Filed by the Registrant

Filed by a Party other than the Registrant

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.)

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

Check the appropriate box: |

|

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): |

|

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

RANGE RESOURCES CORPORATION |

2025 Proxy Statement

Annual Meeting

Wednesday, May 14, 2025

8:00 a.m. Central Time

Please vote promptly by: |

|

|

TELEPHONE

|

INTERNET

|

marking, signing and returning your proxy or voting instruction card |

24 Proxy Statement May 8, 2024 Annual Meeting visit rangeresources.com

Dear Fellow Stockholders,

|

On behalf of the Board of Directors (the “Board”), we are pleased to invite you to participate in Range Resources’ 2025 Annual Meeting of Stockholders (the “Annual Meeting” or the “Meeting”). Our Annual Meeting will be held telephonically, commencing at 8:00 a.m., Central Time, on Wednesday, May 14, 2025. To access the event you will need to register virtually at https://ir.rangeresources.com/events/event-details/2025-annual-meeting-stockholders. The attached Notice of 2025 Annual Meeting of Stockholders and Proxy Statement provide information about the business we plan to conduct.

Board Refreshment

In September 2024 we announced that after a successful tenure on the Board, Steve Gray would retire effective October 2024. James Funk is not standing for reelection and is retiring from our Board effective May 14, 2025 in accordance with our Board retirement age guidelines. Steve's and James's experience and technical skills were invaluable in guiding Range to the best financial and operational position in Company history. The Board is grateful for their service. We continued to enhance and refresh our Board and in February 2025, we added one new director, Christian ("Chris") Kendall. Chris brings a wealth of technical expertise and a proven record of success as an executive in the energy sector. The Board remains committed to ongoing and thoughtful refreshment to maintain an appropriate balance of tenure, background and skills on the Board.

2024 Performance and Strategic Outlook

Our workforce performed at an exceptional level in 2024 as we successfully navigated natural gas pricing weakness. We safely completed our operational plans, while generating free cash flow and investing in the long-term development of Range's world-class asset base. Range's strong performance enabled the Company to return capital to stockholders through share repurchases and dividends, while further strengthening the balance sheet. We believe this demonstrates Range's resilience through commodity price cycles.

Our strategy for 2025 and beyond remains to deliver consistent, repeatable financial returns to our stockholders while executing safe and environmentally responsible operations. We are excited about the opportunities that lie before us. Natural gas and natural gas liquids ("NGLs") are critical sources of energy that are central to meeting the needs of humanity worldwide in the lower-carbon world of the future. We expect Appalachian natural gas to play a pivotal role in meeting surging energy demands driven by domestic base-load power demand growth and the global expansion of liquefied natural gas markets. Our high-quality, low emissions intensity asset base is well-positioned to meet growing future demand for natural gas and NGLs in both the United States and the world.

Listening to Stockholder Feedback

We proactively engage with stockholders and feedback from these engagement helps inform our viewpoints and decisions. We remain committed to regular and transparent engagements. We value your views and would like to hear from you.

On behalf of the entire Board, we would like to thank all of our stockholders for your ongoing support and investment in Range. We are proud of our employees for their many accomplishments, and I am very grateful for the counsel and guidance of my fellow directors. We look forward to your vote at the Annual Meeting.

Sincerely yours, |

|

|

|

|

|

|

|

Greg G. Maxwell |

|

Chairman of the Board April 4, 2025 |

Notice of 2025 Annual

Meeting of Stockholders

|

Items of Business |

|

Who Can Vote |

|||

|

|

|

|||

1 |

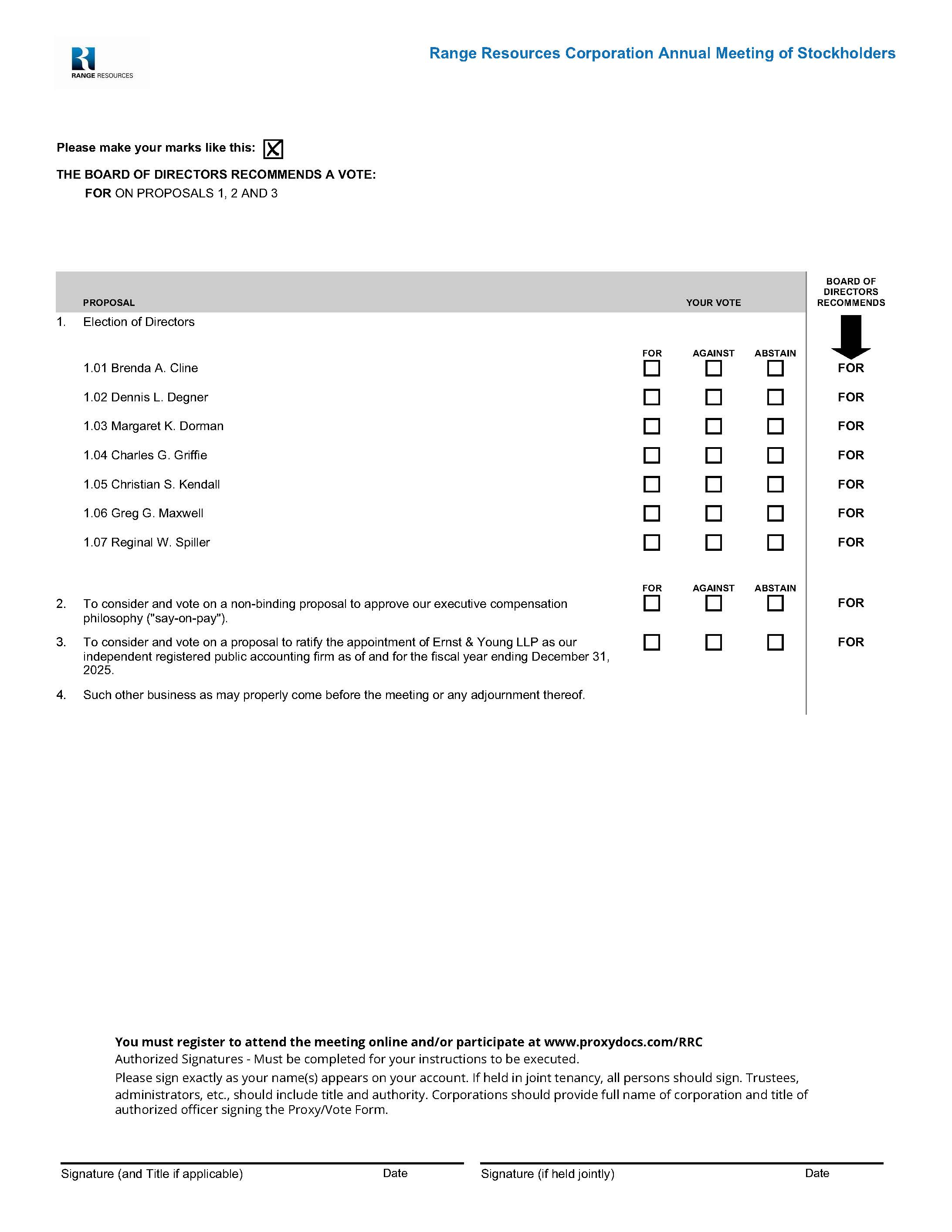

To elect the seven nominees named in the attached Proxy Statement to our Board, each for a term expiring at the 2026 annual meeting or when their successors are duly elected and qualified; |

|

Stockholders of record at the close of business March 17, 2025, may vote at the Meeting or any postponements or adjournments of the Meeting. |

||

|

|

|

|||

|

|

Date & Time Wednesday, May 14, 2025, 8:00 A.M. Central Time |

|||

2 |

To consider and vote on a non-binding proposal to approve our executive compensation philosophy (“say-on-pay”); |

|

|||

|

|

|

|

||

|

|

Place https://ir.rangeresources.com/events/event-details/2025-annual-meeting-stockholders |

|||

3 |

To consider and vote on a proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm as of and for the fiscal year ending December 31, 2025; and |

|

|||

|

|

|

|

||

|

How to Cast Your Vote

|

|

|||

4 |

To transact any other business properly brought before the meeting. |

|

• Online before the Meeting: www.proxyvote.com • By phone: 800-690-6903 • Proxy Card or Voting Instruction Form: Complete, sign, and return your proxy card • Scan the QR code on your proxy card by mobile device • You may vote at the Annual Meeting |

||

|

|

|

|||

Stockholders will also vote on any other business that is properly brought before the Meeting. The list of stockholders entitled to vote at the Meeting will be open to the examination of any stockholder for any purpose relevant to the Meeting during normal business hours for ten days before the Meeting at our Fort Worth office at the address listed below. The list will also be available during the Meeting for inspection by stockholders.

MacKenzie Partners, Inc. has been retained to assist us in the process of obtaining your vote. If you have any questions regarding the Meeting or require assistance in voting your shares, please contact them at 800-322-2885 or call them collect at 212-929-5500.

Whether or not you plan to attend the Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided or you may vote online at www.proxyvote.com using the control number printed on the proxy. You may revoke your proxy at any time before its exercise and vote at the Meeting.

By Order of the Board of Directors |

100 Throckmorton Street Suite 1200 Fort Worth, Texas 76102 |

|

|

|

|

|

|

Erin W. McDowell |

|

Corporate Secretary |

TABLE OF CONTENTS

|

1 |

|

50 |

||

|

|

|

52 |

|

9 |

|

53 |

||

10 |

|

57 |

||

10 |

|

59 |

||

|

60 |

|||

10 |

|

61 |

||

12 |

|

63 |

||

|

|

|

63 |

|

17 |

|

64 64 |

||

26 |

|

|||

27 |

|

|

|

|

|

66 |

|||

Stock Ownership-Directors, Management and Certain |

28 |

|

||

|

||||

29 |

|

66 |

||

|

|

|

67 |

|

30 |

|

68 |

||

|

69 |

|||

30 |

|

69 |

||

31 |

|

69 |

||

|

|

|

|

|

31 |

|

70 |

||

|

|

|

|

|

33 |

|

70 |

||

|

|

|

|

|

40 |

|

71 |

||

47 |

|

71 |

||

|

|

|

74 |

|

48 |

|

|||

48 |

|

|

|

|

49 |

|

76 |

||

|

|

|

|

|

|

|

|

|

|

PROXY SUMMARY

|

This summary does not contain all the information that you should consider, and you should read the entire proxy statement carefully before voting. For more complete information regarding our 2024 performance, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

2025 Annual Meeting Information

|

|

DATE & TIME Wednesday, May 14, 2025 |

|

|

|

PLACE Virtual registration accessible at: https://ir.rangeresources.com/events/event-details/2025-annual-meeting-stockholders |

|

|

|

RECORD DATE March 17, 2025 |

Voting Matters and Board Recommendations

It is important that you vote. Please carefully review the proxy materials for the 2025 Annual Meeting and follow the instructions below to cast your vote on all of the voting matters.

|

PROPOSAL 1: Election of Directors |

|

|

The Board Recommends you vote FOR each Nominee |

|

Page 10 |

|

PROPOSAL 2: Advisory Vote to Approve |

|

|

The Board Recommends you vote FOR this proposal |

|

Page 30 |

|

PROPOSAL 3: Ratification of the Appointment |

|

|

The Board Recommends you vote FOR this proposal |

|

Page 66 |

1 |

|

PROXY SUMMARY

Our Company

Range Resources Corporation ("Range" or "Company") is a leading U.S. independent natural gas, natural gas liquids (NGLs) and oil (predominately condensate as well as crude oil, collectively referred to herein as "oil") producer engaged in operations focused in the Appalachian region of the United States. Our principal area of operations is the Marcellus Shale in the Commonwealth of Pennsylvania.

Our overarching business objective is to build stockholder value through returns-focused development of our natural gas properties. Our strategy to achieve our business objective is to generate consistent cash flows from reserves and production through internally generated drilling projects. We operate in a safe, environmentally responsible manner with a focus on cost-efficiency and responsible development of our world-class asset base. We maintain a large set of customers in domestic and international markets which allows us to maximize potential cash flows and diversify risk.

2024 Financial Highlights

$945M Cash Flows from Operating Activities

|

|

$1.3B Available Under Credit Facility at Year-End |

|

$251M Income before Income Taxes |

|

|

|

|

|

$65M Share Repurchases

|

|

$2.2B Natural gas, NGLs and Oil Sales |

|

$77M Total Dividends Paid |

We delivered strong financial results in 2024 against the backdrop of adverse commodity pricing through responsible development of our world-class asset base coupled with a thoughtful and right-sized hedging program. These financial results are a manifestation of our best-in-class cost profile among U.S. natural gas producers. Our balance sheet strength affords us flexibility in determining the best use cases to return capital to our stockholders.

2024 Business Highlights |

|

|

• Revenue from the sale of natural gas, NGLs and oil (including cash settlements on our derivatives) increased 3% from the same period of 2023 • Cash flow from operating activities, before working capital changes, of $1.1 billion(a) |

|

• Interest expense per mcfe decreased 6% compared to the same period of 2023 • Repurchased in the open market $79.7 million face value of our 4.875% senior notes due 2025 at a discount • Reduced net debt by $172 million(a)

|

(a) Annex A includes reconciliations for non-GAAP financial measures to comparable GAAP measures

2025 PROXY STATEMENT |

2 |

PROXY SUMMARY

2024 Operational Highlights

|

|

|

|

|

|

|

|

|

Total Production |

|

Total Proved Reserves |

|

Number of wells drilled |

|

Capital |

|

Range Produced Water Recycling Rate |

In 2024, Range achieved significant operational milestones underscoring our commitment to efficient use of resources, safety and responsible growth. Our operational performance was driven by safe execution of announced drilling plans coupled with operational improvements through improvements in hydraulic fracturing stages per day and length of lateral wells. These outcomes are a reflection of the dedication of our employees and business partners to the execution of our business strategy. We plan to continue this positive momentum so that we can continue to enhance our commitment to efficiency, safety and responsible growth.

2024 Operational Results |

|

|

• 17th consecutive year of positive reserve performance revisions • 100% drilling success rate • Total 2024 production was comprised of 68% natural gas, 30% NGLs and 2% oil |

|

• Expanded the installation and use of compressed air pneumatic controllers • Completed MiQ recertification process with an "A" grade rating for the second consecutive year for the Company's Southwest Pennsylvania production and operations

|

3 |

|

PROXY SUMMARY

Board Nominees and Committee Memberships

Name |

|

Age |

Director |

Principal Occupation |

A |

C |

ES* |

GN |

|

Brenda A. Cline Independent |

64 |

2015 |

Chief Financial Officer, Treasurer and Secretary of the Kimbell Art Foundation |

▲ |

|

● |

● |

|

Margaret K. Dorman Independent |

61 |

2019 |

Former Executive Vice President, Chief Financial Officer and Treasurer of Smith International, Inc. |

● |

▲ |

● |

|

|

Charles G. Griffie Independent |

52 |

2023 |

Former Senior Vice President Engineering and Operations, Western Midstream Partners |

|

|

▲ |

● |

|

Christian S. Kendall Independent |

58 |

2025 |

Former President and Chief Executive Officer, Denbury Inc. |

|

|

● |

● |

|

Greg G. Maxwell Independent |

68 |

2015 |

Former Executive Vice President, Finance and Chief Financial Officer of Phillips 66 |

● |

● |

● |

|

|

Reginal W. Spiller Independent |

72 |

2021 |

President and Chief Executive Officer of Azimuth Energy Investments, LLC and formerly Deputy Assistant Secretary of Oil & Gas at U.S. Department of Energy |

|

● |

● |

▲ |

|

Dennis L. Degner |

52 |

2023 |

Chief Executive Officer and President, Range Resources Corporation |

|

|

|

|

A Audit C Compensation ES ESG & Safety GN Governance & Nominating ● Member ▲ Chair

*Mr. James Funk currently serves as the Chair of the ESG & Safety Committee. Upon his retirement from the Board in May 2025, the Governance and Nominating Committee intends to recommend the appointment of Mr. Charles Griffie as Chair of the ESG & Safety Committee.

2025 PROXY STATEMENT |

4 |

PROXY SUMMARY

Key Qualifications

The following are some of the key qualifications and skills of our Board.

Skill |

Cline |

Dorman |

Griffie |

Kendall |

Maxwell |

Spiller |

Degner |

CEO/Senior Officer Experience Provides valuable expertise as a "C-level" executive of a publicly traded company |

● |

● |

● |

● |

● |

● |

● |

Industry Experience Provides industry knowledge and understanding of challenges and opportunities that exist in oil and gas |

|

● |

● |

● |

● |

● |

● |

Financial Reporting Experience Provides experience in evaluating our financial performance and overseeing |

● |

● |

|

● |

● |

|

|

Banking/Finance Experience Provides capital markets and M&A experience |

● |

● |

|

● |

● |

|

|

Engineering/Geoscience Provides technical knowledge related to |

|

|

● |

● |

|

● |

● |

Technology Provides experience in managing IT systems and data management |

● |

● |

|

● |

● |

● |

● |

Risk Management Provides experience in enterprise risk oversight and strategic development |

● |

● |

● |

● |

● |

● |

● |

Environmental, Health, Safety and Sustainability Provides understanding of regulatory frameworks and environmental and |

|

● |

● |

● |

|

● |

● |

The lack of a mark for a particular item does not mean the director does not possess that qualification, skill or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates the item is a particularly prominent qualification, characteristic, skill or experience that the director brings to the Board.

The Board considers these competencies when evaluating director nominees and board composition as a whole. The Board believes that a mix of these skills and qualifications provides the composition necessary to effectively oversee the Company’s execution of its strategy.

5 |

|

PROXY SUMMARY

Demonstrated Commitment to Board Refreshment

Since 2021, the Board has added four new directors to the Board, three of whom are independent. These recent refreshment activities have resulted in the Board possessing an average tenure of approximately 5 years. These actions demonstrate the Board’s desire to achieve a diverse and broadly inclusive membership with individuals who collectively possess the skills and experiences we will need to succeed now and into the future.

|

|

Corporate Governance Highlights

The Board is committed to strong corporate governance policies and practices. We seek to evolve with the best practices in governance and encourage input on governance matters from Range’s stockholders. Range’s corporate governance highlights, which are discussed in more detail beginning on page 17, include:

|

Independent Chairman; |

|

Defined roles for Committee work through established Charters; |

|

Independent directors meet regularly in executive session without management; |

|

Annual Board self-evaluation process; |

|

Annual election of all directors; |

|

Majority Vote Standard – No super majority voting requirement; |

|

Stockholders have the right to call special meetings; |

|

Stockholders may take action by written consent; |

|

Stockholders have the right to proxy access; |

|

1/3 of independent directors are women; |

|

Every year, Range’s Board conducts outreach to stockholders, typically covering greater than 65% of shares outstanding, to provide an opportunity to meet directly with several of our independent directors; and |

|

Clawback policy for incentive compensation. |

2025 PROXY STATEMENT |

6 |

PROXY SUMMARY

Engagement and Responsiveness to Stockholders

Management and, in many cases, multiple independent directors conduct regular outreach to gather feedback on our business strategy, corporate governance, executive compensation and sustainability oversight. We maintain a process for stockholders and interested parties to communicate with the Board. Stockholders and interested parties may write or call our Board as provided below:

|

|

|

|

WRITE |

CALL |

ATTEND |

|

Corporate Secretary |

Investor Relations |

ir@rangeresources.com |

Range Annual Meeting |

Our compensation program received strong stockholder support at our 2024 Annual Meeting with 98% of stockholder votes cast voting in favor of the compensation of our Named Executive Officers ("NEOs").

STOCKHOLDER SAY-ON-PAY APPROVAL |

|

|

We have observed a trend of consistent, strong stockholder support for our executive compensation program over the past three years, with stockholders voting to approve the say-on-pay proposal which exceeded a rate of 97% in each of the past three years.

|

|

|

Stockholder Say-on-Pay Approval |

|

|

Stockholder support

97%

in each of the |

|

|

|

Due to our strong stockholder support, the Committee did not make significant changes to the executive compensation program in response to the say-on-pay vote results in 2024. The Committee will continue to evaluate our executive compensation program, taking into account stockholder feedback, including future “say-on-pay” vote results.

7 |

|

PROXY SUMMARY

Executive Compensation Overview Program Summary

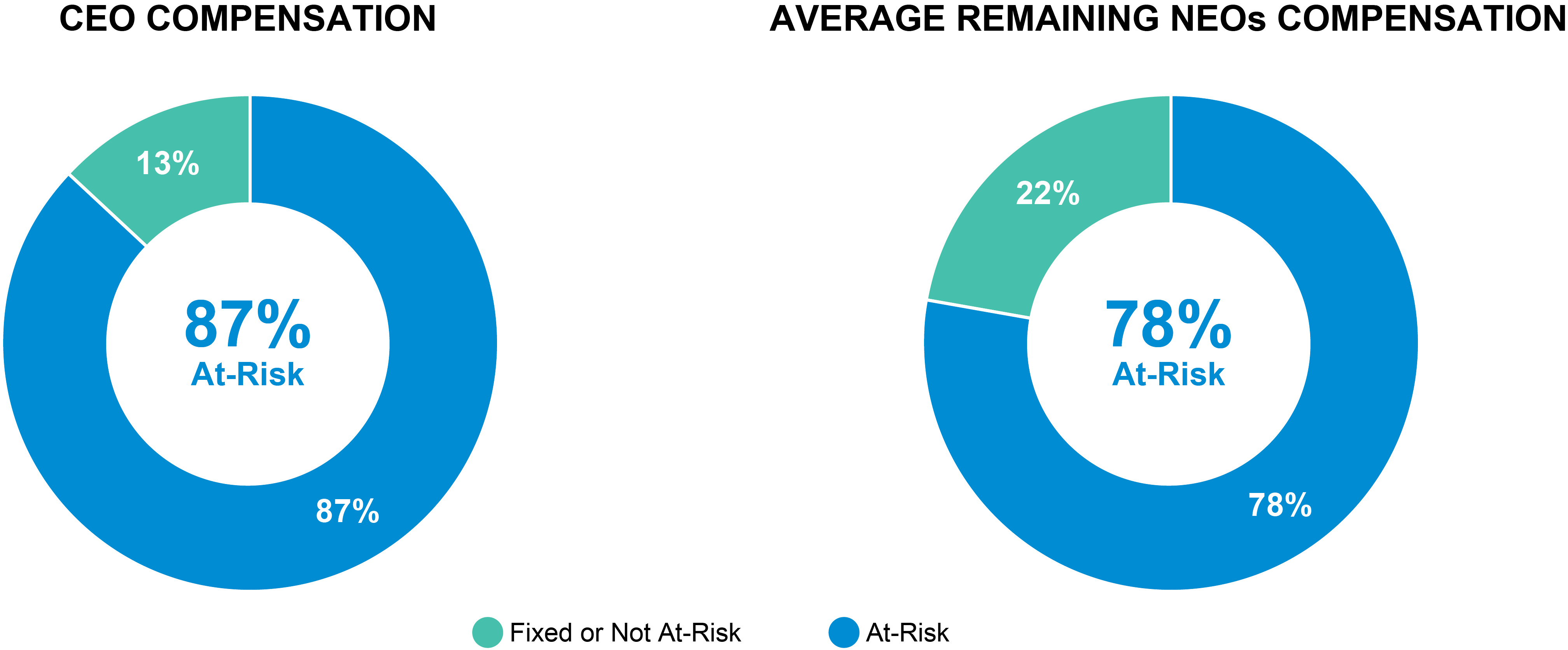

The Compensation Committee believes that a program weighted toward variable, at-risk compensation helps align the interest of management and stockholders. The charts below illustrate our CEO and Average Remaining NEOs 2024 at-risk compensation. A significant portion of reported compensation is an incentive for future performance and realized only if Range meets certain performance measures.

Environmental, Social and Governance (ESG)

Our investors are interested in how sustainability is integrated into our business objectives and corporate culture. In our annual board outreach, we reviewed our progress against stated corporate objectives and covered topics from our 2023–2024 Corporate Sustainability Report (“CSR”), which is available on our company website. We believe our focus on balance sheet strength, full-cycle costs and environmental performance positions us to sustainably create value for our stockholders through commodity cycles. We remain focused on our direct emissions through continued emissions reduction efforts, including evaluation and implementation of new technology and engineering solutions along with appropriate carbon offsets. The 2023–2024 CSR is not incorporated by reference herein or otherwise made a part of this Proxy Statement or any other filings with the SEC.

Important Dates for 2026 Annual Meeting of Stockholders (page 70)

Stockholder proposals submitted for inclusion in our 2026 proxy statement pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be received by us on or before December 5, 2025.

2025 PROXY STATEMENT |

8 |

PROXY SUMMARY

PROXY STATEMENT

|

We are furnishing you this proxy statement to solicit proxies to be voted at the 2025 Annual Meeting of Stockholders of Range Resources Corporation. The meeting will be held telephonically on May 14, 2025, at 8:00 a.m., Central Time. The proxies also may be voted at any adjournment or postponements of the meeting.

The mailing address of our principal office is 100 Throckmorton Street, Suite 1200, Fort Worth, Texas 76102. We are first furnishing these proxy materials to stockholders on April 4, 2025.

All properly executed written proxies and all properly completed proxies submitted by telephone, mobile device or internet that are delivered pursuant to this solicitation will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting.

Only owners of record of shares of Range common stock as of the close of business on March 17, 2025, the record date, are entitled to notice of, and to vote at, the meeting or any adjournments or postponements of the meeting. Each owner of Range common stock on the record date is entitled to one vote for each share of Range common stock held. On March 17, 2025, there were 240,140,426 shares of Range common stock outstanding and entitled to vote.

Important Notice Regarding the Availability of Proxy Materials For the Annual Meeting of Stockholders to Be Held on May 14, 2025. The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2024, are available at www.rangeresources.com. |

9 |

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

PROPOSAL 1 |

|

|

|

Election of Directors |

||

|

|

The Board of Directors recommends a vote FOR all of the nominees |

|

Nomination and Election of Directors Nominated by the Board

All of our directors are elected to a single year term. As a result, the current term of all our directors expires at the 2025 Annual Meeting. Based on the recommendation received from the Governance and Nominating Committee, our Board proposes that each of the nominees, all of which are currently serving as directors, be elected for a new term expiring at the 2026 annual meeting or when their successors are duly elected and qualified. Each of the nominees has agreed to serve if elected. If any one of them becomes unavailable to serve as a director, our Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by our Board. Our Board does not presently contemplate that any of the nominees will become unavailable for election. Mr. James Funk, who served as a director since 2008, is not standing for re-election. The Company and our directors extend their sincere appreciation for his dedicated service as a member of Range’s Board.

Required Vote and Recommendation

Because it is an uncontested election of directors, each nominee must receive more votes “for” the nominee than votes cast “against” the nominee in order for the nominee to be elected to the Board. Under our by-laws, in the event a candidate for the Board does not receive more “for” votes than votes “against,” the candidate’s resignation from the Board will be considered by the Governance and Nominating Committee. A properly executed proxy marked “Abstain” with respect to the election of one or more of our directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether a quorum is present. Uninstructed shares are not entitled to vote on this proposal; therefore, broker non-votes will not affect the outcome of this proposal. Proxies cannot be voted for a greater number of persons than the number of nominees named. The reasons described at the end of each biographical summary for each nominee that discusses the skills, qualifications and attributes of such candidates, led the Governance and Nominating Committee to recommend such persons for reelection to the Board. In the event of a contested election of directors, a nominee would be required to receive a plurality of the votes of the holders of shares of our common stock present in person or by proxy and entitled to vote at the Meeting. Under our by-laws, a "Contested Election" is an election in which the number of nominees for director is greater than the number to be elected, and an election is considered “uncontested” if an election in which the number of nominees for director is not greater than the number to be elected.

2025 PROXY STATEMENT |

10 |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Qualifications

Our Corporate Governance Guidelines contain criteria that apply to nominees recommended by the Governance and Nominating Committee for positions on our Board. Under these criteria, members of our Board should:

Our Board prefers to have a reasonable number of directors who have experience within the oil and gas industry. Our Board has also adopted a policy with regard to the consideration of diversity in the selection of candidates for the Board and that policy has been included in the Governance and Nominating Committee’s charter.

Director Independence

In accordance with applicable laws, regulations, our Corporate Governance Principles and the rules of the New York Stock Exchange (“NYSE”), the Board must affirmatively determine the independence of each director and director nominee. The Governance and Nominating Committee considers all relevant facts and circumstances including, without limitation, transactions during the previous year between Range and the director directly, immediate family members of the director, organizations with which the director is affiliated, and the frequency and dollar amounts associated with these transactions. The Committee then makes a recommendation to the Board with respect to the independence of each director and director nominee. Based on these considerations, the Board determined the following directors indicated by a check mark are independent:

|

Brenda A. Cline |

|

Margaret K. Dorman |

|

Charles G. Griffie |

|

Christian S. Kendall |

|

Greg G. Maxwell |

|

Reginal W. Spiller |

|

Dennis L. Degner* |

* As CEO of the Company, Mr. Degner is not independent.

Director Refreshment

Over time, the Board refreshes its membership through a combination of adding or replacing directors to achieve the appropriate balance between maintaining longer-term directors with deep institutional knowledge and adding directors who bring a diversity of perspectives and experience. Examples include the following:

Board nomination is described in greater detail in the section “Identifying and Evaluating Board Nominees for Directors” within this Proxy Statement.

11 |

|

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees For Director – Terms Expire 2026

Independent Age: 64 Director Since: 2015 Board Committees: Audit (Chair) ESG & Safety Governance& Nominating |

|

BRENDA A. CLINE |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ms. Cline became a director in 2015. Since 1993, Ms. Cline has served as Chief Financial Officer, Treasurer, and Secretary of the Kimbell Art Foundation, a private operating foundation that holds significant investments in oil and gas interests and owns and operates the Kimbell Art Museum, Fort Worth, Texas. Before 1993, Ms. Cline was a Senior Manager with Ernst & Young LLP. Ms. Cline also serves on the Board of Trustees of Texas Christian University. Ms. Cline is a certified public accountant. She earned her Bachelor of Business Administration, Accounting degree, summa cum laude, from Texas Christian University. Current Public Company Directorships Tyler Technologies Public Company Directorships Within the Past Five Years Cushing Funds; American Beacon Funds Skills and Experience |

|||||||||||

|

|

CEO/Senior Officer |

|

Financial Reporting |

|

|

Banking/ Finance |

|

|

Technology |

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Risk Management |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

Independent Age: 61 Director Since: 2019 Board Committees: Compensation (Chair) Audit ESG & Safety |

|

MARGARET K. DORMAN |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margaret K. Dorman became a director in 2019. Ms. Dorman has over 30 years of experience in the energy industry, largely focused in the oilfield service and equipment sector. In 2009, she retired as the Executive Vice President, Chief Financial Officer and Treasurer of Smith International, Inc. (now part of Schlumberger Limited) after spending more than a decade in that role. Previously, she held management positions at Landmark Graphics, prior to its acquisition by Halliburton Corporation, and Ernst & Young LLP. Ms. Dorman earned a Bachelor of Arts degree in Economics-Business from Hendrix College and is a certified public accountant. Current Public Company Directorships None Public Company Directorships Within the Past Five Years Equitrans Midstream Corporation Skills and Experience |

|||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

CEO/Senior Officer |

|

Industry |

|

|

Financial Reporting |

|

|

Banking/ Finance |

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Technology |

|

Risk Management |

|

|

Environmental, Health, Safety and Sustainability |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

2025 PROXY STATEMENT |

12 |

PROPOSAL 1: ELECTION OF DIRECTORS

Independent Age: 58 Director Since: 2025 Board Committees: ESG & Safety Governance and Nominating |

|

CHRISTIAN S. KENDALL |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Kendall became a director in 2025. Mr. Kendall has more than 30 years of experience in the oil and gas industry, most recently as the President and Chief Executive Officer of Denbury Inc., and a member of Denbury's Board of Directors from July 2017. Mr. Kendall guided the company through bankruptcy and emergence therefrom, until November 2023, when it was acquired by ExxonMobil Corporation. Mr. Kendall joined Denbury as Chief Operating Officer in September 2015 and was named President in October 2016. Prior to joining Denbury, Mr. Kendall was with Noble Energy, last serving as Senior Vice President, Global Operations Services. Over the course of his 14-year tenure at Noble Energy, he held a wide range of international and domestic leadership positions, primarily in the Eastern Mediterranean, Latin America and the Gulf of Mexico regions. Mr. Kendall began his career at Mobil Oil Corporation in 1989. Mr. Kendall earned his Bachelor of Science degree in Engineering, Civil Specialty, from the Colorado School of Mines and is a graduate of the Advanced Management Program at the Harvard Business School. He is also a member of the National Petroleum Council. Current Public Company Directorships NOV, Inc., California Resources Corporation Public Company Directorships Within the Past Five Years None Skills and Experience |

|||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

CEO/Senior Officer |

|

Industry |

|

|

Financial Reporting |

|

|

Banking/ Finance |

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Engineering/ Geoscience |

|

Technology |

|

|

Risk Management |

|

|

Environmental, Health, Safety and Sustainability |

||

|

|

|

|

|

|

|

|

|

|

|

||

Independent Age: 52 Director Since: 2023 Board Committees: ESG & Safety (Chair) Governance and Nominating |

|

CHARLES G. GRIFFIE |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Griffie became a director in 2023. Mr. Griffie has more than 25 years of experience in the oil and gas industry, with a focus in midstream and E&P operations. In 2022, he retired as Senior Vice President Engineering and Operations of Western Midstream Partners, LP. Mr. Griffie also worked in the Appalachia Basin and was a founding executive and Senior Vice President, Midstream and Marketing for Olympus Energy. Prior to that, Mr. Griffie had an extensive career with Anadarko Petroleum Corporation. Mr. Griffie earned a bachelor’s degree in mechanical engineering and an MBA from the University of Colorado at Denver. He has also completed the Program for Leadership Development – Executive Education at Harvard Business School. Current Public Company Directorships None Public Company Directorships Within the Past Five Years None Skills and Experience |

|||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEO/Senior Officer |

|

Industry |

|

|

Engineering/ Geoscience |

|

|

Risk Management |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology |

|

Environmental, Health, Safety and Sustainability |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

PROPOSAL 1: ELECTION OF DIRECTORS

Chairman Independent Age: 68 Director Since: 2015 Board Committees: Audit Compensation ESG & Safety |

|

GREG G. MAXWELL |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

Mr. Maxwell became a director in 2015. Mr. Maxwell served as executive vice president, finance, and chief financial officer for Phillips 66, a diversified energy manufacturing and logistics company until his retirement on December 31, 2015. Mr. Maxwell has over 37 years of experience in various financial roles within the petrochemical and oil and gas industries. Mr. Maxwell served as senior vice president, chief financial officer and controller for Chevron Phillips Chemical Company from 2003 until joining Phillips 66 in 2012. He joined Phillips Petroleum Company in 1978 and held various positions within the comptroller’s group, including the corporate planning and development group, the corporate treasury department and downstream business units. He is a certified public accountant and a certified internal auditor. He earned a Bachelor of Accountancy degree from New Mexico State University in 1978. Current Public Company Directorships None Public Company Directorships Within the Past Five Years Jeld – Wen Holding, Inc. Skills and Experience |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

CEO/Senior Officer |

|

Industry |

|

|

Financial Reporting |

|

|

Banking/ Finance |

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

Technology |

|

Risk Management |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Age: 72 Director Since: 2021 Board Committees: Governance and Nominating (Chair) Compensation ESG & Safety |

|

REGINAL W. SPILLER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Spiller became a director in 2021. Mr. Spiller began his energy career as a geologist with Exxon USA and is now President and Chief Executive Officer of Azimuth Energy Investments, LLC, providing energy advisory services to upstream companies. Mr. Spiller also had a distinguished public service career, having served as the Deputy Assistant Secretary of Oil and Gas at the U.S. Department of Energy, focusing on the development of advanced technologies for the natural gas and oil industry. He is still active with the DOE’s fossil energy technology and carbon capture projects and has served on several National Research Council/National Academy of Science boards. He is a member of the American Association of Petroleum Geologists, Society of Petroleum Engineers, Geologic Society of America, and the National Association of Black Geoscientists. He earned a Bachelor’s degree in Geology from the State University of New York and a M.S. in Geology from Pennsylvania State University. Current Public Company Directorships None Public Company Directorships Within the Past Five Years None Skills and Experience |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

CEO/Senior Officer |

|

Industry |

|

|

Engineering/ Geoscience |

|

|

Technology |

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

Risk Management |

|

Environmental, Health, Safety and Sustainability |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 PROXY STATEMENT |

14 |

PROPOSAL 1: ELECTION OF DIRECTORS

Age: 52 Director Since: 2023 Board Committees: None |

|

DENNIS L. DEGNER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Degner became a director in 2023 when he was appointed the Company’s Chief Executive Officer and President. Mr. Degner joined Range in 2010 as vice president of the Appalachia business unit and served in this role until 2018. Mr. Degner was named senior vice president of operations in 2018 and Chief Operating Officer in May 2019. Mr. Degner has more than 25 years of oil and gas experience, having worked in a variety of technical and managerial positions across the United States, including Texas, Louisiana, Wyoming, Colorado and Pennsylvania. Prior to joining Range, Mr. Degner held positions with EnCana, Sierra Engineering and Halliburton. Mr. Degner is a member of the Society of Petroleum Engineers. Mr. Degner holds a Bachelor of Science Degree in Agricultural Engineering from Texas A&M University. Current Public Company Directorships None Public Company Directorships Within the Past Five Years None Skills and Experience |

|||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEO/Senior Officer |

|

Industry |

|

|

Engineering/ Geoscience |

|

|

Technology |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management |

|

Environmental, Health, Safety and Sustainability |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Consideration of Stockholder Nominees for Director

The policy of our Governance and Nominating Committee is to consider stockholder nominations for director candidates as described below under “Identifying and Evaluating Board Nominees for Directors, including Diversity Considerations.” In evaluating such nominations and in evaluating the composition of the Board, our Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on our Board and to address the membership criteria set forth above under “Director Qualifications.” Any stockholder nominations proposed for consideration by our Governance and Nominating Committee should include the nominee’s name and qualifications for Board membership, meet the requirements set forth in our by-laws and should be addressed to: Corporate Secretary, Range Resources Corporation, 100 Throckmorton Street, Suite 1200, Fort Worth, Texas 76102.

Identifying and Evaluating Board Nominees for Directors

Our Governance and Nominating Committee uses a variety of avenues to identify and evaluate director nominees. The Committee regularly assesses the appropriate size of our Board and whether any vacancies are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, our Governance and Nominating Committee considers various potential candidates for the Board. Candidates may come to the attention of the Committee through current Board members, stockholders or other persons. Candidates may be evaluated at regular or special meetings of the Committee and may be considered at any point during the year.

The Board ensures refreshment and continued effectiveness through evaluation, nomination and other policies, processes and practices. For example:

15 |

|

PROPOSAL 1: ELECTION OF DIRECTORS

The Governance and Nominating Committee also considers any stockholder nominations for candidates for our Board. Following verification of the stockholder status of persons proposing candidates, recommendations are provided to and considered by our Governance and Nominating Committee at a regularly scheduled meeting, which is generally the first or second meeting before the issuance of the proxy statement for our annual meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to our Governance and Nominating Committee. Our Governance and Nominating Committee also reviews materials provided by other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, our Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on our Board and evaluates the experience, skills, abilities and qualifications of each candidate and considers the diversity of the current members of the Board. Our Governance and Nominating Committee has in the past used a paid third-party to identify potential directors and if it does engage such third party, it is committed to having any such third party seek candidates, regardless of gender, ethnicity or national origin, as part of the Board’s commitment to consideration of diversity as described in the Company’s Corporate Governance Guidelines and the Committee’s charter. The Governance and Nominating Committee annually assesses the effectiveness of the Company’s diversity policy in connection with the selection of individual candidates for election or re-election to the Board. As the Board evolves, gender, racial and ethnic diversity will be an important factor considered in assessing the overall mix of skills, experience, background and characteristics. We recognize the importance of diversity and welcome continued dialogue with our investors on this topic.

Proxy Access

The Company’s by-laws allow a stockholder or group of stockholders that meet certain criteria and requirements to nominate candidates for election to the Board and have such persons included in the Company’s proxy statement. The basic requirements to be met in order to submit a candidate for election to the Board utilizing proxy access are that a stockholder or group of stockholders comprised of no more than 20 unaffiliated stockholders must have owned at least 3% of the outstanding common stock of the Company for at least 3 years in order to submit a nominee. The maximum number of nominees is 20% of the Board or 2, whichever is greater. If you wish to utilize the Company’s proxy access process, you must submit the information required under the by-laws to the Company not less than one hundred twenty (120) days nor more than one hundred fifty (150) days prior to the first anniversary of the date that the Company first distributed its proxy statement to stockholders for the previous year’s Annual Meeting (i.e. April 4, 2025). Copies of the Company’s by-laws are available on the Company’s website at www.rangeresources.com or upon request addressed to the Company’s Corporate Secretary. Any questions regarding the Company’s proxy access procedures may be directed to the Company’s Corporate Secretary.

2025 PROXY STATEMENT |

16 |

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

|

We are committed to having sound and strong corporate governance principles. We believe having such principles and using them in the daily conduct of our business is essential to running our business efficiently and to maintaining our integrity in the marketplace and among the Company’s various constituents, including the public and you, our stockholders. The Board continually reviews evolving best practices in governance and seeks input from Range’s stockholders through our ongoing stockholder engagement program. Our website contains a number of documents, available free of charge, that are helpful to your understanding of our corporate governance practices, including:

Summary of Key Governance Highlights |

|

|

|

|

|

Board Leadership Structure

Board Overview |

|

|

• Independent Chairman of the Board; • Active engagement by all directors; • 6 of our 7 director nominees are independent; and

|

|

• All members of the Audit Committee, the Compensation Committee, the ESG & Safety Committee and the Governance and Nominating Committee are Independent. |

17 |

|

CORPORATE GOVERNANCE

Chairman and CEO Roles

At different times in the Company’s history, the positions of chairman and chief executive officer have been split or combined as circumstances have warranted. The Board recognizes that no single leadership structure is right for all companies at all times. Accordingly, annually the Board may elect as Chairman any member of the Board, including the CEO. Currently, the Chairman is independent. The Chairman of the Board presides at the Board meetings and meetings of stockholders and his responsibilities include, among other things:

Board of Directors

Attendance

The Board met four times in 2024. Each director attended 98% of the meetings held by the Board and the committees on which he or she served during the year. Directors are expected to attend all meetings of stockholders, the Board and the committees which they serve. All of our directors, other than Mr. Kendall who was not yet a director for us, attended the 2024 Annual Meeting of Stockholders.

Executive Sessions of Non-Employee Directors

Non-employee directors ordinarily meet in executive session without management present at each regularly scheduled Board meeting and may meet at other times at the discretion of the Chairman or at the request of any non-employee director.

Review and Approval of Related Person Transactions

Our Governance and Nominating Committee charter includes a provision regarding the review and approval of related person transactions. Our Governance and Nominating Committee is charged with reviewing transactions which would require disclosure under our filings under the Exchange Act and related rules as a related person transaction and making a recommendation to our Board regarding the initial authorization or ratification of any such transaction. If our Board considers ratification of a related person transaction and determines not to ratify the transaction, management is required to make all reasonable efforts to cancel or annul such transaction.

2025 PROXY STATEMENT |

18 |

CORPORATE GOVERNANCE

In determining whether or not to recommend the approval or ratification of a related person transaction, our Governance and Nominating Committee will consider the relevant facts and circumstances, including, if applicable:

Employment of Family Members

Mark Windle serves as the Company’s Director – Corporate Communications. Mr. Windle is the brother of Erin McDowell, the Company’s General Counsel. Mr. Windle was paid an aggregate salary and bonus of approximately $254,000 for his services in 2024. Like all full-time Company employees, Mr. Windle is eligible to receive an annual equity award along with health and welfare benefits on the same basis as other eligible employees. In 2024, Mr. Windle’s equity award was valued at approximately $179,000. Mr. Windle’s employment with us pre-dates Ms. McDowell’s tenure and he does not report, directly or indirectly, to Ms. McDowell.

Code of Business Conduct and Ethics

We have a written Code of Business Conduct and Ethics which is applicable to all of our directors and employees including our principal executive officer, our principal financial officer and our principal accounting officer. We intend to post amendments to and waivers, if any, from our code of ethics (to the extent applicable to our principal executive and financial officers and directors) on our website at www.rangeresources.com under the section titled “Corporate Governance.” The latest change to our Code of Business Conduct and Ethics was posted February 20, 2013. The Code of Business Conduct and Ethics was reviewed by our Board and our Governance and Nominating Committee in early 2025.

Risk Oversight by the Board

The Board’s role in risk oversight recognizes the multifaceted nature of risk management. It is a control and compliance function, but it also involves strategic considerations in normal business decisions, finance, security, cybersecurity, safety, health and environmental concerns.

The Board has empowered its Committees with risk oversight responsibilities. Each of the Committees meets regularly with management to review, as appropriate, compliance with existing policies and procedures and to discuss change or improvement that may be required or desirable. In addition, the Board receives regular and detailed reports from management covering cybersecurity and other risks involving technology.

19 |

|

CORPORATE GOVERNANCE

Board of Directors – Oversees Major Risks and Strategy |

|||||||||

· Commodity prices and hedging · Financial strength and flexibility · Cybersecurity and technology · Reserves and resources development |

· Health, safety, environment and regulatory matters · Talent development, retention and compensation · Executive succession planning · Asset integrity |

||||||||

|

|

|

|

|

|

|

|||

Audit |

|

Compensation |

|

ESG and Safety |

|

Governance and |

|||

Primary Risk Oversight: · Financial statements and reporting · Enterprise risk management program |

|

Primary Risk Oversight: · Compensation policies/practices · Incentive related risks |

|

Primary Risk Oversight: · Sustainability, EHS and climate matters · Workplace health and safety |

|

Primary Risk Oversight: · Governance structure and policies · Director qualifications and skills |

|||

|

|

|

|

|

|

|

|||

Management |

|||||||||

· Meets regularly · Discusses developments to identified risks |

· Identifies emerging risks · Develops mitigation measures |

· Updates the Board and committees on risk assessments |

|||||||

The Audit Committee plays a central role in the Board’s oversight of internal risks by evaluating the Company’s financial reporting, supervising the internal audit function, interfacing with the independent auditor, regularly communicating with the Chief Financial Officer and other members of management, monitoring the Company’s compliance programs, including the Company’s third party anonymous hotline for the notification of compliance concerns, supervising the investigation of any alleged financial fraud, and monitoring the Company’s internal risk forums and the Company’s enterprise risk management program (the responsibility for which the Audit Committee shares with the Board).

The Compensation Committee considers the possible risk implications of the Company’s various compensation programs and plans and monitors the elements of such compensation programs so that risk in the behavior of the employees of the Company, including our NEOs, is considered in such policies and programs and does not incentivize excess risk taking.

The ESG and Safety Committee monitors risks and opportunities related to ESG, climate and sustainability matters including identifying, assessing, monitoring and managing the principal risks associated with health, safety and the environment.

The Governance and Nominating Committee is responsible for the oversight of the Company’s governance processes and monitors those processes, including the Company’s Code of Business Conduct and Business Ethics compliance function, Board Committee Charters and Board annual evaluations, to evaluate their effectiveness in avoiding the creation of risk to the Company and providing for proper and effective governance of the Company.

Cybersecurity is an integral part of risk management. The Board appreciates the rapidly evolving nature of threats presented by cybersecurity incidents and is committed to the prevention, timely detection and mitigation of the effects of any such incidents. Our Board receives a quarterly cybersecurity report from our information technology department and an update from management which includes additional discussions of any relevant issues related to the understanding of technology and cybersecurity risk that may be relevant at any given time. This report includes, among other things, information regarding our current security posture and on-going cybersecurity events. Cybersecurity incidents meeting a pre-determined minimum threshold are communicated to our Board. Range has not experienced a material cybersecurity breach within the past three years.

2025 PROXY STATEMENT |

20 |

CORPORATE GOVERNANCE

While the Board and its committees oversee risk management, Range management is responsible for managing risk. We have a robust enterprise risk management process for identifying, assessing and managing risk and monitoring risk mitigation strategies which is reviewed quarterly by the Audit Committee. The Company has a standing risk management committee comprised of officers and senior managers from across the business to assess each enterprise level risk and identify emerging risks. The results are reported annually to the Board.

21 |

|

CORPORATE GOVERNANCE

Board Committees

Our Audit Committee, Compensation Committee, ESG & Safety Committee and Governance and Nominating Committee are each composed of independent directors. The primary responsibilities of the committees are described below. From time to time, the Board delegates additional duties to the standing committees.

Members: Brenda A. Cline (Chair) Margaret K. Dorman Greg G. Maxwell

|

|

Audit Committee |

Meetings in 2024: 6* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Responsibilities • prepares the Audit Committee report for inclusion in the annual proxy statement; • annually reviews our Audit Committee charter and our Audit Committee’s performance; • appoints, evaluates and approves the compensation of our independent registered public accounting firm; • reviews and approves the scope of the annual audit; • reviews testing of our disclosure controls and procedures; • supervises our internal audit functions; • reviews our corporate policies with respect to financial information and earnings guidance; • oversees any investigations into complaints concerning financial matters; and • reviews any risks that may have a significant impact on our financial statements. The Audit Committee members are independent within the meaning of the listing standards of the NYSE, SEC regulations and our Corporate Governance Guidelines and are financially literate. The Board has determined that Ms. Cline is the “audit committee financial expert” within the meaning of the SEC’s regulations. In addition, the other members of the committee, Ms. Dorman and Mr. Maxwell also qualify as a “financial expert” under the applicable standards. *The Committee met with the Company’s internal audit team and independent auditor at all six meetings, with and without management present. |

|||

2025 PROXY STATEMENT |

22 |

CORPORATE GOVERNANCE

Members: Margaret K. Dorman (Chair) James M. Funk* Steve D. Gray** Greg G. Maxwell Reginal W. Spiller

|

|

Compensation Committee |

Meetings in 2024: 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Responsibilities • discharges our Board of Directors’ responsibilities for compensation of our executives and directors; • produces an annual report on executive compensation for inclusion in our proxy statement; • provides oversight of our compensation structure, including our equity compensation plans and benefits programs; • reviews and provides guidance on our human resources programs; • retains and approves the terms of the retention of any compensation consultants and other compensation experts; • evaluates human resources and compensation strategies and oversees our total incentive compensation program, including considering the risks associated with such programs; • reviews and approves objectives relevant to executive officer compensation and evaluates performance; • determines the compensation of executive officers in accordance with those objectives; • approves and amends our incentive compensation and equity award or share-based payment program (subject to stockholder approval, if required); • oversees our clawback policy; • recommends director compensation to our Board of Directors; • monitors director and executive stock ownership; and • annually evaluates our Compensation Committee's performance and our Compensation committee charter. All of the members of our Compensation Committee are independent within the meaning of the listing standards of the NYSE, SEC regulations and our Corporate Governance Guidelines. The report of our Compensation Committee is included in this Proxy Statement. The Compensation Committee’s Charter was prepared by the Compensation Committee and approved by the Governance and Nominating Committee and the Board of Directors. * Through current Board term. |

|||

23 |

|

CORPORATE GOVERNANCE

Members: James M. Funk (Chair)* Brenda A. Cline Margaret K. Dorman Steve D. Gray** Christian S. Kendall Charles G. Griffie Greg G. Maxwell Reginal W. Spiller

|

|

ESG & Safety Committee |

Meetings in 2024: 4 |

|

|

|

|

||

|

|

|

||

|

|

|

||

Primary Responsibilities • assists in the Board’s oversight of sustainability and ESG practices, so that sustainability and ESG risks and opportunities are taken into account when making strategic decisions; • develops recommendations to the Board for the formulation and adoption of policies, programs and practices to address sustainability and ESG risks and opportunities; • reviews and monitors our compliance with policies, programs and practices concerning safety, sustainability, ESG and climate change-related issues; • identifies, evaluates and monitors sustainability, ESG and climate-related risks which affect or could affect our business activities, performance and reputation; and • reviews sustainability, ESG and climate change-related legislative and regulatory issues affecting our business and operations. All of the members of our ESG & Safety Committee are independent within the meaning of the listing standards of the NYSE, SEC regulations and our Corporate Governance Guidelines. The ESG & Safety Committee’s charter was prepared by the ESG & Safety Committee and approved by the Board of Directors. To supplement our expertise, we may bring in outside subject matter experts to advise members on current and developing issues relevant to our business. * Through current Board term. |

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

2025 PROXY STATEMENT |

24 |

CORPORATE GOVERNANCE

Members: Reginal W. Spiller (Chair) Brenda A. Cline Christian S. Kendall Charles G. Griffie James M. Funk* |

|

Governance and Nominating Committee |

Meetings in 2024: 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Responsibilities • identifies individuals qualified to become directors (including receiving and considering stockholder suggested nominees) consistent with criteria approved by our Board of Directors; • oversees the organization of our Board of Directors to discharge our Board of Directors’ duties and responsibilities properly and efficiently; • reviews, when necessary, any potential related person transaction of our Company; • identifies best practices and recommends corporate governance principles to our Board, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance; • annually assesses the size and composition of our Board of Directors including the diversity of the Board; • develops membership qualifications for our Board committees; • determines director independence; • monitors compliance with our Board of Directors and our Board committee membership criteria; • annually reviews and recommends directors for election to the Board; • reviews governance-related stockholder proposals and recommends our Board of Directors’ response; and • oversees the annual self-evaluation of our Board. All of the members of the Governance and Nominating Committee are independent within the meaning of the listing standard of the NYSE, SEC regulations and our Corporate Governance Guidelines. * Through current board term. |

|||

25 |

|

CORPORATE GOVERNANCE

Director Compensation

Director compensation is set by the Compensation Committee after working with our independent compensation consultant and a review of a peer group of companies. The Compensation Committee generally approves compensation for directors just prior to the Board’s meeting following the election of directors at the Annual Meeting. Compensation arrangements for directors are effective with each election to the Board at the Annual Meeting. The Compensation Committee has also approved the payment of annual stock awards to the directors for a portion of their overall director compensation. Directors who are company employees do not receive any separate compensation for service on the Board or committees of the Board.

CASH COMPENSATION

The following are the annual cash retainers and fees we paid to our non-employee directors for the 2024-2025 term:

Type of Fee |

|

|

Amount |

|

|

|

|

|

|

|

|

Annual Board Cash Retainer Fee |

|

|

$ |

80,000 |

|

Additional Retainer for Chairman |

|

|

$ |

75,000 |

|

Additional fee for Audit Committee Chair |

|

|

$ |

25,000 |

|

Additional fee for Compensation Committee Chair |

|

|

$ |

15,000 |

|

Additional fee for Governance and Nominating Chair |

|

|

$ |

15,000 |

|

Additional fee for ESG & Safety Committee Chair |

|

|

$ |

15,000 |

|

Directors do not receive meeting fees for attendance at Board or Committee meetings.

EQUITY-BASED COMPENSATION AND STOCK OWNERSHIP REQUIREMENTS

Director stock ownership requirement of 5x annual cash retainer

|

For 2024, non-employee directors received an Annual Restricted Stock Award valued at $200,000. In addition, the Chairman received an additional restricted stock award valued at $75,000. Non-employee directors may defer all or a portion of their cash fees and their stock awards in our Active Deferred Compensation Plan. The Annual Stock Awards are fully vested one year from the date of grant, subject to proration. Directors are expected to own Range stock valued at a minimum of 5 times the annual cash retainer for non-employee directors. If a director has not achieved the required level of share ownership, the director is required to retain an amount equal to 50% of the shares vesting as a result of any equity awards granted to the director by the Company until he or she is in compliance with the stock ownership policy. A director must continue to retain shares in the amount required for as long as the director serves on the Board. As of the date of this Proxy Statement, all of our current directors, except Mr. Griffie and Mr. Kendall, are in compliance with the stock ownership guidelines. Messrs. Griffie and Kendall are currently required to retain a minimum of 50% of each award. The requirement to retain 50% was established to allow limited sales as necessary to satisfy tax withholding obligations. |

2025 PROXY STATEMENT |

26 |

CORPORATE GOVERNANCE

2024 DIRECTOR COMPENSATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name |

|

|

Fees Earned or Paid |

|

|

|

Stock |

|

|

|

Total |

|

|||

(a) |

|

|

(b) |

|

|

|

(c) |

|

|

|

(h) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Brenda A. Cline |

|

|

$ |

105,000 |

|

|

|

$ |

200,000 |

|

|

|

$ |

305,000 |

|

Margaret K. Dorman |

|

|

$ |

95,000 |

|

|

|

$ |

200,000 |

|

|

|

$ |

295,000 |

|

James M. Funk |

|

|

$ |

95,000 |

|

|

|

$ |

200,000 |

|

|

|

$ |

295,000 |

|

Steve D. Gray |

|

|

$ |

65,275 |

|

|

|

$ |

200,000 |

|

|

|

$ |

265,275 |

|

Charles G. Griffie |

|

|

$ |

80,000 |

|

|

|

$ |

200,000 |

|

|

|

$ |

280,000 |

|

Greg G. Maxwell |

|

|

$ |

155,000 |

|

|

|

$ |

275,000 |

|

|

|

$ |

430,000 |

|

Reginal W. Spiller |

|

|

$ |

89,725 |

|

|

|

$ |

200,000 |

|

|

|

$ |

289,725 |

|

Columns (d), (e), (f) and (g) covering stock appreciation rights (“SARs”), Non-Equity Incentive Plan Compensation, Changes in Pension Values and all other Compensation, respectively, have been deleted from the SEC-prescribed table format because the directors do not receive any such compensation.

The Governance and Nominating Committee and Compensation Committee continue to monitor the activities and time responsibilities of each director to determine if a change in circumstances would warrant a change in the director fee structure. The directors are reimbursed for their travel and out-of-pocket expenses in connection with their duties as a director. In addition, the directors are allowed to participate in our Deferred Compensation Plan, but their deferrals do not qualify for our Company match. We do not provide to directors any of the following: any legacy awards or charitable awards programs for directors upon retirement, tax reimbursement arrangements, payments in connection with a Change in Control, securities or products purchased at a discount or life insurance arrangements. However, any unvested restricted stock will become vested in connection with a Change in Control.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of our Board at fiscal year ended December 31, 2024, consisted of Ms. Dorman and Messrs. Funk, Maxwell and Spiller. None of the members of the Compensation Committee were at any time during 2024 an officer or employee of the Company. None of our executive officers serve as a member of a board of directors or a compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

27 |

|

CORPORATE GOVERNANCE

Stock Ownership-Directors, Management and Certain Beneficial Owners

The following table shows, as of March 17, 2025, the number of shares of common stock “beneficially owned,” as determined in accordance with Rule 13d-3 under the Exchange Act, by the directors, the NEOs, and all senior executive officers and directors, as a group:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Total Common Shares Beneficially Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

Shares |

|

|

|

Shares in |

|

|

|

Shares |

|

|

|

Percent |

|

|

|

Share in |

|

|

|

Total |

|

|

|

Percent of |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|