El Cerrito, CA 94530

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of Registrant: AutoNation Inc. (AN)

Name of person relying on exemption: As You Sow ®

Address of persons relying on exemption: 11461 San Pablo Ave, Suite 400, El Cerrito, CA 94530

The attached written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. As You Sow ® does not beneficially own more than $5 million of the class of subject securities, and this notice of exempt solicitation is therefore being provided on a voluntary basis.

|

11461 San Pablo Avenue, Suite 400 | www.asyousow.org |

El Cerrito, CA 94530

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

AutoNation Inc. (AN)

Vote Yes: Item #5 – Report on the Effectiveness of the Company's Diversity, Equity, and Inclusion Efforts

Annual Meeting: April 23, 2025

CONTACT: Meredith Benton at benton@whistlestop.capital

THE RESOLUTION

Resolved: Shareholders request that AutoNation Inc. (AutoNation) report on the effectiveness of the Company’s diversity, equity, and inclusion efforts to create a workplace where all employees can contribute to the Company’s success. The disclosure should be done at a reasonable expense, exclude proprietary information, and provide transparency on outcomes using quantitative metrics for hiring, retention, and promotion of employees, including data by gender, race, and ethnicity.

Supporting Statement: Quantitative data is sought so that investors can assess and compare the effectiveness of companies' efforts to ensure meritocratic workplaces. It is advised that this content be provided through existing sustainability reporting. An independent report is not requested.

RATIONALE FOR A YES VOTE

Effective diversity, equity, and inclusion systems do not advantage one group over another, nor do they disadvantage one group over another. Inclusive workplaces have been extensively linked to stronger businesses and financial returns. However, media reports have indicated that hiring bias may exist at AutoNation. The company does not provide quantitative data on the outcomes of its efforts to create a workplace where all employees are able to contribute to the company’s success.

Concerns about discrimination in the American workforce remain very high. What has shifted are the political beliefs about who is experiencing discrimination and how it should be addressed; more than ever, companies need to be able to illustrate that they host a workplace free of discrimination that allows the best talent to thrive.

Risk of litigation from employees alleging bias has long-existed, however, the release of this data set has not been linked to increased legal risks. Hundreds of other companies have already released the data requested by this proposal.

|

2025 Proxy Memo AutoNation| Shareholder Proposal Requesting a Report on Effectiveness of Efforts to Create a Meritocratic Workplace |

DISCUSSION

AutoNation was named in a study as having “the clearest preference for White Candidates” when sourcing potential talent.

Researchers sent out thousands of identical resumes to analyze whether race and gender impacted callback rates of job applications at 97 U.S. employers. The study analyzed distinctly “Black” names and “White” names as well as male and female names, among other demographic differences. AutoNation was identified as having a clear preference for White candidates.1

Effective human capital management does not advantage one group over another, nor does it disadvantage one group over another.

Investors are seeking data to understand if AutoNation’s workplace is one where all employees can contribute to the Company’s success based on merit. Well managed diversity, equity, and inclusion programs do not place people into roles they don’t deserve; they are focused on ensuring that the bias and discrimination that exist in America2 does not harm the company’s ability to hire, advance, and retain the best possible employees.

The US Supreme Court’s June, 2023, decision striking down affirmative action in university admissions3 alongside the January, 2025, Executive Order 14173 shifted the political and legal landscape in which companies operate, placing significantly more scrutiny on workplace programs that may advantage specific groups. The Equal Employment Opportunity Commission (EEOC) issued clarifying guidance in March, 2025, reaffirming that Title VII of the Civil Rights Act of 1964 continues to prohibit “discrimination based on protected characteristics such as race and sex.” The EEOC emphasized that disparate treatment of workers, such as exclusion from training, mentorship, or networking events on the basis of a protected characteristic was not allowed. This included employee affinity groups, and trainings, as well as any employment decision based on the bias of customers.4

Companies’ obligations to workplaces free of harassment and discrimination have not changed. Companies have a legal obligation5 and financial incentive to ensure equal opportunities that cultivate the strongest possible teams — and to refrain from creating workplaces that are hostile, unsafe, discriminatory, or enable harassment.

Investors should seek effective inclusion programs for reasons that go beyond legal considerations. Numerous studies have pointed to the benefits of a diverse and inclusive workforce. A small subset of their findings include:

| · | Whistle Stop Capital and As You Sow Researchers reviewed the workforce diversity of 1,641 companies between 2016-2021. Linear regressions found statistically significant positive correlations between increased manager diversity and enterprise value growth rate, free cash flow, return on equity, return on invested capital, and 10-year revenue growth, among other indicators.6 |

_____________________________

1 White Men the Most Likely to Get Hired Even With DEI, Finds Research - Bloomberg

2 https://www.pewresearch.org/race-and-ethnicity/2024/06/15/racial-discrimination-shapes-how-black-americans-view-their-progress-and-u-s-institutions-2/, https://academic.oup.com/qje/article-abstract/137/4/1963/6605934?redirectedFrom=fulltext&login=false, https://academic.oup.com/qje/article-abstract/133/1/191/4060073?redirectedFrom=PDF&login=false, https://www.pnas.org/doi/full/10.1073/pnas.1706255114, https://www.shrm.org/topics-tools/news/inclusion-diversity/gender-bias-2024-survey

3 https://www.sidley.com/en/insights/newsupdates/2023/08/us-supreme-court-ends-affirmative-action-in-higher-education--an-overview-and-practical-next-steps

4 https://natlawreview.com/article/what-dei-discrimination-latest-eeoc

5 https://www.eeoc.gov/statutes/title-vii-civil-rights-act-1964

6 https://www.asyousow.org/report-page/2023-positive-relationships-linking-workforce-diversity-and-financial-performance

| 3 |

|

2025 Proxy Memo AutoNation| Shareholder Proposal Requesting a Report on Effectiveness of Efforts to Create a Meritocratic Workplace |

| · | The consultancy BCG found that innovation revenue was 19 percent higher in companies with above-average leadership diversity. In addition, companies with above-average diversity had EBIT margins nine percentage points higher.7 |

| · | A study of the S&P 500 by the Wall Street Journal found that the 20 most diverse companies had an average annual five-year stock return that was 6.0 percent higher than the 20 least-diverse companies.8 |

Researchers have identified benefits of diverse and inclusive teams to include: access to top talent, a better understanding of consumer preferences, a stronger mix of leadership skills, informed strategy discussions, and improved risk management. Diversity and the different perspectives it encourages has also been shown to encourage more creative and innovative workplace environments.9 In contrast, companies where harassment and discrimination exist may experience reduced employee morale and productivity, increased absenteeism, challenges in attracting talent, and difficulties in retaining talent.

Inequality may also threaten the total portfolio return of diversified investors by slowing economic growth: for example, one study determined gender and racial gaps reduced GDP by $2.6 trillion in 2019.10

Unfortunately, corporate initiatives intended to ensure workplace meritocracy vary in quality. Companies need to be intentional in ensuring that negative stereotypes against gender, race, or other diversity characteristics do not harm their workplace; and investors must have the data needed to monitor and compare their companies’ effectiveness in meeting this important goal.

Disclosure does not appear to Increase Legal Risks

As of March 21st, 2025:

| - | 84 percent of the S&P 100 release, or have committed to release, its EEO-1 report. |

| - | 54 percent of the S&P 100 release, or have committed to release, at least one hiring statistic related to gender. |

| - | 37 percent of the S&P 100 release or have committed to release, at least one hiring statistic related to race/ethnicity. |

| - | 29 percent of the S&P 100 release or have committed to release, at least one promotion statistic related to gender. |

| - | 21 percent of the S&P 100 release or have committed to release, at least one promotion statistic related to race/ethnicity. |

| - | 23 percent of the S&P 100 release or have committed to release, at least one retention or turnover statistic related to gender. |

| - | 22 percent of the S&P 100 release or have committed to release, at least one retention or turnover statistic related to race/ethnicity. |

_____________________________

7 https://www.bcg.com/en-us/publications/2018/how-diverse-leadership-teams-boost-innovation.aspx

8 https://www.wsj.com/articles/the-business-case-for-more-diversity-11572091200

9 https://images.forbes.com/forbesinsights/StudyPDFs/Innovation_Through_Diversity.pdf

10 https://www.frbsf.org/wp-content/uploads/wp2021-11.pdf

| 4 |

|

2025 Proxy Memo AutoNation| Shareholder Proposal Requesting a Report on Effectiveness of Efforts to Create a Meritocratic Workplace |

As of the filing of this brief, no research reports or media articles were found that indicated any relationship between the publication

of these data sets and discrimination lawsuits received by companies. Similarly no research was found that indicated that the release

of the requested data sets impacted outcomes of discrimination lawsuits filed against companies that release their diversity and inclusion

data.

AutoNation does not provide transparent quantitative data on the outcomes of its efforts to create a meritocratic workplace.

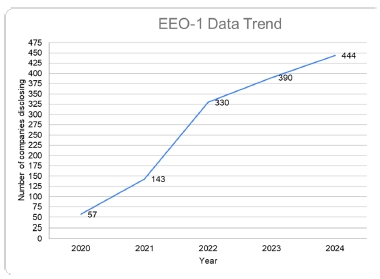

At the time of this filing, AutoNation has only shared basic overall workforce demographic data11, and has not shared its EEO-1 report. The EEO-1 is a report that includes demographic workforce data, including race/ethnicity, sex, and job categories that the US Equal Employment Opportunity Commission requires companies with at least 100 employees to complete. Investors request this data set in order to understand AutoNation’s workforce diversity in a format that allows for benchmarking and comparison among its peers. There has been an upward trend in EEO-1 data disclosure from Russell 1000 companies. Over 40% of the Russell 3000 currently publish their EEO-1 reports.

Companies that release more diversity and inclusion data than AutoNation include, but are not limited to Ross Stores, The TJX Companies, Dollar General, and Best Buy.

The Board states, in its statement of opposition to this proposal, that the “disclosure requested by this proposal would result in an undue cost and administrative burden without commensurate benefit to our stockholders.”12 However, the company already collects this data and would need to only add it to its website or existing sustainability reporting.

_____________________________

11 an24-esg-report_client_final.pdf

12 Inline Viewer: AUTONATION, INC. DEF 14A Not Available.

| 5 |

|

2025 Proxy Memo AutoNation| Shareholder Proposal Requesting a Report on Effectiveness of Efforts to Create a Meritocratic Workplace |

CONCLUSION

Vote “Yes” on this Shareholder Proposal 5

--

For questions, please contact Meredith Benton, As You Sow, benton@whistlestop.capital

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

6