corrs.com.au Quay Quarter Tower 50 Bridge Street, Sydney NSW 2000, Australia GPO Box 9925, Sydney NSW 2001, Australia corrs.com.au Syndicated Loan Note Subscription Agreement – Project Mustang Regional Express Holdings Limited as Borrower The Guarantors specified in the Key Details The Original Lenders specified in the Key Details Air T Lending 25.1, LLC as Facility Agent P.T. Limited in its capacity as trustee of the Project Mustang Security Trust as Security Trustee

Corrs Chambers Westgarth 3445-6323-2315v7 i Syndicated Loan Note Subscription Agreement – Project Mustang Contents 1 Interpretation 4 1.1 Definitions 4 2 Facility and purpose 17 2.1 Facility 17 2.2 Approved Purpose 17 2.3 Cancellation 17 3 Conditions precedent 17 3.1 Conditions precedent to initial Drawing 17 3.2 Additional conditions precedent to each Drawing 17 3.3 Delivery of Loan Note Deed Poll 18 3.4 Conditions precedent for Finance Parties' benefit only 18 4 Requesting and providing Drawings 18 4.1 Drawdown Notice 18 4.2 Form of Drawdown Notice 18 4.3 Loan Note 18 4.4 Drawdown Notice irrevocable 18 4.5 Drawdown Notice for Finance Parties' benefit only 19 4.6 Agreement to provide Drawing 19 4.7 Subscription and issue of Loan Notes 19 4.8 Facility Agent’s and Registrar’s obligations 19 4.9 Excluded issue 19 5 Interest and fees 20 5.1 Interest 20 5.2 Capitalisation of Interest 20 5.3 Security Trustee’s fees 20 5.4 Interest Rate Notice 20 6 Repayment and prepayment 21 6.1 Final Repayment Date 21 6.2 Mandatory prepayment – insurance proceeds 21 6.3 Voluntary prepayment 21 6.4 Interest and costs 21 6.5 Irrevocable notice 21 6.6 Apportionment of prepayments 22 6.7 Re-borrowing of repayments and prepayments 22 7 Representations and warranties 22 7.1 General representations and warranties 22 7.2 Secured Property representations and warranties 23 7.3 Repetition 23

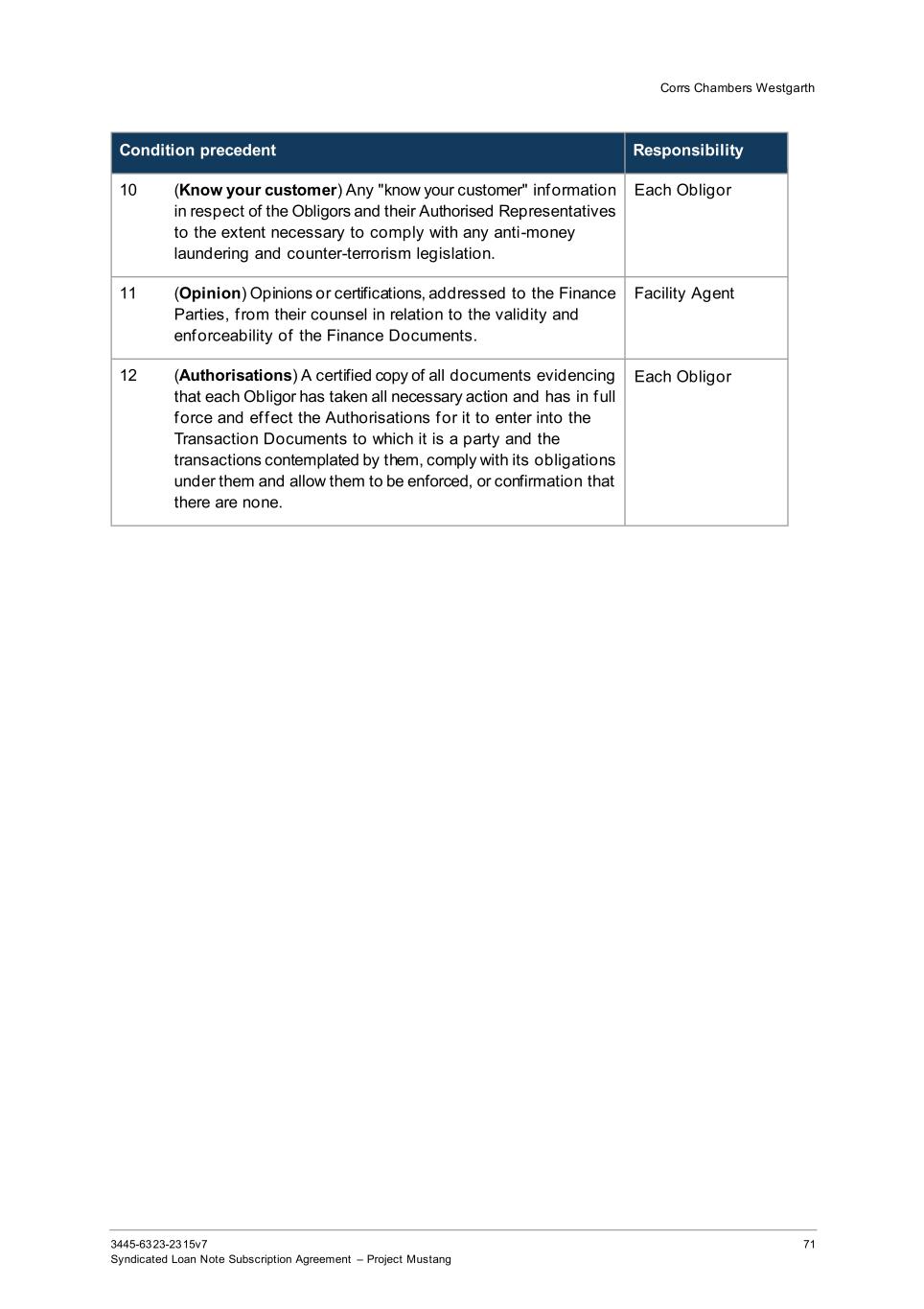

Corrs Chambers Westgarth 3445-6323-2315v7 ii Syndicated Loan Note Subscription Agreement – Project Mustang 7.4 Reliance 24 8 Undertakings 24 8.1 General undertakings 24 8.2 Provision of information 24 8.3 Reporting 25 8.4 Insurance undertakings 25 8.5 Secured Property undertakings 25 8.6 Real Property undertakings 26 8.7 Restrictive undertakings 26 9 Default 27 9.1 Events of Default 27 9.2 Powers on default 28 9.3 Investigating Experts 29 10 Not used 29 11 Guarantee and indemnity 29 11.1 Guarantee 29 11.2 Indemnity 29 11.3 Ipso Facto Event 30 11.4 Demand 30 11.5 Time of demand 30 11.6 Principal obligations 30 11.7 No recourse to Security Document or other rights 30 11.8 Continuing guarantee 30 11.9 Increases in Guaranteed Money 31 11.10 Contingent amounts 31 11.11 Preservation 31 11.12 No obligation to marshal 32 11.13 Suspension of rights 32 12 Costs and expenses 33 12.1 Costs, charges and expenses 33 12.2 Taxes 33 12.3 Facility Agent services 33 13 Indemnities 34 13.1 General indemnity 34 13.2 Prepayment indemnity 34 13.3 Indemnity to the Facility Agent 35 13.4 Operation of indemnities 35 13.5 Duration 35

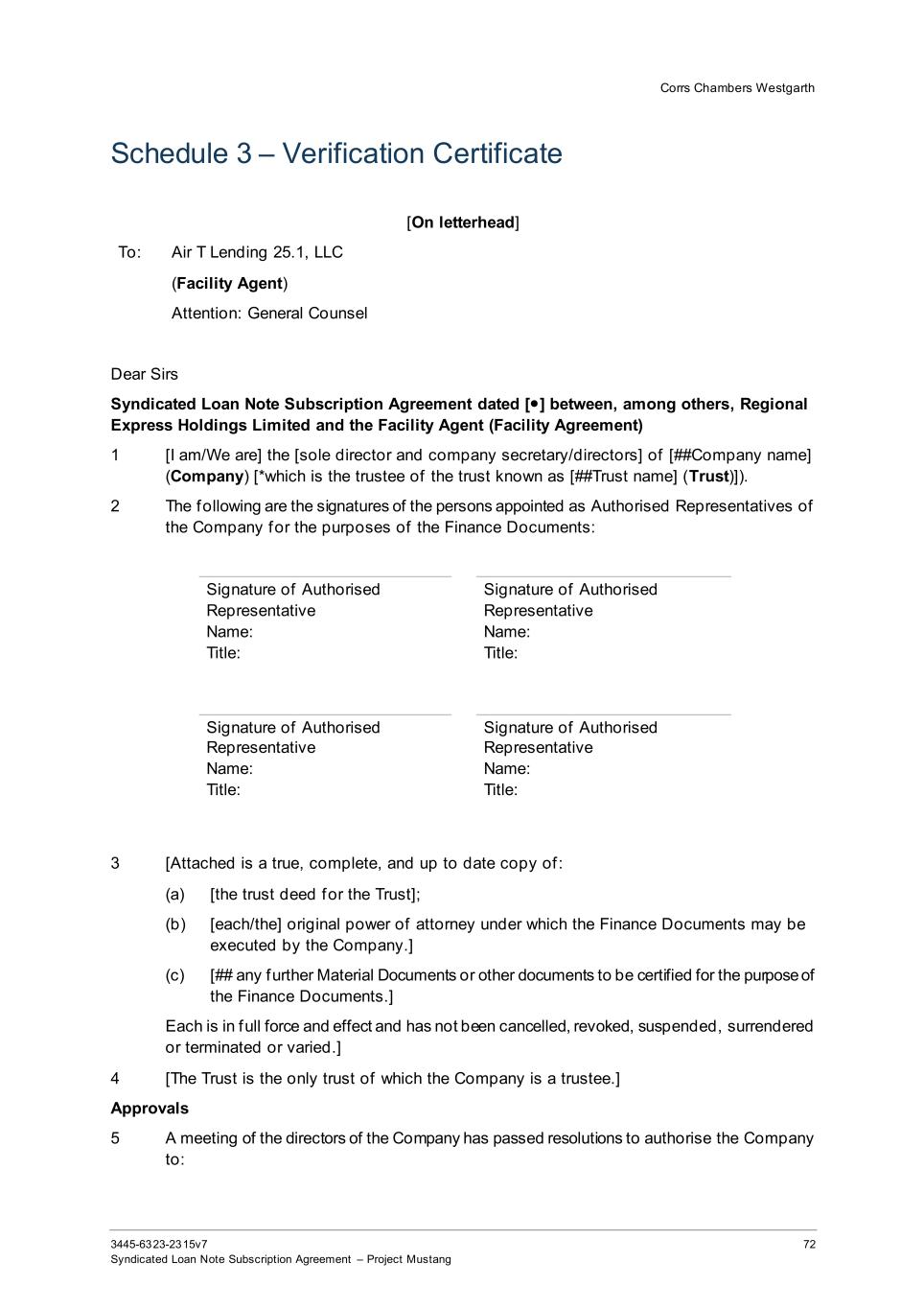

Corrs Chambers Westgarth 3445-6323-2315v7 iii Syndicated Loan Note Subscription Agreement – Project Mustang 14 Payments 35 14.1 Payments 35 14.2 Deduction and withholdings 35 14.3 Not used 36 14.4 Not used 36 14.5 Capitalisation of interest 36 14.6 Merger 36 14.7 Currency 36 14.8 Goods and Services Tax 36 14.9 Payments to the Facility Agent 37 14.10 Distributions by the Facility Agent 37 14.11 Distributions to an Obligor 37 14.12 Clawback and pre-funding 37 14.13 Facility Agent a Defaulting Finance Party 38 14.14 Partial payments 38 14.15 Disruption to payment systems etc. 39 14.16 Rounding 39 14.17 Conduct of Finance Parties 39 15 Illegality and increased costs 40 15.1 Illegality 40 15.2 Increased costs 40 16 Register 41 16.1 Appointment of Registrar 41 16.2 Establishment and maintenance of Register 41 16.3 Location of Register 41 16.4 Information required in Register 41 16.5 Register is paramount 42 16.6 Update and correction of Register 42 16.7 Inspection of Register 42 16.8 Certif ied extracts f rom Register available 42 16.9 Retirement or removal of Registrar 42 17 Anti-money laundering 43 17.1 Finance Party may block transactions 43 17.2 Obligors to provide information 43 17.3 Finance Parties may disclose information 43 17.4 No breach 43 17.5 Capacity of Obligors 43 18 Notices 43 18.1 Communications in writing 43

Corrs Chambers Westgarth 3445-6323-2315v7 iv Syndicated Loan Note Subscription Agreement – Project Mustang 18.2 Addresses 44 18.3 Delivery 44 18.4 Notification of address and email address 44 18.5 Email communication 44 18.6 Communication through secure website 45 18.7 Reliance 46 18.8 English language 47 18.9 Digitally signed notices 47 19 Disclosure of information 47 19.1 Specif ic disclosure by Finance Parties 47 19.2 General disclosure by Finance Parties 48 19.3 Personal Information 48 20 PPS Act 48 20.1 Confidentiality 48 20.2 PPS Act further assurances 49 20.3 PPS Act undertakings 49 20.4 PPS Act costs and expenses 49 20.5 No PPS Act notice required unless mandatory 50 21 Assignments and syndication 50 21.1 Assignment by Obligors 50 21.2 Assignment by Finance Parties 50 21.3 Substitution certif icates 50 21.4 Tax Gross-up on assignment or novation by Lender 51 22 Relationship of Lenders to Facility Agent 52 22.1 Authority 52 22.2 Instructions and extent of discretion 52 22.3 Rights and discretions 53 22.4 Facility Agent not a fiduciary 54 22.5 No liability 54 22.6 Delegation 54 22.7 Reliance on documents and experts 54 22.8 Notice of transfer 55 22.9 Notice of default 55 22.10 Facility Agent as Lender and banker 55 22.11 Exclusion of liability 55 22.12 Indemnity to Facility Agent and Lenders 56 22.13 Independent investigation of credit 57 22.14 No monitoring 57 22.15 Information 57

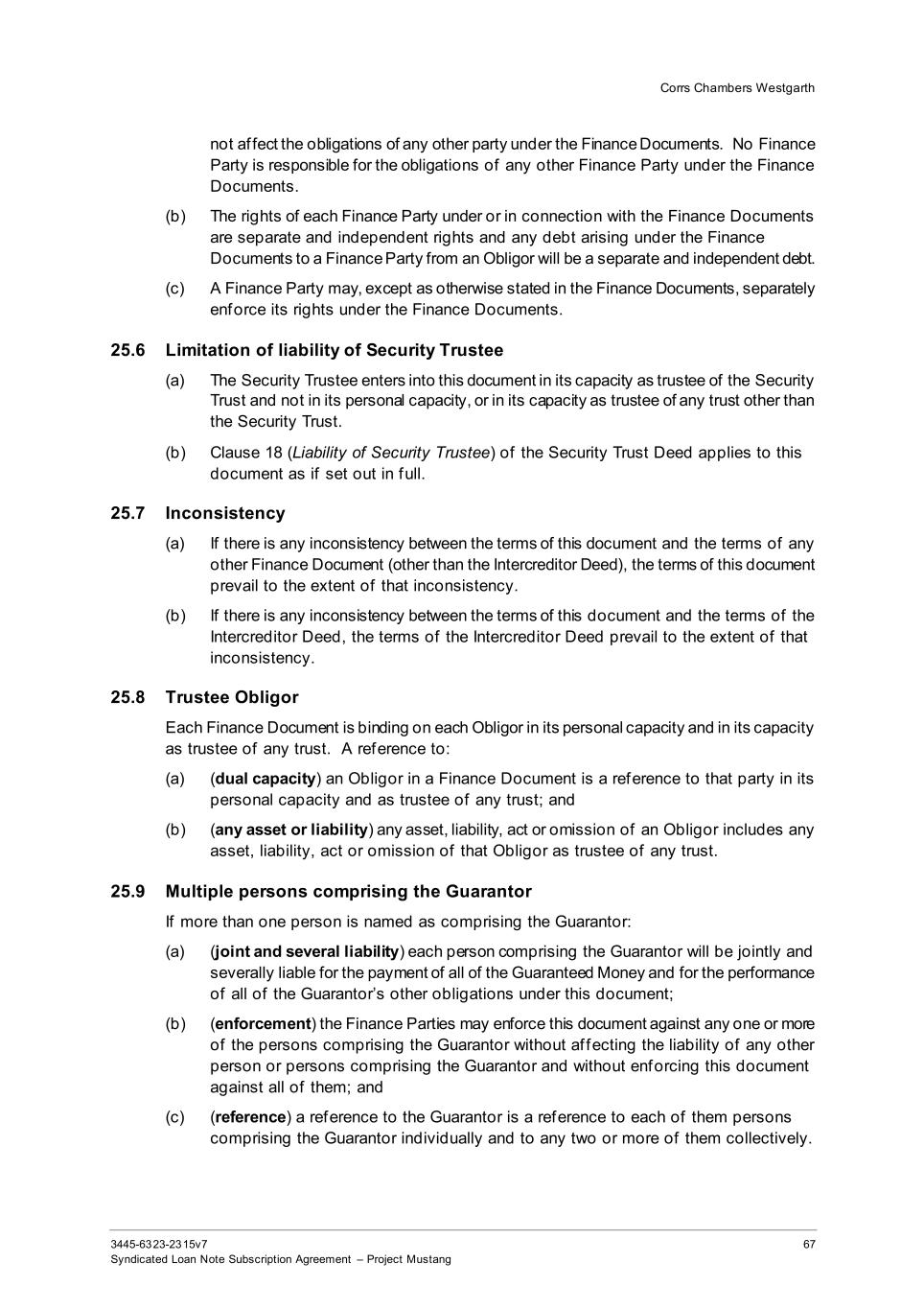

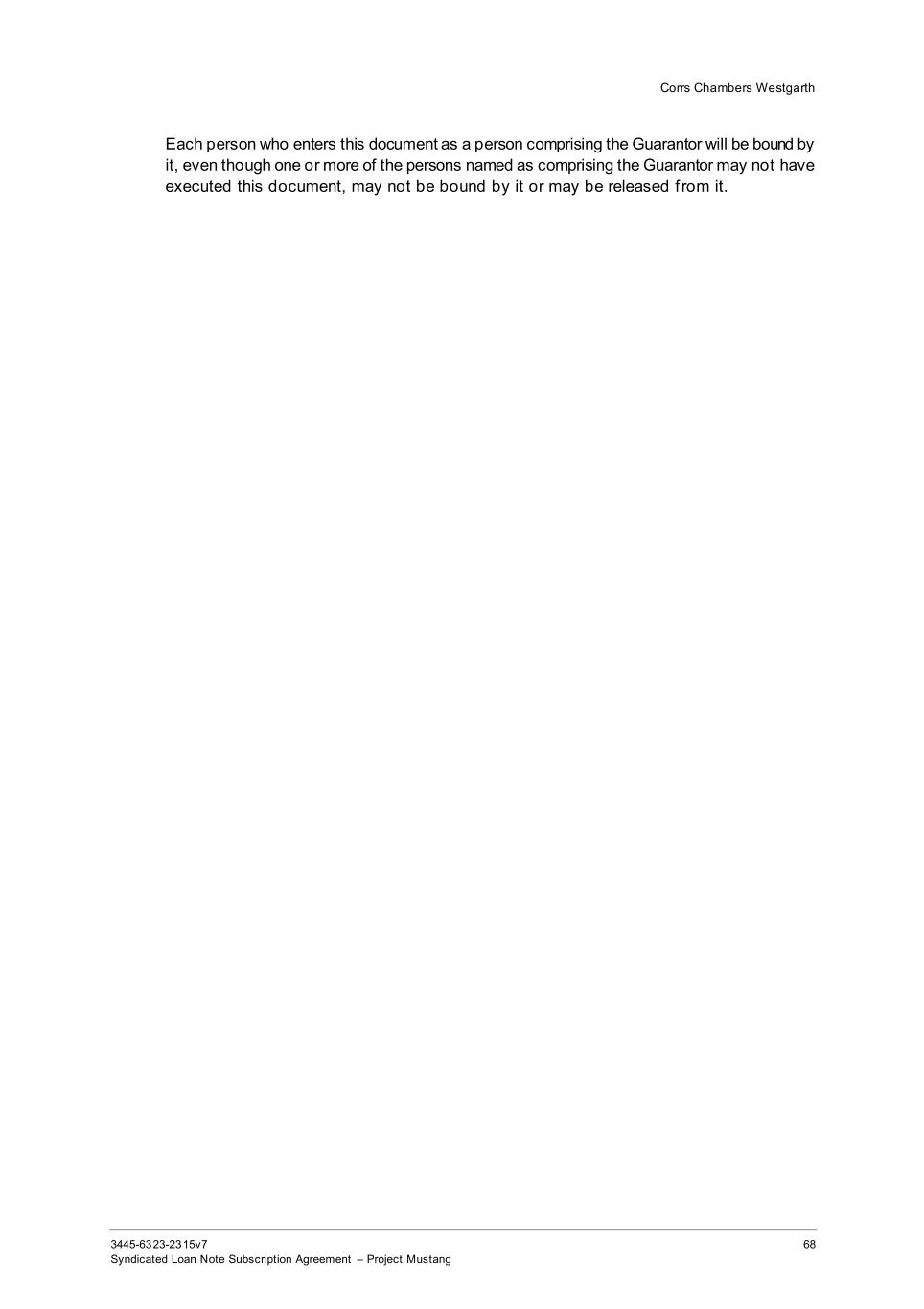

Corrs Chambers Westgarth 3445-6323-2315v7 v Syndicated Loan Note Subscription Agreement – Project Mustang 22.16 Replacement of Facility Agent 57 22.17 Amendment of Finance Documents 59 22.18 No obligations 60 22.19 Responsibility for documentation 60 22.20 Know your customer 60 22.21 Deduction from amounts payable by the Facility Agent 60 23 Proportionate sharing 61 23.1 Sharing 61 23.2 Refusal to join in action 62 23.3 Arrangements with unrelated parties 62 24 General 62 24.1 Further assurances 62 24.2 Reinstatement of rights 62 24.3 Certif icates 63 24.4 Rights 63 24.5 No merger 63 24.6 Waivers, variations and consents 63 24.7 Time of the essence 64 24.8 Invalidity 64 24.9 Set-off 64 24.10 Acknowledgment by Obligors 64 24.11 Counterparts 64 24.12 Governing law and jurisdiction 65 25 Construction 65 25.1 Interpretation 65 25.2 PPS Act defined terms 66 25.3 Business Day rule 66 25.4 Effect of statutes and regulations 66 25.5 Finance Parties' rights and obligations 66 25.6 Limitation of liability of Security Trustee 67 25.7 Inconsistency 67 25.8 Trustee Obligor 67 25.9 Multiple persons comprising the Guarantor 67 Schedule 1 – Guarantors 69 Schedule 2 – Conditions precedent 70 Schedule 3 – Verification Certificate 72 Schedule 4 – Drawdown Notice 75

Corrs Chambers Westgarth 3445-6323-2315v7 vi Syndicated Loan Note Subscription Agreement – Project Mustang Schedule 5 – Substitution certificate 76 Schedule 6 – Form of Loan Note Deed Poll 79 Execution 83

Corrs Chambers Westgarth 3445-6323-2315v7 Our ref: 9206827 1 Syndicated Loan Note Subscription Agreement – Project Mustang Key Details 1 Date 2 Parties Borrower Name Address Attention Email Guarantor Name Address Email Attention Original Lenders Name Address Attention Email Commitment Facility Agent Name Address Attention Email Regional Express Holdings Limited ACN 099 547 270 81-83 Baxter Road, Mascot NSW 2020 Director/Company Secretary/General Counsel xxxx@airt.com Each entity specif ied in schedule 1 As specif ied in schedule 1 As specif ied in schedule 1 As specif ied in schedule 1 Air T Lending 25.1, LLC 5000 W 36th Street, Suite 200, Minneapolis MN 55416 General Counsel xxxx@airt.com $50,000,000 Air T Lending 25.1, LLC 5000 W 36th Street, Suite 200, Minneapolis MN 55416 General Counsel xxxx@airt.com Security Trustee

Corrs Chambers Westgarth 3445-6323-2315v7 2 Syndicated Loan Note Subscription Agreement – Project Mustang Name Address Attention Email P.T. Limited ACN 004 454 666 in its capacity as trustee of the Project Mustang Security Trust Level 14, 123 Pitt Street SYDNEY NSW 2000 Manager, Agency & Trustee xxxx@perpetual.com.au 3 Facility Total Commitment $50,000,000 plus any interest which is capitalised pursuant to clause 5.2 Drawdown Period The period commencing on the date of this document and ending on the date 5 Business Days prior to the Final Repayment Date. Approved Purpose To assist the Borrower: (a) to fund working capital purposes and capital expenditure of the Group; (b) to fund payment of costs and expenses of the Group in connection with ‘catch up’ engine care and maintenance program and airworthiness expenditure; (c) to pay fees and costs payable under this document; and (d) to apply monies toward any such other purpose as may be approved by the Facility Agent in writing. Final Repayment Date The date which is 5 years af ter the date of Financial Close. 4 Fees Interest Rate 12% per annum, subject to clause 5.4 Other fees Any security trustee fees which are payable in accordance with clause 5.3. 5 Security Documents The Security Documents include the following: • General Security Agreement • Aircraf t Security • Each Real Property Mortgage

Corrs Chambers Westgarth 3445-6323-2315v7 3 Syndicated Loan Note Subscription Agreement – Project Mustang

Corrs Chambers Westgarth 3445-6323-2315v7 4 Syndicated Loan Note Subscription Agreement – Project Mustang Agreed terms 1 Interpretation 1.1 Definitions In this document these terms have the following meanings: 138 Elizabeth Avenue Property 140 Elizabeth Avenue Property Accounting Standards Aircraft Security The property located at 138 Elizabeth Avenue, Forest Hills NSW 2650 with title reference xxxx. The leasehold interest in the lease with registration number xxxx in connection with the property known as Hangar Site, Hangar No. xxxx, located at 140 Elizabeth Avenue, Forest Hills NSW 2650 with title reference xxxx. Accounting standards under the Corporations Act and, if not inconsistent with those accounting standards, generally accepted accounting principles and practices in Australia consistently applied. The specific security deed dated on or about the date of this document granted by the Borrower, Rex Investments Holdings Pty Ltd and Regional Express Pty Ltd in favour of the Security Trustee over aircraf t. Approved Purpose A purpose so specif ied in item 3 the Key Details. Approved Valuation A valuation that: (a) is undertaken by an independent valuer acceptable to the Facility Agent; (b) is addressed to each Lender and the Security Trustee for security purposes; (c) is no more than three months old at the time it is provided to the Finance Parties; (d) is at the cost of the Borrower; and (e) is otherwise in form and substance satisfactory to the Facility Agent. ASIC The Australian Securities & Investments Commission or the Government Body that succeeds it. Associate Has the meaning given in section 128F(9) of the Tax Act. Australian Interest Withholding Tax Any Tax required to be withheld or deducted from a payment or deemed payment of interest (or amount in the nature of interest) under any Finance Document under Division 11A of Part III of the Tax Act or Subdivision 12-F of Schedule 1 to the Taxation Administration Act 1953 (Cth). Authorisation Includes:

Corrs Chambers Westgarth 3445-6323-2315v7 5 Syndicated Loan Note Subscription Agreement – Project Mustang (a) any consent, authorisation, registration, f iling, lodgement, agreement, notarisation, certificate, permission, licence, approval, authority or exemption f rom, by or with a Government Body; or (b) in relation to anything which will be fully or partly prohibited or restricted by law if a Government Body intervenes or acts in any way within a specified period after lodgement, filing, registration or notif ication, the expiry of that period without intervention or action. Authorised Representative (a) In respect of an Obligor, its director or secretary or other person notif ied to the Facility Agent and the Security Trustee by that Obligor as being authorised to act as its authorised representative for the purposes of the Finance Documents and in respect of which: (i) that person's identity has been verif ied to each Finance Party's satisfaction in order to complete that Finance Party's KYC Checks; and (ii) the Facility Agent and the Security Trustee have no notice of revocation of that authority; and (b) in respect of a Finance Party, an of f icer of that Finance Party whose title of of f ice contains the word "Director", "Associate", "Head", "Executive", “Senior Manager”, "Manager", “Counsel” or "President" or a person performing the functions of any of them. Avoided Transaction Any payment, settlement, transaction, transfer or other dealing by or on behalf of an Obligor in connection with any Finance Document which is or becomes avoided for any reason, including: (a) as a result of any law relating to bankruptcy, insolvency or the protection of creditors; or (b) any legal limitation, disability or incapacity of or af fecting any person. Bill Borrower Bowral Place Property Business Day A "Bill of Exchange" as defined in the Bills of Exchange Act 1909 (Cth). The person so described in item 2 of the Key Details. The property located at 2 Bowral Place, Mitchell Park, Victoria with title reference xxxx. A day that is not a Saturday, Sunday or any other day which is : (a) a public holiday or a bank holiday in the New South Wales or the Australian Capital Territory; (b) a public holiday or a bank holiday in New York; or (c) a day falling between 24 December and 2 January (inclusive) in any particular year. Commitment (a) In relation to each Original Lender, the amount specif ied as being its “Commitment” in item 2 of the Key Details and the amount of any other Commitment transferred to it under this document; and (b) in relation to any other Lender, the amount of any Commitment transferred to it under this document,

Corrs Chambers Westgarth 3445-6323-2315v7 6 Syndicated Loan Note Subscription Agreement – Project Mustang to the extent not cancelled, reduced or transferred by it under this document. Commonwealth Commonwealth of Australia as represented by the Department of Inf rastructure, Transport, Regional Development, Communications, Sport and the Arts ABN 86 267 354 017. Commonwealth Finance Documents (a) The Commonwealth New Loan Facility; (b) the Commonwealth Secured Perpetual Note; (c) each other “Finance Document” as defined in, and for the purposes of , the Commonwealth New Loan Facility; (d) each other “Commonwealth Finance Document” as defined in, and for the purposes of, the Commonwealth Secured Perpetual Note. Commonwealth New Loan Facility The document entitled “Facility Agreement” dated on or about the date of this document between, among others, the Commonwealth and the Borrower. Commonwealth Secured Perpetual Note The document entitled “Commonwealth Facility Agreement” originally dated 11 November 2024 and further amended and restated on or about the date of this document between, among others, the Commonwealth and the Borrower. Control Has the meaning given in section 50AA of the Corporations Act and in respect of an entity (as defined in the Corporations Act) includes the direct or indirect power to directly or indirectly direct the management or policies of the entity or control the membership or voting of the board of directors or other governing body of the entity (whether or not the power has statutory, legal or equitable force or arises by means of statutory, legal or equitable rights or trusts, agreements, arrangements, understandings, practices, the ownership of any interest in marketable securities, bonds or instruments of the entity or otherwise). Controller Has the meaning given in the Corporations Act. Corporations Act The Corporations Act 2001 (Cth). CPI The Consumer Price Index (all groups – weight average of eight capital cities) published by the Australian Bureau of Statistics. Default (a) An Event of Default; or (b) a Potential Event of Default. Defaulting Finance Party Any Finance Party: (a) which (in any capacity) has failed to make a payment when due under this document or has notif ied a party that it will not make such a payment, except where: (i) its failure to pay is caused by: (A) administrative or technical error; or (B) a Disruption Event; and payment is made within two Business Days of its due date; or

Corrs Chambers Westgarth 3445-6323-2315v7 7 Syndicated Loan Note Subscription Agreement – Project Mustang (ii) the Finance Party is disputing in good faith whether it is contractually obliged to make the payment in question; (b) which (in any capacity) has otherwise rescinded or repudiated a Finance Document; or (c) which: (i) is or is adjudicated to be insolvent; (ii) applies or resolves to be wound up, given protection against creditors or placed in bankruptcy or any analogous process; or (iii) is subject to the appointment of a liquidator, administrator, manager, trustee in bankruptcy or any analogous process. Disruption Event Either or both of : (a) a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of , any of the parties; or (b) the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a party preventing that, or any other party: (i) f rom performing its payment obligations under the Finance Documents; or (ii) f rom communicating with other parties in accordance with the terms of the Finance Documents, and which (in either such case) is not caused by, and is beyond the control of , the party whose operations are disrupted. Drawdown Date In respect of a Drawing, the date on which that Drawing is or is proposed to be made. Drawdown Notice A notice referred to in clause 4.1(a). Drawdown Period The period so specif ied in item 3 of the Key Details. Drawing The outstanding principal amount of a drawdown made by way of subscription of Loan Notes issued by the Borrower under the Facility or deemed to be made in accordance with clause 5. Encumbrance (a) Any Security Interest; (b) any right, interest or arrangement which has the ef fect of giving another person a preference, priority or advantage over creditors, including any right of set-of f ; (c) any right that a person (other than the owner) has to remove something f rom land (known as a prof it à prendre), easement, public right of way, restrictive or positive covenant, caveat, lease or licence to use or occupy; or

Corrs Chambers Westgarth 3445-6323-2315v7 8 Syndicated Loan Note Subscription Agreement – Project Mustang (d) any third party right or interest in property, or any right arising as a consequence of the enforcement of a judgement, or any agreement to create any of them or allow them to exist. Event of Default Has the meaning given to that term in clause 9.1. Excluded Tax (a) A Tax imposed by a jurisdiction on, or calculated by reference to, the net income of a Finance Party in a jurisdiction because the Finance Party has a connection with that jurisdiction, other than a Tax: (i) calculated by reference to the gross amount of a payment (without allowing for any deduction) derived by the Finance Party under a Finance Document or any other document referred to in a Finance Document; or (ii) imposed because the Finance Party is taken to be connected with that jurisdiction solely by being a party to a Finance Document or a transaction contemplated by a Finance Document; and (b) Australian Interest Withholding Tax. Facility The facility provided under clause 2.1(a). Facility Agent The person so specif ied in item 2 of the Key Details. Final Repayment Date The date so specified in item 3 of the Key Details or such later date as the Facility Agent (acting on the instructions of all Lenders) may agree to in writing. Finance Documents (a) This document and each notice or certif icate under it; (b) the Loan Note Deed Poll; (c) the Security Trust Deed; (d) the Security Documents; (e) the Intercreditor Deed; (f ) the Security Trustee Fee Letter; (g) a substitution certificate or other notice referred to in clause 21.3; and (h) any other document the Borrower and the Facility Agent agree in writing is a "Finance Document" for the purposes of this document. Finance Lease Any lease or hire purchase contract which would, in accordance with Accounting Standards, be treated as a f inance or capital lease. Finance Party (a) A Lender; (b) the Facility Agent; (c) the Security Trustee; or (d) any assignee or transferee of any of the above. Financial Close The Drawdown Date for the initial Drawing.

Corrs Chambers Westgarth 3445-6323-2315v7 9 Syndicated Loan Note Subscription Agreement – Project Mustang Financial Indebtedness Includes any indebtedness or other liability (present or future, actual or contingent) relating to any f inancial accommodation including: (a) an advance or loan; (b) drawing, accepting, endorsing, discounting, collecting or paying a bill of exchange, cheque or other negotiable instrument; (c) entering into any agreement or transaction in connection with raising f inancial accommodation as a result of which a debt or liability or a contingent debt or liability will or might arise (including any Finance Lease, hire purchase agreement or title retention agreement); (d) any preference share or unit categorised as debt under Accounting Standards; (e) any commodity, currency or interest rate swap agreement, forward exchange rate agreement or futures contract (as def ined in any statute); (f ) any Guarantee relating to any f inancial accommodation; and forbearing to require immediate payment of any moneys owing or contingently owing on any account, for any reason whatsoever. Financial Statements (a) A statement of f inancial performance; (b) a statement of f inancial position; and (c) a statement of cashf low, together with any notes to those documents and any accompanying reports, statements, declarations and other documents or information. General Security Agreement The general security agreement dated on or about the date of this document granted by each Obligor in favour of the Security Trustee over all of their present and af ter acquired property. Government Body The Crown, a government, a government department, or a governmental, semi-governmental, statutory, administrative, parliamentary, provincial, public, municipal, local, judicial or quasi-judicial body. Group The Borrower and each of its Subsidiaries except Rex Airlines Pty Ltd ACN 642 400 048. GST The meaning given to that term in section 195-1 of A New Tax System (Goods and Services Tax) Act 1999 (Cth). Guarantee (a) A guarantee, indemnity, undertaking, letter of credit, Security Interest, acceptance or endorsement of a negotiable instrument or other obligation (actual or contingent) given by any person to secure compliance with an obligation by another person; (b) an obligation (actual or contingent) of a person to ensure the solvency of another person or the ability of another person to comply with an obligation, including by the advance of money or the acquisition for valuable consideration of property or services ; or

Corrs Chambers Westgarth 3445-6323-2315v7 10 Syndicated Loan Note Subscription Agreement – Project Mustang (c) an option under which a person is obliged on the exercise of the option to buy: (i) any debt or liability owed by another person; or (ii) any property which is subject to a Security Interest. Guaranteed Money All of the Secured Money owing by the Borrower. Guarantor The persons so described in item 2 of the Key Details. Illegality Has the meaning given to that term in clause 15.1(a). Initial Period Has the meaning given to that term in the Intercreditor Deed. Insolvency Event Any of the following events in the case of a corporation: (a) the corporation is dissolved (whether pursuant to Chapter 5A of the Corporations Act or otherwise); (b) a Controller, liquidator, provisional liquidator or voluntary administrator is appointed in respect of the corporation or any of its assets; (c) an application (other than an application which is withdrawn or dismissed within seven days of it having been made) is made to a court or a meeting is convened, or a resolution is passed (or notice is given of such meeting or resolution) or a notice is issued or any other step is taken by any person for the corporation to be wound up (other than as a members' voluntary winding up) or dissolved or for the appointment of a liquidator, provisional liquidator, voluntary administrator in respect of the corporation or any of its assets; (d) the corporation: (i) resolves to enter into, or enters into, a scheme of arrangement, a deed of company arrangement or a composition with its creditors or an assignment for their benef it (other than a solvent winding up or solvent reorganisation of any Obligor); (ii) suspends payment of its debts or proposes or is subject to a moratorium of its debts; or (iii) takes proceedings or actions similar to those mentioned in this paragraph (d) as a result of which the corporation's assets are, or are proposed to be, submitted to the control of its creditors; (e) the corporation seeks or obtains protection from its creditors under any statute or any other law; (f ) the corporation is unable to pay all of its debts as and when they become due and payable or is deemed to be insolvent under any provision of the Corporations Act or any statute or any other law; (g) any attachment, distress, execution or other process is made or levied against any asset of the corporation and is not satisf ied within 10 Business Days; or

Corrs Chambers Westgarth 3445-6323-2315v7 11 Syndicated Loan Note Subscription Agreement – Project Mustang (h) an event occurs in relation to the corporation which is analogous to anything referred to above or which has a substantially similar ef fect. Insurance All of the insurance which an Obligor is required to maintain under any Transaction Document. Insurance Policy Each policy, certificate or other document evidencing the terms of any Insurance. Intellectual Property Any intellectual or industrial property including: (a) a patent, trade mark, service mark, copyright, registered design, trade secret, plant breeder's right, domain name or conf idential information; or (b) a licence or other right to use or to grant the use of any of the foregoing or to be the registered proprietor or user of any of the foregoing. Intercreditor Deed The intercreditor deed dated on or about the date of this document between, the Obligors, the Facility Agent, the Security Trustee and the Commonwealth. Interest Payment Date Each 31 March, 30 June, 30 September and 31 December. Interest Rate The rate so specif ied in item 4 of the Key Details. Interest Rate Notice A notice referred to in clause 5.4(a). Ipso Facto Event The Borrower is the subject of : (a) an announcement, application, compromise, arrangement, managing controller or administration as described in sections 415D(1), 434J(1) or 451E(1) of the Corporations Act; or (b) any process which under any law with a similar purpose may give rise to a stay on, or prevention of, the exercise of contractual rights. James Schofield Drive Property Key Details KYC Checks The leasehold interest in lease with registration number xxxx, known as ‘xxxx’ located at James Schofield Drive, Adelaide Airport SA 5950 (with title reference xxxx). The section of this document headed Key Details. For a Finance Party, that Finance Party's 'know your customer' or similar identification and verif ication checks and procedures required for that Finance Party to comply with the Anti-Money Laundering and Counter- Terrorism Financing Act 2006 (Cth) and any other law or regulation of Australia or comparable law or regulation of another country, and to manage anti-money laundering, counter-terrorism financing or economic and trade sanctions risk. Lease (a) A lease, charter, hire purchase or hiring arrangement of any property; (b) a right to use any Intellectual Property; (c) a right to use a f ranchise; or

Corrs Chambers Westgarth 3445-6323-2315v7 12 Syndicated Loan Note Subscription Agreement – Project Mustang (d) an agreement under which property is or may be used or operated by a person other than the owner. Lender (a) An Original Lender; or (b) any person which has become a Lender in accordance with clause 21, which in each case has not ceased to be a Lender in accordance with the terms of this document. Licence Any consent, permit or licence under any statute or any other law or any Authorisation held or required to be held by or on behalf of an Obligor in connection with the Secured Property or an activity or business conducted in connection with the Secured Property. Loan Note A loan note: (a) having a principal amount of $1.00; and (b) issued for a subscription price of 100% of its principal amount under this document and the Loan Note Deed Poll, and, in this document, references to a Loan Note include a reference to the corresponding interest in the Loan Note Deed Poll. Loan Note Deed Poll A deed poll executed by the Obligors substantially in the form of Schedule 6. Majority Lenders (a) If there are 2 or less Lenders, all Lenders; and (b) at any other time, a Lender or Lenders whose Commitments aggregate at least 66 ⅔% of the Total Commitment (or, if the Total Commitment has been reduced to zero, at least 66 ⅔% of the Total Commitment immediately prior to the reduction). Where a Lender’s Commitment has been reduced to zero, but it has an outstanding participation in any outstanding Drawing, then, for this purpose, its Commitment will be taken to be the aggregate amount of its participation in the relevant outstanding Drawings. Material Adverse Effect A material adverse ef fect on: (a) the ability of the Obligors as a whole to comply with their obligations under the Finance Documents; (b) the f inancial condition or business of the Obligors as a whole; (c) the ef fectiveness, priority or enforceability of this document or any of the Finance Documents. Material Documents (a) Any Licence; (b) any other document the Facility Agent and the Borrower agree in writing is a "Material Document" for the purposes of this document. Obligors (a) The Borrower; and (b) the Guarantor, and Obligor means each or either one of them as the context requires. Original Lender Each person so described in item 2 of the Key Details.

Corrs Chambers Westgarth 3445-6323-2315v7 13 Syndicated Loan Note Subscription Agreement – Project Mustang Permitted Disposal Any sale, lease, transfer or other disposal: (a) made in the ordinary course of trading of the disposing entity; (b) of assets in exchange for other assets comparable or superior as to type, value and quality and for a similar purpose; (c) of worn out or obsolete assets or of surplus assets no longer required for the ef f icient operation of the business; (d) of inventory pursuant to an inventory f inancing or repurchase arrangement, where such arrangements are on arm's length terms; (e) disposals of leases or licenses in the ordinary course of business that do not materially interfere with the business of the Obligors taken as a whole; (f ) where the higher of the market value or consideration receivable (when aggregated with the higher of the market value or consideration receivable for any other sale, lease, transfer or other disposal, other than any permitted under paragraphs (a) to (e) above) does not exceed $5,000,000 (or such other amount as approved by the Facility Agent (acting on the instructions of all Lenders)) in any f inancial year; (g) permitted in accordance with clause 7 of the Intercreditor Deed; or (h) any other disposal for which the Facility Agent (acting on the instructions of all Lenders) has given its prior written consent. Permitted Encumbrance (a) Any Security Document or any other Encumbrance created under, or as permitted by, any Finance Document; (b) each Encumbrance granted by an Obligor in favour of the Commonwealth which is subject to the Intercreditor Deed; (c) each Security Interest which is recorded against an Obligor on the PPSR as at the date of this document; (d) any agreement with respect to the acquisition of assets on title retention terms where that agreement was entered into in the ordinary course of its ordinary business; (e) a lien arising by operation of law in the ordinary course of day-to- day trading and not securing Financial Indebtedness, where it duly pays the indebtedness secured by that lien other than indebtedness contested in good faith; (f ) a charge or lien arising in favour of a Government Body by operation of statute unless there is default in payment of money secured by that charge or lien; (g) any rights of set-of f , netting or combination of accounts; (h) any Security Interest provided for by any of the following transactions if the transaction does not, in substance, secure payment or performance of an obligation: (i) a transfer of an account or chattel paper;

Corrs Chambers Westgarth 3445-6323-2315v7 14 Syndicated Loan Note Subscription Agreement – Project Mustang (ii) a commercial consignment; or (iii) a PPS Lease; and (i) any other Encumbrance for which the Facility Agent (acting on the instructions of all Lenders) has given its prior written consent. Permitted Financial Accommodation Any loan or other f inancial accommodation: (a) made by an Obligor to another Obligor; (b) comprising trade credit extended by an Obligor on normal commercial terms and in the ordinary course of its business; (c) comprising deposits with a bank or f inancial institution provided such deposits do not secure Financial Indebtedness; or (d) any other loan or financial accommodation made by an Obligor for which the Facility Agent (acting on the instructions of all Lenders) has given its prior written consent. Permitted Financial Indebtedness (a) Financial Indebtedness owing by an Obligor under the Finance Documents; (b) Financial Indebtedness which is subject to the Intercreditor Deed; (c) Financial Indebtedness incurred by an Obligor in connection with the purchase and acquisition of one or more aircraf ts where such Financial Indebtedness is secured solely by the relevant aircraf t or aircraf ts which it has funded; (d) Financial Indebtedness under a Finance Lease in the ordinary course of business of a Borrower where the lessor may only have recourse to the assets leased; (e) Financial Indebtedness owing by the Obligors not covered by paragraphs (a) to (d) above (inclusive) provided that the aggregate amount of Financial Indebtedness of the Obligors permitted by this paragraph (d) does not exceed $10,000,000; and (f ) any other Financial Indebtedness approved in writing by the Facility Agent (acting on the instructions of all Lenders). Personal Information Has the meaning given to that term by the Privacy Law. Potential Event of Default Any event or circumstance which (on the giving of notice, lapse of time or fulf ilment of any condition, or any combination of any of the foregoing) would become an Event of Default or non-satisfaction of any condition under a Finance Document. PPS Act The Personal Property Securities Act 2009 (Cth). PPS Lease Has the meaning given to that term in the PPS Act. PPSR The register maintained under the PPS Act. Principal Outstanding At any time, the aggregate amount at that time of all Drawings which remain outstanding. Privacy Law (a) The Privacy Act 1988 (Cth);

Corrs Chambers Westgarth 3445-6323-2315v7 15 Syndicated Loan Note Subscription Agreement – Project Mustang (b) any Australian legislation from time to time in force which af fects privacy rights or Personal Information; and (c) any rules, regulations, guidelines, orders or other instruments issued under the legislation referred to in paragraphs (a) and (b). Real Property (a) The 138 Elizabeth Avenue Property; (b) the 140 Elizabeth Avenue Property; (c) the James Schof ield Drive Property; and (d) the Bowral Place Property. Real Property Mortgage Each real property mortgage in respect of the relevant Real Property dated on or about the date of this document granted by the Obligor who owns that Real Property in favour of the Security Trustee. Receiver A receiver or receiver and manager of the Secured Property appointed under any Security Document. Register The register to be established and maintained under clause 16. Registrar The person appointed under clause 16.1 as the "Registrar". Related Entity In respect of an entity, another entity which is related to that f irst entity within the meaning of section 50 of the Corporations Act or is in any economic entity (as defined in any approved accounting standard) which contains the f irst entity. Representative In respect of a person, an officer, employee, contractor or agent of that person. Reserve Requirement Any law or of f icial requirement, directive, policy or guideline of the Reserve Bank of Australia, the Australian Prudential Regulation Authority, any other central bank or Government Body or the Bank for International Settlements (or its successor). Restructuring Coordination Deed The document entitled “Restructuring Coordination Deed – Regional Express Airlines” dated on or about the date of this document between the Commonwealth and others. Rex Regional Commitments Has the meaning given to that term in the Intercreditor Deed. Secured Money Has the meaning given to it in the Security Trust Deed. Secured Property Any asset which is subject to a Security Interest in favour of or for the benef it of the Finance Parties under a Security Document. Security Any document or transaction which reserves or creates a Security Interest. Security Documents (a) The documents described in item 5 of the Key Details and any Security or Guarantee at any time which is collateral to any of them; and (b) any other document the Borrower and the Facility Agent agree in writing is a "Security Document" for the purposes of this document.

Corrs Chambers Westgarth 3445-6323-2315v7 16 Syndicated Loan Note Subscription Agreement – Project Mustang Security Interest (a) In relation to any personal property, has the same meaning as in the PPS Act; and (b) in relation to any other property, means any charge, mortgage, pledge, bill of sale, hypothecation, lien, arrangement concerning the deposit of documents evidencing title, trust, power, title retention arrangement or any other covenant or arrangement of any nature made to secure the payment of money or the observance of an obligation. Security Trust The "Project Mustang Security Trust" established under the Security Trust Deed. Security Trust Deed The security trust deed dated on or prior to the date of this document between, among others, the Borrower and the Security Trustee. Security Trustee The person so specif ied in item 2 of the Key Details. Security Trustee Fee Letter Any fee letter between the Security Trustee and the Borrower. Share Of a Lender, in respect of a Drawing, means the proportion of that Lender's participation in that Drawing to the amount of that Drawing, as determined under clause 4.6(c). Subsidiary The meaning given in the Corporations Act but also includes, in respect of any entity, another entity whose Financial Statements are required by Accounting Standards to be included in that f irst entity's consolidated Financial Statements. Tax Act The Income Tax Assessment Act 1936 (Cth) or the Income Tax Assessment Act 1997 (Cth) (as applicable). Taxes Charges, deductions, duties (including stamp duty and transaction duty), fees, imposts, levies, taxes (including any consumption tax, goods and services tax and value added tax) and withholdings (together with any interest, penalties, fines and expenses in connection with any of them). Total Commitment The aggregate of the Commitments being, as at the date of this document, the amount so specif ied in item 3 of the Key Details. Transaction Documents (a) The Finance Documents; and (b) the Material Documents. Transaction Party Any person other than a Finance Party who is a party to a Finance Document. Unused Commitment At any time, the Total Commitment at that time less the Principal Outstanding (excluding any Drawings deemed to be made under clause 5). Verification Certificate A certif icate in or substantially in the form of Schedule 3.

Corrs Chambers Westgarth 3445-6323-2315v7 17 Syndicated Loan Note Subscription Agreement – Project Mustang 2 Facility and purpose 2.1 Facility Subject to the other provisions of this document: (a) (Facility) the Lenders agree to provide to the Borrower, by subscribing for Loan Notes to be issued by the Borrower under the Loan Note Deed Poll, a facility of an amount not exceeding the Total Commitment; (b) (availability) the Borrower may use the Facility by making one or more requests for Drawings during the Drawdown Period; and (c) (Loan Note Deed Poll) the Facility Agent and each Lender agree to be bound by the Loan Note Deed Poll. 2.2 Approved Purpose (a) The Borrower may only use a Drawing for an Approved Purpose. No Finance Party is obliged to enquire as to whether a Drawing is used for an Approved Purpose. (b) The Borrower must repay to the Facility Agent any part of a Drawing not used for an Approved Purpose within 5 Business Days of the Drawdown Date for that Drawing . 2.3 Cancellation The Unused Commitment will be automatically cancelled on the earlier of : (a) the Drawdown Date for the initial Drawing; and (b) 5.00 pm on the last Business Day of the Drawdown Period. 3 Conditions precedent 3.1 Conditions precedent to initial Drawing (a) The Borrower may not deliver a Drawdown Notice in respect of the initial Drawing and a Lender is not obliged to provide any Commitment or participate in the initial Drawing unless and until the Facility Agent has received each of the items set out in Schedule 2 in form and substance satisfactory to the Facility Agent (acting on the instructions of all Lenders). (b) The Facility Agent will notify the Borrower and the Lenders promptly upon being so satisf ied of receipt of the conditions precedent in clause 3.1(a). 3.2 Additional conditions precedent to each Drawing Except to the extent the Facility Agent otherwise agrees (acting on the instructions of all Lenders), the obligations of each Lender to make available a Drawing are and remain subject to the further conditions precedent that: (a) (Drawdown Notice) the Facility Agent has received a Drawdown Notice in respect of that Drawing in accordance with clause 4; (b) (Total Commitment): the Principal Outstanding (excluding any Drawings deemed to be made pursuant to clause 5) would not, if that Drawing (and any other Drawings

Corrs Chambers Westgarth 3445-6323-2315v7 18 Syndicated Loan Note Subscription Agreement – Project Mustang requested for provision on the same day) were to be provided, exceed the Total Commitment; and (c) (no Default) no Default is subsisting or would result from the provision of that Drawing. 3.3 Delivery of Loan Note Deed Poll (a) Before the date of Financial Close, the Obligors must sign and seal the Loan Note Deed Poll and forward it to the Facility Agent who must hold it in escrow pending satisfaction of clause 3.3(b). (b) On receipt of each Lender's Share of the total amount of the f irst Drawing under the Facility, the Facility Agent must date the Loan Note Deed Poll and the Obligors will then be taken to have delivered the Loan Note Deed Poll which is then released from escrow under clause 3.3(a). 3.4 Conditions precedent for Finance Parties' benefit only The conditions precedent set out in this document are for the Finance Parties' benefit only and the Facility Agent (acting on the instructions of all Lenders) may waive any of them at any time and in any manner. 4 Requesting and providing Drawings 4.1 Drawdown Notice (a) To make a Drawing, the Borrower must give a notice to the Facility Agent by 2.00 pm at least f ive clear Business Days (or such shorter period as the Facility Agent (acting on the instructions of all Lenders) may otherwise approve) before the proposed Drawdown Date specif ied in the notice. (b) The Facility Agent will give prompt notice to each Lender of the contents of each Drawdown Notice and the amount of each Lender's Share of each Drawing requested. 4.2 Form of Drawdown Notice A Drawdown Notice must be: (a) (in prescribed form) duly completed in the form of Schedule 4 or such other form as the Facility Agent may approve; (b) (signed) signed by an Authorised Representative of the Borrower; and (c) (minimum Drawing) for a minimum amount of $5,000,000 (or such lesser amount as the Facility Agent (acting on the instructions of all Lenders) may otherwise approve). 4.3 Loan Note Each issue of Loan Notes comprises a Drawing. 4.4 Drawdown Notice irrevocable A Drawdown Notice is irrevocable and is effective from the time of its actual receipt in legible form by the Facility Agent.

Corrs Chambers Westgarth 3445-6323-2315v7 19 Syndicated Loan Note Subscription Agreement – Project Mustang 4.5 Drawdown Notice for Finance Parties' benefit only The requirement of a Drawdown Notice is for the Finance Parties' benefit only and the Facility Agent (acting on the instructions of all Lenders) may waive the requirement at any time and in any manner. 4.6 Agreement to provide Drawing (a) Subject to the other provisions of this document, if the Borrower requests a Drawing, then each Lender agrees to make available its Share of that Drawing to the Facility Agent in immediately available funds by 11.00 am (local time in the place of payment) on the relevant Drawdown Date for the account of the Borrower. (b) A Lender is not obliged to make available its Share of a Drawing if , as a result, its participation in that Drawing would exceed its Commitment. (c) Each Lender will participate in each Drawing rateably according to its Commitment. 4.7 Subscription and issue of Loan Notes Each of the Lenders, the Facility Agent and the Borrower agree that, on each Drawdown Date: (a) each Lender will subscribe for Loan Notes by providing its Share of the total amount of the proposed subscription price specif ied in the relevant Drawdown Notice (or, in relation to a Drawing which is deemed to be made pursuant to clause 5, the amount to be capitalised under that clause); and (b) the Borrower will issue to the Lenders Loan Notes which have an aggregate principal amount outstanding equal to the proposed subscription price specif ied in the relevant Drawdown Notice (or, in relation to a Drawing which is deemed to be made pursuant to clause 5, the amount to be capitalised under that clause). Each Loan Note is issued on the conditions set out in the Loan Note Deed Poll by the Registrar entering the Loan Notes in the Register. 4.8 Facility Agent’s and Registrar’s obligations (a) On receipt of any payment f rom a Lender under clause 4.7, the Facility Agent must: (i) pay that amount in the manner specified in the Drawdown Notice or as otherwise provided for in this document; and (ii) as Registrar, issue the Loan Notes referred to in clause 4.7 by entering them in the Register. (b) In relation to a Drawing which is deemed to be made pursuant to clause 5.2, the Facility Agent must, as Register, issue Loan Notes referred to in clause 4.7. 4.9 Excluded issue The Borrower must ensure that each Loan Note is issued in a manner which does not require disclosure to investors under Part 6D.2 of the Corporations Act.

Corrs Chambers Westgarth 3445-6323-2315v7 20 Syndicated Loan Note Subscription Agreement – Project Mustang 5 Interest and fees 5.1 Interest The Borrower must pay to the Facility Agent (for the account of the Lenders) interest on the Principal Outstanding from and including the Drawdown Date for the initial Drawing until the Principal Outstanding is repaid in full. Interest under this clause 5.1: (a) (rate) accrues at, subject to clause 5.4, the Interest Rate; (b) (basis of calculation) is to be calculated daily on the basis of a 360 day year and based on a 30 day month and for the actual number of days elapsed from and including the day when the money on which the interest is payable becomes owing by the Borrower until but excluding the day of payment of that money; and (c) (payment) subject to clause 5.2, is payable on each Interest Payment Date. 5.2 Capitalisation of Interest (a) During the Initial Period, the Facility Agent may elect to capitalise the payment of any portion of interest payable on any Interest Payment Date under clause 5.1, provided that interest of no more than 6% per annum may be capitalised on that Interest Payment Date. Such interest shall be capitalised (which will be deemed to be a Drawing with a Drawdown Date of the relevant Interest Payment Date). (b) Af ter the Initial Period, if interest payable on an Interest Payment Date under clause 5.1 is not paid by the Borrower, the Facility Agent may (subject to the Intercreditor Deed), by no later than 10 Business Days after the Interest Payment Date, elect to capitalise the payment of such interest. Such interest shall be capitalised (which will be deemed to be a Drawing with a Drawdown Date of the relevant Interest Payment Date). (c) To avoid doubt, if the Facility Agent elects to capitalise the payment of interest in accordance with this clause 5.2, no Event of Default shall arise by reason of non- payment of interest on the relevant Interest Payment Date. 5.3 Security Trustee’s fees The Borrower must pay the Security Trustee (for its own account) a non-refundable security trustee fee in accordance with the Security Trustee Fee Letter or on such other terms as the Borrower and the Security Trustee may from time to time agree in writing (which, if such terms increase the fees payable to the Security Trustee (other than those already contemplated by the current Security Trustee Fee Letter or any other Finance Document) by more than CPI in any year, must be agreed by the parties to the Intercreditor Deed). 5.4 Interest Rate Notice (a) The Facility Agent (on behalf of all Lenders) may, at any time, in its absolute discretion, unilaterally vary the Interest Rate under this document by written notice to the Borrower (Interest Rate Notice), provided that: (i) the varied Interest Rate specified in the Interest Rate Notice must be no less than 6.00% per annum and no more than 12.0% per annum; (ii) there is Principal Outstanding owing under this document as at the date of the Interest Rate Notice; and

Corrs Chambers Westgarth 3445-6323-2315v7 21 Syndicated Loan Note Subscription Agreement – Project Mustang (iii) the Facility Agent has notif ied the Commonwealth of the Interest Rate Notice pursuant to paragraph (a) of the def inition of “Relevant Interest Rate” in the Intercreditor Deed. (b) The Facility Agent may (on behalf of all Lenders) issue more than one Interest Rate Notice. (c) The parties acknowledge and agree that, on and from the date specif ied in a relevant Interest Rate Notice the Interest Rate for the purposes of this document will be varied to the interest rate specif ied in that Interest Rate Notice. 6 Repayment and prepayment 6.1 Final Repayment Date Subject to the other provisions of this document, on the Final Repayment Date the Borrower must: (a) (Principal Outstanding) repay to the Facility Agent (for the account of the Lenders) the Principal Outstanding; and (b) (other amounts) pay to the Facility Agent (for the account of the Finance Parties) all interest, fees and other money payable by it under the Finance Documents. 6.2 Mandatory prepayment – insurance proceeds If an Obligor is required to pay the proceeds of any claim under an Insurance Policy to the Facility Agent as a prepayment in accordance with the Intercreditor Deed, then that Obligor must, within two Business Days of receipt of any such proceeds, pay those proceeds to the Facility Agent (for the account of the Lenders) in or towards repayment of the Principal Outstanding. 6.3 Voluntary prepayment (a) (amount) Subject to this clause 6 and the Intercreditor Deed, the Borrower may prepay any Drawing or a part of it on any Business Day. (b) (notice) The Borrower may only make a prepayment by giving to the Facility Agent 5 Business Days' prior written notice (or such shorter period agreed by the Facility Agent) specifying the prepayment date and the amount of the prepayment. (c) (prepay) The Borrower must prepay in accordance with any notice given. 6.4 Interest and costs In respect of any amounts prepaid, the Borrower must pay to the Facility Agent (for the account of the Lenders): (a) interest on the amount prepaid up to the date of payment; and (b) any amounts payable under clause 13.2 as a consequence of that prepayment. 6.5 Irrevocable notice Any prepayment notice given under this clause 6 is irrevocable and is effective f rom the time of its actual receipt in legible form by the Facility Agent.

Corrs Chambers Westgarth 3445-6323-2315v7 22 Syndicated Loan Note Subscription Agreement – Project Mustang 6.6 Apportionment of prepayments Except where expressly specified, repayments and prepayments under this clause 6 will be applied in or towards repayment or prepayment of the Principal Outstanding (rateably in reduction of the respective participations of all Lenders). 6.7 Re-borrowing of repayments and prepayments Amounts repaid or prepaid in accordance with this clause 6 are not available to be re- borrowed. 7 Representations and warranties 7.1 General representations and warranties Each Obligor represents and warrants to the Finance Parties that, unless otherwise disclosed to the Facility Agent in writing and accepted and agreed to by the Facility Agent in writing: (a) (status) it has been duly incorporated as a company limited by shares under the Corporations Act and is validly existing under those laws and has power and authority to carry on its business as it is now being conducted; (b) (due authority) it has power to enter into, and to comply with its obligations under, and has taken all necessary corporate action to authorise its entry into, and comply with its obligations under, the Transaction Documents to which it is a party and the transactions contemplated by those documents; (c) (Authorisations) it has in full force and effect the Authorisations necessary to enter into the Transaction Documents to which it is a party and to comply with its obligations under them and to allow them to be enforced; (d) (valid obligations) each of its obligations under the Transaction Documents to which it is a party constitute its legal, valid and binding obligations and are completely and lawfully enforceable against it in accordance with their terms, subject to any necessary stamping and registration requirements, laws and defences af fecting creditors' rights generally and the availability of equitable remedies; (e) (no contravention) it is not, and will not by entering into the Transaction Documents to which it is a party or the transactions under them be, in contravention of : (i) any law, regulation, or any directive of any Government Body applicable to it; (ii) any obligation, undertaking, deed or warranty binding upon it in any material respect; or (iii) its constituent documents; (f ) (law, Authorisations) it has complied with all laws and Authorisations applicable to it or its business in all material respects; (g) (Financial Statements properly prepared) its Financial Statements: (i) have been properly prepared in accordance with Accounting Standards; and (ii) give a true and fair view and represent its f inancial condition and operations during the relevant f inancial year, in each case except as otherwise disclosed in those Financial Statements;

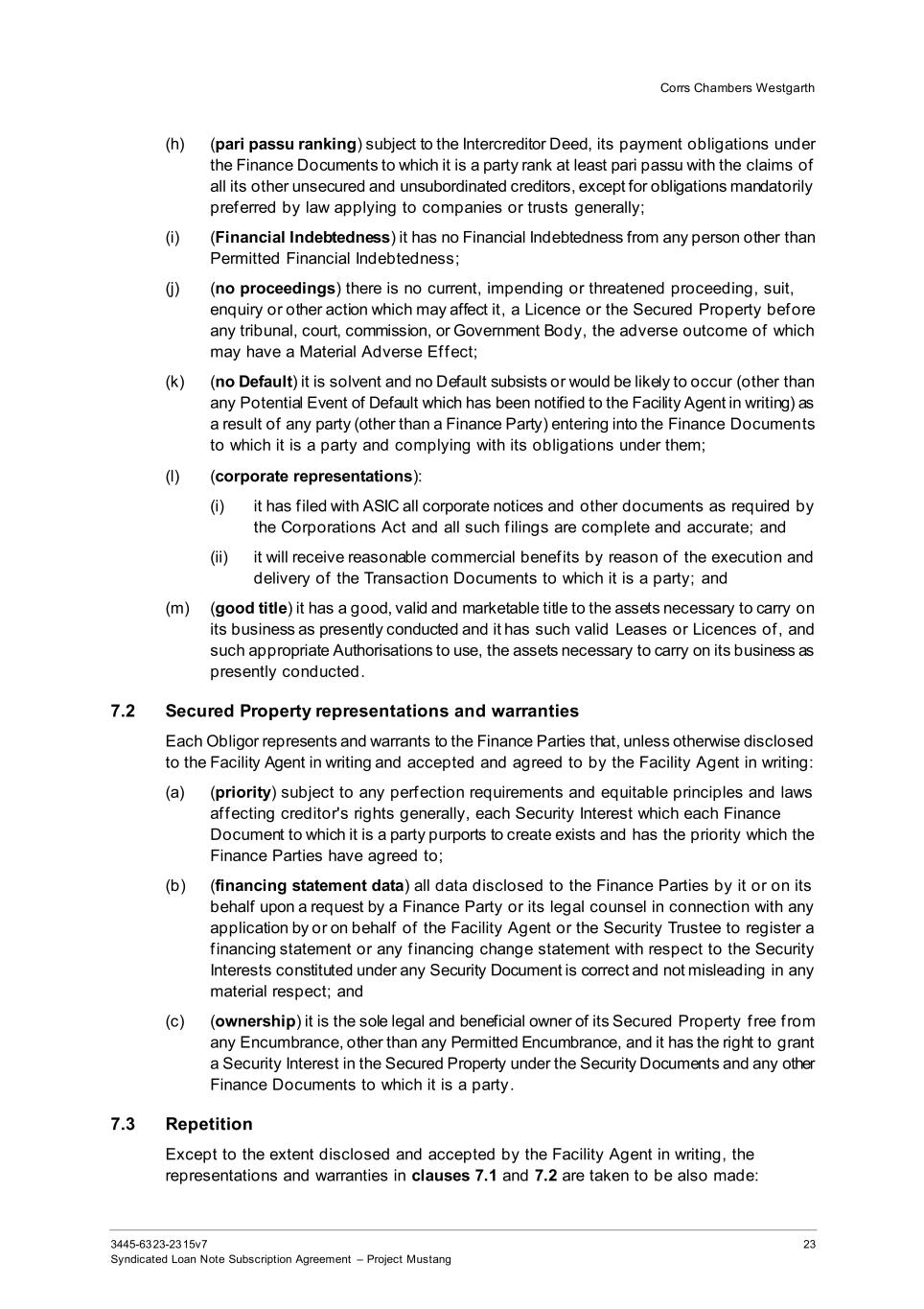

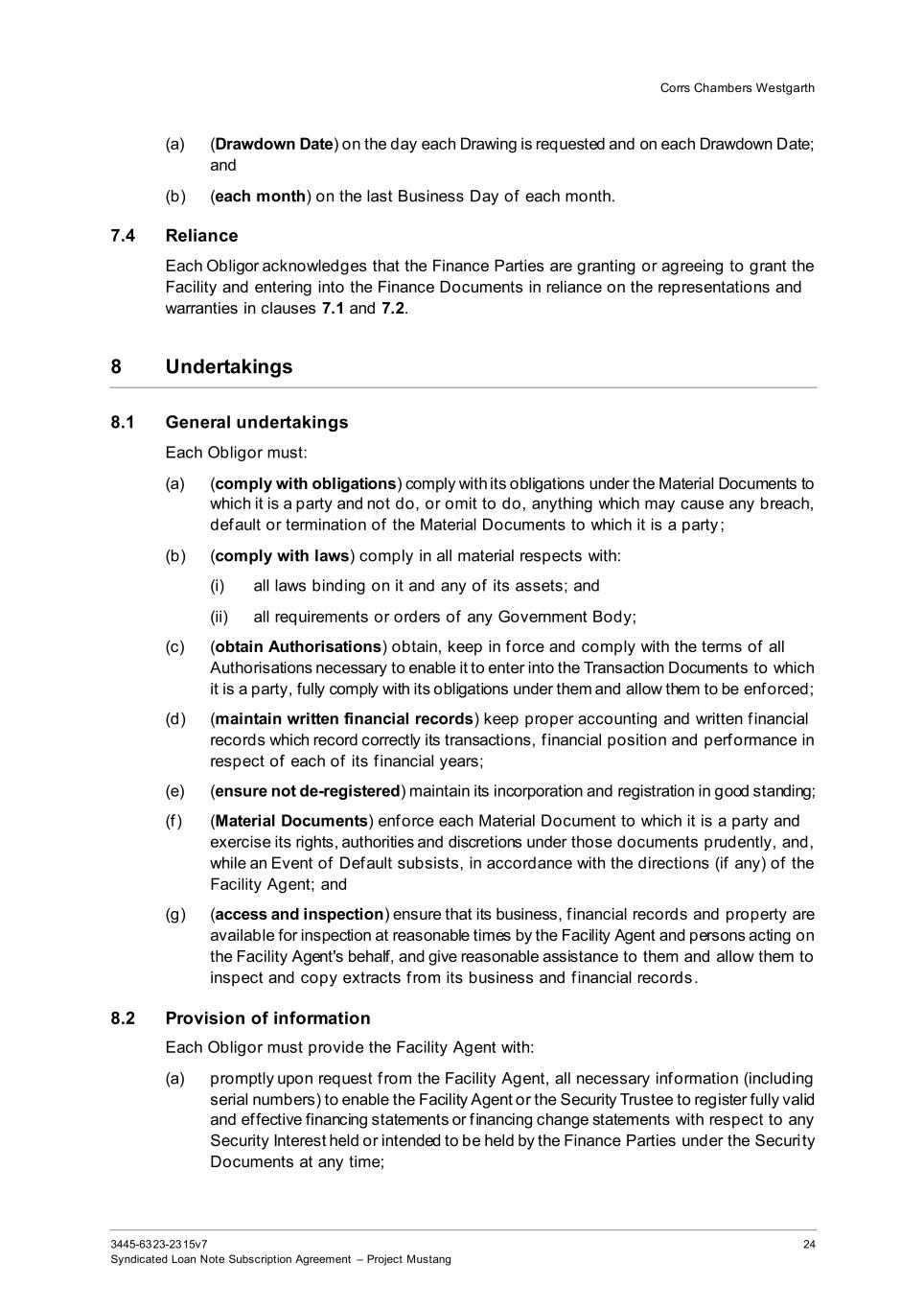

Corrs Chambers Westgarth 3445-6323-2315v7 23 Syndicated Loan Note Subscription Agreement – Project Mustang (h) (pari passu ranking) subject to the Intercreditor Deed, its payment obligations under the Finance Documents to which it is a party rank at least pari passu with the claims of all its other unsecured and unsubordinated creditors, except for obligations mandatorily preferred by law applying to companies or trusts generally; (i) (Financial Indebtedness) it has no Financial Indebtedness from any person other than Permitted Financial Indebtedness; (j) (no proceedings) there is no current, impending or threatened proceeding, suit, enquiry or other action which may affect it, a Licence or the Secured Property before any tribunal, court, commission, or Government Body, the adverse outcome of which may have a Material Adverse Ef fect; (k) (no Default) it is solvent and no Default subsists or would be likely to occur (other than any Potential Event of Default which has been notified to the Facility Agent in writing) as a result of any party (other than a Finance Party) entering into the Finance Documents to which it is a party and complying with its obligations under them; (l) (corporate representations): (i) it has f iled with ASIC all corporate notices and other documents as required by the Corporations Act and all such f ilings are complete and accurate; and (ii) it will receive reasonable commercial benef its by reason of the execution and delivery of the Transaction Documents to which it is a party; and (m) (good title) it has a good, valid and marketable title to the assets necessary to carry on its business as presently conducted and it has such valid Leases or Licences of , and such appropriate Authorisations to use, the assets necessary to carry on its business as presently conducted. 7.2 Secured Property representations and warranties Each Obligor represents and warrants to the Finance Parties that, unless otherwise disclosed to the Facility Agent in writing and accepted and agreed to by the Facility Agent in writing: (a) (priority) subject to any perfection requirements and equitable principles and laws af fecting creditor's rights generally, each Security Interest which each Finance Document to which it is a party purports to create exists and has the priority which the Finance Parties have agreed to; (b) (financing statement data) all data disclosed to the Finance Parties by it or on its behalf upon a request by a Finance Party or its legal counsel in connection with any application by or on behalf of the Facility Agent or the Security Trustee to register a f inancing statement or any f inancing change statement with respect to the Security Interests constituted under any Security Document is correct and not misleading in any material respect; and (c) (ownership) it is the sole legal and beneficial owner of its Secured Property f ree f rom any Encumbrance, other than any Permitted Encumbrance, and it has the right to grant a Security Interest in the Secured Property under the Security Documents and any other Finance Documents to which it is a party. 7.3 Repetition Except to the extent disclosed and accepted by the Facility Agent in writing, the representations and warranties in clauses 7.1 and 7.2 are taken to be also made:

Corrs Chambers Westgarth 3445-6323-2315v7 24 Syndicated Loan Note Subscription Agreement – Project Mustang (a) (Drawdown Date) on the day each Drawing is requested and on each Drawdown Date; and (b) (each month) on the last Business Day of each month. 7.4 Reliance Each Obligor acknowledges that the Finance Parties are granting or agreeing to grant the Facility and entering into the Finance Documents in reliance on the representations and warranties in clauses 7.1 and 7.2. 8 Undertakings 8.1 General undertakings Each Obligor must: (a) (comply with obligations) comply with its obligations under the Material Documents to which it is a party and not do, or omit to do, anything which may cause any breach, default or termination of the Material Documents to which it is a party ; (b) (comply with laws) comply in all material respects with: (i) all laws binding on it and any of its assets; and (ii) all requirements or orders of any Government Body; (c) (obtain Authorisations) obtain, keep in force and comply with the terms of all Authorisations necessary to enable it to enter into the Transaction Documents to which it is a party, fully comply with its obligations under them and allow them to be enforced; (d) (maintain written financial records) keep proper accounting and written f inancial records which record correctly its transactions, f inancial position and performance in respect of each of its f inancial years; (e) (ensure not de-registered) maintain its incorporation and registration in good standing; (f ) (Material Documents) enforce each Material Document to which it is a party and exercise its rights, authorities and discretions under those documents prudently, and, while an Event of Default subsists, in accordance with the directions (if any) of the Facility Agent; and (g) (access and inspection) ensure that its business, f inancial records and property are available for inspection at reasonable times by the Facility Agent and persons acting on the Facility Agent's behalf, and give reasonable assistance to them and allow them to inspect and copy extracts f rom its business and f inancial records. 8.2 Provision of information Each Obligor must provide the Facility Agent with: (a) promptly upon request f rom the Facility Agent, all necessary information (including serial numbers) to enable the Facility Agent or the Security Trustee to register fully valid and ef fective financing statements or f inancing change statements with respect to any Security Interest held or intended to be held by the Finance Parties under the Securi ty Documents at any time;

Corrs Chambers Westgarth 3445-6323-2315v7 25 Syndicated Loan Note Subscription Agreement – Project Mustang (b) any other information the Facility Agent requests (including information relating to the performance of its obligations under the Transaction Documents and information relating to its Secured Property, assets, accounting methods or f inancial position) promptly on being requested to do so. 8.3 Reporting Each Obligor must provide the Facility Agent the following items at the following times: Reporting item Time (a) (annual Financial Statements) Copies of the audited annual Financial Statements of each Obligor, certif ied by two of its directors or its sole director and company secretary (as applicable) as an accurate and complete statement of its f inancial position. As soon as possible af ter the end of each f inancial year of each Obligor (and, at the latest, 15 Business Days af ter they are prepared). (b) (half-yearly Financial Statements) Copies of the half yearly Financial Statements of each Obligor, certif ied by two of its directors or its sole director and company secretary (as applicable) as an accurate and complete statement of its f inancial position. As soon as possible af ter the end of each f inancial half year of each Obligor (and, at the latest, 15 Business Days af ter they are prepared). (c) (other financial information) Such other additional information in relation to the f inancial condition or operation of an Obligor, any Secured Property or the Real Property as the Facility Agent requests f rom time to time. Promptly following a request by the Facility Agent. 8.4 Insurance undertakings Each Obligor must take out and maintain insurances with a reputable insurer in the manner and to the extent which is in accordance with prudent business practice having regard to the nature of the business and assets of the Obligor (including all insurance required by applicable law). 8.5 Secured Property undertakings Except to the extent the Facility Agent otherwise agrees, each Obligor must in relation to its Secured Property: (a) (comply with obligations) comply with all obligations imposed on it by any Encumbrance af fecting the Secured Property; (b) (comply with consents) comply with all terms relating to any consent granted by a Finance Party in connection with any Finance Document to which it is a party;

Corrs Chambers Westgarth 3445-6323-2315v7 26 Syndicated Loan Note Subscription Agreement – Project Mustang (c) (collect book debts) promptly collect its book debts, other debts and other amounts owing to it under any other monetary claims in accordance with the directions of a Finance Party (or, in the absence of such directions, in a proper and efficient manner as the Finance Parties' agent for this purpose); (d) (maintain Secured Property) ensure that the Secured Property is kept in good repair and in proper working order (fair wear and tear excepted) which is necessary or desirable in the conduct of its business; (e) (no affixing of Secured Property) ensure that no part of the Secured Property is af f ixed at any time to any real property over which the Security Trustee does not hold a registered legal or statutory mortgage or becomes an accession to, or commingled with, any property that is not the Secured Property; (f ) (obtain Authorisations) take all action necessary to obtain all required Authorisations to use or continue to use the Secured Property in the manner and for the purpose for which it is used at the date of this document, and comply with all directions, requests or requirements of any Government Body relating to the Secured Property; (g) (provide receipts) promptly following demand, provide to the Facility Agent receipts for all payments made under, required by or referred to in this document; and (h) (protect Secured Property) do everything necessary or reasonably required by a Finance Party to preserve and protect the realisable value of its Secured Property and that Finance Party's interest in its Secured Property. 8.6 Real Property undertakings An Obligor may not, except with the Facility Agent's prior written consent: (a) (Leases) grant, vary, terminate, accept a surrender of or waive any rights under any Licence to use or occupy the Real Property or cause or permit the licence fee payable under any such Licence to be determined; (b) (improvements) demolish, move or remove any improvements on the Real Property or excavate, fill or make structural alterations or additions to the Real Property or other alterations or additions which have, or in the Facility Agent's opinion would be likely to have, a deleterious ef fect on the Real Property or its value; (c) (easements and covenants) cause or allow any easement or covenant benef iting the Real Property to lapse or be partially or wholly extinguished or varied; (d) (subdivision) dedicate the Real Property for a public purpose or subdivide the Real Property or, if the Real Property consists of several titles, call for an apportionment of the Real Property or apply for a consolidation of the titles to the Real Property; or (e) (change of zoning or use) change or take any steps to change the zoning of the Real Property, the use of the Real Property or the general character of any business conducted on the Real Property. 8.7 Restrictive undertakings No Obligor may do any of the following things or agree or attempt to do any of the following things without the Facility Agent's prior written approval: (a) (Encumbrances) create or permit to exist any Encumbrance over or affecting any of its Secured Property except for any Permitted Encumbrance;

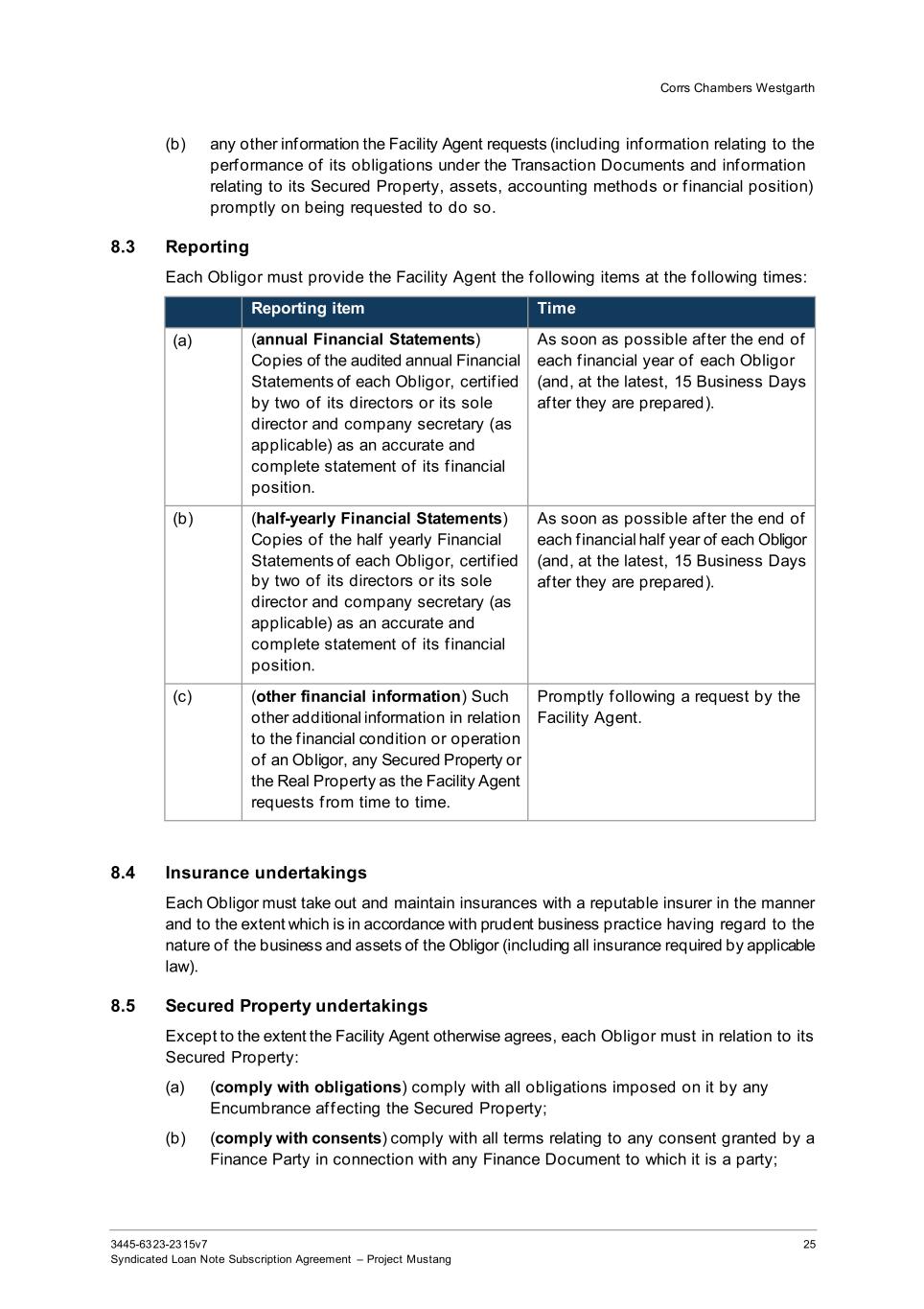

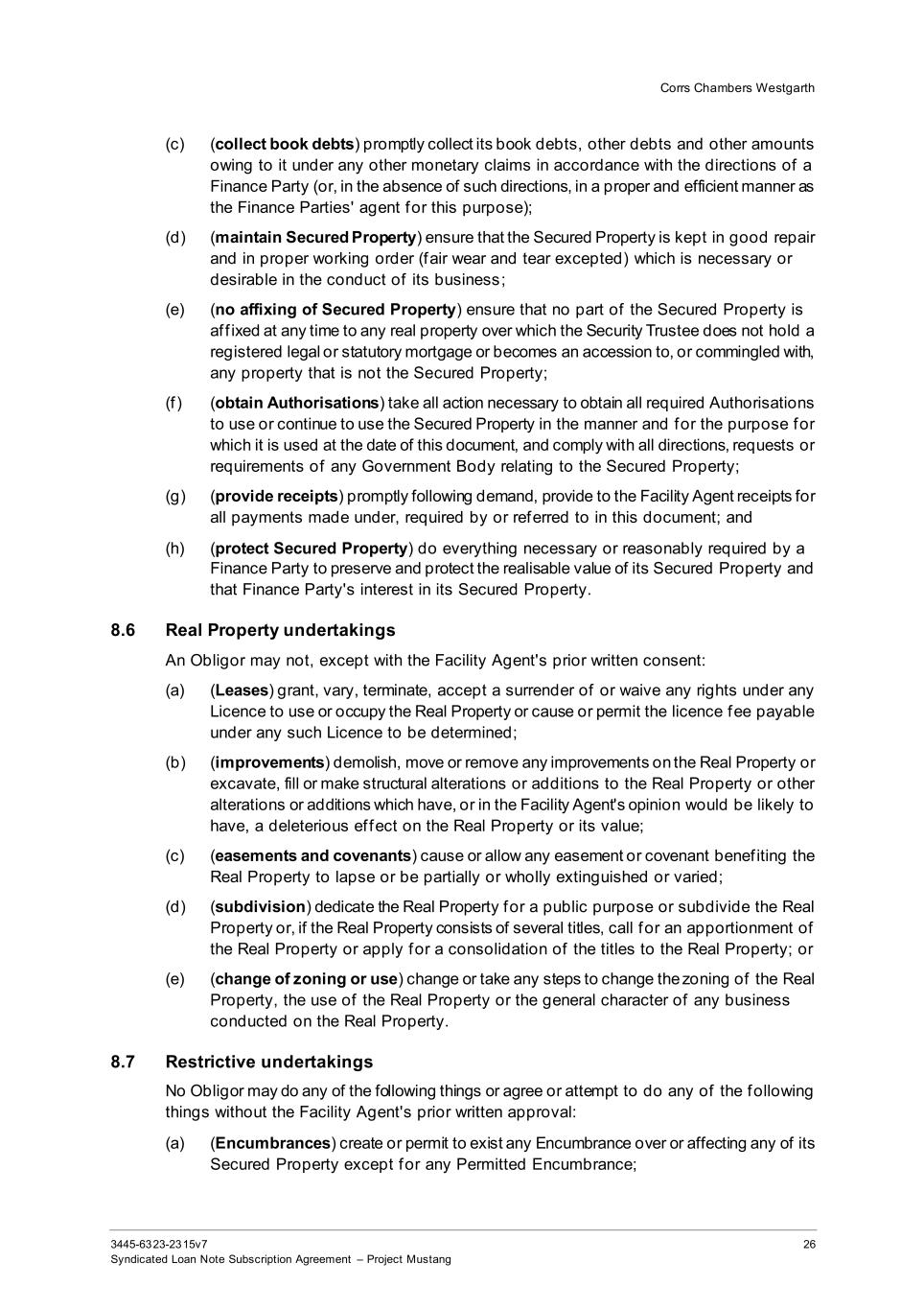

Corrs Chambers Westgarth 3445-6323-2315v7 27 Syndicated Loan Note Subscription Agreement – Project Mustang (b) (deal with Secured Property) sell, transfer, part with possession of , surrender or otherwise deal with any of its Secured Property other than pursuant to a Permitted Disposal; (c) (obtain Financial Indebtedness) obtain or permit to exist any Financial Indebtedness f rom any person other than any Permitted Financial Indebtedness; (d) (provide Financial Indebtedness) provide or continue to provide any Financial Indebtedness to any person other than Permitted Financial Accommodation; (e) (variation of Material Documents) (i) amend, vary or assign any Material Document, or consent to any amendment, variation or assignment of any Material Document; (ii) cancel, terminate, release, surrender, accept repudiation, repudiate, rescind, avoid or discharge (except by performance) all or part of any Material Document to which it is a party; (iii) waive, extend or grant time or indulgence in respect of , any provision of any Material Document to which it is a party; or (iv) do or permit anything which would enable or give grounds to another party to any Material Document to do anything referred to in clauses 8.7(e)(i), 8.7(e)(ii) or 8.7(e)(iii); (f ) (de-registration) request or consent to the removal of any of its Secured Property from any register on which it is recorded or registered; or (g) (obtain protection) take steps to obtain protection under any statute or any other law which allows or causes the Finance Parties' rights in connection with its Secured Property to be prejudiced. 9 Default 9.1 Events of Default An Event of Default occurs if : (a) (Finance Documents – monetary obligation) an Obligor does not pay any amount payable by it under any Finance Document on time and in the manner in which that Obligor has agreed to pay it unless: (i) its failure to pay is caused by an administrative or technical error in the banking system used to transfer the funds which was beyond the control of that Obligor; and (ii) payment is made within 2 Business Days of its due date; (b) (breach of undertaking) an Obligor breaches any other covenant or undertaking given to a Finance Party (other than those referred to in clauses 9.1(a)) under a Finance Document and, if capable of remedy, the breach is not remedied within 20 Business Days of its occurrence; (c) (breach of representation or warranty) a representation or warranty made or taken to be made by an Obligor in any Finance Document is incorrect or misleading in any

Corrs Chambers Westgarth 3445-6323-2315v7 28 Syndicated Loan Note Subscription Agreement – Project Mustang material respect when made or taken to be made and, if capable of remedy, is not remedied within 20 Business Days of being made or taken to be made; (d) (monetary obligation not complied with) any monetary obligation exceeding $5,000,000 (other than that referred to in clause 9.1(a)) of an Obligor to any person, whether actual, contingent or otherwise: (i) is not satisf ied on its due date or within an applicable grace period; or (ii) becomes due and payable or can be rendered due and payable before its stated date of maturity other than due to a voluntary prepayment; (e) (Insolvency Event) an Insolvency Event subsists in connection with an Obligor; (f ) (Commonwealth Finance Documents event of default) an event of default (however def ined or described) subsists under a Commonwealth Finance Document, or a Commonwealth Finance Document otherwise becomes enforceable; (g) (unlawful) it is or becomes unlawful for a Transaction Party to perform any of its obligations under the Finance Documents; (h) (Transaction Document void) a Transaction Document is or becomes wholly or partly void, voidable or unenforceable or is claimed to be so by a person other than a Finance Party; (i) (enforcement against Secured Property) an Encumbrance, judgment or order becomes enforceable, is enforced or is sought to be enforced against the Secured Property or an Obligor and such Encumbrance, judgment or order is not discharged within 10 Business Days; (j) (resumption or destruction) the Secured Property or any part of it is resumed or compulsorily acquired by a Government Body or is materially destroyed or damaged; (k) (investigation) an investigation into all or part of the affairs of an Obligor commences under the Corporations Act or any other legislation in circumstances material to its f inancial condition; or (l) (revocation of Authorisation) an Authorisation which is material to: (i) the performance by an Obligor of a Transaction Document to which it is a party; or (ii) the validity or enforceability of a Transaction Document, is repealed, revoked or terminated or expires, or is modified or amended or conditions are attached to it in a manner unacceptable to the Facility Agent, and is not immediately replaced by another Authorisation acceptable to the Facility Agent. 9.2 Powers on default (a) If an Event of Default subsists the Facility Agent may, and will if the Majority Lenders direct in writing, by notice to the Borrower do any one or more of the following: (b) (accelerate debt) declare that: (i) the Principal Outstanding; and (ii) all interest, fees and all other money payable to a Finance Party under or in connection with the Finance Documents, are either:

Corrs Chambers Westgarth 3445-6323-2315v7 29 Syndicated Loan Note Subscription Agreement – Project Mustang (iii) immediately due and payable; or (iv) payable on demand, in which case they will become so; and (c) (terminate obligations) terminate the obligations of any Finance Party under the Finance Documents which are specif ied in the notice. 9.3 Investigating Experts If a Default subsists the Facility Agent may, and will if the Majority Lenders direct in writing, appoint accountants, insolvency practitioners or other experts (Investigating Experts) to investigate and report on the Finance Documents and the affairs and financial position of each Obligor and the Secured Property. Each Obligor: (a) authorises, and agrees to give reasonable assistance to, the Investigating Experts to undertake the investigation, and must pay the Investigating Experts' costs on demand by the Facility Agent; and (b) authorises the disclosure to the Finance Parties and the Investigating Experts of all information and documentation in connection with the investigation. 10 Not used 11 Guarantee and indemnity 11.1 Guarantee For valuable consideration the Guarantor unconditionally and irrevocably guarantees the due and punctual payment by the Borrower to the Finance Parties of the Guaranteed Money. 11.2 Indemnity As an independent and principal obligation the Guarantor indemnif ies each Finance Party against any loss or liability sustained by that Finance Party (including all charges, costs and expenses incurred by that Finance Party) directly or indirectly in connection with: (a) (failure to pay) any failure of the Borrower to duly and punctually pay to that Finance Party the Guaranteed Money; (b) (liability unenforceable) any liability of the Borrower to pay the Guaranteed Money being or becoming void or otherwise unenforceable for any reason (including, as a result of any legal limitation, disability or incapacity affecting any person), irrespective of whether a Finance Party knew or ought to have known of the relevant facts or circumstances; (c) (Guaranteed Money irrecoverable) the Guaranteed Money (or money which, if recoverable, would have been Guaranteed Money) being or becoming irrecoverable f rom the Borrower for any reason, irrespective of whether a Finance Party knew or ought to have known of the relevant facts or circumstances; or

Corrs Chambers Westgarth 3445-6323-2315v7 30 Syndicated Loan Note Subscription Agreement – Project Mustang (d) (Insolvency Events and Avoided Transactions) the occurrence of an Insolvency Event in relation to the Borrower or the occurrence of any Avoided Transaction. 11.3 Ipso Facto Event If an Ipso Facto Event has occurred, then immediately on demand by the Facility Agent the Guarantor must pay all Secured Money as if it was the principal obligor. 11.4 Demand The Guarantor must pay to a Finance Party on demand the Guaranteed Money guaranteed under clause 11.1 and an amount equal to the amount of any loss or liability in respect of which it has given an indemnity under clause 11.2. 11.5 Time of demand Demand may be made under clause 11.4 at any time and f rom time to time. 11.6 Principal obligations Each obligation of the Guarantor under this document is: (a) (principal obligation) a principal obligation imposed on the Guarantor as principal debtor and is not to be regarded as ancillary or collateral to any other right or obligation; and (b) (independent of Security Document) independent of and not af fected by or in substitution for any Security Document or any obligation of any person. 11.7 No recourse to Security Document or other rights This document is enforceable against the Guarantor irrespective of whether: (a) (recourse to Security Document) recourse has f irst been had to any Security Document; (b) (demands on other persons) demand has been made on or notice is given to the Borrower or any other person; (c) (other enforcement action) any other enforcement action has been taken against any person (including the Borrower or any other person); or (d) (other events) any of the events described in clause 11.11 has occurred. 11.8 Continuing guarantee The obligations of the Guarantor: (a) (continuing guarantee) are continuing guarantee and indemnity obligations; (b) (present and future) extend to the present and any future balance of the Guaranteed Money; and (c) (remains in full force and effect until discharged) remain in full force and effect until a f inal discharge of it is provided to the Guarantor, notwithstanding any settlement of account, intervening payment or other thing.