OFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege Dated Facility Agreement Parties Each entity listed in Schedule 1 Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) Norton Rose Fulbright Level 5, 60 Martin Place SYDNEY NSW 2000 nortonrosefulbright.com Our ref: 4081080

APAC-#312798503-v16 © Norton Rose Fulbright OFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege Contents 1 Definitions and interpretation .......................................................................................... 1 1.1 Definitions .......................................................................................................... 1 1.2 Interpretation .................................................................................................... 12 1.3 Multiple Parties ................................................................................................ 12 2 Availability and limits .................................................................................................... 13 2.1 Availability ........................................................................................................ 13 2.2 Purpose............................................................................................................ 13 2.3 No redrawings .................................................................................................. 13 2.4 Cancellation ..................................................................................................... 13 2.5 Extension ......................................................................................................... 13 3 Conditions for requesting an Advance ......................................................................... 14 4 Interest .......................................................................................................................... 16 4.1 Interest on each Advance ................................................................................ 16 4.2 Interest Periods ................................................................................................ 16 4.3 Default Interest ................................................................................................ 17 5 Repayments and prepayments of Advances ................................................................ 17 5.1 Repayment on Repayment Date ..................................................................... 17 5.2 Mandatory Prepayments.................................................................................. 17 5.3 Voluntary prepayments .................................................................................... 18 5.4 Effect of repayment and prepayment .............................................................. 18 6 Payments ...................................................................................................................... 18 6.1 Payments by Borrowers................................................................................... 18 6.2 No deductions .................................................................................................. 19 6.3 Payment to be made on Business Day ........................................................... 19 6.4 Appropriation where insufficient money available ........................................... 19 6.5 Rounding ......................................................................................................... 19 7 Representations and warranties ................................................................................... 19 7.1 Representations and warranties ...................................................................... 19 7.2 Repetition ......................................................................................................... 21 7.3 Survival of representations and warranties ..................................................... 21 8 Reporting obligations .................................................................................................... 21 8.1 General ............................................................................................................ 21 8.2 Approved Purposes ......................................................................................... 22 9 General undertakings ................................................................................................... 22 9.1 Compliance with laws ...................................................................................... 22 9.2 Compliance with Material Documents ............................................................. 23 9.3 Preservation of assets and minimum cash ...................................................... 23 9.4 Audit ................................................................................................................. 23 9.5 No Financial Indebtedness .............................................................................. 23 9.6 No lending ........................................................................................................ 23 9.7 Authorisations .................................................................................................. 23 9.8 Arm’s length ..................................................................................................... 24 9.9 Negative pledge ............................................................................................... 24 9.10 Disposals ......................................................................................................... 24

APAC-#312798503-v16 © Norton Rose Fulbright OFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege 9.11 Access ............................................................................................................. 25 9.12 Insurance ......................................................................................................... 25 9.13 Taxation ........................................................................................................... 25 9.14 Term of undertakings ....................................................................................... 25 10 Default .......................................................................................................................... 25 10.1 Non-payment ................................................................................................... 25 10.2 Other obligations .............................................................................................. 26 10.3 Misrepresentation ............................................................................................ 26 10.4 Ownership of the Obligors ............................................................................... 26 10.5 Change of holder of Air T New Cap Note ........................................................ 26 10.6 Rex Regional Commitments ............................................................................ 26 10.7 Business stopped or changed ......................................................................... 26 10.8 Cross default .................................................................................................... 26 10.9 Insolvency Event .............................................................................................. 27 10.10 Enforcement against assets ............................................................................ 27 10.11 Material documents ......................................................................................... 27 10.12 Reduction of capital ......................................................................................... 28 10.13 Investigation ..................................................................................................... 28 10.14 Unlawfulness ................................................................................................... 28 10.15 Vitiation of Transaction Documents ................................................................. 28 10.16 Revocation of Authorisation ............................................................................. 28 10.17 Damage or destruction .................................................................................... 28 10.18 Default under Transaction Document .............................................................. 28 11 Lender’s rights on Default ............................................................................................. 28 11.1 Obligation to Inform ......................................................................................... 28 11.2 Occurrence of Event of Default ....................................................................... 29 11.3 Consequences ................................................................................................. 29 11.4 Remedy of Rex Regional Commitments ......................................................... 30 11.5 Payments ......................................................................................................... 31 12 Stamp duties and Taxes ............................................................................................... 31 12.1 Stamp duties and Taxes .................................................................................. 31 12.2 Inclusions ......................................................................................................... 31 12.3 GST .................................................................................................................. 31 12.4 Indemnity ......................................................................................................... 32 13 Indemnities ................................................................................................................... 32 13.1 Nature .............................................................................................................. 32 13.2 Extent of indemnity .......................................................................................... 32 13.3 Survival of obligations ...................................................................................... 32 14 Costs and expenses ..................................................................................................... 33 15 Assignment ................................................................................................................... 33 15.1 No assignment by Transaction Parties ............................................................ 33 15.2 No assignment by Lender ................................................................................ 33 16 Set-off ........................................................................................................................... 33 16.1 Set-off by Lender ............................................................................................. 33 17 Lender’s determination and certificate ......................................................................... 33 17.1 Certificate ......................................................................................................... 33 17.2 Not obliged to give reasons ............................................................................. 33

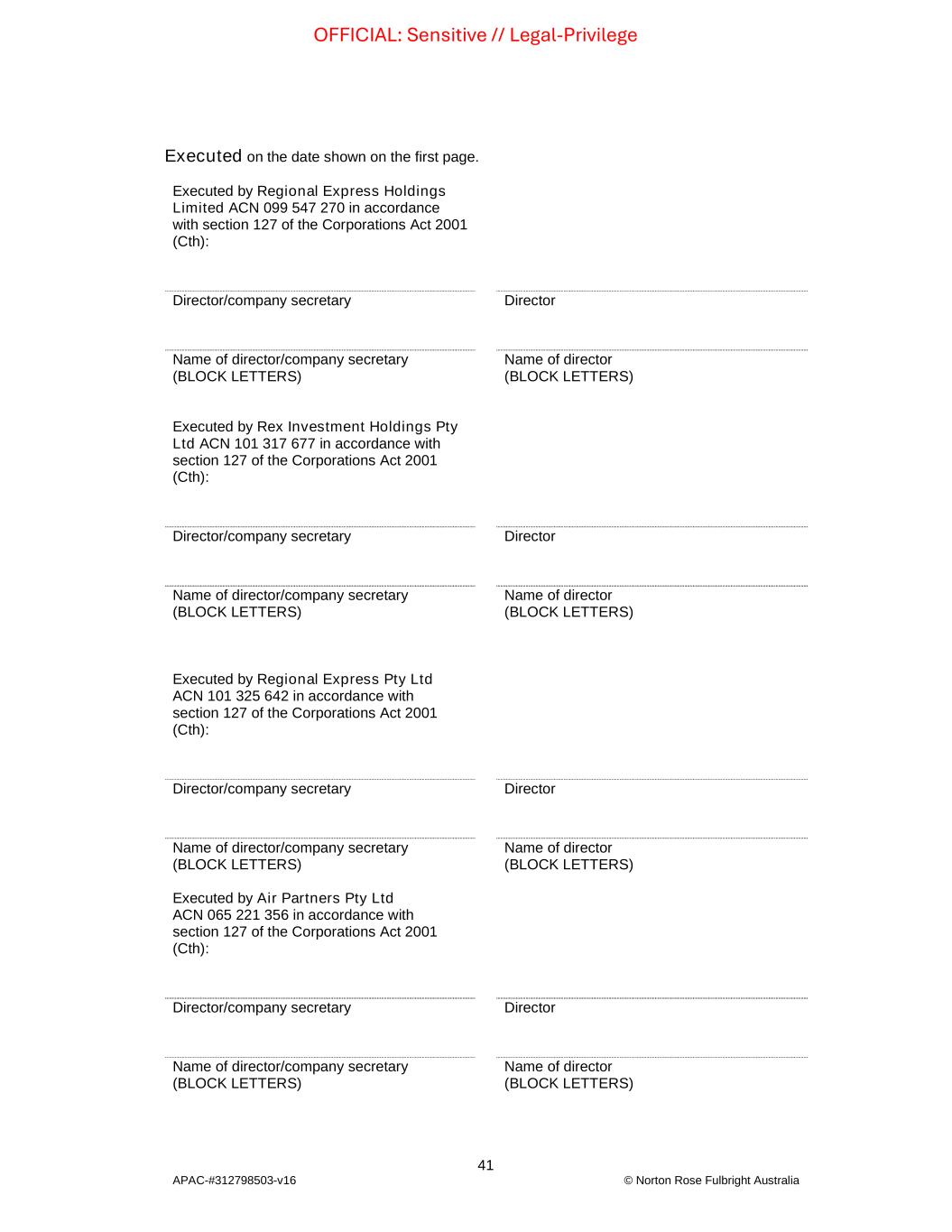

APAC-#312798503-v16 © Norton Rose Fulbright OFFICIAL: Sensitive // Legal-Privilege OFFICIAL: Sensitive // Legal-Privilege 18 Cumulative rights .......................................................................................................... 33 19 Approvals and consent ................................................................................................. 34 20 Time of the essence ..................................................................................................... 34 21 Time for performance ................................................................................................... 34 22 Records as evidence .................................................................................................... 34 23 Supervening legislation ................................................................................................ 34 24 Borrower’s own judgment ............................................................................................. 35 24.1 No reliance on Lender ..................................................................................... 35 24.2 Lender not liable .............................................................................................. 35 25 Authorised Officers ....................................................................................................... 35 26 Severability ................................................................................................................... 35 27 Variation ........................................................................................................................ 35 28 Waiver and exercise of rights ....................................................................................... 35 28.1 Waiver .............................................................................................................. 35 28.2 Exercise of rights ............................................................................................. 35 28.3 No liability ........................................................................................................ 36 29 Notices .......................................................................................................................... 36 29.1 Addresses ........................................................................................................ 36 29.2 Method of service ............................................................................................ 36 30 Governing law and jurisdiction...................................................................................... 37 30.1 Relevant Jurisdiction ........................................................................................ 37 30.2 Non-exclusive jurisdiction ................................................................................ 37 31 Inconsistency of provisions ........................................................................................... 37 32 Electronic execution and exchange of counterparts..................................................... 37 33 Execution by attorney ................................................................................................... 37 Schedule 1 ................................................................................................................................. 38 Schedule 2 – Advance Request ................................................................................................ 39

APAC-#312798503-v16 © Norton Rose Fulbright Australia 1 OFFICIAL: Sensitive // Legal-Privilege Agreement dated 2025 Parties (1) Commonwealth of Australia as represented by the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (ABN 86 267 354 017) of 111 Alinga Street Canberra, ACT 2601 (the Lender) (2) The entities listed in Schedule 1 (each a Borrower and together the Borrowers) Recitals A The Commonwealth has agreed to make available to the Borrowers a facility for the Approved Purposes on the terms set out below. It is agreed 1 Definitions and interpretation 1.1 Definitions In this document the following definitions apply unless the context indicates otherwise: (1) Advance means each loan drawn down under a Facility in accordance with this document (including any Capitalisation Advance provided in accordance with this document) or, as applicable, the outstanding principal amount of that Advance at the relevant time; (2) Advance Date means the date on which an Advance is or is to be made to the Borrowers under this document; (3) Advance Request means a request given under clause 3(1); (4) Air T means Air T Lending 25.1, LLC. (5) Air T Finance Parties means: (a) Air T; and (b) the Security Trustee; (6) Air T Financier has the same meaning as in the Intercreditor Deed. (7) Air T New Cap Notes means each “Loan Note” under and for the purposes of the New Cap Note Facility; (8) Approved Purposes means: (a) in respect of an Advance under the Engine Facility:

APAC-#312798503-v16 © Norton Rose Fulbright Australia 2 OFFICIAL: Sensitive // Legal-Privilege (i) to fund actual or expected expenditure to be incurred within the next calendar quarter for completion of the Engine Care and Maintenance Program; or (ii) to pay or reimburse the Obligors for any other costs or expenses incurred in relation to the Engine Care and Maintenance Program not covered by paragraph (i) above as approved by the Lender in its absolute discretion; (b) in respect of an Advance under the Operations Facility: (i) to support the regional airline business operated by the Borrowers; or (ii) the payment of any other fees, costs or expenses as agreed by the Lender in its absolute discretion, provided that, in each case, no Advance may be used to pay or repay amounts owing to the Air T Finance Parties under or in connection with the New Cap Note Facility; (9) ASIC means the Australian Securities and Investments Commission; (10) Australian Accounting Standards means: (a) the accounting standards from time to time approved under the Corporations Act; (b) the requirements of the Corporations Act in relation to the preparation and content of accounts; and (c) generally accepted accounting principles and practices in Australia consistently applied, except those principles and practices which are inconsistent with the standards or requirements referred to in paragraph (a) or (b); (11) Authorisation means: (a) an authorisation, consent, approval, resolution, licence, exemption, filing or registration; or (b) in relation to anything which will be fully or partly prohibited or restricted by law if a Government Agency intervenes or acts in any way within a specific period after lodgement, filing, registration or notification, the expiry of that period without intervention or action; (12) Authorised Officer means: (a) in relation to a Borrower, any director or company secretary of that Borrower, or any person nominated by that Borrower by a notice to the Lender as an authorised officer on behalf of that Borrower to sign notices or documents in connection with any of the Finance Documents, the notice to be accompanied by specimen signatures of the persons concerned; and (b) in relation to the Lender, First Assistant Secretary, Domestic Aviation and Reform Division or such other person or persons as the Lender may notify to the Borrowers in writing from time to time;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 3 OFFICIAL: Sensitive // Legal-Privilege (13) Available Facility means, at any time, in respect of a Facility, the applicable Facility Limit less any Principal Outstanding in respect of Advances made under that Facility at that time; (14) Availability Period means the period commencing on the Restructure Effective Date and ending on: (a) in respect of the Engine Facility, three years after that date, unless extended pursuant to clause 2.5; and (b) in respect of the Operations Facility, two years after that date; (15) Business Day means a day that is not a Saturday, Sunday or any other day which is: (a) a public holiday or a bank holiday in the Relevant Jurisdiction or in the Australian Capital Territory; or (b) a public holiday or a bank holiday in New York; or (c) a day falling between 24 December and 2 January (inclusive) in any particular year; (16) Capitalisation Advance means an Advance made, or deemed to be made, under a Facility in accordance with clause 4.1; (17) Commonwealth Facility Agreement means the document titled “Commonwealth Facility Agreement” dated 11 November 2024 between, among others, the Borrowers and the Lender, as amended and restated on the Restructure Effective Date by the amendment and restatement deed dated or about the date of this document between certain of the Borrowers and the Lender; (18) Company means Regional Express Holdings Limited (ACN 099 547 270); (19) Compensation Event means any confiscation, resumption, appropriation, forfeiture, repurchase, redemption or compulsory acquisition of Secured Property by any person under a law or otherwise; (20) Compensation Proceeds means any payment or other proceeds resulting from a Compensation Event that are available and required to be applied by the Borrowers towards repayment of Advances under this document in accordance with the Intercreditor Deed; (21) Corporations Act means the Corporations Act 2001 (Cth); (22) Engine Care and Maintenance Program means the program for engine care and maintenance of the engines owned or utilised by the certain of the Borrowers on their existing fleet of SAAB-340 aircraft in the form delivered to the Lender as a condition precedent to the Restructuring Coordination Deed, or as may be subsequently updated in accordance with the provisions of the Intercreditor Deed; (23) Engine Facility means the cash advance loan facility made available by the Lender to the Borrowers under this document; (24) Engine Facility Limit means $40,000,000; (25) Event of Default means any event described in clause 10 or otherwise specified in this document as an Event of Default;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 4 OFFICIAL: Sensitive // Legal-Privilege (26) Existing Aircraft Fleet means: (a) all propeller aircraft and associated engines (whether on-wing of off wing) of the Borrowers as at the Restructure Effective Date, including all Saab airframes and GE engines; and (b) aircraft simulators owned by the Borrowers; (27) Facility means each of: (a) the Engine Facility; and (b) the Operations Facility; (28) Facility Limit means: (a) the Engine Facility Limit; or (b) the Operations Facility Limit; (29) Finance Document means (a) this document; (b) the Commonwealth Facility Agreement; (c) any Security Document; (d) the Restructuring Coordination Deed; (e) the Intercreditor Deed; (f) any other document designated as such by the Lender and the Company; (g) any document amending any of the above; and (h) any document evidencing the terms of a waiver or consent by the Lender under or in connection with any of the above; (30) Finance Lease means any lease, hire purchase or capitalised lease, a liability under which would, in accordance with the Australian Accounting Standards, be treated as a balance sheet liability (other than a lease or hire purchase contract which would, in accordance with the Australian Accounting Standards in for prior to 1 January 2019, have been treated as an operating lease); (31) Financial Indebtedness means any indebtedness for or in respect of: (a) moneys borrowed and any debit balance at any financial institution; (b) any amount raised under any acceptance credit, bill acceptance or bill endorsement facility or dematerialised equivalent; (c) any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 5 OFFICIAL: Sensitive // Legal-Privilege (d) the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with Australian Accounting Standards, be treated as a balance sheet liability; (e) receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); (f) any redeemable shares where the holder has the right, or the right in certain conditions, to require redemption; (g) any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other paragraph of this definition having the commercial effect of a borrowing; (h) consideration for the acquisition of assets or services payable more than 90 days after acquisition; (i) any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) will be taken into account); (j) any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; and (k) the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in clauses 1.1(31)(a) to 1.1(31)(j) above; (32) Government Agency means any government or governmental, semi-governmental or judicial entity or authority in any state, country or other jurisdiction, including any self-regulatory organisation established under a statute or stock exchange; (33) Group means each Borrower and its Subsidiaries; (34) GST means any goods or services tax, value-added tax, consumption tax or similar tax including as that term is defined in the GST Act; (35) GST Act means A New Tax System (Goods and Services Tax) Act 1999 (Cth); (36) Insolvency Event means the happening of any one or more of the following events: (a) an application (not being an application that is being contested in good faith and that is withdrawn or dismissed within 5 Business Days of its commencement) is made to a court for an order or an order is made that a body corporate be wound up or that a liquidator or provisional liquidator be appointed to a body corporate; (b) except to reconstruct or amalgamate while solvent on terms approved in writing by the Lender, a body corporate enters into, or resolves to enter into, a scheme of arrangement, deed of company arrangement or composition with, or assignment for the benefit of, all or any class of its

APAC-#312798503-v16 © Norton Rose Fulbright Australia 6 OFFICIAL: Sensitive // Legal-Privilege creditors, or it proposes a reorganisation, moratorium or other administration involving any of them; (c) except to reconstruct or amalgamate while solvent upon terms approved in writing by the Lender, a body corporate resolves to wind itself up or otherwise dissolve itself, or gives notice of intention to do so, or is otherwise wound up or dissolves; (d) a body corporate is unable to pay its debts as they fall due or is or states that it is insolvent or is treated as or presumed insolvent under any applicable legislation; (e) a receiver, receiver and manager, trustee, administrator or similar official is appointed over any or all of the assets or undertaking of a body corporate; (f) a body corporate takes any step to obtain protection or is granted protection from its creditors, under any applicable legislation; (g) a Liquidation occurs in relation to a person; or (h) anything analogous or having a substantially similar effect to any of the events specified above happens under the law of any applicable jurisdiction; (37) Intercreditor Deed means the document titled “Intercreditor Deed - Regional Express Airlines” dated on or about the date of this document between (among others) the Borrowers, the Lender and the Air T Finance Parties; (38) Interest Payment Date means each of 31 March, 30 June, 30 September and 31 December; (39) Interest Period means, in relation to an Advance, each period determined in accordance with clause 4; (40) Interest Rate means, on any day, 12% per annum, as may be adjusted from time to time after the Restructure Effective Date in accordance with clause 11.5 of the Intercreditor Deed; (41) Liquidation includes provisional liquidation, administration, receivership, compromise, arrangement, amalgamation, reconstruction, winding up, dissolution, assignment for the benefit of creditors, arrangement or compromise with creditors, bankruptcy or death; (42) Material Adverse Effect means a material adverse effect on any one or more of the following: (a) the ability of the Obligors as a whole to comply with their obligations under the Transaction Document; (b) the financial condition or business of the Obligors as a whole; or (c) the effectiveness, priority or enforceability of this document or any of the Finance Documents; (43) Material Document means the New Cap Note Facility; (44) Material Document Counterparty means any party to a Material Document other than the Lender or a Borrower;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 7 OFFICIAL: Sensitive // Legal-Privilege (45) New Cap Note Facility means the document entitled “Syndicated Loan Note Subscription Agreement – Project Mustang” to be entered into on or around the date of this document between, among others, the Air T Finance Parties and the Company; (46) Obligor means each Borrower; (47) Operations Facility means the cash advance loan facility made available by the Lender to the Borrowers under this document; (48) Operations Facility Limit means $20,000,000; (49) PAG means PAGAC Regulus Holding Pte. Ltd.; (50) Party means a party to this document; (51) Permitted Financial Accommodation means any loan or other financial accommodation: (a) made to another Obligor; (b) comprising trade credit extended by a Borrower on normal commercial terms and in the ordinary course of its business (excluding any such trade credit to Air T or other Related Entities of Air T); (c) comprising deposits with a bank or financial institution in Australia provided such deposits do not secure Financial Indebtedness; or (d) made with the prior written consent of the Lender; (52) Permitted Financial Indebtedness means: (a) Financial Indebtedness owing by the Borrowers under the Finance Documents; (b) Financial Indebtedness owing by the Borrowers to the Air T Finance Parties under or in connection with the New Cap Note Facility up to the Air T Priority Amount (as defined in the Intercreditor Deed) or other Financial Indebtedness owing by the Borrowers to the Air T Finance Parties which is subordinated to all amounts owing to the Lender under the Finance Documents; (c) Financial Indebtedness incurred by the Borrowers in connection with: (i) the purchase and acquisition of one or more new aircrafts where such Financial Indebtedness is secured solely by the relevant aircraft or aircrafts which it has funded; or (ii) a Finance Lease of a new aircraft in the ordinary course of business of a Borrower where the lessor may only have recourse to the assets leased; For the avoidance of doubt, a reference to a new aircraft in this paragraph (c) excludes any aircraft comprised in the Existing Aircraft Fleet. (d) Financial Indebtedness under a Finance Lease in respect of goods or equipment (other than aircraft or engines) in the ordinary course of

APAC-#312798503-v16 © Norton Rose Fulbright Australia 8 OFFICIAL: Sensitive // Legal-Privilege business of a Borrower where the lessor may only have recourse to the assets leased; (e) Financial Indebtedness owing by the Borrowers not covered by paragraphs (a) to (d) above (inclusive) provided that the aggregate amount of Financial Indebtedness of the Borrowers permitted by this paragraph (e) does not exceed $10,000,000; and (f) Financial Indebtedness to which the Lender consents in writing (unless the consent was conditional and any of the conditions are not complied with); (53) Permitted Security Interests means in relation to each Borrower: (a) any Security Interest created or arising in favour of the Lender under a Finance Document; (b) the Security Interests which are recorded on the PPS Register as at the date of the document; (c) a Security interest in favour of the Security Trustee contemplated under the Intercreditor Deed; (d) a lien arising by operation of law in the ordinary course of day-to-day trading and not securing Financial Indebtedness, where it duly pays the indebtedness secured by that lien other than indebtedness contested in good faith; (e) a charge or lien arising in favour of a Government Agency by operation of statute unless there is default in payment of money secured by that charge or lien; (f) any rights of set-off, netting or combination of accounts; (g) any Security Interest arising under Financial Indebtedness described in paragraph (c) of the definition of Permitted Financial Indebtedness; and (h) any other Security Interest over any of its assets to which the Lender has expressly consented in writing; (54) Potential Event of Default means any event or circumstance that with the giving of notice or passage of time or both would become an Event of Default; (55) PPSA means the Personal Property Securities Act 2009 (Cth); (56) PPS Register means the register maintained in accordance with the PPSA; (57) Principal Outstanding means, at any time, the aggregate principal amount of all outstanding Advances and, in relation to a particular Advance means the outstanding principal amount of that Advance Draw (including any capitalised interest on an Advance); (58) Related Entity means: (a) in relation to the Lender, any and all Commonwealth entities and companies that are subject to the Public Governance, Performance and Accountability Act 2013 (Cth) and any entity controlled by them; and

APAC-#312798503-v16 © Norton Rose Fulbright Australia 9 OFFICIAL: Sensitive // Legal-Privilege (b) in relation to any other Party, has the meaning it has in the Corporations Act 2001 (Cth); (59) Relevant Jurisdiction means New South Wales; (60) Relevant Location means the capital city of the Relevant Jurisdiction; (61) Repayment Date means the date being 7 years from the date of the Restructure Effective Date; (62) Representative means any Minister or Related Entity of the Commonwealth, and any directors, officers, employees, consultants, agents, contractors and subcontractors of the Commonwealth and any Minister or Related Entity of the Commonwealth; (63) Restructure Effective Date has the meaning given in the Restructuring Coordination Deed; (64) Restructuring Coordination Deed means the document titled “Restructuring Coordination Deed – Regional Express Airlines” dated on or about the date of this document between Air T and the Lender; (65) Rex Regional Commitments has the meaning given in the Intercreditor Deed; (66) RRC EOD Date has the meaning given in clause 11.4 (67) RRC Non-Compliance has the meaning given in clause 11.4 (68) Secured Money means all money and amounts (in any currency) that an Obligor is or may become liable at any time (presently, prospectively or contingently, whether alone or not and in any capacity) to pay to or for the account of the Lender (whether alone or not and in any capacity) under or in connection with a Finance Document. It includes money and amounts: (a) in the nature of principal, interest, fees, costs, charges, expenses, duties, indemnities, guarantee obligations or damages; (b) whether arising or contemplated before or after the date of this Agreement or as a result of the assignment (with or without an Obligor’s consent) of any debt, liability or Finance Document; and (c) which a person would be liable to pay but for its insolvency; (69) Secured Property means all of the assets of the Borrowers which from time to time are the subject of any Security Document; (70) Security Documents means: (a) the document titled “General Security Deed” originally between, amongst others, certain of the Borrowers and PAG dated 15 March 2021, as assigned to the Lender and as amended from time to time; (b) the document titled “General Security Deed” originally between, amongst others, certain of the Borrowers and PAG dated 30 July 2024, as assigned to the Lender and as amended from time to time;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 10 OFFICIAL: Sensitive // Legal-Privilege (c) the document titled “Supplemental Security Deed (Aircraft)” between Regional Express Holdings Limited, Rex Investment Holdings Pty Ltd and PAG dated 25 July 2024, as assigned to the Lender and as amended from time to time; (d) the document titled “Supplemental Security Deed (Aircraft)” between Regional Express Holdings Limited, Rex Investment Holdings Pty Ltd, Rex Airlines Pty Ltd and the PAG dated 30 July 2024, as assigned to the Lender and as amended from time to time; (e) the real property mortgage of underlease 11172419 on land title 6137/606 between Regional Express Holdings Limited and PAG dated 30 April 2021, as transferred to the Lender; (f) the real property mortgage of title over 1/819642 between Regional Express Holdings Limited and PAG dated 15 March 2021, as transferred to the Lender; (g) the real property mortgage of title over 10082/361 between AAPA Victoria Pty Ltd and PAG dated 15 March 2021, as transferred to the Lender; (h) the real property mortgage over sub-lease AJ148894 on title 7330-149 between Regional Express Holdings Limited and PAG dated 15 March 2021, as transferred to the Lender secured by caveat AU773085; (i) the document titled “Aircraft Mortgage (Specific Security Deed)” dated 20 November 2024 between the Lender, Regional Express Limited, Regional Express Holdings Limited, Rex Investment Holdings Pty Ltd and Rex Airlines Pty Ltd, as amended from time to time; (j) the General Security Deed between the Borrowers as grantors and the Lender as secured party dated 20 November 2024; (k) the mortgage of underlease 11172419 on land title 6137/606 between Regional Express Holdings Limited and the Lender dated 20 November 2024; (l) the real property mortgage of title over 1/819642 between Regional Express Holdings Limited and the Lender dated 20 November 2024; (m) the real property mortgage over sub-lease AJ148894 on title 7330-149 between Regional Express Holdings Limited and the Lender dated 20 November 2024 secured by caveat AU773085; (n) the General Security Deed between Rex Flyer Pty Limited, Australian Aero Propellor Maintenance Pty Limited, Australian Airline Pilot Academy Pty Limited and AAPA Victoria Pty Limited as grantors and the Lender as secured party dated on or about the date of this document, as amended from time to time; (o) any document to create a security interest pursuant to clause 3(3)(c); or (p) any document entered into by any Obligor which creates a Security Interest over any of its assets in favour of, or for the benefit of, the Lender in

APAC-#312798503-v16 © Norton Rose Fulbright Australia 11 OFFICIAL: Sensitive // Legal-Privilege respect of all or any part of the obligations of the Obligors (with or without securing the obligations of other Obligors) under the Finance Documents; (71) Security Interest means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect, including any "security interest" as defined in sections 12(1) or (2) of the Personal Property Securities Act 2009 (Cth); (72) Security Trustee means P.T. Limited ACN 004 454 666 in its capacity as trustee of the Project Mustang Security Trust; (73) Subsidiary means a subsidiary within the meaning of Part 1.2 Division 6 of the Corporations Act; (74) Tax includes any tax, GST, rate, levy, impost or duty (other than a tax on the net overall income of the Lender) and any interest, penalty, fine or expense relating to any of them; (75) Tax Consolidated Group means a consolidated group or a MEC group (each as defined in the Income Tax Assessment Act 1997 (Cth)); (76) Tax Funding Agreement means any agreement under which a member of a consolidated group (as defined in the Income Tax Assessment Act 1997 (Cth)) may be required to pay the head company of the consolidated group or to reimburse the head company of the consolidated group after payment of the group liability (as defined in the Income Tax Assessment Act 1997 (Cth)); (77) Tax Sharing Agreement means any tax sharing agreement entered into in accordance with section 721-25 of the Income Tax Assessment Act 1997 (Cth) which complies with the requirements set out in any regulations, and is in accordance with any guidelines published by the Commissioner of Taxation concerning what is a reasonable allocation of Group Tax Liabilities of a Tax Consolidated Group among certain members of that group, or is otherwise accepted by the Commissioner of Taxation as being such a reasonable allocation; and (78) Transaction Documents means: (a) the Finance Documents; (b) the Material Documents; (c) any document or agreement entered into or provided under or in connection with, or for the purpose of amending or novating, any of the above; (d) any undertaking by or to a party or its lawyers under or in relation to any of the above; and (e) any other document that the Lender and the Company agree in writing is a Transaction Document; (79) $ or A$ means the lawful currency of Australia.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 12 OFFICIAL: Sensitive // Legal-Privilege 1.2 Interpretation (1) In this document, unless the context indicates otherwise, reference to: (a) one gender includes the others; (b) the singular includes the plural and the plural includes the singular; (c) a person includes a firm, unincorporated association, corporation and a government or statutory body or authority; (d) a party to this document or another agreement or document includes the party's executors, administrators, successors and permitted substitutes or assigns; (e) reference to a time refers to the time in the Relevant Location; (f) a statute, regulation or provision of a statute or regulation (Statutory Provision) includes: (i) that Statutory Provision as amended or re-enacted; (ii) a statute, regulation or provision enacted in replacement of that Statutory Provision; and (iii) another regulation or other statutory instrument made or issued under that Statutory Provision; (g) this document includes any annexure or schedule to it; (h) a clause, annexure or schedule is a reference to a clause of, or annexure or schedule to, this document; (i) an agreement or document is to the agreement or document as amended, novated, supplemented or replaced, except to the extent prohibited by this document; and (j) "writing" includes a facsimile transmission and any means of reproducing words in a tangible and permanently visible form. (2) Where a word or expression is given a particular meaning, other parts of speech and grammatical forms of that word or expression have a corresponding meaning. (3) Headings and any table of contents or index are for convenience only and do not form part of this document or affect its interpretation. (4) A provision of this document must not be construed to the disadvantage of a party merely because that party was responsible for the preparation of the document or the inclusion of the provision in the document. 1.3 Multiple Parties If a party to this document is made up of more than one person, or a term is used in this document to refer to more than one party, then unless otherwise specified in this Agreement: (1) an obligation of those persons is joint and several;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 13 OFFICIAL: Sensitive // Legal-Privilege (2) a right of those persons is held by each of them severally; and (3) any other reference to that party or that term is a reference to each of those persons separately, so that (for example): (a) a representation, warranty or undertaking relates to each of them separately; and (b) a reference to that party or that term is a reference to each of those persons separately. 2 Availability and limits 2.1 Availability Subject to this document, the Lender agrees to make available each Facility to the Borrowers during the relevant Availability Period for that Facility up to an aggregate amount equal to the applicable Facility Limit. 2.2 Purpose (1) The Borrowers must apply all amounts borrowed by it under a Facility towards an Approved Purpose or any other purpose the Lender agrees to in writing. (2) The Lender is not bound to monitor or verify the application of any amount borrowed pursuant to this document. 2.3 No redrawings Subject to this document, unless otherwise agreed by the Lender, the Borrowers will not be entitled to redraw Advances that have been repaid. 2.4 Cancellation (1) The Available Facility in respect of a Facility will be immediately cancelled at the end of the Availability Period for the Facility. (2) The Company may, if it gives the Lender not less than 5 Business Days' (or such shorter period as the Lender may agree) prior notice, cancel the whole or any part (being a minimum amount of $1,000,000 and a whole multiple of $500,000) of the Available Facility. Any cancellation under this clause will reduce the Facility Limit. 2.5 Extension (1) If the Company considers that the Engine Care and Maintenance Program has been delayed due to factors beyond the control of the Borrowers, the Company may request, by notifying the Lender in writing no later than 60 days before the end of the Availability Period for the Engine Facility, that the Availability Period for the Engine Facility be extended for a further 12 months (Extension Request). An Extension Request is irrevocable. Only one Extension Request may be issued under this document unless otherwise agreed by the Lender. (2) An Extension Request must be accompanied by: (a) updated financial forecasts unless otherwise agreed by the Lender; and

APAC-#312798503-v16 © Norton Rose Fulbright Australia 14 OFFICIAL: Sensitive // Legal-Privilege (b) an updated version of the Return to Service Schedule, being part 1 of the GoForwardRex 2025 Plan (as defined in part 1, Schedule 2 of the Restructuring Coordination Deed; and (c) and any other information requested by the Lender. (3) If the Lender receives an Extension Request, the extension will take effect at the end of the current Availability Period, and the current Availability Period will be extended by 12 months if the Lender confirms in writing to the Company that the following conditions have been met to the satisfaction of the Lender: (a) no Event of Default or Potential Default is subsisting on the date of the Extension Request and will not occur as a result of the Extension Request becoming effective; (b) the Lender has received documentation and other evidence satisfactory to it in all respects that the delay to the Engine Care and Maintenance Program was due to factors beyond the control of the Borrowers. By way of example, such evidence may include an annotated Engine Care and Maintenance Program showing the actual performance to date, purchase orders and correspondence with engine manufacturers, work orders issued to workshops, any letters explaining delays from the workshops or correspondence from any Borrower; (c) the information provided in connection with clause 2.5(2) is satisfactory to the Commonwealth; and (d) the Parties have signed all documents as may be required by the Lender (including, but not limited to, an amendment or variation of this document) to give effect to the Extension Request. 3 Conditions for requesting an Advance (1) A Borrower may utilise a Facility by delivery to the Lender of a duly completed Advance Request no later than 10.00am at least 20 Business Days (or such shorter period agreed by the Lender) before the proposed Advance Date that complies with the following provisions: (a) it must be in the form of, and specifying the matters required in, Schedule 2; (b) in respect of an Advance under the Engine Facility, must be for an amount no greater than $10,000,000 and no less than $500,000, unless otherwise agreed by the Lender; (c) in respect of an Advance under the Operations Facility, must be for an amount no greater than $5,000,000 and no less than $500,000, unless otherwise agreed by the Lender; (d) other than in respect of the initial Advance, it must be accompanied by a report (in a form agreed with the Lender) and which provides details of how the previous Advance has been used; (e) it is signed by all of the Borrowers; and (f) the proposed Advance Date for the Advance is a Business Day within the Availability Period.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 15 OFFICIAL: Sensitive // Legal-Privilege (2) The Borrowers may only deliver one Advance Request per Facility to the Lender in each calendar quarter. For the avoidance of doubt, the Borrowers may deliver one Advance Request in respect of the Engine Facility and one Advance Request in respect of the Operations Facility in the same quarter. (3) The Lender will only be obliged to comply with an Advance Request if on the date of the Advance Request and on the proposed Advance Date, the Lender is satisfied that it has received all of the following documents and other evidence in form and substance satisfactory to it: (a) the Lender has received all information and responses reasonably requested by it (including from third parties) in relation to the business and operations of the Borrowers or in relation to the purpose of the Advance, including, without limitation: (i) reporting of actual expenditure as compared to the most recent cash flow forecast delivered pursuant to clause 3(3)(a)(iv) and the Lender is satisfied that the amount of funding requested in an Advance Request under the Engine Facility has taken into account any funds from a previous Advance Request that have not yet been expended or applied towards the Approved Purpose; (ii) in the case of the first Advance under the Engine Facility, evidence that the Borrowers have drawn down and received not less than $25,000,000 in funding from Air T under the New Cap Note Facility and such funding has been fully utilised and expended or otherwise applied toward direct costs and expenses of the Engine Care and Maintenance Program and not repaid in whole or in part; (iii) in the case of the first Advance under the Operations Facility, evidence that all of the funding available to the Borrowers from Air T under the New Cap Note Facility has been fully utilised and expended or otherwise applied for the purpose for which it was drawn and not repaid in whole or in part; (iv) a financial statement in a form agreed with the Commonwealth along with a cash flow forecast for the next 12 months, prepared on reasonable assumptions no more than 3 months earlier and approved by each Borrower’s board of directors; and (v) information and responses that demonstrate that the Borrowers are complying with the Rex Regional Commitments; (b) the provision of the Advance will not cause the Principal Outstanding under the applicable Facility to exceed the relevant Available Facility; (c) if the Advance Request is in respect of the Engine Facility and the Lender requires, the Borrowers have granted a first-ranking Security Interest to the Lender in form and substance satisfactory to the Lender over any new assets that will be acquired by the Obligors with the proceeds of that Advance; (d) no Event of Default or Potential Default subsists or will result from the Advance being provided; and (e) the Lender is satisfied that each representation and warranty by a Borrower and Air T in the Transaction Documents is correct and not misleading as at the date of the relevant Advance Request and as at the

APAC-#312798503-v16 © Norton Rose Fulbright Australia 16 OFFICIAL: Sensitive // Legal-Privilege relevant Advance Date, with reference to the facts and circumstances on each of those dates. 4 Interest 4.1 Interest on each Advance (1) For each Interest Period, interest accrues daily on the Principal Outstanding of each Advance under each Facility at the applicable Interest Rate, and is calculated on the actual number of days from and including the first day of the Interest Period to and including the last day of the Interest Period and on the basis of a calendar year of 365 days. (2) If a RRC Non-Compliance occurs in respect of any Borrower and an RRC EOD Date occurs in respect of that RCC Non-Compliance, on and from the RRC EOD Date additional interest also accrues daily on the Principal Outstanding of each Advance under each Facility at the rate of 2 per cent per annum in addition to the interest payable under clause 4.1(1) each day during the period of non-compliance on the basis of a calendar year of 365 days. (3) Except to the extent capitalised in accordance with clause 4.1(3), the Borrower must pay to the Lender interest accrued under clauses 4.1(1) and 4.1(2) on each Interest Payment Date. (4) On any Interest Payment Date where the Lender is required by the Intercreditor Deed to capitalise interest payable pursuant to clause 4.1(1) or clause 4.1(2) on the relevant Interest Payment Date pursuant to: (a) a Capitalisation Notice (as defined in the Intercreditor Deed); or (b) clause 11.5(4) of the Intercreditor Deed, such accrued interest will be capitalised to the extent required by payment out of a new Advance under the applicable Facility provided to the Borrower for that amount, and an entry in the Lender's books effecting that capitalisation will be sufficient to satisfy the Borrower's obligation to otherwise make the interest payment and the Lender's obligation to provide the Advance. For the avoidance of doubt, if the date upon which any accrued interest is due to be capitalised (such date being the Due Date) is not a Business Day, then notwithstanding any other provision of this document, the Advance Date for the purposes of this clause 4.1 shall remain as the Due Date and the relevant Capitalisation Advance will be deemed to be drawn and added to the Principal Outstanding in respect of the applicable Facility on the Due Date and not on any preceding Business Day. Any Capitalisation Advance is in addition to and will be not count towards any applicable Facility Limit. 4.2 Interest Periods Each Interest Period for an Advance shall be a period of three calendar months, provided that: (1) the first Interest Period commences on (and includes) the Advance Date for the Advance and ends on (but excludes) the next Interest Payment Date: (2) each subsequent Interest Period commences on (and includes) the preceding Interest Payment Date and ends on (but excludes) the next Interest Payment Date; (3) the last Interest Period shall end on (and exclude) the Repayment Date.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 17 OFFICIAL: Sensitive // Legal-Privilege 4.3 Default Interest (1) If a Borrower fails to pay any amount payable by it under a Finance Document on its due date, interest shall accrue on the overdue amount from the due date up to the date of actual payment (both before and after judgment) at a rate which, subject to paragraph (b) below, is the sum of 2 per cent per annum and the rate which would have been payable if the overdue amount had, during the period of non-payment, constituted a Facility for successive Interest Periods, each of a duration selected by the Lender (acting reasonably). For avoidance of doubt, at any time while additional interest is payable under clause 4.1(2), no additional interest will be applied under this clause. Any interest accruing under this clause 4.3(1) shall be immediately payable by the Borrowers on demand by the Lender. (2) If any overdue amount consists of all or part of a Facility which became due on a day which was not the last day of an Interest Period relating to that Facility: (a) the first Interest Period for that overdue amount shall have a duration equal to the unexpired portion of the current Interest Period relating to that Facility; and (b) the rate of interest applying to the overdue amount during that first Interest Period shall be the sum of 2 per cent per annum and the rate which would have applied if the overdue amount had not become due. (3) Default interest (if unpaid) arising on an overdue amount will be compounded with the overdue amount at the end of each Interest Period applicable to that overdue amount but will remain immediately due and payable. 5 Repayments and prepayments of Advances 5.1 Repayment on Repayment Date On the Repayment Date the Borrower must pay to the Lender: (1) the whole of any remaining Principal Outstanding together with accrued interest; and (2) all other Secured Money then payable by the Borrowers under this document and unpaid. 5.2 Mandatory Prepayments (1) In this clause: Disposal Proceeds means the consideration received or receivable by any Borrower in relation to any Disposal made by any of them and after deducting: (a) any reasonable expenses which are incurred with respect to that Disposal to persons who are not Borrowers; and (b) any Tax incurred and required to be paid by the seller in connection with that Disposal in the year in which the Disposal occurs; Disposal means any sale, lease, transfer or other dealing with any assets of the Borrowers (including any disposal permitted by clause 9.5) that are available and required to be applied by the Borrowers towards repayment of Advances under this document in accordance with the Intercreditor Deed;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 18 OFFICIAL: Sensitive // Legal-Privilege Excess Cash Flow Proceeds means the amount of any Excess Cash Flow (as defined in the Intercreditor Deed) that is available and required to be applied by the Borrowers towards repayment of Advances under this document in accordance with the Intercreditor Deed; Insurance Proceeds means the proceeds of any insurance claim under any insurance maintained by any Borrower (after deducting any reasonable expenses in relation to that claim which are incurred by any Borrower to persons who are not Borrowers or other Related Entities of Air T) that are available and required to be applied by the Borrowers towards repayment of Advances under this document in accordance with the Intercreditor Deed. For the avoidance of doubt, insurance proceeds will not be available to be applied towards the repayment of Advances to the extent that the proceeds are used to replace, reinstate or repair the asset the proceeds relate to. (2) The Borrowers must prepay Advances in the following amounts to the extent available for payment to the Lender under the Intercreditor Deed: (a) the amount of any Excess Cash Flow Proceeds; (b) the amount of Disposal Proceeds or other cash revenue received by the Borrowers of a non-recurring nature; (c) the amount of Insurance Proceeds; and (d) the amount of any Compensation Proceeds, immediately on receipt of those proceeds by the relevant Borrower, except in the case of Excess Cash Flow Proceeds (and, to avoid doubt, Disposal Proceeds, other cash revenue and Compensation Proceeds which comprise Excess Cash Flow Proceeds) which must be applied immediately once available to be distributed to the Lender in accordance with the Intercreditor Deed. 5.3 Voluntary prepayments (1) Subject to the Intercreditor Deed, if at least 5 Business Days prior notice is given to the Lenders, the Borrowers may prepay all or part of the Principal Outstanding. That notice is irrevocable and the Borrowers must prepay in accordance with it. (2) Unless the Lender agrees otherwise, prepayment of part only of the Principal Outstanding may only be made in a principal amount of a minimum of A$500,000 or an integral multiple of that amount. 5.4 Effect of repayment and prepayment (1) If all or part of an Advance under a Facility is repaid or prepaid, an amount of the Facility Limit (equal to the amount which is repaid or prepaid) in respect of that Facility will be deemed to be cancelled on the date of repayment or prepayment. (2) No amount of the Facility Limit cancelled under this document may be subsequently reinstated. 6 Payments 6.1 Payments by Borrowers The Borrowers must make all payments under this document by electronic funds transfer to the account or accounts in Australia specified by the Lender, by 11.00am on the due date.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 19 OFFICIAL: Sensitive // Legal-Privilege 6.2 No deductions (1) All payments to be made by the Borrowers under this document must be made without set-off or counterclaim and free and clear of and without deduction or withholding for or on account of Taxes. (2) If the Borrowers are prohibited by law from making a payment free of all deductions and withholdings then: (a) the Borrowers must pay an additional amount to the Lender so that the actual amount received after deduction or withholding (and after payment of any additional Taxes or other taxes or charges due as a consequence of the payment of the additional amount) equals the amount that would have been received by the Lender if the deduction or withholding were not required; and (b) the Borrowers must promptly provide to the Lender official receipts or other documentation acceptable to the Lender evidencing the payment to the relevant Government Agency of any amount withheld or deducted. 6.3 Payment to be made on Business Day (1) Whenever any payment by the Borrowers becomes due on a day that is not a Business Day, the due date will be the next Business Day. (2) If a payment is received from the Borrowers by the Lender on the due date but after the time specified for payment or otherwise not in accordance with this document that payment will be treated as having been received before the specified time on the following Business Day. 6.4 Appropriation where insufficient money available Amounts received by the Lender will be appropriated as between principal, interest and other amounts as the Lender may respectively determine. This appropriation will override any appropriation made by a Borrower. Without limitation the Lender may appropriate amounts received first in payment of amounts payable to it by way of indemnity or reimbursement. 6.5 Rounding In making any allocation or appropriation under this document the Lender may round amounts to the nearest dollar. 7 Representations and warranties 7.1 Representations and warranties Each Borrower represents and warrants that: (1) it is a corporation validly existing under the laws of the Commonwealth of Australia and its state or territory of incorporation and duly registered under the Corporations Act; (2) it has the power to enter into and perform its obligations under the Transaction Documents to which it is expressed to be a party, to carry out the transactions contemplated by those documents and to carry on its business as now conducted or contemplated;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 20 OFFICIAL: Sensitive // Legal-Privilege (3) it has taken all necessary corporate action to authorise the entry into and performance of the Transaction Documents to which it is expressed to be a party, and to carry out the transactions contemplated by those documents; (4) the obligations expressed to be assumed by it in each Transaction Document are, subject to any necessary stamping and registration requirements, equitable principles and laws generally affecting creditors' rights, legal, valid, binding and enforceable obligations; (5) the execution and performance by it of the Transaction Documents to which it is expressed to be a party and each transaction contemplated under those documents did not and will not violate in any respect a provision of: (a) a law or treaty or a judgment, ruling, order or decree of a Government Agency binding on it; (b) its constitution; or (c) any other document or agreement that is binding on it or its assets, and, except as provided by the Transaction Documents, did not and will not: (d) create or impose a Security Interest on any of its assets, other than a Permitted Security Interest; or (e) allow a person to accelerate or cancel an obligation with respect to Financial Indebtedness, or constitute an event of default, cancellation event, prepayment event or similar event (whatever called) under an agreement relating to Financial Indebtedness, whether immediately or after notice or lapse of time or both; (6) no litigation, arbitration, Tax claim, dispute or administrative or other proceeding is current or pending or, to its knowledge, threatened, other than those about which it has notified the Lender and which the Lender has accepted; (7) no Event of Default or Potential Event of Default has occurred, other than a Potential Event of Default that has been notified to the Lender by a Borrower; (8) each Authorisation that is required in relation to: (a) the execution, delivery and performance by it of the Transaction Documents to which it is expressed to be a party and the transactions contemplated by those documents; and (b) the validity and enforceability of those documents, has been obtained or effected, is in full force and effect, has been complied with; (9) all financial statements and other documents and information provided by that Borrowers to the Lender is true and complete in all material respects at the date of this document or, if provided later, when provided. Neither that information nor its conduct and the conduct of anyone on its behalf in relation to the transactions contemplated by the Transaction Documents, was or is misleading in any material respect, by omission or otherwise; (10) all copies of Material Documents and all other documents which have been given by it or on its behalf to the Lender are true and complete copies and are in full force

APAC-#312798503-v16 © Norton Rose Fulbright Australia 21 OFFICIAL: Sensitive // Legal-Privilege and effect, and each document or agreement that is material to or that has the effect of varying a Material Document has been disclosed to the Lender; (11) it has complied with all laws and regulations binding on it; (12) it does not hold any assets as the trustee of any trust; (13) the entry into the Transaction Documents to which it is a party is for its commercial benefit; and (14) no Insolvency Event has occurred in respect of it; (15) subject to the Intercreditor Deed, its payment obligations under the Transaction Documents rank at least pari passu with the claims of all its other unsecured and unsubordinated creditors, except for obligations mandatorily preferred by law applying to companies generally; (16) subject to the Intercreditor Deed, each Security Document to which it is a party: (a) has or will have the ranking in priority which it is expressed to have in the Security Documents; and (b) is not subject to any prior ranking or pari passu ranking Security Interest, other than Permitted Security Interests; (17) it has a good and marketable title to, or valid leases or licences of, and all appropriate Authorisations to use, the assets necessary to carry on its business as presently conducted; (18) it has no Financial Indebtedness other than Permitted Financial Indebtedness; (19) it is a member of a Tax Consolidated Group for which the head company (as defined in the Income Tax Assessment Act 1997 (Cth) is the Company. Each Borrower acknowledges that the Lender has entered into the Transaction Documents in reliance on the representations and warranties in this document and the other Finance Documents. 7.2 Repetition Each Borrower will be taken to have represented and warranted to the Lender that the representations and warranties contained in this clause 7 are true, correct and not misleading on the date of this document, as at the date of each Advance and on each date on which a Transaction Document is executed and on the first day of each Interest Period while Secured Money exists. 7.3 Survival of representations and warranties All representations and warranties in any Transaction Document survive the execution and delivery of the Transaction Documents and the provision of advances and accommodation. 8 Reporting obligations 8.1 General Each Borrower must provide:

APAC-#312798503-v16 © Norton Rose Fulbright Australia 22 OFFICIAL: Sensitive // Legal-Privilege (1) all documents dispatched by a Borrower to its shareholders (or any class of them) or its creditors generally (or any class of them) at the same time as they are dispatched; (2) promptly upon becoming aware of them, the details of any litigation, arbitration or administrative proceedings which are current, threatened or pending against any member of the Group, and which might, if adversely determined, have a Material Adverse Effect; (3) promptly upon becoming aware of them, the details of any judgment or order of a court, arbitral tribunal or other tribunal or any order or sanction of any governmental or other regulatory body which is made against any member of the Group and which is reasonably likely to have a Material Adverse Effect; (4) on a quarterly basis and (if applicable), after Air T files form 10-K and form 10-Q with the Securities and Exchange Commission of the United States of America on behalf of the Borrowers, their quarterly financial statements to the Lender; (5) copies of all forms, documents or reports filed with ASIC no later than 5 Business Days after the same are filed with ASIC; (6) annually and no later than 15 Business Days after they are prepared, consolidated financial statements for the Group; (7) audited financial statements for the Group no later than 15 Business Days after the same have been provided to ASIC; (8) before the start of the financial year of the Group. an annual budget/forecast for the Group for the next 12 months; (9) at the Restructure Effective Date and within 20 Business Days of each calendar quarter, a detailed forecast of the approved expenditure contemplated by the Engine Care and Maintenance Program that is proposed to be funded under this document for the remainder of the Availability Period; (10) such information as required under the Intercreditor Deed, including clauses 11.3 (Commonwealth New Loan Agreement Reporting and Excess Cash Flow Reconciliation) and 11.4 (Rex Regional Commitments)’; and (11) and other information as the Lender may require in relation to its financial or business condition, property and assets and in relation to any Event of Default or Potential Event of Default. 8.2 Approved Purposes Upon request of the Lender, the Borrowers must provide the Lender with evidence that an Advance has been expended in accordance with an Approved Purpose, including invoices and other information or documents reasonably requested by the Lender. 9 General undertakings 9.1 Compliance with laws Each Borrower must comply in all material respects with all laws and regulations to which it may be subject.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 23 OFFICIAL: Sensitive // Legal-Privilege 9.2 Compliance with Material Documents Each Borrower must comply with its obligations under the Material Documents to which it is a party and not do, or omit to do, anything which may cause any breach, default or termination of the Material Documents to which it is a party. 9.3 Preservation of assets and minimum cash Each Borrower must: (1) ensure that the Group maintains, at all times between the initial draw of the New Cap Note Facility and until the New Cap Note Facility is fully drawn, a minimum of $5,000,000 in cash, or cash equivalent, on hand to fund general operating and working capital requirements of the Group; (2) maintain in good working order and condition (ordinary wear and tear excepted) all of its assets necessary or desirable in the conduct of its business (including, without limitation, implement and comply with its Engine Care and Maintenance Program); (3) do everything necessary to preserve and protect the realisable value of the Secured Property and its interest (and the interest of the Lender) in the Secured Property; and (4) not do or fail to do anything which may result in a reduction of the realisable value of any Secured Property, any charge or liability being imposed on the Secured Property or the interest of the Lender in the Secured Property being prejudiced in any way. 9.4 Audit The Lender may conduct, or engage a third party to conduct, an audit of the Borrowers at any time (on reasonable notice) for the purpose of monitoring and assessing expenditure and compliance with the terms of this document (an Audit). Such Audit may be conducted no more than once per year and will be paid for by the Lender. The Lender will determine the timing of the audit at its sole discretion but will consult with the Borrowers regarding the timing of such audit. 9.5 No Financial Indebtedness No Borrower may incur any Financial Indebtedness other than Permitted Financial Indebtedness. 9.6 No lending No Borrower may make any loans or other financial accommodation available to any person, or discharge any liability or expenses of any person, other than Permitted Financial Accommodation. 9.7 Authorisations Each Borrower shall promptly obtain, comply with and do all that is necessary to maintain in full force and effect, and supply certified copies to the Lender of any Authorisation required to perform its obligations under the Transaction Documents and to ensure the legality, validity, enforceability or admissibility in evidence in its jurisdiction of incorporation of any Transaction Documents.

APAC-#312798503-v16 © Norton Rose Fulbright Australia 24 OFFICIAL: Sensitive // Legal-Privilege 9.8 Arm’s length A Borrower shall not enter into any transaction with any person that is not a Borrower except on arm’s length terms (or on terms more favourable to the Borrower). 9.9 Negative pledge (1) A Borrower must not create or allow to exist any Security Interest over all or any of its respective present or future revenues or assets other than Permitted Security Interests. (2) Without limiting clause 9.5, no Borrower shall without the prior written consent of the Lender: (a) sell, transfer or otherwise dispose of any of its assets on terms whereby they are or may be leased to or re-acquired by a Borrower; (b) sell, transfer or otherwise dispose of any of its receivables on recourse terms; (c) enter into any title retention arrangement in circumstances where the arrangement or transaction is entered into primarily as a method of raising Financial Indebtedness or of financing the acquisition of an asset; (d) enter into any arrangement under which money or the benefit of a bank or other account may be applied, set-off or made subject to a combination of accounts; or (e) enter into any other preferential arrangement having a similar effect, provided that in each case, the Lender acknowledges that the Borrowers will continue, and are permitted, to trade and operate in the ordinary course of business and in accordance with the Rex Regional Commitments. 9.10 Disposals (1) No Borrower shall enter into a single transaction or a series of transactions (whether related or not) and whether voluntary or involuntary to sell, lease, transfer or otherwise dispose of any asset. Without limiting the foregoing, the Borrowers must not sell or dispose of any assets if such sale or disposal is not permitted by clause 7 of the Intercreditor Deed. (2) Clause 9.10(1) does not apply to any sale, lease, transfer or other disposal: (a) made in the ordinary course of trading of the disposing entity; (b) of assets in exchange for other assets comparable or superior as to type, value and quality and for a similar purpose; (c) of worn out or obsolete assets or of surplus assets no longer required for the efficient operation of the business (but excluding any aircraft, engine or simulator to the extent such sale, lease, transfer or other disposal is governed by clause 7 of the Intercreditor Deed); (d) of inventory pursuant to an inventory financing or repurchase arrangement, where such arrangements are on arm's length terms ;

APAC-#312798503-v16 © Norton Rose Fulbright Australia 25 OFFICIAL: Sensitive // Legal-Privilege (e) disposals of leases or licenses in the ordinary course of business that do not materially interfere with the business of the Borrowers taken as a whole; (f) where the higher of the market value or consideration receivable (when aggregated with the higher of the market value or consideration receivable for any other sale, lease, transfer or other disposal, other than any permitted under paragraphs (a) to (e) above) does not exceed $1,000,000 (or such other amount as approved by the Commonwealth) in any financial year; or (g) of an aircraft, engine or simulator comprised in the Existing Aircraft Fleet to the extent such sale, lease, transfer or other disposal is permitted in accordance with clause 7 of the Intercreditor Deed. 9.11 Access Each Borrower must provide ongoing access to employees and members of management of the Borrowers including reasonable access to any property it owns or occupies including the head office (located at 81-83 Baxter Road, Mascot NSW 2020 at the date of this document), to the Lender and its advisers and any other access as reasonably requested by the Lender or its advisers from time to time. 9.12 Insurance Each Borrower shall take out and maintain insurances with a reputable insurer in the manner and to the extent which is in accordance with prudent business practice having regard to the nature of the business and assets of that Borrower (including all insurance required by applicable law). 9.13 Taxation (1) No Borrower shall become a member of a Tax Consolidation Group (except for the Tax Consolidated Group mentioned in clause 7.1(19) without the prior consent of the Lender. (2) No Borrower shall enter into a Tax Funding Agreement or a Tax Sharing Agreement without the prior consent of the Lender except no consent of the Lender is required where the only parties to the Tax Funding Agreement or Tax Sharing Agreement are other Borrowers or a Grantor (as defined in the Intercreditor Deed). 9.14 Term of undertakings Each undertaking in this clause 8 continues from the date of this document until the Secured Money is fully and finally repaid. 10 Default Subject to clause 11.1, each of the following events listed in this clause 10 is an Event of Default (whether or not it is in the control of any Obligor). 10.1 Non-payment An Obligor does not pay on the due date any amount payable pursuant to a Finance Document at the place at and in the currency in which it is expressed to be payable.