Certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) is the type of information that the registrant treats as private or confidential. Triple asterisks denote omissions. OFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege Dated Intercreditor Deed – Regional Express Airlines Parties Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) Air T Lending 25.1, LLC P.T. Limited Each entity listed in Schedule 1 Norton Rose Fulbright Australia Level 5, 60 Martin Place SYDNEY NSW 2000 nortonrosefulbright.com Our ref: 4081080

APAC-#312808975-v19 © Norton Rose Fulbright AustraliaOFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege Contents 1 Definitions and interpretation .................................................................................................. 1 1.1 Definitions .................................................................................................................. 1 1.2 Interpretation ............................................................................................................12 1.3 Inconsistency ...........................................................................................................13 1.4 Multiple Parties ........................................................................................................14 1.5 Designation as Finance Documents ........................................................................14 2 Effectiveness of this document .............................................................................................14 2.1 Effectiveness ...........................................................................................................14 2.2 Interdependence ......................................................................................................14 3 Consent ................................................................................................................................14 4 Priority of Security ................................................................................................................15 4.1 Order of priority ........................................................................................................15 4.2 Ranking ....................................................................................................................15 5 Distribution of Proceeds following Liquidation Event or other Enforcement Action .............16 5.1 Order of application .................................................................................................16 5.2 Contingent liabilities .................................................................................................16 5.3 Obligation to account ...............................................................................................17 5.4 Good discharge .......................................................................................................17 6 Enforcement .........................................................................................................................17 6.1 Restriction on Enforcement Action ..........................................................................17 6.2 Rights not otherwise affected ..................................................................................18 6.3 First priority Security to take precedence ................................................................18 6.4 No obligation to marshal ..........................................................................................18 7 Sale of Relevant Collateral ...................................................................................................18 7.1 Restriction on sale of Relevant Collateral ................................................................18 7.2 Use of Relevant Collateral sale proceeds ...............................................................19 8 Air T payments......................................................................................................................19 8.1 Air T Debt .................................................................................................................19 8.2 Subordination ...........................................................................................................19 8.3 Undertakings by the Grantors in relation to the Air T Financiers and its Related Entities .....................................................................................................................20 8.4 Undertakings of Air T Financiers .............................................................................21 8.5 Permitted Payments ................................................................................................22 8.6 Amendments to Air T documentation and dealings with Air T Debt ........................22 8.7 Turnover of non-permitted payments ......................................................................23 8.8 Appropriations ..........................................................................................................24 8.9 Permitted refinance of Air T New Cap Notes...........................................................24 9 Distributions of Excess Cash Flows and Insurance Proceeds prior to Liquidation Event or other Enforcement Action .................................................................................................24 9.1 Order of application of Excess Cash Flows .............................................................24 9.2 Order of application of Insurance Proceeds ............................................................25 10 Commonwealth step-in right and purchase option ...............................................................26 10.1 Commonwealth step-in right ....................................................................................26 10.2 Commonwealth option to purchase Air T New Cap Notes ......................................26 11 Information undertakings and exchange of information .......................................................27

APAC-#312808975-v19 © Norton Rose Fulbright Australia OFFICIAL: Sensitive // Legal-Privilege 11.1 Enforcement Action .................................................................................................27 11.2 Amounts outstanding ...............................................................................................27 11.3 Commonwealth New Loan Agreement reporting and Excess Cash Flow reconciliation ............................................................................................................27 11.4 Rex Regional Commitments ....................................................................................28 11.5 Relevant Interest Rate, non-payment of interest and principal and Capitalisation Notice ................................................................................................29 11.6 Other information .....................................................................................................31 11.7 No termination .........................................................................................................31 12 Dealing with Security ............................................................................................................31 13 Further Assurances ..............................................................................................................31 14 PPSA ....................................................................................................................................32 15 Financiers’ rights and Grantor’s obligations continue ..........................................................32 16 Termination ...........................................................................................................................32 17 Representations and warranties ...........................................................................................32 18 Notices ..................................................................................................................................33 18.1 Communications in writing .......................................................................................33 18.2 Addresses ................................................................................................................33 18.3 Delivery ....................................................................................................................34 18.4 Reliance ...................................................................................................................34 19 Costs .....................................................................................................................................34 20 Confidentiality .......................................................................................................................34 21 General .................................................................................................................................35 21.1 Variation ...................................................................................................................35 21.2 Waiver ......................................................................................................................35 21.3 Cumulative rights .....................................................................................................35 21.4 Partial invalidity ........................................................................................................35 21.5 Binding obligations ...................................................................................................36 21.6 Counterparts ............................................................................................................36 21.7 Execution by attorney ..............................................................................................36 21.8 Governing law and jurisdiction .................................................................................36 22 Liability of Air T Security Trustee ..........................................................................................36 22.1 Limitation of liability ..................................................................................................36 22.2 Limit on liability ........................................................................................................37 22.3 Exceptions to limit on liability ...................................................................................38 22.4 Paramount ...............................................................................................................38 Schedule 1 – Grantors ......................................................................................................................39 Schedule 2 – Commonwealth Security .............................................................................................40 Schedule 3 – Air T Security ...............................................................................................................41 Schedule 4 – Rex Regional Commitments .......................................................................................42 Schedule 5 – Maintenance Reserve Methodology............................................................................48 Schedule 6 – Form Accession Deed .................................................................................................49

APAC-#312808975-v19 © Norton Rose Fulbright Australia 1 OFFICIAL: Sensitive // Legal-Privilege Deed dated 2025 Parties Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) of 111 Alinga Street Canberra, ACT 2601 (Commonwealth) Air T Lending 25.1, LLC of 5000 W 36th Street, Suite 200, Minneapolis MN 55416, United States (Original Air T Financier and Air T Facility Agent) P.T. Limited ACN 004 454 666 in its capacity as trustee of the Project Mustang Security Trust of Level 14, 123 Pitt Street, Sydney NSW 2000 (Air T Security Trustee) The entities listed in Schedule 1 (each a Grantor, together the Grantors) Introduction A The Commonwealth is, or will be, the holder of the Commonwealth Security. B The Air T Security Trustee is, or will be, the holder of the Air T Security. C The Financiers, with the concurrence of the Grantors have agreed to regulate the priorities between the Securities in the manner set out in this document. D The Air T Financier and the Grantors have agreed to the restrictions on the payment or repayment of the Air T Debt in the manner set out in this document. E The Financiers and the Grantors have agreed to certain other common matters, including, certain general and information undertakings and changes to the applicable interest rates, among other things, which are set out in this document. It is agreed 1 Definitions and interpretation 1.1 Definitions In this document: (1) Accession Deed means a document by which a person or entity accedes to this document as a party substantially in the form of Schedule 6; (2) Administrator has the meaning given to it in the Corporations Act;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 2 OFFICIAL: Sensitive // Legal-Privilege (3) Air T Debt means all Debt of the Grantors to the Air T Financiers and the Air T Security Trustee (whether alone or with others); (4) Air T Financier means: (a) the Original Air T Financier; (b) each Air T Substitute Finance Party (other than a substitute of the Air T Security Trustee); and (c) each Refinance Finance Party, to the extent that such person or entity is or has become a Party to this document and (other than in the case of a Refinance Finance Party) is or remains the registered holder of any Air T New Cap Notes; (5) Air T New Cap Notes means each “Loan Note” under and for the purposes of the loan note subscription agreement dated on or about the date of this document between the Original Air T Financier, the Air T Security Trustee, the Air T Facility Agent and the Grantors; (6) Air T Priority Amount means A$50,000,000 (as reduced pursuant to principal repayments permitted pursuant to this document) plus Interest and Costs; (7) Air T Related Entity means a ‘related entity’ (giving that term the meaning in the Corporations Act) of the Original Air T Financier (which, to avoid doubt, does not include any Grantor); (8) Air T Required Payments means, for any Quarterly Determination Date and subject to clause 11.5(1)(c)(ii), all interest payments due on that date in accordance with the Air T New Cap Notes and any mandatory principal repayments permitted by this document (excluding any payments of principal from Excess Cash Flow contemplated by this document and excluding any repayment at the maturity date), without double counting where a Quarterly Determination Date and Determination Date fall on the same date; (9) Air T Security means at any time, each Security Interest held by an Air T Financier or the Air T Security Trustee from a Grantor or in respect of the Air T Debt, including the Security listed in Schedule 3; (10) Air T Security Trust Deed means the document establishing the Project Mustang Security Trust under which the Air T Security Trustee acts as security trustee in respect of each Air T Security; (11) Air T Substitute Finance Party has the meaning given to that term in clause 8.6; (12) Authorised Officer means: (a) in respect of the Grantor, any director, or any person from time to time nominated as an Authorised Officer by the Grantor by a notice to the Financiers accompanied by certified copies of signatures of all new persons so appointed (and in respect of which the Financiers have not received notice of revocation of the appointment); (b) in respect of the Commonwealth, First Assistant Secretary, Domestic Aviation and Reform Division or such other person or persons as the Commonwealth may notify to the other Parties to this document in writing from time to time;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 3 OFFICIAL: Sensitive // Legal-Privilege (c) in respect of the Air T Security Trustee or the Air T Facility Agent, an employee or officer of the Security Trustee whose title contains the word ‘manager’, ‘senior manager’, ‘director’, ‘executive’, ‘attorney’, or ‘head’ or a similar term; and (d) in respect of an Air T Financier, an employee or officer of the Air T Financier whose title contains the word ‘manager’, ‘senior manager’, ‘director’, ‘executive’, ‘attorney’, or ‘head’ or a similar term or such other person or persons as an Air T Financier may notify to the other Parties to this document in writing from time to time; (13) Available Cash Flow means, for any Relevant Period and the relevant Determination Date, an amount which is calculated as follows: (a) [***]; plus: (b) [***]; less: (c) [***]; (d) [***]; adjusted for (as the context requires): (e) [***]; (f) [***]; and (g) [***] (without double counting). (14) Business Day means a day that is not a Saturday, Sunday or any other day which is: (a) a public holiday or a bank holiday in New South Wales or in the Australian Capital Territory; (b) a public holiday or bank holiday in New York; or (c) a day falling between 24 December and 2 January (inclusive) in any particular year; (15) Capitalisation Notice has the meaning given to that term in clause 11.5; (16) Cash Flow Deduction has the meaning given to that term in clause 8.3(9); (17) Cash Sweep Commencement Date means the date falling 18 months after the Restructure Effective Date (or such earlier date as the Commonwealth and the Air T Facility Agent may agree); (18) Commonwealth Debt means all Debt of the Grantors to the Commonwealth (whether alone or with others) and provided that (unless provided otherwise in this

APAC-#312808975-v19 © Norton Rose Fulbright Australia 4 OFFICIAL: Sensitive // Legal-Privilege document) the Commonwealth shall apply amounts received by it from Proceeds or Excess Cash Flow in the following order of priority: (a) first, towards payment of all Debt owing by the Grantors to the Commonwealth in connection with the Commonwealth New Loan Agreement until the balance of that Debt is repaid in full; and: (b) second, towards payment of all Debt owing by the Grantors to the Commonwealth in connection with the Commonwealth Perpetual Loan Agreement until the balance of that Debt is repaid in full; (19) Commonwealth New Loan Agreement means the document titled ‘Facility Agreement’ dated on or about the date of this document between, among others, the Commonwealth and the Company; (20) Commonwealth New Loan Required Payments means in respect of any Relevant Period and the relevant Determination Date, subject to clause 11.5(4), the aggregate of all interest paid or payable and any mandatory principal repayments permitted by this document (excluding any payments of principal from Excess Cash Flow contemplated by this document) in each case falling due during that period; (21) Commonwealth Perpetual Loan Agreement means the document titled ‘Commonwealth Facility Agreement’ dated 11 November 2024 between, among others, the Commonwealth and the Company (as amended and restated on or about the Restructure Effective Date); (22) Commonwealth Priority Amount means all money secured by the Commonwealth Security at any time plus Interest and Costs; (23) Commonwealth Security means at any time, each Security Interest held by the Commonwealth from a Grantor, including the Security listed in Schedule 2 and any additional Security Interest granted to the Commonwealth in respect of any Specified Collateral after the date of this document; (24) Company means Regional Express Holdings Limited ACN 099 547 270; (25) Controller means a controller as defined in section 9 of the Corporations Act 2001 (Cth); (26) Corporations Act means Corporations Act 2001 (Cth); (27) Costs means all costs, charges and expenses (other than Interest) and, (in respect of the Air T Debt, Air T New Cap Notes and Air T Security only) the Air T Security Trustee’s fees, payable by the Grantors under the relevant Security or otherwise to the Air T Security Trustee, including break costs and costs, charges and expenses incurred by the relevant Financier or the Air T Security Trustee (or a Controller appointed by that Financier or the Air T Security Trustee) as a result of or in connection with Enforcement Action; (28) Debt means all present and future debts and monetary liabilities (whether actual or contingent and whether owed jointly or severally or in any other capacity) irrespective of whether those debts or liabilities are: (a) owed as principal, interest, fees, charges, taxes, losses, damages, Costs or expenses or on any other account; or (b) owed as a result of the assignment of any debt or monetary liability to any person, or as a result of any dealing with that debt or monetary liability by any person;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 5 OFFICIAL: Sensitive // Legal-Privilege (29) Determination Date means, for any Relevant Period, the last day of the Relevant Period; (30) Distribution means any dividend, special dividend, charge, fee or other amount distributed, declared or paid on or in connection with any Marketable Security; (31) EBITDA means, for any Relevant Period and calculated at the relevant Determination Date, an amount which is calculated as follows: (a) the consolidated operating/trading revenue and interest income of the Group; less (b) the consolidated operating/trading expenses of the Group, excluding: (i) interest expenses; (ii) company income tax expenses (or carry forward tax losses that could be used as a deduction toward the payment of future company income tax); (iii) depreciation expenses; and (iv) amortisation expenses. (32) Enforcement Action means any action to enforce any Security, including: (a) crystallising a floating charge; (b) appointing a Controller; (c) entering into possession of property under a Security; (d) exercising a power of sale over, or otherwise realising any property under, a Security; and (e) exercising any remedy of foreclosure, regardless of whether the action is taken by a Financier or by a Controller appointed by a Financier; (33) Event of Default means any event on which a Financier may rely to take action to enforce a Security and includes an event of default (however described) in any Security Agreement and any other document or agreement entered into between a Grantor and a Financier in connection with a Security or any amount secured by a Security; (34) Excess Cash Flow means, for any Relevant Period and calculated at the relevant Determination Date, an amount which is calculated as follows: (a) Available Cash Flow for that Relevant Period; less (b) Required Debt Payments for that Relevant Period (which, for avoidance of doubt, does not include capitalised interest), provided that if the result is less than zero, Excess Cash Flow for that Relevant Period will be deemed to be zero; however;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 6 OFFICIAL: Sensitive // Legal-Privilege (c) in respect of any Relevant Period and the relevant Determination Date that fall after: (i) both: (A) the Air T New Cap Notes are fully drawn; and (B) the earlier to occur of (i) the facilities under the Commonwealth New Loan Agreement are fully drawn or (ii) the availability period under the Commonwealth New Loan Facility has expired and the commitments are cancelled or are otherwise no longer available to be drawn; or (ii) the availability period under the Air T New Cap Notes and the Commonwealth New Loan Facility has expired and the commitments are cancelled, if “Excess Cash Flow” is negative for that Relevant Period, such negative result will be carried forward to subsequent Relevant Periods and subtracted from any positive “Excess Cash Flow” result (if any) for those Relevant Periods until exhausted in full; (35) Existing Aircraft Fleet means only propeller aircraft and associated engines (whether on-wing or off wing) of the Grantors in connection with the Saab airframes and GE engines as at the Restructure Effective Date; (36) Financiers means the Commonwealth, the Air T Security Trustee, the Air T Facility Agent and Air T (including any Air T Substitute Finance Party or Refinance Finance Party which accedes to this document) and Financier means each of them; (37) Group means the Grantors and each of their subsidiaries; (38) Half Year means each 6 monthly period ending on 30 June and 31 December in any year and where applicable will also be a Relevant Period; (39) Half Year End means the last day of a Half Year and where applicable will also be a Determination Date; (40) Initial Period means the period commencing on the date of this document and ending on the earlier of: (a) the date the availability period under the Commonwealth New Loan Agreement has expired and the commitments are cancelled; and (b) the facilities under the Commonwealth New Loan Agreement are fully drawn; (41) Insolvency Event means in respect of a person, that the person: (a) is unable to pay its debts as they fall due or ceases to do so (in each case, unless such debt is waived or due date extended) or is otherwise deemed to be insolvent under any law; (b) is dissolved, deregistered, ceases to carry on all or a substantial part of its business, seeks protection from creditors, enters into a scheme of arrangement, deed of company arrangement, assignment or other arrangement for the benefit of its creditors (whether voluntary or not), has a

APAC-#312808975-v19 © Norton Rose Fulbright Australia 7 OFFICIAL: Sensitive // Legal-Privilege Controller appointed to it or any of its assets or steps are taken towards any of those things; or (c) is the subject of an analogous or equivalent event to any identified above under the law of any jurisdiction; (42) Insurance Proceeds means, in respect of any Relevant Collateral, the balance of the proceeds of any insurance claim under any insurance maintained by any Grantor in connection with that Relevant Collateral (after deducting any reasonable expenses in relation to that claim which are incurred by the Grantor to persons who are not Grantors or an Air T Related Entity) which are not applied in or towards the reinstatement or replacement of that Relevant Collateral in accordance with the then current business plan of the Group (as approved by Commonwealth); (43) Interest means all interest which has accrued and which has not been paid to the relevant Financier in respect of money secured by a Security and includes default interest, interest on interest and interest which has been capitalised; (44) Interest Rate Notice has the meaning given to that term in clause 11.5; (45) Liquidation Event means in respect of a Grantor, any of the following occurs: (a) an Insolvency Event occurs; or (b) without limiting paragraph (a), a provisional liquidation, administration, receivership, compromise, arrangement, amalgamation, reconstruction, winding up, dissolution, assignment for the benefit of creditors, arrangement or compromise with creditors, bankruptcy or death; or (c) an analogous or equivalent event to any identified above under the law of any jurisdiction; (46) Maintenance Reserve Allocation means, for any Half Year and calculated at the relevant Half Year End, an amount which is determined in accordance with the Maintenance Reserve Methodology; (47) Maintenance Reserve Methodology means the methodology used to calculate the maintenance reserve allocation for any Half Year. The approved methodology is, as at the date of this document, set out in Schedule 5, as may be amended from time to time with the consent of the Commonwealth (such consent not to be unreasonably withheld where the amendment relates to an adjustment to the “Estimated Costs (USD)” for components where the Company can demonstrate the estimated cost reflects the market cost of the relevant component (48) Marketable Securities means: (a) 'intermediated securities' and 'investment instruments' (each as defined in the PPSA); (b) a unit or other interest in a trust or partnership; and (c) a right or an option in relation to any of the above, whether issued or unissued; (49) Maturity Repayment (Air T Debt) means the repayment of the Air T Debt in respect of the Air T New Cap Notes on the Maturity Repayment Date (Air T Debt);

APAC-#312808975-v19 © Norton Rose Fulbright Australia 8 OFFICIAL: Sensitive // Legal-Privilege (50) Maturity Repayment Date (Air T Debt) means the “Final Repayment Date” applicable to the Air T New Cap Notes, being no earlier than 5 years after the date of the issue of the relevant Air T New Cap Notes; (51) NSW Stamp Duty Amount means the portion of the Stamp Duty Amount that is payable to Revenue NSW; (52) Option Period has the meaning given to that term in clause 10.2; (53) Party means a party to this document and includes its successors in title, permitted assigns and permitted transferees; (54) Payment Date means, for any Relevant Period, the date falling 5 Business Days after the Determination Date for that Relevant Period; (55) Permitted Other Borrowings means, at any time, the outstanding principal, capital or nominal amount and any fixed or minimum premium payable on prepayment or redemption in respect of any indebtedness described in paragraph (c) of the definition of “Permitted Financial Indebtedness” in the Commonwealth New Loan Agreement; (56) Permitted Payments means any of the following payments: (a) the Air T Required Payments for the relevant Quarter; (b) the payment of the Stamp Duty Amount to the relevant authority (or reimbursement for such amount paid by Air T Inc. or the Original Air T Financier) provided that the Company and its shareholders have complied with Part 2J.3 of the Corporations Act in relation to such payment; ; (c) payments permitted by clause 8.3(9); (d) payments from Excess Cash Flow made in accordance with clause 9.1(1)(b); (e) the Maturity Repayment (Air T Debt) pursuant to a refinance of the Air T Debt in accordance with clause 8.9; and (f) any other payments that have been approved in writing by the Commonwealth; (57) PPSA means the Personal Property Securities Act 2009 (Cth); (58) Principal Default Notice has the meaning given to that term in clause 11.5; (59) Proceeds means any proceeds received by a Party in respect of any Relevant Collateral, including proceeds received by a Financier from: (a) any disposal or realisation of, or other dealing with Relevant Collateral following or as a result of Enforcement Action or Liquidation Event; and (b) any income from the Relevant Collateral received by a Financier following Enforcement Action or Liquidation Event; (60) Purchase has the meaning given to that term in clause 10.2; (61) Purchase Date has the meaning given to that term in clause 10.2;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 9 OFFICIAL: Sensitive // Legal-Privilege (62) Purchase Notice has the meaning given to that term in clause 10.2; (63) Quarterly Determination Date means each of 31 March, 30 June, 30 September and 31 December; (64) Quarter means each three calendar month period ending on a Quarterly Determination Date, or in the case of the first Quarter occurring after the Restructure Effective Date, the period starting on the Restructure Effective Date and ending on the first Quarterly Determination Date to occur after the Restructure Effective Date; (65) Refinance Finance Party has the meaning given to that term in clause 8.9; (66) Related Entity has the meaning it has in the Corporations Act 2001 (Cth); (67) Relevant Collateral means, at any time, the Grantor’s right, title and interest in property which, at that time, is subject to the Commonwealth Security and the Air T Security; (68) Relevant Interest Rate means: (a) in respect of any Air T New Cap Notes, the rate per annum as notified in writing from time to time by Air T Facility Agent to the Commonwealth for the purposes of this paragraph (a), provided that at no time will the rate be less than 6.00% per annum or more than 12.00% per annum. At the date of this document the rate is 12.00% per annum; and (b) in respect of the Commonwealth New Loan Agreement: (i) (A) at any time while the Debt of the Grantor to an Air T Financier in connection with the Air T New Cap Notes is greater than zero, the rate per annum notified by the Air T Facility Agent to the Commonwealth pursuant to paragraph (a) (being, at the date of this document, 12.00% per annum); or (B) if paragraph (A) does not apply, the rate per annum as notified in writing from time to time by the Commonwealth to the Grantors provided that at no time will the rate be more than 12.00% per annum; plus (ii) if and at all times while the Grantors are not meeting the Rex Regional Commitments, an additional 2.00% per annum above the applicable rate in paragraph (i) above; (69) Relevant Period means, each period of 6 months ending on 30 June and 31 December in any year occurring after the Cash Sweep Commencement Date, with the first Relevant Period commencing on the Cash Sweep Commencement Date and ending on 30 June or 31 December whichever is the first to occur after the Cash Sweep Commencement Date; (70) Relevant Portion means: (a) unless paragraph (b) applies, for any Relevant Period and the relevant Determination Date:

APAC-#312808975-v19 © Norton Rose Fulbright Australia 10 OFFICIAL: Sensitive // Legal-Privilege (i) in respect of the Commonwealth: (A) if the Debt owing to the Commonwealth in respect of the Commonwealth Perpetual Loan Agreement is more than 50% of Opening Balance (as defined in the Restructuring Coordination Deed), 70% of the Excess Cash Flow for that Relevant Period and Determination Date; and (B) in any other case, 50% of the Excess Cash Flow for that Relevant Period and Determination Date; (ii) in respect of the Air T Financiers, Air T Security Trustee and the Air T New Cap Notes: (A) if paragraph (a)(i)(A) applies, an amount up to 30% of the Excess Cash Flow for that Relevant Period and Determination Date (the relevant percentage is to be determined by the Air T Facility Agent having regard to the need for the Grantors to retain adequate cash reserves to operate the business of the Group and notified to the Commonwealth and the Grantors prior to the Payment Date immediately following the relevant Determination Date); and (B) if paragraph (a)(i)(B) applies, an amount up to 50% of the Excess Cash Flow for that Relevant Period and Determination Date (the relevant percentage is to be determined by the Air T Facility Agent having regard to the need for the Grantors to retain adequate cash reserves to operate the business of the Group and notified to the Commonwealth and the Grantors prior to the Payment Date immediately following the relevant Determination Date). (b) on and from the earlier of the occurrence of any Enforcement Action or a Liquidation Event: (i) in respect of any Debt owing by the Grantors to the Air T Financiers and the Air T Security Trustee under the Air T New Cap Notes, [***] of that Debt subject to a maximum amount equal to the Air T Priority Amount; and (ii) in respect of any Debt owing by the Grantors to the Commonwealth under the Commonwealth New Loan Agreement, [***] of that Debt; (iii) in respect of any Debt owing by the Grantors to the Commonwealth under the Commonwealth Perpetual Loan Agreement, [***] of that Debt; (71) Required Debt Payments means, for any Relevant Period and the relevant Determination Date, the aggregate of: (a) the aggregate amount (whether in the nature of interest or principal) paid or payable by any member of the Group in respect of Permitted Other Borrowings for that Relevant Period; (b) Commonwealth New Loan Required Payments for that Relevant Period; and

APAC-#312808975-v19 © Norton Rose Fulbright Australia 11 OFFICIAL: Sensitive // Legal-Privilege (c) Air T Required Payments for that Relevant Period; (72) Restricted Cash Flow Deduction means a Cash Flow Deduction which does not satisfy the criteria in clauses 8.3(9)(a) to 8.3(9)(d) (inclusive); (73) Restricted Distribution means any action contemplated in clause 8.2(1)(a); (74) Restructure Effective Date has the meaning given to the term “Restructure Effective Date” in the Restructuring Coordination Deed; (75) Restructuring Coordination Deed means the document titled “Restructuring Coordination Deed – Regional Express Airlines” dated on or about the date of this document between the Original Air T Financier and the Commonwealth; (76) Rex Regional Commitments means the requirements set out in Schedule 4 (as that schedule may be amended from time to time in writing by the Parties); (77) RRC Report means a report, in the form agreed between the Grantors and the Commonwealth from time to time, setting out the information and responses that demonstrate that the Grantors are complying with the Rex Regional Commitments; (78) Securities means, together, the Commonwealth Security and the Air T Security and Security means any of them; (79) Security Agreement means an agreement between a Grantor and a Financier which gives rise to a Security; (80) Security Interest means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement, notice or arrangement having a similar effect, including any "security interest" as defined in the PPSA; (81) Specified Collateral means all the Grantors’ right, title and interest in: (a) the Existing Aircraft Fleet and all aircraft simulators owned by any Grantors; and (b) all property which at any time comprises aircraft assets (including airframes and engines) and aircraft simulators, to the extent that property is acquired by the relevant Grantor after the Restructure Effective Date with proceeds of a loan under the Commonwealth New Loan Agreement; (82) Stamp Duty Amount means the amount of any stamp duty paid or payable by Air T Inc or the Original Air T Financier in connection with Air T Inc’s acquisition of all of the equity interests in the Company that is not otherwise waived; (83) Step-In Right means the Commonwealth’s right to Step-In pursuant to clause 10.1; (84) Step-In has the meaning given to that term in clause 10.1; (85) Step-In Date has the meaning given to that term in clause 10.1; (86) Step-In Notice has the meaning given to that term in clause 10.1; (87) Tax means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same);

APAC-#312808975-v19 © Norton Rose Fulbright Australia 12 OFFICIAL: Sensitive // Legal-Privilege (88) Termination Date means the date on which: (a) the Commonwealth Debt has been repaid in full; and (b) the Commonwealth Security has been released in full, irrespective of whether the Air T Debt has been repaid as permitted by this document; (89) Waiver Notice has the meaning given to that term in clause 11.5; and (90) Waiver Period has the meaning given to that term in clause 11.5. 1.2 Interpretation (1) Any reference in this document to: (a) any Party includes its successors in title, permitted assigns and permitted transferees (including each party which accedes to this document pursuant to and in accordance with an Accession Deed); (b) an amendment includes a supplement, novation, extension (whether of maturity or otherwise), restatement, re-enactment or replacement (however fundamental and whether or not more onerous), and amended will be construed accordingly; (c) assets and property includes present and future properties, revenues and rights of every description; (d) a document includes any agreement in writing, or any certificate, notice, document, instrument or other document of any kind and is a reference to that document as amended, restated or novated; (e) disposal means a sale, transfer, assignment, grant, lease, licence, declaration of trust or other disposal, whether voluntary or involuntary and whether in a single transaction or a series of transactions, and dispose will be construed accordingly; (f) guarantee means any guarantee, letter of credit, bond, indemnity or similar assurance against loss, or any obligation, direct or indirect, actual or contingent, to purchase or assume any indebtedness of any person or to make an investment in or loan to any person or to purchase assets of any person where, in each case, such obligation is assumed in order to maintain or assist the ability of such person to meet its indebtedness or to assure any creditor against loss; (g) indebtedness includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; (h) a law means any law or legal requirement, including at common law, in equity, under any statute, rule, regulation, proclamation, order in council, ordinance, by-law, interim development order, planning scheme or environmental planning scheme whether commonwealth, state, territorial or local; (i) a person or entity includes any person, firm, company, corporation, government, state or agency of a state or any association, trust or

APAC-#312808975-v19 © Norton Rose Fulbright Australia 13 OFFICIAL: Sensitive // Legal-Privilege partnership (whether or not having separate legal personality) or 2 or more of them and any reference to a particular person or entity (as so defined) includes a reference to that person's or entity's executors, administrators, successors, substitutes (including by novation) and assigns; (j) a regulation includes any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department or regulatory, self-regulatory or other authority or organisation and if not having the force of law, with which responsible entities in the position of the relevant Party would normally comply; (k) the words including, for example or such as when introducing an example do not limit the meaning of the words to which the example relates to that example or examples of a similar kind; (l) a provision of law or a regulation is a reference to that provision as amended or re-enacted and a reference to a statute includes all regulations, proclamations, ordinances and by laws issued under that statute and any law or regulation which varies, consolidates or replaces any of them; and (m) unless a contrary indication appears, a time of day is a reference to Sydney time. (2) The singular includes the plural and the plural includes the singular. (3) This document includes any annexure or schedule to it. (4) Section, clause and schedule headings are for ease of reference only. (5) Other parts of speech and grammatical forms of a word or phrase defined in this document have a corresponding meaning. (6) No provision of this document will be construed adversely to a Party because that Party was responsible for the preparation of this document or that provision. (7) If a Party comprises 2 or more persons: (a) a reference to that Party includes each and any 2 or more of them; and (b) this document binds each of them separately and any 2 or more of them jointly. (8) Unless the context indicates otherwise, where a day on or by which anything is to be done is not a Business Day, that thing must be done on or by the next Business Day. 1.3 Inconsistency (1) To the extent permitted by law, this document prevails to the extent it is inconsistent with any law. (2) If there is any inconsistency between any obligations of the Grantor to the Financiers relating to the Relevant Collateral that results in the Grantor being unable to comply with both of them, the obligations to the Commonwealth prevail.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 14 OFFICIAL: Sensitive // Legal-Privilege 1.4 Multiple Parties If a party to this document is made up of more than one person, or a term is used in this document to refer to more than one party, then unless otherwise specified in this document: (1) an obligation of those persons is joint and several; (2) a right of those persons is held by each of them severally; and (3) any other reference to that party or that term is a reference to each of those persons separately, so that (for example): (a) a representation, warranty or undertaking relates to each of them separately; and (b) a reference to that party or that term is a reference to each of those persons separately. 1.5 Designation as Finance Documents The Commonwealth and the Grantors agree this document is a “Finance Document” for the purposes of each of the Commonwealth New Loan Agreement and the Commonwealth Perpetual Loan Agreement. 2 Effectiveness of this document 2.1 Effectiveness Subject to the terms of this document, each Party is bound by this document with effect on and from the date of this document or from the date it becomes a Party pursuant to and in accordance with an Accession Deed. 2.2 Interdependence The parties agree that: (1) this document and the transactions contemplated under it are conditional on the occurrence of Restructure Effective Date; and (2) if for any reasons the Restructure Effective Date does not occur or is deemed not to have occurred, unless otherwise agreed by the parties: (a) this document will be deemed not to be effective; and (b) the transactions contemplated under this document will be deemed not to have been completed. 3 Consent Each Financier: (1) consents to the creation and existence of the Security; and (2) agrees that the creation or existence of a Security is not a breach of any other Security or any other documents relating to amounts secured by a Security, to which it is a party.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 15 OFFICIAL: Sensitive // Legal-Privilege 4 Priority of Security 4.1 Order of priority The Securities rank in the following order of priority: (1) in respect of the Specified Collateral: (a) first, the Commonwealth Security for aggregate amounts up to the Commonwealth Priority Amount; and (b) second, the Air T Security for aggregate amounts up to the Air T Priority Amount and any other money secured by the Air T Security; and (2) in respect of Relevant Collateral (other than the Specified Collateral): (a) first, the Air T Security for aggregate amounts up to the Air T Priority Amount; (b) second, the Commonwealth Security for aggregate amounts up to Commonwealth Priority Amount; and (c) third, the Air T Security for any other money secured by the Air T Security. 4.2 Ranking (1) The priority ranking in clause 4.1 applies regardless of any fact, matter or thing which may otherwise affect that ranking, including: (a) the order of registration, notice or execution of any document or Security; (b) the terms of any Security; (c) the order of attachment or perfection of any Security; (d) the manner in which a Security is perfected; (e) the repayment in whole or in part of any amount secured by a Security; (f) the grant by a Financier or any other person of any time, waiver or other indulgence or concession; (g) any partial discharge or release of a Security or of any person from any obligation in connection with a Security or any amount secured by it; (h) when any amount secured by a Security is incurred or becomes owing; (i) whether or when any Financer is obliged to advance any amount secured by a Security; (j) any fluctuation in the amount secured by a Security, or any intermediate discharge of, any amount secured by a Security; or (k) any other fact or circumstance which might otherwise alter or postpone the priorities. (2) Each Financier agrees to cooperate with each other of them in the implementation of the order of priority specified in clause 4.1.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 16 OFFICIAL: Sensitive // Legal-Privilege (3) Each Party acknowledges and agrees that the arrangements set out in this document are not intended to benefit and may not be enforced by any person other than a Party. 5 Distribution of Proceeds following Liquidation Event or other Enforcement Action 5.1 Order of application (1) Following the occurrence of any Enforcement Action or Liquidation Event, the Proceeds must be distributed by the Financiers in accordance with the following order of priority: (a) first, pari passu and rateably, (i) to the Commonwealth towards payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth New Loan Agreement in the applicable Relevant Portion; (ii) to the Commonwealth towards of payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth Perpetual Loan Agreement in the applicable Relevant Portion; (iii) to the Air T Security Trustee towards payment of the Debt owing by the Grantors to the Air T Security Trustee and the Air T Financiers in connection with the Air T New Cap Notes (up to a maximum amount equal to the Air T Priority Amount) in the applicable Relevant Portion (to be applied in the relevant order of application set out in the Air T Security Trust Deed), until the relevant Debt has been paid in full; (b) second, to the Commonwealth towards payment of the remaining Debt owing by the Grantors to the Commonwealth under the Commonwealth Perpetual Loan Agreement; and (c) third, to the Air T Security Trustee towards payment of any remaining Debt owing by the Grantors to the Air T Security Trustee and the Air T Financiers in connection with the Air T New Cap Notes in excess of the Air T Priority Amount (in the order applied in the relevant order of application set out in the Air T Security Trust Deed). (2) Each Party acknowledges that the obligations of the Financiers to account to each other under this document are subject to any applicable law to the contrary. 5.2 Contingent liabilities If a Security secures a contingent liability owed to a Financier, until the relevant Financier is satisfied that the contingent liability has been extinguished, the Financier may retain from the Proceeds an amount, consistent with: (1) prior to the occurrence of an Enforcement Action or Liquidation Event, the priority established under clause 4.1 subject to clause 9; (2) following the occurrence of an Enforcement Action or Liquidation Event, the priority established under clause 5.1(1), in each case, which it reasonably estimates to be the amount of the contingent liability.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 17 OFFICIAL: Sensitive // Legal-Privilege 5.3 Obligation to account (1) If a Financier receives Proceeds to which the other Financier is entitled under clause 5.1, that Financier must: (a) hold those Proceeds for the benefit of the other Financier, separately from its other assets; and (b) promptly account to the other Financier for the relevant Proceeds. (2) Any Proceeds paid by a Financier (payer) to the other Financier (recipient) in accordance with clause 5.3(1) will be deemed to have been paid by the Grantor to the recipient and the liability of the Grantor to the payer will not be reduced by reason of the payer's receipt of those Proceeds from the Grantor. (3) If the payer is required for any reason to repay to the Grantor or any other person (including a Controller of the Grantor) any amount paid to the recipient in accordance with clause 5.3(1), the recipient must immediately refund to the payer the amount which was paid to the recipient by the payer in accordance with clause 5.3(1) and the rights of the Parties will be adjusted accordingly. 5.4 Good discharge An acknowledgement of receipt signed by the relevant person to whom payments are to be applied under this clause 5 will discharge the payer. 6 Enforcement 6.1 Restriction on Enforcement Action Despite anything contained in any Security Agreement: (1) so long as the Air T New Cap Notes are not subject to a subsisting Principal Default Notice and no Step-In has occurred or a Waiver Notice is subsisting, the Air T Security Trustee and the Air T Financiers must not take Enforcement Action without the prior written consent of the Commonwealth; (2) if any Air T New Cap Note is subject to a subsisting Principal Default Notice and no Step-In Notice has been delivered in accordance with clause 10.1(1), the Air T Financiers and the Air T Security Trustee may only take Enforcement Action if the Air T Security Trustee has first provided the Commonwealth with at least 45 days prior notice of its intention to take Enforcement Action, including details of such proposed Enforcement Action and the basis for taking it; and (3) if any Air T New Cap Note is subject to a subsisting Principal Default Notice and a Step-In Notice has been delivered but no Purchase Notice has been delivered in accordance with clause 10.2(1) and the Option Period has expired, the Air T Financiers and the Air T Security Trustee may only take Enforcement Action if the Air T Security Trustee has first provided the Commonwealth with at least 45 days prior notice of its intention to take Enforcement Action, including details of such proposed Enforcement Action and the basis for taking it; and (4) solely to the extent necessary to preserve its Security Interest but not otherwise unless in accordance with this clause 6.1, a Financier may take Enforcement Action in respect of any Security Interest granted by a Grantor during the 'decision period' for the purposes of section 441A of the Corporations Act if an Administrator has been appointed to that Grantor, without the consent of the other Financier.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 18 OFFICIAL: Sensitive // Legal-Privilege 6.2 Rights not otherwise affected (1) Nothing in this document affects the rights of a Financier in respect of any Security Interest over any assets of the Grantor, other than the Relevant Collateral. (2) Subject to clause 6.1 a Financier may take Enforcement Action in respect of any Security Interest it holds for the payment of money secured by any of its Security in any order and in any manner it considers fit. 6.3 First priority Security to take precedence (1) If a Financier (First Financier) takes Enforcement Action in respect of any Relevant Collateral while it retains priority under clause 4.1: (a) the First Financier’s Enforcement Action will take precedence over any Enforcement Action taken by the other Financier (Second Financier); and (b) the Second Financier must do all things (including signing documents) reasonably requested by the First Financier to facilitate the First Financier’s Enforcement Action, including delivering to the First Financier promptly on request: (i) a duly executed release of each of the Second Financier’s Security as far as it relates to any Relevant Collateral being sold; (ii) any other document reasonably required by the First Financier to provide unencumbered title to any purchaser of any Relevant Collateral. (2) The First Financier is entitled to retain all documents of title to the Relevant Collateral while it retains priority in respect of that Relevant Collateral under clause 4.1 and the Grantor, the Air T Security Trustee and the Air T Financiers must promptly deliver all such documents of title held or controlled by either of them during that time to the Commonwealth. 6.4 No obligation to marshal A Financier is not obliged to marshal in favour of another Financier or the Grantor any right or Security held by it in relation to any money secured by a Security. 7 Sale of Relevant Collateral 7.1 Restriction on sale of Relevant Collateral Despite anything contained in any Security Agreement, at all times prior to the Termination Date: (1) no Specified Collateral may be sold without the prior written consent of the Commonwealth provided that such consent must not be unreasonably withheld with respect to up to 5 Saab aircraft comprised in the Existing Aircraft Fleet if the relevant Grantors demonstrate to the satisfaction of the Commonwealth that the continued holding, maintenance and operation of the relevant aircraft is not commercially or economically viable and the Grantors and Commonwealth agree that it is not necessary to hold the relevant aircraft for spare parts to maintain the reliability of the remaining Existing Aircraft Fleet; and (2) without limiting clause 7.1(1), no Relevant Collateral may be sold to an Air T Related Entity without the prior written consent of the Commonwealth.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 19 OFFICIAL: Sensitive // Legal-Privilege 7.2 Use of Relevant Collateral sale proceeds Unless a Liquidation Event has occurred or other Enforcement Action is continuing, the proceeds from the sale of any Relevant Collateral will be: (1) prior to the Cash Sweep Commencement Date, applied to support the regional airline business operated by the Grantors and provided that no such proceeds may be used to make any distribution to an Air T Financier or any Air T Related Entity nor to pay or repay any Air T Debt (including any management, advisory or other fee to or to the order of an Air T Financier, any Air T Related Entity or (if any) any other shareholders of a Group member); (2) on and from the Cash Sweep Commencement Date, in respect of proceeds from sale or other disposal of any Relevant Collateral, included as part of Available Cash Flow for the Relevant Period in which the sale occurred. 8 Air T payments 8.1 Air T Debt Each Grantor and each Air T Financier undertakes to the Commonwealth that the Grantors will not incur any Debt, and no Air T Financier will make available any Debt to the Grantors, exceeding the Air T Priority Amount without providing prior written notice to the Commonwealth. To the extent that any Debt is incurred or provided in excess of the Air T Priority Amount, the Air T Financiers acknowledge and agree that such Debt shall not form part of the Air T Priority Amount. 8.2 Subordination (1) Until the Termination Date: (a) the Grantors must not (and must ensure that no other member of the Group will): (i) declare, make or pay any Distribution (or interest on any unpaid Distribution) (whether in cash or in kind) as issuer of any Marketable Securities; (ii) repay, pay or distribute any dividend; (iii) pay or allow any member of the Group to pay any management, advisory or other fee to or to the order of an Air T Financier, any Air T Related Entity or (if any) any other shareholders of a Group member; or (iv) redeem, repurchase, defease, retire or repay any of its share or equity capital or membership interests or resolve to do so, in each case, other than: (v) a Permitted Payment; (vi) payment of any such amount by a member of the Group to a Grantor; and (b) each Air T Financier and each Grantor must comply with its obligations under this clause 8.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 20 OFFICIAL: Sensitive // Legal-Privilege (2) Nothing in this document creates a Security Interest over any asset of the Original Air T Financier. 8.3 Undertakings by the Grantors in relation to the Air T Financiers and its Related Entities The Grantors must not do any of the following except as permitted under clause 8.5 or as permitted by this document following a Liquidation Event or Enforcement Action: (1) pay or repay or make or receive any distribution in respect of, any Air T Debt, whether in cash or kind from any source; (2) pay or repay or make or receive any Restricted Distribution, whether in cash or kind from any source; (3) allow any of its Subsidiaries (as defined in the Corporations Act 2001 (Cth)) to purchase or acquire any of the Air T Debt; (4) allow any Air T Debt to be discharged in a manner inconsistent with this document, the Commonwealth New Loan Agreement or the Commonwealth Perpetual Loan Agreement; (5) allow to exist or grant the benefit of any Security Interest, guarantee, indemnity or other assurance against loss in respect of any Air T Debt (other than the Air T Security); (6) set off the Air T Debt against any money owing to the Grantors by an Air T Financier at any time or exercise any right of combination of accounts or similar right or procedure in relation to such money; (7) take or omit to take any action which might impair the priority achieved or intended to be achieved by this document; (8) may make any loans or other financial accommodation available to and Air T Financier or any Air T Related Entity, or discharge any liability or expenses of an Air T Financier or any Air T Related Entity) other than with the prior written consent of the Commonwealth; or (9) make any payments to an Air T Financier or any Air T Related Entity (in cash or in kind) from or on account of: (i) operating expenses; (ii) capital expenditure; (iii) permanent increases in working capital; (iv) the Maintenance Reserve Allocation; (v) or taxes (each a Cash Flow Deduction) unless in each case: (a) the amount paid can be substantiated by evidence reasonably acceptable to the Commonwealth; (b) the amount is a reimbursement or payment of costs and expenses of the Original Air Financier or an Air T Related Entity of the Original Air T Financier to third parties and which represent direct costs in connection with the Group evidenced by invoices (and which are a straight pass through cost with no premium or mark-up) (Direct Passthrough Expenses); (c) in respect of reimbursement or payment of costs of the Original Air T Financier or an Air T Related Entity of the Original Air T Financier, where: (i) the amount paid reflects an appropriate allocation of the Original Air T Financier or the Air T Related Entity of the Original Air T Financier of a shared expense;

APAC-#312808975-v19 © Norton Rose Fulbright Australia 21 OFFICIAL: Sensitive // Legal-Privilege (ii) such shared expense is not otherwise duplicating a similar expense incurred by the Group in its business operations; and (iii) the expenditure is generating value for the Grantors or otherwise represents an expense reduction or cost saving or ‘value add’ for the Grantors (which, on request from the Commonwealth (made no more than once annually), the Air T Financier will demonstrate in a report detailing the relevant value, expense reduction, cost saving or ‘value add’ that the Grantors have received from this expenditure); (d) the aggregate amount of all Cash Flow Deductions in any Half Year (excluding any Direct Passthrough Expenses) does not exceed the lesser of: (i) the ordinary corporate overhead expenses derived by standard allocation methodologies disclosed by Air T to the Commonwealth (and accepted by the Commonwealth); and (ii) the equivalent of 1.0% of the revenue for the Group for that Half Year (to be confirmed by reference to the audited financial reports of the Group to be delivered to the Commonwealth in accordance with the Commonwealth Finance Documents). 8.4 Undertakings of Air T Financiers (1) Each Air T Financier must not (and must ensure no Air T Related Entity will) do any of the following except as permitted under clause 8.5 or as permitted by this document following a Liquidation Event or Enforcement Action: (a) receive or allow any Restricted Distribution, whether in cash or kind from any source; (b) receive any loans or other financial accommodation made available from any Grantor, or allow any Grantor to discharge any liability or expenses of an Air T Financier or any Air T Related Entity; or (c) receive any payments (in cash or in kind) which comprise a Restricted Cash Flow Deduction (2) No Air T Financier may enter into any sub-participation, risk- participation or other funding arrangement that transfers either directly or indirectly the economic or commercial benefit of the Air T Debt to a third party (including any rights to vote in relation to matters concerning the Air T Debt) (each an Air T Debt Funding Arrangement) without the prior approval of the Commonwealth and: (a) without limiting the Commonwealth’s rights under this clause, if an Air T Financier proposes to enter into an Air T Debt Funding Arrangement that Air T Financier must notify the Commonwealth and provide the Commonwealth with such information and documents as it may reasonably require to enable it to consider whether to approve such Air T Debt Funding Arrangements; and (b) the parties agree and acknowledge that any Air T Debt Funding Arrangement entered into without the approval of the Commonwealth will not be binding on the other parties to this document.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 22 OFFICIAL: Sensitive // Legal-Privilege 8.5 Permitted Payments Despite any other provision of this document, the Grantors may make Permitted Payments and an Air T Financier may receive and retain Permitted Payments until the first to occur of: (1) an Event of Default; (2) an Insolvency Event in respect of the Grantor or an Air T Financier; (3) a Liquidation Event; (4) any Enforcement Action is taken; or (5) any continuing contravention by an Air T Financier, the Air Security Trustee or the Air T Facility Agent of any of its material obligations under this document. 8.6 Amendments to Air T documentation and dealings with Air T Debt Neither a Grantor, the Air T Security Trustee, the Air T Facility Agent nor an Air T Financier: (1) may amend, waive or release any term of any document or agreement entered into between an Air T Financier and the Grantors or any other person in connection with the Air T Security or the Air T Debt, except for: (a) an amendment consented to by the Commonwealth; (b) amendments, waivers or releases expressly permitted by this document (including any amendment, waiver or release in connection with an assignment, transfer or other dealing permitted pursuant to, and in accordance with, clause 8.6(2)); or (c) an amendment which: (i) is a procedural, administrative or other similar change; and (ii) does not prejudice any Commonwealth Debt, the Commonwealth or impair the subordination achieved or intended to be achieved by this document; (2) may consent to, permit or otherwise allow any assignment, transfer or other dealing with of all or any part of an Air T Financier’s or the Air T Security Trustee’s rights or obligations in respect of the Air T Debt (including by way of assignment, transfer or other disposal of the Air T New Cap Notes) to any person or persons (each a Substitute Air T Finance Party) unless: (a) the Substitute Air T Finance Party is acceptable to the Commonwealth (other than where such assignment, transfer or other dealing is in respect of the Air T Security Trustee where it is also assigning, transferring or otherwise dealing with its rights and/or obligations in connection with the Air T Security Trust Deed or Air T Security); and (b) the Substitute Air T Finance Party accedes to this document by execution of an Accession Deed and agrees to be bound by the terms of this document as if the Substitute Air T Finance Party were the Original Air T, an Air T Substitute Finance Party, the Air T Facility Agent or the Air T Security Trustee (as applicable); or

APAC-#312808975-v19 © Norton Rose Fulbright Australia 23 OFFICIAL: Sensitive // Legal-Privilege (3) may designate any document or agreement as a “Secured Agreement” for the purposes of any Air T Security without the prior written consent of the Commonwealth unless such document is directly related to or contemplated by the Air T New Cap Loan Notes as at the date of this document or in connection with any assignment, transfer or other dealing permitted pursuant to, and in accordance with, clause 8.6(2); (4) will register, or will lodge for registration, any irrevocable de-registration and export request authorisation with the Australian Civil Aviation Safety Authority in respect of any airframes or engines of any member of the Group that are subject to any Air T Security without the prior written consent of the Commonwealth or in connection with a disposal expressly permitted by this document. 8.7 Turnover of non-permitted payments (1) If at any time prior to the Termination Date: (a) an Air T Financier receives a payment or distribution in respect of any of the Air T Debt from a Grantor or any other source; (b) an Air T Financier, any Air T Related Entity, the Air Facility Agent or the Air T Security Trustee receives a payment or distribution which is a Restricted Distribution or a Restricted Cash Flow Deduction from a Grantor or any other source, (c) an Air T Financier receives the proceeds of any enforcement of any Security Interest or any guarantee or other assurance against financial loss for any Air T Debt, other than as allowed under this clause 8, the Air T Financier, the Air Facility Agent or the Air T Security Trustee (as the case may be) must hold the amount received by it (or in the case of Restricted Distribution or a Restricted Cash Flow Deduction received by an Air T Related Entity an amount equal to that Restricted Distribution or Restricted Cash Flow Deduction (as the case may be)) (up to a maximum of an amount equal to the Commonwealth Debt) for the benefit of the Commonwealth and immediately pay that amount (up to that maximum) to the Commonwealth for application against the Commonwealth Debt. (2) Each Air T Financier, the Air Facility Agent or the Air T Security Trustee grants a security interest over any personal property which is the subject of a trust arising under clause 8.7(1), for the purposes of section 268(2)(c)(iv) of the PPSA. That security interest secures payment of the Commonwealth Debt. (3) If, for any reason, any of the Air T Debt is discharged in any manner other than as allowed under this clause 8, the relevant Air T Financier or the Air Facility Agent (in either case, whether acting directly or through the Air T Security Trustee) or the Air T Security Trustee (as the case may be) must immediately pay an amount equal to the amount discharged to the Commonwealth for application against the Commonwealth Debt. (4) If, for any reason, any trust expressed to be created in this clause 8.7 should fail or be unenforceable, the relevant Air T Financier, the Air Facility Agent or the Air T Security Trustee (as the case may be) will promptly pay an amount equal to the receipt or recovery to the Commonwealth to be held on trust by the Commonwealth.

APAC-#312808975-v19 © Norton Rose Fulbright Australia 24 OFFICIAL: Sensitive // Legal-Privilege 8.8 Appropriations Subject to clause 5, until the Termination Date, the Commonwealth may: (1) refrain from applying any money in reduction of the Commonwealth Debt or taking steps to enforce any Security Interest in respect of the Commonwealth Debt; or (2) apply such money and enforce such Security Interest and rights in such manner and order as it sees fit (whether against those amounts or otherwise), without affecting the liability of an Air T Financier, the Air Facility Agent or the Air T Security Trustee under this clause 8; and (3) hold in an interest-bearing suspense account any moneys or distributions received from an Air T Financier, the Air Facility Agent or the Air T Security Trustee under this clause 8. 8.9 Permitted refinance of Air T New Cap Notes Without prejudice to clause 8.5, the Grantors may refinance the Air T New Cap Notes with new Debt solely for the purposes of making the Maturity Repayment (Air T Debt) (Refinance Debt) and provided the Refinance Debt satisfies each of the following: (1) the maximum principal amount of the Refinance Debt is equal to or less than the Air T Priority Amount as at the Maturity Repayment Date (Air T Debt); (2) the terms of the Refinance Debt are not materially more onerous than the terms of the covenants (such as reporting requirements, representations and warranties, undertakings and events of default) of the Air T New Cap Notes and the interest rate (including step-ups and default rates) and fees must be in aggregate no higher than the equivalent under the Air T New Cap Notes (as if all parties to the Air T New Cap Notes have complied with their obligations under this document regarding amendments and interest rates); (3) the financier(s) of the Refinance Debt are genuine third party lenders acceptable to the Commonwealth (acting reasonably) and to avoid doubt a lender that is a hedge fund, vulture fund or other financer dealing in distressed debt or subject to any international or Australian sanctions will not be acceptable to the Commonwealth (each Refinance Finance Party); and (4) each party to the Refinance Debt accedes to this document and agrees to be bound by this document such that this document will apply to the Refinance Debt and each Refinance Finance Party as if the Refinance Debt were Air T Debt and each Refinance Finance Party were the Original Air T Financier, an Air T Substitute Finance Party, the Air T Facility Agent and the Air T Security Trustee (as applicable). 9 Distributions of Excess Cash Flows and Insurance Proceeds prior to Liquidation Event or other Enforcement Action 9.1 Order of application of Excess Cash Flows (1) On each Payment Date occurring on or after the Cash Sweep Commencement Date and prior to a Liquidation Event or commencement of any other Enforcement Action, an amount equal to the Excess Cash Flow (if any) must be applied by the Grantors in the following proportions:

APAC-#312808975-v19 © Norton Rose Fulbright Australia 25 OFFICIAL: Sensitive // Legal-Privilege (a) to the Commonwealth in the applicable Relevant Portion of the Excess Cash Flow as determined for the Determination Date immediately preceding that Payment Date together with the applicable Relevant Portion of an adjustment amount payable in accordance with clause 11.3(5) on that Payment Date, to be applied by the Commonwealth as follows: (i) first, towards payment of the Debt owing to the Commonwealth under the Commonwealth New Loan Agreement; and (ii) second, towards payment of the Debt owing to the Commonwealth under the Commonwealth Perpetual Loan Agreement; and (b) subject to clause 9.1(2), to the Air T Facility Agent towards payment of Debt owing to the Air T Financiers in respect of the Air T New Cap Notes in the applicable Relevant Portion of the Excess Cash Flow as determined for the Determination Date immediately preceding that Payment Date together with the applicable Relevant Portion of an adjustment amount payable in accordance with clause 11.3(5) on that Payment Date. (2) If the Company has paid the NSW Stamp Duty Amount, an amount equal to that amount shall be retained by the Group for use in its business and the amount of any Excess Cash Flow payable to the Air T Facility Agent after the payment of the NSW Stamp Duty Amount shall be reduced by the amount of the NSW Stamp Duty Amount (until utilised in full). 9.2 Order of application of Insurance Proceeds (1) At all times prior to a Liquidation Event or commencement of any other Enforcement Action, the Insurance Proceeds in respect of any Relevant Collateral must be applied by the Grantors in accordance with the following order of priority: (a) Insurance Proceeds in respect of Specified Collateral: (i) first, to the Commonwealth towards payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth New Loan Agreement until that Debt has been repaid in full; (ii) second, to the Commonwealth towards payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth Perpetual Loan Agreement until that Debt has been repaid in full; (iii) third, to the Air T Facility Agent until the Air T Priority Amount and any other money secured by the Air T Security has been paid in full; and (iv) fourth, to the relevant Grantor. (b) Insurance Proceeds in respect of Relevant Collateral (other than Specified Collateral): (i) first, to the Air T Facility Agent until the Air T Priority Amount has been paid in full: (ii) second, to the Commonwealth towards payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth New Loan Agreement until that Debt has been repaid in full;

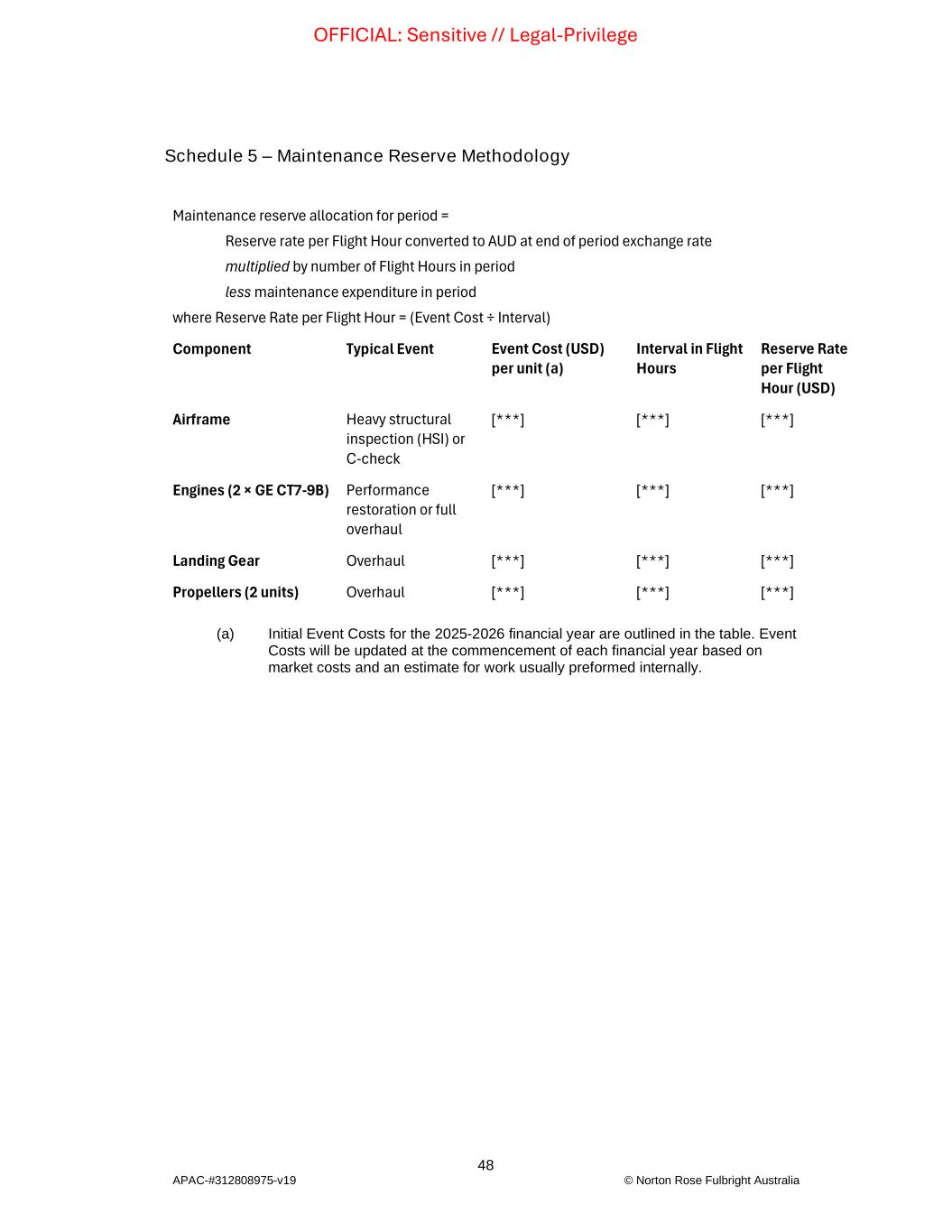

APAC-#312808975-v19 © Norton Rose Fulbright Australia 26 OFFICIAL: Sensitive // Legal-Privilege (iii) third, to the Commonwealth towards payment of the Debt owing by the Grantors to the Commonwealth under the Commonwealth Perpetual Loan Agreement until that Debt has been repaid in full; (iv) fourth, to the Air T Facility Agent until any other money secured by the Air T Security has been paid in full; and(v)fifth, to the relevant Grantor. 10 Commonwealth step-in right and purchase option 10.1 Commonwealth step-in right (1) If a Principal Default Notice is subsisting for a least 30 days from the date of the non-payment giving rise to that Principal Default Notice (or would have been if a Principal Default Notice was issued when it should have been in accordance with this document), the Commonwealth may, if the Principal Default Notice subsists, give a notice to the Air T Facility Agent, the Air T Financiers and the Grantors (Step-In Notice): (a) of its intention to exercise its rights under this clause 10.1; (b) specifying a Business Day on which the Commonwealth (or its nominee) proposes to (Step-In Date): (i) acquire all equity (however so defined) in the Company and the Group for A$1.00; and (ii) replace all members of the board of directors of the Company and the Group with its appointees; and (c) by giving the Step-In Notice the Commonwealth (or its nominee) agrees to acquire all equity (however so defined) in the Company and the Group for A$1.00 and to appoint all members of the board of directors of the Company and the Group on the Step-In Date (Step-In). (2) The Air T Financiers agree to (and procure the applicable equity holder(s) in the Company and the Group will) take all steps necessary or desirable to give effect to the Step-In on the Step-In Date and to do anything the Commonwealth reasonably asks (such as obtaining consents, signing and producing documents and getting documents completed and signed) to effect the Step-In. 10.2 Commonwealth option to purchase Air T New Cap Notes (1) If a Principal Default Notice is subsisting and the Commonwealth has issued a Step-In Notice, the Commonwealth may (but is not obliged to) at any time until and including the date falling 90 days after the Step-In Date (Option Period) give a notice to the Air T Facility Agent, the Air T Financiers and the Grantors (Purchase Notice): (a) of its intention to exercise its rights under this clause 10.2; (b) specifying a Business Day no later than the first Business Day to occur after the expiry of the Option Period on which the Commonwealth (or its nominee) proposes to (Purchase Date) acquire all of the Debt to owing to the Air T Financiers in respect of the Air T New Cap Notes for the Purchase Price; and