.2 Announcing Schwab’s Acquisition of Forge Global Further Democratizing Public & Private Markets for Investors November 6, 2025

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, specifically relating to timing, completion and funding of the acquisition; investor interest in private markets; plans for expansion of private market capabilities and access; competitive positioning and organic growth; and acquisition synergies, financial impact and revenue diversification. These forward-looking statements reflect management’s beliefs, expectations and objectives as of today and are subject to risks and uncertainties that could cause actual results to differ materially. Important factors that could cause results to differ include management’s ability to close the transaction on the anticipated terms and timing; required regulatory approvals and approval by Forge’s stockholders; disruptions to Forge’s business as a result of the announcement and pendency of the acquisition; and the ability and timeframe to integrate the business and realize the anticipated benefits. Additional risks and uncertainties that could affect future results are discussed in the company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which have been filed with the Securities and Exchange Commission and are available on the company’s website (https://www.aboutschwab.com/financial-reports) and on the Securities and Exchange Commission’s website (www.sec.gov). The information in this presentation speaks only as of November 6, 2025 (or such earlier date as may be specified herein). The company makes no commitment to update any forward-looking statements. Charles Schwab Corporation 2

Schwab Management Attendees Rick Wurster Mike Verdeschi President and CEO Managing Director, CFO Charles Schwab Corporation 3

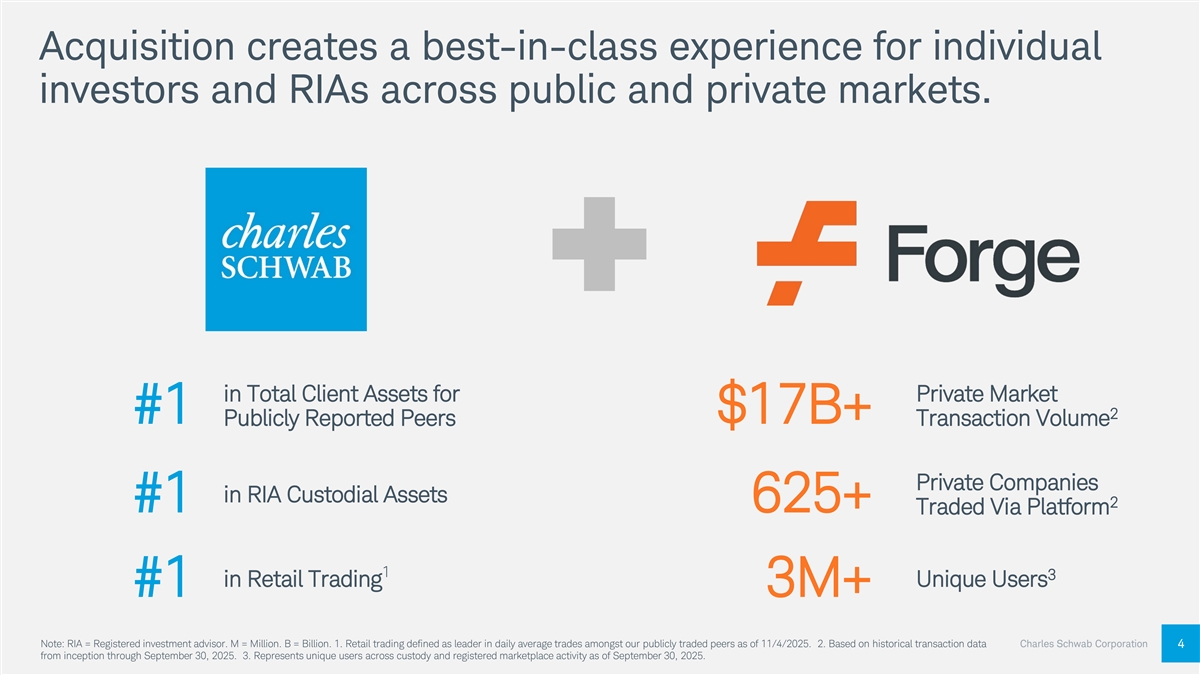

Acquisition creates a best-in-class experience for individual investors and RIAs across public and private markets. in Total Client Assets for Private Market 2 #1 $17B+ Publicly Reported Peers Transaction Volume Private Companies in RIA Custodial Assets 2 #1 625+ Traded Via Platform 1 3 in Retail Trading Unique Users #1 3M+ Note: RIA = Registered investment advisor. M = Million. B = Billion. 1. Retail trading defined as leader in daily average trades amongst our publicly traded peers as of 11/4/2025. 2. Based on historical transaction data Charles Schwab Corporation 4 from inception through September 30, 2025. 3. Represents unique users across custody and registered marketplace activity as of September 30, 2025.

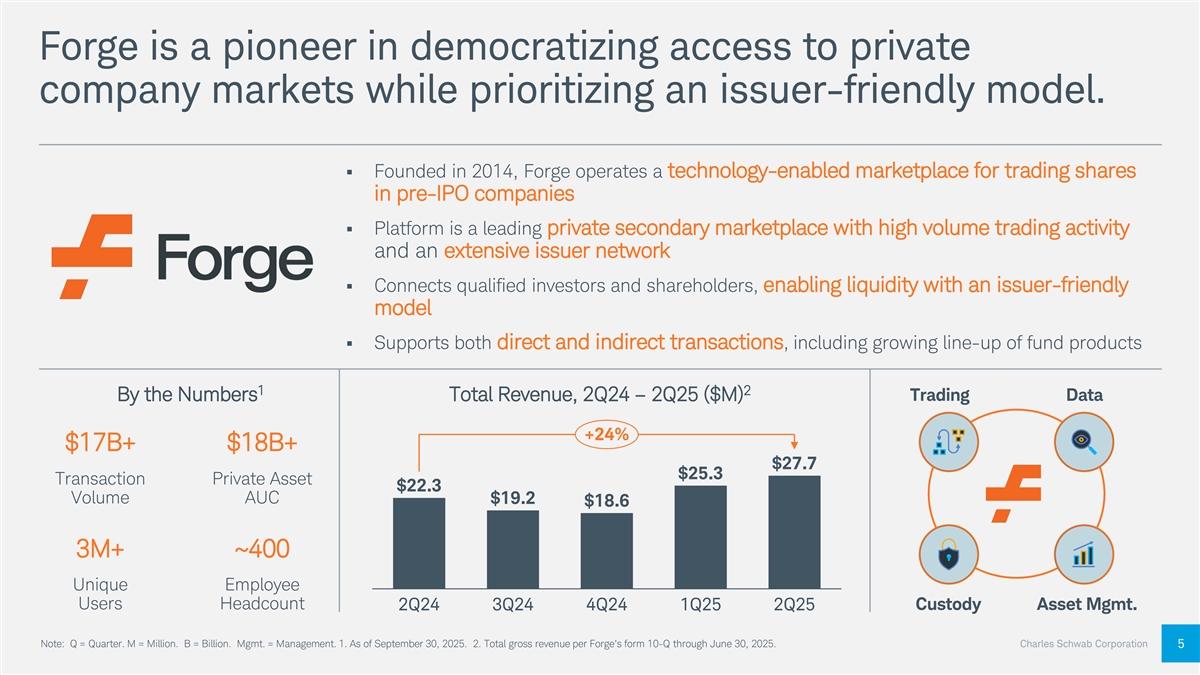

Forge is a pioneer in democratizing access to private company markets while prioritizing an issuer-friendly model. § Founded in 2014, Forge operates a technology-enabled marketplace for trading shares in pre-IPO companies § Platform is a leading private secondary marketplace with high volume trading activity and an extensive issuer network § Connects qualified investors and shareholders, enabling liquidity with an issuer-friendly model § Supports both direct and indirect transactions, including growing line-up of fund products 1 2 By the Numbers Total Revenue, 2Q24 – 2Q25 ($M) Trading Data +24% $17B+ $18B+ $27.7 $25.3 Transaction Private Asset $22.3 Volume AUC $19.2 $18.6 3M+ ~400 Unique Employee Users Headcount 2Q24 3Q24 4Q24 1Q25 2Q25 Custody Asset Mgmt. Note: Q = Quarter. M = Million. B = Billion. Mgmt. = Management. 1. As of September 30, 2025. 2. Total gross revenue per Forge’s form 10-Q through June 30, 2025. Charles Schwab Corporation 5

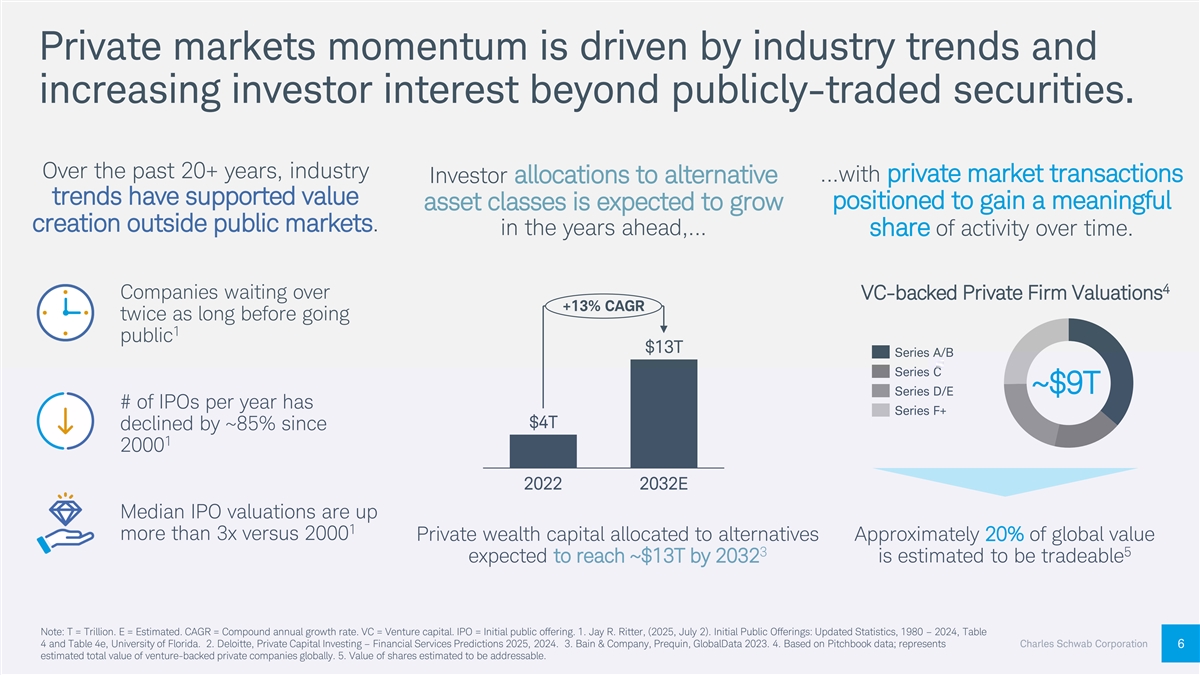

Private markets momentum is driven by industry trends and increasing investor interest beyond publicly-traded securities. Over the past 20+ years, industry …with private market transactions Investor allocations to alternative trends have supported value positioned to gain a meaningful asset classes is expected to grow creation outside public markets. in the years ahead,… share of activity over time. 4 Companies waiting over VC-backed Private Firm Valuations +13% CAGR twice as long before going 1 public $13T Series A/B Series C ~$9T Series D/E # of IPOs per year has Series F+ $4T declined by ~85% since 1 2000 2022 2032E Median IPO valuations are up 1 more than 3x versus 2000 Private wealth capital allocated to alternatives Approximately 20% of global value 3 5 expected to reach ~$13T by 2032 is estimated to be tradeable Note: T = Trillion. E = Estimated. CAGR = Compound annual growth rate. VC = Venture capital. IPO = Initial public offering. 1. Jay R. Ritter, (2025, July 2). Initial Public Offerings: Updated Statistics, 1980 – 2024, Table 4 and Table 4e, University of Florida. 2. Deloitte, Private Capital Investing – Financial Services Predictions 2025, 2024. 3. Bain & Company, Prequin, GlobalData 2023. 4. Based on Pitchbook data; represents Charles Schwab Corporation 6 estimated total value of venture-backed private companies globally. 5. Value of shares estimated to be addressable.

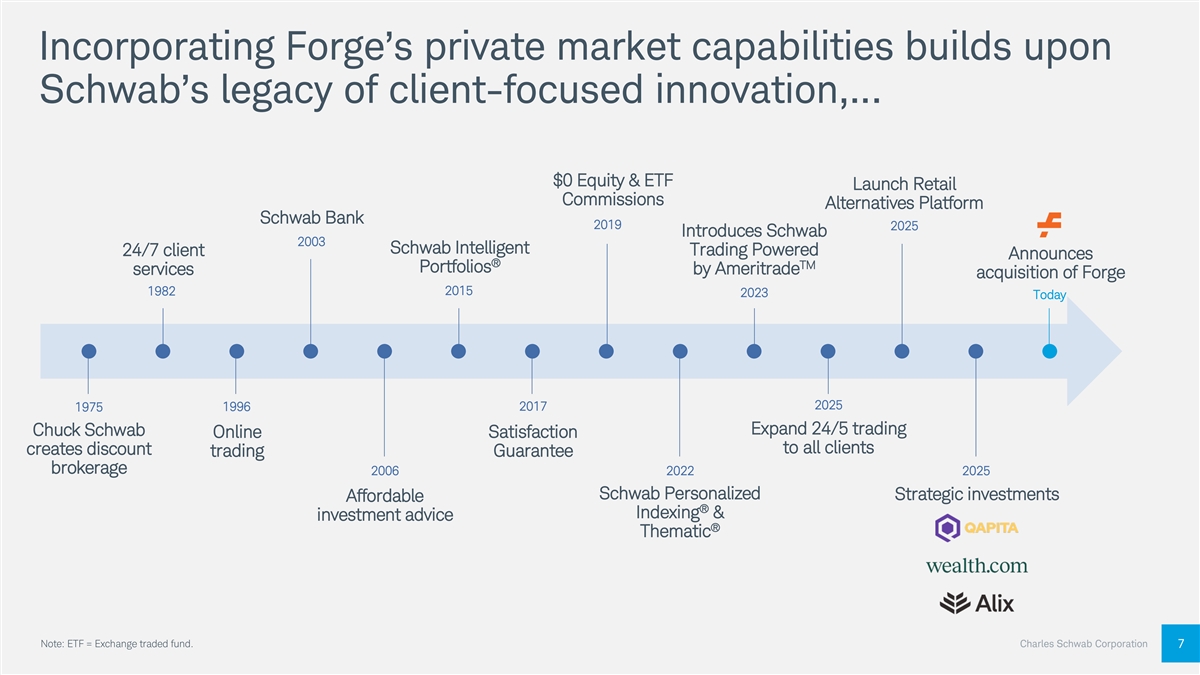

Incorporating Forge’s private market capabilities builds upon Schwab’s legacy of client-focused innovation,… $0 Equity & ETF Launch Retail Commissions Alternatives Platform Schwab Bank 2019 2025 Introduces Schwab 2003 Schwab Intelligent Trading Powered 24/7 client Announces ® TM Portfolios services by Ameritrade acquisition of Forge 1982 2015 2023 Today 2025 1975 1996 2017 Expand 24/5 trading Chuck Schwab Online Satisfaction to all clients creates discount trading Guarantee brokerage 2006 2022 2025 Schwab Personalized Strategic investments Affordable ® Indexing & investment advice ® Thematic Note: ETF = Exchange traded fund. Charles Schwab Corporation 7

…while further enhancing our ability to meet the evolving needs of investors across our growing client base. Private Asset Custody Data + Private Company Education + Marketplace Management Services Technology Solutions Awareness 1, 2 1 3 Retail Advisor Services Workplace Client Profile Mix (%) Client Profile Mix (%) Schwab Private Issuer Equity Services $5.4T $5.0T HHs HHs Assets Assets Client Client Differentiated end-to-end workplace Assets Assets $1M+ < $1M $1M+ < $1M solution that widens growth funnel Offering private market capabilities will support organic growth and help diversify revenue through-the-cycle. Note: M = Million. T = Trillion. HHs = Households. 1. All data as of September 30, 2025. 2. Largest component of Investor Services segment which had total assets of $6.6T of assets as of September 30, 2025. Charles Schwab Corporation 8 3. Announced Schwab Private Issuer Equity Services in October 2025; solution to be powered by Qapita.

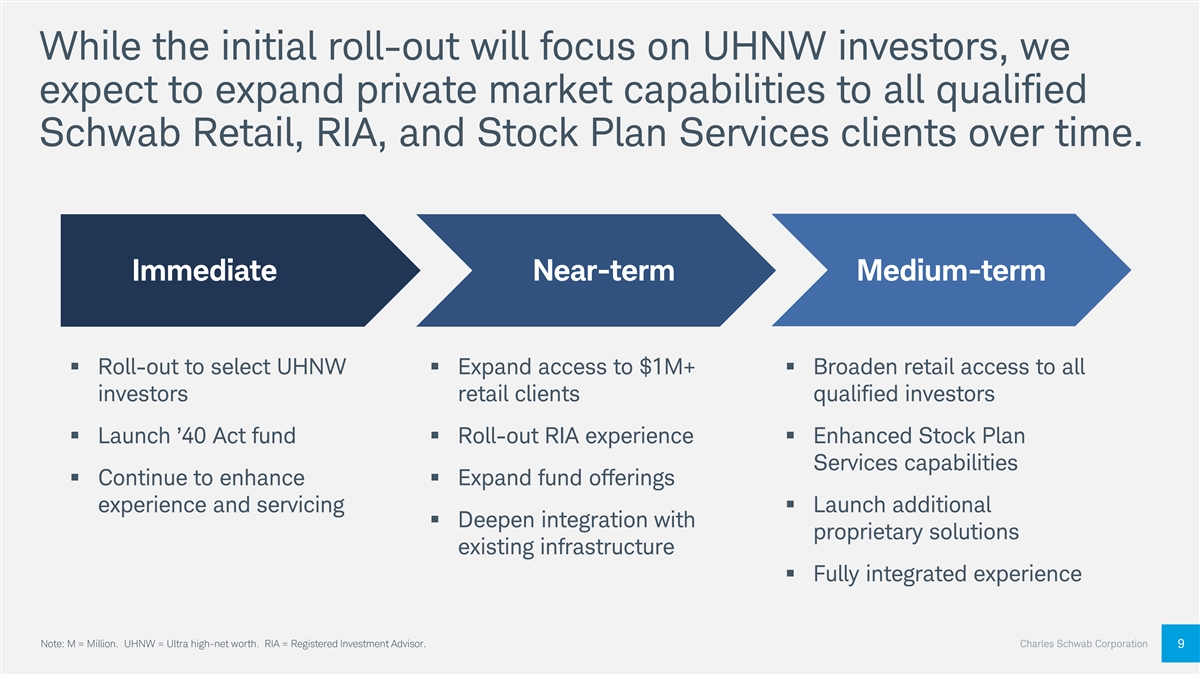

While the initial roll-out will focus on UHNW investors, we expect to expand private market capabilities to all qualified Schwab Retail, RIA, and Stock Plan Services clients over time. Immediate Near-term Medium-term § Roll-out to select UHNW § Expand access to $1M+ § Broaden retail access to all investors retail clients qualified investors § Launch ’40 Act fund§ Roll-out RIA experience§ Enhanced Stock Plan Services capabilities § Continue to enhance § Expand fund offerings experience and servicing§ Launch additional § Deepen integration with proprietary solutions existing infrastructure § Fully integrated experience Note: M = Million. UHNW = Ultra high-net worth. RIA = Registered Investment Advisor. Charles Schwab Corporation 9

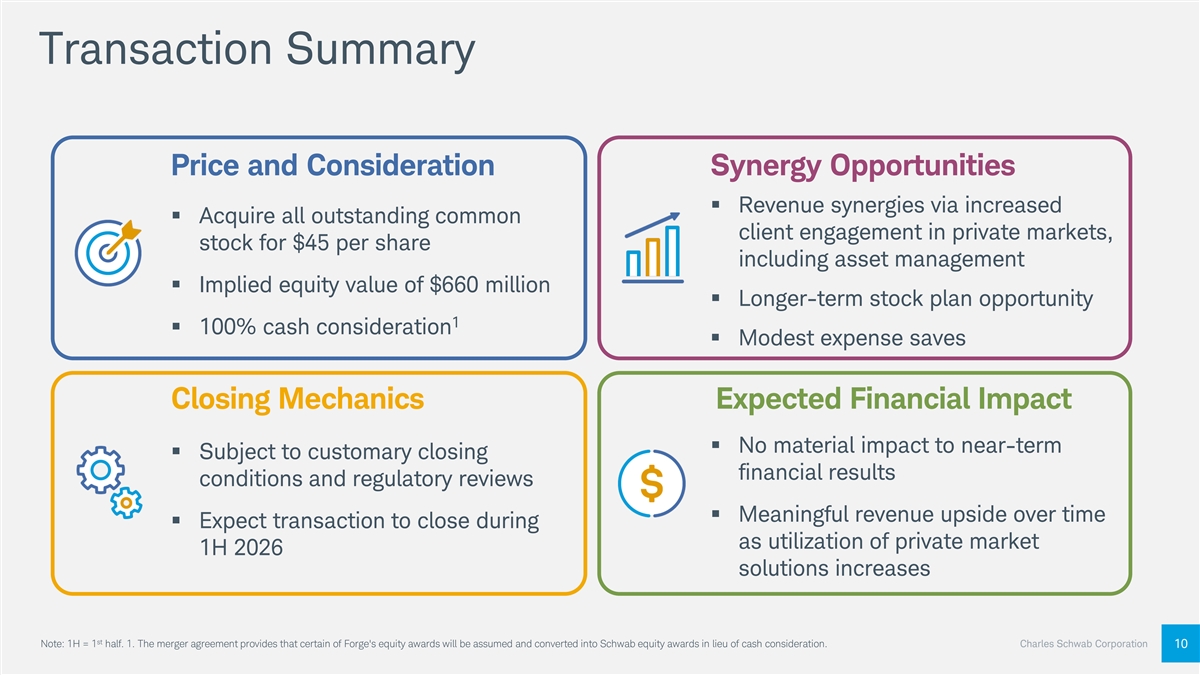

Transaction Summary Price and Consideration Synergy Opportunities § Revenue synergies via increased § Acquire all outstanding common client engagement in private markets, stock for $45 per share including asset management § Implied equity value of $660 million § Longer-term stock plan opportunity 1 § 100% cash consideration § Modest expense saves Closing Mechanics Expected Financial Impact § No material impact to near-term § Subject to customary closing financial results conditions and regulatory reviews § Meaningful revenue upside over time § Expect transaction to close during as utilization of private market 1H 2026 solutions increases st Note: 1H = 1 half. 1. The merger agreement provides that certain of Forge's equity awards will be assumed and converted into Schwab equity awards in lieu of cash consideration. Charles Schwab Corporation 10

Acquisition creates a best-in-class experience for individual investors and RIAs across public and private markets. ü Enhances competitive positioning ü Supports long-term organic growth ü Evolves our offer to retail and RIA clients ü Strengthens our Workplace Services solution set ü Diversifies our revenue mix through-the-cycle Note: RIA = Registered investment advisor. Charles Schwab Corporation 11

ü Enhances competitive positioning Q&A ü Supports long-term organic growth ü Evolves our offer to retail and RIA clients ü Strengthens our Workplace Services solution set ü Diversifies our revenue mix through-the-cycle Note: RIA = Registered investment advisor. Charles Schwab Corporation 12

Announcing Schwab’s Acquisition of Forge Global Further Democratizing Public & Private Markets for Investors November 6, 2025