UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION On August 18, 2025, Arthur J. Gallagher & Co. (the “Company” or “Gallagher”) completed its previously announced acquisition (the “Transaction”) of all of the issued and outstanding stock of Dolphin Topco, Inc., a Delaware corporation (the “Acquired Entity” or “AssuredPartners”). The Transaction was completed pursuant to a Stock Purchase Agreement entered into on December 7, 2024 (the “Purchase Agreement”) among the Company, The AssuredPartners Group LP, a Delaware Limited partnership (the “Seller”), and the Acquired Entity. Upon the closing of the Transaction, the Company paid the Seller an aggregate purchase price of $13.8 billion in cash after giving effect to and subject to certain customary adjustments as set forth in the Purchase Agreement. The Company financed the acquisition with net proceeds from the previously disclosed equity and debt financing transactions (the “Acquisition Financing”). The unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X as amended and should be read in conjunction with the accompanying notes to the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial information was derived from and should be read in conjunction with: • Audited consolidated financial statements and accompanying notes of the Company as of and for the fiscal year ended December 31, 2024 (as contained in its Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 18, 2025); • Unaudited consolidated financial statements and accompanying notes of the Company as of June 30, 2025 and for the six months ended June 30, 2025 and 2024 (as contained in its Q2 2025 Interim Report on Form 10-Q filed with the SEC on August 1, 2025); • Audited consolidated financial statements and accompanying notes of AssuredPartners as of and for the year ended December 31, 2024 and unaudited consolidated financial statements and accompanying notes of AssuredPartners as of June 30, 2025 and for the six months ended June 30, 2025. The unaudited pro forma condensed combined financial information is based on the historical consolidated financial statements of the Company and the historical consolidated financial statements of AssuredPartners, as adjusted to give effect to the Transaction and the Acquisition Financing. The unaudited pro forma condensed combined balance sheet as of June 30, 2025 gives effect to the Transactions as if it occurred or had become effective on June 30, 2025. The unaudited pro forma condensed combined statements of earnings for the s i x months ended June 30, 2025 and the fiscal year ended December 31, 2024, give effect to the Transactions as if it occurred or had b e c o m e effective on January 1, 2024. Further information about this basis of presentation is provided in Note 1 to this unaudited pro forma condensed combined financial information. The following unaudited pro forma condensed combined financial information provides for pro forma adjustments giving effect to the following transactions: • The Transaction • The Acquisition Financing The unaudited pro forma condensed combined financial information has been prepared by us using the acquisition method of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”). Gallagher has been treated as the acquirer in the Transaction for accounting purposes The pro forma adjustments are based upon available information and certain assumptions that the Company believes are reasonable. The unaudited pro forma condensed combined financial information is provided for illustrative and informational purposes only and does not purport to represent or be indicative of the consolidated results of operations or financial condition of the Company had the Transaction been completed as of the dates presented and should not be construed as representative of the future consolidated results of operations or financial condition of the combined entity. Provisional estimates of fair value of AssuredPartners’ assets acquired and liabilities assumed will be subsequently reviewed and finalized within the first year of operations subsequent to the acquisition date to determine the necessity for adjustments. Fair value adjustments, if any, are most common to the values established for amortizable intangible assets, including expiration lists, trade name, and assembled workforce, with the offset to goodwill, net of any income tax effect. Provisional estimates of fair value were used by us to disclose the acquisition of AssuredPartners as of the acquisition date. We are using independent third party valuation specialists to assist us in determining the fair value of assets acquired and liabilities assumed for the Transaction As of this filing, the specialists have not completed their analysis and thus these fair value estimates are provisional. These provisional fair value estimates will be subsequently reviewed and adjusted based on the results of this valuation. As a result of the foregoing, the pro forma adjustments are preliminary and have been made solely for the purpose of providing unaudited pro forma condensed combined financial information. Differences between these preliminary estimates and the final acquisition accounting may arise, and these differences could have a material impact on the accompanying unaudited pro forma condensed combined financial information and the combined Company’s future results of operations and financial position. The unaudited pro forma condensed combined financial information does not reflect any expected cost savings, operating synergies or revenue enhancements that the combined entity may achieve as a result of the acquisition or the costs necessary to achieve any such cost savings, operating synergies or revenue enhancements. .3

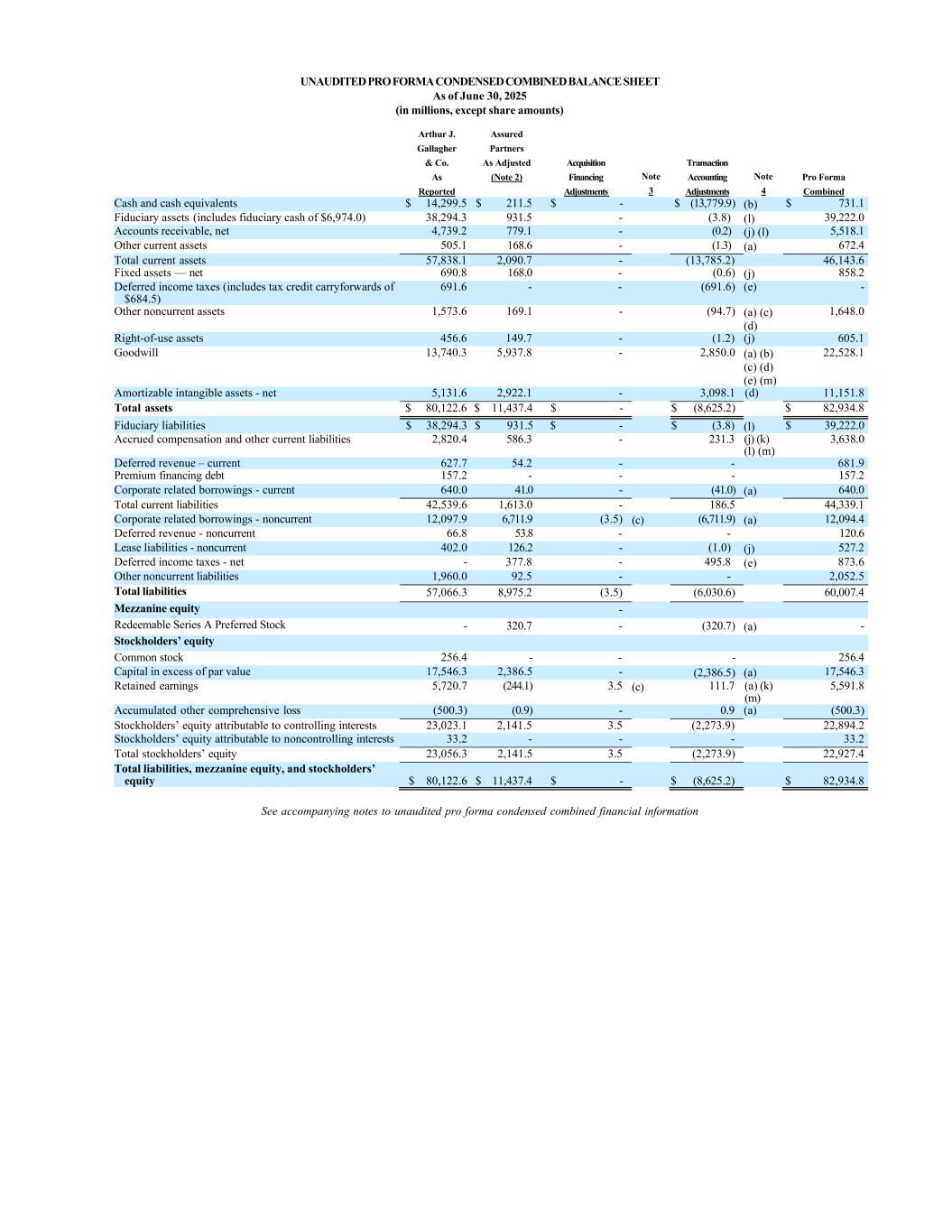

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET As of June 30, 2025 (in millions, except share amounts) Arthur J. Assured Gallagher Partners & Co. As Adjusted Acquisition Transaction As (Note 2) Financing Note Accounting Note Pro Forma Reported Adjustments 3 Adjustments 4 Combined Cash and cash equivalents $ 14,299.5 $ 211.5 $ - $ (13,779.9) (b) $ 731.1 Fiduciary assets (includes fiduciary cash of $6,974.0) 38,294.3 931.5 - (3.8) (l) 39,222.0 Accounts receivable, net 4,739.2 779.1 - (0.2) (j) (l) 5,518.1 Other current assets 505.1 168.6 - (1.3) (a) 672.4 Total current assets 57,838.1 2,090.7 - (13,785.2) 46,143.6 Fixed assets — net 690.8 168.0 - (0.6) (j) 858.2 Deferred income taxes (includes tax credit carryforwards of $684.5) 691.6 - - (691.6) (e) - Other noncurrent assets 1,573.6 169.1 - (94.7) (a) (c) (d) 1,648.0 Right-of-use assets 456.6 149.7 - (1.2) (j) 605.1 Goodwill 13,740.3 5,937.8 - 2,850.0 (a) (b) (c) (d) (e) (m) 22,528.1 Amortizable intangible assets - net 5,131.6 2,922.1 - 3,098.1 (d) 11,151.8 Total assets $ 80,122.6 $ 11,437.4 $ - $ (8,625.2) $ 82,934.8 Fiduciary liabilities $ 38,294.3 $ 931.5 $ - $ (3.8) (l) $ 39,222.0 Accrued compensation and other current liabilities 2,820.4 586.3 - 231.3 (j) (k) (l) (m) 3,638.0 Deferred revenue – current 627.7 54.2 - - 681.9 Premium financing debt 157.2 - - - 157.2 Corporate related borrowings - current 640.0 41.0 - (41.0) (a) 640.0 Total current liabilities 42,539.6 1,613.0 - 186.5 44,339.1 Corporate related borrowings - noncurrent 12,097.9 6,711.9 (3.5) (c) (6,711.9) (a) 12,094.4 Deferred revenue - noncurrent 66.8 53.8 - - 120.6 Lease liabilities - noncurrent 402.0 126.2 - (1.0) (j) 527.2 Deferred income taxes - net - 377.8 - 495.8 (e) 873.6 Other noncurrent liabilities 1,960.0 92.5 - - 2,052.5 Total liabilities 57,066.3 8,975.2 (3.5) (6,030.6) 60,007.4 Mezzanine equity - Redeemable Series A Preferred Stock - 320.7 - (320.7) (a) - Stockholders’ equity Common stock 256.4 - - - 256.4 Capital in excess of par value 17,546.3 2,386.5 - (2,386.5) (a) 17,546.3 Retained earnings 5,720.7 (244.1) 3.5 (c) 111.7 (a) (k) (m) 5,591.8 Accumulated other comprehensive loss (500.3) (0.9) - 0.9 (a) (500.3) Stockholders’ equity attributable to controlling interests 23,023.1 2,141.5 3.5 (2,273.9) 22,894.2 Stockholders’ equity attributable to noncontrolling interests 33.2 - - - 33.2 Total stockholders’ equity 23,056.3 2,141.5 3.5 (2,273.9) 22,927.4 Total liabilities, mezzanine equity, and stockholders’ equity $ 80,122.6 $ 11,437.4 $ - $ (8,625.2) $ 82,934.8 See accompanying notes to unaudited pro forma condensed combined financial information

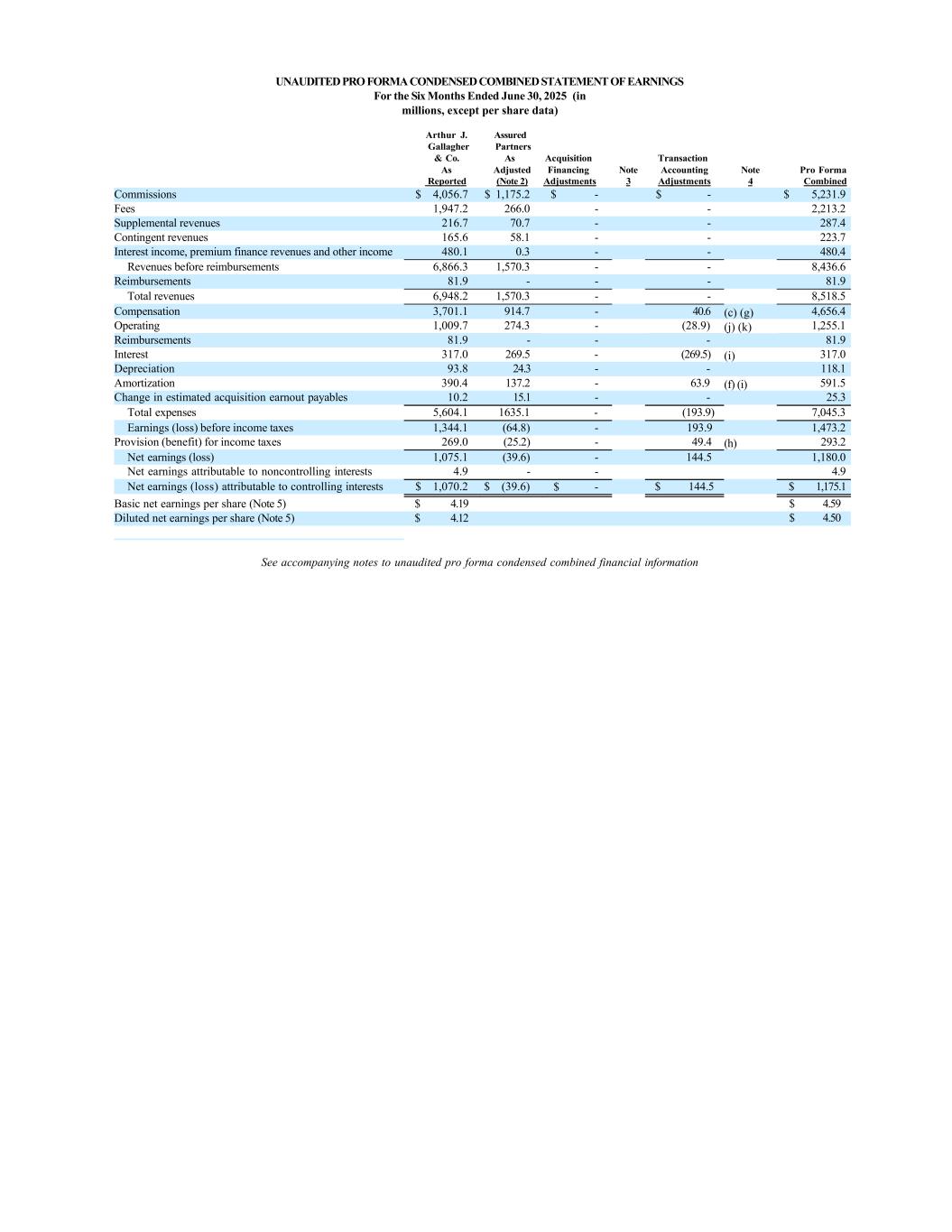

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF EARNINGS For the Six Months Ended June 30, 2025 (in millions, except per share data) Arthur J. Assured Gallagher Partners & Co. As Acquisition Transaction As Adjusted Financing Note Accounting Note Pro Forma Reported (Note 2) Adjustments 3 Adjustments 4 Combined Commissions $ 4,056.7 $ 1,175.2 $ - $ - $ 5,231.9 Fees 1,947.2 266.0 - - 2,213.2 Supplemental revenues 216.7 70.7 - - 287.4 Contingent revenues 165.6 58.1 - - 223.7 Interest income, premium finance revenues and other income 480.1 0.3 - - 480.4 Revenues before reimbursements 6,866.3 1,570.3 - - 8,436.6 Reimbursements 81.9 - - - 81.9 Total revenues 6,948.2 1,570.3 - - 8,518.5 Compensation 3,701.1 914.7 - 40.6 (c) (g) 4,656.4 Operating 1,009.7 274.3 - (28.9) (j) (k) 1,255.1 Reimbursements 81.9 - - - 81.9 Interest 317.0 269.5 - (269.5) (i) 317.0 Depreciation 93.8 24.3 - - 118.1 Amortization 390.4 137.2 - 63.9 (f) (i) 591.5 Change in estimated acquisition earnout payables 10.2 15.1 - - 25.3 Total expenses 5,604.1 1635.1 - (193.9) 7,045.3 Earnings (loss) before income taxes 1,344.1 (64.8) - 193.9 1,473.2 Provision (benefit) for income taxes 269.0 (25.2) - 49.4 (h) 293.2 Net earnings (loss) 1,075.1 (39.6) - 144.5 1,180.0 Net earnings attributable to noncontrolling interests 4.9 - - 4.9 Net earnings (loss) attributable to controlling interests $ 1,070.2 $ (39.6) $ - $ 144.5 $ 1,175.1 Basic net earnings per share (Note 5) $ 4.19 $ 4.59 Diluted net earnings per share (Note 5) $ 4.12 $ 4.50 See accompanying notes to unaudited pro forma condensed combined financial information

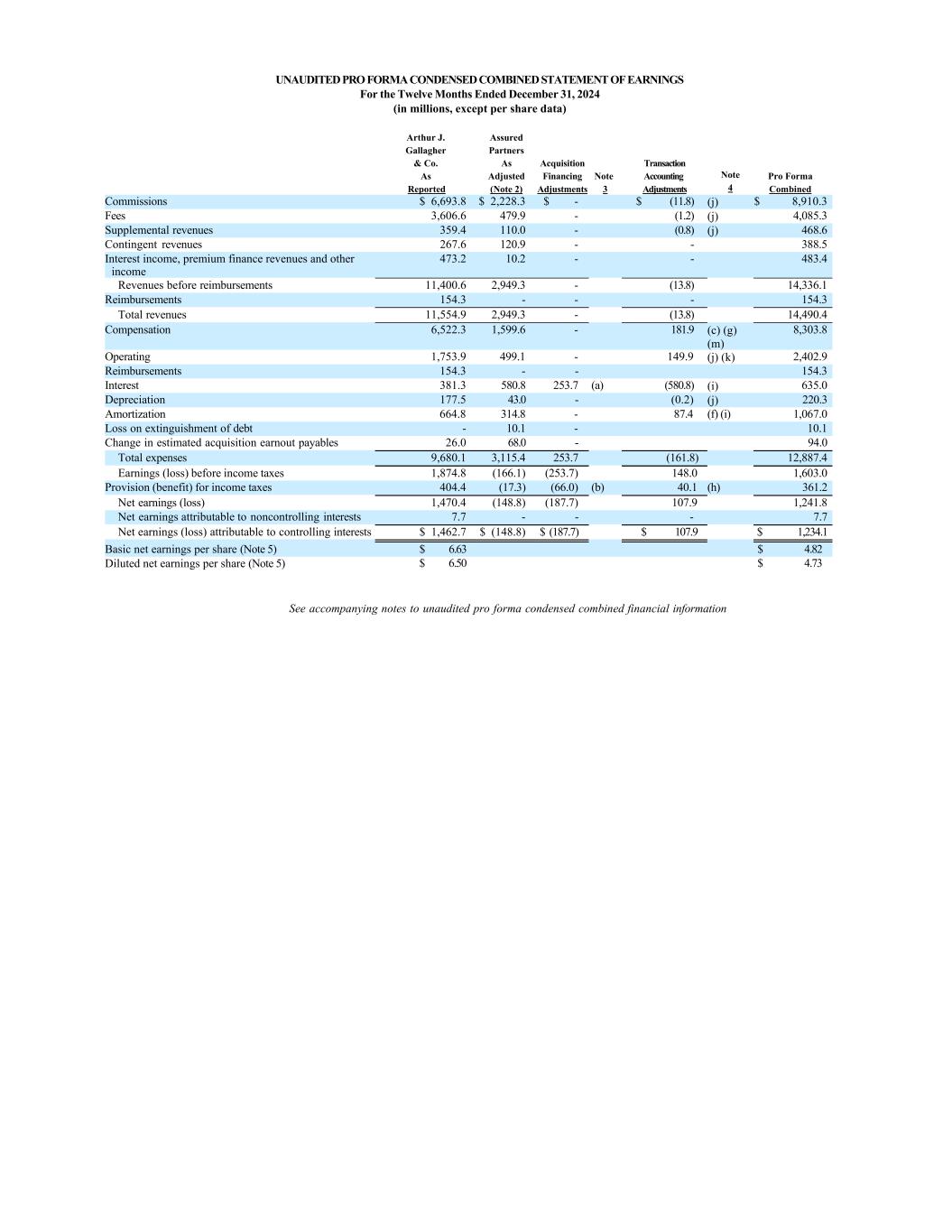

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF EARNINGS For the Twelve Months Ended December 31, 2024 (in millions, except per share data) See accompanying notes to unaudited pro forma condensed combined financial information Arthur J. Assured Gallagher Partners & Co. As Acquisition Transaction As Adjusted Financing Note Accounting Note Pro Forma Reported (Note 2) Adjustments 3 Adjustments 4 Combined Commissions $ 6,693.8 $ 2,228.3 $ - $ (11.8) (j) $ 8,910.3 Fees 3,606.6 479.9 - (1.2) (j) 4,085.3 Supplemental revenues 359.4 110.0 - (0.8) (j) 468.6 Contingent revenues 267.6 120.9 - - 388.5 Interest income, premium finance revenues and other income 473.2 10.2 - - 483.4 Revenues before reimbursements 11,400.6 2,949.3 - (13.8) 14,336.1 Reimbursements 154.3 - - - 154.3 Total revenues 11,554.9 2,949.3 - (13.8) 14,490.4 Compensation 6,522.3 1,599.6 - 181.9 (c) (g) (m) 8,303.8 Operating 1,753.9 499.1 - 149.9 (j) (k) 2,402.9 Reimbursements 154.3 - - 154.3 Interest 381.3 580.8 253.7 (a) (580.8) (i) 635.0 Depreciation 177.5 43.0 - (0.2) (j) 220.3 Amortization 664.8 314.8 - 87.4 (f) (i) 1,067.0 Loss on extinguishment of debt - 10.1 - 10.1 Change in estimated acquisition earnout payables 26.0 68.0 - 94.0 Total expenses 9,680.1 3,115.4 253.7 (161.8) 12,887.4 Earnings (loss) before income taxes 1,874.8 (166.1) (253.7) 148.0 1,603.0 Provision (benefit) for income taxes 404.4 (17.3) (66.0) (b) 40.1 (h) 361.2 Net earnings (loss) 1,470.4 (148.8) (187.7) 107.9 1,241.8 Net earnings attributable to noncontrolling interests 7.7 - - - 7.7 Net earnings (loss) attributable to controlling interests $ 1,462.7 $ (148.8) $ (187.7) $ 107.9 $ 1,234.1 Basic net earnings per share (Note 5) $ 6.63 $ 4.82 Diluted net earnings per share (Note 5) $ 6.50 $ 4.73

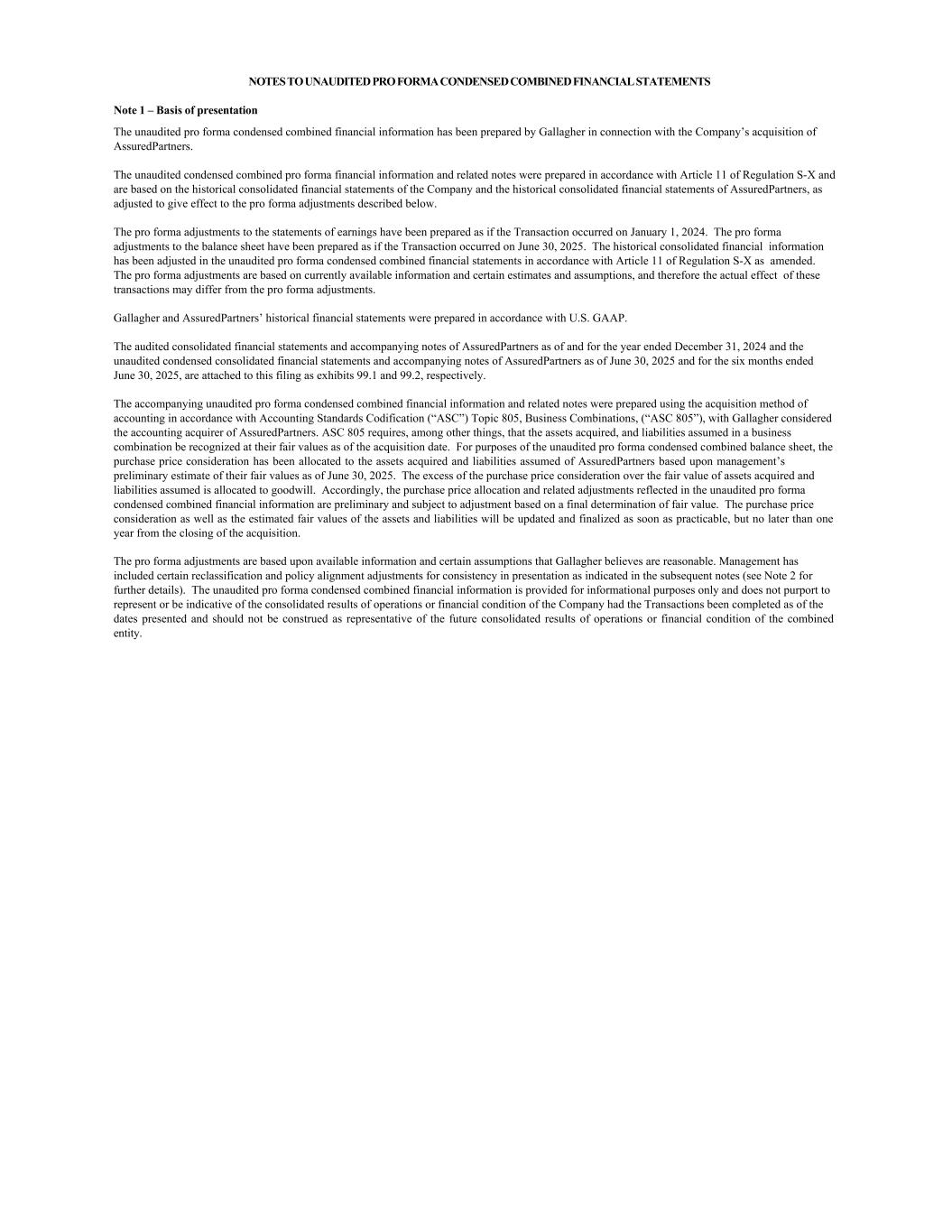

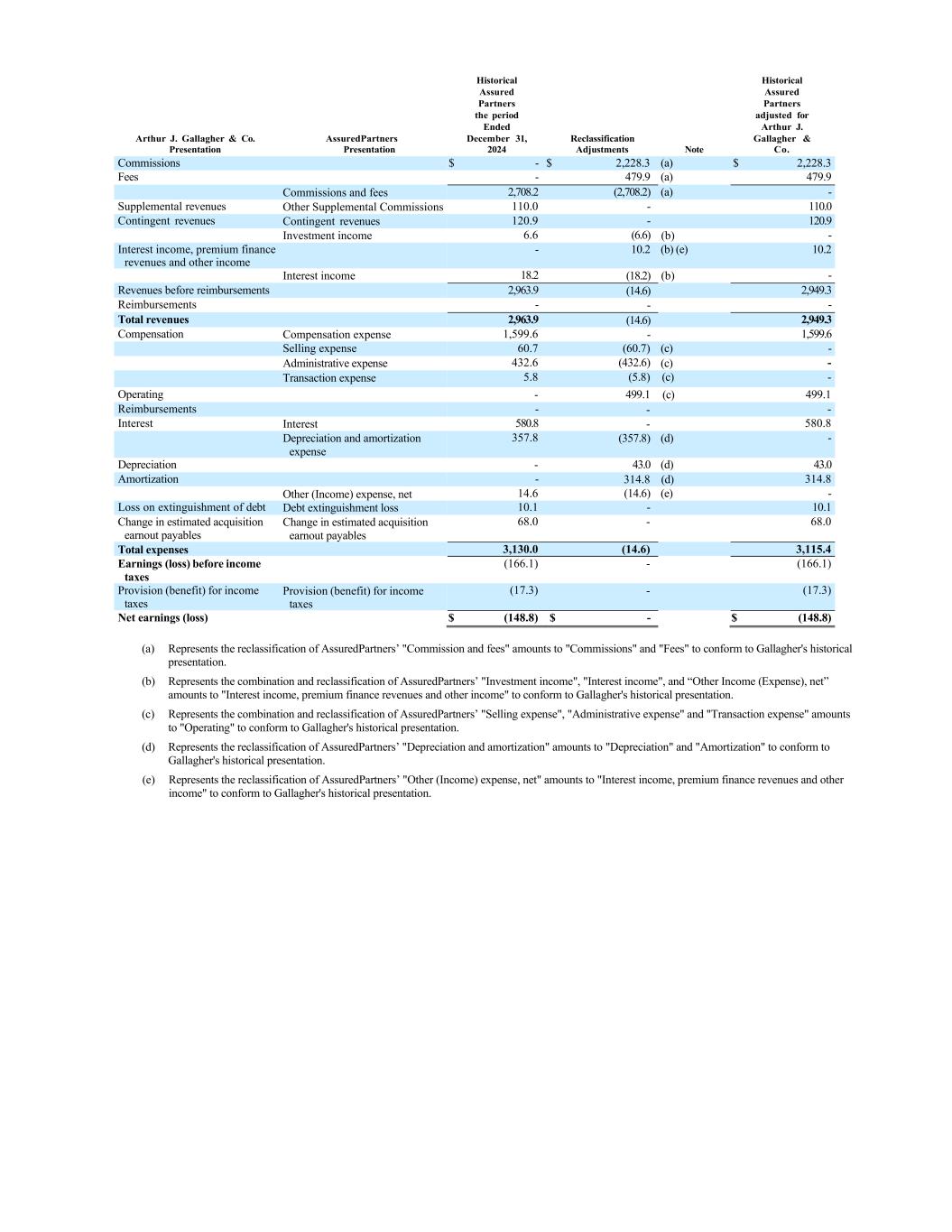

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS Note 1 – Basis of presentation The unaudited pro forma condensed combined financial information has been prepared by Gallagher in connection with the Company’s acquisition of AssuredPartners. The unaudited condensed combined pro forma financial information and related notes were prepared in accordance with Article 11 of Regulation S-X and are based on the historical consolidated financial statements of the Company and the historical consolidated financial statements of AssuredPartners, as adjusted to give effect to the pro forma adjustments described below. The pro forma adjustments to the statements of earnings have been prepared as if the Transaction occurred on January 1, 2024. The pro forma adjustments to the balance sheet have been prepared as if the Transaction occurred on June 30, 2025. The historical consolidated financial information has been adjusted in the unaudited pro forma condensed combined financial statements in accordance with Article 11 of Regulation S-X as amended. The pro forma adjustments are based on currently available information and certain estimates and assumptions, and therefore the actual effect of these transactions may differ from the pro forma adjustments. Gallagher and AssuredPartners’ historical financial statements were prepared in accordance with U.S. GAAP. The audited consolidated financial statements and accompanying notes of AssuredPartners as of and for the year ended December 31, 2024 and the unaudited condensed consolidated financial statements and accompanying notes of AssuredPartners as of June 30, 2025 and for the six months ended June 30, 2025, are attached to this filing as and 99.2, respectively. The accompanying unaudited pro forma condensed combined financial information and related notes were prepared using the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, (“ASC 805”), with Gallagher considered the accounting acquirer of AssuredPartners. ASC 805 requires, among other things, that the assets acquired, and liabilities assumed in a business combination be recognized at their fair values as of the acquisition date. For purposes of the unaudited pro forma condensed combined balance sheet, the purchase price consideration has been allocated to the assets acquired and liabilities assumed of AssuredPartners based upon management’s preliminary estimate of their fair values as of June 30, 2025. The excess of the purchase price consideration over the fair value of assets acquired and liabilities assumed is allocated to goodwill. Accordingly, the purchase price allocation and related adjustments reflected in the unaudited pro forma condensed combined financial information are preliminary and subject to adjustment based on a final determination of fair value. The purchase price consideration as well as the estimated fair values of the assets and liabilities will be updated and finalized as soon as practicable, but no later than one year from the closing of the acquisition. The pro forma adjustments are based upon available information and certain assumptions that Gallagher believes are reasonable. Management has included certain reclassification and policy alignment adjustments for consistency in presentation as indicated in the subsequent notes (see Note 2 for further details). The unaudited pro forma condensed combined financial information is provided for informational purposes only and does not purport to represent or be indicative of the consolidated results of operations or financial condition of the Company had the Transactions been completed as of the dates presented and should not be construed as representative of the future consolidated results of operations or financial condition of the combined entity.

Note 2 – Reclassification adjustments Certain balances were reclassified from the AssuredPartners historical financial statements so its presentation would be consistent with that of Gallagher. These reclassifications are based on management’s preliminary analysis and have no effect on separately reported net assets, equity or net earnings attributed to common shareholders of AssuredPartners. When the Company completes its detailed review of AssuredPartners’ chart of accounts and accounting policies, additional reclassification adjustments could be identified that, when conformed, could have a material impact on the combined Company’s financial information. Refer to the table below for a summary of the reclassification adjustments made to AssuredPartners’ unaudited condensed consolidated balance sheet as of June 30, 2025 to conform its presentation to that of Gallagher.

Historical Assured Partners Historical as adjusted Assured For Partners Arthur at J. Arthur J. Gallagher & Co. AssuredPartners June Reclassification Gallagher Presentation Presentation 30, 2025 Adjustments Note & Co. Cash and cash equivalents Cash and cash equivalents $ 263.0 $ (51.5) (a) $ 211.5 Restricted cash 38.0 (38.0) (a) - Trust cash 377.5 (377.5) (a) - Fixed maturity securities 38.7 (38.7) (b) - Fiduciary assets - 931.5 (a) 931.5 Accounts receivable, net Accounts receivable, net 1,229.9 (450.8) (a) (j) 779.1 Prepaid expenses 37.2 (37.2) (b) - Other current assets Other current assets 106.4 62.2 (b) (j) 168.6 Accounts receivable, noncurrent portion 71.4 (71.4) (c) - Fixed assets – net Fixed assets – net 168.0 - 168.0 Deferred income taxes - - - Other noncurrent assets Other noncurrent assets 97.7 71.4 (c) 169.1 Right-of-use assets Operating lease right-of-use assets, net 149.7 - 149.7 Goodwill - net Goodwill 5,937.8 - 5,937.8 Amortizable intangible assets - net Definite-lived intangible assets, net 2,922.1 - 2,922.1 Total assets $ 11,437.4 $ - $ 11,437.4 Fiduciary liabilities $ - $ 931.5 (a) $ 931.5 Long-term debt, net, current portion 41.0 (41.0) (d) - Earn-out payables, current portion 162.3 (162.3) (e) - Carrier payables 714.4 (714.4) (a) - Accounts payable 128.1 (128.1) (a) (f) - Customer advances 66.4 (66.4) (a) (k) - Producer payables 148.6 (148.6) (f) - Reserve for unpaid losses and loss adjustment expenses, current portion 4.3 (4.3) (e) - Accrued expenses and other 267.2 (267.2) (a) (f) - Accrued compensation and other current liabilities - 586.3 (f) (e) 586.3 Deferred revenue - current Deferred revenue - current 51.2 3.0 (k) 54.2 Corporate related borrowings - current 41.0 (d) 41.0 Corporate related borrowings – noncurrent 6,711.9 (h) 6,711.9 Deferred revenue – noncurrent Deferred revenue – noncurrent 53.8 - 53.8 Earn-out payables, noncurrent portion 51.6 (51.6) (g) - Long-term debt, net, noncurrent portion 6,711.9 (6,711.9) (h) - Reserve for unpaid losses and loss adjustment expenses, noncurrent portion 29.5 (29.5) (e) - Operating lease liabilities, noncurrent portion 126.2 (126.2) (i) - Lease liabilities – noncurrent - 126.2 (i) 126.2 Deferred income taxes - noncurrent Deferred income taxes, net 377.8 - 377.8 Other noncurrent liabilities Other noncurrent liabilities 40.9 51.6 (g) 92.5 Total liabilities 8,975.2 - 8,975.2 Redeemable Series A Preferred Stock 320.7 - 320.7 Total Mezzanine equity Common stock - - - Capital in excess of par value 2,386.5 - 2,386.5 Accumulated other comprehensive loss Accumulated other comprehensive (loss) income (0.9) - (0.9) Retained earnings Retained earnings (244.1) - (244.1) Total liabilities and stockholder’s equity $ 11,437.4 $ - $ 11,437.4 (a) Represents the reclassification of AssuredPartners’ "Restricted cash" amount to "Cash and cash equivalents" and the reclassification of "Trust Cash" and “Agency bill accounts receivables” amounts to "Fiduciary assets" to conform to Gallagher's historical presentation. Additionally, represents the reclassification of AssuredPartners’ "Carrier payables", “Customer advances”, “Reserve for unpaid losses and loss adjustment expenses, current portion” and select “Accounts payable” amounts to "Fiduciary liabilities" to conform to Gallagher's historical presentation. (b) Represents the reclassification of AssuredPartners’ “Prepaid expenses” and "Fixed maturity securities" amounts to "Other current assets" to conform to Gallagher’s historical presentation. (c) Represents the reclassification of AssuredPartners’ "Accounts receivable, noncurrent portion" amounts to "Other noncurrent assets" to conform to Gallagher’s historical presentation. (d) Represents the reclassification of AssuredPartners’ "Long-term debt, net, current portion" amounts to "Corporate related borrowings - current" to conform to Gallagher’s historical presentation. (e) Represents the combination and reclassification of AssuredPartners’ "Earn-out payables, current portion" and "Reserve for unpaid losses and loss adjustment expenses, noncurrent portion" amounts to "Accrued compensation and other current liabilities" to conform to Gallagher’s historical presentation. (f) Represents the combination and reclassification of AssuredPartners’ "Accounts payable", “Producer payables”, and "Accrued expenses and other" amounts to "Accrued compensation and other current liabilities" to conform to Gallagher's historical presentation.

(g) Represents the reclassification of AssuredPartners’ "Earn-outs payables, noncurrent portion" amounts to "Other noncurrent liabilities" to conform to Gallagher's historical presentation. (h) Represents the reclassification of AssuredPartners’ "Long-term debt, net, noncurrent portion" amounts to "Corporate related borrowings - noncurrent" to conform to Gallagher's historical presentation. (i) Represents the reclassification of AssuredPartners’ “Operating lease liabilities, noncurrent portion” amounts to “Lease liabilities – noncurrent” to conform to Gallagher’s historical presentation. (j) Represents the reclassification of Assured Partners’ “Other current assets” amounts pertaining to other receivables to “Accounts receivables, net” to conform to Gallagher’s historical presentation. (k) Represents the reclassification of Assured Partners’ “Customer advances” amounts pertaining to advances from customers to “Deferred revenue - current” to conform to Gallagher’s historical presentation.

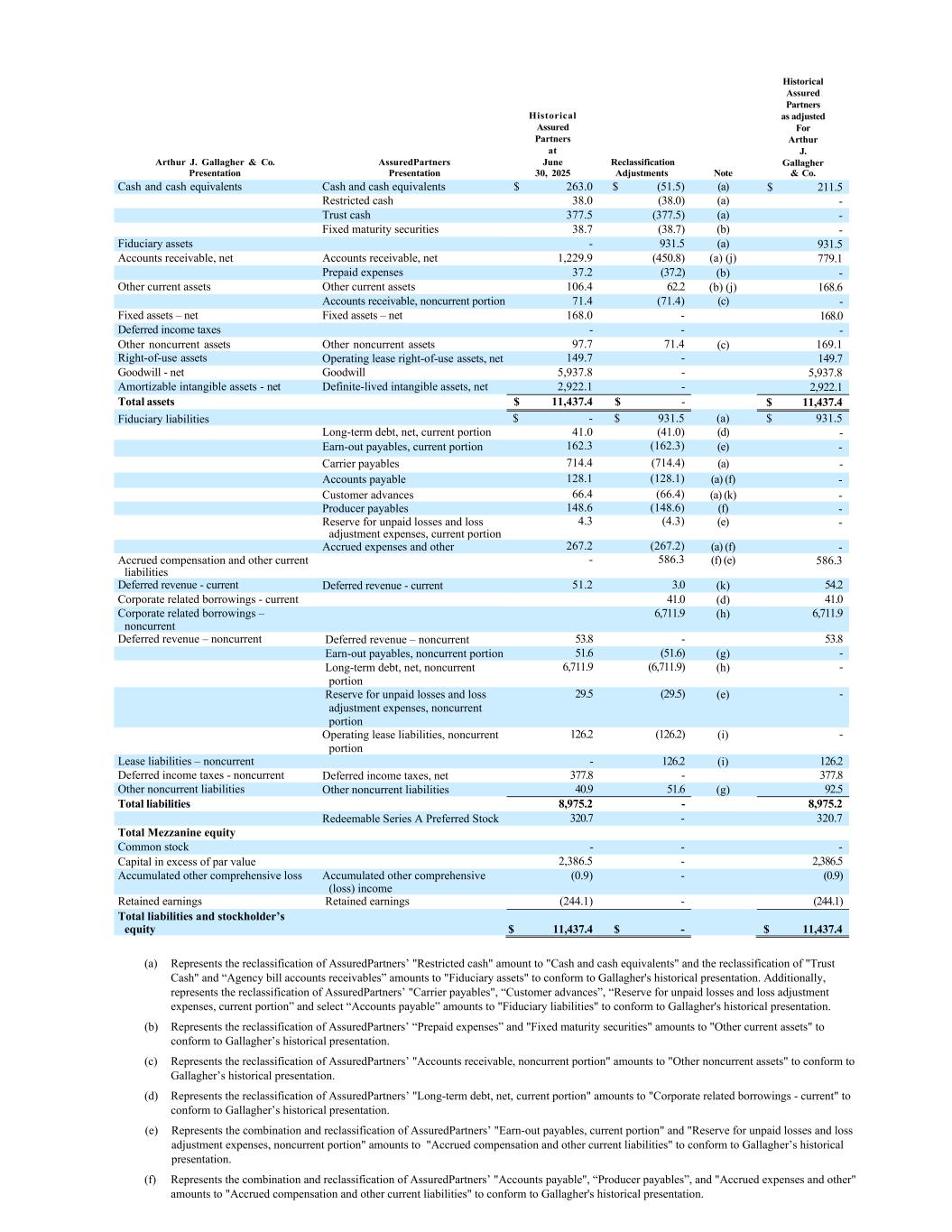

Refer to the tables below for a summary of the reclassification adjustments made to AssuredPartners’ unaudited condensed consolidated statements of comprehensive income for the six months ended June 30, 2025 and the audited consolidated statements of comprehensive income for the year ended December 31, 2024 to conform its presentation to that of Gallagher. Historical Historical AssuredPartners AssuredPartners Adjusted for for the period ended Arthur J. Arthur J. Gallagher & Co. AssuredPartners June 30, Reclassification Gallagher & Presentation Presentation 2025 Adjustments Note Co. Commissions $ - $ 1,175.2 (a) $ 1,175.2 Fees - 266.0 (a) 266.0 Commissions and fees 1,441.2 (1,441.2) (a) - Supplemental revenues Other supplemental commissions 70.7 - 70.7 Contingent revenues Contingent revenues 58.1 - 58.1 Investment income 3.5 (3.5) (b) - Interest income, premium finance revenues and other income - 0.3 (b) (e) 0.3 Interest income 2.1 (2.1) (b) - Revenues before reimbursements 1,575.6 (5.3) 1,570.3 Reimbursements - - - Total revenues 1,575.6 (5.3) 1,570.3 Compensation Compensation expense 914.7 - 914.7 Selling expense 30.0 (30.0) (c) - Administrative expense 242.9 (242.9) (c) - Transaction expense 1.4 (1.4) (c) - Operating - 274.3 (c) 274.3 Reimbursements - - - Interest Interest 269.5 - 269.5 Depreciation and amortization expense 161.5 (161.5) (d) - Depreciation - 24.3 (d) 24.3 Amortization - 137.2 (d) 137.2 Other (Income) expense, net 5.3 (5.3) (e) - Loss on extinguishment of debt Debt extinguishment loss - - - Change in estimated acquisition earnout payables Change in estimated acquisition earnout payables 15.1 - 15.1 Total expenses 1,640.4 (5.3) 1,635.1 Earnings (loss) before income taxes (64.8) - (64.8) Provision (benefit) for income taxes Provision (benefit) for income taxes (25.2) - (25.2) Net earnings (loss) $ (39.6) $ - $ (39.6) (a) Represents the reclassification of AssuredPartners’ "Commission and fees" amounts to "Commissions" and "Fees" to conform to Gallagher's historical presentation. (b) Represents the combination and reclassification of AssuredPartners’ "Investment income", "Interest income", and “Other Income (Expense), net” amounts to "Interest income, premium finance revenues and other income" to conform to Gallagher's historical presentation. (c) Represents the combination and reclassification of AssuredPartners’ "Selling expense", "Administrative expense" and "Transaction expense" amounts to "Operating" to conform to Gallagher's historical presentation. (d) Represents the reclassification of AssuredPartners’ "Depreciation and amortization" amounts to "Depreciation" and "Amortization" to conform to Gallagher's historical presentation. (e) Represents the reclassification of AssuredPartners’ "Other (Income) expense, net" amounts to "Interest income, premium finance revenues and other income" to conform to Gallagher's historical presentation.

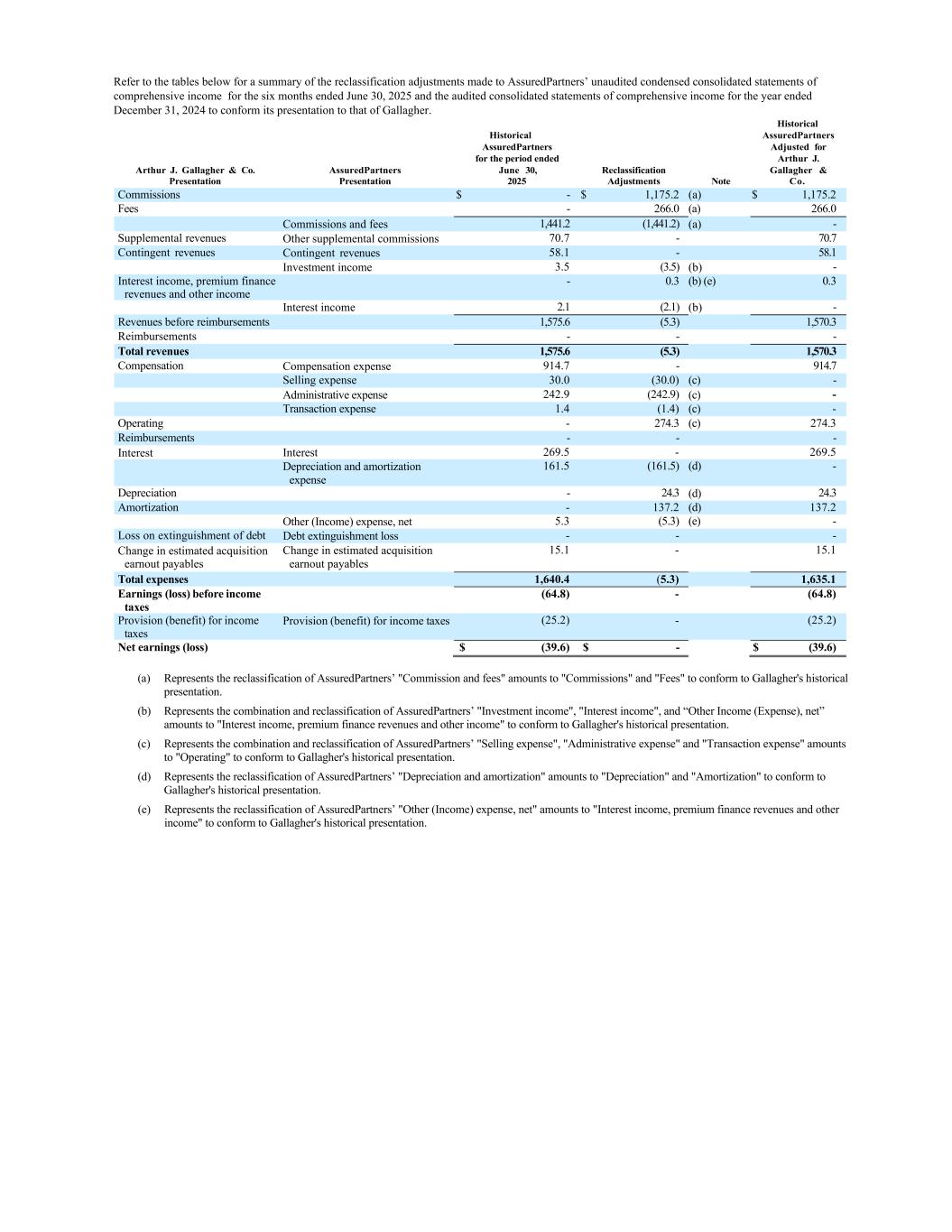

Historical Historical Assured Assured Partners Partners the period adjusted for Ended Arthur J. Arthur J. Gallagher & Co. AssuredPartners December 31, Reclassification Gallagher & Presentation Presentation 2024 Adjustments Note Co. Commissions $ - $ 2,228.3 (a) $ 2,228.3 Fees - 479.9 (a) 479.9 Commissions and fees 2,708.2 (2,708.2) (a) - Supplemental revenues Other Supplemental Commissions 110.0 - 110.0 Contingent revenues Contingent revenues 120.9 - 120.9 Investment income 6.6 (6.6) (b) - Interest income, premium finance revenues and other income - 10.2 (b) (e) 10.2 Interest income 18.2 (18.2) (b) - Revenues before reimbursements 2,963.9 (14.6) 2,949.3 Reimbursements - - - Total revenues 2,963.9 (14.6) 2,949.3 Compensation Compensation expense 1,599.6 - 1,599.6 Selling expense 60.7 (60.7) (c) - Administrative expense 432.6 (432.6) (c) - Transaction expense 5.8 (5.8) (c) - Operating - 499.1 (c) 499.1 Reimbursements - - - Interest Interest 580.8 - 580.8 Depreciation and amortization expense 357.8 (357.8) (d) - Depreciation - 43.0 (d) 43.0 Amortization - 314.8 (d) 314.8 Other (Income) expense, net 14.6 (14.6) (e) - Loss on extinguishment of debt Debt extinguishment loss 10.1 - 10.1 Change in estimated acquisition earnout payables Change in estimated acquisition earnout payables 68.0 - 68.0 Total expenses 3,130.0 (14.6) 3,115.4 Earnings (loss) before income taxes (166.1) - (166.1) Provision (benefit) for income taxes Provision (benefit) for income taxes (17.3) - (17.3) Net earnings (loss) $ (148.8) $ - $ (148.8) (a) Represents the reclassification of AssuredPartners’ "Commission and fees" amounts to "Commissions" and "Fees" to conform to Gallagher's historical presentation. (b) Represents the combination and reclassification of AssuredPartners’ "Investment income", "Interest income", and “Other Income (Expense), net” amounts to "Interest income, premium finance revenues and other income" to conform to Gallagher's historical presentation. (c) Represents the combination and reclassification of AssuredPartners’ "Selling expense", "Administrative expense" and "Transaction expense" amounts to "Operating" to conform to Gallagher's historical presentation. (d) Represents the reclassification of AssuredPartners’ "Depreciation and amortization" amounts to "Depreciation" and "Amortization" to conform to Gallagher's historical presentation. (e) Represents the reclassification of AssuredPartners’ "Other (Income) expense, net" amounts to "Interest income, premium finance revenues and other income" to conform to Gallagher's historical presentation.

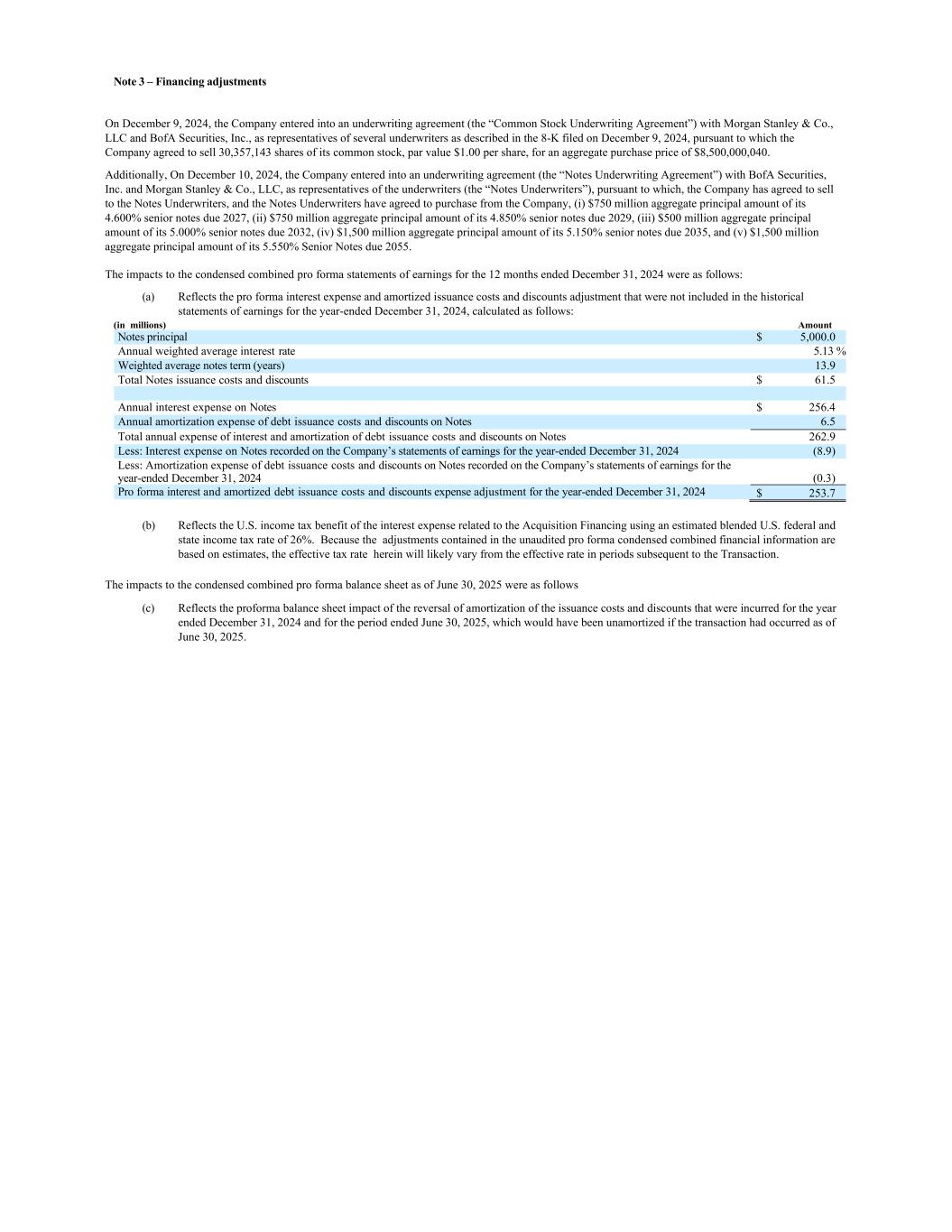

Note 3 – Financing adjustments On December 9, 2024, the Company entered into an underwriting agreement (the “Common Stock Underwriting Agreement”) with Morgan Stanley & Co., LLC and BofA Securities, Inc., as representatives of several underwriters as described in the 8-K filed on December 9, 2024, pursuant to which the Company agreed to sell 30,357,143 shares of its common stock, par value $1.00 per share, for an aggregate purchase price of $8,500,000,040. Additionally, On December 10, 2024, the Company entered into an underwriting agreement (the “Notes Underwriting Agreement”) with BofA Securities, Inc. and Morgan Stanley & Co., LLC, as representatives of the underwriters (the “Notes Underwriters”), pursuant to which, the Company has agreed to sell to the Notes Underwriters, and the Notes Underwriters have agreed to purchase from the Company, (i) $750 million aggregate principal amount of its 4.600% senior notes due 2027, (ii) $750 million aggregate principal amount of its 4.850% senior notes due 2029, (iii) $500 million aggregate principal amount of its 5.000% senior notes due 2032, (iv) $1,500 million aggregate principal amount of its 5.150% senior notes due 2035, and (v) $1,500 million aggregate principal amount of its 5.550% Senior Notes due 2055. The impacts to the condensed combined pro forma statements of earnings for the 12 months ended December 31, 2024 were as follows: (a) Reflects the pro forma interest expense and amortized issuance costs and discounts adjustment that were not included in the historical statements of earnings for the year-ended December 31, 2024, calculated as follows: (in millions) Amount Notes principal $ 5,000.0 Annual weighted average interest rate 5.13 % Weighted average notes term (years) 13.9 Total Notes issuance costs and discounts $ 61.5 Annual interest expense on Notes $ 256.4 Annual amortization expense of debt issuance costs and discounts on Notes 6.5 Total annual expense of interest and amortization of debt issuance costs and discounts on Notes 262.9 Less: Interest expense on Notes recorded on the Company’s statements of earnings for the year-ended December 31, 2024 (8.9) Less: Amortization expense of debt issuance costs and discounts on Notes recorded on the Company’s statements of earnings for the year-ended December 31, 2024 (0.3) Pro forma interest and amortized debt issuance costs and discounts expense adjustment for the year-ended December 31, 2024 $ 253.7 (b) Reflects the U.S. income tax benefit of the interest expense related to the Acquisition Financing using an estimated blended U.S. federal and state income tax rate of 26%. Because the adjustments contained in the unaudited pro forma condensed combined financial information are based on estimates, the effective tax rate herein will likely vary from the effective rate in periods subsequent to the Transaction. The impacts to the condensed combined pro forma balance sheet as of June 30, 2025 were as follows (c) Reflects the proforma balance sheet impact of the reversal of amortization of the issuance costs and discounts that were incurred for the year ended December 31, 2024 and for the period ended June 30, 2025, which would have been unamortized if the transaction had occurred as of June 30, 2025.

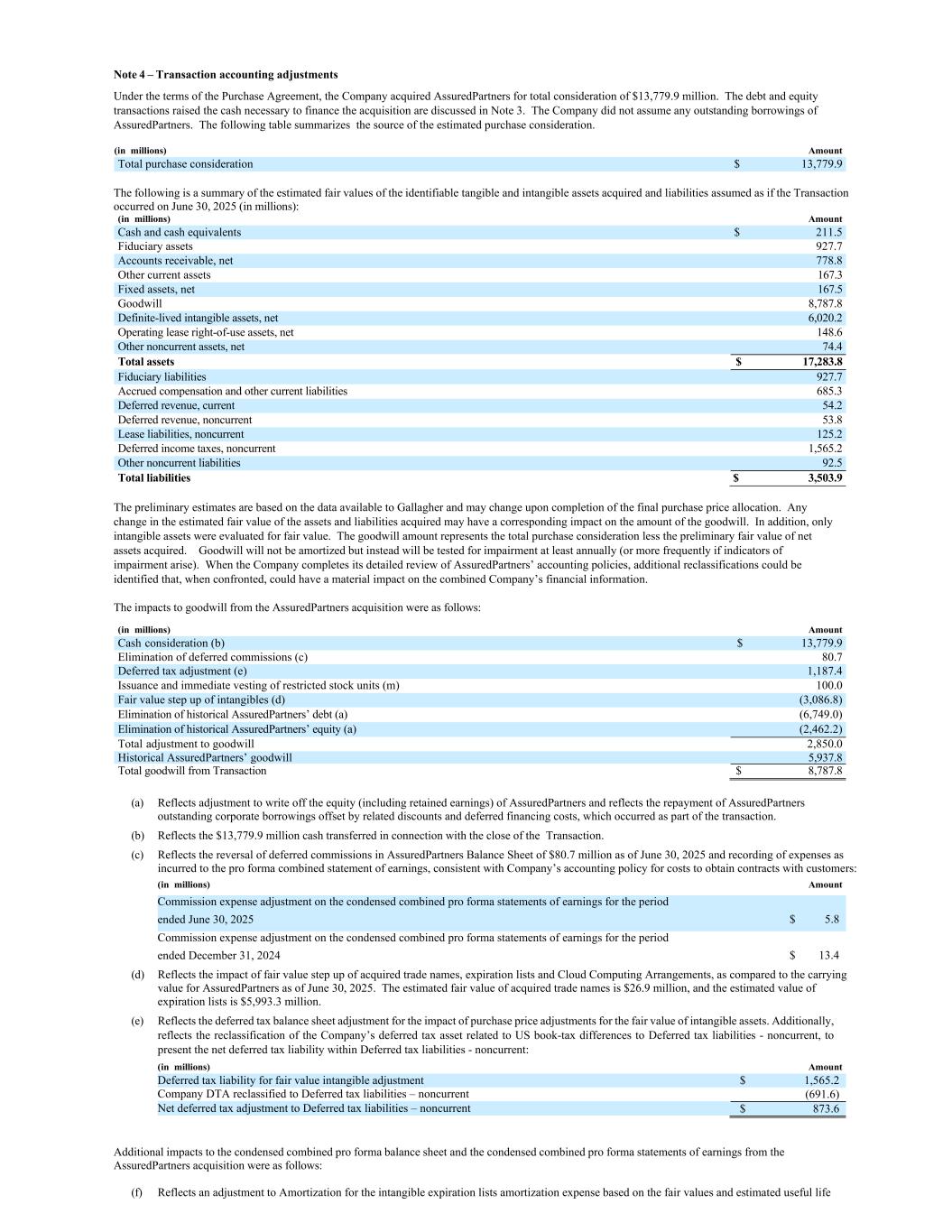

Note 4 – Transaction accounting adjustments Under the terms of the Purchase Agreement, the Company acquired AssuredPartners for total consideration of $13,779.9 million. The debt and equity transactions raised the cash necessary to finance the acquisition are discussed in Note 3. The Company did not assume any outstanding borrowings of AssuredPartners. The following table summarizes the source of the estimated purchase consideration. (in millions) Amount Total purchase consideration $ 13,779.9 The following is a summary of the estimated fair values of the identifiable tangible and intangible assets acquired and liabilities assumed as if the Transaction occurred on June 30, 2025 (in millions): (in millions) Amount Cash and cash equivalents $ 211.5 Fiduciary assets 927.7 Accounts receivable, net 778.8 Other current assets 167.3 Fixed assets, net 167.5 Goodwill 8,787.8 Definite-lived intangible assets, net 6,020.2 Operating lease right-of-use assets, net 148.6 Other noncurrent assets, net 74.4 Total assets $ 17,283.8 Fiduciary liabilities 927.7 Accrued compensation and other current liabilities 685.3 Deferred revenue, current 54.2 Deferred revenue, noncurrent 53.8 Lease liabilities, noncurrent 125.2 Deferred income taxes, noncurrent 1,565.2 Other noncurrent liabilities 92.5 Total liabilities $ 3,503.9 The preliminary estimates are based on the data available to Gallagher and may change upon completion of the final purchase price allocation. Any change in the estimated fair value of the assets and liabilities acquired may have a corresponding impact on the amount of the goodwill. In addition, only intangible assets were evaluated for fair value. The goodwill amount represents the total purchase consideration less the preliminary fair value of net assets acquired. Goodwill will not be amortized but instead will be tested for impairment at least annually (or more frequently if indicators of impairment arise). When the Company completes its detailed review of AssuredPartners’ accounting policies, additional reclassifications could be identified that, when confronted, could have a material impact on the combined Company’s financial information. The impacts to goodwill from the AssuredPartners acquisition were as follows: (in millions) Amount Cash consideration (b) $ 13,779.9 Elimination of deferred commissions (c) 80.7 Deferred tax adjustment (e) 1,187.4 Issuance and immediate vesting of restricted stock units (m) 100.0 Fair value step up of intangibles (d) (3,086.8) Elimination of historical AssuredPartners’ debt (a) (6,749.0) Elimination of historical AssuredPartners’ equity (a) (2,462.2) Total adjustment to goodwill 2,850.0 Historical AssuredPartners’ goodwill 5,937.8 Total goodwill from Transaction $ 8,787.8 (a) Reflects adjustment to write off the equity (including retained earnings) of AssuredPartners and reflects the repayment of AssuredPartners outstanding corporate borrowings offset by related discounts and deferred financing costs, which occurred as part of the transaction. (b) Reflects the $13,779.9 million cash transferred in connection with the close of the Transaction. (c) Reflects the reversal of deferred commissions in AssuredPartners Balance Sheet of $80.7 million as of June 30, 2025 and recording of expenses as incurred to the pro forma combined statement of earnings, consistent with Company’s accounting policy for costs to obtain contracts with customers: (in millions) Amount Commission expense adjustment on the condensed combined pro forma statements of earnings for the period ended June 30, 2025 $ 5.8 Commission expense adjustment on the condensed combined pro forma statements of earnings for the period ended December 31, 2024 $ 13.4 (d) Reflects the impact of fair value step up of acquired trade names, expiration lists and Cloud Computing Arrangements, as compared to the carrying value for AssuredPartners as of June 30, 2025. The estimated fair value of acquired trade names is $26.9 million, and the estimated value of expiration lists is $5,993.3 million. (e) Reflects the deferred tax balance sheet adjustment for the impact of purchase price adjustments for the fair value of intangible assets. Additionally, reflects the reclassification of the Company’s deferred tax asset related to US book-tax differences to Deferred tax liabilities - noncurrent, to present the net deferred tax liability within Deferred tax liabilities - noncurrent: (in millions) Amount Deferred tax liability for fair value intangible adjustment $ 1,565.2 Company DTA reclassified to Deferred tax liabilities – noncurrent (691.6) Net deferred tax adjustment to Deferred tax liabilities – noncurrent $ 873.6 Additional impacts to the condensed combined pro forma balance sheet and the condensed combined pro forma statements of earnings from the AssuredPartners acquisition were as follows: (f) Reflects an adjustment to Amortization for the intangible expiration lists amortization expense based on the fair values and estimated useful life

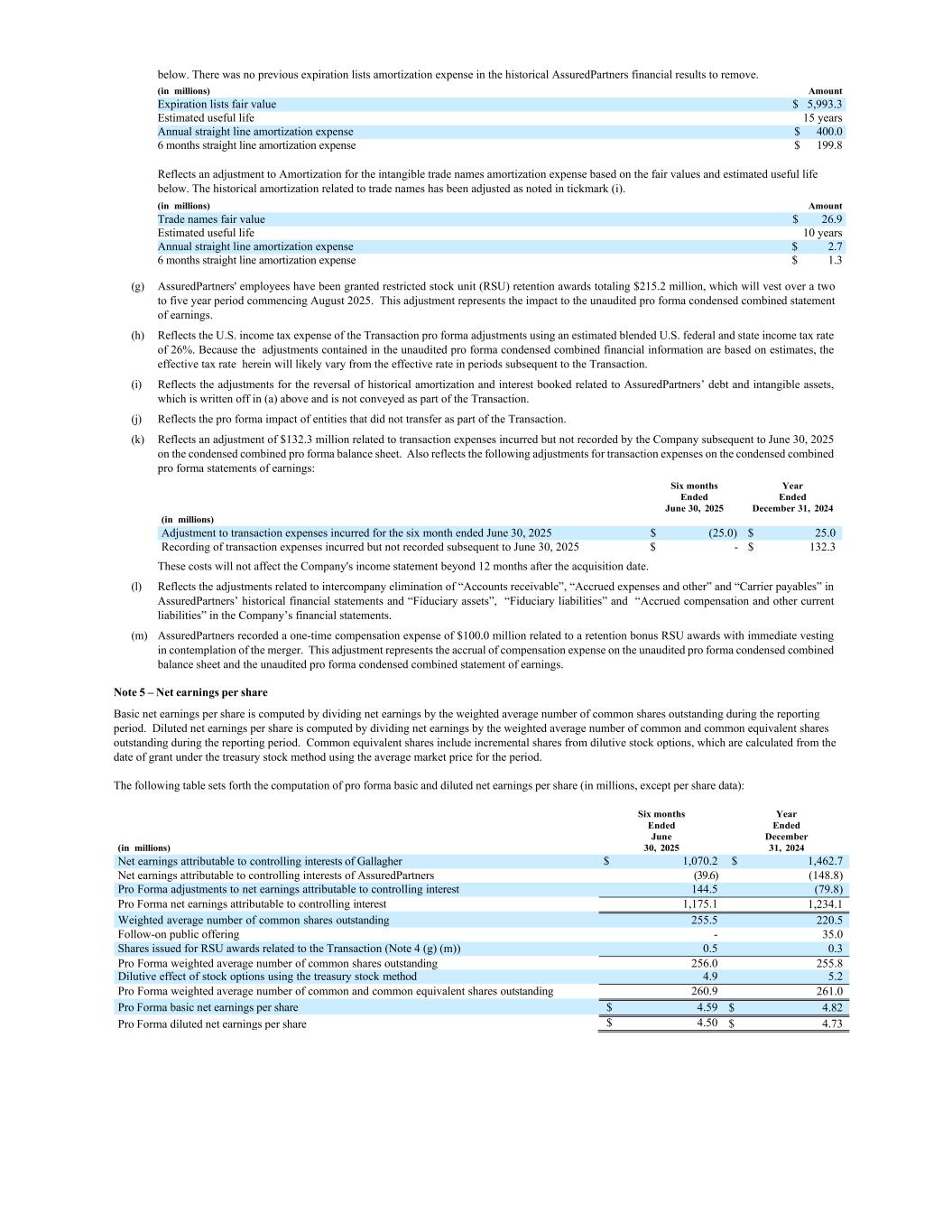

below. There was no previous expiration lists amortization expense in the historical AssuredPartners financial results to remove. (in millions) Amount Expiration lists fair value $ 5,993.3 Estimated useful life 15 years Annual straight line amortization expense $ 400.0 6 months straight line amortization expense $ 199.8 Reflects an adjustment to Amortization for the intangible trade names amortization expense based on the fair values and estimated useful life below. The historical amortization related to trade names has been adjusted as noted in tickmark (i). (in millions) Amount Trade names fair value $ 26.9 Estimated useful life 10 years Annual straight line amortization expense $ 2.7 6 months straight line amortization expense $ 1.3 (g) AssuredPartners' employees have been granted restricted stock unit (RSU) retention awards totaling $215.2 million, which will vest over a two to five year period commencing August 2025. This adjustment represents the impact to the unaudited pro forma condensed combined statement of earnings. (h) Reflects the U.S. income tax expense of the Transaction pro forma adjustments using an estimated blended U.S. federal and state income tax rate of 26%. Because the adjustments contained in the unaudited pro forma condensed combined financial information are based on estimates, the effective tax rate herein will likely vary from the effective rate in periods subsequent to the Transaction. (i) Reflects the adjustments for the reversal of historical amortization and interest booked related to AssuredPartners’ debt and intangible assets, which is written off in (a) above and is not conveyed as part of the Transaction. (j) Reflects the pro forma impact of entities that did not transfer as part of the Transaction. (k) Reflects an adjustment of $132.3 million related to transaction expenses incurred but not recorded by the Company subsequent to June 30, 2025 on the condensed combined pro forma balance sheet. Also reflects the following adjustments for transaction expenses on the condensed combined pro forma statements of earnings: Six months Year Ended Ended June 30, 2025 December 31, 2024 (in millions) Adjustment to transaction expenses incurred for the six month ended June 30, 2025 $ (25.0) $ 25.0 Recording of transaction expenses incurred but not recorded subsequent to June 30, 2025 $ - $ 132.3 These costs will not affect the Company's income statement beyond 12 months after the acquisition date. (l) Reflects the adjustments related to intercompany elimination of “Accounts receivable”, “Accrued expenses and other” and “Carrier payables” in AssuredPartners’ historical financial statements and “Fiduciary assets”, “Fiduciary liabilities” and “Accrued compensation and other current liabilities” in the Company’s financial statements. (m) AssuredPartners recorded a one-time compensation expense of $100.0 million related to a retention bonus RSU awards with immediate vesting in contemplation of the merger. This adjustment represents the accrual of compensation expense on the unaudited pro forma condensed combined balance sheet and the unaudited pro forma condensed combined statement of earnings. Note 5 – Net earnings per share Basic net earnings per share is computed by dividing net earnings by the weighted average number of common shares outstanding during the reporting period. Diluted net earnings per share is computed by dividing net earnings by the weighted average number of common and common equivalent shares outstanding during the reporting period. Common equivalent shares include incremental shares from dilutive stock options, which are calculated from the date of grant under the treasury stock method using the average market price for the period. The following table sets forth the computation of pro forma basic and diluted net earnings per share (in millions, except per share data): Six months Year Ended Ended June December (in millions) 30, 2025 31, 2024 Net earnings attributable to controlling interests of Gallagher $ 1,070.2 $ 1,462.7 Net earnings attributable to controlling interests of AssuredPartners (39.6) (148.8) Pro Forma adjustments to net earnings attributable to controlling interest 144.5 (79.8) Pro Forma net earnings attributable to controlling interest 1,175.1 1,234.1 Weighted average number of common shares outstanding 255.5 220.5 Follow-on public offering - 35.0 Shares issued for RSU awards related to the Transaction (Note 4 (g) (m)) 0.5 0.3 Pro Forma weighted average number of common shares outstanding 256.0 255.8 Dilutive effect of stock options using the treasury stock method 4.9 5.2 Pro Forma weighted average number of common and common equivalent shares outstanding 260.9 261.0 Pro Forma basic net earnings per share $ 4.59 $ 4.82 Pro Forma diluted net earnings per share $ 4.50 $ 4.73