| 4Q 2025 Earnings Call 26 November 2025 .2 (Furnished herewith) |

| 2 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Forward-Looking Statements This earnings call, this presentational and accompanying materials may include forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “forecast,” “guidance,” “project,” “target,” “outlook,” “prospects,” “expect,” “estimate,” “will,” “goal,” “plan,” “anticipate,” “intend,” “predict,” “believe,” “likely,” “future,” “could,” “may,” or other similar words or phrases, including the negative variations of such words or phrases. Examples of forward-looking statements include, among others, comments and information concerning the Company’s future performance and industry outlooks, the Company’s plans and projections for the future, including estimates and assumptions with respect to economic, political, technological, weather, market acceptance, acquisitions and divestitures of businesses, anticipated transaction costs, the integration of new businesses, anticipated benefits of acquisitions, and other factors that impact the Company’s businesses and customers. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations and assumptions regarding the future of the Company’s business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, changes in circumstances, and other factors that are difficult to predict and many of which are outside of the Company’s control causing actual results to differ materially from those projected in these forward-looking statements. Among these factors are risks related to the agricultural business cycle, which can be unpredictable and is affected by such factors as grain stocks, harvest yields, available farm acres, soil conditions, prices for commodities and livestock, input costs, government policies and support, availability of transport for crops as well as adverse macroeconomic conditions, including unemployment, inflation, interest rate volatility, changes in consumer practices due to slower economic growth or a recession, and regional or global liquidity constraints the uncertainty of government policies and actions with respect to the global trade environment including increased and proposed tariffs announced by the U.S. government and retaliatory trade regulations; political, economic, and social instability of the geographies in which we operate, including the ongoing war between Russia and Ukraine and the conflicts in the Middle East; worldwide demand for food and different forms of renewable energy impacting the price of farm commodities and consequently the demand for our equipment; rationalization, restructuring, relocation, expansion and/or reconfiguration of manufacturing and warehouse facilities; accurately forecasting customer demand for products and services, and adequately managing inventory; uncertainty of our ability to sell products domestically or internationally, continue production at certain international facilities, procure raw materials and components, accurately forecast demand and inventory, manage increased costs of production, absorb or pass on increased pricing, accurately predict financial results and industry trends, and remain competitive based on trade actions, policies, and general economic uncertainty; availability and price of raw materials, components, and whole goods; delays or disruptions in our supply chain; changes in climate patterns, unfavorable weather events, and natural disasters; suppliers’ and manufacturers’ business practices and compliance with laws applicable to topics such as human rights, safety, environmental, and fair wages; higher interest rates and currency fluctuations which could adversely affect the U.S. dollar, customer confidence, access to capital, and demand for our products and solutions; our ability to adapt in highly competitive markets, including understanding and meeting customers’ changing expectations for products and solutions, including delivery and utilization of precision technology; the ability to execute business strategies, including our Smart Industrial Operating Model and Leap Ambitions; dealer practices and their ability to manage new and used inventory, distribute our products, and provide support and service for precision technology solutions; the ability to realize anticipated benefits of acquisitions and joint ventures, including challenges with successfully integrating operations and internal control processes;negative claims or publicity that damage our reputation or brand; the ability to attract, develop, engage, and retain qualified employees; the impact of workforce reductions on company culture, employee retention and morale, and institutional knowledge; labor relations and contracts, including work stoppages and other disruptions; security breaches, cybersecurity attacks, technology failures, and other disruptions to our information technology infrastructure and products; leveraging artificial intelligence and machine learning within our business processes; changes to existing laws and regulations, including the implementation of new, more stringent laws, as well as compliance with these laws and regulations; governmental and other actions designed to address climate change in connection with a transition to a lower-carbon economy; warranty claims, post-sales repairs or recalls, product liability litigation, and regulatory investigations because of the deficient operation of our products; investigations, claims, lawsuits, or other legal proceedings, including the lawsuit filed by the Federal Trade Commission (FTC) and the Attorneys General of the States of Arizona, Illinois, Michigan, Minnesota, and Wisconsin alleging that we unlawfully withheld self-repair capabilities from farmers and independent repair providers; and loss of or challenges to intellectual property rights. For a discussion of some of these risks and uncertainties see “Item 1A Risk Factors” in our most recent Annual Report on Form 10-K, as updated by our subsequent filings with the U.S. Securities and Exchange Commission. Investors should refer to and consider the information on risks and uncertainties in addition to the information presented here. All forward-looking statements made in this earnings call, this presentational and accompanying materials are based only on information currently available and speaks only as of the date on which it is made. You should not place undue reliance on forward-looking statements. The Company, except as required by law, undertakes no obligation to update or revise any forward-looking statements whether as a result of new developments or otherwise. This earnings call, this presentational and accompanying materials may contain non-GAAP financial measures. Non-GAAP measures should be viewed as a supplement to, and not in isolation from, or as a substitute for the Company’s GAAP measures of performance and the financial results calculated in accordance with GAAP. A reconciliation of these measures to the most directly comparable GAAP measures can be found in the appendix should be carefully evaluated. 22 |

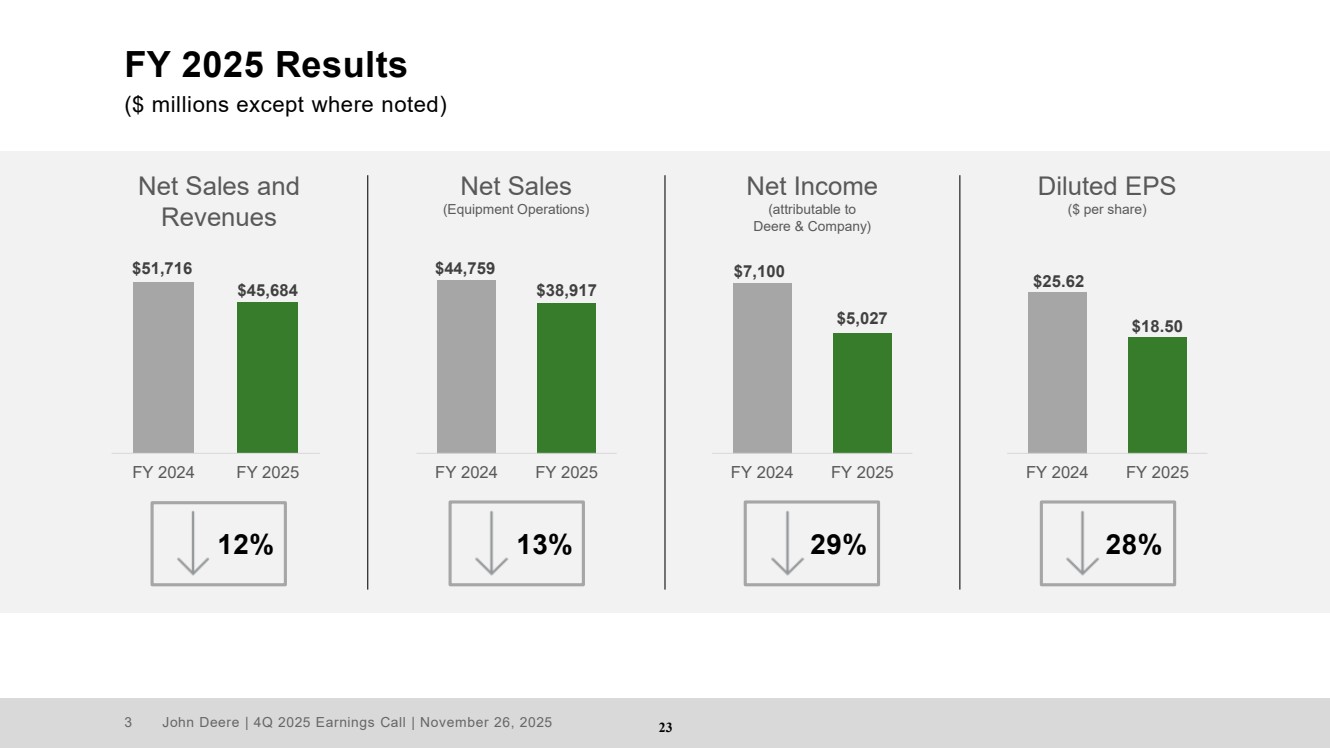

| 3 John Deere | 4Q 2025 Earnings Call | November 26, 2025 FY 2025 Results ($ millions except where noted) $51,716 $45,684 FY 2024 FY 2025 $44,759 $38,917 FY 2024 FY 2025 $7,100 $5,027 FY 2024 FY 2025 $25.62 $18.50 FY 2024 FY 2025 13% Net Sales and Revenues Net Sales (Equipment Operations) Net Income (attributable to Deere & Company) Diluted EPS ($ per share) 12% 29% 28% 23 |

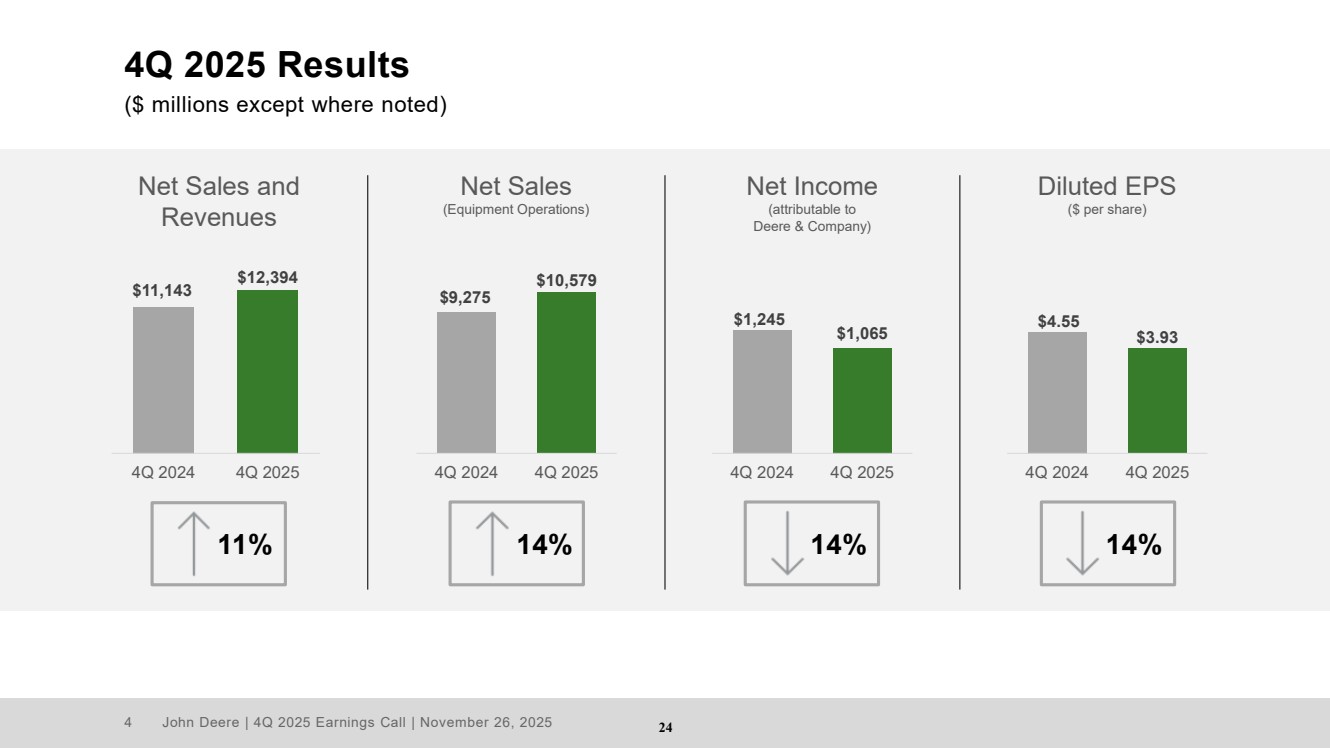

| 4 John Deere | 4Q 2025 Earnings Call | November 26, 2025 4Q 2025 Results ($ millions except where noted) $11,143 $12,394 4Q 2024 4Q 2025 $9,275 $10,579 4Q 2024 4Q 2025 $1,245 $1,065 4Q 2024 4Q 2025 $4.55 $3.93 4Q 2024 4Q 2025 14% Net Sales and Revenues Net Sales (Equipment Operations) Net Income (attributable to Deere & Company) Diluted EPS ($ per share) 11% 14% 14% 24 |

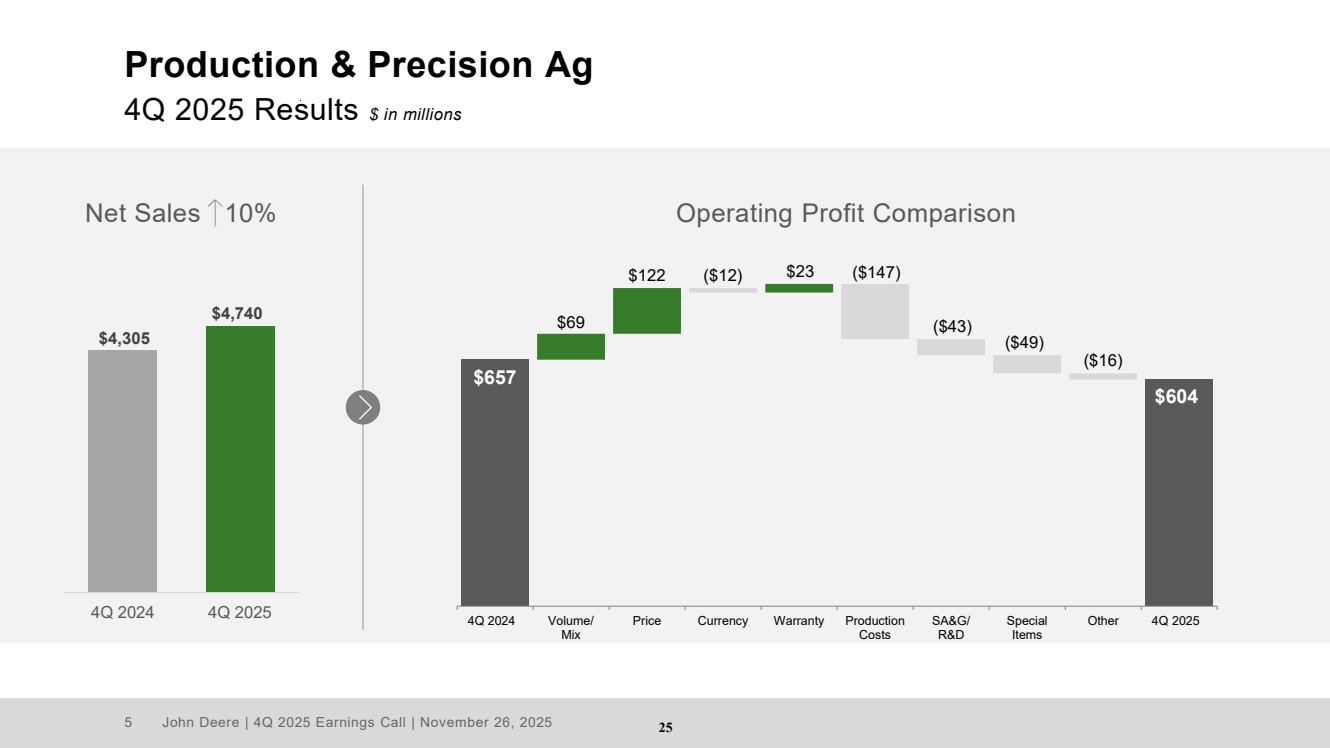

| 5 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Production & Precision Ag 4Q 2025 Results $ in millions $4,305 $4,740 4Q 2024 4Q 2025 Net Sales 10% Operating Profit Comparison ($49) $657 $69 $122 ($12) $23 ($147) ($43) ($16) $604 4Q 2024 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 4Q 2025 25 |

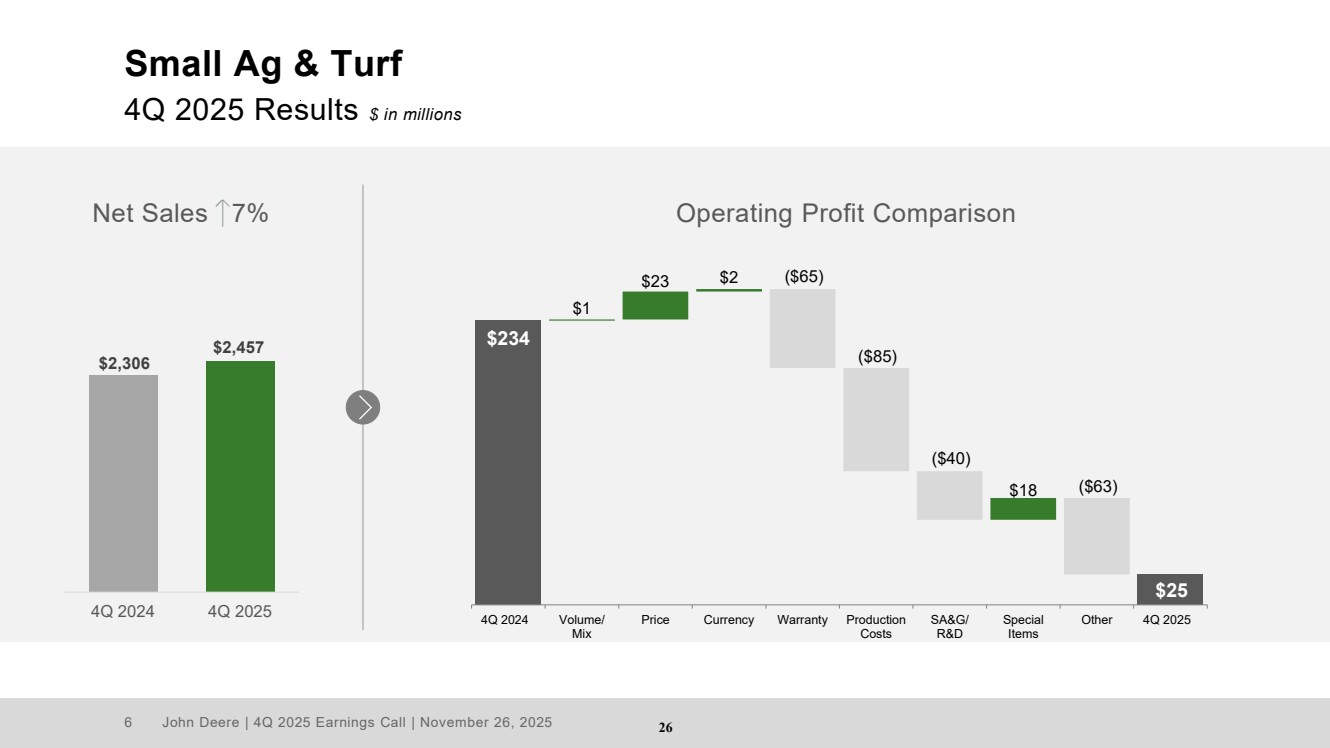

| 6 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Small Ag & Turf 4Q 2025 Results $ in millions $2,306 $2,457 4Q 2024 4Q 2025 Net Sales 7% Operating Profit Comparison $18 $234 $1 $23 $2 ($65) ($85) ($40) ($63) $25 4Q 2024 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 4Q 2025 26 |

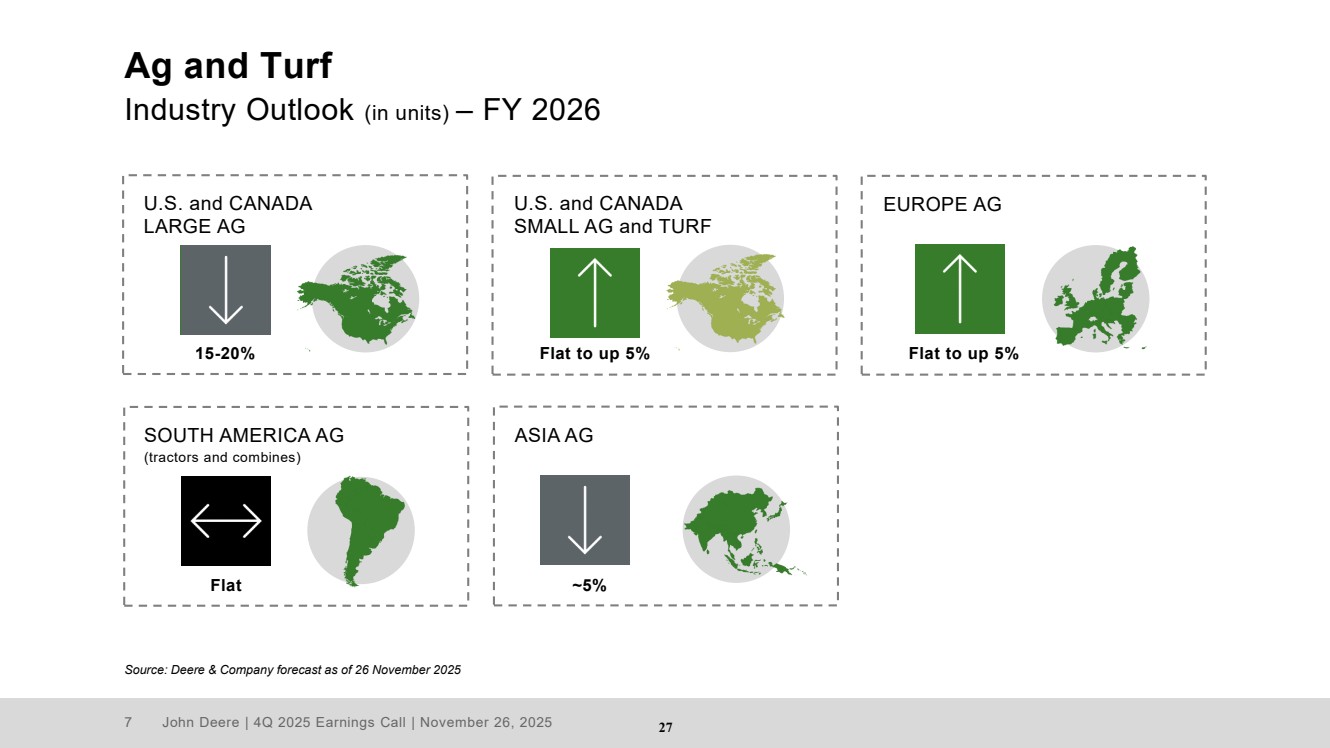

| 7 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Ag and Turf Industry Outlook (in units) – FY 2026 Source: Deere & Company forecast as of 26 November 2025 U.S. and CANADA LARGE AG 15-20% EUROPE AG Flat to up 5% SOUTH AMERICA AG (tractors and combines) Flat U.S. and CANADA SMALL AG and TURF Flat to up 5% ASIA AG ~5% 27 |

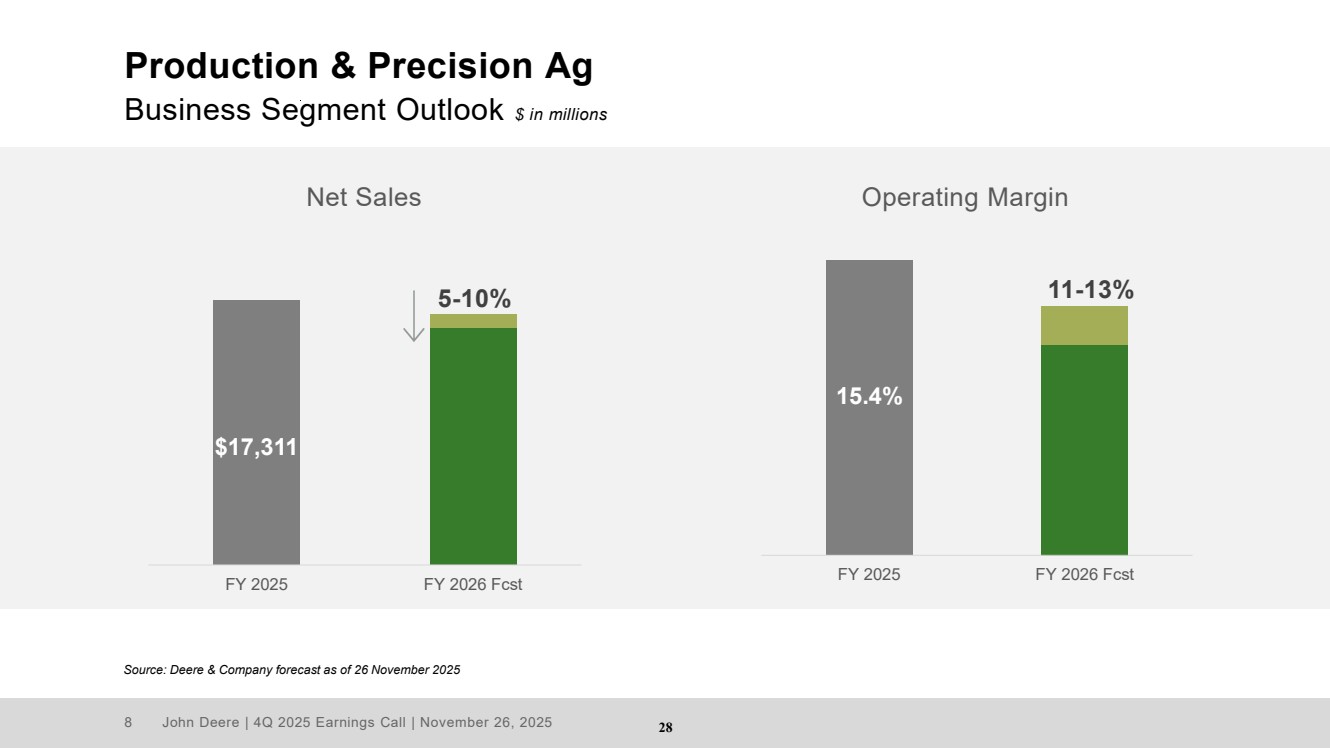

| 8 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Production & Precision Ag Business Segment Outlook $ in millions Source: Deere & Company forecast as of 26 November 2025 15.4% FY 2025 FY 2026 Fcst $17,311 FY 2025 FY 2026 Fcst Net Sales Operating Margin 5-10% 11-13% 28 |

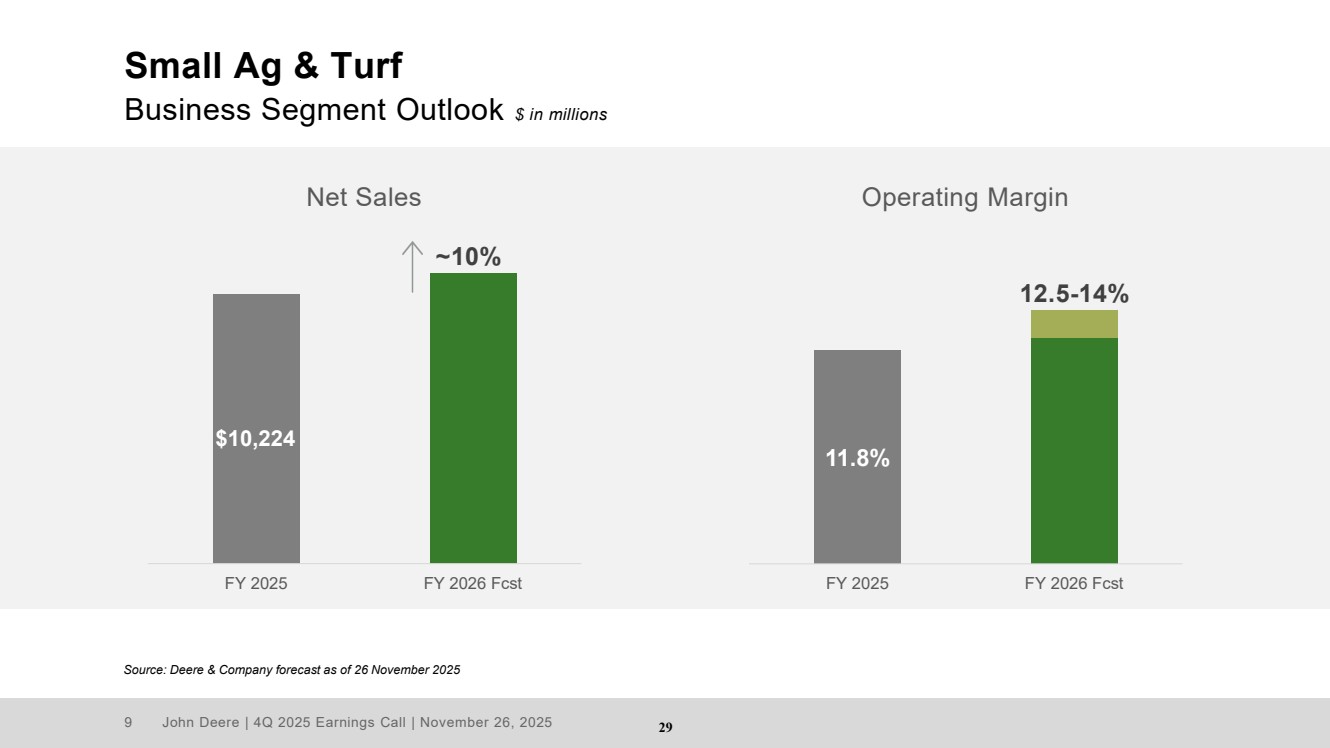

| 9 John Deere | 4Q 2025 Earnings Call | November 26, 2025 $10,224 FY 2025 FY 2026 Fcst Small Ag & Turf Business Segment Outlook $ in millions Source: Deere & Company forecast as of 26 November 2025 11.8% FY 2025 FY 2026 Fcst Net Sales Operating Margin ~10% 12.5-14% 29 |

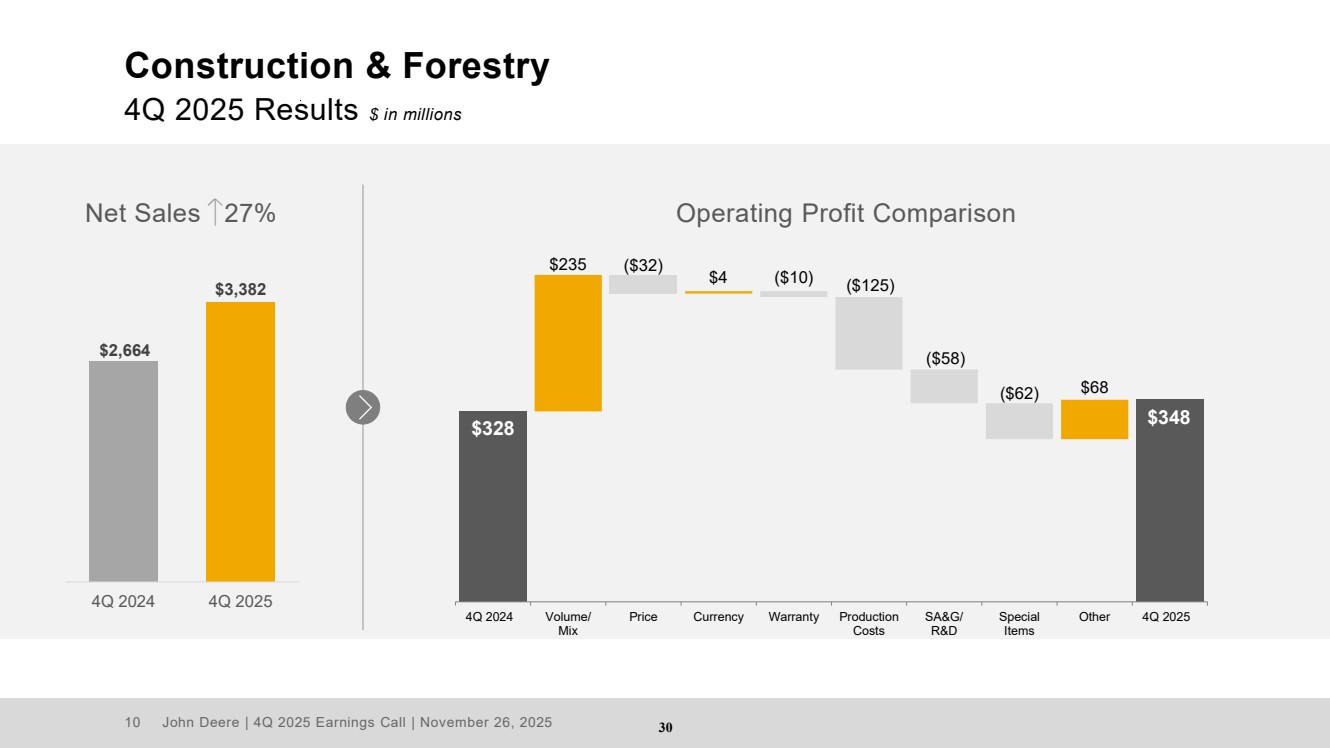

| 10 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Construction & Forestry 4Q 2025 Results $ in millions $2,664 $3,382 4Q 2024 4Q 2025 Net Sales 27% Operating Profit Comparison ($62) $328 $235 ($32) $4 ($10) ($125) ($58) $68 $348 4Q 2024 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 4Q 2025 30 |

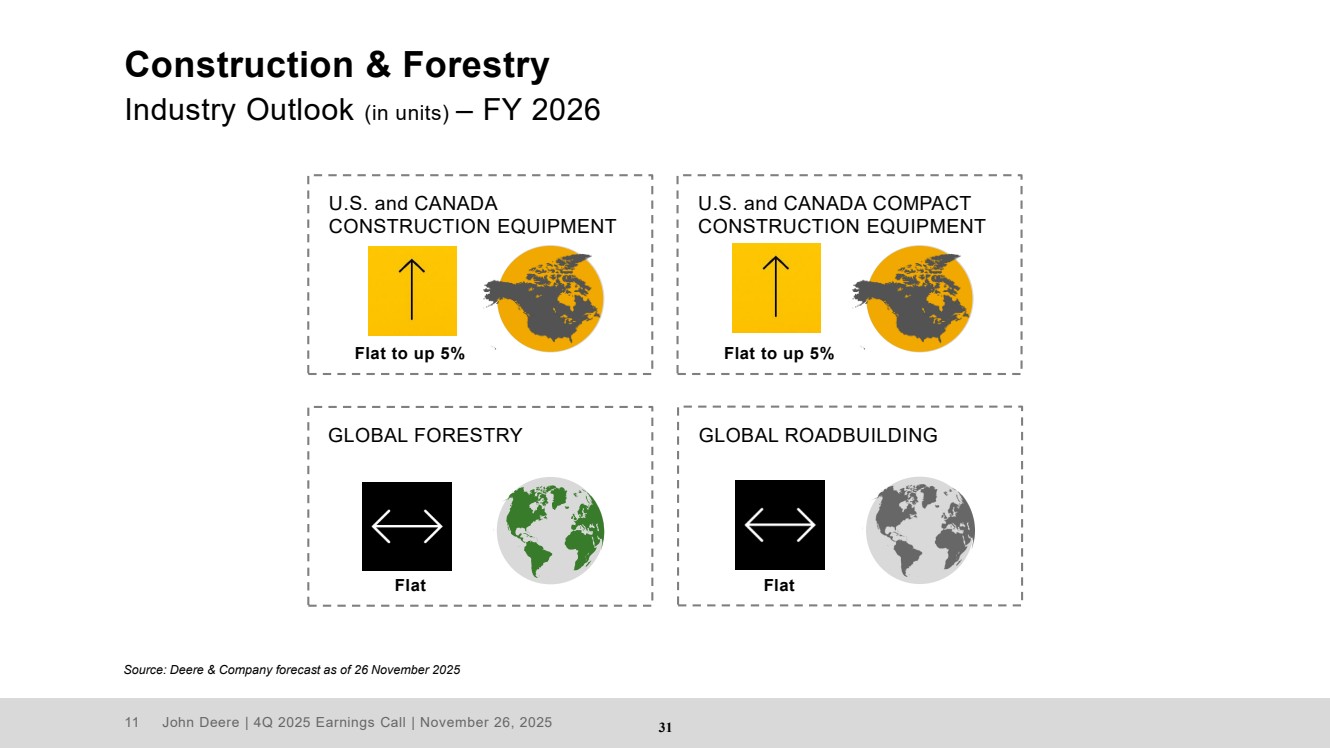

| 11 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Construction & Forestry Industry Outlook (in units) – FY 2026 Source: Deere & Company forecast as of 26 November 2025 GLOBAL ROADBUILDING Flat U.S. and CANADA CONSTRUCTION EQUIPMENT Flat to up 5% U.S. and CANADA COMPACT CONSTRUCTION EQUIPMENT Flat to up 5% GLOBAL FORESTRY Flat 31 |

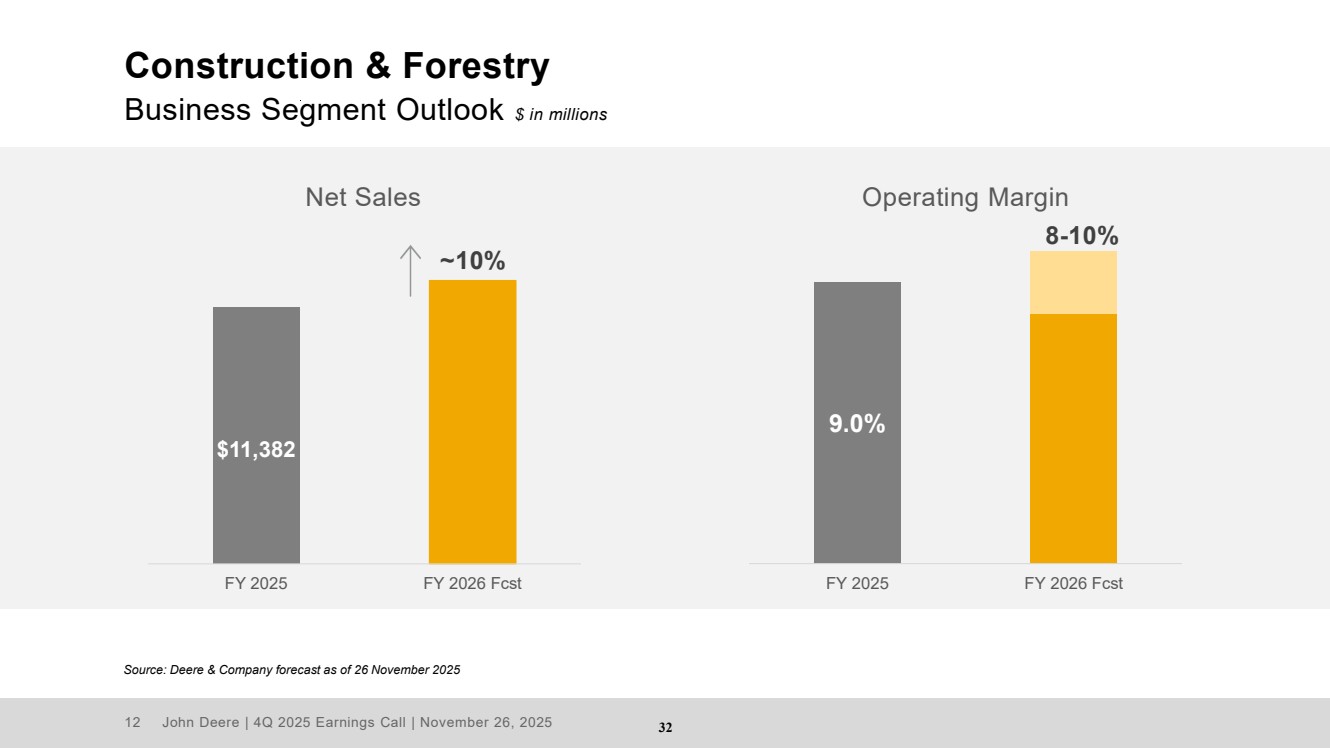

| 12 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Construction & Forestry Business Segment Outlook $ in millions Source: Deere & Company forecast as of 26 November 2025 9.0% FY 2025 FY 2026 Fcst $11,382 FY 2025 FY 2026 Fcst Net Sales Operating Margin ~10% 8-10% 32 |

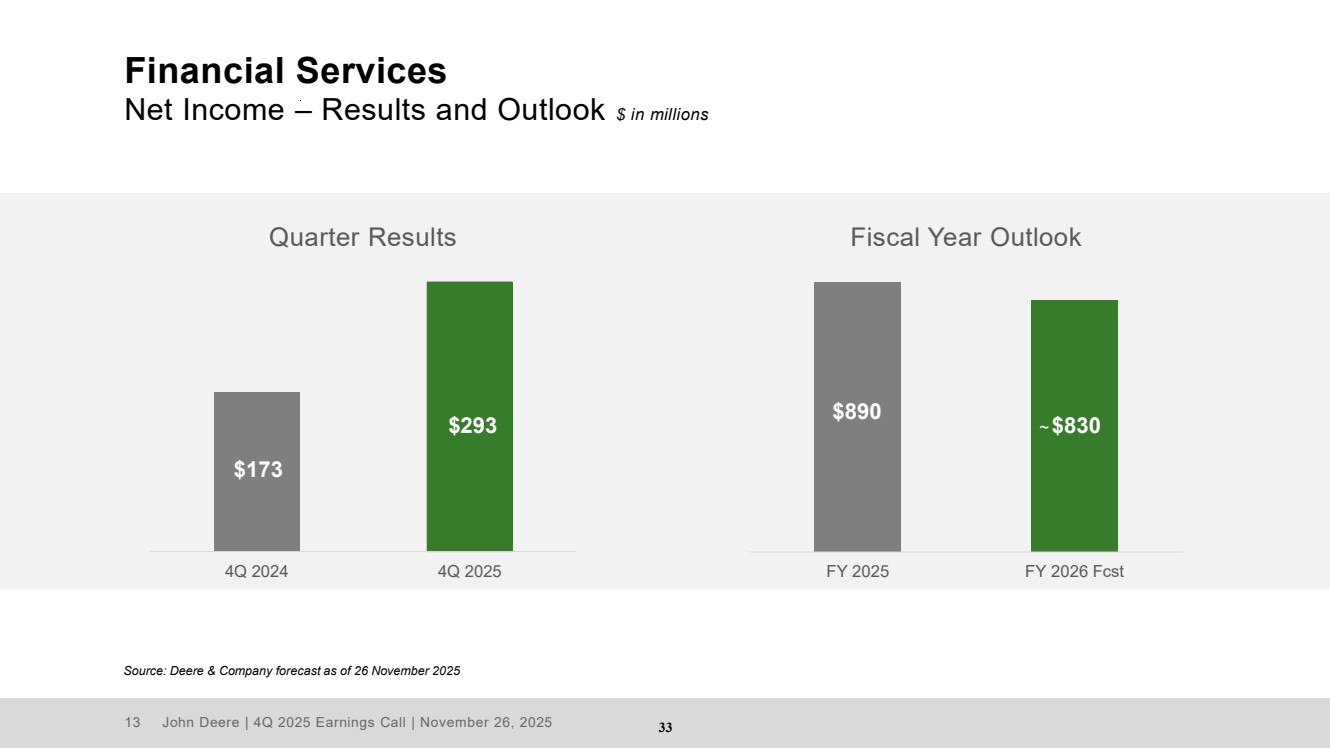

| 13 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Financial Services Net Income – Results and Outlook $ in millions Source: Deere & Company forecast as of 26 November 2025 $173 $293 4Q 2024 4Q 2025 Quarter Results Fiscal Year Outlook $890 $830 FY 2025 FY 2026 Fcst ~ 33 |

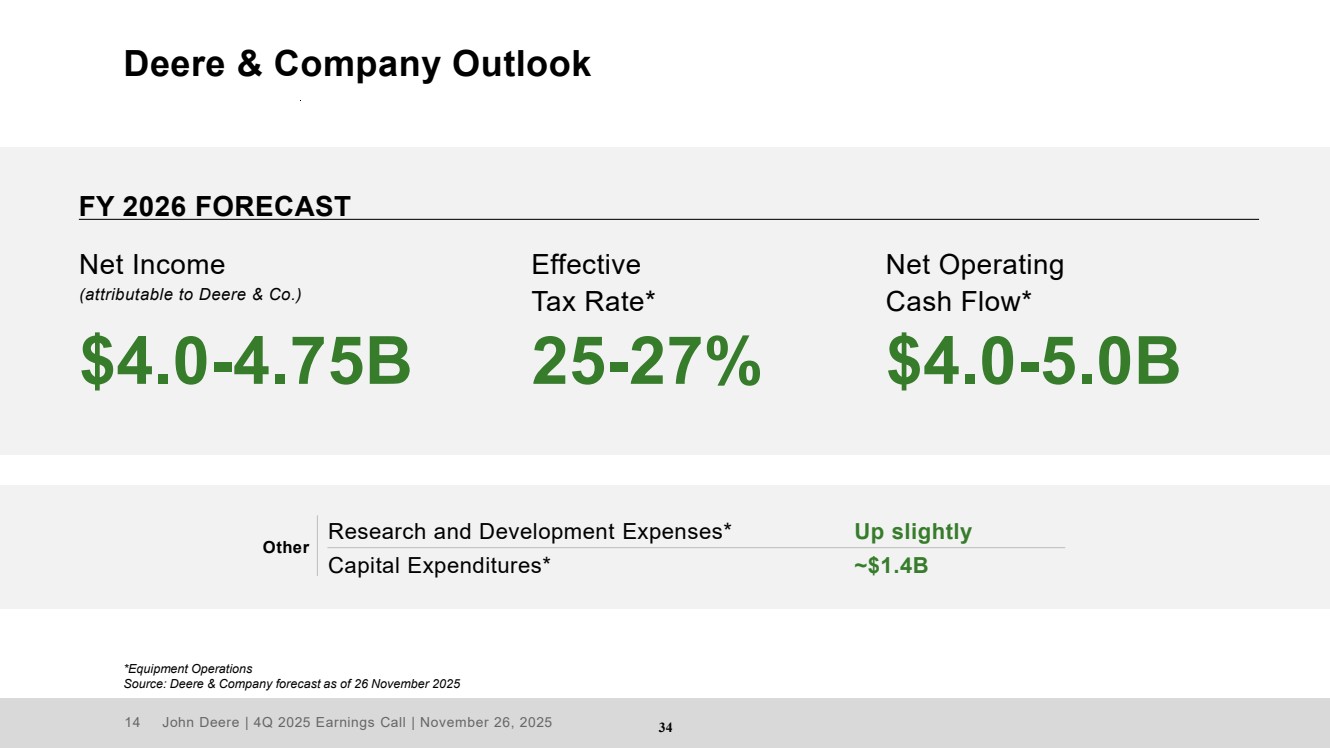

| 14 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Deere & Company Outlook Effective Tax Rate* Net Income (attributable to Deere & Co.) $4.0-4.75B 25-27% FY 2026 FORECAST Net Operating Cash Flow* $4.0-5.0B *Equipment Operations Source: Deere & Company forecast as of 26 November 2025 Other Research and Development Expenses* Capital Expenditures* Up slightly ~$1.4B 34 |

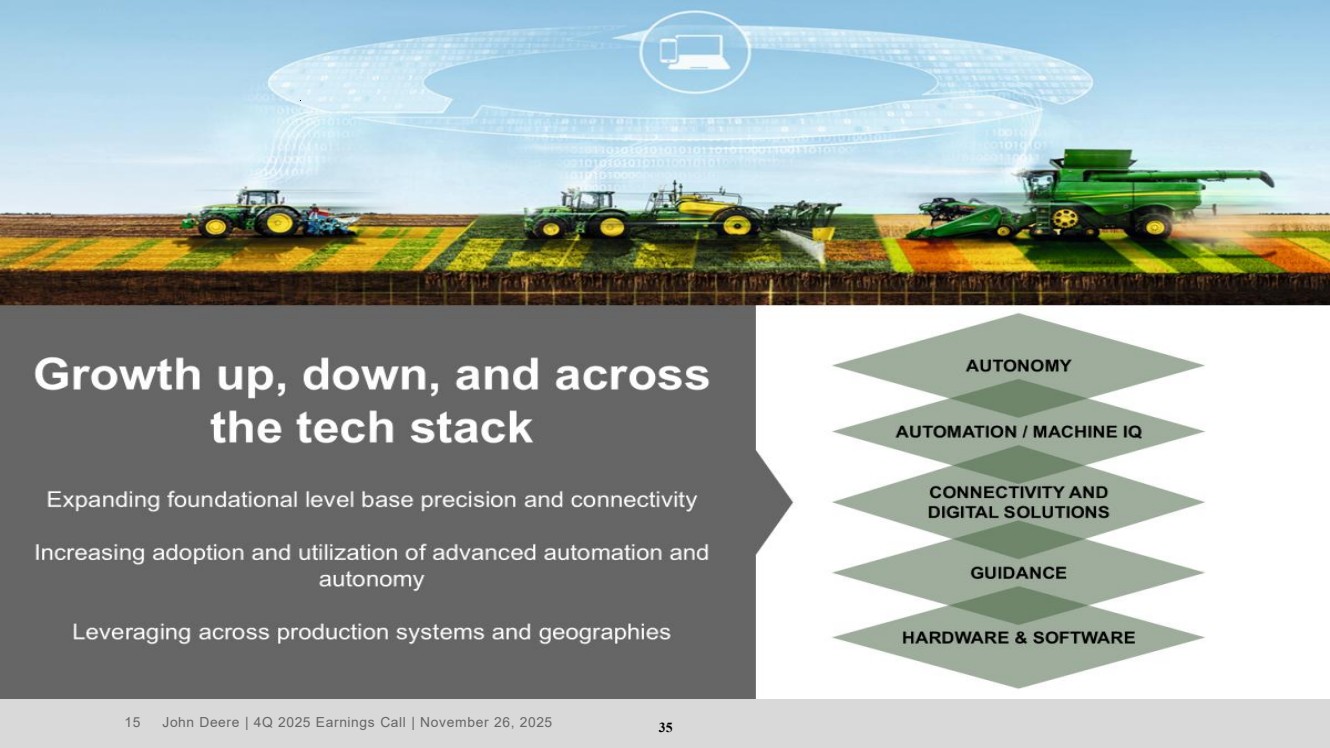

| 15 John Deere | 4Q 2025 Earnings Call | November 26, 2025 35 |

| 16 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Appendix 36 |

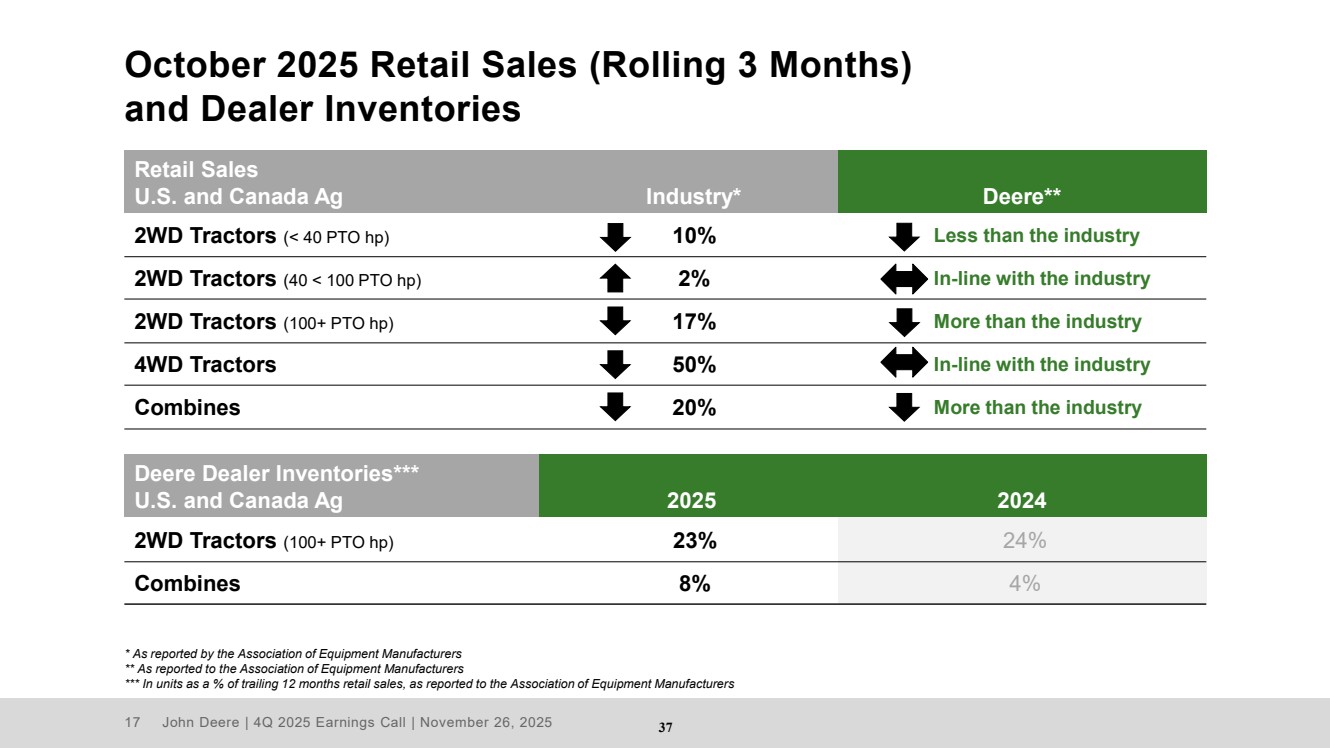

| 17 John Deere | 4Q 2025 Earnings Call | November 26, 2025 October 2025 Retail Sales (Rolling 3 Months) and Dealer Inventories Retail Sales U.S. and Canada Ag Industry* Deere** 2WD Tractors (< 40 PTO hp) 10% Less than the industry 2WD Tractors (40 < 100 PTO hp) 2% In-line with the industry 2WD Tractors (100+ PTO hp) 17% More than the industry 4WD Tractors 50% In-line with the industry Combines 20% More than the industry Deere Dealer Inventories*** U.S. and Canada Ag 2025 2024 2WD Tractors (100+ PTO hp) 23% 24% Combines 8% 4% * As reported by the Association of Equipment Manufacturers ** As reported to the Association of Equipment Manufacturers *** In units as a % of trailing 12 months retail sales, as reported to the Association of Equipment Manufacturers 37 |

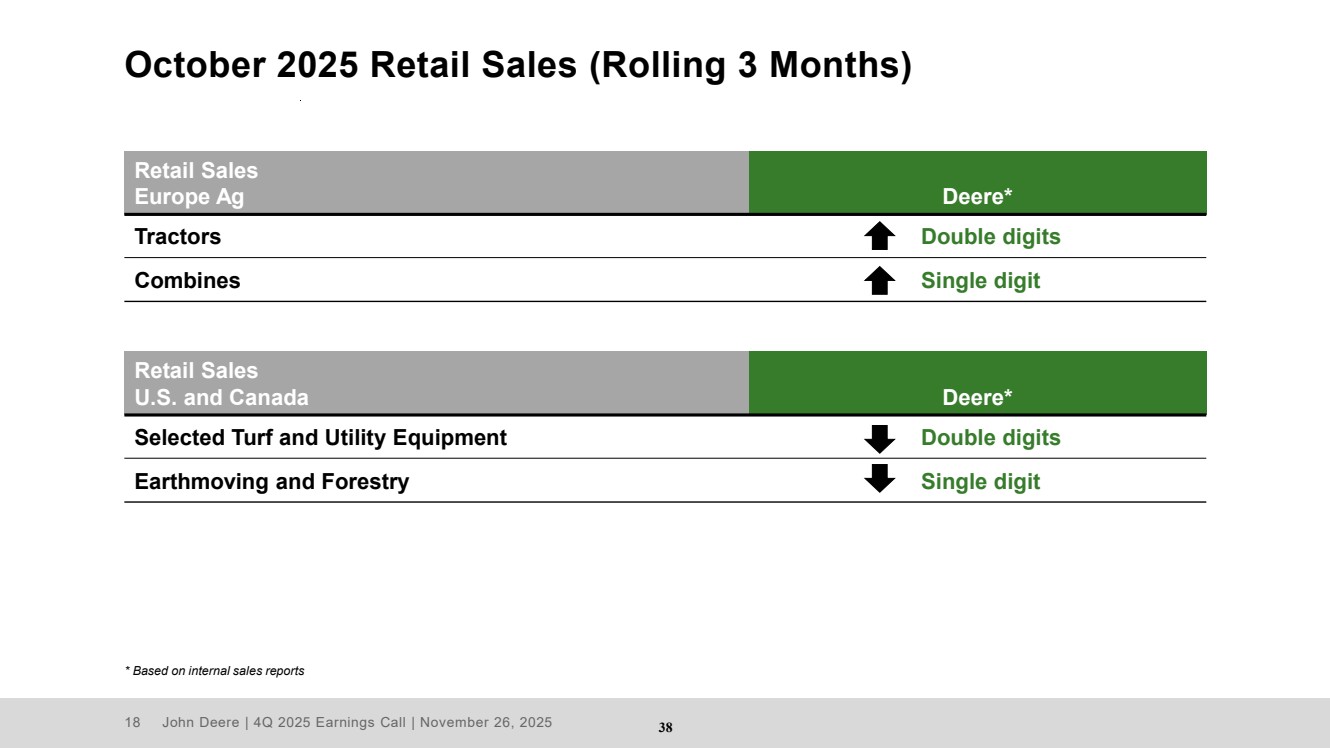

| 18 John Deere | 4Q 2025 Earnings Call | November 26, 2025 October 2025 Retail Sales (Rolling 3 Months) Retail Sales Europe Ag Deere* Tractors Double digits Combines Single digit * Based on internal sales reports Retail Sales U.S. and Canada Deere* Selected Turf and Utility Equipment Double digits Earthmoving and Forestry Single digit 38 |

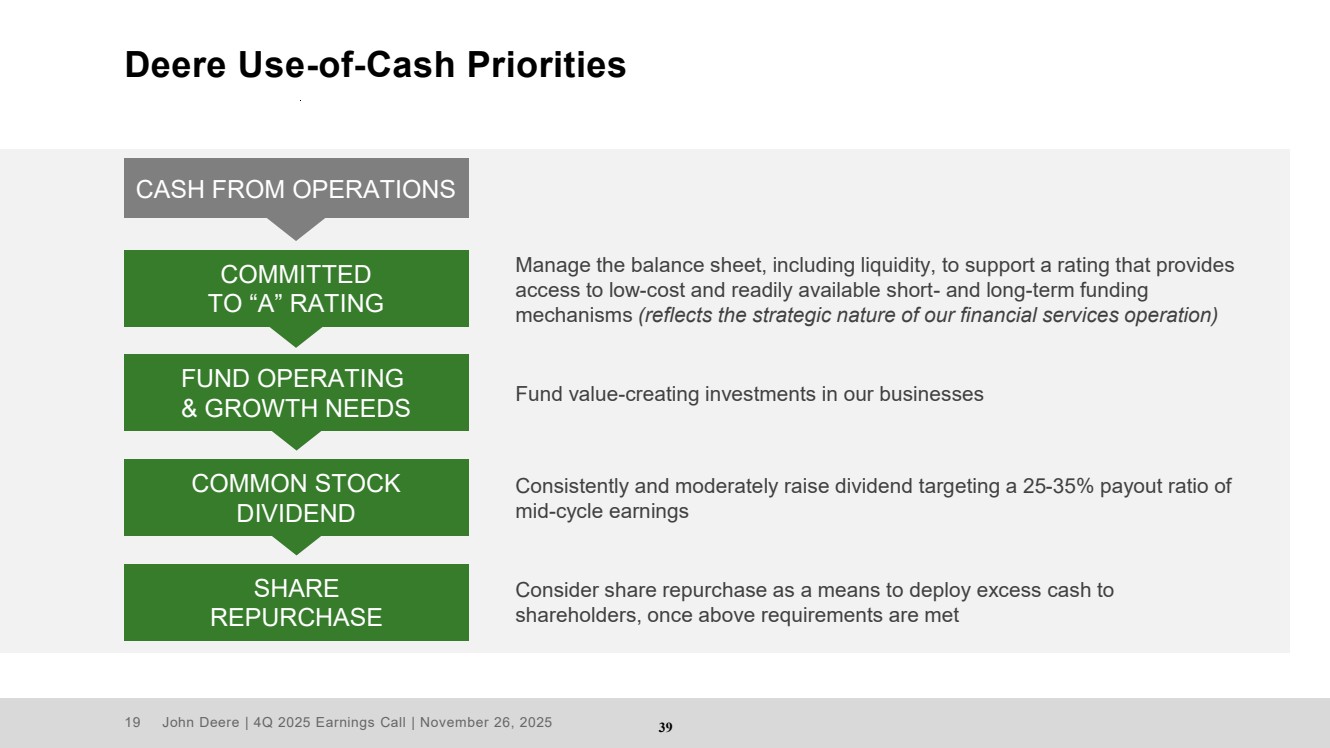

| 19 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Deere Use-of-Cash Priorities SHARE REPURCHASE Manage the balance sheet, including liquidity, to support a rating that provides access to low-cost and readily available short- and long-term funding mechanisms (reflects the strategic nature of our financial services operation) Fund value-creating investments in our businesses Consistently and moderately raise dividend targeting a 25-35% payout ratio of mid-cycle earnings Consider share repurchase as a means to deploy excess cash to shareholders, once above requirements are met COMMITTED TO “A” RATING FUND OPERATING & GROWTH NEEDS COMMON STOCK DIVIDEND CASH FROM OPERATIONS 39 |

| Webcast: John Deere – Investor Relations Website |

| 21 John Deere | 4Q 2025 Earnings Call | November 26, 2025 Deere & Company’s 1Q 2026 earnings call is scheduled for 9:00 a.m. Central Time on Thursday, 19 February 2026. 41 |

|