PART I

ITEM 1. BUSINESS.

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements provide our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements as they do not relate to historical or current facts and by words such as “believe,” “expect,” “estimate,” “anticipate,” “will,” “aim,” “should,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” and similar words or expressions.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Forward-Looking Statements,” in this Annual Report on Form 10-K.

As used herein, the terms “John Deere,” “we,” “us,” “our,” or “the Company” refer collectively to Deere & Company and its subsidiaries, unless designated or identified otherwise. All amounts are presented in millions of U.S. dollars, unless otherwise specified.

Products

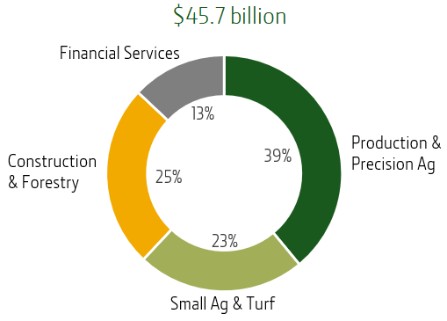

John Deere has manufactured agricultural equipment since 1837. Deere & Company was incorporated under the laws of Delaware in 1958. Our business is managed through the following four business segments: Production & Precision Agriculture (PPA), Small Agriculture & Turf (SAT), Construction & Forestry (CF), and Financial Services (John Deere Financial or FS).

|

|

|

| |||||

BUSINESS SEGMENT | PRODUCTION & PRECISION AGRICULTURE | SMALL AGRICULTURE & TURF | CONSTRUCTION & FORESTRY | FINANCIAL SERVICES | ||||

PRODUCTS | ● 4WD/track and row crop tractors ● Harvesters ● Cotton Pickers and Cotton Strippers ● Sugarcane Harvesters ● Sugarcane Loaders ● Soil Preparation, Tillage, Seeding, Application, and Crop Care Equipment | ● Specialty, Utility, and Compact Tractors ● Self-Propelled Forage Harvesters and Attachments ● Hay and Forage Equipment ● Rotary Mowers ● Utility Vehicles ● Riding Lawn Equipment and Commercial Mowing Equipment ● Golf Course Equipment | ● Backhoe Loaders ● Crawler Dozers and Loaders ● Skid Steers ● Four-Wheel-Drive Loaders ● Compact Wheel Loaders ● Excavators and Compact Excavators ● Equipment used in Timber Harvesting ● Road Building and Road Rehabilitation Equipment ● Articulated Dump Trucks and Motor Graders | ● Retail Notes ● Revolving Charge Accounts ● Wholesale Receivables ● Leases ● Extended Warranties | ||||

CROPS/FUNCTION | ● Corn and Soy ● Small Grain ● Cotton ● Sugarcane | ● Dairy and Livestock ● Lawn and Property Maintenance ● Golf Course Maintenance ● High-Value Crops and Small Acreage Crops | ● Earthmoving ● Forestry ● Roadbuilding | ● Financial Solutions | ||||

2