2 Forward Looking Statements Statements in this presentation that are not strictly historical, including any statements regarding Danaher’s estimated or anticipated financial performance and any other statements regarding events or developments that we believe or anticipate will or may occur in the future are "forward looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include, among other things: the impact of the tariffs and related actions implemented by the U.S. and other countries, the impact of our debt obligations on our operations and liquidity, deterioration of or instability in the global economy, the markets we serve and the financial markets, uncertainties with respect to the development, deployment, and use of artificial intelligence in our business and products, the impact of global health crises, uncertainties relating to national laws or policies, including laws or policies to protect or promote domestic interests and/or address foreign competition, contractions or growth rates and cyclicality of markets we serve, competition, our ability to develop and successfully market new products and technologies and expand into new markets, the potential for improper conduct by our employees, agents or business partners, our compliance with applicable laws and regulations (including rules relating to off-label marketing and other regulations relating to medical devices and the health care industry), the results of our clinical trials and perceptions thereof, our ability to effectively address cost reductions and other changes in the health care industry, our ability to successfully identify and consummate appropriate acquisitions and strategic investments, our ability to integrate the businesses we acquire and achieve the anticipated growth, synergies and other benefits of such acquisitions, contingent liabilities and other risks relating to acquisitions, investments, strategic relationships and divestitures (including tax- related and other contingent liabilities relating to past and future IPOs, split-offs or spin-offs), security breaches or other disruptions of our information technology systems or violations of data privacy laws, the impact of our restructuring activities on our ability to grow, risks relating to potential impairment of goodwill and other intangible assets, currency exchange rates, tax audits and changes in our tax rate and income tax liabilities, changes in tax laws applicable to multinational companies, litigation, regulatory proceedings and other contingent liabilities including intellectual property and environmental, health and safety matters, the rights of the United States government with respect to our production capacity in times of national emergency or with respect to intellectual property/production capacity developed using government funding, risks relating to product, service or software defects, product liability and recalls, risks relating to our manufacturing operations, the impact of climate change, legal or regulatory measures to address climate change and other sustainability topics and our ability to address regulatory requirements or stakeholder expectations relating to climate change and other sustainability topics, risks relating to fluctuations in the cost and availability of the supplies we use (including commodities) and labor we need for our operations, our relationships with and the performance of our channel partners, uncertainties relating to collaboration arrangements with third-parties, the impact of deregulation on demand for our products and services, labor matters and our ability to recruit, retain and motivate talented employees, U.S. and non-U.S. economic, political, geopolitical, legal, compliance, social and business factors (including the impact of elections, regulatory changes or uncertainty, government shutdowns and military conflicts), disruptions and other impacts relating to man-made and natural disasters, inflation and the impact of our By-law exclusive forum provisions. Additional information regarding the factors that may cause actual results to differ materially from these forward looking statements is available in our SEC filings, including our 2024 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the third quarter of 2025. These forward-looking statements speak only as of the date of this presentation and except to the extent required by applicable law, the Company does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise. With respect to the non-GAAP financial measures referenced in the following presentation, calculations of these measures, explanations of what these measures represent, the reasons why we believe these measures provide useful information to investors, a reconciliation of these measures to the most directly comparable GAAP measures, as applicable, and other information relating to these non- GAAP measures can be found in the accompanying information at the end of this presentation or in the “Investors” section of Danaher’s web site, www.danaher.com. All references in this presentation (1) to financial metrics relate only to the continuing operations of Danaher’s business, unless otherwise noted; (2) to “growth” or other period-to-period changes refer to year-over-year comparisons unless otherwise indicated; and (3) to operating profit below the segment level exclude amortization. We may also describe certain products and devices which have applications submitted and pending for certain regulatory approvals.

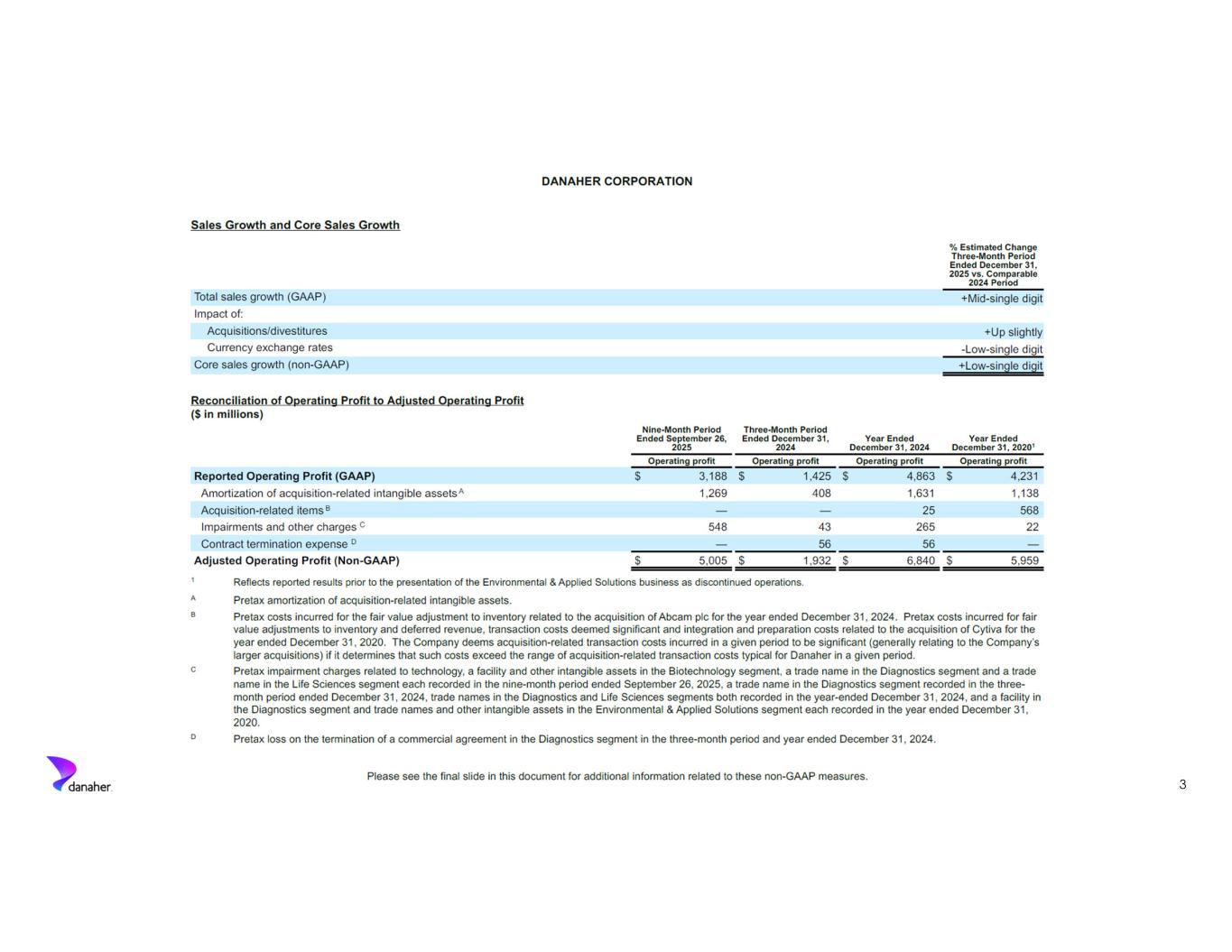

3

4 What You’ll Hear Today Anticipate Q4 2025 results will be slightly ahead of our expectations Differentiated positions in attractive areas of Biotechnology, Life Sciences and Diagnostics Well-positioned to generate sustainable long-term shareholder value through innovation, execution and capital deployment, driven by DBS

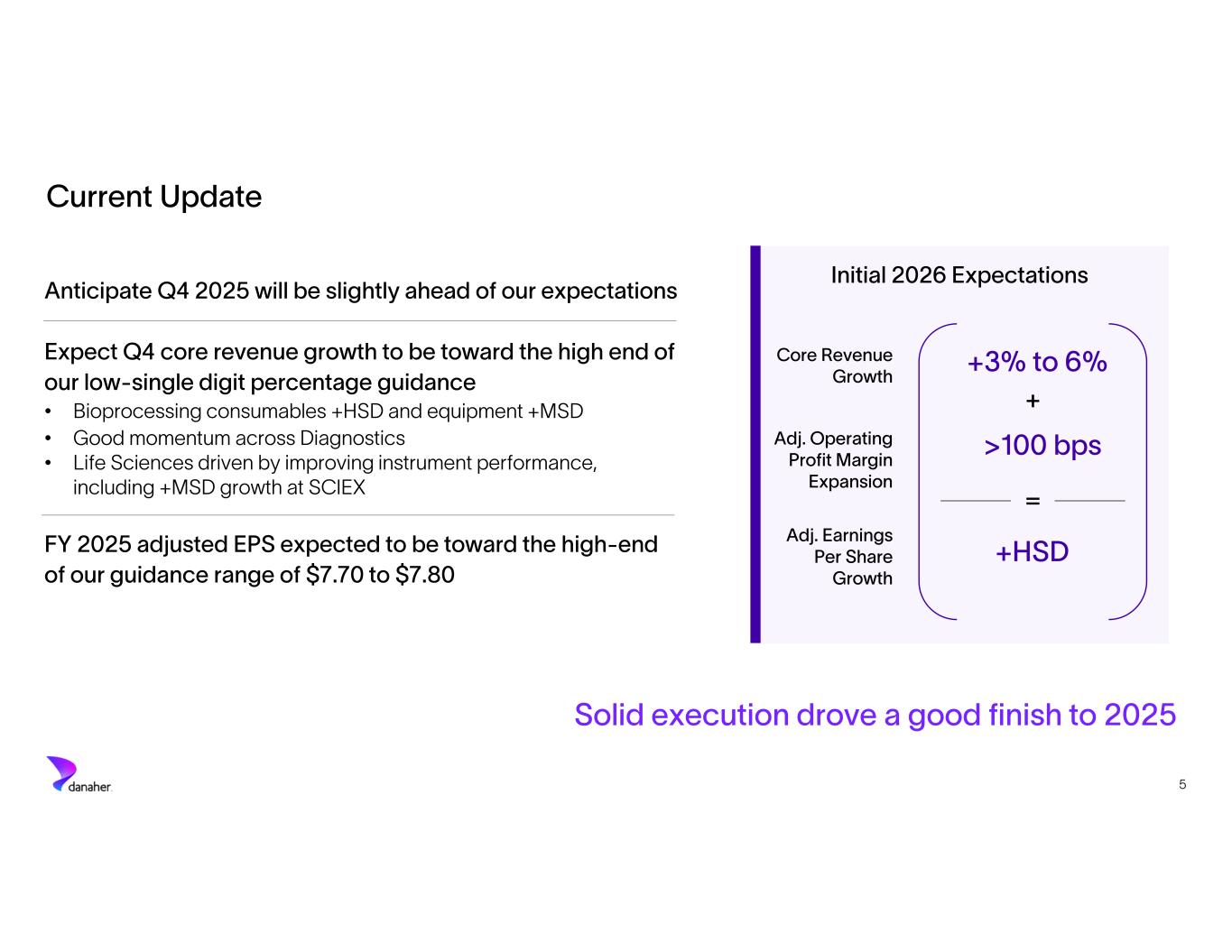

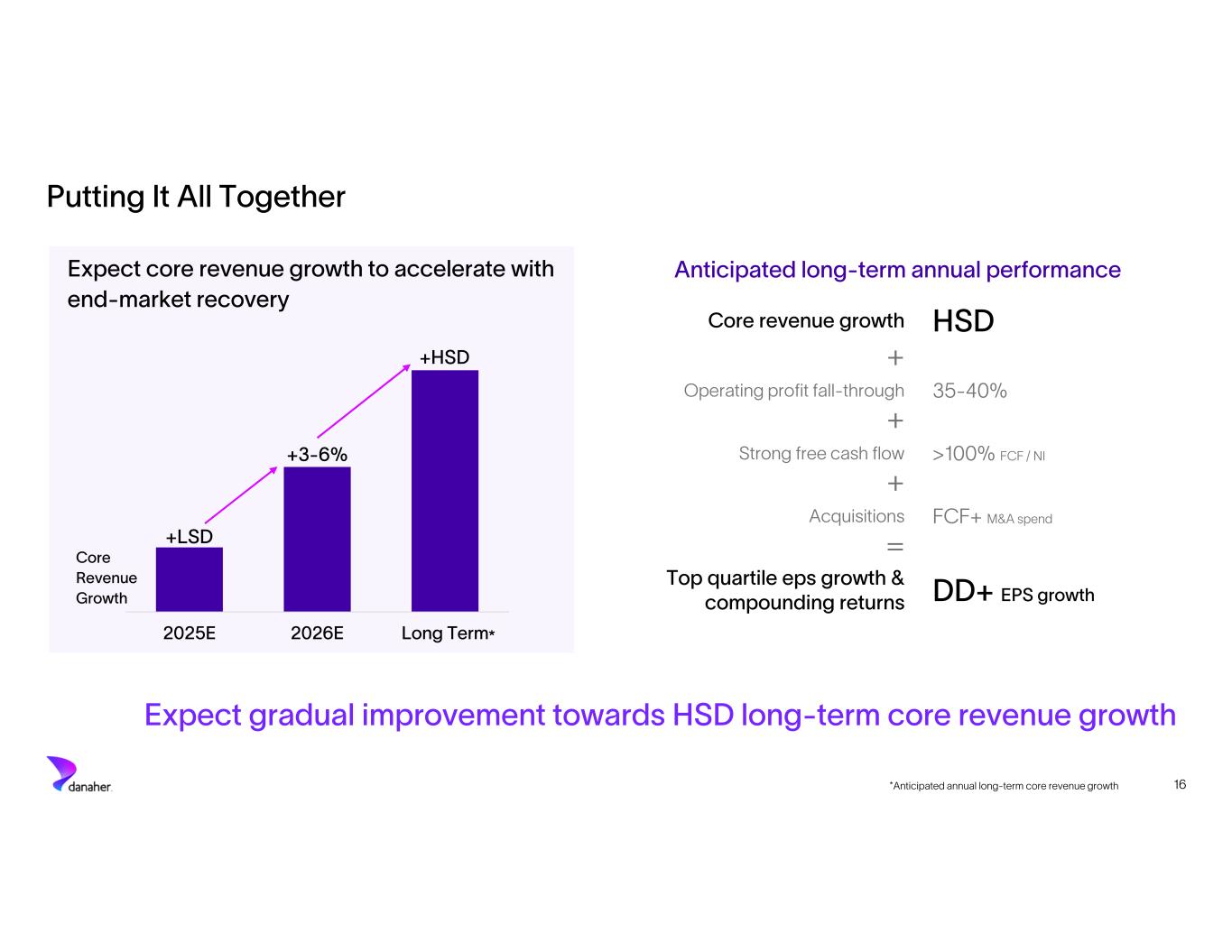

5 Current Update Solid execution drove a good finish to 2025 Anticipate Q4 2025 will be slightly ahead of our expectations Expect Q4 core revenue growth to be toward the high end of our low-single digit percentage guidance • Bioprocessing consumables +HSD and equipment +MSD • Good momentum across Diagnostics • Life Sciences driven by improving instrument performance, including +MSD growth at SCIEX FY 2025 adjusted EPS expected to be toward the high-end of our guidance range of $7.70 to $7.80 Initial 2026 Expectations Core Revenue Growth + +3% to 6% = +HSD >100 bpsAdj. Operating Profit Margin Expansion Adj. Earnings Per Share Growth

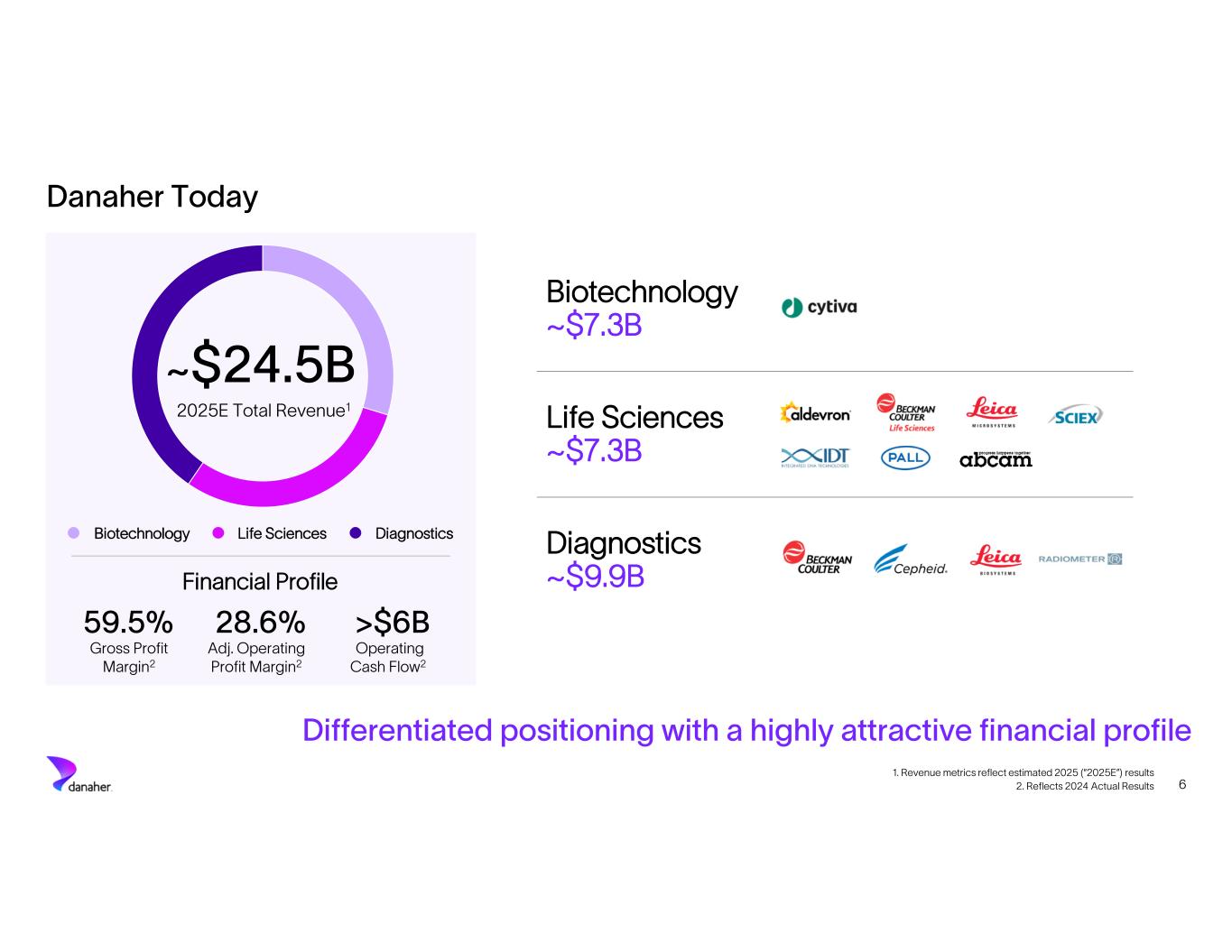

6 Danaher Today 1. Revenue metrics reflect estimated 2025 (“2025E”) results 2. Reflects 2024 Actual Results 2025E Total Revenue1 ~$24.5B DiagnosticsLife Sciences Biotechnology >$6B28.6%59.5% Operating Cash Flow2 Adj. Operating Profit Margin2 Gross Profit Margin2 Differentiated positioning with a highly attractive financial profile Biotechnology ~$7.3B Life Sciences ~$7.3B Diagnostics ~$9.9BFinancial Profile

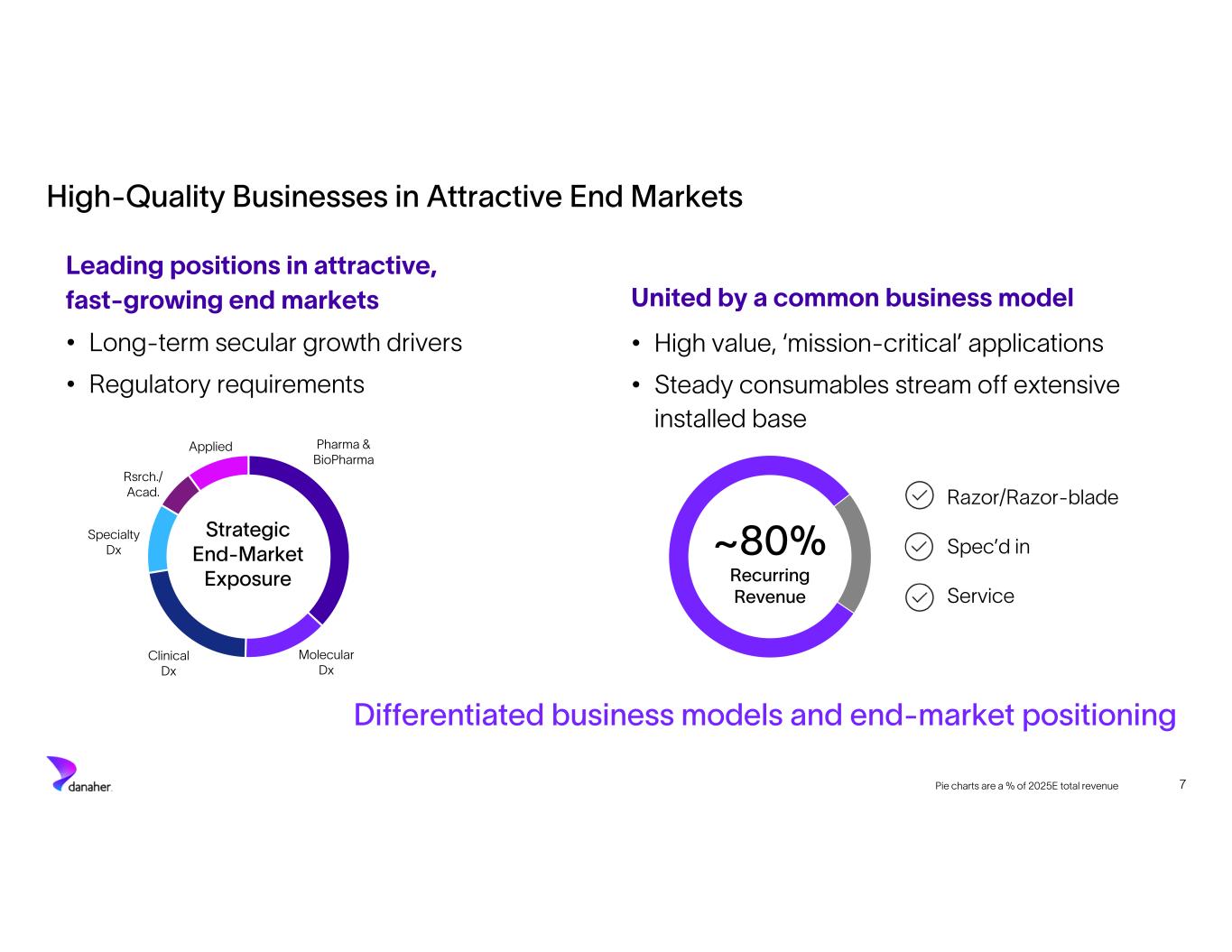

7 Differentiated business models and end-market positioning Leading positions in attractive, fast-growing end markets • Long-term secular growth drivers • Regulatory requirements High-Quality Businesses in Attractive End Markets Pie charts are a % of 2025E total revenue Strategic End-Market Exposure Pharma & BioPharma Molecular Dx Clinical Dx Rsrch./ Acad. Applied United by a common business model • High value, ‘mission-critical’ applications • Steady consumables stream off extensive installed base Razor/Razor-blade Spec’d in Service ~80% Recurring Revenue Specialty Dx

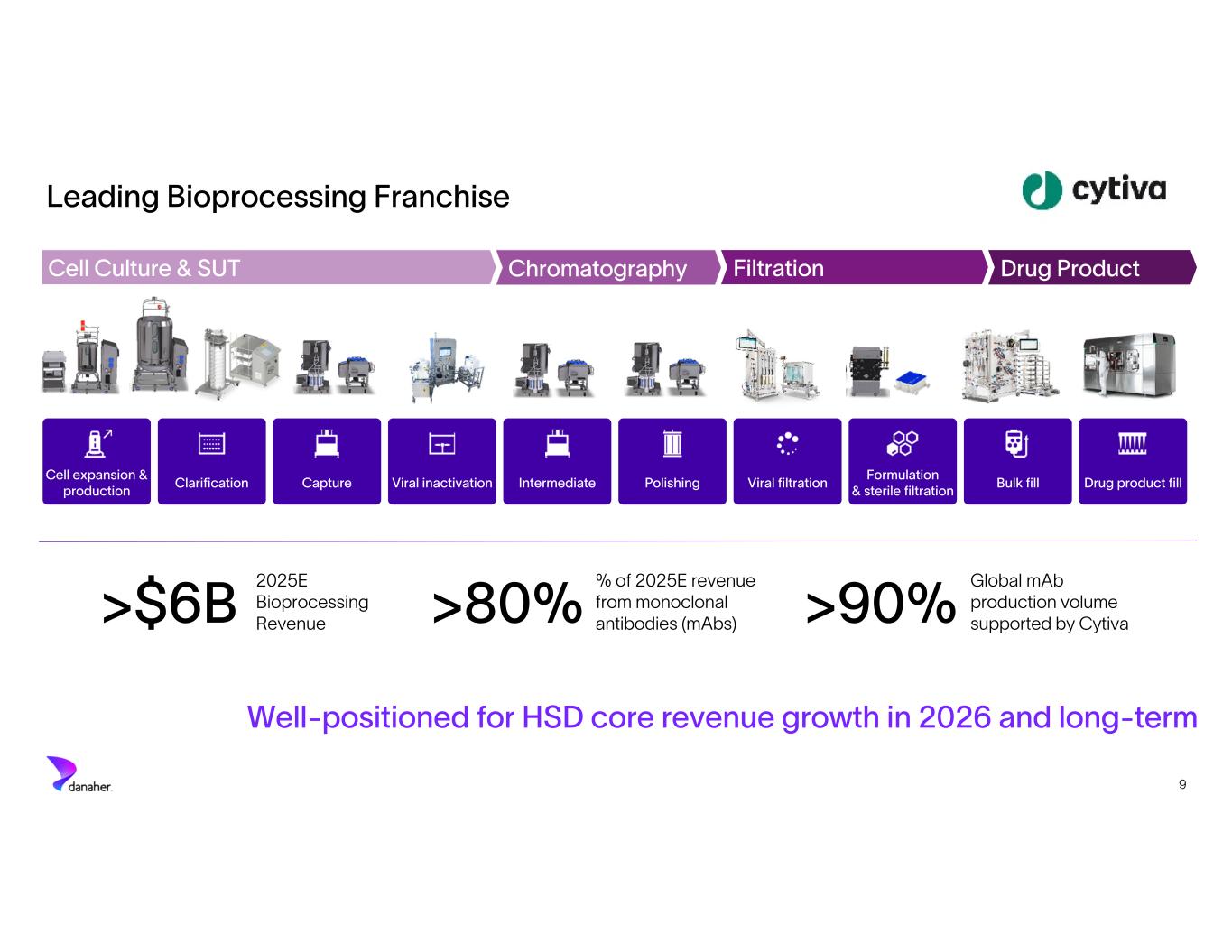

9 Cell expansion & production Clarification Capture Viral inactivation Intermediate Polishing Viral filtration Formulation & sterile filtration Bulk fill Drug product fill Leading Bioprocessing Franchise Cell Culture & SUT Chromatography Filtration Drug Product Well-positioned for HSD core revenue growth in 2026 and long-term 9 2025E Bioprocessing Revenue>$6B >90% Global mAb production volume supported by Cytiva % of 2025E revenue from monoclonal antibodies (mAbs)>80%

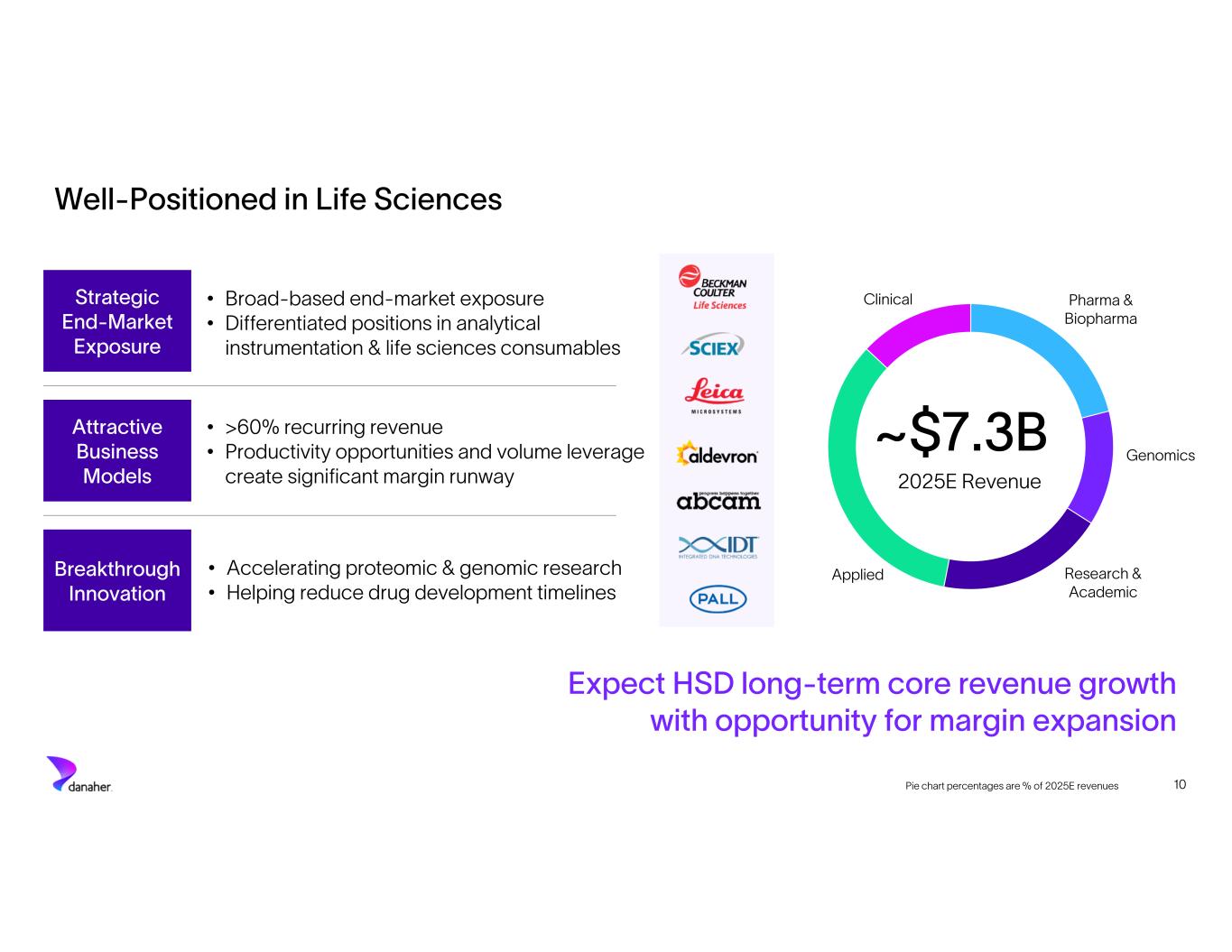

10 Well-Positioned in Life Sciences Pie chart percentages are % of 2025E revenues Expect HSD long-term core revenue growth with opportunity for margin expansion Strategic End-Market Exposure • Broad-based end-market exposure • Differentiated positions in analytical instrumentation & life sciences consumables Attractive Business Models • >60% recurring revenue • Productivity opportunities and volume leverage create significant margin runway Breakthrough Innovation • Accelerating proteomic & genomic research • Helping reduce drug development timelines Research & Academic Pharma & Biopharma Clinical Genomics 2025E Revenue ~$7.3B Applied

12 Innovation Helping Solve Some of Healthcare’s Biggest Challenges Accelerating Drug Discovery ~25% increase in new product revenue generated over the last year Increasing Biologic Manufacturing Yields Improving Patient Diagnoses Xcellerex X-platform Bioreactors Scalable platform designed to increase cell culture productivity and process intensity Oxygen mass transfer vs. prior generation bioreactors >3X DxI 9000 Immunoassay Analyzer Leading sensitivity, workflow & global installed base enabling meaningful Alzheimer’s opportunities More Sensitive vs. Traditional IA Systems 100x ZenoTOF 8600 Mass Spectrometer Significant performance gains in proteomics, lipidomics metabolomics, and small molecule workflows Increased sensitivity vs. previous platform 30xUp To

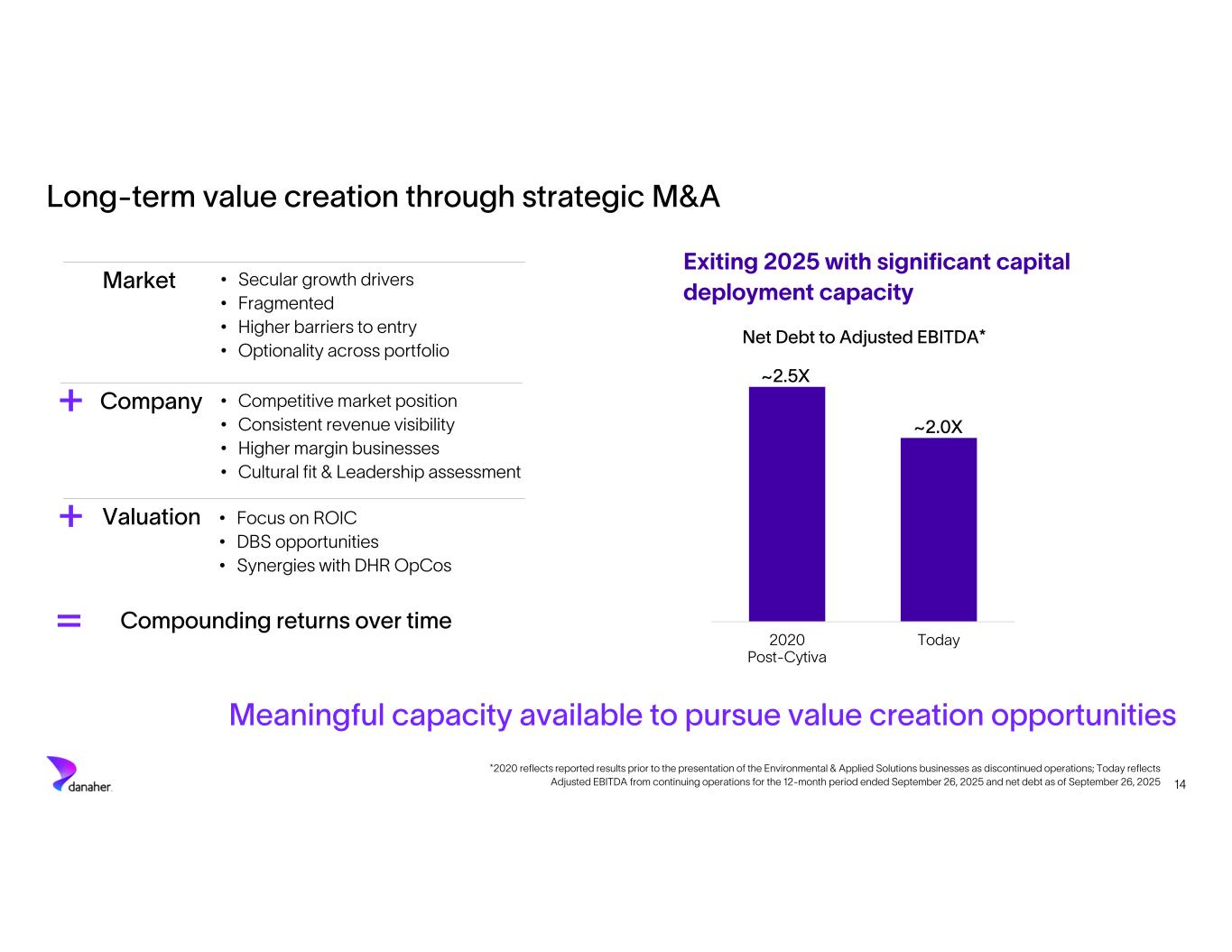

14 Long-term value creation through strategic M&A Meaningful capacity available to pursue value creation opportunities *2020 reflects reported results prior to the presentation of the Environmental & Applied Solutions businesses as discontinued operations; Today reflects Adjusted EBITDA from continuing operations for the 12-month period ended September 26, 2025 and net debt as of September 26, 2025 Compounding returns over time Market Company Valuation + + = • Secular growth drivers • Fragmented • Higher barriers to entry • Optionality across portfolio • Competitive market position • Consistent revenue visibility • Higher margin businesses • Cultural fit & Leadership assessment • Focus on ROIC • DBS opportunities • Synergies with DHR OpCos 2020 Post-Cytiva Today Exiting 2025 with significant capital deployment capacity Net Debt to Adjusted EBITDA* ~2.0X ~2.5X

16 Expect gradual improvement towards HSD long-term core revenue growth Expect core revenue growth to accelerate with end-market recovery Anticipated long-term annual performance Putting It All Together HSDCore revenue growth + 35-40%Operating profit fall-through + >100% FCF / NIStrong free cash flow + FCF+ M&A spendAcquisitions = DD+ EPS growth Top quartile eps growth & compounding returns 2025E 2026E Long Term *Anticipated annual long-term core revenue growth * +LSD +HSD +3-6% Core Revenue Growth

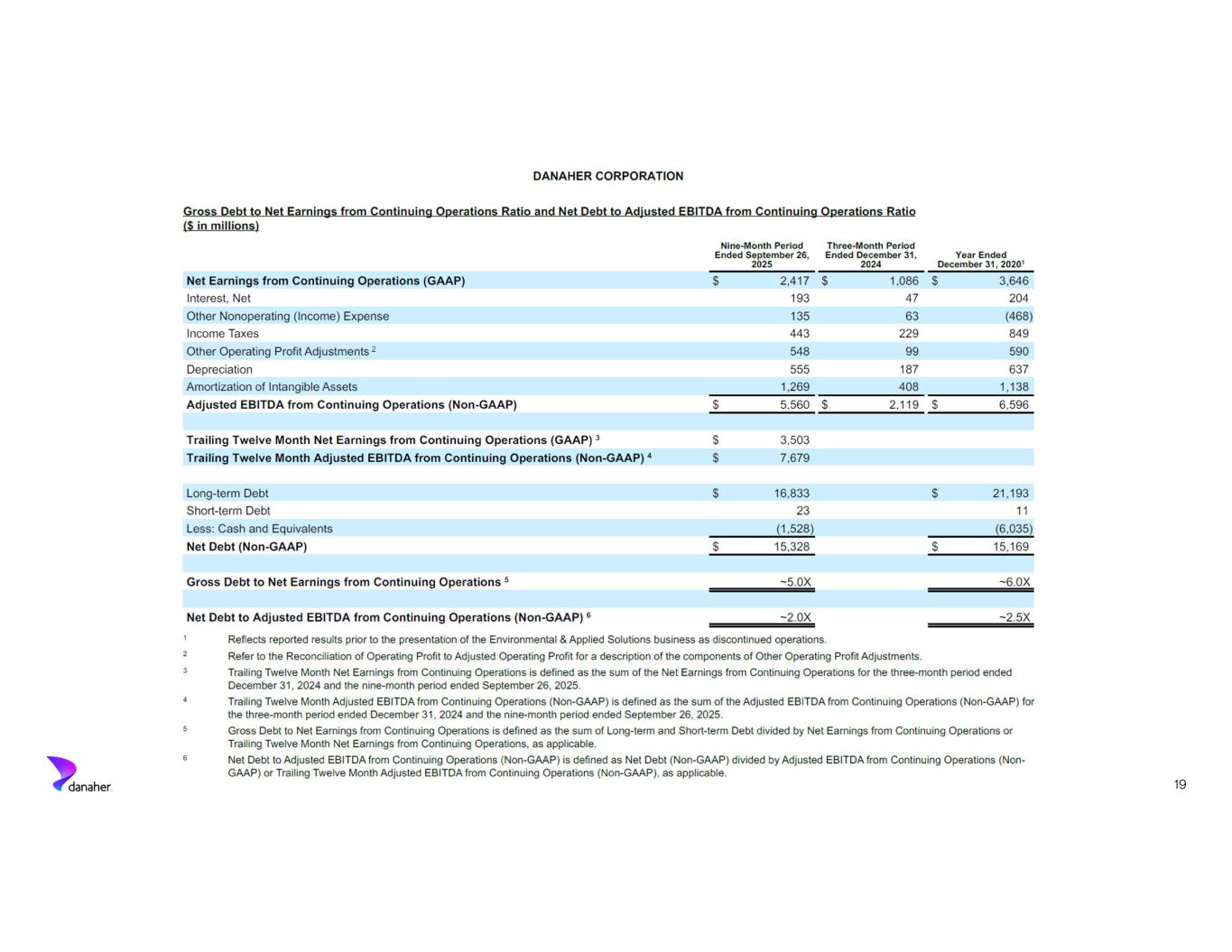

19

20