| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| New Contracts, Extensions and Other Updates Since Last Fleet Status Report | ||

Contract Backlog •Valaris has been awarded the following new contracts and contract extensions, with associated contract backlog of approximately $190 million, subsequent to issuing its previous fleet status report on July 24, 2025. Contract backlog excludes lump sum payments such as mobilization fees and capital reimbursements. •Contract backlog is approximately $4.5 billion as of October 23, 2025. Floater Contract Awards •Five-well contract with Bp Exploration Delta Limited for drillship VALARIS DS-12 in Egypt. The contract is expected to commence in the second quarter 2026 and has an estimated duration of 350 days. The estimated total contract value, inclusive of a mobilization fee, is approximately $140 million. The contract also includes three option wells. Jackup Contract Awards •194-day contract extension for jackup VALARIS 121 with Shell in the UK North Sea. The contract extension is expected to commence in February 2026 in direct continuation of the existing contract. The contracted revenue backlog for the 194-day extension is over $25 million. One further unpriced option remains. •150-day contract extension for jackup VALARIS Norway with Ithaca Energy in the UK North Sea. The contract extension is expected to commence in August 2026 in direct continuation of the existing contract. The contracted revenue backlog for the 150-day extension is approximately $18 million. •120-day contract for VALARIS 248 with GE Vernova in the UK North Sea to provide accommodation support services for an offshore wind project. The contract is expected to commence in November 2025 and will add over $8 million to contracted revenue backlog. The contract includes an additional six priced options with a total duration of 104 days. •Two 28-day contract extensions for jackup VALARIS 122 with Shell in the UK North Sea. The contract extension is expected to commence in January 2026 in direct continuation of the existing contract. The total contracted revenue backlog for the two 28-day extensions is over $6 million. The contract extensions are for accommodation support. One priced option remains. Other Fleet Status Updates •Jackup VALARIS 247 sold for cash proceeds of approximately $108 million in August 2025. | ||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

Contract Backlog(1) (2) ($ millions) | 2025 | 2026 | 2027+ | Total | Contracted Days(1) (2) | 2025 | 2026 | 2027+ | |||||||||||||||||||||

| Drillships | $ | 163.5 | $ | 1,055.4 | $ | 1,398.9 | $ | 2,617.8 | Drillships | 420 | 2,545 | 3,079 | |||||||||||||||||

| Semisubmersibles | 7.3 | — | — | 7.3 | Semisubmersibles | 33 | — | — | |||||||||||||||||||||

| Floaters | $ | 170.8 | $ | 1,055.4 | $ | 1,398.9 | $ | 2,625.1 | Floaters | 453 | 2,545 | 3,079 | |||||||||||||||||

Harsh Environment(3) | $ | 66.4 | $ | 258.7 | $ | 200.2 | $ | 525.3 | Harsh Environment(3) | 495 | 1,961 | 1,342 | |||||||||||||||||

| Benign Environment | 56.4 | 234.2 | 310.4 | 601.0 | Benign Environment | 420 | 1,671 | 2,479 | |||||||||||||||||||||

| Legacy | 13.9 | 72.6 | 50.1 | 136.6 | Legacy | 140 | 730 | 505 | |||||||||||||||||||||

| Jackups | $ | 136.7 | $ | 565.5 | $ | 560.7 | $ | 1,262.9 | Jackups | 1,055 | 4,362 | 4,326 | |||||||||||||||||

Other(4) | $ | 32.7 | $ | 175.2 | $ | 354.4 | $ | 562.3 | Other(4) | 528 | 2,786 | 7,718 | |||||||||||||||||

| Total | $ | 340.2 | $ | 1,796.1 | $ | 2,314.0 | $ | 4,450.3 | Total | 2,036 | 9,693 | 15,123 | |||||||||||||||||

ARO Drilling(5) | Average Day Rates(1) (2) | 2025 | 2026 | 2027+ | |||||||||||||||||||||||||

| Owned Rigs | $ | 68.4 | $ | 204.6 | $ | 606.9 | $ | 879.9 | Drillships | $ | 389,000 | $ | 415,000 | $ | 454,000 | ||||||||||||||

| Leased Rigs | 45.8 | 252.0 | 986.9 | 1,284.7 | Semisubmersibles | 222,000 | — | — | |||||||||||||||||||||

| Total | $ | 114.2 | $ | 456.6 | $ | 1,593.8 | $ | 2,164.6 | Floaters | $ | 377,000 | $ | 415,000 | $ | 454,000 | ||||||||||||||

Harsh Environment(3) | $ | 134,000 | $ | 132,000 | $ | 149,000 | |||||||||||||||||||||||

| Benign Environment | 134,000 | 140,000 | 125,000 | ||||||||||||||||||||||||||

| Legacy | 100,000 | 100,000 | 99,000 | ||||||||||||||||||||||||||

| Jackups | $ | 130,000 | $ | 130,000 | $ | 130,000 | |||||||||||||||||||||||

(1) Contract backlog, contracted days and average day rates as of October 23, 2025. (2) Contract backlog and average day rates exclude certain types of non-recurring revenues such as lump sum mobilization payments. Contract backlog and contracted days may include backlog and days when a rig is under suspension, except any backlog or days for rigs that are under a separate firm contract where backlog or days are otherwise included. Average day rates are adjusted to exclude suspension backlog and days. (3) Contract suspension notice received from Harbour Energy for jackup VALARIS 120. The contract suspension is effective on completion of Harbour Energy's well-in-progress, currently estimated to be in November 2025. Contract backlog includes approximately $125 million for this rig following the suspension effective date. (4) Other represents contract backlog and contracted days related to bareboat charter agreements and management services contracts. (5) ARO Drilling contract backlog as of October 23, 2025. | |||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | ||||||||||||||||||||||||||||||||||||||||||

| Drillships | ||||||||||||||||||||||||||||||||||||||||||||||||||

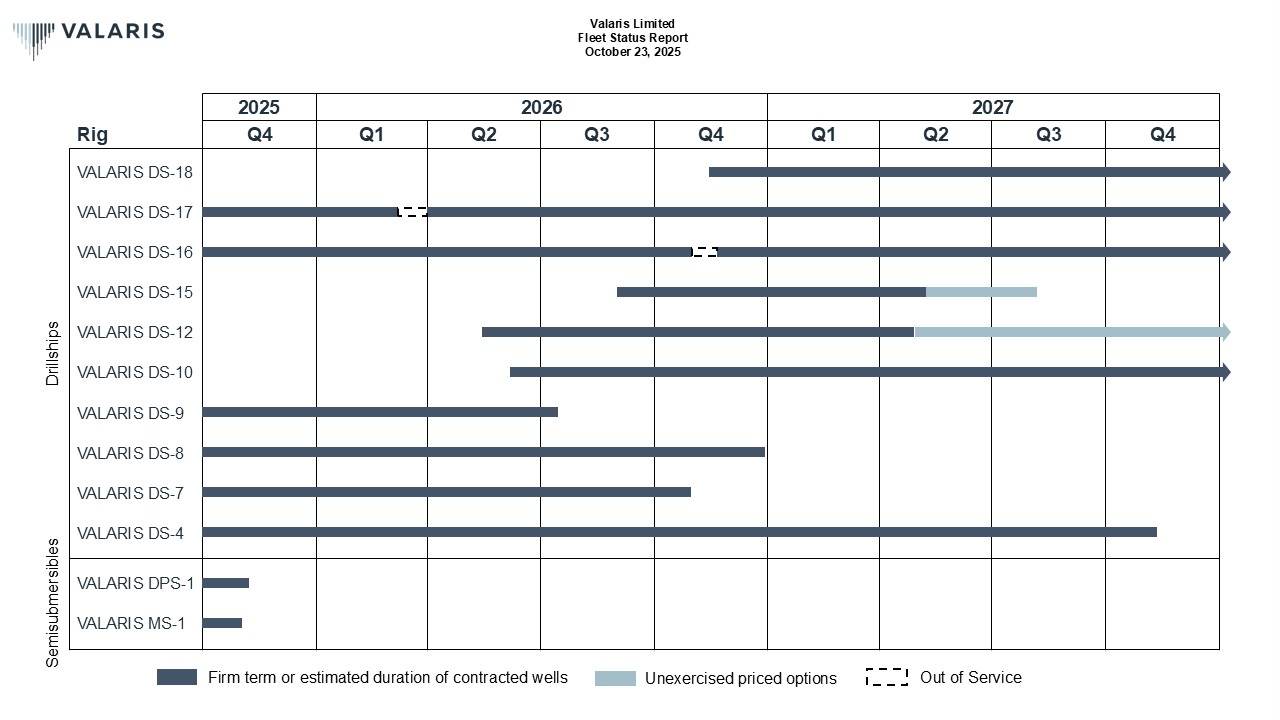

| VALARIS DS-18 | GustoMSC P10000 | 2015 | Chevron Occidental | Gulf of America Gulf of America | Aug 22 Nov 26 | Aug 25 May 29 | Additional rate charged when MPD services provided 914-day contract for DS-18 and 940-day contract extension for DS-16. Combined addition to contracted revenue backlog is approx. $760 million | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-17 | GustoMSC P10000 | 2014 | Equinor Equinor | Brazil Brazil | May 25 Jan 26 | Dec 25 Jan 28 | $497,000 | Expect approx. 25 days out of service for customer required upgrades in 1Q26 Estimated total contract value ("TCV") of $498 million, inclusive of MPD, additional services and fees for mobilization and minor rig upgrades. Based on initial estimated duration of 852 days comprised of a 180-day standby period followed by a 672-day drilling program | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-16 | GustoMSC P10000 | 2014 | Occidental Occidental | Gulf of America Gulf of America | Jun 24 Jun 26 | Jun 26 Dec 28 | Additional rate charged when MPD services provided 940-day contract extension for DS-16 and 914-day contract for DS-18. Combined addition to contracted revenue backlog is approx. $760 million. Expect approx. 20 days out of service for planned maintenance in 4Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-15 | GustoMSC P10000 | 2014 | TotalEnergies Undisclosed | Brazil Spain West Africa | Dec 24 Sep 26 | Aug 25 May 27 | $400,000 | Additional rate charged when MPD and additional services provided Rig is warm stacked in Las Palmas, Spain TCV, based on an estimated duration of 250 days, is approx. $135 million, including upfront payments for rig upgrades and mobilization. TCV does not include the provision of additional services. Priced options with a total estimated duration of 80 to 100 days | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-12 | DSME 12000 | 2013 | BP | Spain Egypt | May 26 | Apr 27 | Rig is warm stacked in Las Palmas, Spain TCV, based on estimated duration of 350 days, is approx. $140 million, inclusive of MPD and mobilization. Three option wells | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-10 | Samsung GF12000 | 2017 | Undisclosed | Spain West Africa | Jun 26 | Jun 28 | Rig is warm stacked in Las Palmas, Spain TCV of $352 million based on duration of two years. TCV does not include the provision of additional services. Additional rate charged when MPD services provided | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-9 | Samsung GF12000 | 2015 | ExxonMobil | Angola | Jul 22 | Jul 26 | Contract includes MPD services | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-8 | Samsung GF12000 | 2015 | Petrobras | Brazil | Dec 23 | Dec 26 | $428,000 | Plus mobilization fee of approx. $30 million. Contract includes additional services | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-7 | Samsung 96K | 2013 | Azule Energy | Angola | Jun 24 | Oct 26 | TCV estimated to be $364 million based on initial estimated duration of 850 days | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-4 | Samsung 96K | 2010 | Petrobras | Brazil | Dec 24 | Nov 27 | $450,000 | Plus mobilization fee of approx. $41 million. Contract includes MPD and additional services | ||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-14 | DSME 12000 | 2023 | Spain | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-13 | DSME 12000 | 2023 | Spain | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-11 | DSME 12000 | 2013 | Spain | |||||||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | ||||||||||||||||||||||||||||||||||||||||||

| Semisubmersibles | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DPS-1 | F&G ExD Millennium, DP | 2012 | Woodside | Australia | Jan 24 | Nov 25 | ||||||||||||||||||||||||||||||||||||||||||||

| VALARIS MS-1 | F&G ExD Millennium, Moored | 2011 | Santos | Australia | Jan 24 | Oct 25 | ||||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | ||||||||||||||||||||||||||||||||||||||||||

| Harsh Environment Jackups | ||||||||||||||||||||||||||||||||||||||||||||||||||

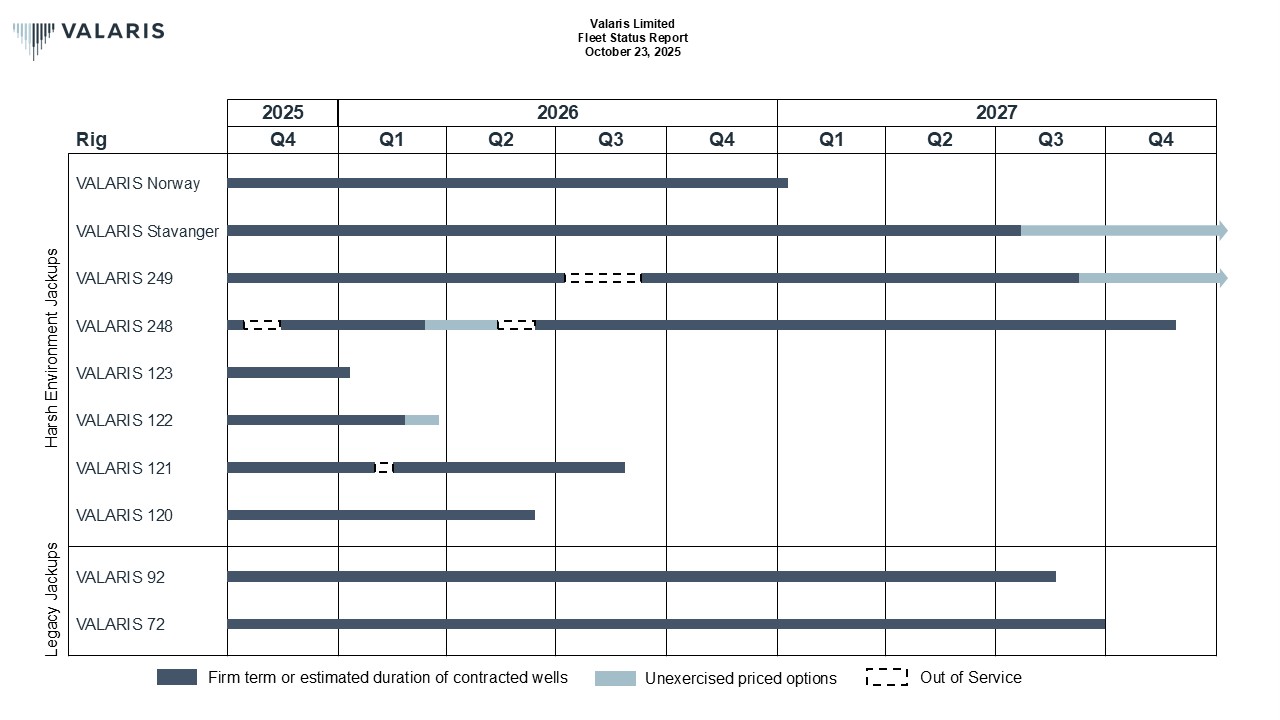

| VALARIS Norway | KFELS N Class | 2011 | Ithaca Energy Ithaca Energy | UK UK | Apr 25 Mar 26 | Mar 26 Jan 27 | TCV of approx. $39 million based on estimated duration of 292 days Contracted revenue backlog of approx. $36 million based on duration of 300 days | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS Stavanger | KFELS N Class | 2011 | TotalEnergies TotalEnergies | UK UK | May 24 Nov 25 | Nov 25 Jul 27 | TCV of approx. $52 million, including minor rig modifications, based on initial estimated duration of 360 days TCV of over $75 million based on 600-day priced extension. Two 200-day priced options | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 249 | LT Super Gorilla | 2001 | Undisclosed BP Shell | Trinidad Trinidad Trinidad | Apr 25 Mar 26 Sep 26 | Feb 26 Jul 26 Sep 27 | $163,000 | TCV of $16.8 million based on duration of 100 days. Expect approx. 60 days out of service for planned maintenance in 3Q26 Contracted revenue backlog of approx. $66 million based on estimated duration of 365 days Three priced options with an estimated duration of 50 days each | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 248 | LT Super Gorilla | 2000 | Ithaca Energy GE Vernova Eni | UK UK UK | Aug 20 Nov 25 Jun 26 | Oct 25 Mar 26 Nov 27 | Expect approx. 30 days out of service for planned maintenance in 4Q25 Contracted revenue backlog of over $8 million for 120-day contract to provide accommodation support services. Six priced options with a total duration of 104 days. Expect approx 30 days out of service for planned maintenance in 2Q26 TCV of approx. $84 million for 730-day contract to perform P&A and CCS work. VALARIS 120 will substitute for VALARIS 248 from Nov 2025 to Jun 2026, while VALARIS 248 completes another customer's program and a special periodic survey | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 123 | KFELS Super A | 2019 | TAQA TAQA | Netherlands Netherlands | Mar 25 Jan 26 | Dec 25 Jan 26 | $153,000 $163,000 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 122 | KFELS Super A | 2014 | Shell Shell Shell | UK UK UK | Sep 23 Dec 25 Jan 26 | Nov 25 Dec 25 Feb 26 | TCV of over $60 million based on initial estimated duration of 500 days Contracted revenue backlog for the 31-day extension is over $3.5 million.The extension is for accommodation support Contracted revenue backlog for two 28-day extensions is over $6 million.The extensions are for accommodation support. One priced option remains | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 121 | KFELS Super A | 2014 | Shell Shell | UK UK | Jan 25 Feb 26 | Feb 26 Aug 26 | TCV of approx. $55 million based on estimated duration of 406 days. Expect approx. 15 days out of service for planned maintenance in 1Q26 Contracted revenue backlog for 194-day extension is over $25 million | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 120 | KFELS Super A | 2013 | Harbour Energy Eni | UK UK | Jul 25 Nov 25 | Nov 25 Jun 26 | $166,000 | Contract suspension notice received from Harbour Energy effective on completion of Harbour Energy's current well, estimated to be in Nov 2025 VALARIS 120 will substitute for VALARIS 248 from Nov 2025 to Jun 2026, while VALARIS 248 completes another customer's program and a special periodic survey | ||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS Viking | KFELS N Class | 2010 | UK | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 102 | KFELS MOD V-A | 2002 | Gulf of America | |||||||||||||||||||||||||||||||||||||||||||||||

| Sold | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 247 | LT Super Gorilla | 1998 | Jadestone | Australia | Mar 25 | Aug 25 | Sold for cash proceeds of approximately $108 million in August 2025 | |||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | ||||||||||||||||||||||||||||||||||||||||||

| Benign Environment Jackups | ||||||||||||||||||||||||||||||||||||||||||||||||||

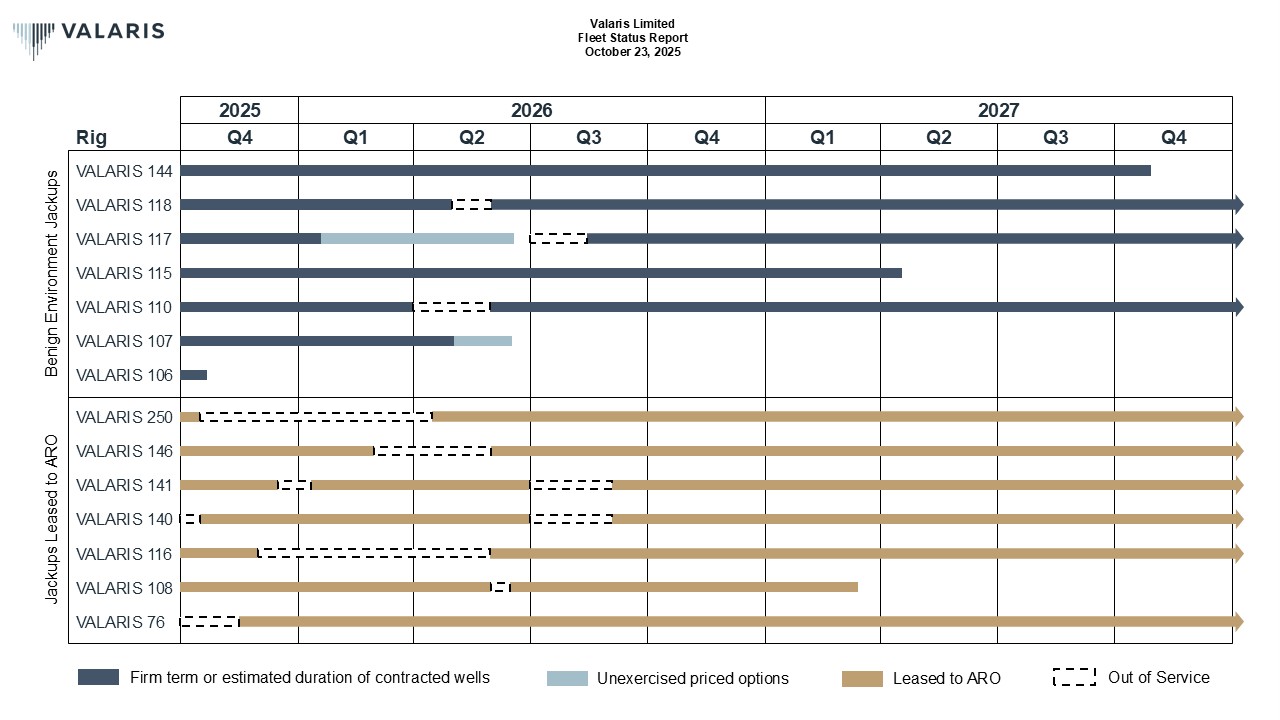

| VALARIS 144 | LT Super 116-E | 2010 | Azule Energy Azule Energy | Angola Angola | Mar 25 Sep 25 | Sep 25 Oct 27 | TCV of approx. $8.5 million based on estimated duration of 45 days TCV estimated to be between $149 million and $156 million based on contract duration of 730 to 770 days, including a mobilization fee from the Gulf of America | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 118 | LT 240-C | 2012 | BP BP | Trinidad Trinidad | Apr 24 Nov 25 | Oct 25 Jul 28 | TCV of approx. $51 million based on initial estimated duration of 365 days TCV of approx. $168 million based on duration of three years. Expect approx. 30 days out of service for planned maintenance in 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 117 | LT 240-C | 2009 | Eni Undisclosed | Mexico Trinidad | Apr 25 Aug 26 | Jan 26 Feb 28 | TCV of approx. $36 million based on duration of 300 days. Up to 150 days of priced options Expect approx. 45 days out of service for planned maintenance in 3Q26 185-day priced option | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 115 | BM Pacific Class 400 | 2013 | Shell | Brunei | Apr 23 | Apr 27 | TCV of approx. $159 million based on duration of four years | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 110 | KFELS MOD V-B | 2015 | NOC Undisclosed | Qatar Qatar | Oct 21 Oct 25 | Oct 25 Oct 29 | 1-year priced option Contracted revenue backlog for the four-year extension is approx. $117 million. 1-year priced option. Expect approx. 60 days of out service for planned maintenance in 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 107 | KFELS MOD V-B | 2006 | ExxonMobil ExxonMobil | Australia Australia | Nov 24 Nov 25 | Nov 25 May 26 | $153,000 $163,000 | 45-day priced option | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 106 | KFELS MOD V-B | 2005 | BP | Indonesia | Jun 25 | Oct 25 | $95,000 | |||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 148 | LT Super 116-E | 2013 | UAE | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 147 | LT Super 116-E | 2013 | UAE | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 145 | LT Super 116-E | 2010 | Gulf of America | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 143 | LT Super 116-E | 2010 | UAE | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 111 | KFELS MOD V-B | 2003 | Croatia | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 109 | KFELS MOD V-Super B | 2008 | Namibia | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 104 | KFELS MOD V-B | 2002 | UAE | |||||||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | ||||||||||||||||||||||||||||||||||||||||||

| Legacy Jackups | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 92 | LT 116-C | 1982 | Harbour Energy Shell | UK UK | Mar 24 Aug 25 | Jul 25 Aug 27 | $95,000 | TCV of approx. $75 million based on duration of 730 days | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 72 | Hitachi 300C | 1981 | Eni Eni | UK UK | Jan 20 Oct 25 | Sep 25 Sep 27 | TCV of approx. $71 million for 730-day contract to perform P&A and CCS work | |||||||||||||||||||||||||||||||||||||||||||

Other - Jackups Leased to ARO Drilling(3) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 250 | LT Super Gorilla XL | 2003 | ARO Drilling | Saudi Arabia | May 25 | Apr 30 | Expect approx. 180 days out of service for planned maintenance across 4Q25, 1Q26 and 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 146 | LT Super 116-E | 2011 | ARO Drilling | Saudi Arabia | May 25 | Apr 30 | Expect approx. 90 days out of service for planned maintenance across 1Q26 and 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 141 | LT Super 116-E | 2016 | ARO Drilling | Saudi Arabia | Aug 22 Aug 25 | Aug 25 Aug 30 | Expect approx. 25 days out of service for planned maintenance across 4Q25 and 1Q26 and 65 days out of service for planned maintenance in 3Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 140 | LT Super 116-E | 2016 | ARO Drilling | Saudi Arabia | May 25 | Apr 30 | Expect approx. 15 days out of service for planned maintenance in 4Q25 and 65 days out of service for planned maintenance in 3Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 116 | LT 240-C | 2008 | ARO Drilling | Saudi Arabia | May 25 | Apr 30 | Expect approx. 180 days out of service for planned maintenance across 4Q25, 1Q26 and 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 108 | KFELS MOD V-B | 2007 | ARO Drilling | Saudi Arabia | Mar 24 | Mar 27 | Expect approx. 15 days out of service for planned maintenance in 2Q26 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 76 | LT Super 116-C | 2000 | ARO Drilling | Saudi Arabia | Nov 25 | Nov 30 | ||||||||||||||||||||||||||||||||||||||||||||

| Other - Managed Rigs | ||||||||||||||||||||||||||||||||||||||||||||||||||

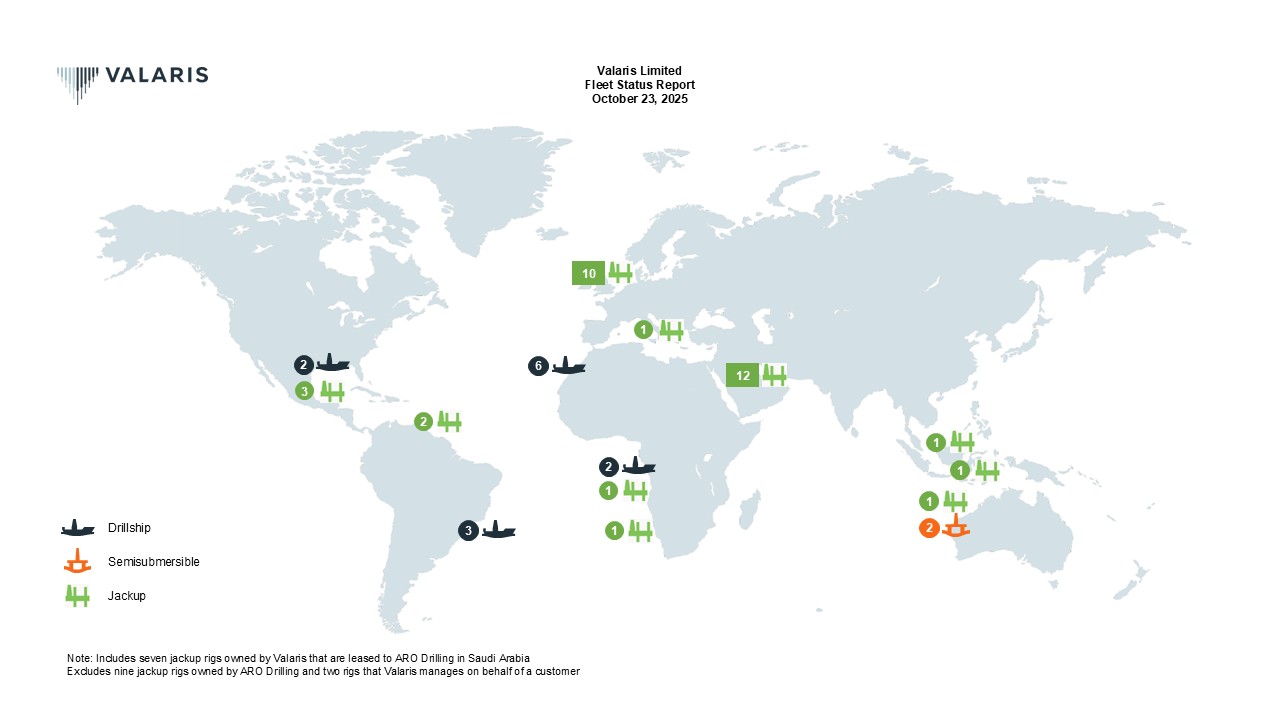

| Thunder Horse | Deepwater Semisubmersible | BP | Gulf of America | Jan 24 | Jan 27 | TCV of approx. $153 million | ||||||||||||||||||||||||||||||||||||||||||||

| Mad Dog | Deepwater Spar Drilling Rig | BP | Gulf of America | Jan 24 | Jan 27 | TCV of approx. $106 million | ||||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

| Asset Category / Rig | Design | Customer | Location | Contract Start Date | Contract End Date(1) | Day Rate(2) | Comments | |||||||||||||||||||||||||||||||||||||

| ARO Drilling | ||||||||||||||||||||||||||||||||||||||||||||

| Jackup Rigs Owned by ARO Drilling | ||||||||||||||||||||||||||||||||||||||||||||

| Gilbert Rowe | LT 116-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | Expect approx. 30 days out of service for planned maintenance in 1Q26 | ||||||||||||||||||||||||||||||||||||||

| SAR 201 | BM 200-H | Saudi Aramco | Saudi Arabia | Feb 18 | Feb 26 | |||||||||||||||||||||||||||||||||||||||

| Bob Keller | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | Expect approx. 100 days out of service for planned maintenance across 1Q26 and 2Q26 | ||||||||||||||||||||||||||||||||||||||

| J.P. Bussell | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | Expect approx. 10 days out of service for planned maintenance in 1Q26 | ||||||||||||||||||||||||||||||||||||||

| Scooter Yeargain | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 18 | Dec 26 | Expect approx. 210 days out of service for planned maintenance across 4Q25, 1Q26 and 2Q26 | ||||||||||||||||||||||||||||||||||||||

| Hank Boswell | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 18 | Dec 26 | |||||||||||||||||||||||||||||||||||||||

| SAR 202 | KFELS Super B | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | Expect approx. 15 days out of service for planned maintenance in 3Q26 | ||||||||||||||||||||||||||||||||||||||

| Kingdom 1 | LT 116-C | Saudi Aramco | Saudi Arabia | Nov 23 | Nov 31 | Expect approx. 30 days out of service for planned maintenance in 3Q26 | ||||||||||||||||||||||||||||||||||||||

| Kingdom 2 | LT 116-C | Saudi Aramco | Saudi Arabia | Aug 24 | Aug 32 | Expect approx. 25 days out of service for planned maintenance in 4Q26 | ||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||

Out of Service Days (1) | ||||||||||||||||||||||||||||||||||||||||||||

| Rig | Segment / Asset Category | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 | Q4 2026 | Q1 2027 | |||||||||||||||||||||||||||||||||||||

| VALARIS DS-17 | Floater - Drillship | 25 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-16 | Floater - Drillship | 20 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 249 | Jackup - Harsh Environment | 60 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 248 | Jackup - Harsh Environment | 30 | 30 | |||||||||||||||||||||||||||||||||||||||||

| VALARIS 121 | Jackup - Harsh Environment | 15 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 118 | Jackup - Benign Environment | 30 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 117 | Jackup - Benign Environment | 45 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 110 | Jackup - Benign Environment | 60 | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 250 | Other - Jackups Leased to ARO Drilling | 75 | 90 | 15 | ||||||||||||||||||||||||||||||||||||||||

| VALARIS 146 | Other - Jackups Leased to ARO Drilling | 30 | 60 | |||||||||||||||||||||||||||||||||||||||||

| VALARIS 141 | Other - Jackups Leased to ARO Drilling | 15 | 10 | 65 | ||||||||||||||||||||||||||||||||||||||||

| VALARIS 140 | Other - Jackups Leased to ARO Drilling | 15 | 65 | |||||||||||||||||||||||||||||||||||||||||

| VALARIS 116 | Other - Jackups Leased to ARO Drilling | 30 | 90 | 60 | ||||||||||||||||||||||||||||||||||||||||

| VALARIS 108 | Other - Jackups Leased to ARO Drilling | 15 | ||||||||||||||||||||||||||||||||||||||||||

| Valaris Limited Fleet Status Report October 23, 2025 | |||||||||||||