#100810477v16 Exhibit 2.1 BINDING TERM SHEET This Binding Term Sheet (the “Term Sheet”) constitutes a commitment by the parties hereto to negotiate in good faith and to enter into one or more definitive agreements as set forth herein. The terms and conditions of the potential transaction described below are not limited to those set forth hereinafter. Matters that are not covered by the provisions hereunder are subject to the approval and mutual agreement of the parties. KUVA LABS / LISATA THERAPEUTICS January 20, 2026 Kuva: Kuva Labs Inc., a Delaware corporation (“Kuva”) Lisata: Lisata Therapeutics, Inc., a Delaware corporation (“Lisata”) Transaction Structure & Steps: Kuva and Lisata will enter into a customary purchase agreement to consummate a negotiated acquisition of Lisata by Kuva (the “Purchase Agreement”). The Tender/ Consideration: Solely pursuant to the terms of the Purchase Agreement, Kuva will commence a tender offer to purchase, on a fully-diluted basis, all of the shares outstanding of common stock of Lisata (“Shares”) at a price of $4.00 per Share in cash (the “Offer”). The Merger: Following the completion of the Offer, Kuva will complete a short- form merger with Lisata under Section 251(h) of the DGCL (the “Merger”). As a result of the Merger, all Shares not tendered in the Offer, other than Rollover Shares, will be exchanged for $4.00 per share in cash. Rollover Shares Kuva may in its discretion, after consulting with Lisata, discuss and agree with certain stockholders of Lisata that Shares held by such Shareholders (“Rollover Shares”) will not be tendered in the Offer or exchanged in the Merger and instead will be contributed to Kuva in exchange for equity interests in Kuva. For so long as this Term Sheet has not been terminated, Lisata hereby waives any standstill, confidentiality or other restrictions currently in effect that would otherwise prohibit Kuva from entering into such discussions and agreements with Lisata stockholders solely for the purpose of and to the extent necessary for Kuva to engage in such discussions and enter into such agreements. Kuva acknowledges that the decision as to whether to enter into any

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 2 of 7 #100810477v16 rollover agreements is solely between Kuva and the applicable shareholders, and the entry into any such agreements is not a condition to Kuva’s obligations to enter into the Purchase Agreement or consummate the Offer. Standstill: Other than pursuant to the Purchase Agreement or as expressly contemplated hereby, for 12 months from the date hereof, Kuva shall not directly or indirectly (x) acquire beneficial ownership (or the substantial equivalent) of any securities of Lisata, (y) seek to or engage in a business combination, tender offer, change of control transaction, or proxy solicitation with respect to Lisata, or (z) initiate any stockholder proposal or convene a stockholders' meeting of or involving Lisata, without, in any such cases, the prior written consent of the Lisata Board of Directors. The foregoing paragraph shall be inoperative and of no force or effect if this Term Sheet is terminated, other than a termination by Lisata due to Kuva’s failure to enter into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet by February 27, 2026 (other than any such failure as a result of a Permitted Exception). This section supersedes and replaces Section 3 of the letter agreement, dated as of April 25, 2025, between Kuva and Lisata. Financing: The Offer and the Merger will not be conditioned on financing. Funding Commitments: Kuva has obtained funding commitments from third party investor(s) sufficient to cover all of its obligations under the Purchase Agreement, which commitments remain subject to completion of diligence and negotiation of definitive terms. Prior to execution of the Purchase Agreement, Kuva will provide bona fide funding commitments from third party investor(s) sufficient to cover all of its obligations under the Purchase Agreement. Conditions: Entry into the Purchase Agreement remains subject to negotiation of customary definitive agreements reasonably acceptable to each party on terms and conditions materially consistent with this Term Sheet. Under the Purchase Agreement, the Offer and the Merger will be subject to customary closing conditions for a transaction of this nature.

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 3 of 7 #100810477v16 Minimum Condition: Kuva will be required to close on the Offer so long as there shall be validly tendered a number of Shares that represents (and will represent immediately following the consummation of the Offer) at least a majority of the aggregate voting power of all Shares then outstanding. CVR: In addition to the consideration of $4.00 per share, each Share tendered in the Offer or exchanged in the Merger will also be entitled to receive two (2) non-tradeable contingent value rights (CVRs), payable as follows: • $1.00 per share within 12 months of the date on which rights to certepetide in the Greater China region revert to Lisata; and • $1.00 per share upon filing of an NDA or similar registration document for approval to commercialize certepetide in any indication in any jurisdiction. Fairness Opinion: Lisata has obtained or will obtain an opinion from its financial advisor that the consideration to be paid to the holders of Shares in the Offer and the Merger is fair to such holders. No-Shop (Exclusivity) Upon the parties’ execution of this Term Sheet, Lisata agrees that until the earlier of (x) thirty (30) days from the date hereof and (y) entry into the Purchase Agreement (which Purchase Agreement will contain a customary no-shop covenant subject to a fiduciary out as described below) (the “Exclusivity Period”), it will not solicit, initiate, engage in or encourage the submission of any discussions, negotiations, proposals, or offers, with respect to a tender offer, merger, business combination, sale of shares, sale of its assets or any other transaction that would prevent or impede the completion of the transaction contemplated herein (a “Competing Transaction”). The Exclusivity Period may be extended upon mutual written agreement of Lisata and Kuva. Notwithstanding the foregoing, if Lisata receives during the Exclusivity Period a bona fide, unsolicited written proposal for a Competing Transaction, and the Lisata Board of Directors determines in good faith after consultation with Lisata’s outside legal counsel and financial advisors that such proposal is superior to the Offer or would reasonably be expected to result in a proposal that is superior to the Offer, and, in each case, that the failure to take such action would be reasonably likely to violate the directors’ fiduciary duties under applicable law, then Lisata may furnish nonpublic information to the person making such proposal and its representatives and engage in

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 4 of 7 #100810477v16 discussions or negotiations with such person with respect to such proposal. Lisata shall shall promptly notify Kuva of the receipt of any proposal for a Competing Transaction, or any inquiry or request for nonpublic information relating to Lisata by any person who has made or would reasonably be expected to make a proposal for a Competing Transaction. Such notice shall indicate the identity of the person making the proposal, inquiry or request, and the material terms and conditions of any such proposal or offer or the nature of the information requested pursuant to such inquiry or request, including unredacted copies of all written requests, proposals, correspondence or offers relating to such proposal or, if such proposal is not in writing, a reasonably detailed written description of the material terms and conditions thereof. Lisata shall keep Kuva reasonably informed on a prompt and timely basis of the status and material terms (including any amendments or proposed amendments to such material terms) of any such proposal or potential proposal, including providing to Kuva copies of all proposals, offers and proposed agreements relating to proposal received by Lisata or, if such information or communication is not in writing, a reasonably detailed written description of the material contents thereof. Fiduciary Out: Lisata will have the right to terminate the Purchase Agreement for a bona fide superior proposal prior to the closing of the Offer, subject to payment of the Breakup Fee (as described below) to Kuva. Kuva will have the right to match any superior proposal received by Lisata from a third party before the board of directors of Lisata may exercise its fiduciary out. Breakup Fee: In consideration for the considerable time, effort and expense to be undertaken by the parties in connection with the transaction contemplated by this Term Sheet: • if Kuva fails to enter into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet by February 27, 2026, other than as a result of a Permitted Exception, and Lisata has confirmed in writing three business days prior to such time that entry into the Purchase Agreement has been approved by its board of directors and it is prepared to enter into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet and remains prepared to into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet at such time, then Kuva shall pay Lisata a breakup fee in the amount

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 5 of 7 #100810477v16 of $2,000,000 in cash (the “Breakup Fee”); and • if Lisata fails to enter into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet by February 27, 2026, other than as a result of a Permitted Exception, and Kuva has confirmed in writing three business days prior to such time that it is prepared to enter into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet and remains prepared to into the Purchase Agreement on terms and conditions materially consistent with this Term Sheet at such time, then Lisata shall pay Kuva the Breakup Fee; • if Lisata terminates this Term Sheet to enter into an agreement providing for a Competing Transaction, then Lisata shall pay Kuva the Breakup Fee “Permitted Exception” means (i) the party invoking the Permitted Exception determines in good faith that it is not willing to enter into the Purchase Agreement because the other party is insisting that the Purchase Agreement include terms (other than any terms that are expressly set forth in this Term Sheet) that are not commercially reasonable or (ii) in the event that Kuva invokes the Permitted Exception, (A) the information included in Lisata’s SEC filings or other diligence information provided by Lisata prior to the entry into this Term Sheet is materially inaccurate, (B) Lisata materially breaches its agreements under this Term Sheet or (C) there is a “Material Adverse Effect” on Lisata. “Material Adverse Effect” shall mean any effect that, considered together with all other effects, has or would reasonably be expected to have a material adverse effect on the business, condition (financial or otherwise), assets, liabilities or results of operations of Lisata; provided, however, that effects arising or resulting from the following shall not be taken into account in determining whether there has been a Material Adverse Effect: (a) general business, political or economic conditions generally affecting the industry in which Lisata operates, (b) acts of war, the outbreak or escalation of armed hostilities, acts of terrorism, earthquakes, wildfires, hurricanes or other natural disasters, health emergencies, including pandemics (including COVID-19 and any evolutions or mutations thereof) and related or associated epidemics, disease outbreaks or quarantine restrictions, (c) changes in financial, banking or securities markets, (d) any change in the stock price or trading volume of Lisata common stock (it being understood,

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 6 of 7 #100810477v16 however, that any effect causing or contributing to any change in stock price or trading volume of such common stock may be taken into account in determining whether a Material Adverse Effect has occurred, unless such effects are otherwise excepted from this definition), (e) the failure of Lisata to meet internal or analysts’ expectations or projections or the results of operations of Lisata, (f) any changes in or affecting clinical trial programs or studies conducted by or on behalf of Lisata or its subsidiaries, including any adverse data, event or outcome arising out of or related to any such programs or studies, (g) the termination of the Exclusive License and Collaboration Agreement with Qilu Pharmaceutical, (h) any change in, or any compliance with or action taken for the purpose of complying with, any law or GAAP (or interpretations of any law or GAAP), (i) the announcement of this Term Sheet or the pendency of the contemplated transactions, (j) any reduction in the amount of Lisata’s cash and cash equivalents as a result of expenditures made by Lisata which are not in violation of the interim operating covenant described below, or (k) resulting from the taking of any action required to be taken by this Term Sheet. In the event that the parties enter into the Purchase Agreement and (i) the Purchase Agreement is terminated (A) by Lisata for a bona fide superior proposal, (B) by Kuva due to a Lisata change of board recommendation or (C) by either party due to the failure of a condition to the Offer being satisfied and, at such time, either there has been a Lisata change of board recommendation, then Lisata shall pay to Kuva the Breakup Fee or (ii) the Purchase Agreement is terminated due to Kuva’s failure to complete the Offer and the Merger when the conditions have otherwise been satisfied, then Kuva shall pay Lisata the Breakup Fee. Upon payment of any Breakup Fee referenced in this section, no party shall have any further liability or obligation relating to or arising out of this Term Sheet or any transaction contemplated hereby. Specific Performance: Other than in a situation where the Breakup Fee is payable and is actually paid, each party shall have the right to seek specific performance of obligations under this Term Sheet and the Purchase Agreement including the obligation to close, subject to the satisfaction of agreed-upon customary conditions to consummation of the Offer and the Merger. Recommendation of Promptly following the Offer commencement date, Lisata will file and disseminate a Schedule 14D-9, recommending that Lisata stockholders

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 7 of 7 #100810477v16 the Company Board: tender their Shares to Kuva pursuant to the Offer. Interim Operating Covenants: From the time of entry into this Term Sheet until entry into the Purchase Agreement, Lisata’s monthly spend shall not exceed its average monthly spend for the 2025 fiscal year, excluding (i) expenses related to the Purchase Agreement and the Merger, (ii) any payments relating to D&O insurance, (iii) any compensation or other employee payments payable pursuant to existing agreements and/or Lisata’s policies, (iv) expenses related to any unforeseen regulatory or legal compliance issues and (v) any payments related to existing clinical studies, which amounts, in the case of clauses (i)-(iv) shall not exceed the amounts therefor included in the Schedule to this Term Sheet and, in the case of clause (v), shall not exceed the amount therefor included in the data room forecast provided to Kuva. Lisata represents and warrants that it does not have any equity securities (including options and restricted stock units) outstanding as the date hereof, and it is not a party to any change of control, transaction, retention of similar bonus agreements, other than as disclosed in Lisata’s SEC Filings or as listed on a Schedule to this Term Sheet. From the time of entry into this Term Sheet until entry into the Purchase Agreement, and from the entry into the Purchase Agreement until the closing of the transaction or the termination of the Purchase Agreement, Lisata shall not issue any equity securities (including options and RSUs), and shall not enter into any change of control, transaction, retention or similar bonus arrangements. From the date of this Term Sheet until the earlier of (x) entry into the Purchase Agreement and (y) the termination of this Term Sheet, Lisata will furnish Kuva with all diligence information that is reasonably requested by Kuva, which shall include a letter from Catalent or its counsel representing that Catalent’s intended use of certepetide, per the Non-Exclusive License with Lisata, is and will be limited to only those as part of its SMARTag® ADC technology platform, provided that if such letter is not received by Kuva by February 27, 2026, (A) Kuva has the right to terminate this Term Sheet and (B) neither Lisata nor Kuva shall be obligated to pay the Breakup Fee to the other party. Costs and Expenses: Except as expressly provided in the Purchase Agreement (if agreed and executed), or otherwise agreed to by the parties in writing, each party shall bear its own costs, fees and expenses in connection with the transactions contemplated by the Purchase Agreement (the “Transactions”), due diligence, and all other costs, fees and expenses in connection with the Transactions and activities contemplated by

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 8 of 7 #100810477v16 The parties agree that the proposed transactions and the contents set forth in this Term Sheet are binding and are covered by the confidentiality obligations set forth in the confidentiality or non- disclosure agreement currently in effect between the parties. The entry into the Purchase Agreement shall be subject to the completion of diligence in a manner satisfactory to each party and the negotiation and execution of definitive agreements in forms satisfactory to each party and its counsel. this Term Sheet. Confidentiality This Term Sheet and the parties’ discussions related to it are confidential, governed by the mutual confidential disclosure agreement executed on April 23, 2025. Notwithstanding the foregoing, this Term Sheet shall be disclosed by Lisata in a press release and Current Report on Form 8-K. Term: This Term Sheet will expire on February 28, 2026 unless extended by mutual written agreement of Lisata and Kuva. Lisata may terminate this Term Sheet at any time in order to enter into a binding agreement providing for a Competing Transaction, provided that (i) Lisata has provided Kuva five business days advance notice of its intention terminate this Term Sheet, (ii) concurrently with such termination, Lisata pays Kuva the Breakup Fee and (iii) concurrently with the termination of this Term Sheet, Lisata enters into a binding agreement providing for a Competing Transaction. Governing Law: This Term Sheet shall be governed by, and construed in accordance with, the laws of the State of Delaware.

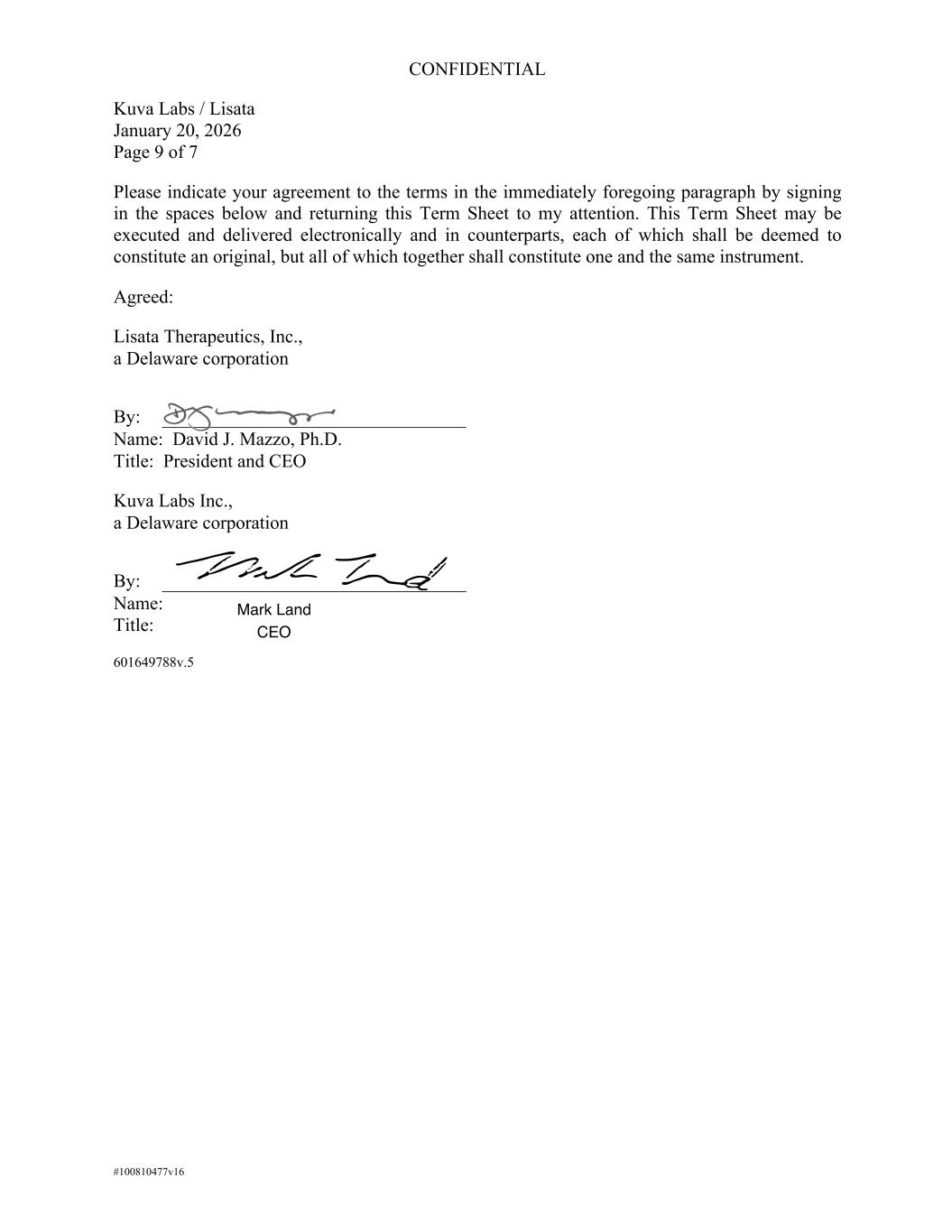

CONFIDENTIAL Kuva Labs / Lisata January 20, 2026 Page 9 of 7 #100810477v16 Please indicate your agreement to the terms in the immediately foregoing paragraph by signing in the spaces below and returning this Term Sheet to my attention. This Term Sheet may be executed and delivered electronically and in counterparts, each of which shall be deemed to constitute an original, but all of which together shall constitute one and the same instrument. Agreed: Lisata Therapeutics, Inc., a Delaware corporation By: Name: David J. Mazzo, Ph.D. Title: President and CEO Kuva Labs Inc., a Delaware corporation By: Name: Title: 601649788v.5