in 1985 and has more than 40 years of experience in the medical imaging interventional and healthcare business. | Shez Partovi Born 1967, Canadian Executive Vice President Chief Innovation Officer and Chief Business Leader Enterprise Informatics Shez joined Philips in 2021, bringing over 30 years of clinical (neuroradiology) and healthcare informatics experience, including cloud transformation, machine learning, and AI. | Heidi Sichien Born 1974, Belgian Executive Vice President Chief People Officer Heidi joined Philips in 2006 and brings over 19 years of experience in leadership roles in HR across many parts of the company. | Julia Strandberg Born 1974, American Executive Vice President Chief Business Leader Connected Care Julia joined Philips in 2023 and has over 20 years of leadership experience in the medical technology industry, especially in monitoring and North America. | Jie Xue Born 1973, American and Chinese Executive Vice President Chief Business Leader Diagnosis and Treatment Jie joined Philips in 2025 with over 25 years of leadership experience in the imaging industry, especially in the US. | ||||||

18 |

19 |

20 |

21 |

Segments | ||||||||||

Diagnosis & Treatment | Connected Care | Personal Health | ||||||||

|  |  | ||||||||

Businesses1: •Image Guided Therapy #1 •Precision Diagnosis #1 in cardiovascular ultrasound #3 in diagnostic imaging | Businesses1: •Monitoring #1 in hospital and ambulatory •Enterprise Informatics #1 in PACS and interoperability •Sleep & Respiratory Care #2 in sleep therapy devices and masks | The Personal Health Business includes three Business Units1: •Personal Care #1 in grooming •Oral Healthcare #2 •Mother and Child Care #2 in infant feeding | ||||||||

22 |

2025 | |

Precision Diagnosis 1 | 59% |

Image Guided Therapy ² | 41% |

Addressing challenges In 2025, we took steps to strengthen the performance and impact of our Precision Diagnosis business, including actions aimed at enhancing quality and operations across all Business Units and stepping up commercial execution to land our latest innovations. We worked on fostering a culture of continuous improvement and accountability. We also built strong momentum in our Image Guided Therapy Business, driving continued growth and reinvesting gains into innovation. We continued our efforts to, year-on-year, improve productivity; shorten delivery timelines by reducing variability; and optimize our portfolio. These are enablers to increase resilience and reduce the negative impact of tariff developments. | ||

23 |

24 |

2025 | |

Monitoring 1 | 59% |

Enterprise Informatics 2 | 22% |

Sleep & Respiratory Care | 19% |

Addressing challenges In 2025, we took action to address geopolitical risks impacting health systems directly. Tariff developments globally led to a focus on cost predictability. This was compounded by changes in healthcare funding in the US and the EU, which led to Medicaid, rural and home-based care initiatives. We positioned Philips as a partner in driving productivity improvements, reducing vendor complexity, and supporting financial predictability – through Enterprise Monitoring as-a-service and productivity-driving software solutions. We also worked with government agencies, industry partners and providers to mitigate cybersecurity threats by closing security gaps and by strengthening digital resilience. | ||

25 |

26 |

2025 | |

Personal Health 1 | 100% |

Addressing challenges In 2025, we took action to address the cost-management challenges posed by tariff developments in various jurisdictions. Through close planning with key retail and distribution partners, we adjusted supply chain strategies, improved forecasting, and adapted pricing structures. This disciplined approach helped us manage volatility in our operating environment while maintaining supply continuity and supporting long-term customer relationships. | ||

27 |

28 |

29 |

2025 developments North America Philips is working with innovative health systems such as Bon Secours Mercy Health, Vanderbilt University Medical Center and Nicklaus Children’s Hospital to advance care – from standardizing patient monitoring and expanding interventional radiology to introducing AI-enabled precision diagnostics. Recognizing the transformative potential of AI in healthcare, we announced a collaboration with Mass General Brigham to advance AI solutions that help clinicians capture, analyze and act on data in real time. We also worked with Hoag to modernize patient monitoring with a software-driven solution across its acute care hospitals. We continue to support the more than 9 million veterans who receive healthcare through the US Department of Veterans Affairs and expanded critical healthcare initiatives in Georgia, Michigan, Virginia and New York. Philips announced a plan for new investments of USD 150 million to expand manufacturing and R&D, including the growth of our Reedsville, Pennsylvania, facility, which produces AI-enabled ultrasound systems, and the expansion of our Image Guided Therapy site in Plymouth, Minnesota. In partnership with Ingeborg Initiatives, the Philips Avent Pregnancy+ app reached families in Arkansas, delivering information about localized maternal health resources that improve access to care and health literacy. | ||

2025 developments International Region We remained focused on delivering our global vision, ensuring it aligned with diverse market realities and customer needs across the region. We refined our go-to-market strategy through a connected, multi-channel approach combining direct, digital, and strategic partner-led engagement to better serve customers and patients. Our Services business remained central to driving customer success, with new life cycle models and offerings that seek to enhance value and performance. We advanced our ‘big bet’ strategy by unlocking opportunities in priority growth markets such as Saudi Arabia, India, and Indonesia. Philips signed a long-term partnership with Indonesia’s Ministry of Health to install its advanced Azurion image-guided therapy system nationwide, expanding access to cardiac, stroke and cancer care to more than 280 million people across all of Indonesia’s 38 provinces. India, in particular, has emerged as a strong microcosm of Philips, bringing together deep local market presence, world- class innovation in AI and software, global manufacturing capabilities, and a growing Services footprint. Solutions developed through this integrated approach, combining locally relevant innovation with manufacturing scale, have strengthened Philips’ position as a leading partner for healthcare providers across India. | ||

2025 developments Greater China We are committed to our strategy of ‘in China, for China first’, focusing on local innovation, manufacturing, services and partnerships. Amid evolving market dynamics and growing healthcare demands, driven by aging populations and the rise of AI-driven care, we continue to see China as a key market shaping the future of healthcare globally. The Region’s leadership is putting strong emphasis on creating value for China’s healthcare system by reinforcing ecosystem collaboration and advancing clinical partnerships. Philips is also promoting innovations to empower consumers to manage their health and well-being through locally relevant, trusted personal health solutions. For example, during China’s 618 festival, Philips ranked No. 1 on JD.com in male grooming sales and in the electric toothbrush category. Celebrating 40 years since our first joint venture in China, we formally launched the Greater China Innovation Headquarters in Beijing to enhance innovation capabilities and speed up time to market. Philips is partnering with local AI innovators and exploring cooperation with the national intervention center to launch the IGT AI Ecosystem Platform to address key gaps in the interventional workflow, which provides physicians and technologists with access to advanced, high-quality guidance and remote expertise. | ||

30 |

2025 | |

Western Europe | 32% |

North America | 33% |

Other mature geographies | 5% |

Mature geographies | 71% |

Growth geographies | 29% |

Philips Group | 100% |

31 |

2025 | 2024 | |

Philips employees | 65,340 | 66,678 |

Contingent workers | 1,614 | 1,741 |

Total | 66,954 | 68,419 |

2025 | 2024 | 2023 | |

Balance as of January 1 | 67,823 | 69,656 | 77,233 |

Consolidation changes: | |||

Acquisitions | - | - | 27 |

Divestments | (109) | (227) | (353) |

Other changes | (1,313) | (1,606) | (7,251) |

Balance as of December 31 | 66,401 | 67,823 | 69,656 |

Permanent employees | Temporary employees | Other | Philips Group | |||||

2025 | 2024 1 | 2025 | 2024 1 | 2025 | 2,024 | 2025 | 2024 1 | |

Western Europe | 15,589 | 16,156 | 211 | 256 | 7 | 1 | 15,807 | 16,413 |

North America | 16,362 | 17,176 | 2 | 5 | - | - | 16,364 | 17,181 |

Other mature geographies | 3,685 | 3,737 | 113 | 109 | - | - | 3,798 | 3,846 |

Mature geographies | 35,636 | 37,069 | 326 | 370 | 7 | 1 | 35,969 | 37,440 |

Growth geographies | 25,440 | 25,562 | 3,929 | 3,676 | 2 | - | 29,371 | 29,238 |

Philips Group | 61,076 | 62,631 | 4,255 | 4,046 | 9 | 1 | 65,340 | 66,678 |

Country | 2025 | 2024 |

US | 15,832 | 16,639 |

The Netherlands | 8,104 | 8,566 |

India | 8,150 | 8,166 |

China | 6,440 | 6,716 |

32 |

33 |

34 |

| |||

“In 2025, we delivered on our commitments and drove performance every quarter. Successfully navigating a complex macro-environment, including tariffs, we increased comparable sales, expanded margins, and strengthened cash flow through industry-leading innovation and productivity improvements.” Charlotte Hanneman CFO Royal Philips | |||

2025 | 2024 | |

Sales | 17,834 | 18,021 |

Nominal sales growth | (1%) | (1%) |

Comparable sales growth ¹ | 2% | 1% |

Income from operations | 1,424 | 529 |

as a % of sales | 8% | 3% |

Financial expenses, net | (233) | (282) |

Results of associates | (9) | (124) |

Income tax (expense) benefit | (282) | (963) |

Income from continuing operations | 901 | (840) |

Discontinued operations, net of income taxes | (4) | 142 |

Net income | 897 | (698) |

Adjusted EBITA ¹ | 2,195 | 2,077 |

as a % of sales | 12.3% | 11.5% |

Income from continuing operations attributable to shareholders ² per common share (in EUR) - diluted | 0.93 | (0.88) |

Adjusted income from continuing operations attributable to shareholders ² per common share (in EUR) - diluted ¹ | 1.56 | 1.36 |

35 |

36 |

2025 | 2024 | |||||

Sales | Nominal sales growth | Comparable sales growth ¹ | Sales | Nominal sales growth | Comparable sales growth ¹ | |

Diagnosis & Treatment | 8,531 | (3%) | 0% | 8,790 | 0% | 1% |

Connected Care | 5,076 | (1%) | 3% | 5,134 | 0% | 2% |

Personal Health | 3,673 | 5% | 8% | 3,486 | (3%) | (1%) |

Other | 554 | 611 | 1% | 4% | ||

Philips Group | 17,834 | (1%) | 2% | 18,021 | (1%) | 1% |

2025 | 2024 | |||||

Sales | Nominal sales growth | Comparable sales growth ¹ | Sales | Nominal sales growth | Comparable sales growth ¹ | |

Western Europe | 3,921 | (1%) | (1%) | 3,978 | 4% | 5% |

North America | 7,542 | (1%) | 3% | 7,655 | 1% | 2% |

Other mature geographies | 1,452 | (5%) | (1%) | 1,526 | (6%) | (1%) |

Mature geographies | 12,915 | (2%) | 1% | 13,159 | 1% | 2% |

Growth geographies | 4,919 | 1% | 5% | 4,863 | (6%) | (2%) |

Philips Group | 17,834 | (1%) | 2% | 18,021 | (1%) | 1% |

37 |

2025 | As a % of sales | 2024 | As a % of sales | |

Costs of materials used | 4,120 | 23% | 4,213 | 23% |

Salaries and wages | 2,249 | 13% | 2,313 | 13% |

Depreciation and amortization | 431 | 2% | 609 | 3% |

Other manufacturing costs | 2,976 | 17% | 3,113 | 17% |

Cost of sales | 9,776 | 55% | 10,248 | 57% |

2025 | 2024 | |

Diagnosis & Treatment | 866 | 899 |

Connected Care | 586 | 599 |

Personal Health | 201 | 190 |

Other | 46 | 59 |

Philips Group | 1,700 | 1,747 |

As a % of sales | 10% | 10% |

38 |

2025 | 2024 | |

Restructuring charges per segment: | ||

Diagnosis & Treatment | 42 | 122 |

Connected Care | 109 | 29 |

Personal Health | 17 | 25 |

Other | 74 | 91 |

Philips Group | 242 | 268 |

Cost breakdown of restructuring charges: | ||

Provision for personnel lay-off costs | 124 | 106 |

Restructuring-related asset impairment | 37 | 134 |

Other restructuring-related costs | 81 | 29 |

Philips Group | 242 | 268 |

2025 | 2024 | |

Diagnosis & Treatment | 2 | 34 |

Connected Care | 17 | 24 |

Philips Group | 19 | 58 |

2025 | 2024 | |

Diagnosis & Treatment | 77 | 45 |

Connected Care | 188 | 765 |

Personal Health | - | - |

Other | 5 | 20 |

Philips Group | 270 | 830 |

Consisting of: | ||

Respironics litigation provision | - | 984 |

Respironics insurance income | - | (538) |

Respironics field-action running costs | 112 | 133 |

Respironics consent decree charges | 97 | 113 |

Respironics-related charges | 209 | 691 |

Quality actions | 89 | 123 |

Contract settlement gain | (27) | - |

Remaining items | (1) | 16 |

Philips Group | 270 | 830 |

39 |

Income from operations | As a % of sales | Adjusted EBITA ¹ | As a % of sales | |

2025 | ||||

Diagnosis & Treatment | 804 | 9% | 998 | 11.7% |

Connected Care | 89 | 2% | 544 | 10.7% |

Personal Health | 631 | 17% | 662 | 18.0% |

Other | (100) | (9) | ||

Philips Group | 1,424 | 8% | 2,195 | 12.3% |

2024 | ||||

Diagnosis & Treatment | 592 | 7% | 1,018 | 11.6% |

Connected Care | (466) | (9%) | 494 | 9.6% |

Personal Health | 544 | 16% | 584 | 16.7% |

Other | (142) | (18) | ||

Philips Group | 529 | 3% | 2,077 | 11.5% |

40 |

41 |

2025 | 2024 | |

Total non-current assets | 17,012 | 18,955 |

Total current assets | 9,932 | 10,022 |

Total assets | 26,944 | 28,976 |

Total non-current liabilities | 8,446 | 8,787 |

Total current liabilities | 7,509 | 8,146 |

Total liabilities | 15,954 | 16,933 |

Shareholders’ equity | 10,957 | 12,006 |

Non-controlling interests | 32 | 37 |

Group equity | 10,990 | 12,043 |

Total liabilities and group equity | 26,944 | 28,976 |

2025 | 2024 | |

Long-term debt | 6,934 | 7,113 |

Short-term debt | 1,151 | 526 |

Debt | 8,084 | 7,639 |

2025 | 2024 | |

New lease liabilities | 135 | 167 |

New borrowings long-term debt | 1,057 | 710 |

Repayments long-term debt incl. leases | (609) | (763) |

New borrowings (repayments) short-term debt | (24) | (30) |

Forward contracts entered (matured) | 127 | (248) |

Currency effects, consolidation changes and other | (241) | 114 |

Changes in debt | 446 | (50) |

42 |

2025 | 2024 | 2023 | 2022 | 2021 | |

Shares issued | 962,920 | 939,939 | 913,516 | 889,315 | 883,899 |

Shares in treasury | 11,631 | 14,930 | 7,113 | 7,835 | 13,717 |

Shares outstanding | 951,289 | 925,009 | 906,403 | 881,481 | 870,182 |

Shares acquired | - | 13,718 | 15,964 | 5,081 | 45,486 |

Shares cancelled | - | 4,437 | 15,134 | 8,758 | 33,500 |

43 |

Share repurchases related to shares acquired for capital reduction | Average price paid per share in EUR | Shares acquired for LTI’s | Average price paid per share in EUR | Total number of shares purchased | Average price paid per share in EUR | Total number of shares purchased as part of publicly announced plans or programs 1 2 3 | Approximate value of shares that may yet be purchased under the plans or programs in thousands of EUR 5 6 | |

January 2025 | - | - | - | - | - | - | - | 131,518 |

February 2025 | - | - | - | - | - | - | - | 131,518 |

March 2025 | - | - | - | - | - | - | - | 131,518 |

April 2025 | - | - | - | - | - | - | - | 131,518 |

May 2025 | - | - | - | - | - | - | - | 131,518 |

June 2025 | - | - | - | - | - | - | - | 244,434 |

July 2025 | - | - | - | - | - | - | - | 244,434 |

August 2025 | - | - | - | - | - | - | - | 244,434 |

September 2025 | - | - | - | - | - | - | - | 246,621 |

October 2025 | - | - | - | - | - | - | - | 246,621 |

November 2025 | - | - | - | - | - | - | - | 246,621 |

December 2025 | - | - | - | - | - | - | - | 246,621 |

Total | - | - | - | - | - | - | - | 246,621 |

Of which 4 | ||||||||

Purchased in the open market | - | - | - | - | - | - | - | |

Acquired through exercise of call options/ settlement of forward contracts | - | - | - | - | - | - | - | |

To be acquired by settlement of forward contracts after December 31, 2025 | 246,621 |

44 |

2025 | 2024 | |

Beginning cash and cash equivalents balance | 2,401 | 1,869 |

Net cash flows from operating activities | 1,172 | 1,569 |

Net cash flows from investing activities | ||

Net capital expenditures | (660) | (663) |

Other cash flows from investing activities | (77) | 90 |

Net cash flows from financing activities | ||

Treasury shares transactions | 13 | (410) |

Changes in debt | 424 | (83) |

Dividend paid to shareholders of the company | (328) | (1) |

Other cash flow items | (141) | 43 |

Net cash flows from discontinued operations | (10) | (13) |

Ending cash and cash equivalents balance | 2,794 | 2,401 |

2025 | 2024 | |

Cash and cash equivalents | 2,794 | 2,401 |

Listed equity investments at fair value ¹ | 2 | 4 |

Committed revolving credit facility | 1,000 | 1,000 |

Liquidity | 3,796 | 3,405 |

Short-term debt | (1,151) | (526) |

Long-term debt | (6,934) | (7,113) |

Debt | (8,084) | (7,639) |

Net available liquidity resources | (4,289) | (4,233) |

45 |

Long-term | Short-term | Outlook | |

Fitch | BBB+ | Stable | |

Moody’s | Baa1 | P-2 | Stable |

Standard & Poor’s | BBB+ | A-2 | Stable |

2025 | |||||

Payments due by period | |||||

Total | Less than 1 year | 1-3 years | 3-5 years | After 5 years | |

Long-term debt | 7,086 | 1,630 | 1,806 | 3,650 | |

Short-term debt | 1,174 | 1,174 | |||

Interest on debt | 1,765 | 216 | 402 | 361 | 786 |

Derivative liabilities | 36 | 35 | 1 | - | - |

Purchase obligations ³ | 1,189 | 293 | 390 | 306 | 200 |

Trade and other payables | 1,927 | 1,927 | |||

Contractual cash obligations | 13,177 | 3,645 | 2,423 | 2,473 | 4,636 |

46 |

Ex-dividend date | Record date | Distribution from | |

Euronext Amsterdam | May 12, 2026 | May 13, 2026 | June 3, 2026 |

New York Stock Exchange | May 13, 2026 | May 13, 2026 | June 3, 2026 |

2025 ¹ | 2024 ¹ | 2023 ² | 2022 ² | 2021 ¹ | |

in EUR | 0.85 | 0.85 | 0.85 | 0.85 | 0.85 |

in USD | 0.97 | 0.92 | 0.93 | 0.90 | 1.03 |

47 |

48 |

49 |

50 |

51 |

52 |

53 |

54 |

Patient Safety and Quality | 2025 | 2024 | 2023 |

Total Class I Recalls | 2 | 5 | 6 |

Total Class II Recalls | 38 | 31 | 40 |

Warning letters issued (FDA) | 1 | 2 | 0 |

55 |

56 |

57 |

58 |

2025 | 2024 | |

Corporate income tax paid | 218 | 186 |

Customs duty | 351 | 131 |

Value-added tax ¹ | 724 | 717 |

Payroll tax | 2,001 | 2,154 |

Other taxes | 44 | 76 |

Philips Group | 3,337 | 3,263 |

59 |

60 |

61 |

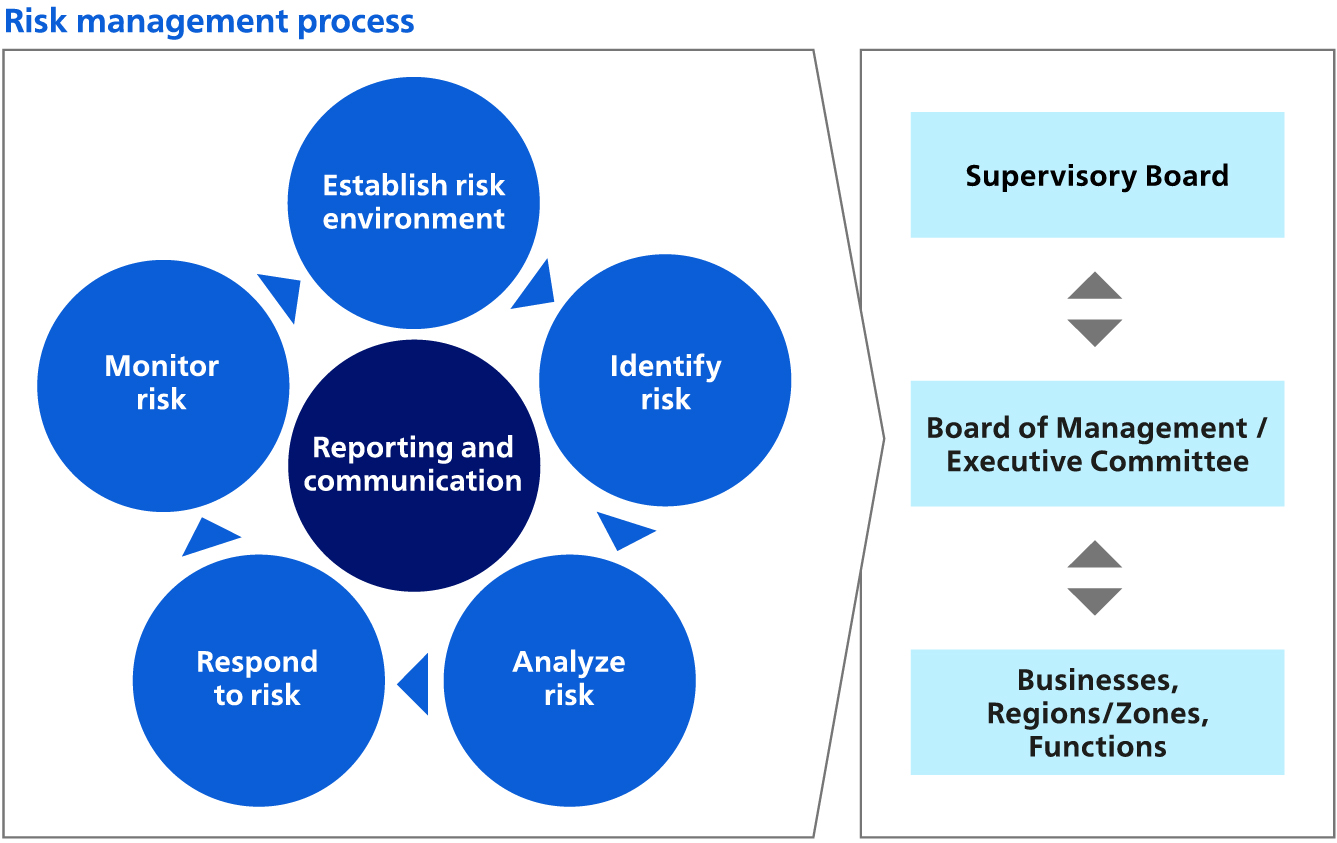

Risk appetite | Averse | Prudent | Balanced | Considerable | Seeking |

Strategic e.g., macro-economics, geopolitics, informatics and AI, M&A, IP, ESG |  |  | |||

Operational e.g., product safety and quality, supply chain, (cyber)security, people |  |  | |||

Financial and reporting e.g., treasury and financing, tax, accounting |  |  | |||

Compliance with our General Business Principles and regulations |  |  |

62 |

63 |

64 |

65 |

66 |

|

Feike Sijbesma 2 3 Born 1959, Dutch Chairman of the Supervisory Board since May 2021 Chairman of the Corporate Governance and Nomination & Selection Committee Member of the Supervisory Board since 2020; second term expires in 2028 Former CEO of Koninklijke DSM N.V. (Honorary Chairman), non- executive Director of Unilever N.V., member of the Supervisory Board of Dutch Central Bank and of Utrecht University. Currently Co-Chair of the Global Climate Adaptation Center and Member of the Board of Trustees of the World Economic Forum. |

1 Member of the Audit Committee 2 Member of the Remuneration Committee 3 Member of the Corporate Governance and Nomination & Selection Committee 4 Member of the Quality & Regulatory Committee |

|

Chua Sock Koong 1 Born 1957, Singaporean Member of the Supervisory Board since 2021; second term expires in 2029 Former Group CEO of Singapore Telecommunications Limited and currently member of the Board of Directors of Prudential plc, Bharti Airtel Limited, Bharti Telecom Limited and Ayala Corporation. Member of the Council of Presidential Advisors of Singapore, the Securities Industry Council and the Dubai Financial Services Authority, Deputy Chairman of the Public Service Commission of Singapore. |

|

Liz Doherty 1 Born 1957, British/Irish Chairwoman of the Audit Committee Member of the Supervisory Board since 2019; second term expires in 2027 Member of the Supervisory Board and Chairwoman of the audit committee of Novartis AG and of Corbion N.V. Member of the advisory committee of Freya Holdco S.à r.l. Fellow of the Chartered Institute of Management Accountants. Former CFO and board member of Reckitt Benckiser Group PLC, former CFO of Brambles Ltd, former non-executive director and audit committee member at Delhaize Group, Nokia Corp., SABMiller PLC and Dunelm Group PLC. Former non-executive board member of the UK Ministry of Justice and of Her Majesty’s Courts and Tribunals Service (UK) and advisor to GBfoods SA and Affinity Petcare SA (subsidiaries of Agrolimen SA). |

|

Marc Harrison 4 Born 1964, American Member of the Supervisory Board since 2018; second term expires in 2026 Former President and Chief Executive Officer of Intermountain Healthcare, former Chief of International Business Development for Cleveland Clinic, former Chief Executive Officer of Cleveland Clinic Abu Dhabi, and co-Founder and former CEO of HATCo (Health Assurance Transformation Company) at General Catalyst. Currently Chair of TowerBrook Healthcare Institute, Senior Advisor of TowerBrook Capital Partners and Strategic Advisor of General Catalyst. |

|

Peter Löscher 1 4 Born 1957, Austrian Member of the Supervisory Board since 2020; second term expires in 2028 Former President and CEO of Siemens AG, President of Global Human Health and Member of the Executive Board of Merck & Co., President and CEO of GE Healthcare Bio-Sciences and member of GE’s Corporate Executive Council, CEO and Delegate of the Board of Directors of Renova Management AG. Currently member of the Board of Directors of Telefónica S.A. and CaixaBank S.A. and Chairman of the Supervisory Board of Telefónica Deutschland Holding AG, Non- Executive Director of Thyssen-Bornemisza Group AG. |

67 |

|

Indra Nooyi 3 Born 1955, American Member of the Supervisory Board since 2021; second term expires in 2029 Former CFO, President, Chairman and CEO of PepsiCo. Currently member of the Board of Directors and Chair of the Audit Committee of Amazon, Inc. and member of the Board of Directors of Honeywell Inc. Member of the Board of Trustees of the Memorial Sloan Kettering Hospital, trustee of the National Gallery of Art. |

|

Sanjay Poonen 2 Born 1969, American Member of the Supervisory Board since 2022; first term expires in 2026 Former Chief Operating Officer at VMware and President at SAP. Currently CEO and President of Cohesity and member of the Board of Directors of Snyk. |

1 Member of the Audit Committee 2 Member of the Remuneration Committee 3 Member of the Corporate Governance and Nomination & Selection Committee 4 Member of the Quality & Regulatory Committee For a current overview of the Supervisory Board members, please refer to our website. |

|

Benoît Ribadeau-Dumas 3 Born 1972, French Member of the Supervisory Board since 2024; first term expires in 2028 Former deputy CEO at SCOR, former Chief of Staff to the French Prime Minister, former CEO of Aerosystems, member of the Management Board of Zodiac Aerospace, former SEVP CGG Veritas and former CEO of Thales Underwater Systems. Currently Chief Companies Officer at Exor, member of the Board of Directors of Stellantis, Institut Merieux, Merieux Nutrisciences, bioMerieux, TagEnergy and Welltec. Member of the Board of Directors of Galileo Global Education. |

|

Paul Stoffels 3 4 Born 1962, Belgian Vice-Chairman and Secretary Chairman of the Quality & Regulatory Committee Member of the Supervisory Board since 2018; second term expires in 2026 Former worldwide Chair of Pharmaceuticals at Johnson & Johnson and Chief Scientific Officer & member of the Executive Committee at Johnson & Johnson, CEO and Chairman of the Board of Directors of Galapagos NV, CEO of Virco and Chairman of Tibotec. |

|

Herna Verhagen 1 2 Born 1966, Dutch Chairwoman of the Remuneration Committee Member of the Supervisory Board since 2022; first term expires in 2026 Former CEO of PostNL, member of the Supervisory Board of Het Concertgebouw N.V. and member of the Advisory Board of Goldschmeding Foundation. Currently member of the Supervisory Board of ING Groep N.V. |

|

Bob White 4 Born 1962, American Member of the Supervisory Board since 2025; first term expires in 2029 Former Executive Vice President and President at Medtronic plc, Senior Vice President at Chemdex Corporation, Accelrys Inc., SourceOne Healthcare Technologies, Inc., GE Healthcare Technologies Inc. (leading the Diagnostic Imaging business) and Covidien plc (President for Emerging Markets and President for Respiratory and Monitoring Solutions). He also formerly held board positions as non- executive member of the public board of Smith & Nephew plc. Currently Director, Representative Executive Officer, President and Chief Executive Officer of Olympus Corporation. |

68 |

69 |

70 |

71 |

Feike Sijbesma | Paul Stoffels | Chua Sock Koong | Liz Doherty | Marc Harrison | Peter Löscher | Indra Nooyi | Sanjay Poonen | David Pyott | Herna Verhagen | Benoît Ribadeau-Dumas | Bob White | |

Year of birth | 1959 | 1962 | 1957 | 1957 | 1964 | 1957 | 1955 | 1969 | 1953 | 1966 | 1972 | 1962 |

Gender | Male | Male | Female | Female | Male | Male | Female | Male | Male | Female | Male | Male |

Nationality | Dutch | Belgian | Singaporean | British/Irish | American | Austrian | American | American | British/American | Dutch | French | American |

Initial appointment date | 2020 | 2018 | 2021 | 2019 | 2018 | 2020 | 2021 | 2022 | 2015 | 2022 | 2024 | 2025 |

Date of (last) (re-)appointment | 2024 | 2022 | 2025 | 2023 | 2022 | 2024 | 2025 | n/a | 2023 | n/a | n/a | n/a |

End of current term | 2028 | 2026 | 2029 | 2027 | 2026 | 2028 | 2029 | 2026 | 2025 | 2026 | 2028 | 2029 |

Independent | l | l | l | l | l | l | l | l | l | l | l | |

Committee memberships ¹ | RC & CGNSC | RC & CGNSC & QRC* | AC | AC | QRC | AC & QRC | CGNSC | RC | QRC | AC & RC | CGNSC | QRC |

Attendance at Supervisory Board meetings | 8/8 (100%) | 8/8 (100%) | 8/8 (100%) | 8/8 (100%) | 7/8 (87,5%) | 8/8 (100%) | 8/8 (100%) | 8/8 (100%) | 4/8 (50%)** | 8/8 (100%) | 8/8 (100%) | 6/8 (75%)** |

Attendance at Committee meetings | RC 3/3 CGNSC 3/3 (100%) | RC 1/3* (33,33%) CGNSC 3/3 QRC 5/5 (100%) | AC 7/7 (100%) | AC 7/7 (100%) | QRC 5/5 (100%) | AC 7/7 (100%) QRC 4/5 (80%) | CGNSC 3/3 (100%) | RC 3/3 (100%) | QRC 2/5** (40%) | RC 3/3 (100%) AC 7/7 (100%) | CGNSC (3/3) (100%) | QRC 5/5 (100%) |

General management | l | l | l | l | l | l | l | l | l | l | l | l |

International business | l | l | l | l | l | l | l | l | l | l | l | l |

ESG and sustainability | l | l | l | l | l | |||||||

(Consumer) health and medical technology | l | l | l | l | l | l | l | |||||

Patient safety, quality and regulatory and product development | l | l | l | l | l | |||||||

Finance and accounting | l | l | l | l | l | l | l | l | l | l | l | l |

Human resources | l | l | l | l | l | l | l | l | l | l | l | |

Manufacturing and supply chain | l | l | l | l | l | l | l | |||||

Information technology and digital | l | l | l | l | l | l | l | l | l | l | ||

Marketing | l | l | l | l | l | l | l | l | ||||

Governmental and public affairs | l | l | l | l | l | l | l | l | l | l | l |

72 |

73 |

74 |

75 |

76 |

77 |

78 |

Compensation element | Purpose and link to strategy | Operation | Policy level |

Total Direct Compensation | To support the Remuneration Policy’s objectives, the Total Direct Compensation includes a significant variable part in the form of an Annual Incentive (cash bonus) and Long- Term Incentive in the form of performance shares. As a result, a significant proportion of pay is ‘at risk’. | The Supervisory Board ensures that a competitive remuneration package for board-level executive talent is maintained and benchmarked. The positioning of Total Direct Compensation is reviewed against benchmark data on an annual basis and is recalibrated if and when required. To establish this benchmark, research is carried out each year on the compensation levels in the Quantum Peer Group. | Total direct remuneration is aimed at or close to the median of the Quantum Peer Group. |

Annual Base Compensation | Fixed cash payments intended to attract and retain executives of the highest caliber and to reflect their experience and scope of responsibilities. | Annual Base Compensation levels and any adjustments made by the Supervisory Board are based on factors including the median of Quantum Peer Group data and performance and experience of the individual member. The annual review date for the base salary is typically before April 1. | The individual salary levels are shown in this Remuneration Report. |

Annual Incentive | Variable cash incentive of which achievement is tied to specific financial and non-financial targets derived from the company’s annual strategic plan. | The payout in any year relates to the achievements of the preceding year. Metrics and their weighting are disclosed ex-ante in the Remuneration Report and there will be no retroactive changes to the selection of metrics used in any given year once approved by the Supervisory Board and disclosed. | Policy (maximum) level: President & CEO On-target: 120% Maximum: 240% of Annual Base Compensation. Other BoM members On-target: 100% Maximum: 200% of Annual Base Compensation. |

Long-Term Incentive | Variable equity incentive of achievement is tied to targets reflecting long-term stakeholder value creation and delivered in the form of performance shares. | The annual award size is set by reference to a multiple of base salary. The actual number of performance shares to be awarded is determined by reference to the average closing price of the Royal Philips share measured over the last month of the quarter preceding the actual grant of performance shares (the day of publication of the relevant quarterly results). Dependent upon the achievement of the performance conditions, cliff-vesting applies three years after the date of grant. During the vesting period, the value of dividends will be added to the performance shares in the form of shares. These dividend-equivalent shares will only be delivered to the extent that the award actually vests. | President & CEO Annual grant size: 200% of Annual Base Compensation. Other BoM members Annual grant size: 150% of Annual Base Compensation. Maximum vesting opportunity is 200% of the number of performance shares granted. |

Mandatory share ownership and holding requirement | To further align the interests of executives to those of stakeholders and to motivate the achievement of sustained performance. | The guideline for members of the Board of Management is to hold at least a minimum shareholding in the company. Until this level has been reached the members of the Board of Management are required to retain all after- tax shares derived from any Long-Term Incentive plan. The shares granted under the Long-Term Incentive plan shall be retained for a period of at least five years or until at least the end of their contract period if this period is shorter. The guideline does not require members of the Board of Management to purchase shares in order to reach the required share ownership level. | The minimum shareholding requirement is 400% of Annual Base Compensation for the CEO and 300% for other members of the Board of Management. |

Pension | Participation in the Philips Flex ES pension plan in the Netherlands (applicable for all executives) combined with a fixed pension contribution intended to result in an appropriate level at retirement. | Defined Contribution plan with fixed contribution (applicable to all executives in the Netherlands – capped at EUR 137,800). Gross allowance of 25% of Annual Base Compensation exceeding EUR 137,800. |

79 |

Compensation element | Purpose and link to strategy | Operation | Policy level |

Additional arrangements | To aid retention and remain competitive within the marketplace. | Additional arrangements include expense and relocation allowances, medical insurance, accident insurance, Philips product arrangements and company car arrangements. The members of the Board of Management also benefit from coverage under the company’s Directors & Officers (D&O) liability insurance. The company does not grant personal loans to members of the Board of Management. | Cash value (grossed up) of the benefits received, which are in line with other Philips executives in the Netherlands. |

Clawback | Risk management and accountability mechanism. | Annual incentives and long-term incentives are subject to claw-back provisions, which allow the Supervisory Board to recoup some or all of the relevant payments. | Clawback provisions are further specified in the Remuneration Policy. |

European companies | Dutch companies | US companies | |

Alcon | Lonza | Ahold Delhaize | Baxter |

BAE Systems | Nokia | AkzoNobel | Becton Dickinson |

Dräger | Reckitt Benckiser | ASML | Boston Scientific |

Ericsson | Roche | Heineken | GE Healthcare |

Fresenius Medical Care | Siemens Healthineers | Medtronic | |

Getinge | Smith & Nephew | Stryker | |

GSK | Thales | ||

US companies | European companies | Japanese companies |

Baxter | Alcon | Canon |

Becton Dickinson | Elekta | Terumo |

Boston Scientific | Fresenius Medical Care | |

Danaher | Getinge | |

GE Healthcare | Reckitt Benckiser | |

Hologic | Siemens Healthineers | |

Johnson & Johnson | Smith & Nephew | |

Medtronic | ||

Resmed | ||

Stryker |

end of term | |

Roy Jakobs | AGM 2026 |

Charlotte Hanneman | AGM 2028 |

Marnix van Ginneken | AGM 2029 |

80 |

Financial performance metric | Weighting as % of target Annual Incentive | Assessment of performance | Weighted pay-out as % of target Annual Incentive | ||||

Threshold performance | Target performance | Maximum performance | Realized performance | Resulting payout as % of target | |||

Comparable Sales Growth ¹ | 35% | 1.0% | 2.0% | 4.0% | 2.3% | 115.0% | 40.3% |

Adjusted EBITA margin ¹ | 20% | 10.8% | 12.3% | 13.8% | 12.3% | 100.0% | 20.0% |

Free Cash Flow ¹ | 15% | 100 | 400 | 700 | 512 | 137.4% | 20.6% |

Total | 70% | 80.9% | |||||

81 |

Member of Board of Management | Performance category | Performance objective | Assessment of performance | Weighted pay-out as % of target Annual Incentive |

Roy Jakobs | Patient safety and quality | Drive patient safety and quality as highest priority in the organization | Overall improvement in processes, controls and culture reflecting commitment to patient safety and quality. Significant progress made on addressing consent decree requirements. FDA inspection resulted in a warning letter. It remains of crucial importance to further resolve the related causes. | 34.5% |

Customer | Improve market share and customer experience | Strong progress made on gaining Market share. | ||

Improve supply chain reliability | On-time delivery of orders as per customer expectations further improved. | |||

Strategy and execution | Drive focused strategy to win in the market | Accelerated growth in strategic growth businesses and launched several world-first innovations. | ||

Establish simplified, more agile operating model | Strong progress on execution priorities with simplification of how work, improved operational performance and rigorous cost management and productivity. | |||

ESG | Deliver on ESG commitments | ESG index realization ahead of target. Employee engagement in line with target. Talent building as per plan. | ||

Charlotte Hanneman | Patient safety and quality | Drive patient safety and quality as highest priority in the organization | Overall improvement in processes, controls and culture reflecting commitment to patient safety and quality. Significant progress made on addressing consent decree requirements. FDA inspection resulted in a warning letter. It remains of crucial importance to further resolve the related causes. | 34.5% |

Customer | Improve market share and customer experience | Strong progress made on gaining Market share. | ||

Improve financial forecasting | Improved predictability on Margin, while opportunity to further improve Sales predictability. | |||

Strategy and execution | Drive focused strategy to win in the market | Accelerated growth in strategic growth businesses and launched several world-first innovations. | ||

Establish simplified, more agile operating model | Strong progress on execution priorities with simplification of how work, improved operational performance and rigorous cost management and productivity. | |||

ESG | Deliver on ESG commitments | ESG index realization ahead of target. Employee engagement in line with target. Talent building as per plan. | ||

Marnix van Ginneken | Patient safety and quality | Drive patient safety and quality as highest priority in the organization | Overall improvement in processes, controls and culture reflecting commitment to patient safety and quality. Significant progress made on addressing consent decree requirements. FDA inspection resulted in a warning letter. It remains of crucial importance to further resolve the related causes. | 33.0% |

Customer | Manage legal issues | In 2025 important milestones were achieved in resolving the Respironics recall related legal proceedings including the resolution of the US personal injury and medical monitoring litigation. | ||

Strategy and execution | Drive focused strategy to win in the market | Accelerated growth in strategic growth businesses and launched several world-first innovations. | ||

Establish simplified, more agile operating model | Strong progress on execution priorities with simplification of how work, improved operational performance and rigorous cost management and productivity. | |||

ESG | Deliver on ESG commitments | ESG index realization ahead of target. Employee engagement in line with target. Talent building as per plan. |

82 |

Annual incentive opportunity | Realized annual incentive | |||||

Target as a % of base compensation | Target Annual Incentive | Financial performance (weighted pay-out %) | Individual performance (weighted pay-out %) | Payout as % of target Annual Incentive ¹ | Realized annual incentive | |

Roy Jakobs | 100% | 1,300,000 | 80.9% | 34.5% | 115.4% | 1,499,680 |

Charlotte Hanneman | 80% | 580,000 | 80.9% | 34.5% | 115.4% | 669,088 |

Marnix van Ginneken | 80% | 580,000 | 80.9% | 33.0% | 113.9% | 660,388 |

83 |

Performance category | Performance objective | Applicable for | Weighting | Measurement description |

Patient safety and quality | Drive patient safety and quality as highest priority in the organization | All members of Board of Management | 7.50% | This objective measures delivery on our company-wide program to strengthen our patient safety and quality culture, capabilities and performance. |

Customer | Improve market share and customer experience | Roy Jakobs | 7.50% | This objective is measured by the market share gain and delivery on prioritized innovations |

Improve market share and customer experience | Charlotte Hanneman | This objective is measured by the market share gain and by a reliable forecast as per plan. | ||

Manage legal issues | Marnix van Ginneken | This objective measures the extent to which litigation strategy is developed and potential liabilities are managed. | ||

Strategy and execution | Drive focused strategy to win in the market and simplify the operating model | All members of Board of Management | 7.50% | This objective measures delivery on our value creation plan and delivery on our operating model simplification plan. |

ESG | Deliver on ESG commitments | All members of Board of Management | 7.50% | This objective measures: •performance on our Impact index (which includes various elements such as emission targets) •our capacity to grow and retain talent and further improve employee engagement |

84 |

achievement | weighting | vesting level | |

TSR | 200% | 50% | 100% |

EPS | 200% | 40% | 80% |

Sustainability objectives | 140% | 10% | 14% |

Total | 194% |

Position | 20-14 | 13 | 12 | 11 | 10 | 9 | 8 | 7 | 6 | 5-1 |

Vesting % | 0 | 60 | 80 | 90 | 100 | 120 | 140 | 160 | 180 | 200 |

total return | rank number | |

Boston Scientific | 126.42% | 1 |

Philips | 93.52% | 2 |

Stryker | 65.33% | 3 |

Fresenius Medical Care | 60.52% | 4 |

Canon | 60.46% | 5 |

GE HealthCare Technologies | 44.57% | 6 |

Smith & Nephew | 32.54% | 7 |

Medtronic | 32.31% | 8 |

Johnson & Johnson | 25.40% | 9 |

Terumo | 22.00% | 10 |

ResMed | 19.67% | 11 |

Reckitt Benckiser | 13.51% | 12 |

Hologic | 2.60% | 13 |

Getinge | 2.16% | 14 |

Alcon | 1.09% | 15 |

Siemens Healthineers | (0.08%) | 16 |

Danaher | (3.75%) | 17 |

Elekta | (6.96%) | 18 |

Becton Dickinson | (15.10%) | 19 |

Baxter | (59.70%) | 20 |

Below threshold | Threshold | Target | Maximum | Actual | |

LTI plan EPS (euro) | <0.54 | 0.54 | 0.64 | 0.83 | 1.26 |

Vesting % | -% | 40% | 100% | 200% | 200% |

85 |

Net income | EPS (euro) | |

Income from continuing operations attributable to shareholders | 899 | 1.02 |

Profit and loss impact of: | ||

- Foreign exchange variations versus plan ¹ | 65 | 0.07 |

- Respironics-related charges ² | 147 | 0.17 |

Adjusted net income from continuing operations | 1,111 | 1.26 |

No. of measures achieved on or above target | Vesting % |

1 | 0% |

2 | 0% |

3 | 50%-100% |

4 | 100%-150% |

5 | 150%-200% |

Sustainability category | Underlying objective | Target range | Realized performance | |

Ensure healthy lives and promote well-being for all at all ages (SDG3) Lives improved | Targeted # of lives improved in year 3 1 | 1.92 – 2.14 billion | 2.0 billion | Within target range |

Ensure sustainable consumption and production patterns (SDG12) Circularity | Targeted circular revenue in year 3 ² | 22.5% – 25.0% | 27.9% | Better than target range |

Targeted waste to landfill in year 3 ³ | 2.5% – 0.1% | <0.01% | Better than target range | |

Targeted closing the loop in year 3 ⁴ | 34.0% – 42.0% | 20.2% | Below target range | |

Take urgent action to combat climate change and its impacts (SDG13) Carbon footprint | Targeted CO2 -equivalent (in kilotonnes) in year 3 | 483 – 433 kilotonnes CO2 | 372 kilotonnes CO2 | Better than target range |

86 |

ESG objective | Rationale | Measurement approach |

Targeted # of lives improved in year 3 1 | Ensure healthy lives and promote well-being for all at all ages (SDG3) Lives improved | We have a lives improved calculation methodology, which follows a three-step approach. 1) We first determine the installed base of our health- and well-being solutions, 2) We determine the number of touchpoints per product per year, and 3) To avoid double- counting, we eliminate all direct- and indirect double-counts between products and solutions. |

Inclusion and belonging score | Aim to be the best place to work for our employees | Inclusion and belonging score in the Philips Engagement Survey |

Targeted full value chain CO2-equivalent (in kilotonnes) in year 3 | Take urgent action to combat climate change and its impacts (SDG13) Carbon footprint | Total greenhouse gas emissions caused by Philips, expressed in kilotonnes CO2- equivalent, which is the sum of our Scope 1, 2 and material Scope 3 (at least 95% coverage) emissions according to the Greenhouse Gas Protocol. |

Virgin non-renewable materials (in kilotonnes) | Aim to use less virgin non-renewable materials and make more materials available for re-use (SDG12) Circularity | Total weight (in kilotonnes) of virgin non-renewable materials which is measured as part of the Philips materials balance |

87 |

Accounting costs in the year | ||||||||||

reported year | annual base compensation ² | base compensation | realized annual incentive | performance shares ³ | pension allowances | pension scheme costs | other compensation ⁴ | total cost | Fixed-variable remuneration ⁵ | |

Roy Jakobs | 2025 | 1,300,000 | 1,287,500 | 1,499,680 | 3,772,196 | 287,425 | 26,609 | 96,386 | 6,969,796 | 24%-76% |

2024 | 1,250,000 | 1,237,500 | 927,750 | 1,692,087 | 274,925 | 32,218 | 83,870 | 4,248,350 | 38%-62% | |

Charlotte Hanneman | 2025 | 725,000 | 718,750 | 669,088 | 835,637 | 145,237 | 26,609 | 108,598 | 2,503,919 | 40%-60% |

2024 | 700,000 | 175,545 | 98,372 | 104,606 | 35,247 | 7,775 | 23,089 | 444,633 | 54%-46% | |

Marnix van Ginneken | 2025 | 725,000 | 708,750 | 660,388 | 1,531,456 | 142,737 | 26,609 | 62,090 | 3,132,030 | 30%-70% |

2024 | 660,000 | 652,500 | 422,374 | 740,101 | 128,675 | 32,218 | 74,227 | 2,050,095 | 43%-57% | |

Total | 2025 | 2,715,000 | 2,829,156 | 6,139,289 | 575,399 | 79,827 | 267,074 | 12,605,745 | 29%-71% | |

2024 | 2,065,545 | 1,448,496 | 2,536,794 | 438,847 | 72,211 | 181,186 | 6,743,078 | 41%-59% | ||

n | Base compensation | n | Annual incentive | n | Performance shares | n | Pension | n | Other compensation |

88 |

2025 | 2024 | 2023 | 2022 | 2021 | 2020 | |

Remuneration | ||||||

CEO Total Remuneration Costs (A) ¹ | 6,969,796 | 4,248,350 | 4,582,347 | 5,133,659 | 5,452,299 | 6,153,067 |

CFO Total Remuneration Costs | 2,503,919 | 3,517,514 | 3,002,907 | 1,896,081 | 2,652,864 | 3,007,990 |

CLO Total Remuneration Costs | 3,132,030 | 2,050,095 | 2,302,397 | 1,416,837 | 2,029,054 | 2,203,160 |

Average Employee (FTE) Total Remuneration Costs (B) ² | 99,667 | 99,091 | 99,866 | 93,373 | 86,853 | 91,455 |

Ratio A versus B ⁴ | 70:1 | 43:1 | 46:1 | 55:1 | 63:1 | 67:1 |

Median Employee Total Remuneration Costs (C) ³ | 83,708 | 89,103 | ||||

Ratio A versus C ⁴ | 83:1 | 48:1 | ||||

Company performance | ||||||

Annual TSR ⁵ | (5.5)% | 43.3% | 42.9% | (60.0)% | (14.5)% | 6.2% |

Comparable Sales Growth% ⁶ | 2.3% | 1.2% | 6.0% | (2.8)% | (1.2)% | 2.9% |

Adjusted EBITA% ⁶ | 12.3% | 11.5% | 10.6% | 7.4% | 12.0% | 13.2% |

Free Cash Flow ⁶ | 512 | 906 | 1,582 | (961) | 900 | 1,635 |

89 |

Grant date | Number of shares originally granted | Value at grant date | Vesting date | End of holding period | Unvested opening balance at Jan. 1, 2025 | Number of shares awarded in 2025 | (Dividend) shares awarded | Number of shares vested in 2025 ¹ | Value at vesting date in 2025 | Unvested closing balance at Dec. 31, 2025 | |

Roy Jakobs | 4/29/2022 | 37,630 ² | 930,000 | 4/29/2025 | 4/29/2025 | 42,148 | - | - | 6,322 | 139,532 | - |

10/28/2022 | 24,279 | 314,137 | 10/28/2025 | 10/28/2027 | 26,233 | - | 1,112 | 4,102 | 101,557 | - | |

4/28/2023 | 124,538 | 2,400,000 | 4/28/2026 | 4/28/2028 | 134,560 | - | 5,702 | - | - | 140,261 | |

7/5/2024 | 131,443 | 2,500,000 | 5/7/2027 | 5/7/2029 | 135,939 | - | 5,760 | - | - | 141,700 | |

6/5/2025 | 120,686 | 2,580,000 | 6/5/2028 | 6/5/2030 | - | 120,686 | 5,114 | - | - | 125,800 | |

Charlotte Hanneman | 7/29/2024 | 25,346 | 613,934 | 7/29/2027 | 7/29/2029 | 25,346 | - | 1,074 | - | - | 26,420 |

7/29/2024 | 37,982 | 920,000 | 7/29/2027 | 7/29/2029 | 37,982 | - | 1,609 | - | - | 39,591 | |

6/5/2025 | 50,871 | 1,087,500 | 6/5/2028 | 6/5/2030 | - | 50,871 | 2,156 | - | - | 53,027 | |

Marnix van Ginneken | 4/29/2022 | 38,237 | 945,000 | 4/29/2025 | 4/29/2027 | 42,828 | - | - | 6,424 | 141,783 | - |

4/28/2023 | 49,037 | 945,000 | 4/28/2026 | 4/28/2028 | 52,983 | - | 2,245 | - | - | 55,228 | |

5/7/2024 | 52,051 | 990,000 | 5/7/2027 | 5/7/2029 | 53,832 | - | 2,281 | - | - | 56,113 | |

6/5/2025 | 50,871 | 1,087,500 | 6/5/2028 | 6/5/2030 | - | 50,871 | 2,156 | - | - | 53,027 |

90 |

Minimum shareholding requirement ¹ | Annual Base Compensation | (Vested) shares held | Ownership ratio ² | |

Roy Jakobs | 4.0x | 1,300,000 | 147,397 | 2.7x |

Charlotte Hanneman | 3.0x | 725,000 | - | 0x |

Marnix van Ginneken | 3.0x | 725,000 | 147,126 | 4.8x |

Fee type (amounts in EUR) | Chairman | Vice Chair | Member | |||

As of 2025 | 2024 | As of 2025 | 2024 | As of 2025 | 2024 | |

Supervisory Board (annual fee) | 175,000 | 166,500 | 130,000 | 123,500 | 113,000 | 107,500 |

Audit Committee | 30,500 | 29,000 | n.a. | 20,250 | 19,250 | |

Remuneration Committee | 23,750 | 22,500 | n.a. | 15,750 | 15,000 | |

Corporate Governance and Nomination & Selection Committee | 23,750 | 22,500 | n.a. | 15,750 | 15,000 | |

Quality and Regulatory Committee | 23,750 | 22,500 | n.a. | 15,750 | 15,000 | |

91 |

Chairman | All members | |

Attendance fee per inter-European trip | 2,750 | 2,750 |

Attendance fee per intercontinental trip | 5,500 | 5,500 |

Entitlement to Philips product arrangement | 2,000 | 2,000 |

Annual fixed net expense allowance | 11,345 | 2,269 |

Other travel expenses | As reasonably incurred | |

membership | committees | other compensation ¹ | total 2025 | total 2024 | |

F. Sijbesma | 175,000 | 39,500 | 11,345 | 225,845 | 232,945 |

P.A. Stoffels | 130,000 | 39,500 | 16,019 | 185,519 | 174,269 |

S.K. Chua | 113,000 | 20,250 | 15,088 | 148,338 | 152,857 |

M.E. Doherty | 113,000 | 30,500 | 11,718 | 155,218 | 156,789 |

A.M. Harrison | 113,000 | 15,750 | 18,769 | 147,519 | 130,269 |

P. Löscher | 113,000 | 36,000 | 10,519 | 159,519 | 160,519 |

I. Nooyi | 113,000 | 15,750 | 15,064 | 143,814 | 142,654 |

S. Poonen | 113,000 | 15,750 | 20,500 | 149,250 | 143,538 |

D. Pyott | 39,627 | 8,329 | 13,992 | 61,948 | 155,019 |

B. Ribadeau-Dumas | 113,000 | 15,750 | 15,270 | 144,020 | 98,198 |

H. Verhagen | 113,000 | 41,195 | 2,847 | 157,042 | 149,996 |

R.J. White | 97,521 | 13,592 | 12,958 | 124,071 | |

Total | 1,346,148 | 291,866 | 164,089 | 1,802,103 | 1,697,054 |

92 |

93 |

94 |

95 |

Contingent Liabilities from Legal Proceedings Related to the Respironics Recall |

As described in Notes 19 and 24, the Company recognizes provisions for legal claims and litigation when it has a present obligation, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and the amount can be estimated reliably. The Company is under criminal and civil investigation by the Department of Justice ("DOJ") and certain US state Attorneys General related to the events leading to the Respironics Recall. As of December 31, 2025, management assessed the outflow of economic resources in connection with these investigations as probable, but is not able to reliably estimate the financial impact. Furthermore, a securities class action complaint in the United States has been filed alleging violations of the Securities and Exchange Act of 1934 causing damage to investors. In the Netherlands, two parties have filed a civil complaint with the Amsterdam District Court. Three parties have filed a request for inquiry proceedings with the Enterprise Chamber of the Amsterdam Court Appeal. Additionally, the Company is subject to an SEC investigation related to the Respironics Recall. As of December 31, 2025, management assessed that it is possible but not probable that these cases could lead to an outflow of economic resources. The Company is not able to reliably estimate the financial impact, if any. The principal considerations for our determination that performing procedures relating to the contingent liabilities from legal proceedings related to the Respironics Recall is a critical audit matter are (i) the significant judgment by management when assessing whether outflow of resources embodying economic benefits is probable or possible and when determining whether the outflow of resources embodying economic benefits can be reasonably estimated; (ii) a high degree of auditor judgment and effort in performing procedures and evaluating audit evidence related to management’s assessment of the contingent liabilities; and (iii) the audit effort involved in the use of professionals with specialized skills and knowledge. Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to management’s assessment of contingencies, including controls over assessing whether an outflow of resources embodying economic benefits is probable and when determining whether the amount can be reasonably estimated, as well as the related financial statement disclosures. These procedures also included, among others (i) the involvement of professionals with specialized skill and knowledge to assist in confirming with internal and external legal counsel the possibility or probability of an unfavorable outcome and the extent to which the outflow of resources embodying economic benefits is reasonably estimable; (ii) evaluating the reasonableness of management’s assessment regarding whether an unfavorable outcome is reasonably possible or probable and reasonably estimable; and (iii) evaluating the sufficiency of the Company’s contingent liability disclosure related to the Respironics Recall. |

96 |

Goodwill Impairment Assessments – Connected Care Segment Businesses |

As described in Note 11, goodwill is allocated to Businesses (groups of cash-generating units (CGUs)). The Connected Care Segment is composed of the Monitoring, Sleep & Respiratory Care, and Enterprise Informatics CGUs. The goodwill allocated to these CGUs is EUR 3,752 million, EUR 625 million and EUR 248 million, respectively, as of December 31, 2025. Management performs an impairment test in the fourth quarter of each year, or more frequently if indicators of potential impairment exist. The carrying amount of each group of CGUs is compared to the recoverable amount of the group of CGUs. An impairment loss is recognized in the Consolidated statements of income whenever and to the extent that the carrying amount of a group of CGUs exceeds the recoverable amount for the group of CGUs, whichever is the greater, its value-in-use or its fair value less cost of disposal. Significant assumptions used in the value-in-use calculations include compound sales growth rates, EBITA in the terminal value, and the rates used for discounting the projected cash flows. Philips defines EBITA as income from operations excluding amortization and impairment of acquired intangible assets and impairment of goodwill. The principal considerations for our determination that performing procedures relating to the goodwill impairment assessments - Connected Care Segment Businesses is a critical audit matter are (i) the significant judgment by management when developing the fair value estimate of the CGUs; (ii) a high degree of auditor judgment, subjectivity, and effort in performing procedures and evaluating management’s significant assumptions related to the compound sales growth rates, EBITA in the terminal value and the rates used for discounting the projected cash flows; and (iii) the audit effort involved the use of professionals with specialized skill and knowledge. Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to management’s goodwill impairment assessments for the Connected Care Segment CGUs. These procedures also included, among others, (i) testing management’s process for developing the fair value estimate of the Connected Care Segment CGUs; (ii) evaluating the appropriateness of the value-in-use approach used by management; (iii) testing the completeness and accuracy of underlying data used in the value- in-use approach; (iv) and evaluating the reasonableness of the significant assumptions used by management; compound sales growth rates, EBITA in the terminal value, and the rates used for discounting the projected cash flows. Evaluating management’s significant assumptions related to the compound sales growth rates, and EBITA in the terminal value involved evaluating whether the assumptions used by management were reasonable considering (i) the current and past performance of the Connected Care Segment CGUs; (ii) the consistency with external market and industry data; and (iii) whether the assumption was consistent with evidence obtained in other areas of the audit. Professionals with specialized skill and knowledge were used to assist in evaluating (i) the appropriateness of the value-in-use model and ii) the reasonableness of significant assumptions; compound sales growth rates, EBITA in the terminal value, and the rates used for discounting the projected cash flows. |

97 |

98 |

Note | 2025 | 2024 | 2023 | |

Sales | 6 | |||

Cost of sales | ( | ( | ( | |

Gross margin | ||||

Selling expenses | ( | ( | ( | |

General and administrative expenses | ( | ( | ( | |

Research and development expenses | ( | ( | ( | |

Other business income | 6 | |||

Other business expenses | 6 | ( | ( | ( |

Income from operations | 6 | ( | ||

Financial income | 7 | |||

Financial expenses | 7 | ( | ( | ( |

Results of associates | ( | ( | ( | |

Income before taxes | ( | |||

Income tax (expense) benefit | 8 | ( | ( | |

Income from continuing operations | ( | ( | ||

Discontinued operations, net of income taxes | 3 | ( | ( | |

Net income | ( | ( | ||

Attribution of net income: | ||||

Net income attributable to shareholders of Koninklijke Philips N.V. | ( | ( | ||

Net income attributable to non-controlling interests |

2025 | 2024 | 2023 | |

Basic earnings per common share | |||

Income from continuing operations | ( | ( | |

Net income | ( | ( | |

Diluted earnings per common share | |||

Income from continuing operations | ( | ( | |

Net income | ( | ( |

Note | 2025 | 2024 | 2023 | |

Net income | ( | ( | ||

Pensions and other-post employment plans: | 20 | |||

Remeasurement, before tax | ( | ( | ||

Income tax effect on remeasurements | 8 | ( | ||

Financial assets fair value through OCI: | ||||

Net current-period change, before tax | ( | ( | ( | |

Income tax effect on net current-period change | ||||

Total of items that will not be reclassified to Income Statement | ( | ( | ( | |

Currency translation differences: | ||||

Net current period change, before tax | ( | ( | ||

Reclassification adjustment for (gain) loss realized | ( | ( | ( | |

Income tax effect on net current-period change and reclassification | 8 | ( | ||

Cash flow hedges: | ||||

Net current-period change, before tax | ||||

Reclassification adjustment for (gain) loss realized | ( | ( | ( | |

Income tax effect on net current-period change and reclassification | 8 | ( | ( | |

Total of items that are or may be reclassified to Income Statement | ( | ( | ||

Other comprehensive income | ( | ( | ||

Total comprehensive income | ( | ( | ||

Total comprehensive income attributable to: | ||||

Shareholders of Koninklijke Philips N.V. | ( | ( | ||

Non-controlling interests | ( |

99 |

Note | 2025 | 2024 | ||

Non-current assets | ||||

Property, plant and equipment | 2 | 10 | ||

Goodwill | 2 | 11 | ||

Intangible assets excluding goodwill | 2 | 12 | ||

Non-current receivables | 16 | |||

Investments in associates | 5 | |||

Other non-current financial assets | 13 | |||

Deferred tax assets | 8 | |||

Other non-current assets | 14 | |||

Total non-current assets | ||||

Current assets | ||||

Inventories | 15 | |||

Other current assets | 14 | |||

Current derivative financial assets | 28 | |||

Income tax receivable | ||||

Current receivables | 16 | |||

Assets classified as held for sale | 3 | |||

Cash and cash equivalents | 29 | |||

Total current assets | ||||

Total assets | ||||

Note | 2025 | 2024 | ||

Equity | ||||

Shareholders’ equity | 17 | |||

Non-controlling interests | 17 | |||

Group equity | ||||

Non-current liabilities | ||||

Long-term debt | 18 | |||

Long-term provisions | 19 | |||

Deferred tax liabilities | 8 | |||

Non-current contract liabilities | 22 | |||

Other non-current liabilities | 22 | |||

Total non-current liabilities | ||||

Current liabilities | ||||

Short-term debt | 18 | |||

Current derivative financial liabilities | 28 | |||

Income tax liabilities | 8 | |||

Accounts payable | ||||

Accrued liabilities | 21 | |||

Current contract liabilities | 22 | |||

Short-term provisions | 19 | |||

Liabilities directly associated with assets held for sale | 3 | |||

Other current liabilities | 22 | |||

Total current liabilities | ||||

Total liabilities | ||||

Total liabilities and group equity | ||||

100 |

Note | 2025 | 2024 | 2023 | ||

Cash flows from operating activities | |||||

Net income | ( | ( | |||

Results of discontinued operations, net of income tax | ( | ||||

Adjustments to reconcile net income to net cash provided by (used for) operating activities: | |||||

Depreciation, amortization, and impairment of assets | |||||

Impairment of goodwill | |||||

Share-based compensation | |||||

Net loss (gain) on sale of assets | ( | ( | |||

Interest income | ( | ( | ( | ||

Interest expense on debt, borrowings, and other liabilities | |||||

Results of associates | |||||

Income tax expense (benefit) | ( | ||||

Decrease (increase) in working capital | ( | ( | |||

Decrease (increase) in receivables and other current assets | ( | ( | |||

Decrease (Increase) in inventories | ( | ||||

Increase (decrease) in accounts payable, accrued and other current liabilities | ( | ||||

Decrease (increase) in non-current receivables and other assets | ( | ( | ( | ||