Dated General security deed Parties Each person named in Schedule 1 Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) Norton Rose Fulbright Australia Level 5, 60 Martin Place Sydney NSW 2000 Tel: +61 9330 8000 nortonrosefulbright.com Our ref: 4081080

APAC-#313417837-v4 © Norton Rose Fulbright Australia Contents 1 Definitions and interpretation .................................................................................................. 1 1.1 Definitions .................................................................................................................. 1 1.2 Interpretation .............................................................................................................. 3 1.3 Commonwealth Facility Agreement definitions.......................................................... 3 1.4 Parties ........................................................................................................................ 3 2 The Security............................................................................................................................ 4 2.1 Grant of security ........................................................................................................ 4 2.2 Mandatory requirement.............................................................................................. 4 2.3 Priority ........................................................................................................................ 4 2.4 Security continues ..................................................................................................... 4 3 Grantors must pay Secured Money ........................................................................................ 4 4 Dealing with Collateral ............................................................................................................ 4 4.1 Restricted dealings .................................................................................................... 4 4.2 Permitted dealings ..................................................................................................... 5 4.3 Revolving Assets ....................................................................................................... 5 4.4 Conversion to Revolving Assets ................................................................................ 5 4.5 Inventory .................................................................................................................... 5 4.6 Creation of other Security Interest without consent ................................................... 5 5 Representations and warranties ............................................................................................. 6 5.1 Commonwealth Finance Document representations ................................................ 6 5.2 Status of Collateral .................................................................................................... 6 5.3 Future property .......................................................................................................... 6 5.4 Repetition ................................................................................................................... 6 5.5 Reliance ..................................................................................................................... 6 5.6 Survival ...................................................................................................................... 7 6 Undertakings........................................................................................................................... 7 6.1 Documents of Title ..................................................................................................... 7 6.2 Control and possession ............................................................................................. 7 6.3 Marketable Securities ................................................................................................ 7 6.4 Change of details ....................................................................................................... 8 6.5 Default........................................................................................................................ 8 6.6 Serial Numbered Collateral ....................................................................................... 8 6.7 Chattel Paper ............................................................................................................. 8 6.8 Collect accounts ........................................................................................................ 8 6.9 PPSA policies and steps............................................................................................ 8 7 Deposit Account ..................................................................................................................... 9 7.1 Open and maintain Deposit Account ......................................................................... 9 7.2 Deposit proceeds in the Deposit Account .................................................................. 9 7.3 Operation of the Deposit Account .............................................................................. 9 7.4 Deposit Account with nominated authorised deposit taking institution ...................... 9 8 Collection and transfer of Collateral .....................................................................................10 8.1 Exercise of rights by Secured Party ........................................................................10 8.2 Accounts receivable .................................................................................................10 8.3 Authorisations ..........................................................................................................10

APAC-#313417837-v4 © Norton Rose Fulbright Australia 8.4 Marketable Securities ..............................................................................................10 9 Enforcement .........................................................................................................................11 9.1 Rights of Secured Party following default ................................................................11 9.2 Cessation of dealings ..............................................................................................11 10 Receivers ..............................................................................................................................11 10.1 Appointment of Receiver .........................................................................................11 10.2 Receiver as agent ....................................................................................................12 10.3 Powers - general ......................................................................................................12 10.4 Powers - specific ......................................................................................................12 10.5 General ....................................................................................................................15 11 Exercise of default rights ......................................................................................................15 11.1 No hindrance ...........................................................................................................15 11.2 Performance of obligations ......................................................................................15 11.3 Secured Party in possession ...................................................................................16 11.4 Exclusion of laws .....................................................................................................16 11.5 Order of enforcement ...............................................................................................16 11.6 Indemnity .................................................................................................................16 12 Application of money ............................................................................................................16 12.1 Application ...............................................................................................................16 12.2 Order of payment .....................................................................................................16 12.3 Creditor’s certificate and disputes ...........................................................................17 12.4 No interest on Remedy Proceeds ............................................................................17 12.5 Payment into bank account .....................................................................................17 12.6 Contingent and prospective indebtedness ..............................................................17 12.7 Payments during default notice period ....................................................................18 12.8 Accounting for Remedy Proceeds ...........................................................................18 13 Third party dealings ..............................................................................................................18 13.1 Secured Party’s receipts and discharges ................................................................18 13.2 No challenge to disposal..........................................................................................18 13.3 No duty to enquire ...................................................................................................19 14 Statutory powers and notices ...............................................................................................19 14.1 Exclusion of PPSA provisions .................................................................................19 14.2 Exercise of rights by Secured Party ........................................................................19 14.3 No notice required unless mandatory ......................................................................20 14.4 Appointment of nominee for PPSR registration .......................................................20 15 Preservation of rights ............................................................................................................20 15.1 Primary obligations ..................................................................................................20 15.2 Preservation of Grantor’s obligations ......................................................................20 15.3 Suspension of each Grantor’s rights .......................................................................21 15.4 Insolvency of Grantor ...............................................................................................21 15.5 No merger ................................................................................................................22 15.6 Subsequent interests ...............................................................................................22 16 Assignments and transfers ...................................................................................................22 16.1 Assignments and transfers by the Secured Party ...................................................22 16.2 Grantor authorises assignment or transfer ..............................................................22 16.3 Assignment and transfer by a Grantor .....................................................................23 17 Set-off ...................................................................................................................................23

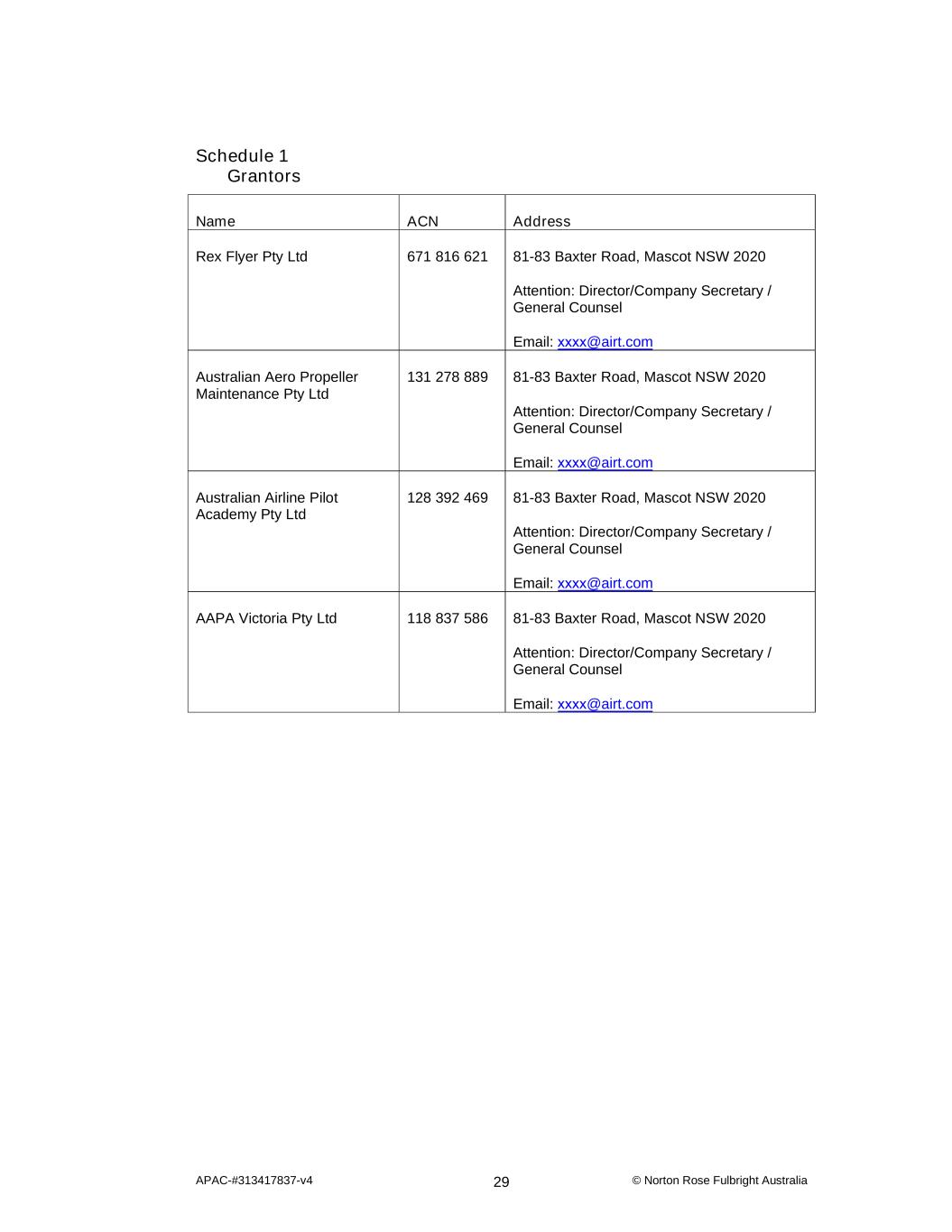

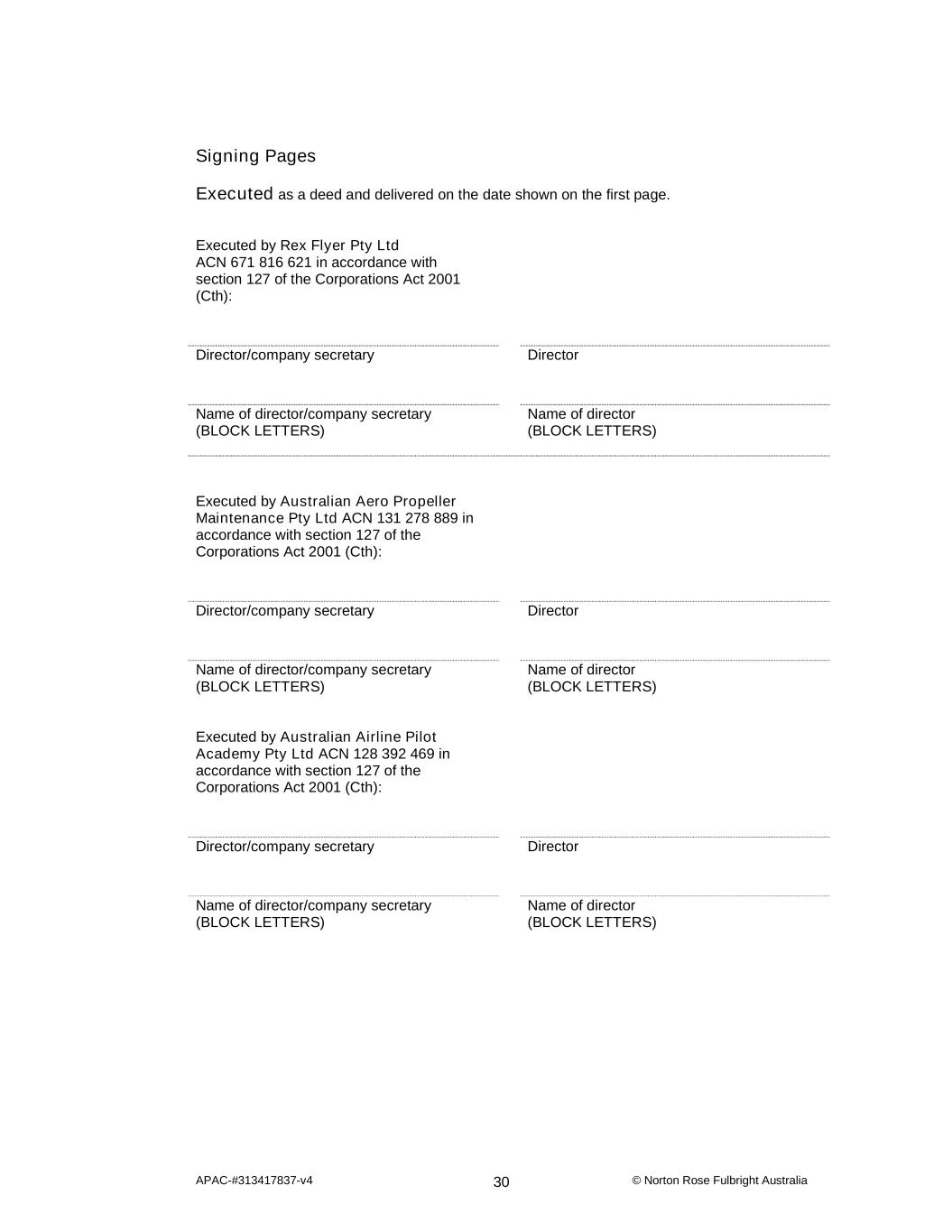

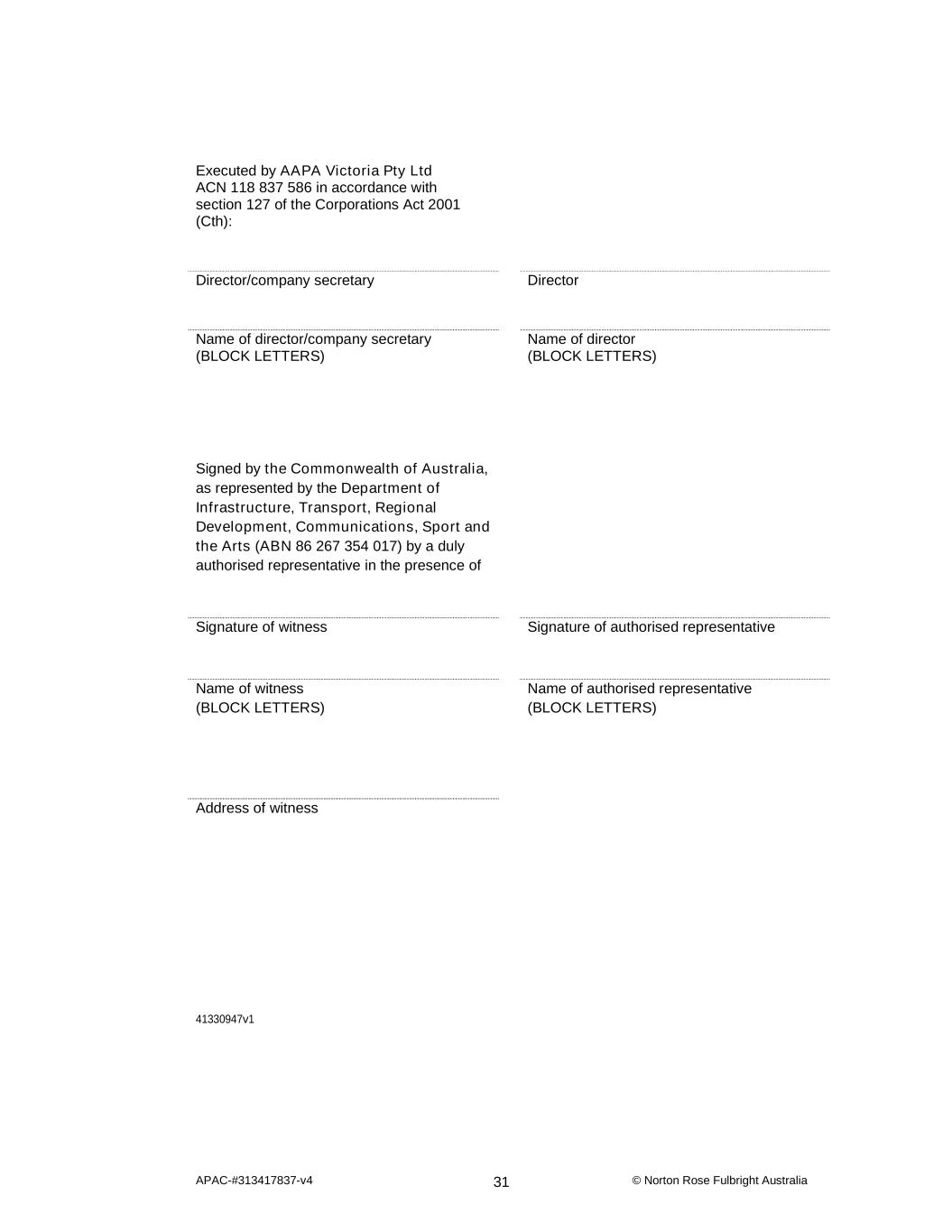

APAC-#313417837-v4 © Norton Rose Fulbright Australia 18 Notices ..................................................................................................................................23 19 Calculations and certificates .................................................................................................23 19.1 Accounts ..................................................................................................................23 19.2 Certificates and determinations ...............................................................................23 19.3 Reinstatement of rights of Secured Party ................................................................23 20 Attorney ................................................................................................................................24 20.1 Appointment .............................................................................................................24 20.2 General ....................................................................................................................25 21 Release .................................................................................................................................25 22 Further assurances ...............................................................................................................25 22.1 Notice to Grantor .....................................................................................................25 22.2 Compliance with notice ............................................................................................26 22.3 Commonwealth Finance Document ........................................................................26 22.4 Authority to complete blanks ...................................................................................26 23 General .................................................................................................................................26 23.1 Amendments ............................................................................................................26 23.2 Waiver ......................................................................................................................26 23.3 Cumulative rights .....................................................................................................27 23.4 Moratorium legislation ..............................................................................................27 23.5 Partial invalidity ........................................................................................................27 23.6 No liability ................................................................................................................27 23.7 Indemnities and reimbursement ..............................................................................27 23.8 Waiver of immunity ..................................................................................................27 23.9 Execution by attorney ..............................................................................................28 23.10 Electronic execution and exchange of counterparts ................................................28 24 Governing law and jurisdiction..............................................................................................28 24.1 Governing law ..........................................................................................................28 24.2 Jurisdiction ...............................................................................................................28 Schedule 1 Grantors .........................................................................................................................29 Signing Pages ...................................................................................................................................30

APAC-#313417837-v4 © Norton Rose Fulbright Australia1 Deed made 2025 Parties Each person named in Schedule 1 (Grantor) Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) of 111 Alinga Street Canberra, ACT 2601 (Secured Party) It is agreed 1 Definitions and interpretation 1.1 Definitions In this document the following definitions apply unless the context indicates otherwise: (1) Attorney means an attorney (including any delegate) appointed under this document; (2) Authorisation means (a) an authorisation, consent, approval, resolution, licence, exemption, filing or registration; or (b) in relation to anything which will be fully or partly prohibited or restricted by law if a Government Agency intervenes or acts in any way within a specific period after lodgement, filing, registration or notification, the expiry of that period without intervention or action; (3) Chattel Paper has the meaning given to that expression in the PPSA; (4) Collateral means all of each Grantor’s present and after-acquired property. It includes anything in respect of which each Grantor has at any time a sufficient right, interest or power to grant a Security Interest; (5) Collateral Security means any document that grants a Security Interest to the Secured Party, any guarantee in favour of the Secured Party or other document or agreement at any time created or entered into in connection with or as security for any Secured Money; (6) Commonwealth Facility Agreement means the document titled “Commonwealth Facility Agreement” between, among others, Rex and the Secured Party dated 11 November 2024, as amended from time to time; (7) Commonwealth Finance Document has the meaning given to that term in the Commonwealth Facility Agreement;

APAC-#313417837-v4 © Norton Rose Fulbright Australia2 Control Event means: in respect of any Collateral that is, or would have been, a Revolving Asset: (a) a Grantor breaches, or attempts to breach clause 4.1 in respect of the Collateral or takes any step which would result in it doing so; (b) a person takes a step (including signing a notice or direction) which may result in Taxes, or an amount owing to an authority, ranking ahead of the security interest in the Collateral under this document; (c) distress is levied or a judgment, order or Security Interest is enforced over the Collateral; and (d) the Secured Party gives a notice to a Grantor that the Collateral is not a Revolving Asset. (However, the Secured Party may only give a notice if the Secured Party reasonably considers that it is necessary to do so to protect its rights under this document or if an Event of Default is continuing). (8) Deposit Account means any account that the Secured Party requires a Grantor to open and maintain under clause 7; (9) Documents of Title means any document evidencing a Grantor’s title to any Collateral, whether an original, duplicate or counterpart and includes a share certificate, a unit certificate, a real property certificate of title and a ‘document of title’ (as defined in the PPSA); (10) Event of Default has the meaning given to that term in a Commonwealth Finance Document; (11) Marketable Securities means: (a) ‘intermediated securities’ and ‘investment instruments’ (each as defined in the PPSA); (b) an undertaking referred to in the exceptions in paragraphs (a), (b) and (c) of the definition of ‘debenture’ in the Corporations Act; (c) a unit or other interest in a trust or partnership; and (d) a right or an option in relation to any of the above, whether issued or unissued; (12) New Facility Agreement means the document titled “Facility Agreement” between, among others, the Grantors and the Secured Party dated on or about the date of this document (as amended from time to time); (13) Party means a party to this document; (14) Permitted Security Interest has the same meaning as in the New Facility Agreement; (15) PPSA means the Personal Property Securities Act 2009 (Cth); (16) PPSR has the meaning given to the term ‘register’ in the PPSA; (17) Receiver means a receiver or receiver and manager;

APAC-#313417837-v4 © Norton Rose Fulbright Australia3 (18) Remedy Proceeds means money received by the Secured Party, Receiver or Attorney from the exercise of any right, including enforcement, against the Collateral; (19) Revolving Asset means any Collateral: (a) which is: (i) inventory; (ii) a negotiable instrument; (iii) machinery, plant, or equipment which is not inventory and has a value of less than A$1000 or its equivalent; (iv) money (including money withdrawn or transferred from an account with a bank or other financial institution); and (b) in relation to which no Control Event has occurred, subject to clause 4.4; (20) Rex means Regional Express Holdings Limited (ACN 099 547 270); (21) Secured Money has the meaning given to that expression in the Commonwealth Facility Agreement; (22) Security means each Security Interest created by this document; (23) Security Interest means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement, notice or arrangement having a similar effect, including any "security interest" as defined in sections 12(1) or (2) of the PPSA; and (24) $ or A$ means the lawful currency of Australia. 1.2 Interpretation Clause 1.2of the Commonwealth Facility Agreement applies as if incorporated into this document and in any notice given under or connection with this document as if all references in that clause to the Commonwealth Facility Agreement are a reference to this document or the notice. 1.3 Commonwealth Facility Agreement definitions Terms and expressions defined in the Commonwealth Facility Agreement apply in this document unless that term or expression is defined in this document or the context indicates otherwise. 1.4 Parties If the Grantor comprises 2 or more persons: (1) a reference to the Grantor includes each and any 2 or more of them; and (2) this document binds each of them separately and any 2 or more of them jointly.

APAC-#313417837-v4 © Norton Rose Fulbright Australia4 2 The Security 2.1 Grant of security (1) Each Grantor grants a security interest in the Collateral to the Secured Party to secure payment of the Secured Money. (2) This security interest is: (a) a transfer by way of security of: (i) Collateral consisting of accounts as defined in the PPSA and Chattel Paper which are not, or cease to be, Revolving Assets; (b) a charge over all other Collateral. If for any reason it is necessary to determine the nature of this charge, it is a floating charge over Revolving Assets and a fixed charge over all other Collateral. 2.2 Mandatory requirement If a law requires that something must be done before a Grantor may validly grant a Security Interest over any of the Collateral, to the extent required, the Security only takes effect in relation to that Collateral when the thing required is done. 2.3 Priority Each Grantor acknowledges that: (1) the Security is intended to take priority over all other Security Interests over the Collateral except for the Permitted Security, those Security Interests which are mandatorily required by any applicable law to have priority; and (2) nothing in this document is intended as an agreement by the Secured Party to subordinate the Security to any other Security Interest in the Collateral. 2.4 Security continues Any dealing with any Collateral on the terms permitted by clause 4.2 will not release or extinguish the Security unless the dealing is the absolute transfer of all of the relevant Grantor’s right, title and interest in the relevant Collateral. 3 Grantors must pay Secured Money The Grantors must pay the Secured Money in accordance with the Commonwealth Finance Documents. 4 Dealing with Collateral 4.1 Restricted dealings Each Grantor must not do, or agree to do, any of the following unless it is permitted to do so by another provision in a Commonwealth Finance Document: (1) create or allow another interest in the Collateral; or (2) dispose, or part with possession, of any Collateral.

APAC-#313417837-v4 © Norton Rose Fulbright Australia5 4.2 Permitted dealings Each Grantor may do any of the following in the ordinary course of that Grantor’s ordinary business unless it is prohibited from doing so by another provision in a Commonwealth Finance Document: (1) create or allow any interest in, or dispose or part with possession of, any Collateral which is a Revolving Asset; and (2) withdraw or transfer money from an account with a bank or other financial institution. 4.3 Revolving Assets If a Control Event occurs in respect of any Collateral then automatically: (1) that Collateral is not (and immediately ceases to be) a Revolving Asset; (2) any floating charge over that Collateral immediately operates as a fixed charge; (3) any Collateral consisting of accounts as defined in the PPSA and Chattel Paper is transferred to the Secured Party by way of security; and (4) the relevant Grantor may no longer deal with the Collateral under clause 4.2. 4.4 Conversion to Revolving Assets If any Collateral is not, or ceases to be, a Revolving Asset, the Secured Party may give the relevant Grantor a notice stating that, from a date specified in the notice, the Collateral specified in the notice is a Revolving Asset, or becomes subject to a floating charge or is transferred back to the relevant Grantor. This may occur any number of times. 4.5 Inventory Any inventory which is not a Revolving Asset is specifically appropriated to the Security. A Grantor may not remove it without obtaining the specific and express authority of the Secured Party to do so. 4.6 Creation of other Security Interest without consent (1) If a law entitles a Grantor to create or allow another Security Interest (other than a Permitted Security) in connection with the Collateral without the consent of the Secured Party, the Grantor must, before creating or allowing any such Security Interest: (a) notify the Secured Party of its proposal to grant the Security Interest; and (b) if requested by the Secured Party, enter into a priority agreement with the Secured Party and the proposed recipient of the other Security Interest (Recipient), granting the Security a first ranking position in respect of the relevant Collateral in a form acceptable to the Secured Party and procure entry by the Recipient into the priority agreement. (2) If the Grantor does not comply with clause 4.6(1), further financial accommodation which would form part of the Secured Money may not, at the

APAC-#313417837-v4 © Norton Rose Fulbright Australia6 discretion of the Secured Party, be made available under any Commonwealth Finance Document. (3) The Secured Party’s rights under this clause 4.6 are in addition and without prejudice to the other rights of the Secured Party under the Commonwealth Finance Documents. 5 Representations and warranties 5.1 Commonwealth Finance Document representations Each Grantor: (1) represents and warrants that all representations and warranties given in any Commonwealth Finance Document are correct and not misleading or will be when given; and (2) makes the representations and warranties set out in this clause 5 to the Secured Party on the date of this document and on each other date set out in clause 5.4. 5.2 Status of Collateral Each Grantor represents and warrants that: (1) it is the sole legal and beneficial owner of, or otherwise has or will have sufficient right, interest or power to grant a Security Interest in the Collateral; and (2) no Security Interest exists over all or any of the Collateral, apart from the Permitted Security and no person has any other interest in or claim to any Collateral, in each case, other than as expressly permitted by a Commonwealth Finance Document. 5.3 Future property When a Grantor acquires any Collateral or the Collateral comes into existence after the date of this document, the Grantor is deemed to have given the representations and warranties set out in this clause 5 in relation to that Collateral. 5.4 Repetition The representations and warranties in this clause are taken to be repeated on each date that any representation or warranty in the Commonwealth Facility Agreement is repeated on the basis of the facts and circumstances as at that date. 5.5 Reliance (1) Each Grantor acknowledges that it has not entered into this document or any other Commonwealth Finance Document in reliance on any representation, warranty, promise or statement made by or on behalf of the Secured Party. (2) Each Grantor acknowledges that the Secured Party has entered into each Commonwealth Finance Document in reliance on the representations and warranties given by the Grantor under this document.

APAC-#313417837-v4 © Norton Rose Fulbright Australia7 5.6 Survival All representations and warranties in any Commonwealth Finance Document survive the execution and delivery of the Commonwealth Finance Documents and the provision of advances and accommodation. 6 Undertakings The obligations and undertakings in this clause 6 remain in full force from the date of this document for so long as the Secured Money or any other amounts are outstanding under any Commonwealth Finance Document. 6.1 Documents of Title Subject to clause 6.2, each Grantor must deliver all Documents of Title to the Secured Party: (1) on or prior to the date of this document; or (2) in the case of Collateral which is acquired or comes into existence after the date of this document, immediately upon acquisition or creation of that Collateral. 6.2 Control and possession If the Collateral includes Marketable Securities or other property which can be subject to ‘control’ or ‘possession’ (each as defined in the PPSA) by a secured party, each Grantor must promptly do anything that the Secured Party requires to enable it to perfect the Security over the relevant Collateral by control or by possession (and otherwise in the manner requested by the Secured Party), including delivery of Documents of Title under clause 6.1 except where (and for so long as): (1) control has been given to the holder of a Permitted Security; (2) it is not possible for more than one party to effect control over the Collateral; and (3) the Secured Party has expressly agreed in writing to subordinate the Security to that Permitted Security. 6.3 Marketable Securities If the Collateral includes Marketable Securities, each Grantor must: (1) notify the Secured Party as soon as it becomes aware of: (a) any right or entitlement it may take up or exercise arising directly or indirectly at any time from or in relation to the Marketable Securities and exercise all such rights and entitlements in accordance with any instructions from the Secured Party (to the extent not inconsistent with any instructions received from the holder of a Permitted Security where the exceptions in clauses 8.2(1) to 8.2(3) are satisfied); (b) any proposal or action taken to convert any Collateral comprising certificated Marketable Securities into uncertificated Marketable Securities and immediately take any steps necessary to comply with its obligations under clause 6.2; and

APAC-#313417837-v4 © Norton Rose Fulbright Australia8 (2) not do anything (including by exercising its voting rights) or fail to do anything which could entitle any person to a lien or other Security Interest (other than pursuant to a Permitted Security) over any of the Marketable Securities or which could result in the forfeiture of the Marketable Securities or adversely affect the value of the Marketable Securities. 6.4 Change of details Each Grantor must notify the Secured Party: (1) on becoming aware that it has received, or is likely to receive, an ACN, ABN, ARBN or ARSN, (in its own capacity or as trustee) under which it holds any Collateral; and (2) at least 14 days before applying for such a new number. 6.5 Default A Grantor must not cause or permit any Event of Default to occur. 6.6 Serial Numbered Collateral Each Grantor must: (1) at the request of the Secured Party, promptly provide details of any serial numbered Collateral to the Secured Party, including all information necessary for the Secured Party to make an effective registration on all applicable registers in respect of serial numbered Collateral; (2) ensure that all serial numbers and other information provided to the Secured Party in connection with any serial numbered collateral is and remains accurate in all respects; and (3) not change or remove the serial number of any serial numbered collateral after the Grantor has disclosed the serial number to the Secured Party. 6.7 Chattel Paper A Grantor must, at the request of the Secured Party, promptly give possession of any Chattel Paper to the Secured Party. 6.8 Collect accounts Unless the Secured Party directs otherwise, each Grantor must procure prompt collection of that Grantor’s trade debts or other debts and accounts receivable and the Secured Party appoints that Grantor as its agent for that purpose. 6.9 PPSA policies and steps If: (1) a Grantor holds any security interests as defined in the PPSA (PPSA Security Interests); and (2) a failure by that Grantor to perfect any of the PPSA Security Interests referred to in paragraph (1) would or would be likely to have a material adverse effect, that Grantor must (at its own cost):

APAC-#313417837-v4 © Norton Rose Fulbright Australia9 (a) provide evidence to the Secured Party that the Grantor has in place procedures for the perfection of those PPSA Security Interests, being procedures which ensure that the Grantor takes all reasonable steps to obtain the highest ranking priority possible under the PPSA in respect of those PPSA Security Interests (Procedures); and (b) keep the Procedures up to date and comply with the Procedures. 7 Deposit Account 7.1 Open and maintain Deposit Account The Secured Party may, at any time, require a Grantor to open and maintain a Deposit Account with an authorised deposit taking institution nominated by the Secured Party. 7.2 Deposit proceeds in the Deposit Account (1) While an Event of Default is continuing, each Grantor must deposit in the Deposit Account: (a) any proceeds that the Grantor receives under any insurance policy in relation to the Collateral; (b) any proceeds of any actual or contingent debt or monetary obligation owed to the Grantor which forms part of the Collateral; (c) any proceeds of sale, disposal or other dealing with any Collateral; and (d) any other proceeds that the Secured Party may designate for this purpose. (2) Clause 7.2(1) does not apply to proceeds received from any workers’ compensation or public liability policy or reinstatement policy to the extent that the proceeds are paid to a person: (a) entitled to be compensated under the workers’ compensation or public liability policy; or (b) under a contract for the reinstatement of the Collateral (being a contract which has been approved by the Secured Party). 7.3 Operation of the Deposit Account Withdrawals may only be made from the Deposit Account with the prior written consent of the Secured Party. 7.4 Deposit Account with nominated authorised deposit taking institution Where a Grantor is permitted to open the Deposit Account with an authorised deposit taking institution (Account Bank), the Grantor must obtain an agreement from the Account Bank in form and substance satisfactory to the Secured Party which allows the Secured Party to direct disposition of the funds from the Deposit Account without reference to or consent from the Grantor and includes agreement by the Account Bank that it: (1) will not repay any money in the Deposit Account to a Grantor or any other person without the prior written consent of the Secured Party;

APAC-#313417837-v4 © Norton Rose Fulbright Australia10 (2) agrees to postpone the priority of any Security Interest held by it at any time in respect of the Deposit Account to the Security and will not exercise its rights under any such Security Interest without the prior written consent of the Secured Party; and (3) waives all rights of set-off and combination in respect of the Deposit Account. 8 Collection and transfer of Collateral 8.1 Exercise of rights by Secured Party The Secured Party may exercise its rights under this clause 8 at any time after an Event of Default has occurred. 8.2 Accounts receivable The Secured Party may notify a Grantor that: (1) the Grantor is prohibited from collecting the Grantor’s trade debts or other debts and accounts receivable; and (2) the Secured Party will collect those trade debts or other debts and accounts receivable in which case the Grantor agrees: (a) to notify its debtors of the Secured Party’s interest; (b) that the Secured Party may prepare and send invoices in relation to the Grantor’s trade debts or other debts and accounts receivable; and (c) to use its best endeavours to assist the Secured Party in collecting the Grantor’s trade debts or other debts and accounts receivable. 8.3 Authorisations The Secured Party may request that any Authorisation that is required in relation to any business activity carried on by any Grantor, the Collateral or any of a Grantor’s property or that of its Subsidiaries is transferred to the Secured Party or its nominee and the Grantor agrees to use its best endeavours to ensure that transfer is completed. 8.4 Marketable Securities The Secured Party may do any one or more of the following: (1) require a Grantor to pay all cash dividends, charges, fees or other amounts distributed, declared or paid on or in connection with Collateral which comprises Marketable Securities to the Secured Party or as it may direct; (2) direct a Grantor how to exercise its voting rights in respect of Collateral comprising Marketable Securities and the Grantor must comply with any such requirement or direction; and (3) procure itself or its nominee to be registered as the holder of any Collateral which comprises Marketable Securities and each Grantor irrevocably authorises the Secured Party to do all things necessary for that purpose.

APAC-#313417837-v4 © Norton Rose Fulbright Australia11 9 Enforcement 9.1 Rights of Secured Party following default In addition to any other rights provided by law or under this or any other Commonwealth Finance Document, at any time after an Event of Default has occurred: (1) each Security Interest arising under this document or any Collateral Security becomes immediately enforceable; (2) the Secured Party may at any time, by notice to each Grantor, declare all or any part of the Secured Money to be due and payable immediately, on demand or at a later date as the Secured Party may specify in the notice; and (3) the Secured Party: (a) may, in the name of a Grantor or otherwise, at any time, do anything that a Grantor, or if a Grantor is a corporation or a trust, its directors or trustee (as the case may be), could do in relation to the Collateral; (b) has all other rights conferred by law in relation to the Collateral; and (c) may do anything that a Receiver may do under clause 10. 9.2 Cessation of dealings Despite any other provision of any Commonwealth Finance Document (but without limiting the operation of clause 4.3), any right which a Grantor has under any Commonwealth Finance Document to deal with any Collateral (other than by or through a Receiver appointed by the Secured Party) ceases immediately if any of the following occur: (1) all of the Secured Money becomes immediately due and payable; (2) a Grantor becomes Insolvent; or (3) the Secured Party takes any step to enforce the Security. 10 Receivers 10.1 Appointment of Receiver (1) In addition to the powers under clause 9 and without prejudice to any of its other rights, the Secured Party may appoint any one or more persons as Receiver to any part of the Collateral at any time after an Event of Default has occurred. (2) In exercising the power to appoint a Receiver, the Secured Party may: (a) appoint a different Receiver for different parts of the Collateral; (b) if more than one person is appointed as Receiver of any part of the Collateral, empower them to act jointly or jointly and separately; (c) remove the Receiver, appoint another in substitution if the Receiver is removed, retires or dies; and

APAC-#313417837-v4 © Norton Rose Fulbright Australia12 (d) fix the remuneration of the Receiver. 10.2 Receiver as agent (1) Subject to clauses 10.2(2) and 10.2(3), a Receiver will be the agent of each Grantor who alone will be responsible for the Receiver’s acts and omissions and remuneration. (2) The Secured Party may appoint a Receiver or any other person as the agent of the Secured Party and may delegate to a Receiver or any other person, any of the Secured Party’s rights under this document. (3) To the extent that as a result of any order being made or a resolution being passed for the winding up of a Grantor, a Receiver ceases to be the agent of that Grantor, the Receiver will immediately become the agent of the Secured Party. 10.3 Powers - general (1) A Receiver has the right in relation to any property in respect of which the Receiver is appointed, to do everything that a Grantor may lawfully authorise an agent to do on behalf of the Grantor in relation to that property. (2) Without limitation, a Receiver may in relation to that property exercise: (a) the rights capable of being conferred on receivers and receivers and managers by the Corporations Act and the law of any applicable jurisdiction; (b) the rights set out in clause 10.4; (c) the rights of the Grantor and, if the Grantor is a corporation, the directors of the Grantor; (d) if the Grantor is not a corporation to which the Corporations Act applies, the rights that the law would allow a Receiver to do if the Grantor was a corporation incorporated under the Corporations Act; and (e) any other rights the Secured Party may by notice to a Receiver lawfully give to a Receiver. (3) The Secured Party may by notice to a Receiver at the time of a Receiver’s appointment or any subsequent times give any rights to a Receiver that the Secured Party determines. 10.4 Powers - specific Without limiting clause 10.3, but subject to any restriction imposed by the Secured Party in the terms of the Receiver’s appointment, the Receiver may do any one or more of the following things: (1) sell or otherwise dispose of any of the Collateral: (a) by private treaty, auction, tender or otherwise; (b) for cash or on credit and with or without security (including over the property being sold);

APAC-#313417837-v4 © Norton Rose Fulbright Australia13 (c) in one lot or separate parcels and by itself or together with other property regardless of ownership, and otherwise on terms determined by the Receiver; (2) enter, take possession of, take control of and get in the Collateral and give up possession or control of Collateral one or more times at its discretion; (3) receive rents and profits derived from the Collateral; (4) carry on any business or activity of a Grantor; (5) manage, develop, use, exploit, quietly enjoy and otherwise deal with the Collateral; (6) exercise the rights and remedies of a Grantor and comply with its obligations in respect of the Collateral and cause and permit any other person to comply with their obligations in respect of the Collateral; (7) vary, replace or release any right or interest of a Grantor in or in relation to the Collateral; (8) carry out or complete, in any form, the construction of any works; (9) lease, licence or hire out the Collateral; (10) surrender or accept the surrender of the Collateral; (11) exchange any part of the Collateral for any other property and, if there is a difference in value between the property exchanged, give or receive, as the case may be, any money or other consideration equal to the difference in value in order to give or receive equal value for the exchange; (12) acquire or grant easements, profits a prendre, covenants or other rights that benefit, burden or relate to the Collateral and dedicate for any public purpose any part of the Collateral; (13) subdivide or consolidate any land forming part of the Collateral; (14) grant options and rights of first refusal to acquire the Collateral; (15) insure, maintain, improve and protect the Collateral; (16) sever trees and improvements or fixtures from the balance of the Collateral and remove them or otherwise deal with them separately from the balance of the Collateral; (17) take on lease or on hire or otherwise acquire any property necessary or convenient in relation to the carrying on of a business or activity of a Grantor; (18) have access to and use the property and services of a Grantor and the services of its personnel in the exercise of any rights under this document; (19) carry out, vary, replace, rescind, repudiate, enforce or terminate any agreement to which a Grantor is a party and that relates to the Collateral; (20) give any guarantee for the protection or enhancement of the Collateral;

APAC-#313417837-v4 © Norton Rose Fulbright Australia14 (21) enter into any derivatives contract, forward rate agreement, hedging contract, currency exchange agreement or any other agreement or arrangement considered desirable for the purposes of protecting against or managing fluctuations in interest rates, exchange rates, currency prices or commodity prices in relation to or for the benefit or protection of any of the Collateral; (22) operate any bank account that forms part of the Collateral and open and operate any further bank accounts; (23) promote or cause the formation of companies including for the purpose of entering into contracts for the transfer to or acquisition by those companies of any of the Collateral or so that the companies assume the obligations of a Grantor, or both; (24) exercise any voting or other rights or powers in respect of any Collateral and do anything in relation to Marketable Securities; (25) surrender, make, enforce, compromise or settle any claim under or in connection with any insurances; (26) on any sale of the Collateral, apportion all costs, expenses and purchase money between the separate property sold; (27) in the name of a Grantor make a call in respect of money unpaid on Marketable Securities in that Grantor; (28) with the agreement of a liquidator of a Grantor, in the name of the liquidator, make a call in respect of money unpaid on account of the nominal value of Marketable Securities in a Grantor or by way of premium; (29) enforce payment of any call that is due for payment and unpaid, whether the calls are made by the Secured Party or otherwise; (30) where a debt or other monetary obligation is owed (whether actually or contingently) to a Grantor, prove the debt or obligation in an Insolvency, receive dividends and assent to any proposal for an arrangement (including a scheme of arrangement), composition or a compromise with, or an assignment for the benefit of, creditors; (31) on any terms that the Receiver determines: (a) borrow or otherwise raise money or obtain financial accommodation on the security of the Collateral; (b) create any Security Interest over the Collateral; (c) borrow on the security of the Collateral including any money required in relation to the exercise of any right by the Receiver; (d) deal with any Security Interest granted by it over the Collateral and enter into any agreement relating to the priority of that Security Interest and discharge it; (e) invest in any way authorised by the Law of any applicable jurisdiction for the investment of trust money, any money the Receiver receives that is not required to be immediately applied in the exercise of any right or under clause 12, and vary or dispose of that investment;

APAC-#313417837-v4 © Norton Rose Fulbright Australia15 (32) on behalf of each Grantor: (a) draw, accept, make or endorse any bill of exchange or promissory note; (b) commence, defend, prosecute, settle, discontinue and compromise litigation, administrative or arbitral proceedings in relation to the Collateral; (c) enter into and execute and deliver any documents and agreements for the purposes of this document; (d) give receipts and releases, discharge or compromise any debt or other obligation owed to or by the Grantor and that is part of the Collateral; (e) employ or engage any person (including professional advisers or consultants) for the purpose of exercising any of the Receiver’s rights in respect of the Collateral and dismiss any employee or contractor of the Grantor; (33) delegate to any person any right (including this right of delegation) under this document; (34) do anything necessary to perform or observe any of a Grantor’s obligations under this document; (35) do or cause to be done anything to protect the priority of this document, to protect a Grantor’s or the Receiver’s right, title or interest in the Collateral, to enforce this document, to recover the Secured Money or to protect or enhance the Collateral; (36) do anything incidental or conducive to the exercise of any of its other rights under this document; (37) determine the allocation of Remedy Proceeds as between different kinds of collateral, including but not limited to allocating between Collateral and other property, and within either of those kinds of property; and (38) obtain registration of the Collateral in the Secured Party’s name. 10.5 General The interpretation of any right or power set out in this clause 10 is not restricted by reference to or inference from any other right or power. 11 Exercise of default rights 11.1 No hindrance A Grantor must not cause or permit the Secured Party, a Receiver or an Attorney to be prevented or hindered from exercising its rights under this document. 11.2 Performance of obligations The Secured Party or any person authorised by it may at the cost of a Grantor do anything that the Secured Party determines is necessary or expedient to make good or remedy any breach by a Grantor of any of the provisions of this document.

APAC-#313417837-v4 © Norton Rose Fulbright Australia16 11.3 Secured Party in possession (1) If the Secured Party, a Receiver or an Attorney exercises its rights under this document or takes possession of the Collateral, it will not be liable to account as a mortgagee in possession. (2) If the Secured Party has taken possession of the Collateral it may give up possession of the Collateral at any time and may re-enter into possession. (3) Each Grantor’s obligations under this document relating to the Collateral will not be affected by the Secured Party, a Receiver or an Attorney taking possession of the Collateral. 11.4 Exclusion of laws (1) The provisions implied in Security Interests by any law will for the purposes of this document be negatived or varied only so far as they are inconsistent with the provisions of this document and are otherwise varied so as to become consistent with this document. (2) Any statutory restrictions (other than mandatory restrictions that cannot be excluded) on any right of the Secured Party, a Receiver or an Attorney to lease or otherwise deal with the Collateral will not apply to the rights of those persons under this document. 11.5 Order of enforcement The Secured Party is not: (1) under any obligation to marshal in favour of a Grantor any Security Interest held by the Secured Party or any of the funds or assets that the Secured Party may be entitled to receive or have a claim on; and (2) obliged to resort to any Collateral Security or enforce any rights against any other person before it resorts to enforcement of this document. 11.6 Indemnity Each Grantor indemnifies the Secured Party, each Attorney and each Receiver (and each of their respective officers, agents and employees) against any cost, expense, loss or liability (including legal fees) incurred by any of them (directly or indirectly) as a result of the exercise or attempted exercise of any right, power, authority, discretion or remedy under or in connection with this document. Each Grantor must pay amounts due under this clause on demand by the Secured Party. 12 Application of money 12.1 Application The Remedy Proceeds received under or arising out of this document or any Collateral Security granted by each Grantor will be applied towards paying the Secured Money subject to the repayment of any claims having priority over any claim of the Secured Party, including the Permitted Security. 12.2 Order of payment (1) The Remedy Proceeds may be appropriated and applied towards paying the Secured Money, in any order that the Secured Party, Receiver, Attorney or

APAC-#313417837-v4 © Norton Rose Fulbright Australia17 other person acting on behalf of any of them determines in its absolute discretion, subject to any applicable law to the contrary, including section 140 of the PPSA; and (2) if the Secured Party does not make a determination under clause 12.2(1) the Remedy Proceeds are to be applied in the following order (subject to any applicable law to the contrary): (a) first, towards the payment or reimbursement of all costs and expenses (other than remuneration of any Receiver or Attorney) incurred by the Secured Party, any Receiver or any Attorney in or incidental to the exercise or enforcement or attempted exercise or enforcement of its rights under this document or any Collateral Security; (b) secondly, towards the remuneration of any Receiver or Attorney; (c) thirdly, towards satisfaction of the Secured Money; and (d) fourthly, as to any surplus to the Grantors or other person entitled to it or authorised to give receipts for it. 12.3 Creditor’s certificate and disputes (1) The Secured Party may rely on a certificate issued by any person who claims to be entitled to receive any of the Remedy Proceeds to the effect that a Grantor owes money to it and stating the amount owing, without being obliged to make any further enquiry. (2) If there is any dispute between any persons as to who is entitled to receive the Remedy Proceeds, the Secured Party may (at its discretion) pay that money into court and when that is done the Secured Party will have no further obligations in relation to that money. 12.4 No interest on Remedy Proceeds The Secured Party is not obliged to pay interest on the Remedy Proceeds to any person. 12.5 Payment into bank account If the Secured Party pays any money into a bank account in the name of any person to whom the Secured Party is obliged to pay money under this clause 12 and notifies that person of the particulars of the account the Secured Party will have no further obligations in relation to that money. 12.6 Contingent and prospective indebtedness If at the time a distribution of Remedy Proceeds is being made under clause 12.2 any of the Secured Money is contingently owing, the Secured Party may: (1) retain any part of the Remedy Proceeds; and (2) pay that part of the Remedy Proceeds into an interest bearing deposit account to hold as security for the payment of the Secured Money on terms that the Secured Party determines with any person (including the Secured Party) until that part of the Secured Money ceases to be contingently owing, at which time the relevant amount is to be applied in accordance with clause 12.2 and any

APAC-#313417837-v4 © Norton Rose Fulbright Australia18 amount remaining in the account will continue to be dealt with in accordance with this clause 12.6. 12.7 Payments during default notice period If: (1) during the period from the service of a notice requiring the rectification of a default in the payment of money by a Grantor under this document or any Collateral Security; and (2) the expiration of that notice, the Grantor pays any money towards satisfaction of the Secured Money, that money may be applied: (3) first, towards satisfaction of any Secured Money due for payment by a Grantor other than that which is the subject of the notice; and (4) secondly, towards satisfaction of the money that is the subject of the notice. 12.8 Accounting for Remedy Proceeds The Secured Party, any Receiver or any Attorney is not obliged to account to a Grantor for any money relating to the exercise by any of them of any right until money is actually received in immediately available funds and, without limitation, if any of them sell the Collateral on terms by which: (1) any part of the purchase price remains unpaid (whether secured or unsecured) after transfer of the Collateral to the purchaser; or (2) the purchase price is payable in instalments on or before the transfer of the Collateral to the purchaser, they are not obliged to account for the purchase price before it is actually received in full in immediately available funds. 13 Third party dealings 13.1 Secured Party’s receipts and discharges The Secured Party may give valid discharges and receipts for any money payable by any third party in respect of any exercise of a right by the Secured Party, any Receiver or any Attorney. 13.2 No challenge to disposal Each Grantor agrees that: (1) if the Secured Party, any Receiver or Attorney transfers or otherwise disposes of the Collateral the Grantor will not challenge the acquirer’s right to acquire the Collateral; and (2) it will not seek to reclaim that Collateral.

APAC-#313417837-v4 © Norton Rose Fulbright Australia19 13.3 No duty to enquire Any person dealing with the Secured Party, any Receiver or any Attorney in relation to the exercise by any of them of a right under this document will not be concerned to enquire whether: (1) the right is exercisable or properly exercised; (2) the Receiver or Attorney is properly appointed; or (3) any money paid by that person to the Secured Party, Receiver or Attorney is properly applied, and the title of that person to any property acquired by that person from the Secured Party, Receiver or Attorney will not be adversely affected by the right not being exercisable or any improper appointment, exercise of the right or application of money by the Secured Party, any Receiver or any Attorney of which that person does not have actual notice. 14 Statutory powers and notices 14.1 Exclusion of PPSA provisions To the extent the law permits: (1) for the purposes of sections 115(1) and 115(7) of the PPSA: (a) the Secured Party need not comply with sections 95, 118, 121(4), 125, 130, 132(3)(d) or 132(4); and (b) sections 142 and 143 are excluded; (2) for the purposes of section 115(7) of the PPSA, the Secured Party need not comply with sections 132 and 137(3); and (3) if the PPSA is amended after the date of this document to permit the Grantors and the Secured Party to agree to exclude other provisions of the PPSA, the Secured Party may notify the Grantors that the Secured Party need not comply with any of those provisions as notified to the Grantors by the Secured Party. 14.2 Exercise of rights by Secured Party (1) If the Secured Party exercises a right, power or remedy in connection with this document, that exercise is taken not to be an exercise of a right, power or remedy under the PPSA unless the Secured Party states otherwise at the time of exercise. (2) This clause does not apply to a right, power or remedy which can only be exercised under the PPSA.

APAC-#313417837-v4 © Norton Rose Fulbright Australia20 14.3 No notice required unless mandatory (1) To the extent the law permits, each Grantor waives: (a) its rights to receive any notice that is required by: (i) any provision of the PPSA (including a notice of a verification statement); or (ii) any other law before the Secured Party or a Receiver exercises a right, power or remedy; and (b) any time period that must otherwise lapse under any law before the Secured Party or a Receiver exercises a right, power or remedy. (2) If the law which requires a period of notice or a lapse of time cannot be excluded, but the law provides that the period of notice or lapse of time may be agreed, that period or lapse is 1 day or the minimum period the law allows to be agreed (whichever is the longer). (3) Nothing in this clause prohibits the Secured Party or a Receiver from giving a notice under the PPSA or any other law. 14.4 Appointment of nominee for PPSR registration For the purposes of section 153 of the PPSA, the Secured Party (the Affected Secured Party) appoints each Grantor (the Security Grantor) as its nominee, and authorises the Security Grantor to act on its behalf, in connection with a registration on the PPSR of any Security Interest in favour of the Security Grantor which is: (1) evidenced or created by Chattel Paper; (2) perfected by registration on the PPSR; and (3) transferred to the Affected Secured Party under this document. This authority ceases if and when the registration is transferred to the Affected Secured Party. 15 Preservation of rights 15.1 Primary obligations A Grantor’s obligation to pay the Secured Money is a primary obligation and the Secured Party is not obliged to proceed against or enforce any other right against any person or property or demand payment from any other person before making a demand for payment by the Grantor of the Secured Money. 15.2 Preservation of Grantor’s obligations Each Grantor’s obligations and the Secured Party’s rights under this document will not be affected by anything that, but for this clause 15.2, might abrogate, prejudice or limit them or the effectiveness of this document including: (1) any amendment of a right or agreement (however material and whether or not more onerous) or the rescission, repudiation or other termination of any agreement;

APAC-#313417837-v4 © Norton Rose Fulbright Australia21 (2) the granting of any forbearance, time or other concession to any person; (3) an arrangement, composition or compromise with any person (including in respect of priority of interests), or absolute or partial discharge or release of any person; (4) any transaction or agreement or any obligation being void, voidable or otherwise unenforceable or any Grantor not being obliged to comply with its obligations; (5) the failure by any person to execute and deliver any document or to register or perfect any Security Interest; (6) a breach of any trust or any incapacity or lack of power, authority or legal personality of or dissolution or change in the members or status of a Grantor or any other person; (7) the insolvency of any person; and (8) any delay, laches, acquiescence, mistake, negligence or other act or omission of any person. In this clause 15.2 a reference to ‘any person’ includes any Grantor. 15.3 Suspension of each Grantor’s rights Each Grantor: (1) waives any right to be subrogated to or otherwise have the benefit of this document until the Secured Money has been satisfied in full and in the reasonable opinion of the Secured Party any payment towards the satisfaction of the Secured Money is not void, voidable or otherwise unenforceable or refundable; and (2) must not exercise a right of set-off or counterclaim available to it or any other person liable to the Secured Party in relation to the Secured Money that reduces or extinguishes the obligation of the Grantor to pay the Secured Money. 15.4 Insolvency of Grantor A Grantor must not in the insolvency of any other Grantor: (1) directly or indirectly claim or receive the benefit of any distribution, dividend or payment; or (2) prove or claim for any distribution, dividend or payment in competition with the Secured Party, so as to diminish any distribution, dividend or payment that but for that claim or proof the Secured Party would be entitled to receive, until the Secured Money has been paid in full and the Secured Party is of the opinion that no payment of that money is or is likely to become void, voidable or otherwise unenforceable or refundable.

APAC-#313417837-v4 © Norton Rose Fulbright Australia22 15.5 No merger This document is in addition to and is not in any way prejudiced by any judgment, order or other thing and the Secured Party’s rights under this document will not be merged with any judgment, order or other thing. 15.6 Subsequent interests (1) If any subsequent Security Interest or other interest affects any Collateral: (a) that is not personal property for the purposes of the PPSA; or (b) where the PPSA does not apply to the Security over that Collateral, the Secured Party may open a new account with a Grantor. If the Secured Party does not open a new account, it will be treated as if it had done so at the time it received or is taken to have received notice of the relevant interest. (2) From the date on which that new account is opened or regarded as opened, all payments made by a Grantor to the Secured Party and all advances and financial accommodation by the Secured Party to a Grantor, are or are regarded as credited and debited to the new account. (3) Payments by a Grantor under clause 15.6(2) must be applied: (a) to reduce any debit balance in the new account; and (b) if there is no debit balance in the new account, to reduce the Secured Money which has not been debited or regarded as debited to the new account. 16 Assignments and transfers 16.1 Assignments and transfers by the Secured Party The Secured Party may: (1) assign any of its rights; or (2) transfer by novation any of its rights or obligations, under this document: (3) in accordance with any applicable assignment or transfer provisions in the Commonwealth Facility Agreement; or (4) if there are no applicable assignment or transfer provisions in the Commonwealth Facility Agreement, to any other entity in accordance with clause 16.2. 16.2 Grantor authorises assignment or transfer If clause 16.1(4) applies: (1) the Secured Party is not obliged to obtain a Grantor’s consent to, or notify the Grantor of, any such assignment or transfer; and

APAC-#313417837-v4 © Norton Rose Fulbright Australia23 (2) each Grantor irrevocably authorises the Secured Party to execute any document effecting a transfer by novation under clause 16.1(2) on its behalf, without any consultation with the Grantor. 16.3 Assignment and transfer by a Grantor A Grantor must not assign or transfer any of its rights under this document without the prior written consent of the Secured Party. 17 Set-off The Secured Party may, but need not, set off any matured obligation due from a Grantor under the Commonwealth Finance Documents (to the extent beneficially owned by the Secured Party) against any obligation owed by the Secured Party to that Grantor (whether or not matured), regardless of the place of payment, booking branch or currency of either obligation. If the obligations are in different currencies, the Secured Party may convert either obligation at a market rate of exchange in its usual course of business for the purpose of the set-off. 18 Notices Any notice or other communication to or by a Party must be given in accordance with the notice requirements of the Commonwealth Facility Agreement. 19 Calculations and certificates 19.1 Accounts In any litigation or arbitration proceedings arising out of or in connection with this document, the entries made in the accounts maintained by the Secured Party are sufficient evidence of the matters to which they relate unless the contrary is proved. 19.2 Certificates and determinations Any certification or determination by the Secured Party of an exchange rate, a rate of interest or amount payable under this document is conclusive evidence in the absence of manifest error of the matters to which it relates and any certification or determination by the Secured Party of any other matter is sufficient evidence of the matters to which it relates unless the contrary is proved. 19.3 Reinstatement of rights of Secured Party If: (1) the Secured Party has at any time released or discharged: (a) a Grantor from its obligations under this document; or (b) any assets of a Grantor from a Security, in either case in reliance on a payment, receipt or other transaction to or in favour of the Secured Party; or (2) any payment, receipt or other transaction to or in favour of the Secured Party has the effect of releasing or discharging:

APAC-#313417837-v4 © Norton Rose Fulbright Australia24 (a) a Grantor from its obligations under this document; or (b) any assets of a Grantor from a Security; and (3) that payment, receipt or other transaction is subsequently claimed by any person to be void, voidable or capable of being set aside for any reason (including under any law relating to insolvency, sequestration, liquidation, winding up or bankruptcy and any provision of any agreement, arrangement or scheme, formal or informal, relating to the administration of any of the assets of any person); and (4) that claim is upheld or is conceded or compromised by the Secured Party, then: (5) the Secured Party will immediately become entitled against a Grantor to all rights (including under any Commonwealth Finance Document) as it had immediately before that release or discharge; (6) a Grantor must, to the extent permitted by law: (a) immediately do all things and execute all documents as the Secured Party may, acting reasonably, require to restore to the Secured Party all those rights; and (b) indemnify the Secured Party against all costs and losses suffered or incurred by it in or in connection with any negotiations or proceedings relating to the claim or as a result of the upholding, concession or compromise of the claim. 20 Attorney 20.1 Appointment Each Grantor irrevocably appoints the Secured Party and each authorised signatory of the Secured Party, its attorney with the right: (1) at any time to do any of the following: (a) do everything that in the Attorney’s reasonable opinion is necessary or expedient to enable the exercise of any right of the Secured Party in relation to this document or any Authorisation; (b) complete this document; (c) complete any document executed by or on behalf of a Grantor in blank and deposited with the Secured Party, including as a Collateral Security; (d) appoint substitutes and otherwise delegate its powers (including this power of delegation); and (e) control any of the Collateral that is collateral within the meaning of section 21(2)(c) of the PPSA; and (2) after any Event of Default has occurred and while it continues, to comply with the obligations of the Grantor under this document and do all other things that

APAC-#313417837-v4 © Norton Rose Fulbright Australia25 the Grantor may lawfully authorise an agent to do in relation to this document and the Collateral. 20.2 General (1) Any Attorney may exercise its rights despite that the exercise of the right constitutes a conflict of interest or duty. (2) Each Grantor by this document ratifies any exercise of a right by an Attorney. (3) The power of attorney is granted: (a) to secure the compliance by the Grantors with its obligations under this document and any proprietary interests of the Secured Party under this document; and (b) for valuable consideration (receipt of which is acknowledged), which includes the acceptance of this document by the Secured Party at each Grantor’s request. 21 Release At the request in writing of a Grantor and at the cost of that Grantor, the Secured Party may release the Collateral from the Security if the Grantor’s obligation to pay the Secured Money and perform all of the Grantor’s other obligations under the Commonwealth Finance Documents are satisfied and in the Secured Party’s reasonable opinion: (1) there is no prospect that money or damages will become owing (whether actually or contingently) by the Grantor to the Secured Party (alone or together with any other person); and (2) no payment towards the satisfaction of the Grantor’s obligation to pay the Secured Money is likely to be the subject of a claim referred to in clause 19.3(3). 22 Further assurances 22.1 Notice to Grantor The Secured Party may, by notice to a Grantor at any time, require that Grantor to do any or all of the following things: (1) take all steps, provide information (including without limitation serial numbers relating to any Collateral), produce documents and obtain consents; (2) execute any notice, consent, document or amendment to this document; (3) execute and deliver to the Secured Party, transfer forms in relation to any of the Collateral (undated and blank as to transferee and consideration); or (4) do any other thing, that the Secured Party considers necessary or desirable to: (5) ensure that this document or any Security Interest arising under it, is enforceable;

APAC-#313417837-v4 © Norton Rose Fulbright Australia26 (6) reserve or create any type of Security Interest over any part of the Collateral in a manner not inconsistent with this document with any additional terms reasonably required by the Secured Party having regard to the nature of that part of the Collateral and the type of additional Security Interest being created, including a registrable Security Interest over any real property or any other property not subject to the PPSA and an assignment of any Collateral; (7) stamp, protect, perfect, record, or better secure the position of the Secured Party under this document in any applicable jurisdiction; (8) obtain or preserve the priority position of the Secured Party contemplated by this document; (9) overcome any defect or adverse effect arising from the PPSA; or (10) aid the Secured Party in the exercise of any right or power under this document. 22.2 Compliance with notice Each Grantor must: (1) comply with the requirements of a notice under clause 22.1 within the time stated in the notice at the cost and expense of that Grantor; (2) reimburse the costs of the Secured Party in connection with anything the Grantor is required to do under this clause 22; and (3) promptly notify the Secured Party of any change to information that it provides to the Secured Party under this clause 22. 22.3 Commonwealth Finance Document Any new document that a Grantor is required to sign under clause 22.1 constitutes a Commonwealth Finance Document. 22.4 Authority to complete blanks Each Grantor agrees that the Secured Party may complete and fill in any blanks in this document or any document connected with it (including assignments, transfers, financing statements, financing change statements, amendment demands or any Corporations Act or PPSA forms). 23 General 23.1 Amendments This document may be amended only in writing with the consent of the Secured Party and each Grantor and any such amendment will be binding on all Parties. 23.2 Waiver (1) A Party’s failure or delay to exercise a power or right does not operate as a waiver of that power or right. (2) The exercise of a power or right does not preclude either its exercise in the future or the exercise of any other power or right.

APAC-#313417837-v4 © Norton Rose Fulbright Australia27 (3) A waiver is not effective unless it is in writing. (4) Waiver of a power or right is effective only in respect of the specific instance to which it relates and for the specific purpose for which it is given. 23.3 Cumulative rights The rights, powers and remedies provided in this document are in addition to those provided by law independently of this document and each right, power and remedy provided in this document (including any right of indemnity) is additional to and not exclusive of every other right, power or remedy provided in this document. 23.4 Moratorium legislation To the fullest extent permitted by law, all laws which at any time operate directly or indirectly to lessen, stay, reduce or otherwise affect in favour of the Grantors any obligation under this document, or to delay or otherwise prevent or prejudicially affect the exercise by the Secured Party of any power or right under this document or otherwise, are expressly waived by the Grantors. 23.5 Partial invalidity If, at any time, any provision of this document is or becomes illegal, invalid or unenforceable in any respect under any law of any jurisdiction, neither the legality, validity or enforceability of the remaining provisions nor the legality, validity or enforceability of such provision under the law of any other jurisdiction will in any way be affected or impaired. 23.6 No liability The Secured Party, its officers, employees, nominees, contractors and agents, will not be liable for any loss, cost, expense or liability of the Grantors caused or contributed to by the waiver of, exercise of, attempted exercise of, failure to exercise or delay in exercising a right of the Secured Party and the Secured Party holds the benefit of this clause 23.6 on trust for itself and its officers, employees, nominees, contractors and agents. 23.7 Indemnities and reimbursement All indemnities and reimbursement obligations (and any other payment obligations of the Grantors) in this document are continuing and survive termination of this document and the release of any Collateral from the Security. 23.8 Waiver of immunity Each Grantor irrevocably and unconditionally: (1) agrees not to claim any immunity from proceedings brought by the Secured Party against it in relation to this document and to ensure that no such claim is made on its behalf; (2) consents generally to the giving of any relief or the issue of any process in connection with those proceedings; and (3) waives all rights of immunity in respect of it or its assets.

APAC-#313417837-v4 © Norton Rose Fulbright Australia28 23.9 Execution by attorney If an attorney executes this document, the attorney declares that the attorney has no notice of revocation, termination or suspension of the power of attorney under which the attorney executes this document. 23.10 Electronic execution and exchange of counterparts (1) A party may execute this document as well as any modification to it by electronic means (including, by electronic signature or by facsimile or email of the signed document in PDF. (2) The Parties agree and intend that such signature by electronic means or by facsimile or email in PDF or scanned format shall bind the Party so signing with the same effect as though the signature were an original signature. (3) A counterpart of this document may also be exchanged by a Party to this document or a Party’s solicitor by electronic method including by email. (4) This document may be executed in any number of counterparts. Each counterpart is an original, but the counterparts together are one and the same instrument. 24 Governing law and jurisdiction 24.1 Governing law This document is governed by New South Wales law. 24.2 Jurisdiction (1) The courts having jurisdiction in New South Wales have exclusive jurisdiction to settle any dispute arising out of or in connection with this document (including a dispute regarding the existence, validity or termination of this document) (a Dispute). (2) The Parties agree that those courts are the most appropriate and convenient courts to settle Disputes and accordingly no Party will argue to the contrary. (3) Each Party irrevocably waives any objection it may now or in the future have to the venue of any proceedings, and any claim it may now or in the future have that any proceedings have been brought in an inconvenient forum, where that venue falls within clause 24.2(1). (4) This clause 24.2 is for the benefit of the Secured Party only. As a result, the Secured Party will not be prevented from taking proceedings relating to a Dispute in any other courts with jurisdiction. To the extent allowed by law, the Secured Party may take concurrent proceedings in any number of jurisdictions.