.2

Stronger Together TRANSOCEAN TO ACQUIRE VALARIS February 9, 2026

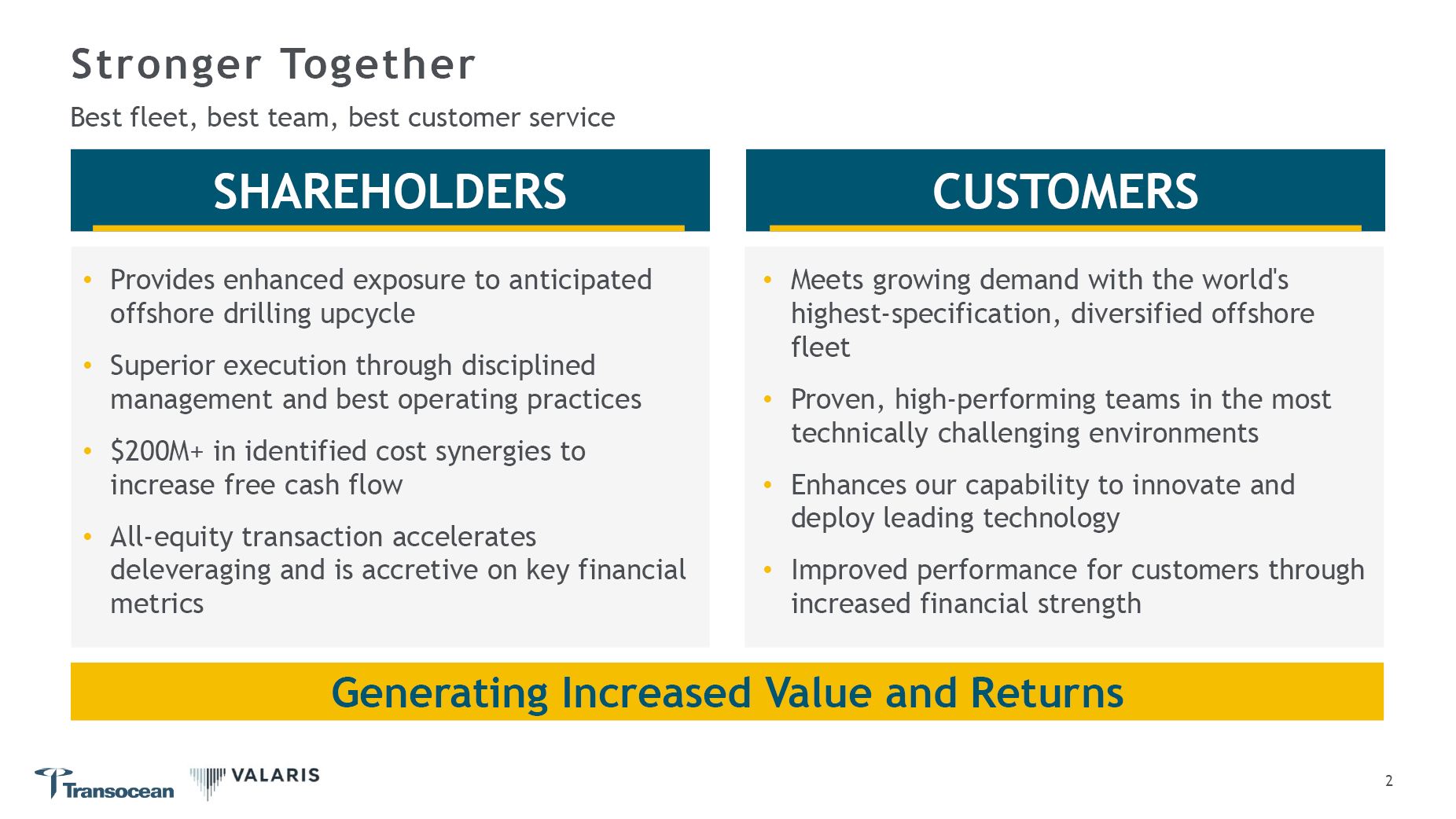

Meets growing demand with the world's highest-specification, diversified

offshore fleet Proven, high-performing teams in the most technically challenging environments Enhances our capability to innovate and deploy leading technology Improved performance for customers through increased financial

strength Provides enhanced exposure to anticipated offshore drilling upcycle Superior execution through disciplined management and best operating practices $200M+ in identified cost synergies to increase free cash flow All-equity

transaction accelerates deleveraging and is accretive on key financial metrics Stronger Together SHAREHOLDERS CUSTOMERS Best fleet, best team, best customer service 2 Generating Increased Value and Returns

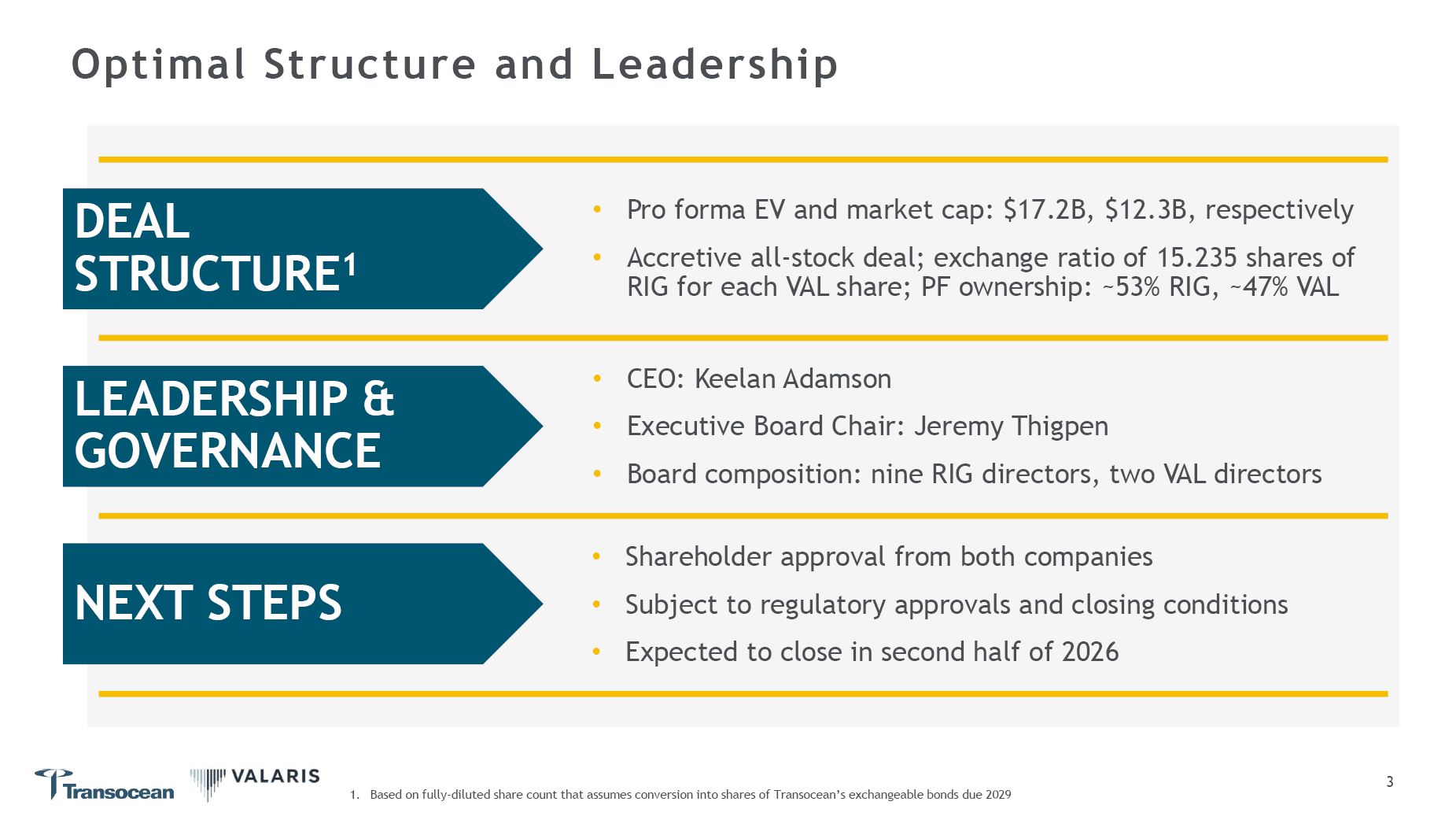

Optimal Structure and Leadership Pro forma EV and market cap: $17.2B, $12.3B,

respectively Accretive all-stock deal; exchange ratio of 15.235 shares of RIG for each VAL share; PF ownership: ~53% RIG, ~47% VAL CEO: Keelan Adamson Executive Board Chair: Jeremy Thigpen Board composition: nine RIG directors, two VAL

directors Shareholder approval from both companies Subject to regulatory approvals and closing conditions Expected to close in second half of 2026 3 DEAL STRUCTURE1 LEADERSHIP & GOVERNANCE NEXT STEPS 1. Based on fully-diluted

share count that assumes conversion into shares of Transocean’s exchangeable bonds due 2029

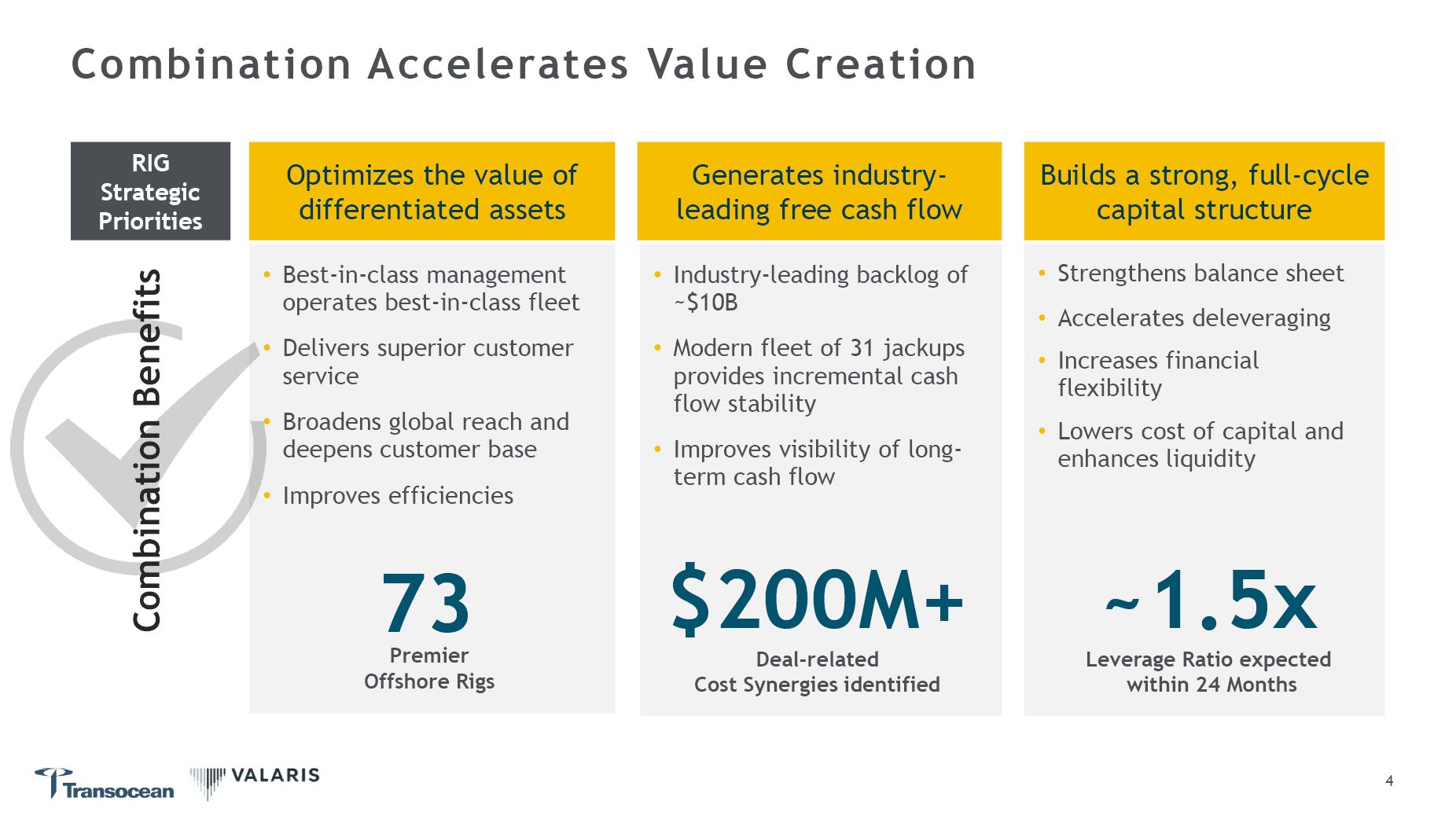

Best-in-class management operates best-in-class fleet Delivers superior

customer service Broadens global reach and deepens customer base Improves efficiencies Strengthens balance sheet Accelerates deleveraging Increases financial flexibility Lowers cost of capital and enhances liquidity Industry-leading

backlog of ~$10B Modern fleet of 31 jackups provides incremental cash flow stability Improves visibility of long-term cash flow Generates industry-leading free cash flow Builds a strong, full-cycle capital structure 4 Optimizes the

value of differentiated assets Combination Accelerates Value Creation RIG Strategic Priorities Combination Benefits ~1.5x Leverage Ratio expected within 24 Months 73 Premier Offshore Rigs $200M+ Deal-related Cost Synergies

identified

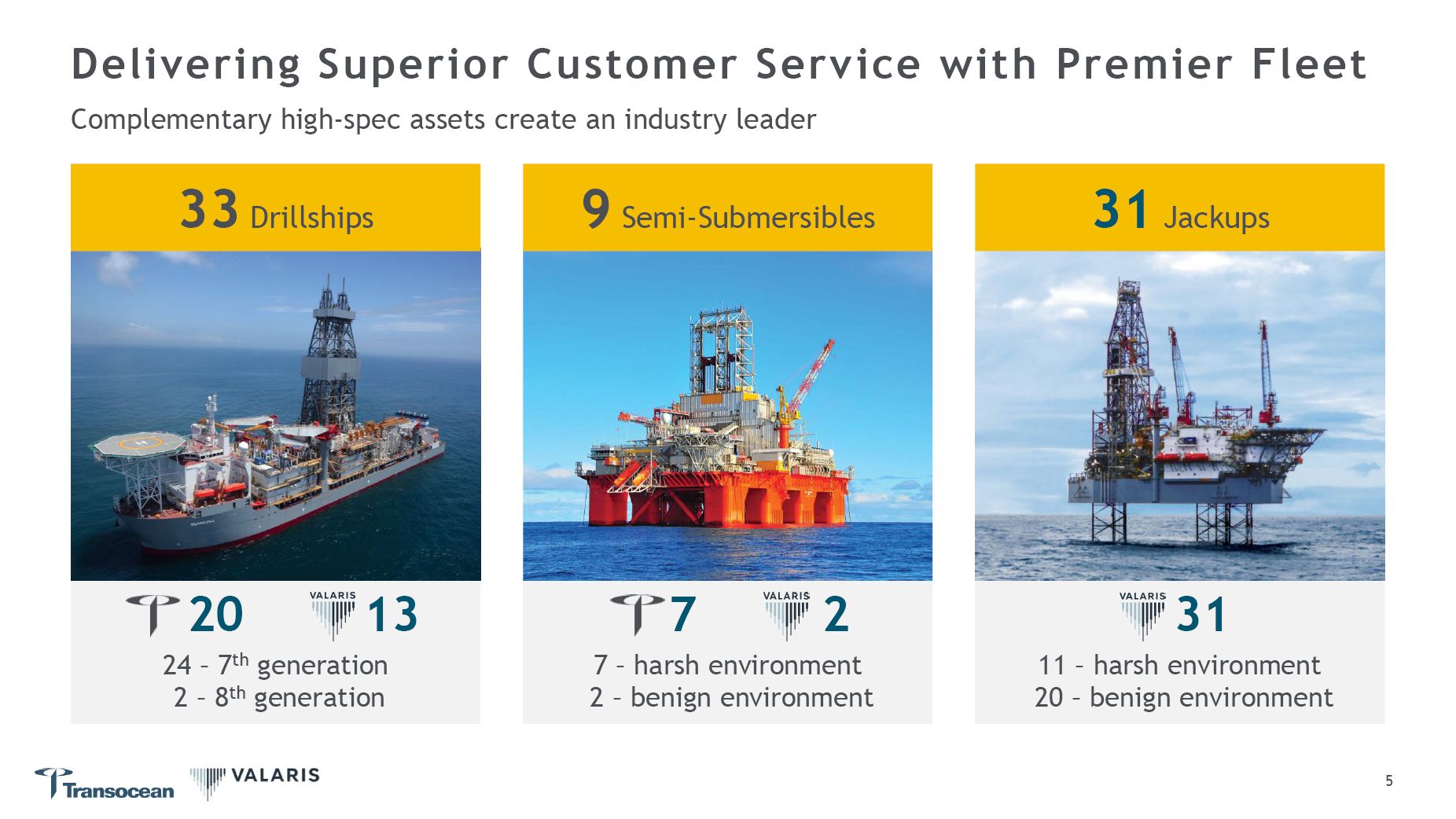

Delivering Superior Customer Service with Premier Fleet Complementary

high-spec assets create an industry leader 33 Drillships 9 Semi-Submersibles 31 Jackups 31 11 – harsh environment 20 – benign environment 20 13 24 – 7th generation 2 – 8th generation 7 2 7 – harsh environment 2 – benign

environment 4

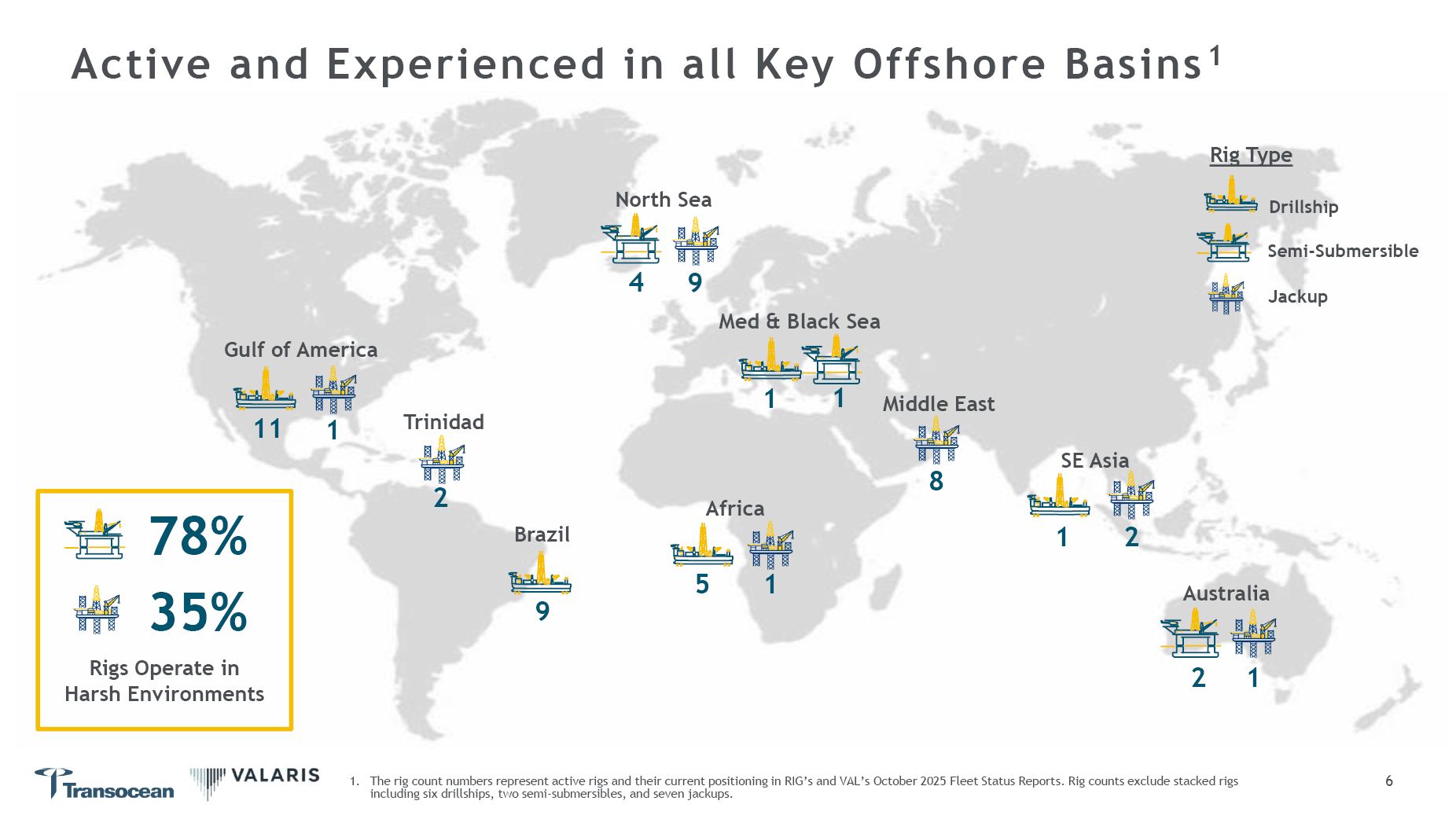

North Sea Africa Trinidad Australia SE Asia Brazil Active and

Experienced in all Key Offshore Basins 1 9 2 1 1 2 4 9 5 1 2 Med & Black Sea 1 1 Gulf of America 11 1 Middle East 8 Drillship Semi-Submersible Jackup Rig Type 78% 35% Rigs Operate in Harsh Environments 6 1. The rig

count numbers represent active rigs and their current positioning in RIG’s and VAL’s October 2025 Fleet Status Reports. Rig counts exclude stacked rigs including six drillships, two semi-submersibles, and seven jackups.

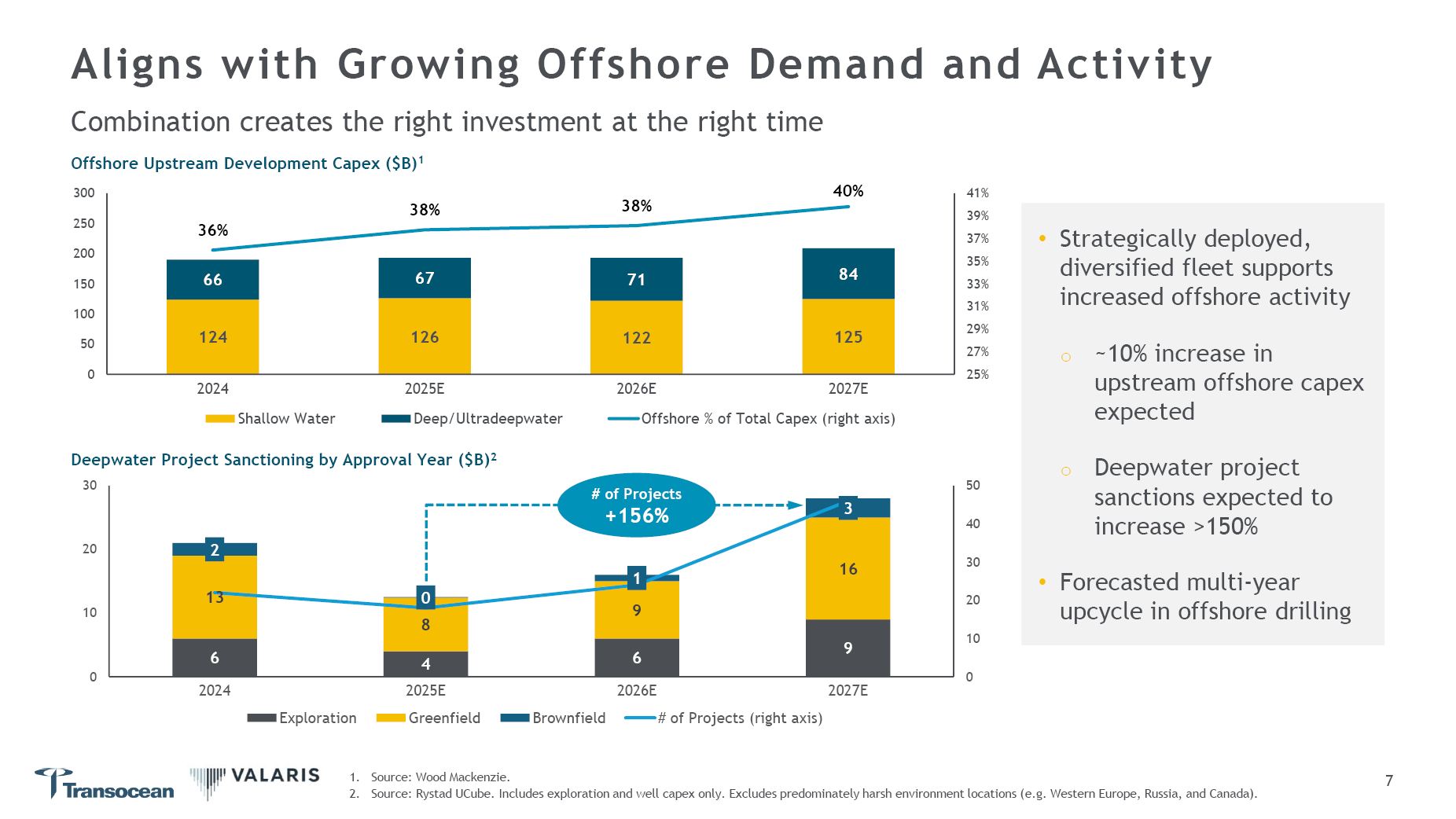

Aligns with Growing Offshore Demand and Activity Combination creates the

right investment at the right time Offshore Upstream Development Capex ($B)1 6 4 6 9 13 9 16 2 0 8 1 3 0 10 20 30 40 50 0 10 20 2024 2026E 2027E Exploration 2025E Greenfield Deepwater Project Sanctioning by

Approval Year ($B)2 30 Brownfield # of Projects (right axis) 38% 38% 36% 84 66 67 71 124 126 122 125 40% 41% 39% 37% 35% 33% 31% 29% 27% 25% 0 150 100 50 200 250 300 2024 Shallow

Water 2025E Deep/Ultradeepwater 2026E 2027E Offshore % of Total Capex (right axis) # of Projects 1. Source: Wood Mackenzie. 2. Source: Rystad UCube. Includes exploration and well capex only. Excludes predominately harsh environment

locations (e.g. Western Europe, Russia, and Canada). 7 +156% Strategically deployed, diversified fleet supports increased offshore activity ~10% increase in upstream offshore capex expected Deepwater project sanctions expected to

increase >150% Forecasted multi-year upcycle in offshore drilling

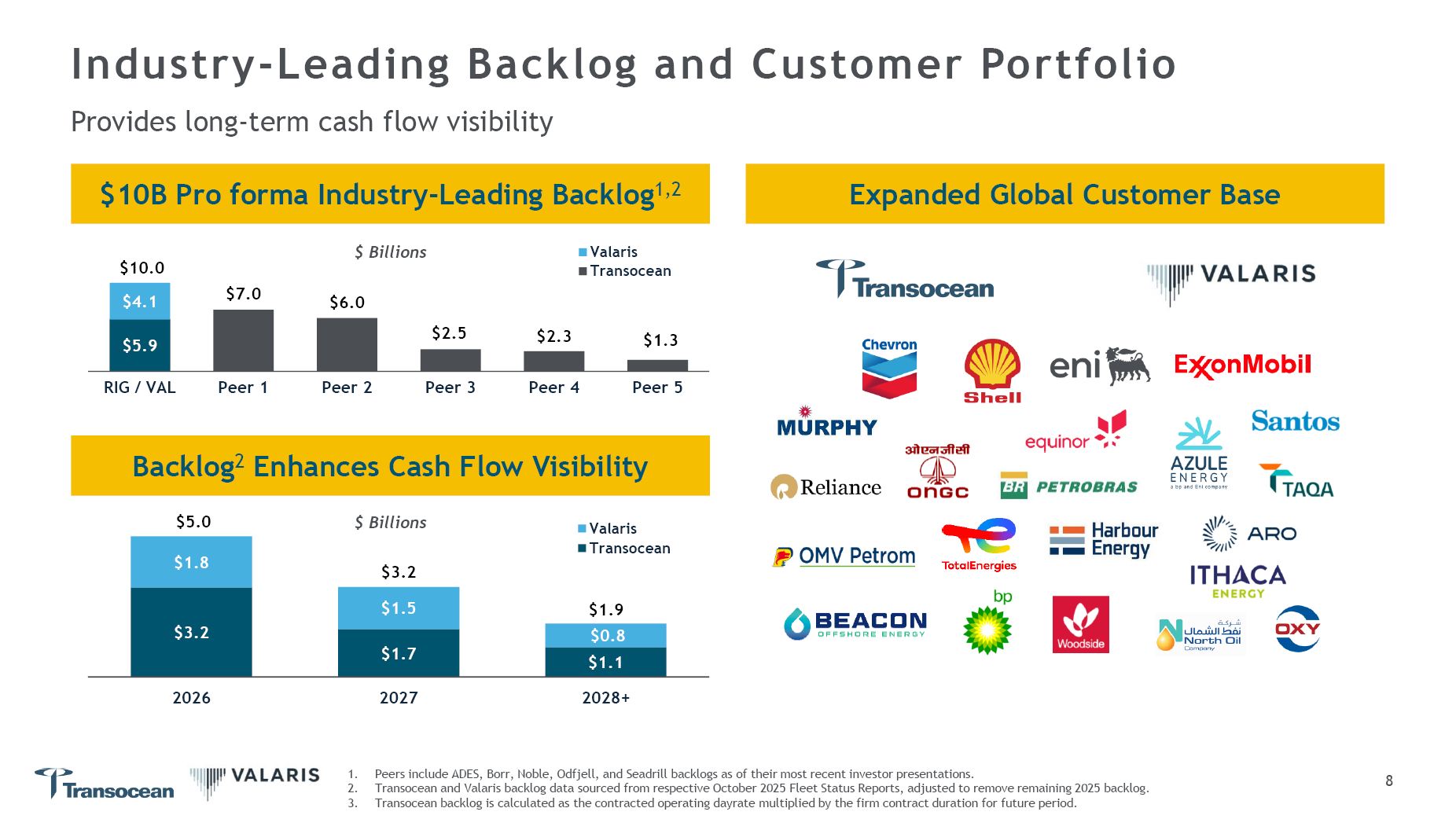

Industry-Leading Backlog and Customer Portfolio Provides long-term cash flow

visibility Peers include ADES, Borr, Noble, Odfjell, and Seadrill backlogs as of their most recent investor presentations. Transocean and Valaris backlog data sourced from respective October 2025 Fleet Status Reports, adjusted to remove

remaining 2025 backlog. Transocean backlog is calculated as the contracted operating dayrate multiplied by the firm contract duration for future period. Expanded Global Customer Base $10B Pro forma Industry-Leading Backlog1,2 Backlog2

Enhances Cash Flow Visibility $5.9 $7.0 $6.0 $2.5 $2.3 $1.3 $4.1 RIG / VAL Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Valaris Transocean $10.0 $

Billions $3.2 $1.7 $1.1 $1.8 $1.5 $0.8 2026 2027 2028+ Valaris Transocean $5.0 $ Billions $3.2 $1.9 8

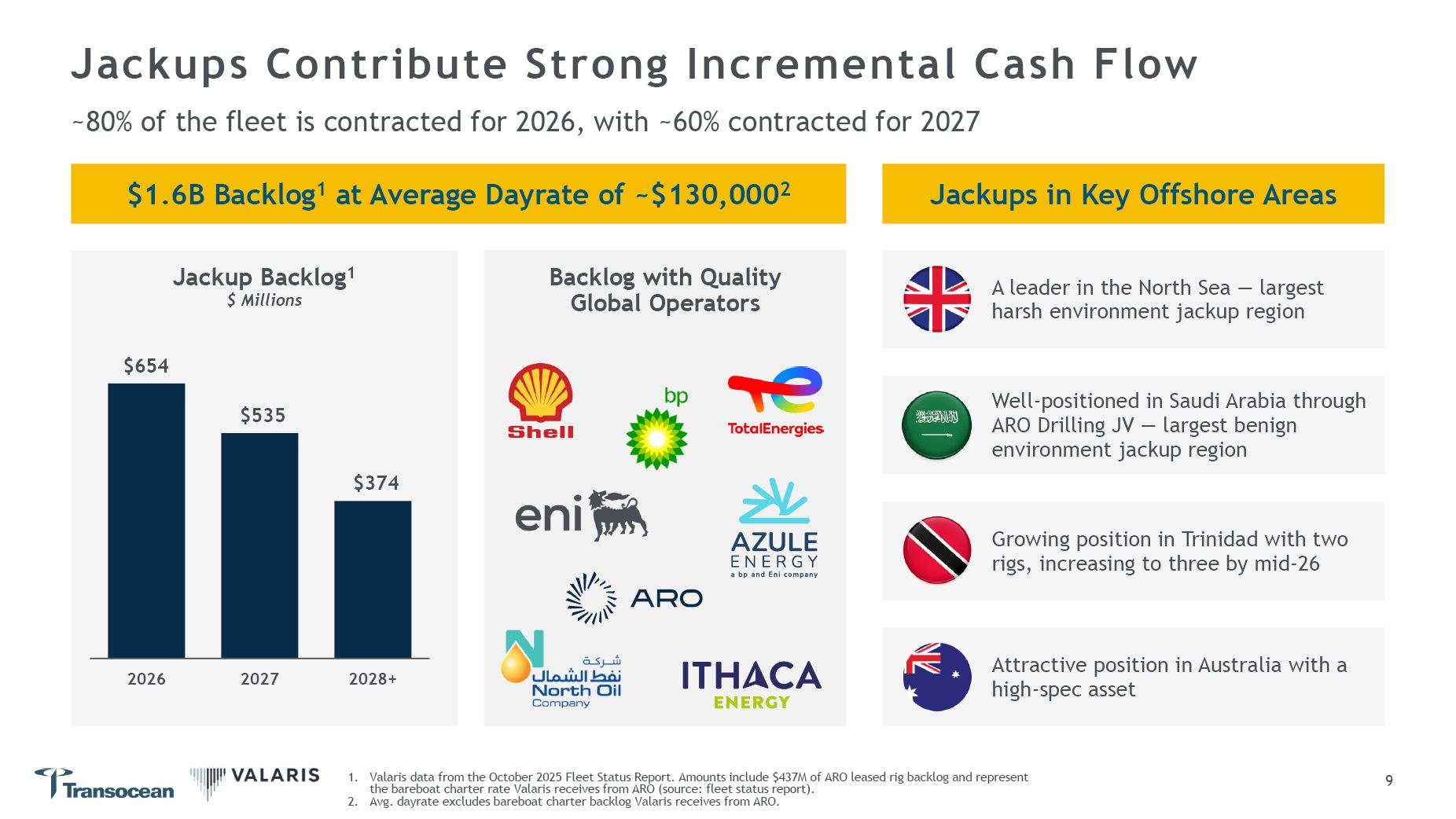

Attractive position in Australia with a high-spec asset Well-positioned in

Saudi Arabia through ARO Drilling JV — largest benign environment jackup region Growing position in Trinidad with two rigs, increasing to three by mid-26 Backlog with Quality Global Operators Jackups Contribute Strong Incremental Cash

Flow ~80% of the fleet is contracted for 2026, with ~60% contracted for 2027 Jackups in Key Offshore Areas $1.6B Backlog1 at Average Dayrate of ~$130,0002 Valaris data from the October 2025 Fleet Status Report. Amounts include $437M of

ARO leased rig backlog and represent the bareboat charter rate Valaris receives from ARO (source: fleet status report). Avg. dayrate excludes bareboat charter backlog Valaris receives from ARO. Jackup Backlog1 $ Millions A leader in the

North Sea — largest harsh environment jackup region $654 $535 $374 2026 2027 2028+ 9

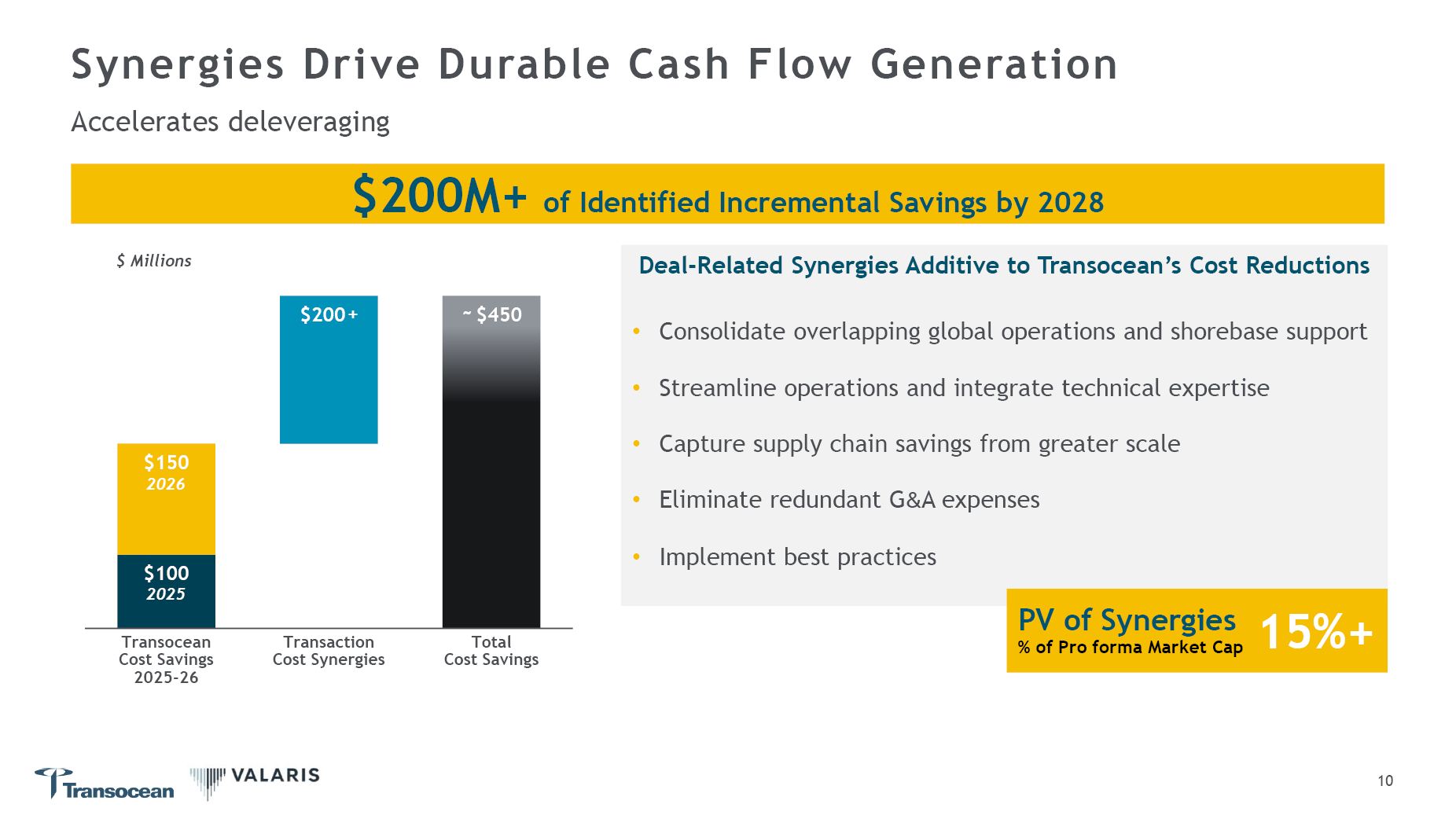

Deal-Related Synergies Additive to Transocean’s Cost Reductions Consolidate

overlapping global operations and shorebase support Streamline operations and integrate technical expertise Capture supply chain savings from greater scale Eliminate redundant G&A expenses Implement best practices Synergies Drive

Durable Cash Flow Generation Accelerates deleveraging $200M+ of Identified Incremental Savings by 2028 $ Millions $200+ ~ $450 $150 2026 $100 2025 Transocean Transaction Total Cost Savings 2025-26 Cost Synergies Cost

Savings 10 PV of Synergies % of Pro forma Market Cap 15%+

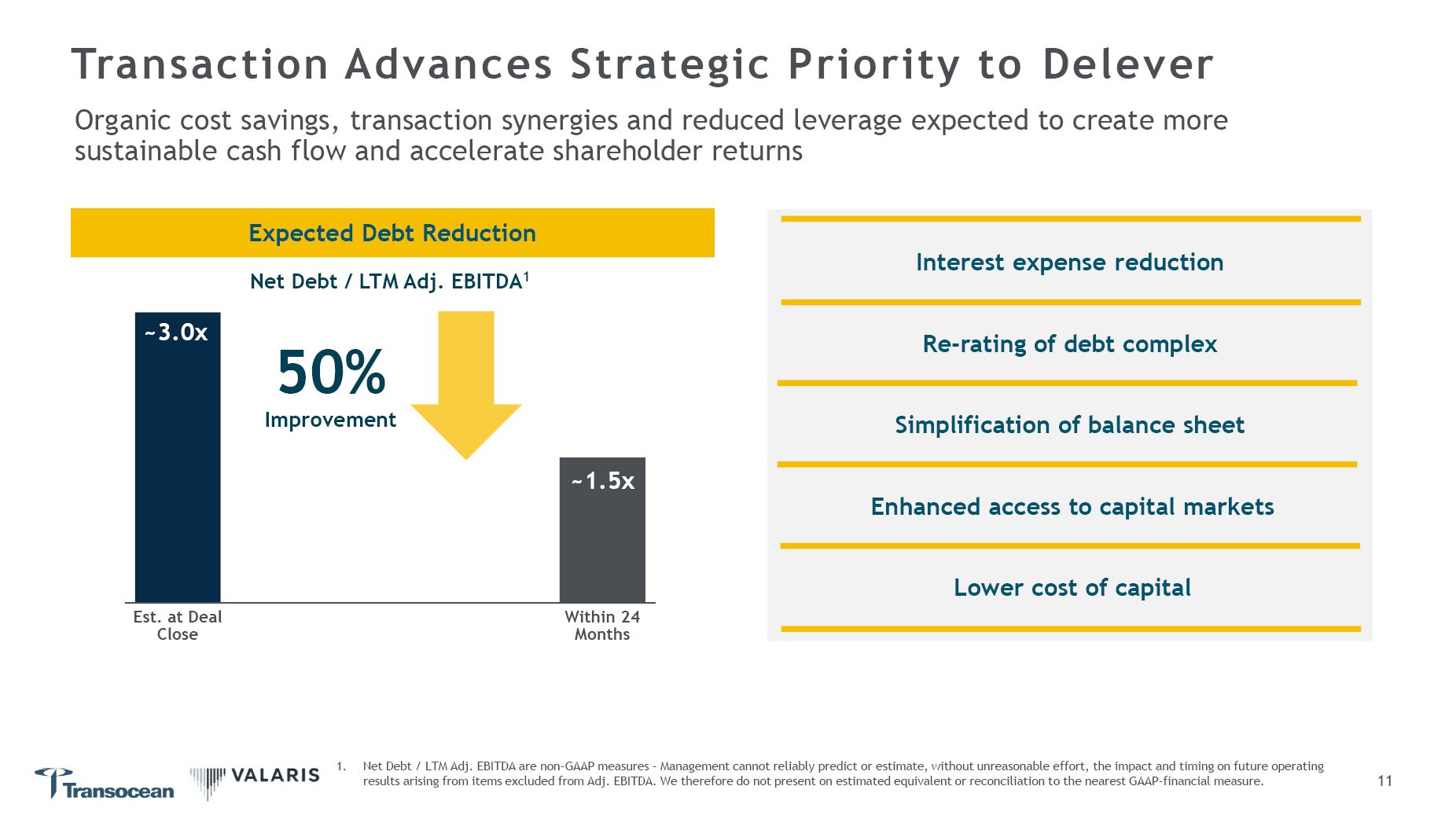

Transaction Advances Strategic Priority to

Delever ~3.0x 50% Improvement ~1.5x Est. at Deal Close Within 24 Months Net Debt / LTM Adj. EBITDA1 Expected Debt Reduction 11 Organic cost savings, transaction synergies and reduced leverage expected to create more sustainable

cash flow and accelerate shareholder returns 1. Net Debt / LTM Adj. EBITDA are non-GAAP measures – Management cannot reliably predict or estimate, without unreasonable effort, the impact and timing on future operating results arising from

items excluded from Adj. EBITDA. We therefore do not present on estimated equivalent or reconciliation to the nearest GAAP-financial measure. Interest expense reduction Re-rating of debt complex Simplification of balance sheet Enhanced

access to capital markets Lower cost of capital

Stronger Together Best fleet, best team, best customer service Expanded

geographic reach and customer base $200M+ of identified incremental cost savings Accelerates debt paydown and enhances returns to shareholders Creates exceptional investment exposure to the offshore upcycle 12

This communication includes certain “forward-looking statements” within the

meaning of the federal securities laws, including, but not limited to, those statements related to the proposed transaction, including financial estimates and statements as to the expected timing, completion and effects of the proposed

transaction. These forward-looking statements are generally identified by the words “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “project,” “might,” “could,” “expect,” “estimate,” “intend,” “strategy,” “plan,”

“predict,” “potential,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. Any statements about

Transocean Ltd.’s (“Transocean”), Valaris Limited’s (“Valaris”) or the combined company’s plans, objectives, expectations, strategies, beliefs or future performance or events constitute forward-looking statements. These forward-looking

statements, including statements regarding the proposed transaction, are based on Transocean’s and Valaris’ current expectations, estimates, projections and assumptions. Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those expressed or implied by such forward-looking statements, which are neither statements of historical fact nor guarantees or

assurances of future performance, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. There is no assurance that these future events will occur as anticipated or that our results,

estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking statements. Actual results could differ materially from those currently anticipated due to a number of

risks and uncertainties, many of which are beyond Transocean’s and Valaris’ control. Important factors, risks and uncertainties that could cause actual results to differ materially from such plans, estimates or expectations include but are

not limited to: (i) the completion of the proposed transaction on the anticipated terms and timing, or at all, including obtaining regulatory and shareholder approvals, and the satisfaction of other conditions to the completion of the

proposed transaction as well as the failure to realize anticipated benefits of the proposed transaction; (ii) potential litigation relating to the proposed transaction, including the effects of any outcomes related thereto; (iii) the risk

that disruptions from the proposed transaction (including the ability of certain customers of Valaris to terminate or amend contracts upon a change of control) will harm Transocean’s or Valaris’ business, including current plans and

operations, including during the pendency of the proposed transaction; (iv) the ability of Transocean or Valaris to retain and hire key personnel, to retain customers or maintain relationships with their respective suppliers and customers;

(v) the diversion of management’s time and attention from ordinary course business operations to completion of the proposed transaction; (vi) potential adverse reactions or changes to business relationships resulting from the announcement

or completion of the proposed transaction; (vii) legislative, regulatory and economic developments; (viii) potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction

that could affect Transocean’s or Valaris’ financial performance as well as unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses,

future prospects, business and management strategies, expansion and growth of Transocean’s or Valaris’ businesses; (ix) the inability of Transocean and Valaris to achieve expected synergies from the transaction or that it may take longer or

be more costly than expected to achieve those synergies; (x) an inability to de-leverage on the expected timeline, or at all; (xi) the imposition of any terms and conditions on any required governmental and regulatory approvals that could

reduce the anticipated benefits to Transocean and Valaris of the acquisition; (xii) the inability to successfully integrate Valaris’ operations with those of Transocean without unexpected cost or delay; (xiii) certain restrictions during

the pendency of the proposed transaction that may impact Transocean’s or Valaris’ ability to pursue certain business opportunities or strategic transactions; (xiv) unpredictability and severity of catastrophic events, including, but not

limited to, acts of terrorism, outbreaks of war or hostilities or public health issues, as well as management’s response to any of the aforementioned factors; (xv) the impact of inflation, tariffs, rising interest rates, and global

conflicts, including disruptions in European economies as a result of the Ukrainian/Russian conflict and the ongoing conflicts in the Middle East, the relationship between China and Taiwan and ongoing trade disputes between the United

States and China; (xvi) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (xvii) the occurrence of any event, change or other

circumstance that could give rise to the termination of the proposed transaction, including in circumstances requiring Transocean or Valaris to pay a termination fee; 12 Cautionary Statement Regarding Forward-Looking Statements

(xviii) the risk that Transocean’s or Valaris’ share price may decline

significantly if the proposed transaction is not consummated; (xix) there may be liabilities that are not known, probable or estimable at this time or unexpected costs, charges or expenses; (xx) commodity price fluctuations and volatility,

customer demand, loss of a significant customer or customer contracts, downtime and other risks associated with offshore rig operations and changes in worldwide rig supply; (xxi) adverse weather or major natural disasters, including

hurricanes; (xxii) the global and regional supply and demand for oil and gas; (xxiii) fluctuation of current and future prices of oil and gas; (xxiv) intention to scrap certain drilling rigs;(xxv) demand, competition and technology, supply

chain and logistics challenges, consumer preferences for alternative fuels and forecasts or expectations regarding the global energy transition, changes in customer strategy and future levels of offshore drilling activity; (xxvi) estimated

duration of customer contracts and contract dayrate amounts, future contract commencement dates and locations, planned shipyard projects and other out-of-service time, sales of drilling units, the cost and timing of mobilizations and

reactivations, operating hazards and delays, weather-related risks, risks associated with international operations, actions by customers and other third parties; (xxvii) increasing regulatory complexity, general economic, market, business

and industry conditions, trends and outlook, general political conditions, including political tensions, conflicts and war, cybersecurity attacks and threats, uncertainty around the use and impacts of artificial intelligence applications,

the effects of contagious illnesses including the spread of and mitigation efforts by governments, businesses and individuals and other factors, including those risks and uncertainties found in Transocean’s and Valaris’ respective filings

with the Securities and Exchange Commission (the “SEC”), including the risk factors discussed in Transocean’s and Valaris’ most recent Annual Reports on Form 10-K, as updated by their Quarterly Reports on Form 10-Q and future filings with

the SEC from time to time, which are available via the SEC’s website at www.sec.gov; and (xxviii) those risks that will be described in future filings with the SEC and available from the sources indicated below. (There can be no assurance

that the proposed transaction will be completed, or if it is completed, that it will close within the anticipated time period. While the list of factors presented here is, and the list of factors presented in the Proxy Statement will be,

considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties and should be read in conjunction with the other forward-looking statements. Unlisted factors may present

significant additional obstacles to the realization of forward-looking statements. The forward-looking statements relate only to events as of the date on which the statements are made and we undertake no obligation to update, and expressly

disclaim any obligation to update, any forward-looking statements, or any other information in this communication, whether resulting from developments, circumstances or events that arise after the date the statements are made, new

information, or otherwise. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we may have expressed or implied by these

forward-looking statements. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. You should specifically consider the factors identified in this communication that could cause

actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. 12 Cautionary Statement Regarding Forward-Looking Statements ( c o

n t i n u e d )

Important Information for Investors and Stockholders 12 Important Additional

Information and Where to Find It The transaction relates to the proposed business combination of Transocean and Valaris pursuant to the terms of the Business Combination Agreement, dated February 9, 2026, and is being made by way of a

scheme of arrangement pursuant to section 99 of the Companies Act 1981, as amended, under the laws of Bermuda. In connection therewith, Transocean and Valaris intend to file relevant materials with the SEC, including, among other filings, a

joint proxy statement on Schedule 14A of Transocean and Valaris that will be mailed or otherwise disseminated to shareholders of each of Transocean and Valaris seeking their approval of the parties’ respective transaction-related proposals.

None of the securities to be issued pursuant to the scheme of arrangement are anticipated to be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws, and any

securities issued in the transaction are anticipated to be issued in reliance upon an exemption from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities

laws. INVESTORS AND SHAREHOLDERS OF TRANSOCEAN AND VALARIS ARE URGED TO READ THE JOINT PROXY STATEMENT, THE BUSINESS COMBINATION AGREEMENT, THE SCHEME DOCUMENT AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC IN CONNECTION

WITH THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION, THE

PARTIES TO THE PROPOSED TRANSACTION AND RELATED MATTERS. This communication does not constitute an offer to buy, or the solicitation of an offer to sell, any securities, nor shall there be any sale of securities in any jurisdiction in

which such offer or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This communication is not a substitute for the joint proxy statement or any other document that Transocean

or Valaris may file with the SEC and send to their respective shareholders in connection with the proposed transaction. Investors and shareholders will be able to obtain free copies of the joint proxy statement (when available) and other

documents filed with the SEC by Transocean or Valaris through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Transocean will be available free of charge on Transocean’s website at

www.deepwater.com under the tab “Investors” and under the heading “SEC Filings.” Copies of the documents filed with the SEC by Valaris will be available free of charge on Valaris’ website at www.valaris.com under the tab “Investors” and

under the heading “Financials” and subheading “SEC Filings.” This communication is not intended to constitute, and does not constitute, an offer or solicitation in or into Switzerland to purchase or invest in any securities, and no

application has been made or will be made to admit any securities referred to herein to trading on any trading venue (i.e., exchange or multilateral trading facility) in Switzerland. Neither this communication nor any other offering or

marketing material relating to the transaction described herein or any securities referred to herein constitutes a prospectus within the meaning of the Swiss Financial Services Act of June 15, 2018, as amended (the "FinSA"), or advertising

within the meaning of the FinSA. Neither this communication nor any other offering or marketing material relating to the transaction described herein or any securities referred to herein has been filed with or approved by any Swiss

regulatory authority. In particular, no material relating to the transaction described herein or any securities referred to herein has been reviewed or approved by a Swiss reviewing body (Prüfstelle) pursuant to article 51 of the

FinSA. This communication is not subject to, and has not received approval from, either the Bermuda Monetary Authority or the Registrar of Companies of Bermuda and no statement to the contrary, explicit or implicit, is authorized to be

made in this regard. Securities may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act 2003 of Bermuda.

Important Information for Investors and Stockholders 12 Participants in the

Solicitation Transocean, Valaris and their respective directors and executive officers and certain other members of management and employees may be considered be participants in the solicitation of proxies from the shareholders of

Transocean and Valaris in connection with the proposed transaction. Information about the interests of the directors and executive officers of Transocean and Valaris and other persons who may be deemed to be participants in the solicitation

of shareholders of Valaris in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement, which will be filed with the

SEC. Information about Transocean’s directors and executive officers is set forth in Transocean’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 18, 2025 and its proxy statement for

its 2025 annual meeting, which was filed with the SEC on March 21, 2025. Information about Valaris’ directors and executive officers is set forth in Valaris’ Annual Report on Form 10-K for the year ended December 31, 2024, which was filed

with the SEC on February 20, 2025, its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 17, 2025. To the extent holdings of Transocean’s or Valaris’ securities by its directors or executive officers have

changed since the amounts set forth in such filings, such changes have been or will be reflected in Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Additional

information about the directors and executive officers of Transocean and Valaris and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security

holdings or otherwise, which may, in some cases, be different than those of Transocean shareholders or Valaris’ shareholders generally, will be contained in the joint proxy statement and other relevant materials to be filed with the SEC

regarding the proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at http://www.sec.gov and from Transocean’s or Valaris’ website as described above.